This section will cover key dimensions of competition law enforcement, including merger control in specific sectors of the economy, anti-competitive practices, investigation powers, sanctions, as well as judicial review and civil damage claims.

Peer Reviews of Competition Law and Policy: Dominican Republic

2. Competition law enforcement

Abstract

2.1. Merger control

As mentioned in Section 1.2, the first version of the draft Competition Act in Dominican Republic included a general competition merger control system, which was later removed from the bill of law and its final version. Thus, the Competition Act was adopted without a merger review system.

Companies and business associations have strongly pushed back the adoption of merger control in the Dominican Republic. They argue that merger control is not adapted to small economies, such as the Dominican, and that concentration is a natural consequence of the insular condition of the country. The business sector is particularly concerned about too many concentrations and acquisitions being blocked by the competition authority.

Effective merger review, which helps avoiding economic concentrations in general, is a key component of almost all competition regimes, independently of their size or condition. Business concerns about a great number of transactions being blocked is not founded. Merger control targets transactions that significantly reduce competition and causes consumer harm. Most of the mergers are authorised by competition authorities because they do not cause harm to competition and will often generate efficiencies. A minority of transactions may create competition problems and will require a thorough analysis and intervention from the competition authority (e.g., imposition of a remedy or the prohibition of the transaction) (OECD, 2021[1])

Almost all jurisdictions in the world have some form of merger control regime, assessing mergers’ competitive impact on their relevant markets (OECD, 2021[1]). Indeed, from the 79 jurisdictions included in the OECD CompStats database in 2023, only seven had no regulatory framework for merger control in place (OECD, 2023[2]). All Dominican Republic’s GDP per capita peers and population peers mentioned in Figure 4 and Figure 5 have a merger control regime.

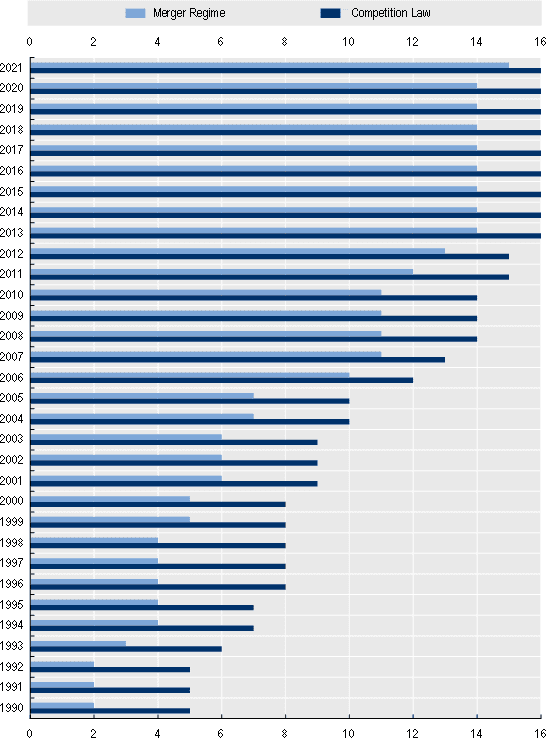

This is also the case in Latin America and the Caribbean, where jurisdictions often have had first a competition law (without merger control) and left the introduction of merger control provisions to a subsequent stage of the development of competition law enforcement as indicated in Figure below. In fact, from the 14 jurisdictions in Latin American and the Caribbean included in the OECD CompStats database, only the Dominican Republic did not have a merger control regime. The other jurisdictions are: Argentina, Barbados, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Mexico, Nicaragua, Panama, Paraguay and Peru (OECD, 2023[2]).

Figure 2.1. Development of competition law and merger control regimes in Latin America and Caribbean

Note: in horizontal axis are the number or jurisdictions in LAC that had merger regime and competition law by the year in vertical axis.

Source: OECD (2023[2]), CompStats database, https://www.oecd.org/competition/oecd-competition-trends.htm.

In this context, the Dominican Republic still lacks a general merger control regime in order to follow common international practices and OECD guidance on this matter. Indeed, most jurisdictions recognise that competition problems of a structural nature may result from certain merger transactions, which justifies the existence of merger control provisions that help preventing market structures from excessive concentration and related competition issues.

In Latin America, Peru has recently adopted a mandatory merger control regime applied to the entire economy following a recommendation of the OECD-IDB Peer Review of the Competition Law and Policy in Peru (OECD-IDB, 2018[3]). The new Peruvian merger control legislation entered into effect in June 2021 and has resulted in 29 merger notifications in its first two years in force: 24 transactions have been authorised; 1 transaction has been withdrawn by the merging parties; and 1 transaction has been approved with restrictions in the pharmaceutical sector. No transactions have been blocked.

Indeed, the OECD Recommendation on Merger Review recognises the important role that an effective merger review plays within competition regimes, which contributes to greater convergence of merger review procedures, including co-operation among competition authorities, towards internationally recognised best practices. It also helps competition authorities and merging parties to avoid unnecessary costs by making merger review procedures more effective (OECD, 2005[4]).

While the Dominican Republic does not have a wide competition merger control regime applied to the entire economy, it has certain mechanisms resembling to merger control, not always based on competition rationale, that can be enforced by regulators in the telecommunications, electricity, and financial sectors. Overall, Pro-Competencia has not played any role in these review assessments, although such mechanisms could potentially benefit from greater interaction with competition experts (e.g., non‑binding opinions by Pro-Competencia).

2.1.1. Telecommunications sector

The Dominican Institute of Telecommunications (Instituto Dominicano de las Telecomunicaciones, INDOTEL) is in charge of reviewing mergers and acquisitions in the telecommunications sector.1 Prior notification of mergers and acquisitions among telecommunication companies is mandatory in the Dominican Republic and non-compliance may be sanctioned with a fine of up to approximately USD 390 thousand (DOP 21.4 million).2 There are no merger notification thresholds in place.

INDOTEL may authorise without conditions, authorise with conditions, or prohibit a merger after having conducted an analysis of its effects on the relevant markets. The reasons for objecting to a merger are the unreasonable lessening, restriction, harm and impediment of free competition.3 This may be the case, for example, if the merger confers the power for the new entity to restrict substantially the supply of products or services.4

INDOTEL has not been very active in this area. Since 2005, two mergers were authorised with conditions by INDOTEL. The example below indicates the most recent case involving companies Altice Hisponiola S.A. and Tricom S.A., which was conditionally approved by INDOTEL in 2017.

Box 2.1. Merger Altice/Tricom approved with conditions by INDOTEL, 2017

On 20 September 2017, INDOTEL, the Dominican telecommunications regulator, authorised with conditions the acquisition of the telecommunications operator Tricom S.A. by Alttice Hispaniola S.A.

The merger included the transfer of the authorisations granted to Tricom S.A. for the use of the radio electric spectrum segments. INDOTEL concluded that the accumulation of spectrum was going to lessen competition in the relevant markets for mobile telephony services and internet access. To address the negative competitive effects of the merger, INDOTEL imposed conditions including (i) granting back to the regulator certain frequencies previously assigned to Tricom S.A.; and (ii) obligations in relation to interconnection prices (e.g., obligation for Altice Hispaniola S.A. to publish its Reference Interconnection Offer – RIO).

On 22 November 2017, INDOTEL adopted a revised decision which considered requests received from both merging parties and one of their main competitors (i.e. Compañía Dominicana de Teléfonos, S. A. – CLARO) as regards INDOTEL’s first decision on this case. As a result, additional obligations were included in the remedy package, e.g., the obligation to adopt a 3-year investment plan of at least USD 11.4 million (DOP 625 million) to deploy infrastructure to expand the coverage of mobile services with broadband capacity in the following underserved provinces in the Dominican Republic: Barahona, Bahoruco, Dajabón, Elías Piña and Pedernales.

Source: INDOTEL (2017[5]), Decision No. 056-17, https://transparencia.indotel.gob.do/wp-content/uploads/2022/10/res-no-056-17.pdf; INDOTEL (2017[6]), Decision No. 077-17, https://transparencia.indotel.gob.do/wp-content/uploads/2022/10/res-no-056-17.pdf.

Pro-Competencia is usually not involved in merger review in the telecommunications sector, although it may be consulted and issue advocacy opinions. As further explained in section 3.1.1, advocacy recommendations issued by Pro-Competencia are not binding, but INDOTEL is required to provide a justification when it decides not to follow such recommendations, even though this does not seem to occur in practice.

2.1.2. Electricity sector

The Superintendency of Electricity (Superintendencia de Electricidad, SE) is in charge of enforcing several regulatory provisions of the electricity legal framework in the Dominican Republic. SE is also in charge of investigating mergers, namely when there are changes in the control of other energy companies.

Indeed, the Dominican legislation establishes a mandatory merger notification system to monitor concentrations in the electricity sector, in which energy companies have to notify their shareholding composition twice a year and economic agents may address complaints to SE if they observe changes in the control of other energy companies as per Article 11 of the 2001 General Electricity Law (Ley General de Electricidad, LGE)5 and Articles 10 and 11 of its implementing Electricity Regulation (Reglamento para la aplicación de la Ley General de Electricidad).6

The SE reviews all transactions leading to a concentration and is expected to block any deal resulting in vertical integration (i.e., those deals that would create entities active in more than one of the regulated markets, namely generation, distribution and commercialisation).7 Vertical integration in the electricity sector is forbidden in the Dominican Republic, except for the three companies resulting from the capitalisation process of the electricity distribution market that was launched in the country in 2001 – which nevertheless must not hold more than a 15% market-share in the national electricity generation market.8

Since 2001, the National Energy Commission (Comisión Nacional de Energia, CNE), the national regulator for the electricity sector, had only adopted one decision ordering the divestiture of the generation activity of one energy company, AES Corporation Ltd., for exceeding the maximum market share allowed in the energy generation market for companies resulting from the capitalisation process of the electricity market. Although the decision had mainly a regulatory nature (i.e., to enforce a regulatory provision that prohibits players to participate in both generation and distribution markets with high market-shares), it developed competition arguments since SE stated that the existence of players with strong market power would have “(i) increased collusive practices; (ii) encouraged parallel conduct; and/or (iii) increased the tendency of oligopolies and excluded mavericks”.9

In sum, the procedure to monitor shareholding composition in the electricity sector is very different from a traditional merger assessment carried out by competition authorities in other jurisdictions, in particular because the rationale of the analysis is not based on typical competition grounds but rather on a regulatory requirement (i.e. the prohibition of vertical integration).

2.1.3. Financial sector

Mergers and acquisitions between financial intermediation entities are reviewed by the Monetary Board (Junta Monetaria), body in charge of designing the monetary policy in the Dominican Republic, which will benefit from a mandatory and previous opinion to be issued by the Superintendency of Banks (Superintendencia de Bancos), the body in charge of monitoring the banking sector.10

The merger control assessment focus on the strategic objectives of the Superintendency of Banks, which include financial stability, digitalisation and innovation, financial inclusion, institutional efficiency and strength, consumer protection, as well as integrity of the financial system. In other words, competition issues do not play a role in the current framework of merger review in the financial sector (and Pro‑Competencia is not required to play any role either). This seems at least inconsistent with the guidance provided in Article 2 of the Monetary and Financial Law that establishes that the regulation of the financial sector should ensure the well-functioning of the system in an environment of competitiveness, efficiency and free market.

Given that competition does not play a role in current merger review mechanism in the financial sector, the pertinent competition case law enforcement is still inexistant at this moment.

2.2. Types of infringements

In the area of anti-competitive practices, the Competition Act identifies two main categories of antitrust infringements: collusive practices between competitors (Article 5 of the Competition Act) and abuse of dominant position (Article 6 of the Competition Act). In addition, unfair competition practices are also established as an infringement in the Competition Act (Article 10 of Competition Act) and may be sanctioned by Pro-Competencia or directly by civil courts.

2.2.1. Collusive practices

The infringement related to collusive practices is established in Article 5 of the Competition Act:

Art. 5. The practices, acts and agreements between competing economic agents, whether express or tacit, written or verbal, which have as their object or which produce or may produce the effect of unjustifiably imposing barriers on the market, are prohibited. The following conducts are included within concerted practices and anti-competitive agreements:

a) Agreeing on prices, discounts, extraordinary charges, other conditions of sale and the exchange of information having the same object or effect;

b) Agreeing or co-ordinating bids or abstention from bids, tenders and public auctions;

c) To allocate, distribute or assign segments or parts of a market of goods and services, indicating specific time or space, suppliers and clients;

d) Limit the production, distribution or commercialisation of goods; or render and/or frequency of services, regardless of their nature; and,

e) Eliminate competitors from the market or limit their access to it, from their position as buyers or sellers of certain products.

Article 5 of the Competition Act covers a list of anti-competitive horizontal agreements, including: (i) price fixing; (ii) bid-rigging; (iii) market allocation; (iv) output restrictions; and (v) boycotts. However, the legal provision uses the following wording of “unjustified barriers” as a core element of the text: “which have as their object or which produce or may produce the effect of unjustifiably imposing barriers on the market, are prohibited” (underlined for this report). This language is not common in other jurisdictions and may limit in practice the prosecution of certain anti-competitive practices. In fact, most competition laws ban conducts that have as their object or effect the restriction, impediment or limitation of competition in the market, which is a broader concept than the imposition of unjustified market barriers. While market barriers play an important role for the competition assessment of certain cases, they have limited utility for the analysis of other cases (e.g., price-fixing agreements, which are considered a per se infringement in most competition law regimes).

In the Dominican Republic, collusive agreements are considered as per se infringements, following a decision issued by Pro-Competencia in 2021, in which it was stated that such practices presumably produce negative effects and therefore there is no need to examine their effects on the market.11

Nevertheless, Article 7, item 1 of the Competition Act provides for an exemption from the general prohibition of collusive agreements when such practices are accessory or complementary to an agreed integration or association that has been adopted to achieve greater efficiency of the productive activity or to promote innovation or productive investment. The application of such exemption must be requested by the investigated parties, who have the burden to prove the economic efficiencies of their behaviour.12

According to Pro-Competencia’s 2021 decision, the anti-competitive effects of an agreement may be outweighed by economic efficiencies if a decision of Pro-Competencia justifies this exemption. This exception may apply only if: (i) the agreement contribute to improving the production, commercialisation and/or distribution of goods and services, or promoting economic or technical progress; (ii) consumers benefit from the efficiencies produced by the agreement; (iii) the restrictions are indispensable and strictly necessary to obtain the benefits derived from the agreement; and (iv) the agreement does not eliminate all competition.13 This is similar to the exemption provided for in Article 101, item 3 of the Treaty on the Functioning of the European Union.

Anti-cartel enforcement is still incipient in the Dominican Republic. Since 2017, when Pro‑Competencia began its enforcement activities, it has investigated seven cases in relation to horizontal agreements, which led to one sanction of a cartel in the pharmaceutical sector. Four cases were dismissed and two are still ongoing. In addition, the sector regulators with competition enforcement powers have not been active in this area either, and no sanctions were identified at the time of writing (see section 1.5).

Box 2.2. Cartel case in the pharmaceutical sector

In 2021, Pro-Competencia sanctioned Profarma Internacional, Sued & Fargesa, J. Gassó Gassó, and Mercantil Farmacéutica, all distributors of Glaxosmithkline (GSK) pharmaceuticals in the Dominican Republic, for having participated in a cartel, with total fines of around EUR 200 thousand (DOP 14 million).

The firms agreed on maximum rebates, prohibited discounts to downstream merchants, and agreed to apply prices recommended by GSK during 2015-2018. E-mails and documents were used as evidence of the concerted practices, which indicated that firms met in Sued & Fargesa headquarters to discuss the collusive conducts.

Despite considering the cartel-like conduct as a per se violation of the Competition Act, Pro-Competencia assessed the efficiency defence arguments presented by the defendants and concluded that the exemption provided for in Article 7, item 1 of the Competition act was not applicable because the evidence submitted failed to prove any pro-competitive effects.

Pro-Competencia identified an overprice of 2% in the affected markets and the fines were calculated based on that estimation.

This decision was appealed by the defendants and upheld by the Superior Administrative Court (TSA), which concluded that Pro-Competencia had presented enough direct evidence to prove the involvement of the sanctioned parties in the cartel scheme. TSA’s decision was appealed before the Supreme Court of Justice and a final decision was still pending at the time of writing.

Source: Pro-Competencia (2021[7]), Decisión No. 010-2021, https://procompetencia.gob.do/wp-content/uploads/2021/06/resolucion-num-010-2021-version-publica.pdf; Decisions No. 0030-02-2023-SSEN-00389 and No 0030-1643-2023-SSEN-00506 of the TSA.

No bid-rigging cases have been sanctioned and only two cases are currently ongoing, which seems a very low figure for usual enforcement standards in the region. The ongoing case relates to an alleged cartel in the procurement of canteen service and was triggered by a complaint from Low-Cost Canteens of the Dominican State (Comedores Económicos del Estado Dominicano), a public entity in charge of providing canteen services to low-income individuals. This indicates the importance of close co-operation between competition authorities and entities in charge of public procurements (see section 3.2.3).

Furthermore, Article 5 of the Competition Act only refers to agreements between competing economic agents. Anti-competitive vertical agreements between undertakings active at different levels of the supply chain are not covered by the Competition Act. However, as in other jurisdictions in the Latin American and Caribbean region,14 anti-competitive vertical restraints can be caught under the Competition Act if they are imposed unilaterally by a dominant company as part of an abuse of dominant position (see section 2.2.2).

2.2.2. Abuse of dominant position

Article 6 of the Competition Act on abuse of dominant position provides that:

Art. 6. Conduct that constitutes an abuse of the dominant position of economic agents in a relevant market susceptible of creating unjustified barriers to third parties is prohibited. Abuses of dominant position include the following conducts:

a) Subordinating the decision to sell to the buyer to refrain from purchasing or distributing products or services of other competing companies;

b) The imposition by the supplier of prices and other conditions of sale to its resellers, without there being a commercial reason that justifies it;

c) The sale or other transaction conditioned to the acquisition or provision of an additional good or service, different or distinguishable from the main one;

d) The sale or other transaction subject to the condition of not contracting services, acquiring, selling or providing goods produced, distributed or marketed by a third party;

e) The refusal to sell or provide, to a certain economic agent, goods and services that are usually and normally available or offered to third parties; and when there are no alternative suppliers in the relevant market available and willing to sell under normal conditions. Exceptions are those actions of refusal to negotiate, on the part of the economic agent, when there is a breach of contractual obligations by the client or potential client, or when the commercial history of the client or potential client shows a high rate of returns or damaged goods, or lack of payment, or any other similar commercial reason;

f) The application, in commercial or service relations, of unequal conditions for equivalent services, which place some competitors in a disadvantageous situation with respect to others without there being any commercial reason to justify it.

Similar to the legal provision related to collusion, the abuse of dominance provision also relies on the on notion of unjustified barriers (i.e., “susceptible of creating unjustified barriers to third parties”), while most jurisdictions adopt an approach based on effects on competition, which is a broader concept. Therefore, abuses that restrict competition but do not create barriers to third parties would not be considered an anti-competitive infringement. Following international practices, abuse of dominance is assessed under the rule of reason, meaning that a behaviour will only be considered illegal if its anti‑competitive effects outweigh its pro-competitive effects (economic efficiencies).15

Article 6 of the Competition Act provides a non-exhaustive list of abusive practices, which are commonly known under competition law such as: (i) exclusive dealing; (ii) resale price maintenance; (iii) tying; (iv) exclusive dealing; (v) refusal to supply; and (vi) discrimination. While vertical restraints are not explicitly mentioned in the list, the legal provision seems sufficiently broad to cover this practice – and the evolution of case law in future years may be useful to confirm or not this assumption. Indeed, vertical restraints are often covered by abuse of dominance provisions in Latin America, namely when the practice is imposed unilaterally by a dominant firm and results on negative effects on the market.16

The Competition Act also has a specific provision that establishes the legal criteria of what should be considered dominance for purposes of antitrust enforcement. It generally follows common standards, stating that Pro-Competencia must consider the market barriers; the power to set prices unilaterally or substantially restrict supply; market shares the ability to access other sources of inputs; and the relationship between firms in terms of competition and recent commercial behaviours.17

The Competition Act does not address exploitative abuses (such as excessive prices) that negatively affect consumers. Unlawful conduct is defined solely in terms of exclusionary practices that foreclose, by imposing barriers, competitors or other firms in the market.

In addition, the Competition Act provides that unilateral conduct may be justified if its pro‑competitive effects (i.e., economic efficiencies) outweigh its anti-competitive effects (Article 7, item 2 of Competition Act). This is commonly known as “efficiency defence” or “rule of reason” in other jurisdictions. Pro-Competencia has the burden of proof in demonstrating the anti-competitive effects of the practice, while the investigated firms have the burden of proof in showing possible efficiencies.

Fighting against abuse of dominance practices is also in its infancy in the Dominican Republic. Pro-Competencia has investigated seven abuse of dominance cases since 2017, when it began its enforcement track-record, which led to one administrative sanction in the beer market (still pending of judicial review). Five cases were dismissed, while one case is still ongoing. The sector regulators with competition enforcement powers have not been active in this area either (see section 1.5).

Box 2.3. Abuse of dominance in the beer market

In 2018, Pro-Competencia imposed a USD 842,000 (DOP 46 million) fine against Cerveceria Nacional Dominicana (CND) for abusing its dominant position in the national beer market.

The investigation was launched in 2017 following a market study published by Pro-Competencia regarding competition in the beer market after CND was acquired in 2012 by AmBev, a major player in the beverage sector in Latin America.

The relevant market was defined as the production, commercialisation and distribution of beer in the national territory of the Dominican Republic. With a market share of over 98%, CND held a dominant position in that market, while United Brands, the main competitor in the national beer market, only held a market share of around 1.5%.

In 2018, Pro-Competencia adopted a decision establishing that CND infringed competition law by (i) imposing barriers to entry to new players; (ii) imposing resale prices; and (iii) imposing exclusivity clauses on distributors and clients. Amongst other practices, CND was discouraging retailers from selling brands from competitors, as well as imposing exclusive resale clauses for clients which prevented other beer suppliers to access consumers (e.g., exclusivity to cover promotion materials).

Pro-Competencia’s decision was annulled by the Superior Administrative Court, since the market study used to prove the anti-competitive practice could not have been used as evidence. Pro-Competencia appealed to the Supreme Court of Justice and a final judicial decision was still pending at the time of writing.

Source: Pro-Competencia (2018[8]), Decision No. 018-2018, https://procompetencia.gob.do/resoluciones-procompetencia/resolucion-num-018-2018/; Decision No. Judgement No. 0030-04-2022-SSEN-02218 of the TSA.

2.3. Procedural issues

2.3.1. Investigative phase

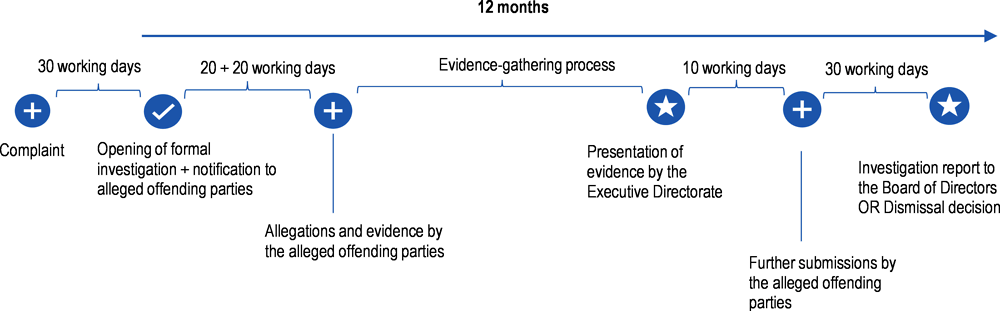

The procedural steps that the Executive Directorate must follow are established in Article 44 of the Competition Act and Article 21 of the Implementing Regulation and must be carried out within 12 months (see section 2.3.3 below). First, the alleged offending parties must be notified of the opening of a formal investigation, informing the objections raised against them.18 Then, the investigated parties have an extendable period of 20 working days to reply to the allegations and present evidence. Within this period, they may also offer commitments (see section 2.4.5). The period for submitting evidence is, however, not limited to the 20 working-days period as the investigated parties may bring forward further evidence anytime during the investigation procedure. This means that the investigated parties could submit evidence at the very end of this phase, and the Executive Directorate would not have the time to analyse it. The alleged offending parties may also request access to the non-confidential version of the file at any stage during the investigation procedure.19

Once the evidence-gathering process has been concluded, the Executive Directorate will submit a copy of the file with all the evidence to the investigated parties. They may present their objections and further evidence within 10 working days. Within 30 working days from the receipt of the investigated parties’ submissions, the Executive Directorate will either present an investigation report to the Board of Directors or adopt a dismissal decision if it considers that the evidence is not enough to prove an anti-competitive conduct or when it concludes that the investigated conduct does not restrict competition.

The investigation report submitted to the Board of Directors must contain: (i) the observed conduct; (ii) the evidence showing the conduct, (iii) the parties involved; (iv) the effects of the conduct on the market(s); (v) the type of infringement; and (vi) the liability of the investigated parties.

Although as a general rule all documents and information within an investigation are public, the Competition Act provides for the protection of confidential information. In fact, Pro-Competencia, ex officio or at the request of an interested party, can classify any document or information as confidential.20 However, only commercial sensitive information seems to subject to confidentiality. Protection of confidential information from third parties (e.g., the identity of the complainant) is essential to ensure an effective detection of anti-competitive infringements.

Figure 2.2. Investigation phase

Source: OECD based on information from the Competition Act.

2.3.2. Decision-making phase

The Board of Directors will decide on the admissibility of the case within 30 working days from the receipt of the Executive Directorate’s investigation report. The admissibility criteria include: (i) whether the Executive Directorate has met the deadline for presenting the investigation report; (ii) identification of the parties; (iii) the precise charges; (iv) compliance by the Executive Directorate with the legality principle (assess whether the actions of the investigation body have been carried out within the framework of its powers); (v) compliance with due process and rights of defence; and (vi) reasoning of the investigation report. If the case is admitted, the Board of Directors will notify its decision to the alleged offending parties.

Once the case has been admitted, the decision-making takes place in two phases: the evidence phase and the decision phase.

During the evidence phase, the Board of Directors, ex officio or upon request of the parties, holds a public hearing for the submission of further evidence within 15 working days from the notification of admissibility of the case. The purpose of the hearing is to assess new evidence and decide on its admissibility. The parties may appeal for reconsideration against the Board of Director’s decision regarding the admission of new evidence within 10 working days.

During the decision phase, the Board of Directors will arrange an additional public hearing to hear the arguments and allegations of the different parties. During this public hearing, the Executive Directorate, the complainant, the witnesses, and the alleged offending parties will be heard. The Board of Director can ask questions and request clarifications to all parties. Once the public hearing has been concluded, the Board of Directors will produce its minutes and may grant an additional reasonable deadline for the alleged offending parties to submit further defence arguments. Once this deadline is over, the Board of Directors has 45 working days to render a final administrative decision on the case.

2.3.3. Statute of limitation and investigation deadlines

Investigations are normally subject to a statute of limitation, which refers to a period of limitation to bring actions against certain anti-competitive practice (e.g., a maximum number of years to open an investigation after the alleged illegal practice has ended). In certain countries, investigations also have formal deadlines to be finalised, which sets a maximum period for conducting an investigation (e.g., a maximum number of years to conclude an investigation counting from the opening of the formal proceedings until the adoption of an opinion to the adjudicative body).

In the Dominican Republic, the deadlines for both the statute of limitation and for investigation deadlines are established in the Competition Act.21

The statute of limitation is of one year and it starts running from the termination of the alleged unlawful conduct.22 This is very short compared to statutes of limitations applied in other jurisdictions, as indicated below.

Box 2.4. Statute of limitation periods for competition law infringements

Brazil

In Brazil, the general statute of limitation of anti-competitive infringements is 5 years (and 12 years for cartels) counting from the date of the wrongdoing. For permanent or continuous infringements, the period should be counted from the day that the violation ceased.

Costa Rica

In Costa Rica, the statute of limitation is 4 years, which starts running from the moment the competition authority has knowledge of the conduct or when it had negative effects on competition. For continuous practices, the statute of limitation starts running from the moment of the last fact related to the conduct.

Mexico

In Mexico, the statute of limitation for prosecuting anti-competitive practices is 10 years and starts running from the ceasing of the alleged illegal conduct.

Source: Brazil, Law No. 12 529/2011; Costa Rica, Ley de Promoción de la Competencia y Defensa Efectiva del Consumidor No. 7472, 1994 and Ley de Fortalecimiento de las Autoridades de Competencia de Costa Rica No. 9736, 2019; Mexico, Ley Federal de Competencia Económica, 2014.

Indeed, a short statute of limitation undermines the effectiveness of the competition enforcement, as well as the competition policy more broadly, particularly when related to secret conspiracies such as cartels that are by nature difficult to detect.

The Dominican Competition Act also establishes investigation deadlines, which exists in certain countries, but remains uncommon when it is not followed by proper suspensory mechanisms of the deadlines (e.g., when an information request is sent by the competition authority). In the Dominican Republic, this deadline is 12 months, meaning that the right to prosecute (and thus to sanction) expires if the Executive Directorate takes longer than 12 months to conclude the investigation.23 The 12-month period can only be suspended under two circumstances:24

i) when the parties have objected to the participation of the Executive Director or a member of the Board of Directors for the reasons established in the Criminal Procedural Code (e.g., alleged criminal conviction or negligence in the performance of their duties); or

ii) when the alleged offending parties refuse to reply to a request from the Executive Directorate, provided that all judicial procedures have been exhausted.

The 12-month expiration deadline is too short for carrying out a fully-fledged investigation, collect the necessary evidence and carry out a careful analysis, especially for complex cases. Most jurisdictions do not establish deadlines for conducting investigations. As shown below, jurisdictions with investigation deadlines have opted for longer time limits than those applicable in the Dominican Republic. They also grant the competition authorities with greater flexibility to suspend or extend the investigation period.

Box 2.5. Competition investigation deadlines in Costa Rica, Mexico and Spain

Costa Rica

In Costa Rica, administrative proceedings against competition infringements are divided into two investigation phases: the preliminary phase and the assessment phase. The preliminary phase lasts 12 months and aims at determining whether there is a competition issue and whether there are reasons for opening a formal investigation. The competition authority can extend the preliminary phase for up to six months in certain situations (e.g., if the investigation involves more than one anti-competitive conduct). If the competition authority decides to open a formal investigation, the assessment phase starts and the authority has 10 months to render a decision, which can be extended once for additional six months (e.g., if more time is necessary to analyse new evidence or new facts). Finally, once the assessment phase is over, the competition authority still has 7 months to present its final decision, which can be extended in 1 month only.

Mexico

In Mexico, competition investigations must be carried out within 120 working days, renewable four times, totalling a maximum of 600 working days (around two and half years). The investigation concludes by either submitting a proposal of decision to the Board (the decision-making body) or recommending the closure of the case.

Spain

In Spain, the CNMC has 18 months to complete an administrative proceeding counting from the opening of the investigation to the adoption of the final decision. The investigation phase may only last 12 months, which can be suspend for the following reasons (i) the need to clarify doubts about the evidence or to gather documents from the parties; (ii) a request for information addressed to another public agent; (iii) co-operation process with other jurisdictions; (iv) ongoing administrative appeal (for example, against the inspection decision); (v) the need to produce complementary evidence; and (vi) negotiation of commitments with the investigated parties.

Source: Mexico, Ley Federal de Competencia Económica, 2014; Spain, Ley Defensa de la Competencia No. 15, 2007 and Real Decreto No. 261 Reglamento de Defensa de la Competencia, 2008; Costa Rica, Ley de Promoción de la Competencia y Defensa Efectiva del Consumidor No. 7472, 1994 and Ley de Fortalecimiento de las Autoridades de Competencia de Costa Rica No. 9736, 2019.

2.4. Enforcement powers

The Competition Act and the Implementing Regulation establish the powers of Pro-Competencia to investigate and sanction anti-competitive conducts. Investigation and detection tools include ex officio investigations, dawn raids, requests for information, and statements during interrogations.

2.4.1. Detection tools

According to Article 36 of the Competition Act, the Executive Directorate may start investigations ex officio (if it suspects that a behaviour breaches the law) or following a complaint by a party with a legitimate interest.

Complaints must be submitted in writing. They must contain the following elements: (i) the name and contact details of the complainant; (ii) the name and contact details of the alleged infringers; (iii) the facts and evidence regarding the alleged infringement; (iv) if the complainant requests interim measures, the measures envisaged and the risks for the market and the complainant derived from not adopting them; and (v) confidentiality request for sensitive information contained in the complaint.25

Complainants must also prove the legitimate interest by submitting evidence that the alleged infringement is causing or may cause them substantial economic damage.26 Infringements may be reported remotely, using an electronic complaint filing system available at Pro-Competencia’s website (Pro-Competencia, 2020[9]), but it is not possible to submit an anonymous competition complaint in the Dominican Republic.

The Executive Directorate must decide on the validity of complaints within 30 working days. Decisions admitting or rejecting complaints must be reasoned and based on a preliminary investigation. Complaints will be considered valid if they contain the above-mentioned elements and include documentary evidence of the alleged facts.

If the complaint is admitted, the Executive Directorate will issue a decision to open a formal investigation and notify it to the parties. The Competition Act provides for inconsistent deadlines for the notification of the opening of a formal investigation. Article 39 of the Competition Act provides for a 3 working-day deadline from the acceptance of the complaint, while Article 44 for a 5 working-day deadline. Together with the notification of the opening of a formal investigation, the parties will receive the complaint, a description of the facts and all supporting evidence submitted by the complainant.

The Executive Directorate must publish on Pro-Competencia’s website all admitted complaints and ex-officio investigations. Parties with legitimate interests may submit information or request to intervene as third parties in the procedure within 10 working days after the publication.27

When it comes to anti-competitive infringements (and cartels in particular), detection methods can be pro-active or reactive. While pro-active methods are started by the competition authority and do not depend on an external event, reactive methods rely on an external event to occur before the competition authority becomes aware of an issue (Hüschelrath, 2010[10]). Complaints (by competitors, customers, other agencies or current or former employees), external information (e.g., whistle-blowers and informants), and leniency application are examples of reactive methods. Examples of pro-active methods include the use of economics (e.g., collusion factors, industry studies and market screening), use of information from past cases (including from other jurisdictions), industry monitoring (e.g., press and internet, career tracking of industry managers and regular contact with industry representatives), co-operation between agencies (national or foreign competition authorities or other agencies) and technology-led screens (e.g., structural screens and behavioural screens) (OECD, 2023[11]).

Although Pro-Competencia has the power to initiate ex-officio investigations, these are still incipient.28 As already mentioned, the Dominican competition authority has very limited resources, both as regards material (e.g., technological devices) and human, and therefore the use of reactive detection methods is limited.29

The OECD Recommendation concerning Effective Action against Hard Core Cartels recognises the importance of ex officio investigations, stating that jurisdictions should use pro-active cartel detection tools, such as analysis of public procurement data, to trigger and support cartel investigations (OECD, 2019[12]). Indeed, there has been a rise in the interest of competition authorities to use screens to detect cartels worldwide, considering the increasing availability of large amounts of digital data on prices and quantities, as well as the emergence of new technologies to extract and analyse data in an increasingly automated manner (OECD, 2022[13]).

As for reactive detection methods, complaints have played a major role in the Dominican Republic. Since 2017, Pro-Competencia has received 59 complaints: 27 related to unfair competition practices, 9 to cartel offences, 5 to abuse of dominance (and the rest to other types of infringements).

However, the fact that it is not possible to submit an anonymous complaint may prevent those aware of an infringement to report it for fear of retaliation (e.g., firing or blacklisting from the industry). Accordingly, the Recommendation concerning Effective Action against Hard Core Cartels encourages jurisdictions to facilitate the reporting of information on cartels by whistle-blowers, providing appropriate safeguards protecting the anonymity of the informants (OECD, 2019[12]).

Moreover, the requirement to publish complaints and the full version of the decisions to open formal investigations may be detrimental to the next steps of the investigation procedure (either ex officio or initiated after a complaint), particularly in cartels cases as it may contain confidential or sensitive information for the investigation.

Finally, the Dominican Republic does not enjoy a leniency policy to fight cartels, which has often been a powerful detection tool in many jurisdictions including some in Latin America, although the number of leniency applications have dropped worldwide (OECD, 2023[11]).

One of the most important objectives for introducing a leniency program is detection. As perpetrators are generally aware of the illegality of their behaviour, they make significant efforts to conceal their activities. At least in theory, a leniency policy increases the probability of detection and effective punishment of secret conspiracies such as cartels and white-collar crimes in general. It can also help to uncover cartels that would otherwise go undetected and destabilises existing cartels. Another objective for setting up a leniency regime is deterrence. When thinking about taking part in a cartel, companies will consider the likelihood of being detected and sanctioned. A functioning leniency programme is likely to increase the possibility of cartel activity to be uncovered because it raises uncertainty as whether other cartel members will use the tool to denounce the anti-competitive agreement (OECD, 2018[14]).

Nevertheless, two of the prerequisites for an effective leniency programme to work is a high risk of detection and significant sanctions. Leniency will generally work well if the relevant competition authority has built up a sufficient level of credibility as to its capacity to detect and punish cartel infringements and if cartel members perceive a genuine risk that competition authorities might detect and establish a cartel infringement, even without recourse to a leniency programme. A functioning leniency programme also depends on whether the sanctions for those cartel members (both individuals and companies) that do not qualify for leniency are significant. Ideally, fines should outweigh the potential cartel yields so that they cannot simply be regarded as a “profitable” activity. Within the last 20 years, there has been a worldwide trend to increase fines against companies as well as against individuals (OECD, 2017[15]).

Pro-Comptencia has adopted an internal mechanism to reduce fines in exchange of collaboration,30 which has some similarities with leniency policies as it increases the quality of evidence and makes stronger cases, although not properly a detection tool. This will be examined further in Section 2.4.5.

2.4.2. Dawn raids

Since 2017, Pro-Competencia has only carried out two dawn raids: one related to the cartel sanctioned in the pharmaceutical market (see Box 2.2) and the other related to an ongoing investigation involving public procurement of medicinal oxygen.

The Competition Act allows Pro-Competencia to carry out two types of inspections: (i) announced inspections with the authorisation of the investigated company; or (ii) unannounced inspections (dawn raids) with a search warrant issued by a competent court, which has been the preferred option since it is often more effective for the investigations. Indeed, the previous request for an announced inspection increases the risk of relevant pieces of evidence being destroyed, which otherwise could have helped the prosecution of wrongdoings.

In terms of procedure, the Competition Act requires that authorisations for unannounced inspections are requested in accordance with the Criminal Procedural Code before a criminal court. This seems inconsistent with the powers granted to Pro-Competencia to conduct inspections in relation to administrative infringements and may increase the standard of proof needed for judges to grant the authorisations for administrative dawn raids. Indeed, in the two successful cases mentioned above it was necessary to build a link between the alleged cartel and a suspicious of money laundering and IP criminal offences to seek judicial authorisation for the dawn raids. In practice, the context and the facts of the individual cases may not always allow this kind of adjustments, which can be detrimental for future cartel investigations.

Additional obstacles relate to internal preliminary steps required by the Competition Act for the use of dawn raids: the Executive Directorate, in charge of the investigations in Pro-Competencia, should first request authorisation to the Board of Directors, who according to the Competition Act is the body entitled to access the premises of the undertakings (although this does not happen in practice) and to request the search warrant before the competent judge with the assistance of the Attorney General’s Office.31 A greater separation between investigative and adjudicative powers would seem more aligned to common international practices given the dual system in place in the Dominican Republic, which provides an investigation body (Executive Directorate) and an adjudication body (Board of Directors) within Pro‑Competencia.

To safeguard the constitutional rights of defence, Pro-Competencia carries out dawn raids once the alleged offending parties have been notified of the initiation of a formal investigation,32 although this is likely to undermine the surprise effect, which is a key feature of the unannounced inspections. In any case, in practice, the Executive Directorate notifies the investigated parties of the initiation of the formal investigation just before submitting the court order authorising the dawn raid and just before entering the premises.

Once the dawn raid is in course, the Executive Directorate may search the premises, the properties, and the means of transport of economic agents to gather evidence, with the support of the National Police (Dirección de la Policía Nacional, DPN). The Executive Directorate may also make extracts and copies of books, documents, and accounting records of the investigated parties, which can be collected on paper or electronically.33 In practice, most incriminating evidence in competition cases is found in electronic form, and IT forensic equipment allows gathering electronic evidence in a safe manner, ensuring the source of information and the chain of custody. As Pro-competencia does not have IT forensic equipment, it gathers digital evidence with the help of and using the IT forensic tools of the National Police. While collaboration with National Police is positive, competition authorities should also be able to develop their own IT forensic expertise, including the necessary staff and equipment, to increase autonomy in cartel investigations.

The Competition Act also imposes an obligation of co-operation to inspected parties during inspections and sanctions and/or the use of state force can be used to ensure the effectiveness of the general provision of obligation to co-operate. Although the Competition Act establishes the possibility of sanction in case of non-compliance of this obligation, it re-directs to Article 64 that does not contain any information on sanctions.34

2.4.3. Requests for information

The Competition Act and the Implementing Regulation35 establishes that Pro-Competencia may request firms to provide information, data or documents at any time during the administrative procedure. Information requests can be sent to investigated parties, but also to third parties. Both investigated and third parties are formally obliged by law to reply to request for information,36 although the Competition Act does not provide any fines for absence of a response or a delay in replying. Indeed, only the submission of false information may be subject to fines imposed by Pro-Competencia.37 However, Article 58 of the Competition Act states that those that do not comply with the requests of Pro-Competencia's Board of Directors will be subject to the criminal sanctions provided in the Dominican Criminal Code. Such infringements should be prosecuted by the public prosecutor’s office.

According to the OECD Recommendation concerning Effective Action against Hard Core Cartels, competition authorities must have effective powers to investigate hard core cartels, including the powers to request and obtain information from investigated and third parties, and also to impose sanctions for non-compliance with mandatory requests and obstruction of investigations (OECD, 2019[12]). The same is also relevant for abuse of dominance cases.

In addition, requests for information do not suspend the 12-months period that Pro-Competencia has to complete its investigation, which also negatively affects the effectivity of this enforcement tool in antitrust investigations. More information about the investigation time-limits including statutes of limitation were examined further above in Section 2.3.3.

The Executive Directorate may also interview and record statements from defendants. The Competition Act provides that interviews to investigated parties must be done in the presence of their defence attorney. The minutes of the interview must be signed by the interviewed party or his/her refusal to sign recorded in writing. The Competition Act is silent regarding the procedural rights applicable to interviews conducted to third parties, and the Executive Directorate applies in practice the procedural guarantees observed in the law for investigated parties when recording statements from other parties.

As for the requests for information made to other government entities by Pro-Competencia, these are mainly governed by the collaboration principle enshrined in Article 12 of the Organic Law of Public Administration (Ley Órganica de la Administración Pública, LOAP) and not properly by the Competition Act.

2.4.4. Interim measures

The Competition Act provides that Pro-Competencia can issue interim measures before the adoption of a final administrative decision to ensure the effectiveness of its enforcement powers. Article 64 establishes the general criteria for granting interim measures: (i) to ensure the effectiveness of an eventual sanctioning decision; (ii) if there is no possibility of causing irreparable harm to the parties that will be affected by such measures; and (iii) when their adoption is in accordance with the law. The interim measures are limited to the ceasing of the alleged infringing conduct and the establishment of a guarantee to cover the damages that the interim measures may cause.38

Nevertheless, the Competition Act is not clear regarding who is the competent authority within Pro-Competencia to grant interim measures. The understanding of Pro-Competencia is that the Executive Directorate has such power, and the Board of Directors can review interim measures imposed by the Executive Directorate.39 The first interim measure granted by the Executive Directorate was issued in April 2023.40

In addition, Pro-Competencia, through the Board of Directors, can request the competent court to issue interim measures.41 Interim measures granted by courts are not limited to refrain from acting (negative injunction), and could therefore include a positive injunction (i.e., requiring the parties to act). Although interim measures are usually more useful during the investigation phase, neither the law nor the Implementing Regulation explain the role of the Executive Directorate in the requests for interim measures before courts. In practice, the Board of Directors has requested interim measures before judicial courts with the support of the Executive Directorate. Since 2017, Pro-Competencia has requested interim measures in relation to six cases, but the Judiciary has not granted any of its requests. These procedures lasted from 3 to 7 months, which seem long given that interim measures usually serve to protect imminent and irreparable harm, amongst other requirements that will be examined below.42

According to international practices, interim measures are granted by public authorities or courts with a protective and corrective objective, i.e., providing temporary relief pending the outcome of a case. In addition, interim measures are commonly granted in exceptional circumstances, and they typically require meeting two key conditions: the likelihood of success on the merits of the case and the urgency to prevent harm (OECD, 2022[16]).

The adoption of interim measures is a powerful and intrusive tool. It requires indeed a balancing exercise between an expedited procedure to urgently (and effectively) act to prevent serious and irreparable harm and the rights of defence of the parties involved. Many jurisdictions have put in place interim measures procedures with essential safeguards to preserve such rights. According to the Implementing Regulation, the Board of Directors must establish the administrative procedure for the adoption of interim measures, but this has not yet been established.43

2.4.5. Sanctions, settlements and commitments

In the Dominican Republic, both undertakings and individuals (e.g., legal representatives or directors of an undertaking)44 can be sanctioned for anti-competitive infringements. Article 61 of the Competition Act establishes the following sanctions:

a) Fines from 200 to 3 000 monthly minimum wages for bid rigging offences.

b) Fines from 30 to 3 000 monthly minimum wage for concerted practices and agreements consisting of price fixing, market allocation, output limitation, elimination of competitors or impeding access to market and abuses of dominant position.

c) Fines from 50 to 200 monthly minimum wages for providing false information to Pro‑Competencia.

The Competition Act sets the fines based on minimum wages, which differ across economic sectors in the Dominican Republic, and thus are calculated on the basis of the minimum wage applicable to the sector where the anti-competitive conduct took place.45 According to the Labour Ministry (Ministerio de Trabajo), the average minimum wage in the country was DOP 17 873 (around EUR 300) in January 2023 (Presidencia de la República Dominicana, 2023[17]). In practice, this means that fines are between EUR 9 000 and EUR 900 000, which seem very low particularly for certain markets that have great profits and turnovers.

Although the Competition Act establishes a fine for providing false information to Pro‑Competencia, it does not contain any sanction for failure to reply, late replies nor for the use of incomplete or misleading information, which are common in other jurisdictions and necessary to ensure that the effectiveness of the investigative powers of the competition authority.

The table below compares the maximum level of competition fines for undertakings in some jurisdictions in the region. Such jurisdictions provide for maximum levels of fines based on a percentage of turnover or a combination of the latter with a specific monetary amount. This allows for more proportionality and flexibility when applying sanctions, enabling competition authorities to better consider the size of the company and the impact of the conduct on the market.

Table 2.1. Maximum level of competition fines for undertakings in selected jurisdictions in Latin America

|

Jurisdiction |

Legislation |

Maximum penalty |

|---|---|---|

|

Brazil |

Art. 37 of Law No. 12 529/2011 |

20% of the revenue of the economic group investigated in the economic sector in which happened the illegal conduct. If it is possible to estimate the economic advantage obtained with the anti-competitive conduct, the fine must not be inferior to that. |

|

Chile |

Art. 26 of Decree-Law No. 211 from 1973 (updated in 2016) |

If it is possible to determine the line of products or services related to the illegal practice or the economic advantage obtained with the conduct investigated, the penalties can be alternatively: 30% of the amount sold of the products or services; or double of the economic advantage. |

|

Colombia |

Art. 4, item 15 of Decree No. 2153/1992 (modified by Law No. 1340/2009) |

Up to 100 thousand times the “Tax Unit Value” (UVT), equivalent to approximately COP 4 billion (around EUR 900 000) or 150% of the economic advantage, if it is possible to obtain. |

|

Costa Rica |

Art. 119 of Law No. 9736/2019 |

10% of the total revenue of the investigated company in the previous fiscal year of the penalty imposition. |

|

Ecuador |

Art. 79 of Law of Regulation and Control of Market Power from 2011 |

12% of the total gross revenue of the company or economic group in the previous year of the penalty imposition. |

|

Mexico |

Art. 127 of Federal Law of Economic Competition from 2014 |

10% of the total revenue of the company within the country in the previous fiscal year of the illegal conduct. |

Source: OECD based on public information.

Proportionate fines are critical to deter companies from breaching the law, which should not be perceived as a profitable activity. Ideally, fines should outweigh the potential returns of infringements divided by the probability of detection (Ginsburg and Wright, 2010[18]; Connor and Lande, 2012[19]). If the expected infringement gains are higher than the expected fine, rational companies might neither consider applying for leniency nor abstain from engaging in anti-competitive conduct (OECD, 2019[20]).

To determine the exact amount of a fine, the following criteria should be taken into consideration by Pro-Competencia:46

a) scope and type of the competition restriction;

b) the size of the affected markets;

c) the anti-competitive effects on actual or potential competitors, consumers and users;

d) premeditation and intent;

e) market share of the infringer;

f) duration of the infringement; and

g) recidivism and offender's criminal and infringement record.

In case of recidivism, an additional fine of up to the double of the fine may be imposed. Moreover, in case the infringer refuses to pay, the amount of the fine may be increased by 3% percent each month until the infringer pays the due amount.

In 2017, the Board of Directors adopted a Decision47 explaining how the competition authority calculates one of the elements necessary to estimate the fine, i.e., the damage caused by the anti‑competitive practice (see Box 2.6).

Box 2.6. Methodologies to calculate the damage caused by competition law infringements

In its Decision No. 021-2017, Pro-Competencia indicates that the quantification of the damages caused by an anti-competitive conduct is mainly based on determining what would have happened if the economic agents did not engage in anti-competitive behaviour. This scenario is commonly known as the counterfactual. Since the counterfactual cannot be directly observed, it is necessary to build it. The decision provides for different methodologies to estimate the counterfactual, namely:

Historical comparison in the market, comparing the situation during the period in which the infringement takes place with the situation in the market before the infringement, or after the effects of the anti-competitive conduct have ceased.

Comparison with other geographic markets and product markets where the infringement did not take place.

Difference-in-difference method, which compares the evolution of the economic variable under study (for example, price) in the market affected by the infringement during a given period of time with the evolution of the same variable during the same period in an unaffected market.

Once the counterfactual has been determined, the decision proposes to use different methods to estimate the economic variable that would be used to calculate the damage, for instance: average, median, linear interpolation, regression analysis, simulation models, methods based on costs and financial analysis.

Additionally, the decision recommends analysing other unrelated elements to establish to what extent the damage could be explained by factors other than by the competition law infringement. Elements not related to the conduct and that could be relevant for conducting this assessment include market regulation, costs of inputs and external market shocks, such as inflation.

Source: Pro-Competencia (2017[21]), Decision No. 021-2017, https://procompetencia.gob.do/wp-content/uploads/2020/02/res_021-1720que20aprueba20criterios20determinacion20y20cuantificacion20del20dano1.pdf.

Pro-Competencia’s initiative to provide clarity in the calculation of damage in competition cases is welcome, but it does not tackle the main issue related to the low fines, particularly the low cap for maximum fines in the country (maximum of around EUR 900 000). This would require a change in the Competition Act.

The obligations created by collusive practices sanctioned by Pro-Competencia are automatically null and void.48 Pro-Competencia cannot impose non-monetary sanctions (e.g., director disqualification and bidder exclusion), which are common in several jurisdictions and can be a powerful general deterrence mechanism (OECD, 2022[22]).

Settlements are also an important mechanism for enforcement usually used to shorten the investigation procedure (which saves costs for the public administration) and/or reinforce a given investigation with better evidence (e.g., policies related to reduction of fines in exchange of collaboration). Indeed, many competition regimes around the world offer the possibility to early terminate competition investigations, commonly referred to as settlements and commitments (usually the first applied for cartel cases and the second to abuse of dominance cases, e.g. with a commitment to allow access to an essential facility).

The Implementing Regulation provides for an early termination tool that contains features of both settlement and commitment mechanisms,49 although this tool has never been used in practice: Pro‑Competencia has not yet received any request for settlement nor commitment. This scenario can hopefully change with the enactment of two regulations by Pro-Competencia in 2021, providing a framework for mechanisms related to settlements and commitments.50

Besides being an administrative infringement to be sanctioned by Pro-Competencia (or the sector regulators with competition enforcement powers), cartel conduct is a criminal offence in the Dominican Republic, and it is punishable by a fine and imprisonment from one month to two years, as per Article 419 of the Dominican Criminal Code. Pro-Competencia has no authority to enforce criminal law, which falls to the Dominican public prosecutors.

Programme of Collaboration and Reduction of Fines

In June 2021, the Board of Directors adopted a Decision51 to establish a “Programme of Collaboration and Reduction of Fines”. It provides for the reduction of sanctions in exchange of collaboration during investigations related to collusive agreements, in particular cartels.

The programme provides a marker system in which firms that apply first get a greater fine reduction than firms that apply later. The first applicant will get a fine equal to the minimum level of fines established in the Competition Act for the corresponding type of infringement, while the second and the subsequent applicants will get a reduction between 50% and 70%. The overall conditions to benefit from the a “Programme of Collaboration and Reduction of Fines” are the following:

a) Acknowledgement of participation in the anti-competitive agreement.

b) Provide evidence that is relevant and conclusive to prove the existence of an anti-competitive agreement.

c) Provide evidence that adds value to the investigation procedure, i.e., that the information is new because the Executive Directorate has not had access to it or would never have access to it unless provided by the applicant.

d) Provide the evidence before the closing of the investigation phase.

e) Full, continuous and diligent co-operation during the investigation phase.

f) No evidence of the alleged anti-competitive behaviour must have been destroyed, falsified, or concealed.

g) Keep the request confidential until the Board of Directors issues a decision putting an end to the administrative procedure.

h) Stop the anti-competitive conduct unless otherwise requested by the competition authority.

i) Neither being a repeat offender nor having previously benefited from the programme.

j) Not having forced or threatened other members of the cartel to form part of it.

The Decision also provides the procedural steps and deadlines for submitting and accepting such applications. The programme is sometimes improperly called leniency in the Dominican Republic, although it does not offer immunity to any of the beneficiary firms, and it is not established in the Competition Act.

A firm benefiting from the programme can lose the benefit of fine reduction in the following situations: (i) if it refutes the acknowledged facts; (ii) if it does not comply with the request of the Executive Directorate to verify or to ratify the information provided or the acknowledged facts; and/or (iii) if it destroys, alters or obstructs access to information or evidence.

At the time of writing, this programme has never been used in practice and was being reviewed by Pro-Competencia.

Programme of Cease-and-Desist Commitments

Also in June 2021, Pro-Competencia issued a Decision52 providing a framework for a programme focused on cease-and-desist commitments in the context of early termination procedures. In a nutshell, it requires that the parties admit liability and commit to cease the conduct under investigation and the following requirements should be met:

1. They must effectively solve in a clear and unequivocal manner the competition issues that led to the initiation of the investigation.

2. The remedies can be implemented timely and effectively.

3. The monitoring of the compliance and the effectiveness of the remedies must be feasible and effective.

4. The likely effects of the alleged anti-competitive conduct have not seriously harmed the market and the consumer welfare. For assessing the likely effects of the alleged conduct, Pro-Competencia will take into consideration, among others, the affected market, the duration of the alleged conduct, the number of companies or consumers presumably affected.

The Decision also provides the procedural steps and deadlines for submitting and accepting such applications.

The investigations can be resumed if, during the one-year monitoring period: (i) there is a material change in any of the facts or data that constituted the essential elements of the decision; (ii) the conditions of a remedy have been breached; or (iii) the early termination decision was based on false information. If Pro-Competencia reinitiates an infringement investigation, the undertakings could be sanctioned in accordance with the rules applicable to recidivists if the same conduct that motivated the adoption of the early termination decision is established. Moreover, an economic operator can request to the Board of Directors a review of its remedies.

At the time of writing, this programme had never been used in practice and was also being reviewed by Pro-Competencia.

2.2. Judicial review

Pro-Competencia’s infringement decisions against anti-competitive and unfair competition practices may be reviewed by administrative courts. Parties may appeal against Pro-Competencia’s decisions before the Superior Administrative Court (Tribunal Superior Administrativo, TSA). During the proceedings before the TSA, the public interest is represented by the Administrative Attorney General and Pro-Competencia acts as a defendant.53

Decisions of the Superior Administrative Court may be subject to appeal on points of law (recurso de casación) before the Supreme Court of Justice (Suprema Corte de Justicia), the highest jurisdictional body in the Dominican Republic.54

At the time of writing, the Superior Administrative Court had reviewed the two infringement decisions that Pro-Competencia had adopted: the cartel decision was upheld, while the abuse of dominance decision was annulled. These judgements do not contain discussions regarding substantive competition law matters, but rather focus on procedural aspects. Both judgements have been appealed before the Supreme Court of Justice, and final decisions were still pending.

Dominican judges in charge of reviewing competition infringement decisions have an administrative and constitutional law background and are not specialised in competition law. Some judges received competition law training in 2008, when the Competition Act was formally adopted, but since then judges have not received further capacity building on the topic.

One of the criteria for the promotion of judges in the Dominican Republic is capacity building. The National School for the Judiciary (Escuela Nacional de la Judicatura, ENJ) offers specialised training for judges and other officials in the national judiciary system. The ENJ encourages new and innovative learning methodologies and offers in-person and online courses through its virtual platform. During the fact-finding mission, the Judiciary indicated that the ENJ chooses the topics of training based on surveys conducted among the judges, but it would also be open to training proposals from other government entities, such as Pro-Competencia.

Reviewing competition enforcement decisions requires a good understanding of competition law, including its legal concepts and economic principles. Ideally, judges reviewing competition decisions should have experience and expertise in the interpretation of competition law to balance two of their main functions, i.e., ensuring due process and applying, when appropriate, substantive economic principles into their reasoning (OECD, 2016[23]).

According to an ICN survey conducted during 2013-2014 with 49 jurisdictions, the activities that have proven most successful to increase the courts knowledge on technical economic issues are tailor-made capacity building activities, such as conferences, seminars, workshops and training programmes (OECD, 2015[24]).

International organisations may play a key role in providing, supporting and facilitating capacity-building initiatives, such as technical assistance, training programmes, seminars or expert meetings, among others (OECD, 2016[23]). Box 2.7 shows an example of a capacity-building initiative for judges organised by the OECD in the region.

Box 2.7. Capacity-building for judges organised by the OECD Regional Centre for Competition

In July 2022, the OECD Regional Centre for Competition in Latin America organised a Workshop on “Judicial Review of Antitrust Enforcement”. The workshop covered the central role that the Judiciary plays in competition policy, particularly in relation to cartel and abuse of dominance cases. It gathered 332 participants from 19 jurisdictions in Latin America and the Caribbean (among which the Dominican Republic) including competition officials and judges.

During the workshop, the following issues were discussed by experts: dawn raids; interim measures; the standard of proof and the use of indirect evidence; judicial review of fines and other sanctions; and the role of economics and economists. Finally, judges and courts shared their country experiences with the audience.

Source: OECD (2022[25]), Annual Report of Activities: Regional Centre for Competition in Latin America, https://www.oecd.org/daf/competition/oecd-rcc-lima-annual-report-2022-en.pdf.

2.3. Private enforcement

Anti-competitive and unfair competition practices may give rise to different types of civil actions. Civil damage claims are possible in relation to both anti-competitive and unfair competition practices. In addition to damage claims, the parties affected by unfair competition practices may bring civil actions to request for injunctive relief.

Regarding anti-competitive conduct cases, Article 63 of the Competition Act provides that only undertakings that have proven, during the administrative proceedings, to have suffered harm from the anti-competitive conduct are able to claim damages. Neither individuals nor undertakings that have not participated in the administrative proceedings or have participated but have not demonstrated any harm from the investigated conduct are, therefore, eligible to claim compensation for damages before a civil judge. As for unfair competition cases, both individuals and legal entities that have suffered damages may bring civil damage claims.

Competition damage actions are governed by civil law and filed based on the principle of extracontractual civil liability (tort liability), established in Articles 1382 et seq. of the Dominican Republic Civil Code (Código Civil de la República Dominicana).

The Competition Act does not mention whether a final decision of Pro-Competencia is a condition for bringing a damage action in anti-competitive conduct cases. Thus, in principle both follow-on and stand-alone actions would be possible. However, it is unclear what would be the probatory value of Pro-Competencia’s decisions in follow-on actions.

In unfair competition cases that are being investigated by Pro-Competencia, only follow-on actions are possible. As explained in Section 3.2.2, parties affected by unfair competition practices may choose to launch a judicial proceeding by bringing an action before a court or trigger an administrative investigation by lodging a complaint before Pro-Competencia. If the party chooses the latter alternative, it can only claim damages when the matter has been decided by the last judicial instance.

Damage actions regarding unfair competition practices seem to be more developed in the Dominican Republic, while civil actions resulting from anti-competitive conduct are unused. Indeed, no information has been provided on any competition damage claim case.

Main findings

The main findings on competition law enforcement in the Dominican Republic include:

In the field of merger control, the telecommunications regulator analyses the competition effects of the transactions, while the electricity and financial sectors only focus on regulatory aspects. The rest of the economy is not subject to merger control enforcement.