The Philippines has set a goal to achieve a 35% share of renewable energy in its power generation mix by 2030 and 50% by 2040, up from 22% currently. In parallel, the Philippines aims to reduce its economy-wide energy intensity by 3% over the same period. Achieving these targets will require unlocking USD 337 billion in cumulative investments to 2040. Such investments can deliver strong benefits for the local communities and the overall economy of the Philippines. This includes contributions to the GDP with taxes and additional economic activity, the creation of long-term highly qualified jobs, and the restructuring and development of rural and coastal communities. Ensuring a sound policy framework and investment environment will be essential to mobilise domestic and foreign sources of capital to a level commensurate with the country’s clean energy ambitions.

Clean Energy Finance and Investment Roadmap of the Philippines

1. Introduction: key trends and market developments for renewable energy and energy efficiency and conservation in the Philippines

Abstract

The Philippines has increased efforts to decarbonise its economy in recent years. The country submitted its first Nationally Determined Contribution (NDC) in April 2021, committing to a 75% emission reduction during the period 2020 – 2030, against a business-as-usual scenario. Of this target reduction, 2.71% is unconditional and 72.29% is conditional upon resources provided from developed countries (NEDA, 2023[1]). While the Philippines does not have a net-zero greenhouse gas (GHG) target, its conditional NDC ambition is considered consistent with the 1.5°C limit under the Paris Agreement (Climate Analytics, 2022[2]).

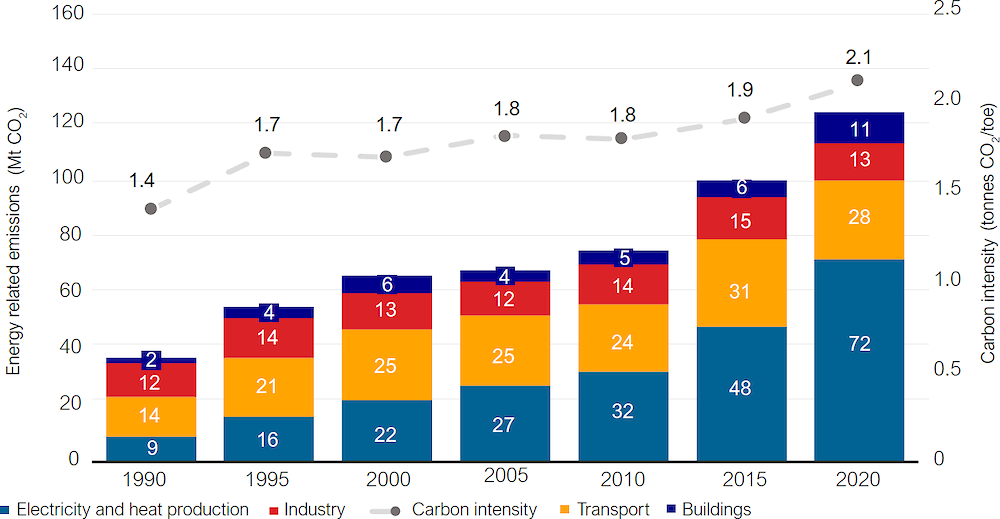

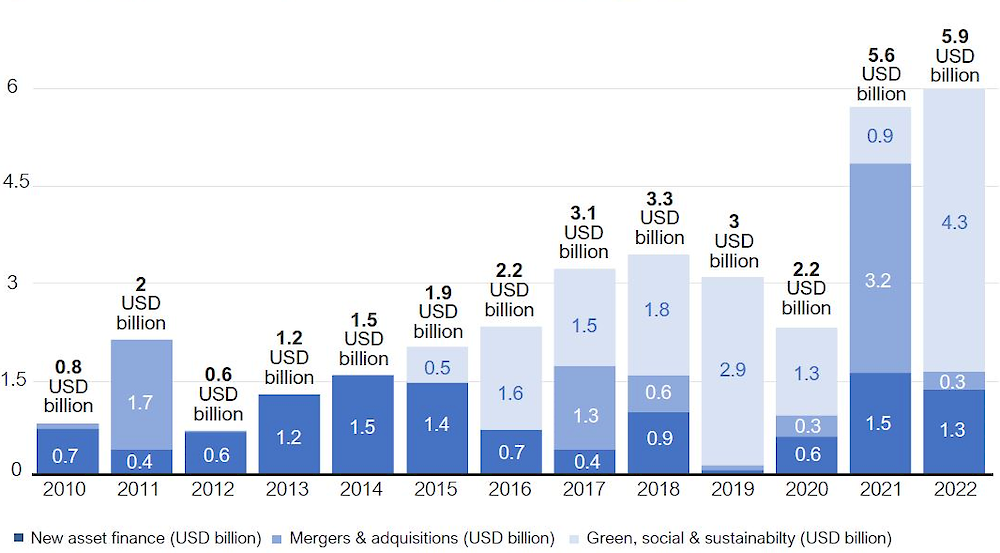

The challenge for the Philippines will be to balance the need for emissions reduction with the need to deliver on economic growth (see Figure 1.1). Philippines is ranked as one of the fastest growing developing markets and the outlook remains positive (S&P Global, 2023[3]). Current government policies focus on high growth and steering the country towards an upper middle-income economy in the coming years (NEDA, 2023[1]). This growth will bring benefits, but it will also put pressure on the power sector where energy demand is forecasted to increase by 7% every year to 2040 (DOE, 2020[4]).

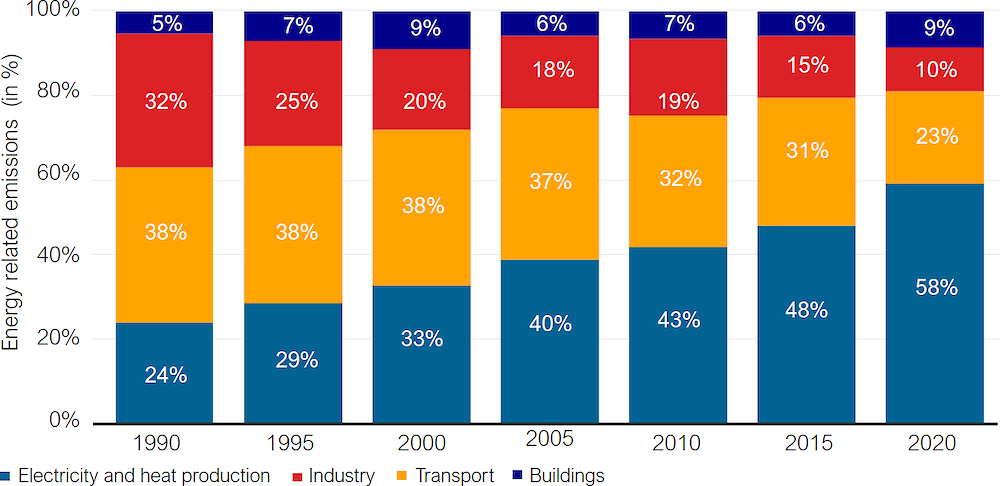

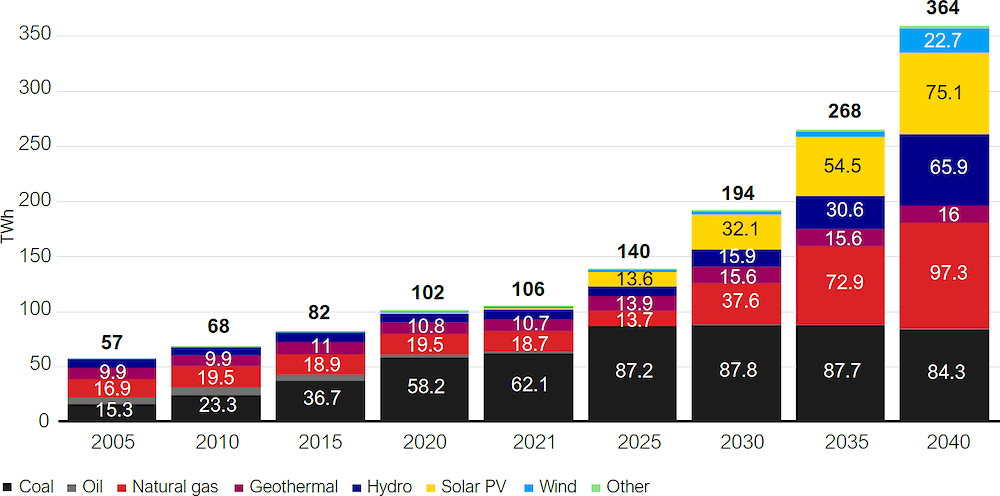

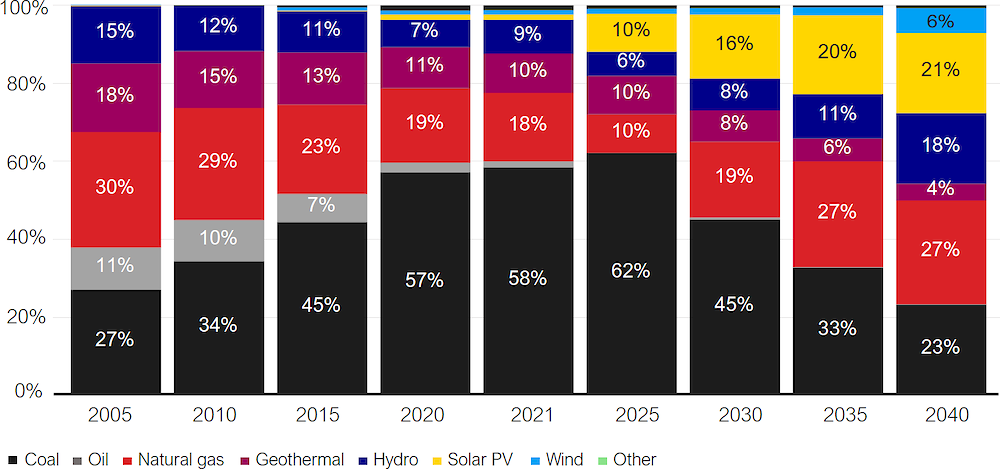

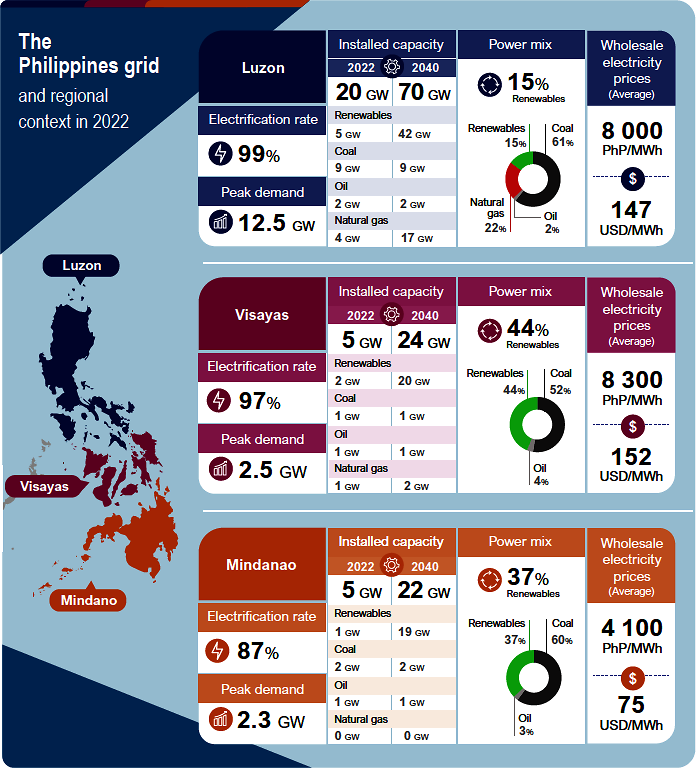

To stay under a 1.5°C compatible pathway, the Philippines power sector, which is currently 58% of country’s overall emissions (see Figure 1.2), would need to be a driver for emissions reduction (Climate Analytics, 2022[2]). Renewables are expected to fill in a big gap in the low carbon supply mix. The National Renewable Energy Program (NREP) 2020-2040 includes a non-binding interim target of 35% renewable energy in its generation mix by 2030 and 50% by 2040, more than double today’s levels (DOE, 2021[5]).

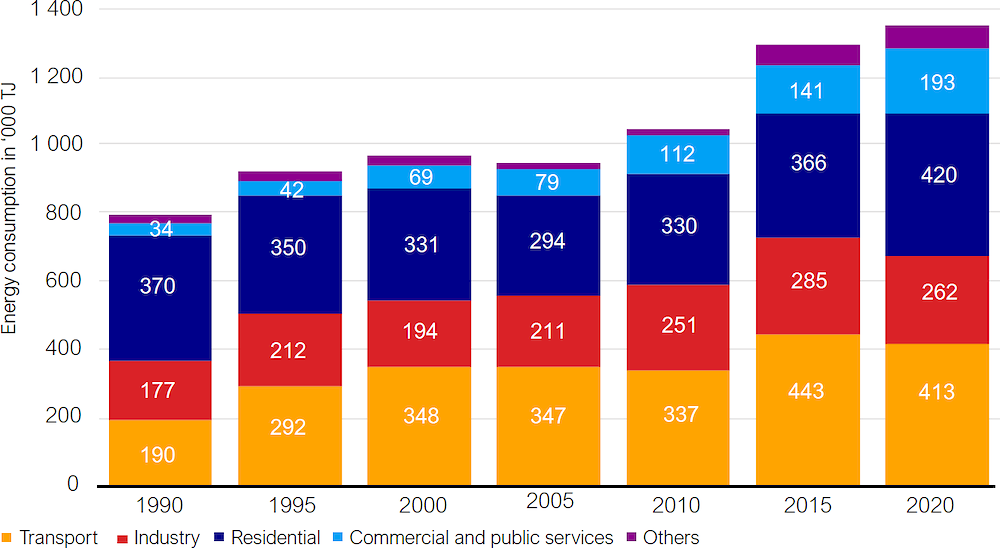

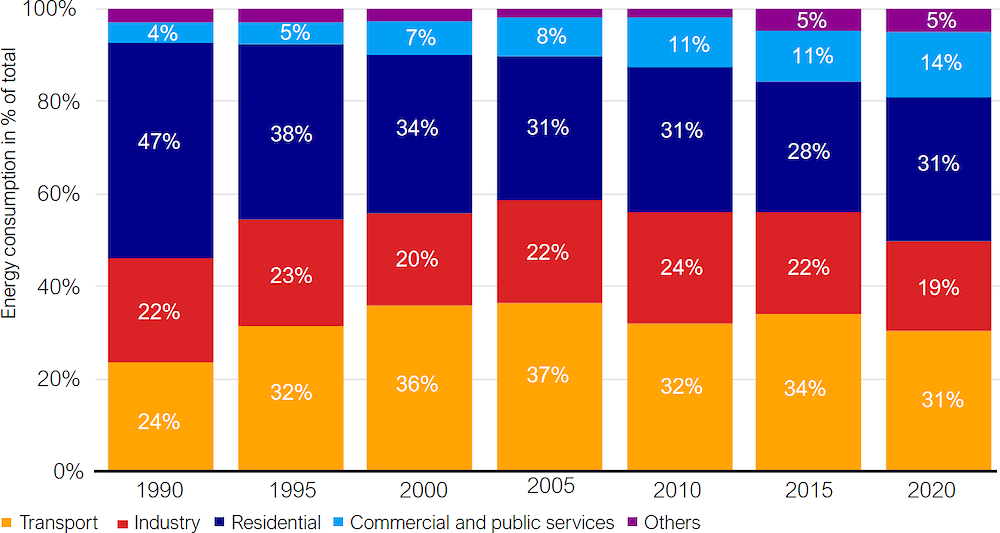

Alongside the power sector, energy efficiency will also play a key role towards the country’s emission reduction goals. Under its first Energy Efficiency and Conservation Plan 2017-40, the Philippines targets a decrease in final energy consumption between 1.2% and 1.9% per year for the residential and commercial sectors (which includes public buildings).

Figure 1.1. GDP growth and CO2 emissions

Source: Actuals data from IEA and World Bank statistics 2022, 2030 GDP estimates from S&P 2023, 2030 CO2 emissions from UN

Figure 1.2. Energy related emissions in the Philippines (in Mt CO2)

Figure 1.3. Energy related emissions in the Philippines (in %)

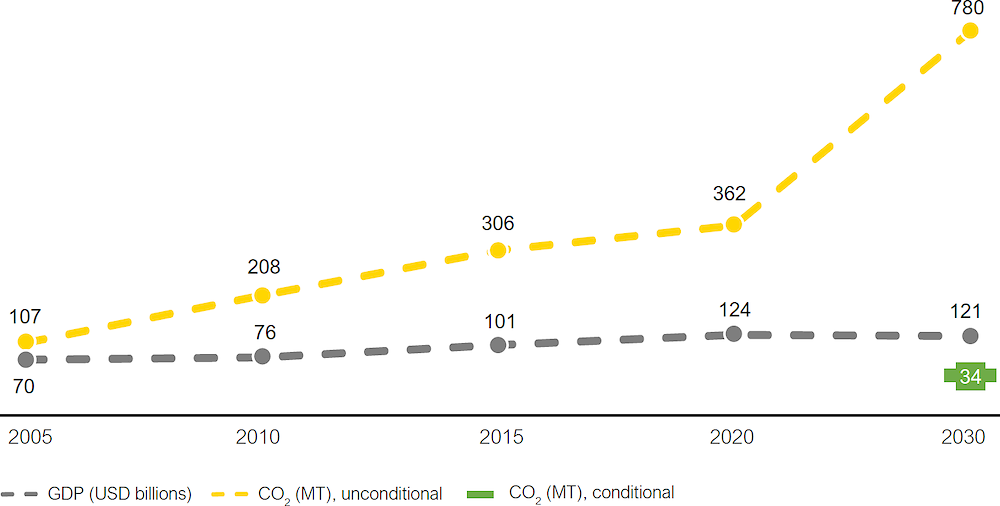

Figure 1.4. The Philippine grid and regional context

Source: Authors’ compilation from IEOMP, 2023; DOE, 2023; IEA Real Time Electricity Tracker, 2023

Box 1.1. The importance of the geographical context in the Philippines

The Philippine power market and its transmission infrastructure need to be considered in the context of the country’s unique geography and archipelagic system. A configuration of more than 7,200 islands and the lack of a centralised national grid creates significant regional disparities in quality of service, electrification rate, development stage, and supply/demand management leading to local hotspots, congestion issues and difference in electricity prices (NGCP, 2022[6]). The three main regions in the Philippines are Luzon, Visayas and Mindanao, which all have their separate sub-grids. The grids of Luzon and Visayas islands are interconnected and operate under a unified wholesale electricity market. The island of Mindanao is expected to integrate in the national network in the course of 2023, under the “One Grid 2020” project (NGCP, 2023[7]). It currently operates under its separate wholesale electricity market. Outside the three main grids, transmission infrastructure challenges remain in more than 120 small islands and isolated power grids (Power Philippines, 2023[8]). These regional differences will be reflected, where relevant, in the sections of Chapter 1.

The Philippine power sector under the current National Renewable Energy Programme (NREP) 2020-2040

The three major power sources in the Philippines are coal, renewables and gas. Almost 60% of the electricity supply in the country comes from coal, the largest generation source in the last 20 years. Renewables supply 22% of electricity in the country, but their share has been decreasing over the years. Gas fired power plants provide 18% of electricity supply.

In recent years, the Philippine power sector has been facing concerns over security of supply and affordability, compounded by climate hazards and technical grid issues. In 2021, a total of 107 million consumer-hours were lost to power outages, 10% higher than the record set in 2015 (Philippines Institute for Development Studies, 2023[9]).

The Philippine power sector has become increasingly dependent on fossil fuel imports for its power needs. Over half of the country’s primary energy supply is imported (PIDS, 2018[10]). Coal imports have been increasing on average 5% year-on-year in the last three years to reach 30 million tons in 2021 (DOE, 2023[11]) and weigh on the country’s annual trade deficit (ILS, 2021[12]). With the depletion of the only gas field in the country, natural gas also faces supply related challenge. As of 2025, all the 10 GW of existing and upcoming gas power plants risk running entirely on imports. This will further expose the country to price volatility and competition for resources in international Liquefied Natural Gas (LNG) markets (IEA, 2023[13]).

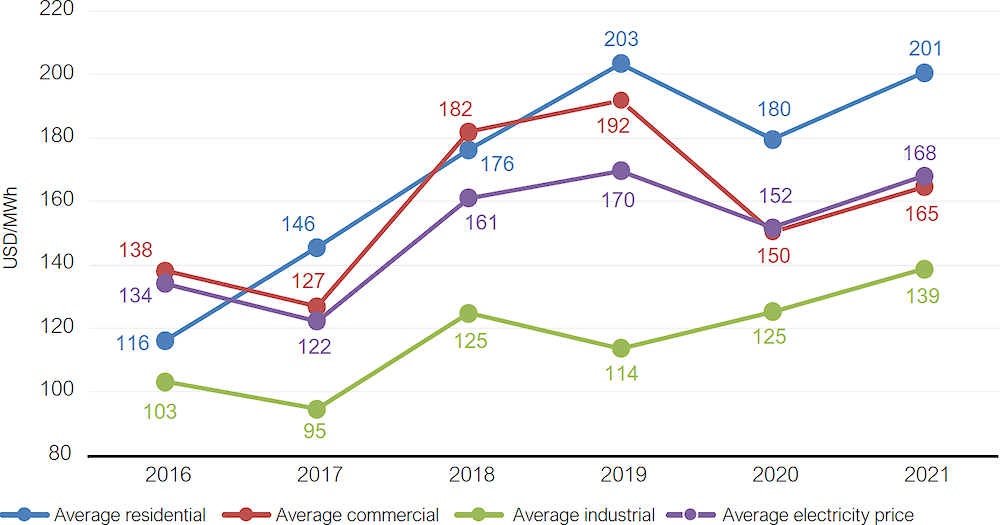

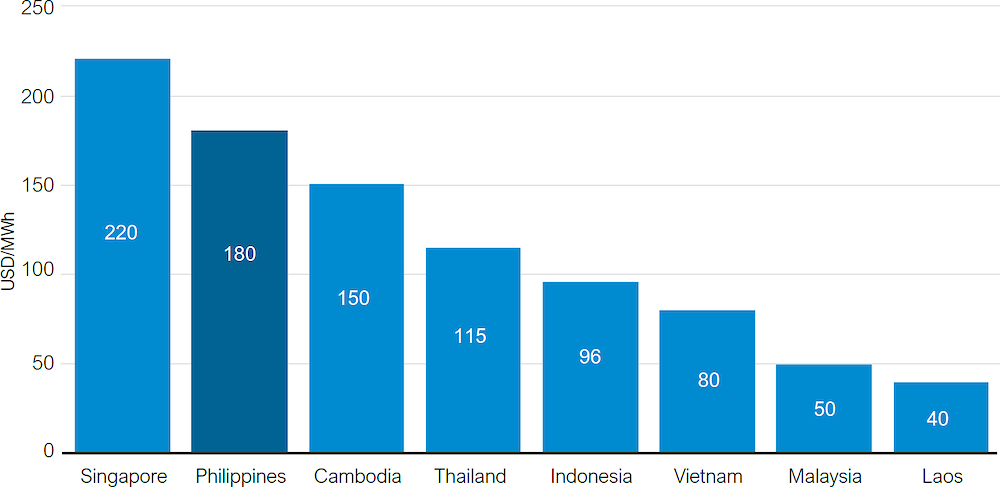

Closely linked to the security of supply, are the high electricity prices in the Philippines despite the country having abundant renewable energy potential. The high reliance on fossil fuel imports and a fragmented grid infrastructure that presents challenges for renewable energy integration, have contributed to some of the highest electricity prices in the Philippines (IEA, 2022[14]), compared to other Southeast Asian countries (see Figure 1.6) (Climatescope, 2023[15]). Within the Philippines, issues of affordability and customer capacity to pay can be critical in diesel-based, off-grid areas with some of the most vulnerable population. Inadequate fuel resources to cover demand in these areas can result in the inevitable decision to reduce the service (NPC, 2023[16]).

Figure 1.5. Average electricity prices in the Philippines

Figure 1.6. Average household electricity prices in Southeast Asia

To address the security of supply and affordability concerns, the DOE launched the National Renewable Energy Program (NREP) to diversify the power generation mix in the Philippines through a range of low carbon sources by 2040 (DOE, 2021[5]). Under the NREP 2020-2040, the DOE aims for 35% renewables target in the power generation mix by 2030 and 50% target by 2040. To achieve this target, a total of 75 GW of additional renewable energy capacity (10 times the current level) is required by 2040 (DOE, 2021[5]).

Figure 1.7. Generation mix under NREP 2020-2040 (in TWh): 50% RE scenario

Figure 1.8. Generation mix under NREP 2020-2040 (in %): 50% RE scenario

Figure 1.9. Installed capacity under the NREP 2020-2040 based on 50% RE generation in 2040

Note: Peak demand excludes 25% reserve rate. NREP not yet updated with offshore wind potential.

Source: DOE, 2023: NREP 2020 – 2040

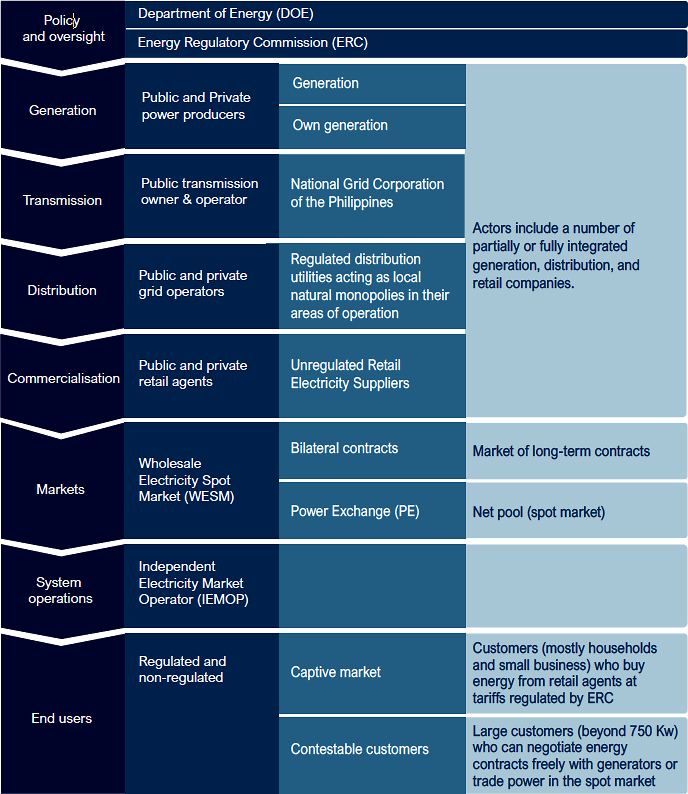

The Philippines electricity market and institutional context

The Philippines has one of the most liberalised power markets in Southeast Asia (OECD, 2023[17]). The comprehensive Electric Power Industry Reform Act (EPIRA) was enacted in 2001 to restructure the power sector and establish an independent regulator to oversee the market, the Energy Regulatory Committee (ERC). The legislation unbundled generation, transmission, and distribution of electricity, though some cross-ownership can exist between generation and distribution businesses within limits set by the ERC (PIDS, 2018[10]).

Independent Power Producers (IPP) provide most of the generation. For rural areas not connected to the main grid, the mandated electricity provider is the government-owned National Power Corporation (NPC). The Government owns all the transmission assets through the National Transmission Corporation (TransCo), but the operations are managed by the grid concessionaire National Grid Corporation of the Philippines (NGCP), a 40% Chinese owned enterprise. Distribution utilities own and operate the distribution network, where qualified customers can choose their supplier and source of power under the various regulations guaranteeing open access (PIDS, 2018[10]).1

Privatisation programmes that followed EPIRA resulted in the creation of wholesale and retail electricity markets. Even though generation in the wholesale market is competitive, most of the electricity (~85%) is traded over the counter (OTC) via bilateral contracts in the form of power supply agreements (PSAs) with a duration of 10 to 25 years (DOE, 2022[18]). The terms are decided privately between the generator and the distributor, except for contracts for the retail captive market. The ERC reserves the right to check the compliance of these contracts with a least-cost approach obligation that follows a competitive selection process (CSP) (World Bank, 2021[19]). The Wholesale Electricity Spot Market (WESM) is the marketplace for buying or selling capacity that is not covered by PSAs.

The opening of the market allowed for new players to enter, yet competition remains limited. There are about 30 independent power producers, but almost 60% of the national installed capacity is concentrated on the balance sheets of the three main players: San Miguel Energy Corp (22% market share), First Gen (17%) and Aboitiz Power (15%).

Similarly, the distribution services sector has over 150 market players, but the majority of operations is concentrated with Meralco (70% market share), mostly in the Luzon grid. The remaining 40% market share consists of a few regional players and over 100 consumer-owned on-grid and off-grid electric co‑operatives, which play an important role in serving the archipelagic island configuration. Regional players include VECO – the largest utility in the Visayan grid and the second largest in the Philippines, and Davao Light and Power – the largest utility in the Mindanao grid (DOE, 2023[20]).

To ensure that there will be no monopoly in power generation, the government has enforced market share limits for generators. These limits stand at 25% market share of the national installed generating capacity and 30% market share in any of the three main grids (ERC, 2022[21]).

Figure 1.10. Overview of the Philippines power market and institutional context

Source: OECD Clean Energy Finance and Investment Mobilisation, 2023

Overview of relevant policies, legislation, and regulation in the Philippine energy sector

The Philippines has taken action to reduce reliance on fossil fuels, despite not having a definite phase-out timeline.

In 2020, the Philippines introduced a ban on new coal power plants, but already approved projects will go through and the Philippines expects another 2.3 GW of new coal capacity to come online by 2027 (IEA, 2022[14]). Some of the early projects have been in operation since 1982 but overall, the current fleet is estimated to have 13 years of operational life remaining. The private sector is already acting on coal asset divestments. As of the first quarter of 2023, two divestments have been announced from two different coal power plants, including both domestic and international investors.2

In 2018, the Philippines introduced higher fuel excise taxes as part of a broader legislation on Tax Reform for Acceleration and Inclusion (TRAIN). To date, this is the only form of carbon pricing available in the Philippines (PIDS, 2018[22]). Meanwhile, all forms of fossil fuel subsidies had already been removed via the industry deregulation through EPIRA (Climatescope, 2023[15]).

In parallel, the Philippines has also taken action to support low carbon generation. In April 2023, an executive order issued by the President, mandates a policy and administrative framework for offshore wind development in the Philippines, including harmonisation in the Energy Virtual One-Stop Shop (EVOSS) (DOE, 2023[23]). This complements already existing measures under the Renewable Energy (RE) Act of 2008, the backbone of the country’s strategy for renewable energy deployment (IEA, 2017[24]).

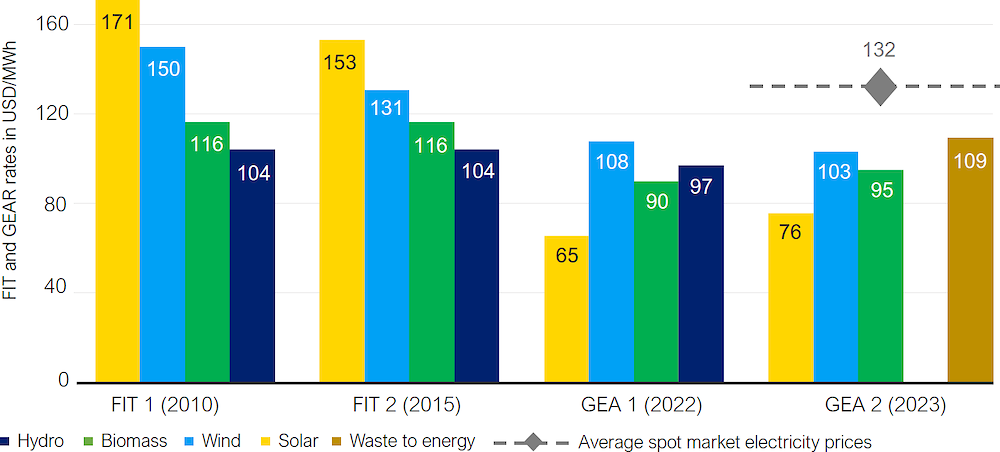

Feed in Tariff (FIT) was one of the early measures introduced under the Act. It supported around 1.4 GW of new renewable energy capacity installed. The FIT was discontinued in 2019, with the exception of run-of-river hydro, a technology still eligible for the tariff. Renewable energy sources still enjoy priority dispatch even after the FIT suspension. The tariff is funded by a fixed charge on all electricity consumers (the FIT-All fund managed by TransCo), except for those customers eligible for subsidies (Climatescope, 2023[15]).

In 2017, the Renewable Portfolio Standards (RPS) policy kicked in to guarantee a revenue stream for the industry by mandating distribution utilities and electricity suppliers to procure or produce a minimum supply generated from renewable energy. Currently this stands at 2.52%, subject to annual revisions where an incremental growth more than 1% on the previous year is foreseen to meet targets and grow the renewable energy market (DOE, 2017[25]).

The Green Energy Auction Programme (GEAP) was introduced in 2021 to help the government achieve its targets, with auction rounds expected to be held annually. The current auction design is organized by technology bands per region, with specific regional targets for hydropower, biomass, solar and wind energy. The first auction was held in June 2022 and awarded almost all the auctioned capacity, a total of 2 GW of renewable energy. The Energy Regulatory Commission (ERC) sets the ceiling price (GEAR – Green Energy Auction Reserves). The winners benefit from 20-year power supply contracts at the awarded strike price, the Green Energy Tariff (GET), which is paid by the FIT-All fund (DOE, 2021[26]).

Building reliable power systems requires solutions beyond the generation side. As such, the other two measures in the RE Act focus on consumers and the end user more broadly. The Net Metering Programme (NMP) incentivises distributed generation by enabling end users to install systems up to 100 KW for own consumption and the ability to sell the surplus power to the grid (DOE, 2023[27]). The Green Energy Option Programme (GEOP) gives end users, with average peak demand of 100 KW, the option to choose renewable energy sources for their supply (DOE, 2023[28]).

In addition to the sector specific policy instruments, the RE Act offers a zero-rated VAT generation charge and a tax exemption for the carbon credits. Renewable energy developers also benefit from a duty-free importation and special realty tax on equipment and machinery that will be used in building the power plant. These incentives are complemented with a seven-year tax holiday on corporate income, followed by a reduced corporate tax rate thereafter. The general eligibility requirements and screening lies with the Department of Energy (DOE) and the Board of Investments (IEA, 2017[24]).

It should be noted that the measures of the RE Act have several elements that have made the Philippines an attractive market in Southeast Asia. These include:

the inflation indexed FIT

a transparent degression FIT rate to reflect technological advances in cost reductions

and more recently the launch of market-based measures such as auctions and the Renewable Energy Market, which is an important tool for the certificate-based tracking of procured power.

Despite this, the Philippines has only added 3 GW of renewable energy sources in the 14 years since the introduction of the RE Act (DOE, 2022[29]).

Stakeholder consultations by the OECD highlighted delayed implementation of the initial measures, liquidity issues on the FIT fund’s allowance and bottlenecks on grid infrastructure, including smart meter roll-out, as some of the reasons leading to the rather low renewable energy capacity additions (relative to 2030 and 2040 targets).

Investors also highlighted issues with the competitive selection process (CSP) rules that demand distribution utilities to contract electricity using a least-cost approach. Although a welcome development, the current CSP requirements to classify technologies by mode of operation (baseload, mid-merit, peak) could limit access of variable renewable projects and thereby contravene the CSP’s technology neutrality principle. Moreover, they lock power generators and distribution utilities in rigid long-term contracts with very few options to hedge against financial losses (or benefit from high prices) resulting from price volatility. This is reflected in continuous renegotiation of the contractual terms, including prices, which contradict the CSP principles (Barcelona, 2023[7]).3

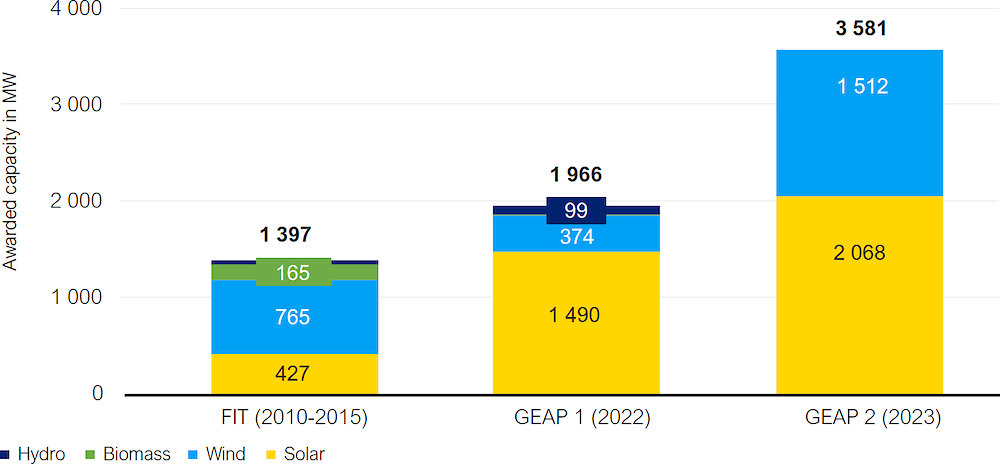

Box 1.2. The FIT and GEAP programmes in the Philippines

The Philippines has transitioned from FIT towards competitive allocation of renewable energy capacity. The country so far has held two auction rounds in 2022 and 2023 respectively. The first auction in 2022 awarded almost all the auctioned capacity, whereas the second auction round in 2023 was largely undersubscribed. Only 3.6 GW of wind and solar PV technologies were awarded, compared to 11 GW offered. This raises questions on the economic viability of the tariffs set by the ERC, supply chain restrictions in global energy markets, delivery timelines for awarded projects and timely access to the transmission grid.

Table 1.1. Summary of FIT and GEAP programmes in the Philippines

|

|

Feed in Tariff |

Green Energy Auction Programme |

Other design features of FIT and GEAP |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

Total |

2010 |

2015 |

2022 |

2022 |

2023 |

2023 |

Tenure |

Dispatch |

Price regime* |

|

|

Awarded capacity (MW) |

FIT-1 Rate PHP/KWh (USD/KWh) |

FIT-2 Rate PHP/KWh (USD/KWh) |

Awarded capacity (MW) |

GEAR PHP/KWh (USD/KWh) |

Awarded capacity (MW) |

GEAR PHP/KWh (USD/KWh) |

|||

|

Solar |

427 |

9.7 (0.17) |

8.7 (0.16) |

1,490 |

3.7 (0.07) |

2,068 |

4.3 (0.08) |

20 |

Must |

Fixed |

|

Wind |

765 |

8.5 (0.15) |

7.4 (0.14) |

374 |

6.1 (0.11) |

1,512 |

5.8 (0.11) |

20 |

Must |

Fixed |

|

Biomass |

165 |

6.6 (0.12) |

6.6 (0.12) |

3 |

5.1 (0.09) |

- |

5.4 (0.1) |

20 |

Priority |

Fixed |

|

Hydro |

40 |

5.9 (0.11) |

5.9 (0.11) |

99 |

5.5 (0.1) |

na |

na |

na |

na |

Fixed |

|

12-month rolling average of spot market electricity prices in the Philippines in 2023 stands at 7.5 PHP / KWh or 0.14 USD / KWh |

||||||||||

|

*Projects subject to FIT are applicable to a degression rate of 6% from Solar PV technologies, applicable after year one from effectivity of FIT, and 0.5% for the rest of the technologies applicable after year two from effectivity of FIT. |

||||||||||

Figure 1.11. Awarded capacity under the FIT and GEAP programmes in the Philippines

Source: DOE, 2023

Figure 1.12. Tariffs set by the ERC under the FIT and GEAP programmes in the Philippines

Source: Author’s compilation from Simmons & Simmons, 2016; Philippines Institute for Development Studies, 2018; DOE, 2023; TransCo, 2023

Transmission assets and grid infrastructure in the Philippines

The transition to a liberal market resulted in higher electrification coverage in the Philippines. The national average stands at 95.5%, albeit with differences between the three main power grids in the country (see Box 1.1). Outside the main grids, transmission infrastructure challenges remain in more than 120 small islands and isolated power grids (Power Philippines, 2023[8]).

As renewables begin to play a greater role in generation, future spending on grids will be needed to ensure a balanced and secure power supply. In the latest development plan, the NGCP has received over 7 GW of connection requests, mostly in the Luzon region. There are another 35 GW of prospective projects in the pipeline that haven’t yet reached financial close. The country’s peak demand in the last two years has been around 15 GW but this is expected to quadruple by 2040 (NGCP, 2022[6]).

During OECD stakeholder consultations, investors noted that the current grid connection planning may not be well suited to support the renewable energy market. Under the current planning, grid owners and operators are required to include requests for connection facilities in their annual development plans prior to building the connection line for a power plant. This means that it may take over a year to receive (or not) a grid connection permit, adding uncertainty to the development and construction of renewable energy projects as financing will not be possible without a grid connection approval.

The Competitive Renewable Energy Zone (CREZ) policy was introduced to overcome some of these challenges, notably to align the grid planning and development in areas that optimise the use of the country’s renewable resources. The CREZ identifies 25 candidate zones and their associated transmission projects including extensions and upgrades of transmission lines as well as substations and island interconnections (DOE, 2020[30]). These are now adopted in NGCP’s latest transmission development plan 2022 – 2040 (NGCP, 2022[6]).

As part of a smarter energy system, DOE and NGCP are also looking at battery energy storage (BESS) to support the integration of more renewables in the grid. Long duration storage can be deployed relatively quickly and serve as backup supply in the event of power interruptions, storage for curtailed power or a dispatchable resource to enhance grid flexibility. In the latest transmission development plan 2022 – 2040, the DOE has identified a total of 2.1 GW storage capacity across the country, of which 450 MW is intended as primary reserve (NGCP, 2022[6]).

Island interconnections feature in most of the sectoral development plans (such as transmission development plans (TDP), island interconnection development plans (IIDP), Missionary Electrification Development Plan (MEDP)). But these plans fall short of providing detailed investment needs, stakeholder mapping or an implementation schedule. More than 2200 km of submarine cable and investments of over USD 3 billion could be needed to interconnect all island grids in the Philippines (Berthau and Cader, 2019[31]). Despite the potential of island interconnections in reducing the power generation costs, these projects may not reach the market in the near term considering the high investment costs.

In 2022, the government enacted a law to promote smart micro-grids for electrification in unserved and underserved areas that will need to be designated by the DOE. The DOE estimates around 900 unserved areas in the country but the official list is yet to be published for the market to launch. Experience from the MEDP in the last six years has shown a lack of unified approach and fragmented implementation at national level (DOE, 2021[32]).

Overview of the potential and policies for energy efficiency and conservation in the Philippines

With a fast-growing population and economy, the Philippines’ energy demand is projected to increase by 7% annually to 2040 under a business-as-usual scenario (DOE, 2020[4]). The residential, commercial and public services are almost half of the total final energy consumption (IEA, 2023[33]). Ensuring an efficient use of energy through energy efficiency and conservation measures, can play a key role in limiting energy‑related emissions as well as reducing future energy needs (DOE, 2017[34]).

Figure 1.13. Share of total final energy consumption in the Philippines

Figure 1.14. Share of total final energy consumption by sector in the Philippines

To promote energy efficiency in the country, the Department of Energy (DOE) implemented the Republic Act No. 11285 or the Energy Efficiency & Conservation (EE&C) Act in 2019, which covers the residential, industry, commercial and transport sector. The act notably requires the mandatory labelling of products, devices and equipment with the DOE in charge of energy label issuance and its enforcement, monitoring and verification within the local market. Pursuant to the EE&C Act, energy efficiency labels and minimum performance standards cover certain retail household products (room air-conditioners, refrigerators/freezers and lamp ballast). Equally, the EE&C Act encourages all new buildings to be “green buildings” – i.e. to comply with the minimum requirements specified in the 2020 DOE Guidelines on Energy Conserving Design of Buildings. To encourage the adoption of energy efficiency solutions, the act allows for the use of fiscal incentives.4

Furthermore, the EE&C Act requires consumers (with an annual consumption above 100,000 kWh) to submit EE&C plans and annual reports, perform energy audits and obtain ISO certifications, as well as hire technical complement to monitor and manage power consumption, among others. Important action has also been taken for public buildings. The Government Energy Management Program (GEMP), which is in place since 2004, is the government-wide program which aims to reduce the monthly energy and fuel consumption of the public sector by at least 10 %, benchmarked against average consumption in 2004 and 2005. With the passage of the EE&C Act, the GEMP covers the whole government sector consisting of the legislative branch, national government agencies, judicial branch, local government units (LGUs), foreign service posts, government-owned and -controlled corporations (GOCCs), constitutional commissions and state universities and colleges. Likewise, the EE&C Act created the Inter-Agency Energy Efficiency and Conservation Committee (IAEECC) to provide strategic direction in the implementation of the GEMP and to evaluate and approve Government Energy Efficiency Projects (GEEPs). Further, it also mandates the LGUs to develop and implement Local EEC Plans that are consistent with the national development plan.

Much like the 2008 RE Act, the 2019 EE&C Act also proposes a number of incentives for energy efficiency projects, the implementation of which is still pending. These incentives include investment support for up to 10 million pesos (around USD 0.18 mln) towards total investment cost, for both new and expansion‑related projects. Moreover, the classification of energy efficiency as both Tier-2 and Tier-3 under the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act also makes these projects eligible for income tax holidays (5-7 years) and duty-free equipment importation. Non-fiscal incentives like Excellence Awards are being given to several categories of establishments (including government) to recognise outstanding performance on energy efficiency.

Investment policies and renewable energy finance trends

Investment policies in the Philippines

In 2020, Philippines was ranked as the third most restrictive country for Foreign Direct Investment (FDI), out of 84 countries ranked by the OECD (OECD, 2023[35]). A series of legal acts mostly related to local content requirements and minimum paid up capital have contributed to this high restrictiveness index. To improve competitiveness, investments, job creation and knowledge transfer, the government has initiated amendments to some of these restrictive legal acts.

In the renewable energy sector, the 40% cap on foreign ownership was removed in November 2022. Foreign investors can now have full ownership in the exploration, development and utilisation of renewable energy sources in the country (solar, wind, hydro and tidal). This also applies to existing projects, where foreign investors can acquire the shares of their local counterparts (DOE, 2022[36]). The power sector is not directly impacted by other administrative local content requirements, mostly related to retail trade and labour practices (Baker McKenzie, 2022[37]).

In February 2023, the Department of Trade and Industry launched the Green Lanes programme to speed up entry of strategic investments into the Philippines. This represents a comprehensive government initiative to improve the overall ease of doing business by expediting, streamlining, and automating government processes specifically for strategic investments, including those in renewable energy (DTI, 2023[38]).

The local content changes have already prompted investment pledges from private investors5 and technical assistance programmes from foreign governments.6 The Danish fund – Copenhagen Infrastructure Partners – becomes the first 100% foreign owned company to explore offshore wind in the Philippines through awarded Wind Energy Service Contracts (WESCs) for three projects and a total of 2 GW capacity.

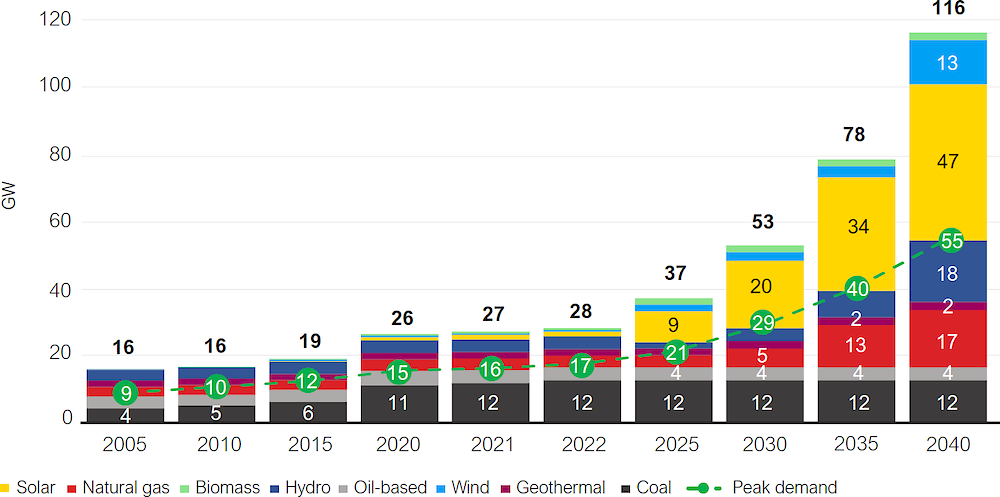

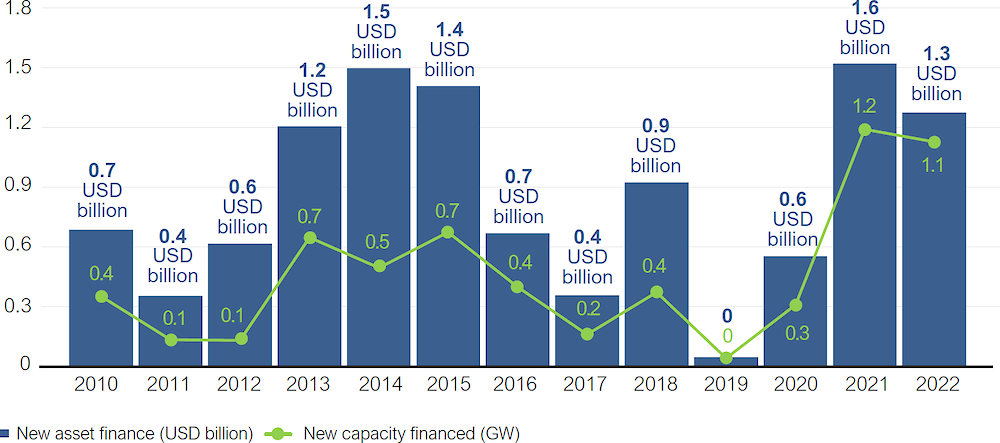

Trends in renewable energy finance in the Philippines7

Since 2010, the Philippines has invested a total of USD 11 bln in renewable energy projects (Clean Energy Pipeline, 2023[39]). The regulatory framework and the support measures implemented under the RE Act since 2008 have helped the market, but they have fallen short of mobilising investments needed to meet the 2030 country ambitions (as per the PDP 2020 – 2040). The Philippines aims for an additional 23 GW grid connected renewable energy capacity between now and 2030, that will require over USD 26 billion in finance. With the current spending rate and an access to finance which is below global average (IEA, 2021[40]), the Philippines may not be able to fund the 2030 capacity build-out on domestic resources alone. The size of the financial market in the Philippines is smaller than that of other emerging economies in Asia (IMF, 2022[41]).

Figure 1.15. Investments in new renewable energy projects in the Philippines 2010 – 2022 (includes BESS)

Source: Clean Energy Pipeline, 2023. Includes estimates for undisclosed values. Note that new capacity financed is different from the installed capacity. New capacity financed includes projects that have reached Final Investment Decisions or Financial Close and are still under construction.

The Philippine banking sector, which has provided most of the clean energy finance so far (Clean Energy Pipeline, 2023[39]) is concentrated in a handful of banks. The top five banks in the country, all domestic, hold 60% of the banking assets. Most of the large domestic banks are interconnected with non-financial corporations in local-family-owned mixed conglomerates (IMF, 2022[41]). Through their various subsidiaries in infrastructure, power sector, banking and investment funds, these conglomerates have financed over half of the renewable energy capacity in the Philippines. They are de facto the project sponsors and the debt providers in the large infrastructure projects in which they participate. To limit exposure, Bangko Sentral ng Pilipinas (BSP) has enacted boundaries on intracompany lending to 15% of the bank’s total loan portfolio (IMF, 2022[41]).

Overseas lenders have a limited presence in the Philippines, holding just 7% of the banking assets in the country (IMF, 2022[42]). Looking at transactional project data from the last 10 years, it can be noted that international banks have participated in transactions jointly with local counterparts in projects where the supply chain has an international element, either equipment or ownership. Despite Philippine companies owning most of the generating assets, the wind energy supply chain draws interest from many international players.8 The solar sector, however, is more weighted toward regional participants rather than global multinationals (Clean Energy Pipeline, 2023[39]).

Liquidity is not considered to be an issue as banks in the Philippines are well capitalised (IMF, 2022[41]). Clean energy technologies have been financed with a complete range of debt, equity and grant based products mainly from foreign governments. Sovereign government guarantees are no longer an option after the market liberalisation under EPIRA (IMF, 2022[41]). The choice of financial instruments will largely be determined by the profile of developers and project owners. For the big conglomerates, with strong balance sheet positions and long credit history, access to finance is not an issue. They tend to finance most of their projects on balance sheet via debt raised at corporate level (Clean Energy Pipeline, 2023[39]).

Where ticket size is large enough and the profile of developers is diverse enough, project finance has been successfully deployed. The Philippines based power producers will usually take the projects through development before raising capital for construction, where they bring in other shareholders and arrange the debt facility. In the same transaction, loan syndication has incorporated dual currency debt financing from local and international banks. Local banks bring the understanding of the domestic market, with their international counterparts supporting the creation of a supply chain (Clean Energy Pipeline, 2023[39]).

Stakeholders noted that the average loan duration in the Philippines is between 7-8 years and debt covenants tend to be more flexible with local banks. However, project finance transactions for onshore wind have secured up to 15-year long tenors for leverages of around 60-70% (Clean Energy Pipeline, 2023[39]). This is also thanks to Export Credit Agencies (ECA), whose participation has been tied to the sale of components or the provision of foreign capital. ECAs have shouldered transaction related risks for up to 80% of the debt facility, but with potential to go higher (OECD, 2022[43]). Transaction de-risking has also been provided by development banks and multilateral financial institutions. Driven by additionality principles, they have been lifting some of the risk that commercial lenders cannot assume or providing finance for smaller developers who cannot access the big banks (Clean Energy Pipeline, 2023[39]).

Stakeholders noted that commercial lending plays a lesser role in energy efficiency finance. The small‑scale nature of energy efficiency projects, and the absence of asset pooling and securitisation in the market lead to high transactional costs, which in turn create limitations for large lenders, investors and development banks. The Philippines has around 500 small thrift banks and rural and co-operative banks (IMF, 2022[41]). Despite this, access to finance for individuals remains low, as indicated in an OECD survey with country stakeholders conducted in 2022. Stringent loan screening criteria and high margins for retail customers lead to energy efficiency projects financed with full upfront equity. At retail level, there is also a lack of demand and to some extent lack of dedicated financial instruments tailored to households and individual loans.

Clean energy finance in the Philippines has equally benefitted from capital market instruments. Initial Public Offerings (IPO) in the Philippines stock exchange for pure renewable energy companies and corporate green bonds have successfully raised equity (Clean Energy Pipeline, 2023[39]). The Philippines is the third largest issuer of green bonds in the Southeast Asian region, with private companies having a prominent role in their issuing, alongside multilateral development banks (MDBs). Currently, the government has not issued any green bonds (Clean Energy Pipeline, 2023[39]). The Asian Development Bank has pioneered considerable financial engineering in clean energy transactions. These include project bonds via the Climate Bonds Initiative (CBI), guarantees via the Credit Guarantee and Investment Facility (CGIF), and most recently the Energy Transition Mechanism (ETM) for the financing of coal phase-out.

Other segments of the Philippine financial system are less developed than other Asian peers. Non-bank financial institutions such as insurance companies, pensions and mutual funds, have a small presence compared to global averages (IMF, 2022[41]).

Figure 1.16. Clean energy finance transactions 2010 – 2022 (bln USD)

While availability of capital has not been an issue, it is highly concentrated in the hands of a select few local companies with mixed ownership structures and conglomerate linkages. This may pose limitations to the financing of future renewable energy capacity, especially with rising interest rates and a globally fragile banking sector. Even though the Philippines has limited exposure to overseas lenders, there still are international spillovers from global events (IMF, 2022[41]). In 2023, the Government of the Philippines announced a merger between the Development Bank of the Philippines and the state-owned Landbank (Department of Finance, n.d.[44]), indicating scope for banking consolidation in the market.

References

[37] Baker McKenzie (2022), Philippine Department of Trade and Industry issues the implementing rules and regulations of the Retail Trade Liberalization Act as amended by Republic Act No. 11595.

[31] Berthau, P. and C. Cader (2019), Electricity sector planning for the Philippine islands: considering centralised and decentralised supply options, Elsevier, https://www.sciencedirect.com/science/article/pii/S0306261919310670.

[39] Clean Energy Pipeline (2023), Philippine New Asset Finance.

[2] Climate Analytics (2022), 1.5°C National Pathways Explorer, https://1p5ndc-pathways.climateanalytics.org/.

[15] Climatescope (2023), The Philippines.

[44] Department of Finance (n.d.), Landbank-DBP merger to strengthen resilience of PH financial sector, https://www.dof.gov.ph/landbank-dbp-merger-to-strengthen-resilience-of-ph-financial-sector/#:~:text=28%2F03%2F23-,Landbank%2DDBP%20merger%20to%20strengthen%20resilience%20of%20PH%20financial%20sector,serve%20the%20country's%20development%20needs.

[20] DOE (2023), Distribution Utility (DU) Profile.

[23] DOE (2023), Executive Order No.21.

[28] DOE (2023), Green Energy Option Program.

[11] DOE (2023), Key energy statistics.

[27] DOE (2023), Net Metering Home.

[18] DOE (2022), 40th Electric Power Industry Reform Act (EPIRA) Implementation Status Report.

[36] DOE (2022), Department Circular Prescribing Amendments to Section 19 of the RE Law IRR.

[29] DOE (2022), DOE Power Statistics.

[26] DOE (2021), Green Energy Auction Program in the Philippines.

[32] DOE (2021), Missionary Electrification Development Plan.

[5] DOE (2021), National Renewable Energy Program.

[4] DOE (2020), Power Development Plan 2020 - 2040, https://www.doe.gov.ph/electric-power/power-development-plan-2020-2040?withshield=1 (accessed on April 2023).

[30] DOE (2020), Ready for Renewables - Grid Planning and Competitive Renewable Energy Zones (CREZ) in the Philippines.

[25] DOE (2017), Renewable Portfolio Standards (RPS).

[34] DOE (2017), The Philippines Energy Efficiency and Conservation Roadmap 2017 - 2040.

[38] DTI (2023), “E.O. 18 Green Lanes launched to speed up entry of Strategic Investments into the Philippines”, Department of Trade and Industry, https://www.dti.gov.ph/archives/news-archives/e-o-18-green-lanes-launched-speed-up-entry-strategic-investments-philippines/.

[21] ERC (2022), A resolution setting the installed generating capacity and market share limitation per grid and national grid for 2022.

[13] IEA (2023), Electricity Market Report 2023.

[33] IEA (2023), Energy consumption in the Philippines.

[14] IEA (2022), Southeast Asian Energy Outlook.

[40] IEA (2021), Financing Clean Energy Transitions in Emerging and Developing Economies.

[24] IEA (2017), Renewable Energy Act.

[12] ILS (2021), Just Transition to Low-Carbon And Climate Resilient Industries: Energy Sector.

[41] IMF (2022), Philippines Financial Sector Assessment Program, https://www.imf.org/en/Publications/CR/Issues/2022/06/02/Philippines-Financial-Sector-Assessment-Program-Technical-Note-on-Macroprudential-Policy-518572 (accessed on 2023).

[42] IMF (2022), Philippines: Financial sector assessment program.

[1] NEDA (2023), Philippines Development Plan 2023 - 2028.

[7] NGCP (2023), NGCP One-Grid, https://www.ngcp.ph/mvip/.

[6] NGCP (2022), Transmission Development Plan 2022-2040.

[16] NPC (2023), National Power Corporation.

[17] OECD (2023), Clean Energy Finance and Investment Mobilisation.

[35] OECD (2023), OECD Statistics FDI Restrictiveness.

[43] OECD (2022), OECD Clean Energy Finance and Investment Consultation Workshop, https://www.oecd.org/environment/cc/cefim/philippines/secondoecd-doeworkshopunlockingfinanceandinvestmentforcleanenergyinthephilippines.htm (accessed on 2023).

[9] Philippines Institute for Development Studies (2023), Consumer hours lost to brownouts up 10%, https://www.pids.gov.ph/details/news/in-the-news/consumer-hours-lost-to-brownouts-up-10 (accessed on 7 February 2023).

[22] PIDS (2018), Assessment of TRAIN’s Coal and Petroleum Excise Taxes.

[10] PIDS (2018), Policy Notes: The Philippine electric power industry under EPIRA.

[8] Power Philippines (2023), Power Philippines News.

[3] S&P Global (2023), “Philippines economy shows strong expansion”, S&P Global Market Intelligence, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/philippines-economy-shows-strong-expansion-jan23.html#:~:text=Over%20the%20next%20decade%20the,growth%20in%20urban%20household%20incomes (accessed on 25 January 2023).

[19] World Bank (2021), Philippines Electric Power Industry Reform Act of 2001.

Notes

← 1. Retail Competition and Open Access (RCOA) mechanism and the Green Energy Option Programme (GEOP) are two measures that allow corporate sourcing of power in the Philippines.

← 2. ETM coal divestment project in collaboration with ACEN and a South Korean investor announcing another coal divestment.

← 3. San Miguel Corporation Global and Meralco seeking rate hikes in their contracts to cover losses on fuel costs due to high global coal prices natural gas supply restrictions from the Malampaya gas field. https://powerphilippines.com/ca-nullify-erc-ruling-on-meralco-smc-rate-hike/.

← 4. The DOE issued Department Circulars DC2021-05-0011 and DC2022-03-0004 which establishes the procedures and criteria for the evaluation, approval, and endorsement of EE projects and strategic investments to the Board of Investments (BOI) for the eligibility under these fiscal incentives.

← 5. Chinese investors commit USD 14 bln in power sector investments in the Philippines; Philippines – Japan consortium is formed to explore renewable energy technology developments; Danish Fund, Copenhagen Infrastructure Partners, amongst others.

← 6. DOE has secured technical assistance from the government of the United Kingdom to address development issues for offshore wind projects in the Philippines.

← 7. Unless otherwise stated, this chapter is based on author’s analysis from Clean Energy Pipeline financial transactions in the Philippines since 2008. This includes new asset finance, refinancing transactions, mergers and acquisitions and capital market transactions. To the extent possible, transactions capture all clean energy technologies in the Philippines, including storage and self-generation. Energy efficiency transactions are not included.

← 8. Mainstream Renewable Power, Acciona, Siemens, Iberdrola, WPD, Vestas, Macquaire, Copenhagen Infrastructure Partners, Total and Shell are some of the international companies present in the onshore wind supply chain and the upcoming offshore wind projects.