The Philippines is estimated to have an offshore wind potential of 178 GW, none tapped so far. With high and more consistent wind speeds and a reduced environmental impact, offshore wind can be a key technology for the country’s energy transition. Offshore wind for the Philippines offers the prospect of better utilising the country’s maritime resources. This can bring additional investments in the local economy such as ports and infrastructure upgrades, direct and indirect jobs, as well as re-skilling and knowledge transfer. This chapter identifies areas for collaborative actions among policy makers, the industry, and financiers to build the country’s offshore wind market.

Clean Energy Finance and Investment Roadmap of the Philippines

2. Mobilising finance and investment for offshore wind

Abstract

Offshore wind growth potential and investment needs

The World Bank estimates that offshore wind projects in the Philippines may require capital expenditure in the range of USD 7.5-50 billion by 2040, depending on the level of ambition which was estimated at between 5.6 and 40.5 GW installed capacity (World Bank, 2022[1]). (Box 2.1) In the Power Energy Plan (PEP) 2023 – 2050, currently under discussion, the DOE is looking at developing between 19 - 50 GW of offshore wind. In line with this ambition, six potential offshore wind development zones have been identified, mostly for floating technologies.

Box 2.1. The World Bank Roadmap on offshore wind in the Philippines

The World Bank estimates that offshore wind in the Philippines has a technical resource potential of 178 GW and the possibility to supply 23% of the country’s electricity by 2050. While some of these resources are found in shallow waters close to population demand centres, the vast majority (about 90%) are in waters deeper than 50 metres, suggesting floating offshore wind as a more suitable alternative for deep waters. In addition to helping the Philippines achieve its climate commitment of peak greenhouse gas emissions by 2030, offshore wind is increasingly seen as a potential source of economic growth, job creation and energy security. With higher capacity factors compared to other renewable energy technologies, reduced competition for land resources, infrastructure upgrades for ports and roads, re-skilling and knowledge transfer in local and often rural communities, offshore wind can help deliver an inclusive and just energy transition (World Bank, 2022[2]). Conscious of the role offshore wind can have in the low carbon transition, the Government is expected to include long term resource-specific capacity or generation targets for offshore wind in the upcoming revisions to the Philippine Energy Plan in 2023 (DOE, 2022[3]).

Table 2.1. World Bank indicators under the Low Growth and High Growth offshore wind scenarios

|

Low Growth Scenario |

High Growth Scenario |

|

|---|---|---|

|

Capacity installed (by 2050) |

5.6 GW |

40.5 GW |

|

Electricity share (by 2050) |

3.3% |

23% |

|

Jobs (by 2040) |

15,000 FTE years |

205,000 FTE years |

|

Local content (by 2040) |

20% |

35% |

|

Gross value added (by 2040) |

USD 1.1 billion |

USD 14 billion |

|

Capital expenditure (by 2040) |

USD 7.5 billion |

USD 50 billion |

|

Infrastructure investment needs |

None |

Significant |

|

Fixed LCOE (in 2030) |

USD 77 per MWh |

USD 76 per MWh |

|

Floating LCOE (in 2040) |

USD 61 per MWh |

USD 47 per MWh |

|

Turbines installed (by 2040) |

150 |

1000 |

Note: FTE = Full-time equivalent; LCOE = Levelised cost of electricity; MWh = Megawatt-hour

Source: (World Bank, 2022[2])

Like most infrastructure projects, offshore wind is capital intensive. In 2021, new offshore wind projects saw an average global capital cost of USD 2,858/kW, 41% below the 2010 level. New plants in Asia and Europe were on average on par with this global weighted average value (IRENA, 2022[4]). Given the large scale of investment that needs to be spent upfront, the cost and availability of finance can be a significant hurdle, especially if risks related to technology, policy and markets are not carefully managed. Any risk mitigation in financial structuring to unlock low-cost capital will require a thorough understanding of the risks associated with offshore wind projects in the Philippines and correct pricing of these risks from the party best placed to capture them.

Offshore wind market and policy developments

The government of the Philippines is progressing quickly to establish the market rulebook for the country’s future offshore wind industry. Several Executive Orders have been issued to speed up offshore wind market development and more broadly strategic investments.

In November 2022, the President of the Philippines approved a proposal made by the Department of Energy (DOE) to explore and develop the Philippines’ offshore wind potential to improve energy security. The President’s approval empowers the DOE to fast-track the policy, regulatory and market developments for offshore wind.

In April 2023, the President issued another executive order to set up the “Offshore Wind Development and Investment Council”, a one-stop shop for offshore wind comprising 10 government agencies. This is expected to accelerate and streamline permitting, update approval procedures for offshore wind projects, and improve interagency co-ordination (DOE, 2023[5]). This would eventually be integrated into the Energy Virtual One-Stop Shop (EVOSS) platform, a web-based monitoring system for energy applications in the Philippines (EVOSS, 2023[6]).

Some of the first steps taken by the DOE to support the development of offshore wind capacity in the country include customising and streamlining the regulatory environment for projects. A series of public consultations has been launched to revise the “Omnibus Guidelines” that govern the administration of renewable (wind) energy service contracts.

As of September 2023, the DOE had awarded 79 wind energy service contracts (WESCs) to offshore wind developers, representing plans for a maximum cumulative capacity of 62. The DOE indicated that several Letters of Intent (LOI) proposing further offshore wind projects have been sent by international developers following the government’s decision to relax foreign ownership limitations on renewable energy projects in 2022, suggesting a strong outlook for offshore wind in the Philippines.

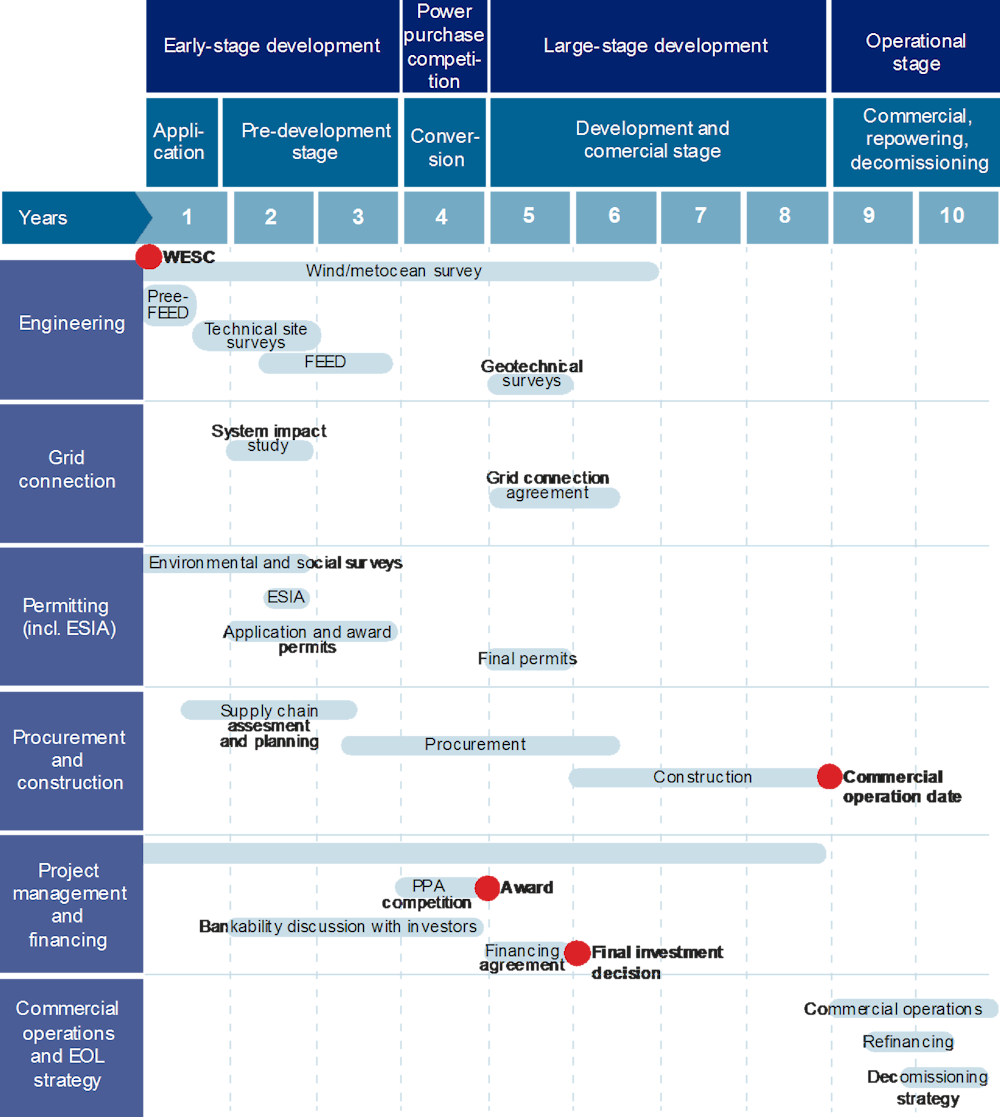

Current offshore wind service contracts (WESCs) are at different stages of pre-development activities. The earliest of these contracts are expected to come online by 2028. Some early development stage projects are in the wind resource measurement phase whereas other projects have been endorsed by the DOE and NGCP for grid System Impact Studies (SIS) to assess the impact of the proposed plants on the current grid infrastructure.

In December 2023, the first offshore wind project in the Philippines received clearance by the Board of Investments (BOI) for an expedited treatment under the country’s Green Lane programme. The 450 MW Frontera Bay Wind Power Project, off the coast of Cavite, is expected to cost around USD 1.5 billion. The project is expected to be operational in 2028 and will create 2700 local jobs in its pre-development, development, and operational phases, while providing training and development to local communities (BusinessWorld, 2023[7]).

Box 2.2. Ongoing international technical assistance programmes in the Philippines

Several international partners are assisting key institutions in the Philippines to establish the right policies and incentives, drawing on global best practices and regulatory conditions across the offshore wind supply chain. In particular:

The World Bank and DOE jointly launched the “Offshore Wind Roadmap of the Philippines” in April 2022, which identifies the technical resource potential, two growth scenarios, and a wide range of recommendations to accelerate offshore wind development in the Philippines. Following the publication of the Roadmap and building on its recommendations, the World Bank is currently providing a package of technical assistance supporting transmission infrastructure planning and environmental regulatory updates. These will be in line with international standards and take into account the specific geographical profile of the country.

The Asian Development Bank is providing technical assistance to the Energy Regulatory Commission (ERC) to develop a baseline and provide recommendations for the country’s first offshore wind regulatory framework, including tariff-setting, potential revenue support mechanisms and least-cost grid integration (ADB, 2022[8]).

The Energy Transition Partnership (ETP) is also supporting the ERC to upgrade overall energy regulations (including the Philippines Grid Code) to accommodate modern renewable energy technologies, including offshore wind (ETP UNOPS, 2021[9]).

Furthermore, Carbon Trust is supporting the DOE and other government agencies with two ongoing projects in the country. The first one is on Marine Spatial Planning (MSP) and will focus on creating the tools for a future MSP exercise led by the DOE, which would subsequently feed into the designation of offshore wind development zones in the country. The second one is on project permitting and consenting procedures. Both projects are currently at early stages of development and are expected to deliver over a timeline of 12-18 months. To facilitate the implementation of both projects, Carbon Trust has established the Philippine Offshore Wind – Joint Industry Platform (POWJIP), a forum to facilitate research, technical support, capacity building, and overall co-ordination between public and private stakeholders. It currently has 17 participants (including the DOE) and is funded by the Energy Transition Council’s Rapid Response Facility.

Source: (OECD, 2022[8])

Offshore wind challenges and market development barriers

Building and operating offshore wind farms comes with a different set of challenges compared to other infrastructure projects. These include the inherent complexities of installing heavy structures in marine environments, as well as the integration of a highly diverse supply chain, which brings together a unique configuration of industrial sectors necessitating multiple interfaces with each other. The scale of operations needed to build an offshore wind farm requires carefully co-ordinated planning, project and risk management (Guillet, 2022[9]).

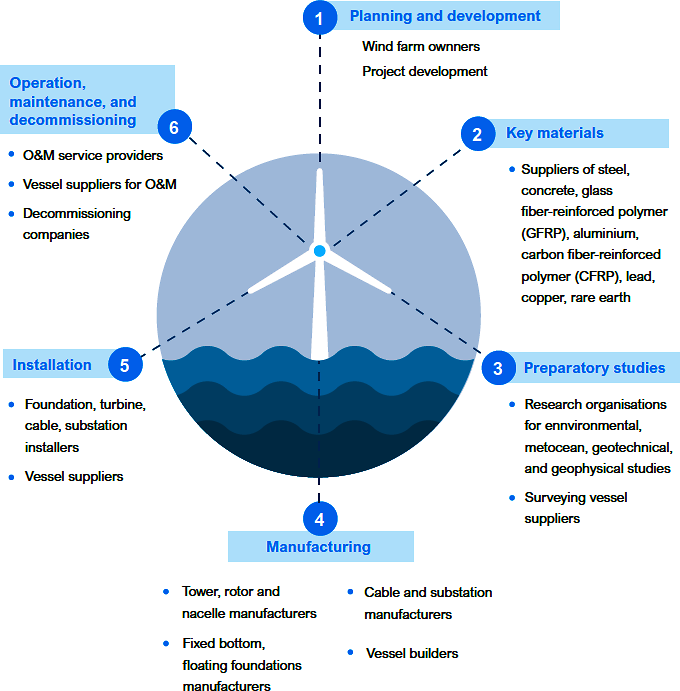

Figure 2.1. Offshore wind supply chain and key sectors

Source: Rabobank, 2023

Financing will play a key role in meeting offshore wind ambitions in the Philippines. The cost of capital is one of the largest determinants in the cost of electricity for offshore wind farms. It reflects the confidence investors and lenders have in achieving a return on their investment or debt respectively (IEA, 2022[10]). In OECD stakeholder consultations, developers indicated that for certain projects a 1% change in the cost of capital could lead to an 8% change in the cost of electricity. The nature of projects, with very high upfront costs and relatively low operational costs means that the cost of electricity will be driven predominantly by the cost of the repayment of the initial investment (in the form of dividends, debt repayments or both).

Individual GW-scale projects typically require around USD 2-3 billion of capital expenditure each and the first few projects usually experience the highest costs per GW generated (BVG Associates, n.d.[11]). However, gradual developments in infrastructure, local supply chains, and manufacturing capacities will bring economies of scale, create a pipeline of projects, and eventually lower the cost of energy from offshore wind. In the meantime, both real and perceived risks and barriers across the offshore wind value chain will need to be addressed to facilitate investments. This is even more important in the financing of the early projects, which have a crucial role in demonstrating the fundamentals of deploying offshore wind in the Philippines.

Policy and regulatory risk

Policy and regulations are critical to the development of offshore wind, as with many large-scale infrastructure projects. In many emerging markets, the economics of offshore wind can be challenging on a purely commercial basis (Shliomenzon, 2022[12]). As a proven technology being adopted in an emerging market, the regulatory framework is expected to evolve with experience. During this process, an open dialogue between government agencies, local communities, offshore wind developers and other players from the marine ecosystem, can help to better shape the rules that enable the formation of new market structures.

Offshore wind targets and consideration in the 2030 and 2040 power generation mix

Investors noted a lack of coherence, frequent revisions and different timelines between the current plans of different government agencies covering generation, transmission and distribution. This makes it difficult for developers to set realistic expectations on deployment volumes. The main provisions related to renewable energy and the power sector in the Philippines are contained in several plans covering power generation, renewable energy, and transmission at central and local government level. These are the Philippine Energy Plan (PEP), the Power Development Plan (PDP), the National Renewable Energy Program (NREP), and the Transmission Development Plan (TDP). The country’s offshore wind potential is expected to be added in future editions of these plans, which are currently under discussion (as of September 2023). This provides an opportunity to harmonise these plans, including targets and revision horizons.

Offshore wind stable and predictable regulatory framework

The renewable energy sector in the Philippines presents an evolving nature to reflect industry, technological and cost developments. For offshore wind, a regulatory framework that will create the industry’s operational model is still to be developed.

Under the current guidelines, wind energy service contracts (WESCs) are awarded on a first come, first‑serve basis to any qualified developer proposing a project in a location that does not overlap with existing military, shipping, trade, or commercial zones. While the existing procedure has enabled many developers to secure WESCs quickly and commence pre-development activities, they don’t provide a route to market.

During OECD stakeholder consultations, investors welcomed the launch of the systematic auction system for renewable energy capacity since 2022. They recognise it as an efficient model to award the most competitive renewable energy projects at the most competitive price, creating similar expectations for the offshore wind sector (see Table 2.3). The auction schedule is published annually, including technology installation targets per region for the upcoming three years (DOE, 2023[13]). Offshore wind is expected to be included in the 2024 GEAP auction round, but details on pricing, delivery schedules and other auction features are yet to be defined.

Risks related to planning, consenting and approvals

Slow planning and permitting can create significant delays, lock projects in lengthy development phases and slow down the market. Experience from more established markets shows that slow permitting has been a barrier in many parts of the world, including Europe, where over 80 GW of wind energy projects were stuck in permitting procedures in 2022 (Dixson-Declève, 2022[14]). During OECD stakeholder consultations in the Philippines, investors identified three key challenges during the planning and permitting phase. These include the site selection, reliable wind measurements and grid connection permit delays.

Environmental compliance certificates for LiDAR equipment

The rules and procedures currently applicable to offshore wind are derived from existing ones for onshore wind or offshore oil and gas projects (DOE, 2022[3]), and thus often fail to account for the specificities of offshore wind projects and create unnecessary hurdles for their development. Under these rules, developers require a certificate prior to the installation of the equipment for Light Detection and Ranging (LiDAR) mapping activities, which is needed to collect site-specific wind speed data as part of their WESC commitments. However, as LiDAR installations do not require drilling in the seabed, such a project should not have to go through an extensive and time-consuming permitting procedure, which in turn delays data collection and eventual deployment (OECD, 2022[15]).

Box 2.3. Obtaining a Wind Energy Service Contract (WESC) in the Philippines under the current guidelines

In the current set-up, developers are responsible for site selection, investigation and permitting. The wind energy service contract (WESC) is the license that enables developers in the Philippines to exclusively carry out preliminary investigations, construction and turbine installation, and exploitation of the wind resources for a specified number of years.

The current Philippine WESC format covers a 25-year timeframe, comprising five years of pre‑development stage (e.g. securing permits, conducting feasibility studies, financial close and declaration of commerciality), five years of development stage (e.g. construction and commissioning) and the remainder for the commercial or operational phase. The WESC license is renewable once. DOE reserves the right to end the WESC contract if there is no progress in meeting the workplan milestones that developers have submitted, or if developers declare that their site is not technically and commercially feasible.

Developers first send a Letter of Intent (LOI) to the DOE proposing an indicative power capacity, deployment schedule and location for the project. The DOE then conducts a mapping verification procedure to confirm that the proposed location is available. If so, the developer is asked to register on EVOSS and submit legal, technical, and financial documents through the online portal to secure a preliminary business permit.

Once the permit is secured, the DOE is required to approve the project and award a WESC within 31 days; if not, the project is considered automatically approved under the rule of positive silence.

Source: Authors compilations from DOE resources and stakeholder consultations.

Wind measurements and reliable site-specific data

During OECD consultation workshops, developers indicated that the 5-year period currently allocated under the WESC framework for reliable wind measurements may not be sufficient to accomplish this and may need to be revised. Existing data for resource potential is limited to desk-based modelling, which is subject to a margin of error given the inconsistent and variable wind patterns in the Philippines (OECD, 2022[15]). The lack of reliable and site-specific data across technical, spatial, economic, environmental and social indicators for developers to optimally locate their offshore wind projects may also lead to delays in securing a WESC contract.

Grid system impact studies and grid connection permits

Development timelines on transmission infrastructure are also not representative of offshore wind and can delay the project financing. Developers noted that it can take up to 18 months in the early development stage for the NGCP to conduct a system impact study, which is needed to assess the project’s viability in relation to the current grid (OECD, 2022[15]). Following the study, the NGCP communicates any changes or necessary upgrades to the DOE (NGCP, 2022[16]). Auctioned projects are granted a grid connection permit only after securing a power supply agreement (PSA) (World Bank, 2022[2]). Merchant projects, or those selling directly in the wholesale electricity spot market, do not need a PSA to obtain a grid connection permit. In either case, and from a lenders’ perspective, no financing activities can start before any power supply agreements (public or corporate) and grid connection permits are in place, leading to interface risk.

Figure 2.2. Offshore wind development cycle

Source: Adapted from World Bank, 2022

Delays and costs linked to transmission infrastructure

Delays linked to transmission infrastructure

Even after access to the high voltage grid is secured in the permitting phase, grid connection delays can happen at any point before and during construction. This can result in project commissioning delays and most likely budget overruns (Guillet, 2022[9]). Developers in the Philippines face long connection delays. Some of the awarded capacity under the FIT system in 2016 did not get connected fully until 2021.

The latest Transmission Development Plan (TDP) 2022-2040, includes plans to upgrade and expand the transmission network to accommodate offshore wind power plants proposed under awarded WESCs (NGCP, 2022[16]). However, stakeholders noted that transmission infrastructure upgrades can take up to 10 years in needs assessments, planning, designing and implementation, as the process often encounters political, administrative and capacity related challenges (OECD, 2022[15]).

Although the DOE is involved in endorsement of power projects and approval of the final transmission development plan, the choice of priority projects and the corresponding timelines for construction ultimately rests with the NGCP. The legal auction framework of 2022 mainly allocated grid reliability responsibilities to the transmission and distribution network providers, which must conduct system tests to allow commercial operation of awarded projects. Any needed adjustments resulting from the system impact studies should be communicated to the DOE to avoid system problems and delays in connection (IRENA, 2022[17]).

Costs and financing of point-to-point transmission lines

Section 9 of EPIRA (RA 9136) allows developers and generation companies to build, own and operate their own project transmission lines. While the system impact study and the grid related permits rest primarily with the NGCP, the construction of transmission facilities can be considered part of the generating asset.

Under current asset boundary classifications, developers may be required to finance any point-to-point transmission lines that have been endorsed by the DOE and NGCP and subsequently included in the transmission development plan (TDP). This is the case provided such facilities are not shared by other generation power plants. Developers may also be responsible for the operation and maintenance, as well as any needed upgrades. For offshore wind this would include the cost of financing and operating subsea transmission lines, offshore substations and connections to mainland.

Should any of these transmission facilities be required for competitive purposes to be used by other power plants, the asset ownership will be transferred to TransCo at a fair market price. Any disagreement on the transfer will be settled by the Energy Regulatory Committee (ERC), who will also determine the fair market value of the asset.

Such a set-up comes with certain advantages. At project level, internalising the transmission build-out in the project construction schedule presents less risk of construction delays. It also allows a developer to use the same substation to connect their other offshore wind farms within the same zone and bring down costs for consecutive offshore wind farms.

However, at regional or national level, such project-by-project approach could potentially lead to unco‑ordinated onshore grid upgrades by the grid operator, and duplication of work and resources. The lack of a proactive grid planning risks resulting in higher costs for both developers and the grid operator.

Supply chain and technology risk

Rising costs in the offshore wind supply chain

The complexity and scale of the offshore wind supply chain is reflected in the set of industrial sectors that it brings together. This includes the wind farm owners and operators, the developers, suppliers of key raw materials, the equipment manufacturers, the construction and installation of turbines at sea (including vessel suppliers), the financiers and legal advisers and the operation and maintenance service providers (see Figure 2.1).

In the Philippines, the offshore wind sector will need to rely extensively on imports of key components at least in the early days (World Bank, 2022[1]), which may present some bottlenecks and delays, as well as geopolitical dependency. Also, given the increased interest in offshore wind from other regional markets such as Viet Nam, Japan and South Korea, developers in the Philippines may have to compete for components, logistical vessels, skills, capital and other resources while the domestic supply chain gradually builds up over time.

Moreover, offshore wind is also exposed to other commodity risk given its reliance on raw materials such as steel, iron and copper (Janipour, 2023[18]). Inflation has resulted in higher material and logistical costs that impact the capital expenditure required and eventually project viability. It is for this reason that cost reductions in wind energy in European and US markets have been partly offset by higher turbine prices (+40% up in the last two years) and supply chain disruptions.

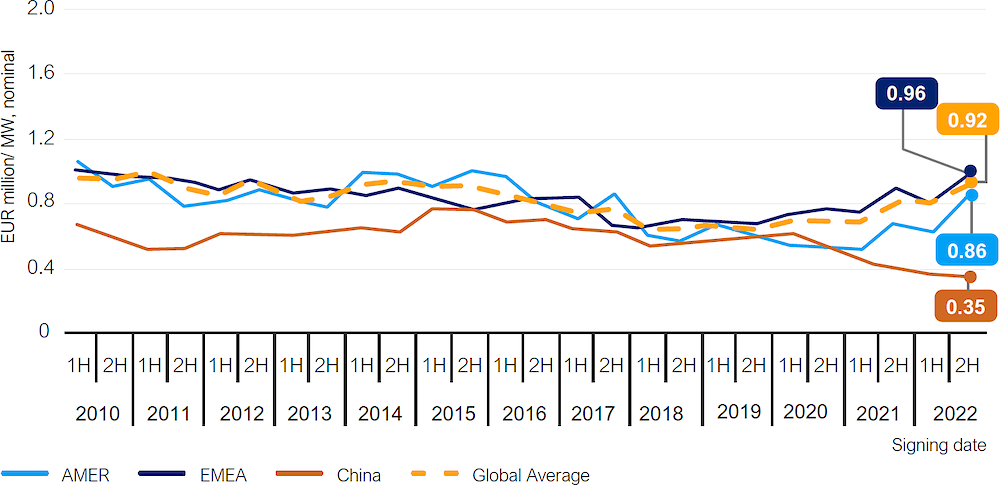

Figure 2.3. Evolution of wind energy turbine prices

Source: Rabobank and BloombergNEF, 2023

All these developments suggest the Philippines may be relying on regional supply chains, mostly in Asia, dominated by Chinese turbine manufacturers. While cost management is important, security of supply and quality control are equally crucial in delivering a timely project. Any potential delays will require higher contingency budgets from the financiers.

Turbine technology and extreme wind speeds

Although the first few projects in the Philippines will rely on commercially mature fixed-bottom technology, the extreme wind resource conditions in the country could pose a significant challenge for construction and turbine installation and encourage instead the use of floating technology. Extreme weather patterns could also be a concern during transportation, storage and the operational lifetime of an offshore wind farm. Any risk of potential damage to physical assets will be reflected in the risk premia of insurance contracts, which is a requirement by most lenders. In natural catastrophe (NAT CAT) exposed areas, the cost of ensuring offshore wind can be significantly higher than non-exposed areas. This can vary from 0.3% to 3%, depending on the phase of a project lifecycle (construction, operation) and project track record (NARDAC, 2023[19]).

Current offshore wind turbines can withstand wind speeds of up to 70m/s, whereas in the Philippines, wind speeds of over 100 m/s can be seen in the north and east of the country (World Bank, 2022[1]). Technological advancements in the global offshore wind industry could help mitigate the risk of extreme weather events. The current turbine technology is already prepared to some extent for higher wind speeds, as typhoon-grade turbines are becoming available in the market.

Further, as 90% of the offshore wind resource potential in the Philippines is concentrated in deep waters, sustained growth will rely on floating technology (World Bank, 2022[2]). As floating offshore wind takes off from demonstration and small-scale projects to multi-turbine commercial arrays by 2030, the technology is also expected to reach global cost competitiveness (Fitch Solutions, 2022[20]). The Philippines could in fact become a regional leader by demonstrating early floating offshore wind projects and developing local manufacturing capacity for their components, thereby accelerating cost reductions.

Merchant risk and counterparty risk

Merchant risk

Merchant risk is the full exposure of a project to short-term electricity prices, thereby creating uncertainties on both price and volume. In the Philippines, most of the renewable energy power sources are exposed to some degree of market risk following the FIT phase-out.

Long-term power purchase agreements (PPAs) can partly mitigate some of the merchant exposure by guaranteeing a minimum price on the volumes sold. The current auction framework allocates contracts based on 20-year power supply agreements with the government, paid in accordance with actual electricity generated as per wholesale electricity spot market rules. A ceiling price (GEAR) is disclosed by the DOE prior to the auction. Contracts are awarded based on minimum price bids called Green Energy Tariffs (GET) until the demand band for a specific technology is met. (DOE, 2021[21]). The 20-year contract duration is considered to provide sufficient tariff certainty for a project to repay the lenders.

Long term PPAs partially limit a project’s exposure to price risk, but uncertainty on the volume of sales remains entirely with the asset owners. Variability of weather patterns may have an impact on power generation and lead to a mismatch between what is produced and what is sold. Too much production can be curtailed, while too little production can lead to lower than anticipated project revenues. Fluctuations on project revenues increases the risk of access to finance and raises questions on a project’s capability to service debt (IEA, 2022[10]).

Lenders are familiar with merchant risk financing, predominantly from oil and gas sector financing. During OECD stakeholder consultations, some of the largest Philippine banks indicated they have assumed some merchant risk financing even in renewable energy projects for onshore wind and solar in the post-FIT phase. High energy prices, sector maturity, shorter construction schedules and falling costs for both onshore wind and solar have made this possible. Developers enter short-term loans with commercial banks (as opposed to long term loans, which need long-term price stability), with a view to then refinance should the electricity prices change.

However, this is not the case for offshore wind farms where capital expenditure is significantly higher, development schedules are longer, construction at sea is riskier and the project track record is not there yet. Spot market prices are too volatile to provide a basis for long-term, capital intensive and price-taking infrastructure projects. The capacity of the smallest offshore wind WESC awarded is 10 times higher than the average renewable energy project currently in operation in the Philippines. Moreover, in project finance transactions, all syndicate banks would have to go on equal terms. Depending on their profile and capitalisation, not all banks may be willing to accept merchant risk elements in project finance.

Counterparty risk

Even when a long-term PPA agreement is secured, there is still counterparty risk that needs to be addressed. A highly concentrated market structure amongst the distribution utilities has resulted in a limited pool of creditworthy off-takers and raises questions on the country’s future capacity to purchase utility scale offshore wind production (World Bank, 2022[1]). Meralco - the Philippines largest utility dominant in the Luzon region, and VECO - the second largest utility in the Philippines dominant in the Visayas region, together own 76% of the total consumption in the country (WESM, 2023[22]). This is further compounded by the Philippine regional context and the different demand and supply profiles of each of the three main grids (see Box 1.1).

Moreover, the market for corporate off-takers and non-utility PPAs remains limited, despite the Philippines having enacted measures to enable the market such as the Green Energy Option Programme (GEOP) and the Retail Competition and Open Access (RCOA). Investors have highlighted low confidence in such practices as the sector has been fraught with low compliance and in some cases, unilateral termination of contracts for contestable consumers.1 In 2022, the ERC had received over 16 complaints linked to disconnection claims from large industry players, together representing over 126 MW capacity impacted (ERC, 2022[23]).

Setting the course for an offshore wind market in the Philippines

Capital expenditure for offshore wind projects in the Philippines could reach USD 50 billion by 2040 (World Bank, 2022[1]). Meanwhile, in the last decade the Philippines has only financed renewable energy projects at an average rate of USD 900 million per year. With investment requirements increasing from millions to billions, the question of capital availability becomes critical to enabling the Philippine renewable energy industry, notably, for offshore wind.

The offshore wind risks outlined above fall under three main categories: political and regulatory risks, sector specific risks and offshore wind project specific risks. What these risks mean for the lenders and equity investors, and how well they’re managed and absorbed in financial structures, will determine the availability and cost of capital for offshore wind in the Philippines.

Central to all this is a stable regulatory framework, strong market fundamentals and investment predictability, including for local supporting infrastructure. A stakeholder poll conducted at the 2nd OECD‑DOE Clean Energy Finance and Investment workshop found that 71% of the participants viewed a simplified regulatory framework as the key immediate priority for initial offshore wind development in the Philippines, followed by transmission infrastructure (19%) and designating offshore wind development zones (10%).

Long-term vision and strategy

A clear role for fixed and floating offshore wind in the country’s power development plans

To encourage the market to set the right expectations on future volumes, a specific role for both fixed and floating offshore wind can be considered in the 2030, 2040 and 2050 power generation mix. Having separate targets for both technologies will enable the industry to run accurate cost and revenue estimates, set cost reduction pathways via economies of scale and optimise industry learning curves. Having a long‑term vision also lays the groundwork for developing a domestic supply chain in the country, enabling infrastructure, manufacturing capabilities and the skill set needed to implement utility scale offshore wind with higher local content.

Coherent and co-ordinated strategic development plans

Given the scale and complexity of the offshore wind supply chain, enhanced cross-government collaboration is needed to convert the high offshore wind potential into bankable projects. Offshore wind is entirely new to the country. As such, the current state of development plans in the Philippines reflects an evolving but fragmented nature at central and local government level.

In the announced whole-of-government approach, a better alignment can be sought between different but interlinked sectors such as maritime planning, power generation, transmission and distribution – all of which are currently treated in separate development plans subject to different revision horizons. This will ensure that climate and energy policies are coherent, calibrated against each other and re-aligned with the high offshore wind potential of the Philippines. This can be reflected in co-ordinated Maritime Spatial Planning, Power Development Plans, National Renewable Energy Plans, and Transmission Development Plans.

Onshore support facilities as a key market enabler

Offshore wind farms typically involve a combination of components that are assembled on land, and others at sea. As such, onshore support facilities, mostly to strengthen and modernise port infrastructure, will also require significant investments for the Philippines to realise its offshore wind potential (both fixed and floating) and reach economies of scale. In the medium term, this includes adequate transportation and port terminals, storage and assembly point for components, training areas, as well as dedicated areas related to operation and maintenance facilities. In the longer term, this can include hosting the needed infrastructure for floating offshore wind and for converting offshore wind power into renewable hydrogen. Currently, there is no single port or industrial site in the Philippines that can deliver the full range of services to build large scale offshore wind projects.

Strong collaboration between central government, local government and the different agencies involved in offshore wind planning is key to bringing the needed infrastructure upgrades for the designated Philippine offshore wind ports. The Department of Energy (DOE) has already started consultations with the Philippine Port Authority (PPA), the Department of Transport (DOT) and the National Grid Corporation of the Philippines (NGCP). Nine priority ports have been identified and the government is looking into business models for financing ports and related onshore infrastructure.

To facilitate finance and investments, the Government can consider a multiport strategy, where different ports collaborate to provide different services during different stages of a project lifecycle. This is particularly important for floating offshore wind, which has the highest technical potential in the Philippines. One of the biggest challenges for floating offshore wind will be the scale of port infrastructure needed in relation to the economic activity in the surrounding areas and the normal business operations of ports outside of offshore wind. As such, it is important that the readiness assessment of the potential offshore wind ports balances expectations of redevelopment and economic feasibility.

Given the strategic nature of ports, these investments can be funded with a combination of public and private capital. Investments in ports have a relatively short payback period, estimated at five years (WindEurope, 2021[24]). This makes ports related infrastructure an interesting investment opportunity for the private sector. Aspiring floating offshore wind markets are looking at models and initiatives that bring together port authorities and wind energy developers to pull out the resources needed for strategic investments. Three different phases for developer collaboration can be identified (Reuters, 2023[25]):

a. The initial port assessment where developers can share the cost of assessing the necessary port upgrades (estimated at USD 50 000 – 100 000).

b. Elaboration of the port development plan, where developers can share the cost as future users (estimated at USD 3 – 4 million).

c. To a lesser extent, port upgrades and major works can also be considered for collaboration. However, different developer requirements, technology specifications and competition concerns make co-operation challenging in the actual investment phase.

In the Philippines, the port infrastructure readiness assessment is expected to be funded by the Asian Development Bank, whereas the actual investments in the ports will be the responsibility of port owners. The revision of the Build-Operate-Transfer (BOT) law in the Philippines in 2022, provides an opportunity to bring more equity investments in ports by speeding up the process of establishing viable Public Private Partnership (PPP) models for public infrastructure. The revised BOT law also reflects a more appropriate risk allocation between the public and private sector, which improves the PPP bankability.

Concessional finance from multilateral development banks can also play an important role in bridging the investment gap needed for the upgrade of ports and onshore support facilities. Long term investments can pose challenges to ports, which normally finance their operations on working capital and revolving loans. As such, it is important to combine development finance with the current credit facilities in use.

To facilitate lending from banks, investment certainty and project pipeline will be key to raising the needed financing. As with other long-term investments, lenders would typically require revenue certainty for port upgrades to cover the debt service throughout the duration of the loan. This can be in the form of estimated utilisation rates and contracts. This investment certainty can only be secured with a frontloaded auction schedule, supported by timely planning and permitting, and facilitated by the allocation of specific offshore wind development zone areas.

Planning and permitting

Creating an offshore wind one-stop shop

One-stop shops and the creation of a unified permitting authority can simplify early project development by avoiding the risk of duplication and reducing administrative barriers to entry. Some departments, like the Department of Environment and Natural Resources (DENR) and the Department of Energy (DOE), have already started to review and customise their respective regulations and processes to include the specific characteristics of offshore wind. However, a more extensive review process would benefit all government agencies involved in approving offshore wind projects. Moreover, this should also be extended to permitting of supporting activities in the supply chain (e.g. the opening of factories).

The permit granting process comes with many different decisions from many different agencies. The DOE’s Executive Order, approved by the President in April 2023, will create an Offshore Wind Development and Investment Council comprising 10 government agencies. The council will aim to encourage the review, to update and streamline permitting and approval procedures in accordance with Good International Industry Practices (GIIP). This effectively means the creation of a custom one-stop shop for offshore wind projects, to be eventually integrated into the EVOSS system (Mercurio, 2022[26]).

To boost the efficacy of one-stop shop solutions, further measures will be needed.

Investing in human and digital resources for the offshore wind one-stop shop will ensure the process is efficient, transparent and consistent.

The industry expects clear decision timelines on permit applications, maintaining consistent permitting requirements across agencies, ensuring durability and exclusive permits once awarded, and facilitating co-ordination among public agencies and private stakeholders.

Political commitment, role-clarity and governance issues within the one-stop shop will need to be addressed early on to avoid any operationalisation delays.

Finally, the Philippines already applies “positive silence” in the WESC award process. Maintaining the same practice would benefit the offshore wind one-stop shop concept.

Reliable site-specific data to allocate special zone areas

Designating specific areas for development can speed up a lengthy planning and permitting phase for projects. In the short-term, the Government needs data and information on site selection to facilitate the allocation of special zone areas. To deploy offshore wind safely and rapidly, developers require reliable and site-specific data across technical, spatial, economic, environmental, social and infrastructural indicators. Bathymetric and geological data collected as part of past offshore oil and gas field projects provide a good starting point for developers seeking site-specific technical data. Other relevant topographical data – for instance, exposure to earthquakes or typhoon risks – can already be found on the National Mapping and Resource Information Authority (NAMRIA) public database.

Non-technical data collection is equally important to ensure that offshore wind projects are located in low‑risk areas. Robust spatial mapping of marine ecosystems and endangered species and surveys of local fishing communities operating in high resource potential areas are required to avoid any potential conflicts linked to high environmental and social risks. A detailed mapping of military zones and shipping routes, available port and shipyard infrastructure, and access to regional supply chains would also be crucial in identifying optimal plant locations and determining infrastructure investment needs. Some of these data can be collected and published as part of a future government-led MSP exercise.

Further, site-specific measurements of wind speeds and patterns, which need to be conducted by developers, are subject to additional permits adopted from the oil and gas sector that are not applicable to offshore wind. This adds further delays in data collection. DENR is currently revising the procedures for obtaining permission to install LiDAR equipment.

The existing datasets are currently housed within different government departments. This would need to be consolidated and made publicly available to improve transparency and efficiency. In the medium term, the DOE can foresee a unified data room under its supervision that can serve as a repository of the different datasets, as well as related legislation that is essential for planning, permitting and developing an offshore wind project. In the longer term, the data platform can take a broader scope including other renewable energy sources that can support the identification of specific renewable go-to areas, similar to EU emergency measures that were enacted in 2021 to cope with the energy crisis (JRC, 2022[27]). Such tools can be integrated in the one-stop shop procedures and help national and regional authorities plan key infrastructure, including transmission grids, roads and ports.

Ongoing technical assistances from the Energy Transition Partnership, the Carbon Trust and the World Bank on energy regulations, maritime spatial planning and grid related standards, will help identify concrete actions to accelerate permitting for offshore wind. They should provide a comprehensive review of the three main offshore wind challenges for projects in development phase: administrative approval process, site selection and grid connection.

Grid connection planning and development

Grid connection permits and development zones

Significant responsibility for project selection rests with the grid operator NGCP. Reforming the procedure for selecting projects for inclusion in the TDP and ensuring the DOE is more closely involved in this process can help ensure transmission assets get built in tandem with offshore wind projects.

The allocation of special zone areas can also help co-ordinate the effort and investments needed for upgrading the onshore grid facilities. This approach facilitates the optimisation of space and resources, while reducing the risk of connection delays. The World Bank is conducting a modelling and systems planning exercise to identify priority locations for grid development as part of its current technical assistance to the DOE. The results from this activity can help the DOE identify specific transmission needs of offshore wind and potentially fast-track certain priority transmission projects for inclusion in the TDP.

This would allow the DOE to side-step the typically long process of endorsements and system impact studies and create a faster avenue for priority transmission projects to get built. Similarly, integrating offshore wind into the Competitive Renewable Energy Zones (CREZ) would also help accelerate corresponding transmission projects to be included in the TDP.

Finance and ownership of the transmission line

The current asset boundary classifications under the grid code would need to be further clarified and a transparent recovery mechanism for ownership transfer of transmission lines would need to be in place. While the system impact study is the responsibility of NGCP, the construction of transmission lines to the shore would typically be considered part of the generation asset and is therefore the responsibility of the developer. However, once the offshore network is developed, it can create positive externalities for other projects and the grid system more broadly. The current legal basis provides a recovery mechanism for such assets, whose ownership will be transferred to TransCo. Given the high transmission costs of building and operating the connection to shore, a transparent methodology for allocating the fair market price can be made publicly available to investors. This can also include provisions for the operation and maintenance of transmission lines after the decommissioning of the wind farm once the project reaches its end of life.

Financing innovation in grid infrastructure

Smart grids are critical to the deployment of renewable energy at scale (IEA, 2022[28]). Nonetheless, there is little consideration for this topic in the transmission development plan of the NGCP. Alongside financing grid expansion and upgrade, both transmission and distribution operators should also focus on financing innovation in grid infrastructure. In a fragmented network like the Philippines, grid optimisation based on digital technologies can play a critical role to reduce congestion issues and loss of revenues for the generators resulting from curtailment measures (IEA, 2022[28]).

Offshore wind regulatory framework

Competitive procurement for projects in the Green Energy Auction Program

A competitive procurement mechanism for offshore wind projects can ensure transparency, efficiency and certainty regarding future offshore wind development in the Philippines. The currently awarded offshore wind WESCs have enabled developers to start with exploration, development and feasibility studies. The Green Energy Auction Program (GEAP) could provide a framework for competitive procurement for offshore wind projects.

Alongside auctions, the government can maintain an “open door policy” for developer led offshore wind deployment, provided the projects obtain all the necessary technical, environmental and grid connection permits to allow them access to the wholesale electricity spot market.

Adequate visibility on timing, technologies, and volumes

The government announcement for systematic auctions is a welcome development. The industry expects offshore wind to be integrated in the upcoming rounds of GEAP auctions with clear, upfront visibility for two to three years. Regular auctions are important to sustain cost reductions, ensure fair competition, and provide a sense of timing to the industry and the supply chain. Decisions to invest in supporting infrastructure (ports, factories, test facilities, logistics) and skills development rely on a predictable project pipeline that can only be secured with a near- and medium-term visibility on auctions.

Alongside frequent and predictable auctions, developers also expect technology-specific demand bands. This will avoid offshore wind competing with other more mature technologies while ensuring a diversified power generation mix in each of the three main regions, with a wide range of complementary technologies.

Consideration for non-price criteria in auctions

Non-price criteria can be integrated in auction design, provided measurable and unambiguous performance indicators are in place, and provided they don’t create additional administrative burden on the projects or duplicate existing permits and measures. Several policy regimes in other offshore wind markets are also looking at broader sustainability considerations.

In the medium term, the Philippines too can consider including sustainability criteria in the current legal auction framework. This can help mitigate some of the environmental and social risks related to biodiversity, and, in the long-term, lead to more local content in the supply chain, particularly in manufacturing capacity.

Non-price criteria can also promote innovation. The latter is important should the DOE allow co-located technologies to compete in auctions. Co-located technologies can include generating assets with storage, electrolysers, or even a combination of offshore wind and floating solar. This can facilitate the integration of renewables to the grid, address some of the grid congestion challenges and risk of curtailment and improve the capacity factor and economics of the generating asset. New business models of co-located technologies are emerging in major offshore wind markets (Jansen et al., 2022[29]) (Lee, 2023[30]). Designing the auction system to keep it open for further integration of other renewable power generation will lower the risk of lock-in situations.

Addressing merchant risk in offshore wind projects in the Philippines

Auction design and revenue regime

The early offshore wind projects in the Philippines will need some form of revenue stabilisation, granted through competitive auctions, to be economically viable. This is especially the case for floating offshore wind, which in the Philippines is most of the sites. But it is also important for the early fixed-bottom offshore wind projects. Whilst the technology is proven, its application in the Philippines is new and this will be priced in the cost of capital. According to international practice from offshore wind auctions, early wind farms and emerging markets tend to rely on fixed price revenue regimes, either through FiTs or through PPAs.

The current auctions in the Philippines award a 20-year-long power supply agreements with a fixed price regime. A ceiling price is set by the ERC and developers bid for a strike price until the maximum volume per technology is fulfilled. This is comparable and aligned with the auction design in some of the major offshore wind markets in Europe. Nonetheless, some areas for improvement that were highlighted in the 2nd OECD-DOE Clean Energy Finance and Investment workshop are as follows:

· A transparent costing methodology needs to be developed for offshore wind prior to establishing the ceiling prices (GEAR). This costing methodology will need to reflect evolving market prices while appropriately balancing the value of offshore wind (e.g. power system services, alternative uses like in green hydrogen production, etc.) against the levelised cost of electricity estimates.

· To mitigate some of the macro-economic risks in a project, it is important to index to inflation the tariffs granted under the auction programme. This will preserve the revenue stability of the offshore wind supply chain, investor confidence in the sector and consequently the jobs and economic value added that offshore wind projects bring. This is also aligned with recent initiatives from established offshore wind markets.

A well-designed revenue regime should aim to minimise risk for investors, while limiting the impact on public finances. The most effective mechanisms are the ones granted through competitive auctions and providing price visibility over 15-20 years. The longer the duration of the revenue regime, the easier it is for lenders and investors to amortise the financing costs over the years. This leads to lower financing costs and, in turn, lower electricity prices for consumers, as these are costs that will not be passed on (IEA, 2022[10]).

It is also important for any kind of public support to avoid the payment of extraordinary revenues. This would put into question the competitiveness of the technology and would come under scrutiny from the public, especially lenders, who are sceptical of over-remuneration. In five out of the eight largest offshore wind jurisdictions, contracts-for-difference (CfDs) have been used to provide price stability to investors (see Table 2.3) and protect consumers from high electricity prices (Florence School of Regulation, 2023[31]). A majority of these are two-sided CfDs, providing a minimum and maximum protection for the projects against volatile market prices. The two-way design means that projects also pay back when wholesale electricity prices are high, thereby guaranteeing the government and the consumers with low electricity prices.

Corporate PPAs as additional revenue streams

Alongside revenue stabilisation, corporate power purchase agreements (PPAs) can serve as an additional source of revenue for developers to access long term debt and command a lower cost of capital. Large industrial players who are heavy energy users can serve as creditworthy off-takers. In Europe and the US, corporate PPAs have been successfully implemented in utility scale projects, alongside policy support. As common practice, large corporate off-takers are bound by additionality principles when choosing the source of power, whereby they only engage in new renewable energy projects that wouldn’t have otherwise reached the market.

Given the large offshore wind volumes to be procured, offshore wind regulatory frameworks need to allow large non-utility corporates to participate in a project alongside distribution utilities and policy support. In this way, project developers can be allowed to reserve a share of the generation for sale via PPA. The certificate-based tracking of procured power, available since mid-2022 with the launch of the Renewable Energy Market, should facilitate the uptake of such business models.

The Green Energy Option Programme, the Renewable Performance Standards and the Renewable Energy Market can provide the basis for a liquid and bankable corporate PPA market. However, confidence in these measures needs to be built. To achieve this, tools can be made available to structure flexible corporate PPA contracts that provide price visibility to the power generator and cost management to the off-taker in a two-sided contract for difference with a minimum and a maximum price. This can be supported further by clear and unambiguous terms on recourse in the event of payment default and a transparent dispute resolution mechanism in the event of contract breaches.

Table 2.2. Corporate PPAs secured alongside policy support for offshore wind projects

|

Project |

Offtaker |

Developer |

Country |

COD |

PPA signed |

Project (MW) |

PPA (MW) |

PPA tenor (Years) |

|---|---|---|---|---|---|---|---|---|

|

Norther |

|

Engie |

Belgium |

2020 |

2019 |

370 |

92 |

5 |

|

Race bank |

Nestle |

Orsted |

UK |

2018 |

2020 |

573 |

31 |

15 |

|

Borkum Riffgrund 3 |

Covestro |

Orsted |

Germany |

2025 |

2019 |

900 |

100 |

10 |

|

Race bank |

NW |

Orsted |

UK |

2018 |

2019 |

573 |

23 |

10 |

|

Borssele III&IV |

Microsoft |

Eneco, Shell |

Netherlands |

2021 |

2019 |

731 |

90 |

15 |

|

Nordsee Ost |

Deutsche Bahn |

Innogy, RWE |

Germany |

2015 |

2019 |

295 |

25 |

5 |

Source: Green Giraffe, 2020

Hedging against wind volume risk

While a minimum price can be guaranteed via PPA contracts, developers are still exposed to some volume risk, which results from deviations between wind estimates and actual production. In cases where wind variability is high, hedging products developed by insurance companies can create value in the energy commodity business. They can be structured as floor on power output. Hedging the wind risk can protect project revenues against unpredictable weather patterns and downside scenarios.

Certainty of demand for power and curtailment risk from insufficient grid capacity

To be able to raise low-cost finance, offshore wind projects in the Philippines would need to see a certainty of demand for power and the ability to deliver the power to where it is needed. Curtailment measures in the Philippines have been taken even for renewable energy projects that benefit from priority dispatch or policy support. Production based support schemes for renewables or PPA contracts such as in the Philippines will not be funded if the power is curtailed and will result in missed revenues for asset generators. Curtailment measures are also not subject to financial products that hedge against commodity risk, leaving projects fully exposed to downside scenarios.

Box 2.4. Comparison of existing auction mechanisms and prices in main offshore wind markets

Auctions have emerged as the instrument of choice for deploying offshore wind capacity globally. Over 53 offshore wind auctions have been conducted globally, the majority in Europe – which has the longest track record in offshore wind. Auctions are primarily used to competitively allocate support measures, which range from fixed tariffs to zero-subsidy. Each of the support measures currently in use (FITs, one-sided or two-sided CFDs, PPAs, Renewable Energy Certificates (RECs) will expose investors to different levels of market risks.

Early and less mature markets tend to use revenue stabilisation mechanisms more extensively and limit to a large scale the merchant risk exposure of developers. None of the offshore wind jurisdictions to date have chosen to expose investors to merchant risk in the early market stages. In the initial market stages in Europe, fixed price support served to incentivise investments through de-risking and enabled the continent to build track record.

In more established markets, developers need less de-risking. This can be seen in Europe, which is transitioning towards more market based and higher risk sharing support regimes. Some countries have even introduced zero subsidy tenders (the Netherlands) or allow negative bidding (Germany). This means two things: full merchant risk exposure in both cases and, in the latter, investors paying for the right to develop. Other countries like the UK have opted to reduce the risk for investors via two-sided CfD.

Stakeholder polling during OECD consultation workshops revealed that FiTs were considered the most effective fiscal support mechanism for initial offshore wind deployment in the Philippines (41% of the vote), followed by tax incentives (30%), contracts-for-difference (22%), feed-in premiums (4%) and tradeable certificates (4%).

Markets also differ in other auction design features such as: i) frequency of auctions; ii) duration of support; iii) market reference price; iv) adjustment for inflation; v) grid-connection responsibility; vi) site development responsibility; vii) allocation of seabed leases; and viii) penalty for non-compliance. Additional policy support outside of the revenue stabilisation mechanisms is granted in some markets, either in the form of development capital support or organised centrally by the government in specific offshore wind development zones. While each of these design features will have an impact on the final bid, awarded prices over the years have shown a significant reduction.

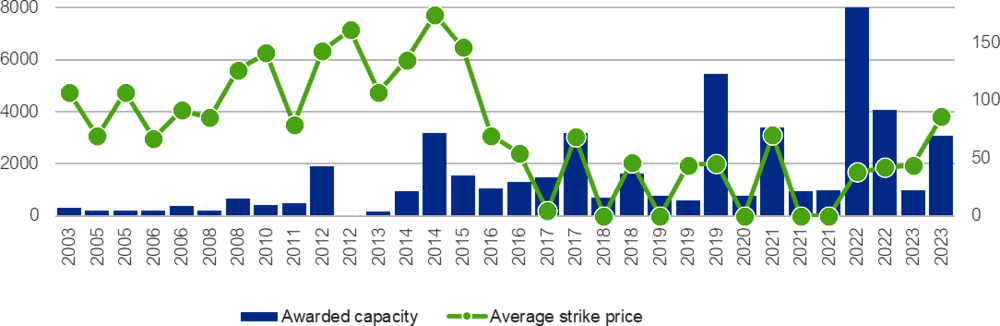

Figure 2.4. Average strike prices and offshore wind auctioned capacity in Europe

Table 2.3. Overview of main fixed-bottom offshore wind auction design in established offshore wind markets (as of December 2021)

|

Country |

Number of auctions (& auctioned projects) |

Auctioned projects reaching FID (% of capacity) |

Capacity weighted average prices (€2020/ MWh) |

Funding mechanism (CfD, FIT, tax credit) |

Tenor (years) |

Inflation indexed |

Grid connection responsibility |

Site development |

Seabed lease auction |

Devex support |

Penalties for non- compliance |

Technology specific |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

China |

7 (21) |

9 (36.8%) |

103.1 |

Administrative FIT/competitive FIT |

n/a |

No |

Guaranteed access |

n/a |

n/a |

n/a |

Permit loss w/o construction >2 years |

Yes |

|

United Kingdom |

4 (9) |

8 (99.9%) |

66.5 |

Two-sided CfD |

15 |

Yes |

Project |

Bidder |

Yes, separate auction prior CfD |

No |

Non-delivery: Banned for 2 years |

Partial (different technology pots) |

|

Germany |

3 (13) |

9 (54.2%) |

15.1 |

One-sided CfD |

20 |

No |

TSO (socialised) |

Government |

No |

Yes |

Financial €0.1–0.2/MW |

Yes |

|

Netherlands |

8 (8) |

7 (83.2%) |

26.8 |

One-sided CfD |

15 |

No |

TSO (socialised) |

Government |

Yes, part of auction criteria |

Yes |

Non-delivery: €10m Late: €3.5m/mo |

Yes |

|

Denmark |

8 (8) |

5 (83.8%) |

89.4 |

Two-sided CfD |

20 |

No |

Project (as of 2021) |

Bidder |

No |

No |

Non-delivery/Late: =€m0.15/MW + less supported production |

Yes |

|

Chinese Taipei |

2 (14) |

6 (38.2%) |

90.8 |

Administrative FIT/competitive FIT |

20 |

No |

TSO (socialised) |

Government |

No |

No |

No |

Yes |

|

United States |

9 (13) |

1 (9.4%) |

75.5 |

Fixed OREC / fixed-priced PPA |

20 |

Yes |

Project |

Bidder |

Yes, prior federal seabed auctions |

No |

No |

Yes |

|

France |

5 (8) |

4 (42.0%) |

133.7 |

FIT / two-sided CfD |

20 |

Yes (for 60% of the tariff) |

TSO (socialised) |

Bidder |

No |

No |

CfD shorted by the number of days delayed |

Yes |

|

Philippines (based on current GEAP) |

na |

na |

na |

Fixed price PPA |

20 |

No |

Project (to be further clarified) |

Bidder |

No |

No |

Delay >1 year: performance bond; Delay<1 year: 0.1%/day to a max of 10% of project cost |

Partial (different technology bands) |

Source: Adapted from Jansen et.al, 2022

Table 2.4. Overview of main policies in floating offshore wind policies (as of October 2023)

|

Main auction design elements |

France |

United Kingdom |

Norway |

Spain |

Ireland |

Italy |

Portugal |

Greece |

|---|---|---|---|---|---|---|---|---|

|

Floating wind target |

Yes 750 MW (3x250 MW) by 2030 and 1500 MW (extensions) |

Yes 5000 MW by 2030 |

Yes 1500 MW |

Yes 1000 - 3000 MW |

Partially 5000 MW of mostly bottom fixed offshore wind by 2030, with strong potential afterwards |

Partially 3500 MW of offshore wind without breakdown |

Yes 2000 MW |

Yes 2000 MW |

|

Areas for floating available in Maritime Spatial Plan |

Yes Specific locations to be determined after stakeholder consultation |

Yes |

Yes |

Yes |

Yes, but work is ongoing The Offshore Renewable Energy Development Plan II identified areas for upcoming auction |

No, but work is ongoing |

Yes |

No, but work is ongoing |

|

Consult stakeholders |

Yes |

Yes |

Yes |

Yes |

Yes |

Under consideration |

Yes |

Under consideration |

|

One-stop shop authority |

Partially |

Yes |

Under consideration |

Under consideration |

Under consideration |

No |

No |

No |

|

Technology specific auctions |

Yes |

Partially |

Yes |

Under consideration |

Under consideration |

Under consideration |

Under consideration |

Under consideration |

|

Rounds frequency, volumes, and evaluation criteria |

Yes |

Yes |

Yes |

Under consideration |

Under consideration |

Under consideration |

Under consideration |

Under consideration |

|

Support for supply chain, ports, and mass production |

Partially Recovery plan budget for greener ports |

Yes |

Under consideration |

Partially Recovery plan budget for R&I |

Under consideration |

No |

Under consideration |

No |

|

Grid connection roles and responsibilities |

Yes |

Yes |

Yes |

Yes |

Yes |

Under consideration |

Under consideration |

Under consideration |

Source: WindEurope, 2023

A reliable, diversified, and sustainable offshore wind supply chain

Until the country builds its own supply chain for parts that can be sourced locally, there will be some element of foreign capital and technology in the early offshore wind projects in the Philippines. To build a reliable, well-diversified and sustainable offshore wind supply chain, the Philippines can integrate supply chain planning early on in its key industrial trade policies. This will also allow for the development of needed onshore supporting infrastructure (see Long-term vision and strategy).

A reliable supply chain

A reliable supply chain needs a predictable timeline of auctions that gives a medium-term visibility to investors. Offshore wind projects have a development time frame of up to seven years, of which two to three years is in construction. Based on this project timeline, a lead time between auctions and commercial operations of three to six years can be assumed. With governments around the world raising their clean energy ambitions, there might be competition in critical technology components, as well as securing vessel contracts. The fully booked foundation manufacturers in Europe for the next three years is an example of shortages that wind energy supply chains may face (WindEurope, 2023[32]). Setting up long-term agreements and partnerships with suppliers can hedge some of these insecurities, but this needs a strong investment pipeline and long-term visibility on auctions.

A well-diversified supply chain

In addition to reliability, the supply chain will need to be well diversified for the country to achieve an uninterrupted supply of components and materials, and avoid any construction delays. Disruptions in the solar PV sector caused by the zero-Covid policy in China reflect the importance of reducing dependency on one single country. Therefore, it is important for the Philippines to also develop local capabilities to have a wide selection of suppliers. In line with this, an overarching industrial policy that goes beyond the actual offshore wind projects, could bring economic benefits and a diversified supply chain.

A sustainable supply chain

Sustainability issues in the supply chain can be a key battleground for policy makers and international companies with high non-financial disclosure standards. The Philippines has regulations in place for promoting responsible business conduct (OECD, 2016[33]). Mainstreaming economic, social, and environmental metrics, combined with a clear communication strategy on business expectations can help the country manage issues in the supply chain and assess the impact on local communities. (OECD, 2016[33]). Closely linked to the sustainability of the supply chain is the consideration of environmental and social criteria in the project planning phase.

Availability and cost of capital

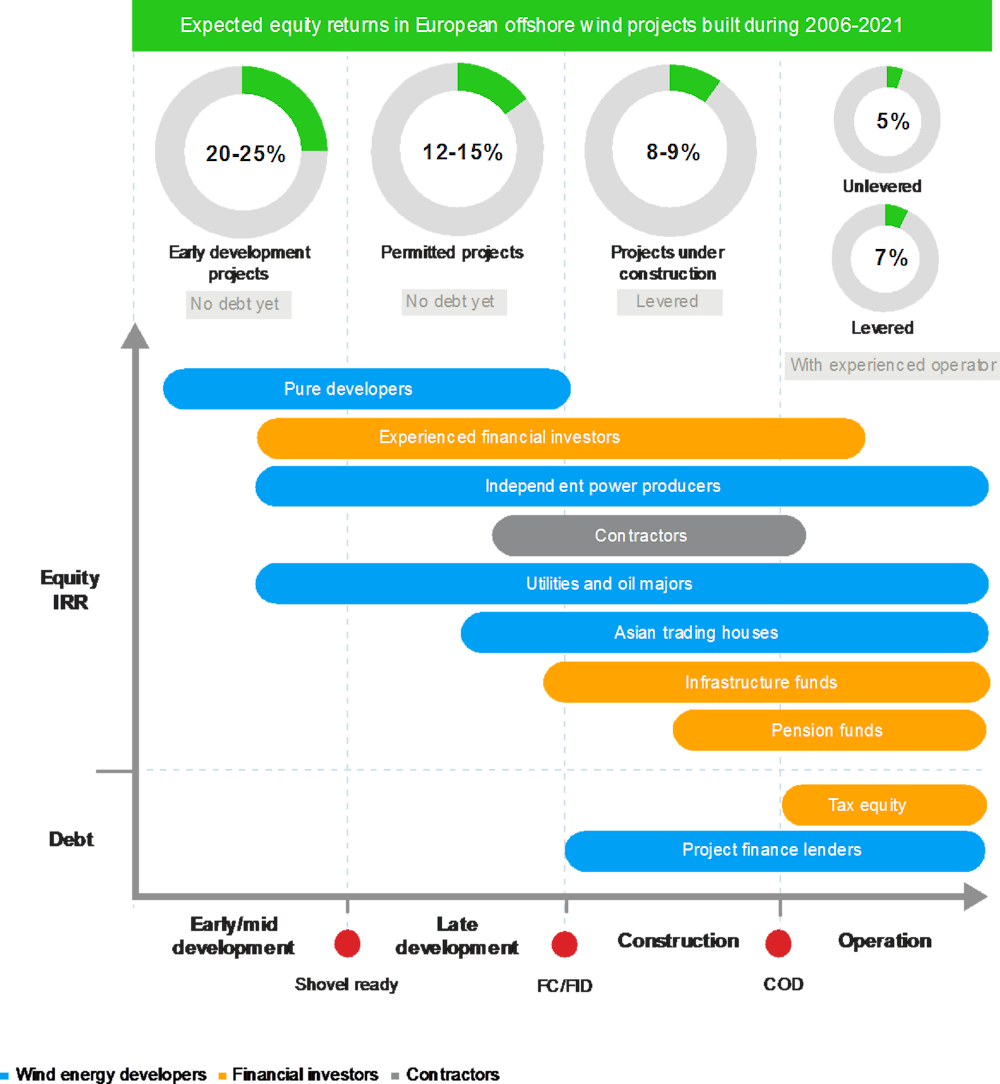

The scale of financing needed between now and 2040 for the Philippines to meet its offshore wind potential is estimated to reach USD 50 billion (World Bank, 2022[1]). Alongside policy, regulations and enabling infrastructure, questions on availability and cost of capital are also at the forefront of offshore wind discussions in the Philippines. Experience from other established offshore wind markets has shown that cost reductions were also possible thanks to the financial optimisation that happened at the transaction level (Guillet, 2022[9]).

The overall policy and macro-economic context will impact the cost of finance

The availability and cost of capital in the Philippines will largely depend on the regulatory framework, administrative set-up in planning and permitting, grid development and a strong understanding of project and country risks by financiers.

The general macroeconomic conditions where the first projects will happen is also very important. The favourable financial context with “lower for longer” interest rates has come to an end. Increasing central bank rates to curb inflation have replaced the low-cost-money era. The Philippines has had one of Asia’s most aggressive interest rate hikes, but currently the outlook stands stable at 6.25% (Reuters, 2023[34]).

Types of funding and financial structures will also impact the cost of finance2

The way a project is funded will also have an impact on the cost of capital and the contractual obligations, with the choice of instruments determined by the type of developer. Utilities and the domestic integrated conglomerates in the Philippines would typically opt for a corporate finance deal, largely based on equity with debt raised at corporate level. These companies can have access to low-cost finance thanks to strong balance sheet positions, diversified asset base and, most importantly, experience building and operating utility scale power plants.

Project finance transactions, funded by a consortium of debt and equity providers, can play a bigger role for smaller developers, independent power producers and international investors who lack local experience. As such, partnerships from a very early stage are key in project finance transactions. Due to the non-recourse nature of these deals and the strict requirements that come with co-ordinating a club of lenders, the cost of capital in these transactions can be higher when compared to corporate finance.

Project finance in the Philippines has been successfully deployed in large scale infrastructure projects, mostly public private partnerships. In the wind energy sector, project finance transactions have been deployed mostly for the refinancing of construction costs. Despite the willingness of lenders to take on construction risk, delays with the disbursement of the tariff meant that project sponsors had to take projects through early construction on equity.

Some non-recourse financing has been structured as dual currency transactions offered by a mix of local and international banks. Such transactions can facilitate knowledge transfer and capacity building indomestic institutions, improved risk perceptions and consequently a lower cost of finance over time (ADB, 2019[35]). Several offshore wind WESC holders in the Philippines have launched calls to form equity partnerships for project development, indicating a strong activity for project finance transactions.

Key actors financing offshore wind in the Philippines

Experience with other renewable energy technologies has shown a liquid debt market, with over 20 banks active, mostly domestic. Availability of capital has not been an issue, but the mixed ownership structures and conglomerate linkages may present some limitations on the domestic lending in the context of the GW scale – billion USD deals.

Moreover, financiers may remain cautious in the absence of an industry track record. There will be some implementation uncertainties and perceived risks that will be reflected in the financing structures as premium on credit spreads and insurance quotes.

Therefore, it is important to bring a diversity of financial actors with different risk profiles, for every stage of project development. Expanding the investor base would diversify the supply and sources of capital (McKinsey & Company, 2017[36]).

Long-term institutional investors have an investment profile that matches that of offshore wind. They look for long-term exposure to stable, cash generating assets, which fit the characteristics of renewable energy assets. Their role is particularly important in post-construction phase as they free up developer capital for new projects. If these refinancings are incorporated early in the financial assumptions, they can have a positive impact on the cost of capital and ultimately the bid prices (Guillet, 2022[9]).

More active investors such as hedge funds can help with both liquidity and price stabilisation. Whereas other private-market investors can provide capital to fund early-stage businesses and new technologies.

Insurance companies with offshore wind market knowledge are needed to provide an all-round coverage. Lenders would assume a worst-case scenario and typically look for insurance that covers all transactions linked to transport, storage, construction, operations and potential business interruption scenarios. This can be provided by a club of insurance companies that come together in the same transaction.

Multilateral and development bank (MDB) finance will continue to be important in financing higher risk operations and providing larger ticket sizes compared to commercial lenders. The World Bank estimates that concessional finance alone – for up to 16% of the project’s capital expenditure – can lower the cost of electricity produced from offshore wind by 13%, down to USD 94/MWh from 108 USD/MWh. Blended with an additional 10% in grants of the project’s capital expenditure, the cost of electricity decreases further by 35%, to reach USD 70/MWh (World Bank, 2023[37]). However, participation of MDBs may come with restrictions and reporting requirements that can delay the financing (ADB, 2019[35]). This can be an issue especially for project finance transactions, where all banks are required to move at the same pace and on equal terms. Lessons learned from previous onshore wind project finance transactions with multilateral development banks show some scope to apply a case-by-case analysis for key projects of national interests. Moreover, concessional finance from MDBs for strategic infrastructure will need to be available in terms that are more favourable than those of commercial banks.

Export Credit Agencies (ECAs) are another avenue to crowd in capital. Given that offshore wind manufacturing companies are already concentrated in Northern Europe, offshore wind projects in the Philippines would easily be able to demonstrate export value, thus creating an ideal opportunity to work with ECAs from that region. ECAs can provide highly rated credit guarantees covering up to 100% of the financing risks and with long risk coverage periods (up to 18 years). From industry consultations in the country, credit guarantees were considered as the most effective de-risking instrument for initial offshore wind projects during a poll.