The global catastrophe (CAT) bond market has grown steadily since the 1990s. However, the implementation of sovereign CAT bonds is still limited in Asia and the Pacific. This chapter provides some examples of the implementation of CAT bonds in various countries, including selected OECD countries such as Australia, Japan, New Zealand and the United States, as well as those sponsored by the governments of Jamaica, Mexico and the Philippines. Case studies of Indonesia, China and India also provide insight on the current situation of disaster risk financing in those countries, as well as the challenges they face in developing CAT bond markets.

Fostering Catastrophe Bond Markets in Asia and the Pacific

4. Country case studies of catastrophe bonds

Abstract

Introduction

This chapter first addresses how countries in Dynamic Asia and the Pacific can overcome the practical challenges of adding CAT bonds to their disaster risk financing menu. Firstly, it provides an overview of the Philippines’ CAT bonds and the supporting factors that facilitated their adoption and discusses further challenges related to the implementation that may need to be addressed. Second, the chapter addresses the current state of play of disaster risk financing in Indonesia and how it can adopt CAT bonds to tackle pressure on the government budget after natural catastrophes. It also discusses further challenges related to Indonesia’s capacity in managing disaster-related data as one of the prerequisites of CAT bond development. Next, the chapter discuss challenges related to financing for post-disaster recovery in the People’s Republic of China (hereafter “China”) and presents examples of the transfer of disaster risk to capital markets by the Chinese reinsurance sector. It then provides an overview of disaster risk financing mechanisms adopted by India. The adoption of CAT bonds and issuance mechanisms by Mexico and Jamaica will also be discussed. Finally, it presents the development of CAT bond markets in selected OECD countries, namely Australia, Japan, New Zealand, and the United States (US).

The case of the Philippines

The Philippines is one of the most disaster-prone countries in the world. It holds the top position as the country with the highest disaster risk according to the 2023 World Risk Index (Bündnis Entwicklung Hilft/IFHV, 2023[1]). Every year, the Philippines experiences many forms of natural disasters, such as earthquakes, typhoons, floods, volcanic eruptions, droughts and landslides. Recently, Typhoon Rai (known as Super Typhoon Odette locally), hit in December 2021. As of early February 2022, over nine million people had been affected (NDRRMC, 2022[2]). In November 2020, Super Typhoon Rolly (Typhoon Goni) battered large parts of the country, affecting over two million people residing in nearly half the country (NDRRMC, 2020[3]). Issuing sovereign CAT bonds is a feasible risk transfer solution that could be emulated by other highly exposed countries. Furthermore, several enabling factors could facilitate more widespread sovereign CAT bond issuance in the Philippines (Table 4.1).

The Philippines is already present in the CAT bond market, albeit indirectly, as the bonds have been issued by the World Bank on the country’s behalf. In 2019, the World Bank issued two tranches of CAT bonds to provide the Philippines with a total of USD 225 million financial coverage against earthquakes and tropical cyclones for three years. The CAT bonds were issued under the IBRD’s Capital-At-Risk Notes programme, which can be used to transfer risks related to natural disasters and other risks of developing countries to capital markets.

Table 4.1. Enabling factors for and challenges to the widespread issuance of sovereign CAT bonds in the Philippines

|

Enabling factors |

Challenges |

|---|---|

|

|

Source: Authors’ compilation.

Of the total USD 225 million insurance coverage, the first tranche, featuring USD 75 million of Class A notes, covered risks of earthquake, while the second tranche, featuring USD 150 million of Class B notes, was exposed to tropical cyclone risks. Both tranches covered the entirety of the Philippines. The Philippines paid an insurance premium for the coverage, which was fixed during the tenure of the bond. The World Bank had a swap agreement with the Philippines, which allowed the former to transfer the collected insurance premium to the CAT bond investors. Investors received monthly coupon payments based on the prevalent three-month USD London Inter-Bank Offered Rate (LIBOR) interest rate plus funding and risk margins (Table 4.2). On a modelled-index loss trigger basis, the World Bank used the swap arrangement to transfer the payout proceeds to the Philippines in the case an earthquake or a tropical cyclone occurring and meeting the predefined criteria under the bond terms.

Table 4.2. Selected terms and conditions of the CAT bonds issued by the World Bank on behalf of the Philippines

|

Parameters |

Class A bond |

Class B bond |

|---|---|---|

|

Aggregate nominal amount |

USD 75 million |

USD 150 million |

|

Perils covered |

Earthquake |

Tropical cyclone |

|

Trigger type |

Modelled loss |

Modelled loss |

|

Issue date |

15 November 2019 |

15 November 2019 |

|

Maturity date |

22 December 2022 |

2 December 2022 |

|

Bond coupon (per annum) |

Three-month USD LIBOR + funding margin + risk margin (subject to a minimum rate of interest equal to the risk margin) |

Three-month USD LIBOR + funding margin + risk margin (subject to a minimum rate of interest equal to the risk margin) |

|

Funding margin |

-0.12% per annum |

-0.12% per annum |

|

Risk margin |

5.50% per annum |

5.65% per annum |

|

Coupon payment dates |

Monthly |

Monthly |

|

Redemption amount |

The aggregate nominal amount reduced by any principal reductions, partial payments or partial redemptions |

The aggregate nominal amount reduced by any principal reductions, partial payments or partial redemptions |

|

Principal reductions |

Depending on the calculated earthquake modelled loss following any earthquake event, the outstanding nominal amount may be reduced by 0%, 35%, 70% or 100%. |

Depending on the calculated tropical cyclone modelled loss following any tropical cyclone event, the outstanding nominal amount may be reduced by 0%, 35%, 70% or 100%. |

Note: LIBOR = London Inter-Bank Offered Rate.

Source: (World Bank, 2019[4]), “World Bank Catastrophe Bond Transaction Insures the Republic of Philippines against Natural Disaster-related Losses Up to US$225 million”, www.worldbank.org/en/news/press-release/2019/11/25/world-bank-catastrophe-bond-transaction-insures-the-republic-of-philippines-against-natural-disaster-related-losses-up-to-usd225-million.

Depending on the calculated modelled loss amount following any earthquake or tropical cyclone event, the outstanding principal of either tranche could have been reduced by 0%, 35%, 70% or 100% (Table 4.2). More precisely, the Philippines government would have received payouts amounting to 0%, 35%, 70% or 100% of the principal, depending on the severity of an earthquake or a tropical cyclone event that occurred during the coverage period. If a qualifying event had occurred, the payout process would have taken approximately one month for an earthquake and five months for a tropical cyclone (World Bank, 2019[5]). The process would not have required assessment of the real losses incurred by the country.

The Philippines CAT bond transaction marked an important milestone in the country’s long collaboration with the World Bank. Its development involved a number of specialised actors, for instance GC Securities and Swiss Re as the joint structuring agents, bookrunners and managers; Munich Re as a joint structuring agent, placement agent and manager; and AIR Worldwide as a risk modeller and calculation agent. In addition, the issue benefited from the Monetary Authority of Singapore’s insurance-linked securities (ILS) Grant Scheme, which reduced the issuance cost by SGD 2 million (Singapore dollar) (DFA, 2019[6]). This instrument was the first CAT bond sponsored by an Asian sovereign and listed on an Asian exchange (the Singapore Exchange).

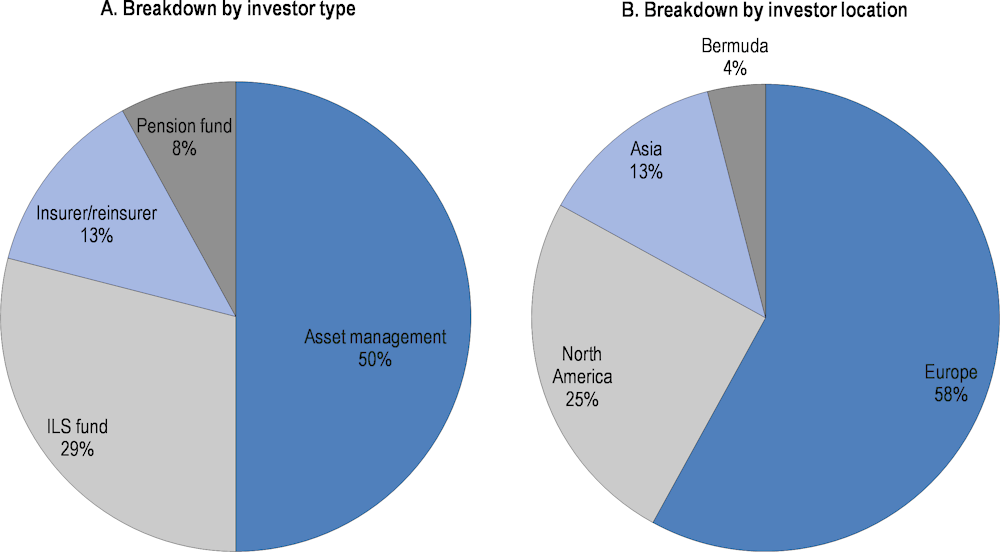

The listing of the Philippines CAT bond on a recognised international exchange may enhance their secondary market liquidity, improve transparency for ILS transactions and increase the securities’ attractiveness for some investors, particularly those required to hold listed and tradable securities in their portfolios. The Philippines CAT bonds were subscribed by 24 investors globally, ranging from asset management companies, dedicated CAT bond funds, pension funds and (re)insurance companies (Figure 4.1): asset management companies (Panel A) and Europe-based investors (Panel B) are the largest holders.

Figure 4.1. The Philippines CAT bond investor distribution by type and location

Note: ILS = insurance-linked securities.

Source: World Bank (World Bank, 2019[4]), “World Bank Catastrophe Bond Transaction Insures the Republic of Philippines against Natural Disaster-related Losses Up to US$225 million”, www.worldbank.org/en/news/press-release/2019/11/25/world-bank-catastrophe-bond-transaction-insures-the-republic-of-philippines-against-natural-disaster-related-losses-up-to-usd225-million.

The Philippines’ regulatory and institutional environment for CAT bond adoption

A strong legal and institutional framework for disaster risk financing is essential to facilitate the development of risk transfer mechanisms such as CAT bonds. The Philippines provides an example of good practice in this regard. The Philippine Disaster Risk Reduction and Management Act of 2010 (DRRM Act or the Republic Act [RA] No. 10121) contains detailed provisions on risk reduction budgets at various levels (Amach, 2021[7]). The Philippine Development Plan 2017-2022 also outlines several DRR strategies, among which was the development of facilities for adaptation, including risk transfer mechanisms (NDRRMC, 2020[8]).

The National Disaster Risk Reduction and Management Plan has been updated. Among other provisions, the updated plan is intended to strengthen disaster and climate risk governance by clarifying the roles, accountabilities, strategies and activities of DRR and management stakeholders at all levels. For instance, in adherence to the RA No. 10121, the Department of Science and Technology is the overall lead for disaster prevention and mitigation activities. One of the main objectives stipulates the institutionalisation of risk financing mechanisms for both ex ante and ex post actions. This scope of activity emphasises the complementarity of resources to help strengthen financial resilience at all levels, with the Department of Finance (DoF) as the lead agency (NDRRMC, 2020[8]).

The updated National Disaster Risk Reduction and Management Plan 2020-30 also outlines several key focus areas within disaster prevention and mitigation pillar. For instance, under the leadership of the DoF, to ensure accessible disaster risk financing strategies efforts will include research and development of new mechanisms on risk financing; creation of an enabling environment for private-sector participation in the development of financing options; an information, education and communication campaign to encourage hazard insurance coverage at all levels; promotion and development of insurance schemes across sectors; and directory update of available financing windows for local government units (LGUs).

The Philippine government’s adoption of a national Disaster Risk Financing and Insurance (DRFI) strategy in 2015 marked a key milestone in the country’s financial planning for disasters. The DoF, supported by the World Bank, developed the national DRFI strategy with the aims of maintaining the sound fiscal health of the national government and of developing sustainable financing mechanisms for LGUs, among others. With the DoF and the Bureau of the Treasury (BTr) leading the implementation, the DRFI has allowed the government to expand its portfolio of disaster risk financing instruments.

The various instruments implemented by the government complement each other within the risk layering approach. This approach allows the government to efficiently use different financial instruments against events of differing frequency and severity. For instance, the government can rely on the resources annually allocated to the national or local DRR and management funds (NDRRM Fund and LDRRM Fund) to address funding needs after the occurrence of a high-frequency, low-severity event. Within each of these funds, 30% is allocated as a Quick Response Fund (QRF) to ensure swift availability of resources for immediate response efforts when disasters strike.

Additional solutions include contingent lending by international partners, such as the Asian Development Bank (ADB), the Japan International Cooperation Agency and the World Bank. The government also implemented the national parametric insurance programme pilot from 2017 to 2019. With over PHP 3 billion (Philippine peso) in premiums from the budget, the programme was intended to protect national government agencies (NGAs) and LGUs from risks of earthquakes and typhoons (World Bank, 2020[9]). The CAT bonds issued in 2019 were an example of instruments belonging to the top layer of the strategy. These instruments are deployed to provide rapid liquidity when rare but high-severity events occurred.

As an additional instrument to strengthen financial resilience, the National Indemnity Insurance Programme (NIIP) is currently being prepared. Led by the BTr, in tandem with the Government Service Insurance System (GSIS), the programme will cover economically important government assets, such as school buildings, bridges and roads in the national capital region and the eastern seaboard against various perils, including typhoons, floods, storm surges, earthquakes and volcanic eruptions. The implementation of the NIIP is supported by the recently issued Joint Memorandum Circular (JMC) No. 2020-001 or the Philippine Government Asset Management Policy (DoF/DBM/NEDA, 2020[10]).

The JMC serves as a guide to government agencies and government-owned and government-controlled corporations on adopting the country’s asset management system, which requires them to submit data related to their non-financial assets to the National Asset Registry System (NARS). Data within this information technology-based registry maintained by the BTr contain geographical, legal and financial data, asset attributes, risk mitigation features and insurance information. This also allows the government to enhance asset management, including prioritisation of assets for insurance coverage and disaster risk modelling (DoF/DBM/NEDA, 2020[10]). Currently, the government, with help from development partners, is enhancing the NARS to make it a web-based portal with more functionalities.

Additionally, the government completed the first nationwide catastrophe risk assessment in 2014 with assistance from development partners (World Bank, 2020[11]). It provided estimates of potential disaster losses of both public and private assets, which in turn allowed the government to analyse the costs and benefits of various risk financing instruments. Additionally, the risk assessment facilitated the evaluation of efficiency gains from combining various instruments to address various risks. For instance, based on the experience of implementing the catastrophe risk insurance programme in 2018, the government opted to use CAT bonds instead of renewing the insurance programme to reflect better the country’s needs during disaster aftermath.

The Parametric Catastrophe Risk Insurance Program as a key facilitator of the Philippines CAT bonds

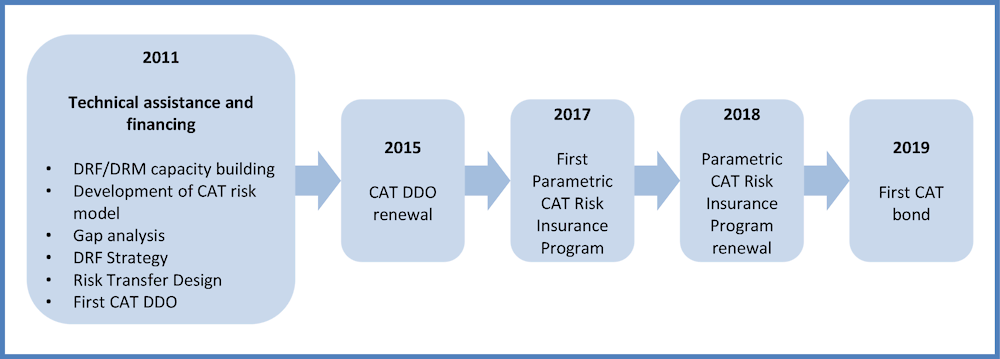

The development of disaster risk financing programmes began in 2012 and culminated with the issuance of CAT bonds (DFA, 2019). This instrument is the latest step of the World Bank’s programme to support the country’s disaster risk management (Figure 4.2). The national Parametric Catastrophe Risk Insurance Program, piloted from 2017 to 2019 with help from the World Bank, allowed the government to enhance its disaster risk management strategically and led to the application of a more suitable instrument that fits the government’s needs (i.e. CAT bonds). Additionally, this pilot CAT risk insurance programme provided the country with technical expertise and lessons learned from its implementation that are useful for the preparation and placement of the CAT bonds (World Bank, 2020[11]).

Figure 4.2. Timeline of selected disaster risk financing programmes in the Philippines

Note: DRF = disaster risk financing. DRM = disaster risk management. DDO = deferred drawdown option.

Source: (World Bank, 2019[5]) “The Philippines: Transferring the Cost of Severe Natural Disasters to Capital Markets”, https://thedocs.worldbank.org/en/doc/752771575392782540-0340022019/original/casestudyPhilippinesCATbondfinal12.3.2019.pdf.

Three underlying contracts exist within the Parametric CAT Risk Insurance Program. The first involves the BTr and the GSIS whereby the BTr acts as the policyholder, and the GSIS acts as the primary insurer. In fact, the structure of the programme initially had the LGUs as the policyholders. However, limitations regarding the LGUs’ capacity to pay the premium and their lack of familiarity with the instrument led the national government to pay the premium on their behalf (World Bank, 2020[11]). The second contract involves the GSIS and the World Bank whereby typhoon and earthquake risks insured by the GSIS were reinsured by the World Bank Treasury. The third contract is between the World Bank and a panel of reinsurers, allowing the World Bank to transfer the aforementioned risks to the international reinsurance market in local currency. The private sector has shown significant interest in the transaction, with various counterparties being attracted, including non-traditional parties, such as pension funds. In the second year of the policy, the number of counterparties doubled. With such strong demand, the achieved price of the insurance programme was comparable to other parametric programmes in the international market (World Bank, 2020[11]).

During the first year of the programme, the insurance policy provided financial protection of USD 206 million. This doubled to USD 406 million in the second year, providing coverage against both perils for NGAs and coverage against major typhoons for 25 selected LGUs (Table 4.3). The proceeds of the insurance coverage were intended solely for recovery and rehabilitation activities related to government infrastructure and facilities that are essential for the reinstatement of operations and the delivery of basic services.

Under the General Appropriations Acts of 2017 and 2018, premium payments were financed through the NDRRM Fund. These amounted to USD 19.84 million (PHP 1 billion) in the first year and increased to USD 39.68 million (PHP 2 billion) in the second year. The premiums are divided into two categories: disaster specific and province specific. For instance, during the first year of the policy, PHP 500 million was allocated on a disaster-specific basis, with 79.2% for typhoon and 20.8% for earthquake. The remaining PHP 500 million was province-specific and split equally among 25 provinces, with each province contributing PHP 20 million. Nonetheless, the way in which premiums were allocated among provinces changed in the second year of the policy (Table 4.3). Previously allocated equally among 25 LGUs, the premium payment of the programme renewal was split among participating LGUs according to the risk level, namely high, medium and low.

Table 4.3. Key facts of the Philippines Parametric Catastrophe Risk Insurance Program

|

Parameters |

Year 1 |

Year 2 |

|---|---|---|

|

Total coverage |

USD 206 million |

USD 406 million |

|

Perils covered |

Typhoon, earthquake |

Typhoon, earthquake |

|

Trigger type |

Modelled loss |

Modelled loss |

|

Policyholder |

Bureau of the Treasury |

Bureau of the Treasury |

|

Intended beneficiaries |

50% for NGAs, 50% for 25 LGUs |

50% for NGAs, 50% for 25 LGUs |

|

Premium |

USD 19.8 million |

USD 39.7 million |

|

Premium allocation |

Equal allocation among 25 LGUs |

Premium allocation based on category of risks |

|

Payout structure |

Predefined partial payout with 10% probability of occurrence; predefined full payout with 3.3% probability of occurrence |

Predefined partial payout with 10% probability of occurrence; predefined full payout with 3.3% probability of occurrence |

|

Number of payouts |

1 typhoon |

1 typhoon and 1 earthquake |

|

Number of calculation requests |

2 typhoons |

2 typhoons and 9 earthquakes |

|

Total value of payouts |

USD 1.7 million |

USD 26.6 million |

|

Policy term |

July 2017-July 2018 |

December 2018-December 2019 |

Note: NGA = national government agency. LGU = local government unit.

Source: Authors’ compilation.

There are, however, a few limitations during the first year of the policy. For instance, as the coverage, hence premium payment, was allocated equally across 25 participating LGUs, this implies that should the predefined trigger be met, all 25 provinces would receive identical payout amount. This mechanism did not consider the fact that each province has different level of risks. With such a mechanism, a province that suffers limited actual losses may receive a large, fixed payout relative to the modelled damages.

As the country’s catastrophe risk model was developed on a modelled-loss basis, the Parametric CAT Risk Insurance Program used modelled loss as a trigger mechanism. The first national catastrophe risk model was released in 2014, and a commercial catastrophe risk model, which includes the subnational level, has been available since 2016 (World Bank, 2020[11]). In the Philippines’ case, AIR developed the new commercial catastrophe risk model used for the programme. The model was benchmarked and validated against previous versions of the country’s catastrophe risk model.

Nonetheless, the experience of the Philippines reveals the complexity of using modelled losses. Indeed, this trigger mechanism has proven hard to understand and explain to potential counterparties. Risk analysis, which is performed using the probabilistic catastrophe risk model, is required for the international reinsurance or capital market, as it forms the basis of the technical price. To participate in this market, market participants require a good understanding of the modelling process, input data, assumptions used for the model and the uncertainties in outputs from the model when deployed for real-time loss estimation.

The complexity of a modelled-index loss trigger was also among the factors that led to the significantly increased number of calculation requests during the second year of the programme, as the government preferred to avoid the risk of missing a potential payout (World Bank, 2020[11]). Indeed, the BTr and the GSIS may request a calculation notice in the event of a disaster. Throughout the first and second policy terms, a total of 13 calculation requests were made. Out of these, the policies paid out for three events, namely typhoons Tembin and Tisoy and the Zambales earthquake.

Through the Parametric CAT Risk Insurance Program, the government could improve its knowledge related to parametric insurance. As the Philippines had no prior experience working with parametric insurance, there was little institutional knowledge about it within the government in general and within the GSIS (the insurer) specifically. This lack of experience working with parametric insurance posed a regulatory challenge for the first implementation in 2017.

For instance, because of the lack of prior experience with parametric insurance policy, the GSIS was unable to retain any of the risks associated with the parametric programme, while legislation stipulates that any insurance provided to the government should be provided by the GSIS. This implies that the GSIS had to seek 100% reinsurance for the programme. However, the country’s standard procurement guidelines, which serve as a reference for laws that govern the GSIS procurement of international reinsurance, are not well suited for the purchase of (re)insurance cover (World Bank, 2020[11]). As a result, it was difficult for international financial markets to provide direct reinsurance coverage to the GSIS.

To overcome this issue, the Insurance Commission registered the World Bank as a reinsurer, thus allowing the GSIS to transfer risk to the World Bank. Amendments to or clarification of the Commission on Audit rules were also implemented, to allow LGUs to use funds from the LDRRM Fund to finance premium payments. This experience in addressing institutional and regulatory challenges created an enabling environment from which future transactions, including CAT bonds, may benefit.

Challenges remain, particularly concerning budget allocation. The NDRRM Fund still lacks the capacity to leverage efficiently its budget allocation through financial instruments, such as insurance and other risk transfer mechanisms. Moreover, budget allocations are still based on the previous year’s allocation or on the known reconstruction costs (IBRD/World Bank, 2020[12]). This has resulted frequently in insufficient funding and often delayed immediate response activities.

Furthermore, the Philippines should give additional attention to the institutional and legal structure so that the NDRRM Fund can play a role as a financial vehicle that can efficiently leverage the national budget allocation. Initiatives may include setting up a special purpose fund with the capacity to channel additional financial instruments in a transparent and efficient way, including contingent financing, insurance, and CAT bonds. This may also help support the Fund during severe disaster years by allowing it to accumulate across fiscal years as a self-insurance mechanism. However, the Republic Act 10121, which governs the NDRRM Fund, primarily focuses on allocating resources for DRR, response, and recovery efforts. For the NDRRM Fund to function as a financial vehicle, potential amendments might be necessary within the legislation to explicitly allow such uses. It would need to incorporate provisions that allow the Fund to engage in financial mechanisms beyond direct disaster response and recovery. A mechanism that balances years with higher and lower disaster costs would enable the government to smooth out unexpected expenditures. It is worth noting that, for the Fund to perform this function, the government may need to work on its governance and operational arrangements to guarantee implementation capacity, appropriate supervision and transparency.

Improving the quality and availability of exposure data is essential for more sophisticated catastrophe models

Regardless of the type of trigger, CAT bonds need to rely on a catastrophe model to assess the average expected loss and the possibility of partial or full loss in order to establish the bond premium. In the Philippines, earthquake and typhoon models have been used in the insurance market for several years and have been continuously improved. Data are indeed fundamental for loss estimation and model development. For instance, developing an earthquake model requires historical data on earthquakes, which can be obtained from local and regional historical earthquake catalogues. For tropical cyclones, sources of information include historical data in the form of barograph traces from land stations and ships, actual wind records from weather service stations, aircraft reconnaissance flight data, and precipitation data, among others.

With regard to the industry exposure databases (IED), much of the information is obtained from government statistical agencies and private firms specialising in this type of information. It includes data ranging from low-tier administrative areas, such as municipalities, to location-level data. According to AIR, the risk modeller and calculation agent for the Philippines’ CAT bonds, the late 2015 edition is the country’s IED, while as of late 2013, it is the exposure database of national government assets. The national government assets database also relies on data from various government agencies, including the Department of Education, the Department of Public Works and Highways, and the GSIS. This database comprises information about state-owned enterprises and specific infrastructure assets, including their location, structural and non-structural characteristics, and replacement cost. Roads, bridges, light rail, airports, seaports, schools, hospitals, prisons and other public administration buildings are among the assets modelled.

Risk modelling can, however, present several challenges, especially when there is a lack of historical loss data that can be useful for projecting future losses. Moreover, the available loss data are often inadequate due to the continued establishment of properties in hazard-prone areas and the constantly changing landscape of insured properties. This includes changing property values and costs of repair and replacement, as well as new building materials, design and structure that may be more or less vulnerable to catastrophe events. As a result, the limited available loss data are not suitable for directly estimating future losses.

The Philippines has put in place a number of initiatives to improve asset information, for instance through the adoption of the Philippines Government Asset Management Policy and the establishment of the NARS. In addition, the government is currently trying to track disaster-related expenditures in a systematic way through the development of a Disaster Risk Reduction Expenditure (DRRE) in the System of National Accounts. The framework encompasses various DRRE activities, including transfer from central to local government; inflow and outflow of international transfers (official development assistance); total disaster-related expenditures by category, by government and by non-government, as well as beneficiaries of total expenditures; and the total transfers received. However, such practices remain challenging due to, among other factors, the lack of standard concepts, definitions, classifications and methodologies; the limited capacity of regular reporting; and data gaps and time lags (Ilarina, 2021[13]). The creation of the Philippine City Disaster Insurance Pool, a risk pool designed to cover municipalities against the risk of typhoons and earthquakes, also enhanced the capacity to strengthen data collection processes and needs assessment (Box 4.1).

Box 4.1. Characteristics of the PCDIP

Cities in the Philippines face particularly high disaster risk. The Philippine City Disaster Insurance Pool (PCDIP) was established to address the need for rapid access to early recovery financing. Ten cities participated in the design of the pool. Their selection was based on an array of factors, including exposure to disaster risk, demographic and economic size, geographic location, data availability and disaster risk management governance. An additional element considered was the relative scale of government and public facilities, as an indication of post-disaster levels of expenditure. To support the optimal design of the PCDIP, the cities took part in a number of activities, including exposure data collection, needs assessment and capacity building.

The PCDIP is intended to provide rapid post-disaster financing for early recovery in a cost-efficient manner. A parametric insurance pool whereby payouts are determined based on the physical features of a catastrophe event (e.g. wind speed, earthquake intensity) rather than on actual losses suffered by the policyholder was identified as the best solution. The PCDIP offered parametric insurance coverage against typhoons and earthquakes in its first phase, with flood coverage added at a later stage. PCDIP payouts are made within 15 business days of the occurrence of an event.

Participating cities can purchase insurance coverage based on the types of hazards they want to insure against, the frequency and scale of payouts they would like to receive, and the funding available for premium payments. The premiums paid by each city are based on the level of risk the respective city brings to the pool. The PCDIP was structured to ensure that: i) municipalities can afford the premiums (e.g. via flexibility in choosing their coverage); ii) the pool is able to honour payouts in a timely manner; and iii) the pool is financially sustainable over the long term. Payouts are funded by a combination of pool capital and reinsurance protection purchased from domestic and international markets. The initial pool capital was provided by the government and will be supplemented by retained profits in years characterised by low disaster-related losses.

Source: (ADB, 2018[14]), Philippine City Disaster Insurance Pool: Rationale and Design, www.adb.org/sites/default/files/publication/479966/philippine-city-disaster-insurance-pool-rationale-design.pdf.

The aforementioned initiatives notwithstanding, data on public assets, particularly assets owned by NGAs, and data on disaster-related damage in the Philippines, remain incomplete (IBRD/World Bank, 2020[12]). Moreover, data on the use of different disaster-related funding sources are fragmented. For instance, detailed information with regard to disaster-related expenditures are often not included in government agencies’ reports. At the local level, it is often difficult to obtain data on LGU expenditures for past disasters or the expected share of expenditures between LGUs and the national government for future disaster scenarios (World Bank, 2020[11]). Additionally, the government lacks access to complete data on all assets owned by NGAs, including information related to the location, condition, maintenance and valuation of assets. This may create challenges for authorities to establish financial and risk management plans, and for stakeholders involved in CAT bond transactions (e.g. the modelling agent) to obtain better model estimates.

There is room to improve implementation of the Philippine Government Asset Management Policy in ways that would facilitate nationwide roll-out. This can be done, for instance, by requiring all government agencies to submit data to the NARS. Capacity building would also be necessary for the government to improve its capacity to assess, record and report damage and loss resulting from natural disasters. The collection and reporting of data should include all details on asset loss, in addition to registering aggregate data. By including granular data, the government could have a better understanding of post-disaster needs, which may in turn help implement the most cost-efficient risk transfer mechanism available.

Clarifying post-disaster responsibilities is crucial for the timely disbursement of funds

The implementation of the Parametric CAT Risk Insurance Program paved the way for the issuance of CAT bonds. While CAT bonds can provide quick liquidity following the triggering events, efficient disaster response and recovery may be hindered if there is a lack of clarity on risk ownership between national and local governments, lack of monitoring of post-disaster spending and lack of predefined fund flow mechanisms and beneficiaries. For instance, following the occurrence of Typhoon Rai (known as Super Typhoon Odette locally) that struck the Philippines in late 2021, the government issued notice to the calculation agent to see whether the event was severe enough to trigger the USD 150 million CAT bonds that cover typhoon losses.

The Typhoon Rai has, indeed, breeched the CAT bond trigger, resulting a partial payout of USD 52.5 million (35% of the principal) for the government. Although details on the use of funds originating from CAT bond payout was unavailable at the time of writing, lessons can be taken from the implementation of the Parametric CAT Risk Insurance Program, as both instruments share characteristics. Both the Philippines’ CAT risk insurance programme and CAT bonds provide coverage against risks of earthquake and tropical cyclone, use the same trigger mechanism, are reinsured and issued by the same institution (the World Bank), transfer risks to international markets, and require loss calculation by the same calculation agent (AIR) for payout procedures, among other aspects. Lessons learned from the Parametric CAT Risk insurance Program, particularly those related to payouts or fund disbursement, may therefore also be relevant for CAT bonds.

As discussed, the Parametric CAT Risk Insurance Program generated a total of three payouts from the first and second policy terms. These payouts were efficiently transferred from the international reinsurance market to the reinsurer (World Bank), then to the insurer (GSIS), and further to the policyholder (BTr). All payouts were completed as planned and in a timely manner. For instance, policy payments to the BTr were made six weeks after Typhoon Tembin hit the country in late 2017, eight weeks after the earthquake struck off Zambales and five weeks after Typhoon Tisoy hit in late 2019 (Table 4.4).

Table 4.4. Payout timeline of the three events that triggered the Philippines Parametric Catastrophe Risk Insurance Program

|

Detail |

Typhoon Tembin |

Zambales earthquake |

Typhoon Tisoy |

|---|---|---|---|

|

Event date |

21 December 2017 |

22 April 2019 |

2 December 2019 |

|

Calculation notice date |

27 December 2017 6 days after event |

8 May 2019 16 days after event |

5 December 2019 3 days after event |

|

Calculation reporting date |

11 January 2018 3 weeks after event |

17 May 2019 25 days after event |

11 December 2019 9 days after event |

|

Reinsurance payment date |

24 January 2018 5 weeks after event |

3 June 2019 6 weeks after event |

23 December 2019 3 weeks after event |

|

Policy payment date |

1 February 2018 6 weeks after event |

17 June 2019 8 weeks after event |

7 January 2020 5 weeks +1 day after event |

Source: (World Bank, 2020[11]) Lessons Learned: The Philippines Parametric Catastrophe Risk Insurance Program Pilot, https://openknowledge.worldbank.org/bitstream/handle/10986/36013/The-Philippines-Parametric-Catastrophe-Risk-Insurance-Program-Pilot-Lessons-Learned.pdf?sequence=1&isAllowed=y.

While payout transfers from the international reinsurance market to the BTr were done successfully according to the plan, fund disbursement from the BTr to the intended beneficiaries had several issues due to the lack of clarity in the rules governing fund disbursement. For instance, during the first policy term, the mismatch between payouts and losses from Typhoon Tembin resulted in misunderstandings and led to difficulties in allocating the funds (World Bank, 2020[11]). In fact, payouts related to Typhoon Tembin were subject to positive basis risk, meaning the payout amount based on modelled losses, was higher than the actual losses observed in the province that triggered the payout.

Given the positive basis risk, there was disagreement among authorities on how the funds would be distributed. Arguments included, among others: i) funds should be transferred to LGUs or NGAs, as the national government had paid the premiums; ii) funds should be given to the triggering province to demonstrate the usefulness of the insurance product; iii) funds should be distributed to the neighbouring provinces most in need; and iv) funds should be retained by the government to support future premium payments. As part of the fund disbursement procedure, the JMC outlines that the Department of Budget and Management requires an allocation report to trigger the Notice of Cash Allocation (NCA). This NCA would further allow the BTr to release the funds. However, due to disagreements among authorities on how to allocate the funds, as well as the lack of clarity in the JMC, an allocation report was not produced, and the NCA was never submitted. As a result, the funds have remained with the BTr (World Bank, 2020[11]).

Learning from the experience of the first policy term, significant changes were made to the JMC to manage payouts better during the second policy term. With the new JMC, payouts would not automatically go to the triggering LGUs. Instead, payouts would be made in accordance with the allocation report produced by the authorities. This could include payouts to affected LGUs, regardless of their inclusion in the programme.

The revision of the JMC also outlines the responsibilities of the Office of Civil Defense (OCD) in conducting post-disaster assessments. From previously being responsible for producing the rapid damage and needs assessments report, the revised JMC mandates the OCD to produce a simpler situational report. Such changes were made to improve the timeliness of fund disbursement. This is due to the production of the rapid damage and needs assessments report, which took a long time to produce during the previous policy term, hence slowing down the production of the allocation report and the disbursement of the funds to the LGUs.

Despite the JMC being revised, an issue remains that hinders smooth fund disbursements from the national government to the intended beneficiaries. The JMC states that the BTr requires the receipt of an NCA to release the funds. However, as of July 2020, the NCA was not prepared or received for either event that triggered payouts during the second policy term (the Zambales earthquake in mid-2019 and Typhoon Tisoy in late-2019) (World Bank, 2020[11]). Therefore, the funds have remained in the BTr account and have reached neither the LGUs nor the NGAs.

The pilot CAT risk insurance programme demonstrates the complexity of allocating funds, including payouts, in the most efficient and fair way during the post-disaster period. From the issues presented above, it follows that the Philippines may need a more efficient procedure of payout from the national government to beneficiaries. This would ensure that the country could really benefit from the rapid payouts offered by risk transfer instruments, including the currently implemented CAT bonds. From a regulatory perspective, the country may need to set clear public financial management rules that ensure the efficient and transparent flow of funds in the aftermath of natural disaster events. More can be done, for instance by establishing clear fund-flow arrangements and by providing clear guidance with regard to the delays or time needed to accomplish each step of the procedure.

In addition, cost sharing between the national government and the local governments may need to be clarified. Indeed, the national government currently covers most of the disaster response costs, including premiums. Through clear and credible rules on how these costs are shared between national and local governments, risk ownership could be more explicit, thereby improving financial planning for disaster response at all levels. Clear risk ownership would also create incentives to strengthen risk management and financial preparedness, especially at the local level, where disaster-related resources are available, but their utilisation is often inconsistent with the intended purpose (COA, 2021[15]).

The case of Indonesia

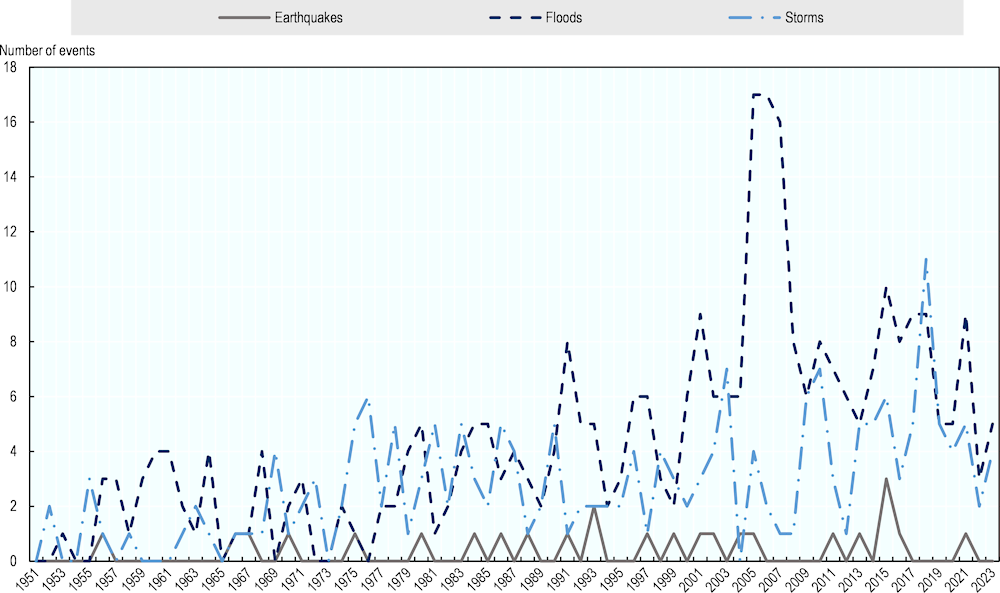

The Indonesian archipelago lies along the Pacific Ring of Fire. Due to its geographical location, the country is often exposed to many disasters, including earthquakes, tsunamis, floods, landslides and volcanic eruptions. According to the World Risk Report 2023, Indonesia’s risk index ranked second in the world, with exposure to natural hazards falling into the “very high” category (Bündnis Entwicklung Hilft/IFHV, 2023[1]). Nonetheless, the Indonesian Disaster Risk Index (IRBI), which is a measure to calculate and monitor disaster risks in Indonesia based on three factors, namely exposure, vulnerability, and capacity, shows a declining trend. The decline in IRBI in recent years is a positive development, as it indicates that Indonesia is making progress in reducing its risks of disasters. However, the decline in the budget for DRR is a concern as it could lead to a decrease in the effectiveness of DRR programs.

Between 2000 and 2022, the annual damages resulting from disasters amounted to around USD 1.4 billion (CRED, n.d.[16]). With such significant losses relative to the USD 214 million annual disaster-related budget (MoF, 2018[17]), the country seeks to improve its financial resilience through risk transfer mechanisms by minimising fiscal risks due to disasters.

Although not by means of a sovereign-sponsored CAT bond, the risk of volcanic eruptions in Indonesia has recently been transferred to capital markets through the world’s first volcanic risk CAT bond, issued on behalf of the Danish Red Cross (Box 4.2).

Box 4.2. Characteristics of the first volcano CAT bond

The world’s first volcano catastrophe (CAT) bond provides a three-year coverage against risks associated with ten volcanoes across parts of Africa, Asia, Central America, North America and South America. The privately placed CAT bond, worth USD 3 million, was issued on behalf of the sponsoring organisation, the Danish Red Cross. The capital is set to be used to support humanitarian relief efforts in the aftermath of a volcanic eruption. The CAT bond features a parametric trigger based on plume heights and prevailing wind direction, meaning varying amounts of payout would be triggered if a volcanic ash plume reaches a certain height within the three plume height thresholds, and the prevailing wind directs the resulting ash fallout towards vulnerable communities.

The ten volcanoes covered by the CAT bond were selected based on the significant humanitarian risks they pose. All have at least 700 000 individuals living within the radius of 100 km, a distance wherein the ash fallout is expected to have greatest impact. The volcanoes are well monitored and studied; hence the CAT bond trigger can be assessed. They include three volcanoes in Ecuador, one in Chile, one in Colombia, one in Guatemala, one in Mexico, one in Cameroon and two in Indonesia (Merapi and Raung).

The typical privately placed CAT bond issuance providing international coverage often features multiple perils from various geographic locations around the world, such as earthquakes in Australia, windstorms in Europe and named storms in the United States. The volcano CAT bond, however, provides coverage against a single type of peril but in multiple locations, making it the first of its kind in the CAT bond market.

This volcano CAT bond has been considered a strong model for CAT bond design due to its innovative features, including the modelled risks that use parametric triggers with a hybrid nature (i.e. the occurrence of an eruption measured by ash plume height and wind direction). With such a model, the trajectory of the ash cloud can be used to estimate the impact better. In addition, the model helps anticipate where funds will be needed, improving the efficiency and effectiveness of humanitarian relief. Another innovative feature is its placement, which is made through a unique blockchain-based ILS platform. This offers a cost-effective way to settle the transaction for both issuers and investors. It reduces issuers’ transaction costs by around USD 200 000 to USD 400 000 per issue compared to the traditional settlement system, and it enables investors to hold their securities on their own computer servers rather than use a custodian bank. This could save a further five to ten basis points per annum on the value of the securities held by investors.

Source: (Evans, 2021[18]), “First volcanic eruption CAT bond issued for the Danish Red Cross”, www.artemis.bm/news/first-volcanic-eruption-cat-bond-issued-for-the-danish-red-cross/.

With regard to sovereign CAT bonds, however, Indonesia is not yet present in the CAT bond market. Nevertheless, there is a possibility for CAT bonds to be used as a risk transfer mechanism within the country’s disaster risk financing strategy. Following a series of deadly catastrophes in 2018 (Box 4.3), including the earthquake in West Nusa Tenggara, the earthquake, tsunami, and liquefaction in Central Sulawesi and the volcanic tsunami in Sunda Strait, the government aims to strengthen its financial resilience against disasters through the use of sophisticated financial instruments (World Bank, 2018[19]). The government also considered CAT bonds among the viable options to fund disaster recovery efforts for future catastrophe events that cause damage beyond the annual disaster-related budget (MoF, 2018[17]). However, several challenges may need to be addressed in order to use CAT bonds effectively (Table 4.5).

Table 4.5. Enabling factors for and challenges to the implementation of sovereign CAT bonds in Indonesia

|

Enabling factors |

Challenges |

|---|---|

|

|

Source: Authors’ compilation.

Box 4.3. Indonesia’s three major catastrophes in 2018

In 2018, Indonesia experienced significant losses resulting from three major catastrophes. The first occurred in July and August 2018, when the province of West Nusa Tenggara was struck by a series of earthquakes. The strongest (magnitude 7.0 on the Richter scale) took place on 5 August 2018. According to the updated report released on 20 January 2019 by the national disaster management agency, Badan Nasional Penanggulangan Bencana (BNPB), the event claimed 564 lives, injured 1 886 people and displaced around 472 000 people (BNPB, 2019[20]). Moreover, the earthquake caused severe damage to property, infrastructure and livelihoods, including to almost 72 000 houses, 671 schools, 52 health facilities, 6 bridges and many roads (BNPB, 2018[21]). Based on the BNPB’s initial assessment using basis data as of 13 August 2018, damage and loss amounted to approximately IDR 7.45 trillion (USD 514 million) (BNPB, 2018[21]).

On 28 September 2018, a magnitude 7.4 earthquake hit the province of Central Sulawesi and led to a tsunami that struck the coastal areas of the Palu Bay. The event caused landslides and liquefaction of soil in several densely populated areas, including the city of Palu and three other regencies, making relief and recovery efforts complicated. As of February 2019, more than 4 000 people have been reported either dead or missing, and approximately 172 000 people have been displaced (BNPB, 2019[22]). Damage to buildings and infrastructure was extensive, including to 68 451 houses, 265 schools, 78 offices and 7 bridges, with an overall cost of IDR 18.5 trillion (USD 1.3 billion) (BNPB, 2019[22]).

On 22 December 2018, a volcanic tsunami affected five regencies in the provinces of Banten and Lampung, located along the Sunda Strait. The event was caused by the eruption and subsequent partial collapse of the Anak Krakatau volcano under the sea. The impact of the tsunami hit the coast around the Sunda Strait, causing damage and loss of life in residential and tourist areas. As of 14 January 2019, the event had caused 437 fatalities and displaced 16 198 people (BNPB, 2019[23]).

The economic and social costs resulting from these disasters led to significant fiscal pressure. Costs are estimated to exceed IDR 40 trillion (USD 2.8 billion) (ADB, 2018[24]), representing around 0.27% of the country’s GDP in 2018. For instance, rehabilitation and reconstruction activities for Central Sulawesi require IDR 22 trillion (Central Sulawesi Provincial Government, 2018[25]), an amount expected to increase due to the need to relocate residents outside of the disaster-prone zone set by the government and to rebuild the settlements of residents who survived the tsunami and liquefaction.

Financing for post-disaster activities often comes from the national government, complemented by sources from regional governments, the private sector and international assistance. Responding to and meeting the needs of disaster recovery therefore require fiscal adjustments at both the national and local levels. To meet the 2018 post-disaster needs, the government also requested support from development partners mainly to address the urgent need for financial and technical assistance. In addition, a number of key agencies and line ministries were instructed to reallocate existing resources under the 2018 budget to provide priority support to affected areas (ADB, 2018[24]). This further highlights the need for additional financing resources to meet emergency needs and, most importantly, to avoid budget reallocations at the expense of government investment projects in other parts of the country.

Indonesia’s legal and institutional arrangements for CAT bond adoption

The overall aspects of disaster risk management in Indonesia are co-ordinated by the national disaster management agency, Badan Nasional Penanggulangan Bencana (BNPB), and its subnational counterparts. The country’s legal framework for disaster risk management, including the financing aspects of it, is outlined in Law No. 24/2007. The law provides guidelines on funding mechanisms for different post-disaster phases and outlines the financial responsibilities of national and subnational governments. It mandates the government to allocate an adequate amount of the state budget for disaster management and for the On-call Fund or Dana Siap Pakai (DSP), which can be released during emergencies.

To support the implementation of Law No. 24/2007, the government issued Regulation No. 22/2008, which states that both the National State Budget (APBN) and Subnational Government Budget (APBD) are obliged to provide funds for three phases of disaster risk management (i.e. before, during and after disasters) (MoF, 2018[17]). Concerning the financial distribution between the national and regional governments, Law No. 33/2004 stipulates that National State Budget emergency funds should be allocated to a region experiencing a catastrophe declared a national disaster for which the region’s Subnational Government Budget faces a shortfall due to the magnitude of its impact.

In emergency funding, DSP serves as readily available funds, while Belanja Tidak Terduga (BTT) or unexpected expenditure is budget expenditure at the expense of the APBD for emergency needs. BTT is used to budget expenditures for emergencies, covering urgent needs that could not be predicted beforehand and refunds of excess payments on regional revenues in previous years as well as for social assistance that cannot be planned. BTT can be employed in various emergency situations, including natural disasters, non-natural disasters, social disasters, and/or extraordinary events. Both DSP and BTT mechanisms play crucial roles in ensuring swift financial response to emergencies, offering flexibility to address immediate needs and unexpected costs during disaster situations. These funds contribute to effective disaster management by facilitating quick and adaptive financial measures.

As disasters keep putting pressure on the state budget by widening the financing gap, and as the financing mechanism focused heavily on post-disaster funding and international assistance, the government sought to fix the shortfalls by adopting a DRFI strategy. The strategy was formally launched in 2018 under the leadership of the Minister of Finance and the Vice President. Improving the governance and funding of disaster management at the local level, as well as developing alternative funding schemes for disaster management, has been set as a national priority and is included in the 2020-24 Medium-Term Development Plan. The recently issued Presidential Regulation No. 87/2020 on the Master Plan for Disaster Management 2020-2044 also outlines innovative funding schemes, including risk transfer as a strategy to strengthen investment in disaster risk management (BPK RI, 2020[26]).

Under the country’s DRFI strategy, the government assigns priority to protecting the state budget through the establishment of a dedicated budgetary mechanism by relying on five main principles. These include: i) synergy and/or collaboration among national and local governments, the private sector and communities; ii) a risk layering strategy; iii) timeliness and adequacy of funds; iv) a well-targeted, transparent and effective fund disbursement mechanism; and v) accurate data and information. Table 4.6 details the implementation of Indonesia’s DRFI strategy, including the government’s targets and priorities in the short and medium terms.

In terms of disaster financing mechanism tailored for specific groups of population, such as farmers, Law No. 19 of 2013 on the Protection and Empowerment of Farmers led to the introduction of agricultural insurance. Following the regulations set by Minister of Agriculture Regulation No. 40 of 2015, which further governs the implementation of agricultural insurance in Indonesia, the program commenced in 2015. The Directorate General of Infrastructure and Agricultural Facilities of the Ministries of Agriculture plays a primary role in this insurance initiative, and the Ministry has partnered with PT Jasa Asuransi Indonesia as the underwriter for the insurance program.

Table 4.6. Indonesia’s DRFI strategy

|

Short term (2018-19) |

Medium term (2020-23) |

|---|---|

|

1. Strengthen the policy framework 2. Implement the Public Asset Insurance programme 3. Strengthen and scale up existing risk transfer schemes 4. Run a feasibility study on a pooling fund 5. Explore appropriate international instruments 6. Provide DRFI education (to law enforcement, parliament, line ministries, and subnational governments) |

1. Prepare and establish a pooling fund 2. Explore new financing schemes 3. Increase subnational governments’ role (cost-sharing) in disaster risk financing 4. Explore prearranged disbursement channels 5. Improve fiscal and budget management 6. Enhance international co-operation (knowledge exchange) and initiatives |

Source: (MoF, 2020[27]), Terms of Reference Environmental and Social Management System (EMS) Development and Environmental and Social Management for Indonesia Disaster Risk Finance Pooling Fund Project (IndoRisk Project), https://fiskal.kemenkeu.go.id/files/lain-lain/file/ToR-Environmental-and-Social-Management-System(ESMS).pdf.

The government launched the Disaster Pooling Fund, or the Dana Bersama Penanggulangan Bencana, also known as Dana Bersama or Pooling Fund Bencana (PFB), by issuing Presidential Regulation No. 75/2021 on 13 August 2021. To complement this presidential regulation, on 3 January 2024, BNPB issued the BNPB Regulation No. 1/2024 on the Review, Verification, and Evaluation of the Distribution of the Disaster Pooling Fund as one of its derivative legal instruments. Article 2 stipulates that it covers distribution for pre-disaster, during emergency response, post disaster (particularly on recovery activities), and risk transfer funding. The PFB is the core component of Indonesia’s DRFI strategy. It marks an important milestone for the country’s disaster risk management, as it has the potential to: i) increase disaster financing capacity by enabling the government to accumulate unspent budget allocations for disaster response, which can be used to build reserves to spend when disaster occurs in future years; ii) improve the efficiency of using funds originating from the state budget through improved upfront planning and budgeting; iii) leverage additional financial instruments by linking them directly to the PFB with clear operating procedures agreed upon in advance; iv) connect the PFB to clear, prearranged disbursement channels and rules, thereby increasing the speed and transparency of post-disaster spending and providing predictability to implementing agencies on the availability of funds; and v) increase the ability to link risk financing to incentives and activities for all phases of disaster risk management (MoF, 2020[27]).

The PFB is managed by a public service agency, the Badan Layanan Umum (BLU), under the supervision of the Ministry of Finance. By using the BLU as a structure to manage the pooling fund, the PFB has some flexibility in financial management, such as the possibility of accumulating budget surpluses over multiple fiscal years. At its launch, the PFB is set to manage initial capital of IDR 7.3 trillion (over USD 500 million) (MoF, 2021[28]). The flexibility gained by using the BLU model can be applied to managing the non-financial aspects of the PFB. For instance, it allows the PFB to design and implement its own governance structure to ensure that the fund is managed appropriately and according to international standards. The PFB may also recruit staff and experts to meet the fund’s varying and complex needs. Most importantly, the PFB may procure services and perform tasks required to fulfil its needs. Examples include purchasing insurance or reinsurance protection for the fund using the managed funds and receiving payouts directly from the insurance companies.

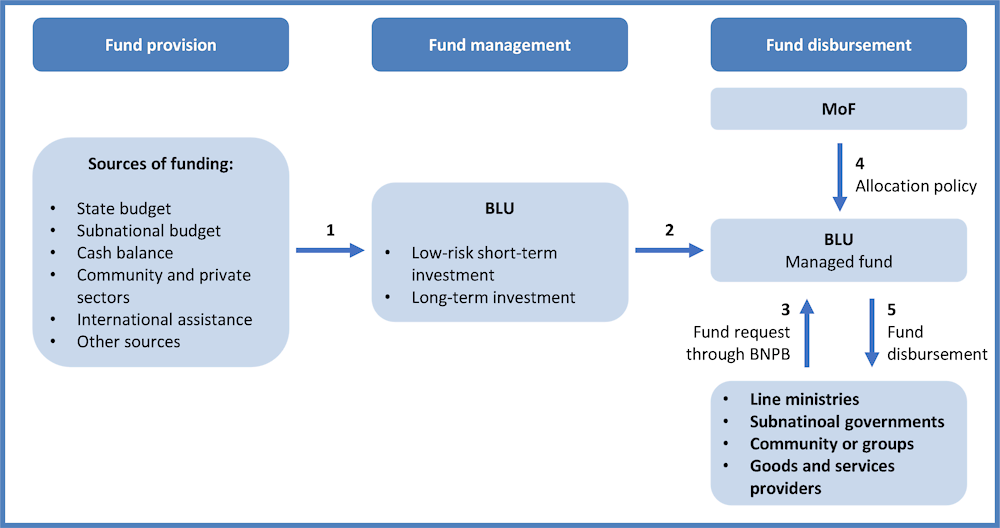

The PFB is designed to serve as a self-insurance mechanism for the government. It will receive budget funding; accumulate and leverage funds received from national and local governments, the private sector, communities and development partners; develop a risk financing strategy; and work with implementing agencies to establish different post-disaster compensation schemes through which funding will be disbursed. The PFB scheme allows the streamlining of some administrative processes, ensuring that disbursement of funds or distribution of insurance payouts is timely, transparent and accountable (Figure 4.3).

Figure 4.3. Characteristics of the PFB scheme

Source: Adapted from (MoF, n.d.[29]), “Pooling Fund Bencana”, https://fiskal.kemenkeu.go.id/strategi-drfi/pooling.

The PFB model builds on international best practices of self-insurance funds, such as Australia’s Comcover (Box 4.4). As such, the adopted model of the PFB operates differently from existing regional risk pools. The latter typically serve as insurance companies that offer specific parametric insurance products, such as the Southeast Asia Disaster Risk Insurance Facility, the CCRIF and the Pacific Catastrophe Risk Insurance Company (MoF, 2020[27]).

Box 4.4. The Australian government’s self-managed insurance fund: Comcover

Comcover was established in 1998 to provide insurance and risk management services to Australian government entities classified as belonging to the General Government Sector (Fund Members). It serves to protect the Commonwealth Budget by ensuring that all Fund Members have comprehensive financial protection from major threats that can arise from claims associated with insurable risks. It is not structured as an insurance company. Instead, it is a self-managed fund that operates by collecting premiums from participating Fund Members, accumulating reserves and meeting future losses from those reserves. Under Comcover’s Statement of Cover, Fund Members receive cover for all general insurable risks, including liability, property, motor vehicle, and personal accident and travel. As of 2015, Comcover insured more than 160 Fund Members with various responsibilities and functions.

Comcover also facilitates a comprehensive and consistent approach to protecting Fund Members by building risk management capability through effective data collection and claims management. Under its risk management programmes, Comcover aids Fund Members in building their risk management capability and ensuring the successful implementation of risk management within their organisations. This is done through education and training programmes that target Australian public service officials at the foundation, practitioner and senior executive levels.

Additionally, as the key part of Comcover’s risk management services, the Risk Management Benchmarking Programme allows Fund Members to self-asses their risk management capability and measure the maturity of their risk management frameworks. Through this mechanism, Fund Members are provided with the ability to track their risk management performance against that of their peers. Comcover’s risk management programmes also include an annual award, giving recognition and rewards to Fund Members who demonstrate excellence in risk management.

Source: (DoF, 2015[30]), “An Introduction to Comcover”, www.finance.gov.au/sites/default/files/2019-11/introduction-to-comcover.pdf.

With the newly established PFB, there is enormous potential for Indonesia to tap into capital markets and adopt an alternative risk transfer mechanism, such as CAT bonds, as part of a broader risk financing strategy. This would allow the country to have greater certainty in terms of budget planning, to diversify its funding sources to cope with the impact of natural catastrophes, and to have guaranteed access to financing sources for timely recovery. However, the adoption of such an instrument will depend on the government’s commitment and capacity to overcome challenges associated with the implementation of CAT bonds, including the high transaction costs, the insufficient legal framework for risk transfer mechanisms and the lack of a regulatory framework for disaster data management (BNPB/BPS, 2020[31]).

Transferring the risk of Indonesia’s severe earthquakes through CAT bonds is an option

Indonesia’s current DRFI strategy consists of various financing options set under a risk layering approach to tackle financing challenges resulting from events of varying frequency and severity. Financing arrangements for risk retention include, among other, the allocation of national and subnational budgets, and the contingency credit. In late 2020, Indonesia was provided with a USD 500 million loan from the ADB (ADB, 2020[32]). This policy-based loan, which can be accessed following disaster declarations, also supports the government in reforming disaster risk management in three areas: i) strengthening policies and action plans for disaster response and health-related emergencies; ii) increasing public infrastructure resilience against disaster and climate risks; and iii) improving financing for disaster risk and pandemic response.

Indonesia has been implementing the government-supported insurance programme as a risk transfer strategy. It targets low-income households, particularly small farmers and fish cultivators. In 2019, the country added the Public Asset Insurance programme to its disaster risk financing menu. Previously, the implementation of programme, including the planning process, budgeting, procurement, claims and repairs fell under the responsibility of participating ministries and institutions. However, with Presidential Decree No. 75/2021, all processes will be conducted by the BLU, the agency that manages the PFB. The new scheme will streamline procurement and claims processes for the insurance industry as the industry will now serve only the BLU rather than all ministries and institutions.

Throughout 2020, the Public Asset Insurance programme covered government losses of IDR 1.14 billion (around USD 78 000), which is the value of claims related to 18 public assets affected by disasters (Retnowati, 2021[33]). Although the claims have been paid, there is a lack of detailed information with regard to the claims process, making it challenging to evaluate the programme and to benchmark it against international best practices. As of mid-2021, the government has insured more than 4 300 public assets of 51 ministries and institutions, with a total premium of IDR 49.13 billion (USD 3.4 million) and a total insured value of IDR 32.41 trillion (USD 2.3 billion) (MoF, 2021[34]). These figures illustrate a promising trend. In 2019, the programme only covered Ministry of Finance assets; in 2020, it evolved to cover 2 112 assets of 13 ministries and institutions (Subekti, 2020[35]). Claims from the Public Asset Insurance programme contribute to the non-tax state revenues, allowing the government to reconstruct damaged state assets while minimising the use other resources within the APBN.

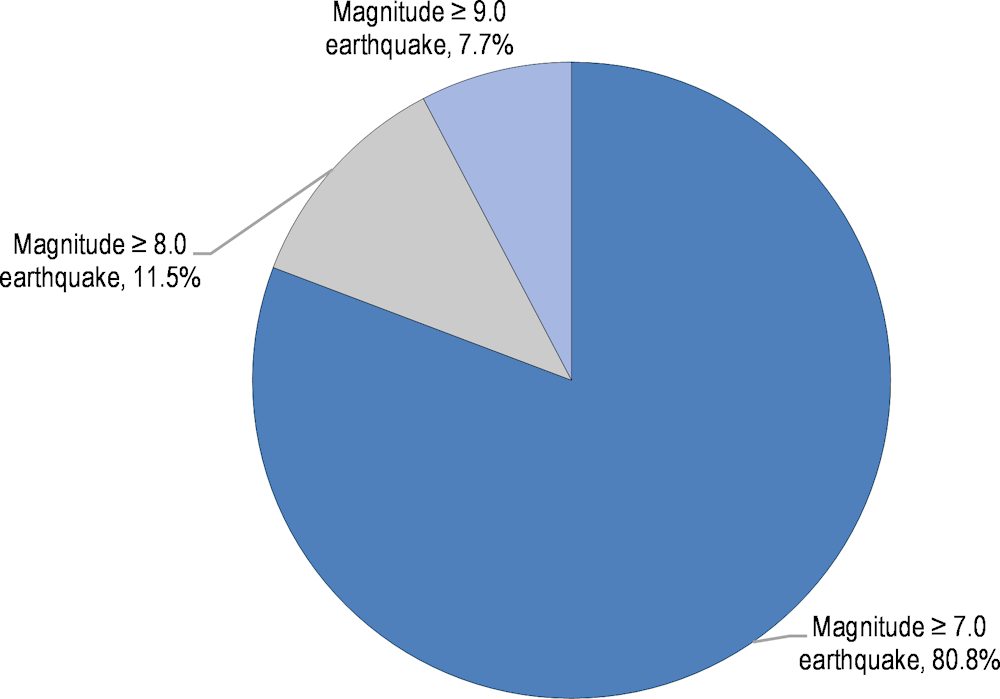

Despite strong efforts, there remains clear opportunities to enhance Indonesia’s post-disaster financing capacity. The current DRFI strategy lacks a mechanism to cover losses from the most severe disasters. At the local level, rehabilitation and reconstruction activities are usually financed through funds allocated within the APBD. However, in the case of large-scale disasters, the APBD may become insufficient, prompting the central government to provide financing using social assistance funds in the forms of grants sourced from the APBN. Looking at the historical data, Indonesia has suffered a number of extreme disasters, in particular strong seismic activities and tsunamis. Between 2000 and 2023, there were 21 earthquakes of magnitude 7.0 or greater; three (11.5%) were magnitude 8.0, and two (7.7%) were magnitude 9.0 (Figure 4.4).

Figure 4.4. Major earthquakes in Indonesia, 2000-23

Source: (CRED, n.d.[16]), Emergency Events Database (EM-DAT) (database), https://public.emdat.be/.

Most of the parametric CAT bonds available in the market that provide coverage against earthquakes were typically triggered by a magnitude 8.0 or greater earthquake event, whether they were sponsored by sovereigns or the private sector. These include Mexico’s CAT bond issued in 2017, in which the magnitude 8.1 Chiapas earthquake fell within the parametric box and triggered a 100% payout (USD 150 million) on the Class A notes. Another example is Peru’s CAT bond issued in 2018 as part of the World Bank’s IBRD multi-country CAT bond. A 30% payout (USD 60 million) was triggered following the magnitude 8.0 earthquake that struck within the parametric zone defined under the terms of the CAT bond.

As suggested by these examples, there is potential for the use of CAT bonds as an additional instrument to protect Indonesia’s state budget against losses from severe earthquakes and to complement other financing mechanisms arranged under the country’s DRFI strategy. However, capacity building and in-depth analysis would be required to ensure that CAT bonds could meet the country’s needs and efficiently bridge the financing gap not covered by the current financing instruments.

Budgetary resources would need to be allocated to the CAT bond transaction should the government decide to transfer part of its exposure to capital markets. Given the allocated budget, the government should take the best possible decision with regard to the coverage, including which trigger mechanism to use and which parts of the country to cover – a critical consideration – as the higher the likelihood of being covered, the higher the price. The choice of trigger mechanism also determines CAT bond price. Typically, a simple trigger mechanism, such as a parametric trigger, generates better CAT bond pricing for the government and provides greater clarity for investors (Michel-Kerjan et al., 2011[36]). To make the best possible decision requires a good understanding of disaster risk exposure. Good-quality data therefore play a vital role in the structuring of CAT bonds, as they may help obtain better probability estimates.

Strengthening risk data and analytics could be achieved, for instance, through investment in cutting-edge technologies to facilitate the development of catastrophe risk modelling and instrument design. Risk assessment and hazard analysis would require a more comprehensive list of the country’s public assets – across the country or in highly vulnerable areas – their construction type and their value. This could be done by optimising the use of the government’s state asset database system. Linking it with the Public Asset Insurance pilot project could be a good start to developing an integrated damage assessment system. Additionally, based on the experiences of the Philippines, strong and continuous co-operation with international development partners may help overcome barriers, especially in terms of strengthening technical capacity to adopt CAT bonds.

Data management and budget tracking can facilitate financial decision making

Risk data and analytics are among the key components of risk-informed decisions and could further help develop high-quality hazard models, inform effective disaster risk prevention, improve financial decision making and help design appropriate financial instruments. In Indonesia, the availability of emergency response data has helped the country meet its needs for disaster-related data. For instance, a georeferenced map, InaRISK, which is integrated with the implementation of DRR activities, serves as a monitoring tool for reducing the disaster risk index. Launched in 2016, InaRISK describes the scope of the hazard-prone area, affected population, potential physical and economic loss and potential environmental damage. This tool, however, may need to be simplified. In addition, data on risks, occurrences, impacts and financing related to disasters and disaster management vary in terms of concept and definitions (BNPB/BPS, 2020[31]), highlighting the need to manage data in a more standardised way.

To address the issue, the country recently launched Indonesia One Disaster Data, a synthesis of existing international guidelines on disaster-related statistics. The initiative was guided by Presidential Regulation No. 39 of 2019 on Indonesia One Data policy and by BNPB Regulation No. 1/2023 on One Disaster Data, issued on 4 January 2023. It was jointly developed by the BNPB and the national statistics agency, Badan Pusat Statistik (BPS), wherein the BNPB acted as disaster data custodian by formulating and setting the policies to manage and facilitate data co-ordination among sectoral data producers, including line ministries and agencies. All actors converged in a Disaster Data Forum. Implementation support was provided by BPS as basic data advisor and by the Indonesia Geospatial Agency as geospatial data advisor.

Indonesia One Disaster Data aims to improve the coverage and consistency in compiled data based on primary disaster-related data and basic statistics for all types of disasters. With such a mechanism, the initiative can create better comparability such that data from one locality or time and period can be matched with data from another based on the actual values of the relevant data. Moreover, data collection and analysis use a standard methodology, metadata and master references, allowing for greater coherence in disaster documentation and data interoperability, regardless of the forms and sources of data, including national and local governments, and national and international development partners.

The scope of Indonesia One Disaster Data covers pre-disaster data, which is information obtained when there is no disaster occurring and/or when there is the potential for a disaster to happen; emergency response data, which refers to temporary data collected to meet needs during emergency disaster situations; post-disaster data, which is data obtained from rehabilitation and reconstruction activities; and disaster management financing data, which includes data on financing and/or investment in the implementation of disaster management. It includes data related to, first, disaster risk, such as data on hazards, vulnerabilities, exposures, the ability or capacity gap in facing potential disaster events, and data on disaster risk reduction programs and activities. Second, it includes data related to disaster events, such as the characteristics of the event, place and time of the beginning and end of the event, status of the event and an identifier or a unique registration code to facilitate recording, reference and tracking. Third, it contains data on both the direct and the indirect impacts of a disaster. The former include data on affected populations, damage to key infrastructure, material and economic losses, disruptions to basic services and impacts on the environment and cultural heritage. The latter (i.e. data on the indirect impacts of a disaster) cover displacement, loss of employment and poverty, among others. Fourth, the disaster management financing data consists of information on prevention, risk reduction, mitigation, and preparedness costs; emergency response costs; recovery costs; and general government, education, research and development-related expenses associated with disaster management. As of 2023, the Indonesia One Data portal is accessible to the public, comprising nearly 300 000 datasets, of which roughly 3 600 are disaster-related data, encompassing information down to the sub-district level.

The majority of financing for preparedness, emergency response and recovery activities still comes from public funding, particularly through transfers from the national government budget to the local government. Statistics within this scope of activities can help ensure transparency, track financing trends and identify beneficiaries and potential funding gaps and opportunities for interventions. For instance, they would allow the government to obtain more information on disaster-related spending by line ministries and which programmes or activities are receiving funds. It would also provide more information on the nature of disaster-related expenditures, such as goods and services, capital expenditure and subsidies. Tracking such spending may provide support for either the public budget or the functionality of the PFB.

However, precision in tracking the financing of disaster management activities remains challenging, as it is implicitly recorded as part of a broader classification of national aggregate transactions within the National Account System (BNPB/BPS, 2020[31]). As a result, tracking is done by monitoring the type of transfers and other activities having specific objectives for disaster management within the balance of payments and national account statistics.