This chapter explores the utilisation of catastrophe (CAT) bonds in regional risk-sharing initiatives. Three regional initiatives from the Caribbean, Southeast Asia, and the Pacific are used as examples. Advantages of such jointly issued CAT bonds lie in cost savings on legal and other fees, and in the increased regional diversity of a multi-country issuer. Challenges arise from the need to accommodate the divergent interests of involved countries, most importantly through detailed risk assessments of each participating country to allow for individual pricing and prevent unwanted cross-subsidisation.

Fostering Catastrophe Bond Markets in Asia and the Pacific

5. Sharing disaster risk among countries: Regional case studies

Abstract

Introduction

Many countries in Asia and Pacific are prone to natural disasters and often have limited capacity to respond quickly to these events due to narrow fiscal space. In recent years, a number of financial solutions to strengthen financial resilience of these countries have become the focus of the regional community. Access to CAT bond markets through a joint issuance could be more feasible than countries seeking access individually. This regional approach may represent an alternative for developing countries in Asia and the Pacific while enjoying cost-sharing benefits (Box 5.1). In addition to cost sharing in transactions, joint issuance of CAT bonds allows sponsors to access a broader investor base.

Nonetheless, challenges may arise when it comes to joint issuance as it involves multiple sovereign entities having different risk appetites and interests. This emphasises the importance of effective collaboration among participating governments. Moreover, different jurisdictions may have varying regulatory frameworks and compliance requirements, adding complexity to the process. By overcoming these challenges, the potential benefits of joint issuance can be fully realised, contributing to the growth and development of the CAT bond markets.

This chapter first discusses how regional initiatives should accommodate the diverse risks and economic profiles of countries in a region. An example of CAT bonds that are structured as a joint issuance to cover multi-country risks is also presented. It then discusses the CAT bond issued on behalf of the Caribbean Catastrophe Risk Insurance Facility (CCRIF). Next, it addresses challenges faced by other regional risk-sharing facilities, including the Southeast Asia Disaster Risk Insurance Facility (SEADRIF) in ASEAN+3 region and the Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI) Facility. The last section provides challenges to enhance the functioning of risk sharing.

Box 5.1. Cost sharing through the joint issuance of CAT bonds

The Pacific Alliance CAT bonds for earthquake risk from Chile, Colombia, Mexico and Peru, which are united under a regional Pacific Alliance initiative for economic integration. The Pacific Alliance countries are located along the seismically active area of the Pacific Rim, making them prone to natural hazards, especially earthquakes.

The CAT bonds provide insurance coverage against earthquake risk in Pacific Alliance countries. Amounting to USD 1.36 billion, the CAT bonds mark the largest sovereign risk insurance transaction and the largest CAT bond issuance the World Bank has ever facilitated. It allows several sovereign nations to be present in the CAT bond markets without any risk pooling facility. For Chile, Colombia and Peru, this transaction represents a means to access capital markets with a view to sourcing disaster risk insurance for the first time.

The transaction was split into five classes of bonds: one class each for Chile, Colombia and Peru and two classes totalling USD 260 million for Mexico (Table 5.1). Although all notes were designed to cover earthquake risks on a parametric trigger basis, the terms of the CAT bonds differ for each class. For instance, the CAT bonds provided three years of insurance protection for Chile, Colombia and Peru with a February 2021 maturity date, while Mexico benefited from two years of coverage with a February 2020 maturity date.

Table 5.1. Summary of the Pacific Alliance CAT bonds transaction

|

Parameters |

Chile |

Colombia |

Mexico |

Peru |

|---|---|---|---|---|

|

Issue size |

USD 500 million |

USD 400 million |

USD 260 million |

USD 200 million |

|

Perils covered |

Earthquake |

Earthquake |

Earthquake |

Earthquake |

|

Trigger type |

Parametric |

Parametric |

Parametric |

Parametric |

|

Issue date |

February 2018 |

February 2018 |

February 2018 |

February 2018 |

|

Maturity date |

February 2021 |

February 2021 |

February 2020 |

February 2021 |

|

Pricing |

2.50% |

3.00% |

Class A: 2.50% Class B: 8.25% |

6.00% |

|

Principal reductions |

Principal reduction by 30%, 70% or 100%, depending on the parameters associated with an earthquake event |

Principal reduction by 25%, 50% or 100%, depending on the parameters associated with an earthquake event |

Class A and Class B: Principal reduction by 50% or 100%, depending on the parameters associated with an earthquake event |

Principal reduction by 30%, 70% or 100%, depending on the parameters associated with an earthquake event |

|

Payouts |

x |

x |

x |

30% payout or USD 60 million following the occurrence of a magnitude 8.0 earthquake in Peru on 26 May 2019. The payout went straight to Peru’s disaster fund with the use of funds determined by the Technical Secretariat of FONDES. |

|

Time to payment |

x |

x |

x |

Payout determination was made within 25 days. |

Note: ‘x’ means not applicable.

Source: Authors’ compilation.

As a facilitator, the World Bank provided end-to-end support for the complex process of CAT bond issuance, including specialised technical assistance and the execution of capital market transactions. Each government was supported in structuring its legal and regulatory framework and in customising its agreement documentation with the World Bank (World Bank, 2019[1]). Given that the CAT bonds were structured as a joint transaction, all four countries benefited from cost savings on legal and other fees incurred in a capital market transaction.

Additionally, the joint issuance offered investors a new risk diversification tool covering four different geographies. The timing of the issuance in early 2018 corresponds to the high demand for new risks, especially for the January renewals. Indeed, the transaction received very strong demand, attracting orders for almost double the size, or around USD 2.5 billion, from more than 45 investors globally (World Bank, 2019[1]). The strong investor demand put downward pressure on prices, resulting in lower premium rates for sponsoring countries.

Transferring regional risk to the capital markets

CAT bonds have also been used as part of regional catastrophe risk sharing mechanisms, similar to the approach adopted by the Caribbean Catastrophe Risk Insurance Facility (CCRIF). This facility has recognised the value of CAT bonds as a means of transferring and managing disaster risks. The CCRIF has implemented the use of CAT bonds to enhance its capacity to respond to catastrophic events in the Caribbean region. Examples of other catastrophe risk sharing mechanisms, include the ASEAN+3’s Southeast Asia Disaster Risk Insurance Facility (SEADRIF) and the Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI) Facility. Case studies about challenges faced by each regional risk sharing mechanism will be further detailed below.

The case of CCRIF

The Caribbean region is highly exposed to natural disasters that are frequent and costly, including hurricanes, intense rains and earthquakes. The Caribbean experienced two-thirds of the 511 natural disasters that have hit Small Island Developing States globally since 1950 (UN, 2020[2]). Over the last 20 years, direct damages resulting from meteorological and geological hazards averaged USD 1.6 billion (United States dollar) per year for the region, leading to the risk of sovereign debt accumulation and narrowing of fiscal space (World Bank, 2018[3]).

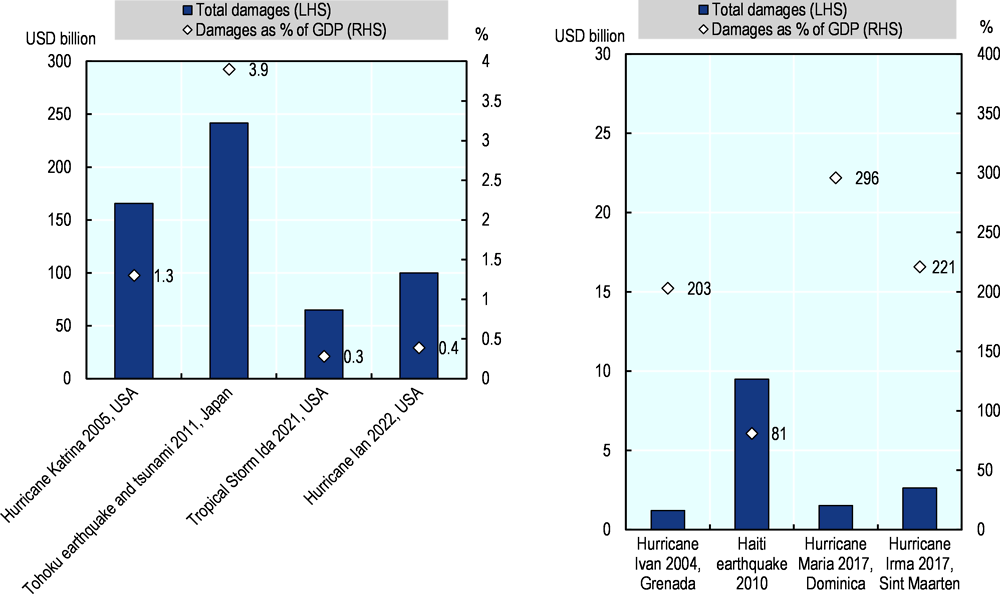

When a major disaster strikes a large economy, the damage is typically equal to a small share of its gross domestic product (GDP). For instance, damages from the Tohoku earthquake and tsunami that struck Japan in 2011 amounted to USD 241.6 billion or 3.9% of the country’s GDP that year (Figure 5.1). Total damages from hurricane Ian in the United States in 2022 amounted to only 0.4% of the country’s GDP that year.

Figure 5.1. Damages from major disasters in selected economies, 2000-23

Note: LHS = left hand scale. RHS = right hand scale.

Source: (CRED, n.d.[4]), Emergency Events Database (EM-DAT) (database), https://public.emdat.be/; (World Bank, n.d.[5]), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

Conversely, damages from a major catastrophe can constitute a multiple of GDP for smaller economies. Small Island Developing States in the Caribbean region, such as Grenada and Sint Maarten, suffered extreme damages amounting to over 200% of their GDP as a result of Hurricane Ivan in 2004 and Hurricane Irma in 2017, respectively (Figure 5.1). When Dominica was struck by Hurricane Maria in 2017, total damages reached 296% of GDP or almost three times the country’s GDP that year.

The vulnerability of the Caribbean region may predominantly be associated with the prevalence of Small Island Developing States (SIDS). The characteristics of small states limit Caribbean countries’ individual capacity to absorb the financial impact of natural disasters. For instance, the small geographic size of each state prevents diversification of risk. Establishing reserves to meet post-disaster needs might be challenging due to limited fiscal revenues. Additionally, transferring risks can be expensive due to high transaction costs, as there is a limited volume of business to be transferred to international (re)insurance markets.

Risk sharing is among the mechanisms that can help SIDS reduce the financial impact of disasters through insurance instruments, as high costs can be shared among pool members. These insurance instruments can help member countries gain access to quick financial liquidity following a disaster event. The CCRIF is an example of a regional catastrophe risk pooling facility that offers financial protection against natural disasters to Caribbean governments. It is financed through both traditional reinsurance and capital market-based instruments.

The CCRIF was developed under the technical leadership of the World Bank and benefited from a grant provided by the government of Japan. The capitalisation came from the Multi-Donor Trust Fund (MDTF), consisting of contributions from the governments of Bermuda, Canada, France, Ireland and the United Kingdom, the Caribbean Development Bank, the European Union and the World Bank.

The capital injection from donor countries and international partners amounted to nearly USD 71 million, enabling the CCRIF to increase its risk-bearing capacity by reimbursing operating costs, including policy payouts and reinsurance premiums (World Bank, 2012[6]). Given that donor support covers payouts and reinsurance premiums, other sources of capitalisation (e.g. premiums and membership fees paid by participating governments) could allow the CCRIF to build the risk-bearing capacity a lot faster than in the absence of donor support and ensure its financial sustainability.

The CCRIF is present in the CAT bond market with a USD 30 million CAT bond directly issued by the World Bank in 2014 under its newly established Capital at Risk Notes programme. This transaction marked an important milestone in the partnership between the CCRIF and the World Bank. In fact, since 2007, the World Bank has been helping the CCRIF to transfer its risks to the international reinsurance markets by intermediating catastrophe swaps between the pool and the markets for the riskiest layer of its portfolio.

The CAT bond provides three years of reinsurance protection against tropical cyclones and earthquakes for the 16 CCRIF member countries. The World Bank acts as an intermediary, standing between the CCRIF and CAT bond investors in capital markets. The World Bank entered into a catastrophe swap with the CCRIF, mirroring the terms of the CAT bond. This allows the World Bank to transfer insurance premiums collected from the CCRIF to investors. Investors receive quarterly coupon payments based on the prevalent six-month London Inter-Bank Offered (LIBOR) interest rate plus 6.3% with a floor of 6.5% (Table 5.2). The notes are transferable in the secondary market and are listed on the Luxembourg Stock Exchange. This means that the CAT bond is highly liquid, and investors holding the notes are able to sell them on the secondary market through broking desks.

The proceeds of the CAT bond are kept on the World Bank’s balance sheet, and the outstanding principal (full or reduced) will be transferred to the CCRIF through the swap arrangement if a predefined disaster meets the triggering criteria specified under the bond terms. If no qualified event occurs during the CAT bond coverage period, investors will receive the principal back following the maturity of the bond.

The CAT bond uses a parametric modelled loss triggering mechanism, by which parameters of an event are applied to member government exposure information to determine loss estimates. This is the same trigger as deployed for the CCRIF’s parametric insurance scheme. With such a trigger, there is no need to assess the damages and losses afterwards, which can be time consuming and contentious, to determine payout. This trigger can therefore ensure transparency and rapidity of payments.

Table 5.2. Selected features of the CAT bond issued on behalf of the CCRIF

|

Parameters |

Details |

|---|---|

|

Aggregate nominal amount |

USD 30 million |

|

Perils covered |

Caribbean tropical cyclone and earthquake |

|

Trigger type |

Parametric modelled loss |

|

Issue date |

30 June 2014 |

|

Maturity date |

7 June 2017 |

|

Bond coupon |

Six-month USD LIBOR + 6.30%, floored at 6.50% |

|

Coupon payment dates |

Quarterly |

|

Listing |

Luxembourg Stock Exchange |

|

Redemption amount |

The nominal amount reduced by all principal reductions as a result of applicable Caribbean tropical cyclone or earthquake events as defined in the terms of the CAT bond |

|

Beneficiaries |

16 Caribbean countries: Anguilla, Antigua and Barbuda, Bahamas, Barbados, Belize, Bermuda, the Cayman Islands, Dominica, Grenada, Haiti, Jamaica, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Trinidad and Tobago, and the Turks and Caicos Islands. |

Source: (World Bank, 2015[7]), “Facilitating Catastrophe Risk Transfer”, https://documents1.worldbank.org/curated/en/463201468015629255/pdf/93909-CCRIF-CatBond-2015.pdf; (World Bank, 2014[8]), “World Bank Issues its First Ever Catastrophe Bond Linked to Natural Hazard Risks in Sixteen Caribbean Countries”, www.worldbank.org/en/news/press-release/2014/06/30/world-bank-issues-its-first-ever-catastrophe-bond-linked-to-natural-hazard-risks-in-sixteen-caribbean-countries.

As the CAT bond was issued under the World Bank’s Global Debt Issuance Facility, no special purpose insurer (SPI) was needed to complete the transaction. This helped streamline the issuance process in terms of time and costs, making the transfer of risk to capital markets efficient and highly cost competitive. Additionally, with the World Bank’s experience as a capital markets issuer, the pool could gain support in the outreach activities and investor engagement required for the CAT bond transaction (World Bank, 2015[7]).

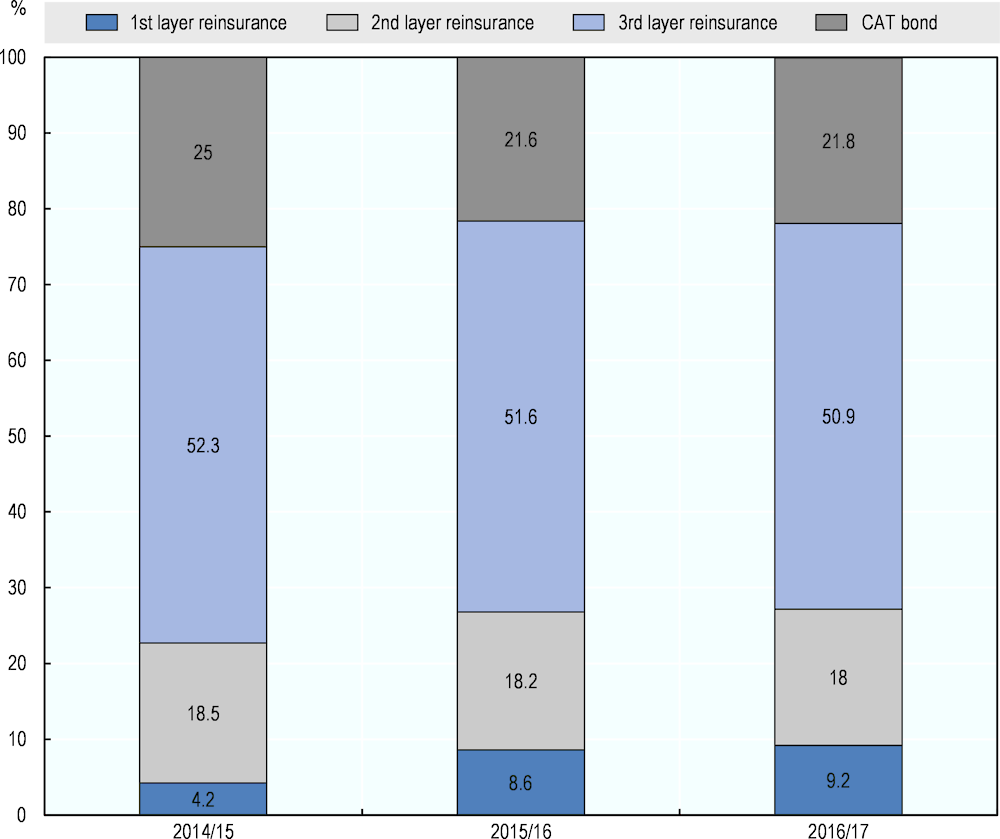

Using CAT bonds, the CCRIF was able to diversify its reinsurance capital sources and secure multi-year access to insurance at a fixed price. This allows the pool to achieve greater stability for its risk transfer programme, as it may reduce the impact of price volatility in the reinsurance market. Indeed, price volatility on reinsurance premiums may account for a significant share of the cost borne by the pooling facility. Deploying CAT bonds in addition to reinsurance, for instance within a layering approach, allowed the CCRIF to achieve greater risk diversification.

Over the three-year CAT bond term, this market-based instrument was deployed in parallel with the second and the third layers of the CCRIF’s traditional reinsurance programme. For the 2014/15 policy year, CAT bonds account for around 25% of the CCRIF’s total annual risk transfer. It then represents 21.6% and 21.8% of the pool’s total annual risk transfer for the policy year 2015/16 and 2016/17, respectively (Figure 5.2). Following its maturity, the CAT bond programme was not renewed, as reinsurance prices remained sufficiently low over the succeeding years as to make the cost gains from the CAT bond marginal (Martinez-Diaz, Sidner and McClamrock, 2019[9]). Although it was not renewed, the experience of the CCRIF might provide a good example of participation in the CAT bond markets for other regional risk pooling facilities, including SEADRIF and the Pacific Catastrophe Risk Insurance Company (PCRIC).

Figure 5.2. Breakdown of CCRIF’s risk transfer programme, 2014-17

Note: Years refer to fiscal years from 1 June to 31 May.

Source: Authors’ elaboration based on (CCRIF, 2017[10]), Annual Report 2016-17, www.ccrif.org/sites/default/files/publications/annualreports/CCRIFSPC_Annual_Report_2016_2017.pdf; (CCRIF, 2016[11]), Annual Report 2015-2016, www.ccrif.org/sites/default/files/publications/annualreports/CCRIF_Annual_Report_2015-2016.pdf; (CCRIF, 2015[12]), Annual Report 2014-2015, www.ccrif.org/sites/default/files/publications/annualreports/CCRIFSPC_Annual_Report_2014_2015.pdf.

The institutional arrangement of the CCRIF

The legal structure of the CCRIF has evolved. The structure was originally established as a captive insurer owned by a purpose trust domiciled in the Cayman Islands.

In 2014, the CCRIF was restructured into a segregated portfolio company (now named the CCRIF SPC). This implies that the facility has no physical office or staff of its own. Moreover, significant parts of its operations, including (re)insurance management, asset management, communication, and research and development, are outsourced to third-party providers. With such design features, the CCRIF has been able to control its fixed costs and keep operating costs low. This helps further lower the costs borne by participating countries.

The restructuring has enabled the facility to expand its activity with new products and to increase the geographic areas of coverage, including coverage of Central American countries under the Council of Ministers of Finance of Central America, Panama and the Dominican Republic. From covering 16 Caribbean countries in its inception year, as of 2020, the CCRIF had 23 members, consisting of 19 Caribbean countries, 3 Central American countries and 1 electric utility company (CCRIF, 2020[13]). As of the same reference year, its products include parametric insurance for tropical cyclones, earthquakes, excess rainfall, fisheries and electric utilities. While greater diversification in terms of geographic coverage and perils can lower reinsurance costs, hence the insurance premiums paid by countries, the CCRIF opted to separate risk pools for the Caribbean and Central America. This was done to address member concerns that the impact of disasters in the latter would deplete the former’s capital base (Martinez-Diaz, Sidner and McClamrock, 2019[9]).

Prior to taking up the insurance coverage, member countries are provided with individualised risk profiles. These include country-specific hazard and exposure mapping, information on historic losses and estimated losses to exposed assets for events of differing frequency. Furthermore, the risk profiles allow participating governments to support their insurance-buying decisions, tailoring policies to suit their risk profile and unique circumstances.

The flexibility and responsiveness to members’ needs offered by the CCRIF may partially explain the strong insurance uptake by participating governments and the consistent renewal of its products, ensuring stable premium revenue over time. Additionally, the cost of coverage is based on the amount of risk that member countries choose to transfer. As each member pays for what it wishes to cover, there is no cross-subsidisation between members transferring a low amount of risk and those transferring a high amount.

Given its structure as a risk pooling facility with great risk diversification and backed with steady capital since its inception, the CCRIF is able to offer insurance to its member countries at the lowest possible prices. At the time of appraisal, the estimated cost of CCRIF insurance for participating governments would be up to 50% lower than the cost of coverage if members insured themselves individually through traditional insurance markets (World Bank, 2012[6]).

The facility has continuously developed its product offer, reducing member countries’ membership fees and premiums. For example, participating countries with three continuous years of coverage could receive a reduction in their participation fee from 100% of premium to 50% (World Bank, 2012[6]). Moreover, a premium discount of 25% is offered in years following years of no claims. These cost-reduction programmes have enabled participating countries to increase their level of coverage over time, in turn increasing the pool’s capital.

An increase in a regional pool’s capital would help scale up risk transfer mechanisms through various channels while maintaining costs that would be passed on to member states through premiums at a lower cost. These channels could include CAT bonds whose transaction costs may be slightly higher than traditional reinsurance due to their more complex and sophisticated nature. As pools need to transfer their risks to reinsurance markets at a cost, CAT bonds could become an alternative or additional instrument to transfer these risks in case the reinsurance market hardens.

The parametric nature of the CCRIF products enables rapid payouts (i.e. within two weeks or less), providing immediate liquidity for recovery and maintaining basic government functions in the aftermath of natural disaster events. Between 2007 and 2020, the CCRIF made a total of 48 payouts to 14 governments totalling USD 194 million (CCRIF, 2020[13]). Around 69% of this amount concerned tropical cyclone-related policies, approximately 5% concerned earthquake-related policies, and 26% concerned excess rainfall policies.

The CCRIF has deployed sophisticated modelling processes since its inception, which is fundamental for the accurate pricing of the CCRIF’s policies and its financial sustainability. The pool has consistently improved and updated its models through investment in research and development. For instance, the new risk model, SPHERA, which was developed using the latest scientific findings and the most updated hazard datasets, was implemented for the 2019/20 tropical cyclone and earthquake policies, replacing the model that had been the basis since 2011 (CCRIF, 2020[13]). The 2019/20 excess rainfall policies also benefited from an upgrade of the model used since 2018. The new model includes features that reduce basis risk, such as the inclusion of soil saturation in loss estimates and the incorporation of assimilated observed data into the meteorological model (CCRIF, 2020[13]).

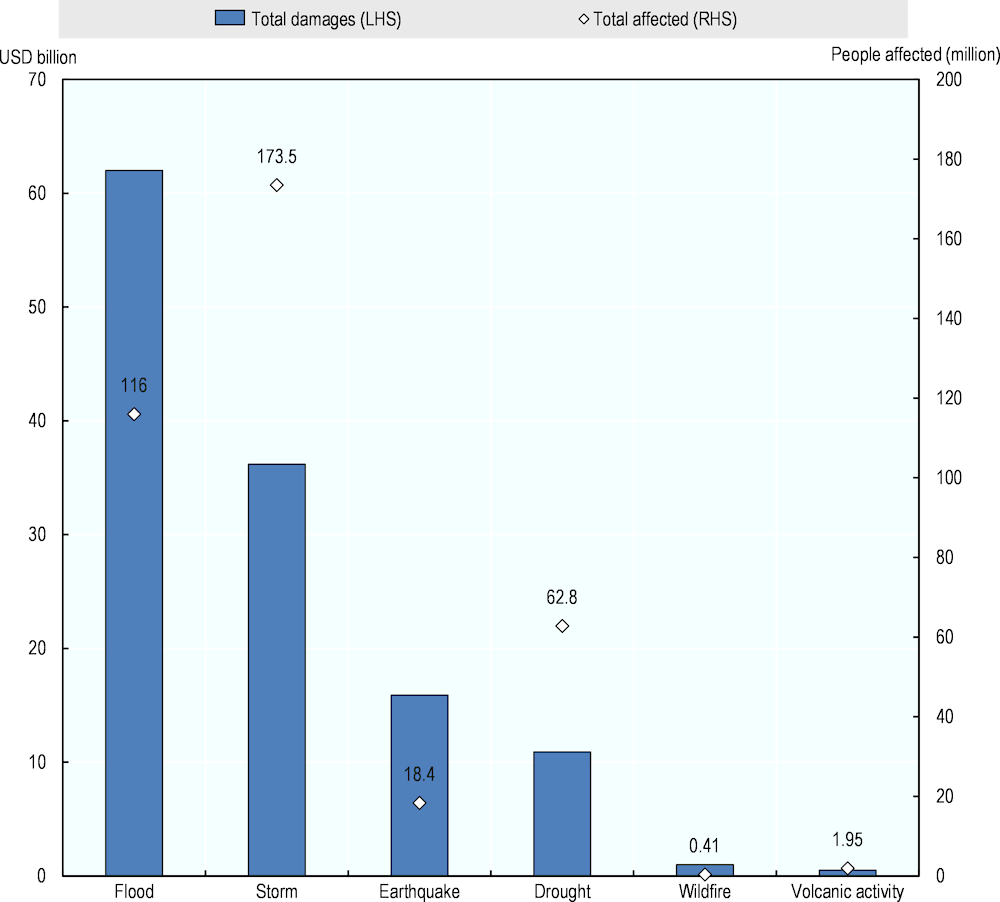

The case of the SEADRIF in ASEAN +3

Countries in the ASEAN+3 region are prone to various types of natural disasters, including floods, storms, earthquakes and tsunamis, drought, wildfires and volcanic activity. The frequency and intensity of these events are increasing due to climate change, leading the ASEAN region, home to almost 680 million people as of 2022 and with a combined GDP of around USD 3.6 trillion), to be highly vulnerable to natural disasters and climate hazards. Over the last two decades, natural disasters have affected more than 370 million lives in ASEAN countries. Almost half of the fatalities were the result of storm events (Figure 5.3). Total damages resulting from natural disasters occurring between 2000 and 2023 has reached USD 126.5 billion. Damages from flood events accounted for almost 50% of the total (Figure 5.3).

Figure 5.3. The impact of natural disasters in ASEAN countries by peril type, 2000-23

Note: Data as of 7 November 2023. LHS = left hand scale. RHS = right hand scale. Countries include Cambodia, Indonesia, Lao People’s Democratic Republic (Lao PDR), Malaysia, Myanmar, the Philippines, Thailand and Viet Nam.

Source: (CRED, n.d.[4]), Emergency Events Database (EM-DAT) (database), https://public.emdat.be/.

Larger ASEAN economies are relatively more capable of raising liquidity to finance their post-disaster needs due to their higher level of insurance and debt-market development. However, it may still be challenging for these economies to obtain adequate liquidity. For instance, although insurance is deployed to cover disaster losses in larger ASEAN countries, including Indonesia, the Philippines and Viet Nam, coverage may be inadequate due to the limited capacity of local insurance markets for catastrophe risks. The capacity of smaller economies, such as those of Cambodia, Lao PDR and Myanmar, to finance disaster risk is even more constrained due to limited borrowing capacity, underdeveloped local debt and insurance markets, and limited access to international (re)insurance and capital markets.

To help countries gain access to additional and reliable sources of disaster risk financing through tailored financial products and enhance their financial resilience through capacity-building services, a regional risk financing facility was established as an initiative of ASEAN+3 finance ministers and central bank governors. The initial capitalisation of the SEADRIF came from grants funded by Japan and Singapore (SEADRIF, 2023[14]). Administrative support is provided by the ASEAN Secretariat and the World Bank also gave capitalisation support. This capital provision allows the facility to retain part of its risk, thus lowering the reinsurance premiums. Similar to the CCRIF, part of the company’s operations, including (re)insurance management, asset management and payout calculations, is outsourced to third-party service providers. This allows the company to lower its operational costs. Owing to the reduced capital requirement, along with the lower transaction and operating costs, participating countries can benefit from premium savings. It has been estimated that, at the appraisal stage, premiums could be more than 20% lower as a result of catastrophe risk pooling, risk retention through joint reserves and economies of scale, compared to the premiums countries would pay if they accessed international reinsurance markets individually (World Bank, 2020). Besides insurance solutions, the most recent 2023-25 Action Plan of the ASEAN+3 Disaster Risk Financing Initiative outlines joint contingent financing as well as joint CAT bonds as its priority areas. Combining these financial instruments will enhance resilience at both the national and regional levels.

The SEADRIF’s first financial product includes a three-year insurance policy against the risk of flood. It consists of two components covered by a single premium. The parametric component features a stepped payout structure, allowing participating members to receive payouts amounting to 40% of the policy limit within ten business days in the event of a medium-severity disaster (1-in-8-year flood event) and 100% in the event of a severe disaster (1-in-20-year flood event) (SEADRIF, 2023[14]). The finite risk component is designed to address basis risk, providing participating countries with protection against smaller shocks, regardless of whether they are related to a flood event. Under this component, insured members can be provided with liquidity within five business days in the case an event does not trigger a payout under the parametric component.

This product was developed in response to a request from Lao PDR. Flood events have caused more damages in the region than other types of natural disasters (Figure 5.3), meaning that affordable financial protection against floods is essential to overcome the financial burden these countries face. The flood insurance product design takes several factors into consideration, including product simplicity, pool sustainability, appetite of international reinsurance markets and, most importantly, affordability such that participating countries are able to pay the premium. Under this product, each country determines its premium, and the SEADRIF calculates the coverage it can offer.

The current financial solution offered by the SEADRIF involves a reinsurance-backed catastrophe risk pool for Lao PDR and Myanmar, in which both countries pay an upfront premium and receive a payout when an eligible disaster occurs. Cambodia was expected to join the pool; however, its participation is pending further feasibility studies (World Bank, 2020[15]). By pooling risks and jointly purchasing insurance under the SEADRIF, the capital requirement and transaction costs can be reduced. As of August 2023, the Government of the Lao PDR received two payouts totalling USD 1.5 million within one business day following the submission of the notice of loss due to flooding. Both of these payouts fall under the finite risk component of the insurance policy.

Retaining a higher share of the risk in SEADRIF can lower premium costs for participating countries, incentivising the active involvement of the current participants and attracting more member countries to join. As the SEADRIF’s coverage is currently limited to flood insurance, the facility may need to develop other products for other types of disasters. The SEADRIF could strengthen monitoring process, including model design, legal arrangement, rating analysis and access to institutional investors in the international capital markets.

In addition, there are other initiatives in Asia, such as APEC’s emergency preparedness work. First established in 2005, the APEC Emergency Preparedness Working Group (EPWG) aims to enhance the region’s capacity, enabling APEC member economies to prevent, prepare for and recover from the increasing risks of disasters more effectively. In 2016, the EPWG was tasked to lead the formulation of the APEC Disaster Risk Reduction Plan. Sharing of information related to Disaster Risk Financing initiatives, promoting private disaster insurance schemes, deepening their penetration, as well as developing risk transfer mechanisms based on robust data and analysis are among key areas of collaboration outlined within this plan.

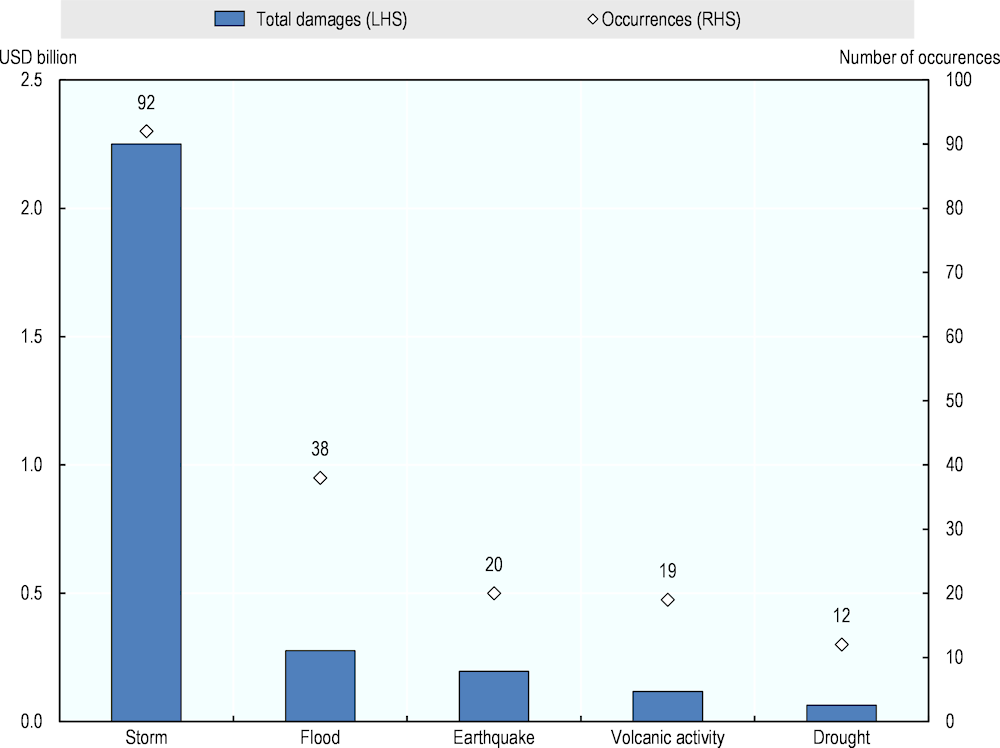

The case of the PCRAFI Facility

The Pacific region consists of a number of Small Island Developing States. High exposure to natural disasters and climate hazards has made these countries some of the most vulnerable in the world. Storm events are among the most frequent natural disasters since 2000, generating total damages of USD 2.25 billion (Figure 5.4). Among the most severe storm events, Severe Tropical Cyclone Pam, which struck Vanuatu in 2015, affected 69% of the population and caused total damages amounting to almost USD 450 million or 61.5% of GDP in 2015 (CRED, n.d.[4]). The following year, category 5 Severe Tropical Cyclone Winston made landfall in Fiji, affecting 62% of the population and generating total damages of USD 600 million or over 12% of GDP in 2016 (CRED, n.d.[4]).

Figure 5.4. Disaster occurrences and damages in the Pacific region, 2000-23

Note: LHS = left hand scale. RHS = right hand scale. Data cover 20 countries in the Pacific region: American Samoa, the Cook Islands, Fiji, French Polynesia, Guam, Kiribati, the Marshall Islands, Micronesia, New Caledonia, Niue, the Northern Mariana Islands, Palau, Papua New Guinea, Samoa, the Solomon Islands, Tokelau, Tonga, Tuvalu, Vanuatu, and Wallis and Futuna.

Source: (CRED, n.d.[4]), Emergency Events Database (EM-DAT) (database), https://public.emdat.be/.

As with other Small Island Developing States, the Pacific Island Countries (PICs) often confront limited access to short-term immediate liquidity in the aftermath of a disaster event. The limited options in raising quick liquidity are a result of PICs’ small size, limited borrowing capacity and limited access to international insurance markets. Their small size tends to rule out any risk diversification options, meaning that a risk pool involving the subsidisation of affected regions using revenues from unaffected ones is practically impossible (World Bank, 2015[16]). High transaction costs, small domestic economies and the inability to spread risk over a large territory are among the factors limiting insurance penetration in the region. As a result, governments and households often bear a large proportion of the economic losses from natural disasters.

Against this backdrop, a catastrophe risk insurance programme was piloted from 2013 to 2015 as part of the initial phase of the PCRAFI. Launched in 2007, the PCRAFI is a joint initiative of the World Bank, the Secretariat of the Pacific Community and the Asian Development Bank. The initiative benefitted from financial support from the Government of Japan, the Global Facility for Disaster Reduction and Recovery and the European Union. Technical support was provided by GNS Science (New Zealand), Geoscience Australia and AIR Worldwide. Under the pilot insurance programme, six participating countries (the Marshall Islands, Samoa, the Solomon Islands, Tonga and Vanuatu, as well as the Cook Islands, which joined in the second policy year) were provided with an affordable parametric insurance product against tropical cyclones and earthquakes or tsunamis. The product provided participants with access to rapid liquidity in the wake of major meteorological and seismic events.

As of 2023, a total of four payouts, exceeding USD 11 million in aggregate, have been disbursed. Two countries benefited from rapid payouts during the three-year pilot of PCRAFI while other two payouts amounting USD 3.5 million and USD 4.5 million were made by PCRIC to the Government of Tonga following the Tropical Cyclone Gita in 2018 and the Tropical Cyclone Harold in 2020, respectively. During the pilot programme, the first payout of USD 1.3 million in 2014 provided Tonga with rapid liquidity to respond to the impact of Severe Tropical Cyclone Ian. The payout was made within ten days following the event (World Bank, 2015[16]). The nominal amount can be considered quite significant relative to the country’s 2013 contingency budget. Additionally, it accounted for more than half of the reserves of the Tonga National Reserve Fund (World Bank, 2017[17]). Vanuatu received the second payout of USD 1.9 million in 2015, following Severe Tropical Cyclone Pam. Payment was made within seven days following the event (World Bank, 2015[16]). Although the nominal payout amount was equivalent to eight times the country’s emergency provision (World Bank, 2017[17]), it was lower than anticipated, reflecting the low level of coverage purchased.

In 2015, the finance ministers of the PICs decided to establish a sovereign regional catastrophe risk pool – the PCRAFI Facility. This marked the end of the PCRAFI pilot and the beginning of Phase II of the PCRAFI. In fact, Phase II has two core components: i) the PCRAFI Facility; and ii) the Technical Assistance Programme to support capacity building for disaster risk financing. To finance these, the PCRAFI MDTF was established, consisting of donor countries Germany, Japan, the United Kingdom and the United States. Donor contributions totalled USD 40 million, a share of which will particularly be used for the establishment and operations of the PCRAFI Facility, as well as to support the initial capitalisation, monitoring and evaluation, and the development of disaster risk insurance products.

The structure of the PCRAFI Facility consists of two entities: the Pacific Catastrophe Risk Insurance Foundation (PCRIF), which is a collective ownership structure for participating countries to govern the risk pooling facility; and the PCRIC, owned and governed by the PCRIF. The PCRIC serves as a captive insurer with a mandate to provide member countries with cost-efficient disaster risk insurance.

Addressing data challenges and client retention issues

The current perils covered by the PCRIC products remain the same as the perils covered during the 2013 pilot insurance programme. PCRIC products still consist of parametric insurance policies covering tropical cyclones, earthquakes and tsunamis whose triggers are based on modelled losses. Under the tropical cyclone policies, modelled loss are calculated using information on storm position and wind speed. Modelled loss under the earthquake policies is based on parameters that include the location, epicentre and depth of the earthquake. Should the earthquake lead to a tsunami, losses incurred from that event will be accounted for in adjusting the modelled loss.

PCRIC products and the insurance model are developed based on the Pacific Risk Information System (PacRIS), the key output of the PCRAFI. This tool uses the probabilistic assessment results for 15 countries in the region and a regional database on exposures, making it the largest database of its kind in the Pacific region. Data on exposure cover infrastructure, crops, and public and private buildings. Information related to construction features and current condition is collected using remote sensing analyses, country-specific datasets and field visits.

In addition to country-specific exposure, PacRIS includes a catalogue of historical earthquakes, tropical cyclones and loss data, and hazard models that simulate tropical cyclones, earthquakes and tsunamis for each country. The risk profiles are further deployed to estimate direct losses from each type of natural disaster event, providing support in determining appropriate disaster risk financing and insurance solutions, including policy premiums for participating countries. Results from risk assessments, including the geographic distribution of potential losses, can be visualised and are easily accessible via an open-source web-based platform.

In addition, PacRIS was designed to support broader aspects of disaster risk management, including rapid disaster-impact estimation, professional and institutional capacity development, urban planning and infrastructure design, and macroeconomic planning, among others. Notwithstanding the tool being open source, the use of PacRIS can be improved, as it is still limited to supporting the development of financial solutions (i.e. insurance) in practice, and some data gathered under this tool are currently outdated (Martinez-Diaz, Sidner and McClamrock, 2019[9]).

Given that risk assessment relies heavily on data, it is critical for the PCRAFI to keep its database current. Although some asset exposure data are already updated in 2023 as a result of PCRAFI Program Phase II, however, the latest update of complete country risk profiles date back to 2015 (World Bank, 2017[17]). By updating country’s risk profiles and information, the facility can ensure the accuracy of its estimates and catastrophe risk models. This can in turn provide participating countries with refined insurance products whose payouts closely reflect the reality on the ground. Improvements in data and thus in risk modelling may also facilitate the pool’s risk transfer through CAT bond markets. However, there seems to be other critical challenges the facility needs to overcome in order to transfer part of its risk to capital markets.

Client retention is another issue affecting the functioning of the PCRAFI Facility. Since it was legally established in 2016, the PCRIC has been offering insurance policies to six countries. However, for Season 9, which began in November 2020, policyholders consisted of only three countries (the Cook Islands, Samoa and Tonga) (World Bank, 2021[18]). Other countries, such as the Solomon Islands and Vanuatu, opted out. This may indicate that the PCRIC currently faces challenges, particularly a client retention issue. The small number of participants and resulting lack of risk diversification may lead to higher premiums as transferring risk to reinsurance or capital markets becomes costly. Considering that CAT bonds may involve higher transaction costs than traditional reinsurance, the cost to participating countries could be even higher.

Affordability of premiums is one of the most important factors that determines insurance pool participation. The tight budget of many Small Island Developing States, for instance due to a small population and narrow government revenue base, appears to be the main barrier to purchasing insurance coverage. Almost all countries that have purchased insurance policies, excluding the Cook Islands, relied on premium subsidies from the government of Japan during the PCRAFI pilot programme.

For instance, the grants fully covered premiums during the first pilot season. In the next two seasons, participating countries contributed 5% and 16% of the total, respectively (World Bank, 2015[16]). This growing contribution may indicate participating countries’ commitment to the programme; however, the country consultation report on the insurance pilot programme points out that participating countries would not have the capacity to purchase coverage and that countries would evaluate their ongoing participation if premiums ceased to be subsidised (SPC, 2015[19]). This further demonstrates the importance of premium affordability with regard to participation.

After the establishment of the PCRIC, participating countries benefited from concessional premium financing. The Marshall Islands, Samoa, Tonga and Vanuatu have relied on IDA resources, combined with own contributions, to finance their premiums for the 2015/16 policy year (Season 4) onwards (Martinez-Diaz, Sidner and McClamrock, 2019[9]). IDA grants have been the partial source of premium payments for the Marshall Islands and Samoa, while Vanuatu relied more on IDA credit. Tonga also used IDA credit, in addition to the small grant received. Some other countries in the Pacific are eligible to purchase insurance coverage from the PCRIC but are not eligible to access IDA funding. The limited sources to finance premiums might become a serious impediment to expanding participation.

Another key factor that may affect participation is payout expectation. The decision to drop coverage or to withdraw from the pool might be the result of unmet payout expectations, as with the Solomon Islands, which dropped out after the second season of the insurance pilot (2013/14 policy year). Vanuatu halted coverage after the sixth season (2017/18 policy year). The magnitude 8.0 earthquake and tsunami in 2013 that generated losses in the Santa Cruz Islands did not trigger a payout, as the degree of physical damage was relatively low. The following year, a tropical depression led to extensive flooding, with estimated damages and losses equivalent to 9.2% of the Solomon Islands’ GDP in 2014 (World Bank, 2015[20]). Notwithstanding the severity of damages and losses, the event did not trigger a payout, as a tropical depression was not an eligible event under the insurance policy (World Bank, 2016[21]).

Challenges of enhancing regional co-operation

Despite the presence of a political platform that accommodates regional collaboration in financing disaster risks, countries may be reluctant to cross-subsidise premiums for other pool participants (World Bank, 2017[22]). The premium for each country should therefore be based on the level of risk the country brings to the regional risk pool (OECD, 2022[23]). Appropriate calculation methods would need to be developed to ensure that each participating country pays a premium that is both commensurate with its risk exposure and economically viable.

In general, regional catastrophe risk pools employ risk-based pricing whereby policies are priced individually depending on the underlying risks: countries could choose the type, frequency and severity of disasters to cover, which would be reflected in their premium. Individual pricing can prevent cross-subsidisation from countries facing lower risk to those facing higher risk. This could be achieved through the pools’ capacity to develop a more detailed risk assessment for each participating country. Granular data and statistical modelling should be able to predict the likelihood and impact of a disaster event for individual locations rather than for a wide area.

In addition to country-specific risk profiles, tailoring appropriate insurance premiums for member countries requires several factors, in particular, a sovereign risk pooling mechanism must accommodate the divergent interests of the parties involved (i.e. participating countries, the catastrophe risk pool itself and donor countries that contributed to the pools’ establishment and development).

For instance, when the CCRIF was first established, following participating countries’ decisions on their coverage, the model was used to calculate the average annual loss (AAL). A range of other factors were taken into consideration to determine the pricing of CCRIF policies. For example, to respond to its need for growing reserves to reduce the chance of insolvency, and to cover its operating expenses, professional fees, and the cost of reinsurance, the long-term aggregate premium from participating countries should be higher than the AAL of the aggregate CCRIF portfolio (World Bank, 2010[24]). The premium is therefore set as a function of the AAL, the expense load (e.g. administrative costs) and the cost associated with capital provision, as the risk pool needs to secure a large amount of capital through reserves or reinsurance to ensure its capacity for claims payments. This implies a premium equivalent to a multiple of the AAL. As the reserves increase, the CCRIF could lower the premium rate by 10% from the first to the second season (World Bank, 2010[24]).

The pricing method can be refined as the catastrophe risk model evolves (see Chapter 3). For instance, while using only participating countries’ AAL in the function of insurance pricing offers simplicity, including countries’ probable maximum loss would better capture the impact of each country’s policy on the risk exposure of the pool’s aggregate portfolio. Using such a function, a country with a lower AAL but higher loss volatility would contribute more to the pool (World Bank, 2010[24]). As of 2021, CCRIF insurance policy pricing is based on the country’s risk profile, presenting losses at various probabilities of occurrence, often referred to as probabilities of exceedance (CCRIF, n.d.[25]).

Conclusion

For countries where issuing CAT bonds independently is infeasible, multi-country CAT bonds represent a possible solution. In such an arrangement, multiple countries share resources to gain the benefits of CAT bonds at a regional level. Multi-country CAT bonds can reduce transaction costs as seen in the example of the Pacific Alliance CAT bonds. Multi-country CAT bonds can also broaden the investor base for the instruments. Indeed, the high demand for the Pacific Alliance CAT bond reduced the necessary premium rates for participating countries.

CAT bonds can also be used as part of regional catastrophe risk sharing mechanisms, as the Caribbean Catastrophe Risk Insurance Facility (CCRIF) has done. The CCRIF was able to diversify its reinsurance capital sources and secure multi-year access to insurance at a fixed price using CAT bonds, stabilising its risk-sharing programme, though CCRIF and other similar programmes still face challenges. High premiums can dissuade countries from joining regional programmes, and the facilities themselves need significant amounts modelling, technical, legal and financial expertise, all of which may be costly in their own right. Furthermore, if the needs of member countries are not met, such as if certain disaster types are not covered or triggers are deemed too restrictive, there is a risk of client attrition.

Finally, some countries might be reluctant to cross-subsidise the premiums of other members of a given risk sharing arrangement. As such, more current technical expertise and data are needed to ensure each country pays an appropriate share of the costs. Administrators of a risk sharing mechanism must also balance the needs and wants of member countries with those of participating countries.

References

[13] CCRIF (2020), Annual Report 2019-20, The Caribbean Catastrophe Risk Insurance Facility SPC, Grand Cayman, https://www.ccrif.org/sites/default/files/publications/annualreports/CCRIF_Annual_Report_2019_2020.pdf.

[10] CCRIF (2017), Annual Report 2016-17, The Caribbean Catastrophe Risk Insurance Facility SPC, Grand Cayman, https://www.ccrif.org/sites/default/files/publications/annualreports/CCRIFSPC_Annual_Report_2016_2017.pdf.

[11] CCRIF (2016), Annual Report 2015-2016, The Caribbean Catastrophe Risk Insurance Facility SPC, Grand Cayman, https://www.ccrif.org/sites/default/files/publications/annualreports/CCRIF_Annual_Report_2015-2016.pdf.

[12] CCRIF (2015), Annual Report 2014-2015, The Caribbean Catastrophe Risk Insurance Facility SPC, Grand Cayman, https://www.ccrif.org/sites/default/files/publications/annualreports/CCRIFSPC_Annual_Report_2014_2015.pdf.

[25] CCRIF (n.d.), CCRIF’s Country Risk Profiles, The Caribbean Catastrophe Risk Insurance Facility SPC, Grand Cayman, http://www.ccrif.org/es/node/12095?page=1.

[4] CRED (n.d.), Emergency Events Database (EM-DAT), Centre for Research on the Epidemiology of Disasters, Brussels, https://public.emdat.be/ (accessed on 22 November 2021).

[9] Martinez-Diaz, L., L. Sidner and J. McClamrock (2019), “The Future of Disaster Risk Pooling for Developing Countries: Where Do We Go From Here?”, World Resources Institute, Washington, D.C., http://www.wri.org/publication/disaster-risk-pooling.

[23] OECD (2022), Economic Outlook for Southeast Asia, China and India 2022: Financing Sustainable Recovery from COVID-19, OECD Publishing, Paris, https://doi.org/10.1787/e712f278-en.

[14] SEADRIF (2023), Frequently Asked Questions, Southeast Asia Disaster Risk Insurance Facility, Singapore, https://seadrif.org/faq/.

[19] SPC (2015), Pacific Catastrophe Risk Insurance Pilot (PCRIP): Country Consultation Report, Secretariat of the Pacific Community, Suva.

[2] UN (2020), Vulnerability of Eastern Caribbean Countries, United Nations in Barbados and the OECS, Christ Church, https://reliefweb.int/sites/reliefweb.int/files/resources/Vulnerability%20of%20EC_FS_4_5_20.pdf.

[18] World Bank (2021), PCRAFI: Furthering Disaster Risk Finance in the Pacific (P161533), https://documents1.worldbank.org/curated/en/303551609998703564/pdf/Disclosable-Version-of-the-ISR-PCRAFI-Furthering-Disaster-Risk-Finance-in-the-Pacific-P161533-Sequence-No-08.pdf.

[15] World Bank (2020), Southeast Asia Disaster Risk Insurance Facility: Strengthening Financial Resilience in Southeast Asia Project, Project Appraisal Document on a Proposed Grant, Report No. PAD3386, World Bank Group, Washington, D.C., https://documents1.worldbank.org/curated/en/448271609883644172/pdf/East-Asia-and-Pacific-Southeast-Asia-Disaster-Risk-Insurance-Facility-Strengthening-Financial-Resilience-in-Southeast-Asia-Project.pdf.

[1] World Bank (2019), Super-sized Catastrophe Bond for Earthquake Risk in Latin America, World Bank, https://thedocs.worldbank.org/en/doc/192341554318525877-0340022019/original/casestudyfinancialproductsPacificAlliancefinal4.1.2019.pdf.

[3] World Bank (2018), Disaster Risk Management in the Caribbean: The World Bank’s Approaches and Instruments for Recovery and Resilience, World Bank Group: Social, Urban, Rural and Resilience, https://www.gfdrr.org/sites/default/files/publication/WBG%20Caribbean%20DRM%20Engagement_web.pdf.

[17] World Bank (2017), PCRAFI Program Phase II: Furthering Disaster Risk Finance in the Pacific - Regional Collaboration on Climate and Disaster Risk Financing, World Bank Group, Washington, D.C., http://www.financialprotectionforum.org/file/892/download?token=MNPrYJS8.

[22] World Bank (2017), Sovereign Climate and Disaster Risk Pooling: World Bank Technical Contribution to the G20, World Bank Group, Washington, D.C., http://hdl.handle.net/10986/28311.

[21] World Bank (2016), Grant … to the Pacific Islands (Marshall Islands, Independent State of Samoa, Solomon Islands, Kingdom of Tonga, and Vanuatu) for a Pacific Catastrophe Risk Insurance Pilot Program, Implementation Completion and Results Report, No. ICR00003696, World Bank Sydney Office, Sydney, https://documents1.worldbank.org/curated/en/655341475523018949/pdf/PIC-CatastropheRiskInsurancePilotSmallGrant-ICR-FINAL-09302016.pdf.

[20] World Bank (2015), Country Note: Solomon Islands - Disaster Risk Financing and Insurance, World Bank, Washington, D.C., https://www.gfdrr.org/sites/default/files/publication/country-note-2015-pcrafi-solomon-islands.pdf.

[7] World Bank (2015), Facilitating Catastrophe Risk Transfer, World Bank, Washington, D.C., https://documents1.worldbank.org/curated/en/463201468015629255/pdf/93909-CCRIF-CatBond-2015.pdf.

[16] World Bank (2015), Pacific Catastrophe Risk Insurance Pilot: From Design to Implementation - Some Lessons Learned, World Bank Group, Washington, D.C., https://www.gfdrr.org/sites/default/files/publication/Pacific_Catastrophe_Risk_Insurance-Pilot_Report_140715%281%29.pdf.

[8] World Bank (2014), World Bank Issues its First Ever Catastrophe Bond Linked to Natural Hazard Risks in Sixteen Caribbean Countries, World Bank, Washington, D.C.

[6] World Bank (2012), Grant … to the Catastrophe Risk Insurance Project for a Caribbean Catastrophe Risk Insurance Project, Implementation Completion and Results Report, No. ICR00002332, World Bank Group, Washington, D.C., https://documents1.worldbank.org/curated/en/733451468225588956/pdf/ICR23320P1080500disclosure070270120.pdf.

[24] World Bank (2010), A Review of CCRIF’s Operation After Its Second Season, World Bank, Washington, D.C., https://documents1.worldbank.org/curated/en/164301468225617268/pdf/846360WP0Box380CCRIFReview200802009.pdf.

[5] World Bank (n.d.), World Development Indicators, The World Bank, Washington, D.C., https://databank.worldbank.org/source/world-development-indicators (accessed on 22 November 2021).