This chapter presents an overview of the Brussels-Capital Region’s urban development trends, the challenges it faces and the opportunities and strengths it has compared to other metropolitan regions in the OECD. The chapter starts by looking at demographic trends in the region. It then examines the region’s economic performance, highlighting that the Brussels-Capital Region is Belgium’s major economic engine but faces important challenges in the labour market. Finally, the chapter explores life in the Brussels-Capital Region through an analysis of urban inequalities, housing, mobility and accessibility, and the region’s environmental performance.

OECD Territorial Reviews: Brussels-Capital Region, Belgium

1. Trends, challenges and opportunities in the Brussels‑Capital Region

Abstract

Introduction

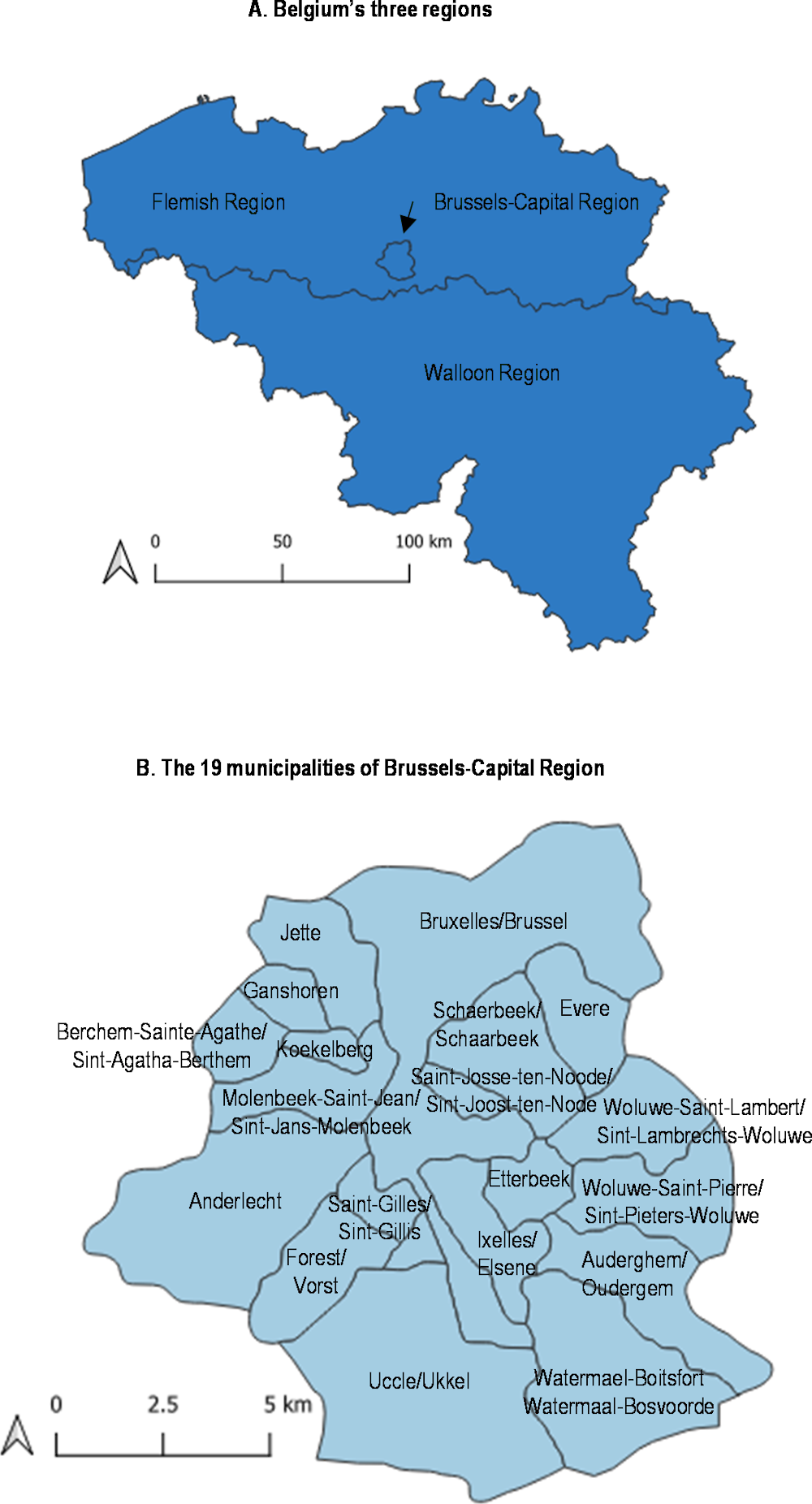

Among the 3 regions composing the federal constitutional monarchy of Belgium, the Brussels-Capital Region has the smallest territory by far (162 square kilometres [km2], compared with 13 635 km² and 16 845 km² for the Flemish and Walloon Regions respectively). The Brussels-Capital Region is also the most urbanised region, with a very high population density and almost three-quarters of its territory covered with buildings. The region encompasses 19 municipalities, including the City of Brussels, the capital of the country, which is also home to the headquarters of many international institutions (including the European Commission and the North Atlantic Treaty Organization [NATO]). The region’s population has grown quickly in the past two decades and more quickly than the rest of Belgium, mainly driven by strong international migration. The Brussels-Capital Region hosts 10.6% of Belgium’s population but generates almost a fifth of the national gross domestic product (GDP) and has a highly productive and competitive economy. Yet, the region faces several challenges on its labour market, including the paradox of a high unemployment rate combined with difficulties for employers to recruit, partly due to a mismatch between the supply and demand of skills. The strong economic performance of the region also contrasts with its poor social conditions. Although the region displays a very high level of GDP per capita – one of the highest of all OECD TL2 regions –, household disposable income remains relatively low. Furthermore, the region faces an acute housing crisis, with a lack of access to affordable and quality housing for a large share of its residents, as well as several mobility challenges, including over-reliance on individual cars, despite good accessibility to public transport.

Urban and demographic trends in the Brussels-Capital Region

Overview of the Brussels-Capital Region territory

The Brussels-Capital Region is one of the three regions of Belgium, together with the Flemish and Walloon Regions (Figure 1.1, Panel A). While the Flemish and Walloon Regions are, in turn, subdivided into five provinces each, the Brussels-Capital Region neither has nor is a province itself. The only bilingual region in Belgium (with Dutch and French as official languages),1 it was also the last of the three regions to be created in January 1989 through the third state reform, which established the region and set up legislative and executive bodies (see Chapter 3 for more details on the competencies and governance of the Brussels-Capital Region). The region is home to 1.24 million people (about 10.6% of the total population of Belgium), on a small territory of 162 km2 (i.e. around 0.5% of Belgium’s total area).

The Brussels-Capital Region consists of 19 municipalities: Anderlecht, Auderghem/Oudergem, Berchem-Sainte-Agathe/Sint-Agatha-Berchem, Ville de Bruxelles/Stad Brussel (City of Brussels), Etterbeek, Evere, Forest/Vorst, Ganshoren, Ixelles/Elsene, Jette, Koekelberg, Molenbeek-Saint-Jean/Sint-Jans-Molenbeek, Saint‑Gilles/Sint-Gillis, Saint-Josse-ten-Noode, Schaerbeek/Schaarbeek, Uccle/Ukkel, Watermael-Boitsfort/Watermaal-Bosvoorde, Woluwe-Saint-Lambert/Sint-Lambrechts-Woluwe and Woluwe-Saint-Pierre/Sint-Pieters-Woluwe (Figure 1.1, Panel B).

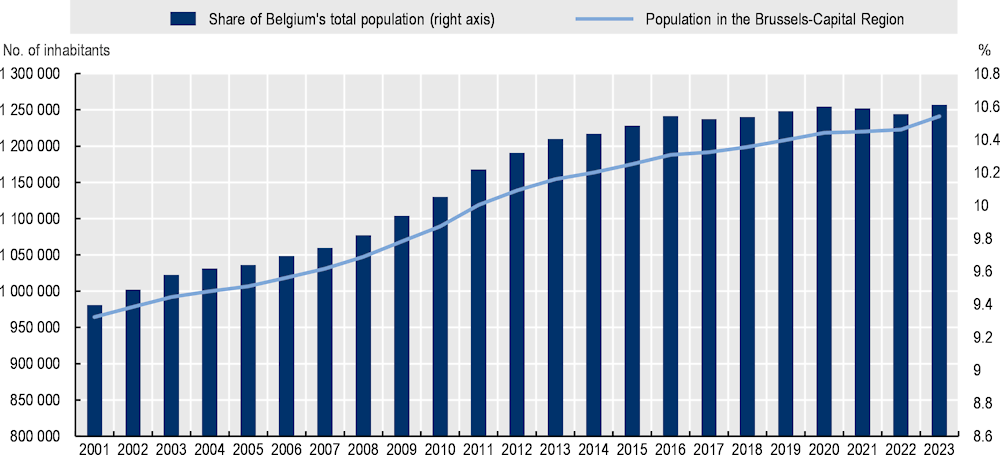

When applying the OECD territorial grid (2022[1]), the Brussels-Capital Region corresponds to an OECD large region (Territorial Level 2, TL2), like the Flemish and Walloon Regions. The OECD and the European Commission have also jointly developed a methodology to create a harmonised definition of cities and their areas of influence for international comparisons as well as for policy analysis on topics related to urban development. This methodology defines functional urban areas (FUAs) based on population density and travel-to-work flows. An FUA consists of a densely inhabited city (called “core”) and a surrounding area (“commuting zone”) whose labour market is highly integrated with the city (Dijkstra, Poelman and Veneri, 2019[2]). This approach to FUAs helps identify and benchmark urban areas in a consistent way across countries. Using this methodology, the Brussels-Capital Region is at the core of the FUA of Bruxelles/Brussel/Leuven, together with Leuven, which is the other core city of the FUA. The FUA of Bruxelles/Brussel/Leuven (hereafter called the Brussels FUA) comprises 137 municipalities, including the 19 of the Brussels-Capital Region. It spans a much wider territory than the region, with more than 4 800 km2, extending both in the Flemish and the Walloon Regions (Figure 1.2) and has a population of 3.34 million people, i.e. 28.6% of Belgium’s population (Table 1.1).

Figure 1.1. Brussels-Capital Region

Source: Brussels-Capital Region.

Figure 1.2. FUAs of Belgium

Source: OECD (2022[3]), Functional Urban Areas: Belgium, https://web-archive.oecd.org/2022-09-01/408790-Belgium.pdf.

Table 1.1. Comparison between the Brussels-Capital Region and the Brussels FUA

|

Brussels-Capital Region |

Brussels FUA |

|

|---|---|---|

|

Surface (km2) |

162 |

4 800 |

|

Surface (% of Belgium) |

0.5 |

15.6 |

|

Population (million) |

1.24 |

3.34 |

|

Population (% of Belgium) |

10.6 |

28.6 |

|

Number of municipalities |

19 |

137 |

Source: IBSA/BISA (n.d.[4]), Population: Évolution annuelle, https://ibsa.brussels/themes/population/evolution-annuelle; OECD (2022[3]), Functional Urban Areas: Belgium, https://web-archive.oecd.org/2022-09-01/408790-Belgium.pdf.

As the Brussels-Capital Region is classified as an OECD TL2 region, this chapter primarily shows data at this territorial level. However, some data are also shown at the territorial level of the Brussels FUA to consider the region’s economic and functional extent beyond its administrative boundaries.

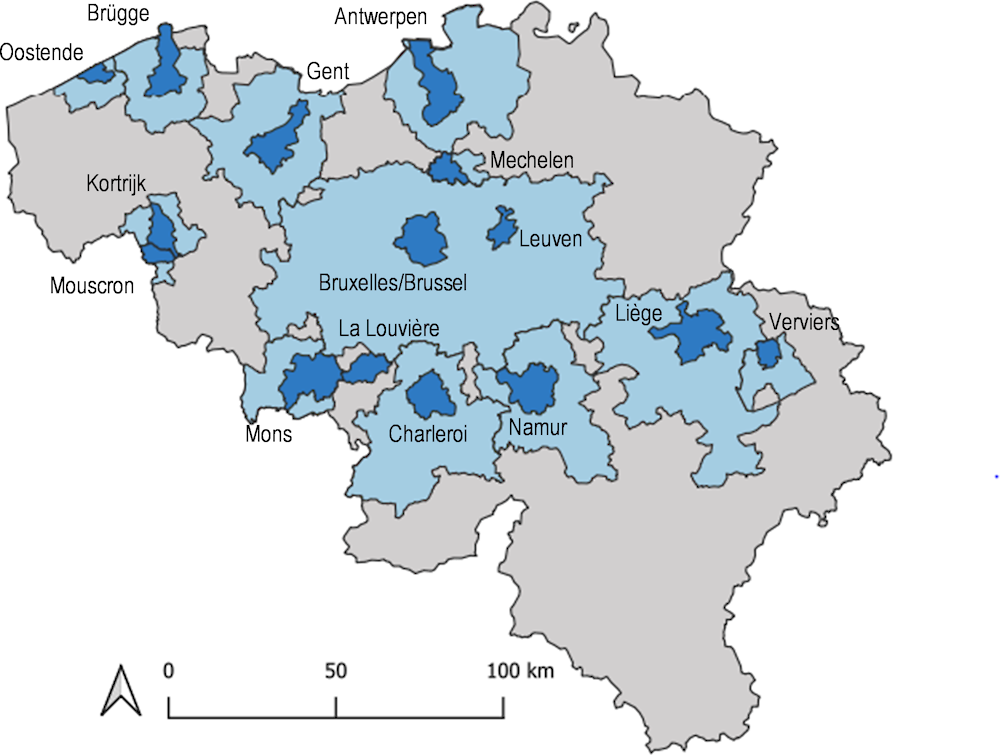

Fast population growth is driven by positive natural balance and international migration

Over the past 2 decades, the population in the Brussels-Capital Region has grown much faster than in the other 2 regions of Belgium (by 28.7% since 2001, compared to 13.8% in the Flemish Region and 10.0% in the Walloon Region over the same period) and reached 1.24 million inhabitants at the beginning of 2023 (Figure 1.3). This fast growth has pushed up the share of the Brussels-Capital Region population in the total population of Belgium from 9.4% in 2001 to 10.6% in 2023.

Figure 1.3. Population in the Brussels-Capital Region, 2001-23

Source: IBSA/BISA (n.d.[4]), Population: Évolution annuelle, https://ibsa.brussels/themes/population/evolution-annuelle.

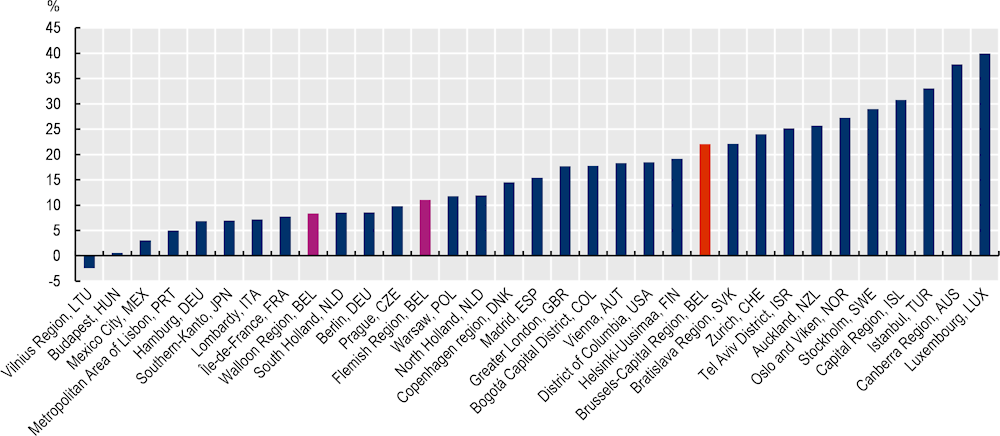

From an international perspective, the population in the Brussels-Capital Region has also grown faster than that of several other capital (TL2) regions in OECD countries. Between 2005 and 2022, its population grew by 22.0%, while it increased by 8.5% in Berlin, Germany, and by 7.8% in Île-de-France, France, over the same period. Population growth was, however, higher in Oslo and Viken, Norway (27.3%) or Stockholm, Sweden (29.0%) (Figure 1.4).

Figure 1.4. Population growth in OECD TL2 regions, 2005-22

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

At the same time, population growth has varied across municipalities within the Brussels-Capital Region. The City of Brussels, which also has the largest population in the region (more than 194 000 inhabitants in 2023, i.e. 15.7% of the population of the region), has grown the fastest, by 44.6% since 2001. The municipality of Watermael-Boitsfort/Watermaal-Bosvoorde, one of the smallest (around 25 000 inhabitants), has grown the slowest, by 3.2%, over the same period.

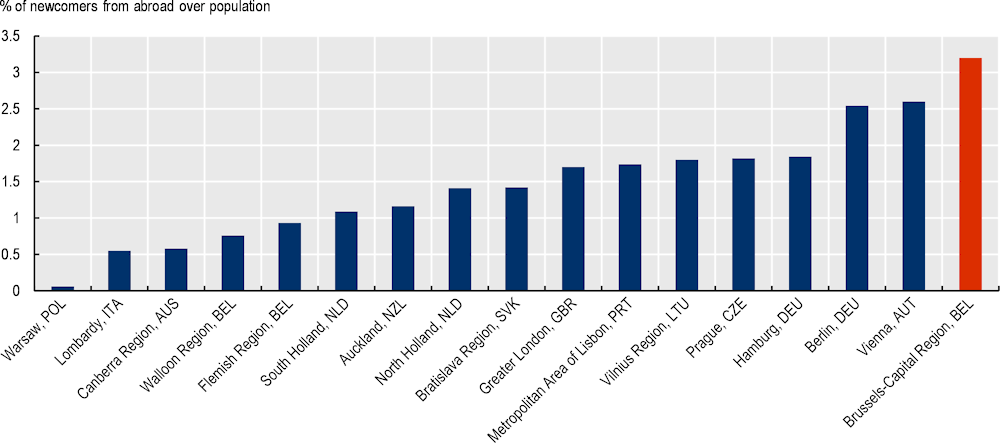

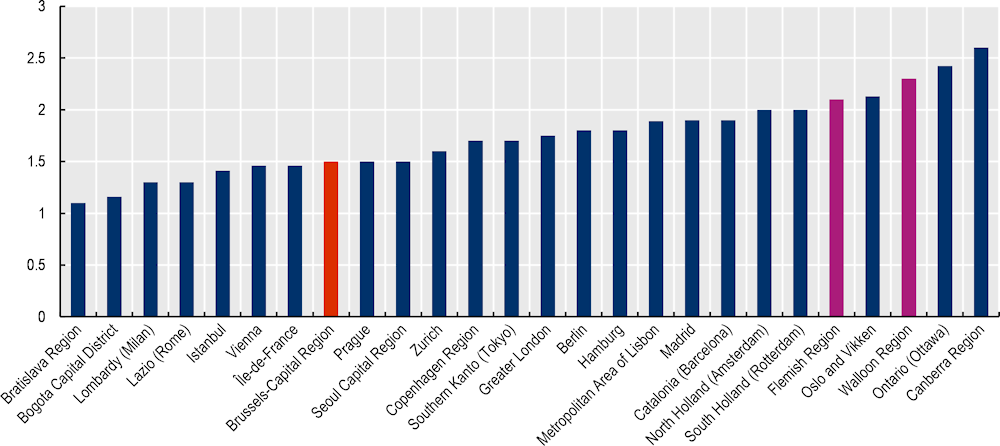

Population growth in the region has been driven by a steadily positive natural balance (i.e. more births than deaths), except in 2020 when the natural balance decreased due to the surge in mortality following the COVID-19 pandemic. Population growth has also benefitted from a strong positive international migration balance, offsetting a negative internal migration balance. With the City of Brussels as the headquarters of many international institutions (European Commission, NATO, etc.) and Belgium’s capital, the Brussels‑Capital Region attracts workers from all over the world, with more than half (57.9%) of international immigration coming from European Union (EU) countries. In 2023, 36.9% of the Brussels population had a non-Belgian nationality (Statbel, 2023[6]). Compared with other regions in the OECD, the share of people coming from abroad over the total population in 2021 was higher in the Brussels-Capital Region than in any other OECD TL2 region where data are available. The number of newcomers from abroad accounted for 3.2% of the Brussels-Capital Region population in 2021, much higher than in Vienna, Austria (2.6%), Greater London, United Kingdom (1.7%) or Bratislava, Slovak Republic (1.4%), for example (Figure 1.5).

Figure 1.5. International immigration rate in OECD TL2 regions, 2021

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

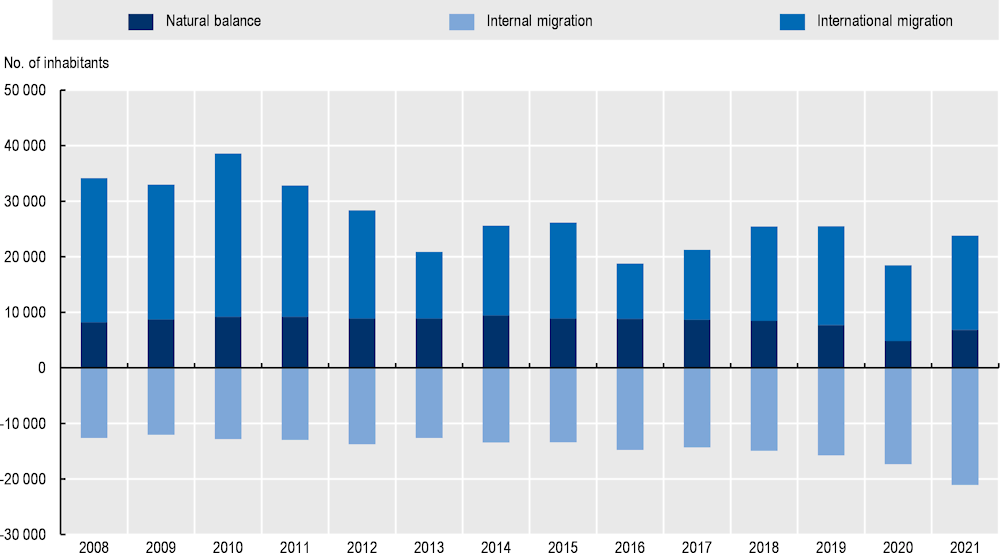

However, population growth has slowed down over the past decade, dropping from 16% over 2001-11 to 9.0% over 2012-23. This slowdown has mainly been due to the negative net internal migration balance, as the number of people moving out of the Brussels-Capital Region to other parts of Belgium has exceeded the number of newcomers. In 2021, almost 45 000 people left the region to settle elsewhere – an increase of almost 10% compared with 2020. This is likely because the pandemic has driven people out of the city centre to seek a larger home or an outside space, thereby amplifying the urban exodus the region has faced for several decades (IBSA/BISA, 2022[7]). The slowdown in population growth has also been partly due to a decreasing net international migration balance, coming down from around 24 500 international migrants per year on average between 2008 and 2012 to around 15 600 between 2017 and 2021 (Figure 1.6).

Figure 1.6. Population movement in the Brussels-Capital Region, 2008-21

Source: IBSA/BISA (n.d.[8]), Population : Mouvement de la population, https://ibsa.brussels/themes/population/mouvement-de-la-population.

According to population projections from the region’s statistical office (Institut Bruxellois de Statistique et d’Analyse – IBSA/Brussels Instituut voor Statistiek en Analyse – BISA), the population is expected to remain roughly stable in the coming decades. It will even decrease slightly after a small rebound between 2030 and 2045, and reach 1.23 million inhabitants by 2070 (i.e. a population decline by 0.6% between 2023 and 2070), as the negative internal migration balance will no longer be offset by the contributions of international migration and the natural balance. Average annual growth is expected to be 100 inhabitants per year between 2022 and 2070, compared with 9 000 inhabitants per year over the 1992-2021 period (Statbel, 2023[9]). By contrast, population in the Flemish and Walloon Regions is expected to grow by 17.9% and 5.2% respectively between 2023 and 2070, which will reduce the share of the Brussels-Capital Region population in the total population of Belgium to 9.4% in 2070.

The number of households in the region is expected to drop more quickly than population, from just under 570 000 households in 2023 down to around 537 000 in 2070 (i.e. a decrease of 5.7%). This results from an expected increase in the average size of households, from 2.20 in 2025 to 2.31 people per household in 2070, contrary to the decreasing trend projected in the other 2 regions of Belgium (Ben Hamou, 2020[10]). This is partly due to the Brussels-Capital Region’s relatively young population (see next section), which should prevent the region from facing a significant increase in the number of elderly single-person households and an expected increase in the number of married or co-living households with children and single-parent families (Bureau Fédéral du Plan, 2021[11]).

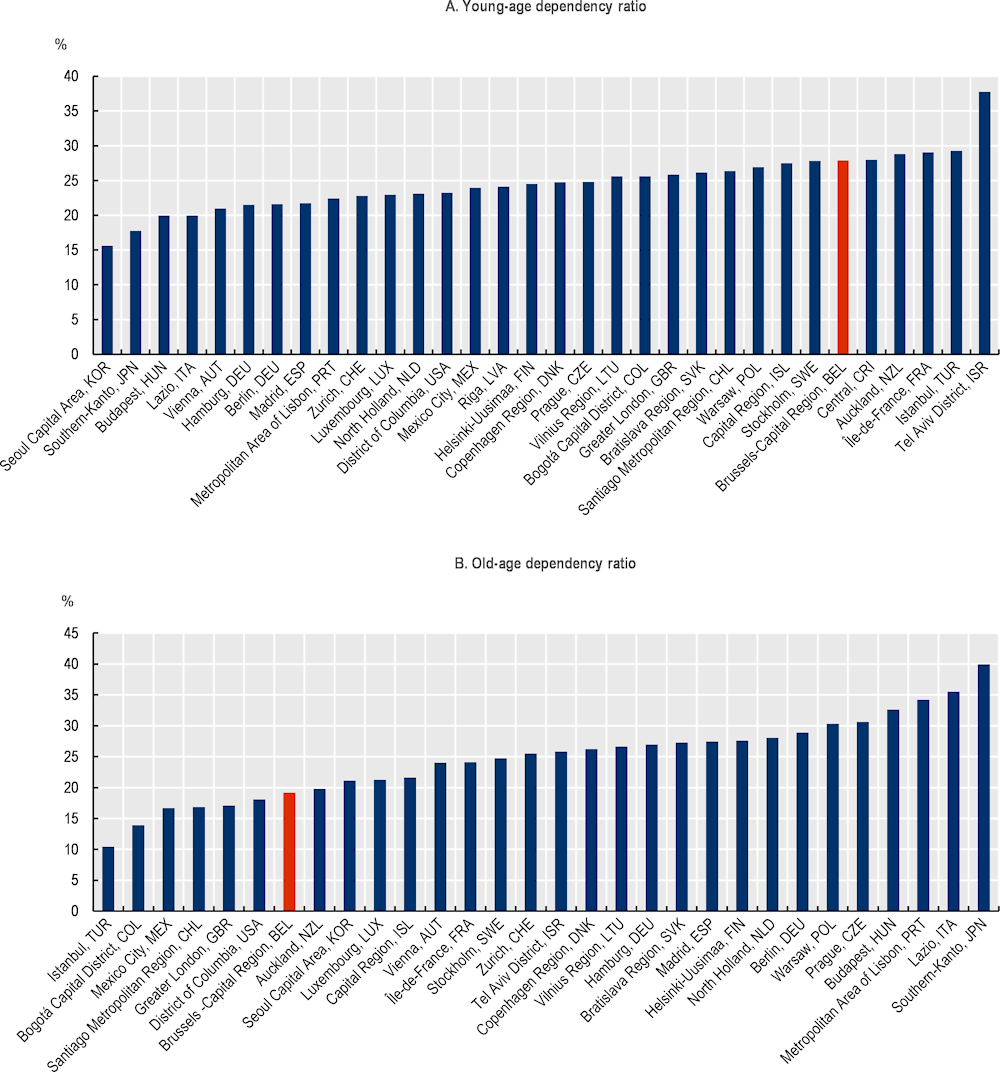

The region has a relatively young population

The population in the Brussels-Capital Region is younger than the national average and relatively young compared to other regions in the OECD. The region’s young-age dependency ratio, i.e. the number of people younger than 15 years old per 100 people of working age (15-64 years old), was one of the highest among all OECD TL2 regions, at 27.9 in 2022. It is similar to Stockholm, Sweden (27.8) or Île-de-France, France (29.1) but much higher than the young-age dependency ratio in Vienna, Austria (21.0) or Hamburg, Germany (21.5) (Figure 1.7, Panel A). Conversely, its old-age dependency ratio, i.e. the number of people older than 64 relative per 100 people of working age, was 19.2 in 2022, compared to 30.6 in Belgium on average. It is slightly higher than the dependency ratio of Greater London, United Kingdom (17.1) but lower than Hamburg, Germany (26.9) and almost half of the old-age dependency ratio of the metropolitan area of Lisbon, Portugal (34.2) (Figure 1.7, Panel B).

Figure 1.7. Dependency ratios in the Brussels-Capital Region and other TL2 regions in OECD countries, 2022 or latest available year

Note: Panel A: The young-age dependency ratio is the percentage of people aged 15 or below over the population of working age (15-64 years old). Panel B: The old-age dependency ratio is the percentage of people aged 65 or above over the population of working (15-64 years old)

Source: OECD (n.d.[12]), OECD Regional Demography (dataset), https://stats.oecd.org/index.aspx?DataSetCode=REGION_DEMOGR.

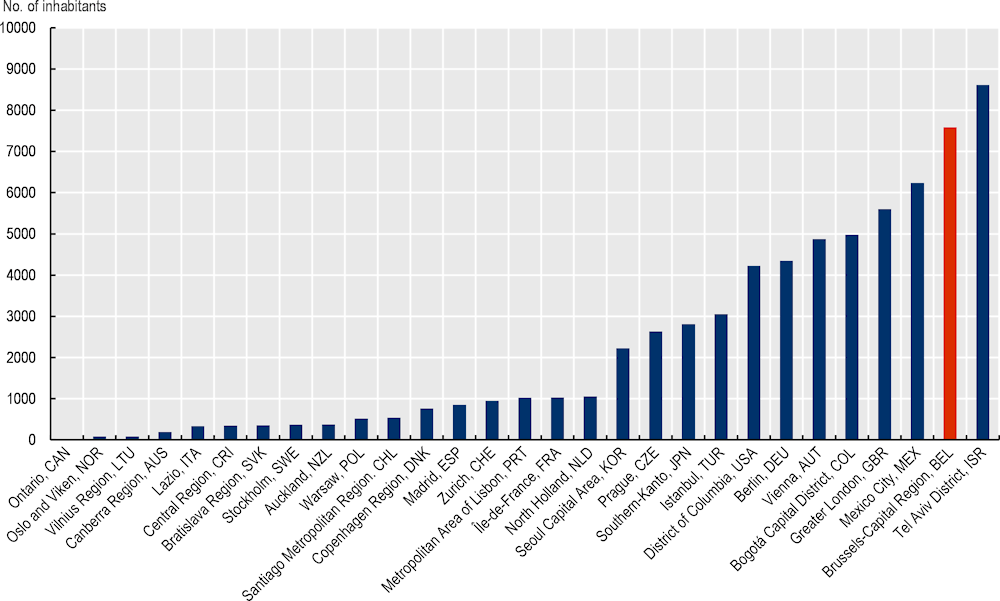

A very densely populated and built-up region

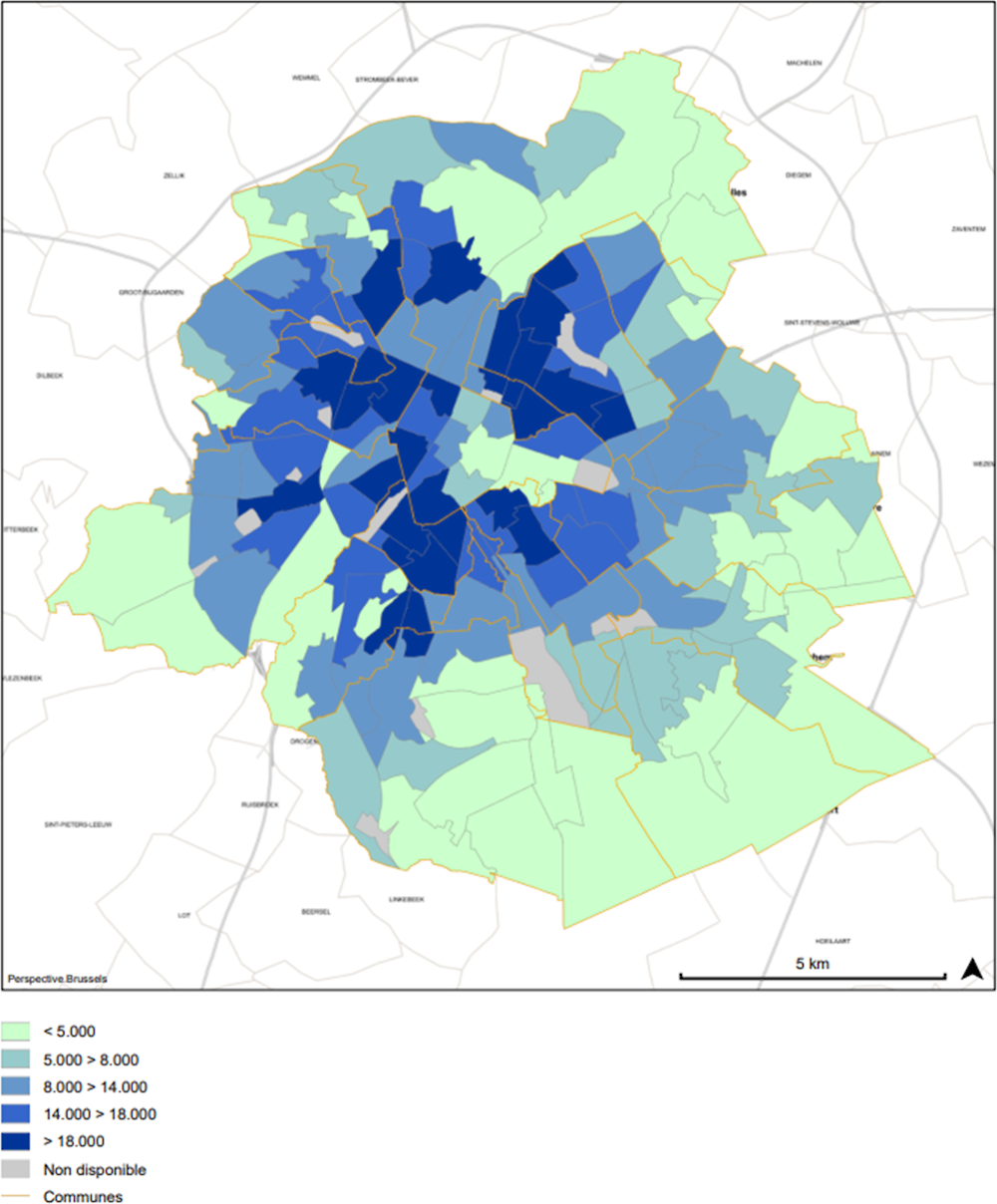

With its high number of residents concentrated in a very small territory, the Brussels-Capital Region is a very densely populated urban area, with more than 7 500 inhabitants per km². Among all OECD large TL2 regions for which data are available (433 in total), only Tel Aviv District, Israel, has a higher population density (around 8 600 inhabitants per km²) (Figure 1.8). Population density varies across municipalities within the Brussels-Capital Region, with Saint-Josse-ten-Noode/Sint-Joost-ten-Node recording the highest density at the municipal level (more than 23 000 inhabitants per km²), while Watermael-Boitsfort/Watermaal-Bosvoorde, where the Forêt de Soignes/Zoniënwoud (Sonian Forest) is located, has less than 2 000 inhabitants per km². At the neighbourhood level, on average, density increases closer to the city centre (Figure 1.9). An exception is the few most central neighbourhoods of the region in the City of Brussels, such as the European Quarter (which is home to the main buildings of the European Union, including the European Parliament), the Royal Quarter and Parc Leopold (which are homes to museums, embassies and palaces and have few inhabitants) (Figure 1.9).

Figure 1.8. Population density in Brussels-Capital Region and other OECD TL2 regions, 2022

Source: OECD (n.d.[12]), OECD Regional Demography (dataset), https://stats.oecd.org/index.aspx?DataSetCode=REGION_DEMOGR.

Figure 1.9. Density by neighbourhood in the Brussels-Capital Region, 2021

Source: IBSA/BISA (n.d.[13]), Densité de population (hab/km²) – 2021, https://monitoringdesquartiers.brussels/Indicator/IndicatorPage/2259?Year=2021&GeoEntity=2.

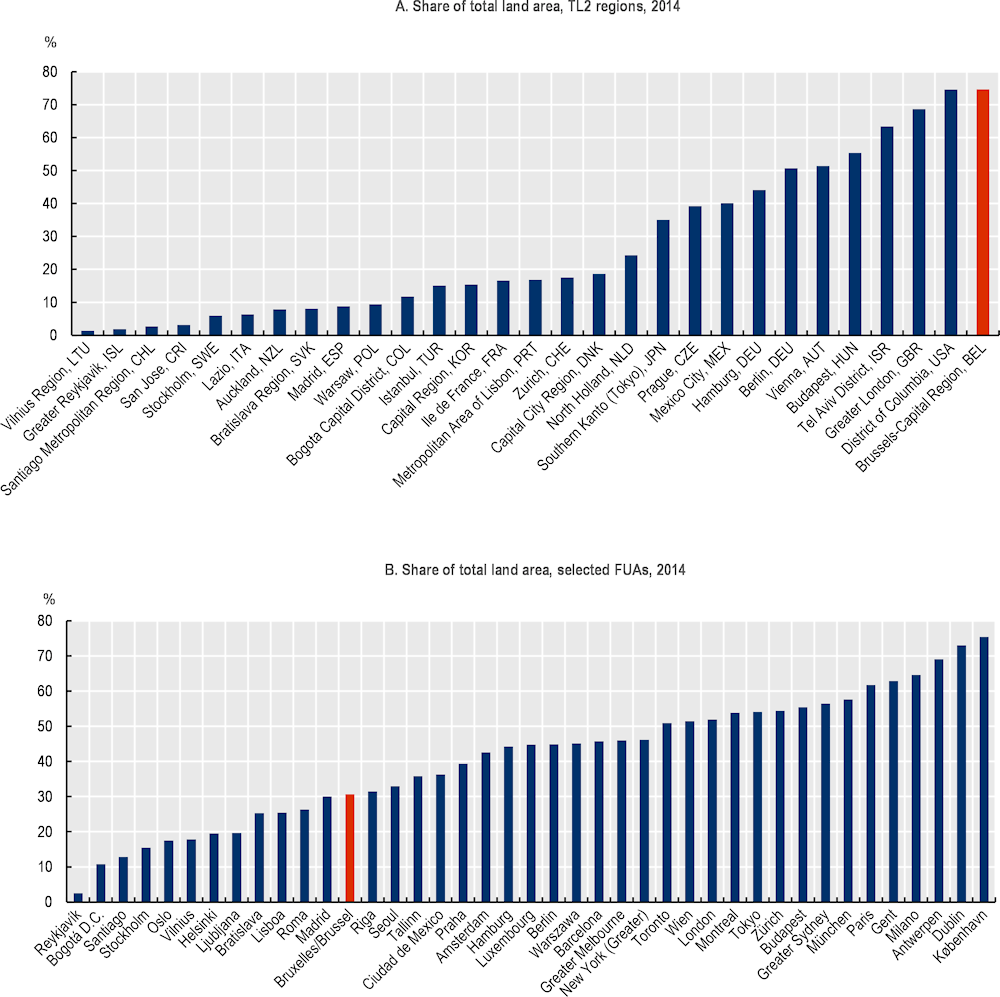

In addition to being densely populated, the Brussels-Capital Region is also largely built up, with almost three-quarters of its territory covered with buildings (roofed structures), the highest share among all OECD TL2 regions (Figure 1.10, Panel A). However, when considering the FUA scale, only 30.7% of the land area of the Brussels FUA is built up, which is lower than in many other FUAs in OECD countries (e.g. 44.8% in the FUA of Berlin, 51.4% in Wien and 61.7% in Paris) (Figure 1.10, Panel B). The lack of developable land within the boundaries of the Brussels-Capital Region combined with more availability in its FUAs can have implications in terms of housing policy and housing supply location. However, while planning policies should allow sufficient new housing to be built to address housing affordability challenges, they should be sensitive to the impact built-up area increases have on the environment (OECD, 2023[14]).

Figure 1.10. Built-up area in the Brussels-Capital Region and the Brussels FUA

Source: Panel A: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/; Panel B: OECD (n.d.[15]), OECD Environment Statistics (database), https://doi.org/10.1787/env-data-en.

Economic performance of the Brussels-Capital Region

A major economic engine of Belgium

The Brussels-Capital Region is an important engine of Belgium’s economy. In 2021, while the region accounted for 10.6% of the national population, it generated about 18.0% of the national GDP (IBSA/BISA, 2023[16]). However, its contribution to national GDP has slowly decreased over the past 2 decades, down from 19.1% in 2005, due to slower economic growth relative to the other 2 regions of Belgium. Between 2005 and 2020, GDP grew by 9.8% in the Brussels-Capital Region, while it rose by 18.9% and 15.6% in the Flemish and Walloon Regions respectively over the same period. Furthermore, GDP growth in the region underperformed the national economic growth, apart from five years between 2005 and 2020 (2009, 2010, 2012, 2014 and 2015).

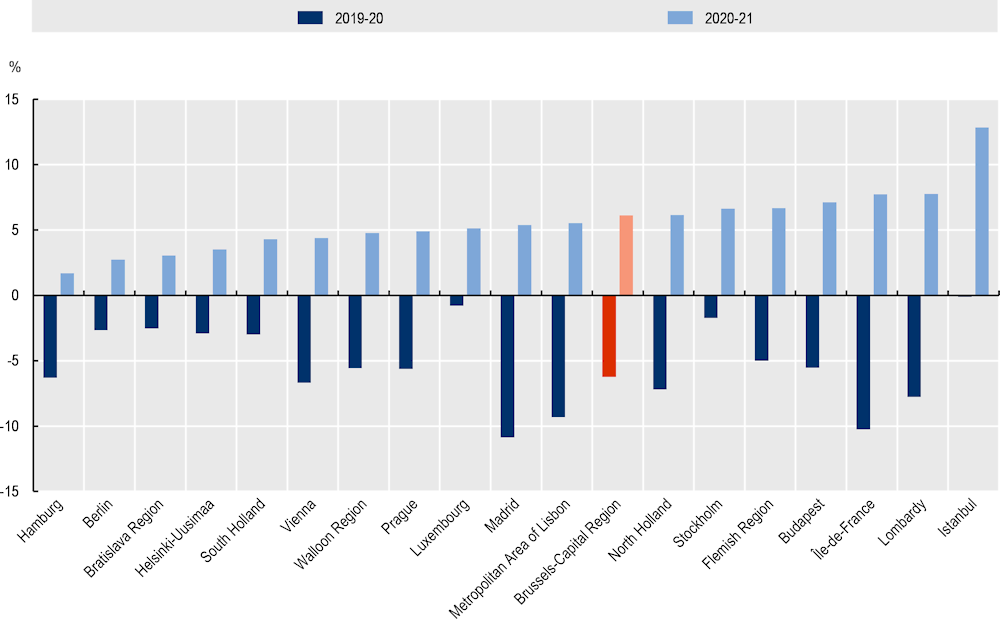

In 2020, due to the COVID-19 pandemic, real GDP fell by 6.2% in the Brussels-Capital Region, a steeper decline than in the Flemish and Walloon Regions, where GDP fell by 5.0% and 5.6% respectively (OECD, n.d.[5]). In 2021, GDP in the region rebounded slightly less quickly than in the other 2 regions, by 6.1% in real terms, compared with 7.0% in the Flemish Region and 6.3% in the Walloon Region (Figure 1.11) (Eurostat, n.d.[17]). In 2022, the Brussels-Capital Region GDP is expected to have grown by 2.1%. This remains lower than the expected economic growth of the Flemish and Walloon Regions where GDP is expected to rise by 2.8% and 2.5% respectively in 2022 (IBSA/BISA, 2022[7]). A possible explanation is that the economy of the Brussels-Capital Region has been more severely impacted by the consequences of Russia’s war of aggression against Ukraine, as it is relatively more dependent on electricity than the rest of Belgium (Godin, 2022[18]).

Figure 1.11. GDP annual change in OECD TL2 regions in Europe, 2019-20 and 2020-21

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

When considering the Brussels FUA, the economic weight of the region is much higher, as Brussels’ FUA accounted for more than a third of the national GDP (36.8%) in 2019, the latest year for which data are available at the FUA level. This is a relatively high proportion compared to other main FUAs in terms of GDP in OECD countries (Figure 1.12). For example, the FUA of Paris accounted for 32.1% of France’s GDP, while the FUA of London represented 28.6% of the United Kingdom’s GDP.

The economy of the Brussels-Capital Region is highly tertiarised. More than 90% of the region’s value-added is created by the tertiary sector and an even higher share of jobs by the service sector (93.0% in 2020, a higher proportion than in the Flemish and Walloon Regions where the service sector makes up between 75% and 80% of total employment) (IBSA/BISA, 2023[16]). Within the tertiary sector, the main subsectors are financial and insurance activities, public administration, and professional, scientific and technical activities, which account respectively for 19.4%, 13.9% and 10.4% of the region’s total value-added in 2020. Home to the headquarters of European institutions (including the European Commission, the Council of the European Union and the European Committee of the Regions), the Brussels-Capital Region is also an essential hub for Belgium’s integration into international service networks. EU institutions and other international organisations contribute to almost a quarter (23.2%) of total employment in the region. About 50 000 people work directly for EU institutions and other international organisations. An extra 70 000 to 110 000 jobs are indirectly linked to the presence of these institutions, for example, in lobbying, journalism and other services such as hotels and catering, etc. (EC, n.d.[19]).

Figure 1.12. Share of selected FUAs in national GDP, 2019

Source: OECD (n.d.[20]), OECD City Statistics (database), https://stats.oecd.org/Index.aspx?datasetcode=FUA_CITY.

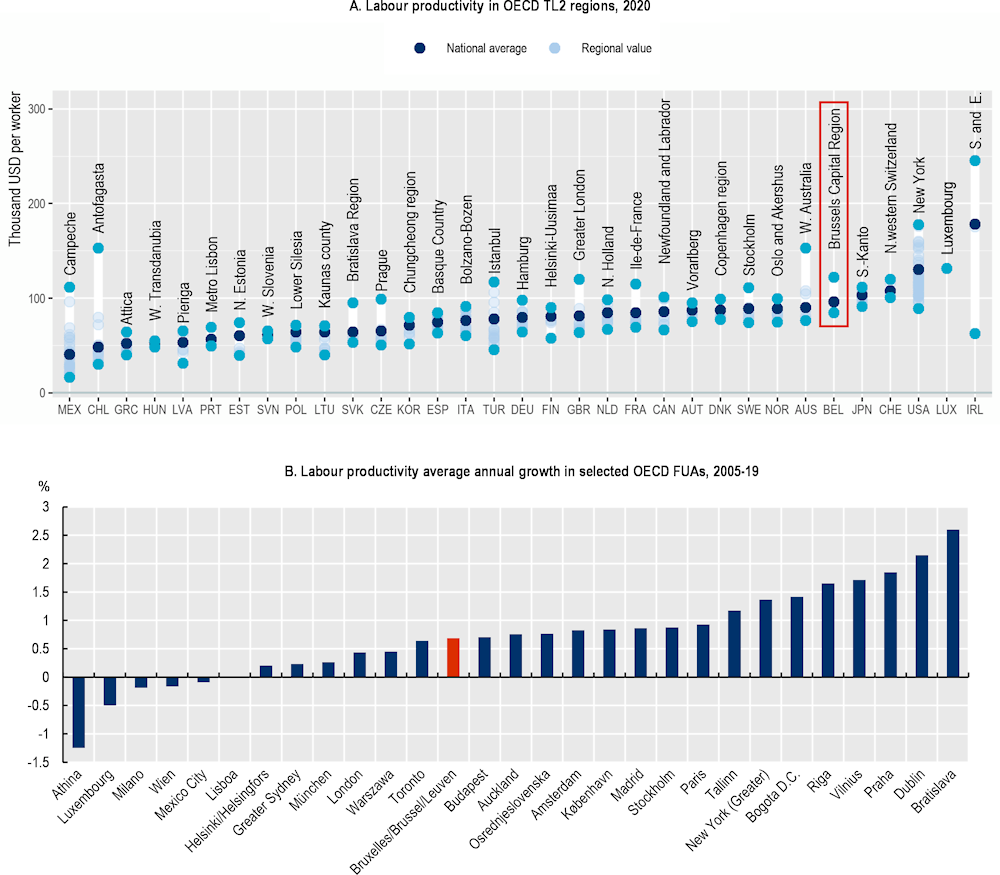

Labour productivity per worker in the Brussels-Capital Region is high compared with other OECD regions. In 2020, gross value added per worker exceeded USD 120 000, i.e. about 25% higher than the Belgian average labour productivity and one of the highest productivity levels across all OECD TL2 regions (Figure 1.13, Panel A). Labour productivity in the region was higher than in the Flemish and Walloon Regions (where gross value added per worker was respectively around USD 96 000 and USD 84 700) and than in many other metropolitan regions such as Île-de-France (France), Berlin (Germany) or London (United Kingdom). At the FUA level, labour productivity is also higher in Brussels than other OECD FUAs.

However, productivity growth in the Brussels FUA has been relatively low, with an average annual growth rate of 0.7% between 2005 and 2019, compared with 0.8% in Amsterdam, 0.9% in Paris or 1.8% in Prague over the same period (Figure 1.13, Panel B).

Figure 1.13. Labour productivity in the Brussels-Capital Region compared with other OECD regions and FUAs

Note: Panel A: 2020 or latest available year: 2019 data for Colombia, New Zealand, Norway, Switzerland and the United Kingdom; 2017 data for Japan. TL3 regions for Estonia, Latvia and Lithuania.

Source: Panel A: OECD (2022[21]), OECD Regions and Cities at a Glance 2022, https://doi.org/10.1787/14108660-en; Panel B: OECD (n.d.[20]), OECD City Statistics (database), https://stats.oecd.org/Index.aspx?datasetcode=FUA_CITY.

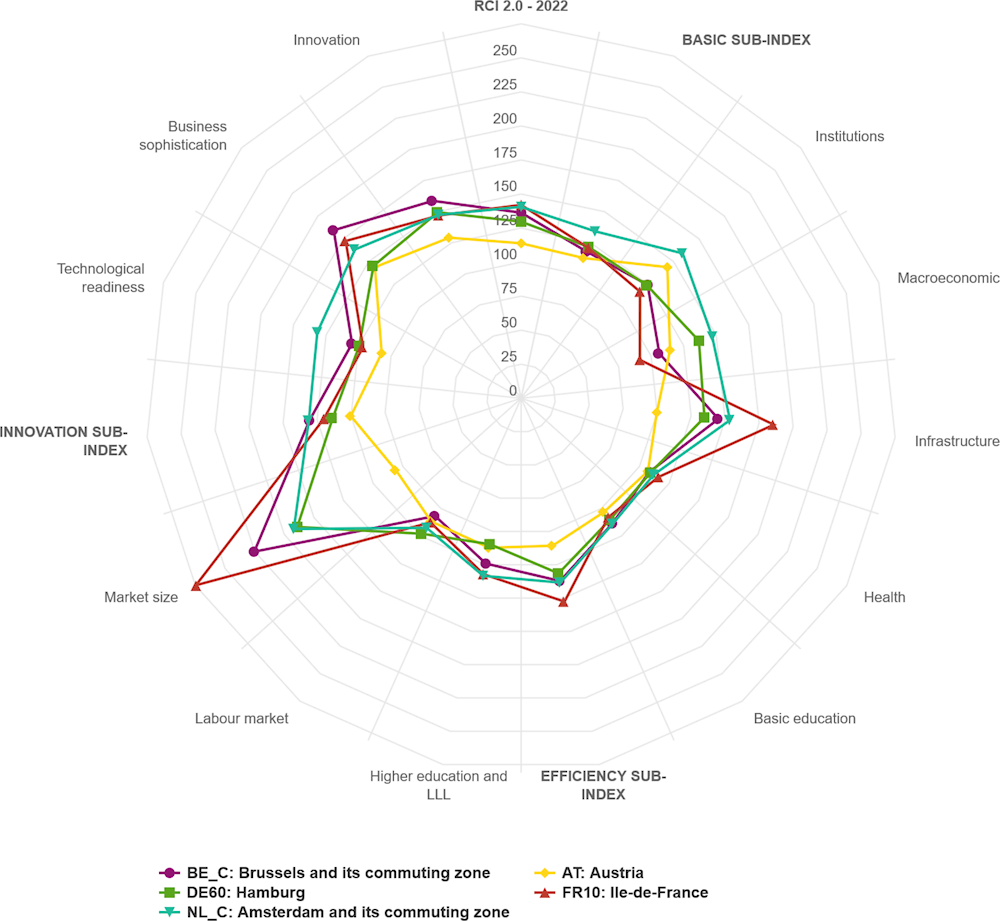

Compared with other European regions, the Brussels-Capital Region (and its “commuting zone” which encompasses the 2 neighbouring provinces of Flemish Brabant and Walloon Brabant (EC, 2022[22])) is relatively more competitive, ranking 8th out of 234 regions in the EU Regional Competitiveness Index 2.0, which measures the major factors of competitiveness across a set of indicators of all of the TL2 regions of the European Union (EC, 2022[22]). The Brussels-Capital Region and its commuting zone are particularly competitive in terms of market size (i.e. disposable income per capita, potential market size in GDP and potential market size in terms of population) and business sophistication (which measures the importance of financial and insurance, real estate, professional, scientific and technical activities and administrative and support services of the regions in terms of employment and growth of value added). These factors can help attract or help firms develop and benefit from economies of scale, potentially incentivising entrepreneurship and innovation (Dijkstra et al., 2023[23]). However, the Brussels-Capital Region and its commuting zone underperform its peers in labour market efficiency, which measures, among other things, the region’s employment rate, its long-term unemployment rate, the NEET (not in education, employment or training) rate of young people, etc. (see next section) (Figure 1.14).

Figure 1.14. EU Regional Competitiveness Index in Brussels and its commuting zone and other European regions, 2022

EU Regional Competitiveness Index 2.0, 2022 edition

Source: EC (2022[24]), Brussels and Its Commuting Zone, https://ec.europa.eu/regional_policy/assets/regional-competitiveness/index.html#/BE/BE_C.

An improving employment situation but with some remaining challenges

The Brussels-Capital Region is a major employment hub in Belgium. In 2022, the region accounted for almost 835 000 jobs across its territory, i.e. about 15% of the country’s total number of jobs. The Brussels FUA comprises almost 1.5 million jobs, i.e. more than a quarter of Belgium’s total number of jobs (OECD, n.d.[20]). The Brussels-Capital Region labour market is very attractive to jobseekers, with a large share of jobs held by workers who reside outside of Brussels. In 2022, almost half of the approximately 835 000 jobs in the region were held by commuters (49.5%). About two-thirds of these commuters came from the Flemish Region and one-third from the Walloon Region.

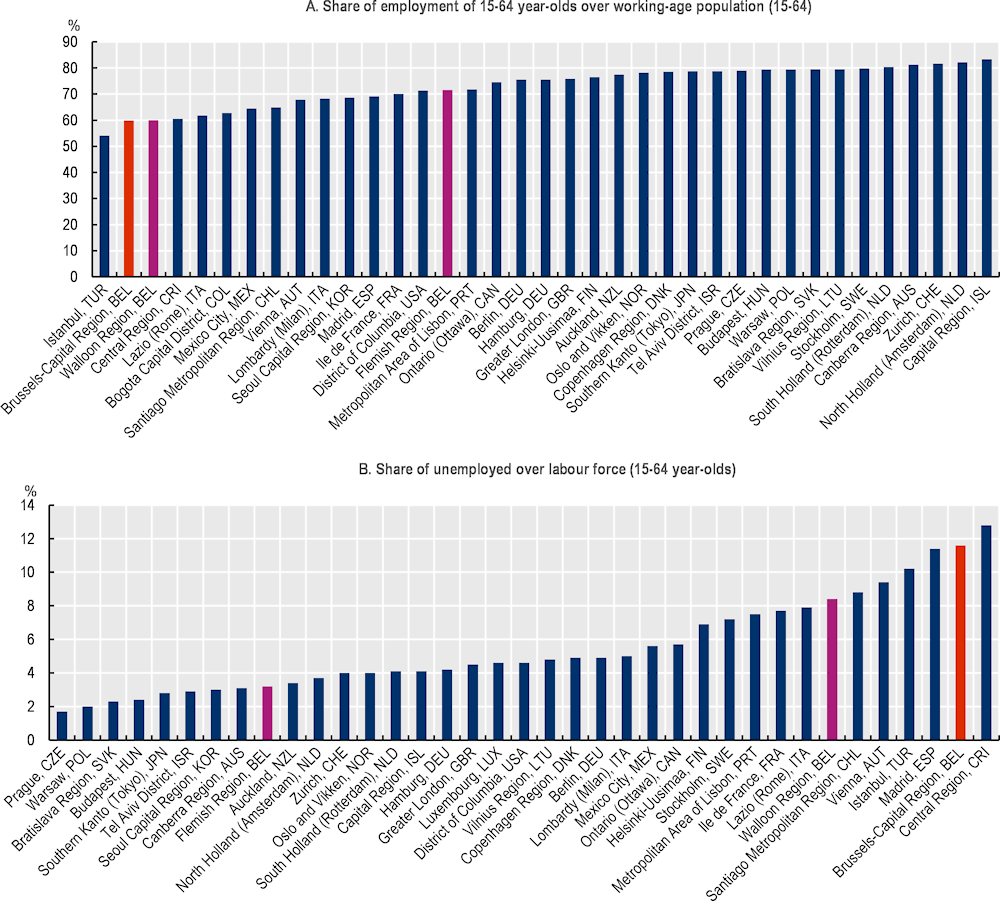

Compared with other metropolitan regions, the Brussels-Capital Region has a relatively low employment rate and a high unemployment rate. In 2022, the employment rate (i.e. the ratio of the employed to the working-age population) in the region was 59.9%, one of the lowest rates among all of the OECD TL2 regions. For example, the employment rate is 67.8% in Vienna (Austria), 75.5% in Hamburg (Germany) and 79.8% in Stockholm (Sweden). At the FUA level, employment shows a similar picture. In the Brussels/Brussel/Leuven FUA, the employment rate was 58.5% in 2016 (latest data available). In the region, the unemployment rate was 11.6%, much higher than in the other 2 regions of Belgium (3.2% in the Flemish Region and 8.4% in the Walloon Region) or in most other TL2 regions of the OECD. In Hamburg, the unemployment rate stood at 4.2%, while the unemployment rate in Vienna was 9.4% (Figure 1.15). According to the OECD Regional well-being database, the Brussels-Capital Region lies in the bottom 20% of all OECD TL2 regions for the composite indicator for jobs (employment percentage rate of 15-64 year‑olds and unemployment percentage rate of 15-64 year-olds) (OECD, n.d.[25]). Economic inactivity in the region is also relatively high, with one-third of people of working age out of the active population.

The labour market performance has improved over the past two decades, especially since 2013, as the employment rate increased from 52.6% and the unemployment rate has been steadily decreasing from a high level of 19.3% in 2013. Unemployment did not increase significantly in 2020 and 2021 despite the impact of the COVID-19 pandemic, primarily thanks to the implementation of support measures for Brussels businesses (e.g. national measures to support temporary lay-offs until the end of June 2021 and a moratorium on bankruptcies until 31 January 2021) (EC, n.d.[19]). Some population groups are, however, still particularly excluded from the labour market. For example, youth unemployment stood at 31.5% in 2022, a much higher rate than in most other OECD TL2 regions (17.0% in Vienna, 18.5% in Greater London or 8.9% in Berlin) (OECD, n.d.[5]). People with low levels of education and non-EU-27 migrants (especially women) also grapple with several barriers to employment due to language requirements or hiring discrimination (OECD, 2023[26]).

At the same time, the Brussels-Capital Region faces a paradox of high unemployment combined with high job vacancies and recruitment challenges. There were about 18 500 vacant jobs compared with around 88 800 jobseekers in 2021 (IBSA/BISA, 2023[16]) at the end of the third quarter of 2021, the highest level since 2012 and corresponding to about 3.7% of all jobs in the region, up from 3.2% in 2020 and 3.1% in 2019 (View.Brussels, 2022[27]).

A major reason for these pressures on the region’s labour market is the mismatch between the supply and demand of skills. On the one hand, there is a large share of high-skilled jobs, with almost two-thirds (62.3%) of jobs in 2020 held by highly qualified workers (i.e. university or other higher education level), compared with about half of jobs in Belgium as a whole (EC, n.d.[19]). But, on the other hand, the average level of skills of the region’s jobseekers is low, as almost half of the jobseekers residing in the Brussels-Capital Region have not completed secondary studies. This average low level of skills poses serious challenges, as more than 60% of jobs in the region require basic digital skills and more than 30% require advanced digital skills (OECD, 2023[26]). Furthermore, a large share of the population in the Brussels-Capital Region is foreign-born and does not meet the nationality or language skill requirements for many vacant positions, especially as the region is bilingual and major international institutions hosted in the region often require English language proficiency (View.Brussels, 2022[27]). Tensions on the region’s labour market have been exacerbated since the COVID-19 crisis and recovery, similar to many other OECD countries where labour shortages have emerged since the pandemic, reflecting not only cyclical factors and the steep rebound in economic activity but also changes in preferences, as some workers may no longer accept low-paid jobs or difficult working conditions (Causa et al., 2022[28]).

Figure 1.15. Employment and unemployment in OECD TL2 regions, 2022

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

A well-performing region in innovation

Compared with other European regions, the Brussels-Capital Region performs well in terms of innovation. According to the EU Regional Innovation Scoreboard 2023, the region is an “innovation leader” and has seen its innovation performance improve over time. It outperforms other EU regions across several dimensions, including international scientific co-publications, innovation expenditures per person employed, innovative small and medium-sized enterprises (SMEs) collaborating and public-private co-publications. Furthermore, the Brussels-Capital Region has implemented a Regional Innovation Plan for 2021-27 structured around six main societal challenges (climate and energy; resource optimisation; mobility; healthy and sustainable food; health and well-being; participatory and inclusive society), which aims to strengthen the innovation performance of the region (Innoviris, n.d.[29]). However, it slightly underperforms other regions in research and development (R&D) expenditures in the public and business sectors and in patent applications (EC, 2023[30]).

The region also has a high proportion of workers employed in R&D: with almost 5% of all workers employed in that sector (4.8%), the Brussels-Capital Region performs better than Belgium as a whole (2.8%), the European Union (1.6% on average) and most OECD TL2 regions, although the regions of Vienna (Austria) and Copenhagen (Denmark) have a slightly higher share of workers in R&D (5.2% and 5.5% respectively).

R&D intensity is, however, relatively weak in the Brussels-Capital Region. In 2017, the share of R&D expenditure was 2.0% of the region’s GDP, a lower proportion than in Belgium as a whole (2.7%), the European Union (2.1%) or Hamburg, Germany (2.1%), and much lower than the R&D spending in other metropolitan regions such as Vienna (3.6%) or Copenhagen (4.8%) (OECD, n.d.[5]; Innoviris, 2021[31]) but with a strong increase since 2011, by 50%. Several reasons explain this relatively weak R&D intensity in the region, including the lack of high- and medium-technology manufacturing industries and the low presence of corporate headquarters of industrial companies, which are often located in other Belgian regions or abroad (OECD, 2017[32]).

According to the Digital Economy and Society Index (DESI) 2021 developed by the European Commission (EC, n.d.[33]), the digital performance of the Brussels-Capital Region, measured along a set of indicators (including Internet user skills, information and communication technology [ICT] specialists in employment, fixed broadband coverage, fifth-generation technology standard for cellular networks [5G] coverage, enterprises using artificial intelligence [AI] technology, etc.), is higher than the performance of Belgium as a whole and of the EU average but is still a long way behind that of Denmark, the leading European country in this area (Kalenga-Mpala, 2023[34]). The region performs relatively well in terms of the integration of digital technologies by businesses, with firms, including SMEs, making extensive use of cutting-edge digital technologies, including AI. However, 40% of Brussels-Capital Region residents still lack basic digital skills, leaving them behind in the digital transformation of the economy, while the demand for digital skills is rising quickly in the Brussels-Capital Region and faster than in other Belgian cities and other OECD metropolitan areas (OECD, 2023[26]). Furthermore, there is a shortage of ICT graduates in the region and companies have difficulties filling jobs for this type of specialist. While it also shows strong results in the supply and use of digital public services, the region lags behind in the 5G rollout (Kalenga-Mpala, 2023[34]).

Life in the Brussels-Capital Region

Urban inequalities

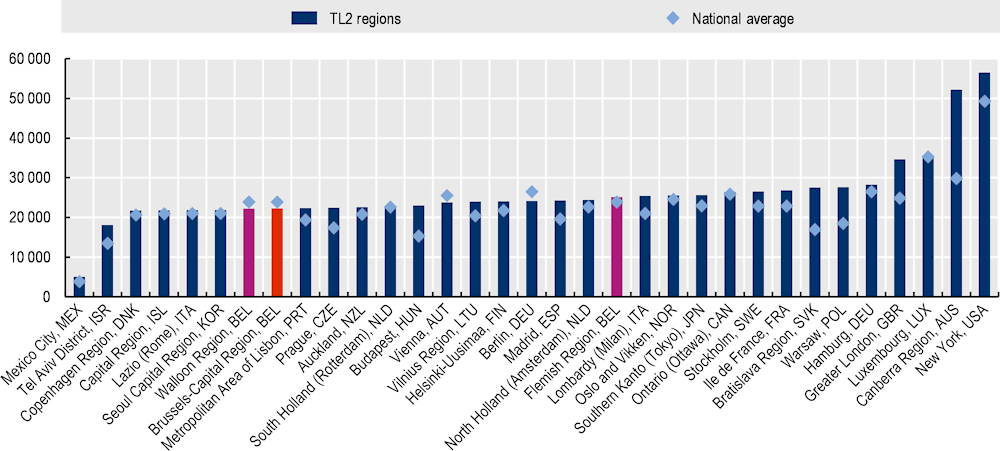

The economic performance of the region somehow contrasts with its social conditions. As seen in the previous section, the Brussels-Capital Region is a major economic engine of the country and has a very high level of GDP per capita (USD 78 036 per capita in 2020), much higher than the other two regions of Belgium and one of the highest of all OECD TL2 regions. This high level of economic wealth produced in the region differs starkly from the relatively low level of income of households living in the region, mainly due to the fact that about half of the workers working in the Brussels-Capital Region and generating regional wealth live outside the region (COCOM/GGC, 2021[35]). At around USD 22 000 on average, the level of disposable income of Brussels-Capital Region households is relatively low compared to other regions in the OECD (taking the same sample of regions as for GDP per capita). For example, the average disposable income of households in Île-de-France, France, was around USD 26 800 in 2020 and USD 34 600 in Greater London, United Kingdom. Furthermore, the income situation has deteriorated over the past two decades. In 2001, per capita disposable income in the Brussels-Capital Region stood at 100.6% of the average Belgian’s disposable income. In 2020, it was only 93.2% (Figure 1.16). The seven municipalities with the lowest median taxable incomes of Belgium are Brussels-Capital Region municipalities: Saint-Josse-ten-Noode, Saint-Gilles, Molenbeek-Saint-Jean, Anderlecht, Brussels, Schaarbeek and Koekelberg, by ascending order of median taxable incomes (COCOM/GGC, 2021[35]).

Figure 1.16. Disposable household income OECD TL2 regions compared to national averages

USD per head, constant prices, constant PPP, 2020 or latest year available

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

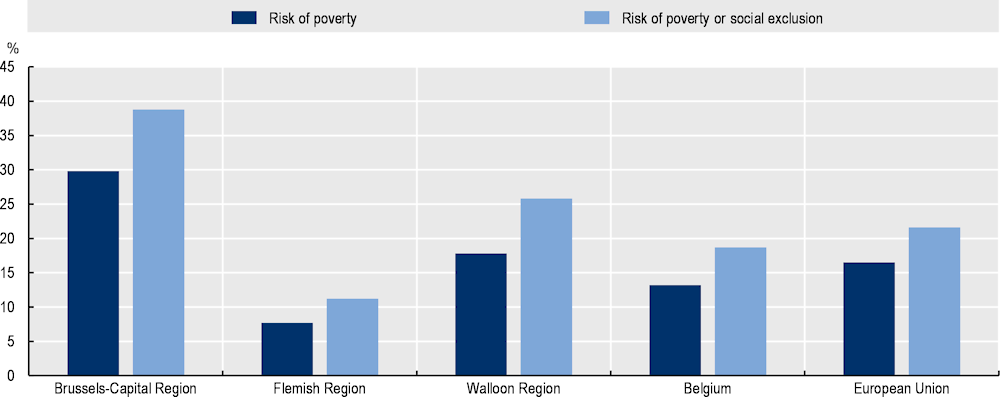

Poverty levels remain high in the Brussels-Capital Region and higher than in the country’s other two regions. The share of population below the at-risk-of-poverty threshold (i.e. 60% of the national median equivalised disposable income after social transfers) is much higher in the Brussels-Capital Region than in the other two regions of Belgium and in the European Union on average. The share of the Brussels-Capital Region population at risk of poverty was 29.8% in 2022, while it was 17.8% in the Walloon Region, 7.7% in the Flemish Region and 16.5% in the European Union (Statbel, n.d.[36]; Eurostat, n.d.[37]). Looking beyond monetary poverty, the rate of risk of poverty or social exclusion as defined by the European Union shows the same picture. The rate of risk of poverty or social exclusion is the share of people meeting at least one of the following conditions: i) at risk of poverty; ii) facing severe material and social deprivation; or iii) living in a household with very low work intensity, i.e. where working-age adults worked no more than 20% of their total potential during the previous 12 months (Eurostat, n.d.[37]). In 2022, the share of the population in the Brussels-Capital Region at risk of poverty or social exclusion reached 38.8%, compared to 18.5% for Belgium (Figure 1.17) as a whole and to 21.6% in the European Union (Eurostat, n.d.[37]).

Disadvantaged people are also paradoxically affected by a lack of access to social benefits, either because they are unaware of their eligibility or because they cannot access them due to administrative complexity, waiting times, etc. (Brussels-Capital Health and Social Observatory, 2016[38]). The COVID-19 crisis and related emergency measures that have restricted many economic activities have also had a significant impact on people’s incomes, hitting those who fall outside the social safety net the hardest (COCOM/GGC, 2021[35]).

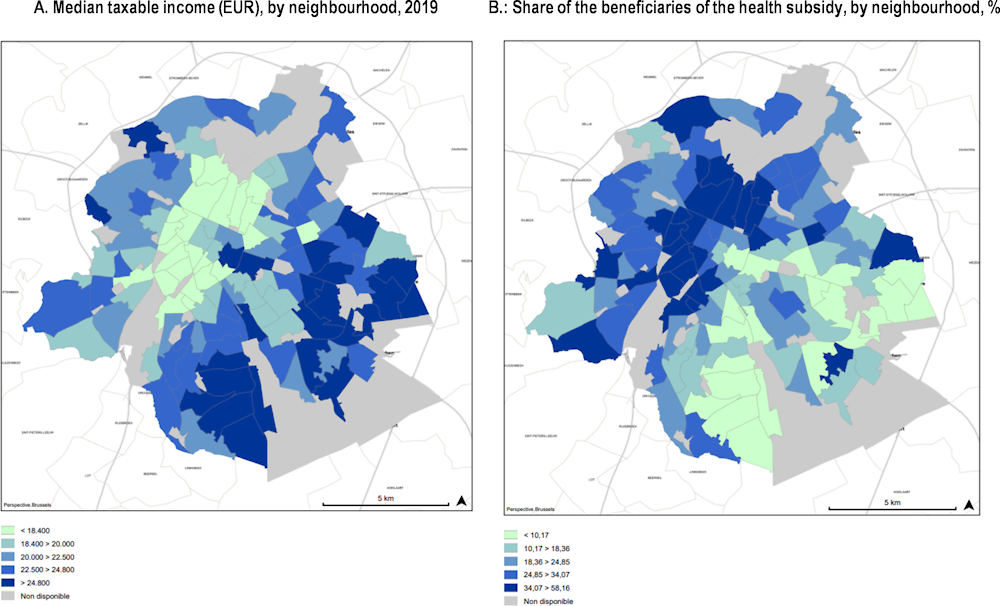

There are also large income inequalities within the Brussels-Capital Region, between the municipalities and between the neighbourhoods. Median taxable incomes vary significantly between the municipalities, from around EUR 16 200 in Saint-Josse-ten-Noode/Sint-Joost-ten-Node to around EUR 26 800 in Woluwe-Saint-Pierre/Sint-Pieters-Woluwe. Neighbourhoods in the south and east are home to the wealthiest households of the region, while neighbourhoods near the canal and its industrial zone (neighbourhoods of the so-called croissant pauvre/arme sikkel) concentrate the most precarious inhabitants (Figure 1.18, Panel A). The map of the median taxable incomes by neighbourhood mirrors the map of the share of inhabitants who benefit from a health subsidy that allows households who receive social allowances and low-income households to obtain better reimbursements for their medical appointments, cheaper medication and preferential rates for other services such as utilities and public transport (Figure 1.18, Panel B) (INAMI, n.d.[39]). Statistical offices use data on this subsidy to estimate the share of the population with low incomes at a more granular level than the regional level.

Figure 1.17. Risk of poverty and risk of poverty or social exclusion in Brussels-Capital Region, Belgium and the European Union, 2022

Source: Statbel (n.d.[36]) Poverty and Living Conditions, https://statbel.fgov.be/en/themes/households/poverty-and-living-conditions; Eurostat (n.d.[37]), Living Conditions Statistics at Regional Level, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Living_conditions_statistics_at_regional_level#People_at_risk_of_poverty_or_social_exclusion.

Figure 1.18. Geography of social disparities in the Brussels-Capital Region

Source: IBSA/BISA (n.d.[40]), Le Monitoring des Quartiers de la Région de Bruxelles-Capitale, https://monitoringdesquartiers.brussels/.

A lack of affordable and quality housing

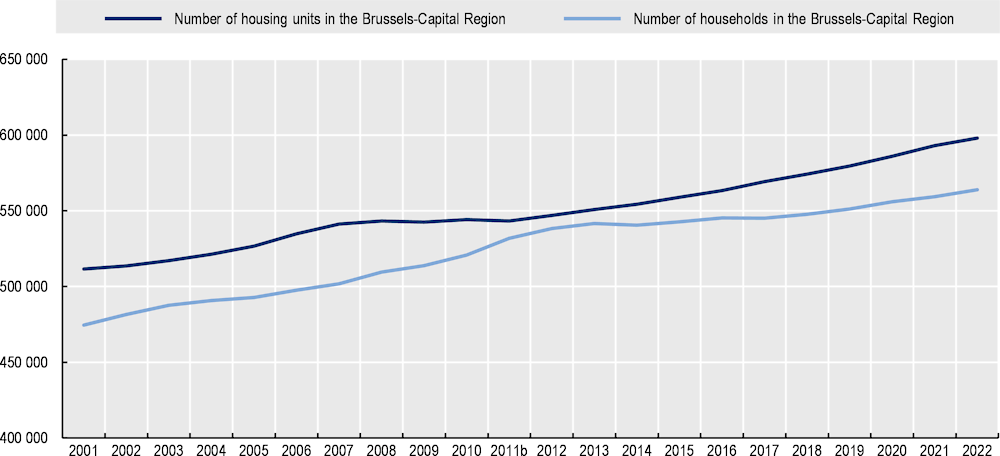

Housing supply has increased steadily in the past two decades and there are currently more housing units available in the region than households. In January 2022, there were around 598 000 housing units in the Brussels-Capital Region, while the number of households was 564 000, although this number does not include certain groups of the population, such as those residing in Belgium without legal status or students whose primary residence is outside the region (Figure 1.19). A small part of this housing stock is, however, unoccupied. It is estimated that between 17 000 and 26 400 housing units are currently vacant, i.e. between 3.0% and 4.5% of the total housing stock. Compared to vacancy rates in OECD countries, the vacancy rate in the Brussels-Capital Region is relatively low, but these numbers could be underestimated (Bruxelles Logement, 2021[41]; Ben Hamou, 2020[10]). On average, in 2020, vacant dwellings in OECD countries for which data are available represented 9.7% of total housing stock (OECD, n.d.[42]). In the city of Paris, France, for example, there are around 114 000 vacant housing units out of around 1.1 million housing units (i.e. about 10% of vacant housing) (French Ministry of Ecological Transition, 2022[43]).

Figure 1.19. Number of housing units and households in the Brussels-Capital Region, 2001-22

Note: Series break in 2011 for the number of households.

Source: IBSA/BISA (n.d.[44]), Aménagement du territoire et immobilier: Parc de bâtiments résidentiels et non résidentiels, https://ibsa.brussels/themes/amenagement-du-territoire-et-immobilier/parc-de-batiments-residentiels-et-non-residentiels; IBSA/BISA (n.d.[45]), Population: Ménages, https://ibsa.brussels/themes/population/menages.

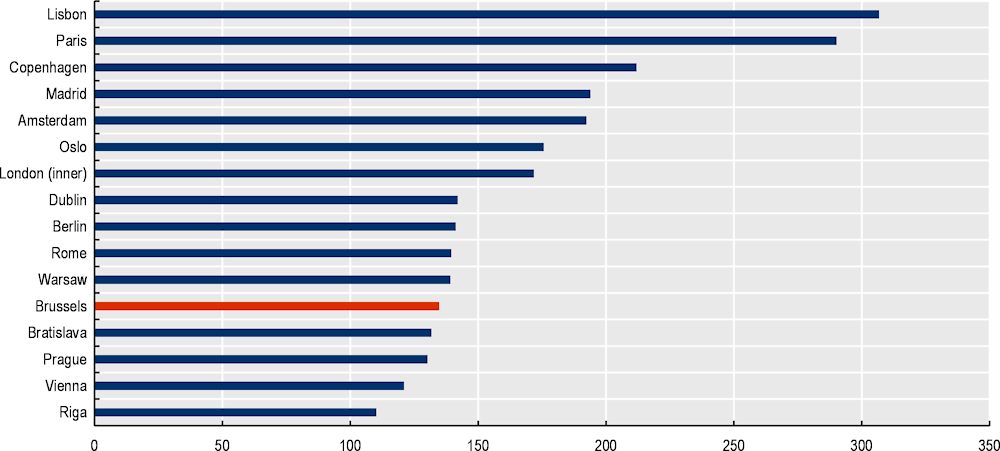

There is a lack of affordable housing in the Brussels-Capital Region. Housing in Brussels is more expensive than the average in Belgium (by 34.7%) but the premium for living in the capital city is lower than in many other European capitals such as Lisbon (Portugal), Paris (France) or Copenhagen (Denmark), where house prices are respectively 3.6, 2.9 and 2.1 times higher than their country’s average (Deloitte, 2022[46]) (Figure 1.20).

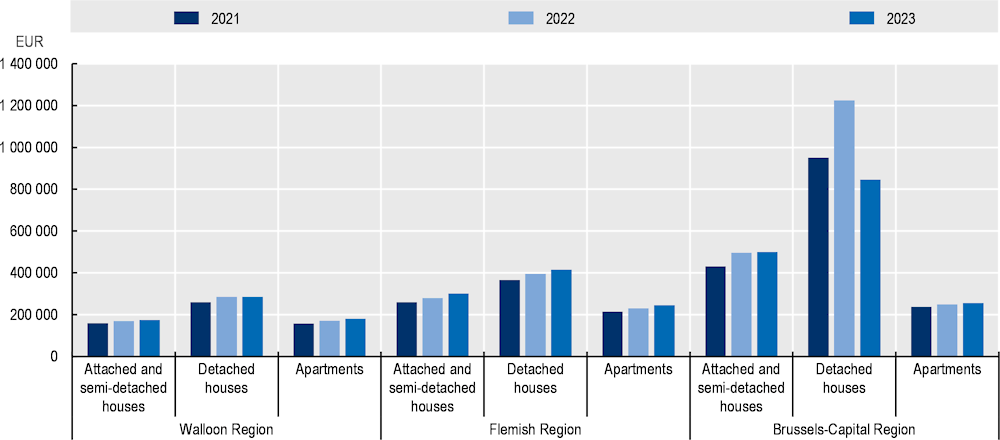

While Brussels is not very expensive compared to other capital cities in Europe, the Brussels-Capital Region is the most expensive region in Belgium for all types of dwellings and the gap between housing purchase prices in the Brussels-Capital Region and the other two regions has widened over the past few years. The median price for detached houses, which account for less than 1% of all housing units of the region, was EUR 845 000 in the first quarter of 2023. This was 3 times more expensive than in the Walloon Region and 2 times more expensive than in the Flemish Region, although there are only very few transactions in this market segment (only 20 transactions in the first quarter of 2023 and 173 for the whole of 2022, three-quarters of them located in 2 municipalities of the region, Uccle/Ukkel and Woluwe-Saint-Pierre/Sint-Pieters-Woluwe). For attached and semi-detached houses (20.1% of all housing units), the median price was EUR 500 000 (2.9 times more expensive than in the Walloon Region and 1.7 times more expensive than in the Flemish Region), while the median price of apartments (78.9% of all housing units in the region) was EUR 255 000, slightly more expensive than in the Flemish Region and 1.4 more expensive than apartments in the Walloon Region (Figure 1.21).

Figure 1.20. House prices in capital cities relative to the country average, 2021

Country average = 100%

Source: Deloitte (2022[46]), “Property Index 2022: Overview of European residential markets”, https://www2.deloitte.com/bg/en/pages/real-estate/articles/Deloitte-Property-Index-2022.html.

Figure 1.21. Median real estate prices in Belgium’s regions, by type of accommodation

Source: Statbel (n.d.[47]), Real Estate, https://statbel.fgov.be/en/themes/housing/real-estate#news.

These high housing prices in the region result from a sharp rise in house prices over the past couple of decades, even in 2020, despite the COVID-19 crisis. Between 1996 and 2020, the median real prices of flats, for example, were multiplied by 2.7 (i.e. increasing by 170%) (Godin, 2021[48]). This is a much faster increase than in the OECD on average, as real house prices rose by almost 50% over the same period, but a slower rise than in some other regions in OECD countries such as Île-de-France (France), where prices more than quadrupled in the same period or North Holland (Netherlands) where prices were multiplied by 3.6 (OECD, n.d.[42]). A much faster price increase in the past two decades in the municipalities of the east side of the canal has led to a widening spatial divide between more affordable municipalities to the west of the canal (Anderlecht, Ganshoren, Jette and Koekelberg being the least expensive) and less affordable ones to the east (Ixelles/Elsene, Uccle/Ukkel, Woluwe-Saint-Lambert/Sint-Lambrechts-Woluwe and Woluwe-Saint-Pierre/Sint-Pieters-Woluwe being the most expensive).

Because of high house prices, people with low or middle incomes cannot access home ownership and most often rely on the rental market. According to estimates, more than 60% of the region’s households are tenants. This is a much higher share than the average for Belgium, as about a third (32.3%) of Belgian households rent their dwelling (either renting at market prices on the private rental market or below market prices, typically social housing). It is also far higher than the average for OECD countries, which is 23.5% of tenants (OECD, n.d.[42]). While growth in house prices has started to slow down since 2022, the cost-of-living crisis, triggered by Russia’s war of aggression against Ukraine, and the associated high interest rate environment have further constrained access to homeownership for many households, particularly low- and middle-income households, in the Brussels-Capital Region as in many OECD countries (OECD, 2023[14]; 2023[49]; IBSA/BISA, 2022[7]).

While rental prices in the Brussels-Capital Region have increased less quickly than house prices, they still rose by around 20% between 2004 and 2018 (De Keersmaecker, 2019[50]), a much faster increase than in the OECD, where real rent prices increased by 3.3% over the same period. Rental prices are often too high for many low- and middle-income households. In 2018, 40% of the poorest households living in the Brussels-Capital Region could afford only 10% of the housing units in the rental market (i.e. the cheapest units). For example, a household earning between EUR 1 500 and EUR 2 000 per month has access to less than 13% of the rental market because rental prices are mostly unaffordable (De Keersmaecker, 2019[50]).

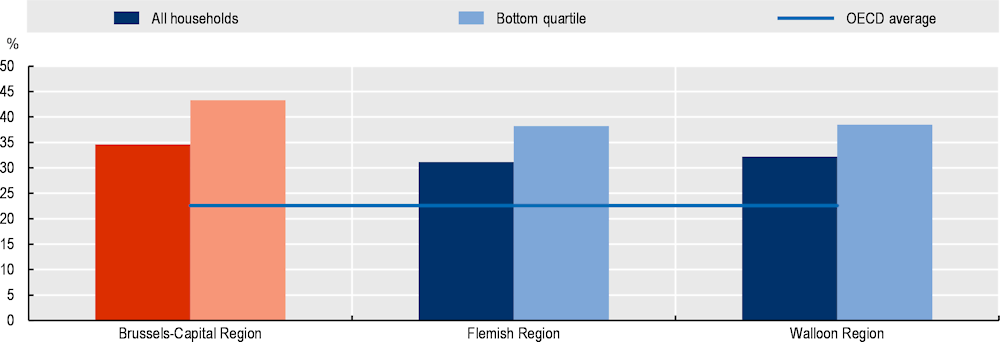

As a result of high house prices and rents, Brussels-Capital Region households devote a large share of their budget to housing-related costs. At more than a third of total spending (34.6%), housing is the single‑largest spending item in household budgets in the region. This holds true across all income groups and even more so for the lowest-income households who spent 43.3% of their budget on housing-related items (including utilities, rent, maintenance and repair) in 2020. This burden is higher than in other regions in Belgium and the OECD, where housing-related expenditure constitutes about 22% of final household consumption expenditure on average (Figure 1.22).

Figure 1.22. Share of housing-related expenditure in total final household consumption, 2019

Source: IBSA/BISA (n.d.[51]), Revenus et dépenses des ménages: Enquête sur le budget des ménages, https://ibsa.brussels/themes/revenus-et-depenses-des-menages/enquete-sur-le-budget-des-menages; OECD (n.d.[42]), OECD Affordable Housing (database), https://www.oecd.org/housing/data/affordable-housing-database/.

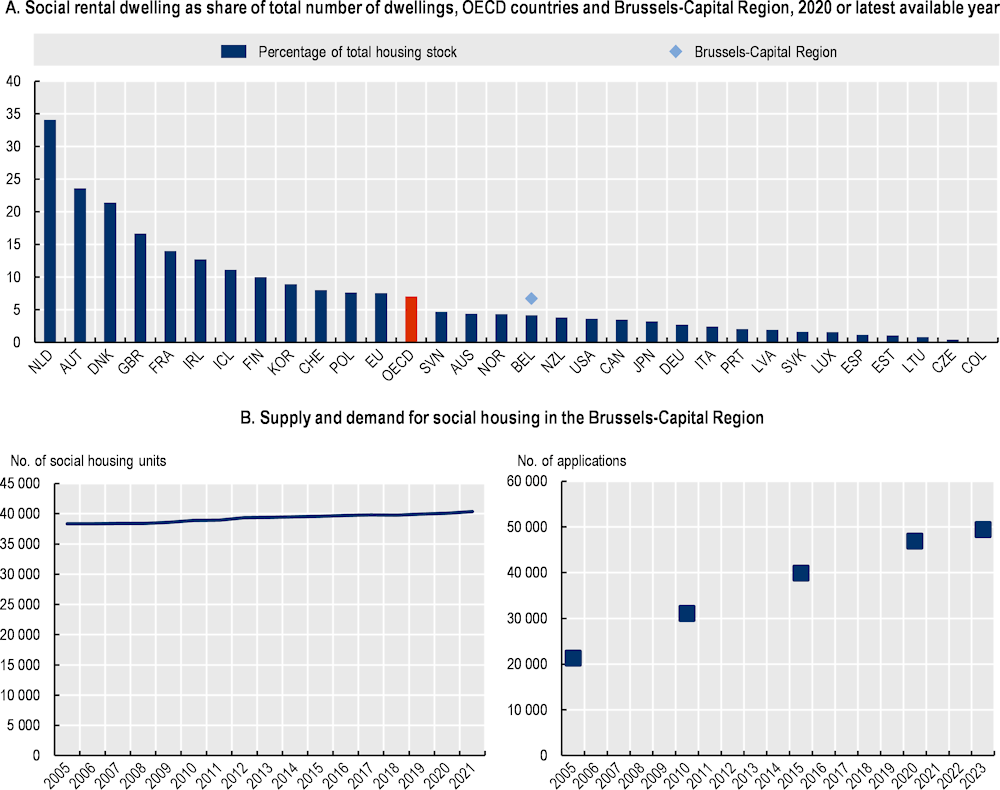

There is also a lack of social housing supply in the Brussels-Capital Region, as the existing stock of social housing in the region is insufficient to match the growing demand for social housing units from low- but also middle-income households. In 2021, the number of social housing units was around 40 000, representing 6.8% of total housing units in the region. This is close to the OECD average of 7% and above the overall share of social housing in Belgium of 4.2% (OECD, n.d.[42]) (Figure 1.23, Panel A). However, social housing supply remains well below demand, which has been rising constantly in the past decades. First, about 10% of the social housing stock is actually vacant, often because their quality is too poor. Other reasons for vacant social housing units include that they may be in the process of being renovated (nearly 37 000 social housing units will undergo renovation works in the region in the coming years) or are being let to another household. Furthermore, to match the demand for social housing, the size of the existing social housing stock would need to at least double. The number of social housing units has remained almost stable since 2005, although the number of applications, i.e. the number of households on the waiting list for social housing, has constantly increased, from around 21 000 in 2005 to almost 50 000 in 2023 (i.e. 8.8% of all Brussels-Capital Region households are waiting for a social dwelling), driven by an increasing gap between supply and demand in affordable housing (Figure 1.23, Panel B). The waiting list for social housing is actually an underestimate of what could be the overall demand for social housing, as around 280 000 households are eligible for social housing given their income level, i.e. about half of the region’s total number of households (Ben Hamou, 2020[10]).

Figure 1.23. Supply and demand of social rental housing in the Brussels-Capital Region

Source: Panel A: OECD (n.d.[42]), OECD Affordable Housing (database), https://www.oecd.org/housing/data/affordable-housing-database/; Panel B: IBSA/BISA (n.d.[52]), Aménagement du territoire et immobilier: Parc de logements sociaux, https://ibsa.brussels/themes/amenagement-du-territoire-et-immobilier/parc-de-logements-sociaux.

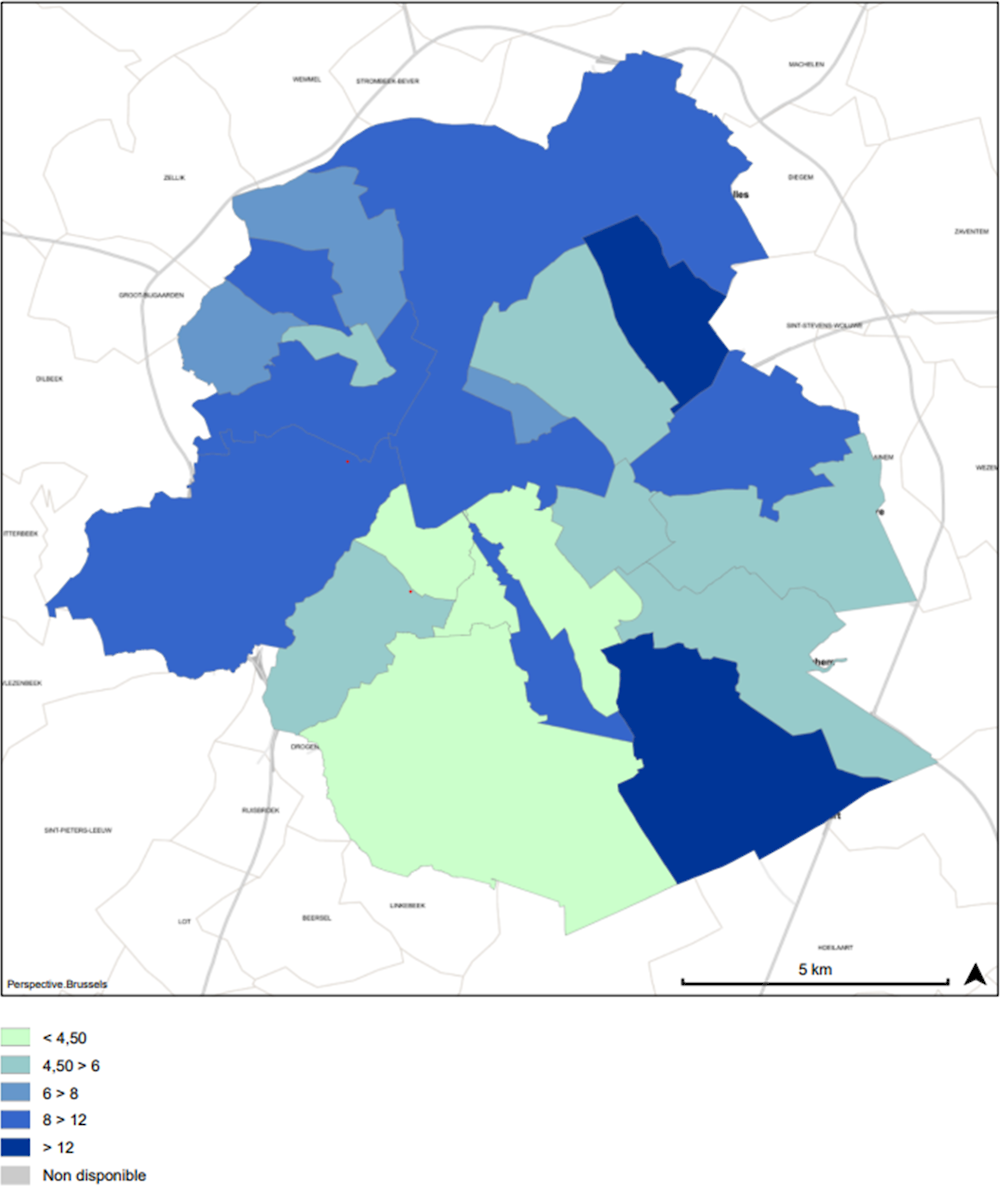

There is a geographical divide in the region in terms of the location of social housing. In general, the municipalities in the west have more social housing per 100 households than the municipalities in the east, except for the municipality of Watermael-Boitsfort/Watermaal-Bosvoorde which has the highest share of social housing per 100 households in the region (18.0 in 2022) (Figure 1.24). The municipalities with the highest share of social housing are also generally the ones with the lowest median taxable income, except again for Watermael-Boitsfort/Watermaal-Bosvoorde, which not only has a high share of social housing per 100 households but also one of the highest levels of median taxable income in the region (IBSA/BISA, n.d.[40]).

Figure 1.24. Number of social housing units per 100 inhabitants, by municipality, in the Brussels-Capital Region, 2022

Source: IBSA/BISA (n.d.[40]), Le Monitoring des Quartiers de la Région de Bruxelles-Capitale, https://monitoringdesquartiers.brussels/.

As for many other cities and urban areas in the OECD, homelessness has become a mounting challenge in the Brussels-Capital Region (OECD, 2023[14]). The number of people experiencing homelessness has also increased sharply in the past years, quadrupling between 2008 and 2022 to reach more than 7 000 people (Bruss'help, 2022[53]). This number includes people living in the streets or public spaces, people in emergency accommodation, people living in accommodation for the homeless, people living in institutions and people living in non-conventional dwellings (e.g. mobile homes, non-conventional buildings, temporary structures) according to ETHOS (European Typology of Homelessness and Housing Exclusion) developed at the European level (FEANTSA, 2018[54]). At about 0.5% of the overall population, homelessness in the Brussels-Capital Region is more prevalent than the averages in most OECD countries (OECD, n.d.[42]). However, comparing homelessness numbers across countries is difficult as definitions vary widely between countries and numerous data gaps persist (OECD, 2020[55]).

Apart from the shortage of affordable housing supply, there is also a lack of supply of adequate and quality housing. In terms of living space available, there were, on average, 1.5 rooms per person in the Brussels‑Capital Region in 2021. This was similar to the space available to inhabitants in Prague (Czechia) or Seoul Capital Region (Korea) but less than in the Flemish Region (2.1) and the Walloon Region (2.3), or other OECD regions such as the region of Madrid, Spain (1.9) or Canberra, Australia (2.6) (Figure 1.25). Furthermore, 29% of Brussels-Capital Region inhabitants live in overcrowded dwellings, considerably more than in the Flemish and Walloon Regions, where 3% of the population live in overcrowded dwellings (COCOM/GGC, 2021[35]). As a benchmark, across the OECD, 16.4% of low-income households live in overcrowded homes (OECD, n.d.[42]). Space is an important dimension of housing quality, as a lack of space can lead to various negative consequences such as decreased well-being, health issues and lower educational outcomes for children (OECD, 2021[56]). The pandemic has renewed concerns around housing quality gaps in the OECD and in the Brussels-Capital Region, and especially around housing space. With people spending more time at home, a lack of sufficient space made it more difficult for them to self-isolate, increasing the risks of contracting and spreading the virus. Furthermore, certain categories of the population, such as the elderly or people with disabilities, have difficulty entering the housing market. In particular, people with disabilities may struggle due to the lack of suitable and adapted accommodation, a greater risk of being discriminated against and the fact that this population group is also more likely to be at risk of poverty (nearly 40% of people receiving a disability allowance live below the poverty line) (Ben Hamou, 2020[10]).

Figure 1.25. Average number of rooms per inhabitant in OECD TL3 regions, 2021 or latest available year

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

The overall quality of housing in the Brussels-Capital Region is relatively low, with more than a quarter (26%) of the population living in an inadequate dwelling (with a leaking roof, damp walls, floors or foundation, or rot in window frames or floor), more than in the Flemish Region and the Walloon Region (12% and 19% respectively) (COCOM/GGC, 2021[35]) and more than the EU average (15%) (Eurostat, n.d.[57]).

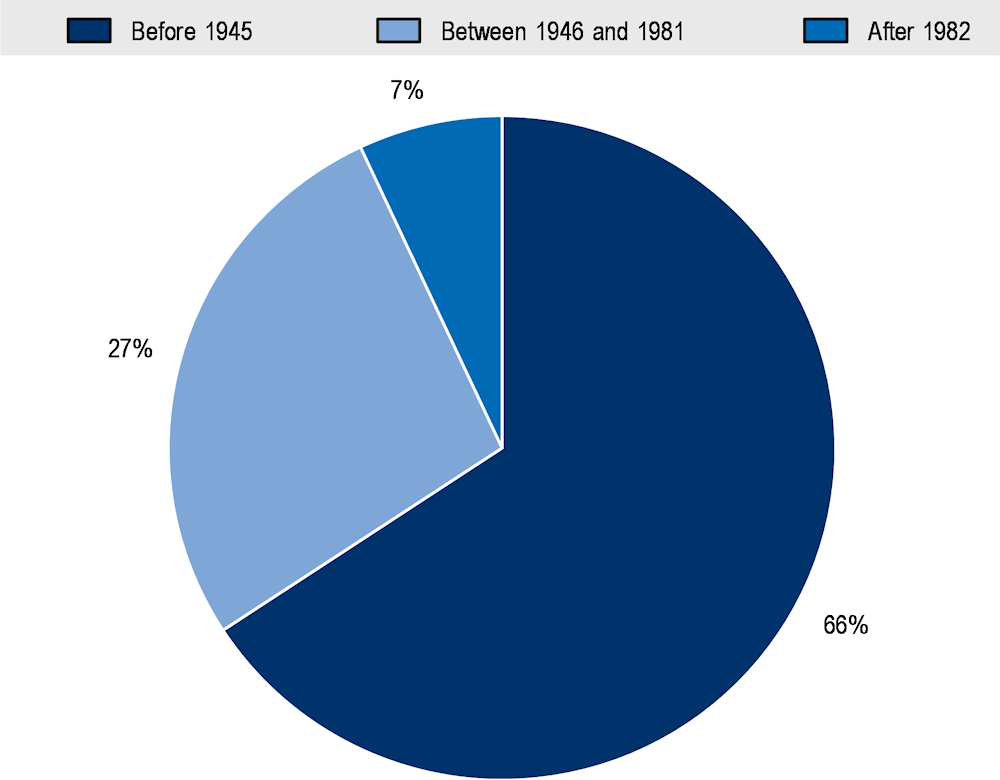

The building stock in the Brussels-Capital Region is also relatively old. About two-thirds of the region’s buildings were built before 1945. This share is considerably higher than in the European Union, where, on average, 22% of the building stock was built before 1945. In the Brussels-Capital Region, only 7% of the buildings were built after 1982 (and just 1% after 2011) (Figure 1.26). This old building stock faces energy efficiency challenges, as buildings constructed before 1945 lose five times more heat than those built after 2010 (EC, n.d.[58]). Poor energy efficiency of housing has far-reaching consequences that go beyond high energy consumption and greenhouse gas emissions. Poor energy efficiency can lead to a range of health issues, such as respiratory diseases and allergies. Simple energy efficiency improvement measures, such as improving insulation, can lead to better health outcomes (IEA, 2019[59]). Decarbonising buildings can yield other co-benefits, such as job creation, as the potential for job creation is estimated to range from 10 to 30 jobs for every USD 1 million spent on energy efficiency measures in buildings (OECD, 2022[60]). In a context of high energy prices, as experienced in 2022 and 2023 in the wake of Russia’s war of aggression against Ukraine, low energy efficiency can also put more households, particularly low-income households, at greater risk of energy poverty. Even before the current cost-of-living crisis, more than a quarter of the Brussels-Capital Region population (26.5%) were already grappling with some form of energy poverty: energy bills too high compared to households’ disposable income, energy consumption below basic needs or difficulties in heating their homes properly (COCOM/GGC, 2021[35]).

Figure 1.26. Buildings in the Brussels-Capital Region by year of construction, as of 2022

Source: IBSA/BISA (n.d.[44]), Aménagement du territoire et immobilier: Parc de bâtiments résidentiels et non résidentiels, https://ibsa.brussels/themes/amenagement-du-territoire-et-immobilier/parc-de-batiments-residentiels-et-non-residentiels.

Mobility and accessibility in the Brussels-Capital Region

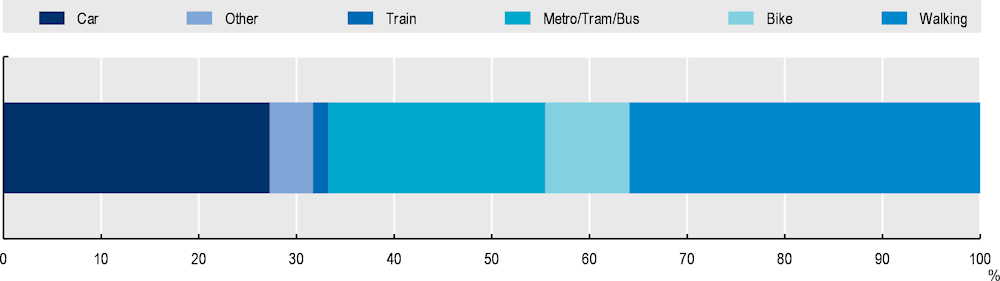

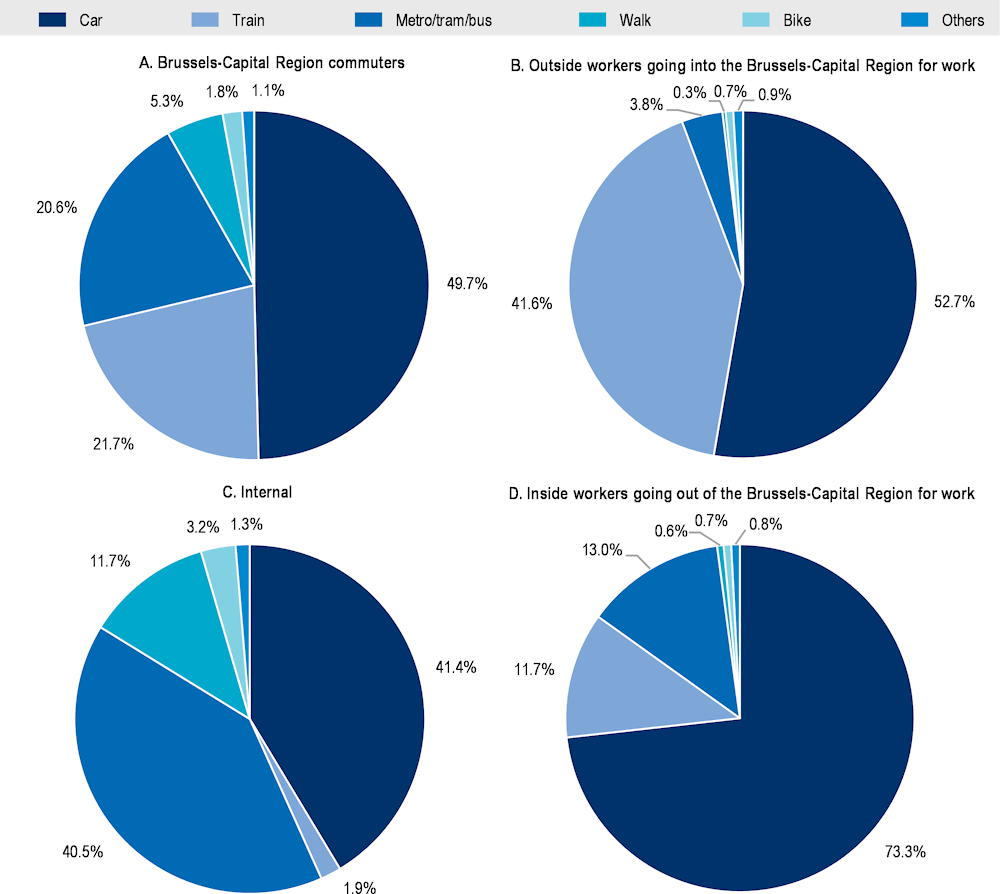

While cars used to be the dominant mode of transport used by Brussels-Capital Region residents until recently (46% of all trips according to a survey conducted in 2019 (Federal Public Mobility and Transport Service, 2019[61])), less than 30% (27.3%) of all trips by Brussels-Capital Region residents were made by car between October 2021 and October 2022. This means that they use an alternative to individual cars for more than two-thirds of their trips. Brussels-Capital Region residents most often rely on walking (36%) or public transport (metro, tram or bus) (22%). Among the remaining trips, almost 9% are completed by bike, 2% by train and 3% by other modes (e.g. moto, scooters) (Figure 1.27) (Brussels Mobility, 2023[62]).

The use of the Brussels-Capital Region intercommunal public transport network (Société des Transports Intercommunaux de Bruxelles/Maatschappij voor het Intercommunaal Vervoer te Brussel, STIB/MIVB) rose steadily between 2012 and 2019, from around 350 million rides to around 440 million. While ridership fell sharply in 2020 due to the COVID-19 crisis, it has been back on an upward trend and reached almost 80% of the pre-pandemic level in 2022 (STIB/MIVB, 2022[63]). The use of bikes also strongly increased between 2009 and 2022, as the number of cyclists registered at the 26 counting points scattered over the region’s territory more than quadrupled over this period. After a relatively contained fall in 2020 (by 16.1%), the number of cyclists is now well above its 2019 level, with a remarkable 43.7% increase in the number of cyclists in 2022 (Brussels Mobility, n.d.[64]).

Figure 1.27. Modal shares of Brussels-Capital Region residents, 2021-22

Source: Brussels Mobility (2023[62]), Enquête sur le comportement de déplacement (2021‑2022), https://data.mobility.brussels/home/media/filer_public/30/65/306537c4-5cec-44b1-8e12-f0cd84f8a11d/ovg_6_rapport_danalyse.pdf.

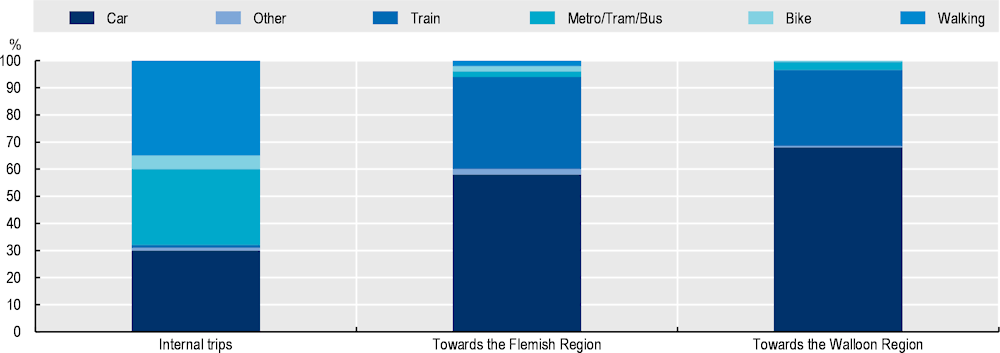

The choice of transport mode depends on various factors, including the distance of the trip, the origin and the destination, and the reason for travelling. For example, while walking is the preferred transport mode for 24% of Brussels-Capital Region residents’ journeys wherever they go, it is the most popular mobility mode chosen for trips within the region, accounting for 35% of total internal trips. In addition, 5% of the internal trips are made by bike, bringing the total active mobility share to 40%. On the other hand, trips from the Brussels-Capital Region to the other regions rely much more on cars. For example, more than two-thirds (68%) of the trips made between the Brussels-Capital Region and the Walloon Region are made by car (Figure 1.28) (Federal Public Mobility and Transport Service, 2019[61]).

Among all trips related to the region, two-thirds are internal trips within the region and the other third coming in and out of the region, partly due to the large number of daily commuters coming in and out of the Brussels-Capital Region. Of the approximately 835 000 jobs in the region in 2022, about half (49.5%) were held by commuters entering the region from outside to go to work (17.5% from the Walloon Region and 32.0% from the Flemish Region), while about 87 500 Brussels-Capital Region residents travel in the other direction (to the Flemish Region, Walloon Region or other countries) (Actiris, 2023[65]). Among all Brussels‑Capital Region commuters (internal, those coming into the region and those going out), almost half (49.7%) use the car to commute to work, 21.7% use the train, 20.6% public transport (metro, tram and bus), 5.3% walk and less than 2% use a bike.

These modal shares also vary according to commuters’ place of residence. In 2014, public transport was the first mode of travel for internal workers (42.4%), thanks to a much more accessible transport network, in terms of time needed to reach a public transport mode from their residence and workplace, both at their origin and destination. The car was the second most popular option, with a share of 41.4%. As for commuters entering the region, they primarily used the car (52.7% of them), followed by the train (41.6%). Commuters leaving the Brussels-Capital Region to work outside the region were the most dependent on their car in 2014, as almost three-quarters (73.3%) drove to go to work (Figure 1.29), mainly due to the lack of alternative transport options. Since 2014 and especially since the COVID-19 crisis, modal shares of internal workers have changed quite significantly, according to a survey of moving behaviours in 2021 (Brussels Mobility, 2023[62]). While public transport remains the first mode of travels for internal workers (41.1%), the use of individual cars has decreased sharply to 24.9% of Brussels-Capital Region internal workers, in favour of walking and cycling, which are the preferred mode of transport of respectively 12.0% and 17.5% of the region’s internal workers. Data for external workers are not available yet but, according to preliminary findings, modal shares have not changed much since 2014.

Figure 1.28. Modal share of trips from the Brussels-Capital Region, depending on the destination, 2019

Source: Federal Public Mobility and Transport Service (2019[61]), Enquête Monitor sur la Mobilité des Belges, https://mobilit.belgium.be/sites/default/files/documents/publications/2022/ENQU%C3%8ATE%20MONITOR.pdf.

Figure 1.29. Modal shares of Brussels-Capital Region commuters, 2014

Source: Brussels Mobility (2019[66]), Analyse des déplacements domicile-travail et domicile-école en lien avec la Région de Bruxelles-Capitale, Cahiers de l'Observatoire de la mobilité de la Région de Bruxelles-Capitale.

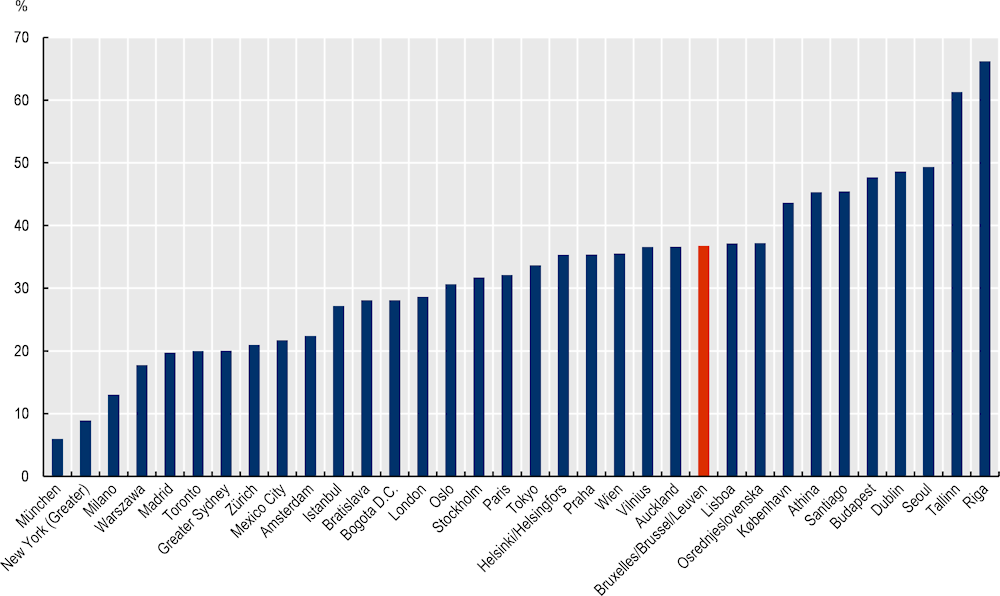

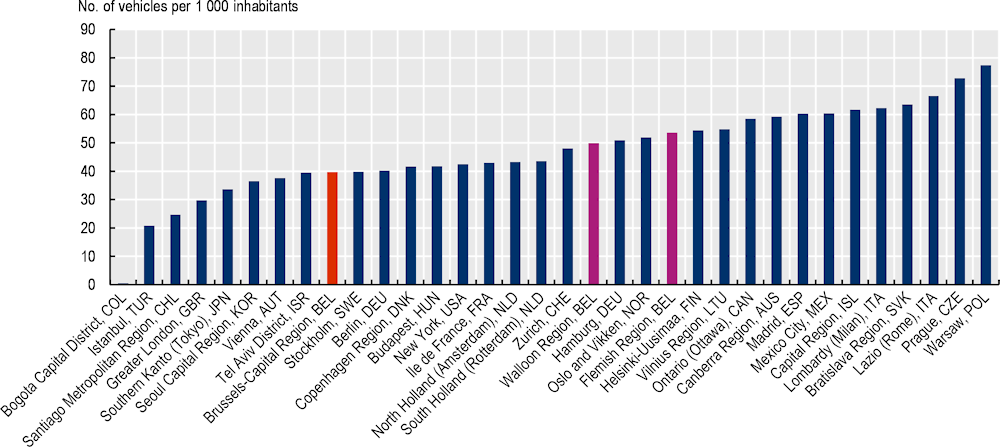

While car ownership in the region is much lower than the Belgian average, the car still remains centre stage in the mobility patterns of the Brussels-Capital Region. Less than half (47.7%) of Brussels-Capital Region households own a car, a much lower number than the national Belgian average of 73.2% (Ermans and Henry, 2022[67]). Compared with other OECD TL2 regions, car ownership in the Brussels-Capital Region is also relatively low (Figure 1.30). There is a geography of car ownership in the region and its outskirts, with households living in the central neighbourhoods much less equipped than those living in areas near the region’s periphery. Furthermore, the majority of households who own a car in the Brussels‑Capital Region only have 1 (8 out of 10), whereas in the close periphery (i.e. municipalities located within 2 km from the region’s boundaries), nearly 8 out of 10 households own a car and many of them have several (4 out of 10 car owners have at least 2 cars) (Ermans and Henry, 2022[67]). Data also show that, in the Brussels-Capital Region, the more accessible the public transport, the lower the owners’ share (Ermans and Henry, 2022[67]).

Figure 1.30. Private vehicle rate, OECD TL2 regions, 2022 or latest available year

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

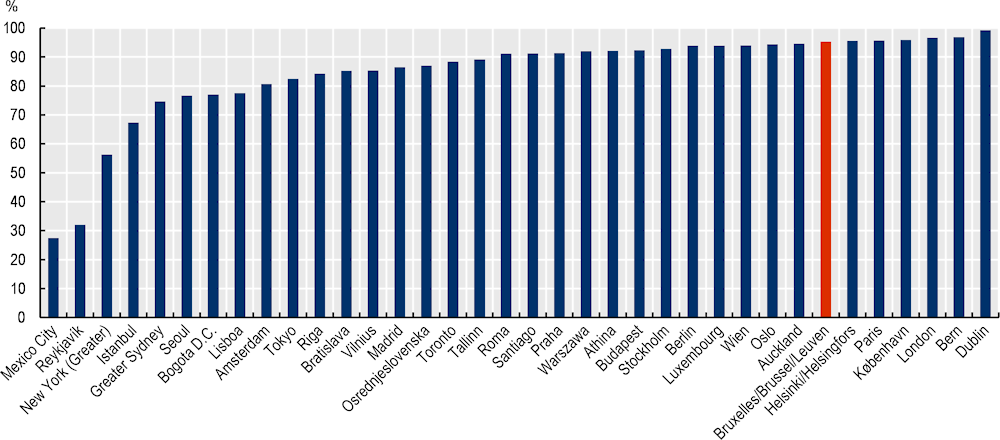

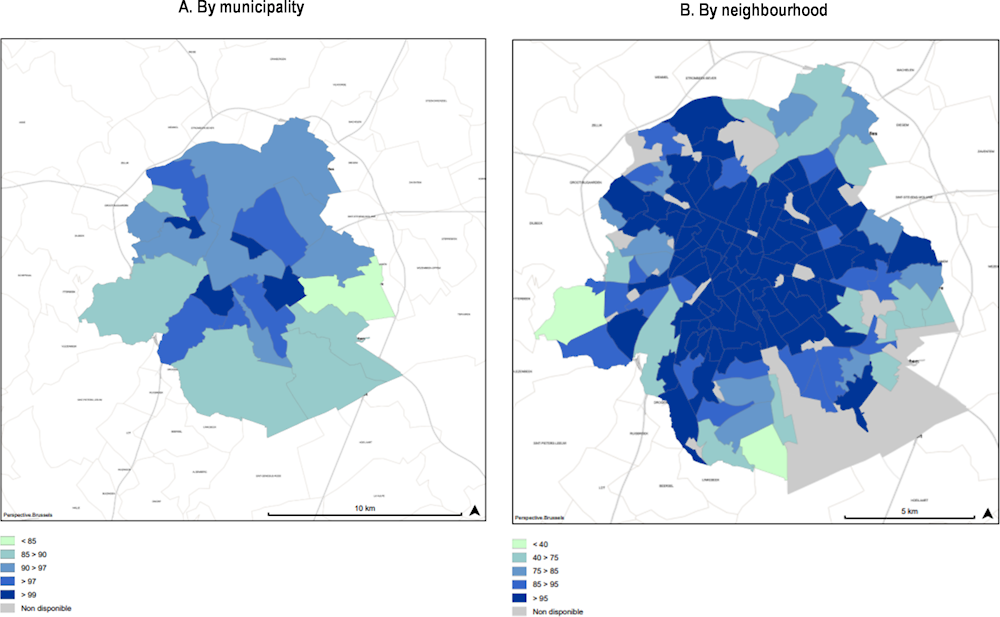

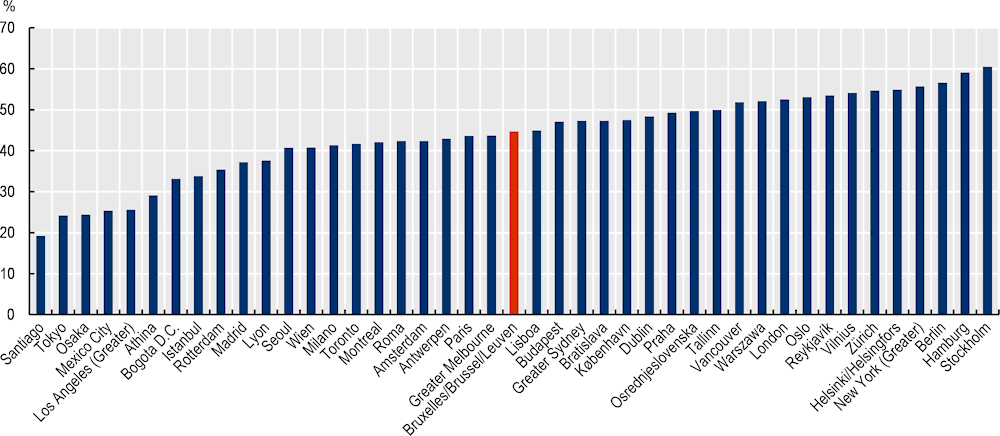

According to comparable data across the OECD at the FUA scale, the share of population with access to a public transport stop within a 10-minute walk in the Brussels FUA is among the highest in the OECD at 95.3% (Figure 1.31). However, more granular data at the municipality level show that some of the municipalities in the second ring, i.e. the municipalities that are the furthest from the centre of the region,2 have a lower level of accessibility, especially in the east and south of the region, while the neighbourhood scale shows that, in some neighbourhoods further from the centre, less than 40% of the population have easy access to a public transport stop, for example in the municipalities of Anderlecht and Auderghem (Figure 1.32).

The fact that about a third of the trips related to the region are still made by car has many negative consequences, including congestion, occupied space, air and noise pollution, also leading to lower well‑being. Despite a slight decrease in the number of vehicles in the capital, congestion has intensified over the past years. In 2019, on average, in the Brussels-Capital Region, the congestion rate, i.e. the extra time required to make a road trip compared with making the same trip but without congestion, was 39%. This was higher than in other European cities such as Barcelona (Spain), Copenhagen (Denmark) or Munich (Germany), where the congestion rates were 29%, 22% and 30% respectively (Brussels Mobility, 2021[68]). The City of Brussels is one of the most congested cities in the world. According to data and analytics provider INRIX, Brussels ranks 17th among almost 1 000 cities, with 98 hours lost in traffic on average in 2022, faring better than London, United Kingdom, where people lose on average 156 hours in traffic, but worse than Mexico City, Mexico (74 hours) (INRIX, 2022[69]). Data from other technology companies that provide satellite tracking of vehicles or develop navigation applications show a similar picture. For example, TomTom ranks Brussels 14th among the 390 most congested cities worldwide (TomTom, 2022[70]).

Figure 1.31. Share of population with access to a public transport stop within a 10-minute walk in FUAs, 2022

Source: OECD (n.d.[20]), OECD City Statistics (database), https://stats.oecd.org/Index.aspx?datasetcode=FUA_CITY.

The Brussels-Capital Region also has a large stock of public parking spaces available (265 000 on the roads), taking up 10% of the total area of the region’s road network or equivalent to 1 450 km, i.e. the distance between Brussels and Rome. On top of these, there is an additional 295 000 parking spaces inside residential buildings and 210 000 parking spaces related to offices. This high availability of parking spaces near or at places of work strongly incentivises the use of cars (Brussels Mobility, 2017[71]).

Furthermore, according to recent data from Brussels Environment, the road transport sector was responsible for 23% of greenhouse gas emissions in the region in 2021, making it the second contributor after residential buildings (which account for 36% of total greenhouse gas emissions). While greenhouse gas emissions from the residential building sector have been decreasing in the past 20 years, emissions from the road transport sector have remained stable. Whereas emissions from the transport sector had decreased in 2020 due to COVID-19 restrictions, they have been back on a rising trend since 2021 and the lifting of restrictions, although they have not rebounded back to their pre-COVID levels (Brussels Mobility, 2019[72]). The impact of structural changes, such as the rise in remote working, is yet to be evaluated in the years to come. Road transport, particularly because of diesel-powered vehicles, also leads to air pollution, contributing, for example, to 53% of emissions of the nitrogen oxides (NOx) in 2021 (Brussels Environment, 2023[73]). Road transport is also the main source of local emissions of PM10 particles, although they have decreased sharply (by 77% between 1990 and 2021) (IBSA/BISA, 2022[7]). In addition, road transport causes noise pollution, which is a nuisance for Brussels residents. According to Brussels Mobility data, 72% of Brussels-Capital Region residents were exposed to a sound level higher than 45 dB at night, which leads to sleep disturbance (Brussels Mobility, 2019[72]). Exposure to noise pollution can have far-reaching negative health consequences, such as an increased risk of heart attacks.

Figure 1.32. Share of the population close to a public transport stop in the Brussels-Capital Region (bus, metro or tram), %, 2018

Note: Being close to a public transport stop means being within a circle of 250 metres (m) around a bus stop, 400 m around a tram stop and 500 m around a metro or tram stop.

Source: IBSA/BISA (n.d.[40]), Le Monitoring des Quartiers de la Région de Bruxelles-Capitale, https://monitoringdesquartiers.brussels/.

Environment

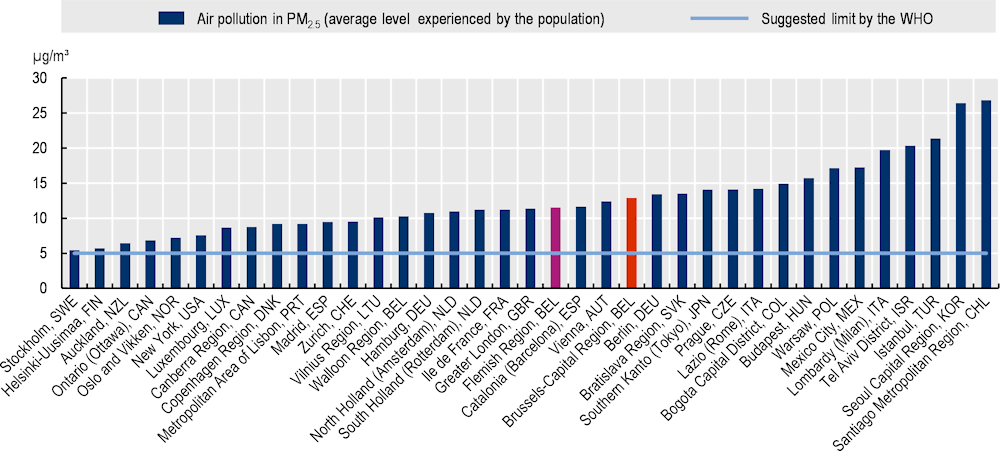

While air pollution has decreased significantly in the Brussels-Capital Region over the past decades thanks to fuel quality improvement, enhanced energy efficiency of buildings and the closing of some nearby polluting factories, air pollution in the region remains high, with levels of exposure to fine particulate matter (PM2.5) well above the limit of 5 micrograms per cubic metre (μ/m3) recommended by the World Health Organization (WHO) (WHO, 2021[74]) (Figure 1.33). This is due to a range of factors, such as the prevalence of thermal vehicles in the city as discussed above, combustion of fossil fuels for residential heating or pollution blown in from the neighbouring regions by wind. Neighbourhoods in the northeast of the region are the most exposed to PM2.5 (with annual exposure between 12 and 14 μ/m3), while neighbourhoods in the south are the least exposed (between 5 and 8 μ/m3).

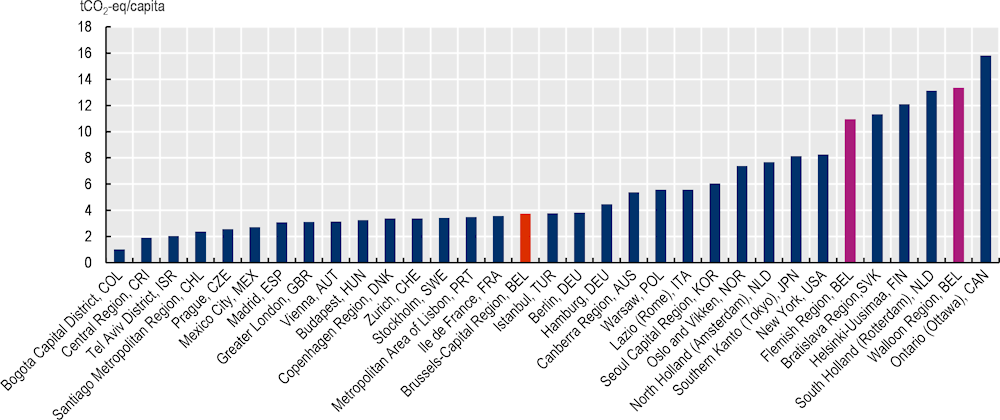

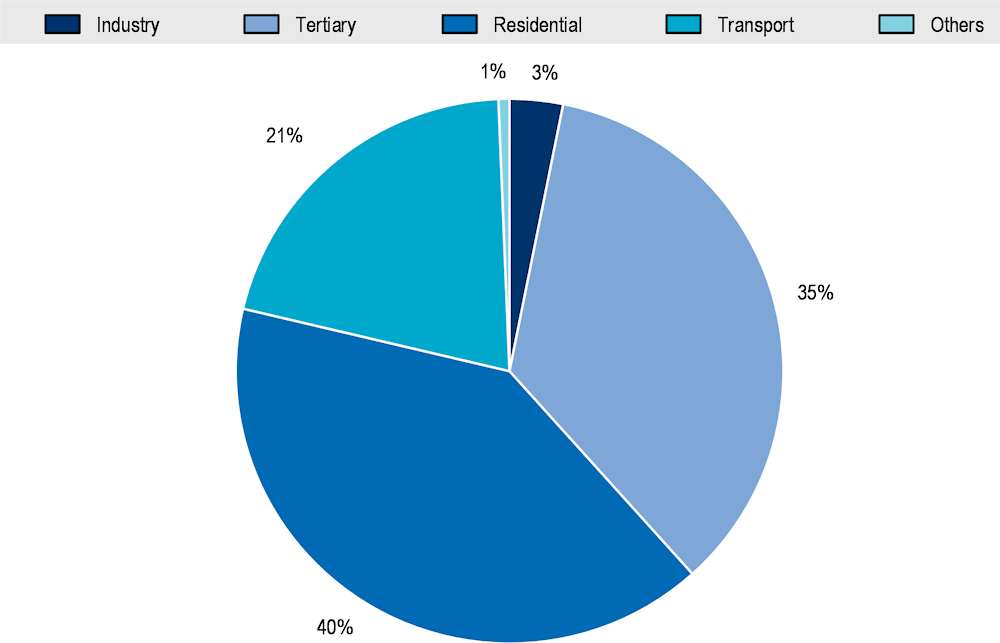

Total greenhouse gas emissions have decreased by 14% since 1990, with a much steeper drop (25%) since 2004 and will reach about 3 500 kilotonnes of carbon dioxide equivalent (kt CO2eq) in 2021. The year 2020 saw a strong annual decrease due to the pandemic and related restrictions, which reduced the use of transport in particular, and also due to particularly mild winter temperatures leading to lower heating needs. However, total greenhouse gas emissions per capita have decreased in the Brussels-Capital Region, by around 32% since 1990, standing below 3 t CO2eq/capita in 2020 and 2021. The last comparison of the OECD metropolitan regions, as illustrated in Figure 1.34, shows that, in 2018, Brussels’ level of emissions per capita was already below many other metropolitan regions such as Hamburg, Germany, or Seoul Capital Region, Korea (OECD, 2022[21]). Buildings (residential and tertiary) are the biggest energy consumers and main emitter of greenhouse gases in the region. The residential sector accounts for 41% of total energy consumption (of which around two-thirds are consumed for heating) (IBSA/BISA, 2022[7]) (Figure 1.35), while heating in residential and tertiary buildings account for 55% of total emissions of the region. Most of the residential sector’s energy consumption comes from natural gas (68%) followed by electricity (19%) (IBSA/BISA). Energy consumption and greenhouse gas emissions from the residential sector and more broadly from the building sector have decreased since 2005 despite the expansion of both the residential and office building stock, in particular due to energy efficiency improvements. To put the region on a more sustainable path, the Brussels-Capital Region has implemented an economic development policy Shifting Economy - Brussels 2022-2030. This comprehensive economic strategy aims to transform the region’s economy by bridging economic development with environmental transition and social justice, focusing on six sectors: food (Good Food plan), resources and waste, construction (Renolution plan), cultural and creative industry, mobility (Good Move plan) and health.

Figure 1.33. Air pollution in the Brussels-Capital Region and other OECD TL2 regions, 2020

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

More than half of the Brussels-Capital Region territory (52%) is covered by vegetation, with about one‑third covered by trees. Furthermore, almost one-fifth of the territory is made of green spaces accessible to people (Franklin, 2023[75]). When using the FUA scale, 44.7% of the core of the Brussels FUA is covered by green areas, a share similar to Paris, France (43.6%) or Lisbon, Portugal (44.9%) but lower than Hamburg, Germany (59.1%) or Stockholm, Sweden (60.5%) (Figure 1.36). These average numbers for the region hide disparities between municipalities and neighbourhoods. The Sonian Forest in the southeast of the region is its main green area. When removing the Sonian Forest from the analysis, the area of green spaces accessible to people decreases from 26 m2/inhabitant to 12 m2/inhabitant, which is still above the minimum level of 9 m² per person recommended by the WHO. Green areas such as parks and natural vegetation contribute to reducing pollution, thereby improving the health and quality of life of residents. Parks can also help keep cities cooler. This is especially important as cities are getting increasingly exposed to extreme heat and the temperature tends to be higher than in the surrounding areas due to the urban heat island effect. This phenomenon results from high building density, heat from human activities, building materials and limited vegetation (OECD, 2022[21]). Promoting equal access to green areas can also foster more inclusive cities, as people in lower-income urban neighbourhoods have less access to green space than people living in higher-income ones (WRI, 2020[76]; EEA, 2022[77]).

Figure 1.34. Total production-based greenhouse gas emissions per capita estimates, 2018, OECD TL2 regions

Source: OECD (n.d.[5]), OECD Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.

Figure 1.35. Energy consumption by sector, Brussels-Capital Region, 2021

Source: IBSA/BISA (n.d.[78]), Environnement et Énergie: Énergie, https://ibsa.brussels/themes/environnement-et-energie/energie.

Figure 1.36. Share of green areas in OECD FUA city centres, 2021

Source: OECD (n.d.[20]), OECD City Statistics (database), https://stats.oecd.org/Index.aspx?datasetcode=FUA_CITY.

References

[65] Actiris (2023), “2022 : année record pour le marché de l’emploi bruxellois”, https://press.actiris.be/2022--annee-record-pour-le-marche-de-lemploi-bruxellois.

[10] Ben Hamou, N. (2020), Plan d’Urgence Logement 2020-2024, https://nawalbenhamou.brussels/wp-content/uploads/2021/01/Plan-Urgence-Logement_DEF.pdf.

[73] Brussels Environment (2023), “Quels sont ces polluants qui affectent la qualité de l’air?”, https://environnement.brussels/citoyen/nos-actions/projets-et-resultats/quels-sont-ces-polluants-qui-affectent-la-qualite-de-lair.

[62] Brussels Mobility (2023), Enquête sur le comportement de déplacement (2021-2022), https://data.mobility.brussels/home/media/filer_public/30/65/306537c4-5cec-44b1-8e12-f0cd84f8a11d/ovg_6_rapport_danalyse.pdf.

[68] Brussels Mobility (2021), “Pourquoi y a-t-il plus d’embouteillages à Bruxelles alors que le trafic diminue ?”, https://mobilite-mobiliteit.brussels/sites/default/files/2021-05/fiche%20congestion-FR-final.pdf.

[72] Brussels Mobility (2019), “À Bruxelles, le secteur des transports impacte-t-il fortement l’environnement ?”, https://mobilite-mobiliteit.brussels/sites/default/files/14796-fichesdiagnogstic_q10_fr_040419-2.pdf.

[66] Brussels Mobility (2019), Analyse des déplacements domicile-travail et domicile-école en lien avec la Région de Bruxelles-Capitale, Cahiers de l’Observatoire de la mobilité de la Région de Bruxelles-Capitale.

[71] Brussels Mobility (2017), “Pourquoi le stationnement est-il difficile à Bruxelles malgré une offre importante d’emplacements de parking ?”, https://mobilite-mobiliteit.brussels/sites/default/files/gm_q7_stationnement_fr_v4.pdf.

[64] Brussels Mobility (n.d.), Observatoire du vélo en Région de Bruxelles-Capitale : comptages manuels, https://public.tableau.com/app/profile/data.mobility/viz/ObservatoireduvloenRgiondeBruxelles-Capitalecomptagesmanuels/Dashb_2010.

[38] Brussels-Capital Health and Social Observatory (2016), Aperçus du non-recours aux droits sociaux et de la sous-protection sociale en Région bruxelloise, https://www.ccc-ggc.brussels/sites/default/files/documents/graphics/rapport-pauvrete/rapport_thema_fr_2016.pdf.

[53] Bruss’help (2022), Dénombrement des personnes sans-chez-soi en Région de Bruxelles-Capitale : Septième édition, https://medecinsdumonde.be/system/files/publications/downloads/Rapport_denombrement_2022_FR_1.pdf.

[41] Bruxelles Logement (2021), Un cadastre régional des logements présumés inoccupés, https://logement.brussels/un-cadastre-regional-des-logements-presumes-inoccupes/.

[11] Bureau Fédéral du Plan (2021), Perspectives démographiques 2020-2070, https://www.plan.be/uploaded/documents/202103310840190.FOR_POP2070_12389_F.pdf.

[28] Causa, O. et al. (2022), “The post-COVID-19 rise in labour shortages”, OECD Economics Department Working Papers, No. 1721, OECD Publishing, Paris, https://doi.org/10.1787/e60c2d1c-en.

[35] COCOM/GGC (2021), Baromètre Socia l: Rapport bruxellois sur l’état de la pauvreté, Commission communautaire commune/Gemeenschappelijke Gemeenschapscommissie, https://www.ccc-ggc.brussels/sites/default/files/documents/graphics/rapport-pauvrete/barometre-welzijnsbarometer/2021_fr_barometre_1.pdf.

[50] De Keersmaecker, L. (2019), Observatoire des Loyers: Enquête 2018, In collaboration with Sonecom, Observatoire régional de l’Habitat, Région de Bruxelles-Capitale, https://www.docu.vlaamserand.be/sites/default/files/2021-06/slrb-obsloyer-enquete2018-fr.pdf.

[46] Deloitte (2022), “Property Index 2022: Overview of European residential markets”, https://www2.deloitte.com/bg/en/pages/real-estate/articles/Deloitte-Property-Index-2022.html.

[23] Dijkstra, L. et al. (2023), “EU Regional Competitiveness Index 2.0 - 2022 edition”, Regional and Urban Policy Working Papers, No. 01/2023, European Commission, https://ec.europa.eu/regional_policy/sources/work/rci_2022/eu-rci2_0-2022_en.pdf.

[2] Dijkstra, L., H. Poelman and P. Veneri (2019), “The EU-OECD definition of a functional urban area”, OECD Regional Development Working Papers, No. 2019/11, OECD Publishing, Paris, https://doi.org/10.1787/d58cb34d-en.

[30] EC (2023), Regional Innovation Scoreboard 2023 Regional Profiles: Belgium, European Commission, https://ec.europa.eu/assets/rtd/ris/2023/ec_rtd_ris-regional-profiles-belgium.pdf.

[24] EC (2022), Brussels and Its Commuting Zone, European Commission, https://ec.europa.eu/regional_policy/assets/regional-competitiveness/index.html#/BE/BE_C.

[22] EC (2022), EU Regional Competitiveness Index 2.0 - 2022 Edition, European Commission, https://ec.europa.eu/regional_policy/assets/regional-competitiveness/index.html#/.

[58] EC (n.d.), EU Buildings Database, European Commission, https://ec.europa.eu/energy/eu-buildings-database_en.

[19] EC (n.d.), Labour Market Information: Belgium, European Commission, https://eures.ec.europa.eu/living-and-working/labour-market-information/labour-market-information-belgium_en.

[33] EC (n.d.), The Digital Economy and Society Index (DESI), European Commission, https://digital-strategy.ec.europa.eu/en/policies/desi.

[77] EEA (2022), “Who benefits from nature in cities? Social inequalities in access to urban green and blue spaces across Europe”, European Environment Agency, https://www.eea.europa.eu/publications/who-benefits-from-nature-in.