This chapter undertakes a diagnosis of innovation and entrepreneurship in Canada by comparing rural and urban areas in terms of characteristics, innovation measures and new entrepreneurship. It identifies strengths and challenges for innovation in rural areas and sets the scene for the report’s policy discussions. It pays special regard to demographic changes in Canadian rural areas.

Enhancing Rural Innovation in Canada

2. Understanding innovation in rural Canada

Abstract

Key messages

Rural areas in Canada are large, vast and varied. One in five people in Canada live in rural areas.* Rural Canada accounts for the quasi-totality of landmass** and approximately 18% of the population, based on population centre estimates of rural areas. With the largest landmass of all OECD countries, Canada’s sparsely populated rural north and rural areas in the south often face different challenges, including providing services to Indigenous peoples in the north.

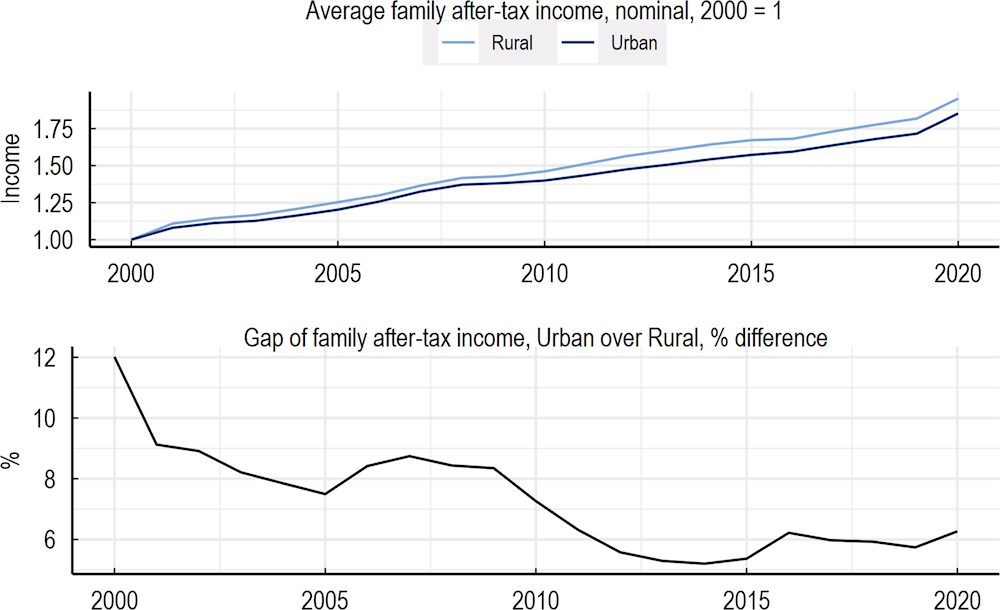

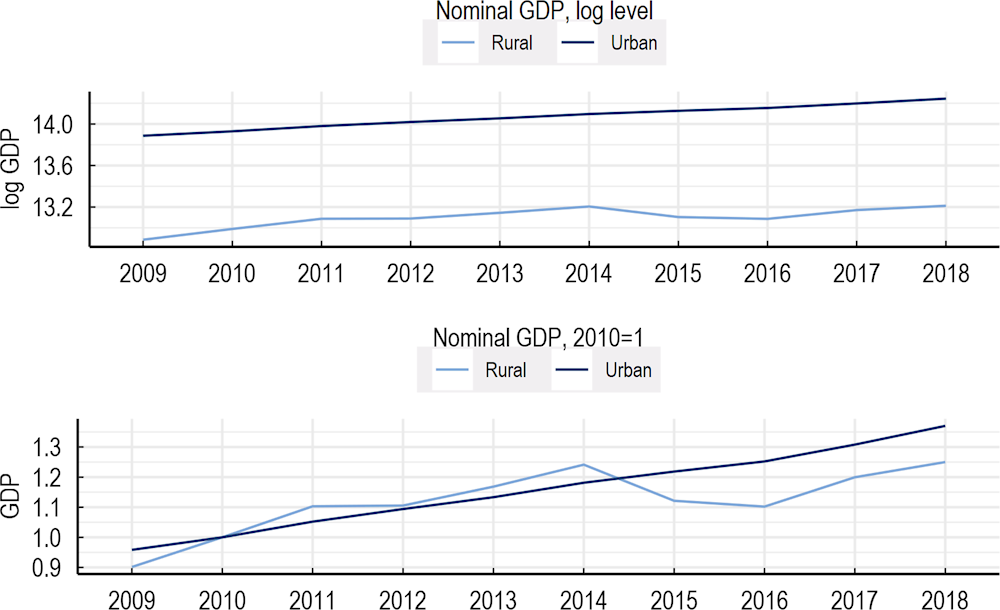

Between 2009 and 2018, Canada’s total gross domestic product (GDP) rose from CAD 1.5 trillion to CAD 2.1 trillion (current prices). Metropolitan regions of Canada represented close to three-quarters of total GDP in both 2018 and 2009 (74% and 73% respectively), meaning that rural regions contained a stable quarter of the economy. Compared to other large OECD countries such as the United States, the contribution of rural Canada is substantial. By comparison, in the United States, non-metropolitan GDP accounted for approximately 10% of total GDP in 2020, while metropolitan GDP accounted for close to 90% of total GDP in the same year. At the same time, levels of income inequality are relatively low in Canada. The income gap between households in rural and urban areas halved, from 12% in 2000 to only 6% in 2020. Income inequality in Canada is close to the average of OECD countries and is much lower than in its closest neighbours, Mexico and the United States.

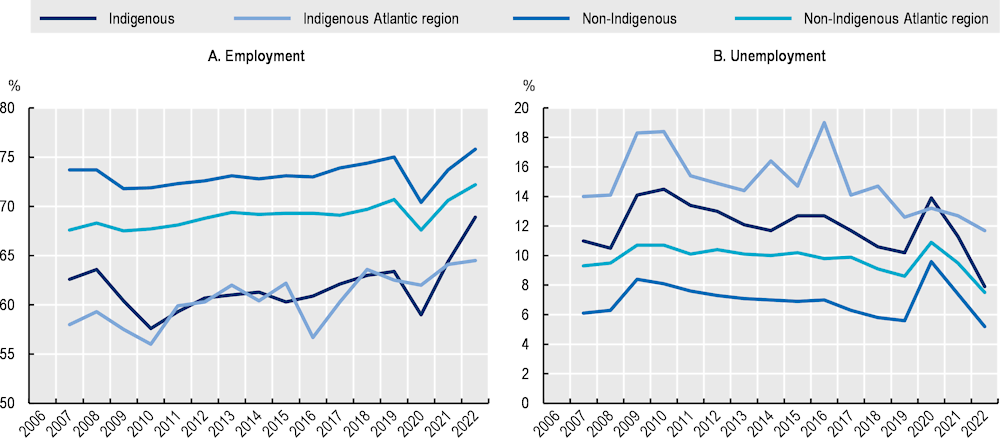

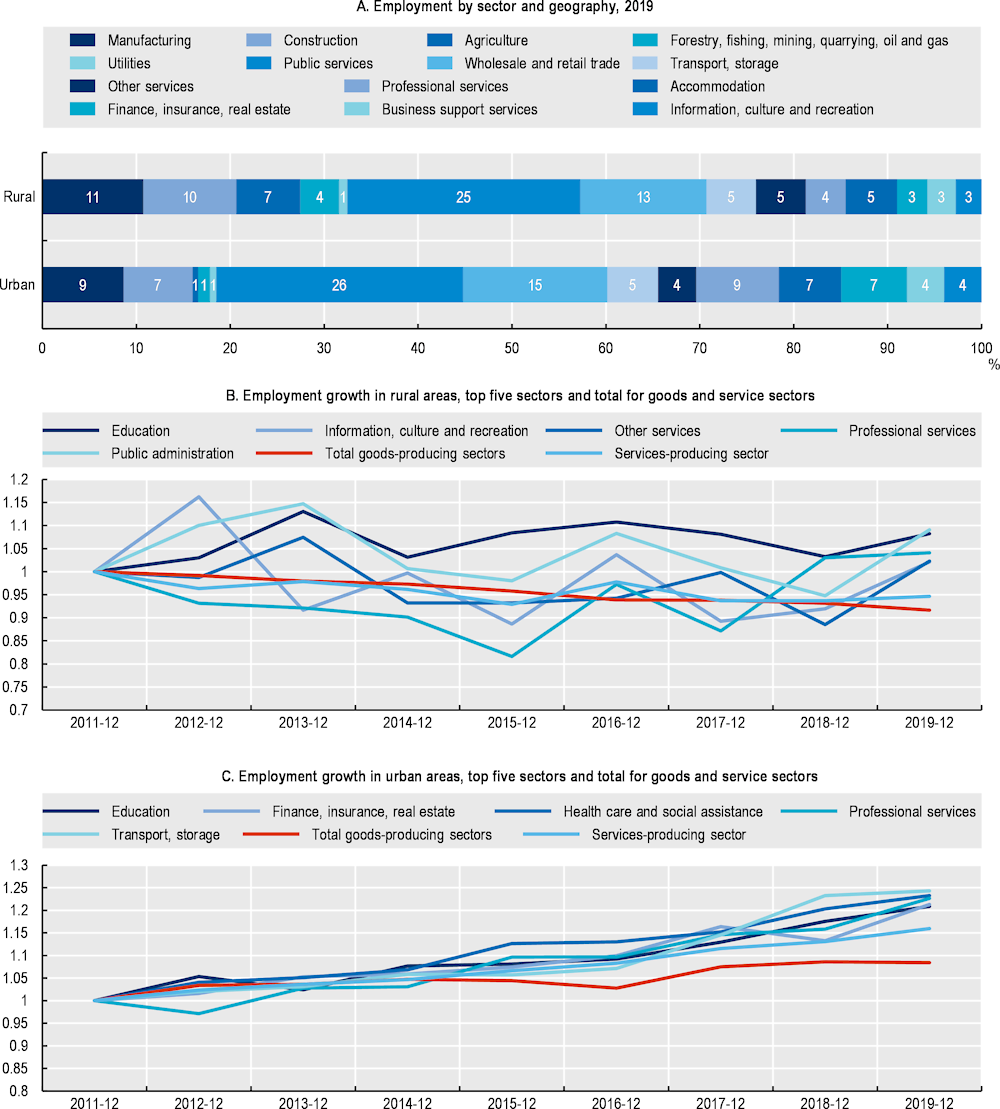

Canada, like many other OECD countries, is facing demographic challenges. The population in rural areas is growing in numbers but slower than population growth in urban areas. The level of employment in rural areas of Canada fell by 6% from 2011 to 2019 while still growing in urban areas.

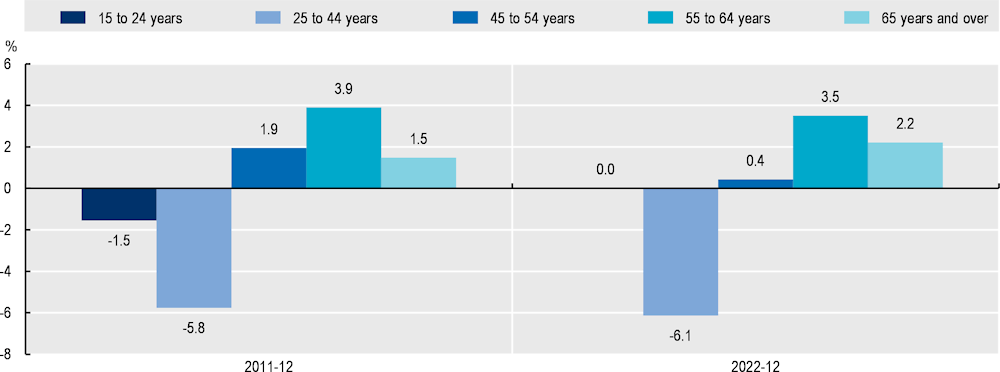

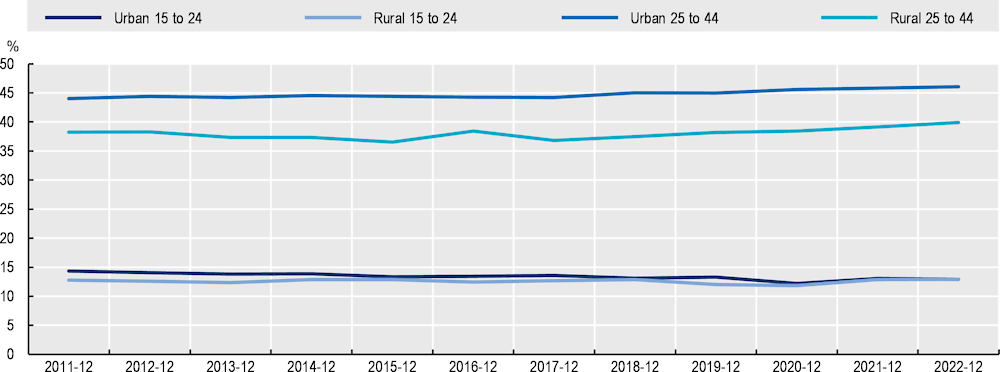

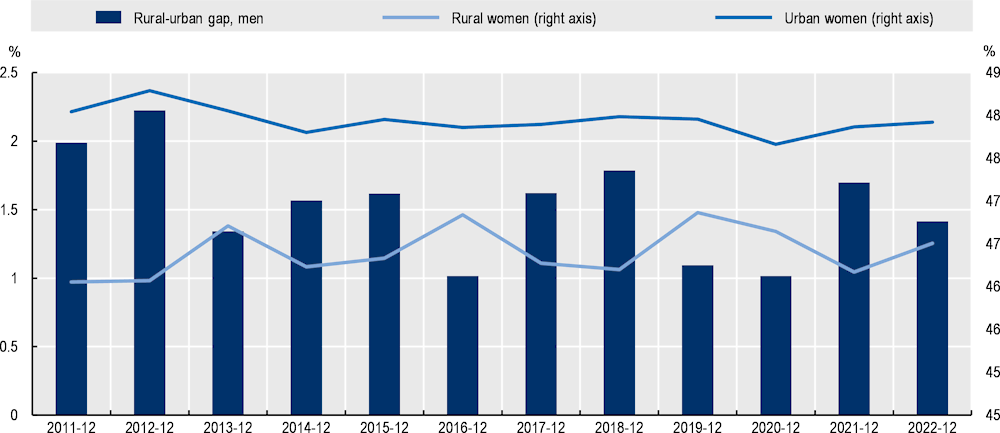

As is observed in most other OECD countries, the rural population and workforce are also ageing and women are relatively less engaged in the formal labour market. In 2022, the average age of the population in rural areas was 43.8, while it was 41.3 in urban areas. Furthermore, as compared to urban areas, in rural areas, there was 6% less of a share of prime-aged individuals (25 to 44 years) in employment and close to a 6% larger share of individuals over the age of 55 in employment. There is a 1.4 percentage point difference between the employment share of women and men in rural areas as compared to those in urban areas, with 1.15 men to every woman employed in rural areas, as compared to urban areas where there are 1.09 men to every woman employed.

Despite these labour and demographic considerations, Canada is attracting an increasing number of migrants across all geographies, many of whom contribute positively to firm formation and innovation in firms. Labour productivity, frequently used as a proxy for innovation absorption, has been growing and is higher in rural areas than in urban areas of Canada. However, in rural areas, labour productivity grew by 16% between 2011 and 2019, compared to 36% in urban areas. Despite a relatively high level of aggregate labour productivity in rural areas as compared to urban areas, the overall share of total aggregate (rural and urban) labour in rural areas was 25% in 2019, as compared to 75% in urban areas in 2019, a 2.1-percentage point fall from the rural share of labour in 2011.

While indicators of growth and innovation absorption demonstrate positive trends, other innovation indicators demonstrate that there may be room for improvement. For example, the intensity of gross domestic expenditure on research and innovation as a percentage of GDP in Canada in 2021 is relatively low, at 1.7%, as compared to the OECD average of 2.7%. Furthermore, Canada ranks 9th out of 35 OECD countries with available data on total patent statistics and is close to the 50th percentile in terms of patenting intensity. Despite room to improve on high-technology innovation statistics proxied by patents, regional disparities between rural and metropolitan regions are lower than that of the OECD average.

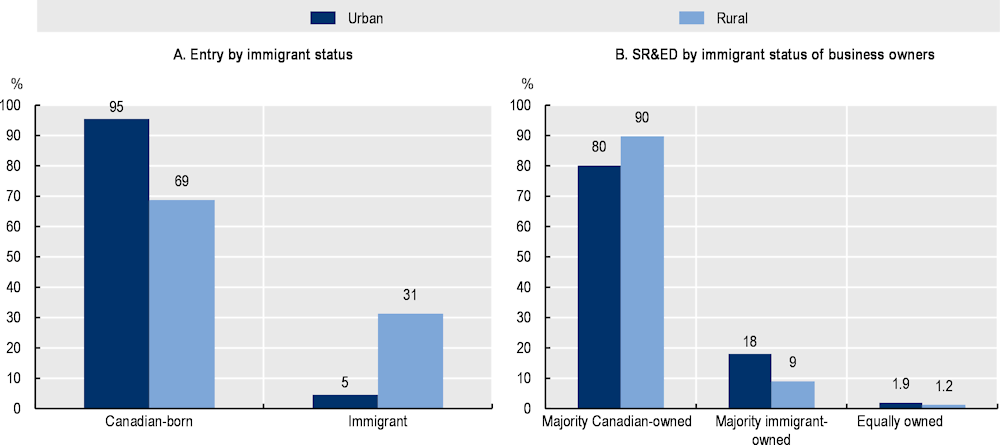

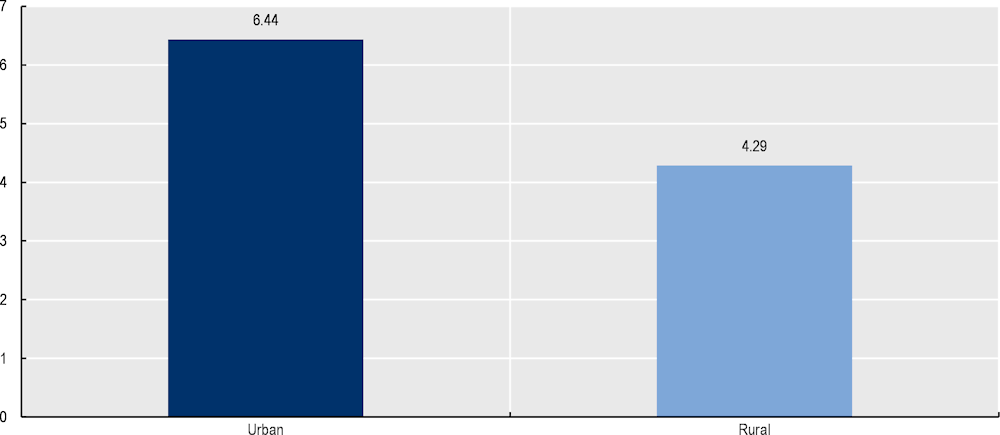

Most firms (99%) do not report participating in research and development (R&D) in Canada. In 2018, 1.1% of firms in urban areas reported participating in R&D activities, against slightly less, 0.8% of firms in rural areas. On the other hand, new firm activity is a promising avenue for innovation in rural and urban areas. On average, close to 4.3% of firms in rural areas are start-ups, compared to 6.4% in urban areas.

Firm and individual characteristics vary across geographies and it matters for innovation and new firm formation.

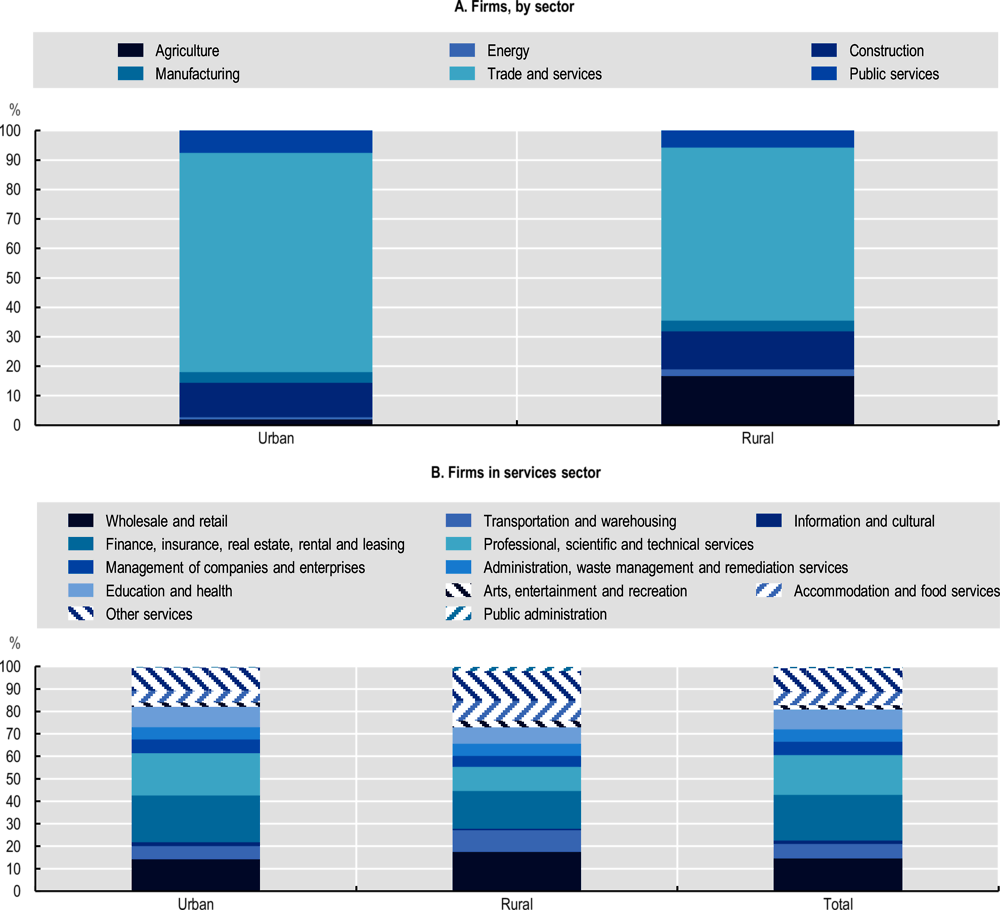

Often, rural areas are characterised as primarily belonging to the agricultural sector. This argument is outdated in most OECD countries.

The largest employers in rural areas of Canada are wholesale retail and trade (13%) and manufacturing (11%). However, in terms of the share of all firms, the largest sectors are trade and services (58%) followed by the agricultural sector (17%). These are also the same sectors in which the newest firm formation activities are located. Even though the trade and services sector accounts for the majority of firms in rural areas, only 21% of firms that participate in formal innovation activities are in the trade and services sector, while 44% are in the agricultural sector.

In rural areas, firms are often smaller and older, yet larger and younger firms are more likely to innovate.

Most firms are small in rural Canada. Between 2010 and 2019, 85% of firms in rural Canada were micro firms, with fewer than 5 employees, or non-employers.

Larger firms tend to participate more often in formal innovation activities.

Larger firms (100 or more employees) tend to innovate more than smaller firms when taking into account sector and other firm-specific characteristics. This is consistent in both rural and urban areas, but there is an increased propensity for larger firms to innovate in rural areas as compared to urban firms.

Nevertheless, there tends to be a higher share of micro and small firms (fewer than five workers) that innovate in rural areas than in urban areas. Of all firms involved in formal R&D processes in rural areas, micro (with 1-4 workers; 31%) or small (with 5‑19 workers; 27%) firms tend to account for the largest share. In comparison, in urban areas, the largest share of firms that participate in formal R&D processes are small firms (29% for small firms with 5-19 workers), followed by medium-sized firms (25% for medium‑sized firms with 20-99 workers) and micro firms (25% for medium-sized firms with 1-4 workers).

In rural areas, firms with more experience are more likely to innovate. This is not as strong a trend in urban areas.

Firms in rural Canada are older than those in urban areas. Close to half of all firms in rural Canada have operated for more than ten years. Rural Canada has a larger share of mature (11-30 years) and old (30 or more years) firms over the period of 2005‑19 than urban areas. In comparison, there is a higher share of start-ups in urban areas (16%) than in rural areas (12%) and a higher share of young firms (between 2 to 5 years of age) in urban areas (24%) as compared to rural areas (19%).

Firms that participate in innovation activities in rural areas tend to be older than those in urban areas. Among firms that have applied for an R&D tax incentive programme, the largest share are mature and old firms (between the ages of 11-30 and 30 or more). In rural areas, 67.2% of firms participating in formal innovation activities were mature or old, while this number is lower in urban areas (55.5%). In urban areas, relatively younger firms participate in formal innovation activities more than the oldest (11 or more) and youngest (5 or less) firms as compared to rural areas.

The peak age when firms are likely to innovate is older (between 11-30 years of age) in rural areas than in urban areas. The probability of innovating for a firm that is young (2‑5) is 0.16 in urban areas and null (non-significant) in rural areas, compared to firms over 30 years of age. For firms that are in their intermediate ages (6-10), the probability is 0.219 in urban areas and 0.086 in rural areas. The highest probability for a firm to innovate in rural areas is in its mature age (11-30), where the probability is 0.105. In comparison, firms in urban areas in this same age group have a higher probability than rural firms (0.195) but less than firms that are between the ages of 6-10.

In rural areas, firms tend to have less connectivity to international markets. Yet, access to global supply chains is particularly important for innovation and the formation of new firms in rural areas.

A remarkable 41% of firms in rural areas that applied for tax incentive programmes related to formal R&D investment participated in global value chains and markets through imports or exports. While this number was higher in urban areas (52%), participating in the global supply chain is a strong characteristic of innovative firms in Canada. This is surprising as only 5% of rural firms participate in trade (compared to slightly more, 7% of urban firms). Furthermore, a larger share of new firms in rural areas (0.71%) participate in global supply chains than in urban areas (0.56%).

For rural firms with only one export partner country, the gains from exporting are substantial and large. In rural Canada, close to 82% of firms have only one export partner country. This is a higher share than in urban areas (74%). However, 26% of firms in urban areas have more than 1 trading partner, while only 18% have more than 1 trading partner in rural areas. Increasing the share of firms exporting by 1% is associated with a close to sixfold increase in export values in rural areas and explains quite a strong share (57% of the variation) of the outcome for export values.

The monetary returns to export activity are stronger in rural areas than in urban areas. Even though most firms that export are in urban areas, the returns to an additional number of exporting firms are neither positive nor statistically significant in urban areas. However, one additional exporter in rural areas is associated with an increase in export values.

While participating in global value chains is important for innovation, there is still a rural disadvantage. In urban areas, participating in global value chains is associated with a 0.68 higher probability of participating in formal innovation, while the likelihood is only 0.56 for rural firms.

The analysis finds that there is some association between foreign ownership (investment) and innovation. However, this finding does not hold when controlling for other characteristics. Nevertheless, in urban areas, foreign ownership does boost the probability of participating in formal innovation processes. Having a foreign owner increases the likelihood of participating in formal innovation activities by 0.175 in urban areas, while no perceivable (statistically significant) benefit is observed in rural areas.

Individual characteristics of entrepreneurs can also impact how places innovate.

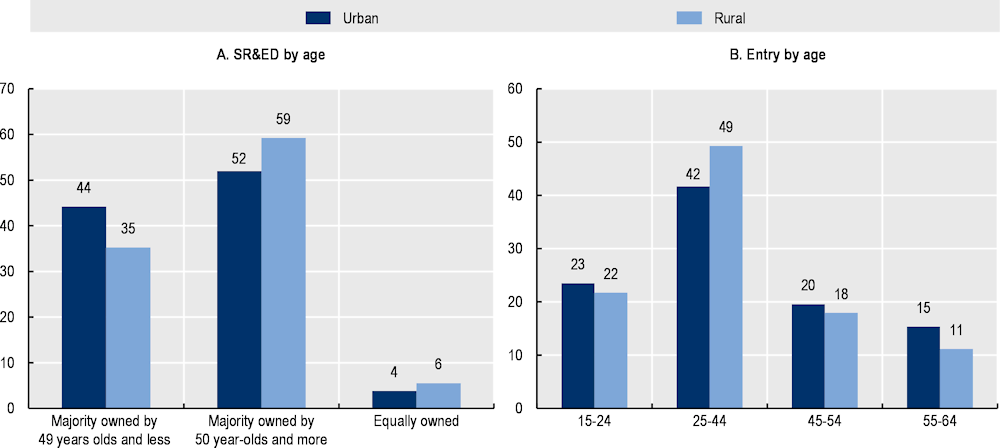

As individuals get older, they are less likely to start a new firm in both urban and rural areas. The oldest working-age group (55-64 years of age) is the least likely to start a firm in both rural and urban areas. The finding on age and new firm formation is relatively consistent across rural and urban areas. In rural areas, the probability of starting a firm is higher (0.23) than in older age groups (0.19 for those aged 25-44 and 0.086 for those aged between 45-55). However, the same-aged individual has a higher probability of starting a firm in urban areas as compared to rural areas.

In rural areas, close to half (49%) of new entrepreneurs are between the ages of 25 and 44, and there are relatively fewer entrepreneurs in older age categories despite the fact that there is a relatively higher share of older individuals in the population and labour market in rural areas. In comparison, close to 42% of new entrepreneurs are between the ages of 25 and 44 in urban areas and there is also a higher share of younger entrepreneurs.

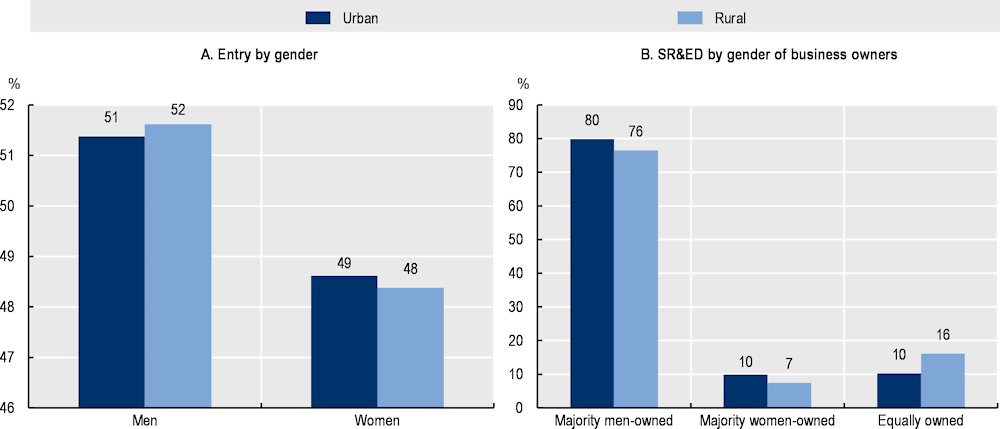

Women are more likely to start a new firm in rural areas than in urban areas but have lower participation in employment and are less likely to apply for formal tax credits for innovation. Being a woman increases the probability of starting a firm in rural areas by 0.018, but not in urban areas, where being a woman is negatively associated with starting a firm (‑0.005). However, the majority of women-owned firms with more equal ownership have a lower probability of participating in formal innovation than firms predominantly owned by men in rural and urban areas.

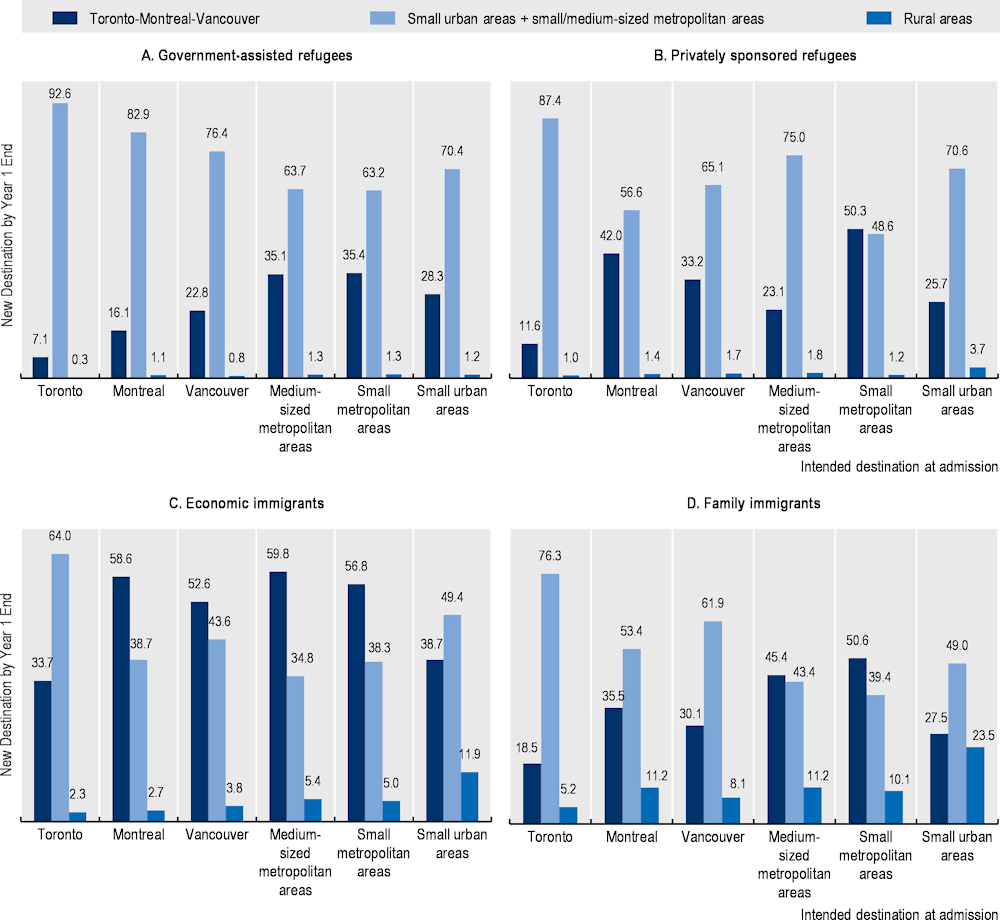

While rural areas have fewer immigrants, the latter are good for innovation and new firm formation in rural areas. The entrepreneurial drive of immigrants in Canada is more pronounced in urban areas than in rural areas. This is a missed opportunity for rural areas. In both urban and rural areas of Canada, immigrants are more likely to start a new firm than non‑immigrants; however, the likelihood of starting a firm in rural areas for immigrants is lower (0.124) than in urban areas (0.162). Immigrants tend to start new firms and a workforce with more immigrant diversity tends to be very positively associated with formal innovation activities. The benefits are larger for rural areas than urban areas. However, there is also a penalty for immigrant entrepreneurs in rural areas as compared to Canadian-born entrepreneurs, and they are less likely than Canadian-born entrepreneurs to extend their entrepreneurial practices to formal innovation activities.

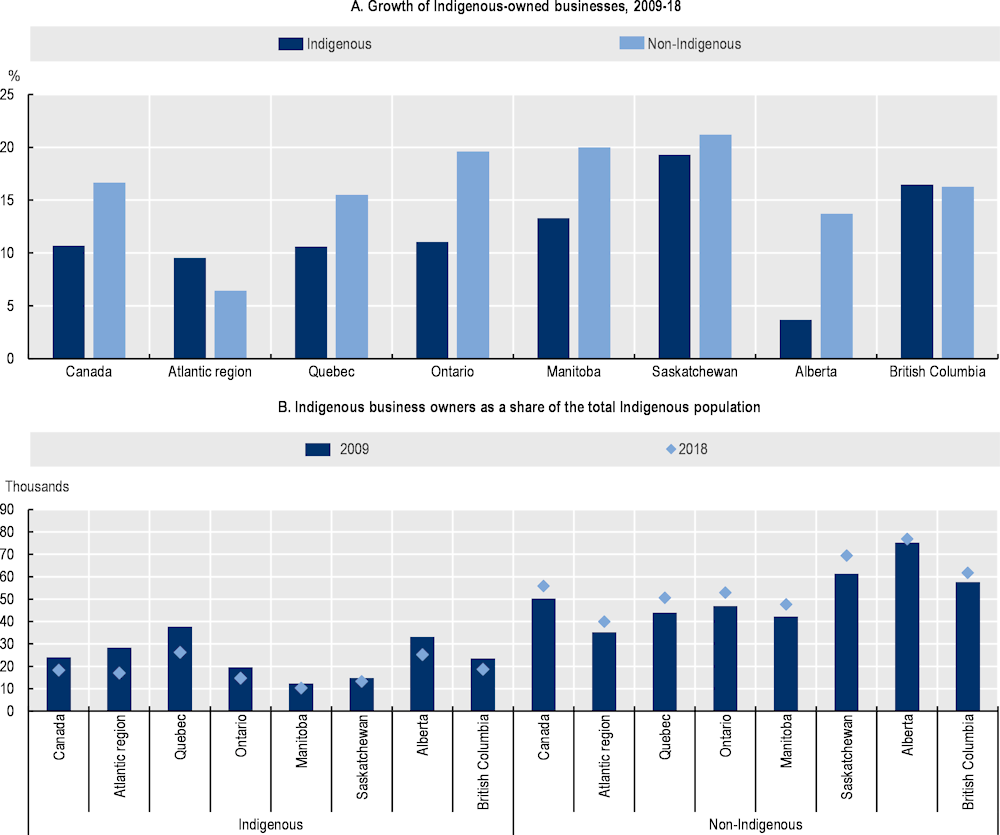

Finally, despite the fact that rural firms in the province of Ontario are the most likely to participate in formal innovation processes and practices, urban and rural firms in Quebec are relatively more likely to participate in formal innovation practices than many other places in Canada. Chapter 3 argues that this may be due to the regional innovation support mechanisms that both provinces of Ontario and Quebec have developed to a larger extent. Firms in rural areas of the northern territories, where there are higher proportions of Indigenous entrepreneurs as a share of total Indigenous peoples and individuals, are the least likely to participate in formal innovation activities.

Notes: *This is based on population centre estimates of rural areas. **According to the CMA/CA definition, this refers to 98% of the landmass, while alternative estimates from Statistics Canada “rural areas” identify 99.82% of the landmass as rural.

Rural areas in Canada are vast and heterogeneous in population and geography. With 98% of the total landmass, rural areas of Canada account for 6.6 million people or 17.8% of the population in 2021. The population living in remote areas represents three-quarters (74.6%) of the landmass but only 12.0% of the total population. Despite the growth in rural population in absolute numbers, there was faster growth in urban areas of Canada from 2016 to 2021 (Statistics Canada, 2022[1]).

The conditions for innovation in rural areas are distinct from those of urban areas. The challenges and opportunities are different in contexts where scale (agglomeration) and density are low and comparative advantages are tied to natural resources. This chapter will focus on how geography, firm characteristics and individual characteristics play a role in formal innovation (through R&D investment and in new firm formation). While the analysis focuses on firm-level innovation, it underlines the importance of going beyond firm-level innovation to social innovation and public sector innovation. Chapter 3 will look further at policies for innovation.

Defining rural innovation

Understanding innovation in rural geographies requires first identifying rural areas within the context of the study and placing a critical lens on better understanding what type of innovation occurs in rural areas before pursing further analysis.

Defining rural areas

Understanding the geography of rural areas informs the perspective through which rural innovation policies can take place. In Canada, as in other OECD countries, no single definition of “rural” is consistently applied across all federal agencies and provinces in Canada. That is because different definitions are used in different contexts and for different purposes. Rural communities are diverse, and any comprehensive definition would need to have a clear purpose and likely capture key features to reflect the wide range of communities, including remote, island and coastal communities, as well as those that are urban-adjacent. Further, population cut-offs can be subjective, and “rurality” is perceived differently depending on the region (e.g. larger communities might be considered “rural” in Southern Ontario compared to Atlantic Canada).

In Canada, one publicly available and commonly used geographical classification is based on the unit of census subdivision (CSD) belonging to census metropolitan areas (CMA) or census agglomerations (CA). A CMA or a CA is formed by one or more adjacent municipalities centred on a population centre (known as the core). A CMA must have a total population of at least 100 000 inhabitants, based on data from the current Census of Population programme, of which 50 000 or more must live in the core based on adjusted data from the previous Census of Population programme. A CA must have a core population of at least 10 000, also based on data from the previous Census of Population programme. To be included in the CMA or CA, other adjacent municipalities must have a high degree of integration with the core, as measured by commuting flows derived from data on place of work from the previous census programme (Statistics Canada, 2022[2]).

For the rest of this report, when using Canadian national statistics, urban areas are defined as a CMA with a population of at least 100 000 inhabitants and a CA with a population of at least 10 000 based on the previous census. Rural areas are defined as non-census metropolitan areas or census agglomerations (non-CMA/CA). In addition to the dichotomous CMA/CA versus non-CMA/CA definition that identifies urban and rural areas, there is a layer of complementary classifications used by some statistical programmes, particularly related to labour force statistics, that identify a core, a secondary core, a fringe area and rural areas (Statistics Canada, 2022[3]). When used and available for a few specific statistical outputs, the disaggregation provides additional insights into geography.

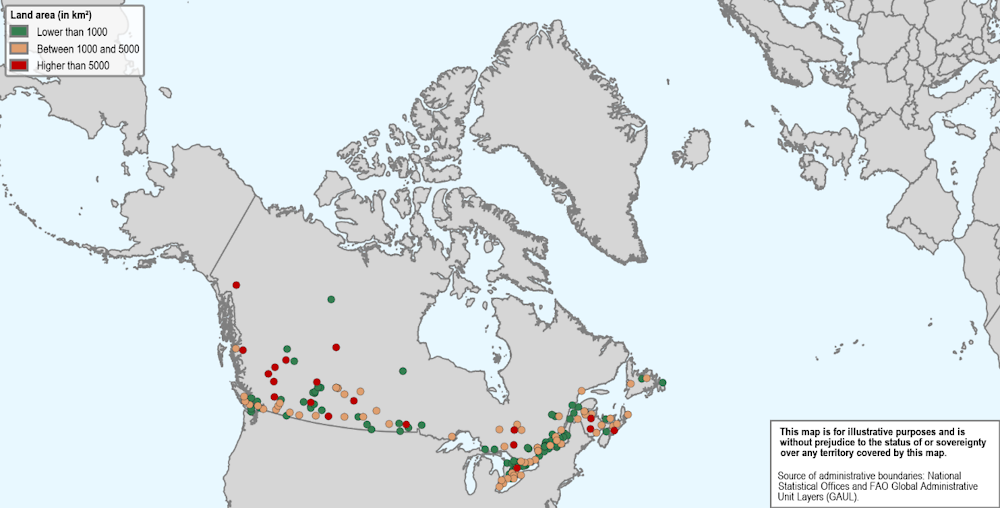

Figure 2.1. Rural and urban areas in Canada

Census Metropolitan Areas (CMA) or Census Agglomerations (CA), by size

Note: This map shows CMAs and CAs coded by size of land area based on the census of population in 2021.

Source: Author’s own elaboration based on Statistics Canada (2022[4]), Census of Population, https://www12.statcan.gc.ca/census-recensement/alternative_alternatif.cfm?l=eng&dispext=zip&teng=lcma000b21a_e.zip&k=%20%20%20%2013083&loc=//www12.statcan.gc.ca/census-recensement/2021/geo/sip-pis/boundary-limites/files-fichiers/lcma000b21a_e.zip (accessed on 9 February 2024).

In consultation with the OECD Working Party on Territorial Indicators, a more recent development is the self-contained labour area (SLA). While not integrated into the primary classifications in the text, it provides an alternative system of classification. SLAs are a breakdown of non-CMA/CA areas into rural functional areas defined on reciprocal commuting flows among municipalities (census subdivision) (Statistics Canada, 2023[5]). It was first released in the context of the remote working conditions applied to the quarterly Canadian Survey on Business Conditions (Statistics Canada, 2023[5]; OECD, 2020[6]). The release is experimental as it uses the new geographical concept of SLAs for the first time in response to the difficulties in gathering data on rural labour markets.

SLAs are a geographic concept that defines functional rural areas based on commuting flows comparable to that used for metropolitan areas. Compared to the CMA/CA-based classifications, SLAs offer a larger geographical coverage, using commuting data for all municipalities. Rural SLAs cover all Canadian municipalities outside CMAs and CAs. Each SLA consists of a self-contained grouping of areas where the majority of residents both work and live. Rural SLAs include only commuting flows among non-CMA/CA municipalities. The SLAs use census subdivisions as building blocks and the version used in this analysis is based on 2016 Census of Population data.1

Placing a rural lens on innovation

When defined as a systematic effort to expand an economy by introducing new products or creating new processes, innovation can be supported by appropriate government policy. The majority of the literature on innovation today is focused on manufacturing or financial services sectors, where the main metrics for measuring innovation are still patent counts and expenditures on formal R&D. Nevertheless, there is a growing recognition that innovation can be found beyond manufacturing and that patent counts and research outputs are incomplete measures of innovation (OECD, 2022[7]). In studies on the geography of innovation, Feldman and Kogler (2010, pp. 383-404[8]) found that many of the conditions for a typical science and technology-based innovation relied on access to universities and spillovers from agglomeration effects. Collectively, these facts suggest that innovation is most likely to take place in locations where it has already occurred and that urban areas offer the best geographic location for this to happen because they have universities and offer opportunities for many forms of knowledge spillover.

While this may be true, it does not preclude innovation from taking place in other types of geography, particularly if the notion of innovation is understood in the original sense and broadened beyond the manufacturing sector. Notably, Shearmur (2012[9]) argues that much of the academic literature on cities and innovation that focuses only on metropolitan innovation systems may overstate both the role of cities in innovation and focus on the wrong reasons why cities play a large role. The first issue arises because of the narrow definition of innovation, while the second reflects the assumption that close interaction leading to spillovers is essential for innovation to occur. In contrast, Shearmur suggests:

“1. not all innovations require the same level and intensity of interaction… some types of innovation may rely more on observation, experimentation and cogitation than on constant interactions with external actors:

2. interaction can occur even if interlocutors are not co-located, yet it remains dependent on physical accessibility. This opens the door to certain types of innovation occurring in rural places.” (Shearmur, 2012, p. 513[9])

While patents provide a useful metric for measuring innovation, they only measure types of innovation that can be or are patented. They overlook innovations that may be related to bringing social goods and public services or are considered “reverse innovations”.2 Even in manufacturing, a firm may choose not to patent because the cost exceeds the perceived benefits. Further, patents are a measure of invention that is not necessarily acted upon through implementation, which is the true measure of innovation. For example, artisanal beer and drink innovators in the Gaspé region argue that innovation is a part of how they function. If they were to patent every new product they provide to the market, more time would be spent on legal and administrative procedures than their human resources could accommodate. Other forms of firm innovation may not be patentable, including innovations in logistical processes, labour relations or other management activities, all of which can increase productivity. This is because innovations in processes are often not patentable (both in terms of eligibility and in terms of financial, legal constraints and pay offs), nor is this the case when we look at some firm products that may not be incremental or not scalable (for example, bespoke engineering) (OECD, 2022[7]). Such innovations are applicable to both firms in the service sectors and to manufacturing firms. Similarly, both governments and civil society organisations can engage in innovative actions that improve their ability to provide public and “third sector” services.

A similar argument can be made for innovation statistics focused on R&D expenditure and jobs. As proxy indicators of innovation, they are input-based measures of innovation activities rather than output-based measures (such as patents). They capture intent to innovate, perhaps more broadly than patent-based indicators. Nevertheless, they miss all forms of innovation from governments, civil society and firms that do not explicitly self-identify the creation of new products, services and practices (processes) as a form of innovation (OECD, 2022[7]).

In rural areas, the importance of a broader perspective on innovation is particularly relevant because these regions do not fit the stylised facts of Feldman and Kochler, and it is easy to conclude that innovation does not occur in rural areas when what is true is that certain types of innovation do not occur in rural areas. When a broader notion of innovation is used, which is expanded to include any activity that leads to a new or improved good or service that increases productivity or the quality of life of the community, then it is fairly easy to find examples of rural innovation. Such a definition is followed by the OECD (2016[10]): “It goes far beyond the confines of research labs to users, suppliers and consumers everywhere – in government, business and non-profit organisations, across borders, across sectors, and across institutions”.

As the scope of innovation expands beyond new products and technologies, the relevance of patents or expenditures on R&D as metrics of innovation also diminishes. In this regard, public sector innovation that focuses on improving services delivered by the public sector, civil society and social innovators has become increasingly important (OECD, 2022[11]). Neither of these activities is captured by standard science and technology-based innovation statistics. Nevertheless, social enterprises provide goods and services to customers but under a business model that is something other than profit-maximising. In Canada, there is a long history of social innovators, co-operatives and credit unions in both urban and rural areas, and there is considerable evidence of innovative behaviour (McMurtry and Brouard, 2015[12]).

The OECD recognises that the structure of the rural economy differs from that of the modern urban economy found in large cities (2016[10]). In rural regions, more remote from urban centres, a “low-density economy” exists that is dominated by small local labour markets with few employers and only a limited number of goods and services being produced (see Chapter 3). Furthermore, the structures of Indigenous economies, in relevant OECD economies, within these regions are unique to other rural/remote populations for many reasons, for example because of the uniqueness of barriers to innovation and economic development on reserves and the different structures of governance among First Nations communities.3 In addition to there being only a limited variety of goods and private services, local governments and, where relevant, government department Indigenous Services Canada also provide limited public services because they lack the resources to fund more than essential activities.4 This places a far greater responsibility on local civil society to play a larger role in providing missing services commonly provided by the market or government in urban areas. Social enterprises (including co‑operatives), church groups, service organisations (like the Lions Club or Kiwanis Club) and a variety of other community organisations voluntarily provide much of the social infrastructure in rural places.

In the context of this study, innovation can be thought of as being driven by the challenges of its environment, including the challenges of scale, density and distance to resources for rural innovators. Some of the challenges that accrue with increased distances and loss of density and scale can be summarised in the following way.

Figure 2.2. Innovation challenges related to scale, density and distance for innovators in increasingly remote rural areas

Challenges of scale, density and distance mean that innovation in rural areas has a very different context. First, for the most part, no local formal innovation system links research to innovation, where people are employed to bring new ideas into practice. Universities and other academic research facilities are rarely located in rural areas unless the nature of their research dictates their location.5 For example, the Experimental Lakes Area in the Kenora District of Ontario conducts globally recognised research on the effects of various forms of pollution on freshwater aquatic systems. However, its direct impact on the immediate area is limited because it focuses on a broad range of pollutants, few of which are experienced locally; it employs few local people and many of its purchases come from urban areas. In addition, rural firms are often small and have little or no formal investment innovation activity.

Second, there is a limited ability to purchase solutions to any problems a firm or household may face in carrying out its activities. This can lead to greater interest in user innovation, user-driven innovation and collaborative forms of user-driven innovation, such as in the following examples:

User innovation: Individuals, such as Armand Bombardier, directly engage in innovative activity because they see no other possibility for a solution.

User-driven innovation: The end user finds another actor to provide a solution that will resolve the problem, such as in partnership with research institutes when they are available and accessible in rural areas.6

Collaborative user-driven innovation: In each small community, the mix of needs and capacities is different, which often leads to novel ways of providing services, including through volunteerism or co‑operative efforts to attain scale.7

Third, while finding examples of innovation in rural areas is relatively easy, it is seldom directly marketable or in a form that has significant consequences for other people and places. This is even more the case for underrepresented business owners in rural areas. Most rural innovations improve the life of the community by giving households new or better services or increasing the competitiveness of local firms so they continue to operate. These local benefits are meaningful to the community and may be applicable in other places but, typically, there is no effort to apply the innovation to another place. Those producing the innovation either do not think to look for other applications or do not have the resources or inclination to promote their idea. They serve a local demand for local goods and services. For example, this could originate from different government initiatives to solve a local challenge with no real perspective for wider commercialisation. Furthermore, it is unlikely that a casual visitor will recognise the potential for the innovation to be applied elsewhere. Nevertheless, the cumulative effect of innovations in small places may well be significant in the aggregate, given the number of small places in Canada.

Source of data

In the majority of the chapter, we examine the structure of rural Canada as it relates to entrepreneurship and innovation using open data from Statistics Canada and the OECD, supplemented with confidential data from government agency Statistics Canada. For the analysis of the firm sector, size and age dynamics, as well as regression analysis on innovation and entrepreneurship, we make use of the Canadian Employer-Employee Dynamics Database (CEEDD) between 2005 and 2019, with the exception of urban start-up figures, which are only available from 2011 to 2019. The CEEDD is a large-scale matched database between workers and firms, covering all individual and corporate tax filers. The database capturing entrepreneurial characteristics of start-up entrepreneurs includes a cumulative count of 123 million observations in urban areas and 37 million in rural areas from 2011 to 2019.8 This represents a cumulative count of 17 million individual entrepreneurs9 in urban areas and 5 million in rural areas from 2011 to 2019. The analysis on innovation within firms (once already established) includes a cumulative count of 8 million observations in urban areas and 2 million observations in rural areas, capturing 1 million establishments10 (statistical clusters)11 in urban areas and 250 000 firms (statistical clusters) in rural areas from 2011 to 2019.

Using this data, we examine how firms operating in rural areas differ from their urban counterparts in characteristics such as industry, firm age, size and patterns of start-ups. We then investigate the role of different individual and local characteristics in fostering entrepreneurship among youth, women and immigrants in rural areas. Data were gathered from openly available Statistics Canada resources to analyse gross domestic outputs, population, exports and labour market characteristics of wages. For analysis of immigration, data were gathered from Gure and Hou (2022[13]) on the 2020 Longitudinal Immigration Database. For analysis related to the section on well-being, the data primarily come from the OECD.

Setting the scene for innovation in rural Canada

Innovation can breed both opportunities and inequalities (Aghion et al., 2018[14]). When innovation leads to higher firm profits, more jobs, higher-paid jobs or better-quality jobs, it can bring prosperity to a region. A study using linked employer-employee data in 20 OECD countries found that firm characteristics determine half of wage inequalities (Criscuolo et al., 2023[15]). In 2020, as in previous years, income inequality in Canada was lower than the OECD average ranking 9 out of 35 OECD countries with available data and much lower than its nearest geographical neighbours, Mexico and the United States (OECD, 2015[16]; 2023[17]).12 In Canada, the income gap between households in rural and urban areas has been falling, from 12% in 2000 to only 6% in 2020 (Annex Figure 2.A.1). Across geographies, the fall in the income gap in rural areas was primarily due to faster growth of average income per household, after taxes and transfers, in rural areas. In addition to low inequalities, Canada is also a place of social mobility.13

The rest of this section will draw on statistics that identify firms that innovate through status as a recipient of the Scientific Research and Experimental Development (SR&ED) tax incentive through the CEEDD. While this is an imperfect measure of innovation, it provides some indicator of whether the firm participates in formal innovation activities through investment and expenditures. It then draws on descriptive data to set the scene for innovative activities.

Productivity, innovation and entrepreneurship in rural Canada

Rural areas are an important contributor to the national Canadian economy. Metropolitan regions of Canada represented close to three-quarters of total GDP in both 2018 and 2009 (74% and 75% respectively), meaning that rural regions contained a stable quarter of the economy (Annex Figure 2.A.1). Compared to other large OECD countries, the contribution of rural Canada is substantial.14 By comparison, in the United States, non-metropolitan GDP accounted for 10% of all GDP in 2020 (OECD, 2023[18]).

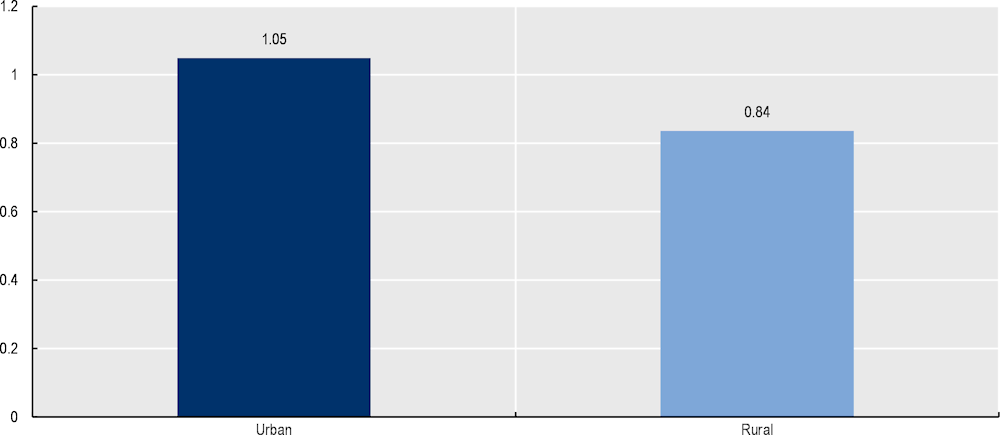

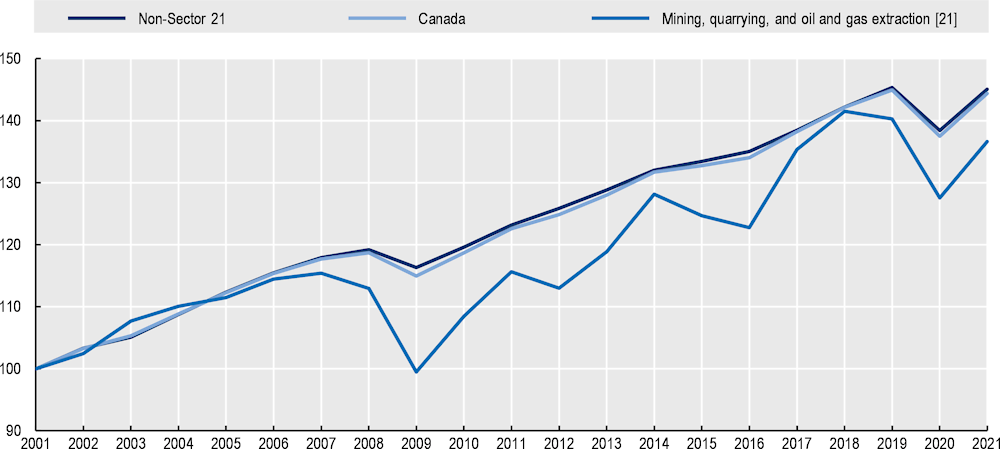

Labour productivity, frequently used as a proxy for innovation absorption, is higher in rural areas than in urban areas of Canada and has been growing (Figure 2.3).15 In rural areas, the labour productivity was higher than in urban areas in 2019 (112 000 GDP per worker in urban versus 116 000 GDP per worker in rural areas) and grew by 16% between 2011 and 2019, compared to 36% in urban areas. Despite a relatively high level of aggregate labour in rural areas as compared to urban areas, the overall share of total aggregate (rural and urban) labour in rural areas was 25% in 2019, as compared to 75% in urban areas in 2019, a 2.1‑percentage point fall from the rural share of labour in 2011.‑

Despite some evidence suggesting a good level of absorption of innovation, as proxied by productivity, other innovation indicators demonstrate room for improvement. For example, Canada has a surplus of individuals with tertiary education in information, communications and technology programmes (OECD, 2022[19]; 2022[20]) and a growing number of migrants filling skills gaps (OECD, 2022[21]). However, investment in research and innovation is low as compared to other OECD countries (OECD, 2023[22]). In addition, many common innovation indicators, such as investment in R&D and patents, often are biased towards industries with a higher composition in rural areas. As such, interpreting such indicators should be taken relatively more cautiously when discussing development in rural areas.

High-technology innovation, as proxied by patents, is a substantial form of innovation in Canada. Canada has the 9th highest number of patent applicants, based on statistics on all available patent applications from 2020. With over 3 100 patent applications in 2020, Canada follows behind the United States, Japan, Germany, Korea, France, the United Kingdom, Italy and the Netherlands (from highest to lowest).16 While it grew 6% from 2010, where the total count was just over 2 900 applicants, it was still lower than the unweighted average of OECD countries (close to 4 700 applicants) (OECD, 2023[23]).

Figure 2.3. Labour productivity is more volatile in rural areas

GDP per worker (labour productivity) in levels, growth rates and shares, 2011 to 2019

Note: Workers 15 to 64 years of age are considered. All sectors of the economy are included. The contribution of rural areas to aggregate labour productivity is the share of aggregate productivity that is due to the rural sector. It is calculated as GDP at basic prices in millions of current CAD by CMA (x 1 000 000). Labour productivity is in thousands in panel A. Exceptionally, due to lack of consistent data, labour productivity is estimated using CMA and non-CMA statistics, rather than CMA/CA and non-CMA/CA statistics, as in the rest of the report. Employment refers to the number of persons who, during the reference week, worked for pay or profit, performed unpaid family work or had a job but were not at work due to their own illness or disability, personal or family responsibilities, labour dispute, vacation or other reasons. Those persons on layoff and those without work but who had a job to start at a definite date are not considered employed. Estimates for employment are in thousands, rounded to the nearest hundred.

Source: Analysis based on Statistics Canada (n.d.[24]), Gross Domestic Product (GDP) at Basic Prices, by Census Metropolitan Area (CMA) (x 1,000,000), Tables 36-10-0468-01 (GDP), https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610046801; Statistics Canada (n.d.[25]), Population Estimates, July 1, by Census Metropolitan Area and Census Agglomeration, 2016 Boundaries 17-10-0135-01 (worker), https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710013501.

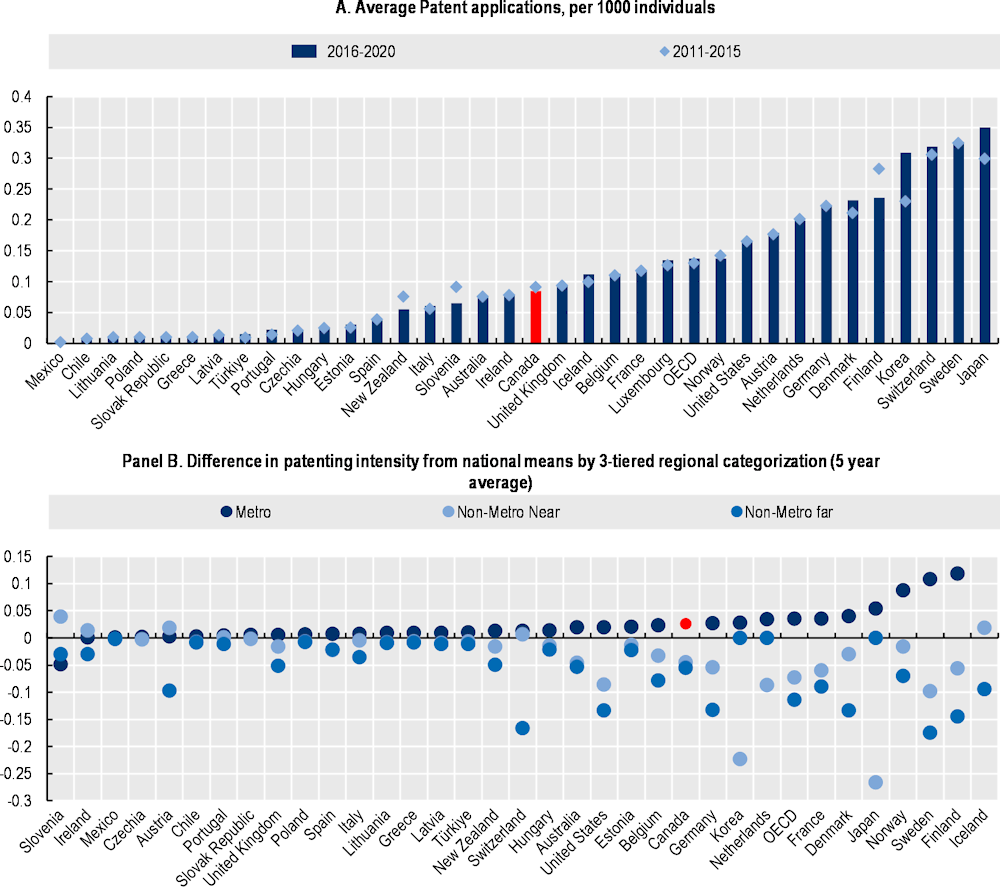

Scaling patenting statistics by the size of the population reduces Canada’s ranking, as it does for many other countries. Patent intensity (number of applicants per 1 000 individuals) is relatively low in Canada over the 5 years from 2016 to 2020, standing at 0.085 patents per 1 000 individuals (or close to 9 per 100 000 individuals) (Figure 2.4, Panel A).17 In comparison, the OECD average is 0.14 patents per 1 000 individuals (or 14 per 100 000 individuals).

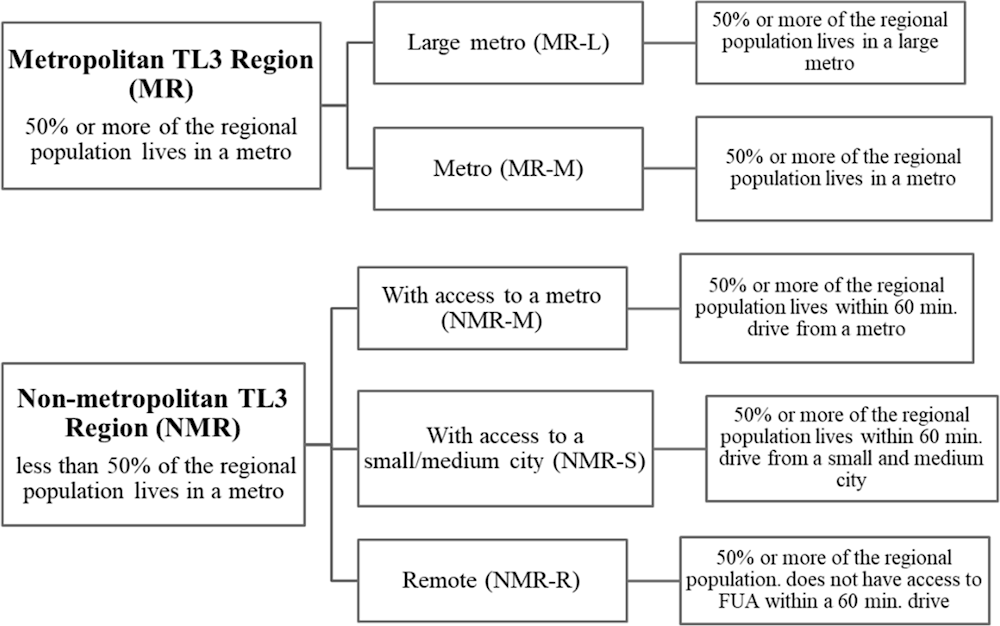

There is lower patent intensity in remote rural regions of Canada than in metropolitan regions (Figure 2.4, Panel B). The patenting intensity in non-metropolitan remote rural regions (using OECD harmonised regional definitions elaborated in Annex 2.B) is low as compared to national averages. Over the average of the 2016-20 period, there were 0.03 patents per 1 000 inhabitants in non-metropolitan rural remote regions of Canada. This was close to a third of the Canadian national average of 0.085 patents per 1 000 individuals. In comparison, in OECD countries, the average country-level patent intensity over the same period was 0.14 patents per 1 000 individuals from 2016 to 2020, with a patenting intensity that was 7 times lower in rural remote regions (0.02 patents per 1 000 individuals).

Figure 2.4. Regional differences in patenting intensity

Total patent applicants filed per 1 000 individuals, 5-year averages

Note: OECD values refer to unweighted country averages based on total population and patent applicant counts over the span of five years. Only countries with regional data for both patents and population were included in Panel B. Colombia was excluded because of only zero patent reporting across all years. Patent applications that were not assigned to a location were not included in the analysis. The small regional classification system (TL3) is based on the description found in Annex 2.B. The category “Metro” includes large metropolitan regions and (medium-sized) metropolitan regions; the category “Non-metro near” refers to non-metropolitan regions close to metropolitan regions and non‑metropolitan regions close to small and medium-sized cities; and the category “Non-metro far” refers to non-metropolitan remote regions. Percentage deviations of patent intensity refer to percentage differences between each type of three-tiered region’s average patent intensity from national means.

Source: Based on OECD (2023[23]), “Regional innovation”, https://doi.org/10.1787/1c89e05a-en.

Unlike some of the top performers on patent-producing innovations, the geographical differences in patenting intensity between metropolitan regions and non-metropolitan remote rural regions are not as stark (Figure 2.4, Panel B).18 Over the 5‑year period from 2016 to 2020, the average difference between patent intensity in non-metropolitan remote regions and metropolitan regions in Canada was 0.08 patents per 1 000 individuals (0.11 patents per 1 000 individuals in metropolitan regions versus 0.03 in non‑metropolitan remote regions). In comparison, over the same period of time, the average difference between patent intensities in non-metropolitan remote regions and metropolitan regions in OECD countries was 0.14 patents per 1 000 individuals (0.17 patents per 1 000 individuals in metropolitan regions versus 0.02 in non-metropolitan remote regions). This makes the geographical differences three-quarters lower in Canada than on average in OECD countries from the period of 2016 to 2020.

Patent intensity differences across regions are also less than half as big as its nearest neighbour, the United States (0.16 patents per 1 000 individuals more in metropolitan regions than in non-metropolitan remote regions), and 4 times less of a gap than Japan (a high-patent intensity country with 0.35 patents per 1 000 individuals more in metropolitan regions than in non-metropolitan regions close to metropolitan regions).19 It is more closely on par with geographical differences in patenting intensity with Australia (0.07 more patents per 1 000 individuals in rural remote regions than in metropolitan regions).

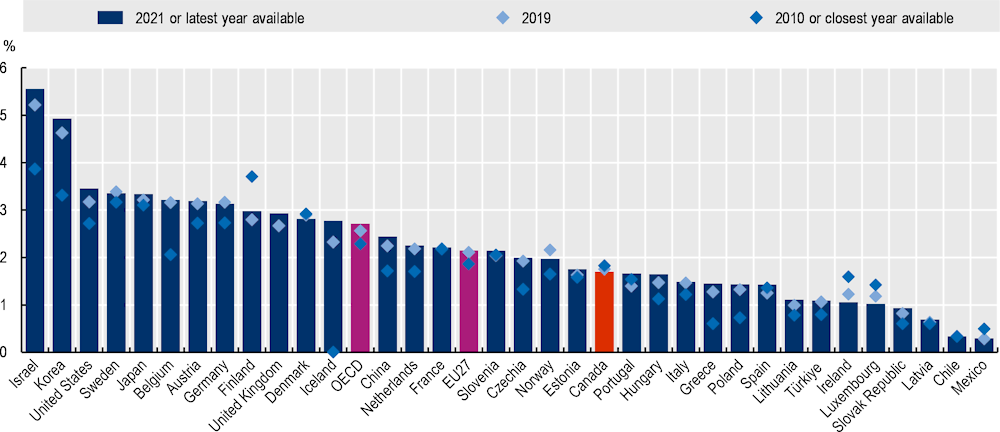

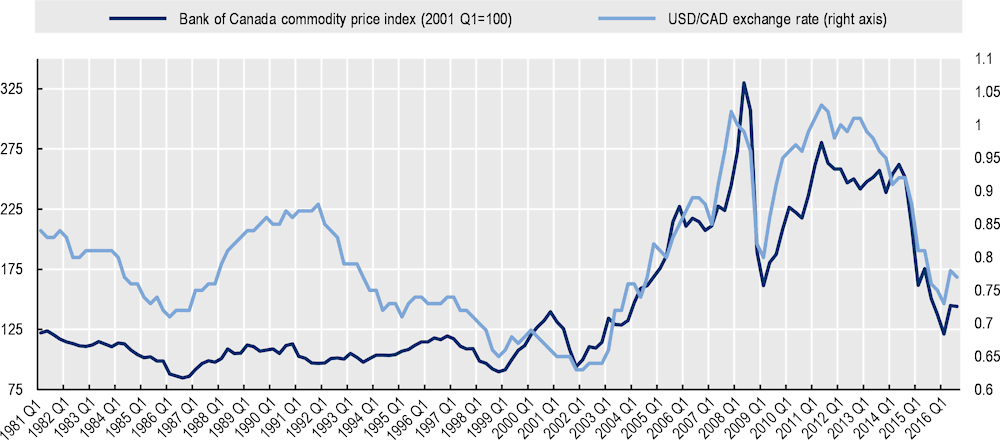

As compared to other OECD countries, the intensity of gross domestic expenditure on R&D as a percentage of GDP in Canada in 2021 was 1.7% (Figure 2.5). In comparison, values were higher in countries such as Israel (5.6%) and Korea (4.9%). R&D intensity in the OECD area climbed from 2.3% in 2020 to 2.7% of GDP in 2021, falling from 1.83% in 2010 to 1.7% in 2021 in Canada. Over the same period, R&D intensity as a percentage of GDP increased in the European Union (EU27) area from 2.1% to 2.2% and in the United States from 3.2% to 3.5%.

Figure 2.5. R&D intensity in OECD countries

Gross domestic expenditure on R&D as a percentage of GDP

Note: Data for the United Kingdom are only available for 2018-20 and are preliminary. Following a major data revision by the UK statistical agency conducted in late 2022 and effective only from 2018, back series for previous years have been suppressed from the data available to OECD. 2021 data correspond to 2020 for Chile, Colombia, Mexico, Türkiye and the United Kingdom. See OECD Main Science and Technology Indicators, http://oe.cd/msti, for the most up-to-date indicators. (accessed 8 February 2023).

Source: OECD (2023[22]), OECD Science, Technology and Innovation Outlook 2023: Enabling Transitions in Times of Disruption, https://doi.org/10.1787/0b55736e-en.

In 2018, the majority of firms in Canada (99%) did not report having spent funds on R&D. Among those that did report having expenditures on research and innovation, the share of firms was marginally higher in urban areas than rural areas, based on analysis from the CEEDD (Annex Figure 2.A.2). In 2018, 1.1% of firms in urban areas reported participating in R&D activities, against slightly less, 0.8% of firms reported participating in R&D activities in rural areas.

Low R&D investments and patenting statistics do not necessarily preclude areas from participating in innovation, as many forms of innovation, such as the wider (non-science and technology) concept of innovation and social innovation, are not adequately captured in these types of statistics. For example, Quebec, a large province with a large rural population, has seen low shares of R&D and patents but still observes that between 2017 and 2019, 78% of firms reported innovating in self-reported, broader measures of innovation (OECD/Eurostat, 2021[26]; OECD, 2023[27]). The large majority of firms’ self-reforming innovation, about 71%, is done through process innovation, while 51.3% of firms stated their focus on product innovation and reported that lack of skills (28.9%) was the largest challenge for innovation.

Finally, an additional indicator of innovation through new activity is the rate of start-ups or new firm formation. While comparative data on start-up activity by geography are scarce, the formation of new firms in a competitive environment can still be an important determinant of innovation (Aghion et al., 2009[28]). Unlike R&D and patent statistics, the challenges of the sectoral applicability of indicators of start-up activities are not as substantial. As such, the direct interpretation of such statistics are determinants of new activities are more easily reliable, despite the fact that it is not possible to know how innovative the firms may be in product or process development. In Canada, on average, close to 4.3% of firms in rural areas are start-ups, as compared to 6.4% in urban areas in 2005-19 (Annex Figure 2.A.3). Despite signs of positive activities in rural areas, lagging in terms of new firm formation can be a challenge for innovation. If the start-up rate was the same in rural areas as in urban areas in 2018, there would be an additional 8 100 new firms in rural areas.

Firm characteristics as drivers of innovation

Firm characteristics impact how firms innovate in Canada (Galindo-Rueda, Verger and Ouellet, 2020[29]). Primary and manufacturing industries tend to play a stronger role in rural areas compared to service-driven urban economies. Firms are often smaller, older and have less connectivity to international markets. Furthermore, larger and older firms often conduct heavy research and investment-type innovations (OECD, 2023[30]). Nevertheless, younger firms tend to enter the market with new ideas for products and processes, despite the fact that they may not always have as easy access to heavy investment for traditional science and technology-type innovation. Small firms innovate through nimble adaption processes and can ultimately impact innovation in larger firms through mergers and acquisitions. Importantly, the characteristics of firms, such as age and size, are often targets of public policies for innovation and entrepreneurship. As such, understanding their distribution across geographies is important for encouraging rural innovation and entrepreneurship.

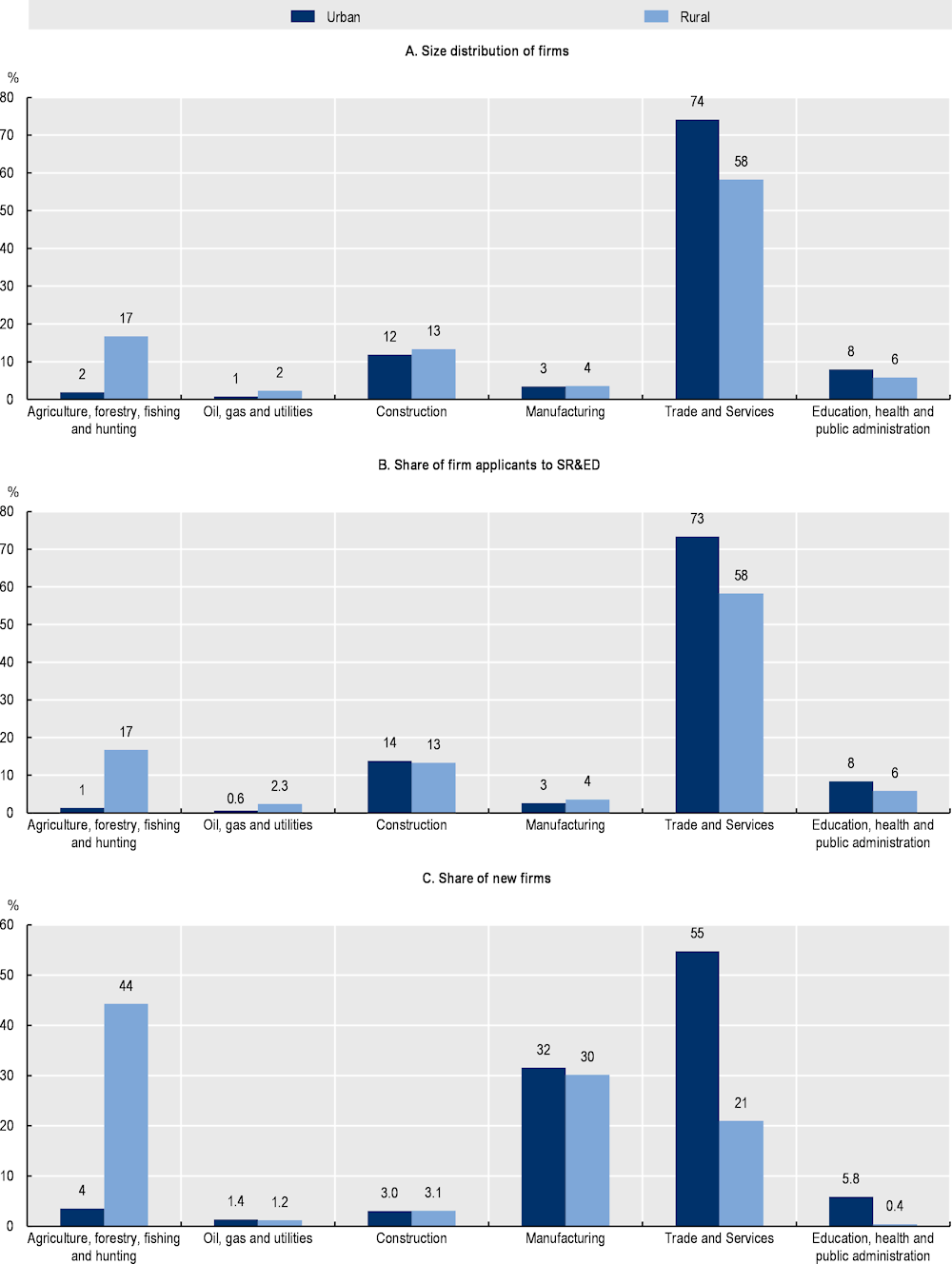

Sectoral activity

In rural areas of Canada, 44% of firms that participate in R&D are in the primary sector (agriculture, forestry, fishing and hunting) (Figure 2.6). In comparison, only 4% of firms in urban areas innovate in the primary sector. In fact, over half of the firms that participate in formal R&D in urban areas are in the trade and services sector. Manufacturing firms in urban and rural areas account for slightly less than a third of innovating firms. For rural areas, the third-largest sector of firms’ innovative activities is the trade and services sector.

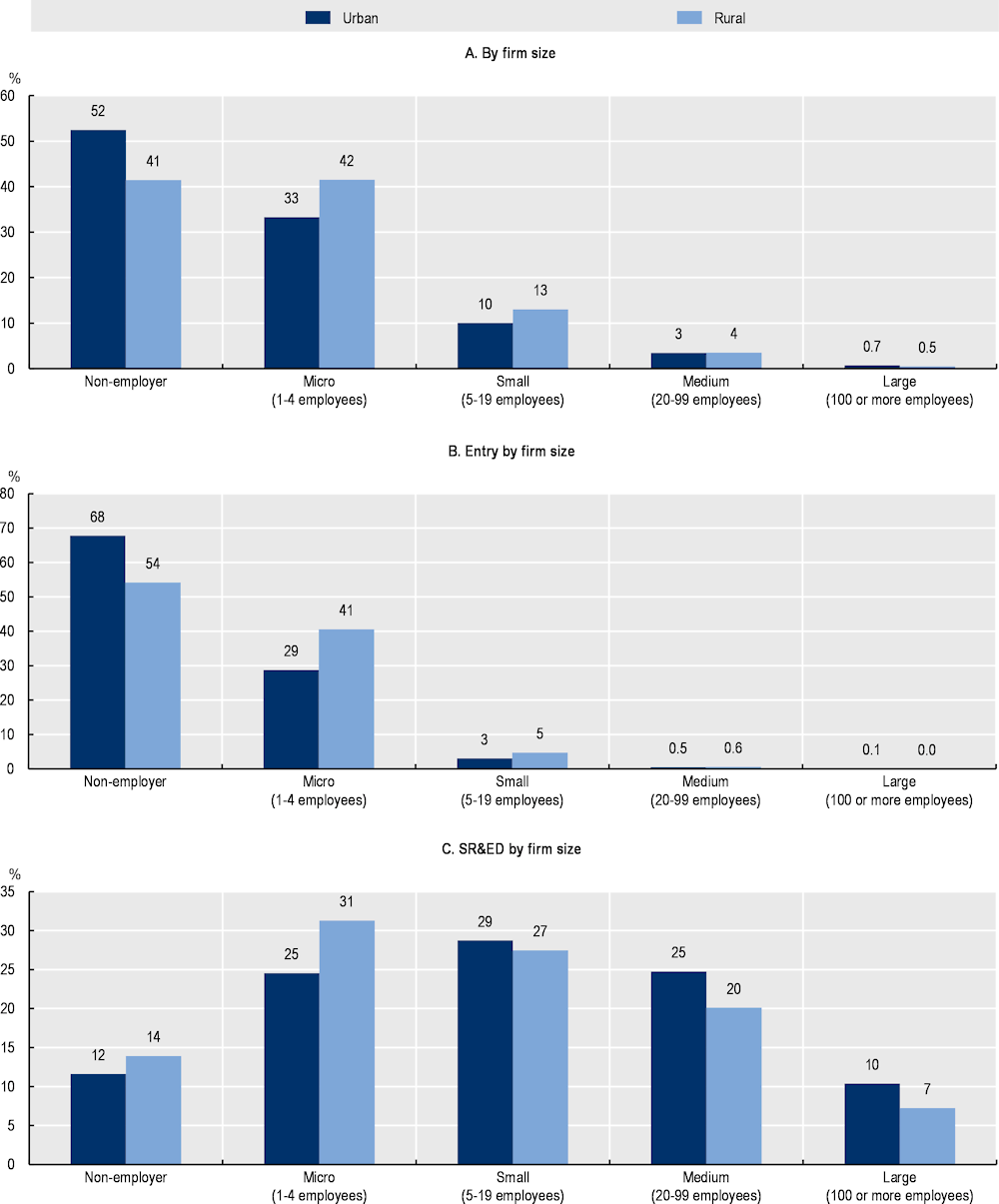

Figure 2.6. Size distribution of firms, innovation and new firm formation

Size distribution of firms, firm entry and SR&ED applicants in Canada, by sector and geography, 2010-19

Source: OECD analysis based on Statistics Canada (2022[31]) Canadian Employer Employee Dynamics Database (CEEDD), https://www.statcan.gc.ca/en/statistical-programs/document/5228_D1_V1 (accessed on 15 July 2023).

The rural trade and services sector is lagging in terms of innovation despite accounting for the largest share of firms. For example, the trade and services sector accounts for 58% of total firms and new firms but only 21% of innovating firms (Figure 2.6). As compared to urban areas, it accounts for 74% of total firms, 73% of new firms and 55% of innovating firms. On the other hand, the primary (agricultural sector) is highly innovative in rural areas, accounting for the highest share of innovating firms (44%) and 17% of both total and new firms.

Excluding the relatively large public sector, the top three industries in terms of employment size are wholesale retail and trade, manufacturing and construction20 (Annex Figure 2.A.6, Panel A). Agriculture alone is still relatively important, accounting for 7% of total employment in rural areas, but is surpassed by wholesale retail and trade services (13%) and manufacturing (11%) sectoral activities. Though relatively important for developing an ecosystem of support services, professional, scientific and technical services are relatively low in rural areas, at 4%, compared to 9% in urban areas. The public sector21 plays an important role in terms of employment in rural and urban areas of Canada, with 25% of rural employment and 26% of urban employment. This share of employment is relatively similar to the public employment rates for OECD countries (OECD, 2021[32]).22

In rural areas, employment fell by 6% from December 2011 to December 2019 and by twice as much (12%) including employment figures for the first year of the COVID-19 pandemic in 2020. In comparison, urban areas saw a 14% growth in employment, which only fell slightly to 11% in the first year of the pandemic.

The services sectors observed the largest growth in both rural and urban areas. However, despite this growth, during the pandemic, there was less growth in information, culture and recreation services in rural areas, while the transport and storage sector observed losses in urban areas. In rural areas, there were only four sectors that grew in terms of employment from 2011 to 2020 and they were primarily in the services sector. These included education (11.5%), professional services (5%), utilities (3%) and public administration (2%). Looking at growth the year before the crisis (2019) indicates that there was still growth in several services sectors, but it additionally included the information, cultures and recreation sectors and other services. In comparison, in urban areas, the majority of sectors saw growth from 2011 to 2020, with the strongest in professional services (28%), education (24%), finance, insurance and real estate (24%) and healthcare (22%). Excluding 2020, growth from 2011 to 2019 was similarly strong in these service sectors but also included the transport and storage sector. The highest growing sectors from 2011 to 2019 were transport and storage (24%), healthcare (23%), professional services (23%), finance, insurance and real estate (21%) and education services (21%).

Despite some growth in a few goods and services sectors, the aggregate trends in the goods-producing sector fell by close to 8% from 2011 to 2019, while the service-producing sector fell by 5% (Annex Figure 2.A.6).

Both goods and services sectors fell further to 12%, from 2011 to 2020. In comparison, in urban areas, both goods and service-producing sectors grew. In urban areas, there was an 8% growth in the aggregate goods sector from 2011 to 2019, which fell 1 percentage point the following year, and a 15% growth from 2011 to 2019 in the services sector, which fell 3 percentage points the following year, in 2020. The weight of the goods-producing sector,23 often associated with industries in the tradeable sector such as manufacturing24 and agriculture, is relatively more important in rural than in urban areas.

Size of firms

Most firms are micro in rural Canada. Between 2010 and 2019, 85% of firms in rural Canada were micro, with fewer than five employees, or non-employer firms (Figure 2.7, Panel A). This is a common finding in most rural areas that tend to have a cluster of small-sized firms rather than large firms (OECD, 2023[30]; 2022[33]). In comparison, 83% of firms in urban areas were micro or non-employer firms. As such, this finding is relatively consistent with other country studies. Of the share of small firms, there are fewer self-employed individuals (non-employer firms) in rural areas (41%) than in urban ones (52%). There is a higher share of micro and small firms among firms with employees than in urban areas.

Figure 2.7. Size distribution of firms, innovation and new firm formation

Size distribution of firms, firm entry and SR&ED applicants in Canada, by geography, 2010-19

Source: OECD analysis based on Statistics Canada (2022[31]) Canadian Employer Employee Dynamics Database (CEEDD), https://www.statcan.gc.ca/en/statistical-programs/document/5228_D1_V1 (accessed on 15 July 2023).

There tends to be a higher share of micro and small firms (fewer than five workers) that innovate in rural rather than urban areas. The share of firms participating in formal R&D processes in rural areas tends to be micro (31% for micro firms with 1-4 workers) or small (27% for small firms with 5-19 workers) (Figure 2.7, Panel B). In comparison, in urban areas, the largest share of firms that participate in formal R&D processes are small firms (29% for small firms with 5-19 workers), followed by medium-sized firms (25% for medium‑sized firms with 20-99 workers) and micro firms (25% for medium-sized firms with 1-4 workers).

Lastly, the formation of new firms follows a different pattern in rural and urban areas. While there are more non-employer firms in urban areas, there is a larger share of firms with at least one employee in rural areas. For instance, the share of new firms created with no employers is high in both rural and urban areas but higher in urban areas (68%) than in rural areas (54%). Relative to urban areas, rural areas have more new firms that have between 1 to 4 employees (41% in rural areas and 29% in urban areas) and more new firms that have 5 or more employees (5.6% of all new firm formation in rural areas and 3.6% of all new firm formation in urban areas).

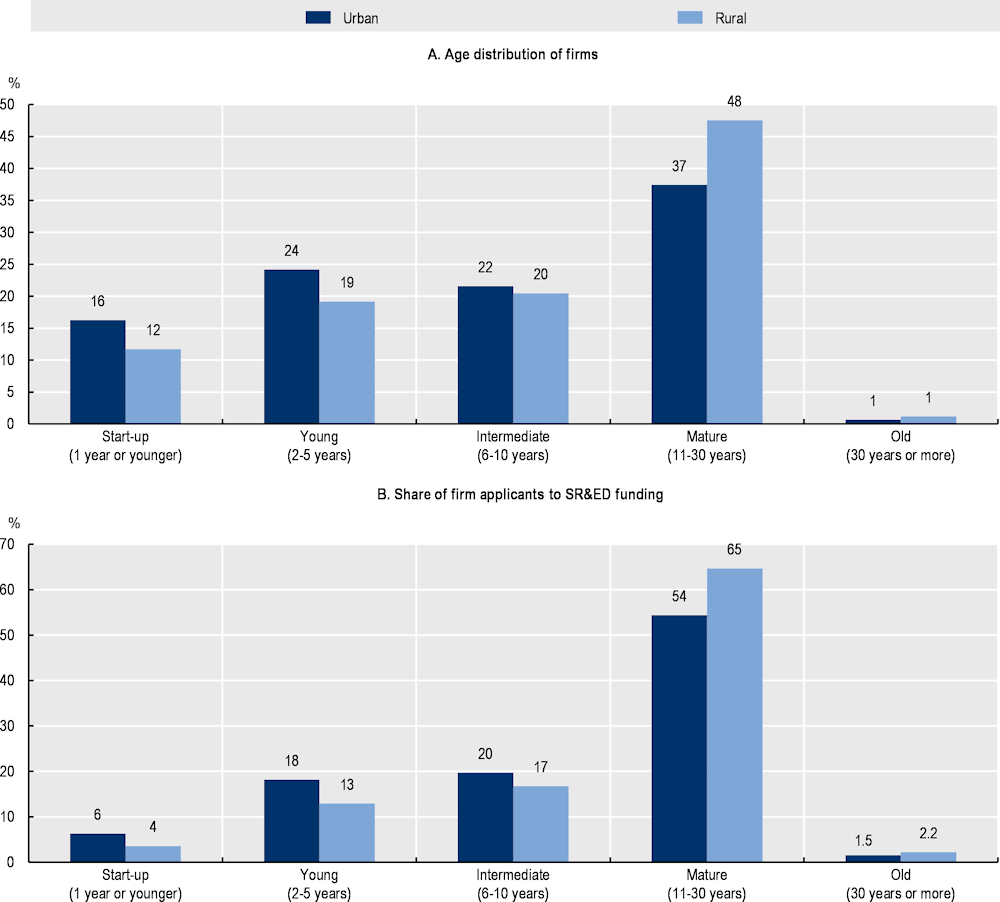

Age of firms

Firm churning (the entry and exit, or openings and closings of firms) is often associated with dynamic and healthy innovative environments. However, too many barriers for young firms can lead to limited opportunities for scale-up, while too little competition can also mean that firms remain in the market past the optimal due date, removing resources from otherwise more innovative and younger firms.

Firms in rural Canada are older than those in urban areas. Close to half of all firms in rural Canada have operated for more than ten years. Rural Canada has a larger share of mature (11-30 years) and old (30 years or more) firms over the 2005-19 period than urban areas (Figure 2.8). In rural areas, 48% of all firms are between 11 and 20 years old, compared to 37% in urban areas%. There is a higher share of start-ups in urban areas (16%) compared to rural areas (12%) and a higher share of young firms (between 2 to 5 years of age) in urban areas (24%) as compared to rural ones (19%).25

Firms that participate in innovation activities in rural areas tend to be older than those in urban areas. Among firms that have applied for an R&D tax incentive programme, the largest share has been operating for at least 11 years (corresponding to the age groups in Figure 2.8 of 11-30 and 30 and more). In rural areas, 67.2% of firms participating in formal innovation activities were mature or old, while this number was lower in urban areas (55.5%). In urban areas, larger shares of younger firms demonstrate R&D-related investment activities than those in rural areas. There are more start-ups (1 or younger), young (2-5 years of age) and intermediate (6-10 years of age) firms in urban areas that participate in formal innovation than in rural areas.

Connected firms and entrepreneurs

No inventor is an island. Networks between individuals matter for innovation and, in particular, for new entrepreneurs (Diemer and Regan, 2022[34]). Innovation can occur through import and export competition as well as through networks of entrepreneurs (Shu and Steinwender, 2019[35]; Guadalupe, Kuzmina and Thomas, 2012[36]; Baldwin, 2004[37]). Foreign owners may provide diverse ideas and opportunities to firms that may otherwise be more difficult, leading to new innovative products and processes. For example, a study on Spanish manufacturing firms found that multinational companies with foreign networks conduct more product and process innovation (simultaneously adopting new machines and organisational practices) and adopt foreign technologies, leading to higher productivity (Guadalupe, Kuzmina and Thomas, 2012[36]).

Figure 2.8. There is a larger share of older firms in rural areas

Age distribution of firms and SR&ED applicants in Canada, by geography, 2010-19

Note: Categories represent average annual counts of firms by age group.

Source: OECD analysis based on Statistics Canada (2022[31]) Canadian Employer Employee Dynamics Database (CEEDD), https://www.statcan.gc.ca/en/statistical-programs/document/5228_D1_V1 (accessed on 15 July 2023).

However, not all firms have equal access to networks in rural areas. One reason for this is the lack of quality communications infrastructure (OECD, 2022[38]). For example, metropolitan regions in Canada have 40% higher broadband download speeds than the OECD average, while regions far from metropolitan areas have 4% slower speeds than the OECD average. This creates a gap of 44% between metropolitan regions and non‑metropolitan remote regions, as compared to the OECD average speeds of Internet access. In comparison, speeds in the United States are higher than OECD averages for both metropolitan and remote regions, but the gap between metropolitan and remote regions is close to half of the gap observed in Canada. Similarly, not all people in places have the right skills for the digital economy (OECD, 2021[39]).

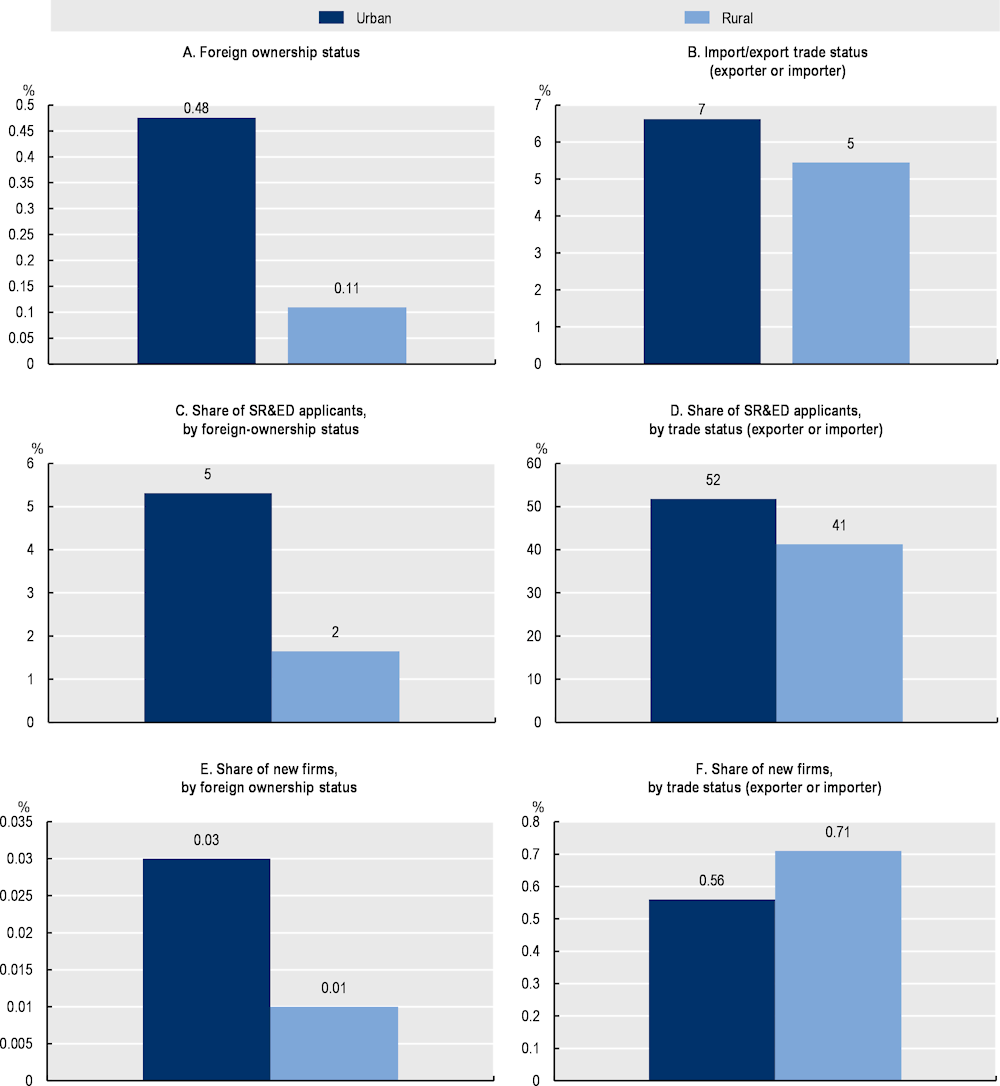

International linkages through foreign ownership

In Canada, foreign ownership has been associated with more intensive use of advanced technology and business practices (Galindo-Rueda, Verger and Ouellet, 2020[29]). However, in rural Canada, a very small share of firms is owned by foreigners and the share is larger in urban than in rural areas (Figure 2.9, Panel A). The share of foreign ownership in urban areas is 0.48%, while it is almost a fifth of the size, 0.11%, in rural areas. While, in part, this may be due to the cluster of firms and larger population centres near the border with the United States, it does suggest that access to international markets is a challenge for firms in rural areas.

Figure 2.9. Ownership and trade status of firms

Share of firms, new firm entry and SR&ED applicant firms in Canada, by foreign or trade status and geography

Note: Foreign ownership refers to firms with at least 10% of owners holding a foreign nationality. Trade status refers to firms that participate in either import or export markets.

Source: OECD analysis based on Statistics Canada (2022[31]) Canadian Employer Employee Dynamics Database (CEEDD), https://www.statcan.gc.ca/en/statistical-programs/document/5228_D1_V1 (accessed on 15 July 2023).

Evidence suggests that firms with foreign ownership are more likely to participate in formal R&D activities. Despite having only 0.11% of total firms in rural areas, foreign firms account for 2% of total firms that apply for the R&D tax incentive programme (Figure 2.9, Panel C). While this is relatively high, it is less than half the share of foreign firms applying for R&D tax incentive programmes in urban areas (5%). The start-up patterns for firms with foreign ownership are similar (Figure 2.9, Panel E). There are 0.01% of new firms in rural areas that have some foreign ownership in the first year but this is less than half (0.03%) of the share in urban areas.

International linkages through trade

Linkage with external firms and markets is a critical factor in overcoming the barriers to distance rural firms perceive for both import and export goods. The possibility of trade can increase incentives for innovation and innovation-induced growth. In a recent report by the OECD, regions that were identified as “catching up” (at least 5 percentage point growth more than the national average over a 14-year period of time) had the highest share of gross value added from the tradeable sector,26 despite the fact that they do not necessarily contribute to an increase of employment (OECD, 2018[40]). Productivity growth is, in general, positively impacted by foreign market exposure (Melitz, 2003[41]; Baldwin, 2004[37]). Baldwin (2004[37]) found that a reduction of tariffs increased the adoption of new technologies, investment in R&D and the proliferation of innovation in firms.27 Rural firms that can develop supply chain linkages with external customers have larger incentives to innovate and additional avenues to adopt innovation through exchanges within global value chains (Crescenzi and Harman, 2023[42]). However, strategies for exporting and innovation differ by regional attributes. For example, findings from research in Quebec suggest that exports in the knowledge-intensive business sector differ across space (Doloreux, Shearmur and Van Assche, 2018[43]).

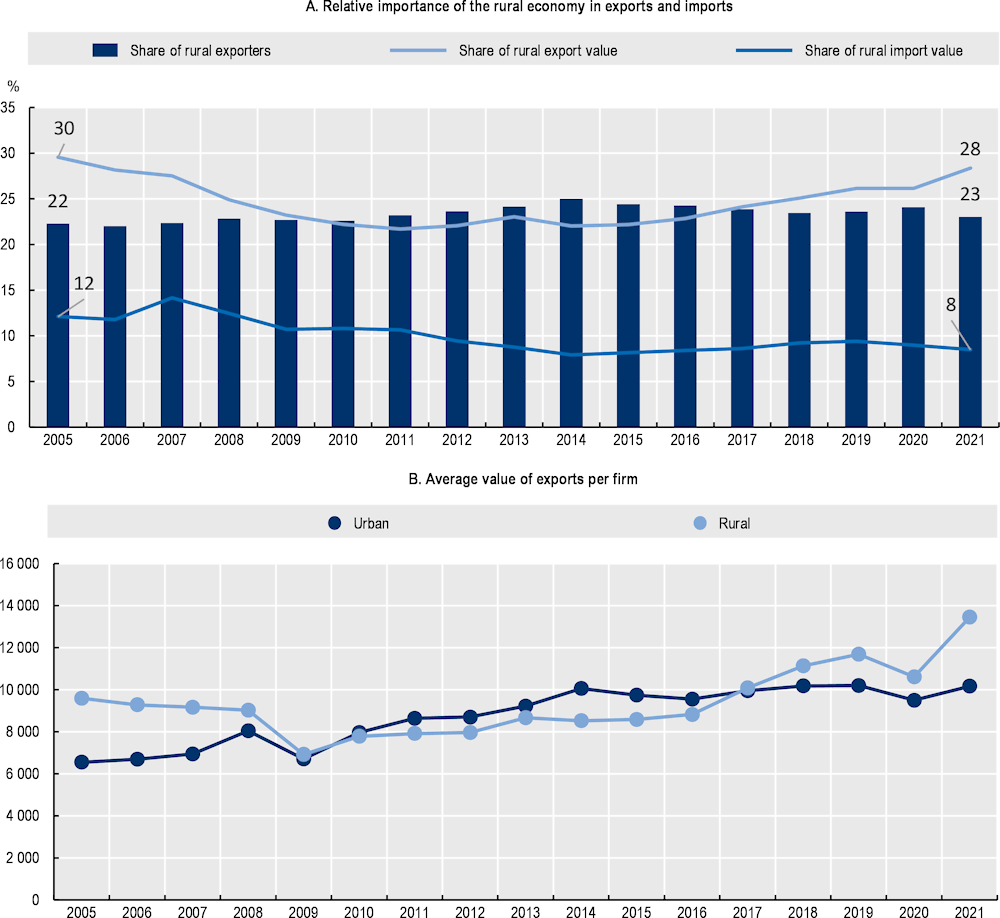

A remarkable 41% of firms in rural areas that applied for tax incentive programmes related to formal R&D investment participated in global value chains and markets through either imports or exports (Figure 2.10). While this number was higher in urban areas (52%), participating in the global supply chain is a strong characteristic of firms that innovate in Canada. This is surprising as only 5% of rural firms participate in trade compared to 7% of urban firms, which is a smaller gap than observed in the foreign ownership analysis. Furthermore, a larger share of new firms in rural areas (0.71%) participate in global supply chains than in urban areas (0.56%). While comparative data are not available, studies from the United Kingdom also find that there is a marginally higher proportion of firms in urban areas that export than those in rural areas, despite the fact that non-family-owned firms in sparse, dispersed rural areas were more likely to export (Mole et al., 2022[44]).

Rural firms are increasingly exporting products but insourcing process goods from Canada. In Canada, most of the firms that export are in urban areas. In 2021, only 23% of firms that exported were in rural areas and 77% in urban areas (Figure 2.10). With less than a quarter of all exporting firms in rural areas, the share of value of exports is relatively high, at 28% against 72% in urban areas.28 The value of rural exports has been rising steadily since the beginning of the last decade, while imports fell. At its lowest, rural areas contributed to only 22% of total export value roughly all years from 2010 to 2015, until reaching 28% in 2021. At the same time, rural firms were less connected to international value chains, importing less in terms of value in 2021 than two decades prior. The share of total Canadian imports attributed to rural firms came down from 12% to 8% of total aggregate Canadian import values.

Figure 2.10. Growth in rural exports but not in exporting firms

Note: The rural economy is measured as all non-CMAs as a whole. Relative importance measures the rural economy as a share of the total economy in respective activities. Panel B figures are in thousands of CAD.

Source: Statistics Canada Tables 12-10-0137-01 (exports) and 12-10-0131-01 (imports), https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1210013701 and https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1210013101.

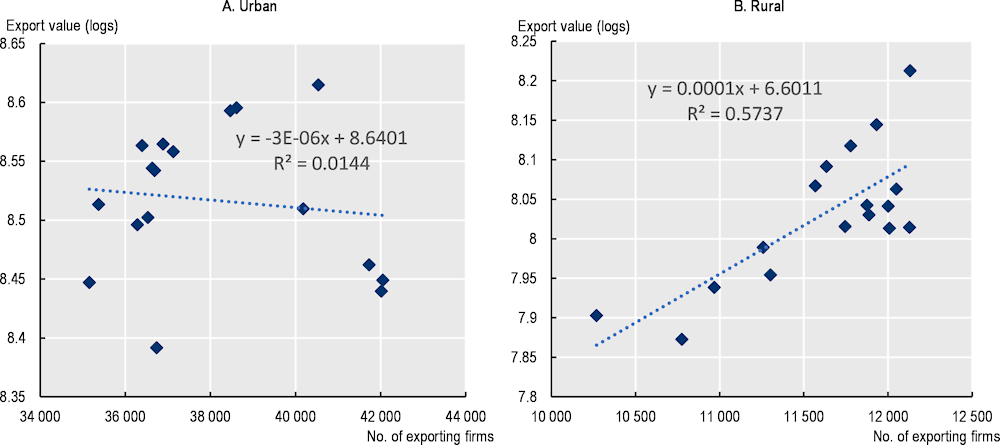

The monetary returns to export activity are stronger in rural areas than in urban areas (Figure 2.11). Even though most firms that export are in urban areas, the returns to an additional exporting firm are negative and relatively spurious in urban areas. However, one additional exporter in rural areas is associated with a 0.01% increase in export values. As such, the marginal return of supporting one additional firm to enter the export market is more clearly associated with positive and significant gains in export value and, by extension, productivity growth. While it is unclear whether firms that export are already more innovative or if, through exports, firms become more innovative, it is likely that both directions of causation are simultaneously creating benefits for rural areas. Furthermore, more analysis should be carried out to exclude the effect of sectors, such as the oil and gas industry, on the average firm. It gives cause to support a place-based approach to export support programmes.

Figure 2.11. Correlation between export value and number of exporters

Two-way correlations between export values (logs) and the number of exporting firms, by geography, 2005-21

Note: The rural economy is measured as all non-CMAs as a whole. Relative importance measures the rural economy as a share of the total economy in respective activities. Each data point refers to the average shares per year for each year from 2005 to 2021 for urban and rural areas.

Source: Statistics Canada Tables 12-10-0137-01, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1210013701.

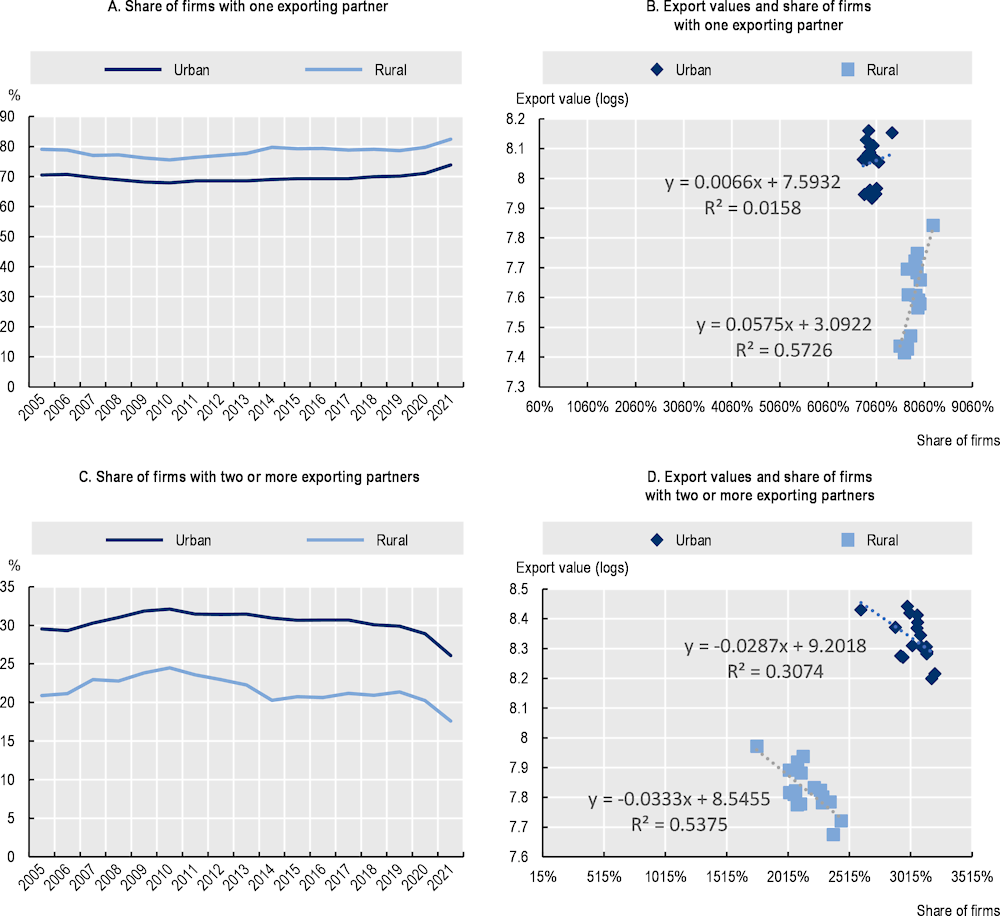

Export gains are substantial and large for rural firms with only one export partner country (Figure 2.12). In rural Canada, close to 82% of firms have only 1 export partner country, as compared to 74% in urban areas. In urban areas, 26% of firms have more than 1 trading partner, whereas in rural areas, the share is lower, at 18%. Increasing the share of firms exporting by 1% is associated with a close to sixfold increase in export values in rural areas and explains quite a strong share (57% of the variation) of the outcome for export values. As in the previous figure, the non-linear relationship between returns, trade and geography is reinforced, as the relationship is less positive and has a lower explanatory power in urban areas. In addition, there are decreasing returns to gains in export partners in both rural and urban areas. While the decrease is relatively less convincing in urban areas, they are particularly important in rural areas, suggesting that the type of firm that exports to multiple export partners may sell products at lower prices than those that focus their export markets in one country. This is in line with the literature that finds heterogeneous results between firms with different levels of productivity (Shu and Steinwender, 2019[35]).

Critically, for governments, the analysis provides ample evidence for the importance of helping rural firms reach at least their first export partner. In a recent randomised controlled experiment for small and medium sized enterprises in six Western Balkan countries, live group training and remote counselling were helpful in overcoming constraints in accessing overseas clients (Cusolito, Darova and McKenzie, 2022[45]). The firms that received the training and counselling services were taught techniques such as search engine optimisation and improved social media content to increase digital presence, with positive and significant impacts on the number of new clients and increased export sales. In part, this was because of a combination of sector-specific advice on market expansion and increased confidence in trying new sales strategies.

Figure 2.12. Marginal returns to exports decrease for rural firms with multiple export partners

Share of firms and export values, by number of exporting partners and geography, 2005-21

Note: The rural economy is measured as all non-CMAs as a whole. Relative importance measures the rural economy as a share of the total economy in respective activities. Each data point refers to the average shares per year for each year from 2005 to 2021 for urban and rural areas.

Source: Statistics Canada Tables 12-10-0137-01, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1210013701.

Individual characteristics as drivers of innovation

The structure of the labour force in rural areas can have substantial impacts on opportunities for innovation in rural areas. Given that innovation in rural regions is often more user-based (either directly, through solutions, or through partnerships) and incremental, the characteristics of individuals in rural areas become particularly important. For example, chief executive officers who gain general managerial skills are more likely to produce more innovation (patents) in their firms (Custódio, Ferreira and Matos, 2019[46]), while manufacturing firms that have more technical skills are more likely to produce more R&D collaborations and product or process innovation (Leiponen, 2005[47]). The incremental nature of most innovations suggests that there is a more substantial role for the development of the broader workforce on innovation and productivity. This can create the “total package” needed for new innovations and new firm activities and includes the quality of post-secondary education as well as vocational educational skills (Toner, 2011[48]).

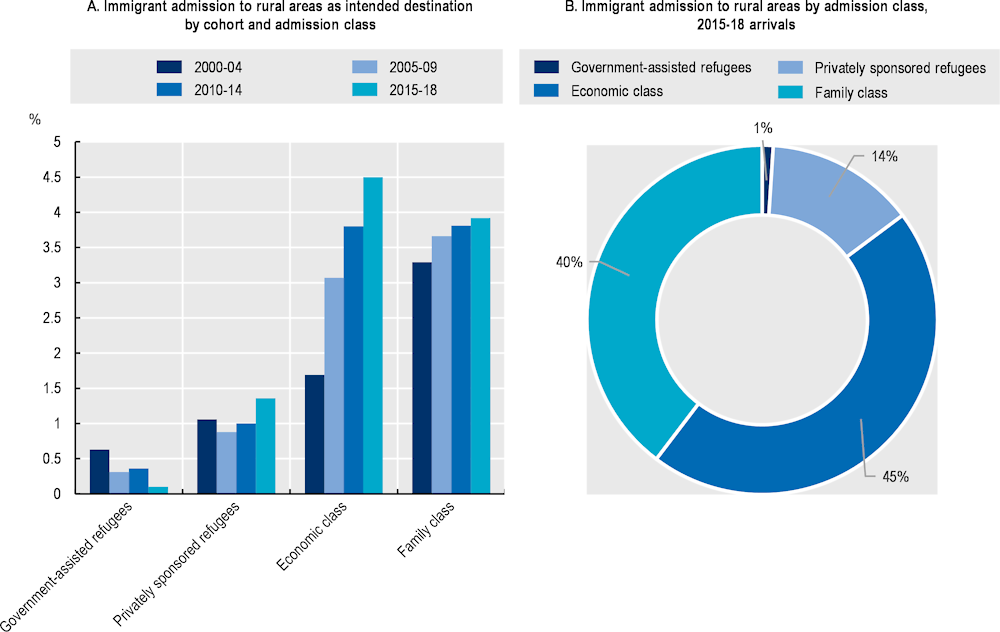

However, individuals in rural areas of Canada may suffer from challenges in terms of ease of access to quality training and education opportunities, leading to less diversity of skills in rural areas for innovation, as observed in other OECD countries (OECD, 2022[7]). This challenge is exacerbated by demographic trends in ageing and the decline of populations in rural areas. Results from the 2021 census indicated that populations outside of urban centres are growing slower and ageing faster than in urban areas. Rural areas have a larger portion of people aged 65 and older (23.2%) than urban areas (18.2%); rural areas also have fewer working-age (15-64 year-old) people than urban centres (60.1% compared with 65.7%) (Statistics Canada, 2022[49]). In Canada, immigration is used as a policy tool to counteract some of this demographic change (Statistics Canada, 2022[49]). However, immigrants rarely go to rural areas of Canada but are often clustered in major cities (Statistics Canada, 2022[1]).

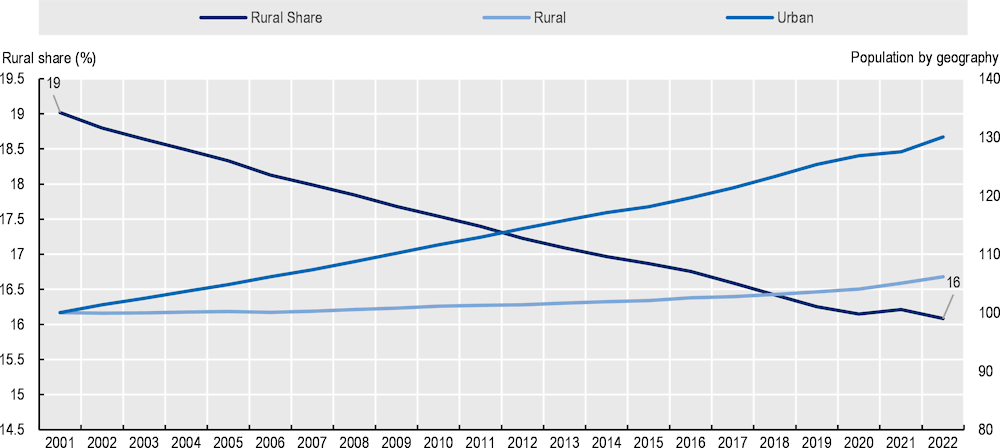

Population demographics in rural areas

Fewer than one in five Canadians live in rural areas. Although there is a 5% growth in the number of rural inhabitants in 2021, as compared to 2001 (Figure 2.13), rural population growth is still lagging significantly behind its urban counterparts. This is resulting in a shrinking share of rural populations due to the faster urban population growth. The trend is a continuation of previous trends, where from 1966 to 2006, rural areas lost about 2 million inhabitants (Reimer and Bollman, 2010[50]), which is reflected in net migration changes between rural and urban areas. The closer a rural community is to a metropolitan agglomeration, the higher the rate of population growth. Within a radius of 25 km, the population grew by a rate of 25%, while within 100 km to 149 km, the population grew by roughly 2% from 1981 to 2001 (Reimer and Bollman, 2010[50]). The observed population decline can have a multitude of impacts on how communities function and deliver services to support innovation in rural areas.

Figure 2.13. There is a growing gap in population between rural and urban areas

Note: The rural areas are defined as all non-CMAs/CAs, whereas the urban economy measures all CMAs/CAs. Population estimates are based on the Standard Geographical Classification (SGC) 2016 as delineated in the 2016 census. Population estimates as of 1 July are final intercensal up to 2015, final postcensal for 2016 to 2020, updated postcensal for 2021 and preliminary postcensal for 2022.

Source: Statistics Canada (n.d.[25]), Population Estimates, July 1, by CMA and CA, 2016 Boundaries, Table 17-10-0135-01, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710013501.

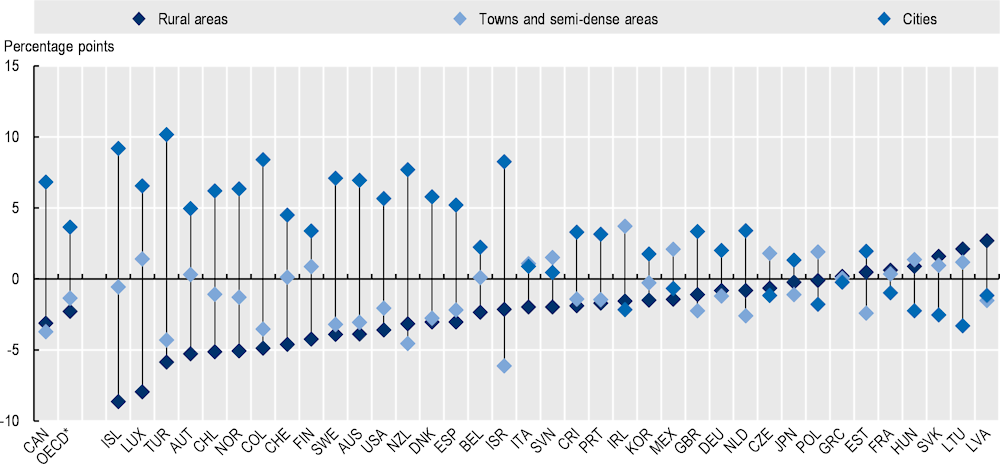

The loss of the relative share of the rural population is rather strong in Canada, even though it is not unique among OECD countries. On average, between 2000 and 2020, 31 of 38 OECD member countries demonstrated a demographic decline in rural areas (Figure 2.14). Cities in OECD countries observed a gain of 3.6-point shares of the population, while rural areas saw a 2.3-point share decline. Canada observed a growth of 6.8-point shares in cities, a decline of 3.1-point shares in rural areas and a decline of 3.7-point shares in suburbs and towns. In comparison, 2 other large and substantially rural OECD countries, Australia and the United States, observed gains of 6.9-point shares and 5.6-point shares in cities and reductions in rural areas of around 3.8-point shares and 3.6-point shares respectively. On average, in the OECD, changes in the total share of the population were less stark. In the OECD, on average, there was a slower growth of 3.6 in urban areas and a smaller decline of 2.3 in rural areas from 2000 to 2020 (OECD, 2022[38]).29

Figure 2.14. Changes in population shares, 2000-20

Change in the share of the population by type of area over the total population

Note: * The reported OECD average is the change in the share of the total OECD population in each of the 3 degree of urbanisation categories from 2000 to 2020. Estimates that were weighted for population in the first year (2000) demonstrated similar changes. The only exception was in cities that grew 0.3 percentage points less when weighted by population in the first year. Estimates in rural areas were the same as the second decimal point.

Source: Based on data from OECD (2022[38]), OECD Regions and Cities at a Glance 2022, https://doi.org/10.1787/14108660-en; updates using the most recent Global Human Settlement Layer release (R2023A), https://ghsl.jrc.ec.europa.eu/ghs_smod2023.php.

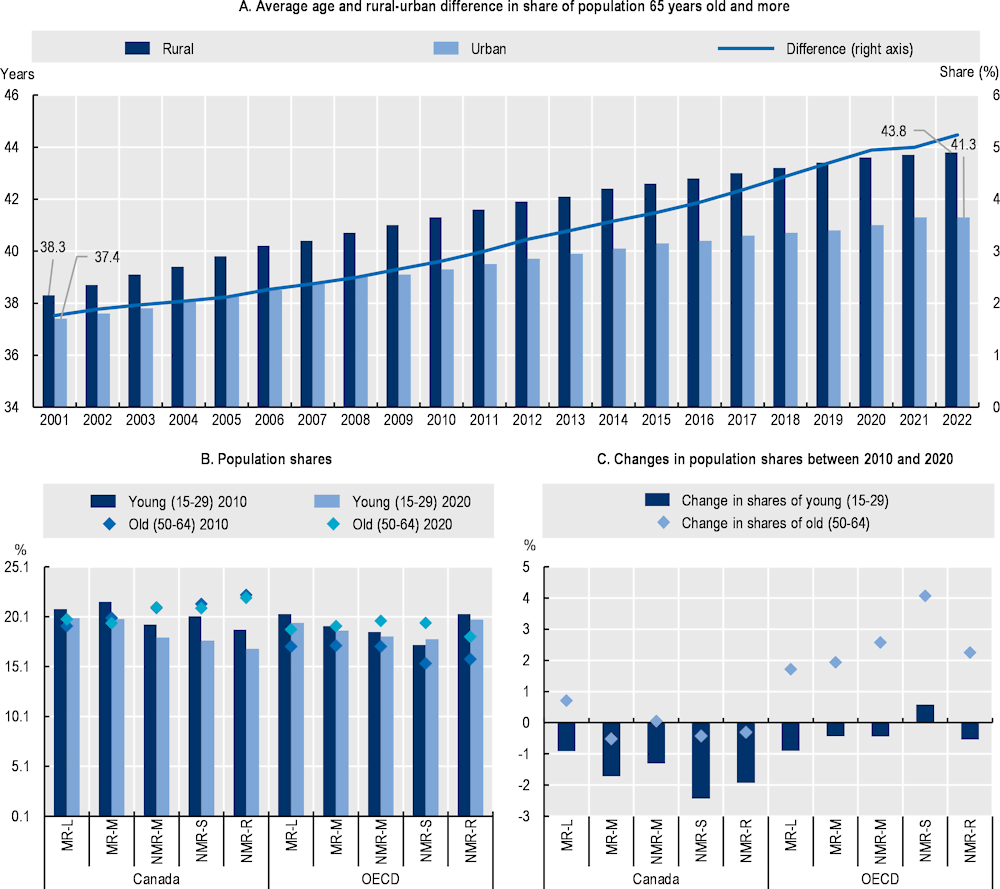

In addition to population decline, rural Canada is ageing. Rural areas of Canada have a higher share of the population over 65 years of age than urban areas. In 2001, the average age in rural areas was 38.3, as compared to 37.4 in urban areas (Figure 2.15, Panel A, left-hand axis). In 2022, the population’s average age in rural areas grew to 43.8, while it reached 41.3 in urban areas. Furthermore, at the age of statutory retirement, the older population has also risen. In 2001, there was a 2% difference between the share of individuals over 65 in rural areas compared to urban areas (Figure 2.15, Panel A, right-hand axis). In 2022, the difference in the population over 65 grew to 5%.

However, much of the observed ageing has to do with fewer younger working-age individuals. Age demographics among younger and older working-age populations are also shifting. Using internationally comparative data on small regions, we observe the demographic change that is more strongly determined by changes in the share of young working-age individuals than older working-age individuals. In 2010, the share of younger individuals (15-29) in all non-metropolitan regions was relatively similar in Canada (19.1%) and the OECD (18.7%) (Figure 2.15, Panel B, left-hand axis).

Figure 2.15. Society is ageing faster in rural areas than in urban areas

Canadian shares in population 65 years old and more and population shares, by young (15-19) and old (50-64) in 2010 and 2020

Note: Panel A: The rural areas are defined as all non-CMAs/CAs, whereas the urban economy measures all CMAs/CAs. Population estimates are based on the SGC 2016 as delineated in the 2016 census. Population estimates as of 1 July are final intercensal up to 2015, final postcensal for 2016 to 2020, updated postcensal for 2021 and preliminary postcensal for 2022. The age is as of 1 July. Panel B: Share of young individuals includes those aged 15-29. The share of old individuals includes those 50 to 64 years of age. Age categories are depicted as a share of the total population. Changes in population shares are depicted as level differences in shares calculated as the last year (2020) minus the first year (2010).

Source: Panel A: Statistics Canada (n.d.[25]), Population Estimates, July 1, by CMA and CA, 2016 Boundaries, Table 17-10-0135-01, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710013501; Panel B: OECD (n.d.[51]), Regional Statistics (database), https://www.oecd.org/regional/regional-statistics/.