Taxes are the primary source of government revenue, playing a crucial role in funding essential public services like healthcare, education, infrastructure and defence. Determining the optimal level of taxation and associated government expenditure is a key question of fiscal policy. Well-designed taxes promote a fair distribution of the financial burden among citizens and contribute to economic stability. However, high taxation levels can discourage investment and hamper economic growth.

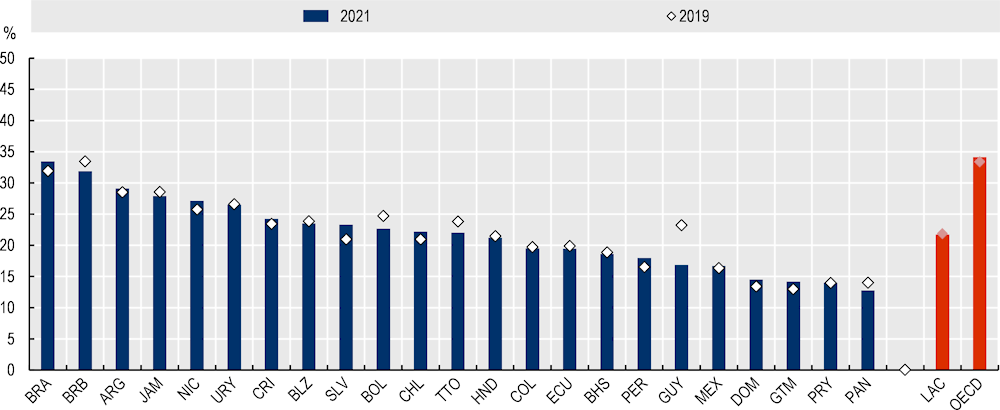

In Latin American and Caribbean (LAC) countries, tax revenues averaged 21.7% of gross domestic product (GDP) in 2021, which is lower than the OECD average of 34.2% in the same year. However, there are wide variations between countries. Brazil (33.5%) and Barbados (31.9%) had the highest tax ratios among LAC countries, followed by Argentina (29.1%) and Jamaica (27.9%). At the other end of the spectrum, Panama (12.7%), Paraguay (14.0%), Guatemala (14.2%) and the Dominican Republic (14.5%) all have comparatively low tax ratios (Figure 10.4). Between 2019 and 2021, tax revenues as a share of GDP have on average remained generally stable in the LAC while it increased slightly in OECD countries. Nonetheless, there were notable differences among LAC countries. Guyana saw tax revenues as a share of GDP fall of 6.4 percentage points (p.p.), attributed to a period of record-breaking GDP growth driven by its nascent and rapidly expanding crude oil production, amounting to 20.1% in 2021 and over 60% in 2022, in real terms (IMF WEO, 2023). This growth was accompanied by several generous tax cuts. Bolivia (-2.1 p.p.) also experienced falling tax revenues relative to its GDP, owing to a slowdown of the economy. In contrast, El Salvador increased its tax revenues as share of GDP in 2021 by 2.4 p.p. and Brazil by 1.5 p.p., the latter primarily driven by higher revenues from corporate income taxes and taxes on goods and services, coupled with increased royalties from oil production (Figure 10.4).

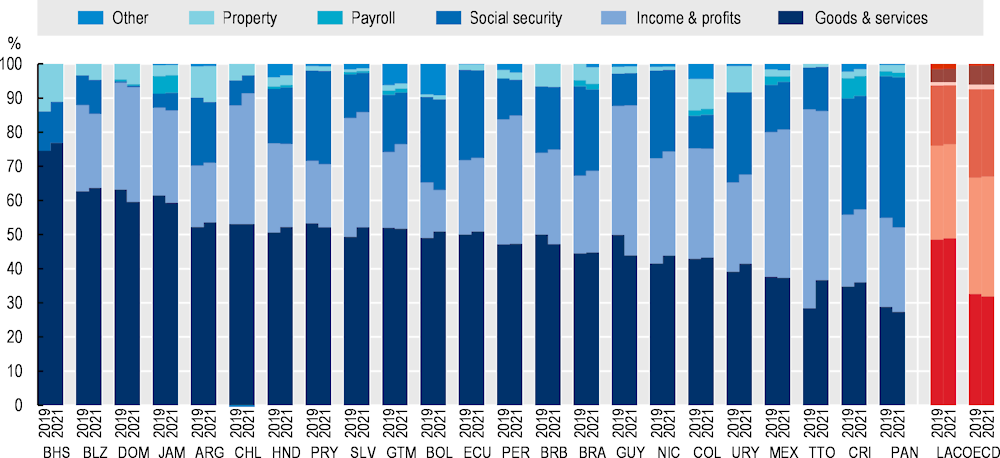

Government tax revenues typically come from three main sources: taxes on income and profits (accounting for an average of 27.6% of government revenue across LAC countries), taxes on goods and services (48.9%), and social security contributions (17.3%). These three sources collectively account for at least 85% of tax revenue in every LAC country, although the specific composition varies. LAC countries tend to be more reliant than OECD ones on tax revenues from goods and services, which account for almost half of all tax revenues, compared to less than one-third on average across OECD countries (31.9%). There are also significant differences between LAC countries. Notably, four Caribbean countries with large tourism sectors, the Bahamas (76.9%), Belize (63.7%), the Dominican Republic (59.5%) and Jamaica (59.29%), rely heavily on taxes on goods and services. In contrast, Trinidad and Tobago (49.5%) and Mexico (43.5%) derive the largest portion of their tax revenues from taxes on income and profits. Although social security is the smallest of the three sources of revenue, it plays a significant role in Panama (44.0%), which is the LAC country with the lowest tax ratio. Beyond these primary revenue sources, property tax makes up an important share in the Bahamas (11.1%) and Argentina (10.5%) (Figure 10.5).