Although decentralised finance markets at their current stage expose investors to significant risks, concepts derived by DeFi protocols and regulated/compliant digital assets could potentially become a relevant part of the financial system at the institutional (i.e. non-retail) level in the future. Technologies and mechanisms associated with decentralised finance that may need to be further explored could potentially produce efficiencies and drive productivity gains in financial markets by improving the effectiveness and safety of trading and settlement at the infrastructure level (OECD, 2020[24]). These include atomic or programmable settlement of securities and payments at the post-trade, with the possibility for seamless delivery versus payment (DvP) or payment versus payment (PvP), increased automation and corresponding efficiency gains and enhanced transparency, as well as increased use of automation and programmability as is the case with smart contracts functionalities.

Policymakers are considering ways to allow for safe and responsible innovation, anticipating and addressing emerging risks for participants and markets. Technical level experimentation is already taking place with innovative pilots involving public-private co-operation, with the participation of traditional and decentralised finance entities. Project Mariana, for example, is a proof of concept launched by the Bank of International Settlements (BIS) Innovation Hub together with the Banque de France, Monetary Authority of Singapore and Swiss National Bank in co-operation with DeFi protocols, and explores the use of Automated Market Makers (AMMs) such as those deployed by DEXs in foreign exchange markets using CBDCs (BIS Innovation Hubs, 2023[30]). Project Guardian is a collaborative initiative led by the Monetary Authority of Singapore and with the participation of other regulators such as the Financial Services Agency of Japan, which seeks to test the feasibility of applications in asset tokenisation and DeFi while managing risks to financial stability and integrity (MAS, 2022[31]; FSA, 2023[32]).

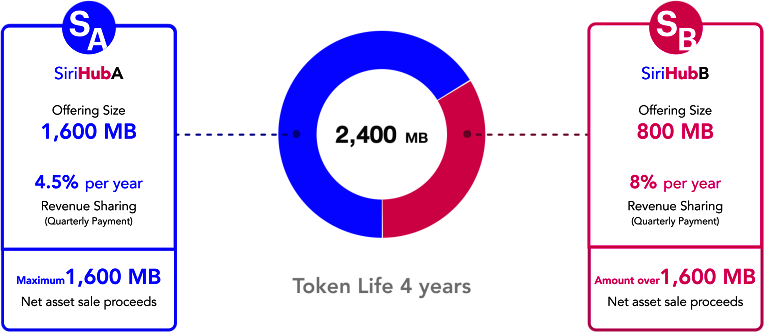

The tokenisation of assets is indeed one of the most promising applications of DLTs in finance with numerous potential benefits (OECD, 2020[24]). It involves the digital representation of rights to real assets on distributed ledgers, or the issuance of traditional asset classes in tokenised form. Potential benefits include efficiency gains driven by automation and disintermediation; transparency; improved liquidity potential and tradability of assets which currently have near-absent liquidity; and faster and potentially more efficient clearing and settlement. When it comes to the impact on retail investors, tokenisation offers an additional tool for fractional ownership of assets1 allowing for small minimum investments, which, in turn, could lower barriers to investment and promote more inclusive access to previously unaffordable or insufficiently divisive asset classes, such as real estate (see Box 3).

The example of tokenisation of real estate assets is a noteworthy one given that retail investors are usually restricted in their ability to participate in such investments due to capital constraints and limited access to commercial projects. Some real estate tokenisation platforms have emerged in Asia, such as KASA in Korea and ADDX in Singapore (Chow and Tan, 2022[33]). Nevertheless, this market is still nascent and there are important challenges to real estate tokenisation which include, inter alia, insufficient evidence of investor demand for tokenisation of single real estate assets and the related difficulty in using digital platforms for such investment, as well rules governing the fractionalisation of ownership of assets (Chow and Tan, 2022[33]).