This chapter examines how regional and local development is funded and financed in Croatia. First, it assesses the changes in subnational public finances in Croatia between 2010 and 2022, while outlining the implications for the country’s regional development. Second, it identifies the main EU and national government funding mechanisms supporting the implementation of Croatia’s regional development policy. Finally, the chapter proposes policy solutions to address five key challenges Croatia faces in mobilising and using funding and financing mechanisms.

Towards Balanced Regional Development in Croatia

5. Regional development funding and financing

Abstract

Introduction

A necessary pre-condition for regional development policy to meet its objectives is having sufficient financial resources to support policy implementation. For instance, governments need to ensure that the tasks and responsibilities assigned to levels of government are matched with sufficient sources of funding and financing (e.g. to support local businesses, provide healthcare or invest in key public infrastructure) (OECD, 2019[1]). However, the effectiveness of funding and financing mechanisms for regional development also depends on other elements, including whether subnational governments have: i) appropriate levels of fiscal autonomy to make spending and revenue-raising decisions; and ii) the capacity to access and deploy available financial resources in a productive way.

Over the past two decades, Croatia has gradually engaged in a process of administrative and fiscal decentralisation, granting counties, cities and municipalities crucial competencies and financial resources for regional development. This has resulted, for example, in a 26% increase in total revenue at the subnational level (in real terms) between 2016 and 2022.

At the same time, despite small increases in the share of tax revenue as part of total subnational government revenue between 2010 and 2022, counties cities and municipalities continue to rely heavily on grants and subsidies. This was mainly driven by a significant uptick in European Union (EU) funding in the wake of Croatia’s accession to the EU in 2013. The influx of EU funding has resulted in an increase of 82.7% of subnational government investment in real terms between 2010 and 2021, with cities and municipalities as the primary drivers. This has directly supported the implementation of regional and local development projects across the country (OECD, 2023[2]). In parallel, Croatia’s national government has established numerous mechanisms to help fund regional development. These include a co-funding programme that helps subnational governments compete for EU funding, as well as grants for subnational governments performing below the national average across a series of economic, well-being and demographic indicators.

An examination of the financial resources available to Croatian subnational governments for implementing regional development policy suggests that there are several areas of improvement. First, Croatia should ensure that the increased access to and use of EU funding by its subnational governments is spent effectively to tackle regional and local development needs and priorities. Moreover, in order to prevent an increasing reliance on EU funding over time, it is important for Croatia to ensure that subnational governments maintain diversified revenue streams.

Second, and relatedly, there is a need to increase the fiscal autonomy of subnational governments (i.e. their capacity to raise own-source revenue) without widening inter-regional or intra-municipal inequalities. This would increase their ability to orient revenue to meet specific local needs and priorities, while also helping to lower subnational government’s reliance on grants.

Third, it would be relevant to review the effectiveness of the way in which the Regional Development Index has been set up, which the government uses to identify those subnational governments that are in need of special financial support. The allocation of funding based on a subnational government’s Index score may inadvertently encourage counties, cities and municipalities to underperform in order to receive funds.

Fourth, Croatia should address the funding- and financing-related challenges associated with county- and local-level fragmentation (e.g. a scattering of financial resources across a large number of small-scale projects, thus limiting their impact). Strengthening existing horizontal and vertical co-ordination mechanisms would help to improve the targeting of development funding to meet regional needs.

Fifth, Croatia should consider revisiting the financing model of regional development agencies (RDAs) in order to ensure their long-term operational sustainability. Their reliance on EU Technical Assistance funding, which ends in December 2025, along with the limited fiscal space of county governments to bolster RDA budgets, has placed the RDAs in a difficult financial position. Finding a more sustainable approach to ensure that RDAs can continue to support regional development efforts should be a priority for all stakeholders involved.

This chapter begins by analysing the current state of Croatia’s public finances at the subnational level by highlighting primary fiscal indicators and the specific funding and financing sources for regional development available to subnational governments. Subsequently, the chapter assesses the five key challenges faced by subnational governments when seeking to mobilise resources for regional development in a sustainable manner.

Box 5.1. Recommendations to strengthen Croatia’s subnational finances for funding regional development

In order to prevent subnational governments from becoming heavily reliant on EU funding to implement regional development plans and projects in the long term, Croatia could:

Explore options to further diversify subnational government revenue streams, including by:

Devolving existing national taxes to lower levels of government (green taxes or fees). This needs to be based on a careful assessment of how the proposed changes to the tax system affect the fiscal capacity of citizens, businesses and different levels of government, and consider mechanisms to mitigate any negative impacts.

Strengthen the capacity of subnational authorities to set up and manage public-private partnerships (PPPs) effectively, including by providing them with information and training on: i) how to assess the value added and risks of PPPs, ii) how to manage PPPs, and iii) how to establish a transparent system that can track the use of public funding through PPPs.

In order to ensure that the 2023 personal income tax reforms do not exacerbate regional and local disparities, Croatia should:

Monitor the effects of the reforms on county and local budgets, in order to ensure that the new rate-setting powers of cities and municipalities do not lead to large fiscal disparities at the subnational level.

In order to strengthen the ability of the Regional Development Index to encourage balanced territorial development, Croatia is recommended to:

Adjust the way in which regional development funding is provided to counties and local governments based on their Index scores, in order to encourage them to improve their performance, for instance by:

Ensuring that county and local governments that recently left the 'assisted areas' category in the Index receive funding that decreases over a set period (e.g. three years). This would help to reduce the incentive for local leaders to deliberately seek an 'assisted area' designation, while also providing them with financial means to consolidate their recent developmental gains.

Using the Index as a foundation to support a more performance-based funding model for regional development, i.e. one in which socio-economic progress yields certain additional rewards, such as tax breaks or increased investment opportunities.

In order to further strengthen the vertical and horizontal co-ordination of regional development funding and financing, Croatia is advised to:

Conduct an assessment of national budget funds allocated to initiatives that support regional and local development. This could help to determine:

Which public bodies, because of their funding for regional and local development, should be part of the Prime Minister-led regional development co-ordination body; and

Whether the funding provided through the national budget aligns with the country’s long-term development objectives and whether there are funding gaps or possible inefficiencies that need to be addressed.

Consider expanding the use of macro-regional co-operation instruments such as development agreements between county governments and RDAs on the one hand, and the national government on the other, including by:

Helping county administrations and RDAs identify funding and financing opportunities to support the implementation of development agreements, e.g. by developing framework agreements with international financial institutions to ensure that macro-regional development councils can borrow from such institutions.

In order to shore up the financial sustainability of RDAs, Croatia needs to:

Consider complementary options to fill the funding gap that will be created when EU Technical Assistance funding for RDAs expires after 2025, including by:

Providing direct funding to the RDAs through the national budget, complementing the funding provided by the RDA founders (counties and cities).

Expanding the membership base of RDAs to include (more) cities and/or municipalities. Their financial contribution could enhance the RDAs’ financial sustainability, while also strengthening the collaborative ties between the RDAs and local governments.

Sources of regional development funding and financing in Croatia

Regional development efforts in Croatia are funded and financed at the subnational government level (counties, cities and municipalities combined) through a wide range of mechanisms, including inter-governmental transfers, shared and own-source tax revenues, non-tax revenues and loans from national and international financing institutions. Regional development funding also comes from the EU.

This section illustrates the evolution of subnational public finances in Croatia between 2010 and 2022, while outlining the implications for the country’s regional development. This section considers specific indicators related to the volume and composition of subnational revenue, expenditure and debt. In addition, information is provided on specific EU and national funding and financing mechanisms that support regional development initiatives.

Croatia’s performance on selected fiscal indicators

Drawing on recent historical data, a number of trends in Croatia’s subnational fiscal performance can be identified. With regard to revenues, county- and local-level budgets have grown steadily in real terms between 2010 and 2022 (OECD, 2023[2]). The composition of subnational budget revenues, however, has been heavily weighted towards inter-governmental transfers. A marked reliance on transfers, which are often earmarked for specific functions, risks limiting the ability of subnational governments to allocate spending to meet specific local needs. At the same time, levels of subnational tax autonomy have slowly increased, with city and municipal governments (but not county governments) able to set rates on a number of subnationally-levied taxes.

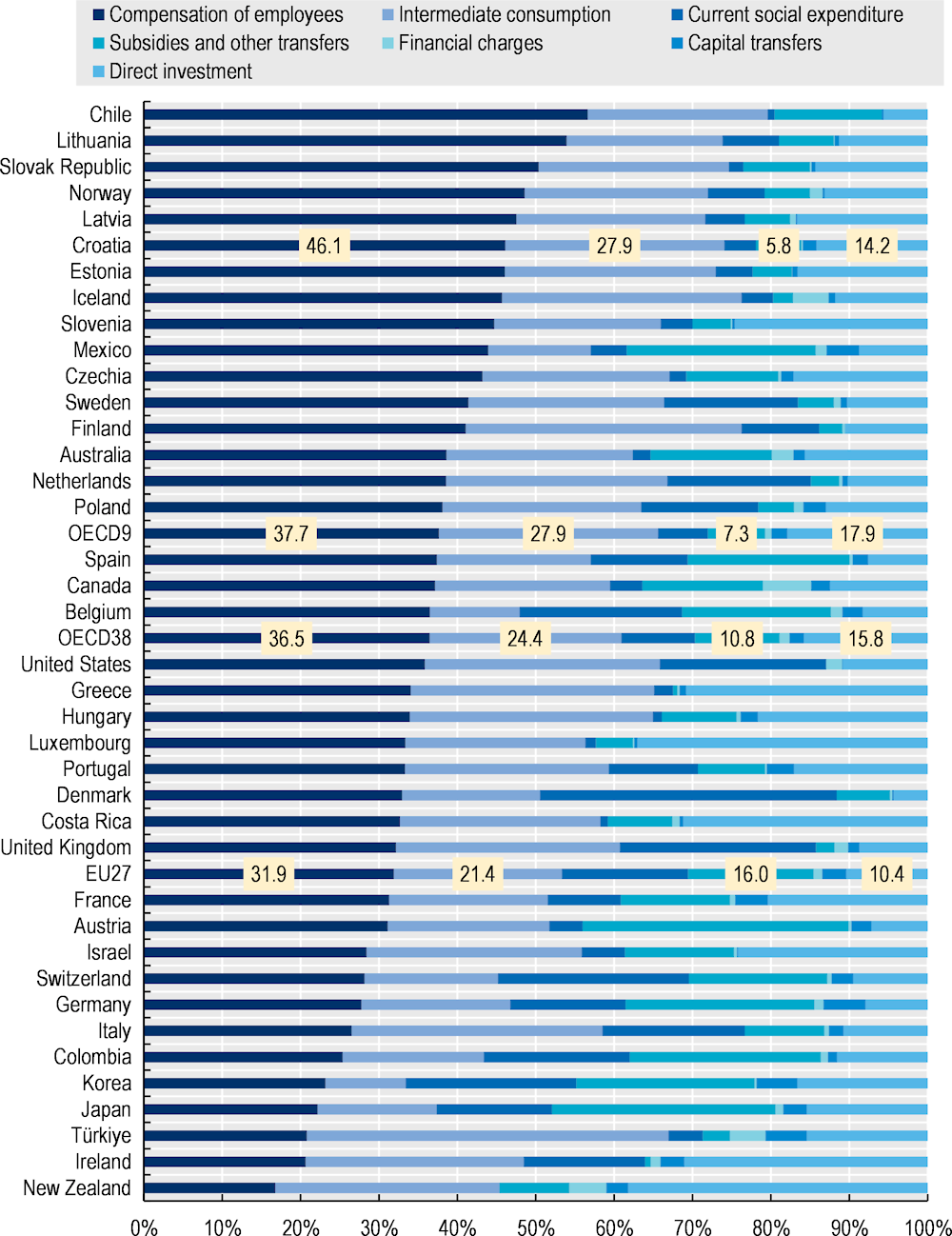

With regards to expenditures, between 2010 and 2022, total subnational expenditure in real terms increased gradually (OECD, 2023[2]). Despite this increase, subnational government spending as a share of total public expenditure in Croatia has remained low compared to the OECD38 and EU27 averages. One notable finding is that the country’s subnational governments allocate a significantly higher share of their budgets to staffing costs than the OECD38 and EU27 averages, which may suggest a need for county and local-level functions to be further streamlined.

The most pronounced expenditure-related change over the past decade has been a substantial rise in subnational public investment in Croatia between 2010 and 2021 (OECD, 2023[2]). While public investment has risen in real terms in counties, cities and municipalities respectively, growth has been particularly strong in the latter two. This might reflect the fact that own-source revenue makes up a larger share of total revenue in cities and municipalities than in counties, providing them with greater flexibility to allocate a larger portion of their budgets towards capital investment. Finally, subnational government investment capacity has been supported by its relatively low level of debt compared to the OECD average.

Subnational governments continue to rely heavily on grants and subsidies, despite increasing tax revenue

Between 2010 and 2022, Croatia reported a 26% increase in total revenue at the subnational level in real terms, rising from EUR 5.3 billion in 2010 to over EUR 6.5 billion in 2022. Despite this upward trend, subnational government revenue now accounts for 27.5% of total revenue in Croatia, which is significantly lower than the OECD38 and EU27 averages (44.9% and 38.1%, respectively) (OECD, 2023[2]; OECD, 2023[3]). This means that compared to the OECD and EU, Croatia collects and manages a larger share of revenue at the national level, leaving subnational entities with a smaller portion of the revenue pie.

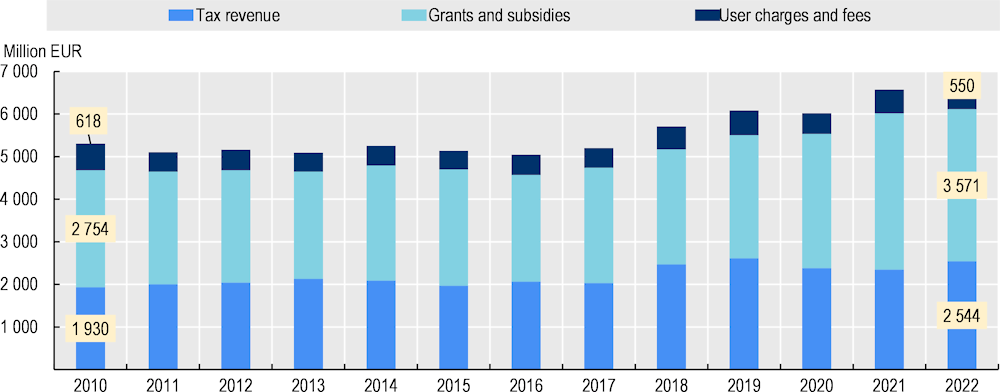

A key driver of the growth in subnational government revenues has been an increase in inter-governmental transfers. Since 2010, the value of inter-governmental grants and subsidies—the main source of subnational revenues—has increased by roughly 30%, reaching over EUR 3.5 billion in real terms in 2022 (Figure 5.1). In parallel, tax revenues rose by nearly a third over the same period, reaching EUR 2.5 billion in 2022, while user charges and fees decreased by 10%.

Figure 5.1. Subnational revenue by category in real terms for Croatia, 2010-2022

Note: User charges and fees include income generated from the use of a public service (i.e. public transport), as well as administrative fees, donations from outside the general budget and administrative fines or penalties.

Source: Author’s elaboration, based on (OECD, 2023[2]).

A significant finding was that between 2010 and 2022, the share of grants and subsidies as part of total subnational revenues grew 3.4%. This mean that, in 2022, grants and subsidies accounted for 53.6% of total subnational revenues. This level surpassed the EU27 and OECD38 averages (of 45.6% and 52.8%, respectively) (OECD, 2023[3]). As such, inter-governmental transfers make up an increasing large majority of subnational budget revenues, while own-source revenues (tax revenue and user charges and fees combined) account for a reduced share. This means that subnational governments’ fiscal autonomy has slightly decreased since 2010. Moreover, as grants are often earmarked and may attach stringent conditions to public expenditure, an increased reliance on intergovernmental transfers can limit the flexibility that governments have to target spending in a way that best addresses territorially-diversified development needs (Council of Europe, 2007[4]; World Bank, 2021[5]).

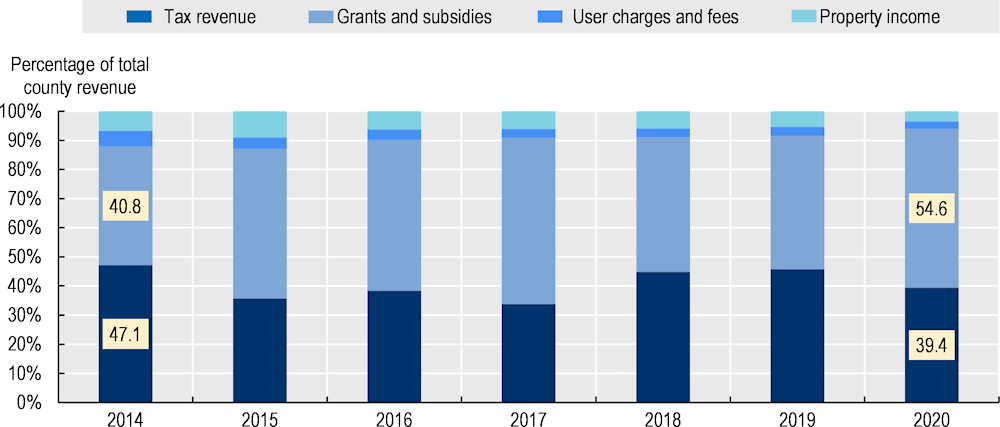

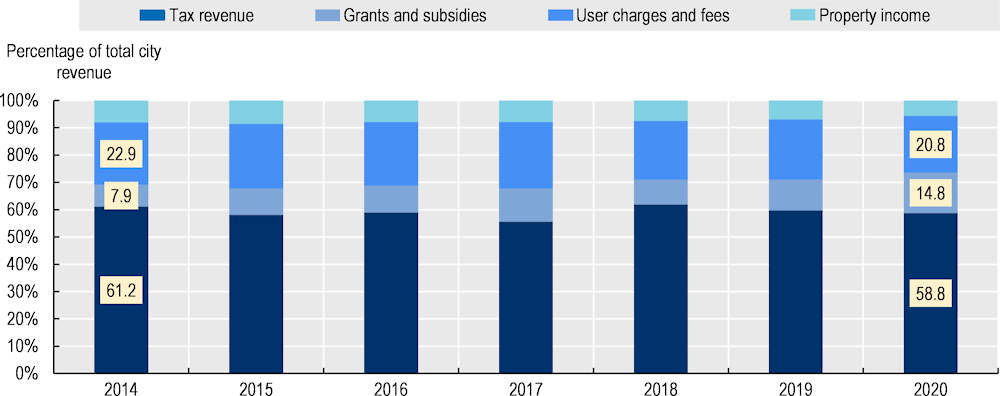

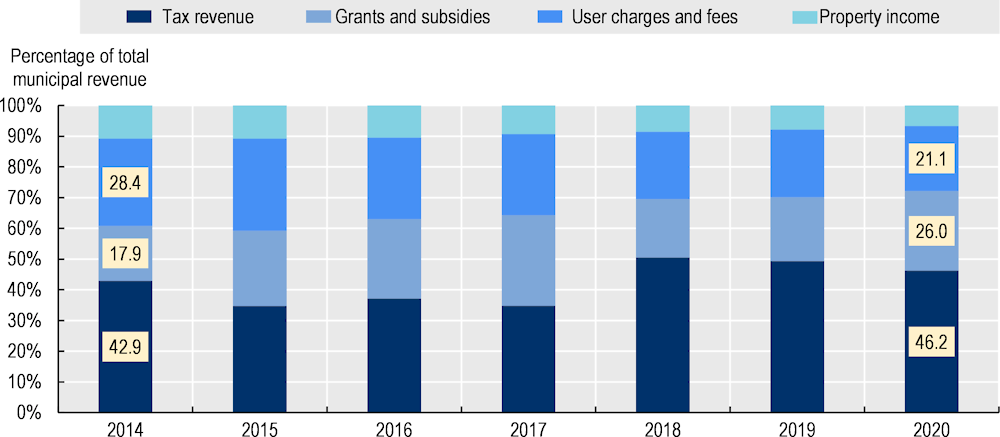

An analysis of subnational revenue distribution by government level, based on data from Croatia’s Ministry of Finance1, shows that the reliance on grants and subsidies is significantly greater at the county level than at the local level. In 2020, inter-governmental transfers accounted for a 54.6% share of county budgets, compared with 14.8% of city budgets and 26% of municipal budgets (see Annex Figure 5.A.1; Annex Figure 5.A.2 and Annex Figure 5.A.3, respectively) (Ministry of Finance, 2023[6]). By the same token, cities and municipalities have a more diversified revenue structure than counties, with own-source revenues (i.e. tax revenues, and user charges and fees) accounting for over two-thirds of their budgets (79.6% and 67.3%, respectively). This, in part, reflects differences in the assignment of responsibilities among subnational governments (see chapter 3) (MRDEUF, 2024[7]). The relative weight of user charges and fees in city and municipal budgets (20.8 and 21.1%, respectively) reflects the wide array of services they provide (e.g. utility services, transportation, disposal of municipal waste, public area maintenance, funeral services and public lighting)2.

The more balanced composition of revenue sources of cities and municipalities, combined with their limited reliance on transfers, compared to that of counties, has different implications for regional development. In addition to giving local authorities more flexibility to allocate resources based on local needs, it can reduce their vulnerability to economic downturns associated with a single revenue stream (OECD, 2021[8]). For instance, local governments that are highly reliant on inter-governmental transfers may be severely affected when, during an economic downturn, the national government decides to reduce spending for subnational governments (Blöchliger et al., 2010[9]). It should be noted, however, that some of this risk is mitigated by the fact that wages related to education and healthcare delivery comprise a significant portion of inter-governmental transfers. Although such wages are paid from the central government, they are formally registered as inter-governmental transfers (Ministry of Finance, 2024[10]).

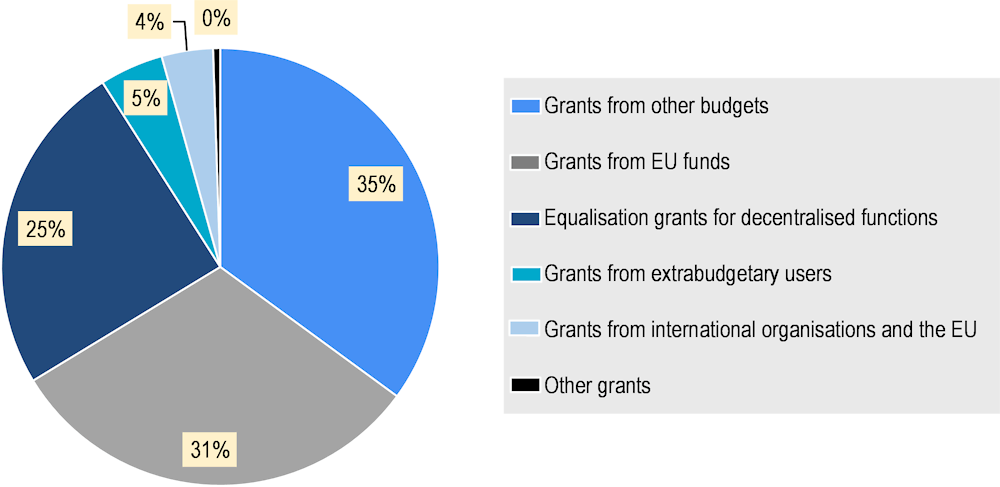

Cities and municipalities receive most of their transfers from EU funds

Grants account for a significant share of subnational transfers, the majority of which come from the Ministry of Regional Development and EU Funds (MRDEUF), the Ministry of Science and Education, as well as international donors. In 2020, subnational governments received most grant funding from the national government (“other budgets”, 35%), from the EU (31%) and from the equalisation mechanism (25%), the latter of which is allocated for decentralised functions (e.g. primary and secondary education, healthcare, social services and firefighting) (Figure 5.2) (Ministry of Finance, 2023[6]).

Figure 5.2. Subnational transfers by sub-category, 2020

Note: ‘Other transfers’ include the items ‘transfers between budget users of the same budget’, ‘aid from foreign governments’, and ‘help to budget users from a budget not under their responsibility’.

Source: Author’s elaboration, based on (Ministry of Finance, 2023[6]).

There were important variations by level of government. In 2020, grants from EU funds accounted for a particularly large share of city and municipal transfer revenue (39% and 44%, respectively) when compared with county transfer revenue (16%). By contrast, equalisation grants for decentralised functions accounted for nearly half (45.1%) of county transfer revenue, compared to 17% and 2% in the case of cities and municipalities, respectively. As noted above, these variations reflect differences in the assignment of responsibilities among subnational governments. They also point to the relative dependency of counties, cities and municipalities on different funding sources (e.g. counties on equalisation grants). This can mean, for example, that counties’ ability to fund public service delivery and/or to make strategic investments (e.g. in transport infrastructure) may be particularly affected if Croatia decided to change its equalisation system. By the same token, cities and municipalities are more vulnerable to possible changes in EU funding volumes and priorities.

Subnational tax autonomy has gradually increased in Croatia

Despite the growing dependence on grants and subsidies at the subnational level in Croatia, the share of tax revenues in subnational budgets has increased slightly over the past decade, from 36.4% in 2010 to 38.2% in 2022 (OECD, 2023[2]). PIT has been the primary source of subnational tax revenue in recent years, accounting 90.1% of the total in 2020 (Ministry of Finance, 2023[6]). Beyond PIT revenues, counties, cities and municipalities have the ability to levy several other taxes (Table 5.1). For example, counties can levy taxes on inheritance and gifts, motor vehicles, vessels, and gambling machines, while city and municipal governments can collect taxes on local consumption of alcoholic beverages and certain non-alcoholic ones, holiday homes, tourism, and the use of public land (Official Gazette of Croatia No 127 et al., 2017[11]; World Bank, 2021[5]). While the rates for all taxes levied by county governments are nationally-defined, city and municipal governments can set rates on a number of locally-levied taxes, albeit sometimes within a band defined by the national government.

Table 5.1. Subnational tax by type and autonomy to set tax rates in 2024: Croatia

|

Tax |

Type |

Autonomy to determine tax rates |

||||

|---|---|---|---|---|---|---|

|

Shared among subnational governments |

County |

City and municipal |

Central government determined |

Local governments determine rates |

Local governments determine rates within range set by central government |

|

|

Personal income tax |

✓ |

✓ |

||||

|

Inheritance and gift tax |

✓ |

✓ |

||||

|

Tax on motor vehicles |

✓ |

✓ |

||||

|

Tax on vessels |

✓ |

✓ |

||||

|

Tax on gambling machines |

✓ |

✓ |

||||

|

Local consumption tax |

✓ |

✓ |

||||

|

Tax on holiday houses |

✓ |

✓ |

||||

|

Tax on the use of public land |

✓ |

✓ |

||||

Source: Author’s elaboration, based on (Official Gazette of Croatia No 127 et al., 2017[11]; World Bank, 2021[5]).

The ability of cities and municipalities to set rates on certain taxes can be an important mechanism to help tailor fiscal policy more closely to local development needs. For instance, local governments can strategically adjust tax rates to encourage or discourage certain economic activities, attract new investment, or fund local infrastructure projects. For example, a city may lower taxes on local consumption of beverages to boost the hospitality sector, making it an attractive location for new bars and restaurants, thereby stimulating local employment. Conversely, municipalities could increase taxes on the use of public land for commercial purposes, aiming to discourage overdevelopment in ecologically sensitive areas, thus preserving local natural resources.

Driven by EU accession, subnational investment increased by 82.7% over the last decade

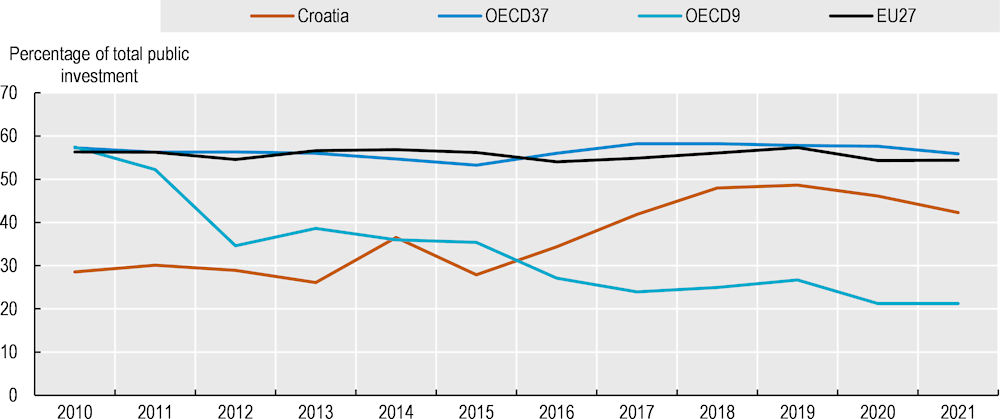

Between 2010 and 2021, Croatia saw a significant increase, in real terms, in subnational public investment. During this time, public investment spending by subnational governments rose 82.7%. As a result, subnational public investment as a share of GDP reached 2.05% in 2021 (nearly double its share in 2010), which exceeded the 1.8% average for both the EU27 and OECD38 (OECD/UCLG, 2022[12]; Eurostat, 2023[13]; OECD, 2023[3]). Driven in part by the influx of EU funding linked to Croatia’s EU accession, direct investment by subnational governments increased from 26.1% of total public investment in 2013 to 42.3% in 2021 (Figure 5.3).

Figure 5.3. Subnational public investment as a share of total public investment, 2010-2021

Note: Colombia is excluded due to lack of data. OECD37, EU27 and OECD9 averages are unweighted. OECD9 includes Estonia, Greece, Hungary, Poland, Portugal, Slovak Republic, Slovenia, Spain and Türkiye, which are all countries that had a similar average GDP per capita as Croatia in 2023. The slight decline in direct investment between 2019 and 2021 (from 48.6%) reflects a reallocation of budget resources in response to the COVID-19 pandemic crisis, as has been the case in other countries (IFC, 2021[14]; OECD, 2021[15]).

Source: Author’s elaboration, based on (OECD, 2023[2]).

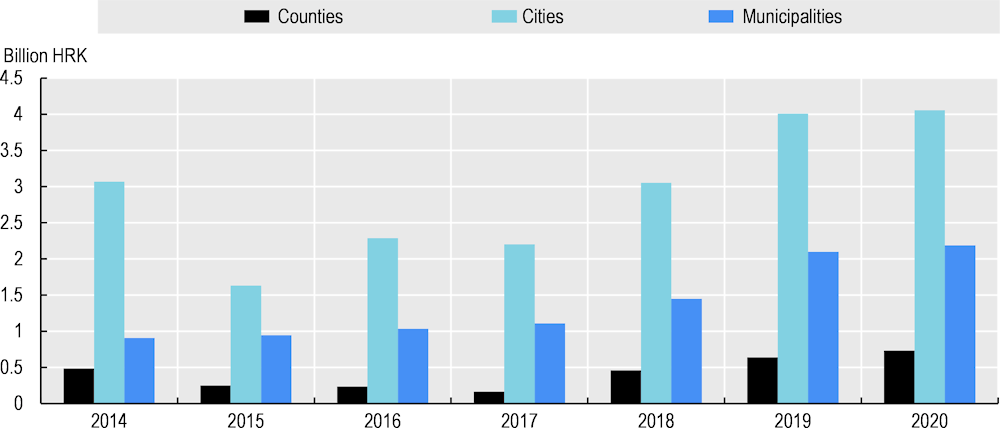

A detailed examination of public investment by county, city and municipal governments shows that subnational public investment is unevenly distributed (Ministry of Finance, 2023[6]) (Figure 5.4). Most subnational investment is undertaken by cities. However, both cities and municipalities have borne witness to substantial growth in investment spending between 2014 and 2020, increasing 25% in the case of the former and more than doubling in the case of the latter. Although counties also somewhat increased their investment spending over the period, they did so from a very low base. As such, cities and municipalities are the main drivers of subnational public investment, having accounted for nearly 90% of total subnational investment spending in 2020.

Figure 5.4. Subnational public investment by subnational government category in real terms, 2014-20

Note: Units in million HRK, base year is 2014. The chart is based on financial reports disaggregated by level of subnational government. It does not include possible additional investments that are presented in consolidated financial reports to which the OECD did not have access.

Source: Author’s elaboration, based on (Ministry of Finance, 2023[6]).

The disparity in public investment suggests that cities and municipalities have greater flexibility to allocate a larger portion of their budgets to capital investments, potentially enabling a more targeted approach to addressing local infrastructure needs and development initiatives. Notwithstanding differences in the assignment of responsibilities among subnational governments, the lower percentage of capital investment by counties may also reflect their more constrained financial capacity, which could be tied to a relatively high reliance on earmarked grants compared to cities and municipalities.

Subnational governments have maintained sound fiscal health during crises thanks to national government support

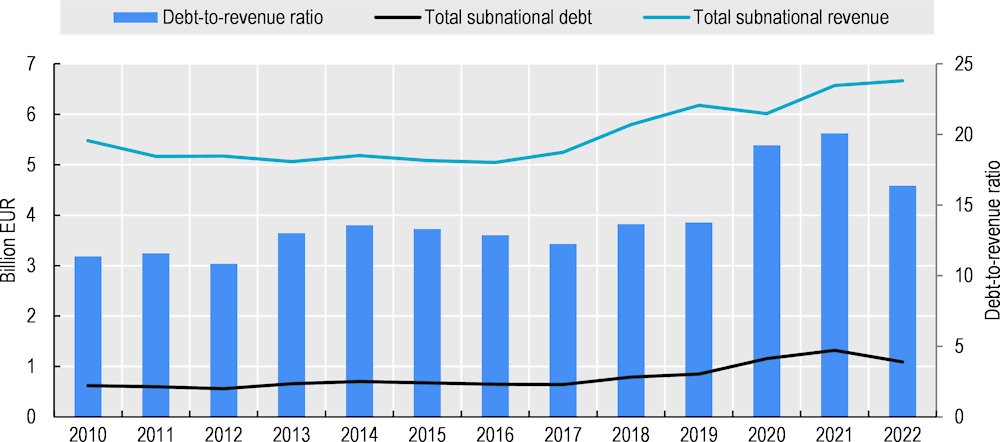

Between 2010 and 2022, total subnational revenues grew slightly faster than subnational expenditures, (26% vs. 19.2% in real terms, respectively). This has helped limit subnational debt levels. In fact, in 2022, subnational debt in Croatia accounted for only 3.0% of public debt, well below the EU27 and OECD38 averages of 13.2% and 12.9% of public debt in 2020 (latest year available), respectively (OECD, 2023[3]).

As shown in Figure 5.5, transfers from the central government have also helped to limit subnational debt by acting as a buffer against economic shocks (e.g. the global financial crisis in 2008 and the COVID-19 pandemic in 2020). The cyclicality of deficits is noticeable almost exclusively at the national government level (e.g. in 2020 and 2021 when the COVID-19 pandemic led to reduced government revenue). This stems from the fact that transfers from the national to subnational governments during this period helped balance the latter’s budgets.

Figure 5.5. Total government expenditure and revenue by sector of government in real terms, 2010-22

The fiscal health of Croatian subnational governments also reflects their application of the “golden rule”, a regulation that limits their borrowing to cover capital expenditure (Figure 5.5) (Official Gazette of Croatia No 144/2021, 2021[16]; OECD/UCLG, 2022[12]). Given the substantial responsibilities that subnational governments have for capital investment spending, the golden rule has played an important role in discouraging budget deficits and fostering fiscal discipline at the subnational level.

Box 5.2. Borrowing by Croatia’s subnational governments

Croatia’s subnational governments can only borrow to finance capital investment (the “golden rule”). Borrowing is subject to prior approval by the national government. In addition, there are two main prudential rules: a general limit on the aggregate borrowing of all subnational governments (5% of current revenues of the previous year) and an individual limit (20% of current revenues of the previous year). Both limits include guarantees and borrowing approvals issued by local governments, including to their utility companies.

Source: Author’s elaboration, based on (Official Gazette of Croatia No 144/2021, 2021[16]; OECD/UCLG, 2022[12]; Ministry of Finance, 2024[10]; Official Gazette of Croatia No 149/23, 2023[17]).

Croatia’s subnational governments also appear to have a stable debt-to-revenue ratio (Figure 5.6). This suggests that, in principle, subnational governments have sufficient capacity to service their debt obligations, which are not particularly burdensome, without compromising their ability to fund essential public services and infrastructure projects (Figure 5.6). Additionally, by keeping the debt-to-revenue ratio stable, subnational governments may have more flexibility and space for borrowing when they seek to finance new development projects.

Figure 5.6. Subnational debt-to-revenue ratio, 2010-22

Note: In real terms.

Source: Author’s elaboration, based on (Eurostat, 2023[13]; Eurostat, 2023[18]).

EU and national funding and financing mechanisms for regional development

This section focuses on the specific EU and national funding and financing mechanisms that have become central to Croatia’s regional development policy. These mechanisms include, among others: i) funds from the Programme for Competitiveness and Cohesion and the Integrated Territorial Programme, ii) funds from the national Recovery and Resilience Plan, iii) funding for regional and local development projects from the national government, iv) funding for the operations of RDAs, and v) financing options for regional development.

Taken together, funding and financing mechanisms established in recent years underscore Croatia's commitment to place-based development. Most of the mechanisms are designed to cater to the specific challenges and needs of distinct territories, e.g. islands, hilly and mountainous areas, and 'assisted areas'. Furthermore, the diverse territorial scope (i.e. local, regional or macro-regional) of funding and financing mechanisms reflects the fact that some development challenges are best addressed through local investment (e.g. maintenance of a school), while others are more effectively and efficiently implemented at a larger territorial scale (e.g. upgrading of transport infrastructure).

Integrated Territorial Investments

The Integrated Territorial Investments (ITI) mechanism stands out as one of the key instruments for regional development funding in Croatia. It facilitates the design and implementation of territorial strategies that extend across local administrative boundaries by pooling investments from different EU structural funds across different priority areas.

In Croatia, the first ITIs were implemented as part of the Operational Programme on Competitiveness and Cohesion during the 2014-20 EU programming period. They involved the eight largest cities in the country, which accounted for almost half of the Croatian population (OECD, 2023[19]). Strategies developed under this initiative had a broad thematic focus. Among other elements, they aimed to strengthen the role of cities in developing business infrastructure, promoting cultural heritage for tourism and enhancing the offer of clean urban transport. In total, ITI funding over the 2014-20 period amounted to EUR 1.5 billion.

For the 2021-2027 EU programming period, an Integrated Territorial Programme (ITP) targets 22 urban centres. ITI funding over the period amounts to EUR 1.5 billion, of which 88.2% and 11.8% has been allocated through the European Regional Development Fund (ERDF) and the Just Transition Fund (JTF), respectively. Investments within the ITP are classified into four main types (MRDEUF, 2022[20]):

1. Industrial transition: More than EUR 550 million (about 35% of total ITP funding) will be allocated to projects that aim to support innovation clusters, broker strategic partnerships for innovation, boost the creation and growth of start-ups and SMEs, develop smart skills, and improve infrastructure for companies. These projects also cover territories classified as ‘assisted areas’.

2. Cities: Approximately EUR 680 million (just over 43% of ITP funding) will be allocated to cities for projects that support brownfield development, clean and smart city traffic, business incubators, tourism, energy efficiency, and green and multifunctional infrastructure.

3. Islands: Approximately EUR 150 million has been earmarked to promote island development, including through the sustainable management and preservation of public space, and encouraging energy efficiency and the use of renewable energy sources.

4. Just Transition Fund: Close to 12% of total ITP investments will be funded by the Just Transition Fund in fields related to the green and digital transitions. These investments will be made in two counties with highly-polluting industries that account for a significant share of greenhouse emissions: Istria and Sisak-Moslavina (European Commission, 2022[21]).

National Recovery and Resilience Plan

Following the economic upheaval caused by the COVID-19 pandemic, the government developed a Recovery and Resilience Plan to support Croatia’s economic recovery, while addressing challenges and opportunities that stem from the green and digital transitions. Funding for the Recovery and Resilience Plan amounts to approximately EUR 10 billion.

Seventy-seven projects being implemented through the Recovery and Resilience Plan will affect regional and local development. For example, 30 projects are located in the Pannonian Croatia macro-region (TL2), and include a wide range of initiatives, including the retrofitting of public buildings with new, energy-efficient technologies, renovating kindergartens, and food distribution centres (European Commission, 2023[22]).

Regional development funding from the national government

There are a variety of national-level funding mechanisms that support regional development in Croatia, many of which have been set up by the MRDEUF. These mechanisms range from place-targeted funds (e.g. assisted areas, mountainous areas and islands) to line ministry or sector grants that indirectly advance development.

The MRDEUF provides funding to assisted and mountainous areas, comprising 12 counties and 304 city and municipal governments, which represent one-third of Croatia’s population. The MRDEUF launches periodic public calls for development projects, with a total annual budget of approximately EUR 34 million (MRDEUF, 2023[23]). Through this funding mechanism, the MRDEUF has launched calls aimed at specific territories, such as one for the economic revitalisation of Slavonia, Baranja and Srijem counties. Funding for assisted and mountainous areas has included initiatives to support demographic revitalisation, economic regeneration, connectivity and mobility and the construction of housing developments.

In addition, the MRDEUF allocates funding for Croatian islands through the Island Development Programme. The Programme aims to support the development of local island communities, in particular by funding projects that facilitate access to and the quality of local public services and business infrastructure, and support the green transition (MRDEUF, 2024[24]). For instance, in early 2024, a call was launched for projects that aim to support the development of civil society organisations on islands. The call has an envelope of EUR 300 000, which can be spent on projects worth between EUR 4 000 and EUR 10 000 (MRDEUF, 2024[24]).

Furthermore, the government created a specific fund for the reconstruction and development of Vukovar, following Croatia’s war of independence. Among other areas, the funds can be used to support local economic development projects and SMEs, as well as for the construction and maintenance of communal infrastructure (MRDEUF, 2024[7]). In 2023, planned spending through the fund amounted to EUR 9.83 million (MRDEUF, 2023[25]).

It is worth noting that other ministries, such as the Ministry of Science and Education and the Ministry of Agriculture, offer sectoral grants that can indirectly promote regional development (OECD, 2023[26]). At present, however, there is no publicly accessible overview of national government grants supporting regional and local government. Given this lack of a comprehensive perspective, county, city, and municipal governments may face challenges identifying and applying for funding opportunities that most closely align with their specific development objectives.

The national government can enter into development agreements with three or more county governments, through which a partnership for macro-regional investment is formed. In the case of the Slavonia, Baranja and Srijem Development Agreement, for example, 67 projects were foreseen across a wide range of sectors, from agriculture, wood and metal processing industries, to tourism and infrastructure. To support the implementation of the development agreement, the Council of Slavonia, Baranja and Srijem, which comprises the five counties of Virovitica-Podravina, Požega-Slavonia, Slavonski Brod-Posavina, Osijek-Baranja and Vukovar-Srijem, secured EUR 1.56 billion in EU funding, as well as additional funds from the national budget (MRDEUF, 2023[25]). As of 2024, counties within the agreement have spent EUR 2.4 billion in total, out of which a relatively small share (EUR 269 million) are labelled as joint projects involving several different counties (Council of Slavonia, Baranja and Srijem, 2024[27]). To date, eight projects have been completed, while an additional 18 are currently being implemented (MRDEUF, 2024[7]).

Funding for the operation of RDAs

As discussed in chapter 3, RDAs were established as limited liability companies that provided paid services. However, following legislative changes in 2017, they were re-established as public regional co-ordinators and are now funded exclusively by the public sector. National government funding accounts for roughly two-thirds of RDA revenues, with the remainder allocated through county budgets (and Zadar City in the case of the Zadar County RDA). Two EU funding calls, paid through the Operational Programme on Competitiveness and Cohesion, sustained RDA activities between 2017 and 2023 (MRDEUF, 2024[7]). A new grant worth EUR 15.2 million will be made available to the RDAs over 2024 and 2025 (OECD, 2023[26]).

Financing options for regional development

Besides funding through national and international programmes, Croatia can also seek financing from domestic financial institutions (e.g. the Croatian Bank for Reconstruction and Development, HBOR) or international financial institutions, such as the World Bank, the International Monetary Fund (IMF), the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) (Box 5.3). These international financial institutions (IFIs) mobilise funds through member contributions, borrowing from capital markets, and other financial instruments. They offer loans to support regional development projects, providing national and subnational governments with the necessary capital to invest in infrastructure, human and institutional capacity building programmes.

Box 5.3. Financing regional development through the HBOR and the EIB

Beyond EU funding, the Croatian Bank for Reconstruction and Development (HBOR) and the EIB provide several financing products that can be used to encourage sustainable regional development. HBOR offers loans with interest rates ranging from 3.1-4% per annum, with repayment periods extending up to 15 years and the possibility of including a grace period of up to five years. A key criterion for these loans is their allocation to capital investments that support green or net-zero initiatives. HBOR also provides incentives such as reduced interest rates for projects that further the green and digital transitions or contribute to the development of lagging regions. HBOR also allows for the reduction of interest rates of up to 75% over loans that support the green and/or digital transition. It is therefore essential for regional and local authorities to build their expertise and skills related to the green or digital transitions, in order to maximise funding and financing from HBOR.

At the international level, the EIB offers a diverse portfolio of financing products tailored to the investment needs of national and subnational governments. These include investment loans designed for large-scale individual projects related to water, waste, or energy infrastructure. For smaller or medium-sized projects, the EIB provides multi-beneficiary intermediated loans, which support smaller-scale projects for subnational governments through national promotional banks and institutions (e.g. the HBOR in Croatia).

Additionally, structural programme loans are available, specifically aimed at co-financing investments managed by public authorities within their Operational Programmes. These are aligned with EU economic and social cohesion objectives and are often supplemented by EU grants. The EIB’s financial instruments extend to equity, hybrid bonds and guarantees. Countries can also entrust the implementation of financial instruments (e.g. European Structural and Investment Funds) to the EIB, thereby benefitting from its professional fund management expertise. Finally, the EIB facilitates framework loans targeting multi-annual investment programmes executed by national and subnational governments. Such loans can also provide co-financing alongside EU funds.

Source: Author’s elaboration, based on (EIB, 2023[28]; EIB, 2017[29]; EIB, 2024[30]; EIB, n.d.[31]).

Loans from IFIs generally have concessional terms, including lower interest rates and longer repayment periods, which help reduce the financial burden on recipient countries. However, subnational governments in Croatia may confront two issues in accessing IFI financing. First, financing from IFIs is not available for projects below a certain size, since very small and local projects are not considered reliable and/or secure enough for investors. For instance, financing from the EIB generally starts at about EUR 25 million (OECD, 2023[26]). Second, applying for a loan requires technical expertise (e.g. with preparing documentation) that may be scarce at the subnational level. Given the limited fiscal and human resource capacity of many subnational governments, and the limited territorial scale at which they operate, only Croatia’s largest cities tend to successfully access financing from IFIs.

Public finance-related challenges to regional development in Croatia

Croatian subnational governments have seen a gradual rise in revenues and expenditures, in real terms, over the past decade. Revenue growth has sustained their ability to deliver basic public services that contribute to regional and local development (e.g. healthcare, education, transport). Moreover, Croatia reported a slight increase in the share of tax revenues as part of total subnational budgets, reflecting a very modest improvement in fiscal autonomy and flexibility to orient spending to meet local needs. In addition, counties, cities and municipalities saw a marked increase in public investment, which was supported by the influx of EU funds and the creation of several regional development grants. Each of these elements have helped Croatia’s subnational governments support the implementation of county and local development plans and contribute to Croatia’s long-term strategic objective of balanced regional development.

Despite these developments, five key challenges regarding the funding and financing of regional and local development in Croatia can be identified. First, subnational governments rely heavily on grants. Second, subnational governments, counties in particular, continue to have relatively limited fiscal autonomy compared to their peers in the OECD. Third, Croatia’s Regional Development Index, created to identify subnational governments in need of particular financial support, potentially provides perverse incentives to subnational governments. Fourth, the uptake of macro-regional development agreement has been limited, despite their potential to mobilise and allocate funding and financing for development projects that span multiple counties. Fifth, the funding model of Croatia’s RDAs is precarious. Addressing these challenges could increase Croatia’s ability to ensure that regional development strategies and plans are properly funded and financed, and can be effectively implemented.

Making the most of EU funding for regional development

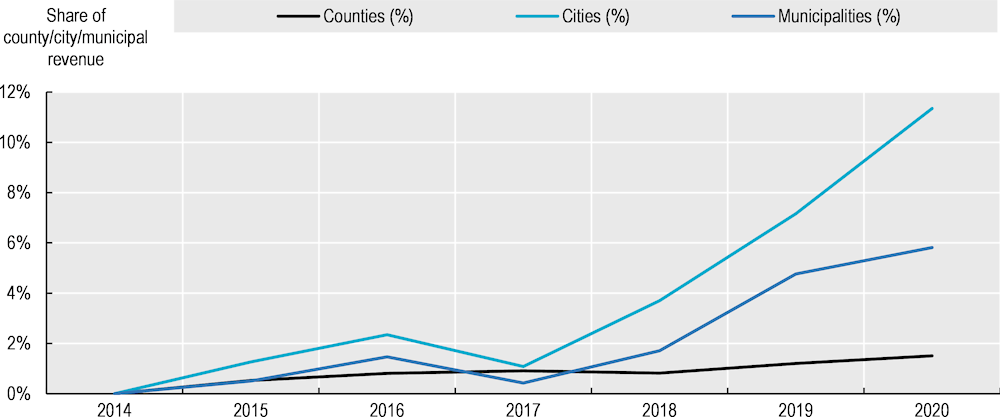

Since joining the EU in 2013, Croatia’s county, city and municipal governments have increasingly been able to mobilise and use EU funding to support the implementation of county- and local-level development plans and projects. The increasing proportion of EU funding within subnational revenues can be clearly seen when looking at grants from EU funds received by subnational governments. While in 2014, Croatia reported that subnational governments did not receive revenue from EU grants, by 2020 close to 8% of subnational revenue (EUR 273 million) came from EU funds (Ministry of Finance, 2023[6]). This trend points to the increasing opportunity for Croatian subnational governments to receive transfers from the EU, primarily to support capital investment spending (IFC, 2021[14]; OECD, 2021[15]). As shown in Figure 5.7 there are sizeable variations by level of government. Municipalities have been able to mobilise EU funding more extensively than cities and counties, the latter of which tend to rely more extensively on decentralisation equalisation funds. In 2020, 11% of city revenue came from EU funds, compared to 6% for municipalities and 2% for counties.

Figure 5.7. Grants from EU funds as a share of total county, city and municipal revenue in Croatia (2014-20)

The increasing use of EU funding by subnational governments has two main advantages. First, it has opened up various opportunities for subnational governments to invest in regional development priorities. Second, it has helped subnational governments hone their strategic planning and investment skills and expertise. In particular, it has helped subnational governments to gain experience in identifying funding opportunities, preparing competitive proposals and conducting monitoring and evaluation activities (OECD, 2023[26]). Skills developed as a result of applying for and managing EU funding are also transferrable to non-EU funding sources, as the processes of application, implementation and evaluation do not vary widely.

The increasing use of EU funding, however, comes with a number of risks. First, EU funding calls may not always be suitable to address specific local needs and priorities. Second, not all county and local governments may have the human and fiscal capacity to meet the requirements (e.g. for co-funding) associated with EU funding opportunities. Third, if the proportion of EU funding as part of total subnational revenues continues to increase significantly, subnational governments, and cities in particular, may risk becoming vulnerable to possible changes in the volume and sectoral priorities of the EU.

An increasing use of EU funding may pose challenges for policy makers to effectively address local needs

While a gradual increase in the use of EU funding by subnational governments, and cities in particular, is normal given the country’s relatively recent accession to the EU, it is crucial to ensure that EU funding be used to help meet specific needs. In other words, Croatian subnational governments should invest their resources in obtaining EU funding that matches their regional and local priorities. Interviews with local stakeholders have pointed to concerns that some local leaders may be chasing EU funding opportunities regardless of whether or not the funding call is closely linked to local priorities (OECD, 2023[26]). When subnational governments aggressively pursue EU funding opportunities, it could lead to a misalignment between the projects that receive funding and the actual needs of the local population. For instance, a local government might allocate significant resources to develop a high-tech innovation park because it will attract EU funding, even though the area has more pressing needs, such as improving public transportation or healthcare services. This phenomenon can result in investments that do not directly contribute to the well-being or economic development of the local community, and it highlights the importance of strategic alignment between funding and local priorities.

Resource disparities across cities and municipalities can affect equal access to EU funding opportunities

Competitive EU funding can ensure that funds are allocated to the authorities that are in the best position to spend them effectively on regional or local development priorities. However, not all subnational governments have the same capacity to prepare robust project proposals. For example, wealthier cities have generally been able to create Local Development Agencies (LDAs), which in turn have helped them to identify funding opportunities and support the drafting of project proposals (OECD, 2022[32]). By contrast, other city and municipal governments need to compete for the attention of already thinly stretched RDAs to secure comparable technical support.

The co-funding requirements that accompany many, if not most, EU funding opportunities present another challenge for subnational governments. In order to help address subnational government co-funding needs, in 2015, Croatia set up a national co-funding programme for the implementation of EU projects at the regional and local levels. In particular, the programme helps county, city and municipal governments (including any legal entities owned by them and institutions established by them) to meet EU co-funding requirements (typically 15% of the total project value). Through the programme, subnational governments can receive a maximum of 50% co-funding for EU projects, or 80% in the case of specific disadvantaged areas (i.e. 50-80% of the 15% that subnational governments generally have to provide as co-funding). This approach renders funding mechanisms sensitive to differences in the fiscal capacity of Croatia’s subnational governments, thereby supporting the ability of subnational governments with a weak fiscal capacity to compete for EU calls.

Under the auspices of this programme, the MRDEUF has so far launched nine public co-funding calls during the 2014-20 EU programming period and one public co-funding call for the 2021-27 EU programming period. For instance, the last 2023 call for co-funding published by the MRDEUF amounted to EUR 50 million and received 323 applications from subnational beneficiaries (MRDEUF, 2023[33]). To date, 2 109 co-funding contracts have been signed, with a total value of EUR 303.72 million, and covering all 20 counties and Zagreb City. In total, national co-funding amounted to over EUR 2 billion during the 2014-2020 programming period and EUR 1.5 billion during the current period, both of which represent just under 15% of the total funding linked to EU projects (European Commission, 2023[34]).

Despite the existence of the MRDEUF-managed co-funding programme, the current levels of co-funding may be insufficient to meet local needs. All 21 Croatian RDAs cited a lack of co-funding resources as the primary challenge to accessing and managing EU funding (OECD, 2022[32]). Smaller county, city or municipal governments in Croatia appear to face a particularly acute challenge in this regard. Their limited size often means that they struggle to raise the necessary own-source funds or access loans to apply to an EU funding call (Rodríguez-Pose and Garcilazo, 2015[35]). The MRDEUF hopes to address this challenge through the latest iteration of the EU co-funding programme covering the 2021-27 period, as part of which annual calls will be launched (MRDEUF, 2024[7]).

Subnational governments should diversify their revenue streams

In order to address the increasing reliance of subnational governments on EU funding to implement regional development plans and projects over time, it is important for Croatia to diversify subnational government revenue streams. This could include measures to: i) boost subnational fiscal autonomy; and ii) strengthen their capacity to enter into financing arrangements that can leverage private sector resources and expertise (i.e. public-private partnerships, PPPs).

In order to enhance subnational government fiscal autonomy, the revenue streams of subnational governments can be diversified through new fiscal decentralisation arrangements, for instance by devolving existing national taxes to lower levels of government or by exploring the introduction of new locally-levied taxes. With regard to the former, Croatia could consider devolving some existing green taxes or fees (i.e. to deter activities that are environmentally-damaging) to subnational governments. For instance, local taxes or fees could be levied on landfill use, on the environmental damage wrought by companies and on the sale of disposable plastic products. With regard to the latter, Italy and Sweden have adopted new taxes on the sale of disposable plastic products, which support local government budgets (Normattiva, 2023[36]; Rödl & Partner, 2022[37]). The assignment of such revenue-raising powers to subnational governments could help to diversify their revenue streams further while also supporting policy action on the green transition. For example, subnational governments with green credentials could generate interest from investors, potentially attracting investment capital, stimulating the local economy, and further increasing subnational tax revenues. Levying such subnational taxes may, however, require Croatia to invest data-gathering tools at the local level (e.g. to track the sale of disposable plastic products). Further to this, any possible adjustments to Croatia’s subnational taxes need to be based on a careful assessment of how the proposed changes to the tax system would affect the fiscal capacity of citizens and businesses.

Under certain conditions, subnational public-private partnerships could mobilise funding for regional development initiatives

Another way for subnational governments in Croatia to further enhance the diversity of their revenue streams is by increasing their use of alternative financing arrangements for public investment, including public-private partnerships (PPPs). PPPs involve collaboration between the public and private sectors to finance, develop, operate, and maintain infrastructure projects or services. Under the right conditions, PPPs can enable subnational governments to leverage private sector expertise, innovation, and resources to deliver projects more efficiently and effectively. This can be particularly beneficial for infrastructure projects that require significant upfront investment, such as transportation networks, energy systems and medical centres (OECD, 2022[38]).

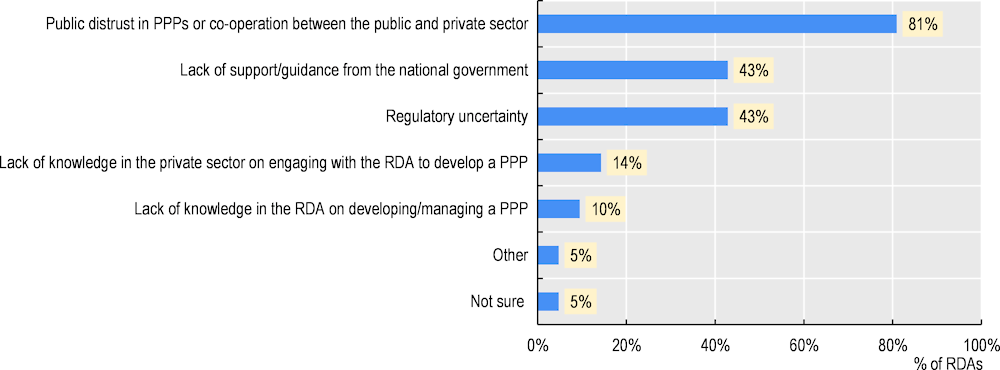

While Croatia has a comprehensive legal framework for PPPs, they are rarely used at the subnational level (Official Gazette of Croatia No 78 et al., 2018[39]; Official Gazette OG No 88/12 15/15, 2015[40]; Official Gazette of Croatia No 16/13, 2013[41]). A large majority of RDAs (86%) felt that one of the primary obstacles to the successful use of PPPs at the county level was public distrust of the mechanism, while a further 43% cited a lack of guidance from the national government and regulatory uncertainty as important barriers (OECD, 2022[32]) (Figure 5.8).

Figure 5.8. Main obstacles to successful PPPs at the county level according to RDAs

Note: Questionnaire question: What does your RDA consider to be the two largest obstacles to successful PPPs in your county?

Full response options: Public distrust in PPPs or co-operation between the public and private sector, in general; Lack of support/guidance from the national government; Regulatory uncertainty; Lack of knowledge in the private sector on engaging with the RDA to develop a PPP; Lack of knowledge in the RDA on developing and/or managing a PPP; Not sure; Other. N=21.

Source: Author’s elaboration, based on (OECD, 2022[32]).

Only under certain conditions and strict control mechanisms can PPPs contribute to diversifying funding for regional and local development projects. Without strict control mechanisms, PPPs can lead to regulatory capture, conflicts of interest and corruption, potentially resulting in long-term impacts on government fiscal capacity and trust in government. In sum, PPPs should be used only when they can produce greater value for money than would be provided by the delivery of public services or investment through traditional means. In practice, this means that they should primarily be directed towards large-scale projects in priority infrastructure sectors (OECD, 2022[42]).

Moreover, the government should also recall that, ordinarily, only larger cities have the fiscal and institutional capacities necessary to make PPPs work. This means that PPPs are generally not appropriate for small local governments. They are typically also not appropriate for small projects, where value for money can be limited. Small PPP projects do not necessarily imply small liabilities, underscoring the need to also consider the full extent of contingent liabilities created through guarantees to PPPs (OECD, 2022[38]). In addition, small PPPs are not always commercially viable. To overcome this challenge, governments in some OECD Member countries (e.g. the United States) have introduced provisions to bundle PPPs across sectors or jurisdictions in order to encourage economies of scale (Box 5.4). Exploring opportunities to bundle subnational PPPs could be of particular value for Croatia, given its high degree of territorial fragmentation.

Box 5.4. Bundled subnational public-private partnerships, an example from the United States

One approach to applying PPPs to support many small projects is to bundle smaller projects into larger ones. This can improve scale and viability thus making them more attractive to larger private sector players, and enable better financing options, including PPPs. In some cases, governments in multiple jurisdictions are involved.

The Pennsylvania Department of Transportation, in the United States, took a bundling approach to small PPPs. It aggregated the construction and maintenance of a few hundred small bridges into a single PPP project. This helped manage the limited viability of individual PPP projects arising from their small size.

Source: Author’s elaboration, based on (OECD, 2021[43]).

In order to increase the responsible use of PPPs to mobilise funding for regional development initiatives, Croatia could take several complementary actions. For instance, the national government could provide support and guidance to ensure that subnational governments are well-informed regarding the potential benefits and risks of PPPs, and the provisions of Croatia’s regulatory framework. It should also aim to strengthen the capacity of subnational authorities to administer PPPs and deliver investment projects effectively, while managing risks. For instance, the government could provide information and training to subnational governments regarding how to assess the value added of PPPs, how to manage partnerships with the public sector and how to establish a transparent system that can track the use of public funding of PPPs and ensure their effectiveness.

Ensuring that the recent PIT reforms do not exacerbate regional and local disparities

Over the last two decades, Croatia has attempted to curb the reliance of subnational authorities on inter-governmental transfers. In 2007, for example, a higher share of Personal Income Tax (PIT) was allocated to subnational governments (from 34 to 52%), with the central government retaining the right to determine a base rate, while subnational governments could apply an additional PIT surtax (Ministry of Finance, 2024[10]). As a result, PIT (including PIT surtax) has become the primary source of own-source revenue of subnational governments, accounting for 90.1% of total subnational tax revenues in 2020. In October 2023, Croatia took additional action, amending the Income Tax Act to grant cities and municipalities flexibility in setting their PIT rates (Official Gazette of Croatia No 114/23, 2023[44]) (Box 5.5). The PIT reform can deliver important benefits to cities and municipalities, for example by strengthening their fiscal autonomy and their capacity to support local economic development. However, the reform also comes with important risks, including a possible ‘race to the bottom’ in which cities and municipalities could consecutively and aggressively lower PIT rates to attract investment and talent, thereby undermining their fiscal capacity.

Box 5.5. The distribution of Personal Income Tax among levels of government and the reform of PIT rates in Croatia

Since Croatian independence, subnational governments have received revenue from PIT. Since 2007, local governments retain 74% of PIT revenues, while counties retain an additional 20%. The remaining 6% is earmarked for those subnational governments tasked with additional decentralised functions, such as primary and secondary education, social care, healthcare and firefighting.

Until 2023, the national government set PIT rates, with lower and upper limits of 20% and 30% respectively. City and municipal governments—but not counties—could add a personal income surcharge on top of the nationally mandated PIT. This surtax varied depending on the size and type of city or municipality. The maximum surtax rates ranged from 10% for municipalities to 18% for Zagreb City. The introduction of the surcharge gave city and municipal governments greater fiscal autonomy. First, it enabled them to increase their own-source revenue. Second, by setting their own surtax rates within the permitted range, local governments were able to tailor their tax policies to better reflect the unique economic conditions, developmental goals, and public service requirements of their respective jurisdictions.

In October 2023, an amendment to the Law on Financing of Local and Regional Self-Government Units put an end to this regulation. As of 2024, city and municipal governments have been able to set their own PIT rates within certain limits, making PIT surtaxes no longer necessary to build local fiscal autonomy. Local governments can now choose two progressive tax rates from a range, with 15% representing the lowest possible rate and 35.4% representing the highest. However, the specific ranges available for municipalities and cities depend on their size (Table 5.2).

Table 5.2. Amended rates in the Income Tax Act as of January 2024

|

Entity |

Pre-2024 PIT surtax rate |

New lower PIT rate (2024 onwards) |

New upper PIT rate (2024 onwards) |

|---|---|---|---|

|

Municipalities |

Up to 10% |

15%—22% |

25%—33% |

|

Cities (< 30 000 inhabitants) |

Up to 12% |

15%—22.4% |

25%—35.6% |

|

Cities (> 30 000 inhabitants) |

Up to 15% |

15%—23% |

25%—34.5% |

|

Zagreb City |

Up to 18% |

15%—23.6% |

25%—35.4% |

Source: Author’s elaboration, based on (Official Gazette of Croatia No 127 et al., 2017[11]; Official Gazette of Croatia No 114/23, 2023[44]; Official Gazette of Croatia No 101/17, 2017[45]; World Bank, 2021[5]).

The 2023 PIT reform could reduce city and municipal dependency on inter-governmental grants

Granting cities and municipalities the power to set PIT rates represents a significant step towards greater fiscal decentralisation and provides a number of other benefits. First, allowing cities and municipalities to set their PIT rates provides them with more control over their revenue base, potentially leading to improved financial stability and reduced dependence on central government transfers. For instance, should a city require additional funds for infrastructure projects or social services, it could elect to raise PIT rates within its jurisdiction. Second, flexibility in setting PIT rates empowers cities and municipalities to use tax policy as a tool for economic development. By adjusting tax rates, cities and municipalities can create more favourable conditions for investment, encourage business creation and expansion and attract skilled labour. This strategic use of tax policy can enhance the economic attractiveness and competitiveness of local areas, thereby driving growth and development.

A race to lower PIT rates may widen fiscal gaps between cities and municipalities

In order to reap the benefits of the new PIT system, city and municipal governments will need to strike a balance when setting local tax rates. They need to set PIT rates that are sufficiently high so as to raise the funds needed to invest in local public services and infrastructure. However, the rates also need to be sufficiently low so as to avoid placing excessive burdens on taxpayers. In this regard, the government will need to monitor the effects of the reform on local budgets closely. In particular, it should ensure that the additional powers afforded to local governments to reduce rates do not lead to excessive competition among city and municipal governments to attract and retain residents and business through aggressive and repeated reductions in the tax burden. This type of ‘race to the bottom’ could widen disparities in the fiscal capacity of local governments, and would be particularly damaging to the economic health of smaller cities and municipalities, given that larger cities typically enjoy greater fiscal space to absorb tax cuts (i.e. through property income or user charges and fees).

The government should also monitor the effects of the reform on county budgets. Although the PIT reform only provides additional rate-setting powers to cities and municipalities, county governments currently receive 20% of all PIT revenues that are levied in their territory. As such, any significant adjustments in PIT rates by city or municipal governments could also affect the PIT revenues that flow to county governments. Such adjustments could create revenue imbalances, thus affecting the ability of certain county governments to support investments in regional development.

A race to lower PIT rates may limit the financial resources available to smaller local governments to support local service delivery or infrastructure investment, which would increase territorial inequalities. This could also increase the need for additional equalisation transfers to ensure that similar levels of local public service access and quality can be maintained throughout all Croatian territories. As such, the government should carefully monitor the effects of the PIT reform on Croatia’s two fiscal equalisation mechanisms (Box 5.6).

Box 5.6. Croatia’s equalisation mechanisms

Croatia has two different equalisation mechanisms: a revenue equalisation mechanism and an expenditure equalisation mechanism. The former corresponds to the Fiscal Equalisation Fund (FEF), a non-earmarked grant that aims to mitigate revenue disparities across county, city and municipal governments respectively, and ensure they have sufficient resources to provide basic public services and infrastructure. The FEF is funded directly from the state budget and compensates counties, cities and municipalities whose fiscal capacity is determined to be below the reference value for the same level of subnational government.

The expenditure equalisation grant is the Equalisation Fund for Decentralised Functions (EFDF), through which funding is distributed to counties, cities and municipalities that are fulfilling additional responsibilities. Six percent of PIT revenues are earmarked for specific decentralised functions, such as primary and secondary education, social care, healthcare and firefighting. These revenues are transferred to the EFDF, and further supplemented by funding from the national budget where needed. The additional national budget funding is intended to cover the difference between the PIT revenues and the minimum expenditure at the subnational level that is needed to carry out each decentralised function.

Source: Author’s elaboration based on (Official Gazette No 127 et al., 2017[46]).

Strengthening the Regional Development Index as a tool to encourage territorial development

The 2014 Law on Regional Development introduced the Regional Development Index (Box 5.7). The Index is used by the national government to: i) identify regional and local governments that score below the national average in terms of development (lagging regions are known as ‘assisted areas’) and; ii) tailor the distribution of financial support to these lagging subnational governments. In particular, the government supports various programmes (e.g. the Programme of Sustainable Social and Economic Development of Assisted Areas and the Programme for the Development of Mountainous Areas) through fiscal transfers that are based on the Index scores of Croatia’s subnational governments (MRDEUF, 2022[47]; MRDEUF, 2022[48]).

Box 5.7. The Regional Development Index

The Regional Development Index is a composite weighted indicator based on an adjusted average of standardised socio-economic indicators. It is calculated every three years in order to help identify county, city and municipal governments lagging behind the national average in terms of development. In accordance with the Regulation, the following indicators are used to calculate the Regional Development Index:

Average income per capita

Average primary income per capita

Average unemployment rate

General movement of the population

Level of education of the population (tertiary education)

Ageing index

County governments are classified into four groups according to their Index value (two of which are above average and two of which are below), while cities and municipalities are grouped into eight categories (four of which are above average and four of which are below). All subnational governments with a below-average Index score are classified as “assisted areas”. The distribution of counties was last updated at the beginning of 2024.

Table 5.3. Distribution of counties according to the Regional Development Index as of 2024

|

Group |

Category |

County |

|---|---|---|

|

1 |

Below-average, lower half |

Slavonski Brod-Posavina, Požega-Slavonia, Sisak-Moslavina, Virovitica-Podravina and Vukovar-Srijem |

|

2 |

Below-average, upper half |

Bjelovar-Bilogora, Karlovac, Koprivnica-Križevci, Lika-Senj, Osijek-Baranja and Šibenik-Knin |

|

3 |

Above-average, lower half |

Krapina-Zagorje, Međimurje, Primorje-Gorski Kotar, Split-Dalmatia and Varaždin |

|

4 |

Above-average, upper half |

Dubrovnik-Neretva, Zagreb City, Istria, Zadar and Zagreb (county) |

Source: Author’s elaboration, based on (Official Gazette of Croatia No 3/24, 2024[49]; Government of Croatia, 2017[50]).

The Index provides an important snapshot of county- and local-level development, which can help make timely adjustments to the reallocation of regional development funding, thereby contributing to Croatia’s long-term strategic objective of balanced regional development. However, interviews with local stakeholders confirmed that some subnational governments try to ‘game’ their Index score in order to be eligible for ‘assisted area’ funding (OECD, 2023[26]). This means that the Index may inadvertently encourage county and local governments to underperform across various socio-economic indicators.

Gradually phasing out funding for subnational governments no longer considered ‘assisted’ could help solidify development gains

To help strengthen the Regional Development Index as a tool that can encourage subnational government to strengthen their performance, Croatia can take several actions. First, the government could consider introducing measures to gradually decrease the financial impact of transitioning out of ‘assisted area’ status, thereby mitigating the negative consequences associated with improving Index scores. This could involve establishing a mechanism whereby the financial support provided to county and local governments formerly considered ‘assisted areas’ decreases incrementally over a set period (e.g. three years). Such an approach could help to limit the incentive for local leaders to deliberately seek an ‘assisted area’ designation. Moreover, gradually phasing out financial support to subnational governments previously classified as ‘assisted areas’ could provide them with financial means to consolidate their recent developmental gains.

Second, the government could consider using the Index as a foundation to support a more performance-based funding model for regional development (i.e. one in which socio-economic progress yields certain rewards). For instance, subnational governments that perform at an above-average level might be entitled to certain concessions (e.g. tax breaks or increased investment opportunities), although such measures should be limited in scope and monitored closely so as not to unduly exacerbate territorial inequalities. Such a mechanism could serve as a vital incentive for those subnational governments that, while considered well-developed within the Croatian context, still find themselves trailing the majority of their EU peers. By recognising and rewarding their achievements, the mechanism would address concerns expressed by some RDAs that current regional development support mechanisms in Croatia predominantly favour underperforming regions (OECD, 2023[26]). Implementing performance-based incentives that are based on Index scores could help encourage all Croatian regions to strive for improvement, acknowledging the efforts of those that have made significant progress yet still have room to grow in the broader European context.

Strengthening existing co-ordination bodies to support regional development funding

To ensure that sufficient financial resources for regional development are effectively mobilised, managed and spent, it is imperative to have robust co-ordination and communication mechanisms in place. Vertical co-ordination (i.e. among levels of government) matters because it can help ensure that regional development funding mechanisms are built on identified territorial needs, as well as fiscal capacities (e.g. ability to co-fund) and human capacities (e.g. ability to respond to competitive calls for proposals). Horizontal co-ordination (across a government tier) is equally important. For instance, inter-ministerial co-ordination can help ensure coherence in how regional development funding is allocated across ministries (i.e. the MRDEUF and other line ministries). Similarly, robust horizontal co-ordination mechanisms can help to address challenges posed by territorial fragmentation, potentially enabling counties, cities and municipalities to pool resources, share expertise, and collaborate on larger scale projects that might be unfeasible for smaller entities to undertake independently.

The section identifies a number of policy options that can help Croatia to strengthen existing co-ordination mechanisms described in chapter 3 (e.g. the Prime Minister-led regional development co-ordination body3). In particular, it identifies measures that could foster inter-governmental debate on regional development funding sources and needs. The section also explores how macro-regional development agreements can help to address funding and financing challenges related to Croatia’s territorial fragmentation.

Enabling the Prime Minister-led regional development co-ordination body to foster debate on regional development funding sources and needs

In principle, the Prime Minister-led regional development co-ordination body, which has been operating since 2016, can support both inter-ministerial and vertical co-ordination on regional development funding. However, as stated in chapter 3, this may require a number of supportive actions, including reorganising the body into two chambers: one to support inter-ministerial co-ordination of regional development policy and the other to support its vertical co-ordination among different levels of government. Second, the list of public bodies slated for mandatory participation needs to be extended, in order to include a wider set of central government bodies whose actions affect regional development.

The national-level chamber of the Prime Minister-led regional development co-ordination body could provide a platform for ministries and other central government bodies (e.g. Bureau of Statistics) to discuss the funding and financing mechanisms that could be marshalled to help achieve balanced regional development. For example, the chamber could commission an assessment of national budget funds allocated to initiatives that support regional and local development. Developing a comprehensive overview of regional development funding, which is currently not available, could serve several objectives. First, it could help to identify which ministries and other central government bodies provide funding to territorial development initiatives. This could help to determine, for example, which bodies, because of their funding for regional and local government, should be part of the Prime Minister-led regional development co-ordination body.

Second, the assessment could help the government to quantify how much is spent on regional and local development from the national budget, and how much is allocated to initiatives that target specific sectors (e.g. education, housing, SMEs, roads and transportation). Based on this information, the Prime Minister-led regional development co-ordination body could identify: i) whether the funding provided through the national budget aligns with the country’s long-term development objectives; and ii) whether there are funding gaps or possible inefficiencies (e.g. due to overlap in spending). A similar exercise was conducted for Ukraine’s Ministry of Communities and Territories Development, which could serve as an example for Croatia (Box 5.8).

Box 5.8. Assessment of Ukraine’s state funding for regional and local development