This chapter analyses the investment trends and dynamics in East Africa (Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda), with a focus on the renewable energy sector. The chapter first shows that investments have been a major driver of East Africa’s recent growth, but their allocation towards social and environmental sustainability remains insufficient. Second, it discusses East Africa’s vast renewable energy potential while highlighting that current investments are insufficient to meet the region’s energy access needs. It outlines major investment barriers hampering the growth of the renewable energy market and identifies the potential of innovative enterprises to both accelerate the uptake of renewable energies and contribute to productive transformation in the region. Finally, the chapter offers policy recommendations for mobilising greater renewable energy investments across East Africa.

Africa's Development Dynamics 2023

Chapter 5. Investing in renewable energies for East Africa’s sustainable development

Abstract

In Brief

Diverse public and private investments have contributed to strong economic growth in East Africa, and the region’s sources of finance have been resilient during the COVID-19 pandemic. Foreign investments, development finance, export credits and regional lead firms have all been drivers of sustainable development but remain concentrated on the region’s largest countries.

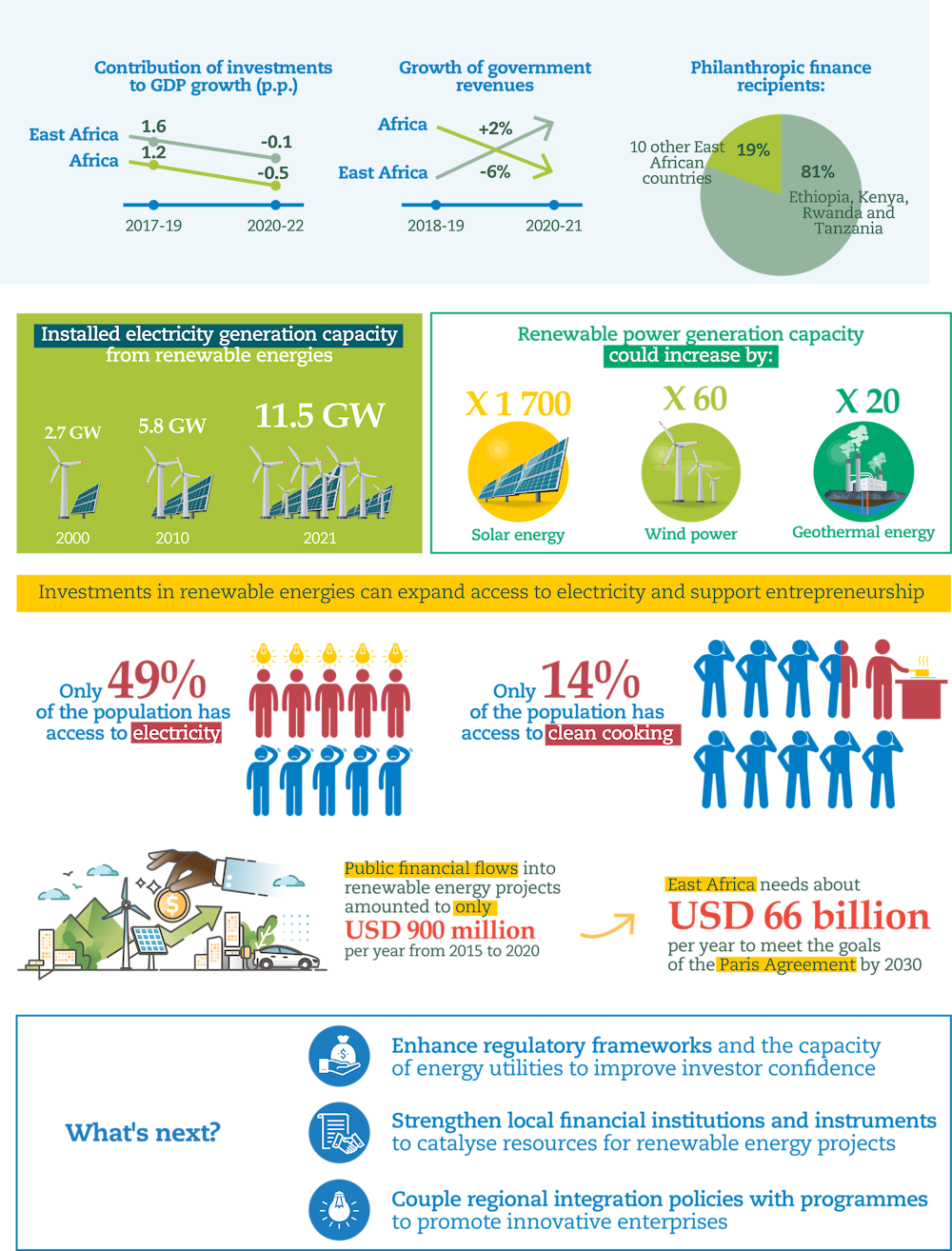

While East Africa’s renewable energy sector has grown, most of its potential for sustainable investments has remained untapped. The sector is core to East Africa’s goal to expand access to electricity and clean cooking, at the same time supporting entrepreneurship and the region’s productive transformation; at the end of 2020, 49% of the population had access to electricity and only 14% to clean cooking. Despite East Africa’s diverse renewable energy assets – encompassing vast hydro, wind, solar and geothermal energy resources – only 4% of greenfield foreign direct investment inflows into East Africa were directed at renewable energy projects during 2017-22, compared to 17% for Africa as a whole.

Ineffective energy regulation, poor energy infrastructures and unstable macroeconomic conditions, exacerbated by recent global shocks, weigh negatively on investor confidence in most East African countries. Nonetheless, innovative enterprises are growing across the region and offer the potential to catalyse more investments in renewable energies and support productive transformation.

Three priorities stand out for policy makers in East Africa to mobilise greater investments in renewable energies:

enhancing regulatory frameworks and the capacity of energy utilities to improve investor confidence in the renewable energy sector

strengthening local financial institutions and instruments to catalyse resources for renewable energy projects

deepening regional integration through infrastructure projects to support the emergence and upscaling of innovative enterprises.

East Africa (infographic)

East Africa regional profile

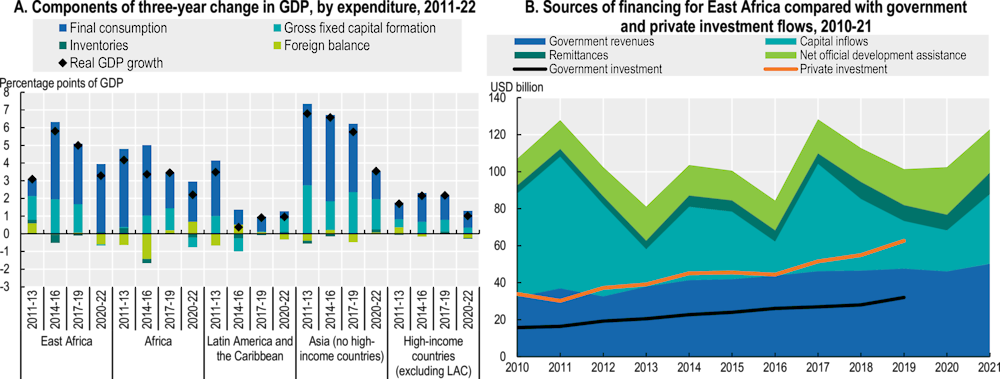

Figure 5.1. Components of economic growth and sources of financing in East Africa

Note: The components of gross domestic product (GDP) growth are calculated on an annual basis by using real annual GDP growth to estimate the increase in real US dollars. Aggregate figures are calculated by taking the average of the national figures weighted by GDP in purchasing-power-parity dollars. The components of GDP growth over three-year periods were calculated by taking the difference between the geometric average of the annual real GDP growth over the period and the real GDP growth when setting each component to zero for individual years. Foreign balance is the difference between imports and exports. Imports contribute negatively to GDP. “High-income countries” refers to countries classified as “high-income” according to the World Bank Country and Lending Groups outside of Latin America and the Caribbean. Government revenues include all tax and non-tax government revenues minus debt service and grants received. Capital inflows include foreign direct investment, portfolio investment and other investment inflows reported by the International Monetary Fund under asset/liability accounting. Figures for capital inflows should be interpreted with some caution as some figures for 2021 and for portfolio inflows are missing.

Sources: Authors’ calculations based on IMF (2022a), World Economic Outlook Database, www.imf.org/en/Publications/WEO/weo-database/2022/October; OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; World Bank (2022a), World Development Indicators (database), https://data.worldbank.org/products/wdi; IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52; IMF (2022c), Investment and Capital Stock Dataset (ICSD) (database), https://data.imf.org/?sk=1CE8A55F-CFA7-4BC0-BCE2-256EE65AC0E4; and World Bank-KNOMAD (2022), Remittances (database), www.knomad.org/data/remittances.

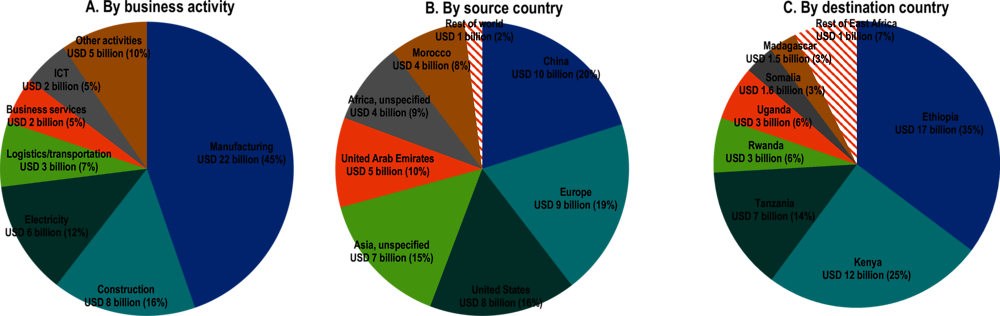

Figure 5.2. Greenfield foreign direct investment flows into East Africa, by activity, source and destination, 2017-22

Note: The fDi Markets database is used only for comparative analysis. Actual investment amounts should not be inferred, as fDi Markets data are based on upfront announcements of investment projects, including a share of projects that do not actually materialise. ICT = information and communications technology.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Diverse investment flows are a major driver of East Africa’s growth and sustainable development but focus on only a few countries

Investments have contributed to strong economic growth in East Africa

Compared to Africa as a whole, East Africa has experienced higher gross domestic product (GDP) growth, with investments being a more important driver. The trend that East Africa consistently achieves higher growth than other African regions has been sustained during the COVID-19 pandemic, with GDP growth reaching 0.7% in 2020, 5.4% in 2021 and 4.3% in 2022, compared to -1.7%, 4.9% and 3.8% for Africa (IMF, 2023a). Investments (gross fixed capital formation) have been on an upward trend in the last decade and have contributed to recent GDP growth far more in East Africa (1.6 percentage points in 2017-19 and -0.1 percentage points in 2020-22) than in the whole of Africa (1.2 and -0.5 percentage points in the same periods) (Figure 5.1, Panel A).

Except for capital inflows, sources of financing have been stable in East Africa, with government revenues showing more resilience than in other African regions. During the COVID-19 pandemic, government revenues have been more stable in East Africa (+2% between 2018-19 and 2020-21) than in Africa as a whole (-6% over the same period). In line with trends at the continental level, official development assistance (ODA) and remittances have increased during the pandemic (by 30% and 6% respectively), thereby partially compensating for the drop in capital inflows (-7%) (Figure 5.1, Panel B).

Global inflows of foreign direct investment (FDI) come from diverse destinations, with Chinese and Emirati investments playing a more significant role than in other African regions. The People’s Republic of China (hereafter “China”) (USD 10 billion), Europe (USD 9 billion) and the United States (USD 8 billion) have accounted for the highest greenfield FDI inflows into East Africa in 2017-22. Notably, 10% (USD 5 billion) of the region’s FDI has come from the United Arab Emirates – which represents more than half of FDI from all African countries outside the region combined (Figure 5.2, Panel B). As of February 2023, the International Monetary Fund considers two East African countries to be in debt distress (Somalia and Sudan), with five other countries (Comoros, Djibouti, Ethiopia, Kenya and South Sudan) facing a high risk of moving to this status (IMF, 2023b).

Private and public investment sources concentrate on a range of sectors but mostly in the region’s largest countries

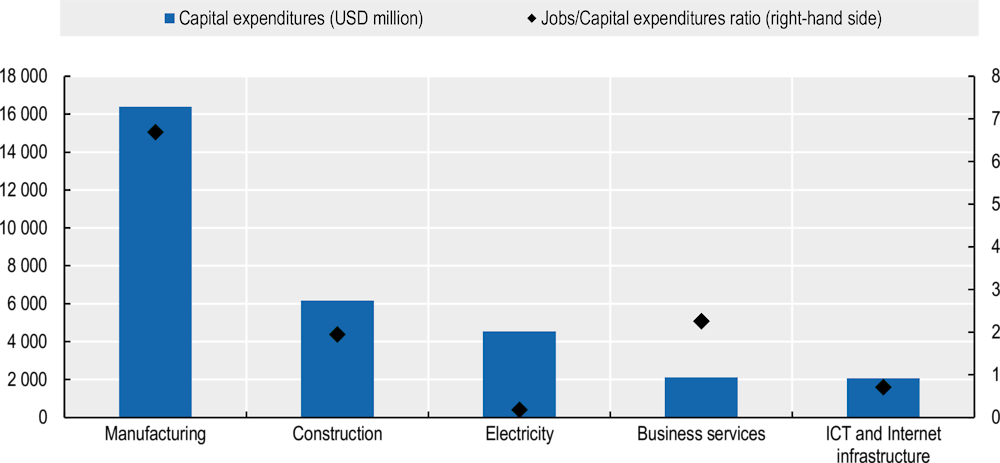

Manufacturing is the largest recipient of greenfield FDI, and business services rank relatively high. Between 2017 and 2021, the manufacturing sector (including the processing of coal, oil and gas) attracted more greenfield FDI than the next four sectors combined (USD 16.4 billion vs. USD 14.9 billion). Absolute investment amounts are well aligned with sectoral job/capital expenditure ratios. East Africa is the only African region where business services rank among the top five sectors targeted by FDI (Figure 5.3).

Figure 5.3. Greenfield foreign direct investment to East Africa, capital expenditures and job creation, by business activity, 2017-21

Note: The figure shows the top five business activities by capital expenditures. It covers the period from 2017 to 2021 and therefore shows a different total capital expenditure for electricity compared to Figure 5.2. ICT = information and communications technology.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

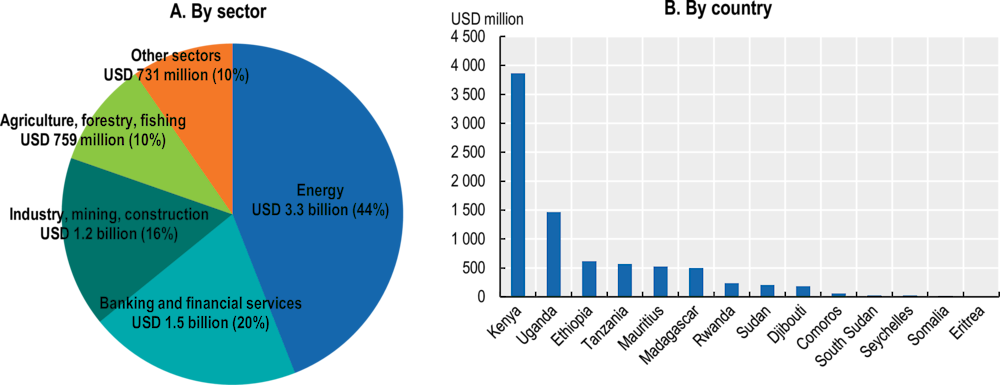

Private finance mobilised through development finance and export credits target different sectors, but both focus on the region’s four largest countries. In 2012-20, USD 8.3 billion of private finance were mobilised by development finance in the region; the energy sector attracted the highest share (40%), followed by banking and financial services (20%). By far, the most private finance was mobilised by development finance in Kenya (USD 3.9 billion), followed by Uganda (USD 1.5 billion), Ethiopia (USD 0.6 billion) and Tanzania (USD 0.6 billion) (Figure 5.4). According to the OECD Export Credits Group, export credits from OECD countries to East Africa amounted to a total of USD 6.64 billion from 2012 to 2021, focusing mostly on construction (47%), transport and storage (23%), health (7%) and industry (7%), with Tanzania attracting the largest amount (USD 2.1 billion), followed by Kenya (USD 1.9 billion), Ethiopia (USD 1.6 billion) and Uganda (USD 0.5 billion).

Figure 5.4. Private finance mobilised through official development finance in East Africa, 2012-20

Note: “Other sectors” includes (by order of magnitude): trade policies and regulations; multi-sector/cross-cutting; education; health; tourism; water supply and sanitation; business and other services; other social infrastructure and services; government and civil society; population policies/programmes; reproductive health and humanitarian aid; and unspecified.

Source: OECD (2022c), “Mobilisation”, OECD.Stat (database), https://stats.oecd.org/Index.aspx?DataSetCode=DV_DCD_MOBILISATION.

ODA and philanthropy inflows focus on social sectors, mainly targeting education, health, agriculture and humanitarian efforts. These funds complement the more limited government spending in these domains. For instance, in 2019, public healthcare expenditures reached 1.4% of GDP in East Africa, less than in North Africa (2.2%) and Southern Africa (3.8%). ODA and philanthropy were concentrated in Ethiopia, Kenya, Rwanda and Tanzania. The four countries account for 62% of the region’s population and received 55% of ODA and 81% of philanthropic flows.

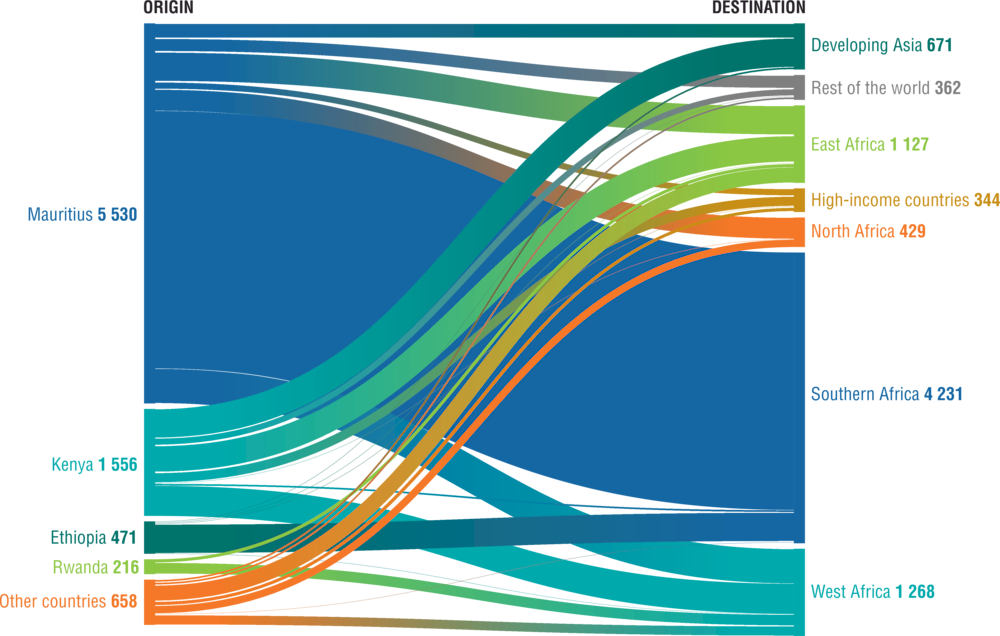

East Africa is more integrated into intra-African investment flows than other African regions, supported by large multinational enterprises in the finance and insurance sector in Mauritius and Kenya. Greenfield FDI outflows from East African countries are dominated by transactions from Mauritius (USD 5.5 billion), mostly targeting Southern Africa, followed by West Africa and other East African countries. Outward greenfield FDI from Kenya (USD 1.6 billion) is more evenly distributed, with similar amounts reaching other East African countries (USD 397 million), developing Asia (USD 422 million) and West Africa (USD 436 million) (Figure 5.5). Finance and insurance companies with headquarters in Kenya and Mauritius also dominate the region’s leading companies. Consumer-facing firms with strong regional footprints (such as the Kenya Commercial Bank) employ the largest number of people, albeit remaining far behind retailers that have headquarters outside the region (such as South African Shoprite operating in East Africa). Kenya also stands out as the country with the largest institutional investors in the region: Kenyan pension fund assets under management amounted to 12% of GDP in 2015-20, the fourth highest share in Africa after Namibia (98%), South Africa (84%) and Botswana (53%).1

Figure 5.5. Greenfield foreign direct investment outflows from East African countries, by destination region, 2017-21, USD million

Note: “Other countries” includes Madagascar (USD 160 million), Seychelles (USD 150 million), Djibouti (USD 146 million), Sudan (USD 105 million), Tanzania (USD 87 million) and South Sudan (USD 2 million). “Rest of the world” includes countries from Central Africa (USD 276 million), Latin America and the Caribbean (LAC) (USD 33 million) other regions not specified in the chart (USD 52 million). “High-income countries” refers to countries classified as “high-income” in the World Bank’s classification of countries by income group, excluding LAC.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Mobilising investments in East Africa’s renewable energy sector can increase access to clean energy and support productive transformation

Despite East Africa’s vast renewable energy potential, current investments are insufficient to meet the region’s energy access needs

East Africa holds unique potential for renewable energies, as its countries benefit from a range of energy reserves. The region’s untapped renewable energy reserves cut across hydro, wind, solar and geothermal power (IEA, 2022). The region has an average annual solar irradiation of 2 100 kilowatt hours (KWh) per square metre and wind speeds averaging 5.5 metres per second – and up to 8 metres per second in Ethiopia, Kenya and Somalia. Based on a mere 1% utilisation of land suitable for energy project development, technically installable capacities amount to 1 067 gigawatts for solar power and 47.2 for wind power (IRENA/AfDB, 2022). The Great Lakes area and Nile Basin offer further potential for hydropower, while the Rift Valley holds the richest geothermal potential on the continent (IRENA, 2022a). The region is currently using less than 5% of its geothermal capacity, mostly in Kenya and Ethiopia (Kincer, 2021).

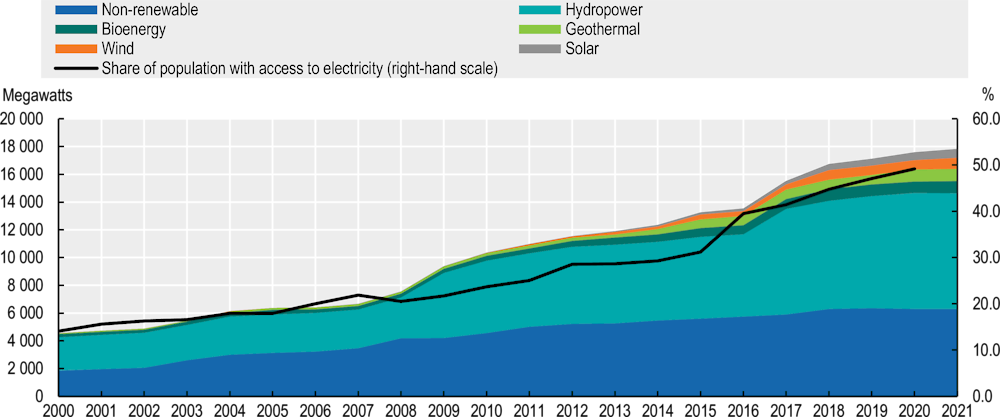

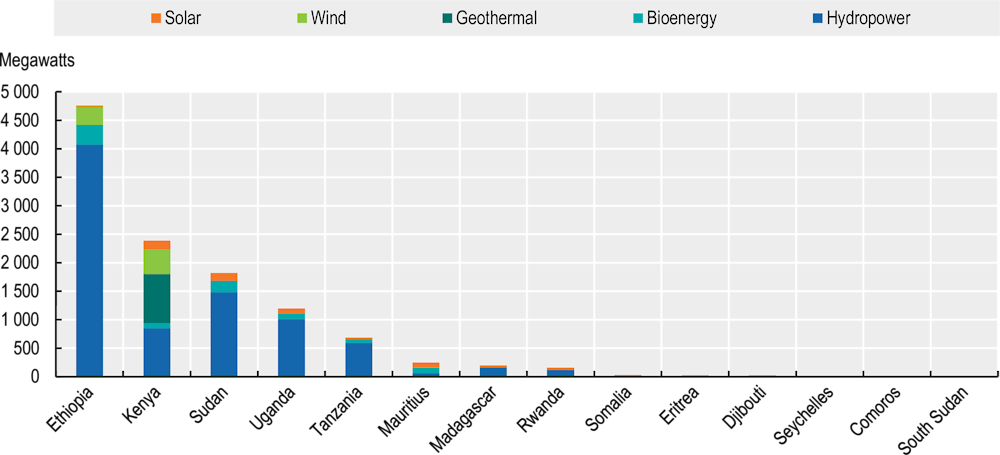

The renewable energy market in East Africa has seen fast growth, but solar and wind power account for only a small share of electricity generation. The region’s electricity generation capacity from renewable energies amounted to 11.5 gigawatts (GW) in 2021, a more than fourfold increase from 2000 (2.7 GW) and a nearly doubling since 2010 (5.8 GW). In 2021, renewable energy thus accounted for 65% of East Africa’s total electricity capacity. This growth was primarily driven by the expansion of hydropower in the early 2000s, which was later complemented by geothermal, bioenergy, wind and solar power. Despite their vast potential, solar and wind energy have only recently begun to be exploited and still represent a small share of the region’s overall capacity (3.5% and 4.5% respectively) (Figure 5.6). Thanks to its large hydropower capacity, Ethiopia has become an electricity exporter and the African country with the most renewable energy jobs (about 57 800 in 2021 [IRENA, 2022b]). Kenya stands out in the region for its diversified renewable energy mix (Figure 5.7).

Figure 5.6. Installed electricity capacity and access to electricity in East Africa by source, 2000-22

Note: “Solar” includes photovoltaic and concentrated solar power. “Wind” includes onshore and offshore wind. “Bioenergy” includes solid biofuels, liquid biofuels and biogas. “Hydropower” includes renewable hydropower and pumped storage. “Non-renewable” includes coal and peat, oil, natural gas, fossil fuels not elsewhere specified, nuclear, non-renewable municipal waste and other non-renewable energy.

Source: Authors’ compilation based on IRENA (2022a), IRENASTAT (database), https://pxweb.irena.org/pxweb/en/IRENASTAT?_gl=1*fltysn*_ga*MTA3NTM0NzYxLjE2NjE3NzAyNzQ.*_ga_7W6ZEF19K4*MTY3ODI4NTgxNC40NC4xLjE2NzgyODU4MzguMzYuMC4w and World Bank (2022a), World Development Indicators (database), https://data.worldbank.org/products/wdi.

Figure 5.7. Installed electricity capacity from renewable energy sources in 2021, by country

Note: “Solar” includes photovoltaic and concentrated solar power. “Wind” includes onshore and offshore wind. “Bioenergy” includes solid biofuels, liquid biofuels and biogas. “Hydropower” includes renewable hydropower and pumped storage.

Source: Authors’ compilation based on IRENA (2022a), IRENASTAT (database), https://pxweb.irena.org/pxweb/en/IRENASTAT?_gl=1*fltysn*_ga*MTA3NTM0NzYxLjE2NjE3NzAyNzQ.*_ga_7W6ZEF19K4*MTY3ODI4NTgxNC40NC4xLjE2NzgyODU4MzguMzYuMC4w.

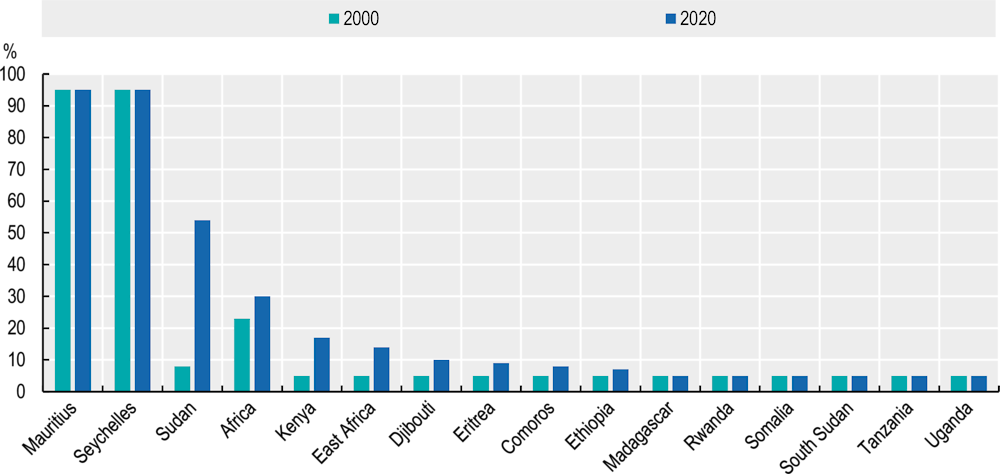

Despite significant progress, half of East Africa’s population – around 200 million people – lack access to electricity, while pollution from non-renewable energy sources remains problematic. In part driven by the growth of renewable energies, the region’s electricity access rates increased considerably between 2000 and 2020 (Figure 5.6). Kenya and Rwanda have been among the world’s fastest-electrifying countries; in 2022, they defied the region’s post-pandemic decline in electricity access by stabilising or reducing the number of people lacking access (IEA, 2022). However, in 2020, only 49% of people living in East Africa had access to electricity. Six East African countries are among the world’s 20 countries with the lowest access rates. While electricity generation has become predominantly renewable-based, the use of fossil fuels in the transport and residential sectors has driven up greenhouse gas emissions, with four East African countries among Africa’s top ten emitters between 2010 and 2020.2

The use of fuel wood and charcoal-based cooking continues to be widespread and leads to immediate health risks, particularly in rural and urban poor communities (IEA, 2022). In 2020, only 14% of East Africa’s population had access to clean cooking (Figure 5.8). In 2019, the number of premature deaths from household air pollution per million population was 1 724 in Somalia and 1 124 in Eritrea, which are three and two times more than Africa’s average (Roy, forthcoming).

Figure 5.8. Percentage of the population in East Africa with access to clean cooking, 2000 and 2020

Source: IEA (2021a), World Energy Outlook 2021, www.iea.org/reports/world-energy-outlook-2021 based on WHO (2021), Household Energy Database, www.who.int/data/gho/data/themes/air-pollution/who-household-energy-db and IEA (2021b), World Energy Balances 2021 (database), www.iea.org/data-and-statistics/data-product/world-energy-balances.

Renewable-based off-grid and mini-grid technologies help expand electricity access in East Africa’s rural and remote areas, but recent global crises have affected affordability. In 2019, decentralised energy access solutions, such as off-grid and mini-grid technologies including standalone and solar home systems, served 38.5 million people, as the region recorded four times as many installations as West Africa and eight times as many as Southern Africa (IRENA/AfDB, 2022). Ethiopia and Kenya boast the most attractive markets for off-grid solutions in the region, accounting for close to 30% of the world’s off-grid solar market in 2021, with 19 million people in Kenya and 8 million people in Ethiopia connected to off-grid solar solutions (IEA, 2022). In Rwanda, solar-based off-grid solutions provide electricity to 15% of households and 7% of the total population, the highest off-grid electricity access rate in Africa and the third highest in the world (GIZ/IRENA, 2020). While off-grid and mini-grid technologies offer potential, especially in rural areas, affordability continues to be a major obstacle. As a result of supply chain disruptions and inflation caused by the COVID-19 pandemic and international conflicts, off-grid devices have become unaffordable for many consumers, slowing down their adoption (IEA, 2022).

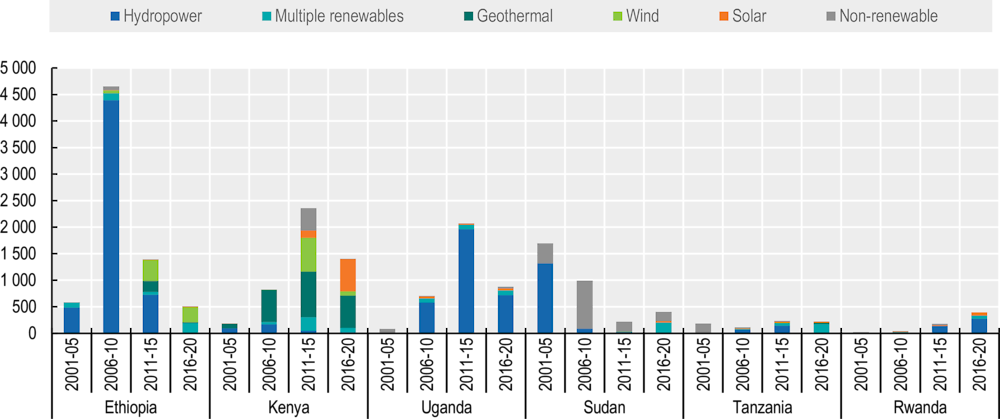

Investments in East Africa’s renewable energy production do not match the potential to widen access to electricity and reduce pollution. Both private and public investments have remained comparatively small. Only 4% of greenfield FDI capital expenditures into East Africa was directed at renewable energy projects in 2017-22 compared to 17% for the African continent.3 Public financial flows into renewable energy projects are even less significant, amounting to USD 5.6 billion from 2015 to 2020, or USD 900 million per year, with an annual low of USD 334 million in 20204, the first year of the pandemic. Public financing particularly under exploits wind and solar energy, with only Ethiopia and Kenya having made significant investments in these technologies in recent years (Figure 5.9). For comparison, East Africa’s combined nationally determined contributions to meet the Paris Agreement’s goal to keep global warming below 1.5°C by 2030 amount to USD 65.96 billion per year from 2020 to 2030 (AfDB, 2022).

Figure 5.9. Top six East African countries with public investments in renewable energy sources, 2001-20, USD million

Note: “Solar” includes photovoltaic and concentrated solar power. “Hydropower” includes renewable hydropower and pumped storage. “Wind” includes onshore and offshore wind. “Non-renewable” includes coal and peat, oil, natural gas, fossil fuels not elsewhere specified, nuclear, non-renewable municipal waste and other non-renewable energy. “Multiple renewables” include public investments in more than one renewable energy technology.

Source: Authors’ compilation based on IRENA (2022a), IRENASTAT (database), https://pxweb.irena.org/pxweb/en/IRENASTAT?_gl=1*fltysn*_ga*MTA3NTM0NzYxLjE2NjE3NzAyNzQ.*_ga_7W6ZEF19K4*MTY3ODI4NTgxNC40NC4xLjE2NzgyODU4MzguMzYuMC4w.

Structural barriers and recent crises hinder renewable energy investments in East African countries

Insufficient regulations, a lack of bankable projects, difficult financing conditions and poor energy infrastructures represent major structural barriers to most private and international investments. Interviews with multinational enterprises and a comprehensive literature review identified a range of investment barriers that consistently hamper investments in renewable energies (Table 5.1; see also Chapter 1). Investors and industry sources mentioned the following as barriers to FDI and other forms of private investments: regulatory restrictions on private participation and inadequately implemented reforms (e.g. in Ethiopia and Kenya), monopsonist behaviour by utilities, high off-taker risk and other vested interests (e.g. in Tanzania and Uganda), a deteriorating or opaque sovereign credit profile (e.g. in Ethiopia), and a lack of bankable projects (e.g. in Seychelles and Tanzania). With some exceptions, domestic, other African and non-African private investors face similar barriers. Philanthropic and international development finance institutions are generally less affected by many barriers, but the implementation of reforms, political stability, and project-specific governance and capacity issues affect their investment decisions.

Table 5.1. Barriers to renewable energy investments in East Africa for different types of investors

|

Investment barrier |

|

Non-African private investors |

African private investors |

Domestic private investors |

Philanthropic institutions |

International development finance institutions |

|---|---|---|---|---|---|---|

|

Unfavourable regulatory and institutional environments |

Restrictions to private and market-based energy production and distribution |

x |

x |

x |

|

|

|

Poor and inconsistent implementation of reforms |

x |

x |

x |

|

x |

|

|

Monopsonist activities of utilities and state-owned enterprises, off-taker risk |

x |

x |

x |

|

|

|

|

Political conflict and security concerns |

x |

x |

x |

x |

|

|

|

Land rights disputes |

x |

x |

x |

x |

|

|

|

Lack of bankable projects |

Governance concerns |

x |

x |

x |

|

x |

|

Project capacity limitations |

x |

|

|

x |

x |

|

|

Skills shortages |

x |

x |

x |

|

|

|

|

Difficult financing conditions |

Weak domestic financing system |

x |

x |

x |

|

x |

|

Sovereign credit risk |

x |

x |

|

|

|

|

|

High upfront cost |

|

|

x |

|

|

|

|

Poor infrastructure |

Inadequate grid infrastructure |

x |

x |

x |

|

|

Note: “Private investors” refer to multinational enterprises, banks, and institutional and portfolio investors.

Source: Authors’ assessment based on interviews with multinational energy producers and a desk review of grey and academic literature.

Recent crises have stalled investments in projects across the region, reducing access to electricity and clean cooking. Deteriorating macroeconomic conditions, due to recent global crises, have had ripple effects on overall investor confidence, the financial stability of utilities, equipment suppliers and off-grid technology providers, thereby stalling infrastructure and energy access projects across East Africa (IEA, 2022; see also Chapter 1). Only a few countries, most notably Kenya, were able to add new on-grid electricity connections in 2020-21, mainly by completing projects initiated prior to the COVID-19 pandemic. Electricity and clean cooking access rates have thus declined, particularly where population growth has outpaced the number of new connections, such as in Ethiopia, Madagascar, Tanzania and Uganda (IEA, 2022).

Renewable energy investment barriers and opportunities differ greatly across countries, depending on market size, energy access levels and energy independence. All East African countries face significant barriers to attracting investments in renewable energies. Yet, based on the above analysis, East African countries can be divided into three clusters based on the different investment barriers and opportunities they face:

Cluster 1: Expanding and diversifying renewable energy markets. Ethiopia, Kenya, Rwanda, Tanzania and Uganda have seen the most significant growth in renewable energy production in the region (AfDB, 2022). Kenya, Ethiopia and Uganda received 66% of greenfield FDI capital expenditures for renewable energy projects in all of East Africa over 2017-22.5 Kenya in particular has been able to diversify its renewable energy production and was recognised as one of the top five global destinations for clean energy investments in 2019 (Business Daily, 2019). Despite a much lower GDP, Rwanda is included within Cluster 1 due to its investment in renewable energies as a percentage of GDP ranking in the top five globally (IEA, 2022). Cluster 1 countries have established national energy strategies, updated regulations and engaged in regional energy trade (AfDB, 2021). Their challenge will be to expand and diversify renewable energy production more quickly, supported by targeted public investments and a reduction of barriers for private investors.

Cluster 2: Widening energy access. Comoros, Djibouti, Eritrea, Madagascar, Somalia, Sudan and South Sudan offer fewer opportunities for private investments. For instance, only Djibouti and Madagascar attracted any greenfield FDI projects for renewable energy projects from 2017 to 2022, according to the fDi Markets database, together receiving 9% of East Africa’s total FDI inflows.6 Cluster 2 countries focus on expanding energy access and replacing polluting energy sources with clean ones wherever this is cost-effective and affordable; however, they continue to rely on combustible renewable energy (biofuels) and even fossil fuels where necessary to increase energy access. These countries mostly concentrate on regulatory fundamentals such as transparent and predictable tariff regimes (AfDB, 2021).

Cluster 3: Achieving renewable-based energy independence. Mauritius and Seychelles are small island states and, as high-income countries, they are attractive destinations for private investments. They received 25% of East Africa’s greenfield FDI capital expenditures in renewable energies over 2017-22.7 They have high electricity and clean cooking access rates, and their energy regulation systems are well developed. These countries can focus on attracting private investments for renewable energy projects to reduce their dependence on fossil fuel imports and increase their resilience. For instance, innovative projects such as floating solar power plants make use of these countries’ natural and financial assets (Largue, 2020).

Emerging innovative enterprises are spurring the regional renewable energy sector, thus benefiting productive transformation

Innovative enterprises and their business models have begun to enhance and expand renewable energy production and distribution in East Africa. Following the success of start-ups such as Kenya’s M-Kopa Solar, local private businesses have taken advantage of opportunities across renewable energy value chains, covering the manufacturing of devices and components, infrastructure development, the direct distribution and access to electricity and clean cooking, and transportation (Table 5.2). Common are manufacturers and assemblers of solar panels (e.g. Kenya’s Strauss Energy and Solinc), wind turbines (e.g. Uganda’s Millennium Engineers), clean cookstoves (e.g. Kenya’s Acacia Innovations) and electricity distributors (e.g. Tanzania’s Juabar). Notably, enterprises have created innovative business models in response to existing energy system challenges (e.g. pay-as-you-go electricity and subscription cookstove models) focused on specific target groups (e.g. agricultural value chains), thereby achieving productive transformation and environmental sustainability goals at the same time. Market-based innovative business models have almost exclusively come from Cluster 1 countries, due to their market sizes, efforts to liberalise energy systems and existing entrepreneurial talent. In Cluster 2 countries, grant-funded innovative projects contribute to sustainable development (see Box 5.1).

Table 5.2. Examples of innovative enterprises and their business models in East Africa’s renewable energy sector

|

Value chain focus |

Enterprise |

Business model |

Target group |

Market reach |

Industrialisation |

Job creation |

Innovation |

Digitalisation |

|---|---|---|---|---|---|---|---|---|

|

Manufacturing and assembly |

Strauss Energy, a Kenyan start-up and manufacturer of innovative solar energy-generating roofing tiles (Building Integrated Photovoltaics) |

Three-year cost-recovery via surplus power sale back |

H, I+C |

N |

x |

x |

x |

|

|

Solinc, Kenya’s and East Africa’s first solar panel manufacturer, assembler and distributor |

Pay-as-you-go via dealers and firms |

C |

R |

x |

x |

x |

|

|

|

Infrastructure provision |

Group Filatex, Madagascar’s leading producer of mini-grids and renewable energy infrastructure (a provider of over 10 000 jobs) |

Servicing of industrial zones’ rooftops |

H, I+C |

C |

x |

x |

x |

|

|

PowerGen, Kenya’s provider of clean renewable energy and leading global mini-grid developer |

10 000 grid connections |

H, I+C |

C |

x |

x |

x |

x |

|

|

Power Point Systems, Kenya’s Infrastructure (grid and mini-grid) developer and power systems provider |

Diversified provider |

I+C, O |

C |

x |

x |

x |

x |

|

|

CrossBoundary Energy, Kenya-based award-winning financier of over USD 100 million in renewable energy infrastructure projects. |

Project financing |

I+C |

C |

x |

x |

x |

|

|

|

Distribution and access |

M-KOPA Solar, Kenya’s provider of solar-powered home systems |

Pay-as-you-go |

H |

R |

|

x |

x |

|

|

Juabar, Tanzania’s provider of solar-powered kiosks for mobile phone charging in off-grid communities |

Franchise |

C |

N |

|

x |

x |

|

|

|

Acacia Innovations, Kenya’s SDG7 award-winning provider of clean cookstoves to schools |

Subscription service |

O |

N |

|

|

x |

|

|

|

Solagen Power Ltd, Kenya’s provider of solar energy |

B2C+B2B |

H, C, O |

R |

x |

x |

|

|

|

|

Energy Systems Ltd, Uganda’s provider of solar energy, including to off-grid areas |

B2C+B2B |

H, I+C, O |

N |

x |

x |

|

|

|

|

Empower Renewable Energy, Sudan’s renewable energy access provider |

Diversified provider |

H, I+C, O |

C |

x |

x |

x |

|

|

|

SunCulture, Kenya’s provider of solar-powered irrigation and ancillary services to smallholder farmers |

Customised provision |

I+C |

R |

|

x |

x |

x |

|

|

Power OffGrid, Somalia’s provider of smart solar solutions to farmers and others in off-grid communities |

PayGo asset financing platform, Goat4kWh |

H, C |

N |

|

x |

x |

x |

|

|

Transportation |

Ampersand, Rwanda’s electric mobility operator |

Rideshare |

C |

R |

|

x |

|

|

|

BasiGo, Kenya’s assembler and provider of renewable energy-powered e-buses |

Pay-as-you-drive |

C |

C |

x |

x |

x |

x |

Notes: SDG7 = Sustainable Development Goal 7: Affordable and clean energy. B2C+B2B = business to consumer and business to business. Target group: H = households; I+C = industrial and commercial; O = organisational. Market reach: N = national; R = regional; C = continental.

Source: Authors’ compilation based on a literature review.

Box 5.1. Solar energy and clean cooking programmes targeting rural areas

Solar energy and clean cooking programmes have a range of benefits for rural communities across East Africa. They offer solutions directly to schools, hospitals, dispensaries, refugee camps or night-time markets.

Power OffGrid Somalia provides solar solutions and clean energy for rural off-grid and hard-to-reach communities in Jowhar, Somalia. Its innovative and affordable hybrid smart renewable energy services and PayGo asset financing platform for unbanked communities, Goat4kWh, allows pastoralists and farmers to use their livestock as capital to finance their electrification. The firm thereby increases access to electricity, adequate clean water, and clean cooking for thousands of Somalian households (Impakter, 2019).

Women in rural Africa can act as community leaders, entrepreneurs and trainers championing access to solar-powered electricity and emission-reducing clean cookstoves. The Maasai Stoves and Solar Project has, for example, been training Tanzanian women for jobs as distributors and installers of solar panels and cookstoves for traditional mud houses. In addition to reducing emissions and indoor pollution deaths, according to Ligami (2017), such clean energy transition initiatives can help alleviate poverty.

Digital technologies have allowed for more renewable energy, through new business models and data sharing. Digital technologies have enhanced renewable energy generation (e.g. digital wind farms and hydropower digitisation), distribution (e.g. smart grid and e-shops) and energy usage (e.g. smart metering, mobile platforms and energy efficiency applications) (Table 5.2). The declining costs of digital components such as sensors and of data storage technologies have enabled the creation of new business models in data analytics and cybersecurity, operational efficiency, and controls for distributed renewable energy and storage (GE, 2018). Kenya’s Plexus Energy, Somalia’s Power OffGrid and Uganda’s Energy Monitoring Ltd exemplify East Africa’s renewable energy-focused digital solution providers (Wilson, 2021). At a larger scale, synthetic weather models such as the Renewable Energy Space Analytics Tool (RE-SAT) and Small Islands Developing States’ Digital Toolkit, developed through collaboration between the Seychelles government, the International Energy Agency, the Commonwealth Secretariat and other international partners, provide data and additional information as a public good (The Commonwealth, 2021).

Some East African energy infrastructure providers are emerging as lead firms, while established regional multinational enterprises act as investors. Large grid infrastructure firms (e.g. PowerGen and Group Filatex), infrastructure finance providers (e.g. CrossBoundary Energy), and regional and continental renewable energy producers (e.g. Power Point Systems and Group Filatex) are beginning to establish a region-wide footprint (Table 5.2). The diversification of Kenya’s Safaricom into solar and wind power generation and the Mauritius Commercial Bank’s financing of renewable energy electrification projects indicate that the region’s largest multinational enterprises seek investment opportunities in the sector (International Finance, 2022).

Increasing demand by commercial energy users and by green development projects is supporting larger-scale, customised renewable energy generation and distribution projects. As a result of the high costs of deployment and of commercial customers, such as retailers and hospitality businesses, seeking alternatives to grid-based energy access, business models that offer renewable energy-based solutions have become increasingly viable in East Africa. For instance, the retailer SunCulture in Kenya provides solar-powered irrigation solutions to farmers (BII, n.d.). In addition, industrial parks and newly established “green cities” now have opportunities to integrate on-site renewable energy sources into their energy provision. Rwanda’s Green City in Kigali, spearheaded by the Rwanda Green Fund (FONERWA), with financial support from Germany’s KfW Development Bank, seeks to use renewable energy investments to generate positive knock-on effects for social and environmental sustainability (Nkurunziza, 2021).

Public policies can improve East Africa’s renewable energy sector and help mobilise investments

To mobilise investments in East Africa’s renewable energy sector, policy makers must improve energy regulation, strengthen public investments and support regional integration and lead firms (Table 5.3). As a first priority, large and small-scale private investments will continue to be required to better exploit the potential of East Africa’s renewable energy generation, and policy makers can focus on improving regulatory reforms and developing the region’s renewable energy sector. Second, scarce public funds need to be invested in more strategic and innovative ways, which requires capable financial and public institutions. Third, regional integration can be further enhanced by promoting large-scale government-led projects and by encouraging investments from regional lead firms and innovative enterprises.

Table 5.3. Priority policy recommendations for clusters of East African countries

|

Policy domain |

Recommendation |

Cluster 1: Ethiopia Kenya Rwanda Tanzania Uganda |

Cluster 2: Comoros Djibouti Eritrea Madagascar Somalia South Sudan Sudan |

Cluster 3: Mauritius Seychelles |

|---|---|---|---|---|

|

Regulatory frameworks and capacity |

Develop a regulatory framework with credible sector plans and incentives, based on learning from regional peers |

|

x |

|

|

Implement reforms robustly and consistently |

x |

|

|

|

|

Regularly evaluate the regulatory framework, drawing pertinent lessons and redress investor concerns |

x |

x |

x |

|

|

Public investments and innovative financial mechanisms |

Create long-term financial commitments and instruments for public and institutional investments |

x |

|

x |

|

Establish a sovereign green bond to support domestic investments |

x |

|

x |

|

|

Resolve conflicts and offer political risk insurance and other de-risking tools |

x |

x |

|

|

|

Enhance institutional governance and capacity to support the development of bankable proposals and access to financing opportunities |

x |

x |

x |

|

|

Regional integration, lead firms and entrepreneurial innovation |

Deepen regional infrastructure projects to facilitate cross-border energy transport and trade |

x |

x |

x |

|

Harmonise regulations to encourage cross-border market development and value chains |

x |

|

|

|

|

Facilitate the emergence of more renewable energy enterprises and strengthen local entrepreneurship and community-based financing |

x |

|

|

|

|

Promote the transformation of utilities and state-owned enterprises into lead firms and reliable partners for enterprises |

x |

x |

x |

|

|

Increase investment in grid infrastructure and partner with private investors and development finance institutions to promote decentralised energy access |

x |

x |

|

Source: Authors’ compilation based on a literature review.

Enhancing regulatory frameworks and the capacity of energy utilities will expand the region’s renewable energy sector

Most East African countries have embraced foundational regulatory reforms and institutional pilot projects in favour of renewable energies, while their full implementation is still pending. A range of promising policy initiatives has emerged across the region, especially in Cluster 1 countries (Table 5.4). This group of countries also has more complete regulatory frameworks than their Cluster 2 counterparts (Table 5.5).

Table 5.4. Examples of policies to enhance institutional capacity and regulatory frameworks in renewable energies in East Africa

|

Policy example |

Policy goal |

Impact |

|---|---|---|

|

Kenya’s regulatory reforms and tax incentives for private investors |

Enhance the legal framework for the renewable energy sector |

Kenya jumped 52 places over 5 years in the World Bank’s Ease of Doing Business Index and has grown into a regional renewable energy powerhouse (RES4Africa and PWC, 2021). |

|

Uganda’s Global Energy Transfer Feed-in-Tariff (GET FiT) Premium Payment Mechanism |

Improve market access for independent power producers (IPPs) |

The additional payments that GET FiT receives make small-scale private renewable energy generation projects more financially viable and have contributed to 17 competed IPPs and have produced a total of 158 megawatts, or 760 GW/hour per annum (KFW and Multiconsult, 2021). |

|

Madagascar’s USD 40 million Off-Grid Market Development Fund |

Accelerate and achieve sustainable electrification through off-grid solar technologies |

The Fund, with the World Bank’s support, has provided debt financing to solar distributors and to institutions that finance end users or distributors (World Bank, 2018), following regional examples, notably from Kenya and Rwanda. |

|

Madagascar’s Electricity Sector Operations and Governance Improvement Project (ESOGIP) |

Promote innovations among utilities and state-owned enterprises to enhance their operations and financial viability |

This World Bank-financed project introduced a transparent international bidding process, digitalisation of state agencies’ work processes and legal frameworks for grid connections (World Bank, 2018). |

|

Uganda’s Twaake pilot project |

Combine centralised and decentralised technologies to achieve universal electrification |

Utilities 2.0 Twaake, the energy integration pilot project of Uganda’s main power utility, Umeme, has resulted in an intelligent and interactive smart network, which delivers clean energy solutions, revenue management and cost efficiencies (Wilson, 2021). |

Source: Authors’ compilation based on a literature review.

Table 5.5. Regulatory frameworks in East Africa’s renewable energy sector

|

Regulatory feature |

Cluster 1 |

Cluster 2 |

Cluster 3 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Ethiopia |

Kenya |

Rwanda |

Tanzania |

Uganda |

Comoros |

Djibouti |

Eritrea |

Madagascar |

Somalia |

Sudan |

South Sudan |

Mauritius |

Seychelles |

|

|

Electrification/energy masterplan or roadmap covering rural areas |

|

|

x |

x |

x |

|

x |

x |

x |

|

x |

|

|

x |

|

Nationally determined contributions commitment |

x |

x |

x |

x |

x |

x |

x |

x |

x |

x |

x |

x |

x |

x |

|

Renewable energy targets and a diversified mix of energy sources |

x |

x |

x |

x |

|

x |

|

|

x |

x |

x |

|

x |

x |

|

Private participation reforms completed |

|

x |

|

x |

|

x |

|

|

x |

|

|

|

|

x |

|

Transparent auction-based energy licensing and procurement |

|

x |

|

|

x |

|

|

|

|

|

|

|

x |

|

|

Unbundled user access provided by utilities |

x |

x |

|

x |

|

|

|

|

|

|

|

|

|

x |

|

Independent regulator |

x |

x |

|

x |

|

x |

x |

|

|

|

|

|

|

|

|

Tax incentives and subsidies for renewable energies |

x |

|

x |

x |

|

|

|

|

|

|

|

|

x |

x |

|

Differentiation in feed-in tariffs by technology and plant size |

|

X |

|

|

|

|

|

|

|

|

|

|

x |

|

Source: Authors’ compilation based on AfDB (2021) and desk research.

East African governments need to regularly evaluate the effectiveness of existing renewable energy regulatory frameworks, including through investor feedback. Such regular policy self-evaluations can help reveal the outcomes of implemented policies and highlight those aspects requiring further reform. Following investor feedback, Uganda replaced its original feed-in-tariff (FiT) policy with a more attractive Global Energy Transfer Feed-in-Tariff (GET FiT) Premium Payment Mechanism (KFW and Multiconsult, 2021). Seeking input, dialogue and active buy-in from investors can help clarify risk perceptions and lead to more impactful and relevant policies (RES4Africa and PWC, 2021).

East African countries can learn from and emulate each other’s successful regulatory efforts. In particular, Cluster 2 countries with incomplete renewable energy policies (Table 5.5) can adapt regulations and laws from Cluster 1 countries to their contexts, notably, national electrification and clean cooking plans that define roles for distribution (e.g. grid and decentralised) and clean cooking technologies (e.g. e-cooking and biomass pellets). Cluster 1 countries can learn from each other about novel and technically ambitious initiatives, such as green, sustainability and sustainability-linked bonds (Dembele, Schwarz and Horrocks, 2021; see also Chapter 2). For example, Kenya’s denomination of its feed-in tariff in United States dollars could potentially serve Ethiopia’s policy makers who have encountered difficulties arising from their Ethiopian Birr-denominated feed-in tariff policy, including the loss of the International Finance Corporation’s backing for the Scaling Solar project (RES4Africa and PWC, 2021).

East Africa’s utilities could be reformed to become facilitators of market access for renewable energy providers and embrace smart grid technologies. Reforms that mandate utilities to unbundle end-user access and allow for private participation in electricity generation and distribution (such as power wheeling, net metering and a direct-to-customer selling option for independent power producers) could be advanced and deepened. Policy makers can also encourage utilities to adopt smart grid technologies that facilitate the seamless and efficient integration of centralised and decentralised sources of energy into intelligent and interactive networks (Blankers, 2022; ESI Africa, 2022;). The Utilities 2.0 Twaake pilot project of Uganda’s main power utility, Umeme, in collaboration with Power for All and the Rockefeller Foundation, recently reinforced the revenue management, efficiency and decarbonisation benefits of its digital grids (Smith, 2021).

Strengthening local financial institutions and instruments can catalyse resources for renewable energy projects

East Africa’s policy makers can increase financing for renewable energy by prioritising long-term public investments, establishing green bonds and improving institutional capacity for the development of bankable projects. High-upfront costs, the costs of capital and investment risks need to be effectively mitigated to raise financing conditions to viable levels. Budgetary commitments, green funds and project preparation toolkits offer solutions (Table 5.6).

Table 5.6. Examples of policies to strengthen local financial systems to mobilise and channel resources for renewable energy projects in East Africa

|

Policy example |

Policy goal |

Impact |

|---|---|---|

|

Uganda’s ten-year budgetary commitment |

Sustain public investments in renewable energy and de-risk private investments |

USD 5.4 billion is allocated over ten years to finance 2 471 megawatts of renewable energy from hydro, solar, biomass and geothermal sources (AfDB, 2022). |

|

Rwanda Green Fund |

Deploy new innovative financing, notably green funding, to mitigate upfront costs and catalyse domestic investments |

The Fund has facilitated investments of USD 40 billion in 35 projects, created over 137 500 green jobs and extended off-grid clean energy access to 57 500 households (UN, 2022). |

|

Seychelles’ SIDS Toolkit |

Drive the development of internal capacity for preparing compelling project proposals |

This digital toolkit for Small Island Developing States effectively supports the preparation of investment-grade business cases (Wilson, 2021). |

Source: Authors’ compilation based on a literature review.

Well-tailored financial instruments and long-term financial commitments by East African governments and institutional investors can expand access to finance and reassure investors. Mitigating the effects of high upfront costs, inflationary pressures and currency depreciation on domestic renewable energy investments by deploying financial instruments tailored to countries’ needs can unlock and mobilise additional local funding (AfDB, 2022). Dedicated facilities and blended finance institutions – such as national climate funds, green banks and regional institutions like the Facility for Energy Inclusion, incubated by the African Development Bank, and the Sustainable Energy Fund for Africa – can help to manage these funds. Long-term commitments can provide security for investors’ decision-making. Rwanda has committed to sustained public investments to boost renewable energy generation, distribution and access through a USD 40 billion Green Bond and Renewable Energy Fund, while Uganda has made a ten-year budgetary commitment of USD 5.4 billion to finance renewable energy projects (AfDB, 2022). Institutional investors can also play an important role: in 2021, Kenya’s Retirement Benefits Authority committed to allocating USD 229 billion to infrastructure assets for the local renewable sector over 2021-26 (US Embassy Kenya, 2020).

New financial instruments can be leveraged for investments in renewable energies. Innovative financing instruments dedicated to climate resilience and the just energy transition are often available for renewable energy projects; they include green, social, sustainability and sustainability-linked bonds, debt-for-climate swaps, and climate-linked debt. Governments can increase their eligibility for financial instruments by strengthening the internal capacity and technical expertise of financial institutions, regulators and utilities. Generating revenue through carbon credits can, for example, support further investment in renewable energy projects as well as co-finance or subsidise upfront investment costs, such as for clean cooking appliances for end users (AfDB, 2022).

Local financial institutions can improve collaboration with development finance institutions and international partners to develop bankable projects, adjusted to the local market size. Local financial institutions, such as development banks, can help co-ordinate funding and support mechanisms from development finance institutions and other international partners (Chapter 2). Particularly in Cluster 2 countries, enhancing the capacities of local institutions to effectively access and channel international support will be essential, since bankable projects will remain scarce due to the small size of their markets. Technical assistance grants, funded internships and personnel exchanges, and project preparation grants from development partners – for instance, the Sustainable Energy Fund for Africa – can support this process (SEFA, 2021). The African Rift Geothermal Development Facility (ARGeo) provides an example of a high-impact project. Launched by the United Nations Environment Program in 2010, ARGeo aimed to develop the untapped potential of geothermal resources and reduce greenhouse gas emissions in several East African countries. Through technical assistance for surface exploration studies, the project lowered risks associated with resource exploration and catalysed USD 300 million of investment in Ethiopia, Kenya, Tanzania and Uganda, while also boosting regional networks and establishing the Africa Geothermal Center of Excellence (GEF, 2021).

Regional integration policies can facilitate the emergence and upscaling of innovative enterprises

East African policy makers can deepen regional integration and support the growth of regional enterprises. The small size of many of the region’s renewable energy markets makes regional integration paramount. East Africa’s vibrant emerging renewable energy sector presents a unique opportunity for the region to complement large-scale regional integration projects with dedicated enterprise promotion programmes (Table 5.7).

Table 5.7. Examples of policies to facilitate the emergence and regional upscaling of innovative enterprises in East Africa’s renewable energy sector

|

Policy example |

Policy goal |

Impact |

|---|---|---|

|

Zambia-Tanzania-Kenya Transmission Line Project |

Increase regional and pan-African energy trade |

Through the Zambia-Tanzania-Kenya Transmission Line Project, more than 2 200 km of a bi-directional 400-megawatt power transmission line from Kabwe in Zambia to Isinya in Kenya will be established by 2026, enhancing regional power transmission capacity by 2 550 megawatts and increasing co-operation with Southern African Power Pool countries (World Bank, 2022b). |

|

Enhancement of a Sustainable Regional Energy Market project |

Harmonise the regional regulatory framework and market conditions |

This project involving the Eastern Africa, Southern Africa and Indian Ocean (EA-SA-IO) Region developed 12 regional guidelines to promote renewable energy and energy efficiency initiatives and trained 363 regional officials on aligning member states’ national legislations with the harmonised regional regulatory framework they adopted (Osemo, 2022). |

|

Rwanda’s Renewable Energy Fund |

Stimulate greater entrepreneurship to optimise renewable energy opportunities |

This fund managed by the Rwanda Development Bank has provided low-cost loans, direct equity and grants to companies, commercial banks and solar companies to purchase off-grid solar home systems, develop mini-grids and support clean cooking technologies (Nkurunziza, 2021). |

|

Africa Adaptation Initiative |

Enhance continental and cross-sector collaboration on climate change adaptation |

The investment led by this public-private partnership enables African countries to achieve their resilience objectives, facilitating the energy transition (UNEP, 2021). |

|

Uganda’s renewable energy policy principle 8: “Stakeholder Participation and the Poor" |

Promote universal renewable energy access to foster social transformation |

The Rural and Urban-Poor Electrification Access Programme expressly mandates future projects to be extended to the poor and women at subsidised connection costs (World Bank, 2021). |

Source: Authors’ compilation.

East African governments and regional institutions can intensify the promotion of cross-border energy trade, including through infrastructure projects (see also Box 3.2 in Chapter 3). The Eastern Africa Power Pool (EAPP), established in 2005, aims to enhance cross-border energy trade and ensures the operation of the interconnected power grid for several East African and other African countries (EAPP, n.d.). The EAPP could reduce energy trade costs by USD 18.6 billion if a tight integration scenario is achieved, including substantial new interconnection projects that support renewable energy plans optimised at the regional level. Under this scenario, the region’s reliance on gas would decrease from 63% to 58% (Remy and Chattopadhyay, 2020), while a lower levelled cost of energy could generate savings of 10% for end users in East Africa (Castellano et al., 2015). Cross-border infrastructure projects, such as the Kenya-Ethiopia Electricity Highway Project or the Zambia-Tanzania-Kenya Transmission Line Project (Table 5.7), underpin this effort.

Regional integration initiatives present opportunities to further harmonise regulatory frameworks and market rules for power producers and organised private sector groups. The EAPP established the basic rules to regulate and govern the regional energy market (Deloitte, 2015). The African Continental Free Trade Area can improve the harmonisation of energy and business regulations, thereby stimulating both supply of and demand for renewables (Yavarhoussen, 2020), including accelerating the interconnectivity of grids. Certain regional institutions can implement market integration and regulatory harmonisation. One such institution is the East African Community’s East African Centre for Renewable Energy and Efficiency, which can provide technical assistance and ensure a more active mobilisation of the region’s organised private sector groups.

Supporting innovative enterprises can have many benefits for sustainable development. Targeted measures to instigate the emergence of new ventures, enterprise scaling and job creation across renewable energy value chains include financial incentives, partial risk guarantees and blended finance for scale-up funding. For instance, the Scaling Solar programme supported by the International Finance Corporation assists governments with project preparation and structuring and provides project developers with documentation and de-risking services (IFC, 2023). Entrepreneurial initiatives in the renewable energies sector can serve to expand access to electricity and clean cooking, foster the energy transition and create high-quality jobs, thereby increasing sustainable development (Tiedeman, 2022).8

References

AfDB (2022), African Economic Outlook 2022: Supporting Climate Resilience and a Just Energy Transition in Africa, African Development Bank, Abidjan, www.afdb.org/en/documents/african-economic-outlook-2022.

AfDB (2021), Electricity Regulatory Index for Africa 2021, African Development Bank Group, Abidjan, https://africa-energy-portal.org/sites/default/files/2021-12/08122021%20ERI%20report%202021.pdf.

BII (n.d.), “How a Kenyan Company is helping farmers with irrigation”, British International Investment, www.bii.co.uk/en/sustainable-investing/solar-powered-irrigation-kenya/.

Blankers, C. (14 July 2022), “Can we build net-zero data centres in Africa?”, Bizcommunity, www.bizcommunity.africa/Article/410/640/229679.html.

Business Daily (8 December 2019), “Kenya rises to the top five in global clean energy ranking”, Business Daily Africa, www.businessdailyafrica.com/bd/economy/kenya-rises-to-the-top-five-in-global-clean-energy-ranking-2273126.

Castellano, A. et al. (2015), Brighter Africa: The Growth Potential of the Sub-Saharan Electricity Sector, McKinsey, www.icafrica.org/fileadmin/documents/Knowledge/Energy/McKensey-Brighter_Africa_The_growth_potential_of_the_sub-Saharan_electricity_sector.pdf.

The Commonwealth (10 November 2021), “New toolkit to boost clean energy investments in small island nations”, The Commonwealth, https://thecommonwealth.org/press-release/new-toolkit-boost-clean-energy-investments-small-island-nations.

Deloitte (2015), “The roadmap to a fully integrated and operational East African Power Pool”, Deloitte, www2.deloitte.com/content/dam/Deloitte/ke/Documents/energy-resources/ER_Power%20TL.pdf.

Dembele, F., R. Schwarz and P. Horrocks (2021), Scaling up Green, Social, Sustainability and Sustainability-linked Bond Issuances in Developing Countries, OECD Publishing, Paris, www.oecd.org/dac/financing-sustainable-development/blended-finance-principles/documents/scaling-up-green-social-sustainability-sustainability-linked-bond-issuances-developing-countries.pdf.

EAPP (n.d.), “Facilitating longterm development of electricity market in the region”, East African Power Pool website, https://eappool.org/.

ESI Africa (2 August 2022), “Why the digital grid is key to RE integration”, ESI Africa, www.esi-africa.com/renewable-energy/why-the-digital-grid-is-key-to-re-integration/.

fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets (accessed August 2022).

GE (2018), Digitization of Energy Transmission & Distribution in Africa: The Future of Energy in Sub-Saharan Countries, Frost & Sullivan, www.gegridsolutions.com/press/gepress/2018/wp-digitization.pdf.

GEF (2021), “African Rift Geothermal Development Facility (ARGeo)”, webpage, United Nations Environment Program, www.thegef.org/projects-operations/projects/2119.

IEA (2022), Africa Energy Outlook 2022, International Energy Agency, Paris, www.iea.org/reports/Africa-energy-outlook-2022.

IEA (2021a), World Energy Outlook 2021, International Energy Agency, Paris, www.iea.org/reports/world-energy-outlook-2021.

IEA (2021b), “World Energy Balances 2021”, International Energy Agency (database), www.iea.org/data-and-statistics/data-product/world-energy-balances.

IFC (2023), “Scaling solar”, webpage, International Finance Corporation, www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/scaling-solar (accessed 17 March 2023).

International Finance (2020), “Safaricom to diversify into energy, to supply power to the national grid”, International Finance, https://internationalfinance.com/safaricom-diversify-energy-supply-power-national-grid/.

IMF (2023a), World Economic Outlook Database, April 2023 Edition, International Monetary Fund, www.imf.org/en/Publications/WEO/weo-database/2022/April (accessed April 2023).

IMF (2023b), “List of LIC DSAs for PRGT-eligible countries”, International Monetary Fund, www.imf.org/external/pubs/ft/dsa/dsalist.pdf.

IMF (2022a), World Economic Outlook Database, October 2022 Edition, International Monetary Fund, www.imf.org/en/Publications/WEO/weo-database/2022/October (accessed October 2022).

IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), International Monetary Fund, https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52 (accessed 22 November 2022).

IMF (2022c), Investment and Capital Stock Dataset (ICSD) (database), https://data.imf.org/?sk=1CE8A55F-CFA7-4BC0-BCE2-256EE65AC0E4 (accessed October 2022).

Impakter (26 April 2019), “Power offgrid: Innovating the energy market in Somalia”, Medium, https://medium.com/@impakter.com/power-offgrid-innovating-the-energy-market-in-somalia-cc3bc502cf1a.

IRENA (2022a), IRENASTAT (database), https://pxweb.irena.org/pxweb/en/IRENASTAT?_gl=1*fltysn*_ga*MTA3NTM0NzYxLjE2NjE3NzAyNzQ.*_ga_7W6ZEF19K4*MTY3ODI4NTgxNC40NC4xLjE2NzgyODU4MzguMzYuMC4w (accessed October 2022).

IRENA (2022b), “Renewable Energy Employment by Country”, Statistics Data (database), www.irena.org/Data/View-data-by-topic/Benefits/Renewable-Energy-Employment-by-Country (accessed March 2023).

IRENA/AfDB (2022), Renewable Energy Market Analysis: Africa and Its Regions, International Renewable Energy Agency and African Development Bank, Abu Dhabi and Abidjan, www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Market_Africa_2022.pdf?rev=bb73e285a0974bc996a1f942635ca556.

IRENA/ILO (2022), Renewable Energy and Jobs: Annual Review 2022, International Renewable Energy Agency/International Labour Organization, Abu Dhabi/Geneva, www.irena.org/publications/2022/Sep/Renewable-Energy-and-Jobs-Annual-Review-2022.

KfW and Multiconsult (2021), Get FiT Uganda Annual Report 2021, KfW Group, www.getfit-uganda.org/annual-reports/annual-report-2021/.

Kincer, J. (July 2021), “What’s the status of East Africa’s geothermal market?”, Energy for Growth Hub, www.energyforgrowth.org/wp-content/uploads/2021/07/Whats-the-status-of-East-Africas-geothermal-market_-.pdf.

Largue, P. (4 July 2020), “Seychelles to build world’s largest floating solar plant”, Renewable Energy World, www.renewableenergyworld.com/solar/seychelles-to-build-worlds-largest-floating-solar-plant/?topic=245866.

Ligami, C. (2017), “Renewable energy projects are uplifting Maasai women”, Earth Island Journal, www.earthisland.org/journal/index.php/articles/entry/renewable_energy_projects_uplifting_maasai_women.

Nkurunziza, M. (1 November 2021), “How can Rwanda make the most of the global clean energy investment platform?”, The New Times, www.newtimes.co.rw/article/190795/News/how-can-rwanda-make-the-most-of-the-global-clean-energy-investment-platform.

OECD (2022a), “Aid (ODA) disbursements to countries and regions”, OECD.Stat (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A (accessed October 2022).

OECD (2022b), “GHG Emissions from fuel combustion (summary)”, IEA CO2 Emissions from Fuel Combustion Statistics: Greenhouse Gas Emissions from Energy (database), https://doi.org/10.1787/445ec5dd-en (accessed 3 September 2022).

OECD (2022c), “Mobilisation”, OECD.Stat (database), https://stats.oecd.org/Index.aspx?DataSetCode=DV_DCD_MOBILISATION (accessed February 2023).

OECD (2021), OECD Global Pension Statistics (database), https://doi.org/10.1787/pension-data-en.

Osemo, W. (8 June 2022), “Comoros to have a national energy regulation board”, Common Market for Eastern and Southern Africa, www.comesa.int/comoros-to-have-a-national-energy-regulation-board/.

Remy, T. and D. Chattopadhyay (2020), “Promoting better economics, renewables and CO2 reduction through trade: A case study for the Eastern Africa Power Pool”, Energy for Sustainable Development, Vol. 57, 2020, pp. 81-97, https://doi.org/10.1016/j.esd.2020.05.006.

RES4Africa/PwC Italy (2021), Investor Survey on Sub Saharan Africa, RES4Africa and PricewaterhouseCoopers Italy, https://static1.squarespace.com/static/609a53264723031eccc12e99/t/6180ffb91e351d4c7fcdd981/1635844031170/Investor+survey+on+Sub+Saharan+Africa_RES4Africa+PwC+%281%29.pdf.

Roy, R. (forthcoming), “Africa’s developmental path as a solution to the problem of air pollution in Africa”, background paper for Africa’s Development Dynamics 2023.

SEFA (2021), Sustainable Energy Fund for Africa (SEFA) - Annual Report 2021, Sustainable Energy Fund for Africa, www.afdb.org/en/documents/sustainable-energy-fund-africa-sefa-annual-report-2021.

Smith, T. (29 June 2021), “Uganda: Integrated energy and approach to create energy for all”, ESI Africa, www.esi-africa.com/business-and-markets/uganda-integrated-energy-approach-to-create-energy-for-all/.

Tiedeman, M. (27 June 2022), “Harnessing renewable energy for climate-friendly development”, RTI International, www.rti.org/insights/harnessing-renewable-energy-for-climate-friendly-development.

UN (2022), “Rwanda Green Fund – FONERWA”, webpage, United Nations, https://unfccc.int/climate-action/momentum-for-change/financing-for-climate-friendly-investment/rwanda-green-fund-fonerwa.

UNEP (2021), “African Adaptation Initiative (AAI)”, webpage, United Nations Environment Programme, 22 September 2021, https://climateinitiativesplatform.org/index.php/African_Adaptation_Initiative_(AAI)

US Embassy Kenya (2020), “U.S. announces new Kenyan pension consortium to mobilize investment in large scale infrastructure projects”, US Embassy Kenya, https://ke.usembassy.gov/united-states-announces-new-kenyan-pension-consortium-to-mobilize-investment-in-large-scale-infrastructure-projects/.

WHO (2021), “Household Energy Database”, World Health Organisation (database), www.who.int/data/gho/data/themes/air-pollution/who-household-energy-db.

Wilson, C. (3 November 2021), “Seychelles: Mobilising the ‘Tools’ for renewable energy investment in the Seychelles”, AllAfrica, https://allafrica.com/stories/202111050484.html.

World Bank (2022a), World Development Indicators (database), https://data.worldbank.org/products/wdi (accessed April 2022).

World Bank (2022b), “AFR RI-3A Tanzania-Zambia Transmission Interconnector (P163752)”, https://documents1.worldbank.org/curated/en/099074001312362436/pdf/P1637520d5d2ff0f0090cd0ce7da89154d2.pdf.

World Bank (2021), The Renewable Energy Policy for Uganda, World Bank, Washington, DC, https://ppp.worldbank.org/public-private-partnership/library/renewable-energy-policy-uganda.

World Bank (14 June 2018), “Madagascar - Electricity Sector Operations and Governance Improvement Project – Additional financing”, World Bank Group, Washington, DC, www.worldbank.org/en/news/loans-credits/2018/06/14/madagascar-electricity-sector-operations-and-governance-improvement-project-additional-financing.

World Bank-KNOMAD (2022), Remittances (database), Global Knowledge Partnership on Migration and Development and World Bank, www.knomad.org/data/remittances (accessed 19 December 2022).

Yavarhoussen, H. (15 September 2020), “Innovation is imperative for Africa’s renewable energy”, Energy Voice, www.energyvoice.com/opinion/265093/madagascar-africa-solar-demand/.

Notes

← 1. Authors’ calculation based on OECD (2021).

← 2. Authors’ calculation based on OECD (2022b).

← 3. Authors’ calculation based on fDi Intelligence (2022). Data for 2022 is available only until May 2022.

← 4. Authors’ calculation based on IRENA (2022a).

← 5. Authors’ calculation based on fDi Intelligence (2022). Data for 2022 is available only until May 2022.

← 6. Authors’ calculation based on fDi Intelligence (2022). Data for 2022 is available only until May 2022.

← 7. Authors’ calculation based on fDi Intelligence (2022). Data for 2022 is available only until May 2022.

← 8. While estimates for East Africa are missing, off-grid or decentralised renewables could create 3.4 million new jobs in India alone by 2030 (IRENA/ILO, 2022).