This chapter makes the case that African countries need more sustainable investments to create jobs and promote inclusive growth. It outlines the extent to which sustainable investments and financing have not met the many opportunities that the continent offers and analyses the potential for improvement. The chapter first assesses the sustainable investment landscape that is emerging from the concurrent crises of the COVID-19 pandemic, the global repercussions of conflicts and climate change and provides an estimate for the continent’s sustainable financing gap. Second, it examines low investor confidence and the high cost of capital as specific investment barriers that these crises have amplified. Third, the chapter identifies investment linkages with small and medium-sized enterprises, intra-African investments and institutional investors as three domains offering untapped potential to support Africa’s regional integration and sustainable growth.

Africa's Development Dynamics 2023

Chapter 1. Africa’s sustainable investments in times of global crises

Abstract

In Brief

As a result of three global crises (the COVID-19 pandemic, the global repercussions of conflicts and the climate crisis), Africa’s sustainable financing needs are growing. At the onset of the COVID-19 pandemic, in 2020, Africa’s sustainable financing gap reached USD 272 billion, the highest level since projections began in 2015. Yet, this gap appears small compared to capital available worldwide and on the continent: the USD 194 billion average sustainable financing gap for 2015-21 calculated in this report is equivalent to less than 0.2% of the global and 10.5% of the African-held stock of assets under management – financial assets that wealth management firms handle on behalf of investors.

The recent global shocks have amplified investment barriers by lowering investor confidence and exacerbating information shortages while increasing the cost of capital in Africa more than in other world regions. Risks related to global shocks and information shortages remain the primary reasons for Africa’s limited investment attractiveness. Due to unfavourable country credit ratings and heightened risk aversion among international investors, the costs of public and private capital are far above global averages in many African countries, especially in the renewable energy sector. The limited availability of data is a pervasive issue, hindering risk assessments and mitigation strategies and increasing the cost of searching for investment opportunities. A lack of data also makes it difficult to measure the allocation of funds towards sustainable development and impacts.

Current sources of investment can better support regional integration, job creation and inclusive growth. Better integrating foreign direct investment into local economies can create jobs and improve Africa’s participation in global and regional value chains. African regional lead firms and institutional investors hold great potential to boost sectors that can better balance economic, social and environmental sustainability, such as information and communications technology, finance, and renewable energy.

Africa’s sustainable investments in times of global crises (infographic)

Africa continental profile

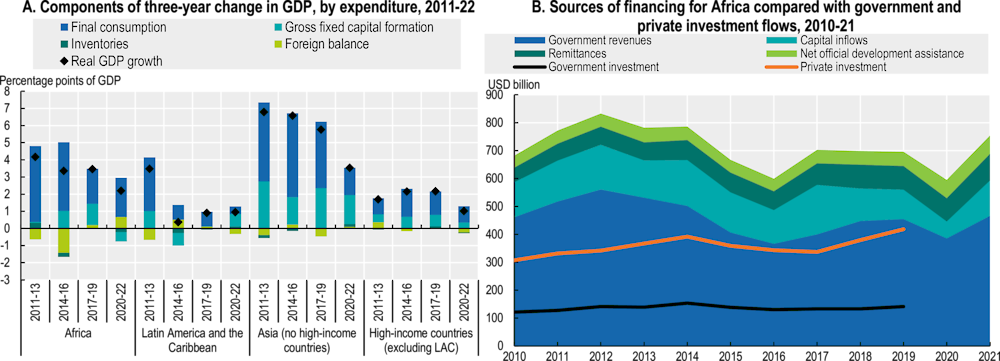

Figure 1.1. Components of economic growth and sources of financing in Africa

Note: The components of GDP growth are calculated on an annual basis by using real annual GDP growth to estimate the increase in real US dollars. Aggregate figures are calculated by taking the average of the national figures weighted by GDP in purchasing-power-parity dollars. The components of GDP growth over three-year periods were calculated by taking the difference between the geometric average of the annual real GDP growth over the period and the real GDP growth when setting each component to zero for individual years. Foreign balance is the difference between imports and exports. Imports contribute negatively to GDP. “High-income countries” refers to countries classified as “high-income” according to the World Bank Country and Lending Groups outside of Latin America and the Caribbean. Government revenues include all tax and non-tax government revenues minus debt service and grants received. Capital inflows include foreign direct investment (FDI), portfolio investment and other investment inflows reported by the International Monetary Fund under asset/liability accounting. Figures for capital inflows should be interpreted with some caution as some figures for 2021 and for portfolio inflows are missing.

Sources: Authors’ calculations based on IMF (2022a), World Economic Outlook Database, www.imf.org/en/Publications/WEO/weo-database/2022/October; OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; World Bank (2022a), World Development Indicators (database), https://datatopics.worldbank.org/world-development-indicators/; IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52; IMF (2022c), Investment and Capital Stock Dataset (ICSD) (database), https://data.imf.org/?sk=1CE8A55F-CFA7-4BC0-BCE2-256EE65AC0E4; and World Bank-KNOMAD (2022), Remittances (database), www.knomad.org/data/remittances.

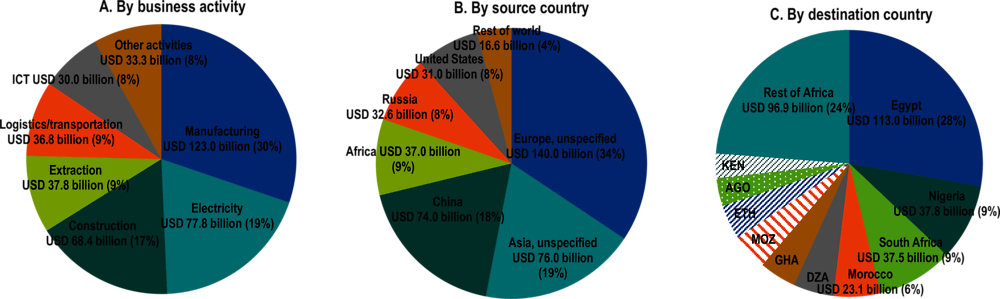

Figure 1.2. Greenfield foreign direct investment flows to Africa, by activity, source and destination, 2017-22

Note: The fDi Markets database is used only for comparative analysis. Actual investment amounts should not be inferred, as fDi Markets data are based on upfront announcements of investment projects, including a share of projects that do not actually materialise. AGO = Angola, DZA = Algeria, ETH = Ethiopia, GHA = Ghana, KEN = Kenya, and MOZ = Mozambique. ICT = information and communications technology.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Sustainable investments have not yet met the opportunities African economies offer

African countries represent the world’s investment frontier, holding important assets. Africa has by far the youngest population of all continents, with a median age of 19 years, compared to 30 for Latin America and the Caribbean, 31 for developing Asia as the next youngest regions and 42 for Europe as the oldest (UN DESA, 2022). By 2050, Africa’s population will almost double, from about 1.4 billion inhabitants to nearly 2.5 billion. More than half of the world’s population growth will happen on the continent, including in rural areas (UN DESA, 2022; AfDB/OECD/UNDP, 2015). In 2022, Africa was the only world region with positive year-on-year growth in start-up funding (5%) (Cuvellier, 2023). Estimates suggest that agricultural yields for cereals and grains in large parts of Africa could double or triple, adding 20% to global output (McKinsey, 2019). The Democratic Republic of the Congo’s cobalt production makes up 70% of the global total – providing a key input for battery production (ANRC, 2021). From 2011 to 2020, African forests increased carbon stock by 11.6 million kilotons of CO2-equivalent net emissions, while carbon stocks in forests outside Africa declined by 13 million kilotons. Of this increase, 59% was in Central African forests, now recognised as the world’s largest carbon sink. The continent boasts 60% of the best solar resources globally (IEA, 2022a).

Africa has enjoyed high growth, supported by investment, but this has not sufficiently driven productive transformation. Since the turn of the 21st century, Africa has boasted the world’s second-highest rate of economic growth after developing Asia. African growth is bouncing back since the global recession of 2020: growth estimates are at 3.7% in 2023 and projected in 2024 at 4.2% – after developing Asia and before Latin America and the Caribbean, respectively at 5% and 1.6% for 2023 and 4.9% and 2.2% for 2024. High investment rates boosted Africa’s growth, with the contribution of gross fixed capital formation to gross domestic product (GDP) growth reaching a peak of 1.2 percentage points in 2017-19, before declining during the COVID-19 pandemic in 2020-22 (Figure 1.1). Overall, high growth has not sufficiently catalysed productive transformation, including job creation and value chain integration (AUC/OECD, 2018, 2019, 2022).

Sustainable investments are essential to steer the productive transformation towards inclusion and resilience. When mobilising and allocating investments, African countries need to manage tensions between economic goals of productive transformation and social and environmental goals such as inclusion and resilience to climate change (Box 1.1). This is the case, for example, when balancing energy production and carbon mitigation, agricultural land use and conservation, or mass employment creation and labour standards. To face the emerging global challenges of the 21st century, African countries can use sustainable investments to make the most of the continent’s unique assets while reducing their vulnerability to crises and shocks.

Box 1.1. Agenda 2063 and sustainable investments: This report’s approach

The African Union’s Agenda 2063 provides a blueprint for a transformation that combines productivity and sustainability. Agenda 2063 codifies the goal of a “prosperous Africa, based on inclusive growth and sustainable development” (AU, 2015). While creating quality jobs and developing highly productive sectors remain essential (AUC/OECD, 2018), the African continent now faces a growing opportunity to steer its economic transformation towards responses to climate change and the preservation of natural environments. Agenda 2063 explicitly considers environmental sustainability, stating that “Africa’s unique natural endowments, its environment and ecosystems [should be] healthy, valued and protected, with climate resilient economies and communities” (AU, 2015).

Investments are sustainable if their total economic, social and environmental benefits can be predicted to outweigh their total cost. Economic sustainability refers to the long-term viability of a market-based activity for all actors involved. Social sustainability consists of effects on human development, individual well-being and collective outcomes such as peace and social cohesion (UN Global Compact, 2022). Environmental sustainability is achieved if the investment’s activity does not surpass the boundaries of ecological systems that support life on Earth (considering issues such as climate change, chemical pollution and freshwater use) (NBS, 2022). Global frameworks to track sustainability outcomes include the United Nations’ Sustainable Development Goals (SDGs) and various environmental, social and governance standards (OECD, 2022b).

The Africa’s Development Dynamics 2023 report investigates which investments offer the best balance and minimise trade-offs between economic, social and environmental sustainability, with each dimension hinging on Africa-specific challenges:

Economic: Regional integration. Recent crises have demonstrated the need for Africa to reduce its vulnerability to global shocks through better market integration and stronger regional supply chains (AUC/OECD, 2022).

Social: Employment creation and inclusive growth. Given Africa’s population growth and rural-urban inequalities, the creation of large numbers of high-quality jobs and opportunities for Africa’s poor populations are foundational for social sustainability (AUC/OECD, 2018, 2019, 2021).

Environmental: Climate resilience and a just energy transition. In view of Africa’s small contribution to climate change and its vulnerability to extreme weather events, climate adaptation and a nationally specific mix of energy investments are priorities.

To capture the complexity of sustainable investments, the Africa’s Development Dynamics 2023 report analyses public and private sources of sustainable finance, comparing them across regions, countries and sectors. It covers a range of databases, including on foreign direct investment (FDI) and multinational enterprises, government revenues, pension funds, official development assistance (ODA), impact investing and philanthropy, complemented by primary data from a survey and interviews with multinational investors. The report compares sustainability outcomes across sectors based on current literature and available indicators such as greenhouse gas emissions and job creation. It features additional analyses on specific sectors with high sustainability potential, such as renewable energies and infrastructure.

Despite the impact of global crises, Africa’s sustainable financing gap can be bridged

The COVID-19 pandemic, the global repercussions of conflicts and climate change are widening Africa’s sustainable financing needs.

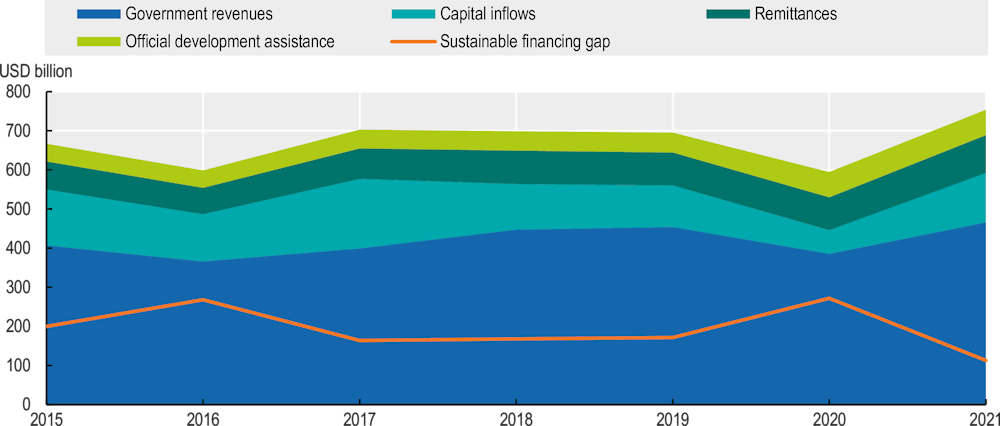

In 2020, the annual sustainable financing gap (i.e. the gap between the financing needed to achieve the SDGs and the availability of financial resources) reached USD 272 billion, the highest level since projections began in 2015 (Figure 1.3), largely as a result of the COVID-19 pandemic. While available financing rebounded in 2021, worsening macroeconomic conditions in 2022 are likely to widen the gap yet again.

The repercussions of conflicts are creating additional investment needs and strains on Africa’s finances. Recent conflicts have led to disruptions in supply chains and increases in the prices of critical imports (food, energy and fertilisers) while fuelling inflation and triggering a global tightening in monetary policies. This could add an estimated financing need of USD 6 to 10 billion per annum for African commodity-importing countries (IMF, 2022d).

To keep global warming below 1.5°C by 2030, African countries need an estimated USD 277 billion per year to implement their nationally determined contributions as per the Paris Agreement – almost ten times more than the USD 29.5 billion mobilised so far (CPI, 2022).

Figure 1.3. Available financing and sustainable financing gap, 2015-21

Note: See Annex 1.A for details.

Source: Authors’ calculations based on OECD (2022b), Global Outlook on Financing for Sustainable Development 2023: No Sustainability Without Equity, https://doi.org/10.1787/fcbe6ce9-en; IMF (2022a), World Economic Outlook Database, www.imf.org/en/Publications/WEO/weo-database/2022/October; OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; World Bank (2022a), International Debt Statistics (database), https://databank.worldbank.org/source/international-debt-statistics; IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52; and World Bank-KNOMAD (2022), Remittances (database), www.knomad.org/data/remittances; UNCTAD (2020b), “Economic Development in Africa Report 2020: Press Conference”, Press Release, https://unctad.org/osgstatement/economic-development-africa-report-2020-press-conference.

Decreasing tax revenues and rising debts and interest rates are putting many African countries in debt distress. While government revenues continue to represent by far the largest individual source of finance, they decreased sharply in reaction to the COVID-19 pandemic (Figure 1.3) while per-capita GDP dropped by 4.1% in 2020. African governments collected on average 6.2% less revenues in 2020 than in 2015, on a real per-capita basis (taking into account population growth and inflation). Rising debt levels, increasingly owed to private creditors, contributed to raising the cost of debt service from only 3% to over 5% of gross national income over the 2010-20 period. The rise in global interest rates since March 2022 has added constraints for African governments by impacting global liquidity and exchange rates and triggering portfolio investment outflows. By February 2023, the International Monetary Fund (IMF) considered 8 African countries in debt distress,1 plus 13 countries2 at a high risk of debt distress (IMF, 2023). For instance, between 2021 and 2022, Eurobond yields more than tripled for Ghana and roughly doubled for Egypt, Gabon, Kenya, Nigeria and Tunisia, pricing these countries out of the market (Smith, 2022). Debt relief mechanisms can address part of the debt burden; these include the G20 Debt Service Suspension Initiative (DSSI) or the G20 / Paris Club Common Framework for Debt Treatments beyond the DSSI (Ekeruche, 2022; IMF, 2021a).

ODA to Africa must continue to increase, especially for adapting to climate change. ODA increased in response to COVID-19, with African countries receiving around USD 65 billion in 2020 and 2021, compared to less than 51 billion in 2019. However, in 2020, this increase did not compensate for shortfalls in spending by African governments and in financial inflows (Figure 1.3). ODA has also not yet met the levels pledged by the international community. In 2020, high-income countries provided and mobilised USD 83.3 billion for climate action in developing countries, missing the USD 100 billion target set at the United Nations Climate Summit in Copenhagen in 2009 (OECD, 2022c). From 2019 to 2020, international public climate finance for African countries grew only marginally from USD 22.3 to USD 24.3 billion (CPI, 2022). The most fiscally constrained countries are also the most vulnerable to climate change: on average, low-income countries in Africa would need an equivalent of 21% of their GDPs to implement nationally determined contributions compared to only 9% for middle-income countries (CPI, 2022).

Africa’s sustainable financing gap remains small in global comparison. The USD 194 billion average sustainable financing gap for 2015-21 calculated in this report (Figure 1.3) would be equivalent to an annual reallocation of less than 0.2% of the USD 112 trillion total global stock, or 10.5% of the USD 1.8 trillion African-held stock of assets under management (BCG, 2022; Juvonen et al., 2019). An annual reallocation of 0.2% would bring the total allocation of global assets under management to Africa from currently under 1% (Table 1.1) to around 2.3% by 2030, still well below the continent’s share of global GDP (2.9% in 2020).

Table 1.1. Allocation of selected sources of institutional investment to world regions

|

Type of investment |

Global |

Africa |

Latin America and the Caribbean |

Asia |

Year |

|---|---|---|---|---|---|

|

Venture capital |

USD 600 billion |

USD 5 billion (0.8%) |

n.a. |

n.a. |

2021 |

|

Equity financing |

USD 250.1 billion |

USD 1.7 billion (0.7%) |

USD 5.3 billion (2%) |

USD 63.3 billion (25%) |

2022 Q1&Q2 |

|

Pension funds |

USD 3.3 trillion |

USD 24.5 billion (~0.7%) |

USD 57.9 billion (1.76%) |

USD 180 billion (5.46%) |

2017-18 |

|

Insurance companies |

USD 1.8 trillion |

USD 0.36 billion (~0.02%) |

USD 2.88 billion (0.16%) |

USD 32.76 billion (1.8%) |

2017-18 |

Note: Venture capital and equity financing figures are based on comprehensive data sources. Pension fund and insurance companies data are derived from the 2019 edition of the OECD Annual Survey of Large Pension Funds and Public Pension Reserve Funds (OECD, 2019). Thirty-six pension funds and 30 insurance companies provided data. Figures for pension funds and insurance companies have been extrapolated from their declarations of total investments in developing countries.

Source: Authors’ compilation based on AVCA (2022), Venture Capital in Africa Report, www.avca-africa.org/media/2967/62644-avca-avca-venture-capital-in-africa-report-v13.pdf, CB insights (2022), State of Venture, www.cbinsights.com/reports/CB-Insights_Venture-Report-Q2-2022.pdf; and OECD (2021a), Mobilising Institutional Investors for Financing Sustainable Development in Developing Countries: Emerging Evidence of Opportunities and Challenges, www.oecd.org/dac/financing-sustainable-development/Mobilising-institutional-investors-for-financing-sustainable-development-final.pdf.

The African continent’s share of global investment has stagnated

Due to global crises, uncertainty, risk and sovereign debt have become more prevalent as investment barriers for African countries. The “Lucas paradox”, after Robert Lucas’ seminal article (Lucas, 1990), captures the phenomenon that global capital does not flow from rich to poor countries despite higher marginal returns in poorer economies. Empirical studies have suggested that domestic institutional factors such as government stability and bureaucratic quality have been the dominant explanations of this puzzle (Alfaro et al., 2008). Yet, the recent global crises have had little effect on institutional factors, while exacerbating alternative explanatory factors: capital market imperfections, specifically uncertainty, risk, sovereign debt and home biases (Leimbach and Bauer, 2022; Ndikumana and Boyce, 2003).

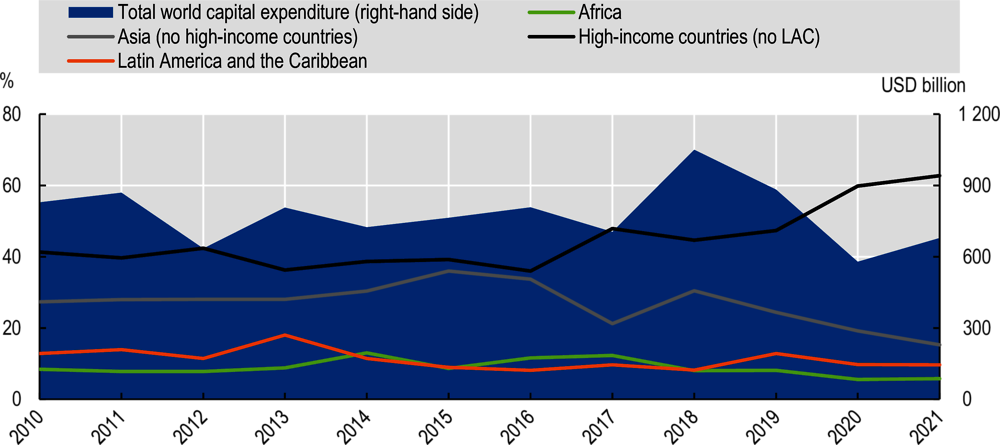

Recent global events have accelerated an increasing preference for new greenfield FDI in high-income over developing countries, have reduced Africa’s participation in global value chains and may be increasing poverty. In the last decade, global greenfield FDI – new FDI projects reflecting future investment trends – has decreased at an average annual rate of 3%. Since 2016, new investments have been shifting from developing countries to high-income countries (Figure 1.4). The COVID-19 pandemic accelerated this trend: in 2020-21, high-income countries outside of Latin America and the Caribbean attracted 61% of global greenfield FDI (the highest share ever recorded), compared to 17% for developing Asia, 10% for Latin America and the Caribbean and only 6% for Africa (the lowest share since 2004). Similarly, Africa’s participation in global value chains has stagnated since the 2008 global financial crisis and was only 1.7% in 2019 (AUC/OECD, 2022). The pandemic exacerbated this trend, in part due to multinational enterprises in high-income countries reshoring or near-shoring their production to reduce their exposure to supply chain shocks or postponing investment decisions in the face of global instability. The World Bank (Brenton, Ferrantino and Maliszewska, 2022) estimates that a shift towards global reshoring to high-income countries and the People’s Republic of China (hereafter “China”) could drive an additional 52 million people into extreme poverty, more than 80% of them in Africa.

Figure 1.4. Greenfield foreign direct investments by world region, as a percentage of world capital expenditure, 2010-21

Note: LAC = Latin America and the Caribbean.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

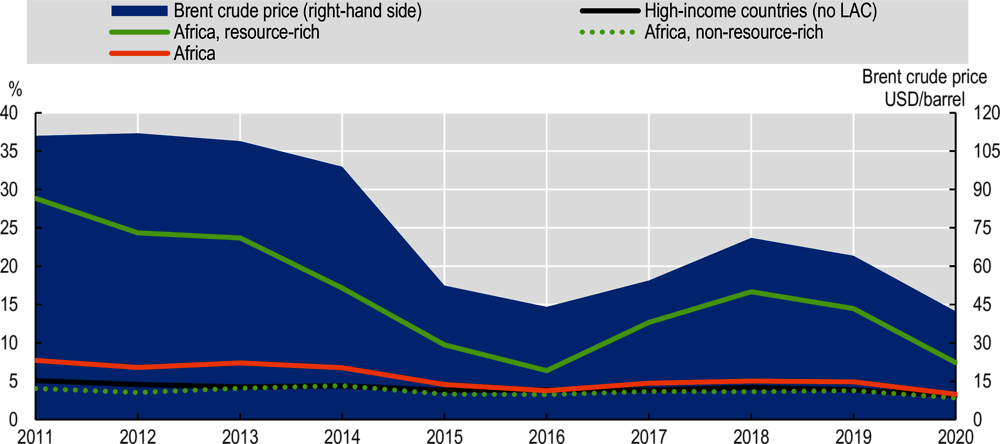

Returns to FDI in Africa have narrowed compared to FDI in high-income countries. Narrowing FDI return differentials between developing and advanced economies have contributed to declining shares of FDI inflows to developing countries (Evenett and Fritz, 2021). In Africa, the decline in FDI returns has been mostly driven by resource-rich economies due to a downward trend in oil prices from 2011 until prices rebounded in 2021 (Figure 1.5). In contrast, FDI inflows to non-resource exporters (such as Ethiopia, Kenya, Madagascar and Mauritius) have been relatively more resilient (Ideue, 2019).

Africa attracts the lowest share of capital from institutional investors compared to other world regions. In the last decade, global assets under management grew from USD 48 trillion in 2010 to over USD 112 trillion in 2021, despite economic downturns. Even during the first year of the COVID-19 pandemic, global assets under management further grew at a record 12% (BCG, 2022). Africa receives the lowest share of global capital across different types of investors, ranging from 0.8% for venture capital to as low as 0.02% for insurance companies (Table 1.1).

Figure 1.5. Rates of return on foreign direct investment inflows by world region, 2011-20

Note: FDI rates of return are calculated as the ratio of FDI income debit at year t over the average of FDI positions’ liabilities at year t and t-1 (UNCTAD, 2019). Data for Africa cover 28 countries. Of the 9 resource-rich African countries, a complete time series is only available for Angola and Nigeria. LAC = Latin America and the Caribbean.

Source: Authors’ calculations based on IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52.

Lower investor confidence and the higher cost of capital help explain why investment remains weaker in many African countries compared to other world regions

Among the many factors that can attract a greater share of global investments, African countries can focus on improving investor confidence and reducing the cost of capital. The global crises have amplified the detrimental effects of elevated uncertainty, risk and information asymmetries that characterise investments in many – though not all – African countries. Addressing the specific barriers to investor confidence and decision making is essential to reverse current trends and sustain high levels of investment, even during future shocks.

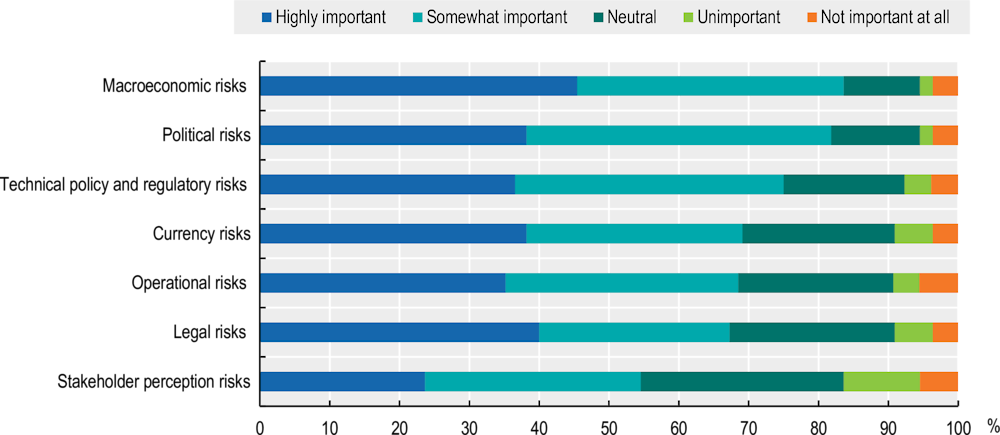

Risks and information shortages persist as barriers to investment in many African countries

Foreign investors continue to point to economic and political risks as barriers to investment. Current survey data suggest that factors that have weighed on investor confidence for several decades – such as macroeconomic conditions, political risk, weak regulatory systems, rising debt and currency volatility (Collier and Pattillo, 2000) – continue to be of concern (Figure 1.6). Representatives of global multinational enterprises (interviewed for this report) emphasised policy instability and the lack of regulatory capacity as barriers, mentioning abrupt shifts in these leading them to withdraw investments. Interviewees expressed their wish, in particular, for better transparency in the negotiation process of the African Continental Free Trade Area (AfCFTA), pointing to limited public information and insufficient opportunities to provide technical inputs.

Figure 1.6. Responses to the AUC/OECD investor survey question “Which of the following risks have been most important for your investments in African countries?”

Note: n = 52 to 55. The survey was administered in September 2022 to the networks of African business councils and the EU-Africa Business Forum. Risk dimensions are ranked by weighted average. The following examples were provided to illustrate risk categories: macroeconomic risks – economic volatility, government default; currency risks – devaluation, fluctuation; operational risks – fragile supply chains, resource availability; legal risks – enforceability of contracts; political risk – protectionism, favouritism, retroactive policy changes; technical policy and regulatory risks – licensing, taxation, regulations, procurement processes; stakeholder perception risk – management or shareholders opposed to invest in Africa.

Investors take into account risks related to political and policy factors, including governance. While investors have traditionally looked to Africa for market access, growth and natural resources (Onyeiwu and Shrestha, 2016; Cheung et al., 2012), recent evidence suggests that preconditions of political and policy factors can be as important (Andoh and Cantah, 2020; Calderon et al., 2019; Osabutey and Okoro, 2015). Good governance is especially conducive to investment once countries reach a minimum threshold of government stability, democratic accountability, law and order, and bureaucratic quality (Yeboua, 2020).

Non-equity modes of entry into foreign markets, which can limit exposure to risks, have become more prevalent. Modes of entry into foreign markets that do not require investors to acquire an ownership stake (i.e. licensing, franchising and management contracts) have increased rapidly over the past two decades, outpacing the growth of FDI (Qiang, Liu and Steenbergen, 2021). Since these agreements lie between arm’s-length trade and FDI, they can enable technology-driven multinational enterprises to access overseas markets through contracts and digital channels without a significant physical presence (UNCTAD, 2020b).

Information shortages and limited data availability, amplified by fragmented African markets, hinder investments. In-depth interviews, literature review and the AUC/OECD investor survey conducted for this report confirm that an overall lack of information and data inhibits assessments of investment opportunities in African markets (see also Pineau, 2014). Limited data may result in delays (investors “wait and see”) and thwarted investment activity (where information is insufficient for an informed decision). Despite ongoing progress on the implementation of the AfCFTA, African markets remain heterogenous and fragmented, with varying statistical capacities, which increase search costs and prevent economies of scale for market-seeking foreign investment.

Information shortages can fuel “perception premiums”. A lack of information such as statistical data creates uncertainty, thereby amplifying the detrimental effects of real risks on investment mobilisation. As risks become more difficult to assess, subjective perceptions gain importance, potentially affecting investment decisions directly (Jaspersen et al., 2000) or indirectly via the increasing cost of capital (Fofack, 2021).

The cost of capital is high for many African countries

The cost of capital for African governments increased sharply as a result of conflicts and tightening global financial policy, effectively pricing most countries out of capital markets. For instance, the spread on an average African Eurobond (a measure for the potential cost of borrowing on capital markets) across 20 African countries issuing such bonds reached a 15-year high of about 12% in September 2022, eclipsing previous peaks of about 9% during the global financial crisis in 2008 and roughly 10% during the COVID-19 crisis in 2020. In September 2022, only Morocco and South Africa had bond yields low enough to ensure access to capital markets with relative certainty, while even these countries’ yields reached over 7% and 8% respectively, roughly doubling compared to 2021 (Smith, 2022).

The poor credit ratings of many African countries drive up the cost of capital. Country credit ratings express the likelihood with which a sovereign will service or default on its foreign financial obligations. Credit ratings not only influence the conditions for sovereign debt but also serve as a benchmark for private debt holders (UN, 2022). They influence the cost of both public and private capital (e.g. interest rates and longevity of loans). Private investors mostly rely on ratings published by credit rating agencies (Box 1.2), while export credit agencies (e.g. Coface, SACE) and international organisations (e.g. IMF, OECD) develop ratings to determine the financial conditions that sources of public finance can offer. The high cost of capital acts as an investment barrier, especially in sectors where high upfront capital expenditures are required (Box 1.3).

Box 1.2. The influence of credit rating agencies on the cost of capital in Africa

Country risk ratings published by global credit rating agencies (CRAs), such as Moody’s, Standard & Poor’s, and Fitch, are foundational for investment risk assessments. In addition to quantifiable factors (such as public revenues or debt levels), CRAs use qualitative, expertise-based subjective judgments and predictions by analysts, notably to determine political risk (Bouchet et al., 2003). As of December 2022, leading CRAs gave Botswana and Mauritius investment-grade ratings based on high political stability and commitment to debt repayments, followed by Côte d’Ivoire, Morocco and South Africa in the non-investment grade speculative category (Trading Economics, 2022).

Critiques contend that CRAs lack accountability and overestimate risks for African countries. Critiques of how CRAs rate African countries intensified after 17 African countries were downgraded in 2020 at the onset of the COVID-19 pandemic – the highest number for developing regions (OECD, 2022d). Such downgrades are often pro-cyclical, increasing the cost of capital for African countries at a time when spending should be expanded (Fofack, 2021). Critics contend that CRAs tend to overestimate African country risk due to information shortages. African countries may lack the detailed and historic data that CRA methodologies depend on while leading CRAs have a narrow capacity for direct and in-depth risk assessments of African governments and firms. This may result in “herding”, with CRAs following each other’s rating trends, rather than relying on independent assessments (Mutize, 2022; Pandey, 2020). For most African countries, credit ratings are unsolicited (Ahouassou, 2011), which may incentivise agencies to lower the rating score (Fulghieri et al., 2014). While African governments have initiated several rejections and appeals, so far such efforts have not resulted in any rating revisions, in part because appeals are administered directly by CRAs (Mutize, 2022). CRAs also disincentivise African governments from restructuring their debt, as they consider restructuring a sovereign default, affecting the rating negatively (AU/UNECA, 2021).

Policy makers can engage CRAs to adopt fairer market behaviour, make their methodologies more transparent and share more data. Ambitious proposals include the establishment of new, impartial rating agencies, either at the global level or through the African Union (Fofack, 2021; Sovereign Group, 2022). South Africa pursued the more immediate approach of requiring CRAs to be licensed locally, enabling regulatory review of alleged anti-competitive practices of CRAs and the imposition of fines (Mutize, 2022). The transparency and accountability of CRAs could be improved by mandating them to specify the extent to which ratings are based on models or on subjective judgments, to discern short-term and long-term ratings that take into account climate transition pathways and to co-ordinate and share data with an international organisation such as the IMF (Fofack, 2021; UN 2022; see also Chapter 2).

Box 1.3. Africa’s renewable energy sector and the high cost of capital

Renewable energy production is an unequivocal sustainable investment opportunity for Africa. Investments in renewable energy production can support several of Africa’s development priorities, such as access to electricity, the mitigation of carbon emissions, reduced dependence on natural resource extraction and fuel imports, and employment creation (IEA, 2022a; OECD/World Bank/UNEP, 2021; RES4Africa, 2022; UNECA 2016).

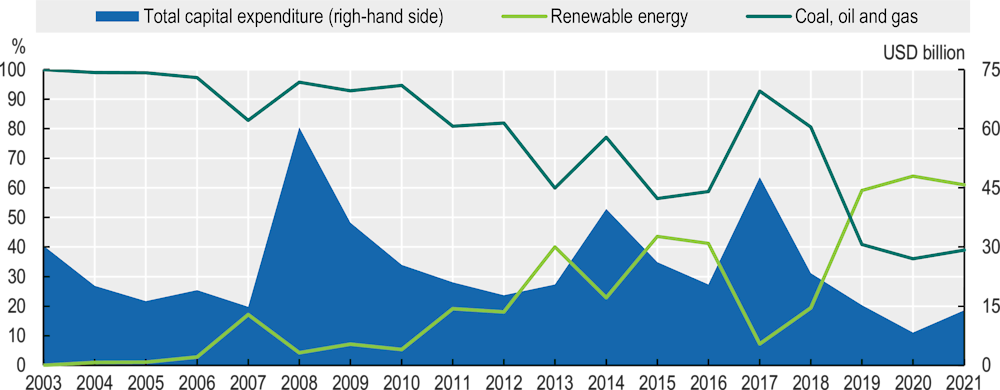

New investments in Africa’s energy sector have increasingly gone towards renewables rather than fossil fuels, but following the global energy crisis in 2022, investment in some African oil and gas markets is resurgent. The share of renewable energy in total energy greenfield FDI increased from 5% in 2010 to 61% in 2021 (Figure 1.7). Despite a general downward trend across all sectors during the COVID-19 pandemic, the value of international project finance deals in Africa’s renewable energy sector increased by 19% in 2020 and 117% in 2021 (UNCTAD, 2022b). Solar has become a major contributor to African renewable energy production over the last decade. It is projected to become by far the cheapest source of energy in Africa by 2030 (USD 18-49 per MWh compared to USD 33-86 for onshore wind and USD 30-110 for gas) (IEA, 2022a). Driven by companies such as ZOLA Electric (Off Grid Electric), EcoZoom, M-Kopa and Mobisol (Engie Energy Access), Africa has become the leading destination for investments in off-grid solutions, attracting 70% (USD 1.7 billion) of the global total between 2010 and 2020 (IRENA and AfDB, 2022, based on data from Wood Mackenzie, 2021). Nonetheless, in 2022 Europe’s attempts to diversify away from Russian natural gas fuelled investment in some African oil and gas markets which are secured against international off-take. In July 2022, the governments of Algeria, Niger and Nigeria signed a memorandum of understanding to build a trans-Saharan gas pipeline, a project estimated at USD 13 billion that could send up to 30 billion cubic meters of gas a year to Europe (Chikhi, 2022).

Figure 1.7. Greenfield foreign direct investment to Africa’s energy sectors, capital expenditures, 2003-21

Source: Authors’ calculations based on the fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

The high cost of capital is particularly detrimental to investments in the renewable energy sector. For instance, after Ghana’s central bank raised its benchmark rate to 17% (the comparable United States [US] prime rate is 3.5%), the cost per kilowatt-hour for solar energy systems increased eight times more than that for a gas plant (Kincer and Moss, 2022). The COVID-19 pandemic reversed a slow downward trend in the weighted average cost of capital for energy projects in Africa, which in 2021 was about seven times higher than in Europe and North America (IEA, 2022a). The weighted average cost of capital for renewable energy projects varies widely across Africa (between 8% and 32%). The highest risk premiums often materialise in the countries with the greatest need for investments (Ameli et al., 2021).

Investments remain far below the levels necessary for Africa to achieve its clean energy production targets. The continent is home to 60% of the best solar resources globally, yet only 1% of global installed solar PV capacity (IEA, 2022a). Achieving full access to clean modern energy in Africa by 2030 would require investments totalling USD 25 billion per year until 2030, which is slightly above 1% of total energy investments globally. Current annual investments fall far short of these targets and would need to increase by almost eight times for Africa to achieve universal energy access by 2030 (IEA, 2022a). Investments will need to shift from fuel supply towards power supply and end uses such as energy-efficient buildings. Achieving Africa’s sustainable energy transition would require private capital to cover 60% of the cumulative energy investment between now and 2030 (IEA, 2022a).

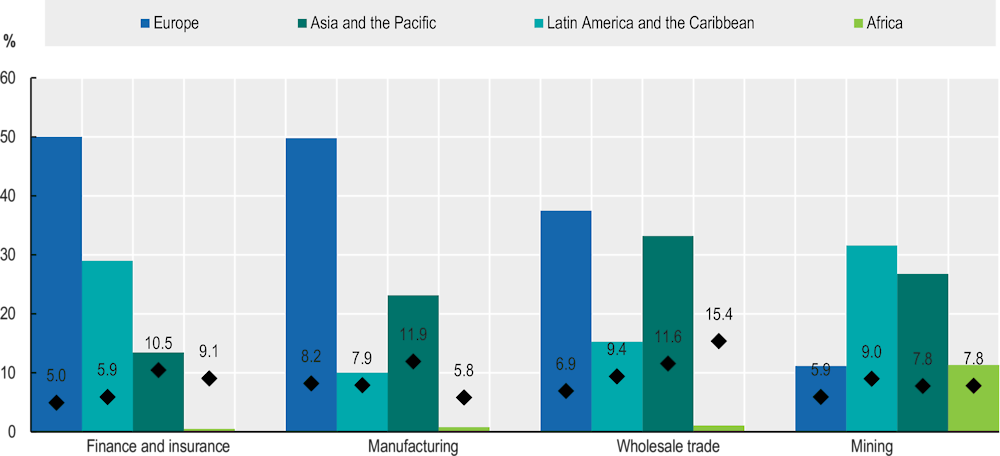

Africa’s better investment performance compared to other world regions does not necessarily result in increased investment amounts. Historically, superior returns on investments in African countries have not translated into rising investment amounts, as investors expect higher returns to compensate for higher risk (Asiedu, 2002). For instance, over the past decade, risk-adjusted rates of return have been depressed as a result of policy uncertainty (e.g. around protectionist measures) (Evenett and Fritz, 2021). Market-seeking FDI in sectors such as retail, information and communications technology (ICT), financial services, and other consumer services in Africa has increased less than in other parts of the world, despite higher returns. For instance, US-based companies active in wholesale trade, finance and insurance earn significant premium returns on their activities on the continent compared to those in other world regions, though less than 1% of their foreign investments takes place in Africa (mostly in Egypt, Nigeria and South Africa) (Figure 1.8).

Figure 1.8. Within-sector shares and rates of return of outward foreign direct investment from the United States, by investment destination and sector, 2017-21

Note: Bars show within-sector shares of outward US FDI stocks by investment destination. Diamonds show US FDI rates of return by sector and investment destination, calculated as the ratio of US FDI income abroad at year t over the average of US FDI end-year stocks abroad at year t and t-1 (UNCTAD, 2019). The figure shows averages over the 2017-21 period and covers selected sectors and destinations. Sectors are sorted in descending order by total FDI stock.

Source: Authors’ calculations based on the U.S. Bureau of Economic Analysis (2022), U.S. BEA (database), https://apps.bea.gov/iTable/iTable.cfm?ReqID=2&step=1.

The majority of infrastructure projects in African countries lack the investment necessary to succeed, but some countries’ specificities benefit experienced investors. In infrastructure, 80% of projects fail at the feasibility and business-plan stage, as only a few projects meet investors’ risk-return expectations (OECD/ACET, 2020; McKinsey, 2020). At the same time, Africa shows the lowest default rates on infrastructure project finance debt at 5.3%, compared to 6.1% in Asia and 10.1% in Latin America (Kelhoffer, 2021). Multinational enterprises interviewed for this report emphasised that Africa-specific experience allows them to generate higher rates of return in Africa compared to other world regions. Once the upfront costs for risk mitigation are borne (see Box 1.4), virtuous cycles between recognition by other market actors, operational expertise, government relations, economies of scale and innovation can unfold. New investors frequently rely on experienced intermediaries to compensate for information shortages, creating competitive disadvantages for smaller investors that are unable to afford such services.

Box 1.4. Risk mitigation strategies used by infrastructure investors

Extensive due diligence and risk mitigation measures help explain lower selection and default rates for infrastructure projects in African countries. Several asset managers with experience on the continent identified the following approaches to deal with typical challenges for infrastructure projects:

Due diligence. Asset managers operating in African countries often need to build local knowledge over time through desk research, lengthy local due diligence processes and organisational efforts (Deloitte, 2016). While these long-term efforts improve comfort with investing in the region and increase the overall quality of infrastructure projects, the significant upfront effort often discourages inexperienced or smaller asset owners.

De-risking. Governments and development finance institutions often back infrastructure deals in Africa through co-funding, guaranteed revenue streams or credit support. In 2015-20, non-domestic public actors (i.e. multilateral development banks, bilateral development finance institutions, foreign African and non-African governments, and international multilateral funds) were the major sources of finance for infrastructure projects in a large part of Africa (Lee and Gonzalez, 2022).

Currency risk control. Infrastructure projects, especially in the energy sector, are often pegged to US dollars or euros, thus lowering the project’s currency risk. However, this significantly reduces the portfolio of bankable projects. In countries such as Ethiopia and Zimbabwe, US dollars are both scarce in the market and difficult to repatriate even when they are available. In addition, most countries lack appropriate financial products in local currency markets to meet investor needs and fund major projects. As a result, investors often have to borrow in foreign currency for projects where revenue flows are in local currency (Orbitt, 2020).

Exit strategies. The possibility to exit projects within a given timeframe is also a concern for most investors with a medium-term investment horizon (Deloitte, 2016). According to a study by African Infrastructure Investment Managers, the exit environment for African infrastructure investments has improved in recent years. It is providing better refinancing opportunities once projects are operational and earning revenues. Nonetheless, narrow and underdeveloped financial markets, capital controls and weak legal frameworks can often slow down or increase the cost of exiting.

Source: Authors’ elaboration based on Mercer (2018), Investment in African Infrastructure: Challenges and Opportunities, and Eyraud, Pattillo and Selassie (14 June 2021), “How to attract private finance to Africa’s development”, www.imf.org/en/Blogs/Articles/2021/06/14/blog-how-to-attract-private-finance-to-africa-s-development.

Existing channels for investment show untapped potential to support Africa’s regional integration and sustainable development

External financial inflows and domestic sources of investment can be better exploited for sustainable growth

External financial inflows represent important sources of finance for development on the African continent (Table 1.2). In 2021, as in previous years, FDI and remittances made up the largest external financial flows (6.4% of Africa’s GDP); yet their potential to promote sustainable growth remains underexploited due to limited integration with productive activities on the continent. ODA and sustainability-oriented private investments (impact investing and philanthropy) are still small and show specific sectoral and country biases (Box 1.5).

Similarly, among domestic sources of investment in African countries, regional multinational enterprises and institutional investors offer untapped potential to support sustainable and resilient growth (Table 1.2). Mobilising domestic resources is necessary to widen the fiscal space of national governments and reduce debt burdens, as well as attract sustainable investments from the private sector.

Table 1.2. Africa’s external and domestic potential sources of sustainable finance

|

External/domestic |

Sources |

Amounts |

% of Africa’s GDP |

|---|---|---|---|

|

External |

Foreign direct investment |

USD 83 billion (2021) |

2.6% (2021) |

|

Portfolio investment |

USD -9.7 billion (2021) |

-0.1% (2021) |

|

|

Remittances |

USD 96 billion (2021) |

3.8% (2021) |

|

|

Official development assistance |

USD 65 billion (2021) |

2.5% (2021) |

|

|

Global impact investors |

USD 24.3 billion (2019) (assets under management invested in Africa) |

1.0% (2019) |

|

|

Private philanthropy |

USD 2.1 billion (2018-19) |

0.1% (2019) |

|

|

Domestic |

Government revenues |

USD 466 billion (2021) |

16.7% (2021) |

|

Multinational enterprises based in Africa |

USD 2.7 billion (2021) (FDI outflows) |

0.1% (2021) |

|

|

Domestic institutional investors |

USD 1.8 trillion (2020) (assets under management based in Africa) |

73.3% (2020) |

Note: “Amounts” refers to financial flows during the reference period with the exception of “Global impact investors” and “Domestic institutional investors”, which refer to end-of-period stocks (assets under management). Financial sources may overlap and cannot be aggregated. Government revenues exclude grants and expenditures on debt services. Global impact investors (GIIN, 2020) and private philanthropy (OECD, 2021b) are considered external sources of finance as they mostly originate outside the African continent.

Source: Authors’ compilation based on UNCTAD (2022c), UNCTADstat (database), https://unctadstat.unctad.org/EN/; IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52; IMF (2022c), Investment and Capital Stock Dataset (ICSD) (database), https://data.imf.org/?sk=1CE8A55F-CFA7-4BC0-BCE2-256EE65AC0E4; World Bank-KNOMAD (2022), Remittances (database), www.knomad.org/data/remittances; OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; GIIN (2020), Annual Impact Investor Survey, https://thegiin.org/assets/GIIN%20Annual%20Impact%20Investor%20Survey%202020.pdf; OECD (2021b), OECD Private Philanthropy for Development: Data for Action (database), https://oecd-main.shinyapps.io/philanthropy4development/; IMF (2022a), World Economic Outlook (database), www.imf.org/en/Publications/WEO/weo-database/2022/October; Juvonen et al. (2019), “Unleashing the potential of institutional investors in Africa”, AfDB Working Papers, No. 325, www.afdb.org/sites/default/files/documents/publications/wps_no_325_unleashing_the_potential_of_institutional_investors_in_africa_c_rv1.pdf.

Box 1.5. Africa’s external sources of sustainable finance

Official development assistance rose during the COVID-19 pandemic, prioritising social sectors especially in Africa’s low-income countries. In 2020, 18 African countries received a larger increase in ODA than in any other year since 2015, partly offsetting the contraction in public finance. On average, net ODA accounted for 9% of GDP for low-income African countries in 2020, compared to only 1.4% and 0.5% for lower- and upper-middle-income counties. Consistent with bilateral ODA allocation recorded in the past decade, over half went to support social sectors in 2020, such as health (28%) and education (9%) or to address humanitarian emergency situations (20%).

Private funding mobilised through ODA has increased, though low-income countries have not been the main recipients. Private finance mobilised through ODA intervention grew fivefold in Africa between 2012 and 2020, from only USD 4 billion to USD 22 billion. About three-quarters of the amounts targeted three sectors: banking and financial services (31%), industry, mining and construction (27%), and energy (20%). However, less than 30% of the amounts mobilised targeted low-income countries (OECD, 2022e).

Despite risk perceptions, appetite for impact investing is expected to grow among global institutional investors, but current assets are held largely in two African countries. Impact investing refers to “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return”.1 According to the 2020 Annual Impact Investor Survey (GIIN, 2020), African countries are attracting more than 21% of assets worldwide (USD 24.3 billion), and 52% of global impact investors plan to expand their investments in Africa by 2025. Until 2015, about 50% of impact investments went to Kenya and South Africa (GIIN, 2015, 2016). Policy uncertainty may prevent Africa from fully realising its potential for impact investment, with 35% of investors citing currency and country risks as severe.

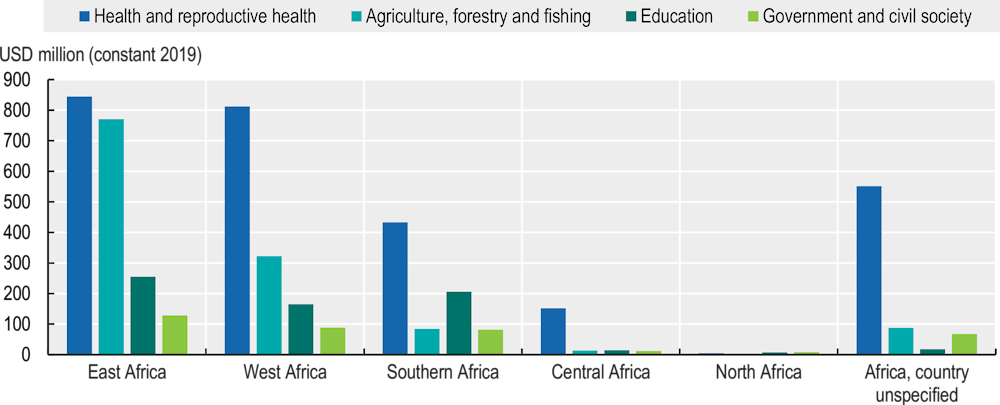

Though Africa receives a larger share of private philanthropic giving than other parts of the world, its poorest regions are not the main beneficiaries, and several obstacles exist. Between 2016-19, Africa attracted 39% of philanthropic flows of global cross-border philanthropy, while Latin America and the Caribbean and developing Asia received 33% and 23% respectively. East Africa received most of Africa’s philanthropic inflows with USD 2.4 billion, followed by West Africa with USD 1.7 billion (see Figure 1.9). Cross-border philanthropic giving does not focus on Africa’s poorest regions: for example, Southern Africa has a GDP (purchasing power parity) per capita three times larger than Central Africa but received over four times more philanthropic inflows per capita. The major obstacles to philanthropic flows to African countries include political uncertainty, strict regulations, currency volatility and perceptions of corruption (Indiana University Lilly Family School of Philanthropy, 2022; Murisa, 2022).

Figure 1.9. Cross-border philanthropy inflows by African region and sector, USD million, 2016-19

Source: Authors’ calculations based on OECD (2021b), OECD Private Philanthropy for Development: Data for Action (database), https://oecd-main.shinyapps.io/philanthropy4development/.

Better foreign direct investment integration with local economies can create jobs and spillovers that benefit African firms

Foreign direct investment can contribute to sustainable development beyond the capital invested and can have long-term crowding-in effects. Through spillovers to local suppliers and domestically owned firms and through training the workforce, FDI can enhance growth and innovation in the host country and contribute to its sustainable development (Box 1.6). A recent study finds that FDI in Africa has little effect on domestic private investment in the short run but creates significant crowding-in effects in the long run: a one percentage point increase of the share of FDI in GDP led to a 0.3% rise in private domestic investment in a large sample of African countries, with weaker effects in non-diversified commodity-exporting countries (Diallo, Jacolin and Rabaud, 2021).

Box 1.6. OECD FDI Qualities Indicators in Africa

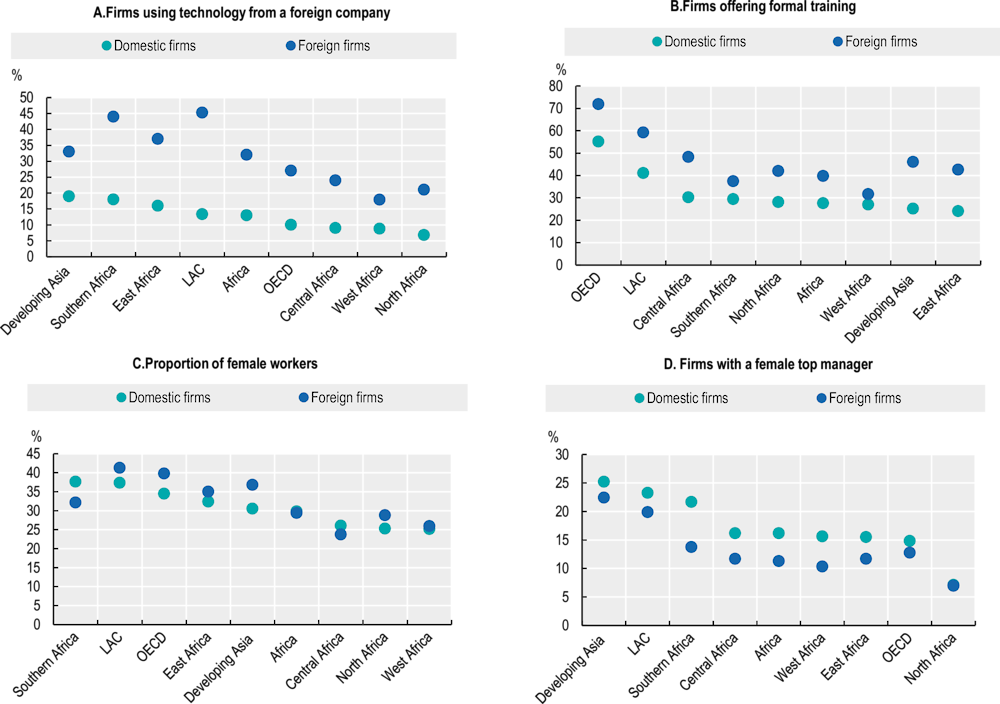

The OECD FDI Qualities Indicators seek to shed light on how FDI contributes to sustainable development, focusing on productivity and innovation, job quality and skills, gender equality, and the low-carbon transition (OECD, 2022f). The OECD FDI Qualities Policy Toolkit further supports governments in identifying policies and institutional arrangements to improve FDI impacts on sustainable development (OECD, 2022g).

Economies in developing and emerging regions, whose domestic technology is often further away from the technological frontier, can particularly benefit from FDI through the transfer of more advanced foreign technologies. Across Africa, the share of foreign firms using technology from abroad is 32%, compared to 13% for domestic firms. This difference is lower than in Latin America and the Caribbean but higher than in developing Asia and OECD countries (Figure 1.10, Panel A). By providing more training opportunities for their employees, foreign firms in African regions contribute significantly to on-the-job skill development (Figure 1.10, Panel B). In most African regions, female employment rates are similar to those for foreign and domestic firms, whereas the share of female top managers is higher in domestic than in foreign companies. This pattern suggests that FDI can create employment opportunities for women, while foreign companies do not necessarily offer better career advancement opportunities for their female workforce in general (Figure 1.10, Panels C and D).

Figure 1.10. OECD FDI Qualities Indicators for Africa and other world regions

Note: The FDI Qualities Indicators cover 153 countries globally, of which 38 are in Africa. Depending on data availability, some regions do not fully cover all countries. Southern Africa excludes South Africa. LAC = Latin America and the Caribbean.

Source: OECD (2022g), FDI Qualities Policy Toolkit, https://doi.org/10.1787/7ba74100-en.

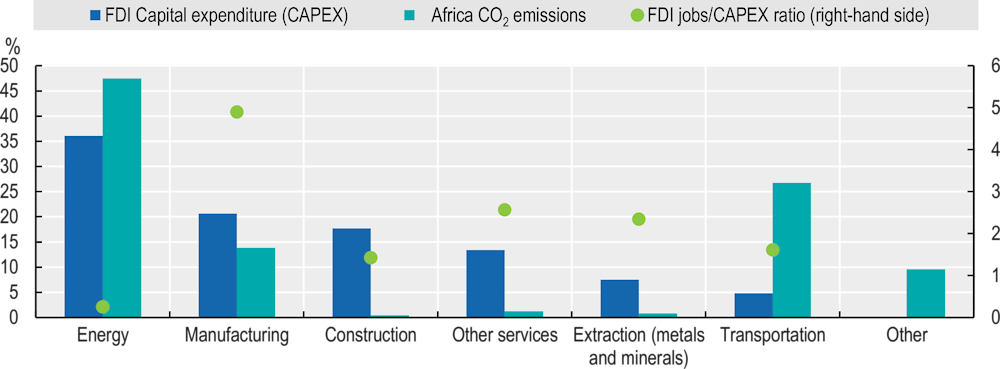

In the last two decades, Africa’s coal, oil and gas industry attracted the largest share of greenfield FDI, but recent trends show increasing market-seeking investments in Africa’s services sectors, such as retail and ICT. In 2003-20, the largest share of greenfield FDI in the continent went to the energy sector (36%), mostly targeting activities in the coal, oil and gas industry (30%), with renewable energy investments representing only 6% of the total. About 60% of the greenfield FDI that went into coal, oil and gas came from Europe and North America. These investments generated on average only 0.25 jobs per USD 1 million of capital expenditure while feeding Africa’s most polluting industry, responsible for almost 50% of continental CO2 emissions since the beginning of the century (Figure 1.11). While this industry has represented the largest source of government revenues and accounted for half of the exports outside the continent for many resource-rich African countries (IEA, 2022a), it has not led to productive transformation and regional integration. In recent years, the emergence of new technologies and booming domestic consumption markets meant that new FDI has focused less on Africa’s extractive sectors and more on retail, ICT, financial services and other consumer services (AUC/OECD 2021).

Figure 1.11. Greenfield foreign direct investment to Africa by sector and selected sustainability indicators, 2003-20

Note: “FDI Capital expenditure (CAPEX)” shows sectoral shares of Africa’s greenfield FDI capital expenditures. “Africa CO2 emissions” shows sectoral shares of Africa’s total CO2 emissions from fuel combustion. “FDI jobs / CAPEX ratio” shows the ratio of the number of jobs announced over greenfield FDI capital expenditure to Africa, by sector. “Energy” covers extraction, production and supply activities in coal, oil and gas and renewable energy, “Manufacturing” includes all other manufacturing sectors and agriculture and fishing, “Other services” includes retail, ICT, financial services and other services, and “Other” is a residual category which includes households, unallocated auto-producers and final consumption not elsewhere specified.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets and IEA (2022b), Data and Statistics (database), www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer.

Africa’s manufacturing sectors – in particular textiles, industrial and electronic equipment, and automotive – show the highest potential for creating jobs but remain less attractive to foreign investors. During the 2003-20 period, greenfield FDI to Africa’s manufacturing sectors accounted for 20.6% of total foreign investment on the continent and generated on average 5 jobs per USD 1 million invested – the highest ratio across sectors. Manufacturing activities are responsible for a relatively small share of CO2 emissions on the continent (Figure 1.11). The specific sub-sectors of textiles, industrial and electronic equipment, and automotive have the best records in terms of job creation (14, 10 and 9 jobs per USD 1 million invested respectively), but they attracted only 4.5% of total greenfield FDI capital expenditures in Africa over 2003-20.3

Linkages between local affiliates of multinational enterprises and domestic suppliers are important channels for productivity spillovers from FDI. Such linkages can help domestic firms and small and medium-sized enterprises upgrade (Amendolagine et al., 2019; Javorcik and Spatareanu, 2008) through several spillover channels (Table 1.3).

Table 1.3. Examples of spillovers from foreign to domestic firms

|

Spillover channel |

Short description |

Example |

|---|---|---|

|

Demand creation |

Foreign firms open up market opportunities for local suppliers |

A World Bank firm-level study of multinational enterprise suppliers in Rwanda (Qiang, Liu and Steenbergen, 2021) shows that supply linkages with multinational enterprises increase by 2% the probability for a domestic firm to become an exporter. The effect is greater in more complex value chains that require higher product standards and deeper interactions, such as textiles, chemicals and professional services. |

|

Knowledge and technology transfer |

Foreign firms provide training and technical assistance to local suppliers |

In 2022, Renault Trucks, Toyota Tsusho Corporation and Carrier Global Corporation partnered with the World Food Programme and the Government of Ghana to build a Transport Training Centre in Accra. The centre aims at enhancing transport and logistics capacities across West Africa through free online and hands-on training for up to 400 people per year (WFP, 2022). |

|

Certification |

Foreign firms facilitate input quality certification processes within local suppliers |

In 2015, the Zurich-based manufacturer Barry Callebaut launched a certification programme to promote sustainable farming within its cocoa supply chain. By February 2022, the programme registered about 121 000 farmers in Ghana, 101 000 in Côte d’Ivoire, 19 000 in Cameroon and 1 700 in Nigeria (Cocoa Horizons, 2022). |

Source: Authors’ compilation based on literature review.

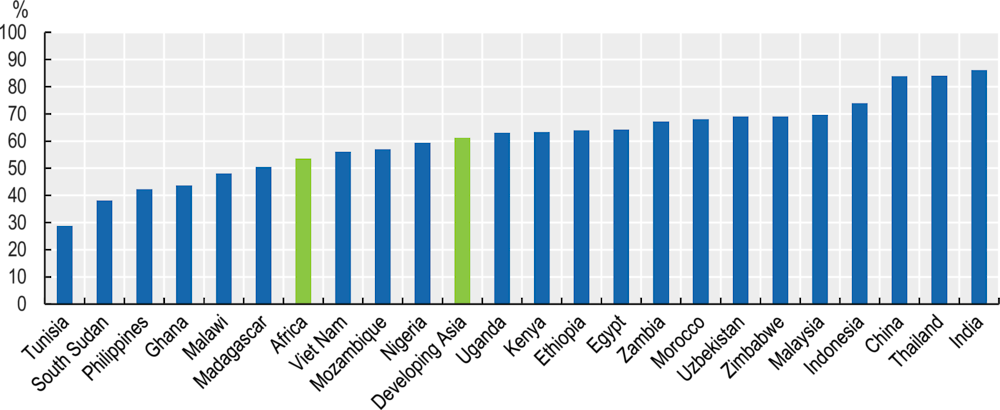

Foreign firms are less likely to source supplies locally in Africa than in Asia, and the extent of local sourcing varies among African countries. Analysis of firm-level data from the World Bank Enterprise Surveys shows that, on average, foreign firms operating in African countries rely less on inputs sourced from local suppliers compared to their peers in Asia (Figure 1.12). Sector-specific factors, value chain structures and policy considerations can explain variations across African countries: for example, in Ethiopia and Morocco, advanced local supplier capabilities exist in key sectors such as textiles and automotive, allowing foreign manufacturers to source locally. Differences in shares of local sourcing by foreign investors can result from legal and regulatory requirements, as in Egypt (OECD, 2020a) and Tunisia (OECD, 2021c).

Figure 1.12. Local sourcing of inputs by foreign manufacturing firms in selected countries in Africa and Asia, % of total sourcing

Note: Countries covering less than 50 survey respondents have been excluded.

Source: Authors’ calculations based on World Bank (2022b), Enterprise Surveys (database), www.enterprisesurveys.org.

The transfer of knowledge and technology from multinational enterprises depends on the absorptive capacity of Africa’s small and medium-sized enterprises, which often suffer from a high level of informality and information asymmetries. Absorptive capacity – defined as the production and technology gap between domestic and foreign firms – shapes the ability of local firms and small and medium-sized enterprises to benefit from technological spillovers from multinational enterprises (Lugemwa, 2014; Vu, 2018). A recent study on 100 manufacturing firms in Kenya shows that absorptive capacity plays a statistically significant role in FDI’s boosting firm performance, implying that firms need some level of knowledge and technology capacity to fully tap the benefits of FDI (Wanjere et al., 2021). However, investments targeted at African small and medium-sized enterprises are often hampered by informality and information asymmetries (Box 1.7).

Box 1.7. Sustainable investments in African small and medium-sized enterprises: Coupling financing with impact assessments

The numerous financial challenges that many African small and medium-sized enterprises (SMEs) face make it difficult for them to attract traditional investors, especially for sustainable investments. The capital requirements of Africa’s SMEs typically range between USD 2 000 and USD 100 000, depending on a country’s income levels. This “mesofinance” segment of companies is not a well-established target group for typical financing channels: SMEs are often too large for microfinance but too small and unstructured to attract traditional banks and investors. Most entrepreneurs are not trained in business planning, lack documented financial data and – apparently the most significant barrier to accessing credit – are unable to provide collateral in obtaining credit (e.g. land, buildings or equipment) (EIB, 2022). Some entrepreneurs are also unwilling to open their books to equity investors, as they are loath to have their decisions challenged or are unfamiliar with this type of finance. Due to lacking liquidity in financial markets, investors cannot easily sell their shares in SMEs and achieve profitable exits, especially in Francophone Africa and its least developed countries. These challenges are even more pronounced for attracting sustainable investments that seek to expand SMEs while also improving their social and environmental practices.

While SMEs remain unattractive to traditional financiers, specialised investors that couple funding with business advisory can provide sustainable investments. For example, Investisseurs & Partenaires (I&P), a social investor focusing on Africa’s least developed countries, provides dedicated solutions for start-ups and high-potential SMEs (I&P, n.d. a; Severino, 2018). I&P developed an impact scorecard to determine a project’s alignment with I&P’s impact pillars (e.g. the provision of essential goods and services, gender promotion, and environmental impact). It carries out an environmental and social audit to assess a company’s current practices and define an action plan to mitigate identified risks. So far, I&P has carried out over 150 investments, with 87% located in the least developed countries and around 75% contributing directly to the SDGs. With an average post-investment employment growth of around 50%, these micro enterprises and SMEs have maintained or created nearly 9 000 direct jobs (with 96% of employees benefiting from health coverage) and have indirectly impacted nearly 50 000 family members (I&P, n.d. b; Coulibaly, 2022). The investor’s experience suggests that SMEs may continue to yield lower financial returns for impact investors but offer the greatest additionality for social and environmental impacts.

Mobilising remittances as part of diaspora investment can help develop local production networks. According to International Fund for Agricultural Development (IFAD/World Bank, 2015), up to 30% of remittances target economic activities. However, most of these remittances are channelled towards informal activities and micro, small and medium-sized enterprises through extended family ties and social networks, rather than towards structured diaspora investment products. This is due to limitations including a lack of knowledge about investment opportunities along with low confidence in regulatory and political systems (Asquith and Opoku-Owusu, 2020). Diaspora investments can support the development of local production networks as most diaspora investors tend to establish more connections with local suppliers than non-diaspora foreign investors (Amendolagine et al., 2013). Structured diaspora investment products could tap into the estimated USD 33.7 billion annual diaspora savings, channelling some of these funds more directly towards productive investments on the continent (Faal, 2019).

The growth of intra-African investment can support job creation and regional integration

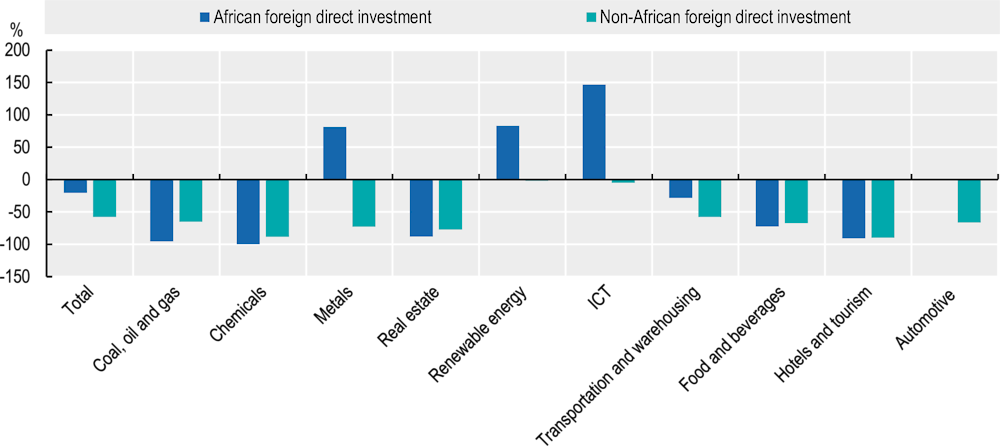

African multinational enterprises account for a minor share of greenfield FDI to the continent but have increased their investment in specific sectors. From 2017 to 2021, intra-African FDI flows accounted for only 9% of total greenfield FDI to the continent.4 However, in 2020-21, despite a sharp reduction in total greenfield FDI to Africa during the COVID-19 pandemic, Africa-based investors increased their engagement in new investment projects in ICT, renewable energies and metals (Figure 1.13). For example, in 2020, MTN Nigeria (a subsidiary of the South Africa-based MTN Group) announced plans to invest over USD 1.6 billion in 4G network infrastructure across the country until 2023 (NIPC, 2020).

Figure 1.13. Greenfield foreign direct investment to Africa by source region and sector, % change in capital expenditures between 2018-19 and 2020-21

Note: The figure shows the top ten sectors by total capital expenditures in 2018-19. Sectors are sorted from left to right by decreasing total capital expenditures in 2018-19. ICT = Information and communications technology.

Source: Authors’ calculations based on the fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Original analysis for this report shows that the growth of African multinational enterprises in services – such as finance and retail – has increased the potential for job creation, but they are highly dominated by South African groups. Overall, Africa’s services sectors combine comparatively low environmental impact with a relatively positive job creation potential (Figure 1.11). For example, greenfield FDI in retail generates on average 5.6 jobs per USD 1 million of capital expenditures.5 In South Africa, Africa’s top FDI source and destination in 2021, the retail sector accounts for 21.5% of total employment (Statistics South Africa, 2022), mostly due to the dominance of large domestic retail companies. Analysis of firm-level data from the Orbis database across 521 African private companies listed on a stock market with subsidiaries in Africa highlights the dominance of South African firms as intra-African investors (Table 1.4). They represented 34% of firms included in the sample and three-quarters of turnover and market capitalisation. While 23% of Africa-based listed firms in the sample operate in manufacturing, the vast majority (69%) is active in service-oriented sectors such as financial services (29%), retail (8%), real estate (6%), and information and communication technologies (6%).

Table 1.4. The top ten Africa-based listed companies by market capitalisation

|

Rank |

Company name |

Country |

Sector |

Turnover (USD million) |

Employees |

Market capitalisation (USD million) |

% of domestic subsidiaries |

% of continental subsidiaries |

% of subsidiaries outside Africa |

|---|---|---|---|---|---|---|---|---|---|

|

1 |

Naspers Limited |

South Africa |

ICT |

5 934 |

28 445 |

89 883 |

30% |

2% |

68% |

|

2 |

Firstrand Limited |

South Africa |

Finance and insurance |

7 710 |

- |

28 560 |

81% |

12% |

7% |

|

3 |

Standard Bank Group Limited |

South Africa |

Finance and insurance |

8 426 |

49 224 |

21 180 |

54% |

32% |

14% |

|

4 |

Sasol Limited |

South Africa |

Manufacturing |

14 275 |

28 949 |

19 108 |

56% |

4% |

41% |

|

5 |

Sanlam Limited |

South Africa |

Finance and insurance |

6 892 |

- |

12 726 |

56% |

32% |

12% |

|

6 |

MTN Group Limited |

South Africa |

ICT |

11 455 |

16 390 |

12 294 |

17% |

56% |

27% |

|

7 |

Dangote Cement Plc |

Nigeria |

Manufacturing |

3 378 |

17 747 |

10 040 |

8% |

89% |

4% |

|

8 |

Nedbank Group Limited |

South Africa |

Finance and insurance |

3 667 |

- |

9 915 |

62% |

22% |

16% |

|

9 |

Absa Group Limited |

South Africa |

Finance and insurance |

5 404 |

35 267 |

9 782 |

66% |

28% |

6% |

|

10 |

Safaricom PLC |

Kenya |

ICT |

2 593 |

5 852 |

9 646 |

70% |

20% |

10% |

Note: See Annex 1.B for methodological information.

Source: Bureau van Dijk (2022), Orbis (database), www.bvdinfo.com/en-gb/our-products/data/international/orbis.

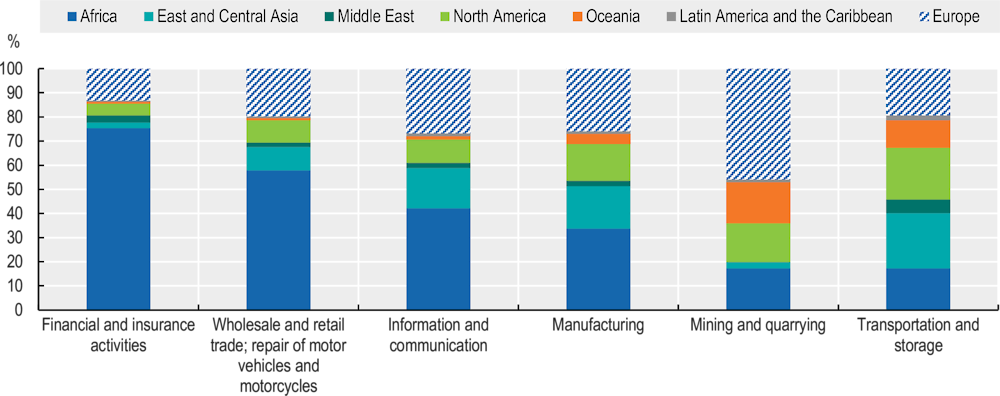

African groups in financial services and retail tend to have a larger geographical footprint. Based on the analysis of the Orbis database, on average Africa-based listed companies have established 17 subsidiaries on the continent, compared to 8 for Western European companies, 4 for North American companies and only 3 for Asian companies. African groups hold three-quarters of subsidiaries operating in Africa in the financial sector – mostly financial holding companies and banks – compared to companies from other regions (Figure 1.14). While less than 10% of African listed firms operate in retail – mostly food and beverage, construction materials – they account for over half of retail subsidiaries on the continent, illustrating the dominance of a few large African groups (e.g. Shoprite, Pick n Pay).

Figure 1.14. Subsidiaries of listed companies active in Africa, by sector and home region of company group

Note: The figure shows the top six sectors by number of African subsidiaries. The sample includes 521 Africa-based listed private companies and 2 355 non-Africa-based listed private companies with subsidiaries in Africa. See Annex 1.B for further methodological information.

Source: Authors’ calculations based on Bureau van Dijk (2022), Orbis (database), www.bvdinfo.com/en-gb/our-products/data/international/orbis.

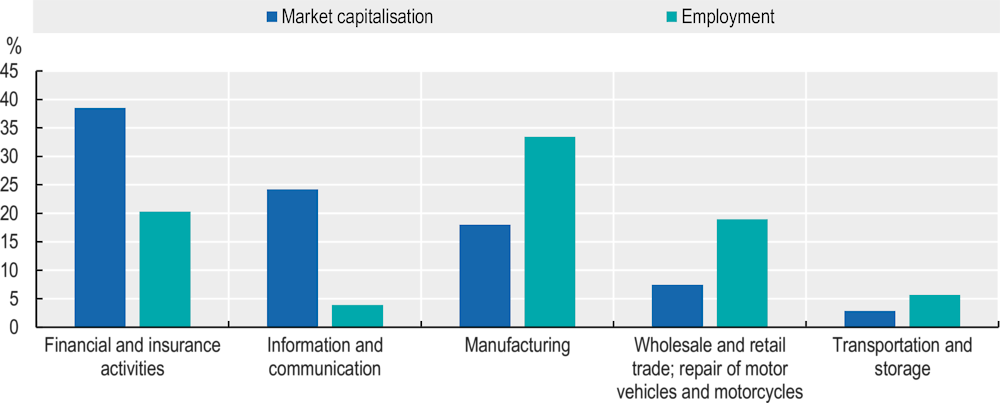

Manufacturing and retail are the most job-intensive sectors, but sectors with high market value – financial and ICT – can indirectly create jobs. Manufacturing and retail account for over 50% of direct employment among Africa-based listed firms. In contrast, the financial and ICT sectors represent over 60% of market capitalisation, but they create less than one-fourth of total direct employment: about 500 000 employees (Figure 1.15). However, the financial and ICT sectors offer the potential for indirect job creation through increasing financial inclusion and digital upgrading in the rest of the economy (AUC/OECD, 2021).

Figure 1.15. Shares of market capitalisation and employment among Africa-based listed companies

Note: The figure shows the top five sectors by market capitalisation. The sample includes 521 Africa-based listed private companies. See Annex 1.B for further methodological information.

Source: Bureau van Dijk (2022), Orbis (database), www.bvdinfo.com/en-gb/our-products/data/international/orbis.

African firms expanding within the continent often have better knowledge of the new business environments than non-African firms. Formal and informal knowledge of the business environment often helps regional pioneers enter neighbouring markets by facilitating investment decisions and reducing costs (Kathuria, Yatawara and Zhu, 2021). Using such knowledge, Dangote Cement, for instance, has successfully competed against non-African incumbent companies and expanded across ten African countries (World Bank, 2016). Firms can acquire capabilities in their domestic market that can allow them to expand to countries that have similar institutional settings; this appears crucial to succeed in difficult market environments (Verhoef, 2011). Research on the location strategies of three South African firms – SABMiller, MTN and Massmart – highlights the ability to implement non-market strategies as well as leverage important political connections to navigate weak institutional environments (White, Kitimbo and Rees, 2019).

Domestic institutional investors hold untapped potential to unlock sustainable finance

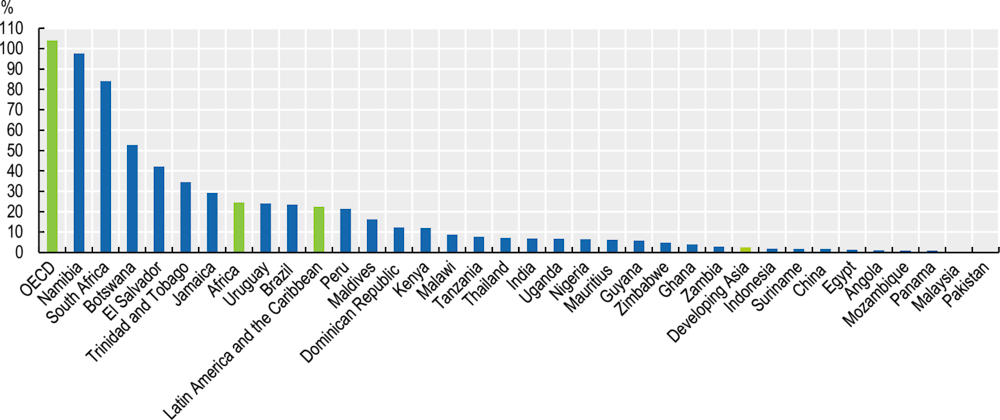

African institutional investors have grown, while their investments in alternative assets remain negligible. According to the latest estimates, in 2020, African institutional investors had assets under management of about USD 1.8 trillion, registering a 48% increase from 2017 (Juvonen et al., 2019). OECD data show that pension funds across 15 African countries accumulated USD 380 billion of assets by 2020, with South Africa accounting for almost 80% of the total (OECD, 2021d). This translates into an average GDP share of 25% for Africa (mostly driven by South Africa, Namibia and Botswana), compared to 22% in Latin America and the Caribbean and 3% in developing Asia (Figure 1.16). Yet, alternative assets – such as infrastructure, real estate, green and sustainable assets, private equity, and venture capital – accounted for less than 3% of portfolios in an assessment of five African pension markets, namely Ghana, Kenya, Namibia, Nigeria and South Africa (AfDB/IFC/MFW4A, 2022).

Figure 1.16. Assets under management of pension funds, 2015-20, % of GDP

Note: OECD includes 38 countries, Africa includes 15 countries, Latin America and the Caribbean includes 10 countries and Developing Asia includes 7 countries.

Source: Authors’ calculations based on OECD (2021d), OECD Global Pension Statistics (database), https://doi.org/10.1787/pension-data-en.

The absence of environmental, social and governance (ESG) frameworks, capacity constraints and a lack of information for investors limit sustainable investment in African countries. Specific sustainable investment frameworks are still missing across the African continent, with South Africa’s implementation of an ESG taxonomy in April 2022 as one exception. Data and management capacity constraints make accurate ESG criteria assessments more difficult, which can lower ESG scores and increase the risk of exclusion from international sustainable investment (OECD, 2022b). In a survey of 70 African banks, 70% saw green lending as an opportunity, but 60% cited technical capacity as a barrier to implementation (EIB, 2022). Mirroring global trends among institutional investors (OECD, 2021a), half of the major African pension funds provide information on the importance of sustainability to their investments. And these share only limited information on their specific strategies and implementations (Stewart, 2022).

Better institutional governance and co-operation across countries can help Africa’s sovereign wealth funds (SWFs) attract private capital for sustainable investments. Total assets under management of Africa’s SWFs amount to USD 100 billion across 30 funds (Global SWF, 2022). Several SWFs have established private equity funds for sectors such as healthcare and renewable energy to attract foreign investors to sustainable investment opportunities (Table 1.5). In a recent survey of senior executives of African SWFs, all respondents underlined the importance of independent and effective institutional governance as the first priority to generate the trust of international and domestic partners. Eighty-three per cent of respondents said that the current collaboration between the continent’s SWFs was insufficient and that much more needs to be done also in the context of the AfCFTA (IFSWF and Templeton, 2021). In June 2022, African SWFs, with collective assets under management of USD 12.6 billion, formed the African Sovereign Investors Forum, a new shared platform to accelerate co-ordination to mobilise capital for sustainable investments (AfDB, 2022).

Table 1.5. Examples of sustainable investment projects by African sovereign wealth funds

|

Sovereign wealth fund |

Country |

Assets under management (2020) |

Sustainable investment projects |

|---|---|---|---|

|

Fonds Souverain d’Investissements Stratégiques (Fonsis) |

Senegal |

USD 846 million |

Since 2017, Fonsis has set up four solar farms which today represent more than 50% of the solar capacity of Senegal, energy supply for nearly a million households and the potential to save 160 tons of carbon dioxide annually. |

|

Ghana Infrastructure Investment Fund (GIIF) |

Ghana |

USD 330 million |