Poverty rates are very high in the United States compared to other OECD countries, especially among older people. Supporting longer careers for all socio-economic groups is one way of reducing old-age poverty without putting additional strain on the fiscal sustainability of pension systems. In the United States, like in many other OECD countries, working lives and the pathways out of the labour market vary substantially across socio-economic groups, however. Low-educated people tend to stop working earlier than their high-educated peers and they are far more likely to face periods of unemployment or disability prior to retirement. In addition, bad health as a barrier to extended careers is more widespread among low-educated people. Tackling the main drivers of early retirement involves eliminating disincentives to work in the pension system, preventing health problems among all workers, including among older workers, and increasing the flexibility of labour market exits through well-tailored policy intervention.

Ageing and Employment Policies: United States 2018

Chapter 1. Pathways out of the labour market for older workers in the United States

Abstract

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Introduction

The financial sustainability of pension systems has become a major concern in OECD countries. Population ageing is gathering momentum and progressing at a fast pace in many countries, and the share of retirees in the population is steadily growing. The United States is not exempt from this trend, yet the changes are taking place more slowly than in other OECD countries. The so-called old-age dependency ratio - defined as the number of people aged 65 and over for every 100 people of working age - in the United States is currently below the OECD average (25 against 28) and it is expected to increase less strongly over the next decades, by 60% by 2050 against 90% in OECD countries (OECD, 2017[1]).

While life expectancy at the age of 65 has substantially increased since the 1970s in the OECD, the average effective age of labour market exit (or effective age of retirement) plummeted by about 5.5 years between 1970 and the early 2000s. Only recently have effective labour market exit ages started to rise again − in many countries at least partly as the result of pension reforms. In the United States, the rising normal retirement age, higher average educational attainment among older workers and changing family patterns are factors that contributed to the trend reversal. Yet, effective labour market exit ages across the OECD are still considerably lower today than 45 years ago, adding to the financial pressure on pension systems.

This chapter examines the pathways that are available and commonly used to exit the labour market within the United States and in other OECD countries. A comparison and discussion of the main retirement drivers between the United States and a set of European countries is also provided. Conclusions are then given at the end of the chapter. Initially, however, the chapter begins by setting the scene of the current situation of older age groups within the United States in comparison to other OECD countries, to help put the main content of the chapter into context.

Old-age poverty risk in the United States and internationally

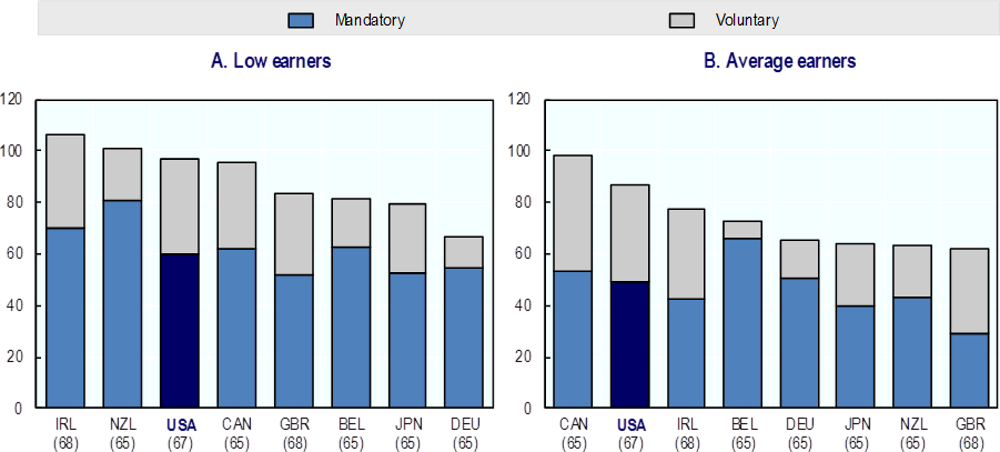

Older people in the United States are more strongly exposed to poverty risks than their peers in most other OECD countries, particularly for those aged over 75, as their poverty rate is 26% in the United States compared to 14% in the OECD ( Figure 1.1). Poverty rates have increased over time amongst the working age population, particularly for those younger than age 50, whilst people over 65 have seen a steady decline since the mid‑1980s. Even so, people over 75 are still the group with the highest overall poverty risk and are far more likely to have incomes under the poverty line than younger age groups.

Figure 1.1. Poverty is very widespread in the United States, especially among the over 75s

Source: OECD Income Distribution Database, www.oecd.org/social/income-distribution-database.htm.

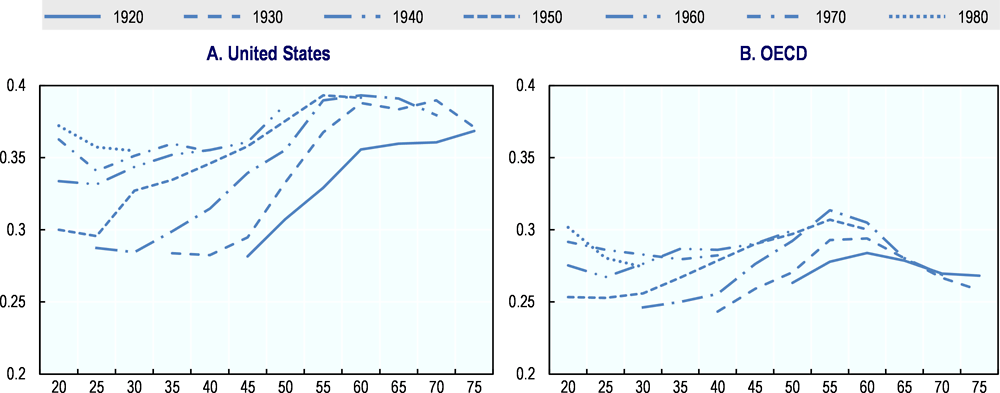

One of the reasons for the poverty problem is that inequality in the United States is high and has been increasing from one generation to the next at a faster pace than on average across OECD countries (Figure 1.2). Gini coefficients by age and birth decade show that income inequality decreases slightly in early adulthood, for people in their 20s, as young adults enter the labour market; it then increases during working life and finally decreases after the retirement age. This pattern has been common across generations in the United States (Panel A) and in the OECD (Panel B). Strikingly, income inequality at the same age has been shifting up from one generation to the next in the United States. In the OECD, such an increase could also be observed for about two-thirds of countries (OECD, 2017[2]) but it has been less pronounced than in the United States. Younger generations – born in the 1970s or later – tend to have similar levels of age-specific income inequality at early stages of their working life.

Figure 1.2. Inequality in the United States is higher and has been increasing faster between generations than in the OECD

Source: OECD calculations based on the Luxembourg Income Study Database, http://www.lisdatacenter.org/our-data/lis-database/.

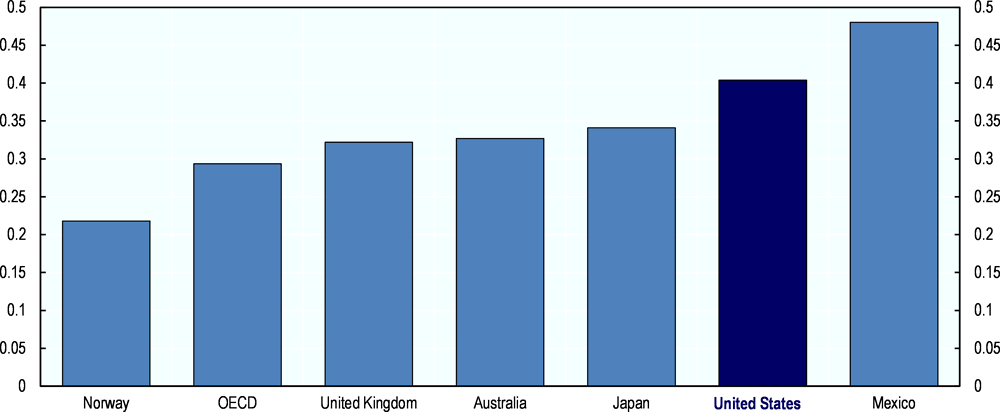

Also among the 65+ inequality levels are high in the United States compared to other OECD countries (Figure 1.3). The Gini coefficient in the United States (0.40) is almost twice as large as the one in Norway (0.22), one of the least unequal countries in the OECD. If the trend of rising inequality across generations continues this may also affect older people future retirees in the United States will become even more unequal than current retirees.

Figure 1.3. Inequality in the United States is high among the population 65 and over

a. 2012 for Norway and 2013 for Japan, Mexico and the United Kingdom.

Source: OECD Income Distribution Database, www.oecd.org/social/income-distribution-database.htm.

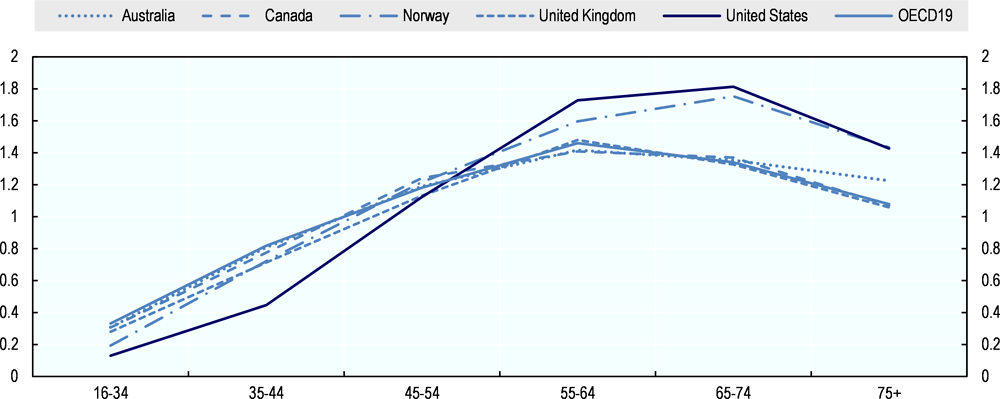

Wealth, as a complement to income, also affects households’ capacity to deal with negative economic shocks. It is a critical factor for the accumulation of inequality over the life course, given that wealth inequality is typically much larger than income inequality (Murtin and Mira d’Ercole, 2015[3]). Due to substantial data limitations, a thorough analysis of wealth disparities across cohorts is unfortunately not possible. Available data, however, do allow comparing average wealth across age groups – who thus belong to different cohorts – for a recent period for 19 OECD countries.

At a given point in time, older individuals are wealthier than their younger peers. On average across 19 OECD countries, wealth in 2010 was 4.4 times higher among the 55-64 year-olds, where the wealth level peaked, than among the 16-34 year-olds (Figure 1.4). The age-wealth relationship was similar in a number of developed countries, including Australia, Canada and the United Kingdom. The United States showed a steeper age pattern in wealth than the average. For instance, the peak was reached at later ages (65‑74) and the ratio between older and younger age groups was substantially higher (14.1). The increase across age suggests that, in addition to receiving bequests and intervivo transfers, households use a substantial part of their income to build up wealth during their working life, hence replicating patterns of income inequality in the wealth distribution. During retirement, average wealth declines due to the loss of labour earnings in old age, uninsured expenditures (e.g. health and long-term care costs) and due to monetary transfers to children and other relatives. In the United States, wealth among the 75+ was still about 40% higher than among the total population in 2010.1

Figure 1.4. In the United States wealth is distributed more unevenly across age groups than in most other countries

Note: OECD19 is an unweighted average of the 19 OECD countries with available data. Data refer to 2010 for the 13 European countries and the United States, to 2011 for Chile, to 2012 for Australia, Canada and the United Kingdom and 2013 for Korea.

Source: OECD Wealth Distribution Database http://stats.oecd.org/Index.aspx?DataSetCode=WEALTH.

A key component of the financial situation amongst the older age groups is their pension entitlement, whether from mandatory or voluntary schemes. The pension system in the United States has three components, each of which plays a different role (Box 1.1).

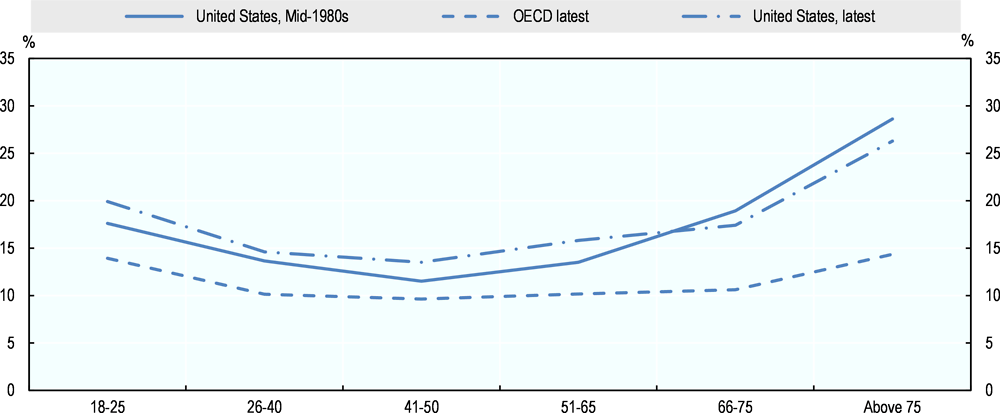

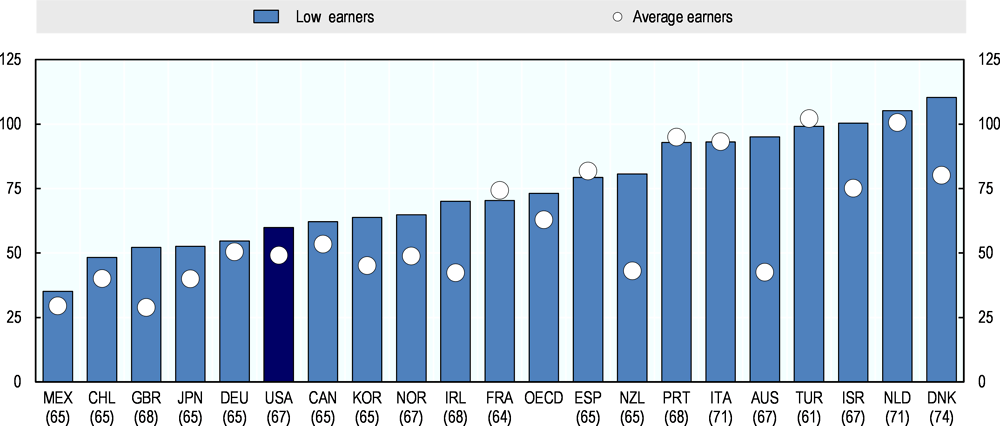

One explanation of the high relative poverty – defined as 50% of median household disposable income - and inequality levels in the United States can be found in the pension promise from the mandatory Social Security and Supplemental Security Income schemes. Even with a full career from age 20 to retirement age, based on OECD pension models, the gross replacement rate at the low earnings levels (50% of average earnings) will be under 50% of previous earnings in the United States, which is very low in international comparison (OECD, 2017[1])). That is, retirees with low past earnings in the United States, even after a 47-year career, will have a pension lower than one-quarter of average earnings, generating a high risk of poverty. Although these are projections for future retirees, they are also relevant to today’s retirees in the United States as there has been minimal reform to the pension system over the last few decades.

These low pension replacement rates in the United States are not just confined to low income earners, but are extended across higher earnings levels unless retirees dispose of additional non-mandatory pension components. The United States ranks as a country with one of the lowest replacement rates from mandatory schemes across the OECD (Figure 1.5).

Figure 1.5. Pension replacement rates are low in the United States

Note: Labour market entry is assumed at age 20 in 2016 with a full career until the normal retirement age (shown in brackets).

Source: (OECD, 2017[1]), Pensions at a Glance 2017, OECD Publishing, Paris.

Box 1.1. Pension system in the United States

The pension system contains three separate components: Social Security, Supplemental Security Income and private pensions.

The normal retirement age (NRA) – the age at which eligible for full Social Security benefits - is currently 66 years and four months for workers aged 62 in 2018, and will increase to 67 years for workers aged 62 in 2022. It is possible to retire early at age 62, subject to an actuarial reduction. For each year of retirement before the normal age, the benefit is reduced by 6.67%. However, after three years, the reduction falls to 5%. This applies to retirees with a NRA of over 65. Initial receipt of the pension can be deferred until after NRA, and credit is given for deferment up to age 70. The actuarial increment is 8% for each year deferred.

The earnings-related Social Security pension benefit requires a minimum of 10 years of contributions to be eligible. The formula for calculating the benefit is progressive with the first USD 896 a month of relevant earnings attracting a 90% replacement rate. The band of earnings between USD 896 and USD 5 399 a month is replaced at 32% with earnings up to USD 10 725 replaced at 15%.

Earlier years’ earnings are revalued up to the year in which the recipient reaches age 60 in line with growth in economy-wide average earnings. The basic benefit is computed for payment at age 62 years. Thereafter, the basic benefit is adjusted in line with price increases. The benefit is based on the career average earnings for the 35 highest years of earnings, after revaluing, including years with zero earnings if needed to total 35 years. Pensions in payment are adjusted in line with price increases.

It is possible to combine work and pension receipt subject to an earnings test. For beneficiaries who are receiving benefits in a year before the year they reach their NRA, the pension is reduced by 50% of earnings in excess of USD 17 040. Benefits are reduced by USD 1 for every USD 3 of earnings above USD 45 360 in the year the insured reaches the full retirement age. Beginning the month the insured reaches the full retirement age, there is no earnings test.

There is a means-tested benefit for the elderly, known as Supplemental Security Income. Individuals aged 65 or older without an eligible spouse can be eligible for up to USD 9 000 a year depending on assets and other income. The maximum benefit rate for cases where both members of a couple are eligible is USD 13 500 (50% higher than the rate for singles). These benefit rates are equivalent to around 17% and 26% of the estimated national average wage index for 2016, respectively. Individual states and the District of Columbia can supplement the federally determined minimum. The maximum benefit is indexed to price increases.

The final component is private pensions which are entirely voluntary with no obligation for employees or employers to make contributions. In the United States, 47% of workers are covered by such a scheme (OECD, 2015[4]). These are primarily defined contribution plans for new employees, with an assumed contribution rate of 9%.

The results shown in Figure 1.5 are based solely on the mandatory pension schemes that exist for private sector workers, but a number of countries, including the United States, have highly developed private savings schemes in the form of voluntary pensions. The rules for these schemes clearly differ between countries, in terms of whether they are auto-enrolment, such as in New Zealand or the United Kingdom or purely voluntary, such as Germany and Ireland, whether incentives are offered to contribute and indeed the level of contribution.

Within the OECD there are eight countries that have funded private pension schemes with over 40% of those aged 15-64 covered: Belgium, Canada, Germany, Ireland, Japan, New Zealand, the United Kingdom and the United States. In two countries, Canada and Japan, a defined benefit scheme has been modelled, with the other six countries having a defined contribution scheme, with contribution rates varying between 4% and 10%. The impact on net replacement rates of including these schemes differs across countries (Figure 1.6).

Figure 1.6. If voluntary pensions were more widespread old-age income would be less of a problem

For average earners the replacement rate for the voluntary schemes in Canada, Ireland and the United States is only slightly less than that from the mandatory component and it is larger in the United Kingdom. In these four countries full career workers would in fact approximately double their pensions if they contributed to the voluntary scheme throughout their working lives. For low earners the impact is slightly lower, at around a 50% increase in Canada and Ireland, 60% in the United Kingdom and 70% in the United States. Therefore if low earners were able to contribute to the voluntary scheme for a full career in the United States old-age poverty would no longer be an issue for them.

These replacement rates represent the best case scenario when everyone has a full career with full contribution periods to both the mandatory social security pension and to a voluntary private pension. However, for this to be the case the coverage rate would have to be close to 100%. This is certainly not the case for the United States as only 47% of workers are covered. By comparison the auto-enrolment scheme in New Zealand covers 75% of those aged 15 to 64, with the voluntary scheme in Germany also covering over 70%.

While the level of coverage from voluntary pensions is relatively high in international comparison, differences in the coverage level by age and income are huge. Poterba (2014[5]) reports that only 13% of the lower half of the income distribution receives (occupational and personal) private pensions in the United States compared to over 50% of the upper half. Also only 20% of younger employees, aged 20-24, are contributing, compared to 70% of those aged 55-64 (Antolín, 2008[6]). Although coverage tends to increase with age in all OECD countries, it generally falls back for those aged 55-64. Uniquely in the United States the upward trajectory continues to the older worker age group.

According to Dushi et al. (2017[7]) defined contribution coverage levels barely increased between 2006 and 2012, going from 49% of full-time wage and salary workers aged 25‑59 in 2006 to 52% in 2012. Starting from only 14% and 26%, coverage improved most for those at the lowest earnings levels, going up by 3.5 and 4.5 percentage points for the 1st and 2nd income deciles, respectively. Despite these increases the level of coverage for the bottom two deciles remains well below the levels for all other income deciles, the top decile earners are the best covered at a rate of 82%.

The differences in voluntary pension coverage levels by age group and income level imply disparities across ethnic groups. The proportion of White employees covered by an occupational pension is higher than that of African Americans and Asians, and much higher than that of the Latino population (Rhee, 2013[8]). Although these statistics do not control for other characteristics correlated with ethnicity, such as education and income, amongst the 25-64 year-old employees only 38% of those classified as Latino have an employer offering a sponsored retirement plan. By contrast 54% of African Americans or Asians and 62% of White employees have such an employer.

This difference is even more significant when limited to private sector employees with African Americans and Asians being 15% and 13%, respectively, less likely than Whites to have access to an employer sponsored retirement plan. For Latinos this discrepancy trebles to being 42%less likely than White employees to be offered such a scheme. However, the level of take-up is relatively consistent across the ethnic subgroups, ranging between 78% and 87%, suggesting that if employers of Latino workers in particular were to offer a retirement plan then there would be less disparity in coverage levels.

These coverage differences are not a recent phenomenon, and they translate into ethnic differences in accumulated pension savings for those approaching retirement. For heads of household aged 55-64, the total pension assets are, on average, three times as high if the head is White compared to non-White, with the African American head subgroup being less than one-sixth that of a White head household (Rhee, 2013[8]). When looking at median figures, White households are four times that of non-White households for the 55‑64 age groups, at USD 120 000 and USD 30 000, respectively.

In sum, long-term inequality, variable voluntary pension coverage and low replacement rates from mandatory pensions all contribute to the old-age poverty problem in the United States. Pension entitlements dictate the level of poverty as they are often the main source of income after retirement. The level of these pensions directly depends on workers’ career paths during their working life and the age at which they exit the labour market. The following section focuses on labour market patterns among older workers, recognising that employment outcomes and poverty at older ages are narrowly intertwined.

Main drivers of early retirement in the United States and other OECD countries

Extending working lives beyond their current levels could considerably alleviate the financial pressure on pension systems and obviate restrictive measures, such as benefit cuts, that bear the risk of increasing old-age poverty. Life expectancy at birth increased by almost 3.5 years across OECD countries between 2000 and 2015 and much of these increases have led to additional lifetime spent in good health, i.e. without disability. (OECD, 2017[2]). Providing incentives for people to spend some of these additional healthy life years in work is a frequently formulated policy objective because employment rates fall much more steeply with age than can be explained by health factors (OECD, 2017[2]).

Average life expectancies and average labour market exit ages hide substantial disparities across population subgroups, however. While some workers are able to work until older ages, others are not. These differences need to be taken into account in order to design effective, inclusive and politically sustainable policy measures to support longer working lives.

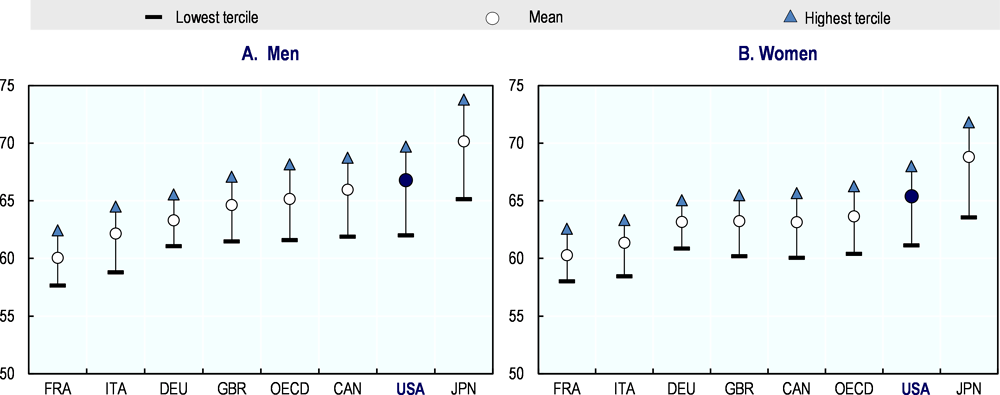

Labour market exit patterns in the United States and internationally

In the United States, average effective labour market exit ages are higher than in many other OECD countries (Figure 1.7), exceeding 66 years for men (Panel A) and 65 years for women (Panel B) in 2016. While these already high levels may leave only limited scope for further working life extensions on average, labour market exit ages are unevenly distributed. Both late labour market withdrawals and early exits are common. Even the number of workers who leave the labour market before age 62, when Social Security benefits become available, is far from negligible. Targeted policy measures have the potential to reduce the share of workers who exit the labour market too early to secure sufficient incomes at older ages.

Employment rates among 65-69 year-olds are higher in the United States (31% in 2016) than in most other OECD countries (25% on average), indicating that many people work beyond normal retirement age. Only seven OECD countries, including Iceland, Japan and Korea, report higher employment rates in this age-group than the United States. In most OECD countries, especially in Europe, employment rates among 65-69 year-olds are substantially lower; in the European Union only 15% of men in this age group work. While further employment increases at older ages are possible, the international experience on how to achieve high employment rates among 65-69 year-olds is very limited.

Figure 1.7. Labour market exit ages are unevenly distributed in most countries

Note: The OECD average does not include Australia, Estonia, Finland, Hungary, Iceland, Norway and Sweden.

Source: OECD estimates based on Labour Force Statistics.

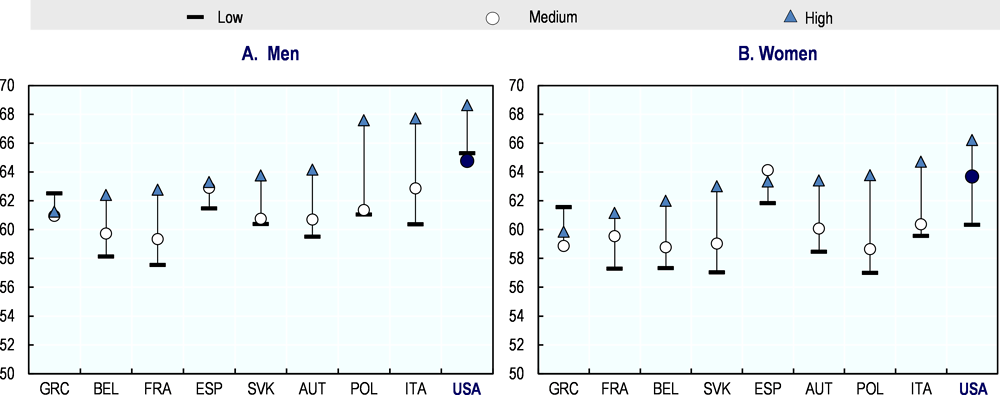

Socio-economic and gender differences

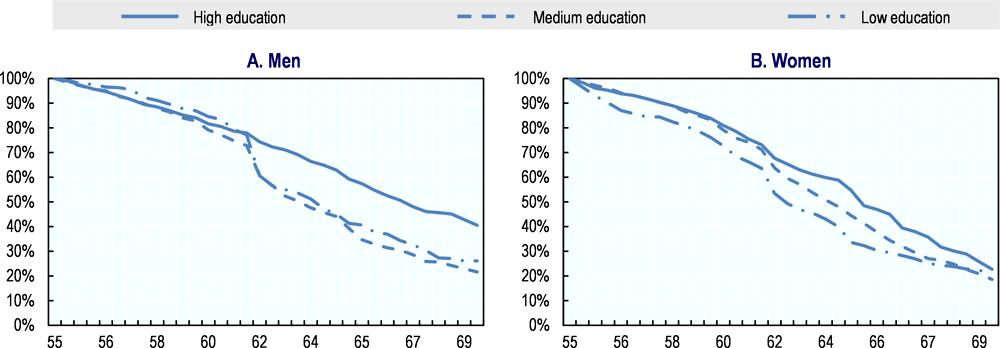

Withdrawing early from the labour market usually reduces pension rights and entails a financial penalty. As a consequence, low-wage workers who retire early face higher risks of old-age poverty. Workers’ socio-economic backgrounds are key drivers of their labour force participation at older ages (Figure 1.8). While highly-educated people leave the labour market late in the United States – their average age of effective labour market withdrawal exceeds 68.5 years for men and 66 years for women – other educational groups exit several years earlier. Especially women in the lowest education category often leave the labour market years before reaching full retirement age. Similar patterns can be found in many other OECD countries.

Understanding under which circumstances and why workers from different socio‑economic backgrounds leave the labour market is instrumental to ensuring that longer careers and adequate pension levels are accessible to everyone. Several factors can help explain why highly educated workers retire later in most countries. On average, the high‑educated invest more time and resources in building up their human capital and start working later than their lower-educated peers; as a result, they often benefit from better working conditions and have spent shorter periods in employment than low‑educated workers of the same age, who typically started their working lives very early. It is physically easier for high-educated workers with good job conditions and shorter career histories to stay on their jobs, which is one of the reasons why they retire later.

In addition, highly educated people tend to earn higher wages and forgo larger sums than their low-educated peers when they retire early and stop receiving their salaries. In some cases, low-income workers earn wages that are only slightly above old-age safety net provisions and the financial incentives to work are reduced. On average across OECD countries, pension replacement rates are higher for low- than for high‑income earners, implying that high-income earners forgo more money when they retire not only in absolute but also in relative terms.

Figure 1.8. High-educated people tend to leave the labour market later

Note: Levels of educational attainment are defined in accordance with the International Standard Classification of Education (ISCED): low education (ISCED 0–2), medium education (ISCED 3–4), and high education (ISCED 5–6).

Source: OECD estimates. Labour market exit age data are based on the results of national labour force surveys and the European Union Labour Force Survey.

On the labour demand side, employers are typically more inclined to retain high-educated older workers with very specialised job skills who are difficult to replace (see Chapter 2). More training opportunities are available to high-educated older workers than to their low-educated peers, exacerbating job prospect disparities (see Chapter 3).

There are exceptions to this typical education gap, however. In Greece, low-educated men and women leave the labour market later than their peers with higher educational attainment. This unusual pattern may be driven by the fact that low-educated population groups tend to have low income levels and may not be able to afford retirement at younger ages.

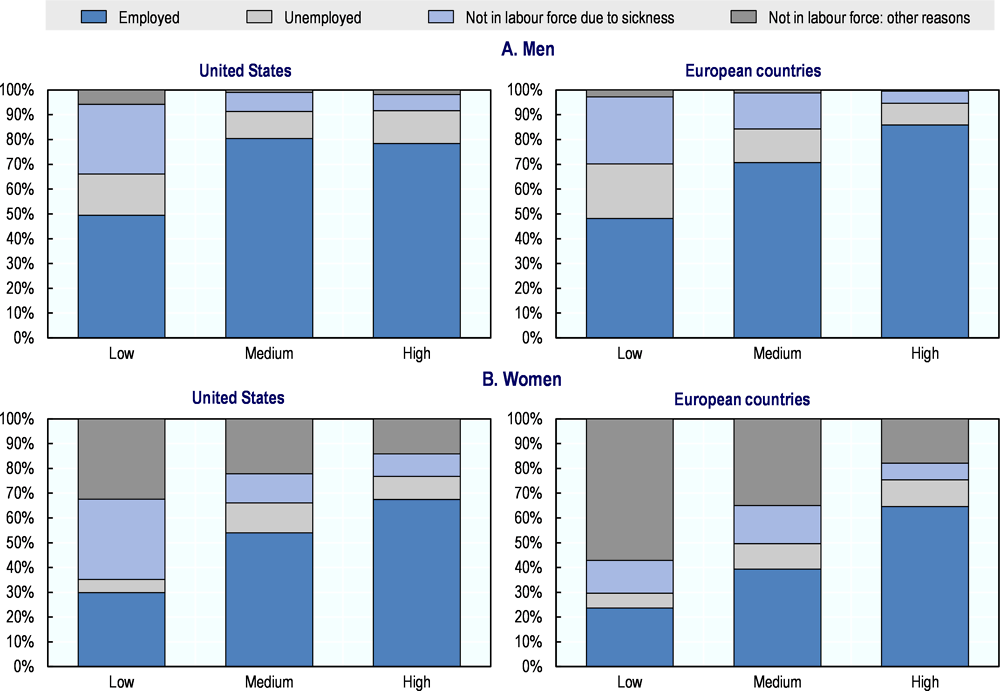

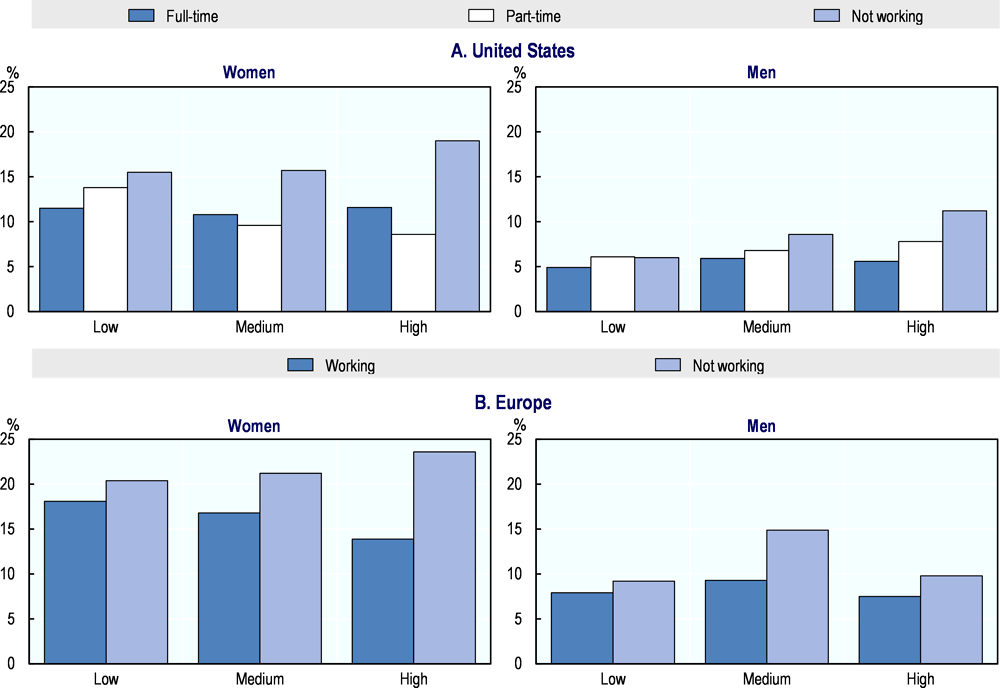

In addition to employment patterns, the typical exit paths out of the labour market differ across socio-economic groups (Figure 1.9). The vast majority of men with high educational attainment transits directly from employment to retirement in both the United States (about 80%) and European countries (about 85%). Among the low-educated, the share is lower, at about 50%. Alternative pathways into retirement, e.g. unemployment and spells of inactivity due to sickness, are much more common among the low-educated.

Gender differences are striking. Many women self-define as inactive for reasons other than health – sometimes because they take care of household chores – prior to retirement, while the corresponding share among men is low. Especially among low-educated women inactivity is widespread, much more than among their high-educated peers. Overall, the share of low‑educated women who report a period of inactivity just before retirement, either due to sickness or other reasons, exceeds 60% both in the United States and European countries.

Figure 1.9. Many low-educated people enter retirement from inactivity or unemployment

Note: The pathways are not age-specific. The European countries covered are Austria, Belgium, the Czech Republic, Denmark, Estonia, France, Germany, Israel, Italy, Luxembourg, Slovenia, Spain, Sweden and Switzerland. Levels of educational attainment are defined in accordance with the International Standard Classification of Education (ISCED): low education (ISCED 0–2), medium education (ISCED 3–4), and high education (ISCED 5–6).

Source: OECD calculations based on micro-level data from the English Longitudinal Study of Ageing (ELSA), the Health and Retirement Study (HRS) and the Survey of Health and Retirement in Europe (SHARE).

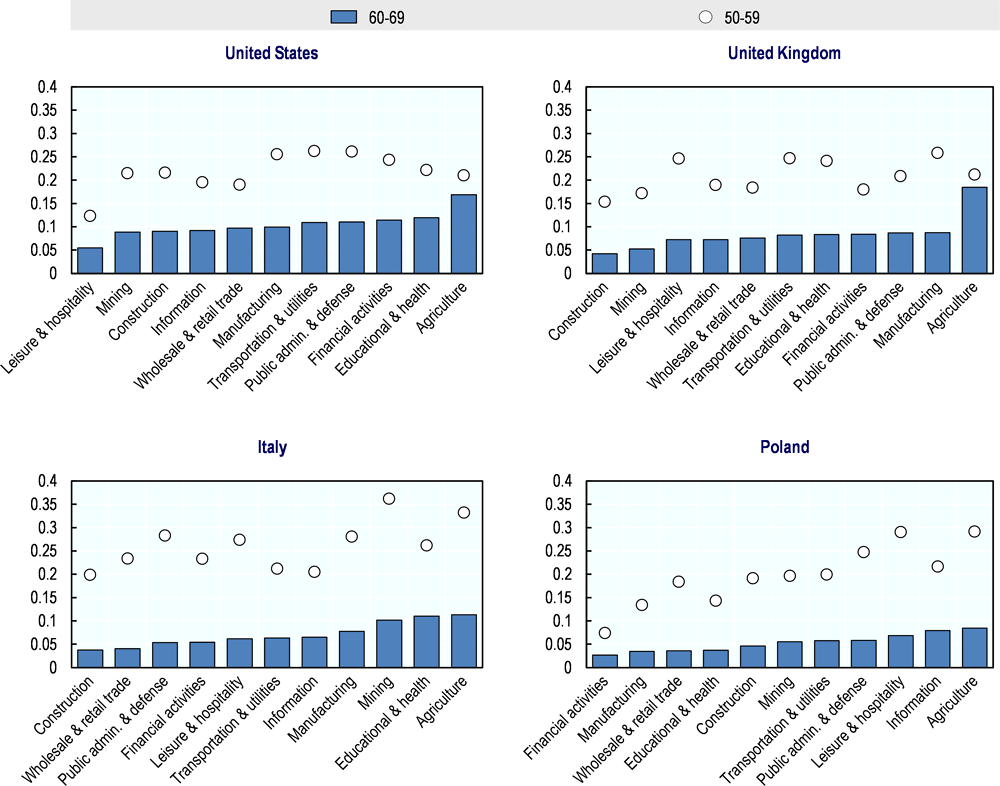

Sectoral differences

The length of working careers is far from uniform across sectors. While just over 5% of workers in “leisure and hospitality” jobs are between 60 and 69 years old in the United States, this share exceeds 15% in “agriculture”. In many sectors, the share of workers drops sharply between ages 50-59 and 60‑69. This is the case, for instance, in “manufacturing”, “transportation and utilities”, and in “financial activities”, suggesting that early retirement may be common in these professions. In some cases, job changes from one sector to another may also be at play. Internationally, older workers do not specialise in the same sectors. In Poland, the share of 60-69 year-olds in “leisure and hospitality” is higher than in most other sectors, contrasting with the situation in the United States. Overall, the share of workers between 60 and 69 among all workers is higher in the United States than on average in 14 European OECD countries in all sectors except “leisure and hospitality”. In “financial activities”, the difference is particularly striking, with 11% of workers being 60‑69 year-olds in the United States against less than 4% in European OECD countries.

Figure 1.10. Older workers are not equally represented across sectors

Source: OECD calculations based on micro-level data stemming from national or international Labour Force Surveys.

Determinants of early retirement

This section aims to identify the factors that lead to the large disparities in employment rates at older ages and retirement patterns across the population. Employment is the outcome of labour demand and labour supply and the numerous factors that impact on them. Only when sufficient labour supply and sound labour demand come together can employment rates among older workers increase.

Importance of retirement system characteristics

A country’s institutional setting influences labour supply at older ages, for instance through its social security entitlements and labour market regulation. According to economic research, much of the increase in labour force participation among older adults in the United States between the late 1980s and the early 2000s can be explained by the increase in the Social Security full retirement age and higher rewards for claiming pension benefits after the full retirement age.2 In the past, delaying benefits beyond the full retirement age increased pension rights only slightly; this bonus has been gradually strengthened and today deferred benefits increase by no less than 8% for each year up to age 70.

The OECD carried out an econometric analysis using data from the Health and Retirement Study (HRS) to estimate age-specific retirement rates in the United States (Figure 1.11). The results reflect retirement patterns for the time period 1992-today for different socio-economic groups. They suggest that many workers – in particular men with low and medium educational attainment – retire at the age of 62, when Social Security benefits first become available to them. The drop in labour force participation at age 62 is very large among these population groups. Among women, reaching age 62 does not single out as a retirement driver as clearly as among men, which is at least in part due to the fact that alternative pathways out of the labour market are much more common among women than among men (Figure 1.9). Even so, both male and female employment decreases rapidly between the early retirement age and the full retirement age, underscoring how strongly pension parameters influence retirement patterns.

Figure 1.11. Many workers retire at age 62 in the United States

Note: The estimates refer to people who worked at the age of 55 and reflect their probability of still being employed at a given age. For technical reasons, only people with a direct work-retirement transition are considered. The way to read the graphs is as follows: Among high- and low-educated men in the United States who were employed at age 55, correspondingly, about 75% and 60% are still employed at age 62 (Panel A).

Source: Estimates based on survey data from the Health and Retirement Study, all waves (1992-present).

Health

Old age brings a greater risk of chronic or acute health problems. And poor or deteriorating health is a frequent reason for early labour market exit3. Older workers with low socio-economic backgrounds leave the market earlier than their high-educated peers (Figure 1.8) and are on average in worse health (OECD, 2017[2]). The OECD analysed a sample of people who worked at age 55 to single out the importance of health for their future labour force status, disentangling the health effect from other potential employment and retirement drivers. Health is captured as a summary measure of many different health indicators, including severe diseases, such as cancer and functional limitations. This technique allows ranking the sample in terms of “health quartiles” (Box 1.2).

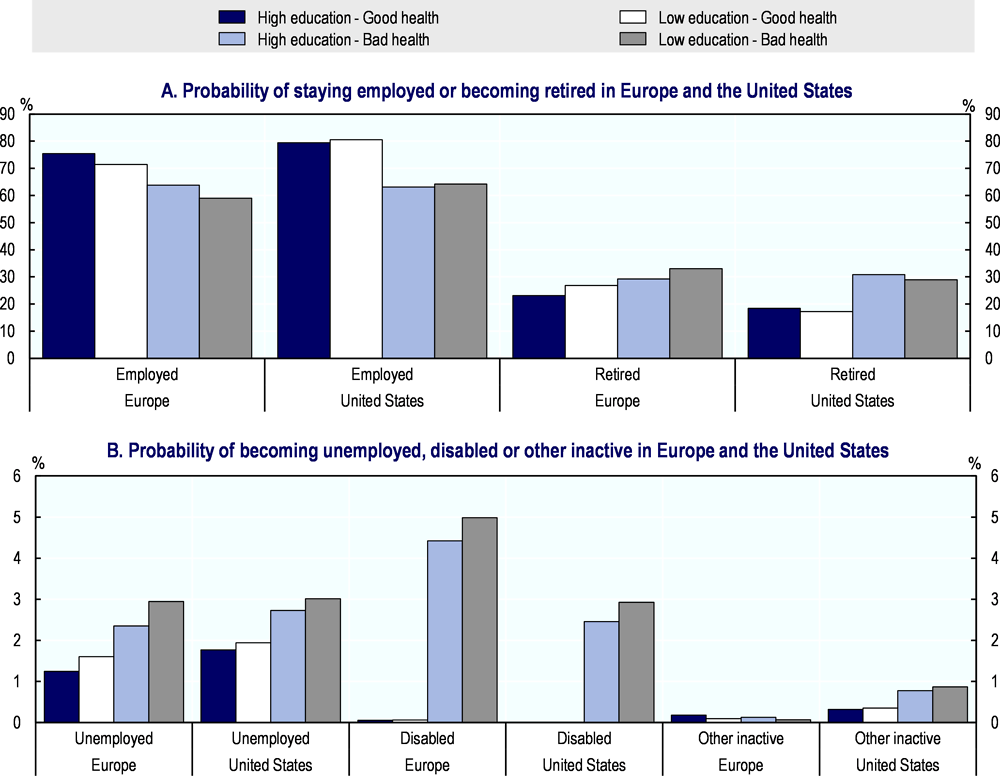

A bad health status lowers the probability of remaining employed and increases the chances of retiring, becoming unemployed and becoming disabled. This general result holds both in the United States and Europe for the low-educated and the high-educated (Figure 1.12 and Figure 1.13). In Europe, the high-educated in good health are the population group with the highest probability of remaining employed and the lowest probability of becoming unemployed or disabled, although the latter two probabilities are overall fairly small. In the United States, education matters less when workers are in good health: Both healthy high‑educated and healthy low-educated people have a high probability of being employed and a low probability of retiring, or becoming unemployed or disabled.

While employment levels after age 55 are higher in the United States than in Europe, health‑related gaps within education groups tend to be larger in the United States. Among men, the percentage point difference between the healthy and the unhealthy in the probability of staying employed is about 12‑13 percentage points in Europe, against 16 percentage points in the United States.

Similarly, there is a large health‑related gap of becoming retired. Men in bad health are 6 percentage points more likely than their healthy peers to retire at a given age in Europe. In the United States, the difference is even larger, at 12 percentage points. One possible explanation for the higher health effect on retirement in the United States may be that access to disability benefits is more easily granted in some European countries than in the United States and people can rely on these benefits instead of retiring. Education-related gaps within health categories turn out to be smaller in the United States than in Europe, however. While in Europe high-educated men in good health are 4 percentage points more likely to be employed and 4 percentage points less likely to be retired than low‑educated in good health, education-related employment and retirement differences among healthy men are small in the United States.

Box 1.2. Modelling employment and retirement drivers

The empirical analysis of the retirement decision in this section uses longitudinal data from two surveys: The Health and Retirement Study (HRS), with twelve waves that cover the period 1992-2014, and the Survey of Health, Ageing and Retirement in Europe (SHARE), with five waves that cover 2004-2015. HRS contains data on the United States whereas SHARE includes 15 European countries – Austria, Belgium, the Czech Republic, Denmark, Estonia, France, Germany, Greece, Italy, the Netherlands, Poland, Slovenia, Spain, Sweden and Switzerland – and Israel. An important advantage of using these surveys is that they are well comparable. They include, for instance, similar questions to measure health problems, labour market outcomes and certain job characteristics. Nonetheless, some caution is warranted as cultural and linguistic differences may bias responses (Chan et al., 2012[9]; Kapteyn, Smith and Soest, 2007[10]).

Two different methodologies are implemented to model retirement and employment drivers. First, survival analysis is used to estimate age-specific retirement rates. As this technique requires long panels it is implemented for the United States only (Figure 1.11). It starts with a sample of people who worked when they were 55 years old. For technical reasons, only workers who transited directly from work into retirement are considered and workers following other pathways out of the labour market are excluded. The curves in Figure 1.11 report the non-parametric Kaplan-Meier estimators of the “retirement survival curve”, i.e. of the share of people who, at a given age, have not retired yet. Defining as the number of workers who at age t are not retired yet and as the number of former workers who are already in retirement, the estimated “retirement survival curve” S at age t is calculated as .

The second methodology disentangles the effect of health on retirement patterns from other retirement drivers (Figure 1.12 Figure 1.13). This analysis relies on data from SHARE and HRS and includes 55-to-70 year-olds who were working when they were first observed in the survey. The longer workers are observed, the older they get and the more likely they are to retire at some point. To take account of this fact and make results based on HRS and SHARE comparable, the sample is restricted to individuals with two to five observations only. Five labour force outcomes are considered: Workers can either continue working (W), become retired (R), become unemployed (U), become disabled (D) or move into the group of other inactive (OI), which are mostly homemakers. More precisely, the dependent variable, , represents the latent propensity for each individual at time to be in labour force status , where . The following equation is used to estimate the effects of various independent variables on the propensities :

where

is a vector of individual characteristics that do not change over time, including dummy variables for educational attainment defined according to the International Standard Classification of Education (ISCED) (low education (ISCED 0–2), medium education (ISCED 3–4), and high education (ISCED 5–6)), a measure for working on a physically demanding job defined when the person is first observed and variables indicating the country of residence (only for the regressions using SHARE data),

is a vector of time-varying characteristics, including a measure of health (the quartiles from a health index that is obtained from an auxiliary health regression as in e.g. Disney et al. (2006[11])), a dummy variable for having a retired spouse, a dummy variable for being married, a dummy variable for caring for one’s parents at least one hour per week, the number of parents that are alive, household size, the distance to the normal retirement age in years (which depends on an individual’s age, country, year, year of birth, gender, marital status and the number of children), and the unemployment-rate gap defined at the country-year level as the deviation of the unemployment rate from the Non-Accelerating Inflation Rate of Unemployment (NAIRU), which is included to capture cyclical time effects,

and are the corresponding parameter vectors to matrices and that have to be estimated,

is a random individual-specific effect, that may be correlated with the independent variables in the specifications that take possibly correlated individual unobserved effects into account (see below),

is an error term, which is independent and identically distributed across all outcomes .

Equation 1 is estimated as a multinomial logit model. Despite the rich set of independent variables that are included in the analysis, there could still be omitted variables that drive the association between the independent and the dependent variables. For instance, personality traits, such as openness to experience, conscientiousness or preferences for leisure, could drive the correlations between health and labour force status. To address this issue, equation 1 is also estimated as a fixed effects multinomial logit model, allowing for correlated unobserved individual time-constant effects (i.e., the terms can be correlated with the independent variables).* Because this model uses only individuals who switch labour force status, it is implemented on the full HRS data set including all twelve waves. A similar model was tested for Europe but could not be fit, most likely due to the much shorter panel in the SHARE data set. This model estimates, by definition, only the effects of characteristics that vary over time (included in ). The results confirm that even after accounting for possible time-constant confounding factors that are not measured in the data, health remains an important driver of early labour market exit in the United States, especially for men. Below, only the results from Equation 1 are discussed, as these allow for a comparison between the United States and Europe.

*: The Stata module femlogit (Pforr, 2014[12]) is used to estimate this fixed effects multinomial logit model.

Figure 1.12. Health is an important retirement driver among men

Note: The predicted probabilities are computed after estimating Equation 1 as a multinomial logit model (see Box 1.2) setting education level at either high (ISCED 5–6) or low (ISCED 0–2) and health status at either good or bad health, but using otherwise respondents’ actual characteristics.

Source: OECD calculations based on the Survey of Health, Ageing and Retirement in Europe (SHARE, all five longitudinal waves) and the Health and Retirement Study (HRS, first five waves of each respondent).

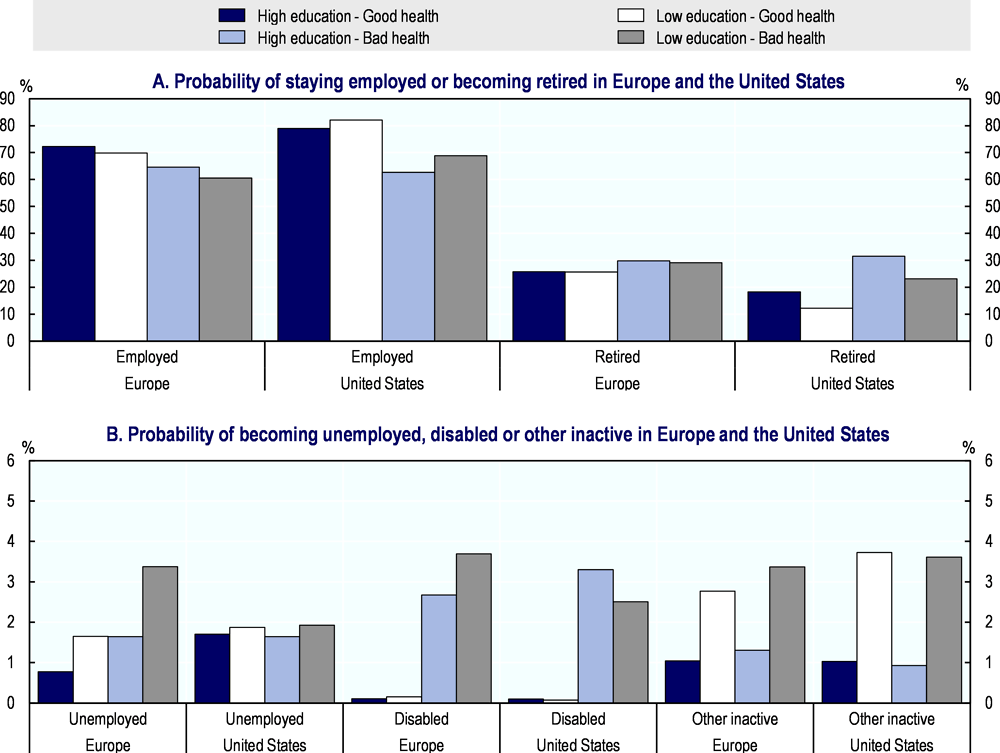

Predicted employment probabilities among women in the sample are similar to men’s both in the United States and Europe (Figure 1.13). Gender differences are small because the sample is restricted to people who were still working at the age of 55, which excludes some individuals, especially women.

While health is among the factors that matter for the timing of retirement and bad health is an important driver of early labour market exit, health alone cannot explain the sharp drop in employment rates for the people in their late 50s and early 60s. Other factors, such as the availability of early pension benefits and potentially shrinking labour demand at older ages, sometimes due to age discrimination, also contribute to the decline in employment as people get older. If health was the only barrier to longer working lives, employment rates among older adults could be considerably higher (see OECD (2017).

Figure 1.13. Healthy women have a higher chance of remaining employed

Note: The predicted probabilities are computed after estimating Equation 1 as a multinomial logit model (see Box 1.2) setting education level at either high (ISCED 5–6) or low (ISCED 0–2) and health status at either good or bad health, but using otherwise respondents’ actual characteristics.

Source: OECD calculations based on the Survey of Health, Ageing and Retirement in Europe (SHARE, all five longitudinal waves) and the Health and Retirement Study (HRS, first five waves of each respondent).

Other determinants of the retirement decision

In addition to socio-economic characteristics, retirement system parameters and health, other factors also affect the timing of retirement.

Difficult working conditions drive early retirement. Working conditions can be difficult because the job is physically very demanding, very stressful or because of complicated personal relationships within teams. Bad working conditions are particularly common among workers from low socio-economic background and push some of them out of employment, hence reinforcing labour market disparities among older adults. The empirical model of the retirement decision (see Box 1.2) includes a measure for working on a physically demanding job. Among male workers aged 55 and over in the United States, having a physically demanding job increases the probability of retiring over a given time frame by 7%, and the risk of becoming unemployed by 15% among their female peers.

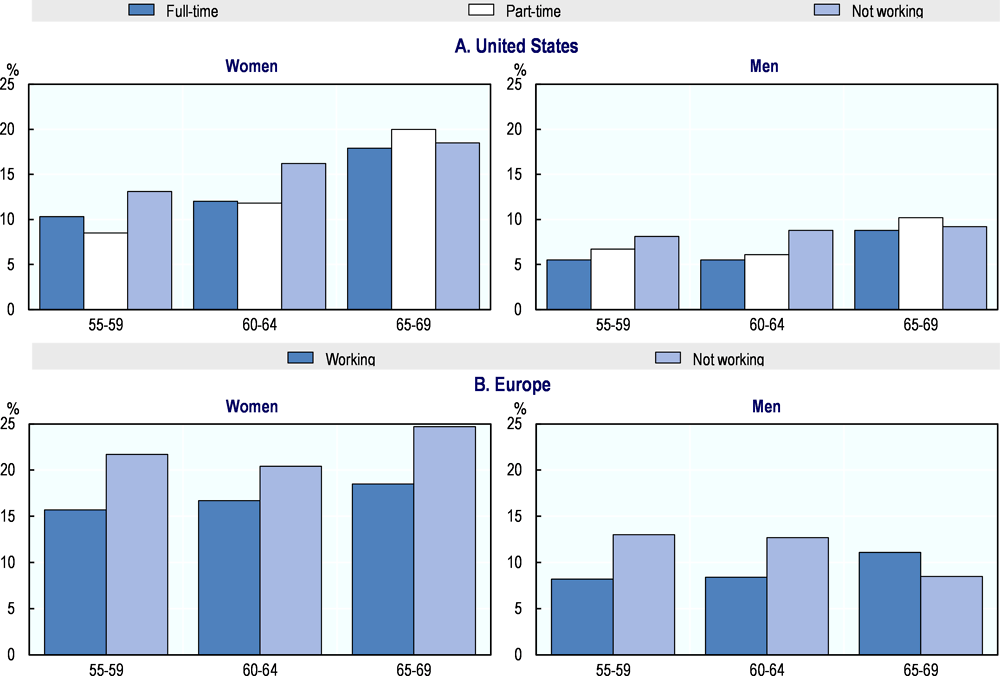

Caregiving responsibilities prevent some older workers from extending their working lives and pull them into retirement, especially in the case of women. In the United States, 16% of 60-64 year-old women and 9% of men who do not work take on care activities for their parent(s) at least one hour per week, compared to 13% and 5% among working women and men of the same age (Figure 1.14). In Europe, 20% of non-working 60-64 year-old women and 13% of men fulfil care activities. For both sexes in the United States and for women in Europe, caring for a parent is more common among older individuals and, within the same age group, among those who do not work (for people with at least one living parent). Moreover, in the United States, part-time workers aged 65-69 are more likely to care for their parent(s) than full-time workers and those not working. Overall, part-time workers are slightly more likely to care for their parents than full-time workers among men, but this does not hold among women.

Figure 1.14. Many older people with care responsibilities do not work

Note: Only individuals who were working at age 55 and who have at least one living parent. The way to read the graphs is as follows. Among 60-64 year-old women in the United States, for example, about 17% of those not working have care responsibilities for a parent, while they are only 13% among those who work full-time or part-time (Panel A, left).

Source: OECD estimates based on the Survey of Health, Ageing and Retirement in Europe (SHARE) and the Health and Retirement Study (HRS), all waves.

Among women, the low-educated are more likely to care for a parent than their peers with higher educational attainment while the opposite is the case among men (Figure 1.15). Within all education groups, people who do not work are more likely to care for their parent(s) and in both the United States and Europe non-working high‑educated women take on care responsibilities for their parent(s) more frequently.4

Figure 1.15. The relationship between caregiving and working differs across educational groups

Note: Only individuals who were working at age 55 or later and who have at least one living parent.

Source: OECD calculations based on the Survey of Health, Ageing and Retirement in Europe (SHARE) and the Health and Retirement Study (HRS), all waves.

Macroeconomic conditions and trends over time can have a substantial impact on labour demand. The Great Recession, for instance, posed serious challenges to employment among workers of all ages. In recent years, many workers have delayed retirement or re‑entered the workforce in response to the financial losses they endured during the Great Recession. To account for such time trends, the empirical model of retirement drivers (Equation 1 in Box 1.2) includes cyclical unemployment (the unemployment-rate gap) as an explanatory factor, i.e., the deviation of the unemployment rate from the Non‑Accelerating Inflation Rate of Unemployment (NAIRU). Cyclical unemployment, by definition, increases during economic downturns and decreases during economic booms, even if structural unemployment (NAIRU) is unchanged. For workers aged 55 and over in the United States, a 1 percentage point increase in cyclical unemployment (the unemployment‑rate gap) increases their probability to become unemployed by about 9% compared to staying employed, while it decreases their probability of becoming retired by about 16%. Among female workers, it also decreases the probability of becoming disabled or moving into the group of other inactive by about 30% compared to staying employed.

In the past, mandatory retirement at a prescribed age was not uncommon in the United States. In such cases, the incentives to stop working altogether were considerable: People who wanted to continue to work had to sign a new contract or find a new employer, which often involved a wage loss. In 1986, Congress amended the Age Discrimination in Employment Act, prohibiting mandatory retirement regulation for most professions. Except for some particular job families, such as air traffic controllers, mandatory retirement was phased out over the following years and is less common today.

The effect of private pensions on retirement behaviour can be very strong, also without mandatory retirement rules. Workers who remain employed after having reached the age of pension eligibility and do not claim their retirement benefits reduce the total discounted value of their pensions -pension wealth, i.e. the expected net present value of their pensions – if benefits are not adjusted upwards in an actuarially neutral way. In many cases, defined benefit plans do not increase benefits for delayed retirement, thereby making longer careers less attractive.

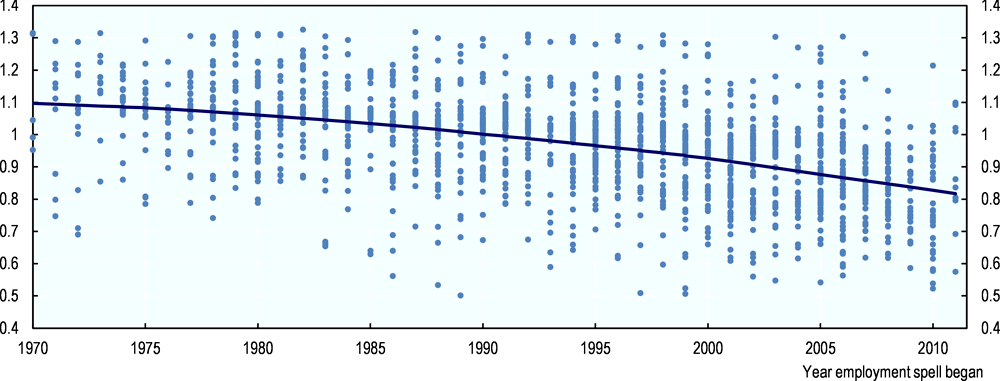

Over the last years, the financial disincentives to work have decreased in private pension plans. The Health and Retirement Study (HRS) provides estimates of the value of workers’ employer‑related defined benefit plans, depending on the age at which workers retire. The OECD used these estimates to compare financial incentives in defined benefit plans in the United States over time (Figure 1.16). Workers whose employment began a long time ago often face decreasing net present values of their total defined benefit pensions if they do not claim benefits at age 62 but continue employment until 65. This disincentive to work is a lot less common among workers with shorter tenure. Workers who started their last job only a few years ago are much more likely to face sizable penalties if they retire at age 62. In addition, there is a notable trend among employers to offer defined contribution plans rather than defined benefit plans. Defined contribution plans usually do not generate financial incentives to retire early. As there has been a general shift from defined-benefit to defined-contribution in private pension schemes worldwide (see OECD (2016[13])), disincentives to work from occupational pensions are likely to become less of a concern in the future.

Figure 1.16. Defined benefit pension plans provide less incentive to retire early than in the past

Note: The graph shows how much the defined benefit occupational pension is worth if benefits are claimed at age 62 versus age 65. More precisely, it compares the present value of all expected future pension benefits, depending on the age at which payments start. 100% stands for actuarial neutrality (excluding contributions), 110% means that the value of all expected benefits is 10% higher if payments start at age 62 rather than 65. The fitted line is based on non-parametric scatter-plot smoothing, the so-called lowess smoother with bandwidth=0.8. The results rely on HRS estimates of net present values of pension plan entitlements.

Source: Unweighted calculations based on the Health and Retirement Study’s (HRS) estimates on net present values of defined benefit pensions.

The working status of workers’ spouses can also impact retirement patterns. Married workers often exit employment at about the same time as their spouses, suggesting that interactions within couples are at play. Preference for shared leisure time may be one of the main reasons behind joint retirement of couples5. Having a retired spouse has been shown to increase the chances of retiring for both men and women. In the United States, one-fourth of the increase in labour force participation between 1994 and 2005 among 55‑64 year-old married men is attributed to an increase in their wives’ labour force participation; this share is even higher in the United Kingdom (one-third) and Canada (one-half) (Schirle, 2008[14]). Blau and Goodstein (2010[15]) study a longer time period (1980s to first half of the 2000s) and find that the rise in labour force participation of married women explains about 16% of the increase in older married men’s labour force participation, which is just below the effect of better educational attainment (18%). The empirical model of the retirement decision in Equation 1 (Box 1.2) controls for having a retired spouse. Both male and female workers are more likely to retire when their spouse is already retired.

Towards a more flexible retirement system?

In many countries, the retirement decision remains a binary choice: retire or continue working full time. In addition, the timing of retirement is often rigid. In some cases, mandatory retirement rules give employers the option to terminate contracts of older workers at a certain age. Moreover, working after the retirement age can be financially unattractive, for example because combining work and pension can be subject to earnings limits beyond which pensions are reduced. Such limits are in place in Australia, Denmark, Greece, Israel, Japan, Korea and Spain. Retirement is not always a rigid process, however, and flexible retirement options are sometimes available (OECD, 2017[1]).

A flexible retirement process can take different forms. In its most common use, the term “flexible retirement” refers to drawing a pension benefit – full or partial – while continuing in paid work, often with reduced working hours. This mechanism is also called “gradual”, “partial” or – specifically in the case of reduced working hours – “phased” retirement. Flexible retirement can also refer to systems in which the timing of retirement is not fixed but workers can choose when they want to retire. Allowing people to draw a pension before or after the official pension age introduces flexibility in the form of early or deferred retirement. Some countries have implemented age ranges for retirement, e.g. workers can freely choose when to retire within the boundaries of these age corridors.

Opinion surveys confirm that many workers consider the option to enter retirement flexibly as positive: Almost two-thirds of EU citizens say it appeals more to them to combine a part-time job and a partial pension than to fully retire. Retirement planning and retirement wishes differ across countries, however: a 2015 survey found that in Japan, 43% of the survey respondents wanted to continue working past retirement, whereas in France only 15% were considering this option (Aegon Center for Longevity and Retirement, 2015[16]) ).

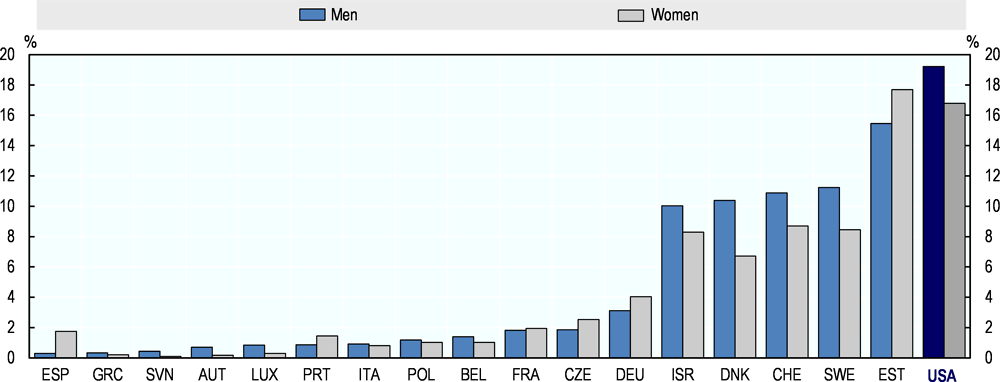

Intentions and actual behaviour do not always coincide, and flexible retirement is still uncommon in many OECD countries. In most European countries for which data is available, less than 5% of people aged 60-69 combine work and pensions (Figure 1.17). However, in some other countries, including the United States and Estonia, more than 15% of people in this age group work and receive a pension at the same time. The way retirement systems are constructed, how high pension levels at different ages are and the gains from working longer are also important factors that shape workers’ desire for flexibility.

Figure 1.17. Combining pensions and work is uncommon in many OECD countries

Source: OECD calculations based on the Health and Retirement Study (HRS) and the Survey of Health, Ageing and Retirement in Europe (SHARE).

In the United States, and even more so in many other OECD countries, employment rates fall sharply for the people in their 50s and 60s. Weekly hours of work per worker, by contrast, decline only gradually in most countries (Figure 1.18). This pattern demonstrates that the main changes in labour supply occur on the extensive margin and not on the intensive margin – most older adults stop working altogether and do not simply reduce their working hours when they get older. In the United States, employment decreases are particularly marked between age 62 and 65 (Figure 1.11), coinciding with the ages at which financial disincentives to work set in. Not only are workers able to draw Social Security benefits from age 62 onwards, they also become eligible for Medicare when they turn 65. The drop in employment rates also corresponds to an age range at which wages tend to decline6.

For the older workers in the United States that are covered by private defined benefit pension schemes the pension levels in such plans are sometimes a function of a worker’s last salary. In this case, a decline in working hours, and thus in earnings, can impinge negatively on pension benefits. Conversely, in the United Kingdom, most defined benefit pensions are calculated on a full-time equivalent basis. Moving from full‑time to part‑time at the end of their careers will not reduce workers’ pension benefits in the United Kingdom unless the hourly wage decreases.

Smoothing the transition from work to retirement requires – on top of modifying pensions rules − both employers and employees to become more flexible in terms of retirement patterns. Some workers are able and willing to work until older ages, even beyond the retirement age, while others are not. In jobs without phased retirement arrangements workers face a binary decision: either they retire fully or they remain employed full time. Many employees who would have been able and willing to perform part-time work withdraw fully from the labour force as a result. Policy debate has evolved in several countries discussing whether phased retirement schemes can contribute to keeping people in the labour market until older ages.

Phased retirement may extend working lives, especially if it targets older workers who would otherwise leave the labour market. Conversely, if workers use phased retirement schemes to reduce their working hours as early as possible instead of staying employed full time, introducing phased retirement may reduce total hours worked. Recent research suggests that the second effect might dominate. The level of workers’ reservation wages, i.e. the wage at which they are willing to work, depends on their preferences, their health and other factors, including fixed costs such as train tickets for commuters. Empirical research suggests that labour supply elasticities peak towards the end of working lives (Blundell, French and Tetlow, 2016[17]); small wage changes can result in large labour supply responses at these ages. In parallel, wages tend to decline at older ages, partly because of declining productivity that can be caused by factors such as worsening health. Bad health and the need to care for relatives are likely to impact on workers’ willingness to remain employed and increase their reservation wages.

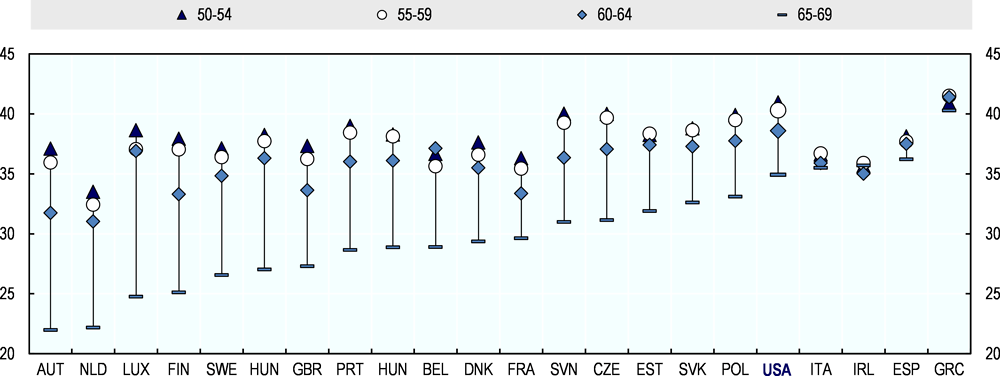

In most OECD countries, the average hours worked per week shrink only slightly between ages 50-54 and 60-64 (Figure 1.18). In the United States, for instance, 50-54 year-olds work about 41 hours per week on average while those aged 60-64 report an average of 39 hours. The decrease in hours worked between these ages exceeds 4 hours in two OECD countries in the sample only: Austria and Finland.

After the age of 65, average hours worked per week decline much faster. In the United States, however, the difference between ages 60-64 (39 hours) and 65-69 (35 hours) is comparatively small, indicating that those older workers who remain employed work long hours on average. In many other countries, workers over 65 work less, suggesting that they withdraw from the labour market more gradually. In Austria and the Netherlands, 65-69 year-old workers work around 22 hours per week and in Luxembourg just under 25 hours.

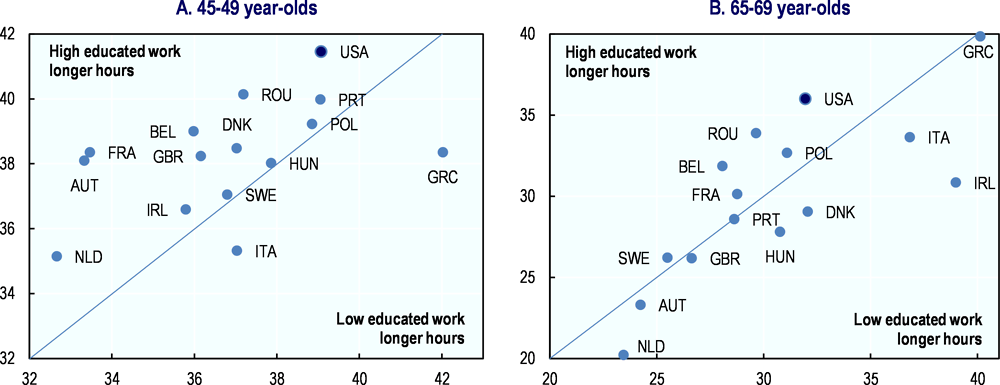

Figure 1.18. In the United States working hours decline only slightly with age

How flexibly workers leave the labour market differs across socio-economic groups. In the majority of OECD countries, high-educated prime-age individuals work longer hours than their low‑educated peers, often much longer such as in France and in Austria (Figure 1.19, Panel A). Conversely, at older ages, there are numerous countries in which low-educated 65-69 year‑olds work longer hours than their highly educated co‑workers of the same age (Figure 1.19, Panel B). High-educated workers, who start from a higher level of weekly hours worked, reduce their working hours more markedly at older ages than low‑educated people. This finding may indicate that low-educated people are less often in jobs that can be adapted to phased-retirement programmes. The situation is different in the United States. Educational disparities in terms of hours worked are actually a bit larger among older workers than among prime-age workers, suggesting that high‑educated people do not exit employment more flexibly than their low-educated peers.

Figure 1.19. High-educated people reduce their working hours more with age than the low‑educated in most countries

Direction for policy

The in-depth analysis above of the impact of education, health, retirement system parameters and other factors affecting employment aims to help identify effective and inclusive policy intervention to support better retirement conditions and longer careers among workers of all socio-economic backgrounds.

Increasing statutory and early retirement ages

Retirement ages are key determinants of individuals’ retirement behaviour as this chapter and other research have shown.7 This is the case even though retirement age increases cannot be expected to increase effective retirement ages by the same amount. The United States has one of the highest normal retirement ages (NRA) across OECD countries (OECD, 2017[1]). It is 66 for people born between 1943 and 1954 and will increase to 67 for people born in 1960 or later. Across OECD countries, the average NRA was equal to 64.3 years for men and 63.7 years for women in 2016 and will increase to 65.8 years for men and 65.5 years for women by around 2060.

Early retirement in the United States is possible from age 62, subject to an actuarial reduction, and under the current rules this option will remain available for a person entering the labour market today (see Box 1.1). According to current legislation, early retirement will remain available in the majority of OECD countries, usually between ages 60 to 63.

Linking normal and early retirement ages to gains in life expectancy, gains in healthy life expectancy or alternative demographic indicators can help to ensure that the number of retirees cannot grow disproportionally compared to the size of the workforce, thereby limiting the burden on younger generations. It is important, however, to acknowledge that some occupations are physically much more demanding than others, especially at older ages. In such cases, facilitating job changes to less arduous sectors and establishing phased retirement entry can alleviate the problem.

Maintaining current retirement ages in the long term will be challenging as the average age of the population continues to increase and retirees form an ever greater share. Although pension systems are designed to provide an income upon retirement they are not normally constructed to eliminate labour market differences across socioeconomic groups. Even for full-career workers, around half of wage inequality in the United States is transferred to pension inequality at retirement, against about two‑thirds on average in the OECD (OECD, 2017[2]). The lower transmission of lifetime earnings into pension inequality in the United States comes mainly from the stronger progressive pattern of Social Security benefits. Moreover, as only the best 35 years of earnings are considered in calculating pension benefits, longer periods of unemployment, for example, which may more commonly affect lower earners, will not affect their replacement rates. However, on top there is retirement income inequality generated by differences in private savings accumulated during the working years.

The well-documented inequalities in life expectancy mean that increasing retirement ages as a response to longer lives may have undesirable distributional effects. While low-income earners receive greater pension replacement rates than high-income earners due to redistributive features built into the Social Security system, they also have a lower life expectancy. Pension arrangements do not take life expectancy disparities into consideration and low earners generally receive benefits over shorter periods than high earners, lowering their total pension benefits, that is, their pension wealth. Goldman and Orszag (2014[18]) showed that life expectancy gaps between income levels have a large impact on the progressivity of Social Security in the United States.

OECD (2017) estimates that a life-expectancy difference of three years at age 65 between low- and high-earners – which is an order of magnitude that is in line with the gap between the high- and low-educated on average in the OECD as well as in the United States – further reduces their pension wealth by about 13%.8

As a result, apparently distribution-neutral schemes, such as a pure defined contribution pension, are in fact regressive. These estimates are relatively large and encourage policy makers to consider adjusting pension parameters to limit the impact of socio-economic differences in life expectancy on pension benefits (OECD, 2017). Such inequalities can be addressed through first-tier pensions and redistributive components embedded in benefit and/or contribution rules.

A further issue relates to the distributive consequences of increasing the retirement age in line with life expectancy gains. If the effective retirement age were raised across the board, the increase would eat relatively more deeply into low earners’ average remaining life expectancy due to socio-economic mortality differences. All other things being equal, low earners’ accumulated pension entitlements would fall relative to those of high‑income earners as retirement age increases would affect them more strongly given their shorter life expectancy. The relative fall would, however, remain moderate. If the retirement age were to be increased by three years between 2015 and 2060, the pension wealth of low earners relative to that of high earners would fall by a cross-country average of 1.2% (OECD, 2017).9

However, if gains in life expectancy are not evenly distributed and favour higher-income groups, hence further exacerbating inequality in life expectancy, a higher retirement age would raise equity concerns. There is conflicting evidence about trends in life-expectancy inequality (OECD, 2017). However, in some countries, such as Denmark and the United States, it has risen.

Leaving health aside, one of the main reasons why a higher retirement age might affect more disadvantaged groups relates to the shortage of employment opportunities as they near retirement. It is a serious issue. However, this does not imply that increasing the retirement age is the wrong policy. Low-earning workers’ struggling to find work in their later years throws into relief the importance of labour market policies that foster a more inclusive older labour participation (Chapters 2 and 3 in this report). After all, shortcomings in the labour market are the root cause of these difficulties.

Moreover, it is important to assess whether individuals who retire early are well‑informed and financially literate enough to understand the financial long-term consequences of their choice. The fact that claiming Social Security as early as possible is so widespread, especially among workers with low educational attainment, casts doubt on whether workers fully anticipate the monetary impact of their decisions and the costs of their future needs, for instance in terms of healthcare expenditure. In some cases, people who leave the labour market as early as possible incur old-age poverty risk, contributing to the high poverty levels among the over 75s in the United States. Adjusting early retirement ages or requiring a sufficient level of retirement income for early labour market exits can be ways of preventing financial distress at older ages.

Optimising occupational pensions

Occupational pensions are more common in the United States than in many other OECD countries. Recent analyses suggest that entitlements from private pensions are roughly as high as Social Security wealth in the United States. However, occupational pensions should not provide disincentives to work at older ages. Actuarially neutral adjustments for early and late retirement in employer-sponsored defined benefit plans are one way of making sure that early retirement is not more attractive than working longer. Today, recent defined benefit schemes typically include a penalty for early withdrawal, but sometimes fail to grant higher benefits when workers delay their benefit receipt beyond retirement age. This may create strong incentives to retire no later than the retirement age when working longer lowers the total value of all pension payments - the expected net present value of the pensions – as the pension is withdrawn over a shorter period.

Conversely, incentives to retire early are usually small or absent in defined contribution schemes. As more and more employers offer DC instead of DB schemes, the impact of occupation pensions on labour market exit ages will most likely diminish.

Only 31% of workers in the lowest income decile are even offered a DC scheme, compared to 76% in the highest decile. The take-up rate is 40% of those in the lowest decile compared to 81% in the top decile (National Compensation Survey, 2017). Therefore offering low paid workers a better option of saving through a DC scheme, perhaps through auto-enrolment, can increase coverage levels substantially. While offering every worker a private pension would increase the level of coverage, just providing the offer is not sufficient. Low‑income earners may not be able to contribute a sufficient proportion of their salary to generate sufficient funds for a reasonable replacement rate.

For a guaranteed annual payment upon retirement purchasing an annuity is one available option, but these are not widely offered by employers. On average, only around one in ten Americans purchase a life-long annuity (TIAA, 2016[19]), with 68% saying they have no plans to purchase them in the future. Both of these figures contradict the fact that 49% declared their retirement goal as being able “To provide guaranteed money every month to cover your living costs in retirement”. There is therefore an issue of understanding the value and purpose of annuity products; 66% of Americans are unfamiliar with annuities.

Beyond saving constraints experienced by some individuals, insufficient financial literacy raises obstacles for some workers to seize the opportunities offered by tax subsidies typically embedded in pension schemes, including voluntary pensions. According to the 2016 National Capability Study by the Financial Industry Regulatory Authority, nearly two-thirds of Americans could not pass a basic financial literacy test, and the pass rate has fallen by 5 percentage points between 2009 and 2015, despite society's greater awareness of financial matters during the financial crisis.

A low level of financial literacy is common among OECD countries (OECD (2016[20]).10 It is important to start financial literacy early, ideally in school so that once reaching adulthood more people will be able to achieve a minimum level of financial knowledge. Moreover, women should be better targeted as they typically fare lower in financial literacy scores while being more likely to need to rely on financial products for longer due to greater life expectancy.

Increasing the value of mandatory pension components

A fundamental issue is that the level of benefit received from the mandatory earnings‑related pension is low in the United States in comparison to other countries. Full-career average earners can expect to receive a future gross pension of around 38% of their last earnings at retirement, nearly 15 percentage points below the OECD average. In the United States both employees and employers each contribute 6.2% of earnings for pensions, compared to around 8% for employees and 15% for employers on average in the OECD. A higher mandatory contribution rate to pensions is the key parameter to improve pension prospects in the United States.

The level of the Supplemental Security Income is relatively low, under 17% of gross average earnings. This is around 55% of the relative poverty threshold (defined as 50% of median disposable incomes). As of July 2017, around 4.4% of those aged 65 and over are receiving the Supplemental Security Income, either on its own or with some Social Security. Fundamental reforms to this component could be expensive if the aim is to eliminate poverty entirely, but increases could partially alleviate the burden of old-age poverty. The level of the safety net is ultimately a political decision. Relative to average earnings, the level of SSI is among the lowest in the OECD, while poverty rates, in particular for the elderly, are among the highest. This strengthens the case for increasing basic protection for the most vulnerable older individuals.

Survivors’ pensions are designed to primarily protect the spouses and children of retirees who die before or during retirement. These were often the only source of income for those remaining family members, and therefore an essential element to help alleviate poverty. However, the choice to subscribe, or not, to the joint-and-survivor life option for private pensions in the United States substantially changes the risk that surviving spouse falls into poverty (Orlova, Rutledge and Wu, 2015[21]). A great majority of couples prefer to opt out from the survivor pension to get a higher pension at the time of retirement. Hence, the joint-and-survivor life option should be automatic and reflected in either higher contributions or lower benefits. Maintaining standards of living after the death of an earlier spouse – at least when the survivor is older than a given, high enough age – should remain an objective of social policies.

Lowering the cost of the survivors’ component may happen naturally in the United States as the next generation of female retirees will have longer working careers than their predecessors. However, legislation may be required to ensure that costs are reduced for benefits that may not actually be needed based on the value of their own entitlements.

Finding the right answers to health limitations

Bad health as an obstacle to longer working lives can present itself in the form of many different medical conditions. Different health problems require different policy responses. Especially in the case of arduous manual occupations, physical health problems are a common barrier to longer working lives. Ensuring that workers with physical impairments can find a less strenuous job would limit the problem. A flexible labour market and special training programmes are necessary to redirect workers with years of experience in arduous physical jobs to less strenuous employment, for which a very different set of skills is needed. Supporting training programmes throughout the career, including for older workers, to sharpen their skills in their current or a less strenuous sector is one way for policy to step in.

Even without persistent serious health limitations, health deteriorations can reduce labour market participation. Workers who perceive themselves as less healthy than before may expect to die earlier, value their leisure time more or perceive work tasks as more strenuous than before. As a result, they may reduce their working hours or quit employment entirely even though they are physically still able to carry out the same workload as previously. Financial incentives encouraging employment and flexible working conditions such as teleworking and flexible retirement entry can reduce the labour force loss in these situations.

From a policy perspective it is important to distinguish situations in which early retirement due to bad health is inevitable because a person is not able to work at all any more, i.e. severe disability, from situations in which people with minor disabilities are still able to work and want to continue working. In the second case, adequate policy measures (see below) can increase the number of older workers who keep working despite their health problems. In addition to measures aiming at preventing health problems policy makers can use tools to alleviate the impact health conditions have on employment rates.

Changes in health insurance provision

The provision of health insurance in European countries is mostly universal and therefore its impact on individuals’ retirement patterns is limited. In many European countries, access to health care services and the age of retirement are only very loosely or not at all connected. This is not the case in the United States, where health insurance is often provided by the employer, at least until individuals turn 65 and become eligible for the Medicare system. Prior to age 65, the provision of health insurance is an important factor that keeps workers from retiring; this situation is sometimes referred to as “job lock”. When employer-sponsored health insurance plans provide better coverage than Medicare, these incentives remain even at older ages (see more in Chapter 2).

Transforming disability into ability

The generosity of disability insurance can affect how health shocks affect the labour supply of older workers. High disability benefits may encourage labour market exit after an acute health shock if they cover a large part of the income loss from not working. While a high insurance coverage is desirable in the case of severely disabled people, it can create undesirable labour market incentives for workers with minor health problems. Conversely, in-job protection regulation contributes to retaining disabled workers in their jobs.

Too many workers leave the labour market permanently due to health problems or disability, and too few people with reduced work capacity manage to remain in employment. Disability benefit take-up has become a one-way street. People almost never leave disability benefits for a job; and if they leave the disability benefit scheme before retiring, they are far more likely to move on to another benefit (Wise, 2012[22]). This is why policy objectives have been shifting in most OECD countries from merely paying benefits to people with disability towards helping them stay in their job or return to work. Policy should continue on this path.