This chapter demonstrates that informal workers and their family members often encounter a broader spectrum of risks compared with formal workers. These risks stem from weaker labour and social protection. Informal workers earn less than formal workers, even in comparable jobs. Moreover, in many countries, informal employment comprises a two-tier structure. The lower tier consists of workers earning modest incomes, while the upper tier consists of informal workers with higher earnings. The lower tier is often substantially larger than the upper tier, meaning that a compelling number of informal workers face a risk of individual but also household poverty.

Breaking the Vicious Circles of Informal Employment and Low-Paying Work

2. The double burden of informal employment and low-paying work

Abstract

Informal employment has been on the policy agenda since around the 1960s. Despite many countries’ numerous commitments to take a proactive stance on informal employment, progress towards the sustainable formalisation of economies is slow. Informal employment is extremely persistent. In contrast, the meagre formalisation gains are often reverted by an array of forces, including national, regional and global crises, such as the COVID‑19 pandemic. Still today, nearly 2 billion workers, representing close to 60% of the world’s employed population, are in informal jobs (OECD, 2023[1]).

Informal workers are more vulnerable than formal workers in the face of various risks

Informal employment is a concern in many countries around the world for a number of reasons. One of the key reasons is that, by definition (Box 2.1), informal workers throughout the world lack social protection and enjoy fewer rights at work (OECD/ILO, 2019[2]). As will be shown in this report, they have fewer opportunities to upgrade their skills that could help them access formal jobs.

Box 2.1. Differentiating between the informal economy and informal employment

The informal economy refers to all economic activities (excluding illicit activities) by workers and economic units that are, in law or in practice, not covered or insufficiently covered by formal arrangements (ILO, 2015[3]).

The definition of informal employment used in this report differentiates between three groups of workers: i) employees, ii) employers and own-account workers, and iii) contributing family members. These are further explained as follows:

i. Employees are considered to have informal jobs if their employment relationship is, in law or in practice, not subject to national labour legislation, income taxation, social protection or entitlement to certain employment benefits (advance notice of dismissal, severance pay, paid annual or sick leave, etc.). In statistical terms, employees are considered informally employed if their employer does not contribute to social security on their behalf or, in the case of a missing answer, if they do not benefit from paid annual leave or sick leave.

ii. Employers (with hired workers) and own-account workers (without hired workers) are considered informally employed if they run an economic unit in the informal sector (a non-incorporated private enterprise without a formal bookkeeping system or that is not registered with relevant national authorities). In the case of the question not asked or a missing answer, the enterprise is considered part of the informal sector if there is no fixed place of work or it employs five employees or fewer. This threshold can vary, depending on the reporting structure of country questionnaires.

iii. Contributing family members are informally employed by definition, regardless of whether they work in formal or informal sector enterprises.

Estimates of informal employment presented in this report follow the Resolution concerning statistics of employment in the informal sector (ILO, 1993[4]) and the Guidelines concerning a statistical definition of informal employment (ILO, 2003[5]). Some adjustments to the definition of informal employment were discussed at the time of writing of this report, for adoption during the International Conference of Labour Statisticians (ICLS) in October 2023. The revised definition takes into account the introduction of the broad concept of work and the more restricted definition of employment in the 19th ICLS resolution (ILO, 2013[6]). In addition, it considers the different categories of status in employment, as defined by the International Classification of Status in Employment (ICSE‑18) (ILO, 2018[7]), such as the new category: dependent contractors.

Source: (OECD, 2023[1]), Informality and Globalisation: In Search of a New Social Contract.

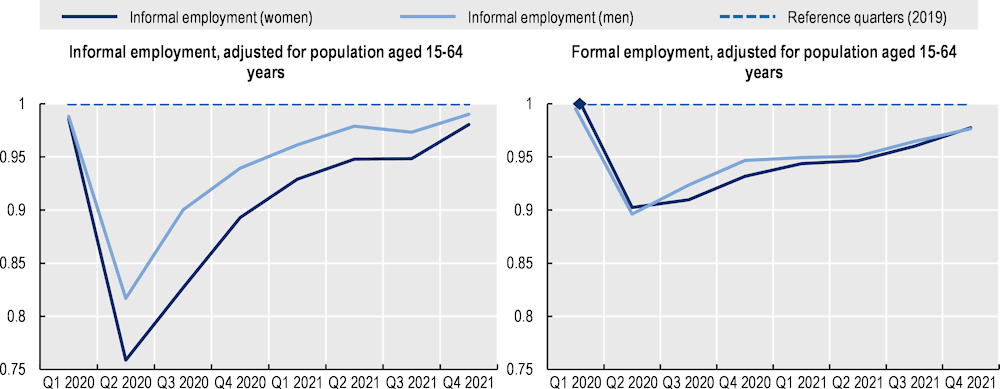

Another reason why informal employment is a concern is that informal workers can also be more vulnerable to different types of crises, which is often the result of a lack of social protection. For example, during the COVID‑19 crisis, the informal economy did not play the traditional “cushioning” countercyclical role of absorbing workers who had been displaced from the formal economy (OECD, 2023[1]). During the 2020‑21 period, informal workers were more likely than formal workers to lose their jobs or be forced into inactivity because of the prevalence of informal employment in sectors that were heavily affected by lockdown and containment measures; limited possibilities to telework; the relative ease of terminating informal employment relationships; and a higher proportion of informal workers in smaller enterprises, which struggled to survive longer periods of inactivity and had less (or no) access to support measures, including worker retention schemes (ILO, 2020[8]; ILO, 2020[9]; ILO, 2022[10]; OECD, 2023[1]). Informally employed women were disproportionately affected (Figure 2.1), not only exacerbating workers’ vulnerability to COVID‑19-related policy measures but also widening gender employment gaps during the pandemic.

Figure 2.1. Evolution of informal and formal employment during the COVID‑19 crisis, by sex

Reference quarters in 2019 = 1

Note: Estimates are based on trends in the number of formal and informal jobs in Argentina, Plurinational State of Bolivia (hereafter: Bolivia), Brazil, Chile, Costa Rica, Dominican Republic, Ecuador, Guyana, Mexico, Republic of North Macedonia, Palestinian Authority, Paraguay, Peru, Saint Lucia, South Africa, Uruguay and Viet Nam. See individual country results in (ILO, 2020[8]). A review of country data. Impact of the Covid-19 pandemic on informality: Has informal employment increased or decreased? Missing observations are imputed using time-fixed effects in a panel regression of countries without missing observations.

Source: Courtesy of the International Labour Organization (ILO); (OECD, 2023[1]), Informality and Globalisation: In Search of a New Social Contract.

Many informal workers typically earn lower incomes compared with formal workers

Another concern with informal employment is the fact that many informal workers earn low labour incomes.

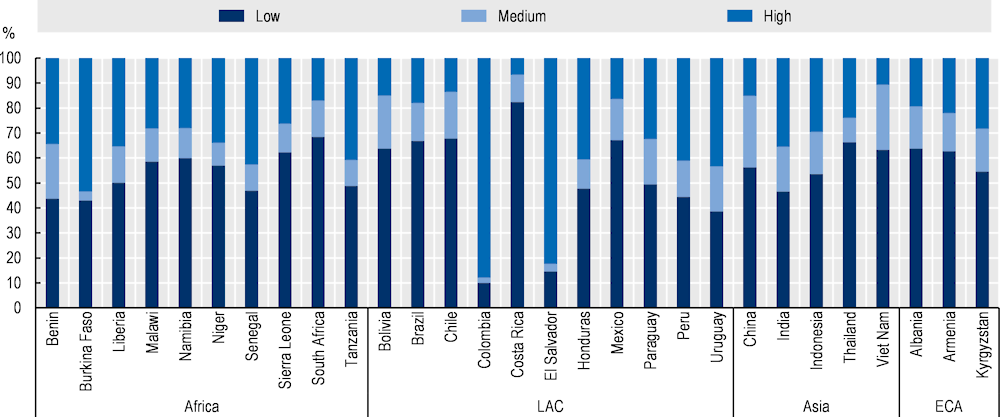

There is a greater share of informal workers who are low earners rather than high earners

Evidence from the Organisation for Economic Co‑operation and Development’s (OECD’s) Key Indicators of Informality based on Individuals and their Households (KIIbIH) database confirms a well-known feature of informal employment: in many countries, it follows a two-tier structure (Jütting and de Laiglesia, 2009[11]; Tonin, 2013[12]; Fields, 2020[13]; Fields et al., 2023[14]). Workers in the upper tier are more productive (possibly due to higher-level skills relative to workers in the lower tier) and enjoy higher earnings than those in the lower tier. Workers in the lower tier are engaged in low-productivity activities (possibly due to a lack of skills, but also due to the lack of opportunities elsewhere) and have low earnings. “Middle” earners are relatively few among informal workers. The lower tier is larger in size than the upper tier in the vast majority of countries with available data. Across countries with available data, nearly 54% of informal workers on average have earnings below 50% of the median earnings level; this proportion exceeds 80% in Costa Rica (Figure 2.2).

Figure 2.2. Distribution of informal workers by the size of labour earnings

Percentage of informal workers by earnings category

Note: Earnings categories are defined based on the total earnings distribution: low earnings are from the bottom of the distribution to 50% of the median earnings level; medium earnings are from 50% of the median to 150% of the median; and high earnings are 150% of the median and above. LAC – Latin America and the Caribbean. ECA – Europe and Central Asia.

Source: Authors’ calculations based on (OECD, 2021[15]), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

If these results are not new, what is “distressing”, in the words of (Rodrik, 2014[16]), is that in many developing and emerging economies, the proportion of lower-tier informal earners is not shrinking; on the contrary, in many cases, it is expanding, as particularly witnessed during the COVID‑19 crisis (OECD, 2023[1]).

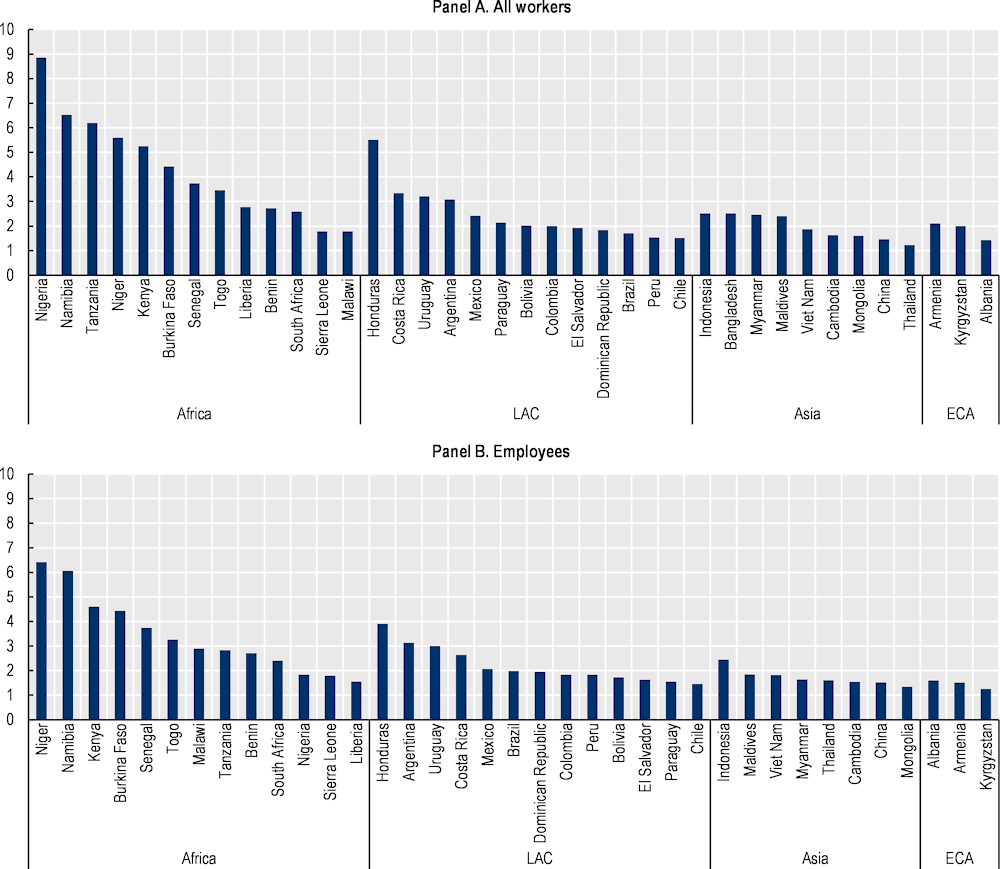

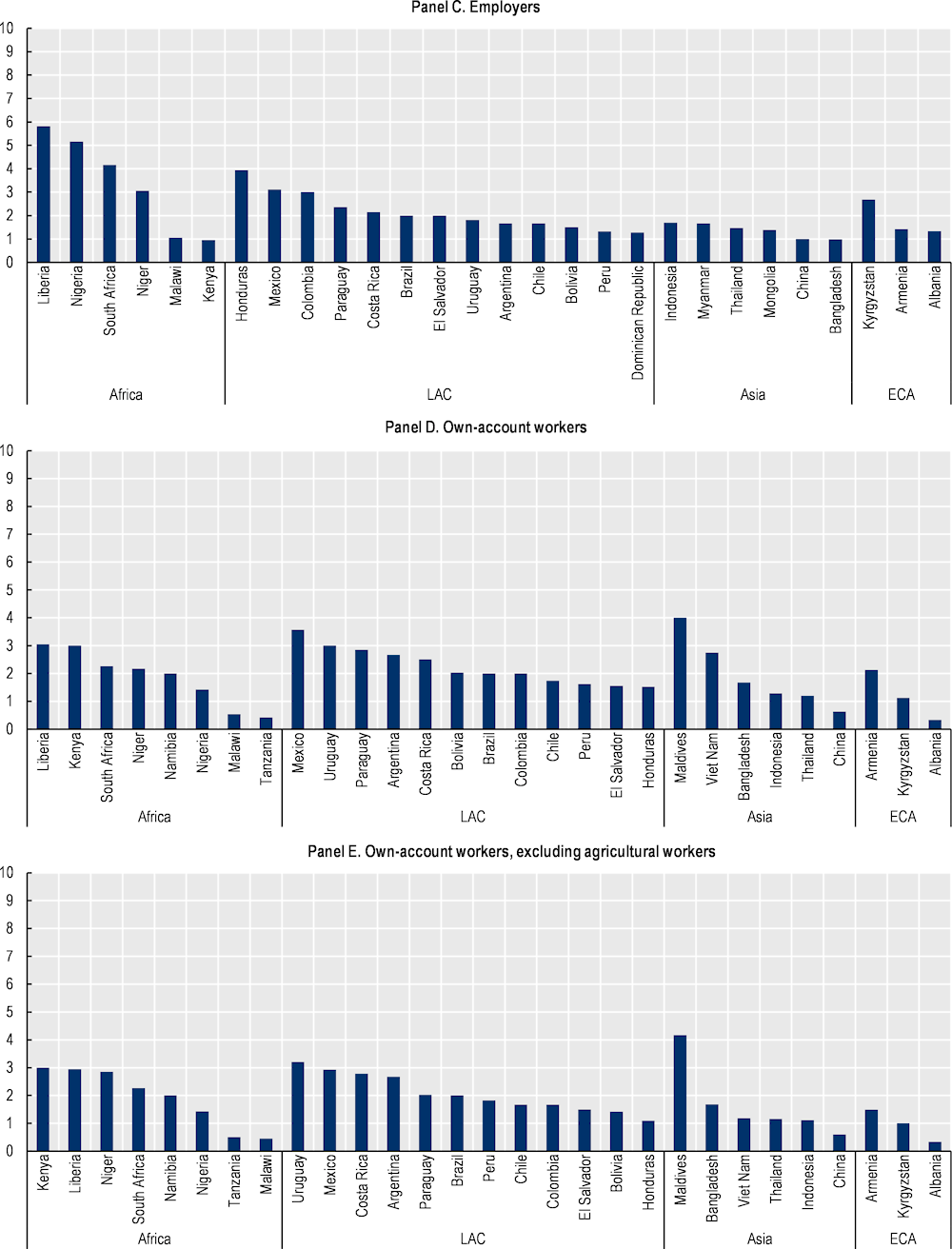

Informal workers are earning less than formal workers, even in similar jobs

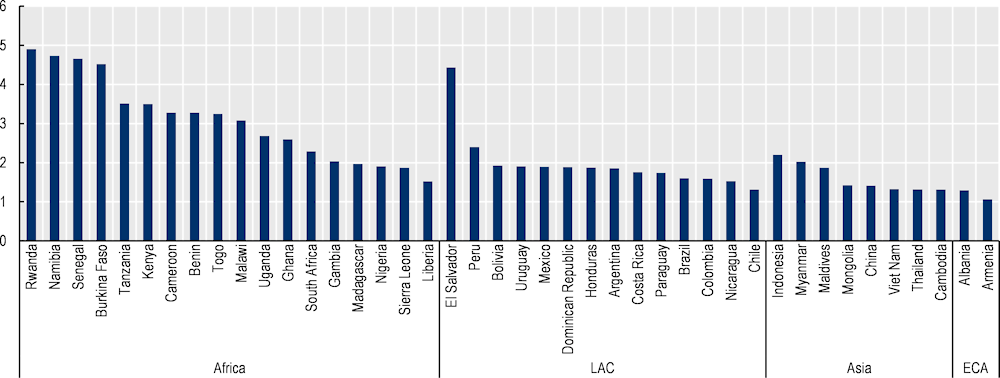

The median individual monthly labour earnings of informal workers are also substantially lower than the median individual monthly earnings of formal workers. Individual monthly labour earnings are composed of wages for employees, and labour incomes for employers and own-account workers. Comparing the median earnings of all workers (Figure 2.3, Panel A), informal workers are earning 9.0 times less than formal workers in Nigeria, 5.5 times less in Honduras, and 2.5 times less in Indonesia. There are sizeable differences in the formal-to-informal median individual monthly labour earnings across and within regions, with the greatest disparity between countries being observed in Africa. Informal workers of all statuses in employment, whether employees (Figure 2.3, Panel B), employers (Figure 2.3, Panel C) or own-account workers (Figure 2.3, Panels D and E), are affected by this earnings penalty. Excluding agricultural workers somewhat narrows (but does not eliminate) the gap, especially in countries where the size of the agricultural sector is relatively large compared with other sectors, and where informal employment is largely confined to the agricultural sector (Figure 2.3, Panels D and E).

Figure 2.3. Ratio of individual monthly labour earnings of formal to informal workers (median), by country

Note: The data refer to the ratio of the median formal over the median informal individual monthly labour earnings of workers. Individual monthly labour earnings consist of wages for employees, and labour incomes for employers and own-account workers. Some countries do not provide sufficient disaggregation of workers by all statuses in employment. Data are from the latest available year for countries within the KIIbIH database. LAC – Latin America and the Caribbean. ECA – Europe and Central Asia.

Source: Authors’ calculations based on (OECD, 2021[15]), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

There are many reasons why median individual monthly labour earnings vary across formal and informal workers. One of them may be the unequal number of hours that formal and informal workers devote to productive activities. The information on hours worked is available for wage employees only in selected countries. Taking these data into account, one can see that the gap between formal and informal earnings is still present in all countries, although it is different from the monthly earnings gap: it is lower in some countries, but higher in others. Across 41 countries for which data are available, the ratio of median formal to informal individual hourly earnings is 2.3; it ranges from 1.1 in Armenia to 4.9 in Rwanda (Figure 2.4). In some countries, such as Kenya, the gap between the median formal and informal hourly wage for employees is smaller than the gap between the median formal and informal monthly wage (Figure 2.3, Panel B), while in others, such as Senegal, it is larger, suggesting that, depending on the country, informal workers may work more or fewer hours per month compared with formal workers. Other factors that explain this earnings penalty include the generally lower level of education among informal workers, informal workers’ lower level of productivity, and informal workers’ over-representation in occupations and sectors that generally pay lower wages (OECD/ILO, 2019[2]).

Figure 2.4. Ratio of individual hourly earnings of formal to informal employees (median), by country, latest available year

Note: The data refer to the ratio of the median formal over the median informal hourly wage of employees in their primary job. Data are from the latest available year for countries within the KIIbIH database. LAC - Latin America and the Caribbean. ECA - Europe and Central Asia.

Source: Authors’ calculations based on (OECD, 2021[15]), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

Empirical evidence – which takes into account other job-related and worker characteristics, including workers’ age, gender, education, employment status, sector of activity and occupation – also confirms that informal jobs usually pay lower wages and incomes, even in similar formal jobs (Bertranou et al., 2014[17]; Reich, 2008[18]; Peña, 2013[19]; Pratap and Quintin, 2006[20]; Nordman, Rakotomanana and Roubaud, 2016[21]; Xue, Gao and Guo, 2014[22]; Bargain and Kwenda, 2014[23]; Tansel and Acar, 2016[24]). Informally working women are usually penalised more than men (Wirba, Akem and Baye, 2021[25]). For employees, enterprise characteristics – including enterprise size – also affect earnings (Nordman, Rakotomanana and Roubaud, 2016[21]).

Informal workers and their households are at greater risk of poverty, health problems and old-age hardships

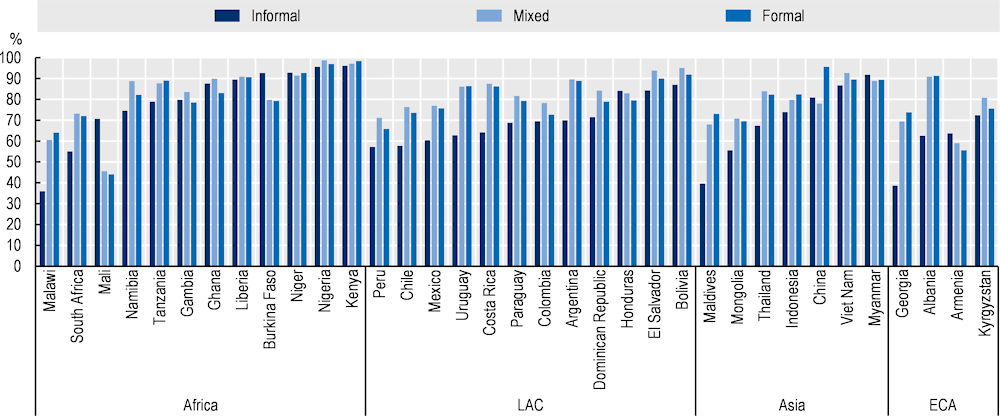

Individual earnings typically contribute significantly to household income. Indeed, the average share of household income from labour as a percentage of total household income per capita, across countries with available data, stands at 72.0% among informal households, 81.5% among mixed households and 80.5% among formal households; it exceeds 95.0% for all types of households in Kenya and Nigeria (Figure 2.5).

Figure 2.5. Employment is the main source of income for most households

Share of income from work as a percentage of household income per capita, by households’ level of informality

Note: LAC – Latin America and the Caribbean. ECA – Europe and Central Asia.

Source: Authors’ calculations based on (OECD, 2021[15]), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

Because informal workers’ earnings are generally lower than those of formal workers, the formal to informal earnings disparity often makes informal workers more susceptible to falling into low-wage and poverty traps (Pham, 2022[26]; Amuedo-Dorantes, 2004[27]; Devicienti, Groisman and Poggi, 2010[28]; Tassot, Pellerano and La, 2019[29]). This is especially true for workers who are in the lower tier of informal employment, making poverty and informal employment intimately interrelated (OECD/ILO, 2019[2]; Kanbur, 2017[30]).

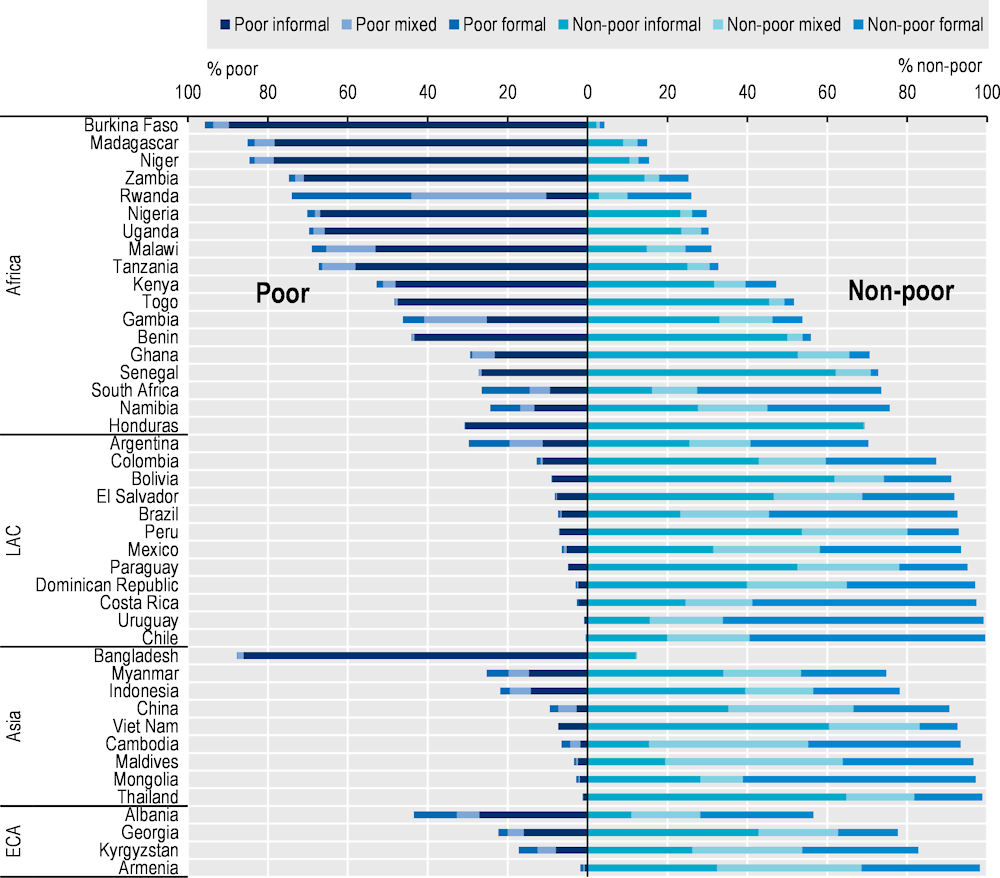

Moreover, depending on the composition of workers in the household, low pay for informal workers can be a determinant of not only individual but also household poverty. Indeed, the association between households’ degree of informality and the incidence of household poverty seems to be quite strong in several countries, especially in African countries, in Bangladesh, and in Albania (Figure 2.6). More generally, households with lower income levels are significantly more likely to be completely informal.

Figure 2.6. Household poverty risk increases with households’ degree of informality

Distribution of people by the poverty and informality status of their households

Note: Poor households are those that fall below the international poverty line of USD 3.20 (United States dollars) Purchasing Power Parities (PPPs). LAC – Latin America and the Caribbean. ECA – Europe and Central Asia.

Source: Authors’ calculations based on (OECD, 2021[15]), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

The lower earnings of informal workers, coupled with the fact that labour earnings are often their only source of income, exacerbates informal workers’ vulnerability to various other risks. For example, unexpected out-of-pocket medical expenses may simply be unaffordable to poor informal workers, preventing them from seeking the necessary healthcare (Oliveira, Islam and Nuruzzaman, 2019[31]; OECD, 2023[1]). Lower earnings also disproportionately increase the risk of income insecurity and income poverty in old age, because of both the lack of pension social protection and an inability to save for retirement (OECD, 2019[32]). These risks are especially pronounced for women.

Low pay for informal workers also reduces potential economic resources available to other household members. As such, it can influence choices for other household members such as education (as shown in subsequent chapters), labour market participation, healthcare and retirement. It can also translate into limited social capital, as well as limited educational and labour market opportunities for household members (Domínguez and Watkins, 2003[33]).

Moreover, both poverty and informal employment are highly persistent circumstances that can reinforce each other. Past poverty can determine current informal employment, and past informal employment, in turn, can lead to higher chances of current poverty (Devicienti, Groisman and Poggi, 2010[28]). This opens space for specific policies to break the poverty–informal employment cycle for informal workers, especially for those in the lower tier of informal employment, as well as for their families.

Key policy messages

This chapter has shown that informal workers and their family members often face a greater range of risks compared with formal workers. These include risks associated with poorer protection by labour laws and absent or inadequate social protection. As the recent COVID‑19 crisis has shown, informal workers may also face higher risks of losing their job. Informal workers also tend to earn lower incomes compared with formal workers. Moreover, informal employment in the majority of developing and emerging economies with available data features two tiers. The lower tier, often comprising the greatest number of workers, is composed of low-skilled, low-productivity workers earning low incomes; the upper tier, which is usually relatively small, is composed of informal workers with higher-level skills and earning high incomes. If all informal workers face a greater range of socio-economic risks, workers in the lower tier, as well as their household members, are particularly vulnerable to poverty because, in the absence of social protection, they cannot afford to cover these risks on their own. Taken together, these risks and poorer outcomes of the majority of informal workers point to the high costs that informal employment presents to individuals and to society.

The next chapter shows that opportunities to transition from informal to formal employment remain quite limited. Moreover, such transitions have a potential to increase labour income only for those workers who are already high earners, confirming the two-tier view of informal employment.

As will be argued later in this report, the two-tier nature of the informal employment sector begs for different policy actions for each of the two tiers.

One type of action concerns the skills development of informally employed adults and of their children in order to equip them with higher-order skills, and thus allow them to break the skills barrier of the lower tier of informal employment that features low productivity. Chapters 4 and 5 inquire into the specificities of such potential policy actions.

Another type of action concerns redistribution and social protection. Indeed, informal workers’ individual earnings are one of the key indicators that can help identify social protection extension strategies, as discussed in Chapter 6.

On the one hand, informal workers in the lower tier lack the contributory capacity to pay for social protection. For these workers, informal employment is most likely not a choice, but the outcome of a lack of formal employment opportunities. With this lack of social protection, informal work is also often the only option to survive (OECD/ILO, 2019[2]; Banerjee and Duflo, 2011[34]; Margolis, 2014[35]; Günther and Launov, 2012[36]; La Porta and Shleifer, 2014[37]). As such, informal employment earnings do play a role in reducing poverty when the alternative is no earnings at all, and in a certain sense already substitute for nonexistent social protection. It is therefore important to recognise the role that the informal economy is playing in sustaining people’s livelihoods. For informal workers, contributory social protection schemes would have to be either subsidised by the government and/or complemented with employer contributions when possible. Some of these schemes should also include other vulnerable household members of informal workers, such as children or elderly family members. This subsidisation of lower-tier informal workers and their families should be seen as an investment into a more inclusive growth process and as a way to break the poverty–informal employment cycle (OECD, 2019[32]).

On the other hand, informal workers in the upper tier actually do have some individual capacity to contribute to social insurance schemes. As such, there is scope for including them in the existing schemes, either by extending coverage or by improving access, compliance and enforcement.

More broadly, since income is an important determinant of general well-being, life satisfaction, political engagement and social cohesion (Frank-Borge, Wietzke and McLeod, 2013[38]), lower pay of informal workers presents broader social limitations to these workers, making the case for continued efforts to create more formal employment opportunities and decent, better-paying jobs at all levels of skill, and in all sectors and occupations.

References

[27] Amuedo-Dorantes, C. (2004), “Determinants and Poverty Implications of Informal Sector Work in Chile”, Economic Development and Cultural Change, Vol. 52/2, pp. 347-368, https://doi.org/10.1086/380926.

[34] Banerjee, A. and E. Duflo (2011), Poor Economics, PublicAffairs Press, New York.

[23] Bargain, O. and P. Kwenda (2014), “The informal sector wage gap: New evidence using quantile estimations on panel data”, Economic Development and Cultural Change, Vol. 63/1, pp. 117-153, https://doi.org/10.1086/677908.

[17] Bertranou, F. et al. (2014), “Informality and employment quality in Argentina: country case study on labour market segmentation”, ILO Conditions of Work and Employment Series, No. 49, International Labour Office, Geneva, https://EconPapers.repec.org/RePEc:ilo:ilowps:994854223402676 (accessed on 17 February 2022).

[28] Devicienti, F., F. Groisman and A. Poggi (2010), “Chapter 4 Are informality and poverty dynamically interrelated? Evidence from Argentina”, in Research on Economic Inequality, Studies in Applied Welfare Analysis: Papers from the Third ECINEQ Meeting, Emerald Group Publishing Limited, https://doi.org/10.1108/s1049-2585(2010)0000018007.

[33] Domínguez, S. and C. Watkins (2003), “Creating Networks for Survival and Mobility: Social Capital Among African-American and Latin-American Low-Income Mothers”, Social Problems, Vol. 50/1, pp. 111-135, https://doi.org/10.1525/sp.2003.50.1.111.

[14] Fields, G. (ed.) (2023), The Job Ladder: Transforming informal work and livelihoods in developing countries, Oxford University Press.

[13] Fields, G. (2020), Informality and work status, UNU-WIDER, https://doi.org/10.35188/unu-wider/2020/916-7.

[38] Frank-Borge, Wietzke and C. McLeod (2013), “Jobs, Wellbeing, and Social Cohesion: Evidence from Value and Perception Surveys”, World Bank Policy Research Working Paper, No. 6447, World Bank.

[36] Günther, I. and A. Launov (2012), “Informal employment in developing countries”, Journal of Development Economics, Vol. 97/1, pp. 88-98, https://doi.org/10.1016/j.jdeveco.2011.01.001.

[10] ILO (2022), ILO Monitor on the world of work. 9th edition, International Labour Office, Geneva.

[8] ILO (2020), COVID-19 crisis and the informal economy: immediate responses and policy challenges.

[9] ILO (2020), ILO Monitor on the world of work. 4th edition, International Labour Office, Geneva, https://www.ilo.org/global/topics/coronavirus/impacts-and-responses/WCMS_745963/lang–en/index.htm.

[7] ILO (2018), Resolution concerning statistics on work relationships, ILO Twentieth International Conference of Labour Statisticians, Geneva, 10-19 October.

[3] ILO (2015), Recommendation No. 204 concerning the Transition from the Informal to the Formal Economy, http://www.ilo.org/ilc/ILCSessions/previous-sessions/104/texts-adopted/WCMS_377774/lang--en/index.htm (accessed on 30 April 2021).

[6] ILO (2013), Resolution concerning statistics of work, employment and labour underutilization, ILO Nineteenth International Conference of Labour Statisticians, Geneva.

[5] ILO (2003), Guidelines concerning a statistical definition of informal employment, ILO Seventeenth International Conference of Labour Statisticians, Geneva.

[4] ILO (1993), Resolution concerning the measurement of employment in the informal sector, ILO Fifteenth International Conference of Labour Statisticians, Geneva, https://www.ilo.org/wcmsp5/groups/public/—dgreports/—stat/documents/normativeinstrument/wcms_087484.pdf.

[11] Jütting, J. and J. de Laiglesia (2009), Is Informal Normal ?: Towards More and Better Jobs in Developing Countries, Development Centre Studies, OECD Publishing, Paris, https://doi.org/10.1787/9789264059245-en.

[30] Kanbur, R. (2017), “Informality: Causes, consequences and policy responses”, Review of Development Economics, Vol. 21/4, pp. 939-961, https://doi.org/10.1111/rode.12321.

[37] La Porta, R. and A. Shleifer (2014), “Informality and Development”, Journal of Economic Perspectives, Vol. 28/3, pp. 109-126, https://doi.org/10.1257/jep.28.3.109.

[35] Margolis, D. (2014), “By Choice and by Necessity: Entrepreneurship and Self-Employment in the Developing World”, The European Journal of Development Research, Vol. 26/4, pp. 419-436, https://doi.org/10.1057/ejdr.2014.25.

[21] Nordman, C., F. Rakotomanana and F. Roubaud (2016), “Informal versus Formal: A Panel Data Analysis of Earnings Gaps in Madagascar”, World Development, Vol. 86, pp. 1-17, https://doi.org/10.1016/J.WORLDDEV.2016.05.006.

[1] OECD (2023), Informality and Globalisation: In Search of a New Social Contract, OECD Publishing, Paris, https://doi.org/10.1787/c945c24f-en.

[15] OECD (2021), OECD Key Indicators of Informality based on Individuals and their Household (KIIbIH), OECD, Paris, https://www.oecd.org/dev/Key-Indicators-Informality-Individuals-Household-KIIbIH.htm (accessed on 29 October 2021).

[32] OECD (2019), Can Social Protection Be an Engine for Inclusive Growth?, Development Centre Studies, OECD Publishing, Paris, https://doi.org/10.1787/9d95b5d0-en.

[2] OECD/ILO (2019), Tackling Vulnerability in the Informal Economy, Development Centre Studies, OECD Publishing, Paris, https://doi.org/10.1787/939b7bcd-en.

[31] Oliveira, M. Islam and M. Nuruzzaman (2019), “Access to health services by informal sector workers in Bangladesh”, WHO South-East Asia Journal of Public Health, Vol. 8/1, p. 35, https://doi.org/10.4103/2224-3151.255347.

[19] Peña, X. (2013), “The formal and informal sectors in Colombia: Country case study on labour market segmentation”, Employment Working Paper, No. 146, ILO, Geneva, http://www.ilo.org/employment/Whatwedo/Publications/working-papers/WCMS_232495/lang--en/index.htm (accessed on 17 February 2022).

[26] Pham, T. (2022), “Shadow Economy and Poverty: What Causes What?”, The Journal of Economic Inequality, https://doi.org/10.1007/S10888-021-09518-2.

[20] Pratap, S. and E. Quintin (2006), “Are labor markets segmented in developing countries? A semiparametric approach”, European Economic Review, Vol. 50/7, pp. 1817-1841, https://doi.org/10.1016/j.euroecorev.2005.06.004.

[18] Reich, M. (ed.) (2008), Segmented labor markets and labor mobility, Edward Elgar Publishing, https://www.e-elgar.com/shop/gbp/segmented-labor-markets-and-labor-mobility-9781847203496.html (accessed on 17 February 2022).

[16] Rodrik, D. (2014), The growing divide within developing economies.

[24] Tansel, A. and E. Acar (2016), “The formal/informal employment earnings gap: Evidence from Turkey”, Research on Economic Inequality, Vol. 24, pp. 121-154, https://doi.org/10.1108/S1049-258520160000024006/FULL/XML.

[29] Tassot, C., L. Pellerano and J. La (2019), “Informality and Poverty in Zambia: Findings from the 2015 Living Conditions and Monitoring Survey”, ILO/OECD, Geneva, https://www.ilo.org/wcmsp5/groups/public/---africa/---ro-abidjan/---ilo-lusaka/documents/publication/wcms_697953.pdf (accessed on 14 June 2022).

[12] Tonin, M. (2013), “Informality”, in Cazes, S. and S. Verick (eds.), Perspectives on Labour Economics for Development, https://www.ilo.org/wcmsp5/groups/public/@dgreports/@dcomm/@publ/documents/publication/wcms_190112.pdf.

[25] Wirba, E., F. Akem and F. Baye (2021), “Earnings gap between men and women in the informal labor market in Cameroon”, Review of Development Economics, Vol. 25/3, pp. 1466-1491, https://doi.org/10.1111/RODE.12765.

[22] Xue, J., W. Gao and L. Guo (2014), “Informal employment and its effect on the income distribution in urban China”, China Economic Review, Vol. 31, pp. 84-93, https://doi.org/10.1016/J.CHIECO.2014.07.012.