This chapter examines the current status and future requirements of clean energy finance in Viet Nam. It reviews the current state of financial markets and highlights the need to deepen capital market development. It highlights financial market regulation, including the role of sustainable finance policies and targeted green finance instruments in mobilising finance for clean energy projects. The chapter also examines the role of development finance in mobilising private capital and opportunities for institutional innovation to catalyse private sector finance and investment.

Clean Energy Finance and Investment Policy Review of Viet Nam

6. Financial market policy

Abstract

A major scale up in financing will be needed to meet Viet Nam’s clean energy transition goals that will require both domestic and international public and private sources of finance. Creating a clean energy finance ecosystem that has reach across governments, financial markets, industry and development co‑operation can support this goal. The green banking policies led by the State Bank of Viet Nam (SBV) are commendable and have played an important role in facilitating domestic finance for clean energy projects. This chapter looks at the current status and future requirement of clean energy finance in Viet Nam; green banking regulation and opportunities to develop capital markets and targeted green finance instruments; and the role of development finance and opportunities for institutional innovation to catalyse private sector finance and investment.

Assessment and recommendations

Rapid solar expansion financed mainly through domestic and regional banks

The impressive solar expansion in Viet Nam that has seen installed capacity reach 8.85 GW of utility scale solar and 9.7 GW of rooftop solar at the end of 2020, was financed to a large degree through domestic banks and added mainly in the last two years (OECD, 2020[1]). Regional developers and financial institutions have also contributed significantly to renewables development in Viet Nam. This signals positive momentum among domestic and regional financial institutions on the attractiveness of renewable energy projects and a recognition of the need to integrate environmental considerations into the finance sector. A growing number of financial institutions around the world have adopted policies to stop financing coal fired power plants making it increasingly difficult to raise capital for coal and helping to accelerate its eventual phase out. Growing difficulty in financing coal both domestically and internationally combined with a strong outlook for electricity demand has helped to increase the attractiveness of financing renewables in Viet Nam.

Regulation has guided the development of green finance frameworks that facilitated domestic lending

The State Bank of Viet Nam should be commended for strong policy direction that has helped to guide the greening of the finance sector by requiring banks to integrate environmental and social (E&S) risk management into their lending practices. Two key policy interventions released in 2015 include the Financial Sector Green Growth Action Plan to 2020 and Directive No. 03 / CT-NHNN on promoting green credit and managing environmental and social risks in credit activities. The 2018 Directive No. 1604/QD-NHNN approves the Green Banking Development Scheme in Viet Nam that encourages banks to increase the weighting of lending portfolios to priority sectors listed on SBV’s green projects portfolio. This directive also requires that all banks integrate internal procedures for E&S risk and credit risk evaluation by 20251. While some domestic banks have been active in financing clean energy projects, others still lack sufficient technical capacity to undertake project due diligence and additional support is required to further develop domestic capacity and reduce perceived risks among local financial institutions.

Refinancing of operational projects could create opportunities for new investors

Mechanisms will be needed to recycle capital from operational projects to support those that are at the development or construction phase. This can allow new financial institutions to gain valuable experience and exposure to clean energy projects and drive more private capital (both domestic and international) into the sector.

Lack of access to long term debt capital remains a major barrier to future developments

While there is good appetite to finance clean energy projects, a lack of access to long term debt capital has meant that typical debt tenors of 5 to 7 years are well below that of OECD and some major emerging economies where tenors are often above 15 to 20 years or more. The absence of non-recourse project finance in Viet Nam, which is the norm for renewable energy projects in OECD and other major economies, restricts the funding capacity of individual developers with limited equity capital and prevents efficient risk allocation and market development. High collateral requirements also pose a particular challenge for smaller developers, including energy service companies that are implementing energy efficiency projects as their limited capital is often used up after just one or two projects.

Viet Nam will need to access international capital to meet future financing needs

Development finance institutions have played a key role in financing hydropower, transmission and distribution network expansion and industrial energy efficiency in Viet Nam, but have only played a limited role in financing solar and wind projects as the domestic finance sector has so far had sufficient financing capacity. Liquidity issues may become a constraint as Viet Nam looks to develop its offshore wind resources which require funding above USD 2-3 billion in a single project. This is beyond the capacity of the domestic market and will require an international consortium of development and private finance institutions to address the unique risk characteristics of such large projects. International lenders have also maintained that the current power purchase agreement (PPA) conditions are not bankable due to high perceived risks related to arbitration and risks of curtailment. PPA contracts in Viet Nam are also not as comprehensive as those in Europe or other OECD countries, leaving uncertainty which is difficult for financial institutions to manage.

Box 6.1. Main policy recommendations on financial market policy:

Implement regulation that includes a clearly defined green bond framework including definitions for eligibility, reporting and verification protocols. Support the development of green bond issuances for sovereign, sub-sovereign and corporate issuers. Such a framework should be consistent with the ASEAN green bond standard and aligned with other green bond standards to allow for a broad investor base. Green bonds offer an attractive opportunity to refinance existing projects and provide a source of much needed long-term capital.

Develop solutions that can facilitate on-lending schemes or other financing mechanisms that can facilitate access to long-term capital by domestic finance institutions and take advantage of low cost capital from multilateral and bilateral development banks. Such schemes could be designed to target energy efficiency and smaller renewable energy projects where project developers struggle to access financing due to limited equity capital. This could require a re‑evaluation of development finance mandates to shift from sovereign lending to be able to facilitate more direct lending to financial institutions without a sovereign mandate.

Consider the creation of a clean energy fund that can support the use of blended finance structures to mobilise financing from the private sector for renewable energy and energy efficiency projects. This includes the use of de-risking instruments such as guarantees and insurance products as well as support for project preparation and financial structuring. Such mechanisms could be used to attract financing from both domestic and international investors.

Develop a sustainable finance roadmap that outlines key requirements for financial institutions to develop action plans and regular reporting on alignment of portfolios to sustainable development criteria and exposure to climate change impacts. This should be accompanied by capacity building and information campaigns to build expertise among financial market actors to support sustainable infrastructure finance and in particular the clean energy transition. A further step would include the development of green finance definitions or a sustainable finance taxonomy to support the development of green finance products and overcome concerns of green washing.

Improve the availability of clean energy finance and investment data through the development of monitoring and evaluation tools. The creation of a clean energy finance and investment database can help to identify funding gaps and help to track climate finance flows. It can also support the development of targeted policy interventions and the design of financing mechanisms to help mobilise private capital for clean energy projects. Increasing the availability of project level data would also help to build investor confidence and reduce perceived risks that could potentially lower the cost of finance, as financial institutions are better able to evaluate various risk return profiles.

Strengthening and deepening local financial markets

Banking sector dominates the financial markets

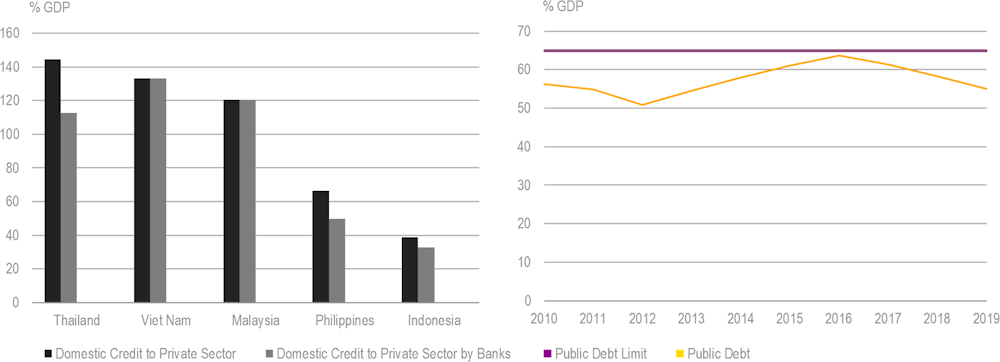

Viet Nam’s financial sector is dominated by banks that account for about 70% of the capital provided in the market (World Bank, 2019[2]). The country’s economic growth has been fuelled by high lending rates with one of the highest credit to GDP shares in the region at levels similar to some OECD countries (Figure 6.1). Over the last 25 years, banking credit rose rapidly from just 17% of GDP to over 130% in 2018 (World Bank, 2019[2]). Much of this credit growth has been directed towards lending to state-owned enterprises and more recently towards real estate and housing with small and medium enterprises struggling to access credit (World Bank, 2019[2]). About 80% of the banks’ capital is held in short-term accounts limiting the availability of long-term credit that is needed to finance infrastructure projects (World Bank, 2019[2]).

Figure 6.1. Viet Nam's economic growth has been accompanied by rising debt levels

Public sector debt levels have risen significantly, as the government invested in critical infrastructure to support the growing economy and attract foreign direct investment. Overall public debt is constrained by a legal lending limit of 65% of GDP. After reaching nearly this limit in 2016, public debt has fallen, as a result of government efforts to tighten fiscal policy. The government is increasingly relying on the private sector to fund infrastructure development to maintain public debt well below the legal limit.

The rapid growth of the credit market in Viet Nam has raised some concerns around its sustainability particularly given the slower than anticipated implementation of Basel II capital adequacy requirements. The State Bank of Viet Nam (SBV) had initially set a deadline of 1 January 2020 for the country’s 17 leading banks to comply with Basel II requirements. Despite some progress with 10 of the 17 banks fulfilling the capital requirements by December 2019, SBV decided to extend the deadline to 2023 to allow the remaining banks more time to meet the requirement as many struggled to raise sufficient additional capital. The current restriction on foreign ownership of 30% and nonperforming loans left from the 2012 banking crisis have led to slow progress among smaller banks (Denimal, 2020[3]).

According to the Global Infrastructure Outlook, Viet Nam will need to invest a total of USD 605 billion from 2016 – 2040 to meet the country’s infrastructure needs (GIH, 2021[4]). These investments are required in the energy, telecommunications, transport and water sectors with energy accounting for the largest share at 42% of total investment needs in infrastructure. Based on current investment trends, the country is on its way to reaching infrastructure investments of about USD 503 billion with an investment gap of about USD 102 billion. Filling this gap will require an improvement in the overall investment environment for infrastructure to attract foreign investors and expand private participation in infrastructure development.

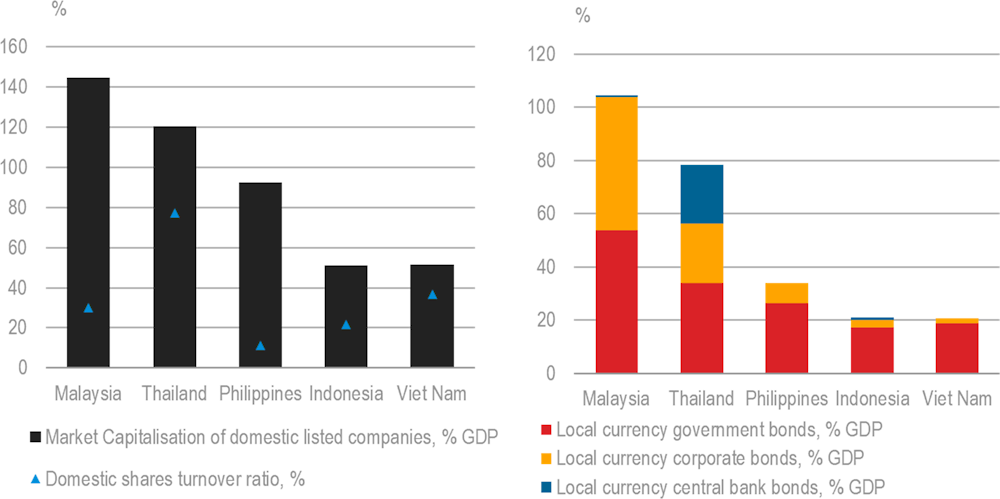

Development of capital markets could unlock additional financing for clean energy

Meeting the investment needs of the infrastructure sector will require an increase in the availability of long‑term capital and further development of Viet Nam’s capital markets. The country’s stock and bond markets are both significantly less developed than some of its regional peers (Figure 6.2) and represents an opportunity to shift savings from short-term deposits towards longer-term investments in bonds and equity. With significant investment needs in infrastructure development, a deepening of the capital markets is needed to attract long-term capital to finance these long-lived assets. Diversification of the bond market to stimulate more corporate bond issuances could help to widen the bond market that is currently made up almost exclusively of government bonds, with corporate bonds representing just 8% of the market. In 2018, the government issued Decree 163, which is the first corporate bond framework to support corporate bond issuances. Regional neighbours such as Malaysia, Thailand and to a lesser degree the Philippines have issued corporate bonds to support financing needs of the private sector.

Figure 6.2. Further expansion of capital markets needed to increase access to long term capital

Regulatory barriers have created obstacles to the creation of a liquid corporate bond market as issuances via private placement are much easier and less costly, making the public bond market less attractive. Private placements require less disclosure to investors and are quicker than those of a public offering and hence corporates have tended to issue corporate bonds via private placements. Decree 163 also prohibits the resale of corporate bonds issued via private placements for one year. With limited disclosure requirements for private placements, concerns have risen that these bonds could come to the market without sufficient information that would provide for retail and public investor protection.

Equity markets in Viet Nam have performed well with the Ho Chi Minh Stock Index rising 240% since 2015 compared to the FTSE ASEAN All-Share Index falling 7% over the same period. Viet Nam’s stock market as a share of GDP reached over 50% in 2019, similar to Indonesia, but well below other regional peers such as Malaysia, Thailand and the Philippines where the stock market capitalisation is near or well above 100% of GDP (Figure 6.2). Although total capitalisation is comparatively low, the secondary market is relatively active and behind just Thailand in terms of domestic share turnover.

Growth of Viet Nam’s capital markets and banking sector will need to be accompanied by improvements in reporting and disclosure that are in line with international standards. While most major markets have adopted International Financial Reporting Standards, Viet Nam has yet to adopt such requirements. Lack of transparency and comparability in reporting practices poses additional risks to investors and will limit the potential growth of the market and can lead to higher financing costs.

Access and status of finance for clean energy

Unprecedented growth in rooftop solar in 2020 makes Viet Nam the 3rd largest solar market and 8th largest renewable market

Whereas other countries have struggled to meet roof top solar targets, Viet Nam in 2020 added an astounding 9.3 GW of rooftop solar capacity which boosted total investments in renewable electricity capacity to USD 7.4 billion, just ahead of France, making it the 8th largest renewable market last year (Bloomberg, 2021[5]). Two-thirds of this capacity (6 GW) was added in December, as developers rushed to complete projects to meet the deadline for the solar rooftop feed-in-tariff that expired at the end of 2020. The vast majority of financing for these projects have come from domestic banks (both state-owned and private commercial banks) with limited concessional investment made available from public sources (although some funds have been channelled into the sector through the Viet Nam Environmental Protection Fund and the Viet Nam Development Bank).

Table 6.1 . Top renewable energy markets by capacity investments in 2020

|

Country |

2020 Renewable energy capacity investment (USD billions) |

Change from 2019 |

|---|---|---|

|

China |

83.6 |

-12% |

|

United States |

49.3 |

-20% |

|

Japan |

19.3 |

10% |

|

United Kingdom |

16.2 |

177% |

|

Netherlands |

14.3 |

221% |

|

Spain |

10.0 |

16% |

|

Brazil |

8.7 |

23% |

|

Viet Nam |

7.4 |

89% |

|

France |

7.3 |

38% |

|

Germany |

7.1 |

14% |

|

India |

6.2 |

-36% |

|

Total |

303.5 |

2% |

Source: BNEF (2021)

Viet Nam’s rise to one of the largest renewable energy markets in just a short time frame demonstrates the role that incentives and in particular, feed-in tariffs (FITs) can play in establishing renewable energy markets but requires good planning to facilitate licensing and to ensure adequate grid development. The time bound nature of the ground mounted and solar roof top FITs created strong incentives for developers to accelerate project development to benefit from the attractive FITs and sent a strong signal to the market on the key role solar and renewables will play in the Vietnamese power sector. This however has created a solar boom that if not carefully managed could lead to a repeat of the boom and bust cycles seen in Europe as a result of changes to FITs. Viet Nam’s plans to shift to competitive auctions will need to be carefully designed and the country could learn from experiences in other countries (see chapter 5).

Many of the leading Vietnamese conglomerates such as BIM Group, Trung Nam Group and Xuan Cau Group as well as major ASEAN developers such as AC Energy (from the Philippines), Super Energy and B Grimm (from Thailand) have been among the leading developers of the solar market in Viet Nam. Financing of these projects has benefitted from strong balance sheets of project developers and existing relationships with local and regional commercial banks. Viet Nam’s top down central planning has also facilitated co‑ordination between its economic development strategy and that of its financial market strategy, with the benefit of preparing financial institutions on the need to integrate climate risks and support for environmental solutions including clean energy as part of lending practices. Further details on the greening of the banking sector and integration of sustainable finance regulations are outlined in the following section.

Attracting private sector investment and finance key to meeting future electricity needs

According to the draft power development plan (PDP) VIII released for consultation in early 2021, the Ministry of Industry and Trade (MOIT) estimates that cumulative investments in the power sector between 2021 and 2030 will need to reach an estimated USD 128 billon, of which USD 95 billion will be required for new generation capacity and USD 33 billion for grid expansion (Baker McKenzie, 2021[6]). Investment needs in the power sector over the 2031 to 2045 period rise to an estimated USD 192 billion (USD 140 billion for generation capacity and USD 52 billion grid development). These estimates do not include investments that will also be required in energy efficiency to help control overall electricity demand growth and thereby future power sector investment needs.

Under the draft PDP VIII, MOIT estimates that annual investment needs in electricity infrastructure for the next decade will reach an average of USD 12.8 billion per year, rising to USD 19.2 billion after 2030. In comparison, a World Bank study estimates that the government of Viet Nam has the capacity to finance about USD 15 to 18 billion in annual infrastructure spending out of a total demand for infrastructure investment of USD 25 to 30 billion (World Bank, 2020[7]). The government’s capacity to finance infrastructure is limited due to the legal public debt ceiling of 65% of GDP. Viet Nam was close to reaching this limit in 2016 but a tightening of fiscal management in recent years has effectively brought this down to 55% in 2019 (Figure 6.1).

This highlights the need to attract more finance from the private sector to meet Viet Nam’s growing demand for infrastructure and in particularly electricity infrastructure that will account for roughly half of total infrastructure spending. Private sources of finance have a bigger role to play in the financing of electricity generation and in particular renewable generation projects in Viet Nam (IEA, 2019[8]). The government is also exploring options to attract private investments in transmission given high capital expansion needs over the next decades. Despite the critical role for private capital in the electricity sector the government must also carefully consider the continued role of public finance, particularly for early phase technology deployment, with offshore wind a case in point, and for critical enabling infrastructure such as storage assets and network strengthening. Transmission network expansion and strengthening, as an example, has benefited greatly from the availability of overseas development assistance, particularly from Japan. This financing is contingent on government guarantees which are now rarely provided.

Viet Nam Electricity (EVN), the state-owned utility, has struggled to keep up with investments in grid expansion under the recent solar boom that has left a surplus of power in the central and southern region and insufficient network capacity to transmit power to the northern region where there is a shortage of power supply. In 2018, EVN received a standalone credit profile rating of BB by Fitch, equivalent to Viet Nam’s sovereign rating. The rating helps to facilitate future fund raising needs via the domestic and international capital markets to help ease public sector borrowing (including reducing the need for government guarantees). The outlook for EVN’s rating was recently upgraded from stable to positive, in line with the revision in Viet Nam’s sovereign outlook.

Domestic and regional banks have been the main source of financing for the rapid solar expansion in Viet Nam. International banks together with international developers, have played a relatively limited role, given international bankability concerns related to the power purchase agreements (PPAs) that domestic (and some regional) banks are more willing to accept. Consultations with financial institutions confirmed the willingness of domestic banks to increase lending to solar and onshore wind projects and interest in building capacity to evaluate offshore wind and energy storage projects with a view to potential financing of these projects in the future. De-risking mechanisms will be needed to support the first offshore wind and energy storage projects to help banks build experience and technical capacity. The scale and high capital costs of offshore wind projects will require a consortium approach to financing, with both domestic and international finance institutions from the public and private sector working together to address different risks in order to finance these projects.

Developing project finance structures could help to lower financing costs and increase capital availability

While liquidity in the financial market for solar and onshore wind is reasonably good, the cost of financing that is often above 10% is very high compared to OECD and other major economies where interest rates for renewable projects are closer to 5-6% (Coleman, n.d.[9]) (Steffen, 2020[10]). Projects have almost been exclusively financed through corporate finance with significant collateral requirements. This limits the capacity of project developer’s to raise adequate finance as firms are limited by equity availability. In more mature financial markets, non-recourse project finance with long tenures (15-20 years) is considered the norm and these attractive financing conditions have dramatically lowered renewable energy costs in these markets.

Project finance structures allow for a larger share of debt financing for projects that can lower the overall financing costs for projects. However, strong cash flow certainty is necessary and some risks can be difficult to mitigate unless covered by power purchase agreements that can address risks such as curtailment through take or pay structures or other guarantee mechanisms. Large project finance transactions in the energy sector have happened for the large build-operate-transfer (BOT) thermal power plants but these have been led by syndications with large international bank involvement. This has been made possible due to flexibility in negotiating PPA terms under the PPP laws and availability of government guarantee undertakings.

Vietnamese banks lack experience in structuring non-recourse project finance and underwriting based on renewable project fundamentals rather than on balance sheets. Regulation (Circular 22) also sets limits on long-term lending using short-term deposits, highlighting the need to improve access to long-term sources of capital. In addition, the high credit risk rating (SBV Circular 41) applied to project finance loans of 160% regardless of the underlying structure of projects creates a major barrier for non or limited recourse project financing. Standard Basel II guidelines applied in other countries provides for a project by project evaluation that allows for a lower risk weighting for projects demonstrating high certainty on project cash flows that are often provided through long term PPAs.

Energy efficiency projects developed by energy service companies (ESCOs) tend to be developed by relatively small firms with limited balance sheets and experience in financial structuring of projects. With little or no credit history, ESCOs often face additional challenges accessing finance including high collateral requirements from commercial banks that can exceed the value of the project and are often beyond the firms’ means. Support is needed through guarantee schemes aimed at de-risking projects or via dedicated energy efficiency funds. These funds should target projects with good replicability structures that address risks which the market currently is not able to adequately evaluate so that in the future, as these projects demonstrate their financial viability, the market can take over without the need for de-risking.

Improving data availability on energy efficiency loan performance and support to build technical capacity for energy efficiency project due diligence is also needed to better evaluate underlying project cash flows and savings. The development of standardised energy performance contracts can also facilitate project replication and aggregation as well as leasing business models that can help to improve project scale to levels that can increase the attractiveness of such projects for financial institutions.

Sustainable finance regulation, green banking and green bonds

Viet Nam’s sustainable finance policies are rooted in the National Action Plan for Green Growth (2014‑2020)2 and the National Strategy for Green Growth (2011-2020) that calls for the mainstreaming of green growth objectives within the financial sector and the development of green financial products. This strategy outlines the need to formulate mechanisms and policies to stimulate green practices among financial institutions and corporations. It identifies the need to use financial, credit and market-based instruments to encourage the development of a green economy and also signals the development of a greenhouses gas (GHG) emissions trading system as well as a carbon tax. The strategy also highlights the use of green credit, overseas development assistance and technical assistance to support the implementation of the country’s green growth strategy. The various regulations governing Viet Nam’s green banking policies are summarised in the timeline below (Figure 6.3).

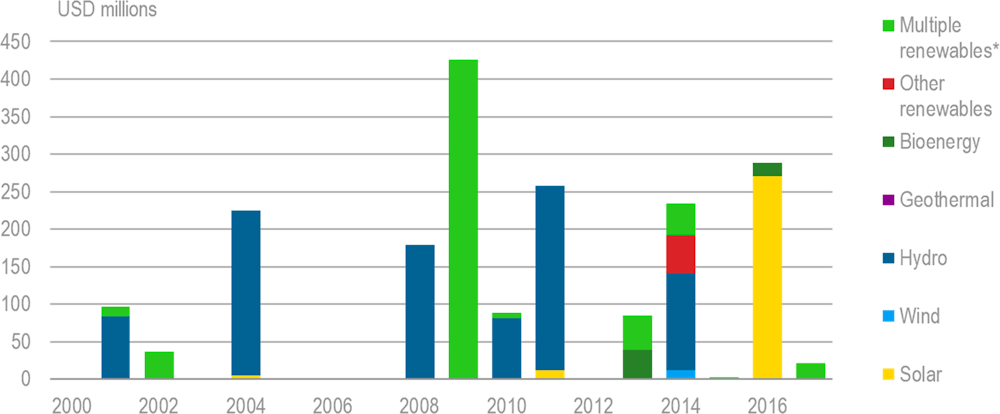

Figure 6.3. Summary of Viet Nam’s Green Banking regulation

Source: ADB 2021

The State Bank of Vietnam (SBV) has issued a number of sustainable finance regulations and policies to promote the availability of green credit and integrate environmental and social risks within lending activities of finance institutions. These include Directive No. 3 from 2015 that encourages the banking sector to consider a number of sustainable development issues within its lending practices such as environmental protection, energy efficiency, human health and improving environmental quality. The directive calls for an increase in lending towards activities that contribute to green growth and sustainable development objectives, including designing green lending policies for sectors such as energy efficiency and renewable energy.

Viet Nam’s green banking action plan

Decision No. 1552 from 2015 sets out an action plan for the banking sector to implement Viet Nam’s green growth strategy and has helped to raise awareness and build capacity among domestic financial institutions on green credit development and banking products. SBV Decision No.1604 GD-NHNN introduced in August 2018 approved a scheme for green bank development in Viet Nam. This scheme aimed to accelerate awareness and corporate responsibility within the banking sector to increase the credit available for environmentally sustainable projects including energy efficiency and renewable energy and aims to ensure that all banks will have developed internal procedures that support green banking. This includes building a strategic framework for green banking; establishing a comprehensive ESG risk management strategy; and developing an action plan to expand green banking activities.

Directive No 3. issued by SBV requires credit institutions to provide quarterly reports on green credit issuances and undertake environmental and social risk assessments and Circular No. 9050/NHNN-TD provides further implementation guidelines. The reporting framework covers 12 including clean energy and renewable energy. However, data is reported for the sector as a whole without details at the technology or sub-sector level. The State Bank of Viet Nam should consider further developing the reporting frameworks to include this level of detail and working with banks to improve green tagging. This is particularly critical for credit extended for energy efficiency which is commonly not distinguished from general corporate loans. Additional clarity is needed on definitions for green projects that align with international and ASEAN standards and hence a revision of the current green credit reporting format should be considered. The Ministry of Natural Resources and Environment (MONRE) has also been tasked with helping to lead the development of a green finance taxonomy to provide clearer definitions on qualifying green projects and close co-ordination with SBV and MOIT will be needed to ensure alignment with sectoral plans and policies.

Reports submitted by finance institutions to SBV, show a total of VND 46.6 trillion (USD 2 billion) in outstanding credit to renewable energy projects representing a mere 0.5% of loan portfolios among banks which submitted reports (ADB, 2021[11]). The directive also requires all credit institutions to formalise environmental and social (E&S) risk management and encourages the implementation of E&S risk management systems for lending activities that also includes regular monitoring of borrowers’ own E&S risk management processes and quarterly disclosures.

To improve confidence and help facilitate project due diligence for clean energy projects among financial institutions, additional monitoring and evaluation tools could be developed to facilitate the development of a comprehensive clean energy finance and investment database. Such a database would help to lower perceived risks by providing details on project performance that can reduce financing costs by allowing finance institutions to more accurately price risk. It would also help the government and development partners to better target interventions that could help mobilise private finance and investment to clean energy technologies that might require additional support. To start, the database could collect information on financing volumes, cost of capital and participants to help improve market transparency.

Viet Nam is committed to supporting the development of sustainable finance practices in the country and has implemented a comprehensive set of regulations targeted at ESG risk management practices. As a member of the Sustainable Banking Network, Viet Nam is engaging with financial regulators and banking associations in other countries to improve ESG risk evaluation practices and share international good practices on sustainable finance development.

Status of Green Banking in Viet Nam

Viet Nam has made impressive progress in establishing the country’s green banking framework and this has helped to increase domestic lending for clean energy projects by improving awareness among the banking sector and encouraged the development of targeted green lending products that has helped to facilitate access to domestic funding for clean energy projects. At the end of 2020, 36 domestic credit institutions held VND 333 trillion (USD 14.5 billion) in outstanding debt for green projects, mainly in agriculture and renewable energy projects (SBV, 2021[12]).

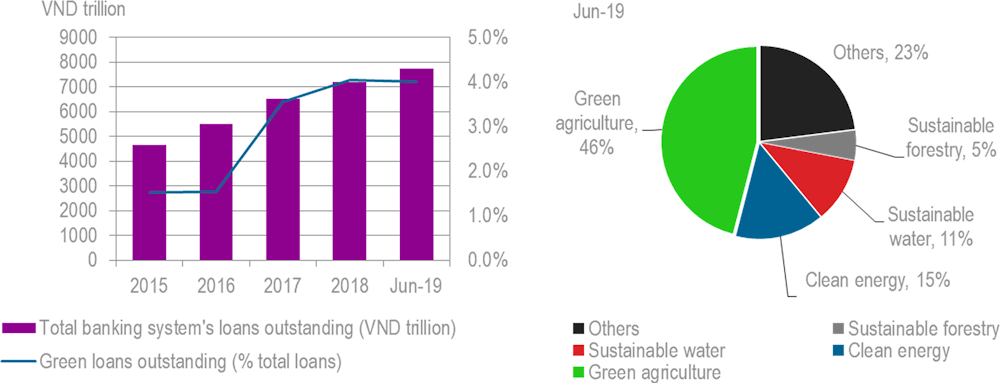

Data from the end of June 2019 shows that clean energy projects accounted for approximately 15% of the green lending portfolio in Viet Nam, the second largest after green agriculture which accounts for nearly half of all outstanding green credit (Figure 6.4). While lending to green projects has more than quadrupled between 2015 and June 2019, green credit still represents a very small share of total credit availability in Viet Nam reaching just over 4% in June 2019.

Figure 6.4. Green lending development in Viet Nam and breakdown by sector

Early success of SBV’s efforts to green the banking sector are demonstrated in the country’s impressive solar market development that was led by domestic developers and financed locally with regional developers and financing institutions also playing an important role. Ensuring sustained momentum for renewable energy investments and accelerating energy efficiency deployment will require continued efforts to promote green banking in the finance sector and awareness to overcome potential barriers created by efforts to improve and implement prudential regulation.

The roadmap outlined in SBV Circular 22 to delay the implementation of a lower maximum short-term to medium to long-term loans has been delayed by one year, as a result of the need to ease lending capacity to improve credit availability for firms to manage COVID-19 related business challenges. The gradual reduction from 40% to 30% by October 2023 outlined in the circular will effectively reduce the capacity of banks to provide medium and long-term credit and reduce credit liquidity in the domestic market. These prudential regulations are a necessary step to ensure financial sustainability of the banking system, but create additional challenges for financing clean energy projects and put pressure on banks to raise additional sources of capital to be able to increase financing.

The development of capital market vehicles, such as green bonds, and facilitating securitisation to refinance operational projects is one option to addressing liquidity issues. Financial market regulation will need to be developed to provide for a comprehensive green bond framework (green bond development is discussed below) and to also permit securitisation of existing loans. To date, refinancing remains limited and has mainly occurred through development banks such as the 2021 refinancing of the 240 MW Dau Tieng 2 solar power project 3and via state owned banks such as Vietcombank, BIDV and Agribank that have refinanced participating banks at lower interest rates.

Green bonds offer an attractive opportunity to raise long term capital at scale

Viet Nam’s green bond market remains relatively untapped with just two small municipal green bonds issued in 2016 by Ho Chi Minh City and Vung Tau. Listed on the Ha Noi Stock Exchange, these two pilot issuances raised USD 25 million and USD 4 million, respectively, to finance water infrastructure. Since then no other green bonds have been issued. A survey of commercial banks in Viet Nam undertaken by the Global Green Growth Institute (GGGI) in 2020, highlights the absence of a green bond framework as the main challenge in accelerating the green bond market in Viet Nam (GGGI, 2020[13]). This survey also highlighted the lack of internal procedures for green bond investments as well as insufficient project pipelines (green bond issuers) as other major obstacles.

Decree 163 released by the government in 2018 is the first legal framework for corporate bond issuances and supports Viet Nam’s 2017-2020 roadmap for the development of the bond market. While it encourages the use of corporate bonds for green projects, the decree lacks sufficient clarity on standardised definitions for green projects. Development of a comprehensive green bond framework will be a priority to establish the green bond market in Viet Nam and in addition to standardised definitions, should also include guidelines for issuances, a reporting framework and standards for disclosure.

The ASEAN Capital Markets Forum, has released Green, Social and Sustainability Bond Standards based on the ICMA’s Green, Social and Sustainability Bond Principles. As a member of this forum, Viet Nam should align any future green bond policies and definitions with this international standard. Many ASEAN member economies including Indonesia, Malaysia, Thailand and the Philippines have already raised billions in international financing via green bonds and Viet Nam should evaluate the potential of meeting the country’s long-term capital requirements via green bonds.

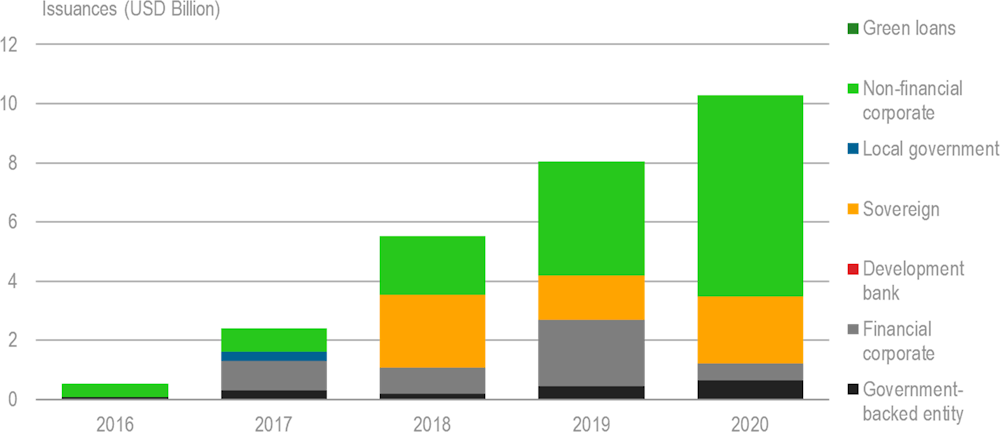

Green bond and loan issuances globally reached USD 258 billion in 2019, up over 50% compared to 2018. In ASEAN, 2019 also saw a big increase in green bond and loan issuances reaching USD 8.1 billion, a near doubling of 2018 levels (Climate Bonds Initiative, 2020[14]). Between 2016 and 2019, the region completed a total of 39 green bond/loan/sukuk issuances with a total cumulative value of USD 13.4 billion (Figure 6.5). The buildings and energy sectors accounted for two-thirds of all funds raised in ASEAN from green bonds and loans. In 2019, financial corporate issuances accounted for the largest share of funds raised at more than 29%, followed by non-financial corporates representing 27% and sovereign issuances at 15% of funds raised.

Figure 6.5. Corporates lead green bond and loan issuances in ASEAN

The development finance community could play an important role in helping Viet Nam to access long term capital via the international green bond market. This could be achieved through the provision of technical assistance for establishing a suitable green bond framework, preparation of issuances, capacity building for potential issuers, de-risking instruments (guarantees or debt subordination) to increase the attractiveness of issuances for international investors and through directly investing in the green bonds (OECD, 2021[15]). A number of development partners and multilateral development banks such as Asian Development Bank (ADB), World Bank (WB), GGGI in Germany and the UK are currently providing technical assistance to Viet Nam to support the development of the green bond market. ADB’s technical assistance is targeted at supporting Viet Nam in the development of its domestic green bond market which shows significant potential for growth and a good source of local currency finance.

In other markets, development finance institutions have played a key role in kick-starting the green bond market. Private investors new to a market are attracted by co-investing with DFIs as they often have strong political influence in the issuing country that can lower perceived risks. To attract the trillions held by international institutional investors will require significant scale (typically issuances of USD 500 million and above) and bonds denominated in hard currency. While Viet Nam’s clean energy sector represents a very attractive market for international investors looking for green investment opportunities, liquidity and hard currency requirements are challenging for most corporates and sub-sovereign issuers in the Vietnamese clean energy sector and may require involvement from the central government.

Indonesia’s green bond market has been driven by large sovereign issuances which have supported investments in clean energy projects among other green projects. To date the country has raised a total of USD 3.2 billion of green sukuk issuances, comprised of USD 2.75 billion from the three global issuances and USD 490 million (IDR 6.88 trillion) from the two domestic issuances. In addition to the above mentioned sovereign issuances, three financial institutions have also issued corporate green bonds. In November 2019, the government of Indonesia also issued the world’s first retail sovereign green sukuk raising IDR 1.46 trillion (USD 150 million) in the local market from retail investors. This success was followed by the second retail green sukuk issuance in December 2020, raising IDR 5.4 trillion (USD 557 million) that achieved the highest purchase volume and attracted the largest number of investors in the history of Savings Sukuk issuance. Millennials also accounted for more than half (56.7%) of the new investors attracted from this issuance. Indonesia’s experience developing its green bond market could provide useful lessons for Viet Nam as it considers developing this market (Box 6.2).

Box 6.2. Lessons from developing Indonesia’s green bond market

To support the implementation of Indonesia’s sustainable finance regulation and facilitate a shift towards sustainable finance products, Indonesia’s financial services authority (OJK) issued Regulation No. 60/2017 that outlines the conditions for green bond issuances in the domestic market. The regulation defines 11 eligible sectors (including renewable energy and energy efficiency) that qualify as a green project and is in line with both the Green Bond Principles and the ASEAN Green Bond Standards issued by the International Capital Market Association. Issuers are also required to report on the use of proceeds and environmental benefits from the projects must be reported and verified by an independent third party.

Indonesia was the first country to issue a sovereign green sukuk in 2018 raising USD 1.25 billion in the foreign bond market. While a green bond needs to meet certain environmental thresholds, a green sukuk must also comply with Sharia investment principles that go beyond environmental considerations to include other sustainability and well-being considerations as well as precluding certain investments that are not permitted under Sharia law. This first issuance was followed by subsequent issuances in 2019 and 2020 that raised a further USD 1.5 billion to fund green projects including energy efficiency and renewable energy projects. The 2020 Green Sukuk Issuance in the global market has made notable achievements including obtaining the lowest coupon rate for a 5 year tenor, oversubscription by 7.4 times and attracting a greater share of Green Investors (34% vs. 29% compared to the two previous issuances).

Indonesia has so far raised a total of USD 3.2 billion of green sukuk issuances, comprises USD 2.75 billion from the three global issuances and USD 490 million (IDR 6.88 trillion) from the two domestic issuances. In addition to the above mentioned sovereign issuances, a number of financial institutions have also issued corporate green bonds. In November 2019, the government of Indonesia also issued the world’s first retail sovereign green sukuk raising IDR 1.46 trillion (USD 150 million) in the local market from retail investors. This success is followed by the second retail green sukuk issuance in December 2020, raising IDR 5.4 trillion – which achieved the highest purchase volume and attracted the largest number of investors in the history of savings sukuk issuance.

Millennials also accounted for more than half (56.7%) of the new investors attracted from this issuance. While the amount was relatively small and the tenor short at just 2 years, it represents a number of important milestones in the transition towards more sustainable finance. First, it demonstrated that there is appetite for green bonds among retail investors and allows for a diversification of the investor base, particularly millennial investors who were the primary audience for this issuance; secondly, the issuance was completely done online using a platform developed in-house by the Ministry of Finance which paves the way for further issuances at relatively low costs demonstrating the capacity fintech can play in helping to reduce financings costs as well as to increase financial inclusion; and thirdly, it helped to raise awareness of the importance of investing in solutions to address climate change and the role individuals can plan in being part of the solution as minimum subscriptions to the bond were fixed at just IDR 1 million (USD 70) making the bond widely accessible to a significant portion of the population.

Role of development finance

Development finance institutions have been active in supporting Viet Nam in the development of its clean energy sector both in terms of providing technical assistance and financing energy efficiency and renewable energy projects. Multilateral development banks such as the World Bank and the ADB have been working closely with the government to provide technical assistance to policy makers, project developers and the financial sector to help strengthen the country’s clean energy ecosystem. A number of bilateral development banks including KfW (Kreditanstalt für Wiederaufbau), AFD (Agence Française de Développement) and JBIC (Japan Bank for International Co-operation) among many others are also financing clean energy projects and an overview of some of the major development finance programmes are highlighted in Table 6.2 below.

In 2017 the government of Viet Nam and international development partners created the Viet Nam Energy Partnership Group (VEPG) to strengthen co‑operation and exchange of expertise and knowledge on the energy sector. The objective of the VEPG is to facilitate more effective international support to help Viet Nam achieve its sustainable energy objectives. This is achieved by providing a platform for high level policy dialogues, a platform to align ODA with Viet Nam’s energy and climate objectives, a platform to coordinate technical assistance and through information sharing with partners. VEPG activities are undertaken through 5 thematic technical working groups covering renewable energy, energy efficiency, energy sector reform, energy access and energy data and statistics. Each group is headed up by two co-chairs representing MOIT and one of the development partners, which allows for more effective coordination and support among various partners to help meet clean energy priorities through targeted technical and financial assistance.

Table 6.2. Selected clean energy programmes with DFI support

|

Selected programmes |

|

|---|---|

|

ADB |

USD 100 million loan to finance municipal waste to energy project USD 37 million loan to finance 47.5 MW Da Mi floating solar project USD 116 million loan (of a total USD 173 million syndication) to finance 144MW of onshore wind Viet Nam’s first certified green loan of USD 27.9 million (of a total USD 186 million syndication) to finance 257MW solar project USD 24.5 million loan (of a total USD 160.5 million syndication) for refinancing 240MW Dau Tieng 2 Tay Ninh solar power project |

|

AFD |

€ 24 million loan to EVN to finance the Se San 4 solar pant and other planned loans to EVN for expansion of Laly hydro plant and grid strengthening |

|

IFC |

USD 57 million loan for onshore wind projects Phu Lac 2 and Loi Hai 2 |

|

JBIC |

USD 200 million credit line to Vietcombank for on lending to renewable energy projects |

|

EU |

€ 100 m grant for energy sector policy support and financing for energy access, renewables, energy efficiency and energy data |

|

EU |

Sustainable Energy Transitions programme - €142 m grant to support improved energy efficiency, increase the renewable energy mix and improve the energy information system |

|

KfW |

€14.5 million grant to provide a top up for solar and wind IPPs |

|

WB |

A number of grants covering renewable energy mapping, roof top solar PV development, solar auction design and implementation, and a USD 411 million mix grant/loan to support the Trung Son Hydropower project. the WB will also support the development of a commercial financing market for industrial energy efficiency investments with a USD 11.3 million grant in coordination with a USD 75 Million Green climate Fund guarantee to establish a risk sharing facility to scale-up commercial energy efficiency loans. |

Source: VEPG 2020 Project partner survey4 and (World Bank, 2021[16]).

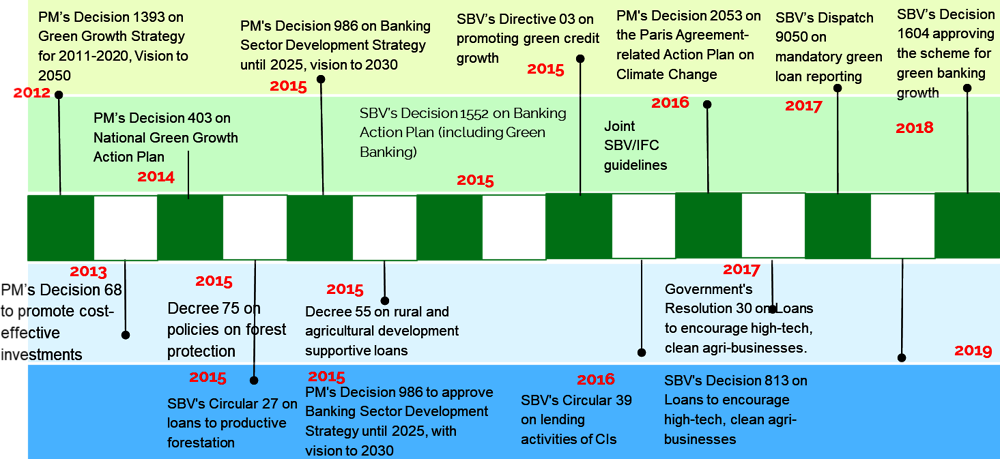

Between 2001 and 2017, development finance institutions supported nearly USD 2 billion in renewable energy projects with hydropower accounting for the largest share of funding over this period (Figure 6.5). As the bulk of the hydro potential in the country has now been developed, financing has shifted more recently to other renewable technologies such as solar and biomass. Solar in particular stands out in 2016 as receiving the bulk of DFI funding for renewable electricity generation. These early investments have helped to demonstrate solar power projects and increase confidence among domestic banks to lend to solar projects. In addition to the values shown below, DFIs have been a major source of financing for the expansion of the country’s transmission and distribution infrastructure.

Figure 6.6. Renewable energy financing by development finance institutions

As Viet Nam’s economy developed and attained lower-middle income status, ODA support for clean energy has shifted from grants and concessional lending to non-concessional loans and technical assistance. The recent expansion of the utility scale and roof top solar markets benefited from the availability of domestic and regional credit, with interventions from development finance institutions playing a role in a either very large projects such as the 275 MW solar project in Phu Yen Province or helping to demonstrate new technologies such as the 47.5 MW floating solar project in Binh Tuan Province. Both projects attracted international banks and also benefited from financing from ADB and by Leading Asia’s Private Infrastructure Fund, a special fund set up by ADB to provide co-financing for non-sovereign infrastructure projects and supported by development partners such as JICA.

Current clean energy development assistance programmes are relatively concentrated on renewable energy programmes with fewer programmes targeted at energy efficiency and less direct funding targeted at energy efficiency projects. While development finance institutions have been active in supporting energy efficiency, particularly industrial energy efficiency the current overall share of funding and number of individual projects is significantly less than for renewable energy projects. The small scale of the average energy efficiency project and diversity of actors makes it more challenging and the usual requirement for government involvement to access development funding also creates limitations. Options to overcome these challenges include dedicated on-lending programmes through domestic banks, government procurement for energy efficiency and financial support for energy service companies.

Viet Nam has offshore wind targets of about 3-5 GW of capacity to be added from 2030. With individual projects requiring investment capital of USD 2-3 billion, financing these projects will be beyond the capacity of domestic financing institutions (DFIs). Financing offshore wind will require a consortium of domestic and international banks with development finance institutions and export credit agencies supporting through the provision of guarantees to help de-risk the first projects. Other emerging clean energy technologies such as energy storage and waste to energy projects will also need support from DFIs as domestic finance institutions lack sufficient technical capacity and experience to finance such projects.

Although domestic banks have so far been very active in financing solar and wind projects, many have highlighted the lack of long-term capital as a major obstacle. Prudential regulation around short-term capital to medium and long-term debt, currently set at 30% will limit the sector’s ability to continuing meeting future clean energy financing needs unless the sector can raise long term capital. A number of DFIs are keen to support Viet Nam’s clean energy development and take advantage of their low cost capital to help finance projects through on-lending programmes to domestic banks. However, the reduction in issuance of sovereign guarantees due to the public debt management law has prevented wider use of on-lending of concessional debt to state-owned banks whereas on-lending to private commercial banks is often restricted to near commercial rates. This has so far limited the use of on-lending programmes as a way to increase long-term capital for clean energy projects.

Blended finance to unlock private capital

Blended finance mechanisms that use development funds to help catalyse private finance through various de-risking instruments including first loss and partial risk guarantees, co-investments and subordination among others has not been widely used in the clean energy sector in Viet Nam, although there is good experience for financing water infrastructure in the country5. Other blended finance mechanisms include grants for project preparation and project structuring. Development finance institutions could work with the government to develop a multi-donor blended finance platform, similar to the Sustainable Development Goas (SDG) One Indonesia Fund which has received commitments of about USD 3 billion.

The SDG One Indonesia fund is designed to use strategic development finance to crowd in private capital. One notable example for renewable energy includes the use of a grant from AFD to set up a first loss mechanism covering a maximum of 15% of the loan value for a mini-hydro plant that helped to de-risk and encourage other commercial banks to fund the project. The SDG One Indonesia Fund is implemented by PT SMI, a state-owned enterprise responsible for financing infrastructure projects. In the clean energy sector, PT SMI is developing a financing facility with funding from AFD to set up a dedicated USD 150 million loan facility that also includes an additional grant component (EUR 5.6 million) for technical assistance to support project preparation (AFD, 2020[17]).

For blended finance facilities to have the largest benefits, projects should focus on those with good catalytic potential that can help create markets. In particular, where there is opportunity for replicability and standardisation to help prove market viability and demonstrate new business and financing models for renewable energy or energy efficiency technologies that have yet to be established. As reflected in the OECD blended finance principles, blended finance should be deployed with a view to exit concessional finance and exit public development finance overall (OECD, 2018[18]).

In Viet Nam, blended finance funds could be targeted to support the creation of early markets for less mature clean energy technologies such as waste to energy, energy storage, energy efficiency in commercial buildings, low emission high efficiency cooling projects, among others. For energy efficiency projects, on-lending schemes have worked well in other countries such as Mongolia where the Mongolia Green Finance Corporation (MGFC) was set up under a green bank model with funds from the Green Climate Fund, the Government of Mongolia and a consortium of commercial banks. MGFC provides concessional funds for on-lending by banks and other non-bank financial institutions to blend with commercial funding for financing energy efficiency projects in the residential sector and for small and medium enterprises (MGFC, 2020[19]).

Dedicated finance facilities and institutional innovation to promote clean energy

The Viet Nam Environment Protection Fund (VEPF), under the Ministry of Natural Resources and Environment is a state-owned financing institution created to provide financial support for projects that support environmental protection and biodiversity. This includes the deployment of environmentally‑friendly technologies including energy efficiency and renewable energy. VEPF was set up with a capital of VND 1 trillion (USD 43 million) and receives its funding from the state budget and through environmental taxes. There are also discussions underway to allow VEPF to receiving funding from domestic and international institutions that could be an option for the setup of a dedicated blended finance facility as highlighted above.

VEPF provides concessional loans for environmental projects for a tenure of up to 10-years at a fixed rate of 2.6% per year for up to 70% of the total investment capital of a project with a limit that does not exceed more than 50% of the chartered capital of the fund. This equates to a maximum loan of about USD 22 million for any single project. VEPF can also co-finance projects, but has yet to do so. When initially established, VEPF’s mandate included the provision of guarantees to projects, although no guarantee structures were ever implemented and the prime minister’s decision outlining the fund’s operational mandate removed this option. Should the government and donors decide to set up a blended finance structure through VEPF, the ability to implement guarantee mechanisms should be reconsidered as this has been shown as one of the main advantages of blended finance in catalysing private capital.

The renewable energy sector, and solar rooftop projects in particular, is one of the largest sectors to receive VEPF funding with a total of VND 210 billion provided in 2019 and 2020 across 14 solar rooftop projects. In the future, VEPF plans to support rooftop solar, waste to energy and wind projects. While energy efficiency projects qualify for VEPF funding, none have yet been financed and should be considered as a priority in the future. The existing funding limit on individual projects poses challenges for reaching scale given the current sole financing model applied by VEPF and means that financing has so far been limited to small distributed renewable projects. A shift towards more co-financing and provision of de-risking could allow VEPF to be more active in the financing of utility scale renewable energy projects.

Other public financing institutions that can support clean energy projects include the Viet Nam Development Bank (VDB) which has a re-lending programme with funds provided by the European Investment Bank for climate mitigation in Viet Nam and also provides on-lending of ODA loans. Currently, these funds are only provided to state-owned enterprises and not available to support financing of private sector projects, which limits its potential to help scale renewable energy generation as the government has left the expansion of generation to the private sector and also for private investments in energy efficiency.

Green finance facility could help to unlock long term capital and build local capacity

A green finance facility could play an important role in overcoming barriers to raising commercial finance for clean energy projects by using public funds to crowd in private finance. The green finance facility (or green bank) model is designed to address market constraints in finance for climate investments. It uses concessional funding to blend public funds with private capital to build investor confidence and help lower financing costs for new technologies that offer climate mitigation or adaptation solutions. Financial instruments used by countries with green banks or green finance facilities include the provision of debt and equity finance, investing in green bonds, investment and creation of funds to co-deliver projects, concessional finance, on-lending facilities, credit enhancement via first loss or subordinated funding and tenor extension, reimbursable grants to help smaller project developers meet collateral requirements and green mortgages.

Green banks or green finance facilities typically establish products for repeatable financing of a target market and their objective is to mobilise finance from domestic finance institutions. They should focus funding towards commercial or near commercial projects (although some do support promising new technologies to overcome “valley of death” constraints related to technology deployment and reaching scale) that have a strong demonstration impact or potential for replicability to help build investor confidence and develop knowledge and expertise among local financiers. Finance should focus on additionally and pull in commercial finance which would otherwise not have funded a project.

Operational independence from the government can protect against political uncertainty that often comes with changes in government. Such independence can be achieved through the legal frameworks set up in the creation of the facility or institution. Through a programmatic approach, such a facility could also help address capacity gaps (lack of clean energy expertise) within the financial sector including for financial structuring that could also be supported with risk mitigation measures.

Where grants or concessional funding is used, such projects should have significant social impacts and benefits of low interest rates should be passed on directly to the project developer. Once a sector has reached maturity, the facility should phase out financing such projects and shift funding towards other promising sectors that are not able to access commercial funding. A detailed assessment of market needs should be undertaken to ensure that any new facility is well targeted and measures are designed to address suitable risks. Financing challenges linked to regulatory or policy barriers (such as land permitting or PPA terms) cannot be overcome by such a facility and should not be used in such situations.

There is potential to design such a facility to facilitate financing vehicles that could use targeted funding from development finance institutions that can help attract long term capital from international institutional investors either directly for large scale clean energy projects or via on-lending schemes through domestic finance institutions. The current high cost of debt in Viet Nam is an area where a green finance facility might help to lower financing costs through blended finance mechanisms that can use lower cost development finance to increase access to more affordable long term capital sources.

Many domestic banks in Viet Nam are already active in the utility scale and solar roof top market as well as onshore wind market. Such a facility could however help to build experience and capacity for emerging clean energy technologies such as energy storage, waste to energy and offshore wind projects where high individual project costs will require de-risking to be able to raise sufficient capital as well as for energy efficiency projects where project aggregation and standardisation could help facilitate financing.

References

[11] ADB (2021), Regional Technical Assistance Program on Green, Social and sustainable Bond Market Development.

[23] ADB (2020), Projects and Tenders, https://www.adb.org/projects (accessed on 22 December 2020).

[17] AFD (2020), Promoting renewable energy and climate investments through a green credit line to PT SMI, a key public financial institution of Indonesia, https://www.afd.fr/en/carte-des-projets/promoting-renewable-energy-and-climate-investments-through-green-credit-line-pt-smi-key-public-financial-institution-indonesia (accessed on 22 December 2020).

[6] Baker McKenzie (2021), Vietnam: Key highlights of new draft of national power development plan (Draft PDP8).

[5] Bloomberg (2021), What Does $500 Billion for Clean Energy Mean for Climate Change?, https://www.bloomberg.com/news/articles/2021-01-21/what-does-500-billion-for-clean-energy-mean-for-climate-change (accessed on 1 April 2021).

[28] Bold Magvan (2020), Mongolia Green Finance Corporation, https://www.slideshare.net/OECD_ENV/bold-magvan-mgfc-mongolia-green-finance-corporation (accessed on 18 December 2020).

[14] Climate Bonds Initiative (2020), ASEAN Green Finance: State of the Market, https://www.climatebonds.net/files/reports/cbi_asean_sotm_2019_final.pdf (accessed on 6 April 2021).

[9] Coleman, B. (n.d.), “Assessment of a Social Discount Rate and Financial Hurdle Rates for Energy System modelling in Viet Nam”, OECD.

[3] Denimal, F. (2020), Radical Steps Needed from Vietnam Banking Sector, https://www.regulationasia.com/radical-steps-needed-from-vietnam-banking-sector/ (accessed on 5 April 2021).

[13] GGGI (2020), Potential of Green Bond in Viet Nam.

[4] GIH (2021), Vietnam - Global Infrastructure Outlook, https://outlook.gihub.org/countries/Vietnam (accessed on 5 April 2021).

[20] HSBC, C. (2020), ASEAN Green Finance Report 2019: HSBC & Climate Bonds launch major analysis of green investment and policy directions in SE Asia | Climate Bonds Initiative, https://www.climatebonds.net/2020/04/asean-green-finance-report-2019-hsbc-climate-bonds-launch-major-analysis-green-investment (accessed on 6 April 2021).

[8] IEA (2019), Southeast Asia Energy Outlook 2019, https://www.iea.org/reports/southeast-asia-energy-outlook-2019 (accessed on 12 April 2021).

[25] JBIC (2014), Project Financing and Political Risk Guarantee for Sarulla Geothermal Power Plant Project in Indonesia, https://www.jbic.go.jp/en/information/press/press-2013/0331-19526.html (accessed on 22 December 2020).

[22] Keuangan, I. (ed.) (2009), Economic and fiscal policy strategies for climate change mitigation in Indonesia : Ministry of Finance green paper, Ministry of Finance, Republic of Indonesia : Australia Indonesia Partnership.

[19] MGFC (2020), Presentation by Bold Magvan, Mongolia Green Finance Corporation at OECD Focus Group Discussion on developing a green finance facility to catalyse private investment, https://www.slideshare.net/OECD_ENV/bold-magvan-mgfc-mongolia-green-finance-corporation (accessed on 1 July 2021).

[21] Ministry of Finance, I. (2020), Green Sukuk: Allocation and Impact Report, https://www.djppr.kemenkeu.go.id/page/loadViewer?idViewer=9468&action=download (accessed on 8 March 2021).

[26] Muhammed Sayed (2020), Climate Finance Facility, Development Bank of Southern Africa, https://www.slideshare.net/OECD_ENV/muhammed-sayed-dbsa-climate-finance-facility (accessed on 18 December 2020).

[15] OECD (2021), De-risking institutional investment in green infrastructure: 2021 progress update | en | OECD, https://www.oecd.org/environment/de-risking-institutional-investment-in-green-infrastructure-357c027e-en.htm (accessed on 5 July 2021).

[1] OECD (2020), Multi-dimensional Review of Viet Nam: Towards an Integrated, Transparent and Sustainable Economy, OECD Development Pathways, OECD Publishing, Paris, https://dx.doi.org/10.1787/367b585c-en.

[18] OECD (2018), Making Blended Finance Work for the Sustainable Development Goals, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264288768-en.

[12] SBV (2021), “Presentation on bank credit policy contributing to the implementation of green growth”.

[10] Steffen, B. (2020), “Estimating the cost of capital for renewable energy projects”, http://dx.doi.org/10.1016/j.eneco.2020.104783.

[27] Sylvester, B. (2020), About the Clean Energy Finance Corporation, Clean Energy Finance Corporation, https://www.slideshare.net/OECD_ENV/bianca-sylvester-cefc-about-the-cefc-experience-setting-up-a-green-finance-facililty-in-australia (accessed on 18 December 2020).

[24] US International Development Finance Corporation (2019), Information Summary for the Public PT Energi Bayu Jeneponto.

[16] World Bank (2021), Green Climate Fund provide Vietnam with US$86.3 million to spur energy efficiency investments, https://www.worldbank.org/en/news/press-release/2021/03/08/wb-gcf-provide-vietnam-with-us863-million-to-spur-energy-efficiency-investments (accessed on 7 May 2021).

[7] World Bank (2020), Vibrant Vietnam Forging the Foundation of a High-Income Economy Main Report, https://www.mendeley.com/reference-manager/reader/6ed9f731-3ca4-3612-aa71-6e44bbfd64c8/62e8a610-2cba-9619-5bc4-e9e19d214633 (accessed on 12 April 2021).

[2] World Bank (2019), Unlocking capital markets for Vietnam’s future development FINANCE IN TRANSITION.

Notes

← 1. Decision 1604/QD-NHNN (2018) on approval of the green banking development project in Vietnam. https://www.vir.com.vn/green-banking-aims-push-forward-63006.html.

← 4. A full list of development partner programmes is available VEPG website.