This chapter presents current trends in energy efficiency in Thailand’s building and cooling sectors and examines the policy and regulatory framework and targets for energy efficiency in buildings and cooling appliances. It also provides an overview of the key business models for energy efficiency projects in Thailand, as well as an analysis of the main financing barriers and regulatory challenges. Based on a set of case studies of financing instruments deployed in other countries, the chapter also presents a series of potential financing models that could be explored in Thailand to mobilise financing and investment for energy efficiency buildings and cooling systems, such as energy savings insurance, green bonds, on-bill financing, bulk procurement and green mortgages. The chapter ends with recommendations for the Government of Thailand and key Thai stakeholders across three key pillars: (i) financial support; (ii) policy, regulation and governance; and (iii) capacity building, data collection and awareness-raising.

Clean Energy Finance and Investment Roadmap of Thailand

4. Unlocking finance and investment for energy efficient cooling and buildings

Abstract

The buildings sector has a critical role to play in meeting global decarbonisation ambitions. The IEA estimates that energy consumption in buildings accounted for 30% of global final energy demand in 2022 and 26% of emissions (including 8% of direct emissions, such as from gas heating and cooking, and 18% of indirect emissions from consumption of electricity) (IEA, 2023[1]). Space cooling, particularly the use of air conditioners (ACs), is showing the fastest growth in final energy consumption among building end-uses. Emerging markets and developing economies (EMDEs) are experiencing the most significant increase as the stock of ACs is set to double by 2030 due to rising incomes and cooling needs in EMDEs.

In the Association of Southeast Asian Nations (ASEAN) region, where nearly a quarter of final energy consumption is dedicated to buildings, cooling demand is increasing rapidly. Between 1990 and 2020, electricity for space cooling in buildings multiplied by seven, reaching 80 TWh. Efficient cooling measures could help cut electricity demand in ASEAN by over a third by 2040 (IEA, 2022[2]).

Improved building design can reduce the need for cooling through natural ventilation, nature-based solutions and superior air sealing and insulation, which, coupled with efficient fans and smart devices, can already combat much of Thailand’s cooling needs. At the same time, where space cooling is used, increasing the efficiency of ACs, or developing district cooling solutions for groups of buildings or big commercial premises, such as office complexes, shopping malls, hotels, and hospitals, can moderate the pace at which energy demand and related GHG emissions increase. On-site consumption of distributed renewable energy such as rooftop solar photovoltaic (PV) systems can also help meet increasing demand. Several features such as battery storage, demand response ready equipment, and smart devices can also help to reduce peak demand from space cooling.

Current trends in energy efficiency for cooling in Thailand’s building sector

Demand for cooling in Thailand is increasing

Thailand has a warm and humid climate, averaging around 28 degrees Celsius and 75% humidity throughout the year. The climate is marked by three broad seasons, including a summer season from mid-February to mid-May, a rainy season until mid-October, and a winter season from mid-October to mid-February. The rainy season is influenced by a south-west monsoon wind, bringing warm, moist air from the Indian Ocean to Thailand, causing abundant rain. In the winter season, relative humidity drops to its lowest levels (70%) under a north-east wind bringing cold and dry air from the Chinese mainland (World Data, 2024[3]). Cooling demand is greatest in the summer months, where high levels of humidity amplify Thailand’s cooling needs. Mean maximum temperatures in Thailand have been rising steadily over the last decades, which suggests that rising temperatures will continue to drive increasing cooling needs (Figure 4.1) (Government of Thailand, 2021[4]).

Figure 4.1. Annual mean maximum temperatures in Thailand

Source: Ministry of Natural Resources and Environment (2022[5]), Thailand's long-term low greenhouse gas emission development strategy (revised version), https://unfccc.int/sites/default/files/resource/Thailand%20LT-LEDS%20%28Revised%20Version%29_08Nov2022.pdf

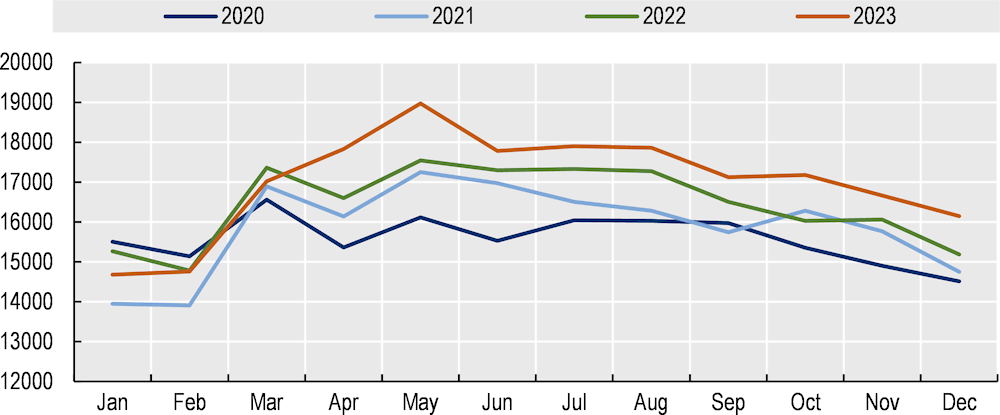

While there is increasing interest in efficient cooling strategies through green building design and district cooling, refrigerant-based AC systems remain the most accessible option to achieve thermal comfort in buildings. The summer months are marked a sharp peak in electricity consumption reflecting unbridled use of cooling systems, increasing year-on-year (Figure 4.2) (EPPO, 2022[6]).

Figure 4.2. Monthly electricity consumption in Thailand (2020-2023)

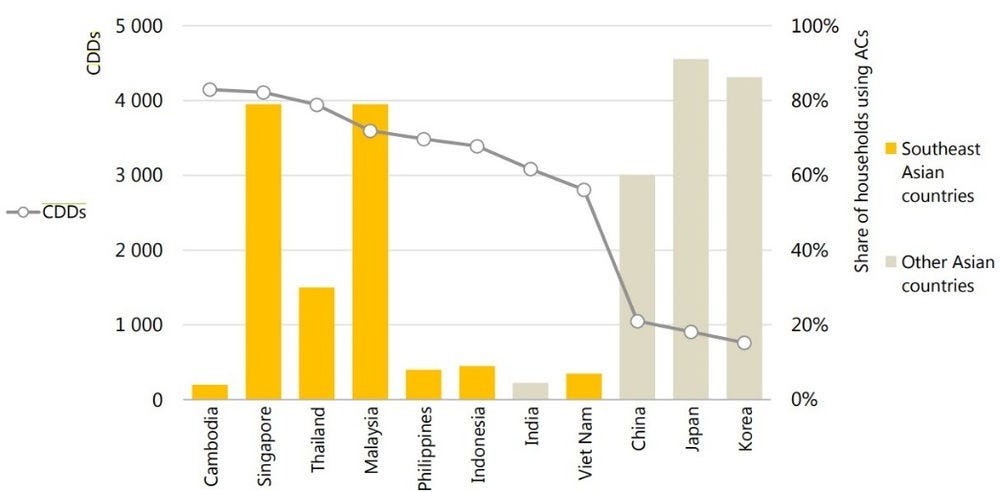

Thailand is seeing increasing cooling demand as incomes are increasing, tourism is booming and temperatures are rising. Already in 2019, the share of households using ACs was around one third, but this is much lower than in other Southeast Asian countries such as Malaysia and Singapore, which have similar cooling needs, measured in cooling degree days. In these countries in 2017, 80% of households used AC units, as opposed to roughly 30% in Thailand, pointing to increasing levels of AC ownership in the years to come as incomes continues to rise in Thailand (IEA, 2019[7]) (Figure 4.3).

Figure 4.3. Cooling degree days and share of households using air conditioning systems by country (2017)

Note: CDD = cooling degree days.

Source: IEA (2019[7]), The Future of Cooling in Southeast Asia, https://iea.blob.core.windows.net/assets/dcadf8ee-c43d-400e-9112-533516662e3e/The_Future_of_Cooling_in_Southeast_Asia.pdf.

Commercial and public buildings are seeing increasing electricity demand

The buildings sector represented on average approximately 25% of the total electricity consumed in Thailand in 2019 (EPPO, 2024[8]). Electricity consumption of the building sector has grown from roughly 27 855 GWh in 2009, to 49 128 in 2019, with an annual increase of 5.91% and has been the most rapidly increasing sector in terms of electricity consumption growth (Seeley and Dhakal, 2021[9]).

In 2018, shopping malls represented the single largest electricity consumed at approximately at 5 235 GWh, equivalent to 8% of the total electricity consumption of the building sector. Hotels and commercial office buildings were next with 4 363 and 2 966 GWh, respectively (Seeley and Dhakal, 2021[9]). It is projected that by 2036 the commercial building sector will consume approximately 175 000 GWh of electricity, with an estimated 425 649 kilotonnes of CO2 equivalent (kt CO2e) under a business-as-usual scenario (Seeley and Dhakal, 2021[9]).

Shopping malls have the highest energy intensity among commercial buildings in Thailand, estimated to consume roughly 295 kilowatt hours per square meter per year (kWh/m2/year). Hotels, which consume 255 kWh/m2/year, were second, while commercial office buildings consume approximately 225 kWh/m2/year (Seeley and Dhakal, 2021[9]).

Building design for many commercial and public buildings is ill-adapted to Thailand’s climate

Rapid urbanisation in Thailand drew from ideas and building materials from Europe and America, which can be ill-suited for the Thai climate. For example, many buildings did not feature overhangs or other features to provide shading, resulting in easy penetration of solar radiation. This is particularly problematic for office buildings that favour glass facades. Other types of building materials used for building envelopes typically include concrete and brick, which have a high thermal mass. This means that a large amount of heat is stored during the day, transferring heat both day and night (Tantasavasdi, Srebric and Chen, 2001[10]).

A recent study by JLL – a real estate investment consulting firm – measured the total stock of office space in Bangkok at 9.97 million square metres, of which nearly 70% represents buildings aged over 20 years (JLL, 2022[11]). This means that more than two-thirds of Bangkok’s office stock is classified as ageing, with a significant portion of these buildings poorly maintained compared to newer stock. This is causing challenges for building owners in post-COVID-19 times, as tenants tend to prefer premium office buildings due requirements for new hybrid working models and high maintenance costs for older buildings. Between 2022 and 2026, the Bangkok office market will see an additional 2.2 million sqm of new space. Of this, more than 1.7 million sqm or 81% will consist of prime grade developments (JLL, 2022[12]).

Good building design is a fundamental component to enabling thermal comfort for building occupants, for example through natural ventilation, thermal insulation and shading from direct sunlight to moderate temperature and humidity in interior spaces. Other approaches for large buildings include ground floor openings for cross ventilation and use the Box-in-Box concept that includes interior and exterior shell, where the zone between two facades can also act as a buffer area to cool down the air before entering to the building. These features are an important consideration for new constructions to avoid the same challenges of those built over the last decades. Retrofits provide significant opportunities to improve energy efficiency and reduce cooling needs, particularly via increasing thermal insulation of building envelopes.

In a study of 42 commercial building retrofits undertaken between 2011 and 2020 (mainly for heating ventilation and air conditioning), it was found that energy savings ranged from 6% to 31%. Hotels had the highest average energy reduction at just under 19%, with retail having a slightly lower average at 18%, and commercial office buildings at just above 15% (Seeley and Dhakal, 2021[13]). Other research in Thailand on office buildings in three cities in hot and humid summer zones found that natural ventilation was able to provide up to 30% energy savings. High-performance windows and installation of wall insulation were also seen to have created energy saving for cooling of an average of 12.4–15.1%. Other approaches such as horizontal shading devices could slightly save the cooling energy by approximately 2.7% (Lohwanitchai and Jareemit, 2021[14]).

Yet, as the main driver of electricity consumption in commercial and public buildings, besides building efficiency improvements the importance of high-performance ACs could not be underestimated. Building retrofits with high-performance ACs were seen to deliver total estimated electricity savings ranging from 38% for hotels to up to 58% for retail buildings (Seeley and Dhakal, 2021[13]).

Increasing sales of air conditioners in Thailand

There is a wide range of air conditioners (ACs) available on the market which vary enormously in scale and cost, from small (sometimes portable) devices designed to cool a single room to large-scale systems for entire buildings. Products include Split, variable refrigerant flow, Window, Chillers and others (Business Wire, 2022[15]).

There are two main types of ACs used in in large buildings in Thailand. A central cooling system through water chiller can produce cold water that is distributed to parts of the building. Heat from rooms is transferred to the cold water, which is returned to the water chiller for heat removal. Air temperature and humidity of each room are adjusted or set from a single control location. Some large buildings with several tenants also use split-type ACs, which provide total control on how to condition the air inside each room.

The split-type AC are most common in small buildings and consequently dominate AC market sales in Thailand. These include both wall-mounted split units and concealed split units. At larger capacities, standing, cassette and floor/ceiling units are more common. The figures below represent models available on the market. Cooling capacities are between 11 000 British thermal unit per hour (Btu/h) and 15 000 Btu/h are the most popular, with ACs under 15 000 Btu/h accounting for most of the sales, even though they represent only approximately 30% of the models available on the market (CLASP, 2019[16]).

For commercial buildings, the choice of AC unit depends on several factors, including the cost of system, ease of maintenance and size of project. For energy conscious developers requiring large systems this tends to be chiller systems, for medium this could be variable refrigerant flow, or else it could be many small-scale split systems. Only governmental and prestige projects are exploring water cooled, oil free systems which have the highest efficiency but are the most expensive.

Thailand has a large air conditioning manufacturing industry with a deep local supply chain (CLASP, 2019[16]). Systems with Seasonal Energy Efficiency Rating of up to around 4 W/W are widely available and are often locally manufactured. More efficient systems are also available (up to 6 W/W) but are not widely used. Thailand’s air conditioner (AC) industry is heavily export-driven. Almost 10% of the ACs manufactured worldwide come from Thailand, and the country is the second‑largest producer of air conditioners after China, thanks to its strategic location coupled with its manufacturing competency. In 2021, Thailand’s air conditioning industry was valued at Thai Baht (THB) 39 billion (USD 1.2 billion) almost on a par with 2020, compared with THB 36-37 billion (USD 0.99-1.07 billion) in 2019 (Jitpleecheep, 2022[17]).

Several international multinational companies have chosen Thailand to be their production site both to tap into the Thai market and to respond quickly to the demand for residential and commercial ACs from Asian markets. Manufacturers are also looking at energy efficiency as a strategy to increase market shares, with manufacturers working towards providing Wi-Fi enabled, higher efficiency inverter-based ACs, to fulfil the need for energy and cost-saving (Business Wire, 2022[15]).

Solar Photovoltaics (PV) can contribute to meet the rising electricity demand for cooling

Commercial buildings and factories in Thailand are increasing using solar PV for self‑consumption, given the falling cost of solar PV systems, emergence of innovative financing options and the potential to reduce electricity bills using solar power, as shown in Chapter 3. Solar PV can contribute to meeting rising energy demand for cooling with clean energy produced on-site as well as to achieving zero-energy building goals (Suntorachai, 2020[18]). However, it would be difficult to achieve zero-energy buildings relying primarily on PV in the rainy season, where the PV production capacity is relatively low under cloudy sky conditions and not matching evening load peaks, so other energy efficiency measures will be needed (Lohwanitchai and Jareemit, 2021[14]).

Solar PV for self-consumption in commercial buildings faces several other challenges, including limited space on rooftops. Furthermore, the timing of PV energy production (which spans from November to March) does not match AC cooling peaks (April to October) (Lohwanitchai and Jareemit, 2021[14]).

District cooling is becoming more commonplace in Thailand

District cooling, which is the distribution of cooling from one or more sources to multiple buildings, can be a cost-effective alternative to conventional AC systems as it leverages a centrally located chilled water plant to serve a cluster of buildings through a network of pipes. By aggregating the customers’ energy loads, the overall installed capacity can be lower than if each building used a separate cooling unit. The Thai district cooling market is dominated by absorption cooling and electric chillers. In 2021, absorption cooling, which uses heat waste rather than electricity (electric chillers) as the primary energy source, dominated the market. This further results in reduced cost of heating and cooling for facilities and increased energy saving during peak demand. An alternative means of district cooling is free cooling, using which uses external ambient temperature to reject heat (Data Bridge, 2021[19]).

District cooling projects have been developed in Thailand, mainly as government-funded projects or as prestige projects in the private sectors. For the private sector, projects have typically been developed by the land or building owner, an equity investor and a project developer. A number of district cooling projects are in operation in Thailand in governmental buildings, commercial building, industrial, hospital, airports, data centers and others (Table 4.1) (Vorasayan, 2021[20]).

The earliest project dates back to a government project in 2006 and according to the DEDE, district cooling is currently under development in most large business districts and mixed-use complexes. The commercial buildings sector is experiencing the largest growth due to ongoing district cooling projects in commercial buildings, including malls and corporate offices, greater focus on energy efficiency, and increasing expectations for better thermal comfort. The district cooling market is expected to grow to a United States Dollars (USD) 202 million market by 2028 (Data Bridge, 2021[19]).

Table 4.1. District cooling projects in Bangkok

|

Project |

Owner |

Description |

Technology |

Cooling capacity |

Year |

|---|---|---|---|---|---|

|

District Cooling System and Power Plant |

Electricity Generating Authority of Thailand (EGAT), Metropolitan Electricity Authority (MEA) and PTT Public Company Limited (PTT) |

Supply Electricity, Chilled Water and Steam to Suvarnabhumi International Airport |

110 MW combined cycle power plant using 2 sets of gas turbine generators for cooling and electricity generation. Cooling through electric Chillers and cooling towers. |

13 748 RT |

2006, upgraded in 2018 |

|

Chaengwattanna, Bangkok |

Government Complex |

Multiple Office Buildings, Convention Center |

Electricity used as primary energy source. Electrical Chiller, cooling tower, condenser water pump and chilled water pump. |

GFA 975,200 sqm 12 000 RT |

2009, 2013 |

|

Siriraj towards Medical Excellence in Southeast Asia |

State facility Siriraj Piyamahajkarun Hospital |

Multi Buildings Hospital Campus |

Chilled Water & Electricity |

GFA 238,000 sqm, 6,000 RT |

2012 |

|

Kasikornbank – Head Office Ratburana Office |

Kasikornbank |

Office Building |

Chilled Water & Electricity |

GFA 163,000 sqm 4,000 RT |

In operation |

|

The Forestias |

Magnolia Quality Development Corporation Limited |

Mixed Use Complex (e.g. hotels, offices, hospitals, retail) |

115 kV MEA electrical substation compressors |

GFA 750,000 sqm 10,000 RT |

Design Development / Construction 2024+ |

|

One Bangkok |

TCC Group |

Mixed Use Complex |

Chilled Water & Electricity |

GFA 1,830,000 sqm 38,000 RT |

Design Development / Construction |

|

CU Smart City |

Property Management of Chulalongkorn University (PMCU) |

Mixed Use Complex |

Chilled Water & Electricity |

GFA 842,000 sqm 18,000 RT |

Concept Development |

Note: Refrigeration ton (RT), Square meters (sqm), Mega Watts (MW)

Source: Vorasayan (2021[20]), Energy Efficiency and District Cooling in Thailand

There is growing interest in district cooling as a cost-efficient means of cooling commercial and public buildings. However, project development costs for district cooling are still relatively high.

Governance and planning of energy efficiency policies for buildings and cooling

The building sector’s contribution to Thailand’s draft Energy Efficiency Plan (EEP)

The Government of Thailand set a 20-year Energy Efficiency Plan (EEP) which aims to reduce energy intensity by 30% by 2037, compared to 2010 levels. Within the EEP, commercial buildings are expected to conserve 21,167 ktoe, by 2037 (Ministry of Natural Resources and Environment, 2022[5]). The commercial sector is expected to account for the largest share of energy efficiency improvements (41%). Policy measures contained in the EEP include minimum energy performance standards (MEPS), energy efficiency resource standards (EERS) and energy management systems in buildings.

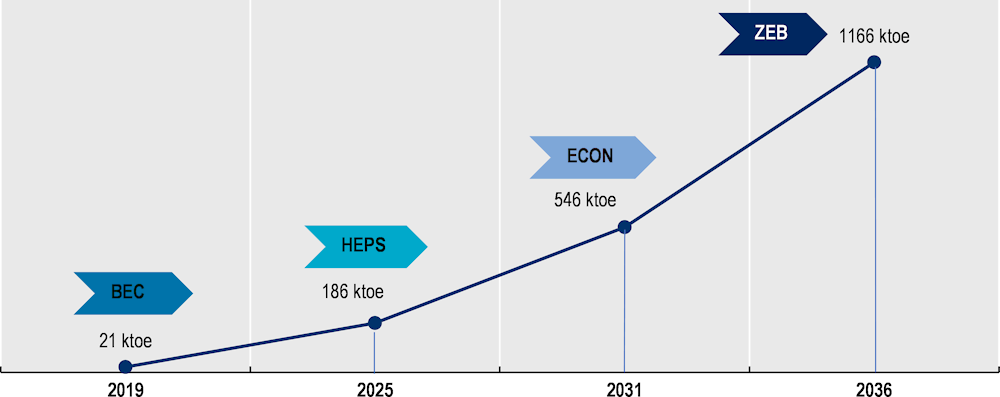

Thailand aims to reach Zero Energy Buildings in 2036, a type of building whose external energy supply is near-zero thanks to low energy demand on-site energy generation from renewable sources. In this scenario, office buildings are consuming around 57 kWh/m2 per year from a business-as-usual energy consumption of 219 kWh/m2 per year. Thailand also aims to implement High Energy Performance Standards (HEPS) by 2025, where office buildings consume 141 kWh/m2 per year via high efficiency standards of existing technology and systems, and to reach the Economic Buildings (ECON) category by 2031, where technologies and systems are developed to be more energy efficient (82 kWh/m2 energy consumption a year) but still cost effective (Figure 4.4) (Lohwanitchai and Jareemit, 2020[21]). The estimated energy saving of HEPS-type buildings amounts to 30-35% whereas for ECON it is 60-65% (Thailand's Ministry of Energy, 2020[22]). Concrete actions on how to implement the next steps of the roadmaps have not yet been determined.

Figure 4.4. Building Energy Code (BEC) Roadmap

Source: DEDE (2018[23]), Building Energy Code, https://seforallateccj.org/wpdata/wp-content/uploads/ecap17-thailand.pdf.

Institutional co-ordination and governance

The Department of Alternative Energy Development and Efficiency (DEDE)’s duties include energy efficiency promotion and energy conservation regulation. DEDE is responsible for developing Minimum Energy Performance Standards (MEPS) and high efficiency performance standards (HEPS), which designate the top performing products in the market. Although DEDE develops MEPS, the Thai Industrial Standards Institute (TISI), under the Ministry of Industry, is responsible for regulating MEPS. On the other hand, DEDE alone responsible for regulating HEPS.

The Department of Alternative Energy Development is also responsible for determining standards for the building energy code (BEC) but implementation of the BEC is under the Ministry of Interior, who oversees land management and public works. Review of permits for building construction therefore falls under the purview of the Ministry of Interior. Moreover, implementation of the BEC requires significant levels of co-ordination with local authorities across Thailand’s 76 provinces and one special administrative areas. Co-ordination between these agencies has led to some delays in the implementation of the BEC.

Energy efficiency policies for buildings

The Energy Conservation Promotion (ECP) Act B.E. 25351 of 1992 (amended in 2007) is the cornerstone of energy efficiency and cooling regulation in Thailand. It covers energy conservation in factories, buildings, machinery, equipment and materials, and listed AC as one of the specific methods of building energy efficiency. The ECP Act requires “designated” factories and buildings to conduct an energy audit. The ECP contains legal requirements for designated buildings to appoint a “person responsible for energy”, who is in charge of maintaining and monitoring efficiency of machines, improving energy use and helping to conduct energy management, amongst other duties (Thailand's Ministry of Energy, 2017[24]).

Minimum energy performance standards and labelling of cooling appliances

The Electricity Generating Authority of Thailand (EGAT) has had a pivotal role in the labelling programme for energy efficient products, with initial support from the World Bank and other donors. EGAT is responsible for developing monitoring and enforcing the voluntary labelling programme.1

Minimum Energy Performance Standards (MEPS) for room ACs were developed in 2002 and became compulsory standards in 2005. In 2009, HEPS for eight products, including water heaters, window glass, chillers, electric kettles, refrigerators, ACs, fans and rice cookers, were created. While MEPS focus on removing the least energy efficient products from the market, High Energy Performance Standards (HEPS) intend to stimulate the development and demand of higher energy performance products (Table 4.2). The Electrical and Electronics Institute of Thailand, an autonomous institution under the supervision of the Thai Ministry of Industry, which possesses three AC test chambers, conducts AC testing for the MEPS and labelling program (CLASP, 2019[25]).

ASEAN member states have explored options for harmonisation of MEPS while strengthening the existing ASEAN Roadmap Towards Sustainable and Energy-Efficient Space Cooling (ASEAN, 2023[26]; IEA, 2022[27]). Harmonisation of MEPS throughout the region could allow deeper integration of the air conditioning market and reduce barriers to trade including tariffs and inconsistent labelling and enable energy efficiency improvements in the buildings sector. As incomes grow throughout the region and appliance penetration grows, consumers and manufacturers alike will benefit from this (E3G, 2020[28]).

Table 4.2. Thai Minimum energy performance standards for air conditioners

|

Type |

Capacity |

EER |

|---|---|---|

|

Window type |

≤8 000 W

|

≥ 9.6 (Btu/hr/W) ≥ 2.82 (W/W) |

|

≥ 8 000 W ≤ 12 000 W

|

≥ 8.6 (Btu/hr/W) ≥ 2.53 (W/W) |

|

|

Split type |

≤ 8 000 W

|

≥ 9.6 (Btu/hr/W) ≥ 2.82 (W/W) |

|

≥ 8 000 W ≤ 12 000 W

|

≥ 9.6 (Btu/hr/W) ≥ 2.82 (W/W) |

Source: TISI (2011[29]), Thai Minimum energy performance standards for air conditioners, https://service.tisi.go.th/fulltext/2134_2553.pdf.

Labelling in Thailand is now well established depending on energy-saving performance, products are classified into five levels, with level 5 products having the highest level of energy efficiency. The EGAT level 5 label displays the product’s energy rating, estimated electricity bill cost (in THB per year), electricity consumption (in kWh per year), seasonal energy efficiency ratio, brand, model and capacity. However, there are different label requirements for inverter and fixed speed models. In 2019, EGAT updated the label to include 3 stars that go beyond the level 5 (Table 4.3).

The most efficient level 5 products are generally in line with HEPS which are established by DEDE. Though there is currently no HEPS for AC. Labelling also only covers units up to 12kW which leaves a gap in regulation of large units.

Refrigerants used in AC are not currently indicated by labelling (GIZ, 2021[30]). Thailand ratified the Montreal Protocol in 1989, aiming to phasing out the production and consumption of ozone-depleting substances. Thailand had yet to ratify the Kigali Amendment to the Montreal Protocol.

Table 4.3. EGAT No 5 labelling

|

Type |

Capacity |

No Star |

One Star |

Two Stars |

Three Stars |

Four Stars |

Five Stars |

|---|---|---|---|---|---|---|---|

|

Fixed speed

|

≤ 8 000 W |

13.17 – 13.70 |

13.71 – 14.23 |

14.24 – 14.77 |

14.78 – 15.30 |

15.31 – 15.84 |

≥ 15.85 |

|

> 8 000 W – 12 000 W |

12.56 – 13.12 |

13.13 – 13.69 |

13.70 – 14.25 |

14.26 – 14.82 |

14.83 – 15.39 |

≥ 15.40 |

|

|

> 12 000 W – 18 000 W |

10.00 – 10.59 |

10.60 – 11.19 |

11.20 – 11.79 |

11.80 – 12.39 |

12.40 – 12.99 |

≥ 13.00 |

|

|

Variable speed / inverter

|

≤ 8 000 W |

17.06 – 18.55 |

18.56 – 20.05 |

20.06 – 21.55 |

21.56 – 23.05 |

23.06 – 24.55 |

≥ 24.56 |

|

> 8 000 W – 12 000 W |

16.04 – 17.15 |

17.16 – 18.27 |

18.28 – 19.38 |

19.39 – 20.50 |

20.51 – 21.62 |

≥ 21.63 |

|

|

> 12 000 W – 18 000 W |

14.00 – 15.49 |

15.50 – 16.99 |

17.00 – 18.49 |

18.50 – 19.99 |

20.00 – 21.49 |

≥ 21.50 |

|

|

Variable Refrigerant Flow (VRF) |

≤10 000 BTU/hr |

14.00 – 15.49 |

15.50 – 16.99 |

17.00 – 18.49 |

18.50 – 19.99 |

20.00 – 21.49 |

≥ 21.50 |

Source: EGAT (2024[31]), Energy Efficiency Criteria

https://www.eppo.go.th/images/Infromation_service/public_relations/PDP2018/PDP2018Rev1.pdf.

Building energy code

While Thailand has building energy codes in place since 2009, only from 2021 did building energy codes become binding on state agency buildings. Over the past decade, the Building Energy Code (BEC) was revised to strengthen the code requirements (see Table 4.4 below) and the last updates strengthens enforcement on new and retrofitted buildings with floor areas equivalent to or exceeding 2 000 square meters. The Thai BEC is the key tool to ensure that buildings are designed to conserve energy, increase energy efficiency and reduce energy consumption and greenhouse gas emissions. The latest BEC prescribes better building practices for greener and more efficient buildings and has a greater focus on enforcement of BEC standards, with priority given to building capacity for auditing.

Table 4.4. Thailand’s Building Code revisions

|

Year |

Regulation |

Title |

Overview |

|

1992 |

B.E. 2535 Amended |

Energy Conservation Promotion Act |

Annual report regarding the energy usage and a plan concerning energy policy, energy training etc. to be submitted to the Department of Alternative Energy Development and Efficiency |

|

1995 |

B.E. 2538 |

Royal Decree on designated buildings |

Definition of designated buildings |

|

2007 |

B.E. 2550 |

Energy Conservation Promotion Act (No.2) |

|

|

2009 |

B.E. 2552 Repealed by B.E. 2563 |

Ministerial Regulation Prescribing the Type and Size of Buildings and Standards, Rules, and Procedures for Designing Energy Conservation Buildings |

Standards on building envelope, HVAC, lighting, water heating for construction or modification of buildings with the total area in all stories of 2 000 sq square meters or more |

|

2020 |

B.E. 2563 |

Ministerial Regulation Prescribing Type or Size of Building and Standard, Criteria and Procedures in Designing Building for Energy Conservation (Umeyama, 2020[32]). |

Standards on building envelope, electric lighting, air conditioning, water heating, whole building energy, and renewable energy system. |

|

2021 |

B.E 2564 |

Ministry of Energy’s Notification Prescribing Standard Values in Designing Building for Energy Conservation B.E. 2564 Ministry of Energy’s Notification on Criteria, Calculation Methods and Certification in Designing Building for Energy Conservation of Various Systems, an Overall Energy Consumption of Buildings and a Use of Renewable Energy Systems. |

Prescribes energy performance standards for different types of buildings as well as related technical standards. |

Source: Authors

From 2023 onwards, new buildings larger than 2000 m2 are required to achieve the BEC energy standard as a minimum requirement in the approval process. The BEC targets nine types of buildings, including exhibition buildings, hotels, entertainment services, hospitals, schools, offices, department stores, condominiums and theatres. Buildings can meet the standard by either passing energy performance standards for all four systems, which includes the building envelope, lighting system, air conditioning system and hot water generating system, or by passing the whole building energy performance and hot water generating system. If a building uses renewable energy, this is taken into consideration when calculating the energy performance of the building. Annex D provides further details on BEC standards and specifications.

Green building certification scheme

Green buildings are usually certified on the basis of voluntary green building certification programmes. The term “green building” refers to environment-friendly and eco-efficient planning, constructing, operating, renovating and demolition of buildings, with a view to energy saving, water efficiency, reduction of waste, reduction of carbon dioxide and pollution control. The voluntary green building certifications that are mostly used in Thailand are (Lorenz & Partners, 2020[33]):

Leadership in Energy and Environmental Design (LEED): it was developed by the U.S. Green Building Council and is used worldwide.

Thailand Rating Energy & Environment System: it was developed on the basis of the LEED and tailored to fit Thailand’s needs and circumstances.

Green buildings in Thailand mostly concern government projects or private sectors prestige projects. This is notably due to the higher construction and renovation costs for these buildings and low recognition of the resulting cost savings. Construction costs of green buildings exceed those of a standard building by approximately 20% (Lorenz & Partners, 2020[33]). Renovating a standard building into a certified green building would also exceed the simple renovation costs by roughly 30%. These costs can significantly dissuade building developers, despite the potential for long-term savings of 20‑30% on electricity and water supply expenses compared to a standard building, which will benefit building owners in the long run.

The regulatory framework for district cooling

There is no specific regulatory framework for district cooling (DC) in Thailand. Lack of awareness and knowledge also emerges as a barrier hindering the development of DC projects (APUEA, 2022[34]). Thailand’s DC market is dominated by absorption cooling and electric chillers, which are not governed by MEPS when over 12 kW. Guidance could be strengthened for DC to ensure that those systems are green and energy efficient as well as cost effective.

As an example, in 2023, the Bureau of Energy Efficiency of India, with support of development partners and research centres, developed District Cooling Guidelines, to provide guidance on planning, construction and business models for DC in India and identify roles of different stakeholders involved in decision-making processes of DC projects (GIZ, 2023[35]).

Business models for energy efficiency projects in Thailand

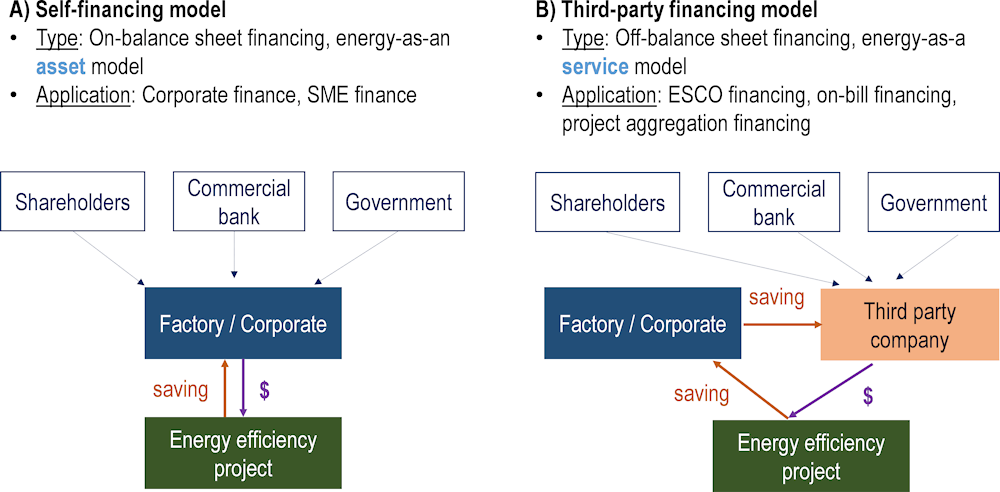

There are two key business models for energy efficiency (Figure 4.5 below):

Self-financing model: Under the self-financing model, businesses finance energy efficiency projects through the savings generated by those projects. With this form of on-balance-sheet financing, the building owner typically borrows money from a bank and/or uses its own equity to buy and install the energy efficiency device. The energy savings resulting from energy efficiency measures are used to pay for their costs, making the projects self-sustaining over time. The business can be financed by a third party (e.g. shareholders, commercial banks or the government) but the financing obtained would be booked on the corporate’s balance sheet (on-balance-sheet model).

Third-party financing model: Under the third-party financing model (or off-balance sheet financing model), businesses can finance energy efficiency projects through a third-party, such as energy service companies (ESCOs). The third-party financing entity provides upfront capital to finance the project and the client/business will then share some or all monetary savings generated by the project with the ESCO as a repayment for the delivered services over a defined period of time.

Figure 4.5. Business models for energy efficiency

Source: Authors

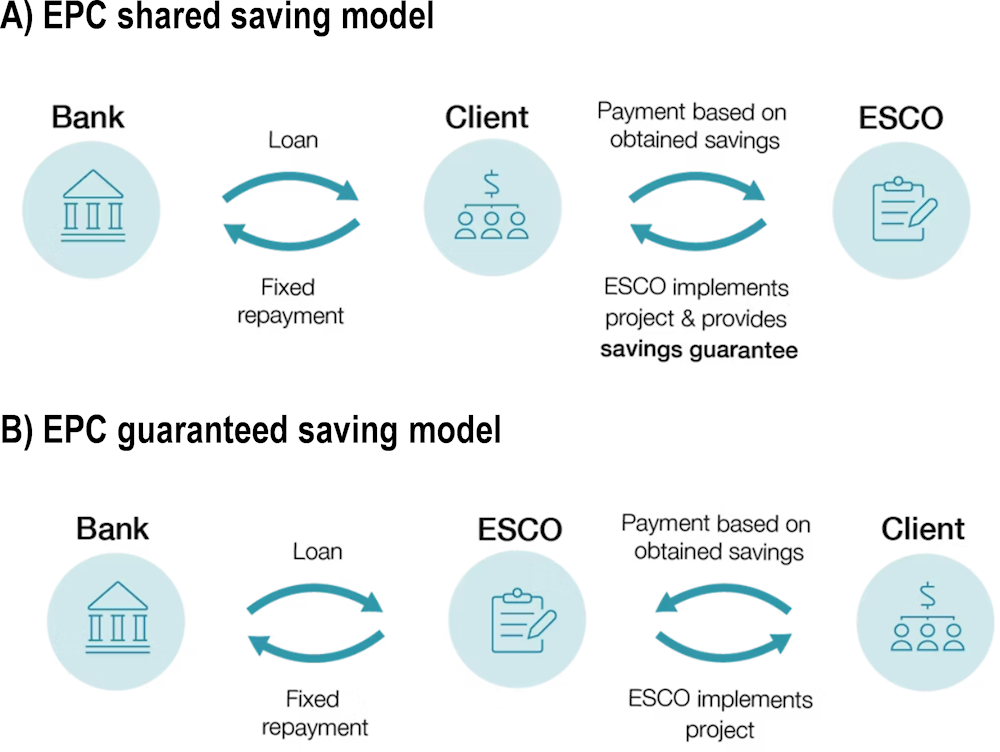

Energy Performance Contracts (EPCs) are often used to finance energy efficiency projects. EPCs are contracts in which the ESCO is paid based on the realisation of energy or cost savings and transfers certain risks away from the customer. Two common types of EPC models include (IEA, 2018[36]) (see Figure 4.6):

The EPC shared savings model – an off-balance-sheet model whereby the ESCO provides the financing as well as project development and implementation services and agrees with the client on sharing the realised energy savings over a defined period of time. Under this model, the ESCO is taking on technical, financial and credit risks, which can be valuable to the client as it avoids the need for upfront capital costs, with ongoing payments to the ESCO based on the savings obtained.

The EPC guaranteed savings model – an on-balance-sheet contractual agreement whereby the ESCO guarantees a certain savings on the client’s energy bill. The client obtains third-party capital, e.g. a bank loan, or uses their own equity, to pay contractually determined fees to the ESCO and the bank, and keeps the difference. Under this model, the ESCO does not provide finance to the client and only bears the technical (energy performance) risk.

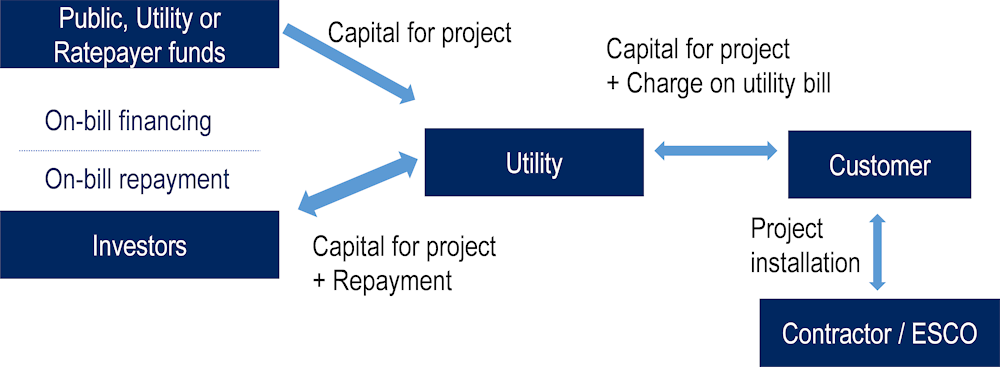

On-bill financing (OBF) is also an effective instrument to incentivise energy efficiency investments. OBF is a mechanism in which the financing entity, typically a utility or financial institution, provides upfront capital to fund energy efficiency measures. The business repays the financing over time through a surcharge on its utility bill.

ESCOs are key players in Thailand’s energy efficiency financing landscape and Thailand’s ESCO market is dynamic and fast-growing. In 2012, the Thai ESCO Association was founded, tasked with establishing an accreditation process for registered ESCOs and fostering ESCO activities across Thailand, such as training, capacity building and other initiatives to increase the development of the overall Thai ESCO market. As of October 2023, there are 27 ESCOs registered as members with Thai ESCO Association.

The dominant ESCO business model in Thailand is the EPC guaranteed savings model (Ablaza, Liu and Llado, 2020[37]). Thailand is one of the countries with the highest presence of private companies among ESCOs’ client base, as nearly all Thai ESCOs generate their revenues from private clients (UNDP, 2023[38]).

Figure 4.6. Types of Energy Performance Contract (EPC) models

Source: IEA (2018[36]), ESCO contracts, https://www.iea.org/reports/energy-service-companies-escos-2/esco-contracts.

Financing barriers and regulatory challenges

Finance

ESCOs face challenges in accessing finance for energy efficiency projects

Most ESCOs in Thailand are of small size. Currently ESCOs mainly operate within a business model where the customer finances the energy efficiency investment directly (guaranteed savings) and so far the shared savings model has been rarely applied in Thailand (Seeley and Dhakal, 2021[9]). Interviews conducted for this report revealed that this is mainly due to the fact that ESCOs still face severe barriers in accessing affordable financing for energy efficiency projects, which are often perceived as too risky by commercial banks. Many ESCOs in Thailand also have low capitalisation and can thus offer low collateral to banks. In addition, many commercial banks are not familiar with energy efficiency technologies and ESCO’s business model as energy efficiency projects involve uncertain revenue streams, making traditional financing evaluation methods inadequate. Therefore, banks often find it challenging to evaluate revenue streams or cash flows derived from energy savings. Moreover, demand for ESCO services is still relatively low due to limited understanding of the ESCO business model by the private sector (Ablaza, Liu and Llado, 2020[37]).

Thailand's efforts to boost energy efficiency financing through national initiatives have spurred commercial banks to introduce products for both energy efficiency and renewable energy projects, yet limited access persists for MSMEs due to creditworthiness constraints.

As mentioned in Chapter 1, the Department of Alternative Energy Development and Efficiency (DEDE) under the financial support from Energy Conservation Promotion Fund (ENCON Fund), established the ESCO and the Energy Efficiency Revolving Fund to encourage private investments in renewable energy and energy efficiency projects which are viable, but lack project finance.

The EERF and ESCO revolving funds have been hailed as effective tools for bolstering commercial lending, especially at their inception when commercial banks were unfamiliar with energy efficiency (EE) and renewable energy (RE) projects. The EERF succeeded in stimulating the appetite of commercial banks in energy efficiency financing and creating connections between private financiers and ESCOs (Frankfurt School - UNEP Collaborating Centre for Climate & Sustainable Energy Finance, 2012[39]). The ESCO revolving fund notably played a pivotal role in financing Thailand's first commercial solar farm. Government support for these funds extends beyond financial aid, encompassing valuable technical assistance.

As the fund periods draw to a close, commercial banks have responded by introducing a range of products aimed at promoting energy efficiency and renewable energy initiatives. This proactive approach has significantly increased accessibility to financing for energy efficiency and renewable energy projects, particularly among large companies. However, most of the projects financed under the EERF tended to be large projects and many small and medium-sized enterprises (MSMEs) still face challenges accessing financing due to issues related to creditworthiness. Moreover, these funds were channelled mainly through few large Thai commercial banks, whereas uptake from other banks outside of the programme was limited. Most banks suspended the loan product during the gap in the concessional funding that occurred between different phases of the Funds. Moreover, the EERF received limited marketing and promotion, and frequent staff changes within banks increased communication costs (ACE and GIZ, 2019[40]).

The ESCO Fund also had low up take. Requirements on equity were stringent, which maxed out ESCO borrowing capacity very quickly. ESCOs were not financially strong enough to raise equity portion which was around 25%. ESCO lending was also limited due to high collateral requirements.

The economics of energy efficient building retrofits in Thailand are positive but widespread adoption is still limited

In Thailand, over the last decade various retrofitting initiatives and case studies of implemented projects demonstrate that in commercial buildings energy consumption is typically reduced by approximately 15 to 20% by energy efficient retrofits. Improving the efficiency of the Heating Ventilation and Air Conditioning (HVAC) system alone can often deliver savings of between 10-15%of a commercial building’s total energy consumption. These projects had an average payback period ranging between 4 to 5 years. However, although these findings demonstrate the positive economics of retrofits and could be sufficient to instigate widespread adoption, this has not yet taken place (Seeley and Dhakal, 2021[13]). This points to the need for stronger policy to drive investment in retrofits.

Recent concern over office vacancy during the COVID-19 period has had positive impacts on retrofits, which are seen as means of increasing the competitiveness of buildings on the market. The current market is showing that retrofits have the potential to maintain occupancy rates above 80% and generate rental increases of up to 20% compared to pre-enhancement. The costs of retrofits typically range between USD 850 000 and 5.8 million (THB 30 million to 200 million), while redevelopment typically costs up USD 28 million (THB one billion). LEED-certified standard, which requires higher investment, is also being targeted by some investors as these are more attractive to major multinational corporations and will have higher energy savings (JLL, 2022[12]).

Misaligned incentives of market participants deter investment in green buildings

High upfront costs, a mismatch between the life of the asset and its holding period in a portfolio, and misplaced incentives of market participants can deter investment in green buildings (ADB, 2020[41]).While owners and occupants directly benefit from the cost savings associated with energy efficiency measures, developers are hesitant to bear large upfront costs of construction. Landlords have low incentives to invest energy-efficiency measures as long as the tenant is paying the utility bill.

Mismatch between the longevity of buildings and the time horizon of real estate investment portfolios

Another reason for the financing gap for green buildings is the mismatch between the longevity of buildings and the relatively short holding periods for real estate assets in investment portfolios (ADB, 2020[41]). For instance, while the lifespan of a building is 70 to 100 years, financiers hold real estate assets mostly for 7 to 10 years while building owners hold them for 10 to 15 years. Moreover, the buildings sector is also subject to high and unpredictable climate risks and hazards.

Regulation and implementation

The AC labelling system only goes up to 12 kW AC units, whereas commercial AC unites are as large as 16 to 18kW. Labelling does not extend to large commercial systems. There is a need to expand labelling for commercial projects to use higher efficiency systems. Without adequate requirements, project developers will pick the lowest cost system, as they are not responsible for consumption costs.

One regulatory tool to promote and facilitate investment in energy efficient cooling appliances would be to develop a high-performing Energy Efficient Technology List (EETL), with appliances and solution providers that have been pre-approved as eligible for financing from partnering financial institutions. The pre-approved equipment would meet defined minimum energy performance requirements as well as safety standards and surpass prevailing market practices to ensure the desired outcomes in terms of energy savings and co-benefits achieved. Performance requirements for technologies are regularly updated to reflect market developments. This tool could be made available through an online platform such as the European Bank for Reconstruction and Development (EBRD)’s Green Technology Selector, which offers a shopping‑style platform that connects vendors of best-in-class green technologies with businesses and homeowners (EBRD, 2024[42]).

Partnerships with international and local financial institutions can ensure that financing with favourable conditions or tax incentives are made available to businesses and homeowners that want to invest in pre-approved equipment already contained in the EETL. Even without direct collaboration with financial institutions, lists of energy efficient technologies can be used as effective information and procurement tools. An example for such an EETL was published by the Indian Bureau of Energy Efficiency in 2023, containing information on energy efficient technologies with their sectoral applicability, savings potential, estimated investment costs as well as typical payback times, annual monetary savings potential and typical equipment capacity (Bureau of Energy Efficiency of India, 2023[43]).

Governance

Institutional co-ordination remains a challenge for effectively enforcing and promoting energy efficient cooling standards in Thailand. Implementation of the Building Energy Code (BEC) falls under both DEDE and the Ministry of Public Works. There has been a lengthy delay in enforcement of BEC between 2009 and 2017 due to co-ordination challenges.

The implementation plan towards Net Zero Building is not yet in place. There is no clear plan to incrementally increase stringency of MEPS on space cooling and other standards in building codes. Clearer milestones would help to build momentum. A cooling action plan is needed to establish a systemic approach with clear milestones and priorities for the building envelope, AC standards and district cooling.

Financing models for mobilising finance and investment for energy efficient buildings and cooling systems

Blended finance mechanisms including technical assistance can de-risk energy efficiency projects and thus mobilise commercial finance and investment. Blended finance instruments can take the form of first loss or non-payment guarantees as well as project preparation support to improve the capacity of project developers and financial institutions to improve access to both domestic and international debt finance.

Based on stakeholder consultations, the Roadmap focuses on a set of potential financial instruments that were highlighted as having a high potential to mobilise private investment for energy efficient buildings and cooling systems, notably: energy savings insurance (ESI), green bonds for buildings, on-bill financing (OBF), bulk procurement for energy-efficient appliances and green mortgages. Several of these financing mechanisms are applicable to both energy efficient buildings and energy efficient appliances, which go hand-in-hand as enhancing building efficiency would reduce active energy needs (including for cooling).

Some of these mechanisms (namely, ESI, OBF and bulk procurement) were developed as fully-fledged and detailed case studies in Annex B. The choice of the case studies was based on consultations and interviews with a wide range of stakeholders on challenges and barriers for attracting financing in the two sectors in Thailand.

Energy savings insurance (ESI) model

One of the barriers to implementing energy efficiency projects in Thailand is the uncertainty about their performance. An energy savings insurance (ESI) model directly addresses this challenge by insuring the projected savings. With such an insurance product, ESCOs can back their contractual guarantees for the performance of their products and clients can be assured of compensation in case the projected energy savings are not realised. In addition to addressing scepticism regarding technology providers' claims, the ESI model alleviates the challenge of accessing financing for energy projects. Implementation of the ESI model could significantly ease barriers to investment in energy efficiency for Thai firms.

The ESI model was first developed by the Inter-American Development Bank (IDB) in Colombia in 2014, with the support of Basel Agency for Sustainable Energy (BASE), as a mechanism to build investor confidence and improve access to low-cost finance for energy efficiency projects. Since its conceptualisation, the ESI model has been replicated in many other countries worldwide, usually in co-operation with National Development Banks. See Annex B below and (OECD, 2023[44]) for an overview of previous and ongoing ESI programmes in other countries.

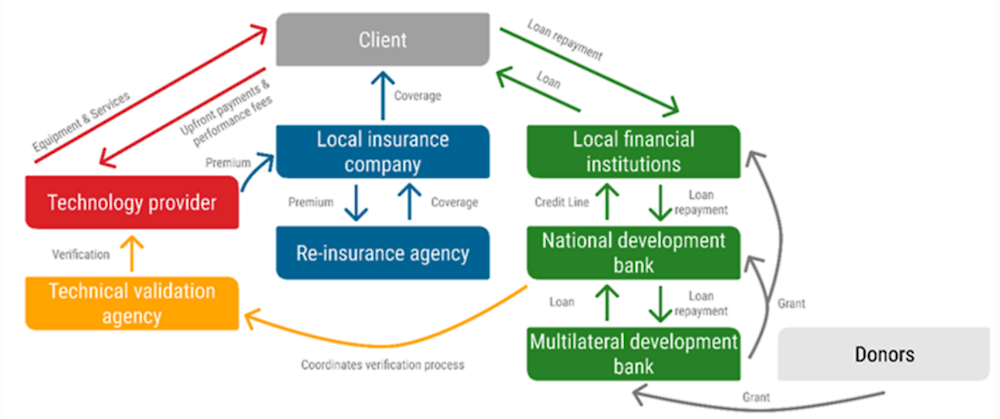

ESI is a de-risking package which combines four financial and non-financial elements to support the identification and structuring of technically robust and bankable projects: a standard performance contract, a technical validation, an energy savings insurance product, and concessional financing. Table 4.5 below summarises the main function of each of these four products.

Table 4.5. Financial and non-financial elements of ESI: functions and benefits

|

Element |

Functions |

Benefits |

|---|---|---|

|

Standard performance contract |

|

|

|

Technical validation |

|

|

|

Energy savings insurance |

|

|

|

Concessional financing |

|

|

Source: OECD (2023[44]), Energy Savings Insurance: International Focus Group Discussion, https://www.oecd.org/environment/cc/cefim/cross-cutting-analysis/Discussion-paper-first-energy-savings-insurance-international-focus-group-discussion.pdf.

A conceptual visualisation of the ESI model is shown in Figure 4.7 below, while key players and potential challenges of implementation of an ESI in Thailand are presented in Table 4.6 below. Key challenges with the implementation of ESI in Thailand include the limited technical capacity to assess risks of energy efficiency projects by Thai financial institutions as well as potential lack of confidence in and familiarity with ESI models. Moreover, accurately assessing energy savings and determining insurance premiums would necessitate reliable data on energy consumption as well as on performance factors, which is challenging to obtain from diverse businesses in different sectors.

Figure 4.7. ESI implementation: institutional arrangement

Source: Authors based on OECD (2023[44]), Energy Savings Insurance: International Focus Group Discussion, https://www.oecd.org/environment/cc/cefim/cross-cutting-analysis/Discussion-paper-first-energy-savings-insurance-international-focus-group-discussion.pdf.

Table 4.6. Key players and potential challenges of implementation of an ESI in Thailand

|

Key players |

Potential Thai actors |

Challenges |

|---|---|---|

|

Donor |

Domestic public funding: Energy Conservation Promotion Fund (ENCON Fund) |

• Eligibility criteria of the fund • Political priorities |

|

Multilateral development Banks: World Bank, ADB, etc. |

• Stringent eligibility criteria • Complex application process • Currency and repayment risks • Competitive funding environment |

|

|

Financial institutions |

Local commercial banks |

• Limited technical capacity to offer energy efficiency financing • Lack of confidence in the new business model • Stringent eligibility criteria |

|

Insurance regulator |

Office of Insurance Commission |

• Lack of understanding on EE |

|

Insurance company |

Local insurance companies |

|

|

Re-insurance agency |

e.g. Thai Reinsurance Public Co., Ltd. |

|

|

Technology provider |

ESCOs RE & energy efficiency equipment supplier |

• Difficult access to market |

|

Technical validation agency |

Academic and research institutions, e.g. Joint Graduate School of Energy and Environment, Chulalongkorn University |

• Limited resources |

|

International agencies, e.g. GIZ, UNDP |

Source: Authors

Experience with ESI in other countries provides insights that could be useful for the design and implementation of an ESI scheme in Thailand (OECD, 2023[44]). In particular, the experience of Colombia provides a proof of concept for other countries to replicate. For example, several countries benefited from the availability of templates, methodologies for standard performance contracts, project investment analysis and validation and verification tools developed by predecessors like Colombia. The availability of standard documents can reduce complexity and transaction costs. Moreover, one lesson learnt from previous programmes is that concessionality was often incorporated into their ESI credit lines, thanks to the concessional financing and non-reimbursable grants extended by international donors. These concessional elements allowed to offer preferential terms to MSMEs at suitably long payback periods than available in the commercial market.

Experience from other countries also highlight the importance of having existing acceptance and up-take of insurance products in the market, an enabling insurance regulatory environment as well as a holistic demand creation strategy. Several approaches to demand creation exist, such as marketing and information dissemination campaigns, targeting specific clients based on market research, or establishing ESI as a pre-requisite for accessing concessional credit lines. Choosing the most effective mix of approaches entails undertaking a detailed market assessment, including consultations with key stakeholders, to understand the specific barriers to demand and identify the right solutions. Finally, training and capacity building efforts are also a critical success factor of ESI programmes. Stakeholder consultations and market research will be needed to assess the training needs of each of the different actors involved.

Green bonds for green buildings

As discussed in Chapter 1, in Thailand the green bond market is emerging as an important source of financing for projects or assets with positive environmental or climate benefits. In ASEAN countries, green buildings are one of the main uses of green bonds’ proceeds. Green buildings accounted for just 20% of green bond issuance proceeds in ASEAN+3 (USD 52.9 billion) and approximately the same share of local currency bond issuance in ASEAN+3 (USD 34.5 billion) as of 2021 (ADB, 2022[45]).

Green bonds appear to be a viable and important financing mechanism for green building projects in ASEAN and they hold large potential for growth (ADB, 2020[41]). However, in Thailand the vast majority of green bond proceeds are used to finance renewable energy generation projects and they are underutilised in the buildings sector (CBI, 2019[46]).

Examples of green bond proceeds used to finance green buildings in ASEAN states include Merdeka Ventures Sdn. Bhd.’s green sukuk in Malaysia and Arthaland Corp.’s green bond in the Philippines.

In 2017, Merdeka Ventures Sdn. Bhd issued a MYR 690 million green sukuk (USD 170 million), aligned with ASEAN Green Bond Standards and used to finance its Merdeka PNB Tower, the tallest building in Malaysia, with triple-platinum ratings using the international LEED, Malaysia’s Green Building Index, amongst others (Malaysian Sustainable Finance Initiative, 2017[47]). In the Philippines, Arthaland Corp. issued a first tranche of USD-equivalent 59 million ASEAN green bond in 2020 to finance its real estate portfolio certified by multiple national and international green building standards, followed by a second tranche of the same amount in 2023 (Arthaland, 2023[48]).

Certification schemes for green buildings increase the credibility of green building projects and information availability within bond market players, thus improving the attractiveness of green bonds issued for green building projects (ADB, 2020[41]).

On-bill financing (OBF)

On-bill financing (OBF) is a financing mechanism whereby utilities or private lenders provide customers with capital for energy-efficient, renewable, or other power-related projects, with repayment being made through the customer’s regular utility bill payments. On-bill financing programmes rely on the willingness of the utility to invest and/or collect repayments from their customers via the monthly utility bills. On-bill programmes may require customers to select technologies and/or suppliers from a pre-approved list, and can be combined with government rebate programmes for high-efficiency appliances or equipment. OBF financing is typically applied for smaller scale energy efficiency projects.

Typical on-bill financing or repayment structure comprises investors, utilities, contractors or ESCOs, and customers as shown in Figure 4.8 below.

Figure 4.8. On-bill financing structure

Source: US Department of Energy (2023[49]), On-Bill Financing / Repayment, https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/bill-financingrepayment#case-studies.

The OBF model has multiple advantages:

Improved energy efficiency: OBF programs help customers invest in energy efficiency improvements, such as upgrading to a high-efficiency air conditioner or adding insulation, yielding mutual advantages like lowered energy bills, enhanced property values, amongst others.

Convenient repayment and simple structure: Regular monthly loan payments are collected by the utility on the utility bill until the loan is repaid. This makes it easier for customers to repay the loan and helps ensure that the loan is repaid on time. OBF agreements are typically simple, thereby creating confidence for customers, utilities and possible investors.

Reduced risk of loan default risk: OBF schemes authorise utilities to discontinue services for non-payment, thereby reducing the risk of loan defaults and assuring repayment. The customer’s repayment obligation can also be collateralised by the installed equipment.

Bill neutrality: Energy efficiency improvements financed through OBF can be structured to match or exceed loan payments, ensuring that the customer's utility bill remains neutral or decreases post-upgrade.

Wider adoption of energy efficiency measures: The unique characteristics of on-bill loans, particularly their tie to utility services and the assurance of bill neutrality, provide tangible benefits that can encourage more customers to invest in energy efficiency upgrades.

The past decade saw the introduction of several on-bill programs, notably in the United States’ residential sector and later in Europe. In the US, OBF programmes have been used to finance energy efficiency improvements in the residential, commercial and industrial sectors, as well as for universities, schools and hospitals, but not typically in government facilities (US Department of Energy, 2023[49]). A notable OBF example is that of Southern California Edison (SCE), which offered qualified non-residential customers 0% financing from USD 5 000 to USD 1 000 000 per Service Account for a wide variety of efficiency improvement projects. The monthly loan payments are added directly to the customer's bill over a period of up to five years. Monthly energy savings help to offset the monthly loan charges. The program was delivered by a dedicated third-party contractor, who provided energy audits, technical assistance, and project implementation to customers. After pilot tests in 2007 – 2008, the program was launched in 2010, The execution of the program during 2010 – 2012 resulted in the issuance of over USD 10 million in loans and had commitments in place for another USD 20.4 million. The loans issued supported energy efficiency projects with ex ante savings of 17 GWh and 2.8 MW (US Department of Energy, 2024[50]). The program has been continued and expanded by the California Public Utilities Commission (CPUC) due to high demand and success. See Table 4.7 below for further details on the SCE case, including challenges encountered throughout the programme. Annex B includes an overview of the actors, timeframe and potential challenges of OBF implementation in Thailand.

Table 4.7. Southern California Edison’s OBF programme

|

Key characteristics |

|

|---|---|

|

Terms and conditions |

• No-interest, no-fee loan: A loan that is repaid on the utility bill or in full by the borrower, with no interest or fees charged to the customer. • Site meter attachment: A feature that attaches the financing obligation to the site meter rather than the customer, allowing the charge to transfer to the next service account holder automatically. • Customer eligibility: A criterion that is based on the customer’s payment history and standing with SCE and does not require credit or income qualification. |

|

Implementation dates |

2007 – ongoing |

|

Outcomes |

• 2010 – 2012 resulted in the issuance of over USD 10 million in loans and had commitments in place for another USD 20.4 million. The loans issued supported energy efficiency projects with ex ante savings of 17 GWh and 2.8 MW. • Till 2023, over 2 400 loans were issued, worth USD 99 million, with a 99.3% collection rate. |

|

Financed activities |

2007 – 2022: Energy efficiency measures such as insulation upgrades, HVAC system replacements, or purchasing energy-efficient appliances 2003: Expansion to finance clean energy projects beyond energy efficiency measures |

|

Targeted sectors |

2007 – 2022: Non-residential sectors 2023: Expansion to both non-residential and residential sectors |

|

Stakeholders involved |

• Southern California Edison Company (SCE): SCE is the primary stakeholder and the proposer of the OBF program to the California Public Utilities Commission (CPUC). • California Public Utilities Commission (CPUC): CPUC is the regulatory agency that oversees the OBF program and approves the program design, funding, and implementation. • Non-residential customers: Non-residential customers are eligible to participate in SCE’s OBF program and can use it to finance energy efficiency and renewable energy projects. • Residential customers: Residential customers are expected to be eligible for SCE’s OBF program in the future, once the program is developed and approved by the CPUC. • Third-party lenders: Third-party lenders can partner with SCE to provide financing for the OBF program and receive a return on investment. • Energy service companies (ESCOs): ESCOs can partner with SCE to provide energy efficiency and renewable energy services to customers and receive payments through the OBF program. • Other Investor-owned Utilities in California: Under the CPUC’s leadership, SCE has partnered with other utilities to develop a statewide model for OBF in California. |

|

Challenges |

• Limited customer awareness: Many customers are not aware of the programme or its benefits. • Lack of contractors’ skills: The programme requires customers to choose and retain a licensed contractor to install measures, but many contractors are not familiar with the programme or do not have the necessary qualifications or experience to participate. • Limited funding: The programme has limited funding and loan capacity, which restricts the number and size of projects that can be financed and the customer segments that can be served. • Complex design: The programme design and delivery have been criticised for being too complex, bureaucratic, and inflexible, which discourages customer participation and satisfaction. • Lack of evaluation: The programme lacks a comprehensive and transparent evaluation framework that can measure the programme's effectiveness, efficiency, equity, and environmental impact, and provide feedback for improvement. |

Source: US Department of Energy (2024[50]), Southern California Edison: On-Bill Financing for Energy Efficiency Projects, https://betterbuildingssolutioncenter.energy.gov/implementation-models/southern-california-edison-bill-financing-energy-efficiency-projects.

Bulk procurement and demand aggregation for energy-efficient appliances

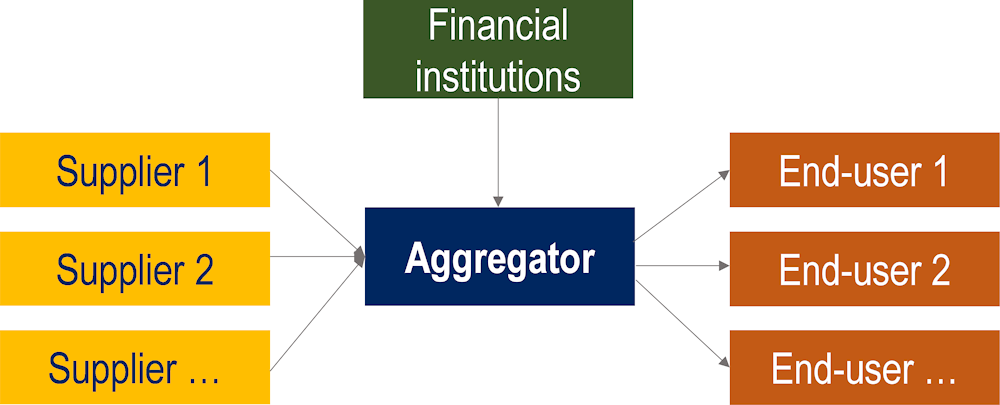

As mentioned in Chapter 2, aggregation models can help tackle some of the barriers that clean energy projects face, and lower transaction costs and risks. Bulk procurement models can significantly boost the deployment of energy efficiency technologies. By aggregating demand, bulk procurement harnesses economies of scale, achieves cost savings and operational efficiency and manages repayment risks while encouraging manufacturers to innovate and produce more competitive and efficient products.

In a bulk procurement model, key players include (see Figure 4.9 below):

the aggregator: an entity responsible for aggregating demand and co-ordinating the procurement process (e.g. a government agency or an ESCO)

suppliers: manufacturers or distributors of energy-efficient technologies and equipment

end-users: businesses, government agencies, households, or other entities looking to improve energy efficiency

financial institutions: banks or lending institutions that provide financing options (loans, grants, etc.) or incentives to help end users acquire energy-efficient products.

Figure 4.9. Bulk procurement structure

Source: Authors

A notable example of a subsidy-free bulk procurement model that delivered significant efficiency improvements in an emerging economy is India’s UJALA programme. The Government of India launched the UJALA light-emitting diode (LED) scheme in 2015 to help households save money on their electricity bills through efficient lighting while enhancing Light Emitting Diode (LED) affordability (OECD, 2022[51]).

By January 2022, more than 367 million LED bulbs were distributed, saving an estimated 47.78 billion kWh energy per year, with an avoided peak demand of 9567 MW and estimated GHG emission reduction of 38.70 million tonnes CO2 (Energy Efficiency Services Limited, 2022[52]). UJALA also distributed over seven million LED tube lights and over two million energy efficient fans. By aggregating demand, procuring appliances and equipment in bulk as well as providing innovative up‑front payment options to consumers, UJALA managed to reduce the retail price of LEDs price from USD 3.60 – 4.20 in 2014 to USD 0.84 – 0.96 in 2017, or by almost 80%. Concessional financing covered all initial costs for the bulk procurement of LED bulbs. The programme also incorporated quality control measures (such as a less than 0.3% failure rate and mandatory three-year warranty for LED bulbs) and comprehensive measuring, reporting and verification procedures to create trust in the initiative and ensure its effectiveness and impact. The massive scale of the programme and the Government of India’s financial incentives in support of UJALA contributed to boosting the local manufacturing capacity. Table 4.8 below and Annex B provides further details on the UJALA scheme.

Table 4.8. Bulk procurement of efficient lighting: India’s UJALA scheme

|

Key characteristics |

|

|

Implementation dates |

2015 – 2021 |

|---|---|

|

Lead implementer |

Energy Efficiency Services Limited (EESL), a super energy service company (ESCO), promoted by the Ministry of Power, Government of India, as a Joint Venture company of four Central Public Sector Undertakings. |

|

Financiers |

• Equity capital from its four promoters • Proceeds from domestic bond issuances within 2016-2018 • Financial support from multilateral and bilateral donors • Lines of credit with commercial banks to finance its working capital needs |

|

Outcomes |

• over 367 million LED bulbs distributed, with an estimated energy savings of 47.78 billion kWh per year and GHG emission reduction of 38.70 million tonnes CO2 per year; • seven million LED tubes distributed, with an estimated energy savings of 316.17 million kWh per year and GHG emission reduction of 259.26 kilotonnes CO2 per year; • 2 million energy-efficient fans distributed, with an estimated energy savings of 219.40 million kWh per year and GHG emission reduction of 179.91 kilotonnes CO2 per year. |

|

Financed activities |

• 7 W and 12 W LED light bulb • 20 W LED light tube • Energy efficient fans with a BEE 5-star rating |

|

Targeted sectors |

Residential sector |

|

Stakeholders involved |

• The Ministry of Power is the nodal ministry that plans and coordinates India’s energy efficiency efforts; • the Bureau of Energy Efficiency (BEE) is the nodal agency for implementing the national energy efficiency plan; • the EESL is the implementer of the UJALA scheme; • the World Bank provided a concessional loan to EESL under the India Energy Efficiency Scale-up Program; • the State Electricity Distribution Companies (DISCOMS) are the partners of EESL for implementing UJALA in each state. |

|

Financing model |

The UJALA scheme provides consumers with two payment options for purchasing LED bulbs: • full payment upfront at 40% of market price; • initial payment of USD 0.15 (Rs. 10) per bulb, with the remaining amount recuperated in monthly installments of USD 0.15 (Rs. 10) added to the electricity bill (on-bill financing). Customers can purchase a maximum of eight LED bulbs per electricity bill under this program. |

Source: Authors based on (Energy Efficiency Services Limited, 2022[52]; India Brand Equity Foundation, 2021[53]; Partnership on Transparency in the Paris Agreement, 2018[54]), https://eeslindia.org/wp-content/uploads/2022/09/Annual-Report-FY-2021-22.pdf, https://www.ibef.org/government-schemes/ujala-yojna, https://api.knack.com/v1/applications/5b23f04fd240aa37e01fa362/download/asset/5c94a552be4c1909acfe389b/190318_gpd_parisabkommen_india_rz.pdf.

The success of the UJALA program underscores several key lessons to promote energy efficiency at scale, which could be useful for Thailand to consider for setting up a bulk procurement scheme for energy efficiency appliances. Firstly, the robust business model of a super ESCO, taking on the upfront investment risk for bulk procurement of energy-efficient appliances, is instrumental in creating a conducive environment for market growth. By demonstrating tangible benefits and significantly lowering retail prices through volume discounts, the super ESCO can stimulate demand and foster widespread adoption of energy-efficient technologies among consumers. Moreover, comprehensive policy support from the government, electricity distribution companies and multilateral development banks can lend credibility and legitimacy, crucial for securing buy-in from various stakeholders and ensuring sustained momentum.

Secondly, evidence from the UJALA programme suggest the need for building awareness and trust in energy-efficient products, by effectively communicating about the results and impacts of the programme. To enhance customer trust in a relatively pricey and unfamiliar technology, an on-bill financing option was added at the onset of the programme, so that customers would not have to bear the upfront investment costs but instead paid for their LED bulbs through monthly instalments on their electricity bills. In addition, stringent quality specifications and robust after-sales services bolstered consumer trust in the reliability and durability of energy-efficient appliances, further enhancing adoption rates. The programme was combined with a large-scale consumer awareness and education programme as well as a national UJALA dashboard, tracking and updating LED deployment in real time and providing essential performance data.

More recently, examples of private sector initiatives taking the role of the aggregator entities have also emerged, namely in the Philippines. The OECD Clean Energy Finance and Investment Roadmap of the Philippines showcases the example of Climargy, a private company that serves as a commercial ESCO aggregator of energy efficiency project assets, fully funded with private capital (OECD, 2024[55]). Climargy is also tapping into grant funding through a partnership with the United Nations Office for Project Services Southeast Asia Energy Transition Partnership. The company is planning to use these grants to subsidise and de‑risk the upfront development costs of energy audits for energy efficiency projects in commercial and industrial entities.

The USAID Southeast Asia's Smart Power Program is currently working with partners in the region, including Thailand, to support the bulk procurement of energy efficiency technologies, with an initial focus on cooling and lighting technologies (USAID, 2022[56]).

Green mortgages

Through green mortgages, banks or mortgage lenders can offer home buyers preferential access to finance, such as discounted interest rates or higher loan amounts for building construction or building renovations meeting efficiency criteria (IEA, 2023[57]). Green mortgages have been offered by financial institutions in several countries, with the United Kingdom and United States leading the way, with around 60 green mortgage products available in the United Kingdom alone (IEA, 2023[58]). Evidence from the EU suggests that green buildings represent lower risk investments for banks because i) their operating costs are lower, thereby putting the borrower in a better position to repay the mortgage with a lower probability of default; and ii) they have higher value compared to so-called “brown discount” in markets where inefficient or unsustainable buildings become less attractive (World Green Building Council, 2024[59]). Green mortgages are also a type of financial product that can be easily securitised and tranched, allowing banks to transfer their credit risks and free up their lending capacity.

In Thailand, the green mortgage market is nascent, but some banks have recently started to develop and offer green mortgages schemes. In 2022, the Thai bank Kasikornbank Pcl and the Thai leading property developer SC Asset partnered to offer green home loans to buyers of energy‑efficiency homes. The loan program offers interest rates starting at 2.5% per annum during the first three years with loan amount granted at up to 100% and loan term up to 30 years, with no appraisal fee (KBank, 2022[60]).

In 2023, UOB, a leading bank headquartered in Singapore and active in Asia, launched “U-Green” home loan campaign, offering green home loan solutions for customers seeking to make energy efficiency improvements in their houses in Thailand. The campaign includes financing options for home renovation and refurbishment, solar panel and electric vehicle charger installation, in line with the UOB’s recent partnership with the Provincial Electricity Authority (PEA). Offered products under this campaign include loans with an average interest rate of 3.49% per year during the first three years, a credit line of up to 100% of the appraised value and a maximum loan tenor of 30 years (UOB, 2023[61]).

Recommendations

The Government of Thailand is committed to accelerate finance and investment in energy efficiency projects in the Thai building sector and has put in place several supportive policies comprising government regulations, financial incentives and awareness-raising initiatives. Based on extensive desk research and a series of in-country stakeholder consultations, this Roadmap provides a set of recommendations to further support Thailand’s efforts to mobilise financing for energy efficient buildings and cooling. It should be noted that several of the following recommendations can also be applied to promote energy efficiency across sectors. Key recommendations for unlocking financing for energy efficiency buildings and cooling in Thailand addresses three main areas summarised below:

Financial support, including: maintaining consistent public support to promote the ESCO market; conducting ex-post evaluations of the Energy Efficiency Revolving Fund and the ESCO Fund; establishing a bulk procurement model for energy-efficient cooling appliances; implementing the energy savings insurance (ESI) model in Thailand; creating an on-bill financing programme for energy-efficient cooling appliances; and fostering issuances of green bonds in the building sector.