The Assessment and recommendations present the main findings of the OECD Environmental Performance Review of the Czech Republic and identify 46 recommendations to help the Czech Republic make further progress towards its environmental policy objectives and international commitments. The OECD Working Party on Environmental Performance reviewed and approved the Assessment and recommendations at its meeting on 14 February 2018. Actions taken to implement selected recommendations from the 2005 Environmental Performance Review are summarised in the Annex.

OECD Environmental Performance Reviews: Czech Republic 2018

Assessment and recommendations

Abstract

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

1.1. Environmental performance: trends and recent developments

After joining the European Union (EU) in 2004, the Czech economy grew at a faster pace than the OECD average until it was hit by the global downturn due to its reliance on exports – mostly from the machinery and automobile industries. Convergence of income levels towards the OECD average has stalled since the crisis, reflecting weak productivity growth (OECD, 2016). Nevertheless the unemployment rate has steadily decreased since 2010 and is one of the lowest among OECD countries. The poverty rate in the Czech Republic is the second lowest among OECD countries. GDP growth picked up in 2015, with the absorption of expiring EU funds, before moderating in 2016. It is expected to remain above 3% in 2017-18 (OECD, 2017a).

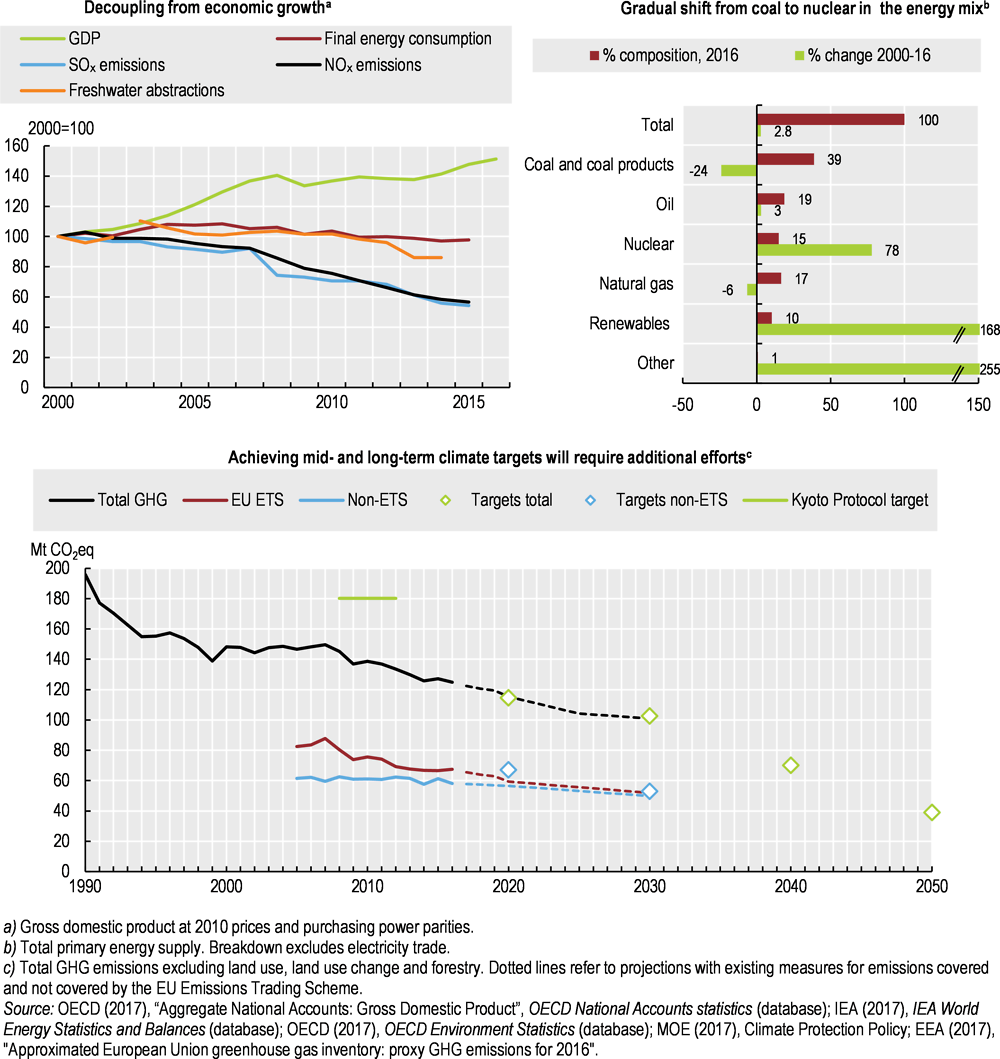

The Czech Republic has made progress in decoupling environmental pressures from economic activity (Figure 1). However, its strong industrial base and reliance on coal place the country among the most energy- and carbon-intensive economies in the OECD and the population is exposed to severe levels of air pollution. Increased use of road transport, changes in land use, infrastructure development and intensive farming undermine the resilience of ecosystems. Czech Republic 2030, approved in 2017, is the overarching policy document defining long-term priorities for implementing the 2030 Agenda for Sustainable Development. Relative to the OECD average, the country performs well on goals related to poverty, water and biodiversity, but is behind on gender equality, climate and energy (OECD, 2017b). Progressing towards sustainable development will require strengthening political commitment to a low-carbon economy and implementing more cost-effective environmental policies.

1.1.1. Transition to a low-carbon and energy-efficient economy

The Czech Republic has succeeded in decoupling greenhouse gas (GHG) emissions from economic growth. After almost a decade of relatively stable level of GHG emissions, they started decreasing due to the economic crisis and declining use of fossil fuels. The country overshot its Kyoto target of reducing GHG emissions by 8% over 2008-12, with a 30% reduction below 1990 levels (Figure 1). According to government projections, the country is on track to reach its 2020 and 2030 objectives. However, this will require further progress in energy savings and development of renewable energy resources in a context of economic recovery and a significant increase in GHG emissions from road transport.

The policy framework was improved with the adoption of the 2017 Climate Protection Policy, and the 2015 Strategy on Adaptation to Climate Change, with its 2017 action plan (MoE, 2017a, 2017b, 2015). The Climate Protection Policy sets 2020 and 2030 emission reduction targets and indicative long-term objectives for 2050, in line with EU commitments. The next update of the 2015 State Energy Policy (SEP) will have to be aligned with EU objectives on energy efficiency and renewables for 2030 and to ensure long-term targets are compatible with the Paris Agreement objectives. The Czech Republic was the last EU member to ratify the Paris Agreement, in October 2017, due to lengthy parliamentary debates. Like other EU members, it has to develop an integrated national energy and climate plan by early 2019 to ensure the climate and energy targets for 2030 are on track.

Nuclear power has been gradually replacing coal in the electricity mix (Figure 1). However, fossil fuels (with coal accounting for about half) make up three-quarters of the energy supply. The Czech Republic has relied on domestic coal to ensure energy security, but this has been detrimental to the environment. In addition to being the largest source of GHG emissions, coal combustion is a major source of local air pollution. The SEP aims to further shift the energy mix from coal to nuclear energy, which benefits from strong public support. However, the target ranges are so wide that they create uncertainty for investors (IEA, 2016, MIT, 2014).

Figure 1. Selected environmental performance indicators

The SEP also aims to support development of renewables up to 22% of the total energy supply and 25% of electricity production by 2040. Since 2000, the share of renewables has almost tripled in the energy supply and quadrupled in electricity generation. By 2015, the Czech Republic had exceeded its targets set for 2020 under the EU Renewable Energy Directive, except in transport. However, the share of renewables in electricity production remains below the OECD average and is unlikely to increase in the medium term following the abolition of support mechanisms for renewable-sourced electricity (IEA, 2016). Renewable development and closer integration into European networks represent alternatives to ensure energy security.

Since 2000, the Czech Republic has managed to decouple its energy consumption from economic growth, but energy intensity remains high due to the importance of heavy industry. Energy use in the transport sector grew strongly to 2008, slowed during the crisis, then recovered in 2014. The Czech Republic is not on track to achieve its saving targets under the EU Energy Efficiency Directive and measures to reduce transport energy use could be better emphasised in the National Energy Efficiency Action Plan (NEEAP).

Emissions of major air pollutants have been further decoupled from economic growth through stricter regulation. The Czech Republic met its 2010 targets under the EU National Emission Ceilings Directive and seems on track to achieve the 2020 objectives, except for NH3 (EEA, 2017). However, significant additional efforts will be required for 2030. The rate of mortality from ambient air pollution is nearly twice the OECD average. It is estimated to have cost 7% of GDP in 2015 (Roy and Braathen, 2017). Although declining, mean annual exposure to PM2.5 concentrations remains above the OECD average. EU limit values for PM10, PM2.5, benzo(a)pyrene and ozone have repeatedly been exceeded. The main sources of local air pollution are road transport and fossil fuel combustion for residential heating. The Moravian-Silesian region is also affected by industrial sources and transboundary air pollution at the Polish border.

1.1.2. Transition to efficient resource management

The material intensity of the Czech economy is higher than the EU average due to its large amount of coal and construction materials use, but it is not among the most intensive OECD economies. Since 2000, domestic material consumption has decreased while GDP increased, suggesting improvement in material productivity. This trend is explained by the reduction in the share of solid fuels in the energy mix and the decline of construction activity during the economic crisis. However, progress has slowed since 2012 and material consumption started to increase with the economic recovery. The Czech Republic is heavily dependent on imports of oil, natural gas, metallic minerals and some industrial minerals, but is self-sufficient in biomass and construction minerals.

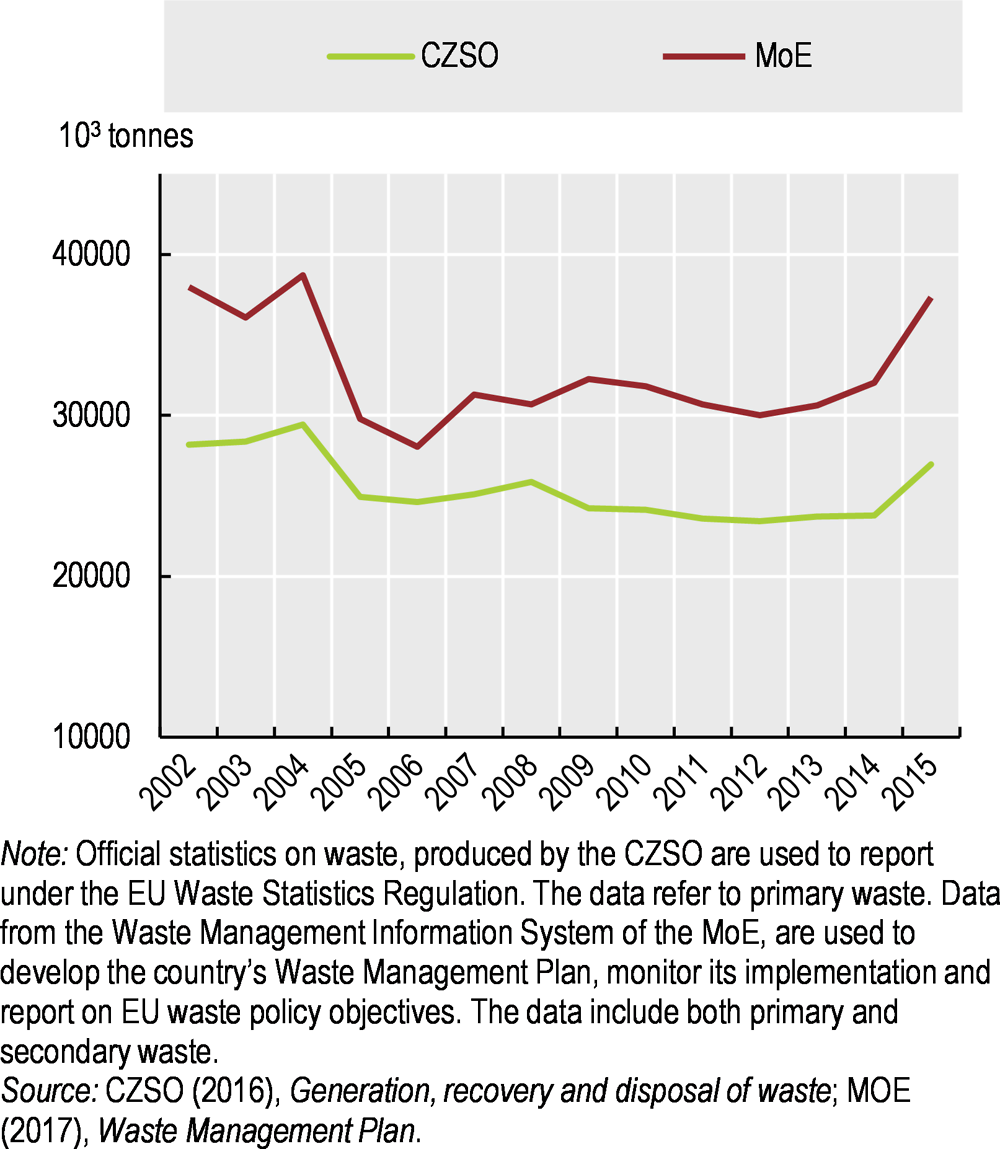

Over most of the past ten years, total waste generation was relatively stable, but it increased in 2015 due to construction activity. According to the Czech Statistical Office, municipal waste evolved broadly in line with private final consumption. Landfilling is declining but still accounts for about half of municipal waste treatment. The coexistence of two information systems on waste hampers assessment of performance in this domain (Section 1.4).

Chemicals consumption has doubled in the last decade with an increase in both production and imports (Eurostat, 2017). Efforts to comply with international and EU requirements have resulted in a general decline in, and subsequent stabilisation of emissions of, key pollutants and levels of certain chemicals tracked through human bio-monitoring studies. Nevertheless, the number of emergencies involving leakage of hazardous chemical substances requiring intervention by fire brigade units has increased noticeably in recent years and monitoring studies have identified concerted areas for improvement (CZSO, 2016). Environmental and bio-monitoring programmes should continue to be supported to identify where further chemical risk management is required. Moreover, ensuring sufficient resources for enforcement and other enabling activities under European chemicals legislation (REACH and CLP) will be critical in preventing and controlling chemical pollution.

More than 40% of the territory is covered by arable and crop land. Since 2000, there has been a slight shift to permanent grassland and meadows, driven by implementation of the EU Common Agricultural Policy and the EU milk crisis. Agricultural production remained broadly stable, decreasing livestock production being offset by a slight increase in crop output. At the same time, consumption of nitrogen fertiliser per hectare of agricultural land increased sharply, highlighting the need to decouple agricultural inputs from production. Overall, pesticide use also increased, though it started to fall in 2012 with implementation of the National Action Plan to Reduce the Use of Pesticides. Adopting and implementing measurable targets would help in tracking progress on reducing risk associated with pesticide use and its impact on human health and the environment (EC, 2017a). Intensive agricultural practices remain a major source of water pollution, habitat alterations and biodiversity loss. The Czech Republic has implemented three consecutive action plans on organic farming. Since 2000, the share of agricultural area under organic farming has tripled, reaching 12% in 2015, below the 15% national target but one of the highest shares in the OECD.

1.1.3. Management of natural assets

Substantial progress has been made in expanding protected areas, which covered 22% of the territory in 2016, above the Aichi target of 17% for 2020. However, the share of area under the highest level of nature protection (mostly national parks) is low and the establishment of a fifth national park has been under discussion since 2010 (CENIA, 2016). There is room to complete the list of sites designated under the EU Natura 2000 network and to ensure their effective management (EC, 2017b). Despite improvement, only 16% of habitats and 27% of species of community importance have favourable conservation status. Urban sprawl and road infrastructure development are fragmenting landscape and habitats. Over 2000-15, built-up areas expanded by 4%, mostly due to land take of agricultural surfaces for road infrastructure. The 2016-25 National Biodiversity Strategy seeks to address the weaknesses of the previous strategy, in particular by raising awareness of the economic consequences of biodiversity loss to better mainstreaming biodiversity in sector policies (MoE, 2016a).

Freshwater resources are scarce compared with other OECD countries. However, water stress remains low thanks to below-average and declining abstraction levels (Figure 1). Climate change is expected to lead to increased variability of precipitation and more frequent floods and droughts, with adverse effects on biodiversity, soil erosion and water quality.

EU funds helped increase the share of population connected to public sewage treatment plants to 81% in 2015, in line with the OECD average. Although the Czech Republic met the 2010 requirements of the EU Urban Waste Water Treatment Directive in terms of collection, it did not achieve the objectives on secondary and more advanced treatment. Better access to wastewater treatment has helped improve water quality. However, the status of water bodies largely remains unsatisfactory. In 2012, only 19% of surface water bodies achieved good ecological status, while 61% of surface water bodies and 27% of groundwater bodies reached good chemical status. The main pressures include flow regulation and hydro-morphological alteration, which affect two-thirds of surface water bodies. Diffuse pollution is a concern for more than half of water bodies.

Recommendations on climate change, air, chemicals, water and biodiversity management

Climate change, air and chemicals management

Strengthen political commitment to a low-carbon economy: develop an integrated energy and climate plan to reach the 2030 and 2050 GHG reduction targets, in line with EU climate policy and the Paris Agreement; develop analysis of the economic, environmental and social impact of the underlying scenarios; consider restoring mining limits.

Implement the National Adaptation Strategy and complete local strategies in Prague, Brno and Pilsen as a pilot for other cities. Mainstream climate change adaptation into government policies.

Implement the National Emission Reduction Programme to comply with standards for protection of human health. Raise awareness of the effects of local air pollution on health.

Pursue efforts to monitor chemicals in environmental media and in humans to identify where risk management is required. Allocate sufficient resources for enforcement and other enabling activities under European chemicals legislation (REACH and CLP) to prevent and control chemical pollution. Adopt and implement the 2018-22 National Action Plan to Reduce the Use of Pesticides and assess progress towards targets.

Water and biodiversity

Address diffuse pollution from agriculture by reducing the use of fertilisers and pesticides and by speeding up implementation of measures such as information, training, research and funding of environmentally sound agricultural practices. Improve the water quality monitoring system to better measure effectiveness of pollution reduction measures. Develop market opportunities to swiftly achieve the target of 15% of agricultural land under organic farming.

Continue to improve information on biodiversity by assessing the extent and values of ecosystem services and promoting the use of these evaluations in policy decisions. Complete the designation of protected areas under the EU Natura 2000 network and ensure their effective management (e.g. by clearly defining conservation objectives and measures and providing adequate resources for their implementation). Consider expanding the national park network to protect the most valuable species and habitats. Prevent habitat fragmentation associated with infrastructure development and develop ecological networks to facilitate wildlife migration.

1.2. Environmental governance and management

1.2.1. Institutional framework

The Czech Republic is a unitary state with three government levels: central, regional and municipal. The Ministry of the Environment (MoE) is the main authority for environmental policy, compliance monitoring and enforcement, and environmental quality monitoring. Though administrative capacity is generally sufficient, high turnover of ministers and staff has caused implementation gaps. The Government Council for Sustainable Development brings together representatives of all ministries, Parliament, municipalities, non-government organisations (NGOs), trade unions, industry and academia. In addition, the inter-ministerial commenting procedure on draft policies and legislation contributes to horizontal co-ordination by gathering input from regions, municipalities and NGOs.

The country has some of the OECD’s smallest municipalities and regions (14 regions and 6 258 municipalities), which contributes to governance fragmentation. Closer inter-municipal collaboration could increase efficiency by reducing duplication and streamlining provision of some services. Municipal and regional co-operation is through the Union of Czech Towns and Municipalities (SMO ČR), the Association of Local Governments (SMS ČR) and the Association of Regions. Regional authorities have environmental departments dealing with transport, biodiversity, spatial planning, health and tourism. Local authorities are in charge of local transport, waste management, wastewater treatment, local planning and housing.

Nine MoE regional departments oversee lower-level authorities, although the ministry has not yet developed implementation guidelines. The Czech Environmental Information Agency (CENIA) supports regional authorities in issuing integrated permits. Vertical co-ordination is also carried out through SMO ČR, SMS ČR and the Association of Regions. The two municipal associations participate in the preparation of draft legislation on topics pertaining to municipal responsibilities. The Association of Regions represents regional interests before Parliament and the government.

1.2.2. Regulatory framework

EU accession in 2004 helped strengthen the environmental agenda, but over the past decade central and subnational authorities have not been proactive on environmental policy. Over the years, there have been gaps in the transposition of EU directives on water management, environmental impact assessment (EIA) and air quality.

Since the 2005 OECD Environmental Performance Review (EPR), the Czech Republic has made progress in ex ante evaluation by introducing regulatory impact assessment (RIA) and expanding the use of strategic environmental assessment (SEA) of plans and programmes. While RIA is based on cost-benefit analysis, such analysis is generally conducted in more qualitative than quantitative terms, and it is rarely applied to policies and strategies. No clear criteria on how to do cost-benefit analysis have been defined, including rules for covering GHG emissions in assessments (OECD, 2017c). Ex post evaluations have been carried out on an ad hoc basis. The Czech Republic is working on a proposal to develop methodological guidelines for ex post evaluations.

The country has had challenges in incorporating the EU EIA directive into national law. It has made EIA conclusions binding for zoning decisions and for construction and operation permits, in line with the last EPR recommendation to strengthen use of EIA (Tomoszkova, 2015). In accordance with OECD best practices, consideration of project alternatives should be integrated into the EIA process. In the Czech Republic, such consideration is rarely undertaken beyond the “zero alternative”, i.e. not carrying out the project. Permits based on integrated pollution prevention and control (IPPC) have been introduced for economic activities with high environmental risk, and their conditions are based on best available techniques.

1.2.3. Compliance assurance

The Czech Environmental Inspectorate (CEI) is responsible for monitoring and enforcing compliance with environmental law. There are binary performance indicators that register facilities’ non-compliance rates, but the country could consider introducing more meaningful ones to more effectively evaluate compliance assurance. Inspections follow a risk-based planning approach for IPPC installations, but not for all facilities.

The CEI can impose administrative fines of up to CZK 50 million (about EUR 1.8 million), which is high compared to other OECD countries. Criminal sanctions on environmental violations were introduced in the 2009 Criminal Code, last amended in 2011, which provides for imprisonment of up to five years for the most serious environment-related offences and stipulates criminal fines (CEI, 2015; Zicha, 2012). There is no information available about the effective use of criminal sanctions.

The liability regime is fault-based rather than strict, which means the polluter is exempt from remediation costs if the damage occurred despite the operator taking all necessary steps to prevent it. Hence compliance with environmental permit conditions releases the polluter from liability. Operators whose activities may cause significant damage must obtain insurance covering remediation costs. In accordance with the polluter-pays principle, liability for cleaning up historic contamination lies with the polluter if it can be identified and is financially solvent. Otherwise, the state undertakes remediation (Rovenský and Sequens, 2015). Despite progress in mapping and remediation, a large number of contaminated sites continue to pose potential risks to the environment and human health (CENIA, 2016).

The MoE has not developed any information tools to strengthen compliance promotion targeting small and medium-sized enterprises. Such tools could include seminars and workshops, direct advice during inspections, and written guidance for regulated entities.

1.2.4. Environmental democracy

As the 2005 EPR recommended, progress has been made in improving public access to environmental information and participation in decision making. A 2015 amendment of the EIA Act significantly contributed to this goal by expanding citizens’ and organisations’ access to environmental decision making, information and justice.

The Charter of Fundamental Rights, which is part of the Constitution, enshrines the right to participate in administration of public matters and the right to information. EIA, SEA, permitting procedures and the development of safety programmes and emergency plans are open to any member of the public. Anyone can submit comments orally (especially at public hearings) or in writing (including electronically). The EIA procedure requires a public hearing if dissenting comments on the EIA report are submitted. The competent authority has an obligation to consider all comments received and to provide a justification for those that are not accepted, which is good practice not always followed by other OECD countries. A recent amendment of the Building Act could reduce public participation in permitting procedures of projects that do not undergo EIA.

The extensive range of tools to disseminate environmental information includes annual MoE reports on the state of the environment and the Statistical Environmental Yearbook, both available online. Documents submitted for or resulting from the EIA process are also available online. Individual facilities’ compliance records are publicly available upon request.

The 2015 amendment of the EIA Act improved access to justice on EIA and permitting. In permitting procedures for projects subject to EIA, interested parties and NGOs that have operated for at least three years before the permit was issued, or that are supported by at least 200 persons, have legal standing in the permitting procedure and may challenge the procedural and substantial legality of a permit. The Charter of Fundamental Rights allows citizens and NGOs to ask the competent authority to take action or impose corrective measures. In addition, the Czech Republic should make sure the public can exercise its right to go to court if an authority fails to act in response to non-compliance.

Environmental education and awareness raising are well developed and emphasised in the State Environmental Policy. The State Programme for Environmental Education and Public Awareness and its action plan contain clearly defined objectives and indicators with which to evaluate results. Environmental education is part of the general curricula at all education levels, from primary to post-secondary. Around 80% of primary schools have a co-ordinator for environmental education to develop environmental targets for the school and organise activities (MoE, 2016b).

Recommendations on environmental governance and management

Institutional framework

Enhance collaboration between municipalities to increase their efficiency in providing environmental services (e.g. by setting minimum size or standards for service provision, establishing a dedicated central government unit to facilitate and monitor co-operation). Improve vertical co-ordination by strengthening guidance from the MoE to regional and local authorities.

Regulatory framework

Ensure consideration of alternatives in EIA, beyond the “zero alternative”.

Enhance the use of, and human resource capacity for, cost-benefit analysis for assessing environmental policies, and expand ex post evaluation of their implementation.

Compliance assurance

Enhance risk-based planning of environmental inspections by applying risk criteria to all regulated activities, including low risk ones.

Consider introducing additional performance indicators to evaluate the effectiveness of compliance assurance, such as compliance rates diversified by the gravity of violation.

Establish and enforce strict (independent of fault) liability for environmental damage by removing exemptions for compliance with environmental permits. Continue to update the register of contaminated sites and develop a financing mechanism for their gradual remediation.

Strengthen compliance promotion targeting small and medium-sized enterprises through online information tools and guidance to regulated entities.

Environmental democracy

Continue extending citizens’ and organisations’ access to justice in environmental matters to guarantee broader environmental democracy by ensuring that the public and NGOs have a right to go to court if the competent authority fails to act in response to non-compliance.

Ensure that recent amendments to the Building Act do not restrict public participation in permitting proceedings.

1.3. Towards green growth

1.3.1. Framework for sustainable development and green growth

The Czech Republic has improved its institutional framework for sustainable development. In 2014, the Government Council for Sustainable Development was moved from the MoE to the Government Office, supporting a whole-of-government approach for developing the 2017 Sustainable Development Strategy. However, ensuring coherence between environment and energy policies remains a challenge. The government commitment to a low-carbon economy seems mainly driven by EU obligations and the 2015 decision to lift the restriction on lignite mining sent a contradictory signal. Although the SEP envisages a switch from fossil fuels to nuclear power and renewables, uncertainty remains on financing the expansion of the nuclear plant fleet and on scaling up energy efficiency and renewables.

There is no government green growth strategy, though the Czech Republic applied the OECD monitoring framework to develop a set of green growth indicators. However, there is little evidence of their use in policy making. While the SEP promotes conventional energy sources as the main opportunity for growth and jobs, assessing the social costs of carbon lock-in and the benefits of a low-carbon economy would help support the transition and gain social acceptance of carbon pricing.

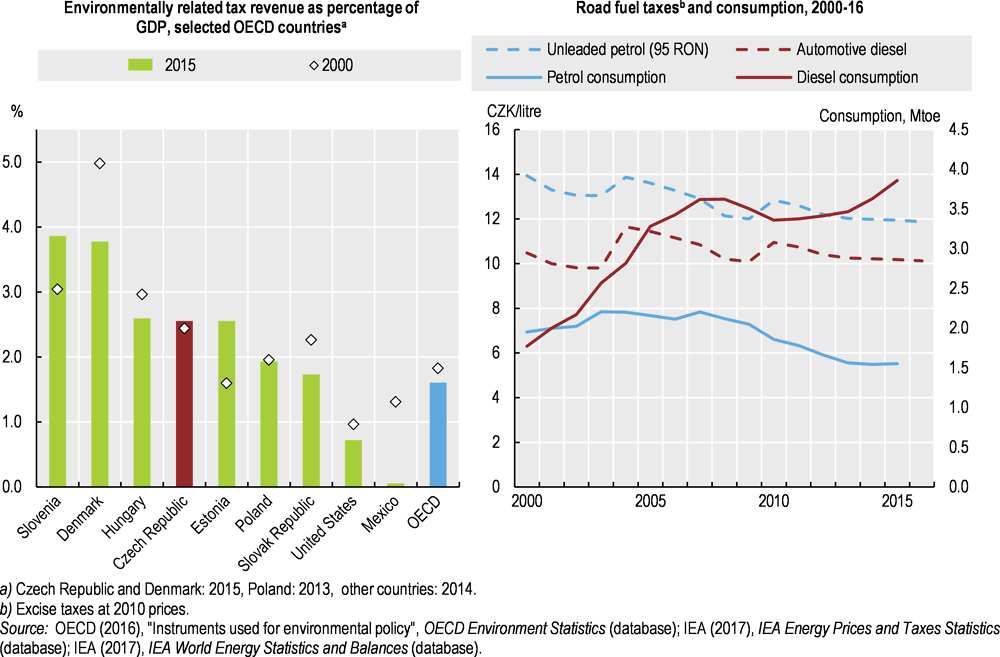

1.3.2. Greening taxes and subsidies

While public debt is low and the budget is broadly in balance, future pension expenditure may pose a challenge for public finances (OECD, 2016). Raising environmental taxes can help finance social expenditure and lower the tax burden on labour, which is heavy in the Czech Republic. “Taxing bads”, such as pollution, can raise revenue at lower economic cost than “taxing goods”, such as labour income (OECD, 2017d). Environmentally related tax revenue rose from 2.4% of GDP in 2000 to 2.9% in 2011 before declining to 2.6% in 2015, well above the OECD average of 1.6% (Figure 2).

Taxes on energy products account for the bulk of these receipts (78% compared with the 70% OECD average). Related revenue rose in real terms over 2000-08, mainly driven by increased road fuel consumption. After a peak in 2011 due to a rise in motor fuel taxation, revenue decreased because of a slowdown in consumption, lower real tax rates and a switch from petrol vehicles to more lightly taxed diesel ones. Like most OECD countries, the Czech Republic grants preferential tax treatment to diesel despite its higher carbon and air pollutant emissions. The share of diesel in road fuel consumption grew from 46% in 2000 to 66% in 2015. Although taxes on natural gas, solid fuels and electricity were introduced in 2008 to comply with the EU Energy Taxation Directive, rates were set at relatively low levels that do not reflect the estimated environmental costs of fuel use, thus giving polluters no incentive to take account of these costs. They are also not adjusted for inflation. The exemptions currently in place mean energy taxes do not provide a consistent carbon price signal across fuels and energy uses, which is necessary to maximise cost-effective carbon abatement.

Figure 2. Lower and differentiated taxes on road fuels have boosted diesel consumption

Like other Central and Eastern European countries, the Czech Republic has maintained low energy tax rates out of affordability concerns: about 14% of households face energy affordability risk1 (Flues and Van Dender, 2017). Providing direct support to vulnerable households decoupled from energy use and setting tax rates at levels that better reflect the environmental costs of energy use would be more efficient at achieving both efficiency and equity. OECD simulations have shown that using a third of the additional revenue from higher taxes on heating fuels and electricity would decrease the share of Czech households facing energy affordability risk by 15% with an income-tested benefit. This would also improve health by reducing air pollution.

Several tax exemptions applied to various fuel uses decrease end-use prices and reduce incentives to save energy or to switch to cleaner fuels. For example, exemptions apply to natural gas used for residential heating and coal and natural gas used in combined heat and power plants, and part of the excise tax on diesel used in agriculture is refunded. It has been estimated that these provisions resulted in revenue losses equivalent to 5% of energy tax revenue in 2014. There is no comprehensive information on potentially environmentally harmful subsidies and tax expenditure in the Czech Republic. The annual report of the new National Budgetary Council could be a vehicle for screening public support programmes against their potential environmental impact. This would be useful for reforming subsidies and special forms of tax treatment that are not justified on economic, social or environmental grounds.

More than 75% of CO2 emissions from energy use are priced via energy taxes and the EU Emissions Trading System (EU ETS). However, when considering the combined price signal from taxes on energy and allowance prices, in 2012 only 16% of emissions were priced above EUR 30 per tonne of CO2 (a conservative estimate of the climate damage from one tonne of CO2 emissions), and emissions priced at this level were primarily from road transport. Carbon pricing instruments thus do not provide an adequate price signal corresponding to the external costs of fuel use, in particular outside the road sector. The EU ETS has not provided a strong price signal to induce low-carbon investment. Installations consistently received free excess allowances over 2005-12. Although an increasing share of emission allowances must be auctioned in the third period (2013-20), most energy-intensive industrial installations continued to be allocated free allowances in 2016, exceeding actual emissions in some sectors (e.g. iron and steel). Like other lower-income EU countries, the Czech Republic received a derogation to provide free allowances to its power sector worth about EUR 1.9 billion over 2013-19, conditional upon investment of equivalent value to modernise electricity generation and diversify the energy mix. However, over 2013-15, investment was mostly devoted to modernising lignite- and hard coal-powered plants (EEA, 2016). Compared with auctions, free allocations weaken emission abatement incentives for firms and imply large costs for government due to forgone revenue (OECD, 2017e).

Since 2000, revenue from vehicle taxation has doubled in real terms driven by strong growth in road freight transport and the introduction of a toll system. However, it continues to make up a relatively small share of revenue from environmentally related taxes (16%, compared to the 26% OECD average), leaving room to review the rates to better address environmental externalities. In 2007, the Czech Republic introduced a distance-based charge for trucks and buses on motorways and high-speed roads. The rate varies by emission class, number of axles, road type, day and time. It has proven effective for reducing traffic during peak times. Such a system could be extended. The one-off registration and annual recurrent taxes on vehicles do not take environmental parameters into account. The average age of the car fleet is about 15 years. In 2009, an environmental tax was introduced on top of the registration tax for second-hand, high-polluting cars. However, the emission criteria were not adjusted to car market evolution and old car registrations increased steadily. As the 2005 EPR recommended, there is room to further develop traffic management in urban areas where the share of cars in passenger transport is growing.

The government outlined the principles of an environmental tax reform in 2007. The plan was to implement it gradually over ten years, and it was expected to be revenue neutral. The first step was implementation of the EU Energy Taxation Directive in 2008, associated with the introduction of a single personal income tax rate and a reduction of corporate income tax rates. The second phase was supposed to include a carbon tax but its introduction has been postponed. Contrary to the principle of the reform, the implicit tax rate on energy2 has declined since 2011, while implicit tax rates on labour increased. Air pollution tax rates were increased, but are too low to motivate emission reductions. While it is rational for the Czech Republic to focus on CO2 and local air pollutant emissions, there is room to review environmentally related taxes and charges on the basis of other environmental parameters. For example, opportunities exist to better reflect the environmental and resource costs in water charges and to address diffuse pollution, which affects the majority of the Czech water bodies.

1.3.3. Investing in the environment to promote green growth

Public and private environmental expenditure3 rose from 1.2% of GDP in 2005 to 1.5%4 in 2015, boosted by public investment in wastewater management and higher private investment in air and climate protection. Increased operational expenditure on waste management did not result in an equivalent improvement in performance, highlighting the need to better control the cost of service provision (Section 1.4). In 2016, environmental expenditure fell to 1.2% with the transition to the new EU programming period.

EU cohesion policy has been a major source of funding for environmental infrastructure. Over 2007-13, EU funds5 allocated to the Czech Republic represented 2% of GDP a year, on average (EC, 2016a). Transport was the first priority, receiving 35% of funds, followed by environment (18%), mostly financed through the environment operational programme. However, implementation of EU co-financed projects on environmental infrastructure has been delayed and some funds have been lost due to irregularities in procurement processes and inadequate public control. Although measures taken significantly increased the absorption rate of 2007-13 funds at the end of the programming period, the uptake of EU funds for 2014-20 has been slow and deficiencies remain (EC, 2017c).

Higher than average public spending on wastewater management has helped the Czech Republic meet the connection rates required by the EU Urban Waste Water Treatment Directive. In 2015, 81% of the population was connected to public sewage treatment plants, in line with the OECD average. However, treatment level objectives were not achieved. Full compliance will require additional and better-planned investments to avoid oversized infrastructure, as sometimes happened over 2007-13. The regulatory office for the water and sanitation sector, established in 2015, is a welcome step to streamline a fragmented sector and improve the cost-effectiveness of service provision. Although infrastructure is in good condition, ageing of assets is becoming an issue as many were built in the 1970s and 1980s (World Bank, 2015). Despite significant increases in the past decade, tariffs remain too low to cover renewal and new investment costs for water and sanitation infrastructure. While the Czech Republic should take redistributive impact into account when pricing water services, some studies suggest achieving full cost recovery would not lead to substantial affordability issues (Reynaud, 2016).

Although the Czech Republic made good progress towards meeting its 2020 climate target, achieving more ambitious targets in 2030 and 2050 will require substantial investment in clean energy infrastructure. A range of regulatory measures and investment programmes promote energy efficiency. For example, the Green Saving Programme, which supported energy saving in the housing sector through the sale of emission allowances under the Kyoto flexible mechanism, was instrumental in meeting the energy saving goal for 2010. However, the numerous programmes implemented have been fragmented and cost-inefficient, and some (e.g. boiler replacement) have provided incentives for continued reliance on coal (IEA, 2016). While NEEAP lags behind the planned targets, introducing savings obligations for energy providers, as many European countries have done, could help promote demand-side management. Such an option would require careful analysis of interaction with other instruments (e.g. the EU ETS and energy taxes), and a well-defined and transparent evaluation framework. In addition, measures to address energy efficiency in transport should be strengthened.

A feed-in tariff (FIT, guaranteed price) and feed-in premiums (FIPs, paid on top of the market price) boosted investment in renewables until 2013. In 2010, favourable market conditions and generous FITs resulted in the Czech Republic becoming the Europe’s fourth-largest solar photovoltaic (PV) market (IEA, 2016). However, as in other OECD countries, high FIT rates were not adjusted quickly enough as production costs declined, which led to a rapid and costly expansion of PV installations. To curb rising electricity prices, the government first tightened the conditions then removed the FITs and FIPs in 2014. In addition, profit taxes on FITs and FIPs were imposed retroactively on PV installations. These changes have stopped the expansion of renewable electricity capacity. Reaching the SEP target of 25% renewables in electricity production by 2040 will require new support mechanisms such as capacity auctions or quotas, to avoid excess production (IEA, 2016). Introducing a carbon tax or increasing existing energy taxes on emissions in sectors outside the EU ETS would be a cost-effective tool to stimulate greater investment in renewables and energy efficiency. The Czech Republic has a power system with sufficient, but inflexible, capacity reserves (mostly lignite and nuclear). Its high level of interconnection capacity provides some flexibility but there is a need for a closer market integration to reduce overflows of renewable power from neighbours. Within the domestic market, the grid flexibility could be increased by fostering market signals for investment in flexibility and demand response.

Poor transport infrastructure continues to hamper Czech competitiveness. The quality of the roads is significantly below European standards and the rail network requires substantial modernisation (EC, 2017c). After sharp growth over 2000-08, investment in transport infrastructure fell substantially to 2013 before recovering with the late absorption of EU funds. Implementation of transport infrastructure projects is affected by structural deficiencies including lengthy procedures for issuing building and land use permits (EC 2017b). In 2015, investment in transport infrastructure represented 1.2% of GDP, far below the 2.5% annual expenditure required to operate, maintain and develop the country’s transport infrastructure (MOT, 2013). Over 2000-15, road infrastructure absorbed two-thirds of investment. To stabilise government funding of infrastructure, the transport policy suggests extending distance-based charging to a wider network and other vehicle categories. Differentiating toll rates by vehicle emissions and congestion levels, and implementing low-emission zones, would help address some external costs linked to road transport more efficiently. Instead of earmarking revenue for one expenditure type, project selection should be based on evaluation of social returns. Public-private partnerships are envisaged only for the most important sections of the road network.

1.3.4. Expanding environment-related markets and employment

The environmental goods and services sector (EGSS) accounts for an estimated 1.8% of total employment and 2% of GDP, on a par with the EU averages. Waste management accounts for most jobs and the bulk of the value added in environmental protection activities, while management of minerals and renewables contribute the most to resource management activities. However, with the removal of support programmes, more than half the jobs in the renewables sector were lost over 2012-14. Information on the EGSS needs to be improved to support reallocation of labour from shrinking to growing sectors. The authorities could draw on the experience of other countries (e.g. Austria, France) in monitoring existing skills and forecasting future skill requirements for the transition to a low-carbon economy.

1.3.5. Promoting eco-innovation

The Czech Republic is an average eco-innovation performer, according to the EU scoreboard (EC, 2017d). Since 2000, public budget and patent applications have shifted from environmental management to climate- and energy-related technology.

In contrast with the trend in IEA countries, public expenditure on energy-related nuclear research, development and demonstration increased to absorb more than half of spending in 2015. Since 2011, this shift has been accompanied by declining budgets for energy efficiency and renewables. The National Research, Development and Innovation Policy 2016-20 and the Smart Specialisation Strategy put a clear focus on nuclear energy and adaptation of conventional combustion installations to comply with emission limits (GOCR, 2016a, 2016b).

While there is no national policy outlining a coherent approach on eco-innovation, some funding programmes, agencies and ministries support eco-innovation and a circular economy (EC, 2016b). Support programmes for R&D are the main instruments used but demand-side instruments, including regulations, standards, labelling and certification, have played an increasing role. Use of price and tax instruments has been limited, and green public procurement has not progressed as planned. Eco-innovation faces the same challenges as general innovation: weak outcomes of R&D activities, limited co-operation between academia and business, a fragmented R&D policy and funding framework, high dependence on the activities of foreign-owned companies and inefficiency in the business environment.

Recommendations on green growth

Implement an environmental tax reform so that prices better reflect environmental externalities, including GHG emissions and local air pollutants:

introduce a carbon component in energy product taxation to reflect the external costs associated with carbon emissions outside the EU ETS and provide a stronger and more consistent price signal across the economy; raise the excise tax on diesel to at least match that on petrol, and index the taxes on both fuels to inflation; consider recycling part of revenue from higher taxes on heating fuels and electricity to vulnerable households using an income-tested cash transfer.

extend distance-based charging to a wider network; link road tolls for passenger vehicles to the vehicles’ emission standards; extend the annual road tax to all (not only business) vehicles; make its rate vary by fuel economy and air emission standards and delink it from the age of vehicles; harmonise the rates of the registration tax on new and used vehicles and tighten environmental criteria to promote fleet renewal towards cleaner vehicles; implement low-emission zones as planned in the Air Protection Act.

remove environmentally harmful exemptions to the energy and vehicles taxes; consider establishing a green tax commission, possibly as part of the National Budgetary Council, to review the environmental effects of fiscal instruments, identify subsidies with adverse environmental effects and prioritise which to phase out.

ensure that groundwater abstraction charges reflect resource scarcity and remove exemptions that are not justified on environment grounds. Consider introducing taxes on fertilisers and pesticides.

Improve the effectiveness of EU funding for green infrastructure by strengthening public procurement procedures, improving project co-ordination, oversight, planning and evaluation, and ensuring the achievement of measurable environmental targets.

Promote investment in low-carbon energy technology: assess the environmental impact of investment in electricity production under the national plan on free allocations and select projects with the highest social return; increase more rapidly the share of permits auctioned in the power sector under the EU ETS.

Strengthen cross-government co-ordination on energy efficiency activities; reinforce transport-related measures in NEEAP; streamline support programmes for households and phase out support to coal boilers; consider introducing energy savings obligations for energy providers; develop the capacity of the banking sector to leverage investment in energy efficiency.

Introduce new support mechanisms for renewable electricity, avoiding any retrospective changes; strengthen the national electricity grid and increase power system flexibility, including through enhanced regional co-operation and demand response.

Promote efficient provision of water services by improving the regulatory framework, including for the financing of these services; apply user charges that allow sustainable cost recovery; promote inter-municipal co-operation; ensure systematic monitoring by independent regulatory authorities of utilities’ efficiency and service quality.

Develop monitoring and analysis of the EGSS; forecast skill requirements resulting from the transition to a resource-efficient and low-carbon economy and adapt education and training policies accordingly.

Develop and implement a comprehensive and coherent framework for promoting eco-innovation by improving the co-ordination of energy, innovation and environmental policies across the government; streamline public support for R&D and ensure that it targets long-term priorities; improve co-operation between academia and business and ensure sound framework conditions for business innovation; develop demand for environmental goods and services.

1.4. Waste, materials management and circular economy

1.4.1. Introduction

The Czech Republic has well-developed and fairly complete policy and legal frameworks for waste and materials management, supported with quantitative targets, voluntary agreements and economic instruments. The country has progressed on several recommendations of the 2005 EPR and further aligned its policy framework with EU legislation.

But the pace of progress since 2005 has been insufficient to consolidate the advances made in the late 1990s and 2000s, and to seize the benefits of continued EU support. Implementation has been partial and not sufficiently co-ordinated. Some targets of the 2003-14 Waste Management Plan were not met. Most achievements were driven by EU requirements and funding. In areas such as landfilling of municipal waste, economic analysis of waste management and investments in recycling, improvement has been marginal. Waste prevention has not received sufficient attention. The Czech Republic’s performance in waste management has improved but remains modest. The current Waste Management Plan contains measures which should help achieve a better performance over 2015-24 (MoE, 2014). The emphasis is on the value of waste as a resource, with the aim of reducing amounts going to final disposal, increasing recycling and reuse, and preventing waste generation.

1.4.2. Producing reliable information on waste and materials for decision making

Two information systems on waste generation and treatment co-exist: the MoE waste management information system and the CZSO waste and material flow statistics, which are based on different EU legal acts. The two systems produce data that differ greatly in terms of definitions, reporting boundaries and surveying methods. This leads to duplication and gaps, impedes policy planning and evaluation, and wastes public money. In 2016, the two institutions and the Government Office agreed to co-operate to review and consolidate the information base. Implementation of this agreement is essential and should be speeded up, supported with a related provision in the new Waste Act.

Figure 3. Waste generation: two data sources, two messages

Material flow accounts are well established, but not integrated with waste statistics. Waste reduction efforts in the business sector are rarely monitored. It is thus not easy to get a complete picture of material flows through the economy and how they relate to waste streams and recycling efforts. The Czech Republic could make much better use of the data produced if they were harmonised and integrated. Industry should also be encouraged to integrate this information in corporate reporting, performance assessments and financial statements.

1.4.3. Creating incentives for more cost-effective waste management

Economic instruments have long been established but do not create the right incentives for compliance with the waste hierarchy. Municipal waste fees are too low to spur waste reduction and recycling, and to cover the cost of service provision. Pay as you throw systems for collection of mixed household waste are in place in only 15% of municipalities. Associated with free separate collection of recyclable waste, expansion of the pay as you throw system could become an important tool for reducing waste going to final disposal.

Landfill taxes remain very low. Landfilling is up to six times cheaper than incineration with energy recovery, contradicting the objective of promoting recycling before energy recovery and final disposal.

In recent years, energy and heat recovery from waste has been promoted to contribute to renewables targets and divert waste from landfills. The Waste Management Plan calls for an expansion of waste-to-energy facilities by 2024. Given the amount of investment involved in such infrastructure and the risk of creating a lock-in effect, it is important for the long-term costs and benefits of alternative waste technology and infrastructure to be carefully examined, along with existing capacity in neighbouring countries.

1.4.4. Strengthening waste reduction and recycling

Waste recovery and associated recycling rates are growing but remain below those in many other OECD and EU countries. The material intensity of the economy has been reduced, more than in most other OECD and EU countries. A well-functioning extended producer responsibility system deals with packaging waste and has met EU targets. The Czech Republic was the first Eastern European country to adopt extended producer responsibility for packaging, in 2000. It has since expanded the system to end-of-life vehicles, tyres, batteries, and waste electrical and electronic equipment (WEEE), and achieved most of the relevant EU targets. Producer responsibility for products other than packaging, particularly WEEE, is not yet sufficiently efficient, however, and lacks transparency.

The country’s system of green public procurement encourages recycling markets, as does the government’s recent secondary raw materials policy. Recycling markets, however, remain weak. A trading system for recycled and recyclable materials and products was envisaged but is not operational. Awareness among businesses about the benefits of waste prevention and a circular economy seems low.

Despite efforts to move to a more knowledge-intensive economy, Czech companies’ innovation performance is lagging, and R&D remains insufficiently connected to business needs. Developments in eco-innovation and clean production technology related to waste management and a circular economy have suffered as a result.

1.4.5. Improving the effectiveness of waste management

Waste is not managed in a cost-effective and environmentally sound manner. Current measures to minimise the environmental impact of waste and materials over their life cycle are insufficient. Direct landfilling still represents a much higher share than in other OECD countries. The recovery target of 50% of municipal waste by 2010 set in the 2003 Waste Management Plan was not met (SAO, 2011). Nor was the EU target of halving the amount of landfilled biodegradable municipal waste from the 1995 level by 2013 (SAO, 2017). Energy recovery is promoted, including as a way to divert waste from landfill. Weaknesses in the monitoring of waste sent to landfill lead to hazardous waste being landfilled by circumventing the landfill risk fee (SAO, 2013).

Waste reduction at source and reduction of hazardous substances in products are encouraged through the producer responsibility system and implementation of the EU directive on Restriction of Hazardous Substances and regulation on the Registration, Evaluation, Authorization and Restriction of Chemicals, but their outcomes are not well known. Synergies with chemicals policies could be strengthened, and businesses should be given greater incentives and guidance on design for environment, including through the producer responsibility system.

Despite important reforms, irregularities in public procurement and lack of transparency still exist (OECD, 2013).

At the national level, co-operation between the MoE and other ministries (industry, agriculture) works well for issues related to waste management. But there is no institutional platform for broader co-operation to steer the transition to a circular economy and related investment choices, nor any platform where businesses, banks and other stakeholders can meet.

At the local level, the large number of municipalities, their autonomy and inefficient inter-municipal co-operation imply a lack of capacity to absorb and implement new policies. Municipalities need more support to carry out their responsibilities. Harmonised guidance by the government is needed to set up a system to assess municipalities’ performance in providing waste services, including through the use of cost accounting indicators.

1.4.6. Performance outlook

The Czech Republic’s modest performance in waste management means essential steps need to be taken before circular economy approaches can be implemented. In the years ahead, it will be important to effectively implement the Waste Management Plan and associated Waste Prevention Programme, and to use synergies with the secondary raw materials policy and the eco-innovation and cleaner production programmes. Adoption of the new Waste Act is crucial in this regard and should be speeded up. The proposed increases in the landfill tax to divert reusable, recyclable and recoverable waste from landfill, for example, cannot be done until the new act is adopted. Its approval before the end of 2018 thus seems indispensable.

The establishment of a reliable, transparent and integrated information system on waste and material flows will be essential to monitor progress and should be reflected in related provisions of the act. Stronger efforts are required to encourage waste prevention in production processes and further upstream in the value chain (design phase), to stimulate “upcycling” of waste into higher-value products and to assess opportunities arising from circular business models. Such efforts must be on a par with modernisation of Czech enterprises, effective alignment of measures and objectives across policies and ministries, and increased co-operation.

Recommendations on waste, materials management and circular economy

Improve the information base on waste and materials to support policy making

Harmonise the national waste management information system and official statistics on waste and materials to create a consolidated, transparent integrated system that supports development, implementation and monitoring of national policies and international reporting. Ensure that a related provision is included in the new Waste Act.

Encourage industry to use waste and materials flow information in combination with accounting data to establish material flow cost accounts so as to better understand the environmental and financial consequences of material and energy use practices and identify opportunities for efficiency improvements (e.g. production processes and product supply chains where material losses could be reduced).

Increase the environmental and economic efficiency of waste management

Speed up the adoption of the new Waste Act, ensuring its approval no later than end of 2018.

Review waste-related taxation in line with the waste hierarchy: gradually increase the landfill tax to a level high enough to divert waste from landfill; consider introducing a tax on incineration for reusable and recyclable waste; ensure municipal waste fees cover the full costs of service provision, and extend the pay as you throw system to all areas.

Provide greater incentives to households to participate in separate collection by implementing door-to-door separate collection.

Improve separate collection rates for WEEE and improve the cost-effectiveness, monitoring and transparency of extended producer responsibility for WEEE. Conduct a competition assessment to identify how market forces can be further strengthened.

Enhance co-operation between government levels and find ways for more efficient inter-municipal co-operation on waste management by encouraging the creation of inter-municipal organisations.

Encourage the use of harmonised cost accounting indicators as part of a broader system to assess municipalities’ performance in providing waste services.

Promote waste prevention and circular business models

Expand efforts early in the value chain to reduce waste generated and hazardous substances in recovered materials. Provide incentives and guidance to businesses on eco-design, including through the producer responsibility systems.

Strengthen waste prevention in industry by fostering awareness among businesses of the economic and environmental benefits of a circular economy, and by creating incentives for the adoption of new technology and environmental management systems. Exploit the synergies between measures on cleaner production, eco-innovation, waste prevention and secondary raw materials by establishing effective mechanisms for co-ordinating and monitoring the actions of all ministries involved.

Strengthen markets for secondary raw materials and recycled goods by stimulating the upcycling of waste, including construction and demolition waste, into high-quality, high-value products, and by integrating secondary raw materials and recyclable waste in the appropriate commodity exchange.

Strengthen the institutional framework to steer the transition to a circular economy and related investment choices, and set up a platform for broader co-operation where businesses, banks and other stakeholders can meet.

1.5. Sustainable urban development

1.5.1. Key urban and environmental trends

The Czech Republic has 16 functional urban areas6 (FUAs), which are its economic power source. Together, the FUAs of Prague, Brno and Ostrava account for 41% of GDP, 31% of employment and 30% of the population. This suggests that productivity and competitiveness improvements in these areas will have positive repercussions nationwide. According to the OECD regional typology,7 the Czech Republic is among the least urbanised countries in the OECD. In recent decades, it has experienced a process of suburbanisation. Changes in urban population have been mainly driven by migration. In Prague, for instance, 97% of the total population increase over 2000-16 was due to migration and 3% to natural increase. The Czech Republic is also undergoing a demographic shift as the population ages, bringing about long-term challenges related to housing, transport, water and other public services.

Prague has the highest population density in the country, but the level is lower than in cities of neighbouring countries such as Poland and Slovakia. Among Czech major cities, the capital and its surroundings in the Central Bohemia region have seen the strongest population growth. Built-up area has been growing, especially in Prague’s commuting zone. This expansion has created short-term growth, but evidence suggests that, in the long run, compact cities are more resilient and have better environmental outcomes (e.g. lower energy consumption).

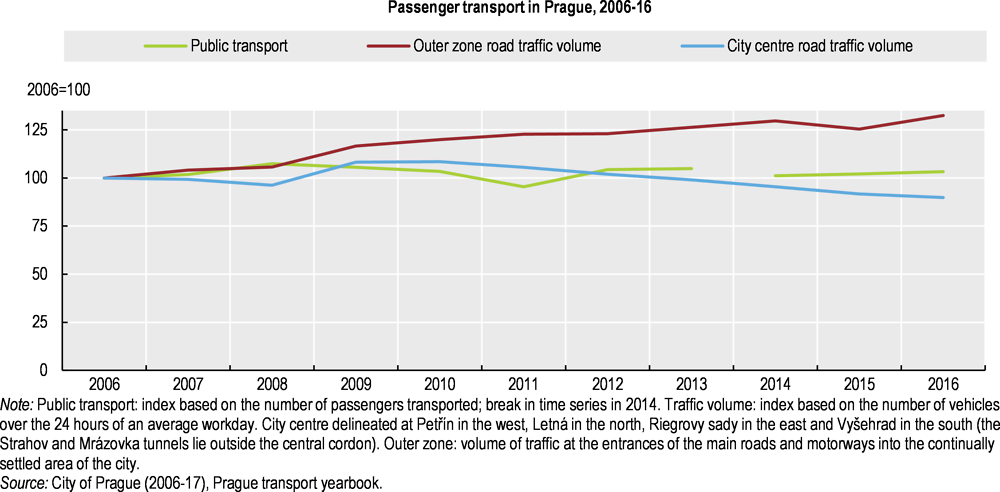

Despite the economic benefits cities bring to the Czech economy, they are a source of long-term challenges regarding housing, transport and environmental protection. Housing affordability has become a major concern. Free market affordable housing is mostly located on the fringe of Prague in housing estates. Although significant investment is being made to regenerate housing estates inherited from the Soviet era, many lack adequate maintenance. The high rate of home ownership limits labour mobility. While Czech cities continue investing in urban mobility, improvements in public transport are counterbalanced by increased car use (Figure 4). This trend is exacerbating air and noise pollution, which remain major health concerns. The development of environment-friendly transport infrastructure and related incentives for public transport and cycling, as recommended in the 2005 EPR, is still pending. The 2016 Programme to Improve Air Quality in Prague is rightly linked to transport strategies reflecting a more integrated approach to urban development. In large cities, almost all residents are connected to public water supply and sewage treatment. However, financing the operation, maintenance and upgrade of the infrastructure remains an issue.

Figure 4. Car traffic volume is growing in Prague’s outer zone

As the 2005 EPR recommended, Local Agenda 21 (LA21) – a voluntary tool for sustainable development at the local level – is being implemented, mostly through the Healthy Cities platform. The municipalities that have adopted the agenda seem to have made some citizens and economic actors more environmentally aware (Kveton et al., 2014), although they remain a minority. The national government should disseminate the agenda’s benefits more widely through the Union of Czech Towns and Municipalities. The Sustainable Municipalities Committee of the Government Council for Sustainable Development has created methodological tools for evaluating LA21 initiatives that could be used more broadly.

1.5.2. Urban governance

The Czech Republic is adopting an integrated approach to territorial development so as to use EU structural and investment funds in certain areas, not only to support national competitiveness but also to reduce territorial disparity. Instruments to use these funds include integrated territorial investment, integrated territorial development plans and community-led local development. However, individual investment projects cannot replace metropolitan-area planning. For instance, Prague has no metropolitan-wide planning approach to land use. This lack compromises Czech cities’ socio-economic and environmental performance.

The territorial organisation is among the most fragmented in the OECD. A majority of municipalities have fewer than 500 inhabitants. A municipality with at least 3 000 inhabitants can be considered a city. The capital, Prague, has the level of a regional government. The distribution of responsibility across government levels is complex. The Ministry of Regional Development is responsible for national policy on regional and spatial development and urban issues. Regional responsibilities include upper secondary education, regional roads, public transport, health care/general hospitals, economic development and planning, as well as social assistance for disadvantaged groups. Municipalities are responsible for local planning and also public transport and the management of local roads, housing, the environment, infrastructure (water and waste management, urban heating, environmental protection), agriculture, primary health care, social care services and local development in general. In addition, the national government has district offices that supervise municipal-level implementation of some central functions.

1.5.3. Policy framework

Czech Republic 2030 and the 2015 Spatial Development Policy set the main priorities on sustainable urban development: integrated development in cities and regions, prevention of spatial-social segregation, redevelopment of brownfield sites and improvement of public urban transport and connectivity. The 2007 Building Act introduced “development principles” as a regional planning tool. The Principles of Urban Policy, a comprehensive cross-sector document presenting the central government’s views on urban development, was updated in 2017 to reflect the Sustainable Development Goals and the UN-Habitat New Urban Agenda. The principles provide guidance and aim to co-ordinate urban development activities at all levels of government.

At the local level, cities’ strategic development plans indicate that environmental protection and sustainable development are key priorities. For instance, the 2016 Strategic Plan of Prague seeks to promote creativity, citizen participation in urban life, enhanced social cohesion, green infrastructure, the sustainable development of peri-urban landscape and revitalisation of public spaces. However, these development plans lack a holistic approach to align housing, spatial planning and transport policies. Sectorisation and specialisation seem well rooted in the Czech administration and while these characteristics have provided clarity for accountability and responsibility, their drawback is that they limit ministries’ ability to co-operate on holistic solutions.

1.5.4. Policy instruments

Spatial planning instruments are well defined and regularly updated, and have a clear multilevel structure. Cities are not legally required to adopt land use plans, but, once adopted, such plans are binding. At the national level there is a hierarchical system of plans, with the Spatial Development Policy at the top of the hierarchy (MRD, 2015). Although it contains planning guidelines and delimits development areas as well as the main transport and infrastructure corridors, it does not outline a general vision for spatial development. As spatial planning and economic policy are separated from territorial planning,8 they lack immediate connection to central, regional and municipal financial planning. All three levels of government often make spatial and land use plans without clearly anchoring them in public budgets, so there is a mismatch between resources and objectives.

Prague’s intensive suburbanisation suggests that its land use planning system is highly permissive, a situation that seems to be replicated in other municipalities. Its urban core has a share of developed land per person only slightly below the European average, but its commuting zone is characterised by dispersed development. Since 2000, developed land across the Prague FUA has grown faster than the OECD Europe average. By far the greatest increases have been in the commuting zone, indicating that better links between rural and urban areas are needed. The updated Principles of Urban Policy suggest that rural-urban partnerships working through a functional approach may be the way forward. Prague’s 2016 Strategic Plan aims to reduce pressure on the urban core and improve the quality of the urban environment and architecture. It focuses on encouraging development in built-up areas and protecting unbuilt ones (open landscape, agricultural land) from development. Prague’s latest land use plan – the Metropolitan Plan – aims to control sprawl and protect green areas in the municipality. However, due to legal restrictions, the Metropolitan Plan does not cover the entire metropolitan area, which is seeing considerable peri-urban growth.

Although local authorities seem to acknowledge the importance of developing brownfield sites, it is not clear if they have the financial and technical instruments to do so. In many cases, site ownership is unclear, so local authorities’ ability to act on their regeneration is limited. Brownfield development presents a valuable opportunity for cities to prevent loss of green areas, enhance urban spaces and remediate sometimes contaminated soil. Such sites could help solve the housing shortage in central areas, as they are usually well connected within the urban boundaries, offering a competitive alternative to greenfield investment. Public urban transport seems to be a success story, at least in the city cores. Prague, for example, is well served by urban transport, though connections to the suburbs are rather limited. The lack of mobility options in the suburbs has led to increased car ownership, traffic and pollution (Figure 4). Green mobility options are largely underdeveloped. Prague’s building regulations promote better, more sustainable urbanisation but the lengthy approval process compromises their effectiveness.

Improving energy efficiency in buildings is a priority of the government. The focus is on improvement in the thermal properties of buildings and the insulation of houses and apartment buildings. Litoměřice is a good example of national efforts to increase energy efficiency. Since 2012, the city has refurbished public buildings through the Municipal Energy Plan. This is expected to reduce energy consumption by at least 20% by 2030. A revolving energy savings fund has already saved about EUR 830 000. However, despite increased funding for energy efficiency programmes, investment needs are high.

Czech cities face increasing risk of flood and drought. The government’s water policy aims to enhance flood protection and ensure long-term sustainable use of water resources. With the expansion of impervious surfaces and the shrinkage of green areas, heavy rains can lead to sewer overflow and release of untreated wastewater into the environment. Thus, a critical challenge for cities is to build systems to discharge storm water and keep it from mixing with wastewater, taking into account local specificities. Czech cities could learn from what other cities are doing and gain transfer of knowledge and secure capacity building.

Cities need a mix of economic instruments for urban development adapted to their specific situation. Fiscal policy is sometimes at odds with spatial and environmental objectives. Prague does not use fiscal instruments to encourage density despite this being a critical spatial objective. A mixture of congestion charges, vehicles taxes and parking charges could be considered as a way to address Prague’s congestion and pollution issues. The introduction of a low-emission zone is being considered but not until the long delayed ring road is completed. For a city like Ostrava, where air pollution is also linked to industrial sources, emission taxes might have more effect.

1.5.5. Financing and investment

The public finance system is highly centralised. Central government spending accounts for two-thirds of general government expenditure (OECD, 2017g). Municipalities have greater spending responsibilities than regions. Subnational government spending is sizeable on education, economic affairs (particularly transport), general public services and environmental protection (particularly waste and wastewater management). However, discretionary powers of subnational governments are limited, as much spending is on behalf of the central government. In practice, local governments have limited fiscal and spending autonomy and in many respects are centrally regulated.

Subnational governments are financed through a mix of shared tax, grants and transfers from the central government and fees for public service provision (OECD, 2016). The share of taxes allocated to municipalities is mostly based on demography, which can act as an incentive for sprawling development. Municipalities have more revenue from their own sources than regions but their autonomy is limited by centrally determined restrictions. In addition, most of them impose minimum rates for the recurrent tax on immovable property. Increasing the share of municipal revenue that is directly controlled could help drive improvement in public service provision by strengthening the link between taxation and services.

Recommendations on sustainable urban development

Urban governance

Strengthen the urban governance system by i) sharpening the distribution of expenditure responsibilities across levels of government; ii) using a functional rather than administrative approach in delimiting metropolitan areas; iii) considering creating metropolitan governance bodies (e.g. have the Prague Institute for Planning and Development cover the entire metropolitan area and/or integrate responsibility for transport and housing planning in a single metropolitan body); and iv) incentivising co-operation through concrete inter-municipal projects (e.g. infrastructure or even cultural events).

Enhance horizontal collaboration across government agencies on urban policy by i) ensuring that related recommendations of the Government Council for Sustainable Development are implemented and ii) making responsibilities of ministries, agencies and municipal departments more cross-cutting and clarifying their role in urban development.

Policy framework

Increase sustainability through density by i) adopting the compact, co-ordinated, connected development model, with a holistic approach to urban development; raising awareness on the benefits of a compact city model to achieve sustainability among public, private and non-profit stakeholders; and ii) easing administrative burdens of the building approval process to support urban regeneration and brownfield redevelopment.

Continue to promote Local Agenda 21 beyond the Healthy Cities platform by developing the use of evaluation tools and disseminating benefits through a dedicated communication strategy.

Ensure that the Principles of Urban Policy emphasise i) monitoring and evaluation as permanent features of the urban planning system and its programmes; ii) the need for strong political and organisational leadership, long-term vision, and citizen engagement in urban life (based on the experience of Litoměřice in energy efficiency); iii) integrated policies for urban development that link transport solutions to housing and land use policies and facilitate synergy building in various policy domains involving all municipalities in the Functional Urban Area; and iv) building rural-urban partnerships for regional development.

Policy instruments

Review the land use planning system to promote urban sustainable development by: i) making land use planning, including implementation strategies, mandatory; ii) adopting integrated spatial planning to coordinate investments; iii) using fiscal incentives to complement spatial development objectives; iv) encouraging metropolitan spatial planning through fiscal incentives and regulatory frameworks set by the national government; v) ensuring that cities, particularly Prague, align sector and borough-level plans with the strategic plan; vi) linking urban transport solutions to housing and land use planning to improve mobility and reduce air pollution; and vii) monitoring the impact of spatial development plans in relation to urbanisation, land use, and environmental objectives.

Adopt a wide set of measures to deal with the housing shortage by i) revising building laws to reduce unnecessary procedures that lead to higher construction costs; ii) establishing a one-stop process for building permits so that the onus is not on the developer to obtain multiple approvals from individual departments; iii) adopting ways for low-income households to gain access to housing (e.g. by developing the rental market); and iv) if needed, increasing the availability of land for new development through land use planning, especially on brownfield sites.

Promote the development of brownfield sites to help deal with urban environmental challenges and bridge the housing gap. For that purpose: i) revise fiscal instruments to incentivise brownfield investment and guide land use to a more sustainable path; and ii) facilitate access to affordable, environmentally sound building materials.

Financing and investment

Improve the use of environmental fees and taxes at city (municipal) level to tackle urban air pollution and congestion, considering the cost of the various options (congestion charge, vehicle tax, subsidies, parking charges); revise water and sewage treatment charges to recover the costs of investment, operation and maintenance of water and sanitation infrastructure.

Remove the demographic criteria for tax sharing, considering population size only when assigning responsibilities to local governments. Thus, larger cities could have responsibility for some services provided by the central government in more sparsely populated regions. This could remove the incentive to compete for population to get more fiscal resources.