This chapter applies the OECD Online Dispute Resolution (ODR) Framework to three specific types of claims – simplified procedures, warning procedures and consumer claims – in Latvia. It describes the pathways of simplified procedures, warning procedures and consumer claims from a legal, institutional and people-centred perspective. Drawing on mapping exercises, fact-finding interviews and OECD country practices, this chapter explores a range of potentialities for improvements in Latvia’s ODR landscape, including the value of monetary claims, guidance on dispute mechanisms and hearing options, integration between platforms and seamless pathways. In addition, it examines prospects for scaling up automation, including the use of artificial intelligence, and acknowledges the need to factor in ethical, transparent and fairness standards in dispute resolution mechanisms.

Developing Effective Online Dispute Resolution in Latvia

4. Applying ODR to specific types of claims in Latvia: Simplified procedures, warning procedures and consumer claims

Abstract

4.1. Introduction

The analysis of pathways for three specific types of claims – simplified procedures, warning procedures and consumer claims – aims to narrow the application of the OECD Online Dispute Resolution Framework (“OECD ODR Framework”) to specific areas and address the concrete needs of dispute resolution in Latvia.

These specific claims have been identified following an extensive consultation process with the Latvian Ministry of Justice and Court Administration. In addition, the OECD administered a questionnaire to and ran a focus group with business stakeholders (e.g. business associations, chamber of commerce, investment council) in order to inform the choice of the cases (see Annex A). These consultations made it possible to capture some of the businesses’ impressions and alternative dispute resolution (ADR) needs with a focus on online dispute resolution (ODR).

The analysis of pathways for each type of claim involved service mapping and assessment from both institutional and user perspectives. For each case, such analysis also aimed to highlight legal and institutional arrangements, processes, and services, as well as the application of digital technologies to transform dispute resolution mechanisms. The service mapping and assessment methodology can be found in Annex A.

Following the broader analysis found earlier in this report, this chapter explores the application of ODR to three specific types of claims:

1. Simplified procedure refers to civil litigation of small claims up to EUR 2 500, with a specific focus on debtor claims.

2. Warning procedure allows the creditor to obtain an enforcement order against the debtor in an abbreviated procedure, provided the debtor does not contest the claim. This procedure usually applies to cases of small amounts and is contingent on the debtor’s lack of action.

3. Consumer claims between a person who acquired goods or services from someone acting within their economic or professional capacity (trader or service provider). Such cases often revolve around issues on the quality of goods and services, delays in performance by traders or service providers, or unfair contractual terms, among others. While this category of disputes does not have its own specific form of litigation, it has special ADR and pre-conditions for litigation.

4.2. Simplified procedure

The simplified procedure in Latvia aims to reduce the complexity and expenses associated with the ordinary procedure (outlined in Sections 25018‑25027A of the Civil Procedure Law) (Government of Latvia, 1998[1]). This procedure has four fundamental characteristics that distinguish it from the ordinary procedure:

1. It does not involve a hearing unless the court considers it necessary or any of the parties request a hearing under a justified request.

2. The court decision can be reviewed only once, while in the ordinary procedure, the decision may be reviewed before two instances (Section 44012 of the Civil Procedure Law).

3. Rather than a full reasoned judgment, the court issues a summary judgment.

4. Importantly, if a creditor opts for litigation and specific criteria are met, the simplified procedure must be followed. If these criteria are not fulfilled, disputes are decided following the ordinary procedure.

The simplified procedure is available for two types of claims: monetary claims capped at EUR 2 500 (excluding contractual penalties and interest), and maintenance claims limited to EUR 2 500.

The simplified procedure may be used by a range of stakeholders, such as consumers, tenants and employees seeking compensation for damages or unpaid salary. Commercial entities, such as financial institutions reclaiming small loans, can also use this procedure. For instance, banks and non-bank lenders might use the simplified procedure to reclaim small loans granted to consumers.

There is no arbitration threshold in Latvia and fees can vary according to several factors, including dispute value and complexity (see Box 4.1). Hence, mediation and arbitration may not be viable options in disputes where arbitration fees could be disproportionate. . For eexample, one of theleading arbitration institutions, the Arbitration Court of Latvian Chamber of Commerce and Industry provides that claims up to EUR 1000 arbitrator's fee is EUR 125. If the claim is EUR 1,001 up to 5,000, then the arbitrator's fee is EUR 175. However, at the same time for all disputes up to EUR 10.000 the arbitration fee is EUR 250. These sums do not include value-added tax (VAT) and additional expenses, like a fee for minutes of an arbitration hearing. Hence, for a claim of EUR 1001, fees would amount to at the very least EUR 514.25 (EUR 425 + 89.25 VAT).

Given the considerable disparity between the value of the claim and arbitration fees, parties often prefer to proceed with litigation if informal negotiations fail. Similarly, for mediation services at the Riga Arbitration Court for claims up to EUR 1 500, the administrative fees are 10% of the amount of the claim but not less than EUR 70. Additionally, a mediator incurs an extra EUR 70 fee, applied to claims up to EUR 1 500.

Box 4.1. Arbitration in Latvia and suitability to small claims: The case of the Arbitration Court of Latvian Chamber of Commerce and Industry

The Arbitration Court of Latvian Chamber of Commerce and Industry (LCCI) is a permanent, independent arbitration court with competence over all civil disputes subject to arbitration. The LCCI reviews both domestic and international civil disputes, and available both for merchants and other persons who have included the arbitration clause of the LCCI Court of Arbitration in their transaction documents. It provides swift arbitration processes with reasonable arbitration costs. Parties can mutually decide on the selection of arbitrators, the language of the arbitration process, the place of proceedings, and its form.

Despite the advantages of arbitration, costs can be dissuasive, particularly for disputes involving small sums, which is often the case for most claims. For instance, if the amount of a claim is EUR 400 and the case is heard by a single arbitrator with only one applicant and one defendant, the arbitration service fee would be approximately 450, which is above the initial claim value. Furthermore, supplementary fees may apply if a language other than the official one is chosen, if the hearing is recorded or if an interpreter is needed.

Source: The Arbitration Court of Latvian Chamber of Commerce and Industry (2023[2]), About the LCCI, https://www.ltrk.lv/en/node/30.

4.2.1. Pathways to simplified procedure

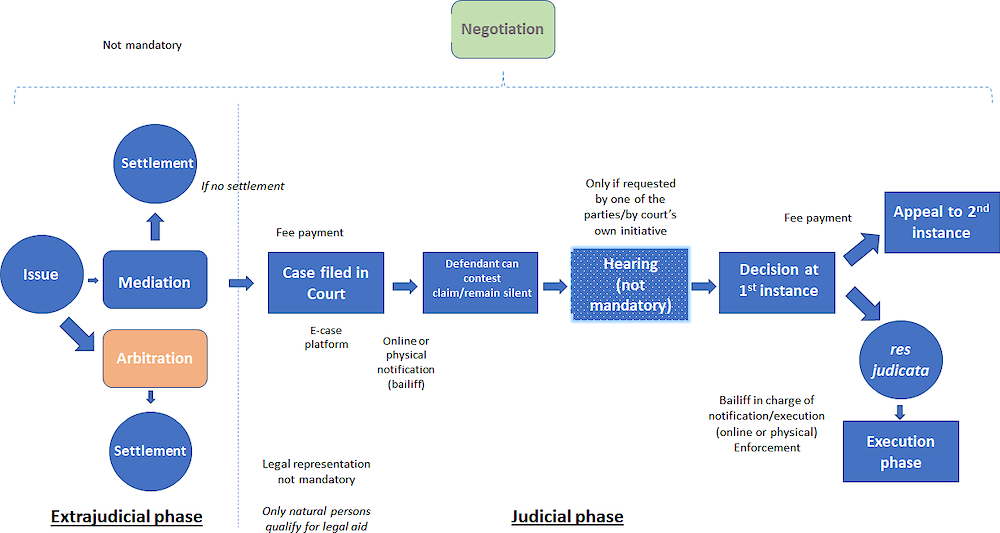

The simplified procedure initiates with the submission of a statement of a claim to the court (see Figure 4.1). The submission can be done either online through the e-case portal (Elieta.lv), by e-mailing a claim signed with an electronic signature to the e-mail of the court or in person (for paper-based claims). The statement of a claim employs a standardised template. Litigants can access information through Legal Aid Offices or Latvia’s one-stop-shop platform Latvija.lv (see One-stop-shops in Chapter 3). Under the simplified procedure, people can represent themselves or engage a representative who may or may not be an attorney (Government of Latvia, 1998[1]).

Figure 4.1. Mapping of the simplified procedure

Source: Author’s own design.

Upon receiving the statement of claim and accompanying documents, the court shares this package with the defendant. The defendant has 30 days to provide explanations upon receipt, with the option to request a hearing or initiate a counterclaim. If the counterclaim surpasses EUR 2 500, the case may be transferred to the ordinary procedure. The absence of explanations from the defendant does not prevent the court from issuing a judgment. Any explanations received from the defendant are forwarded to the claimant (Government of Latvia, 1998[1]). In communication with the parties, the court also:

explains each party their procedural rights

provides information about the court

provides information about the right to petition for the removal of a judge.

While the simplified procedure typically does not involve hearings, they can occur if one or both parties request a hearing, and the court agrees; or if the court deems a hearing necessary.

In the case of a hearing, the court serves the summonses to the parties, informing them that the hearing will take place even in case of absence (Government of Latvia, 1998[1]). The summary decision is available in the court information system (TIS) within two weeks and then distributed to the e-case portal for case parties. Following this, parties have 10 days to request a full judgment, which is delivered within 10 days of the summary decision and made available within 20 days via the TIS and the e-case portal. The court may also prepare the full judgment on its own initiative, which could be sent to any party upon request.

If no hearing is held, the case is conducted through a written process, with the court examining materials without party involvement (Government of Latvia, 1998[1]). Once a summary decision (judgment) is issued, parties are notified about the date of its availability on the E-case portal. Similarly, within the 10day period after the decision, any party may request a full judgment, to be issued within 20 days. Alternatively, the court can independently render a full judgment (within the same time frames), published in the TIS and then distributed to the e-case portal for case parties‑. In the case of technical difficulties with the TIS, the judgment must be made available in the Court Registry on the same date as the date of the judgment.

The simplified procedure allows one appeal based on either substantive or procedural grounds. Typically, the appellate procedure does not involve a hearing unless the court decides otherwise. The appellate decision is published on the TIS or the Court Registry in the case of technical issues. Each party has the right to request the delivery of the judgment (Government of Latvia, 1998[1]).

Regarding the costs of the simplified procedure, state fees apply, following the same rules as for the ordinary procedure. In most cases, the state fee is calculated based on the amount of the claim. If the principal claim, excluding interest and contractual penalties, is EUR 2 500 or less, then the claimant must pay 15% of the sum but no less than EUR 70 or more than EUR 320. Once a judgment is issued, the defendant needs to fully or partially compensate the state fee if the claim has been fully or partially satisfied.

In addition to the state fee, there are litigation costs that primarily involve the cost of legal assistance. If the litigant has personally prepared the application (or with the help of another lawyer but not an attorney), then costs related to legal assistance are not reimbursed. When an attorney is engaged for claims up to EUR 2 500, the winning party can recover actual expenses up to 30% of the satisfied part of the claim. If the claim is examined only at the first instance court, the reimbursed amount cannot exceed half of the amount that would be reimbursed by the losing party (i.e. 15% of the satisfied part of the claim). However, in any case, the court has the right to reduce the reimbursable amount considering the principles of fairness, proportionality and other relevant objective circumstances of the case, such as complexity, size, number of hearings and the court instance of examination. The losing party is responsible for reimbursing the winning party for legal assistance and state fees.

According to these criteria, the highest reimbursement claimable by the winning party for legal representation could be EUR 750 and EUR 375 if the decision of the first instance court is not appealed. However, since the simplified procedure normally proceeds without hearings, the actual amount could be notably lower. Currently, the writ of execution issued after a final decision is created in the TIS, then sent to the bailiff for execution. Bailiffs have other information system.

Another pathway to simplified procedure at the EU level is the European small claims procedure, available for cross-border claims up to EUR 5 000 (Box 4.2). Claims can be brought entirely on line through the European e-Justice Portal against businesses, organisations or customers. This cross-border dispute resolution mechanism has the advantage of encouraging trade, strengthening confidence in the EU single market and enforcing EU single market rules in line with its fundamental values and “four freedoms” (European Union, 2007[3]; 2002[4]).

Box 4.2. European Union: Simplifying cross-border claims through the European small claims procedure

The European small claims procedure is an alternative to existing procedures in the laws of the EU member states. This procedure applies for cross-border small claims resulting from civil and commercial disputes up to EUR 5 000. It offers litigants a swift and cost-effective alternative to national procedures. The judgment resulting from this procedure is recognised and enforceable in any other EU country except for Denmark. A court can only decline to enforce the judgment if it conflicts with an existing judgment between the same parties and on the same issue.

The entire procedure can be completed on line through the European e-Justice Portal. Claims can be made against businesses, organisations or customers. The claimant must fill in a form and send it to the competent court. Within 14 days, the court should provide an answer form and serve a copy of both forms to the defendant. The defendant has 30 days to reply by filling in the answer form. The court must send the plaintiff a copy of any reply within 14 days. Within 30 days of receiving the defendant's answer, the court must either issue a judgment, request further details in writing from either party or summon the parties to an oral hearing. If the court is equipped for it, the hearing should be conducted through videoconference. The parties can request an electronic certificate of judgment directly through the platform. The possibility of appealing the judgment depends on the laws of each EU member state.

The simplified procedure allows the claimant to save both money and time. Depending on the country, a court fee must be paid by the unsuccessful party, but the amount is considerably lower than in ordinary procedures. For instance, the court fee in France is EUR 18.72 without a hearing and EUR 70 with a hearing. In the case of a court hearing, having a lawyer is optional.

Source: European Union (2022[5]), Small claims: The European Small Claims procedure is designed to simplify and speed up cross-border claims of up to €5000, https://e-justice.europa.eu/42/EN/small_claims?init=true.

The use of ADR for disputes that qualify for the simplified procedure follows similar patterns as for other disputes. Instead of going through the courts, parties can negotiate, engage in mediation, or resort to arbitration, as long as it is not a consumer dispute (see Advancing in digital transformation in Chapter 3 and Pathways to consumer claims below). However, it is important to highlight that these choices might be less attractive than litigation. Factors like the costs linked to ADR, lack of smooth transition from ADR bodies to courts, limited enforceability, and the perception of ADR in Latvia may discourage parties, leading them to lean towards litigation channels, such as the simplified procedure (see Applying ODR to dispute prevention and resolution in Chapter 3).

4.2.2. Revamping the simplified procedure

Latvia could consider reforming certain aspects of the simplified procedure to increase its use. This may include assessing the threshold for monetary claims, improving access to information, and automating certain procedure elements, among other potential changes. The following sections outline some recommendations to help Latvia optimise the simplified procedure.

Consider increasing the threshold for monetary claims

A potential area for improvement involves increasing the maximum value of claims eligible for the simplified procedure, which are currently capped at EUR 2 500. Increasing the allowable value of monetary claims would facilitate a broader use of the simplified procedure. This reform would potentially require amending Section 25019(2) of the Civil Procedure Law (CPL) (Government of Latvia, 1998[1]).

The higher value of monetary claims may not necessarily imply greater complexity of cases and require cassation review. A higher amount could also be justified both by the EU's simplified procedure that considers small claims as those under EUR 5 000 (see Simplified procedure) and Latvia’s high inflation rate compared to other OECD countries (OECD, 2023[6]).

Improving access to information on the simplified procedure

The simplified procedure allows parties to be self-represented. Particularly in these cases, access to information in plain language is important to ensure a fair trial and access to justice for all (OECD, 2023[7]). In this regard, Latvia could consider improving its one-stop-shop platform to integrate clear guidelines as part of a justice section in the platform with comprehensive information on the simplified procedure. Guidelines could include applicability, requirements to file a claim under the simplified procedure and the step-by-step process. Taking the example of projects PARLe (the Platform to Aid in the Resolution of Litigation electronically, in Canada; see Chapter 3 and Box 4.6) has implemented, a chatbot would be useful to help people assess their legal and justice needs and understand if their case is eligible for the simplified procedure (see One-stop-shops in Chapter 3).

Consider automating certain aspects of the simplified procedure

Repetitive tasks representing significant workload are good candidates for automation, notably procedural acts that are not contradictory or do not require in-depth analysis of facts or law. Concretely, Latvia could consider automating the reconsideration of hearings; the granting of due date extensions; time-bound decisions after no response from parties; notifications to parties for fulfilling specific requirements, such as payment of charges, presentation of documents; or responding to information requests.

In specific cases, algorithms could identify missing requirements or elements in a file, leading to the refusal of a claim following the simplified procedure. Currently, the Civil Procedure Law (Section 132) provides 11 grounds for refusal of the simplified procedure. While some of them might require an in-depth analysis of the facts of the case (e.g. certain criteria to identify court jurisdiction), the identification of certain elements, such as the total amount of a claim or the monetary or maintenance nature of the claim (Section 25019[2]), could easily be identified by AI. In this scenario, an automated decision rejecting the initiation of a claim could be issued, which would be subject to review by a judge upon the claimant’s request under Section 132(3) (Government of Latvia, 1998[1]).

Providing further guidance on hearing options

Latvia could consider providing further guidance to parties and judges on whether and how to conduct or attend in-person or online hearings in simplified procedure when there is a court hearing. Fact-finding interviews suggested that judges would gladly welcome guidelines that could help them identify circumstances when online hearings are more suitable than in-person hearings. Moreover, it has been suggested that the CPL could provide an option for a court – sua sponte or based on a motivated request of the party – to set a hearing limited to the clarification of a specific issue (e.g. to hear witness statements on one particular issue where the court believes that the written evidence is insufficient). While clear guidance is recommended, final decisions on conducting hearings in person or on line should remain at judges’ discretion.

Important aspects to be considered in such guidelines are the right to participate effectively, the integrity of witnesses and experts, and the presentation of evidence in hearings. Concretely, guidelines could offer guidance on pre-testing and walking parties through videoconference tools/platforms; monitoring the quality of image and sound to minimise technical incidents; preserving the public nature of hearings except for claims running under legal secrecy; and addressing the challenges and particular needs of vulnerable groups in the decision to have a remote hearing.

4.3. Warning procedure

The Warning Procedure is regulated in Sections 4061 through 40610 of the Civil Procedure Law and Regulations of the Cabinet of Ministers No. 792 Rules on the Forms to be Used in the Enforcement Notice Procedure (Government of Latvia, 2009[8]). The warning procedure is optional, in contrast to the simplified procedure, which can be a mandatory form of litigation in certain cases. According to the Court Administration, in 2019, out of 41 384 total applications received, 152 applications (0.37%) were submitted by a natural person, and the rest were submitted by legal entities (Government of Latvia, 2022[9]).

The warning procedure offers an option for creditors who do not want to engage in full-fledged litigation before a court. This procedure is applicable to monetary obligations with a clear performance date based on a documented agreement; and monetary obligations without a specified time, provided they are documented and related to the payment for the supply/purchase of goods or provision of services.

The warning procedure has specific characteristics. First, it does not involve an actual trial or hearing. Second, it is not a mandatory procedure [i.e. the creditor can opt between enforcing the debt through the warning procedure (Torgāns, 2012[10]) or ordinary litigation]. Third, according to Latvian practitioners consulted throughout the assessment phase, the warning procedure is frequently employed by public utility providers (e.g. heat, water, gas, electricity) to collect unpaid fees and financial institutions (e.g. for loan collections). However, these sectors do not encompass the whole scope of the warning procedure. For example, landlords can use it to claim rent or employees to claim salary.

Exceptions apply to the warning procedure, prohibiting its use. These cases include:

1. for payments linked to a non-performed counter-performance (e.g. the seller cannot claim payment of price if the payment is dependent on the delivery of goods to the buyer and no goods have been delivered)

2. if the debtor’s declared residence is unknown

3. if the debtor is a natural person and their declared place of residence is outside Latvia; or if the debtor is a legal person (e.g. a company or a public institution) and their statutory address is outside Latvia

4. if the requested contractual penalty is larger than 10% of the principal debt

5. if the claimed interest is larger than the principal debt

6. if the amount claimed exceeds EUR 15 000

7. for obligations that have to be paid in solidarity1 by more than one person.

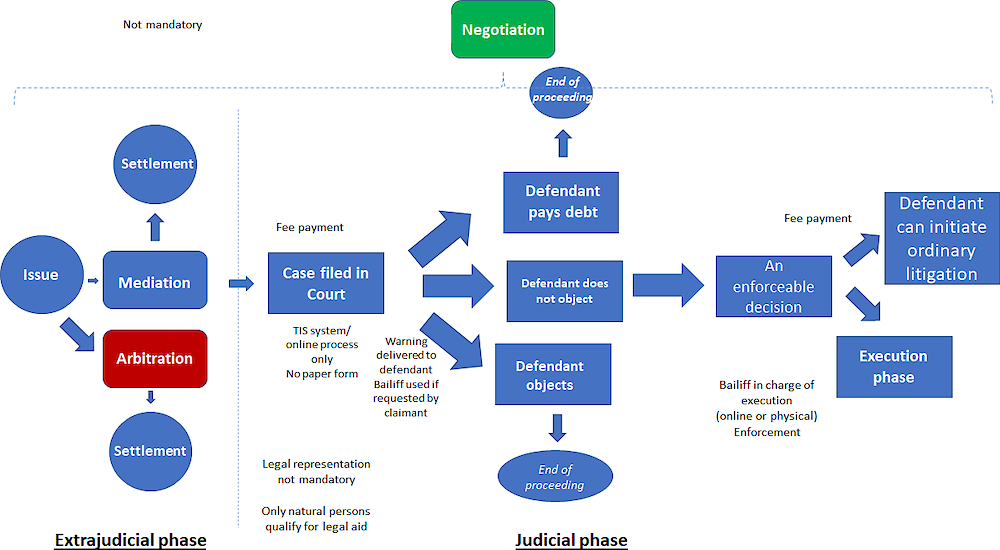

4.3.1. Pathways to the warning procedure

To trigger the warning procedure, the claimant (creditor) should initiate it via an online application through the e-case portal. The application2 is submitted to the district court, where a district court judge reviews it concerning its formal compliance with the CPL. If the application does not provide the information required by law, the judge of the district court declines it, issuing a reasoned decision that is not subject to appeal (Government of Latvia, 1998[1]). The decision does not prevent the resubmission of future applications. If the requirements are met, the court issues a warning that, along with a reply form, is sent to the debtor (Government of Latvia, 2009[8]). In view of the technical nature of these steps, they are good candidates for potential automation (see Figure 4.2). The applicant can also opt for the bailiff to issue a warning to the debtor.

The application must include documents certifying payment of the state fee and related expenses. If the court accepts the creditor’s application, the judge issues a warning3 to the debtor, which the judge must sign through electronic signature. The warning package is issued to the debtor against a signature of receipt, which is returned to the court. If the applicant had indicated that the bailiff must issue the warning, then the court employs the bailiff or their assistant. In that case, the bailiff prepares an act confirming that the debtor received the documents or refused to receive them. This act is returned to the court. The applicant must compensate the bailiff expenses.

If it is impossible to deliver the warning to the debtor (against a signature) or, in case the bailiff was employed and failed to deliver the warning within a month or failed to submit the act confirming delivery/refusal to the court, the judge terminates the proceeding. The decision is communicated to the applicant electronically. This decision does not prevent the applicant from re-applying for the warning or using ordinary litigation. The already paid state fee and expenses related to the issuance of the warning are fully or partially offset from the state fee and issuance expenses in the new proceeding.

Figure 4.2. Mapping of the warning procedure

Source: Author’s own design.

The debtor can respond to the warning on paper or electronically. If the debtor opposes the claim, the judge closes the procedure. The same applies if proof of payment accompanies the reply. If the debtor acknowledges the debt in part, then the judge makes a decision to enforce the obligation in that part but closes the case for the rest. If the debtor does not reply within 14 days, the judge, within 7 days, must take a decision on the enforcement of the obligation specified in the application and recovery of court expenses. The decision is effective immediately and has the force of an enforcement document. The decision is enforced as a judgment. Within three days, the decision is sent to the debtor. The decision serves as an enforcement document for the creditor.

If the judge decides to close the procedure due to the performance of the obligation or the debtor’s objection, the decision cannot be appealed. This decision is made by the judge manually. The decision and the reply by the debtor are communicated to the applicant. However, this does not prevent the creditor from bringing an action via ordinary litigation.

If the debtor does not agree with the decision on substance, they have three months from the day the decision was submitted to initiate ordinary litigation against the creditor and dispute the claim. When initiating the litigation, the debtor may also request that the court suspend the enforcement of the warning procedure decision. If it has already been enforced, then the debtor may request that the court secure the action. If the request to stay enforcement or to secure the action is satisfied, then it cannot be appealed and is effective immediately. If the court refuses these requests, the decision can be appealed by the debtor.

If the court has suspended the enforcement, the creditor can submit his/her own application requesting the repeal of the stay. The request must be motivated. If satisfied, the decision to repeal the suspension is effective immediately and cannot be appealed. If the creditor’s application is rejected, the creditor can appeal it.

The standard category of expenses for the warning procedure is the state fee. The state fee is 2% of the debt. Thus, the maximum state fee is EUR 300. In addition, since January 2022 the applicant must pay EUR 4.00 for the issuance of the warning.4 In the case the judge renders the decision, these expenses will be added to the claimed amount and included in the decision, thus being enforceable against the debtor. If the applicant has requested the court employ a bailiff, then the bailiff must be remunerated for the delivery of a warning (EUR 40 per address). These expenses will not be included in the decision and must be carried by the applicant as using a bailiff is not mandatory.

The use of ADR for disputes that qualify for the warning procedure is similar to other types of disputes within a certain ceiling. Rather than litigate, parties can choose to negotiate, proceed with mediation or arbitration, provided the issue is not a consumer dispute (see Advancing in digital transformation and Applying ODR to dispute prevention and resolution in Chapter 3 and Pathways to consumer claims). However, it is worth noting that these options might be less appealing than litigation. Costs associated with ADR; lack of swift transfer of cases from ADR institutions to courts; limited enforceability; and ADR’s reputation in Latvia might have a dissuasive effect on parties, encouraging them to opt for litigation avenues, such as the warning procedure (see Advancing in digital transformation in Chapter 3).

4.3.2. Revamping the warning procedure

Looking ahead, Latvia could explore alternatives to optimise the warning procedure. Improvements could encompass reforms in the value limit for monetary claims; automation of processes and decisions; and the period to initiate an ordinary procedure following the closure of a warning procedure. The ensuing sections provide recommendations aimed at revamping the warning procedure in Latvia.

Consider increasing the value of monetary claims

In the current Latvian legal framework, the principal claim under the warning procedure must not exceed EUR 15 000. This cap can have several implications. For example, for financial institutions, the relatively low amount limits the use of the procedure to consumer loans, credit card loans, and leasing. Larger debts, notably “mortgage debts”, may be excluded from the procedure due to their size. To maximise the use of the warning procedure, Latvia could consider amending the Civil Procedure Law to increase the value of monetary claims to at least EUR 25 000.

This proposal is supported by similar legal instruments. The European Order for Payment is an example of simplified procedure for cross-border monetary claims that does not have any restrictions regarding the size of the claim (European Union, 2008[11]) (see Box 4.3). Another similar example that could inspire Latvia to reform the cap for the warning procedure is the German procedure, which does not have any monetary cap (Government of Germany, 2008[12]).

Box 4.3. European Union: The European Order for Payment procedure

The European Order for Payment (EOP) is a simplified procedure for cross-border civil and commercial uncontested monetary claims. It is an optional procedure that provides a creditor with a fast means of repayment from a debtor who lives in another EU country. The procedure can be used for any sum of money that is due for payment at the date of the claim.

Applicants must fill out a standardised form available at the European e-Justice portal and send it to the competent court. The court issues the EOP within 30 days. The defendant has 30 days to lodge any statement of opposition to the EOP. After this period, the EOP becomes automatically enforceable. If the court rejects the defendant’s application, the EOP remains in force. Conversely, if the court decides that the review is justified, the EOP becomes null and void.

The EOP provides a wide and efficient alternative to national procedures thanks to the absence of restrictions regarding the amount of the claim. Once issued, the EOP is recognised and enforceable in all EU countries except Denmark.

Source: European Union (2008[11]), Regulation (EC) No. 1896/2006: European order for payment procedure, https://eur-lex.europa.eu/EN/legal-content/summary/european-order-for-payment-procedure.html.

Consider reducing the period to initiate an ordinary procedure after a warning procedure

There is scope to reduce the three-month period to initiate ordinary litigation from the closure of the warning procedure with a positive decision to the creditor. This could help improve the efficiency of the process and increase legal certainty for the creditor. Given that the debtor had the opportunity to raise any objections during the warning procedure phase, reducing the period to initiate the ordinary procedure to two months seems reasonable and sufficient for the debtor to object to the claim. This change would require amending the Civil Procedure Law.

Improving e-signature and authentication

Fact-finding interviews revealed that one of the most time-consuming steps in the process of issuing the warning is the signing process by electronic signature in the TIS. Interviews suggested that the current e-signature process could be more cumbersome and time-consuming than a paper signature due to the e-signature system and authentication process.

This points to a need to improve the basic technology infrastructure to support the e-signature process. This includes securing servers, databases and network connections to facilitate the electronic signing and storage of documents. Likewise, the e-signature system should seamlessly integrate with the applications and platforms where electronic documents are created and managed. The system should be designed to accommodate a growing volume of signatures and documents as needs expand (see Leveraging digital technologies and data to transform dispute resolution in Chapter 1).

At present, judges need to insert their credentials for each decision requiring an electronic signature. This points to the need to streamline the authentication process. Latvia could consider requiring judges’ credentials only once, allowing them to sign as many warnings as needed within a certain timeframe. Implementing an automated signing and sending process in the TIS and delegating this task to assistant judges would be recommended to streamline the signature process. This solution has been implemented in other countries, such as Germany, where, historically, court clerks are authorised to administer equivalent procedures. Improving e-signature and authentication processes would help increase the effectiveness of the warning procedure and reduce judges’ workloads, leaving resources available for cases that require analytical work.

Some judges raised concerns about potential liability for the automatic signing of such warnings. However, it has to be considered that the automatic signing of the warnings themselves does not constitute a decision. The warning is the starting point in the process, and the first instance taken later by the judge's decision is not automatic and not final – it can be challenged in the court of appeal. Thus, in this case, AI or simply the use of algorithms would not be applied to core decisions of the warning procedure but rather to a very specific administrative task – signing and sending of the warning. Consequently, introducing automation would likely have low risks of potential negative impacts on unfair decisions or constraints in access to justice. Instead, the automation of signatures would contribute to diminishing administrative burdens for judges, speeding up processes and contributing to the smoothness of the warning procedure in Latvia.

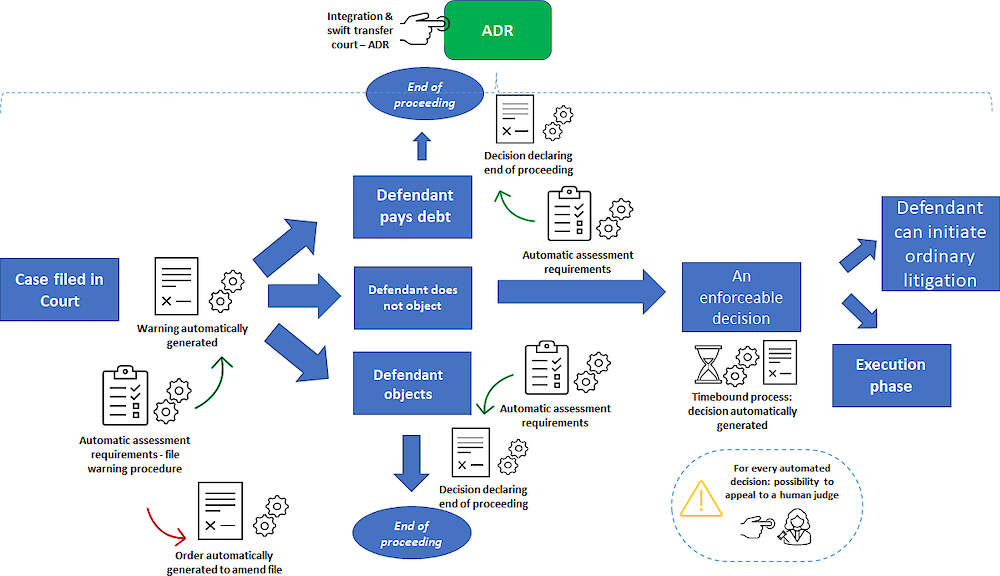

Consider automating the warning procedure

The mapping of the warning procedure (see Figure 4.2) suggested it is a great candidate for automation. The warning procedure follows clear steps based on certain requirements that could be translated into simple rules. However, as the process currently stands, the warning procedure is time-consuming for justice officials and involves only the formal administration of justice.

Among the aspects eligible for automation, Latvia could consider automating time-bound processes. For example, the system could automatically generate a decision if the debtor does not take certain action within a timeframe. Similarly, it would be desirable to automate the review of the end of the procedure when the debt is paid or contested; or move forward with the process if the defendant does not object to the claim (see Figure 4.3).

Figure 4.3. Automating the warning procedure

Source: Author’s own design.

Automation could also apply to decisions issuing the warning and enforceable decisions for execution, as they are reasoned on clear formal requirements in the Civil Procedure Law and Regulations of the Cabinet of Ministers No. 792 Rules. A similar approach is in place in Germany, where the warning is generated automatically as an official court document (see Box 4.4). Automating these aspects would help the Latvian justice system reallocate and optimise its limited resources with administrative assignments, such as rubberstamp orders, towards more analytical tasks.

Box 4.4. Germany: Automated order for payment procedure

EU countries started implementing the EOP Regulation in 2008. The implementation process across EU countries has shown a spectrum of progress. Some countries have embraced it effectively into their legal frameworks, streamlining cross-border debt recovery. Automation has played a pivotal role in this process, enhancing the efficiency and accuracy of procedures. This is the case for Germany.

Differently from other countries, in Germany, order for payment procedures are automated in all federal states. Applications can either be made on pre-printed paper forms or by electronic data exchange, following the principle of digital by design and an omni-channel approach. A number of service providers offer software programs for the electronic filing of applications in automated order for payment procedures. In some local courts, it is also possible to make online applications. For those wishing to file the order for payment in paper, pre-printed paper forms can be purchased in stationers’ shops.

Source: European Union (2022[13]), European payment order: Germany, https://e-justice.europa.eu/41/EN/european_payment_order?GERMANY&member=1.

To support judges and justice civil servants, information extraction and searchable databases would be useful to enable the generation of template decisions populated with relevant information about a case. Having a unified system for submitting the warning is another important aspect to be taken into account to revamp the warning procedure and support the daily work of judges and justice civil servants. The mapping of the warning procedure revealed that there is currently no option to send the warning via the Latvija.lv system, and the response does not come back within the unified system. Further integration of systems would be desirable (see Pathways and the seamless transfer of information and cases in Chapter 3).

Assessing the use of AI

As the use of AI in the justice system becomes more prevalent and no longer uncommon, automation and the use of AI would need to be considered together with adjustments in the Civil Procedure Law and Regulations of the Cabinet of Ministers No. 792. Specific considerations would need to be taken into account in light of Latvia’s legal and societal contexts (see Managing technological advances and Pillar 3: Ethics and safeguards in Chapter 2).

Some stakeholders have raised concerns that the introduction of automation in the warning procedure could potentially conflict with the right to access to justice, specifically access to court guaranteed by Article 92 of the Latvian Constitution. However, it is important to highlight that a number of considerations can justify the automation of the warning procedure. First, as explained earlier in this section, the warning procedure is an optional avenue of litigation (see Warning procedure). In addition, the decision issued by the court while issuing a warning is not final, as the debtor preserves the right to initiate the ordinary procedure against the creditor and challenge the validity or enforceability of the debt. Finally, similar automated procedures are already implemented in other EU countries, such as Germany (see Box 4.4).

Notably, the mapping of the warning procedure and the broader scene of digital transformation of justice in Latvia pointed to the need to secure digital infrastructure to support AI implementation, including reliable Internet connectivity and technology accessibility. This could be accompanied by adequate training on the use and interpretation of AI-assisted decisions to justice civil servants, continuously strengthening general understanding of the latest best practices, regulatory developments and guidance, including the EU Artificial Intelligence Act (see Box 2.8 in Chapter 2). These efforts should be well-coordinated with justice, digital transformation and broader national strategies (see Chapter 1 and Strategic approach to dispute resolution in Chapter 2).

Consider introducing other functionalities

Fact-finding interviews brought to the surface technical aspects that could be improved in TIS and the e-case platform and portal in the context of the warning procedure. Stakeholders mentioned technical aspects that could be improved, such as the size allowed for attachments; a resubmission option for the same document several times; and difficulties with following the latest updates of court cases in TIS. It is worth noting that most of these issues reflect pitfalls in Latvia’s broader digital and data governance model highlighted throughout this report (see Data governance and its strategic use in Chapter 2 and Advancing in digital transformation in Chapter 3).

Interviews and service mapping of the warning procedure also suggested other technical issues in the use of the TIS system. Staff must manually verify the name/surname of the debtor and his/her address, as the system is not connected to the Register of Natural Persons. This becomes particularly problematic if the debtor has a common surname or the creditor has incorrectly indicated the name/surname or address. The problem could be solved if, at the stage of application, the system could automatically connect the information provided by the creditor with the information available in registers. This would avoid wrong surnames or errors in debtors’ addresses.

Likewise, currently, courts have to manually verify that the state fee is paid as creditors attach proof of payment to their application. Latvia could consider incorporating a payment option within the online application. The warning itself, the template for the response by the debtor and the decision of enforcement of the claim could be generated automatically from the information provided to the system.

There is scope to achieve greater efficiency in notifying the debtor by introducing notifications via electronic means, in line with good practices in other OECD countries (see Box 4.5). Expanding communications with parties and/or their legal representatives through online channels could bring several improvements, such as facilitating and reducing costs and decreasing the time usually spent to notify them. Reforms in this regard need to be assessed against the backdrop of the Constitutional Law that requires the duly receipt of the warning provided by the debtor.

Box 4.5. Norway: Improving communication between citizens and the government through digital mail

Norway has embraced the widespread use of digital communication between citizens and the government. This commitment to fostering digital communication in the delivery of public services is not just a preference but a legally enshrined requirement in Norwegian law. The primary goal of this initiative is to enhance the efficiency and effectiveness of public services by streamlining interactions and redirecting public resources more effectively.

A significant aspect of this digital transformation is the establishment of the digital mailbox as the default mode of communication between citizens and government authorities. Once the government has a citizen's digital contact information (such as an ID-porten log-in, phone number or email address), all official communications are automatically directed to a secure digital mailbox. To ensure citizens are promptly informed about new messages, notifications are also sent via SMS or personal e-mail. Importantly, citizens retain the option to "opt out" of digital communication if they prefer to receive traditional paper letters.

This innovative approach not only reflects Norway's commitment to modernising its public services but also underscores its dedication to making interactions with the government as convenient and efficient as possible for its citizens.

Source: Government of Norway (2022[14]), Digital communication, https://www.norge.no/en/digital-citizen/digital-communication.

4.4. Consumer claims

Consumer disputes arise from consumer law and encompass conflicts between a person who has acquired goods or services from another person or entity acting within their economic or professional capacity (Vītoliņa, 2015[15]). In practice, consumer disputes pertain to conflicts involving the quality of goods or services, delays in performance by traders or service providers or unfair contractual terms.

Unlike the previous two types of claims – simplified procedures and warning procedures – consumer cases do not fall into a separate category of civil litigation, without any specific rules specified in the CPL. Nevertheless, these disputes have certain particularities prior to litigation, most of them foreseen in the Consumer Rights Protection Law.

4.4.1. Pathways to consumer claims

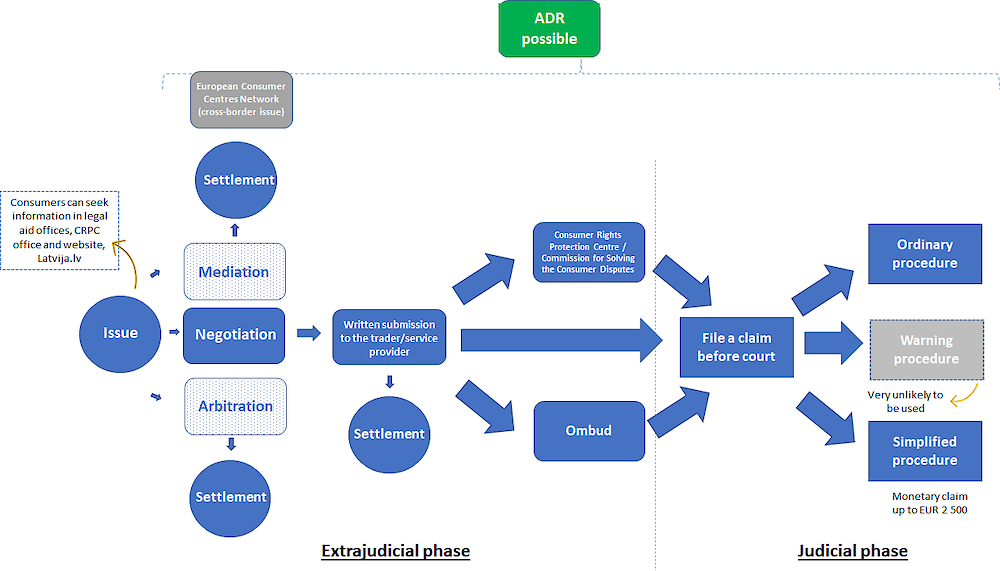

The Consumer Rights Protection Law specifies that all disputes between the trader/service provider and the consumer must be resolved amicably through negotiations before attempting a solution through one of the dispute resolution mechanisms, as detailed in the following sections. In the case of cross-border conflicts, claimants need to go through the European Consumer Centres Network (European Union, 2022[16]).

If the parties cannot resolve the dispute amicably, the consumer must submit an electronic or paper-based submission to the trader/service provider indicating the dispute, accompanied by copies of documents confirming the transaction and, if possible, copies justifying the submission.

Upon receipt of the written submission, the trader/service provider may:

1. Request that the consumer present or hand over the disputed goods, after which a written response must be provided within 15 working days.

2. Provide no reply, which will be treated as a rejection of the claim.

3. Provide a justified rejection of the claim (within 15 days).

4. Offer an alternative solution to the dispute if they believe the claim is not unfounded (within 15 days). If the offered solution satisfies the consumer, the dispute is considered resolved.

If the trader/service provider rejects the claim or if the offered solution are not satisfactory, the consumer may apply to the Consumer Rights Protection Centre (CRPC), which ultimately can lead to the Consumer Dispute Resolution Commission (CDRC); apply to the sectoral out-of-court solver (ombud) in the relevant industry if such an ombud exists; seek ADR mechanisms; or file a claim before the court – simplified, warning or ordinary procedure – depending on the value of the claim.

Consumers can access information about their rights and available dispute resolution options through Legal Aid Offices, Latvia’s comprehensive one-stop-shop platform Latvija.lv (see One-stop-shops in Chapter 3), the CRPC or their websites (see Consumer Rights Protection Centre and Consumer Dispute Resolution Commission) (see Figure 4.4).

Figure 4.4. Mapping of consumer claims

Source: Author’s own design.

Consumer Rights Protection Centre and Consumer Dispute Resolution Commission

The Consumer Rights Protection Centre (CRPC) is the civil authority under the Ministry of Economics, responsible for enforcing the protection of consumer rights and their interests (Government of Latvia, 2023[17]). The CRPC offers free service to consumers and handles conflicts between consumers and traders related to the delivery of goods or services, including public transport. The centre enjoys recognition among businesses and citizens in Latvia.

Among its main competences, the CRPC provides legal advice and assistance to address consumer complaints involving violations of consumer rights. Support may include helping consumers negotiate with traders or service providers. In practice, fact-finding interviews revealed that CRPC usually does not handle cases when a specific industry has a designated out-of-court dispute resolution body. For example, if a consumer engages in a dispute with a bank or insurer, they are directed to use special ombud schemes for these sectors. Consequently, such disputes cannot be resolved through the CRPC.

There are several limitations to the CRPC’s competence. The centre is only competent for disputes related to consumer protection law. For conflicts and parts of conflict that fall beyond consumer protection law, consumers need to seek recourse through the courts. This scenario arises, for instance, when a consumer claims damages based on legal grounds unrelated to consumer protection law. Moreover, the CRPC's jurisdiction is further delimited by specific exclusions, particularly in the realms of cosmetics, chemicals and housing. In such situations, consumers must approach other relevant bodies for assistance.

The avenue of conflict resolution through the CRPC offers a two-step procedure. The first step takes place with the CRPC itself. The CDRC manages the second step. The CRPC serves as the secretariat for the CDRC. Both consumers and traders can avail the complaint procedures free of charge for both steps, including the resolution offered by the commission.

The first step at the CRPC is commenced by the consumer submitting a claim. While claims can also be submitted through the EU ODR Platform (see Box 4.6), this accounts for only about two cases per year. The CRPC contacts the trader. As mentioned above, consumers are required to engage with the trader directly in bilateral attempts to resolve the dispute before approaching the centre. Consequently, the CRPC deals with cases that cannot be resolved bilaterally. This includes cases when traders did not answer consumers’ bilateral attempts to resolve the conflict. When consumers have not contacted the trader before approaching the centre, the CRPC guides them to engage with the trader first. The centre also rejects cases if they lack the expertise to handle them. In summary, it is primarily the consumers’ responsibility to identify the appropriate ombud scheme. If the consumer addresses the wrong ombud scheme, the CRPC provides support in the form of sign posting. The CRPC estimates receiving around 3 000 consumer complaints annually.

If the case is admissible, the centre first examines the consumer’s claim and, if necessary, explains their rights. The centre contacts the trader as necessary and attempts to facilitate a resolution through a discussion with the trader if deemed appropriate. If the complaint remains unresolved at this first stage, the centre can transfer the case5 to the CDRC upon the consumer’s request. The CDRC is an independent collegial decision-making body with the authority to settle a dispute between consumers and sellers or service providers (Government of Latvia, 2021[18]). The commission assesses the case based on the consumer’s written submission and the explanations provided by the trader or service provider, with a hearing organised as needed. The commission issues a decision within 90 days from the date of document receipt.

In the past, the CDRC issued decisions approximately 150 times per year. However, during the first 6 months of 2022, this was the case for around 150 complaints, resulting in an estimated 300 cases for the year. Overall, in relation to Latvia’s entire population, a range of 150 to 300 cases within a general ombud scheme appears relatively low and raises the concern that many consumers may not find formal dispute resolution accessible for lower-value disputes.

The CDRC’s competence also presents some limitations. Excluded from its jurisdiction are disputes (Government of Latvia, 1999[19]) that:

1. are insignificant or vexatious

2. concern the price of goods or services that do not exceed EUR 20 or exceed EUR 14 000

3. are about legal services

4. are about healthcare services

5. are about the use of residential premises and related areas

6. are about insurance services for vehicle owners

7. are simultaneously examined by a court or another out-of-court dispute resolution body (ombud)

8. whose examination would significantly disrupt the efficient operation of the CDRC.

The CDRC makes decisions through a majority vote. The CDRC could also decide that expenses for expert examination should be reimbursed to the consumer by the trader or service provider if the consumer prevails, the case is settled, or the consumer is satisfied with the solution offered by the trader or service provider. The decision may also propose its own remedy if the consumer’s claim is disproportionate or does not conform to the law. The CDRC can also terminate the dispute if the consumer’s claim is unjustified. Regardless of its content, the decision must be well-founded.

The decision is not binding; it only serves as a recommendation and is not subject to any appeals. This decision should be implemented within 30 days. It is estimated that 50‑60% of traders do not comply with the decisions. The only consequence is that the CRPC publishes the names of traders or service providers that do not comply with their decisions on their website. This means the decision cannot be used to request enforcement documents from the state judiciary. Therefore, if the trader or service provider does not comply with the decision issued by the CRPC, the consumer must initiate litigation, and the CDRC decision will be just a fact to be considered by the court. This is a strong incentive for traders to follow the commission's decision.

The communication channels used by the CRPC and the CDRC are mainly e-mail and paper post. Currently, both institutions do not use any platforms to manage their internal and external communications. For example, Latvia could be inspired by international initiatives in the European Union and Canada to improve consumer ODR processes and services (see Box 4.6).

Box 4.6. Consumer ODR platforms

The EU ODR platform

The European Union Online Dispute Resolution (EU ODR) platform offers consumers and traders/service providers an online tool through which they can resolve consumer issues out of court. The platform is accessible to consumers who face disputes related to products and services purchased from online retailers or traders. It facilitates direct discussion and resolution between the parties involved or through a dispute resolution body associated with the platform. This platform is available to consumers and traders based in the European Union, Iceland, Liechtenstein and Norway. Additionally, traders can use the platform to address disputes with consumers residing in Belgium, Germany, Luxembourg and Poland by involving an approved dispute resolution body. Parties can submit their claims directly on the platform from any type of device and in all EU languages, Icelandic and Norwegian.

EU regulations oblige online traders to provide an e-mail address and an easily accessible link to the ODR platform. Consumers can contact traders through this platform. Traders are notified about the request and have two options:

1. Accept to engage with consumers through the platform to attempt direct resolution of the dispute within a maximum of 90 days. In this case, the platform facilitates scheduling meetings and exchanging messages and documents.

2. Refuse the request. If the consumer does not withdraw from the process within 90 days, parties can opt to submit their dispute to a dispute resolution body. They have 30 days to agree on a competent dispute resolution body. Otherwise, they explore different dispute resolution mechanisms.

The platform serves as a central access point to all ADR bodies in Europe, proving a valuable tool when traders and consumers are located in different European countries. The EU ODR platform provides an easy and accessible tool to solve disputes on line. It is an innovative tool that helps consumers and traders save time and money with cumbersome judicial procedures. The platform contributes to enhancing trust in Europe's Digital Single Market, fostering online marketplaces and promoting cross-border trade within the European Union.

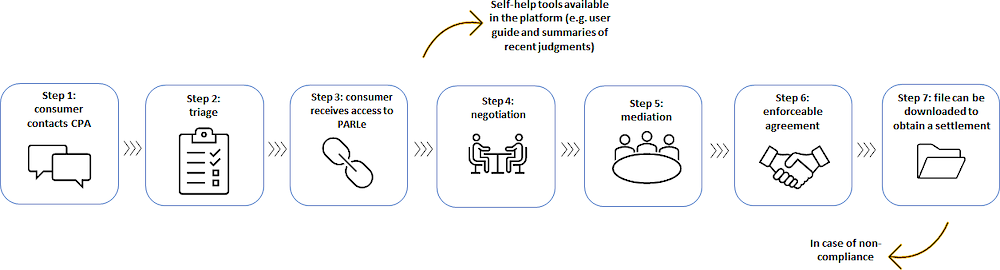

Canada: ODR platform for Quebec’s Consumer Protection Agency

In Quebec, the Consumer Protection Agency (CPA) offers a free and impartial ODR platform designed to solve conflicts between consumers and traders. Since 2016, PARLe has been the platform of choice when the CPA decided to implement an ODR mechanism in Quebec. PARLe provides a swift and complimentary online service for resolving low-intensity disputes related to consumer protection.

Because of its modularity, PARLe has been tailored to support the CPA in implementing an ODR platform as part of the strategic objectives for 2014‑18 in collaboration with the Canadian Ministry of Justice. Consumers who wish to initiate a settlement process through “PARLe consommation” should first contact the CPA. If they satisfy the terms and conditions of use, an agency officer will send them an e-mail with a link to the platform and some information to assist them in the process. To access the platform, consumers need to fulfil two conditions: 1) involvement in a civil dispute; and 2) the other party being a participating merchant. Once these conditions are met, consumers can open an account on the platform and create a file to submit a proposal to the other party. The platform provides a user guide and summaries of recent judgments to help consumers build and substantiate their proposed solution. Merchants can either accept the proposal or provide a counterproposal. The parties can request a certified mediator once a proposal and a counterproposal have been submitted. A mediator will automatically be appointed to settle the dispute if no solution has been found after 20 days of negotiation. The platform offers the possibility to download the agreement document, which can later be used to finalise the settlement when filing a claim.

PARLe has already managed over 5 000 cases for the CPA, with a success rate of 70% of cases reaching an agreement (45% at the negotiation stage and 25% at the mediation stage). PARLe’s success in consumer protection is evident in various aspects. While cases can take up to 1.5 years to reach trial in Quebec, with PARLe agreements, settlements have been reached on average within 28 days at nearly 7% of the cost. Customer and merchant satisfaction rates with the PARLe platform are also remarkably high, with almost 90% expressing satisfaction at the CPA.

Source: European Commission (2023[20]), Find a solution to your consumer problem, https://ec.europa.eu/consumers/odr/main/index.cfm?event=main.home2.show&lng=EN; Office de la Protection du Consommateur (2022[21]), What is PARLe consommation?, https://www.opc.gouv.qc.ca/a-propos/parle/description/; Cyberjustice (2022[22]), PARLe: Transform the Court Experience with Online Dispute Resolution, https://cyberjustice.openum.ca/files/sites/102/Livret_LABOCJ_PARLe_demilettre_GN-1-Corrige%CC%81-2.pdf.

Latvia could consider whether the current two-step procedure, as offered by the CRPC in combination with the CDRC, provides easy access to effective dispute resolution. An advantage of this two-step procedure is that it ensures that consumers are informed about their legal position before they start the conciliation procedure. A drawback might be that consumers might not perceive a straight and low-barrier route to dispute resolution, as they first need to go through the procedure with the CRPC before they reach the dispute resolution stage with the CDRC. Fact-finding interviews and data collected suggest that less than 10% of complaints reach the CDRC. This may raise questions on whether the current two-step procedure offers swift dispute resolution access. It is, therefore, recommended to reconsider the two-step procedure in developing approaches in which consumers have a clear and easy pathway to an ombud procedure (see Revamping consumer dispute resolution mechanisms).

Ombud schemes in consumer-trader disputes

Ombud schemes are a free and accessible avenue for citizens or consumers seeking remedies as recipients of public and/or private sector goods or services. They are also referred to as “ombuds” or conciliation schemes. Ombud schemes are procedures in which parties present their facts and opinions to an ombud, who shares the communication with the other party. This approach reduces the amount of cases brought before the courts, as parties often find resolution through the ombud process without the need for litigation.

In recent years, there has been a substantial increase in complaints filed with ombuds, alongside a significant focus from policy makers on the development of effective dispute resolution systems for consumer-trader disputes. Two main factors drive the adoption of ombud schemes for consumer-trade disputes. The first factor is the realisation that existing dispute resolution mechanisms often fail to address the dispute needs of consumers and traders. In particular, court litigation and mediation can prove too expensive and time-consuming for small, online transactions. For instance, transactions valued below EUR 100 seldom prompt consumers to pursue full court proceedings or engage in prolonged discussions with the trader (Bradford, Creutzfeldt and Steffek, 2022[23]).

Second, ombud schemes are rooted in the recognition that the growth of online commerce needs the presence of attractive ODR mechanisms. Based on the principle of “fitting the forum to the fuss” (Sander and Goldberg, 1994[24]), online ombud schemes align well with the nature of online consumer-trader transactions. The swift procedure fits well with the parties’ interest in quick and efficient transactions. Where the parties fail to reach a resolution within a given timeframe (e.g. within a month from the presentation of all information), the ombud issues a recommendation that usually is not binding. Despite not being mandatory, the recommendation is often accepted as parties consider the ombud a fair procedure. Alternatively, if both parties agree, the ombud can be granted the authority to transform the recommendation into an enforceable instrument. In some instances, legislatures may empower ombud schemes to issue binding recommendations. For example, certain ombud schemes can make recommendations binding on traders (but not on consumers) for cases below a certain threshold (e.g. under EUR 500). This is the case of the United Kingdom (see Box 4.7). If a consumer accepts the UK Financial Ombudsman Service’s decision, it becomes binding on business (Financial Ombudsman Service, 2022[25]).

Box 4.7. Ombud schemes with binding decisions

Germany: The German Conciliation Body

The German Conciliation Body (Söp) is an independent and neutral consumer dispute resolution institution. It is an alternative to courts for individual disputes between travellers and companies. Söp is competent for disputes involving companies that participate in the conciliation procedure. This concerns almost 100% of long-distance travel companies relevant to Germany. Complaints are free of charge.

Söp submits a written conciliation proposal after legal assessment and the examination of facts. If parties agree with the conciliation recommendation, the document becomes legally binding. At any stage of the conciliation procedure, the complainants can bring the case to court.

United Kingdom: The Financial Ombudsman Service

The UK Financial Ombudsman Service is a free and independent ADR service that settles complaints between consumers and businesses providing financial services. The ombud is competent for complaints against businesses that provide retail financial products and services in or from the United Kingdom. It provides an informal alternative to court services with binding decisions for businesses.

Consumers must complain directly to the financial business before contacting the Financial Ombudsman Service. The financial business has eight weeks to provide a final answer to the plaintiff. If not satisfied with the final response from the business, customers can submit their complaint to the Financial Ombudsman Service within six months. The website provides an online tool to check the eligibility of the dispute. Consumers can then fill out an online complaint form. Both parties can provide evidence. Consumers can withdraw from the process at any stage before the final decision is issued. The decision becomes legally binding to the business once accepted by the consumer. Businesses cannot withdraw from the process and must comply with the final decision.

Source: Schlichtungsstelle für den öffentlichen Personenverkehr e.V. (2023[26]), The conciliation procedure, https://soep-online.de/en/the-conciliation-procedure/; Financial Ombudsman Service (2022[25]), How we make decisions, https://www.financial-ombudsman.org.uk/who-we-are/make-decisions.

Ombud proceedings enable parties to present their views and submit documents. Usually, this happens on line through entering information in online platforms or by e-mail. In most cases, users also have the option to send statements and documents by paper post. However, in practice, electronic means of communication are more commonly used. Generally, the ombud scheme can also be contacted by phone, mostly for inquiries about the procedure. Most ombud schemes have set up procedural and cost rules within the legal framework of their establishment. These rules usually allow the ombud scheme to use various dispute resolution mechanisms, including conciliation and mediation. Cases can be decided with or without a hearing, including the examination of witnesses. In practice, hearings are typically rare. Usually, fact finding and decision making in an ombud scheme are more straightforward than in a court proceeding.

The reason for having a more simplified and faster procedure, usually without requiring collecting evidence or hearing witnesses, is that ombud proceedings are designed to solve cases that are less complex and of lower value. Against this background, ombud schemes should not be seen as inferior alternatives to court proceedings. Instead, they are a valuable means of resolving conflicts for specific types of cases (e.g. cases with lower values, such as below EUR 5 000, EUR 10 000 or EUR 20 000), in which parties often prefer a swift resolution over a lengthier and costly court proceeding. Ombud proceedings are effective both in online and in-person transactions with these characteristics. In other words, there is no need to limit ombud schemes to online transactions.

Over the past decade, there has been an increase in online ombud proceedings (European Union, 2013[27]; 2013[28]). The introduction of online ombuds aligns well with a justice environment that needs to manage a high number of lower-value conflicts based, in particular, but not exclusively, on online transactions. Other dispute resolution mechanisms, such as court proceedings and mediation, often lack a suitable framework for these disputes. Court proceedings are often too expensive for such low-value claims, and parties often have little interest in extensive discussions with the opposing party, as offered by mediation.

Numerous jurisdictions have established legislative frameworks to ensure the quality, fairness and efficiency of conciliation bodies and ombud schemes. A prominent example is the EU Directive on Consumer ADR (European Union, 2013[28]) in conjunction with the EU Regulation on Consumer ODR (European Union, 2013[27]). This set of documents paves the way for independent, impartial, transparent, effective, fast and fair online out-of-court dispute resolution between consumers and traders. It also provides a common ground for operating ombud schemes and other ADR bodies in the European Union. These frameworks are also important to foster collaboration and exchange of best practices of cross-border and domestic disputes in the region.

Finally, providers of ombud schemes have managed to offer attractive dispute resolution platforms that are transparent and user-centred. For example, they offer easy-to-use online forms that are understandable for non-experts. Services provided by ombud schemes are generally affordable and often, free for consumers. They also allow parties to stay updated on case developments by making all relevant information accessible on the platform. Examples of attractive and user-centred online platforms are the Söp (Schlichtungsstelle für den öffentlichen Personenverkehr e.V.), the Federal German Conciliation Body in Germany, the UK Financial Ombudsman Service in the United Kingdom (see Box 4.7), the Financial Markets Authority (Autorité des marchés financiers) and the Mediator of Consumption (Médiateur de la consomation) in France (see Box 4.8).

Box 4.8. Enhancing ombuds through simplified platforms

In France, consumer ombuds are required to provide an online channel for users to submit their disputes. The ombuds of the Financial Markets Authority (Autorité des marchés financiers, AMF) is one of the various French consumer ombuds. The AMF is a free service competent for financial disputes involving a financial intermediary or an issuer. The AMF’s platform provides tools to facilitate users' submission and case management. The platform includes an admissibility assessment tool to help consumers address their litigation to the appropriate body. If the request is admissible, users can complete an online form and provide supporting documents directly. The platform also enables users to follow the progress of the claim using a personal mediation file number.

Other ombuds also offer user-centred dispute resolution platforms facilitated by online tools. The German Conciliation Body (Söp) provides a detailed online form to assess the admissibility of conciliation requests and submit requests with the same tool. The General Conciliation Body (Universalschlichtungsstelle) website also makes it possible to submit applications on line. Consumers can access their online personal space to follow up and monitor the progress of their requests. In the United Kingdom, the Financial Ombudsman Service provides an online tool to check the eligibility of a dispute. If eligible, consumers can fill out an online complaint form and upload evidence files to support their claims.

Source: Autorité des marchés financiers (Autorité des marchés financiers, 2023[29]), Le Médiateur de l’AMF (The AMF Ombudsman), https://www.amf-france.org/fr/le-mediateur; Schlichtungsstelle für den öffentlichen Personenverkehr e.V. (2023[26]), Your conciliation request, https://soep-online.de/en/your-conciliation-request/; German Federal Ombud Scheme (2023[30]), Welcome to the website of the Universalschlichtungsstelle (General Conciliation Body), https://www.verbraucher-schlichter.de/english/english-version; Financial Ombudsman Service (2022[31]), Make a complaint, https://www.financial-ombudsman.org.uk/make-complaint.

As part of its efforts to enhance dispute resolution mechanisms in the country, Latvia could consider expanding and modernising its consumer-trader dispute resolution by reforming its ombud scheme. This concerns both the nationwide setting of the ombud ecosystem and the organisation of individual ombud schemes.

Regarding the nationwide ombud scheme setting, Latvia could consider providing a framework that enables all consumers to effectively resolve their disputes with traders. This framework could aim to minimise entry barriers, making it simple for consumers to initiate and engage in ombud proceedings.

An important starting point for facilitating access to dispute resolution concerns the initiation of the process. Currently, consumers need to find out which body to address and, in the case of the CRPC, navigate a two-step procedure to dispute resolution. It might be worthwhile to consider setting up a one-stop-shop platform for all consumer-trader disputes or, alternatively, through e-case portal (Elieta.lv). Such a platform would not require collectivising all existing dispute resolution bodies into one institution. Instead, the single-entry platform could distribute incoming complaints to the competent bodies, mainly utilising algorithms. For the remaining cases, human caseworkers could handle the distribution. Such a single-entry point would benefit consumers, eliminating the uncertainty of addressing the wrong body. In addition, the application to the single-entry point could be used to suspend the time limitation of claims, offering consumers assurance while attempting ADR.

Further potential can be tapped by providing a comprehensive array of options, ensuring easy access to an ombud scheme for any consumer-trader dispute that might be encountered. Currently, there are various limitations and restrictions in place. There are some specialised ombud schemes for banking and insurance disputes and a more general consumer dispute resolution offered by the CRPC in combination with the CDRC. However, these specialised schemes do not cover many legal and justice needs, and the competence of the CRPC/CDRC is limited in many aspects. Altogether, this means that consumers currently only have limited access to effective consumer-trader dispute resolution for low-value claims. It is, therefore, recommended to ensure a comprehensive ombud offering.

There are a number of alternatives to achieve this (see Revamping consumer dispute resolution mechanisms). One approach is to incentivise the creation of industry-specific ombud schemes (see Box 4.9). Simultaneously, another viable approach could be to create a general ombud scheme that is competent for all disputes that lack a specialised ombud scheme. Germany, for example, has opted to create a universal ombud scheme. The General Conciliation Body is competent for almost all consumer-trader disputes unless a higher-priority ombud scheme exists (Universalschlichtungsstelle des Bundes, 2022[32]) (see Box 4.9).

Box 4.9. Germany: Federal ombud schemes and the German General Conciliation Body (Universalschlichtungsstelle)

The German General Conciliation Body is an independent, neutral, universal ombud scheme competent for all disputes involving a consumer contract unless a specific ADR body has a priority competence to settle the dispute. It offers a broader opportunity for consumers to resolve their cases out of court.

The dispute must involve a trader based in Germany and a consumer residing in the European Union, Iceland, Liechtenstein or Norway, and bringing the case on a voluntary basis. Certain types of disputes are excluded from the General Conciliation Body’s competence, such as those concerning employment contracts, deriving from contracts on non-economic services of general interest, healthcare services or further and higher education by public service providers.

The consumer can fill out the complaint on line, directly on their website, by e-mail or by letter in German, English or French. The procedure is exempt of charges for the consumer, while the trader must pay a fee based on the General Conciliation Body’s regulation. Thus, the General Conciliation Body offers a flexible, faster, less expensive alternative to court procedures.

Source: Universalschlichtungsstelle des Bundes (2022[32]), About us, https://www.verbraucher-schlichter.de/english/english-version.

To facilitate access to dispute resolution, it would be beneficial to allow ombuds the authority to render decisions on an entire case rather than confining it solely to matters of consumer protection law. This approach is followed in certain other jurisdictions, such as in Germany. There appears to be no compelling reason to limit the competence of ombuds to consumer protection law in Latvia. The rationale is that, in particular, both parties can still litigate the conflict in court if they are not satisfied with the decision of the ombud (whether this concerns consumer protection or any other area of law). To this end, Latvia may consider allowing the CDRC to decide the cases encompassing all areas of law.

A further improvement is re-evaluating the governance of ombud schemes. Generally, it is best practice to ensure the neutrality of these justice institutions (see Revamping consumer dispute resolution mechanisms). The credibility of ombud schemes could be at risk when either the consumer or the trader has concerns about the neutrality of the process and the outcomes. Against this background, it is recommended to prevent conflicts of interest that might cast doubts on the impartiality of decision making. For example, consumers might be concerned about the neutrality of the CDRC due to its members currently being delegated by trader associations. This could lead consumers to question whether a fair decision can be expected when those making the decision are appointed by an association representing the opposing party.

Sectoral out-of-court dispute resolution mechanisms in relevant industries