This chapter highlights key results on the state of carbon pricing in 44 OECD and G20 countries. It introduces the carbon pricing score as summary indicator for carbon pricing efforts. Results are provided for the 44 countries as a group, as well as by country and by sector in 2018. A divergence in progress made since 2015 is observed between the countries that are most advanced with carbon pricing and those that are least advanced. The rear part of the chapter provides an outlook on the impacts of recent developments in emissions trading in China and the European Union on carbon pricing scores.

Effective Carbon Rates 2021

4. Attainment of near term carbon pricing benchmarks, the carbon pricing score and the gap

Abstract

The Carbon Pricing Score (CPS) measures the extent to which countries have attained the goal of pricing all energy related carbon emissions at certain benchmark values for carbon costs or more. The more progress that a country has made towards the relevant benchmark value, the higher the CPS. For example, a CPS of 100% against a EUR 30 per tonne CO2 benchmark means that the country (or the group of countries) prices all carbon emissions in its (their) territory from energy use at EUR 30 or more. A CPS of 0% means that the country prices no emissions at all. An intermediate CPS between 0% and 100% means that some emissions are priced, but that not all emissions are priced at a level that equals or exceeds the benchmark. Similarly, a EUR 60 or EUR 120 CPS of 100% means that all emissions are priced at a level that equals or exceeds EUR 60 or EUR 120 per tonne CO2.

The Effective Carbon Rates database reports the CPS for the following three benchmarks: First, EUR 30 per tonne of CO2, which is an historic low-end price benchmark of carbon costs (CPS30). Second, EUR 60 per tonne of CO2, which is a forward looking 2030 low-end and mid-range 2020 benchmark (CPS60). Third, EUR 120 per tonne of CO2, which is a central estimate of the carbon costs in 2030 (CPS120). For the presentation of key results, this document focuses on the CPS60. The Effective Carbon Rates database on OECD.STAT will show results for all three carbon pricing scores (CPS30, CPS60 and CPS120).

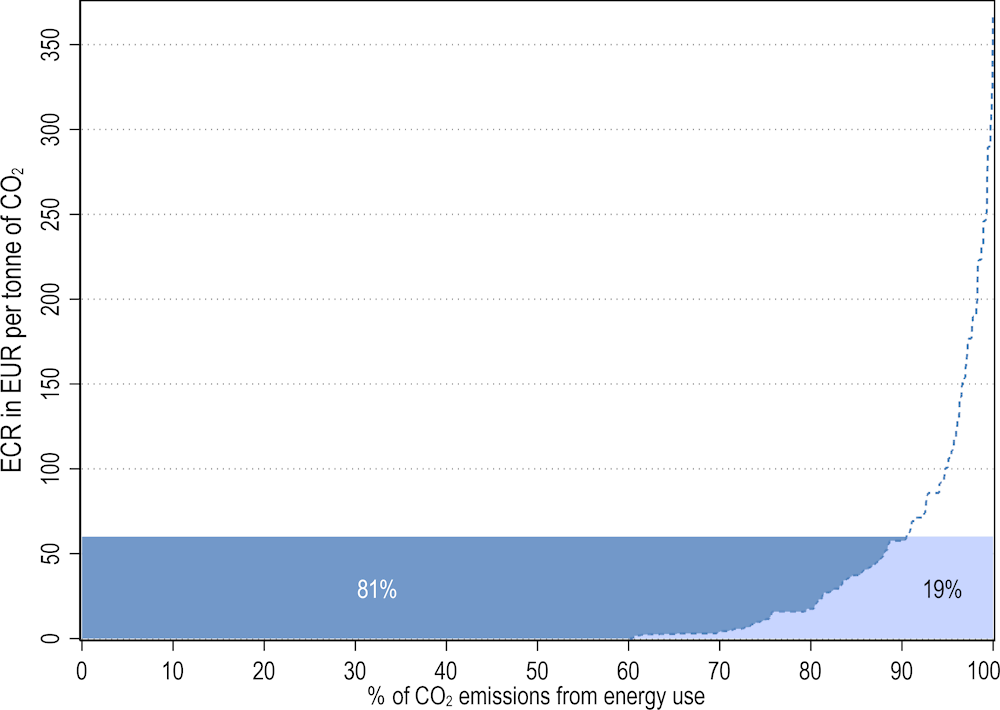

Earlier versions of Effective Carbon Rates summarised the state of carbon pricing using the carbon pricing gap. The gap measures the extent to which carbon prices fall short of various benchmarks for carbon costs. Readers can calculate the carbon pricing gap at a certain benchmark (BM) value by subtracting the CPS from 100%, i.e. . Figure 4.1 below illustrates this relationship.

In 2018, the 44 OECD and G20 countries analysed, which are responsible for about 80% of energy related global CO2 emissions, had a CPS60 of 19%, i.e. they reached 19% of the goal of pricing all emissions at EUR 60 or more per tonne of CO2; see the area shaded in light blue in Figure 4.1. The corresponding carbon pricing gap was 81% (i.e. 100% - 19%) and is shown in dark blue.

Figure 4.1. The Carbon Pricing Score

Note: The area shaded in light blue shows the Carbon Pricing Score (CPS) at EUR 60 per tonne CO2 (CPS60). It shows the extent to which the group of 44 OECD and G20 countries together reached the benchmark to price all emissions from energy use at least at EUR 60 per tonne CO2 in 2018. The area shaded in dark blue shows the Carbon Pricing Gap, i.e. the shortfall to pricing all emissions at least at EUR 60 per tonne CO2.

Stronger progress had been made towards the more moderate EUR 30 benchmark, but the CPS30 is still just under a quarter (24%). Considering the more ambitious and forward-looking central carbon pricing benchmark of EUR 120 in 2030, the CPS120 was only 12% in the 44 countries in 2018.

The light and dark blue area in Figure 4.1 together provide a revenue estimate of a uniform carbon price of EUR 60 per tonne CO2, showing that there is still significant revenue potential from strengthening carbon pricing. See Marten and Van Dender (2019[21]) for estimates of potential revenue from carbon pricing, and a survey of how countries make use of the revenue from carbon pricing.

Across the 44 countries, there was hardly any progress with carbon pricing between 2018 and 2015. However, between 2012 and 2015 the CPS60 improved by 3 percentage points.

Fuel excise taxes dominate effective marginal and effective average carbon rates

Looking at the components of carbon prices, 93% of the overall price signal resulted from taxes; 89 percentage points of the 93% were the result of fuel taxes, while the other 4 percentage points resulted from carbon taxes. Countries generally implement both fuel and carbon taxes through fuel excise taxation, but a distinction is made here based on whether a jurisdiction labels a certain tax to be a carbon tax or not. The remaining 7% of the price signal results from permit prices.

To account for the commonly observed free-allocation of some or all emission permits, this edition of Effective Carbon Rates calculates effective average carbon rates (EACRs) in addition to the already existing effective marginal carbon rates (EMCRs).1 The EACR adjusts the effective carbon rate for any free allocation of tradeable emission permits. Thereby, the EACR captures the effect of free allocation on total expected profits and the ranking of zero- and low-carbon versus high-carbon investment projects, and thus allows for a comparison of the incentives to invest in zero- and low-carbon technologies (Flues and van Dender, 2017[22]; Flues and van Dender, 2020[23]).

Box 4.1. Effective marginal carbon rates (EMCRs) and effective average carbon rates (EACRs)

Carbon prices vary in how their rate applies to the entire carbon emission base. Fuel and carbon taxes generally apply at one (or several) rates without exemptions or reductions for a certain fuel or carbon emission base. Energy users thus pay the rate that applies for their energy use for all emissions.If fuel or carbon taxes include tax-free allowances, this implies that emitters do not have to pay the tax for all emissions. For example, tax-free allowances in the South African carbon tax imply that emitters have to pay only for 5% of their emissions (Roelf, 2019[24]). Tax-free allowances drive a wedge between the marginal price emitters pay for an additional unit of emissions and the average price they pay for their entire emissions.

Emission trading systems generally allocate permits via permit auctions and some form of free permit allocation. Any free allocation of permits in an ETS reduces the effective carbon emission base, for which the emitter needs to buy permits. Free allocation of permits also drives a wedge between marginal and average carbon prices, much like tax allowances do for taxes. Considering the same set of emissions, emissions trading and effective carbon taxation are equivalent in terms of their effective emission base coverage when permits are fully auctioned and no tax-free allowances are granted.

Taxes with uniform carbon rates for all emissions and emission trading systems with full permit auctioning provide stronger incentives for investment in clean technologies than taxes with tax-free allowances and emission trading systems with benchmarking or allocation based on historical emissions (Flues and van Dender, 2017[22]). Tax-free allowances, benchmarking and allocation based on historical emissions affect economic rents, and the current allocation rules tend to do so in ways that favour carbon-intensive technologies.

The effective average carbon rate (EACR) adjusts for any tax-free allowances and free permit allocation. It captures the effect of allowances and permit allocations on total expected profits and thus on project rankings. In other words, the strength of the incentives to invest in clean technologies can be compared across different tax and emission trading systems by comparing their EACRs. The effective marginal carbon rate (EMCR) shows the strength of the marginal incentive to reduce emissions, e.g. via small-scale efficiency improvements or demand reductions for an investment that has already been carried out.

The effective average CPS60 for the group of 44 countries together was 17% in 2018, i.e. countries reached 17% of the goal of pricing all carbon emissions from energy use with an EACR of at least EUR 60 per tonne of CO2. The score is about 1.5 percentage point lower than for the (effective marginal) carbon pricing score. This limited deviation reflects that, even though free permit allocation is common in emissions trading systems, permit prices only account for 7% of the total marginal carbon-pricing signal. The contribution of effective average permit prices to the total effective average carbon price signal is correspondingly lower than in the case of marginal rates, namely 3%. The effective average CPS30 was 22% in 2018, and the effective average CPS120 was 12%.

Divergence in carbon pricing progress

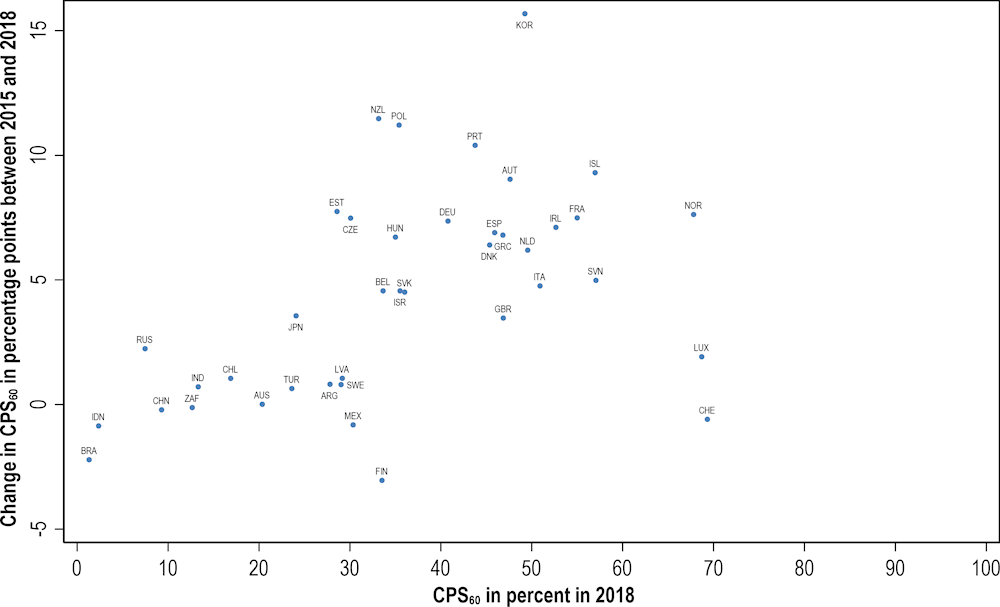

Figure 4.2 shows countries´ CPS60 in 2018 on the horizontal axis, and the change in their CPS60 between 2015 and 2018 on the vertical axis. Countries with a higher CPS60 increased their CPS60 between 2015 and 2018 on average more than countries with a lower CPS60.2

Figure 4.2. Between 2015 and 2018, carbon pricing scores increased most where they were relatively high

The ten countries with the highest CPS60 in 2018 achieved more than half (52%) of the goal of pricing all emissions at EUR 60 or more per tonne of CO2 in 2018.3 These countries reached a CPS30 of 71% and a CPS120 of 39%.

Significant progress is observed for these ten leading countries between 2015 and 2018; they advanced by around 6 percentage points towards the low-end 2030 benchmark of pricing all emissions at EUR 60 or more per tonne of CO2, or 1.8 percentage points per year. If the ten leading countries continue to make similar progress on carbon pricing, their CPS60 would rise to 74% by 2030. For pricing all emissions at EUR 60 per tonne CO2 or more by 2030, they would need to increase the CPS60 by 4 percentage points per year.

Many of these ten countries participate in the EU ETS. The recent reform of the EU ETS with the introduction of the Market Stability Reserve (MSR) helped to increase permit prices in the EU ETS from about EUR 5 in 2017 to about EUR 25 today. The higher permit prices are a major factor explaining the progress in carbon pricing by these countries. Other factors relate to stronger carbon prices in some countries for the residential and commercial sector. Korea´s strong progress with carbon pricing is largely due to an increase in the permit prices of its broad-based emissions trading system.

By contrast, the ten countries with the lowest CPS60 in 2018 together reached a CPS60 of 13% in 2018. The CPS30 was 16% and the CPS120 was 7% in 2018. These countries made no progress between 2015 and 2018 on the CPS60.

The strength of carbon pricing varies across sectors

In the road sector, in 2018 the CPS60 was 80%, the CPS30 was 91%, while the CPS120 stood at 58%. The other external costs of road usage (such as accidents, noise, local air pollution and congestion), however, exceed climate costs by far. Thus, there are good reasons for charging effective carbon rates that are substantially higher than low-end and mid-point estimates of climate costs in the road sector.4 For a more detailed discussion of the social costs of road usage and economic instruments that advance user contributions, see Van Dender (2019[25]).

Table 4.1. Progress varies significantly across sectors

Effective Marginal Carbon Pricing Scores by sector for the group of 44 OECD and G20 countries together

|

Effective Marginal Carbon Pricing Score |

|||

|---|---|---|---|

|

Sector |

EUR 30 |

EUR 60 |

EUR 120 |

|

Agriculture & Fisheries |

43% |

38% |

23% |

|

Electricity |

10% |

5% |

3% |

|

Industry |

9% |

5% |

3% |

|

Off-road Transport |

34% |

25% |

13% |

|

Residential & Commercial |

14% |

10% |

6% |

|

Road Transport |

91% |

80% |

58% |

In the electricity sector, CPS60 was 5%, the CPS30 was 10% and the CPS120 was 3% in 2018. However, some countries achieved significantly higher carbon pricing scores in the electricity sector. Both Korea and Iceland reached a CPS30 of 93%, and the United Kingdom scored 77% in 2018. All three countries also attained a CPS60 of 50%. In the United Kingdom, emitters need to pay for all emission permits from the EU ETS and need to pay a tax (the carbon price support) in addition to the permits. This results in a significant effective carbon rate for fossil fuels of about EUR 36 per tonne of CO2 in 2018. Since 2012, the year before the carbon price support was introduced, carbon emissions in the UK electricity sector fell by 73%. Korea, where emitters still receive almost all emission permits for free, did not show a strong decline in emissions from the electricity sector.5

In the industry sector, in 2018 all countries combined scored a CPS60 of 5%, a CPS30 of 9%, and a CPS120 of 3 %. Norway, Slovenia and Korea reached a CPS60 of 33% and a CPS30 of 50% or more. Considering the effective average carbon pricing score, all countries combined scored a CPS60 of 3%. This results from a significant share of permit prices in the overall carbon-pricing signal (nearly 50%) and a large share of free allocation for industrial facilities that are subject to carbon pricing.

In the residential and commercial sector, the CPS60 was 10% for all 44 countries together in 2018. The CPS30 was 14% and the CPS120 6%. Some countries achieved a significantly higher carbon pricing level in the residential and commercial sector. The Netherlands reached a CPS60 of 90%, while Switzerland achieved a CPS60 of 78% and Italy, France and Greece achieved a CPS60 of about 50%. Five countries achieved a CPS30 of more than 70% (Netherlands, Iceland, Switzerland, Korea and Ireland). With the exception of Korea, which prices emissions in the residential and commercial sector through emissions trading, effective carbon rates in the residential and commercial sector result mainly from the use of taxes on fossil fuels, sometimes also labelled explicitly as carbon taxes.

A handful of carbon pricing leaders attain high carbon pricing scores

In 2018, Switzerland, Luxembourg and Norway reached a CPS60 of close to 70%. In Switzerland, the high CPS60 is the result of fuel taxes in the road sector that are fully earmarked for road infrastructure purposes, a significant carbon incentive tax (CHF 96 or EUR 83 per tonne CO2 since 2018) for fossil fuel use in the residential and commercial sector, a highly decarbonised electricity supply and few industrial emissions, that are largely subject to the Swiss ETS. In Norway, this is the result of a highly decarbonised electricity supply, significant taxes on fossil fuels used in the residential and commercial sector, as well as a large share of industrial sector emissions resulting from the offshore petroleum industry, that is subject to both a carbon tax and the EU ETS. In Luxembourg, a small country with a significant share of daily commuters who live abroad, a high share of transit traffic and considerable fuel tourism, the high CPS60 is largely due to the road sector dominating overall energy use. Even though road fuel taxes in Luxembourg are lower than in its neighbouring countries, the fact that road fuels have generally a higher effective carbon rate than other sectors (see also the previous section) leads to the high carbon pricing score for Luxembourg. While given the specific circumstances it is challenging to translate the carbon pricing score for Luxembourg in a certain carbon pricing effort, it is worth noting that Luxembourg levies a carbon tax from 2021 onwards.

Table 4.2. Some countries attain high carbon pricing scores

|

Carbon pricing score at EUR 60 per tonne CO2 |

|

|---|---|

|

CHE |

69% |

|

LUX |

69% |

|

NOR |

68% |

|

SVN |

57% |

|

ISL |

57% |

|

FRA |

55% |

|

IRL |

53% |

|

ITA |

51% |

|

NLD |

50% |

|

KOR |

49% |

|

AUT |

48% |

|

GBR |

47% |

|

GRC |

47% |

|

ESP |

46% |

|

DNK |

45% |

|

LTU |

45% |

|

PRT |

44% |

|

DEU |

41% |

|

SVK |

36% |

|

ISR |

36% |

|

POL |

35% |

|

HUN |

35% |

|

CAN |

34% |

|

BEL |

34% |

|

FIN |

34% |

|

NZL |

33% |

|

MEX |

30% |

|

CZE |

30% |

|

LVA |

29% |

|

SWE |

29% |

|

EST |

29% |

|

ARG |

28% |

|

COL |

25% |

|

JPN |

24% |

|

TUR |

24% |

|

USA |

22% |

|

AUS |

20% |

|

CHL |

17% |

|

IND |

13% |

|

ZAF |

13% |

|

CHN |

9% |

|

RUS |

7% |

|

IDN |

2% |

|

BRA |

1% |

Note: This table includes emission from the combustion of biomass in the emission base. Results excluding emissions from the combustion of biomass are available in Annex 4.A as well as on OECD.STAT.

Nearly a quarter of the analysed countries (10 out of 44) had a CPS60 of around 50% or more in 2018, i.e. they had achieved the goal of pricing all carbon emissions at least at the midpoint benchmark for carbon costs in 2020 and the low-end benchmark for carbon costs in 2030 by more than a half. These countries have in common that they price emissions from the road sector significantly, have moderate to high carbon prices for fossil fuel use in the residential and commercial sector and many participate in or are linked to the EU ETS, which prices emissions from the electricity generation and industry. Korea, with a CPS60 of 49% in 2018, has a broad based emission trading system, which contributes 30% to its overall carbon pricing effort, while the remaining 70% results from taxes on fuel use.

The previous section showed that carbon pricing scores differ across sectors when considering all 44 together (see Table 4.1). In addition, the section mentioned substantial variation in carbon pricing scores within sectors across countries. While a full discussion of results by country, by sector is beyond the scope of this report, the Effective Carbon Rates database on OECD.STAT provides carbon pricing scores by country for six economic sectors.

Reforms can increase the carbon pricing score

While China had a CPS60 of only 9% in 2018, the introduction of a national ETS in February 2021 increased its CPS significantly. In a first step, China included the electricity sector in its national ETS. Assuming that the national ETS covers 3.6 billion tonnes of carbon emissions from the electricity sector in the first step (Zhang, 2020[26]) at an estimated carbon price of 43 CNY (EUR 5.51) per tonne CO2 (Slater et al., 2019[27]), this increased its CPS60 to 12% and its CPS30 to 16%.6 In a second step, China plans to also include emissions from industrial facilities into its national ETS. Based on estimates for this development phase, (Zhang, 2020[26]) the system will cover all Chinese electricity sector emissions and about 60% of all industrial emissions. Together with an expected permit price of CNY 75 (EUR 9.60) per tonne CO2 in 2025 (Slater et al., 2019[27]), the CPS60 would then increase to 19% and the CPS30 to 29%. As a result, the overall CPS60 for all countries together would increase to 22%, and the CPS30 to 31%, reflecting the significant share of Chinese emissions in the total emissions of the 44 OECD and G20 countries considered in this report.

Table 4.3. ETS reform can increase the carbon pricing score

Estimated effect of the Chinese National ETS and higher permit prices in the EU ETS on the carbon pricing score

|

Country or group |

Scenario |

CPS30 |

CPS60 |

|---|---|---|---|

|

China |

Status quo in 2018 |

10% |

9% |

|

China |

National ETS covers 3.3. billion tonnes CO2 from electricity generation at an estimated carbon price of CNY 43 (EUR 5.51) per tonne CO2 |

16% |

12% |

|

China |

National ETS covers 100 % of electricity sector emissions plus 60% of industrial emissions at an estimated carbon price of CNY 75 (EUR 9.60) per tonne CO2 |

29% |

19% |

|

EU 23 |

Status quo 2018 |

57% |

44% |

|

EU 23 |

Permit prices increase to EUR 30 per tonne CO2 |

73% |

52% |

|

EU 23 |

ETS expands to cover also residential and commercial emissions as well as emissions from small industrial facilities. Permit prices increase to EUR 30 (& EUR 60) per tonne CO2 respectively |

85% |

61% (84%) |

Note: The estimates do not consider any demand response to the ETS reforms. See this chapter’s endnote 6 for additional detail.

Prices in the EU ETS have increased since 2018 and trade above EUR 30 per tonne of CO2 since early January 2021. With the announcement of the Green Deal and the goal to achieve climate neutrality by 2050 a further increase of permit prices is possible. At permit prices in the EU ETS of EUR 30 or above, the CPS30 for the 23 EU countries considered in this document increases from 57% in 2018 to 73%. In addition, the CPS60 increases from 44% in 2018 to 52% with a permit price of EUR 30 per tonne of CO2. To close the carbon pricing gap entirely - pricing all emissions at EUR 30 (or EUR 60) or more per tonne of CO2 - carbon prices would also need to increase in the sectors that are currently not covered by the EU ETS and that have low effective carbon rates. In particular, many countries charge only very moderate effective carbon rates in the residential and commercial sector, while some levy significant carbon prices through fuel excise taxes (e.g. the Netherlands) or explicit carbon taxes (e.g. Switzerland, which is linked to the EU ETS).

If the EU ETS were expanded to include all fossil fuel emissions from the residential and commercial sector as well as from industry, the CPS30 would increase to 85%, assuming a permit price of EUR 30 per tonne CO2. The remaining gap to pricing all emissions at EUR 30 or more would result largely from biofuels, which often have an effective carbon rate of zero, or a substantially lower rate than those of comparable fossil fuels. The CPS60 would increase to 61%. If in addition permit prices increased to at least EUR 60 per tonne CO2, the CPS60 would increase to 84%.

Annex 4.A. The carbon pricing score excluding emissions from the combustion of biomass

This Annex provides results for the carbon pricing score across countries excluding emissions from the combustion of biomass. Additional results excluding emissions from biomass are available on OECD.STAT.

The results excluding emissions from the combustion of biomass complement the results including emissions from biomass. The latter are shown by default in line with previous editions of Taxing Energy Use (OECD, 2013[3]; OECD, 2015[4]; OECD, 2018[5]; OECD, 2019[1]), as well as Effective Carbon Rates (OECD, 2016[2]; OECD, 2018[6]) as well as considering recent evidence on lifecycle emissions from biofuels. Nevertheless, the biomass exclusion approach may be of interest to specific countries and users as it may better reflect local conditions or improve comparability with other inventories.

Annex 3.A of Effective Carbon Rates 2018 (OECD, 2018[6]) discusses the implications of including and of excluding emissions from the combustion of biomass in more detail.

Annex Table 4.A.1. Carbon pricing score at EUR 60 per tonne CO2

Excluding emissions from the combustion of biomass

|

Carbon Pricing Score at EUR 60 per tonne CO2 (CPS60) |

|

|---|---|

|

CHE |

84% |

|

NOR |

77% |

|

LUX |

71% |

|

LTU |

70% |

|

DNK |

69% |

|

SVN |

67% |

|

FRA |

63% |

|

AUT |

63% |

|

FIN |

63% |

|

SWE |

62% |

|

ISL |

61% |

|

ITA |

58% |

|

LVA |

57% |

|

PRT |

56% |

|

IRL |

55% |

|

NLD |

52% |

|

GBR |

52% |

|

KOR |

50% |

|

ESP |

50% |

|

GRC |

49% |

|

DEU |

45% |

|

HUN |

42% |

|

SVK |

40% |

|

NZL |

39% |

|

POL |

38% |

|

BEL |

37% |

|

CAN |

37% |

|

ISR |

36% |

|

EST |

36% |

|

CZE |

34% |

|

MEX |

33% |

|

COL |

32% |

|

ARG |

30% |

|

JPN |

25% |

|

CHL |

25% |

|

TUR |

24% |

|

USA |

22% |

|

AUS |

21% |

|

IND |

18% |

|

ZAF |

14% |

|

CHN |

10% |

|

RUS |

8% |

|

IDN |

3% |

|

BRA |

2% |

References

[3] Flues, F. and K. van Dender (2020), “Carbon pricing design: Effectiveness, efficiency and feasibility: An investment perspective”, OECD Taxation Working Papers, No. 48, OECD Publishing, Paris, https://dx.doi.org/10.1787/91ad6a1e-en.

[2] Flues, F. and K. van Dender (2017), “Permit allocation rules and investment incentives in emissions trading systems”, OECD Taxation Working Papers, No. 33, OECD Publishing, Paris, https://dx.doi.org/10.1787/c3acf05e-en.

[1] Marten, M. and K. van Dender (2019), “The use of revenues from carbon pricing”, OECD Taxation Working Papers, No. 43, OECD Publishing, Paris, https://dx.doi.org/10.1787/3cb265e4-en.

[11] OECD (2019), Taxing Energy Use 2019: Using Taxes for Climate Action, OECD Publishing, Paris, https://dx.doi.org/10.1787/058ca239-en.

[13] OECD (2018), Effective Carbon Rates 2018. Pricing Carbon Emissions Through Taxes and Emissions Trading, OECD Publishing, Paris, https://doi.org/10.1787/9789264305304-en.

[10] OECD (2018), Taxing Energy Use 2018: Companion to the Taxing Energy Use Database, OECD Publishing, Paris.

[12] OECD (2016), Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264260115-en.

[9] OECD (2015), Taxing Energy Use 2015: OECD and Selected Partner Economies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264232334-en.

[8] OECD (2013), Taxing Energy Use: A Graphical Analysis, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264183933-en.

[4] Roelf, W. (2019), “South African parliament approves long-delayed carbon tax bill - Reuters”, Reuters, https://www.reuters.com/article/us-safrica-carbontax/south-african-parliament-approves-long-delayed-carbon-tax-bill-idUSKCN1Q81U8 (accessed on 7 May 2019).

[7] Slater, H. et al. (2019), 2019 China Carbon Pricing Survey, China Carbon Forum.

[5] Van Dender, K. (2019), “Taxing vehicles, fuels, and road use: opportunities for improving transport tax practice”, OECD Taxation Working Papers, No. 44, OECD Publishing, Paris, https://doi.org/10.1787/fd193abd-en.

[6] Zhang, X. (2020), Estimates for emission coverage of Chinese emissions trading systems.

Notes

← 1. This document reports effective marginal carbon rates by default. If effective average carbon rates are shown the term “effective average” is always explicitly mentioned.

← 2. Higher effective carbon rates are expected to reduce emissions over time. If all emissions of a jurisdiction are priced at the benchmark value (for carbon costs) or more, the corresponding CPS will remain at 100%. If, however, many rates are below the benchmark and rates are increased for some emissions only, it can happen that subsequently only those emissions decline for which the price increase applies. As a result, the share of the higher priced emissions in overall emissions declines over time. The effect on the CPS would be an initial increase in the CPS (immediately after the rate increase and before the emission decline), that, overtime, is counteracted by a decreasing share of higher priced emissions.

← 4. Considering air pollution more generally, there also good reasons to charge higher carbon prices than what low-and mid-point estimates of carbon costs suggest in other non-transport sectors. For example, air pollution from coal, oil, gas and wood combustion for electricity generation and heating purposes in the industry sector and the residential and commercial sector, provide an economic argument for effective carbon rates that exceed low- and mid-point estimates of carbon costs.

← 5. The effective average carbon pricing score at EUR 30 and EUR 60 per tonne of CO2 were 42% and 21% respectively in 2018, reflecting a significant share of free allocation in the Korean electricity sectors, which mutes the incentives to invest in cleaner power generation and reduce emissions.

← 6. The estimates of ETS reforms described in this section do not include any demand response. To evaluate the effects of higher effective carbon rates on emissions and the CPS, consider that if a jurisdiction increases its CPS, the higher effective carbon rates are expected to reduce emissions where they apply. If the jurisdiction increases its CPS to 100%, emissions are expected to decline, but this will not change the CPS. However, if a jurisdiction only increases its CPS in one sector to 100%, emissions in this sector are expected to decrease, but in the absence of other policies not in the other sectors. After an initial increase in the jurisdiction-wide CPS, due to the carbon pricing increase in one sector, the jurisdiction-wide CPS may thus decrease over time to the extent that sectors with lower effective carbon rates gain more weight in the share of jurisdiction-wide emissions.