This case study aims to provide an illustration of how the Guide can be operationalised in a specific country context. It does not intend to provide a comprehensive review or establish recommendations for development co-operation in Jordan. Rather, it provides an example of how projects can be mapped to support the implementation of this Guide. It starts with an overview of the Jordanian context, which provides a short and non-exhaustive summary of findings from a recent FDI Qualities review of Jordan. This review, carried out by the OECD in the context of the EU-OECD Programme on Investment in the Mediterranean, was based on the FDI Qualities Policy Toolkit (OECD, 2022[1]). The case study then attempts to map development co-operation projects related to investment and sustainable development in Jordan, using the framework of this Guide. This mapping relies on a comprehensive review of development co-operation projects implemented in Jordan in 2018-19.

FDI Qualities Guide for Development Co-operation

Annex B. Mapping interventions: Jordan case study

Understanding the impact of FDI on sustainable development in Jordan

FDI and integration into global value chains (GVCs) have contributed to economic growth in Jordan in the 2000s. Ambitious liberalisation reforms in the 1990s made Jordan one of the most successful countries in attracting FDI, leading to an FDI stock-to-GDP ratio exceeding 80% in 2020. However, persistent structural challenges and dependence on a few industries, combined with global shocks and regional instability, have also gradually eroded Jordan’s FDI performance in the last 15 years. FDI inflows represented less than 2% of GDP in 2020, which is comparable to other countries in the region, but much lower than the country’s average performance over the last decade.

While restoring and increasing FDI levels is important, there is also scope to enhance the impact of FDI on the SDGs. The sectors that attract the most FDI, such as construction and the energy sector (70% of greenfield FDI for the two sectors combined), do not contribute the most to productivity, green growth or the creation of quality jobs for women and men. FDI in manufacturing created many jobs in the early 2000s, including for women, but accounted for only 20% of total greenfield FDI. Furthermore, manufacturing FDI has been concentrated in low productivity and low skill-intensity sectors, such as the garment industry, and has been responsible for large shares of oil-based fuel consumption.

Foreign companies in Jordan perform better than domestic firms in several dimensions of sustainability, but their performance premium is small and weaker than in other peer countries. This suggests a strong potential for policy interventions that help FDI to achieve better sustainability outcomes. This potential is even higher when it comes to green business practices, an area in which foreign firms perform relatively poorly. While FDI typically also influences SDG outcomes indirectly through supply chain linkages, the potential for positive spill-overs is limited in Jordan due to relatively weak supply chain linkages between foreign and domestic firms. Furthermore, weak competition has created a large group of small business with low productivity levels that are vulnerable to foreign competitors. A more dynamic private sector could enable FDI to reallocate human capital to more productive activities and, in turn, support sustainable development.

Water, food and energy security are amongst the biggest challenges to achieving sustainable development in Jordan. Jordan is one of the world’s most water-scarce countries – a challenge that could be exacerbated by climate change. Jordan’s energy sector is overwhelmingly fossil fuelled, and has been subject to rising costs. Given its natural resource endowments, Jordan has a strong potential for the development of renewable energy technologies, especially in solar and wind energy. The country has already made important strides in that area, reaching its 10% renewable energy target for 2020 ahead of schedule, and is now aiming for as much as 30% of its electricity mix to come from renewable sources by 2022.

Jordan’s growth and productivity potential largely lies in export activities and foreign investment inflows. The fiscal and balance of payment situation limits options to seek growth through fiscal stimulus or through an increase in private domestic demand for non-tradable goods. As a result, reigniting exports and FDI presents the most viable opportunity to drive growth while lowering the current account deficit. The immediate potential for inclusive and sustainable growth lies in services activities that are neither energy- nor water-intensive, such as information and communication technology (ICT) and other business services, transport and logistics, creative industries and tourism. The potential for inclusive growth in services is supported by the growing workforce with tertiary education, where women are also increasingly represented.

Identifying national priorities on investment and sustainable development

Jordan gives high priority to private investment as a driver for sustainable development. Jordan has a coherent framework of national strategies to support the SDGs with consistent references to the role of private (and foreign) investment. Jordan’s vision 2025 and the Economic Growth Plan 2018-22 point to sectors with significant potential for investment, productivity, employment (including for women) and green growth. The emphasis is on the development of modern, ITC services and sustainable infrastructure (e.g. renewable energy or transport), in line with key challenges and opportunities identified above.

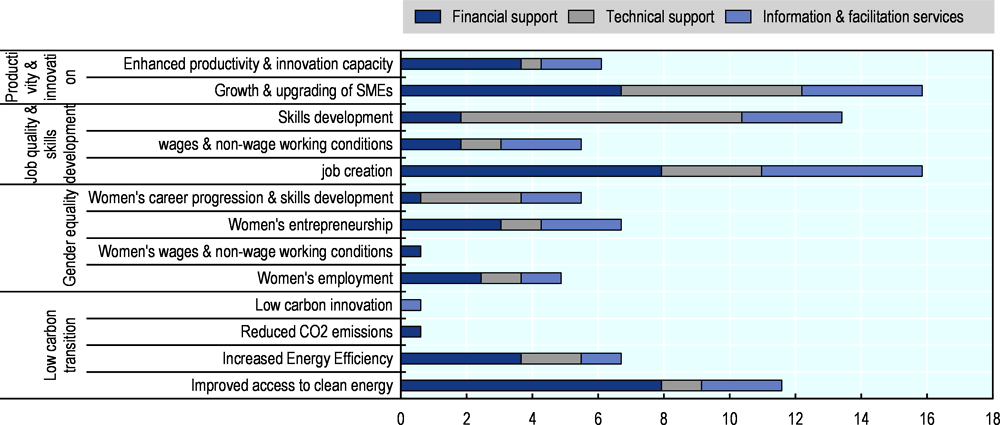

Figure A B.1. Policy instruments influencing the impact of FDI on sustainable development in Jordan

Note: Every policy instrument can influence several outcomes across and within the four sustainability dimensions.

Source: OECD (2022[1]), FDI Qualities Review of Jordan: Strengthening Sustainable Investment, https://doi.org/10.1787/736c77d2-en.

The policy mix reflects the country’s most pressing priorities, as most policy instruments influence – directly or indirectly – the contribution of FDI to job creation and SME growth (see Figure A B.1). This emphasis is coherent with Jordan’s daunting needs of absorbing a growing labour force through private sector development. Policy interventions that enable the benefits of FDI also focus on incentivising private investment in the clean energy sector and on equipping workers with the right skills, although often only for low-skilled jobs.

The FDI Qualities Review of Jordan identifies various policy considerations to enhance sustainable investment in Jordan. These policy areas have been identified through consultations with a wide range of stakeholders, including businesses, civil society, and policy makers. A selection of policy considerations highlighted by the review is summarised in Box A B.1.

Box A B.1. Selected policy considerations highlighted by the FDI Qualities Review of Jordan

Further consolidate the strategic framework for investment and sustainable development. Jordan has a coherent framework of national strategies to support the SDGs with consistent references to the role of private (and foreign) investment. However, strategies are not always developed in a co‑ordinated manner both within and across areas of sustainable development. Furthermore, while the importance of private investment is mentioned in all strategies, references are sometimes generic and not always linked to specific priority actions or projects.

Strengthen institutional co‑ordination. There are no mechanisms in Jordan dedicated to policy co‑ordination in the area of investment and sustainable development. Other existing mechanisms could take a more prominent role, and co‑ordination could be further strengthened by ensuring that public and private institutions from all pertinent policy areas and all stakeholder groups (including for example foreign investors) are represented in relevant committees, councils and boards of directors.

Enhance monitoring and evaluation, including through greater stakeholder engagement: Currently, the practice of monitoring and evaluation depends on the discretion of policy implementing agencies. A key challenge is a lack of qualitative information received from investors, which could be addressed through stakeholder engagement to assess gaps between laws and their implementation and identify key challenges that policy beneficiaries (e.g. investors, SMEs and workers) may face on the ground.

Implement business climate reforms, including to address FDI restrictions in areas where FDI has a high impact potential, reduce “behind-the‑border” barriers, address regulatory obstacles that can hamper the positive effects of FDI, and lower the cost of doing business in Jordan.

Design policies that can promote FDI benefits on gender equality, reducing carbon emissions, boosting productivity in tradable services and creating better quality jobs. Jordan’s policy mix on sustainable investment reflects the country’s most pressing priorities, such as job creation and SME growth. However, sustainability dimensions that are crucial to meeting emerging challenges are less prioritised. For example, few programmes focus on gender equality, reducing carbon emissions, boosting productivity in tradable services and creating better quality jobs.

Strengthen the capabilities of Jordan’s National Contact Point (NCP) for RBC. As an adherent to the OECD Declaration on International Investment and Multinational Enterprise, Jordan has established an NCP to promote and support implementation of RBC standards. This mechanism could be enhance by ensuring adequate human and financial resources to fulfil its mandate.

Source: OECD (2022[1]), FDI Qualities Review of Jordan: Strengthening Sustainable Investment, https://doi.org/10.1787/736c77d2-en.

Mapping development co-operation interventions in Jordan

A review of development co-operation projects related to sustainable investment in Jordan can help shed light on the allocation of support across SDGs and policy levers. Such a review is important to identify potential support gaps, as well as opportunities to scale up, complement or replicate interventions. It can also support co‑ordination among development co-operation actors and help assess alignment with national priorities. Table A B.1 provides a “heat-map” of development co-operation interventions related to sustainable investment in Jordan over the period 2018-‑19. The colour density reflects comparative levels of amounts disbursed for each SDG area and development co-operation solution in 2018‑19.

Table A B.1. Distribution of development co-operation projects in Jordan (2018-19 data)

|

Principles |

Development Co-operation options |

Estimated resource allocations |

||||

|---|---|---|---|---|---|---|

|

Productivity and innovation |

Job quality and skills |

Gender equality |

Environment and decarbonisation |

|||

|

Governance |

Supporting governments in the design of coherent strategies and policies on investment and sustainable development |

|||||

|

Sustaining engagement and providing budget support to ensure policy continuity and implementation of reforms to strengthen sustainable investment |

||||||

|

Building the capacity of public institutions to ensure inclusive decision-making and inter-agency co‑ordination in the design and implementation of policies related to sustainable investment |

||||||

|

Supporting efforts to assess and monitor the impact of FDI, and related policies, on sustainable development |

||||||

|

Domestic and international regulation |

Supporting efforts to join major international agreements and conventions that promote sustainable development and foster responsible business conduct |

|||||

|

Supporting alignment of national legislation with international sustainability standards |

||||||

|

Supporting the negotiations and implementation of trade and investment agreements, including on sustainability-related provisions |

||||||

|

Financial and technical support |

Ensuring a robust impact management and monitoring strategy in the provision of de-‑risking instruments and scale up the use of blended finance in least developed countries |

|||||

|

Adopting a targeted approach to catalysing FDI in activities and sectors with high impact potential |

||||||

|

Providing support to build the domestic capabilities of firms, entrepreneurs and workers to foster decarbonisation, productivity and innovation, as well job qualities, skills and gender equality |

||||||

|

Information and facilitation |

Raising awareness and facilitating implementation of corporate sustainability standards, including RBC due diligence |

|||||

|

Supporting government agencies in the delivery of services in support of investment and sustainable development |

||||||

|

Developing, supporting or partaking in industry and / or multi-stakeholder initiatives to promote SDG alignment and supply chain linkages |

||||||

Source: Authors compilation based on the data from DAC CRS statistics.

Identifying potential opportunities and considerations for project design

The mapping reveals a relatively high level of alignment between recent interventions in Jordan and the government policy priorities identified through the FDI Qualities Review. In particular, the concentration of development co-operation interventions focused on employment and skills is coherent with Jordan’s priority of absorbing a growing labour force through private sector development, and coincides with Jordan’s policy mix on sustainable investment. The Jordanian Government also prioritises policy interventions that incentivise private investment in the clean energy sector, which appears to be prevalent in development co-operation interventions.

Sustainability areas that are less prioritised in Jordan’s policy mix on sustainable investment receive very limited development co-operation support. While this reflects a high degree of alignment with national priorities, findings from the FDI Qualities review have identified several areas that are crucial to meet emerging challenges, such as gender equality, reducing carbon emissions and boosting productivity in tradable services. Projects do exist in all these areas. For example, the Jordan Valley Links programme, supported by Canada, aims to better integrate women and youth in food processing, tourism and clean technology value chains, including through training and capacity building (MEDA, 2016[2]). Development finance institutions, including the French Proparco and Finnish Finnfund, invest in renewable energy projects, for example the development of solar panels. However, the number of projects and breadth of intervention modalities tend to be relatively narrow compared to other SDG areas. While a few programmes aim to promote gender equality, funding allocations are limited, and interventions overwhelmingly focus on training and capacity building, leaving less emphasis to systemic challenges that may have to do with policies and regulations. When it comes to carbon reduction, allocations tend to be larger, but concentrated in interventions that take the form of loans or equity investment to finance renewable energy infrastructure.

Development co-operation actors provide significant support to investment climate reform and implementation, which largely focuses on economic growth and job creation. For example, the World Bank Group’s Country Partnership Framework for Jordan 2017-‑22 aims to improve the conditions for inclusive, job creating growth, including by tackling labour market productivity issues (World Bank, 2022[3]). This type of support can help Jordan achieve its most pressing priorities, and provides solid foundations to support the design and implementation of reforms targeting a range of sustainability areas prioritised by the Jordanian Government going forward. In particular, existing engagement with the development co-operation community could be an asset to further engage on the design of policies that can promote FDI benefits on gender equality, reducing carbon emissions, boosting productivity in tradable services and creating better quality jobs. The focus of business climate reforms could also seek to assess and address challenges including behind the border barriers and regulatory obstacles to greater FDI impacts.

Institutional capacity and co‑ordination, as well as monitoring and evaluation of FDI impacts may deserve further attention from the development co-operation community. While strengthening capacity and co‑ordination across administrations involved in areas related to investment and sustainable development is often a key issue to promote sustainable investment, few projects and very limited resources have that objective. Exceptions include the support provided by the World Bank and European Bank for Reconstruction and Development (EBRD) to the National Centre for Innovation and private sector development (see Box A B.2). Similarly, building metrics and frameworks to monitor FDI impacts is crucial to ensure the effectiveness of both government and development co-operation interventions. Only very few projects include such a focus. The ILO, for example, provided support to develop Decent Work-related indicators mainstreamed in SDGs’ national implementation strategy with enhanced institutional capacities in labour market information systems.

BOX A B.2. EBRD and World Bank support to the National Centre for Innovation

The European Bank for Reconstruction and Development (EBRD) and the Word Bank implement development co-operation with the potential to address the issue of institutional capacities in the innovation ecosystem in Jordan. The banks work with the Higher Council for Science and Technology (HCST) to establish the National Centre for Innovation (NCI), which is expected to function as the national one-‑stop information and referral hub for all activities related to innovation and private sector development, including start-up activities. The project supports the HCST to define and develop the NCI’s mandate, functions, procedures, tasks and capacity.

The NCI is to provide legal advocacy and advisory services to SMEs as well. The NCI co‑ordinates with national and international administrative, financial and technical services to enhance and support innovation and private sector development. While supporting national innovation scenes, the NCI creates a feedback mechanism to the government to ensure best practice and transparency. The Centre accumulates all co‑ordinating activities in the technology platform that combines existing data resources with the data to be collected in order to co‑ordinate resource referrals, monitor and evaluate innovation activities and other key performance indicators reflecting the economic shifts towards innovation. After the official launch of the NCI in 2018, the Middle East and North Africa Transition Fund administered by the World Bank financially supported the first two years of the operation as well.

Source: Website of the EBRD https://www.ebrd.com/news/2018/jordans-national-centre-for-innovation-launches-at-ebrd-annual-meeting.html

Very few projects explicitly seek to enhance the impacts of FDI on sustainable development. While various projects seek to promote SDG-related objectives through engagement with the private sector, interventions do not typically have a direct or structured approach to increasing the qualities of investment. As a result, while such projects may yield results in specific SDG areas, they tend to be fragmented and may not maximise synergies and complementarities on investment and sustainable development.

Support to industry and / or multi-stakeholder initiatives presents some potential, especially in strategic sectors and SDG areas. Indeed, the development and strengthening of such initiatives could help reinforce supply chain linkages which are relatively weak in Jordan, while providing a platform to strengthen implementation of RBC and other international sustainability standards along the value chain. Examples such as the Better Work Programme, which is active in Jordan, could be replicated to other industries and sustainability areas. Support to strengthen the capabilities of the National Contact Point on RBC could also help raise awareness and implementation of sustainable practices among domestic and foreign businesses operating in Jordan, and enhance their impacts on sustainable development.

About 10% of funding for projects reviewed is channelled through private sector institutions or NGOs, which is significantly below the average of private sector development projects at global level (approximately 30%). While various modalities may exist to engage with businesses and stakeholders, which do not necessarily involve financial flows, this could be an indication of the prevalence of inclusive partnerships in interventions related to sustainable investment in Jordan. The share of resources channelled through the private sector or NGOs is down to 6% for projects focusing on jobs and skills, which is consistent with Jordan’s current sustainable investment policy mix emphasising job creation and SME growth. Further engagement with the private sector could provide an avenue to enhance business practices and spill-over effects on the quality of jobs.

References

[2] MEDA (2016), Enterprise Development for Women and Youth in the Jordan Valley, https://www.meda.org/projects/jvl/.

[1] OECD (2022), FDI Qualities Review of Jordan: Strengthening Sustainable Investment, OECD Publishing, Paris, https://doi.org/10.1787/736c77d2-en.

[3] World Bank (2022), Country Partnership Framework for Hashemite Kingdom of Jordan for the Period FY17-FY22, https://openknowledge.worldbank.org/handle/10986/24679?show=full.