This chapter presents options to address the financial challenge through a multi-pronged approach. It sets out the key components of the enabling environment for investment, consisting of policies, regulations and institutional arrangements for both the water and the financial sector. It highlights the need for making the best use of existing sources of finance and assets to minimise overall investment needs. Finally, the chapter discusses how strategic investment planning can help to optimise future investment needs, including through nature-based solutions.

Financing a Water Secure Future

3. Options to address the financing challenge

Abstract

Mobilising capital for investment in water security requires urgent attention and action. Ensuring that water-related expenditures deliver value for money and tangible benefits in terms of water security and sustainable growth matters as well.

The scale of investment needs is a testament to inadequacy of prevailing policies, financing strategies and mechanisms. Public finance (supplemented by official development assistance in developing countries), although an essential contribution to financial sustainability of the sector, is not available at scale to cover current and projected investment needs. Moreover, individual investments and projects must form part of a robust pathway towards a resilient water management system if the multiple benefits are to materialise.

The challenge is not merely about mobilising more capital. A multi-pronged approach is required. Four key action areas discussed in turn below can guide efforts to improve the effectiveness and efficiency of water-related investments.

3.1. Strengthen the enabling environment for investment

3.1.1. Why a strong enabling environment is needed to facilitate investment

It is widely recognised that the water sector needs robust public policy and institutional frameworks to function effectively, given the common pool nature of water resources and the public good dimensions of selected water policies and services (OECD, 2019[1]). Such frameworks also have a profound influence on the water sector’s attractiveness to investors and its ability to recover costs and secure sustainable financing. As noted above and further examined in Chapter 4, the huge investment needs of the water sector over the coming decades demand increased volumes of sustainable finance drawn from a more diverse range of public and private sources (Money, 2017[2]; Pories, Fonseca and Delmon, 2019[3]; OECD, 2019[4]). To meet the financing challenge, governments should consider how existing policies and institutions might be enabling or impeding water-related investments.

A strong enabling environment for water-related investment can be broadly characterised as a set of policies, regulations and institutional arrangements that facilitate investment in activities that contribute to water security. This includes sector-specific policies, regulations and institutional arrangements as well as those relating to the regulation of the financial sector and capital markets. Well-designed policies and institutions are important for not only attracting investors, but also for ensuring that individual investments deliver their intended benefits and contribute to the sustainable financing and management of water resources and the delivery of water and sanitation services. Such conditions can therefore also play a pivotal role in minimising countries’ water-related investment needs over the long term, by contributing to policy coherence and ensuring the sector adapts to changing conditions, including climate change. A robust enabling environment is critical for allowing governments and investors to situate individual investments within their broader policy context, and to develop new projects and markets not as isolated, standalone investments conducted for their own sake, but instead as part of a holistic approach to achieving water policy aims (OECD, 2020[5]). Further, clearly defined policy orientations for water-related investment help governments to articulate both the benefits and the risks of different investment proposals (World Bank, 2017[6]).

By assessing the policy and institutional arrangements that create the settings for water-related investments, governments and investors can adopt a systemic perspective on the financing challenge and identify how such frameworks may be supporting or undermining efforts to scale up and diversify finance for the water sector. This applies to both public and private finance sources, but is especially critical in the context of efforts to secure commercial finance; the enabling environment can be a key determinant in the creditworthiness of potential borrowers and the “bankability” of proposed water projects (Pories, Fonseca and Delmon, 2019[3]; Streeter, 2017[7]).

This section examines various components of the enabling environment for investment to identify some of the main levers of influence available to governments seeking to increase water-related investment. These include the evaluation of policy settings (legal and regulatory, economic and financial, and information-based policy instruments) as well as the coherence of policies across different sectors and domains (e.g. water, agriculture, land use, urban planning, energy, and finance). An assessment of the structure and operation of the institutions that design, implement and evaluate policies and activities in the water sector is equally vital for ensuring accountable and efficiently functioning investment environment. Finally, adequate resources and capacities are needed for policies to be delivered and institutions to function as intended.

3.1.2. Policies and institutional settings define the conditions for water-related investment

A country’s public policy and institutional settings create a set of multi-layered conditions for water-related investments that can be complex for governments, service providers and investors alike to grasp and navigate. As outlined in Chapter 2, water-related investments have characteristics that challenge conventional approaches to public and private financing, including long payback periods and often complex risk-return profiles and project attributes. This reflects the fact that water policies and institutions are focused on ensuring access to water as a dynamic resource managed across jurisdictional boundaries and is essential for life. This demands sustainable management over decades-long time frames, and has strong interdependencies with other policy domains (e.g. agriculture, energy, urban planning) (OECD, 2016[8]). The inherent complexity of many water-related policy interventions has contributed to investors’ perception of water-related investments as more risky and generally less attractive than those in other sectors (Streeter, 2017[7]).

Strengthening the enabling environment for investment requires governments to recognise this diversity of potential projects and investors as well as the spectrum of diverse types of water-related investments and consider how adjustments to policies and institutions could help to facilitate the types of investments and investors that are most needed in their water sector.

3.1.3. Key components for improving the enabling environment

Table 3.1 summarises key elements of the enabling environment for investment, including policy frameworks and institutional arrangements related to water. In addition to the elements included in the table, financial policies, regulations and markets need to be conducive to providing long term, low cost capital to fund infrastructure investments (see discussion in the section on blended finance). These elements are discussed in more detail in the section below.

Table 3.1. Key elements of the enabling environment for investment

|

Component |

Examples of instruments, mechanisms or interventions |

Selected examples relevant to the water sector that can influence the investment environment |

|---|---|---|

|

Policy settings |

Legal and regulatory policy instruments |

Legal status for water resources Legal recognition of the human right to water Clear legal status for WSS service providers Laws and regulations for managing water resources allocation (e.g. abstraction limits, enforcement mechanisms, entitlements to use water) Laws and regulations related to water quality standards (for drinking water, wastewater treatment, pollution loads in water bodies, etc.)> Laws governing infrastructure and services for e.g. drinking water supply, wastewater collection and treatment |

|

Economic policy instruments |

Tariffs for WSS services Targeted subsidies to address household affordability constraints in accessing WSS services Charges or taxes for water abstraction or pollution (Polluter Pays principle) Markets to trade for abstraction entitlements and pollution rights Payments for ecosystem services Insurance for water related risks (drought, flood protection) |

|

|

Information-based policy instruments |

Information systems (e.g. data collection, monitoring and early warning systems on water quality/quantity, service quality and efficiency, asset status, etc.)1 Public registers and information schemes (e.g. disclosure requirements on WSS service operations or service provider finances) Education and training programmes for WSS service providers Communication strategies and campaigns (e.g. for households, farmers) |

|

|

Mechanisms to facilitate policy coherence across domains/sectors |

Systems for tracking and monitoring shared policy objectives in a given sector (e.g. checklists, tracking finance for activities with multiple objectives) Policy mainstreaming processes (e.g. climate policy mainstreaming across sectors) Designating coherence objectives as part of central government processes (e.g. budgeting) Intra- and inter-governmental water policy co-ordination mechanisms |

|

|

Institutional arrangements and provisions |

Independent oversight |

Regulation of the WSS sector (e.g. WSS tariff-setting) by an independent economic authority |

|

Devolution or decentralisation reforms for service delivery |

Devolution of authority for WSS service delivery to municipal/local level Reconfiguration of service provision boundaries to consolidate service delivery at a defined scale |

|

|

Mechanisms for accountability to e.g. citizens, service users |

Public consultation and participation requirements for water tariff reforms WSS service user feedback and complaint mechanisms |

|

|

Mechanisms to improve services |

Performance incentive structures and monitoring for WSS service providers (economic regulation of service provision) |

|

|

Supporting resources and capacities |

Finance for policy implementation |

Resourcing for effective auditing and enforcement of water regulation (infringement proceedings, etc.) |

|

Capacity building measures |

Technical assistance, education and training to improve the technical, human resource and financial capabilities of WSS service providers |

Note: The examples in this table illustrate some relevant settings and conditions, but cannot provide a comprehensive or fully accurate depiction of the enabling environment across all countries. Governments combine various instruments and interventions to support and reinforce each other to meet policy objectives.

Source: Authors

Strengthening policy settings

Legal and regulatory instruments

Legal and regulatory policy instruments set the fundamental rules and parameters for a well-functioning water sector. Governments use them not only to establish their long-term water policy goals and plans, but also to ensure the accountability and cost-effectiveness of the activities and investments undertaken to achieve those goals. Relevant laws and regulations range from instruments that define water quality standards, allocation regimes, flood protection standards, to legal frameworks governing the design and implementation of and the delivery of WSS services.

A well-designed regulatory framework is particularly critical in the water sector because of water’s fundamental role in ensuring the well-being of people and ecosystems and the function of many economic sectors (OECD, 2009[9]). Given the monopolistic nature of the market for WSS services, a strong regulatory regime is important to ensure the cost-effectiveness and efficiency of policy measures, and to provide assurance to financiers which seek both predictability and transparency in the regulation and design of services (World Bank, 2017[6]). A regulatory regime is only strong if and when compliance is monitored and enforced.

The regulation of water pricing and charges such as WSS service tariffs offers an insight into the interplay between water laws, public and political expectations for water policy and services, and the sustainability of water sector financing. Considering that WSS are essential services, the public often has the expectations for keeping WSS tariffs low, with accompanying political pressure to regulate to keep tariffs low, sometimes also due to concerns about service affordability2. This can directly inhibit adequate cost recovery, which WSS service providers need to work towards to enable the delivery of reliable, sustainable services

Laws and regulations focused in other policy domains – such as those governing competition policy and financial markets – also influence the conditions for water-related investment. In low- and middle-income countries in particular, underdeveloped financial sectors and markets are a widely recognised challenge for increasing water-related investment, particularly from commercial investors (Pories, Fonseca and Delmon, 2019[3]). For example, some countries have legal restrictions in place that limit the scope for both potential borrowers and lenders to engage in new water-related investments and do not facilitate the water sector’s participation in markets. Further, some countries require banks to lend certain percentages of their portfolios to local infrastructure projects in defined areas, which may not encompass water sector priorities (World Bank, 2017[6]). Similarly, there may be rules in place that confine service providers to borrowing from government sources or prohibit them from issuing corporate bonds, or banks may only be permitted to invest a limited percentage of their capital in securities sold by service providers (World Bank, 2017[6]). In the case of improving catchment management via payments for ecosystem services, financial transfers to farmers can be restrained by regulations designed to promote fair competition and trade (e.g. WTO or EU law).

Economic and financial instruments

Governments use a variety of economic and financial policy instruments to influence the behaviour of individuals, communities and organisations to help achieve water policy goals. Such measures generally aim to account for the costs or benefits that different actors incur from using services or from polluting or abstracting water resources3. Examples include instruments such as WSS tariffs, taxes, charges and fiscal transfers (e.g. subsidies), along with mechanisms such as markets for trading water entitlements or pollution permits, and conditional and voluntary incentive schemes such as payments for ecosystem services.

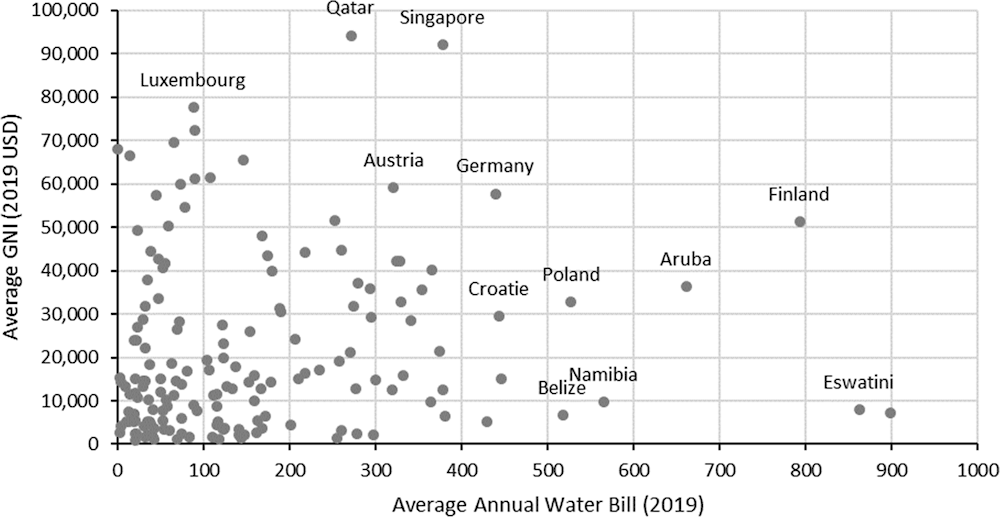

Economic and financial measures not only provide important price signals of the value of water and provide incentives for water-wise decisions, but are also a vital means for providing revenue streams. In the case of WSS, service providers’ ability to generate revenue is derived from tariff levels and structures, bill collection and the associated incentives they create; typically, the WSS service providers should aim to achieve sustainable cost recovery, efficiency in the provision and use of water, and service affordability (World Bank, 2017[6]). In both emerging and developed markets, low WSS tariffs are the main constraint to sustainable cost recovery and reliable revenue streams for WSS service providers (World Bank, 2017[6]; Pories, Fonseca and Delmon, 2019[3]). Tariffs are often fixed at a level that is well below what is needed to recover the costs of operations and maintenance (O&M) ( (Leigland, Trémolet and Ikeda, 2016[10]) in (Pories, Fonseca and Delmon, 2019[3])). Figure 3.1 illustrates that average annual water bills (for a representative household) remain relatively low, even in many higher income countries.

Figure 3.1. Average Gross National Income vs. Average Annual Water Bill

Source: Authors, based on World Bank for GNI data and GWI for average annual water bill

To attract investors’ interest, tariffs need to be set in a predictable and transparent way with the aim of covering O&M costs, the cost of debt service and a progressive share of capital expenditure (CAPEX) where feasible. A lack of sustainable cost recovery can leave commercial lenders hesitant to provide loans as they need an assured sufficient and constant operating surplus that can service the debt over the maturity period (Pories, Fonseca and Delmon, 2019[3]).

While water tariffs provide a stable revenue stream for water supply and sanitation investments, it is more challenging to quantify and monetise the benefits of other water-related investments, such as for flood protection or water resource management. Dedicated economic instruments are needed to help internalise externalities and to create revenue streams to capture the benefits of such investments. Further, combining water-related investments with objectives from other domains, such as agriculture, energy, tourism and urban planning can help to exploit synergies, creating opportunities to capture additional revenues and can unlock investment by applying an integrated approach across the value chain of water-related investment (OECD, 2019[1]; OECD-WCC, 2017[11]; OECD, 2018[12]). Examples include pollution taxes, which can provide funding for investments in water quality or wastewater treatment. Taxes on urban development in floodplains or impervious surfaces generate revenues for flood protection measures. Abstraction charges can fund water resource management interventions and can help cover some of the costs related to droughts or water scarcity. Reduced storm water fees for non-residential customers can encourage direct investment by private property owners and thus reduce the burden on public budgets. (OECD, 2020[13]; OECD-WCC, 2017[11]).4 However, highlighting opportunities for synergies should not overlook the reality that there will inevitably be trade-offs among policy objectives that must be addressed. Table 3.2. summarises selected examples which generate funding for various water security interventions. Box 3.1 discusses cost recovery for water in the agriculture sector.

Table 3.2. Selected policy instruments to generate revenue for water-related investments

|

Policy instrument |

Type of costs to recover |

|---|---|

|

Pollution taxes |

Wastewater treatment costs, investments in water quality improvements |

|

Taxes on urban development in floodplains or impervious surfaces |

Flood protection costs |

|

Abstraction charges |

Water resource management and allocation, costs related to drought or water scarcity |

|

Reduced storm water fees for non-residential customers |

Encourages direct investment by private property owners, reduces burden on public budgets |

|

Charges or fees on resources recovered from wastewater treatment |

Revenue generated from energy or nutrient recovery from wastewater treatment |

Source: Authors, based on OECD (2020) Financing Water Supply, Sanitation and Flood Protection, Challenges in EU Member States and Policy Options and OECD-WCC (2017) Session 3. Converting economic benefits of water security investments into financial returns. Background paper for OECD-WWC-Netherlands Roundtable on Financing Water, 12-13 April 2017, Paris.

Box 3.1. Cost recovery for water in the agriculture sector

Like the WSS sector, the agriculture sector also faces challenges in recovering the costs of O&M and capital. Irrigating farmers generally do not cover the costs of the water they access. Only nine of 39 respondents to a recent survey of countries that adhere to the OECD Council Recommendation on Water indicated that they have full cost recovery in place for both capital and O&M costs for irrigation. In Germany, for example, operators bear the full costs of capital and O&M, and the federal states set different abstraction fees, some of which internalise a portion of the environment and resource costs. Under the EU Water Framework Directive, countries are required to ensure that the water prices charged reflect the full costs (e.g. operation and maintenance costs, capital costs, environmental and resource costs), although full recovery is not required and derogations are possible for less-favoured areas or on grounds of social welfare.

Most country adherents to the OECD Council Recommendation on Water only partially recover the costs of capital and/or O&M. A limited number of countries responding to the survey (Austria, Denmark, Finland, New Zealand, Sweden and the United Kingdom) indicated that they are covering a progressive proportion of the capital costs of infrastructure in addition to O&M costs.

Cost recovery is even less common for groundwater, though the situation differs from surface water as costs are often borne by users of individual wells.

Information-based instruments

Information-based policy instruments can help to achieve water policy goals and create strong conditions for investment in two vital ways: as standalone information systems and products (e.g. monitoring databases, communication campaigns) and as an input and support to other policy measures and investments (e.g. to inform water resource allocation reforms, or WSS tariff restructuring). Information systems (including accounting and measurement frameworks) are a key example of information-based instruments (such as for data collection, monitoring, and early warning systems on water resource quality/quantity; water-related risks; water infrastructure assets; WSS service efficiency, quality and quantity). Other examples include public registers and information schemes (e.g. disclosure requirements for WSS service operations or provider finances), education and training programmes (e.g. for WSS service providers or new investors), and communication strategies and campaigns (e.g. targeted at key audiences to facilitate or accompany other policy measures). Each of these play a role not only in ensuring access to salient information for decision makers, but also in creating a transparent and accountable water sector in which the public (including investors) can have confidence.

A prominent challenge is the lack of detailed knowledge in most countries of the current state of water infrastructure and assets across multiple water sub-sectors. For example, in the European Union, member states lack a detailed knowledge of the rate of asset renewal in the WSS sector (OECD, 2020[13]). Where the rate of renewal is known, it is usually below a level that would be consistent with assets’ life expectancy, which suggests an urgent need for increased renewal efforts to avoid the rapid decay of built infrastructure and declining service quality. The deterioration of assets also results in water leakage and reduced water quality, creating greater challenges for WSS service providers while affecting the health of humans and ecosystems and increasing downstream treatment costs (OECD, 2020[13]).

Countries face similar data challenges for flood protection: only a few countries monitor financial flows for this purpose, making it difficult to project further investment needs (OECD, 2020[13]). Limited knowledge and data on both the state of infrastructure and existing financial flows make it difficult to identify or monitor problems and properly plan improvements, and are thus a major barrier to investment. In some countries, ageing networks are expected to be the single biggest driver for investment in water supply and sanitation (OECD, 2020[13]).

Box 3.2. Information-based instruments for accurate knowledge of WSS assets

In recognition of the vital need for better access to robust water data (observations, processed data and model output), the international High Level Panel on Water (2016-18) endorsed the World Water Data Initiative. In its first phase the initiative resulted in the production of good practice guidelines for water data policy by the Australian Government and the World Meteorological Organization (WMO). The High Level Panel on Water recommended that the subsequent second phase, directed by the WMO, should inter alia support the dissemination of guidance for improving water data policy and secure funding for new innovations in water data (United Nations, 2018[16]).

A key area of innovation in information-based instruments for water management is in the use of artificial intelligence (AI), including for more accurate knowledge of WSS assets. A recent report estimates that AI-enabled innovation for the water sector will contribute USD 200 billion in value to the global economy by 2030 (Mehmood et al., 2020[17]). AI is already being used in countries such as Singapore, Kenya and the United States to support the predictive maintenance of water supply and wastewater assets and to track non-revenue water. These developments are occurring as part of a shift away from traditional scheduled inspection and maintenance approaches towards the use of intelligent sensor-physical systems that monitor the condition of assets (e.g. identifying leaks, blockages and damage) to inform the scheduling and prioritisation of maintenance. Machine learning algorithms are also being used to calculate the likelihood of failure of water infrastructure. Countries are also using AI to forecast water demand and consumption, monitor water reservoirs and dams, track water quality, and monitor and predict water-related disasters.

On the regulatory side, France has embarked on a programme that aims to contribute to better knowledge of the state of the assets for water services, thus supporting more accurate planning and decisions for operation, maintenance and renewal. A regulation issued in 2020 requires local authorities to inventory public networks for water supply and sanitation. An index was set to assess compliance with this requirement. When an authority scores below 40 (out of a maximum score of 120), the abstraction charge aid to the water agency is multiplied by two. There is no such incentive for sanitation. In 2014, two thirds of water services in France failed to comply with this regulation (figure provided by Canalisateurs de France, based on SISPEA data).

Sources: (OECD, 2020, p. 66[13]; Mehmood et al., 2020[17]; United Nations, 2018[16]; WMO, 2018[18])

Mechanisms to support policy coherence

As noted above, water’s essential role across many sectors means that governments should aim to continually assess and improve the coherence of water policies with those of related domains to ensure that priorities, measures and investments support, rather than undermine, one another. Some prominent examples of policy domains that intersect directly with water include agriculture, climate, energy, health, industry, urban planning and land use policy (OECD, 2016[8]). Common mechanisms for policy coherence include processes by which governments systematically assess how a given sector integrates other sectors’ objectives in its policies and measures (e.g. checklists for new policy proposals, finance tracking and monitoring, such as for water-related finance as a share of dedicated climate finance). Processes that centralise certain policy priorities in decision-making are another example (e.g. mainstreaming, central government budgeting). Effective cooperation both within and between governments and non-state actors – i.e. at horizontal and vertical scales – can enhance coherence among different institutions. Address potentially competing policy aims will require identifying and addressing trade-offs.

Improved policy coherence can help to ensure that water-related investment decisions are taken with a systems perspective and are not isolated from broader government decision making and priority setting. In the absence of such coherence efforts, water projects and investments can be left exposed to significant risk as a result of unforeseen or inadequately considered influences from other policy domains.

Strengthening institutional arrangements

Alongside the policy settings outlined above, the institutional arrangements that govern and facilitate the operation of a country’s water sector can have a considerable influence on the enabling conditions for water-related investment. It is important that the institutions that are part of the water policy landscape are designed and fully adapted according to each country’s specific context, governance systems and structures, and policy priorities, as underscored in the OECD Water Governance Principles (OECD, 2016[19]). Overall, investors are attracted to working with institutions that have established autonomy and leadership at the right levels to deliver on their mandates, offer confidence in their financial management capabilities, and are well equipped to help ensure transparency, accountability and predictability (World Bank, 2017[6]; Streeter, 2017[7]).

The devolution of authority for water sector functions – particularly decentralisation processes for local-level WSS service provision or water resources management at basin level – are a key example of institutional water sector reforms that aim to improve economies of scale and the conditions for investment. The devolution of WSS service delivery needs to be to the right level to ensure sufficient scale of operations, reduce operating costs, and support economic viability (Streeter, 2017[7]). In many countries, decentralisation processes are fragmented or incomplete. In emerging market countries in particular, municipal and local-level institutions often have weaker capacities and need significant support to improve their administration, planning and operations if they are to be deemed creditworthy (Streeter, 2017[7]). While decentralising service delivery can increase accountability by devolving responsibility to a level that is closer to the service user, it can also allow for greater variation in the design and enforcement of policies, make central oversight more onerous and complex, and introduce financial sustainability issues (World Bank, 2017[6]).

To address issues such as these in decentralisation processes, there are a number of options and imperatives. WSS service providers require clear mandates to support their financial self-sufficiency and autonomy. This requires sufficient capacity and independence to develop accurate projections on costs to inform tariff setting as well as long-term planning for infrastructure O&M and service delivery, with adequate consultation with connected authorities and the public (service users/customers), and without undue influence from political cycles and interests (Streeter, 2017[7]). Processes and mechanisms that support accountability and transparency in WSS service provision include requirements for systematic public consultation in decision making, as well as standardised, publicly available financial information and disclosure requirements for contractual processes (Streeter, 2017[7]).

Many countries opt to establish designated institutions with a mandate to independently oversee water sector operations, facilitating economic regulation and creating incentive structures to improve the performance of service providers. The independent regulation of public WSS service providers has been an increasingly common government response to deteriorating quality of WSS service delivery and, when well-designed, can help to reduce political interference in implementing key economic instruments such as tariffs (Mumssen, Saltiel and Kingdom, 2018[20]). Independent economic regulation can take various forms according to countries’ governance structures and priorities, and is examined in more detail below. While independent local- or national-level regulators can be instrumental in reducing political influence and financial mismanagement in service provision, they are not a silver bullet, and local circumstances should inform the appropriate solution that supports adequate oversight of service provision by a properly resourced and autonomous regulator (Pories, Fonseca and Delmon, 2019[3]).

Ensuring adequate resources and capacities to support policies and institutions

As noted in the above, two vital underlying components of a strong enabling environment for water-related investment are sufficient resourcing and capacities to enable policies to be implemented and institutions to function as intended. This reflects the principle that policy and institutional plans for the water sector should be backed by sustainable financing and resourcing strategies adapted to the specific context (OECD, 2020[13]). Naturally, adequate resourcing entails ensuring appropriate levels and structures of funding and financing are available to support policy implementation and institutional operations – for example, sufficient resources to carry out audits and enforce water regulations (and e.g. to undertake infringement proceedings when regulations are breached). These fundamental resources should be accompanied by efforts to ensure that institutions have appropriate levels and types of capacity and expertise. Stronger capacity is typically pursued through measures such as technical assistance, education and training aimed at improving the technical, human resource and financial capabilities of WSS service providers.

Water sector institutions need adequate capacities in order to attract investors, maximise existing finance, and increase their potential to attract, manage and sustain new and innovative investments into the future (Streeter, 2017[7]). In some cases, a commitment from institutions to undertake capacity improvement reforms may be a condition for receiving finance, as it will help to maximise the sustainability of that investment over the long term (Streeter, 2017[7]).

To improve the enabling conditions for investment, capacity building measures can target different types of institutions. For example, WSS service providers might receive technical assistance to reduce non-revenue water or improve billing and collection, and through this, improve their creditworthiness (OECD, 2019[1]). To increase local banks’ capacity to evaluate the profitability of water-related investments, financial providers might be provided with technical assistance and training to assess the financial viability of investments in the sector. Capacity building measures that are well designed and embedded in institutions over time can help to ensure that staff have the right skill sets and are motivated to achieve sector strategies and policies and participate in organisational change processes (World Bank, 2017[6]). This better positions them to meet minimum performance standards and supports staff to recognise incentives for improved performance (e.g. in service delivery, in financial management).

Capacity considerations such as these are vital for governments seeking to improve the conditions for investment and support investor confidence in local-level institutions. Ideally, local governments’ and WSS service providers’ capacities should be addressed as a pre-condition for introducing local borrowing (Streeter, 2017[7]). Investors seek evidence that providers have a strong ability to manage taxes and tariffs, collect revenues, prepare and manage transparent budgets, devise capital plans, co-ordinate contracts and tender processes, and conduct accountable consultation processes with the public and investment partners (Streeter, 2017[7]). Such capacities at the provider level are also important to enable national and sub-national governments and independent regulators to access the information they need to carry out their own responsibilities in determining and reforming water policy.

3.2. Make the best use of existing sources of finance and assets

Structural and operational inefficiencies limit the optimisation of available funding and existing assets in the water sector. The water sector has traditionally relied heavily on public finance (and concessional loans in developing countries), which in many cases has contributed to the inefficient allocation and use of existing funding. This section explores five options that governments can consider to focus their efforts to make better use of existing sources of finance and assets, and lay the groundwork for increasing access to more diverse sources of finance across the water sector. A focus on both the supply and demand side of finance provides two distinct entry points to address the financing challenge. Options to consider include:

improving timely asset management to reduce operational inefficiencies

sound capital expenditure planning

targeted allocation of public subsidies

seizing opportunities to improve economies of scale, and

creating and maintaining incentives for performance.

Action in these areas can generate efficiency gains and financial savings that can be used to provide better services and contribute to broader policy objectives (such as more secure, less polluted water resources and healthier ecosystems). WSS service providers and related institutions with transparent and efficient operations benefit not only from an increased and more reliable revenue base, but also from increased credibility that reinforces customers’ willingness to pay for quality services and encourages investor confidence. This helps to ensure a sustainable stream of finance to meet the full scope of a country’s service needs, address emerging challenges for the sector, and free up scarce public funds to be deployed to other policy priorities (World Bank and UNICEF, 2017[21]).

3.2.1. Improving timely asset management to reduce operational inefficiencies

Timely management of water assets – such as reservoirs, pipes and wastewater treatment facilities – supports efficient operations and maintenance (O&M) that in turn strengthens the sustainability of water services and supports water security (OECD, 2016[22]). When timely asset management is prioritised, asset owners and managers are able to identify and address O&M needs in the present – rather than deferring them to be borne by future water managers or service users – and ensure that deteriorating assets do not increase overall water-related investment needs. Timely asset management adequately accounts for assets’ economic life spans as well as the emerging challenges that the water sector will face over the coming decades. This involves a focus on sustaining assets throughout their full life cycles – from their design and construction to O&M and continuous monitoring and evaluation to facilitate necessary improvements in response to future risks (Kingdom et al., 2018[23]; World Bank, 2017[6]). As such, timely asset management can facilitate the supply of finance by ensuring cash flow reliability.

Conversely, insufficient investment in asset management reduces existing assets’ value and increases the risk that assets will need to be prematurely replaced. It can also mean that maintenance efforts are preoccupied with fixing asset breakdowns, rather than upgrades that have been strategically prioritised (ADB, 2013[24]). While this section focuses on the need for timely asset management, this issue is closely interlinked with the need for robust capital expenditure planning, which is examined in the next section.

As outlined above in Section 1 on the enabling environment for investment, a number of conditions are needed to support strong O&M – notably sustainable cost recovery based on an appropriate mix of revenue from the “3Ts” (tariffs, taxes and transfers) (OECD, 2009[25]). For WSS, low tariff levels are typically the primary factor preventing the recovery of O&M costs and thereby inhibiting adequate maintenance, reducing assets’ performance and shortening overall asset life (World Bank and UNICEF, 2017[21]). Where revenues from tariffs are insufficient to recover O&M costs, the gap needs to be filled using tax revenues that are carefully targeted, predictable and transparent to facilitate rigorous O&M (World Bank and UNICEF, 2017[21]).

Timely asset management is only possible when it is informed by accurate, sufficiently detailed data on the state and renewal rates of assets, yet as noted above, many countries lack this information (OECD, 2020[13]). A clear, well-articulated vision of asset renewal needs and accurate forecasts of water demand and risks allows WSS service providers and water management authorities to rigorously plan O&M and future investments (OECD, 2016[22]). This information can also support transparency about the effectiveness of services, and act as a basis for establishing precise, secure service contracts, reducing information asymmetries and rent-seeking behaviour (OECD, 2016[22]). Box 3.3 illustrates how various tools and technologies are being used to gather more precise data on assets and inform their sound management.

Box 3.3. Technologies and methodologies for data gathering and analysis to inform water asset management

Urban WSS service providers in developed countries have been increasingly relying on remote sensing and imaging technologies to acquire precise knowledge of assets’ status and performance levels, particularly those that are located underground (see, for example applications of AI discussed in Box 3.2). This information supports better planning of investments in maintenance and renewal to improve system reliability (e.g. to repair damaged pipes). Innovative and emerging tools and technologies expand the scale and scope of infrastructure monitoring, and extend the time horizon for asset management.

In New Zealand, the city of Auckland has used geographical information systems to overlay actions and investments that have a direct or indirect effect on freshwater quality, including those targeting storm water asset maintenance, renewal and development, cycleway and road construction, and network infrastructure development (e.g. broadband rollout).

In the United States, the Massachusetts Water Resources Authority developed a predictive maintenance strategy based on condition monitoring, and the probability and consequences of failure of each component. The programme increased equipment availability to 99%; it achieved cost savings by eliminating unneeded and low-value preventive maintenance work, and shifting the freed-up resources to predictive tasks and actual maintenance work. Predictive and probability-based maintenance illustrates a shift from zero-risk asset management (which translates into high degrees of infrastructure redundancy) to more thorough risk analysis, allowing more strategic and cost-effective asset management.

Sources: Adapted from (OECD, 2016[22]; OECD, 2015[26]; OECD, forthcoming[27])

Where the renewal rates of water assets are known, they often reflect a significant backlog of investment in O&M for existing assets. In the WSS sector in European Union countries, renewal rates are typically below levels that would be commensurate with assets’ life expectancy (OECD, 2020[13]). Other parts of the water sector – such as agricultural water – face similar challenges with ageing and deteriorating assets: for example, while Japan has invested heavily in its irrigation infrastructure over the last 50 years, more than 20% of the core irrigation facilities have now exceeded their expected lifespan (OECD, 2019[28]).

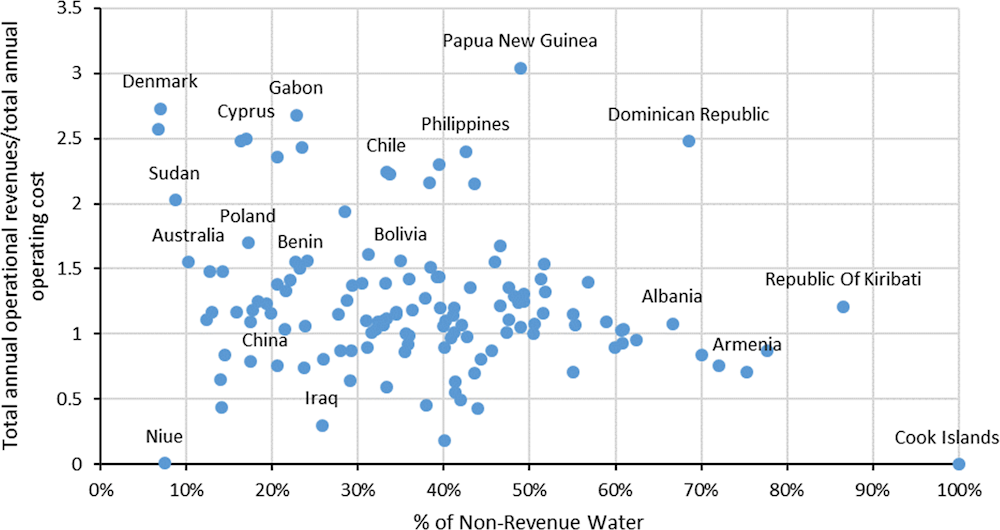

Failure to monitor assets, resolve problems or implement upgrades in a timely way can lead to excessive water losses, including non-revenue water, which undermines the efficiency and effectiveness of water services and raises costs. High rates of non-revenue water are often a sign of operational inefficiency and can provide a partial insight into the extent of backlogs of investment in O&M (OECD, 2020[13]). As non-revenue water can be driven by a combination of issues arising from key operational aspects of service provision – such as water production and distribution, asset maintenance, management of service users, and billing – timely asset management is just one of the possible solutions5 (Sy and Ahmed, 2016[29]). A recent OECD study found that there is significant potential to reduce non-revenue water in EU countries including Bulgaria, Poland, Cyprus6 and Romania, including through targeted maintenance of assets to improve leakage control and drive asset renewal and modernisation (OECD, 2020[13]). Such asset-focused interventions can be accompanied by measures such as performance based contracts to improve incentives for higher O&M performance, or capacity building programmes to build service providers’ skills in managing the technical dimensions of O&M. Indeed, in some cases, such measures can reduce or fully avoid the need for capital-intensive asset upgrades by minimising non-revenue water through other means (Kingdom et al., 2018[23]).Figure 3.2 illustrates the position of select countries with respect to the operating expenditure (OPEX) ratio (total annual operational revenue over total annual operating cost) and the share of non-revenue water (NRW). A higher OPEX ratio reflects a higher share of cost recovery for OPEX, providing more stable financing for timely maintenance of infrastructure assets. However, it is notably that there is significant scope for improvement to reduce non-revenue water, irrespective of the OPEX ratio.

Figure 3.2. Operational Ratio vs. Percentage of Non-Revenue Water, by Country

3.2.2. Sound capital expenditure planning

CAPEX in the water sector should be carefully planned to ensure that finance is used to maximise economic, social and environmental benefits and improve overall capital efficiency. As noted in the above section, the need for well-planned, efficient CAPEX is interlinked with the need for investment in robust O&M; both are critical to making the best use of existing sources of finance and assets over their full life cycles (Kingdom et al., 2018[23]). This interconnection is illustrated by the WSS sector’s emphasis on the need to move away from the “design, build, neglect, rebuild” approach that has traditionally characterised capital expenditure in many countries and shift to a more cost-effective “design, build, maintain” model (Kingdom et al., 2018[23]). While the imperatives for operational efficiency have been gaining attention in the WSS sector, capital costs amount to around 50% of the total costs of service provision, which suggests that it is equally important to identify and exploit opportunities to reduce wasteful capital spending and make better use of existing finance and assets (Kingdom et al., 2018[23]).

Sound CAPEX planning should focus on reducing capital costs and minimising the associated long-term costs of O&M (World Bank and UNICEF, 2017[21]). This can be done in various ways. For example, planners should ensure that demand management options have been fully explored and new infrastructure is actually needed; policies are coherent across sectors, and exposure and vulnerability to water-related risks are considered; lower cost options have been considered in determining selected approach; robust design standards are in place; overpricing is mitigated (with costs and contract awards adequately regulated and monitored and transparently benchmarked); and communities are involved to provide local oversight (World Bank and UNICEF, 2017[21]). They should also conduct cost-benefit analyses with a view to supporting policy coherence and solutions that generate multiple benefits, including those that are difficult to monetise (such as nature-based solutions, potentially in combination with more traditional “grey” infrastructure) (see discussion on NbS in Section 3). Addressing trade-offs across geographic scales needs to be considered, though this can add significant complexity.

Investment in the water sector has traditionally focused on large-scale CAPEX, while commonly overlooking smaller investments that could improve performance or maximise local capacities and increase operational efficiency over the longer term. Planning that over-emphasises large-scale CAPEX can result in expensive yet underused infrastructure: a considerable share of WSS infrastructure, particularly in low- and middle-income countries, is oversized and fails to be used to capacity, or is not connected to sewerage networks at all (World Bank, 2017[6]). This sometimes occurs when technical standards are imported from high income countries and insufficiently adapted to the local context (World Bank, 2017[6]). Unnecessary costs can also arise in the design, selection and implementation of new infrastructure due to inefficient procurement processes, limited competition, or vested interests and biases towards the use of certain (and often more expensive) technologies (World Bank, 2017[6]). A lack of capacity and/or sufficient performance incentives for planners and operators can also drive poor CAPEX decisions. All of these issues not only undermine well-planned CAPEX, but also diminish the credibility and creditworthiness of service providers, limiting their ability to attract commercial finance (OECD, 2018[30]).

A bias in CAPEX planning towards large-scale “grey” and networked solutions can also impede the consideration and adoption of alternative options that may cost less now or in the future offer the same levels of service, often with other social and ecological benefits. This is an especially critical issue in countries that still have sizable populations lacking access to safe, reliable WSS services. Decentralised WSS systems can sometimes have lower costs and offer greater flexibility in hard-to-reach or rapidly changing environments (such as informal settlements), and avoid the need for large investments in piped infrastructure (Kingdom et al., 2018[23]). Experience in Dakar, Senegal, offers one example: a 2012 study found that the estimated annualised cost for sewerage services was almost USD 55, while the cost of on-site sanitation with faecal sludge management was estimated at less than USD 12 ( (Dodane et al., 2012[31]) in (World Bank, 2017[6])). These decentralised systems can deliver cost savings relative to conventional networked infrastructure, although should be accompanied by reliable monitoring and enforcement capacity.

Nature-based solutions (NbS) are another example of interventions with strong potential cost-benefit ratios. They are generally less capital-intensive ‑ with lower O&M and replacement costs, can avoid lock-in associated with capital-intensive grey infrastructure, and appreciate in value over time with the regeneration of ecosystems and their associated services (OECD, 2020[13]). NbS can also present distinctive challenges in terms of investment design, funding and financing (further details in the following section).

A disconnect between the accountability and incentive structures of asset financiers and asset operators can also undermine cost-efficient capital expenditure. This is particularly the case in low- and middle-income countries, where WSS service providers are often public entities that pay either nothing or a minimal cost for the infrastructure they use for service delivery (i.e. it is highly subsidised) (World Bank, 2017[6]; Kingdom et al., 2018[23]). This can directly constrain service providers’ accountability for asset use and management, and limit their incentives to pursue adequate cost recovery. Experience in some higher income countries, where the full cost of service delivery is accounted for, reflects that the debt service to repay loans for capital costs can be significant. For example, capital costs amount to an average of 49% of total costs for water utilities in England and Wales in the United Kingdom (Kingdom et al., 2018[23]).

3.2.3. Targeted allocation of public subsidies

Funding from public budgets is a significant source of funding of water services and water resources management. Yet in many countries the allocation of public funding could be better designed and allocated to improve equity and ensure the best use of available finance. Public subsidies refer to transfers that fill the gap that results from inadequate cost recovery through pricing. In the context of water supply and sanitation services, a subsidy7 occurs when a water user pays less for a product or service than the cost to the service provider, and the responsibility for covering the difference is shifted onto a third party, such as the government, other water users, or future generations (Andres et al., 2019[32]). Subsidies may be direct financial transfers from one entity to another (e.g. from a government to a service provider) or implicit transfers, such as non-payment for services or delayed maintenance (Andres et al., 2019[32]).

When well designed and deployed, public subsidies can be an important means for extending access to water resources and services for groups that may otherwise struggle to access them (e.g. due to affordability constraints), and need to be carefully targeted, transparent and predictable (World Bank, 2017[6]). Subsidies often fail to meet these criteria, instead distorting prices or creating perverse incentives that negatively affect water availability, quality or demand, including generating impacts beyond the water sector, for example through detrimental impacts on biodiversity via the intensification of agriculture. In such cases, governments should reform subsidies to ensure they meet their intended purpose, or phase them out where appropriate, using transition plans that avoid adverse impacts on vulnerable groups (OECD, 2016[8]).

This section focuses on examples of subsidies in the WSS and agricultural water sectors to identify some of the available options for fairer allocation that can support the best use of available resources. Table 3.3. outlines further examples of subsidies in the different parts of the water sector.

Table 3.3. Examples of subsidies in water services and water resources management

|

Transfer mechanism |

Example |

|---|---|

|

Direct transfers of funds |

Capital investment subsidies for water supply and sanitation providers |

|

Foregone tax revenue |

Environmental pollution charges that do not cover the cost of pollution, as well as special reductions or exemptions |

|

Foregone user charge revenue |

Water supply and sanitation tariffs that do not cover the cost of service provision; lack of abstraction charges; reduced electricity tariffs for irrigation pumps |

|

Transfer of risk to government |

Government compensation to households and firms for property damage due to water‑related disasters |

|

Induced transfers |

Cross-subsidies for water supply and sanitation services (industrial vs. household tariffs) |

|

Economic advantage due to unequal regulation or policy |

Different regulations or charges for industry discharging pollutants to sewer systems or directly to water bodies |

Note: These are illustrative examples and not an exhaustive list of all subsidies that may exist in the water sector.

Sources: (OECD, forthcoming[27]) adapted from (EAP Task Force, 2013[33]).

Subsidies in the water supply and sanitation sector

Governments have traditionally heavily subsidised the WSS sector, usually with the overarching aim of expanding access to safe WSS services and capturing the positive externalities of access to WSS services (e.g. benefits for public health, productivity or educational outcomes). A recent study finds that subsidies are prevalent across countries, regardless of their region or income level (Andres et al., 2019[32]). This is not only because of the fundamental need for governments to support access to safe WSS services, but also because of the networked nature of many WSS services. Approximately 65% of the cost of supplying piped water and 80% of the cost of sewerage systems are for long-lived capital assets; this can allow service providers to use pricing structures in the short- to medium-term that do not cover capital or O&M costs, relying on subsidies that are often driven by pressure to keep prices low for users (Andres et al., 2019[32]).

Most existing WSS subsidies are costly, non-transparent and distortionary: they typically fail to benefit users through better services or lower prices, can allow rent-seeking by governments and service providers, and can limit service efficiency and sustainability (Andres et al., 2019[32]). They are also often poorly targeted and regressive. For example, subsidies commonly focus on networked services that poorer communities cannot access or afford, and ultimately disproportionately benefitting wealthier segments of the population that are already connected to services (see Box 3.4) (Andres et al., 2019[32]; Leflaive and Hjort, 2020[34]).

Box 3.4. Potential limitations of WSS subsidies that are delivered through tariff mechanisms

Subsidies that are delivered through tariffs for WSS services tend to be poorly targeted and regressive, as the most common tariff structures are unable to effectively direct subsidies to poor households. Studies have shown that such subsidies in fact lead to more unequal distribution of resources as compared to if subsidies were equally distributed among the population, due to errors of inclusion as well as of exclusion from the subsidies (Fuente et al., 2016[35]).

In Lima, Peru, 20-30% of the population faces water affordability issues (the critical share of total water expenditure in income is set to 2%). As many as 90% of poor connected customers receive a WSS subsidy; however, 91% of the subsidy beneficiaries, or 78% of the connected population, are non-poor (Barde and Lehmann, 2014[36]). A similar situation is observed in Nairobi, Kenya, where households in the lowest wealth quintile receive 15% of the total WSS subsidies delivered.

Source: (Leflaive and Hjort, 2020[34])

Subsidies in the WSS sector need to be more carefully designed and targeted if they are to facilitate access to sustainable services and efficiently address equity and affordability issues. This means accurately identifying and aiming subsidies at priority groups (e.g. poor and vulnerable populations) and priority types of services (e.g. avoiding a disproportionate focus on urban, networked water services and duly addressing other areas of need, such as for rural sanitation services) (Andres et al., 2019[32]). Subsidies may target either connection fees (e.g. one-off financial support to expedite connection to existing or new networks, or the recurrent part of water bills (when there is one). Rather than being tied to individual expenditures, subsidies can also be made conditional on improved performance by service providers, using transparent key indicators and targets for better service results (Andres et al., 2019[32]).

Subsidies for WSS services tend to be most effective when they are decoupled from service access and consumption charges, and are instead provided as separate, targeted measures – for example, through dedicated funds for payment relief to poor households, or via rebates, vouchers or lump sum transfers to water users. Subsidies that are based on the volume of water consumed can distort consumption and, as a result, hamper efficient allocation of water resources ( (Reynaud et al., 2016[37]) and (OECD, 2011[38]) in (Leflaive and Hjort, 2020[34])). This implies that measures should be designed in order to secure basic needs, rather than be based on measured consumption at the household level. In Chile, policymakers have created a clear distinction between basic water needs and optimal consumption. Eligible poor households are provided with vouchers that help them cover a smaller or larger share (depending on their assessed needs) of the bill for basic water volumes, but never for volumes above this level. This guarantees that the social measures never cover water for profligate use (Leflaive and Hjort, 2020[34]).

Whether they are phasing out an existing subsidy or considering the introduction of a temporary one, governments should prepare well-considered “exit strategies” for subsidies’ eventual removal. These should be informed by whether the conditions driving the need for the subsidy are long-standing, permanent, or will change or disappear over time. Proposals to remove subsidies should be transparently consulted upon and communicated, with phase-outs accompanied by complementary measures such as legal reforms and transitional measures that account for the impacts of lost benefits (Andres et al., 2019[32]).

Subsidies for agricultural water

Governments often provide public subsidies for agricultural water; as is the case in the WSS sector. This can create perverse incentives and distortions that harm the efficiency, equity and/or sustainability of water resources management. One example is water-related input subsidies (e.g. of the costs of irrigation, fertilisers, pesticides or groundwater pumping): by lowering input costs, they can directly undermine water allocation regimes or harm water resources in certain contexts (Gruère and Le Boëdec, 2019[39]). Other examples include forms of support for agricultural activities that indirectly affect water resources, for example by encouraging the use of water, fertiliser, pesticides, or livestock intensification. Both types of subsidies can harm water resources by encouraging the overuse, overconsumption and/or pollution of surface water and groundwater (Gruère and Le Boëdec, 2019[39]).

Farm subsidies that negatively affect water resources are often designed with a different policy objective in mind – for example, they may effectively raise agricultural production or profitability, yet trigger inefficient or unsustainable water use or pollution of water resources (OECD, 2007[40]). When a subsidy has unintended negative consequences for water quality and quantity, it is sometimes highly politically sensitive or controversial to attribute the consequences to the subsidy, and this can be an early stumbling block for governments seeking to reform or remove it. For example, support for irrigation efficiency technologies might increase water consumption, to the detriment of other users and water ecosystems, due to a misrepresentation of the local hydrology or farmers’ response ( (Grafton et al., 2018[41]) in (Gruère and Le Boëdec, 2019[39])). Long-standing subsidies can sometimes be viewed by certain groups as entitlements.

Subsidies that negatively affect water resources can also further entrench existing inequalities. For instance, if the size of a subsidy is proportional to the amount of land owned, it will likely benefit wealthy farmers with larger farms. Subsidies’ impact on equity can also be indirect: irrigation subsidies can exacerbate existing operations and maintenance deficits by encouraging more water use, which in turn deteriorates the quality of the service and the availability of the resource (Gruère and Le Boëdec, 2019[39]). This can affect poor farmers the most, as they are often downstream users at the end of irrigation systems and cannot afford to invest in alternative sources of water or cope with the degradation of water quality (e.g. due to salinisation) (Gruère and Le Boëdec, 2019[39]).

As in the WSS sector, to improve equity and ensure that any agricultural water subsidies are fair and consistent with water policy objectives, governments can use packages of measures to reform the subsidies (e.g. through better targeting) or, as appropriate, phase them out over time. These measures can be combined to complement each other, and may include, for example (Gruère and Le Boëdec, 2019[39]):

pilots and demonstration projects that allow governments to test and make a case for the adjustment or removal of subsidies in certain locations before they are scaled up

legal or governance reforms that increase transparency around subsidies

engagement and consultation with key stakeholders to foster transparency and build trust in reform processes, and

purposefully designed and targeted transfer payments to certain groups, to protect or insulate them from short-term shocks or negative impacts from the reform.

To be effective, these actions typically require a lengthy but clearly time-bound implementation period, fortified by a continual effort to sustain political buy-in throughout the process of the reform.

Data and tools to improve the equity of water sector subsidies

The importance of access to accurate information and tailored methods for improving the fairness of water sector subsidies cannot be overstated. Governments should be attuned to how technological development and data innovation are creating new opportunities to better tailor and target subsidies.

For example, in the WSS sector, relevant data is indispensable to inform the tariff-setting process as well as the design of accompanying social measures, yet decision makers and service providers’ reform efforts can be hampered by data restrictions. For example, an absence of metering limits detailed documentation of water use, and in some countries, privacy laws prevent service providers from accessing data on the households “behind” the meters (Leflaive and Hjort, 2020[34]). However, when affordability and equity issues are addressed through separate measures outside of the water bill, relevant data – such as on household incomes and health – can be more readily available. The World Bank has piloted the use of remote sensing and street view data along with machine learning algorithms to map poor communities in Luanda, Angola, to inform the targeting of subsidies (Andres et al., 2019[32]). Analytical tools such as these can be instrumental in supporting governments to accurately identify which groups benefit or lose as a result of existing subsidies, as well as how subsidies may be better tailored to reach those groups as needed. Such analysis is fundamental to any rigorous effort to more fairly allocate subsidies in support of overall water policy objectives.

3.2.4. Seizing opportunities to improve economies of scale

Governments may consider institutional and market reforms to improve economies of scale, and through this, reduce operational costs and investment needs in the WSS sector. Aggregation reforms in the WSS sector are one option for reducing fragmentation in service delivery and optimising the use of existing sources of finance and assets.

As discussed above in Section 1 on the enabling environment for investment, the authority for WSS service provision in many countries is decentralised and devolved to the municipal or local level. While this is typically driven by the recognition that WSS services are intrinsically local and therefore best managed at that level, poorly designed or incomplete decentralisation can result in the creation of small, under-resourced WSS service provider institutions with inadequate capacities for administration and financial management, planning, and/or technical operations (Streeter, 2017[7]; OECD, 2010[42]). Decentralisation reforms can be particularly challenging for countries that need to provide WSS service coverage in areas with low density and/or hard-to-reach populations (e.g. rural areas, remote areas, or informal settlements). In such contexts, WSS services are often provided via devolved, dispersed networks of small providers that struggle to efficiently allocate their limited resources over large and sometimes technically complex service areas. This can create a varied and fragmented landscape for WSS service provision that is difficult to coherently oversee and sustainably finance.

To address these fragmentation challenges, some countries opt to adjust the scale and scope of WSS service provision by aggregating service provider institutions (OECD, 2010[42]). For example, aggregation reforms may seek to deliver WSS services at a more appropriate scale by creating a single institution that is responsible for services across multiple municipalities or within a given region. They may also adjust the scope of a provider’s responsibilities by either reducing or expanding the range of WSS services it delivers. Aggregation reforms generally aim to reduce perceived inefficiencies and low capacities in WSS service delivery by ensuring that providers have a customer base of appropriate size and a staff with the necessary capabilities to cost-effectively deliver WSS services (ERM, Stephen Myers and Hydroconseil, 2005[43]). This can in turn make WSS service providers financially viable, improving their creditworthiness and attractiveness to investors.

Currently, work is underway in Estonia and Lithuania on these issues, in the context of policy dialogues led by the OECD in co-operation with the European Commission DG Reform. The work will examine options for different modalities of water utilities sector consolidation, increasing social equity in access to - and prices for - WSS services in these countries. It will consider different scenarios of consolidation, including consolidation based on the principles of scale (national, regional, basin level) or/and scope (aggregation of such functions as technical maintenance, customer relation, revenue collection, etc.).

Aggregation reforms can have a variety of drivers and take different forms, depending on countries’ legal, regulatory and institutional frameworks. Like reforms of WSS tariffs or subsidies, aggregation processes can also be influenced by political cycles and interests, given their potential implications for different institutions’ roles and responsibilities, mandates and resources. Aggregation reforms might be locally-led and voluntary (e.g. arising from local governments’ initiative), incentivised and supported by a higher level of government and locally implemented, or wholly mandated and led by a higher level of government (ERM, Stephen Myers and Hydroconseil, 2005[43]). These drivers can be an important determinant of the willingness of existing service providers and other government institutions to support or participate in aggregation. For example, authorities at the local level may sometimes be reluctant to engage with aggregation reforms, due to concerns about losing their ability to oversee and adequately respond to customers’ demands and concerns, or losing access to and oversight of existing sources of finance, or where local utilities perform multiple functions. Factors such as these have delayed some countries’ reforms (OECD, 2020[13]). Governments also need to consider whether their aggregation process will be accompanied by a transfer of asset ownership to the level of service provision – this depends on the country context and identified service needs, and can be another sensitive factor (ERM, Stephen Myers and Hydroconseil, 2005[43]). Regardless of aggregation reforms’ main drivers, these considerations underscore the need for thorough scoping, consultation and negotiation processes for aggregation reforms among different levels of government and institutions.

Countries’ various experiences with aggregation to date reflect that while they require a strong grasp of institutional incentives and potentially extensive or lengthy negotiations, they can be most effective when they combined with complementary measures aimed at improving services (such as independent regulation or programmes to strengthen performance). Indeed, aggregation commonly leads to a need for governments to reform existing mechanisms for the oversight of service provision (ERM, Stephen Myers and Hydroconseil, 2005[43]). Aggregation of service providers can also be important in facilitating cross-subsidies between water users and territories, such as between rural and urban areas. This is the case in Romania and Bulgaria, and to a lesser extent in Lithuania, Latvia and Poland (OECD, 2020[13]).

3.2.5. Creating and maintaining incentives for performance

Strong administrative and operational performance within the institutions that manage water resources and deliver WSS services is vital to ensuring the best use of existing finance and assets. In the WSS sector, inadequate performance requirements and incentives for service provision can have various drivers – such as insufficient institutional accountability structures, a lack of well-defined and attainable performance standards, and/or insufficient institutional resources and capacities to enable good performance. Such conditions can translate to low motivation and poor standards for O&M, deteriorating assets, and low service quality. In turn, this reduces providers’ credibility and public trust in their ability to provide high quality WSS services – and can result in, for example, low user willingness to pay for local WSS services, or decisions by central government authorities to allocate much-needed finances to other purposes that are deemed more worthy or valuable. These issues also limit service providers’ creditworthiness and attractiveness to investors.

The section above on the enabling environment outlined the importance of policy and institutional settings – supported by the necessary resources and capacities – in creating the conditions for accountable, effective and efficient water service provision and ensuring reliable, financially sustainable institutions. Mechanisms for the independent regulation of services and information-based instruments are two types of measures that can help to make service providers’ performance transparent and set standards and incentives to further improve it. This section briefly expands on these measures and their role in driving higher performance to optimise existing finance and assets.

The role of independent economic regulation in driving consistent performance

Service accountability and transparency can be limited when the roles and responsibilities of the different actors involved in WSS services are not delineated and structured through clear institutional arrangements (e.g. for government authorities, asset owners, and service operators). Institutional structures sometimes also fail to provide clear requirements and incentives for service providers to improve service efficiency, meaning there is limited impetus for them to address problems or strengthen services in order to confront future challenges. Governments may struggle to require or incentivise higher service provider performance where the functions and powers of policy- and decision-making (e.g. on the design of economic instruments) are not explicitly separated from operations. Where such institutional separations do exist, regulatory bodies sometimes still lack the necessary powers to ensure that service provision complies with regulations and/or other standards.

Properly resourced independent regulation can help to address these issues, providing a clear accountability structure for institutions and a basis for setting and enforcing service performance standards. The three core elements of sound water regulation are to protect the environment (water resources and broader ecosystems), protect service users’ (customers’) interests, and protect the quality of services (e.g. for drinking water or wastewater management) (OECD, 2020[13]). Independent regulation can be designed and implemented in different forms according to countries’ specific governance contexts and needs. Regulation may be conducted by government; by contract (with regulation specified through legal instruments); by one or multiple independent regulators (e.g. with separations between decision-making, management and financing); or by outsourcing selected regulatory functions to third parties (i.e. external contractors that undertake tariff reviews or benchmarking) (OECD, 2020[13]).

The way in which a regulator acquires performance information and sets performance targets for service provision is important in bridging any gap between governments’ and customers’ expectations (OECD, 2020[13]). An outcome-based approach can help to ensure that service providers’ focus is not simply on easily measured outputs, but also accounts for longer-term aims for WSS services and the environment. A regulator should expect the service delivery body to monitor its services, the operational performance of its assets, and how it is planning for resilient systems operation in the face of shocks, such as drought, process failures or cyber-attacks. Just as governments need to ensure adequate resourcing for the regulator, the regulator should ensure the adequate funding of service provision institutions to enable them to efficiently and effectively meet service standards.

Transparency is crucial: defined standards and targets, and service providers’ performance against them, should be published and made available to customers (OECD, 2020[13]). Customers should also expect to be able to express their views on levels of service, priorities for investment and options for major infrastructure where this is proposed. The extent to which customers participate in the development of business plans can influence both their behaviour – and how much they value water and the service they receive – as well as that of the service provider.

Information-based instruments for improving performance