This chapter presents an overview of the use of land value capture across 60 countries included in the Global Compendium of Land Value Capture. It begins with an introduction of the principles of land value capture and the motivation for the Compendium. It presents the OECD-Lincoln taxonomy of land value capture instruments, which provides a common framework for comparative analyses of land value capture practices across countries. It briefly discusses the large scale survey and data collection process for the data underlying the Compendium. The enabling environments for land value capture across countries are discussed, with a distinction between higher and lower income countries. Subsequently, the chapter briefly overviews cross-country findings for each land value capture instrument. It concludes with some common considerations for land value capture implementation.

Global Compendium of Land Value Capture Policies

1. Land value capture across the globe

Abstract

Introduction

By mid-century, two thirds of the world population will live in urban centres (OECD/European Commission, 2020[1]), driving intense demand for land equipped with infrastructure. This pressing demand for serviced land is strong especially in the urban periphery. At the same time, cities will need to become climate neutral and sharply reduce other environmental footprints, such as from raw materials use. It requires different and more upfront infrastructure investment, including in public transport, sustainable water supplies, renewable energy, and green open space, among others. It also requires better urban planning to make jobs and facilities in cities accessible with low energy input and zero emissions. The land value capture instruments discussed in this Compendium can contribute to meeting these challenges.

The altering of land use or provision of public services by governments often triggers significant increases in the value of land. Making even some of this additional value available for public investment can significantly help make cities more liveable and sustainable. This is because land is one of the most valuable forms of capital. In eight OECD countries, land makes up approximately 40% of the total capital stock. For the entire OECD, this amounts to USD $152 trillion (OECD, 2017[2]).

While local governments increase land value with public investment and changes in land use regulation, they often grapple with fiscal shortfalls holding back efforts to finance and manage urban development. Traditional fiscal policies largely ignore the fact that the cost of providing urban infrastructure is public, but some of the economic benefits, notably those that materialise in higher prices of land are private, meaning that landowners typically reap unearned wealth (Smolka, 2019[3]). A common example is when rural land is converted to residential or commercial uses.

Policymakers need to think creatively about policy instruments to mobilise the resources to pay for needed investment. Land value capture (LVC), also known as land value recovery, is one method that enables governments to recover and reinvest land value increases that result from public decisions. By tapping into the windfall profits public investment and urban planning generates in land ownership, it may also avoid the distortions that taxation imposes on economic incentives. In this way, it may help direct efforts away from rent-seeking behaviour, for example to acquire land for the mere purpose of realising value gains, towards gainful economic activity.

The growing appeal of LVC also includes its potential to put fiscal decentralization into practice. It allows local governments to raise local funds for cities and communities’ urban planning and infrastructure needs (Smolka, 2019[3]).

The principles of LVC: How does it work?

LVC is based on the simple premise that public action should generate public benefits. It refers to policies that allow public authorities to recover increases in land values which result from government actions, including the development of land, infrastructure and service deployment, and the alteration of land use regulations (OECD, 2017[2]). This recovered land value serves to fund urban infrastructure and public services.

LVC constitutes three basic steps. First, there is a value creation stage. This is when the government or public administration takes some action on or adjacent to private land, that results in increased land value. This action may be an investment or a change in administrative or regulatory statutes conditioning the use of land. Second, there is the value recovery stage. This is when the full or partial value increase is recovered by the public. Finally, there is the value distribution stage. This is when the recovered land value is reinvested in public benefits.

Hence LVC includes the following elements:

It refers exclusively to increments in the value of the land.

It requires a definition of how public action generates land value gains, so they can be recovered.

Land value increments derived from such public action need to be mobilised by creating LVC instruments. These are commonly fees or in-kind contributions, among others (Smolka, 2013[4]).

From an equity perspective, LVC policies can distribute both the costs and benefits of urbanization and land development, because value capture allows a community as a whole to reap the benefits of development more fully. If land value increments due to public action are not recovered, those increments will remain with private property owners.

This Global Compendium of Land Value Capture (hereafter ‘the Compendium’) shows that successful LVC requires overcoming a number of challenges, as with any other policy tools. These include building an adequate legal framework and developing administrative and technical capacity to assess land value gains from public actions. Additionally, there can be challenges to secure support from stakeholders. For example, there may be disagreement about how contributions to LVC should be distributed.

While LVC can mobilise additional resources sustainable and more equitable urban development requires, LVC also needs to be implemented in a way that serves this purpose. Land value gains can result from developing land in an unequitable, unsustainable way. If it is not linked to good planning practices and consistent enforcement of land use regulations, LVC can lead to overdevelopment and increased built-up area, resulting in adverse environmental impacts. As LVC is highly dependent on changes in land values, it can also result in unstable and cyclical fiscal revenues during boom-bust cycles in macroeconomic markets and construction activity (Kim and Dougherty, 2020[5]). Equity benefits will also depend on how the resources mobilised by LVC are used. The Compendium illustrates these issues with examples.

Motivation for the Compendium

Many countries use LVC policies to some degree, but the instruments and methods as well as the success in applying them differ greatly. The implementation of LVC depends on different historical traditions, the context of land markets, institutional capacity, along with constitutional and legal frameworks and experience in applying them. For example, the history of active land policy in the Netherlands is closely linked to considerable public land holdings and municipalities’ capacity for large-scale land management (van Oosten, Witte and Hartmann, 2018[6]). Latin America’s long tradition of utilising infrastructure levies and developer obligations (contribución de valorización and contribución por mejoras) can partly be attributed to historic influences from Spanish law (Henao González, 2005[7]). Land readjustment in Japan and Korea developed with industrialisation after World War II, where it led to rapid urbanisation which increased demand for serviced urban land (OECD, 2022[8]).

Previous case studies are typically limited to developed economies. They already document a wide range of approaches to LVC and of their success. But little systematic, comparable information has been available about the instruments countries use, as well as about the enabling conditions at national and regional levels which can guide local governments toward greater use. There is also no uniform application of basic terms and names of LVC instruments. These barriers present challenges for policymakers in embracing the more frequent and robust use of LVC to advance societal goals, manage urban development, and mitigate social and spatial inequalities. As a result, few governments use LVC on a large scale.

The Compendium, a joint project by the OECD and the Lincoln Institute of Land Policy (hereafter ‘Lincoln Institute’), is hence an ambitious undertaking to understand the full landscape of LVC instruments, how they are configured and deployed as well as their enabling conditions across the globe in OECD and Non-OECD countries. The Compendium features an overview of the LVC approaches in 60 countries, the governance and legal frameworks in which they are embedded as well as enabling factors and barriers for their further development. It highlights the differences and similarities across countries. They show which countries have a mature LVC practice, and in which countries they are nascent or remain undeveloped.

This introductory chapter provides a concise overview of LVC practices across countries included in the Compendium. Importantly, the chapter should not be taken to be an exhaustive summary of the state of LVC across the globe, but rather a harbinger for further research on LVC. The following chapter provides country fact sheets with a wealth of comparable information, focusing on aspects that are important for the systematic adoption of LVC. The Compendium allows local and national governments to compare their approaches, learn from each other as well as understand and apply good practices in different context. It can help researchers and policy makers recognise what it would take to unleash their full potential. It can help countries develop the capacity and competences for LVC to understand the opportunities, trade-offs, and pitfalls to avoid when configuring legal, governance, and other enabling frameworks. It can help deploy tools that provide the resources we need for sustainable urban development.

The OECD-Lincoln taxonomy of LVC instruments

Providing common definitions for the fiscal or regulatory instruments that comprise LVC is difficult, especially at a global scale, because these instruments are in many cases tightly integrated with broader legislative frameworks, planning practices and property rights that are unique to countries or regions. They are also diverse in scope. They include instruments that levy taxes or fees, in-kind contributions in the form of land or infrastructure, and government practices for managing land and its development.

The ‘OECD-Lincoln taxonomy’ of instruments developed for the Compendium stems from extensive debate between the OECD, the Lincoln Institute and leading academics in the field. This taxonomy allows meaningful cross-country comparisons, cutting through the heterogeneous definitions and uses of instruments across the globe. The taxonomy recognises how similar instruments are referred to differently across countries, for example how ‘betterment levies’ in Colombia are similar in scope to ‘special assessments’ in the United States. It also minimises confusion by identifying a common set of underlying characteristics for each instrument, thus recognising how, for example, ‘infrastructure levies’ in Israel and Poland are in fact ‘developer obligations’ in other countries.

Reflecting the practical difficulties in defining the scope of LVC instruments, the OECD-Lincoln taxonomy is not exhaustive. Firstly, the taxonomy does not include land and property taxes. This is not to say that such taxes do not function as LVC instruments. With the right tax structures, they can indeed effectively recover the value increments triggered by public interventions. However, in practice, it is difficult to delineate and define the role of land taxes as a separate LVC instrument, as they are typically used in a more general fiscal context. This is especially the case as these taxes are usually levied in a uniform manner without distinguishing property owners that are affected by public interventions. Similarly, other tools such as joint ventures, public-private partnerships, or tax increment finance are not included in the taxonomy or the Compendium due to difficulties in delineating their role in capturing value increments.

The following sections present the OECD-Lincoln taxonomy of LVC instruments. For each instrument, the taxonomy provides a name, definition, and short description that outlines the defining characteristics of the instrument in question.

Infrastructure levy

An infrastructure levy is a tax or fee levied on landowners possessing land that has gained in value due to infrastructure investment initiated by the government.

With an infrastructure levy, landowners pay a tax or fee for public infrastructure from which they specifically benefit, for example nearby public roads, transport, utilities and parks. The decision to build infrastructure is generally initiated by the government, and is not a consequence of private development interests. The government identifies the catchment area in which landowners are deemed to benefit from public works and pay the levy. The amount of the levy should be based on the amount of land value benefit obtained and can be either a one-time payment or payable over a longer period. Other common terms for the infrastructure levy include betterment contributions, betterment levies or special assessments.

Developer obligations

A developer obligation is a cash or in-kind payment designed to defray the costs of new or additional public infrastructure and services private development requires.

Developer obligations mainly apply when developers seek development approval or special permissions. The obligations can consist of cash or in-kind contributions. In some countries, developers are required to build affordable housing in exchange for approval. This practice, called inclusionary zoning, can be viewed as a form of developer obligation. Unlike the infrastructure levy, developer obligations are triggered by the initiative of private developers and land owners. The obligations can be either negotiated between the government and developers, or calculated using a fixed formula. Common developer obligations include impact fees, negotiated exactions, or development charges.

Charges for development rights

Charges for development rights are cash or in-kind contributions payable in exchange for development rights or additional development potential above a set baseline.

Charges for development rights may be levied to build at a higher density beyond an established baseline that is defined by a jurisdictional ordinance or regulation. Thus, they require clear, predefined land-use and zoning regulations that set baseline and maximum densities. Developers may also be charged for development rights when governments alter zoning or relax density regulations. In some cases, limited development rights, for example in protected environmental areas, can be transferred to a different plot better suited to higher density development. Usually, the types and amounts of cash or in-kind charges are defined in advance in ordinances or local regulations. Related terms include sale of development rights, sale of air rights, and transfer of building rights.

Land readjustment

Land readjustment is the practice of pooling fragmented land parcels for joint development, with owners transferring a portion of their land for public use to capture value increments and cover development costs.

Land readjustment is where privately-owned, contiguous plots of land are pooled and developed jointly. It is often accompanied by zoning changes or relaxed density regulations so that newly developed land becomes more valuable. In turn, landowners provide a share of their plots for public infrastructure and services, such as public roads, utilities and parks. Landowners are returned a smaller plot of land that is nonetheless more valuable due to the improvements made. Land readjustment can be initiated by local governments or private landowners. The instrument is referred to as land pooling in some countries.

Strategic land management

Strategic land management is the practice of governments actively taking part in buying, developing, selling and leasing land to advance public needs and recoup value increments borne through public action.

With strategic land management, governments buy land or use existing land holdings to extract values from them, which can in turn be used to fund public infrastructure and services. If governments acquire land at predevelopment prices, they can fully capture increases in land value that are due to public development or regulatory changes. Governments can recover land value gains with the sale or lease of rezoned and developed plots that are greater in value. Similarly, governments can lease usage rights, capturing value increments through higher rents.

Box 1.1. Examples of LVC instrument use in practice

Infrastructure levy (Colombia)

The legal basis for the infrastructure levy (contribución de valorización) in Colombia has a long history, dating back to 1921. It applies to public roads, public transport, public utilities and green space, among others. It has been widely used in large and intermediate cities to finance road infrastructure.

The total levy usually amounts to the estimated total cost of public works. In some cases, the levy is proportional to the land value increment, which is often preferred by landowners. Recovery of up to 30% of administrative costs is also allowed by law, although in practice local governments usually charge less than 10%. Affected landowners are identified based on market-based approaches that estimate the distance within which public works increase land values. Landowners pay the levy according to a fixed formula, based on the distance to the new infrastructure, location, size, quality and property value.

Developer obligations (Germany)

Two types of developer obligations exist in Germany, both which are regulated by the Building Code (Baugesetzbuch). ‘Urban development contracts’ (städtebauliche Verträge) cover a wide range of costs generated by private developments, and are always applicable. They are based on formulas that consider the size, type and value of land, or based on negotiations. Charges usually cover a significant share of public costs. They can be paid through affordable housing, for example in Frankfurt where up to 30% of housing units are required to be affordable rental units. Local governments can also charge ‘development contributions’ (Erschließungsbeiträge) in addition to städtebauliche Verträge for costs associated with utilities and road construction in the immediate vicinity of private development, if not already covered by the städtebauliche Verträge. These contributions can amount to 90% of public costs.

Charges for development rights (Brazil)

Developers pay charges for development rights for zoning changes (density and use) and for higher density above a baseline determined by local plans and ordinances. Such charges are common in large capital cities such as São Paulo, where the real estate market is dynamic and the Floor Area Ratio (FAR) is low, either historically or through legal reforms. The charge is calculated as a proportion of the extra FAR multiplied by average land price per square meter in some cities, while others such as São Paulo and Curitiba determine charges through an auction market. Development rights can be transferred within the city or a specific zone. Local governments spend collected revenues throughout the city, and some cities have created urban development funds through which revenues are invested.

Land readjustment (Japan)

Land readjustment has been used since the late 19th century, and was formalized in 1954 with the Land Readjustment Act. It is used for urban expansion, urban development or renewal, disaster prevention and reconstruction. An average of 870 land readjustment projects are conducted yearly. Land readjustment projects can be initiated by governments, special public bodies, private entities, and land owners and leaseholders. Land readjustment first needs approval from prefectures, similar to urban planning projects, as well as the consent of at least two-thirds of involved landowners and leaseholders. Typically, 30-40% of readjusted plots are reserved for public improvements including infrastructure and utilities. Newly readjusted areas also typically include publicly owned plots for sale, which are used to recover development costs.

Strategic land management (Netherlands)

Strategic land management (called Active Municipal Land Policy) plays a crucial role in spatial planning, housing policy, and land value capture in the Netherlands. The instrument is mainly used in the largest cities of Amsterdam, Rotterdam, The Hague and Utrecht. The legal basis is defined in "Besluit Begroting en Verantwoording Provincies en Gemeenten" (BBV) and the "Mededingingswet" (Competition Law), which outlines conditions for how municipalities must act as market players in the land market. Typically, local governments acquire vacant, abandoned or unproductive land through debt financing (e.g. bonds), in advance of needs for the purposes of urban development, spatial planning, and capture of capital gains. After rezoning, municipalities service the land through physical preparation and the building of public spaces and infrastructure. Local governments recover initial investments through the sale or lease of the developed plots.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Data and survey methodology

The analysis presented in this chapter and throughout the Compendium are based on unique data from a large-scale questionnaire covering aspects of LVC instruments and their legal and enabling frameworks. The ‘OECD-Lincoln LVC survey’ was a joint initiative of the OECD and the Lincoln Institute, with significant contributions from Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. Country-level data for 60 OECD and non-OECD countries was collected over the course of 2020 and 2021. Box 1.2 provides further details concerning the survey methodology.

Box 1.2. The OECD-Lincoln LVC survey

Data collection for the OECD-Lincoln LVC survey began with the OECD developing a comprehensive questionnaire in close collaboration with the Lincoln Institute. The methodology and content of the questionnaire also benefited from consultation with an expert advisory group set up by the OECD and the Lincoln Institute, comprised of leading urban planning, economics and law experts. The questionnaire was first piloted in three countries—Brazil, Japan, and the Netherlands— to identify potential issues, and the final version of the questionnaire was completed online during the course of 2020 and 2021 by a pool of academic experts having substantial expertise of LVC practices in each country. These experts were identified jointly by the OECD and the Lincoln Institute, with special contribution from GIZ. The completed questionnaires were reviewed by the OECD Secretariat, after which revisions were conducted until early 2022.

The questionnaire covered all main aspects of LVC, including the legislative and administrative frameworks, enabling factors and obstacles, along with detailed information concerning the use of individual LVC instruments in a particular country. The questionnaire included over 350 queries. Respondents were given 6 to 8 weeks to complete the questionnaire, with extensions provided upon request. As much as possible, respondents were asked to refer to typical scenarios of LVC use in the country within the last 10 years. Respondents were asked to choose cities, municipalities, or states that are as representative as possible of the entire country, according to individual best judgement.

The main aim of the questionnaire was to collect data comparable across countries on the use of LVC, while also considering each country’s nuances and specificities. While it relied mostly on closed-ended questions to obtain comparable, factual information, responders were asked to provide additional information in open-ended format to contextualise the standardised responses. To reduce confusion, the questionnaire also refrained from referring to instruments by name, rather giving detailed descriptions and use-case scenarios to describe the instrument in question.

Table 1.1 provides a tabulation of the countries studied based on location and income levels. 27 (45%) of countries are located in Europe, followed by 12 (20%) in the Asia-Pacific region, 11 (18%) in the Americas, and 10 (17%) in the Middle East and Africa. 35 (58%) of the countries studied are high-income economies. Notably, data was also collected for 11 (18%) lower-middle income countries, as well as 2 (3%) low-income countries (Ethiopia and Uganda).

Table 1.1. Countries in the Compendium by continent and income level

|

Americas |

Asia & Pacific |

Europe |

Middle East & Africa |

||

|---|---|---|---|---|---|

|

High-income |

Canada Chile United States |

Australia Hong Kong Japan Korea New Zealand Singapore |

Austria Belgium Czech Republic Denmark Estonia Finland France Germany Greece Hungary Ireland Italy Latvia |

Lithuania Luxembourg Netherlands Norway Poland Portugal Slovak Republic Slovenia Spain Sweden Switzerland United Kingdom |

Israel |

|

Upper-middle income |

Argentina Brazil Colombia Costa Rica Dominican Republic Ecuador Mexico Peru |

China |

Turkey |

Namibia South Africa |

|

|

Lower-middle income & Low-income |

Bangladesh India Indonesia Pakistan Vietnam |

Ukraine |

Egypt Ethiopia Ghana Morocco Nigeria Tunisia Uganda |

||

Note: Classification of countries into income groups is based on World Bank country and lending groups for 2022, utilising 2020 GNI per capita calculated using the Atlas method. Low-income countries are those with a GNI per capita of $1,045 or less; lower middle-income countries are those with a GNI per capita between $1,046 and $4,095; upper middle-income economies are those with a GNI per capita between $4,096 and $12,695; high-income economies are those with a GNI per capita of $12,696 or more.

Source: World Bank (2022[9]), World Bank Country and Lending Groups, https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups (accessed on 25 Feb 2022); OECD-Lincoln LVC survey

The enabling environment for Land Value Capture

Implementation of LVC instruments depends on the enabling environment, including the constitutional and legal frameworks along with the administrative system. Legislative frameworks are important for setting the legal basis for LVC, defining procedures and coordinating intergovernmental interests, among others. Administrative systems such as the planning system, land registries, cadastres and land valuation mechanisms are critical to implementing LVC. Differences in these frameworks and systems leads to a wide variation in LVC utilisation across countries. The following sections highlight these observations.

Constitutional and legal frameworks

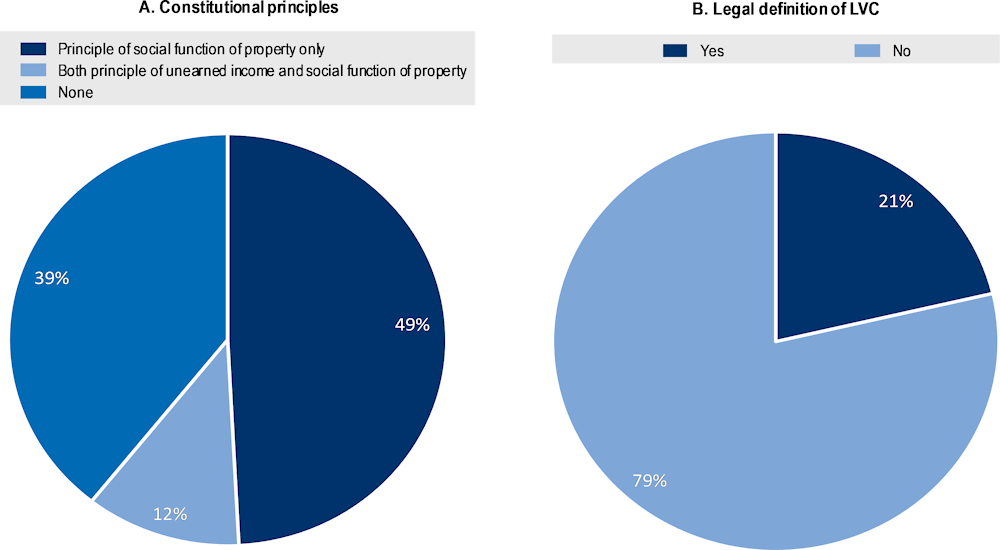

LVC is closely linked to the principle of social function of property and the principle of unearned income. The former implies that private property rights are limited by an obligation to use property (including land) in ways that benefit society as a whole. The latter implies that no citizen should accumulate wealth that does not result from his or her own effort. The majority of surveyed countries have at least the principle of social function of property embedded in their constitutions, while 12% of countries, mostly in South America and Africa, also embed the principle of unearned income (Figure 1.1, panel A). However, only 21% of countries specifically define LVC in legislation (Figure 1.1, panel B). Incorporating these definitions into law can reduce legal disputes and garner citizen support, two issues commonly stated to be major obstacles in LVC implementation across many countries. For example, the Organic Law of Spatial Planning, Land Use and Management of Ecuador establishes LVC as the “equitable distribution of the benefits of public actions, and decisions on the territory and urban development in general”, while stating that “society has the right to participate of these benefits under the social function of property”. In Spain, Article 47 of the 1978 Constitution states that “the society will participate in the land value gains produced by the urban actions of public entities”.

Figure 1.1. Legislative frameworks for LVC

Note: Principle of unearned income refers to principles stating that no citizen should accumulate wealth that does not result from his/her own efforts. Principle of social function of property refers to principles stating that private property rights are limited by an obligation to use property in ways that benefit society as a whole. For Panel A, no countries have a principle of unearned income only.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

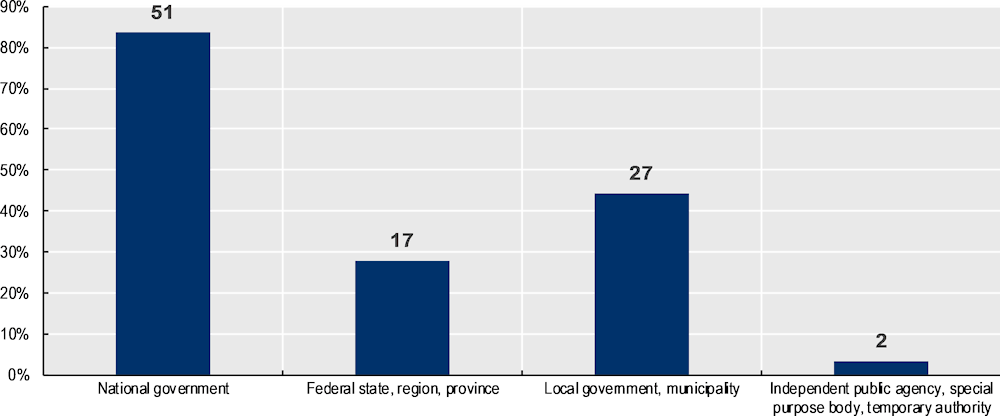

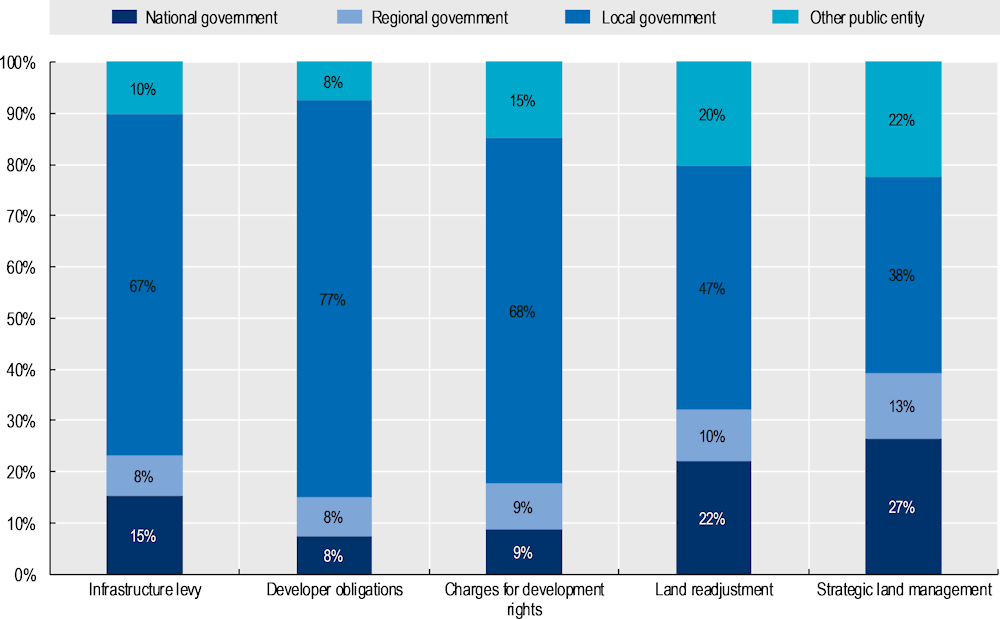

The national government is in charge of creating the framework legislation for LVC in most countries (Figure 1.2). This is in contrast to the actual implementation of LVC, which is largely the responsibility of subnational actors in most countries. Out of the 51 countries where national governments play a role, 43% do not share legislative responsibilities with subnational governments, while only 35% shared responsibilities with local governments or municipalities. Whether the hierarchy of responsibilities in defining legal frameworks for LVC has an effect on local government initiative and capacity to effectively use LVC is an open area of research. Further understanding of the drivers and motivating factors for local governments in implementing LVC is needed.

Legal frameworks are closely connected with governance traditions of countries. In unitary countries or centralised federal countries, guidelines and a legal basis for LVC provided by national governments could be helpful in implementing LVC more effectively. Conversely, in federal countries where states have strong levels of autonomy, a national legal basis for LVC may not necessarily be useful, or realistic. In the United States, Canada and Australia for example, states are responsible for LVC frameworks and implementation (OECD, 2017[10]). How legal frameworks determine the frequency and effectiveness of LVC implementation differently across a range of government structures is another topic open to research.

Figure 1.2. Governments involved in LVC legislation

Note: Multiple responses allowed. Labels indicate the number of countries in each category.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

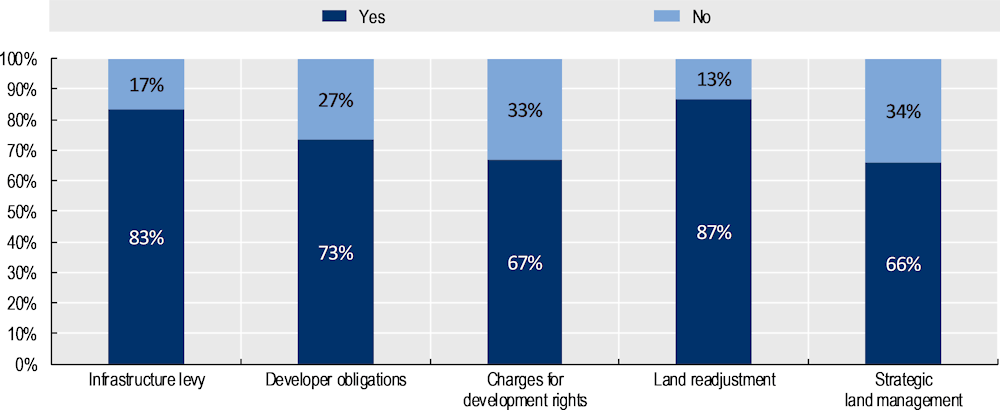

While most countries do not specifically define LVC in national legislation, the majority of surveyed countries do have a legal basis for individual LVC instruments (Figure 1.3). Over 80% of countries utilising infrastructure levies and land readjustment have a basis for them in law that outlines implementation procedures and criterion for use. The legal basis for charges for development rights and strategic land management is comparatively less widespread, with roughly one-third of surveyed countries indicating no such basis in legislation. For charges for development rights, this may be due to the fact that the instrument, and its use, is comparatively new. Legislation in most countries, when present, has only been in place since the late 1990s. For example, related legislation was only enacted in 2001 in Brazil, a country well-known for the use of Certificates of Additional Construction Potential (known locally as CEPACs, or Certificados de Potencial Adicional de Construção). For strategic land management, many of the activities that constitute LVC are regular government tasks, possibly making specific legislation unnecessary or difficult to enact.

Figure 1.3. Presence of legal basis for LVC instruments

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

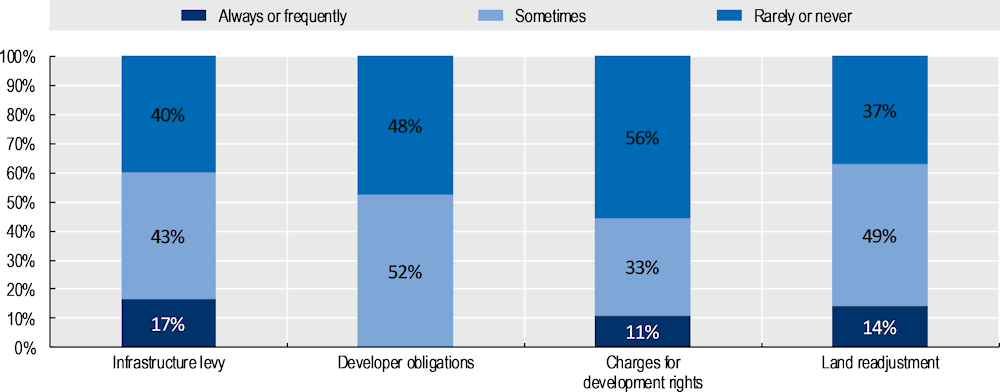

Legal appeals against the use of LVC instruments are common, although variation exists across instruments (Figure 1.4). They are most common for the infrastructure levy and land readjustment. Appeals against developer obligations and charges for development rights are comparatively less common. Such patterns likely relate to individual instrument characteristics. The infrastructure levy is commonly charged against the interests of property owners for infrastructure investments that benefit the general public, and not individual owners. Similarly, land readjustment requires that private land owners give up a portion of land for the public good, as a result of government action. Appeals are more likely to arise in such cases, compared to developer obligations and charges for development rights which apply when developers take the initiative to apply for development approval, and not involuntarily through government action.

Figure 1.4. Frequency of appeals against the use of LVC

Note: Not applicable for strategic land management.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Administrative system

The implementation of LVC is mostly the responsibility of local governments (Figure 1.5). However, some variation exists across instruments. The majority of countries task local governments with the implementation of the infrastructure levy, developer obligations and charges for development rights. Responsibilities for land readjustment and strategic land management, however, tend to be shared with the national government and other public entities, such as government-owned corporations.

Figure 1.5. Administrative responsibilities for LVC implementation

Note: Administrative responsibilities include levying fees, issuing development approvals, selling development rights, and pooling, rezoning, and managing land, depending on the instrument. Other public entities may include independent public entities, special purpose bodies, publicly owned non-profit organisations, and temporary authorities. Multiple responses allowed.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

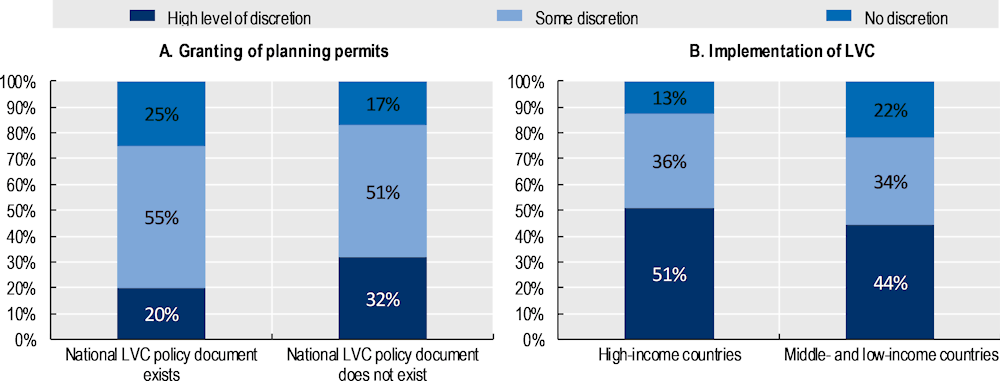

Local officials have at least some level of discretion in granting planning permits in 49 out of 60 countries surveyed. Countries having national policy documents concerning LVC tended to award a lower level of discretion to local officials (Figure 1.6, panel A). It is important to note that higher discretion for local officials does not necessarily preclude the need for a LVC policy document at the national level, as such documents may be important in aligning interests and initiatives across government levels while providing the working conditions for LVC implementation. Denmark, Norway, and Egypt are examples of countries that award a high level of discretion to local planners while still maintaining national policy documents.

Middle and low-income countries tend to award a lower level of discretion to local officials for implementing LVC compared to high income countries. For example, local officials in countries such as the Dominican Republic, Nigeria, Peru, and South Africa have no discretion in estimating LVC fees or in reinvesting collected funds. Among other issues, fear of corruption and lack of trust in local governments is a common reason for limiting the discretion awarded to local officials in implementing LVC.

Figure 1.6. Level of discretion awarded to local officials

Note: Country income groups determined based on World Bank country and lending groups for 2022. See Table 1.1 notes for further information. Percentages for panel B are an average over all relevant instruments.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

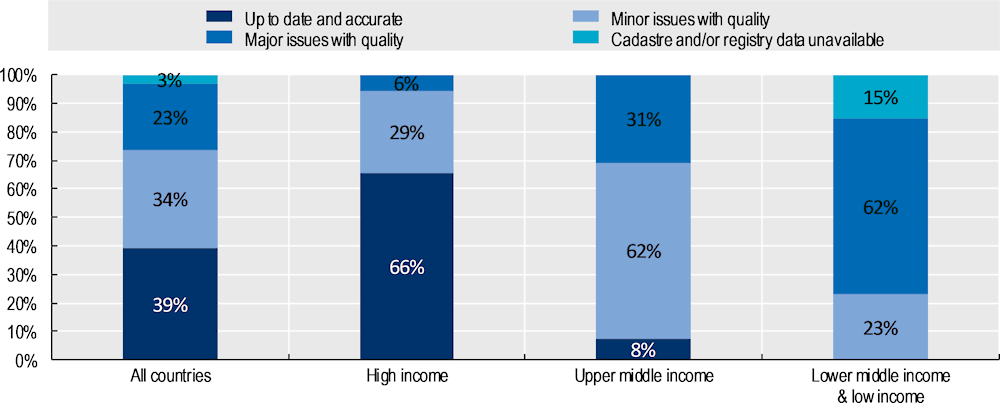

The survey highlights a gap in quality cadastre or registry data for local governments especially in middle- and low-income countries. This makes it difficult for local governments to properly implement LVC, as accurate data on land is essential for carrying out key administrative tasks. Across all countries, 26% either had no land cadastre or registry data available or had major issues in the quality of this data (Figure 1.7). The problem is particularly pronounced in lower middle-income and low-income countries, with 10 out of 13 having major issues or no available data altogether. Providing this data to local governments possibly through independent bodies or with help from the central government is needed to boost administrative capacities and properly implement LVC instruments. For higher income countries, the administrative capacity to analyse existing cadastres and registries in implementing LVC is often cited as a common obstacle, rather than availability of the underlying data per se.

Figure 1.7. Quality of cadastres and land registries

Note: Country income groups determined based on World Bank country and lending groups for 2022. See Table 1.1 notes for further information.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

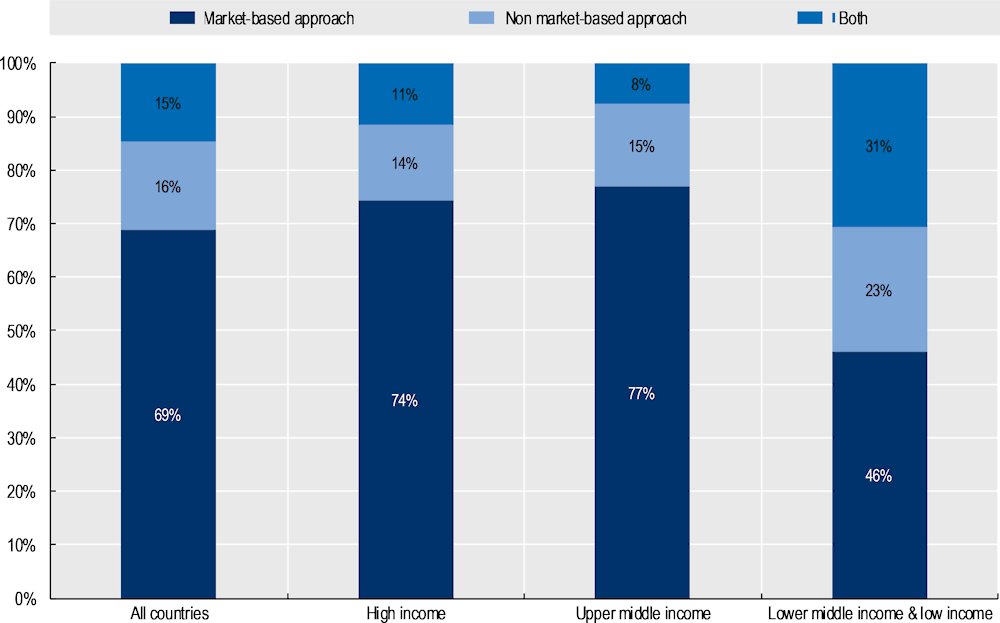

The lack of quality cadastres and registry data results in more lower-income countries resorting to non-market-based approaches for land valuation (Figure 1.8). Market-based approaches for land valuation are generally preferred due to their accuracy and ability to differentiate plot values at a granular level. Such approaches also better justify the value capture process and can reduce legal conflicts. For lower-income countries, providing cadastre and registry data to local governments together with administrative support measures is necessary to promote effective use of LVC. The cases of Costa Rica, Ghana, India, Indonesia, Nigeria, and Peru among others, highlight in particular the need for such measures.

Figure 1.8. Methods for land valuation

Note: Country income groups determined based on World Bank country and lending groups for 2022. See Table 1.1 notes for further information.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

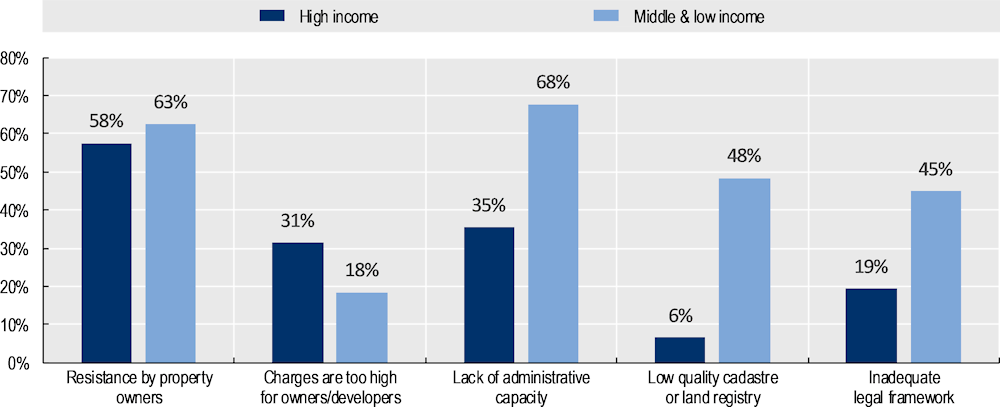

Obstacles for LVC implementation

Across all countries, the most common obstacle in LVC implementation is resistance by property owners, followed by lack of administrative capacity (Figure 1.9). Owners’ resistance is a common obstacle for the majority of countries regardless of income levels, while middle- and low-income countries in particular are burdened by a lack of administrative capacity. For high-income countries, the charges or fees that are levied on land owners and developers are often too high, compromising the successful implementation of LVC instruments. For middle- and low-income countries, low quality cadastres and land registries together with inadequate legal frameworks are common obstacles in the successful implementation of LVC. Among other obstacles not shown in Figure 1.9, by far the most common was political will, stated as a major obstacle in countries regardless of income levels.

Figure 1.9. Common obstacles for LVC implementation

Note: Country income groups determined based on World Bank country and lending groups for 2022. See Table 1.1 notes for further information. Percentages are an average over all relevant instruments.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey.

An overview of LVC instrument use across the globe

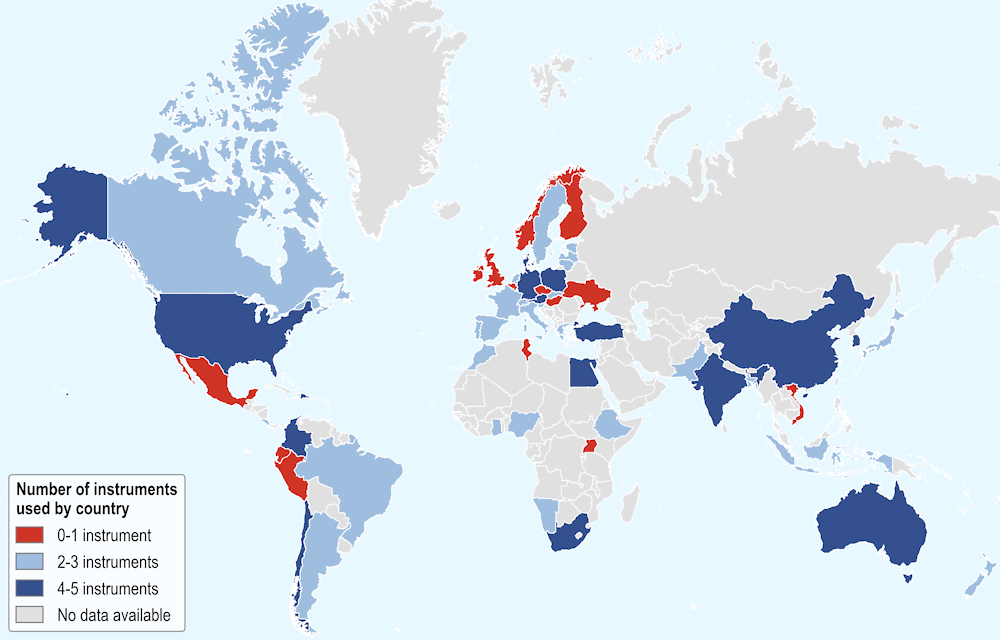

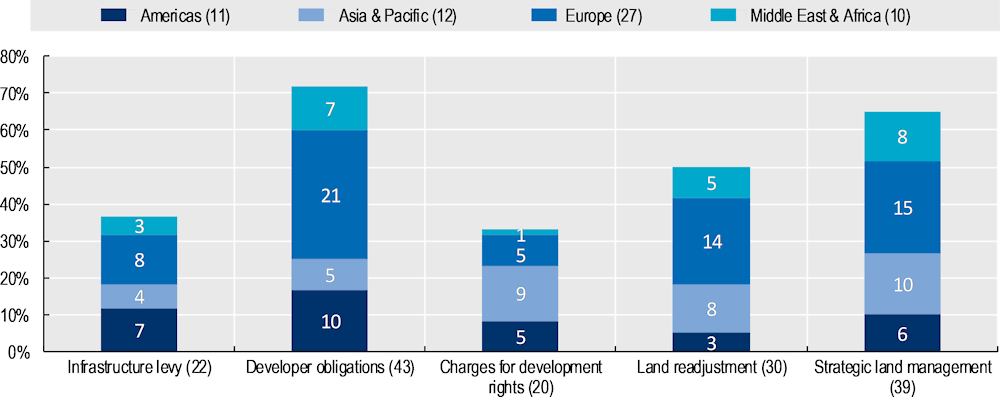

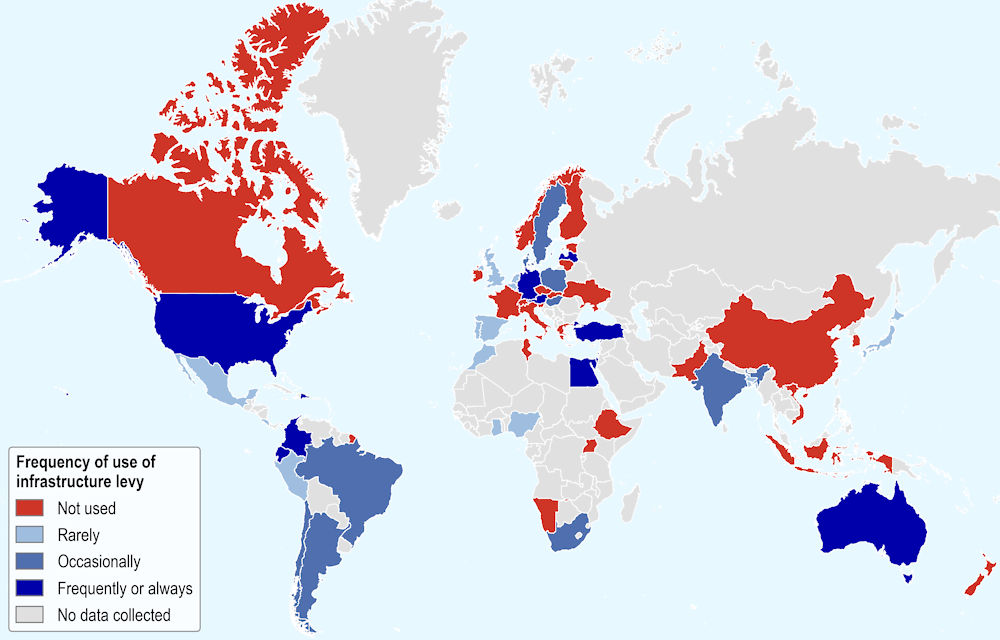

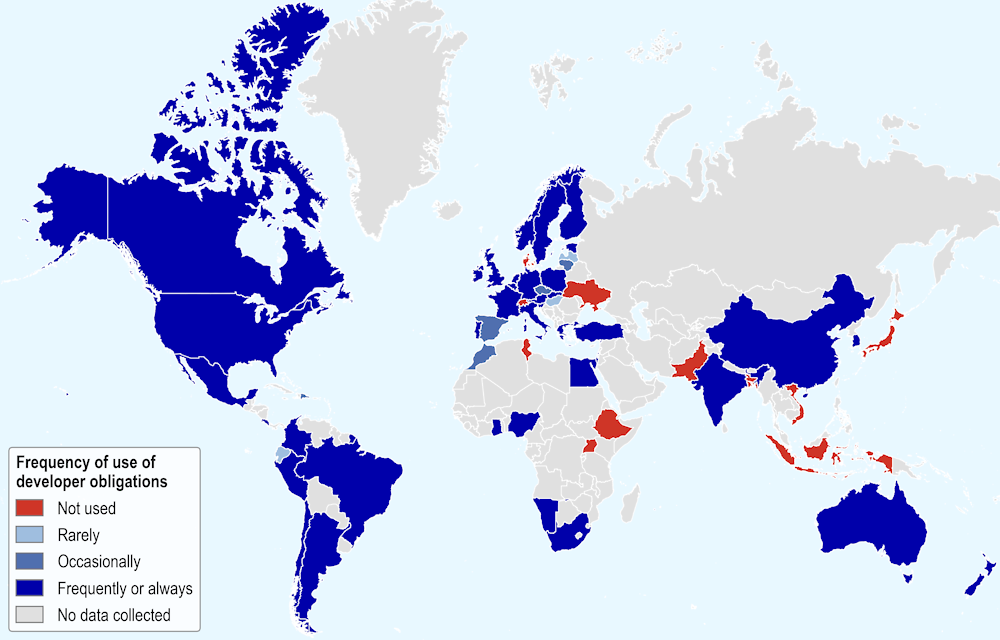

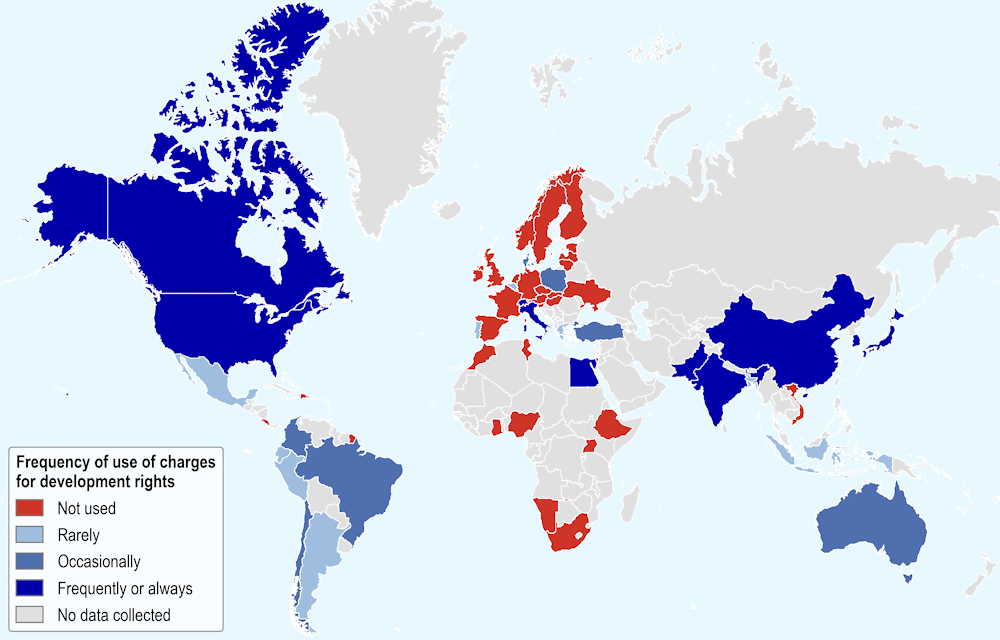

Figure 1.10 depicts the number of instruments used by countries in the Compendium, and Annex 1.A provides maps of the frequency of use of individual instruments. All countries excluding Uganda use some form of value capture at least on an occasional basis. Developer obligations are the most common instrument, followed by strategic land management (Figure 1.11). Charges for development rights were least common. European countries tend to rely more on developer obligations and strategic land management, while the use of charges for development rights is relatively rare. Most Middle Eastern, African and Asia-Pacific countries utilise strategic land management. Charges for development rights are common in the Asia-Pacific, while land readjustment in the Americas is particularly rare.

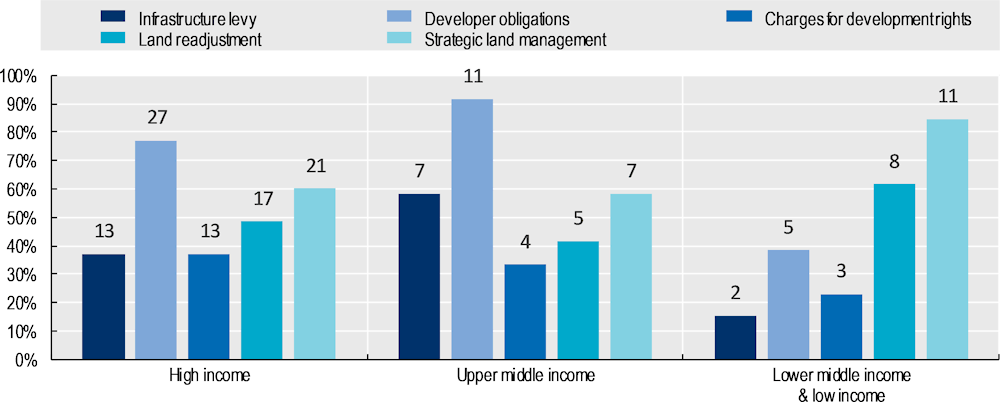

Low- and lower middle-income countries use an average of 2 LVC instruments at least on an occasional basis, compared to 2.5 for high- and upper middle-income countries. Chile, Egypt and India use all five instruments on a regular basis. Low- and lower middle-income countries rely more on strategic land management and land readjustment compared to high- and upper middle-income countries (Figure 1.12). This is likely due to the rapid urbanisation occurring in lower-income countries. Urbanisation necessitates the strategic management of land by local and national governments, evident in countries such as China, Egypt, Ethiopia and Vietnam. Land readjustment is also a useful planning tool in the urbanisation process as value increments from converting rural to urban land are high, such as in the cases of China and India. High- and upper middle-income countries use developer obligations much more frequently than countries with lower income levels (e.g., Chile, France, Greece, Israel, Italy, Korea, Netherlands). Possible reasons for such patterns include that developer obligations are generally more administratively demanding, and that expected standards for infrastructure and services are higher in higher-income countries, necessitating a transfer of some of these additional costs from the government to developers. However, basic government services are needed in poor countries as well. With the right governance frameworks, making greater use of developer obligations in poor countries, especially for new developments, could provide additional funding for governments in providing infrastructure and key services. For example, countries such as Egypt and Ghana use developer obligations frequently during approval processes for developments. Nonetheless, issues including corruption, low-quality cadastres and land registries, along with administrative capacity are cited as common obstacles for their effective implementation.

Figure 1.10. Use of LVC instruments across countries

Note: Instruments that are used only rarely are excluded from counts.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Figure 1.11. Frequency of LVC instrument use

Note: Countries using the instrument only rarely are excluded from counts. Labels indicate the number of countries in each category.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Figure 1.12. Use of LVC instruments by country income levels

Note: Countries using the instrument only rarely are excluded from counts. Country income groups determined based on World Bank country and lending groups for 2022. See Table 1.1 notes for further information. Percentages are calculated based on the number of countries in each income group. Labels indicate the number of countries in each category.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey.

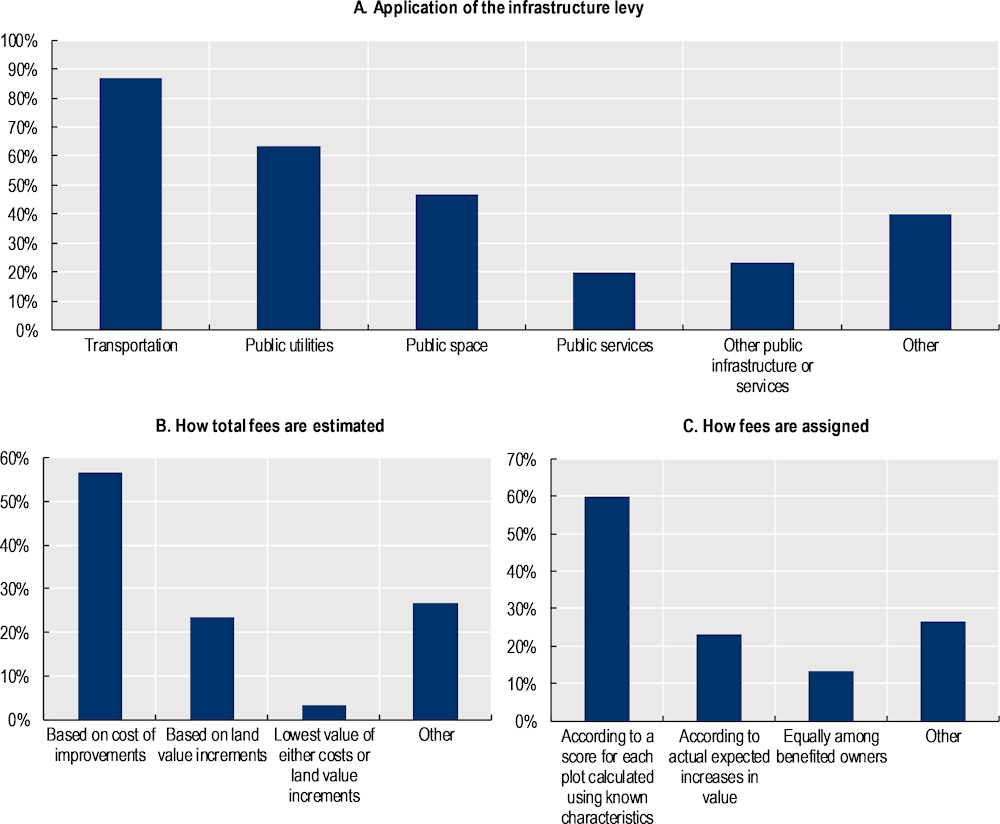

Infrastructure levy

The infrastructure levy most often applies to transportation infrastructure (Figure 1.13, panel A), followed by public utilities and public space. The common use of the infrastructure levy for transport and utilities is related to the fact that their catchment areas are relatively straightforward to define, facilitating the identification of paying owners and minimising the likelihood for disputes. Among other applications, countries use the infrastructure levy for urban management, such as services related to crime, and for sustainability efforts such as soil rehabilitation and noise reduction. In Mexico, the infrastructure levy can be applied theoretically to any public investment.

The amount of fees that need to be collected through the infrastructure levy for a particular infrastructure project are usually estimated based on the cost of the improvement (Figure 1.13, panel B). Only 23% of countries estimate the amount of total fees based on actual land value increments. This is likely because estimating value increments for land is difficult, especially for local governments that often lack administrative capacity and expertise. Additionally, there may be opportunities for localities to make administrative processes more efficient. However, basing fees on the cost of improvements rather than actual value increments risks controversies and disputes with land owners, as fees may not necessarily coincide in proportion to land value gains. Perhaps not by coincidence, appeals against the infrastructure levy are most common out of all instruments (Figure 1.4).

The fees levied are assigned mostly according to a score based on known characteristics of plots (Figure 1.13, panel C). These typically include area, zoning, density levels, taxable values, and distance from the improvement. Countries such as Colombia and Spain use a variety of characteristics of plots, while others such as France and the United Kingdom calculate fees based on land area alone. The prevalent use of known characteristics is likely because calculating actual value increments is administratively challenging, while levying fees equally among owners is often controversial.

Figure 1.13. Implementation of the infrastructure levy

Note: Multiple responses allowed.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

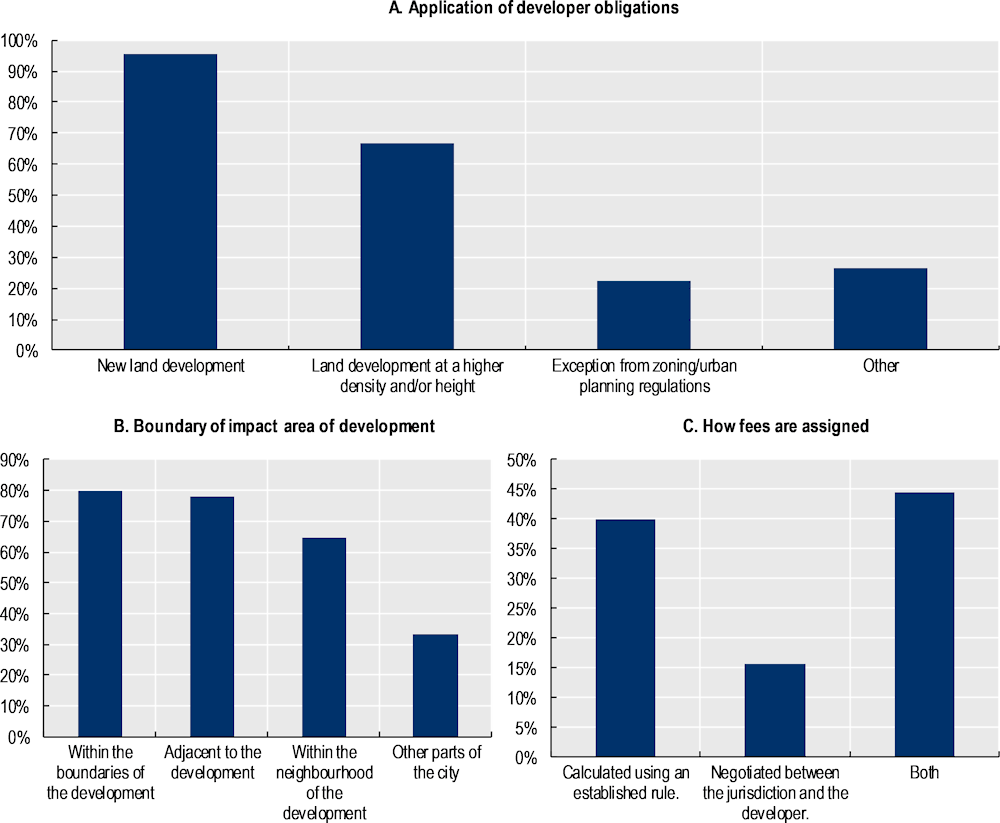

Developer obligations

Developer obligations are in essence fees or contributions developers pay in exchange for development approval, which fund or directly provide for public services. Of countries that utilise the instrument, over 90% apply them towards new land development applications, while over 60% of countries apply them when developers file for approval for higher density developments (Figure 1.14, panel A). The application of developer obligations for exemptions from planning regulations is less common. Among other use cases, Norway and Poland use developer obligations for urban redevelopment, while Finland applies developer obligations when local governments alter land use plans.

Defining the impact area of the development is important for implementing developer obligations, as this area determines where new infrastructure is required. 79% of countries consider the impact area to be within the boundaries of development, and charge fees or mandate contributions for infrastructure within these boundaries (Figure 1.14, panel B). In countries such as Finland, France, and the Netherlands, the impact area stretches out to other parts of the city, meaning that in principle, fees and contributions can be levied for infrastructure works across the city or jurisdiction.

Figure 1.14. Implementation of developer obligations

Note: Multiple responses allowed for panels A and B.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Developer obligations tend to be assigned more frequently based on established rules, rather than through negotiations between the jurisdiction and the developer alone (Figure 1.14, panel C). This is likely to reduce legal disputes and streamline the development approval process. However, many countries also use both established rules and negotiations. For example, France uses two different types of developer obligations, the taxe d’aménagement and the contributions d’aménagement. The former levies a fixed cash charge per square metre, while the latter levies cash or in-kind contributions based on negotiations with developers in designated urban development zones. Local governments increasingly use the rule-based method to streamline procedures and reduce costs.

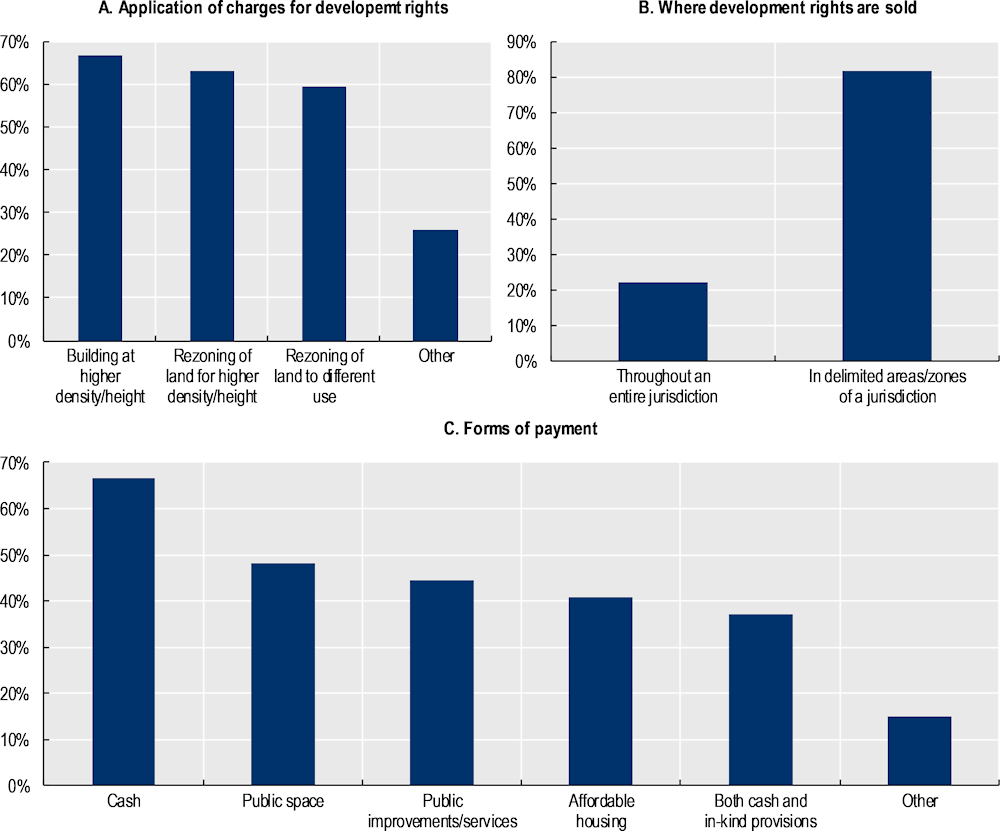

Charges for development rights

In most countries, developers mainly pay charges for development rights for building at higher density, and when applying for zoning changes that increase permitted densities or alter land use (Figure 1.15, panel A). In countries such as Brazil, China, and Italy, these charges apply for a broad range of development activity related to building and rezoning. In other countries such as Canada, charges for development rights apply only when development at a higher density actually takes place, and not for zoning changes. Among other use cases, in China and Singapore, charges for development rights are used when renewing land leases.

Figure 1.15. Implementation of charges for development rights

Note: Multiple responses allowed.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

In the majority of countries, charges for development rights apply to specific zones within a jurisdiction (Figure 1.15, panel B). Such zones commonly include areas demarked for environmental protection, or historical preservation districts. In the United States for example, Incentive Zoning and Density Bonusing apply to specific areas within jurisdictions determined by ordinances. In countries such as Brazil, development rights are sold throughout the entire jurisdiction, by charging for additional development rights above an established baseline but within the maximum density permitted by local plans.

Charges for development rights can be paid for in a variety of ways (Figure 1.15, panel C). The majority of payments take the form of cash, followed by in-kind contributions including the provision of public space, infrastructure and services, as well as affordable housing. While still less common, the provision of affordable housing in particular has become increasingly popular. In Korea for example, new national legislation was introduced in 2009 outlining affordable housing requirements for housing development projects in the Seoul Metropolitan Area, and in 2011 for the rest of the country. Under the law, affordable housing units remain affordable for up to 30 years, and benefit households with an income below 70% of the median income of the area.

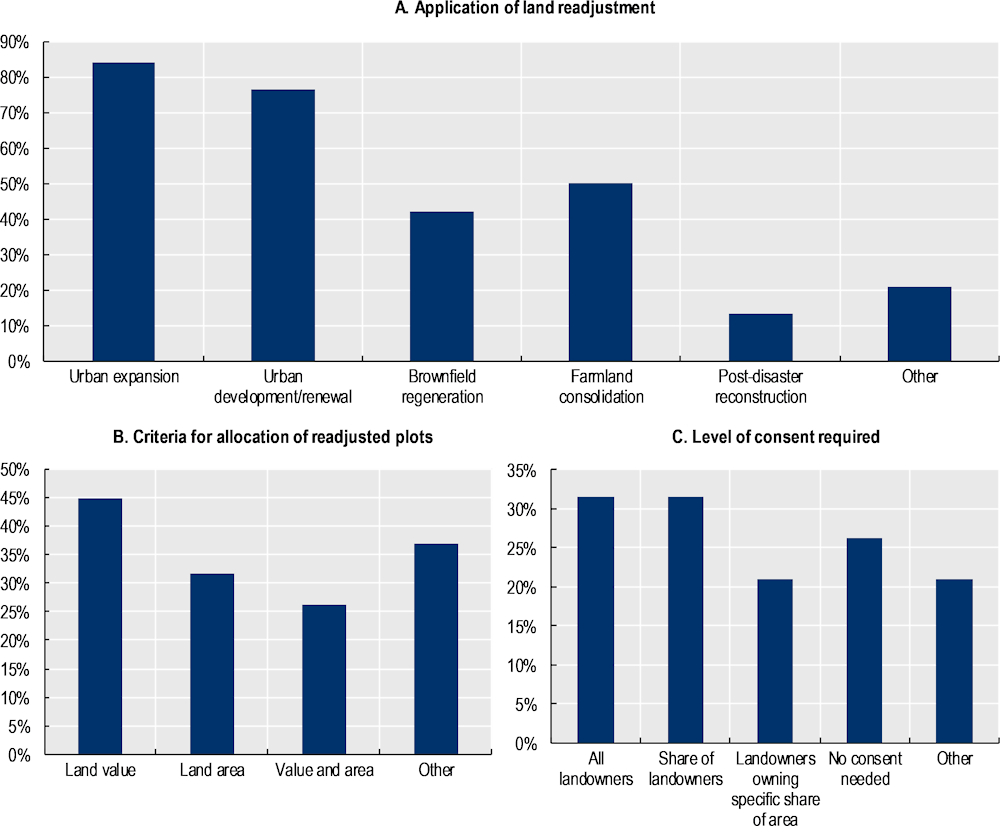

Land readjustment

Land readjustment has traditionally been used extensively in converting from rural to urban land use. Over 80% of countries use land readjustment for this purpose (urban expansion), which is still the most common use case today (Figure 1.16, panel A). Another common use of land readjustment is for urban developments and renewals, followed by farmland consolidation and brownfield regeneration projects. Countries including India, Italy and Japan also utilise land readjustment for the reconstruction and reservicing of plots affected by natural disasters. Among other uses, land readjustment is also used to consolidate forests (Finland), construct railways (Estonia), and to simplify complex property ownerships in areas where government owned land is interspersed with private plots (Israel).

Figure 1.16. Implementation of land readjustment

Note: Multiple responses allowed.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Countries utilise a variety of approaches to reallocate plots that have been readjusted. Most commonly, land is reallocated proportionally based on the value of the original plots (Figure 1.16, panel B). Other countries such as Indonesia, Italy, and Turkey exclusively use the area of the original plots as the criteria for reallocation, while countries such as Chile and China use a combination of value and area-based criteria. Notably, Israel and Hong Kong apply vertical land readjustment practices, where land owners are reallocated housing units or specific portions of buildings rather than plots of land.

The level of consent required among landowners to commence land readjustment projects also varies significantly across countries (Figure 1.16, panel C). A roughly equal number of countries require either the consent of all land owners, a certain share of landowners, or no consent whatsoever. When a share of landowners are required to consent, this share is typically two-thirds of all affected owners, although Colombia and Korea only require a simple majority (i.e. 51%). In Austria, land readjustment typically occurs for agricultural areas, where there is no need for property owners’ consent. In countries such as Portugal, landowners face expropriation in instances where full consent is not achieved.

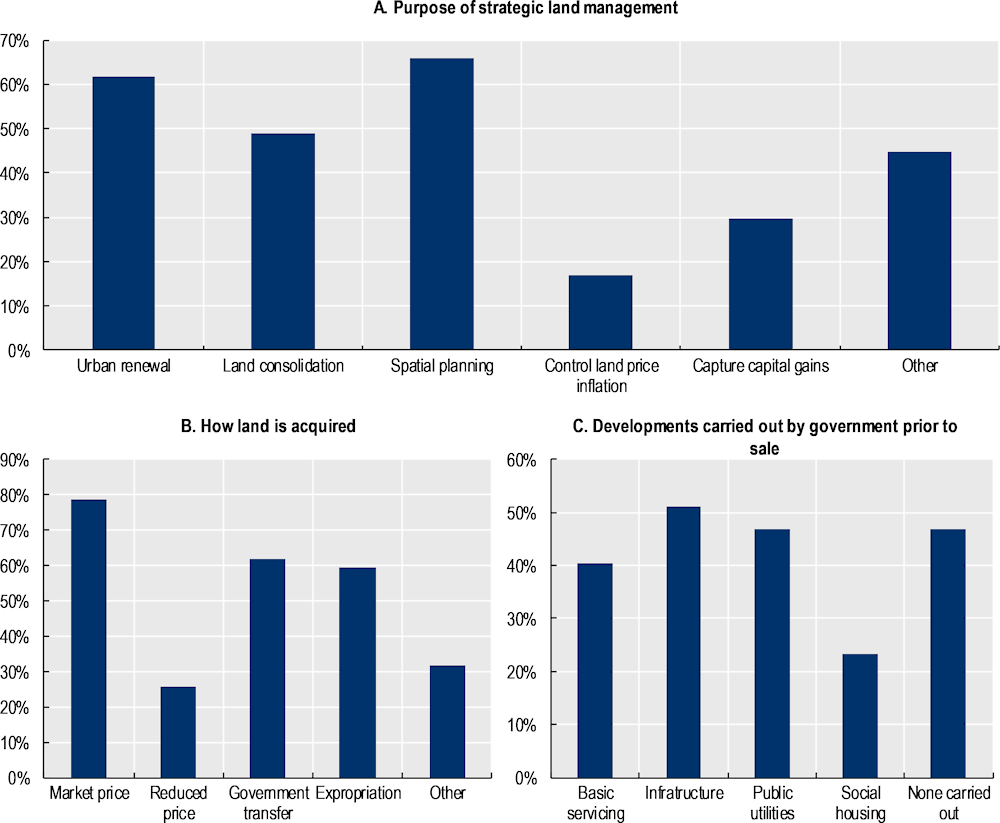

Strategic land management

Governments engage in strategic land management mainly to promote coherent spatial development, including for spatial planning, urban renewal, and land consolidation (Figure 1.17, panel A). In countries such as Singapore and Switzerland, governments also engage in strategic land management to control land price inflation. Among other purposes, strategic land management is often used to provide for social housing in countries such as Australia, Canada, Colombia. Mexico uses the instrument to promote strategic projects related to tourism, while Ethiopia uses it to control the spread of informal settlements.

Most commonly, governments acquire land for strategic management through purchases at market prices (Figure 1.17, panel B). Nonetheless, many governments also acquire land through expropriation. In Latvia for example, land is typically acquired through expropriation to provide public infrastructure, although the government does not have the authority to freeze land prices prior to announcing public involvement. In Ethiopia, public land is scarce and governments acquire land through expropriation, which is in turn used for various purposes including land banking and public land lease. In other countries such as China, Estonia and Turkey, governments already own significant portions of land suitable for strategic management.

Once land is acquired, governments can service the land, provide infrastructure and utilities, and in some cases develop the land for other purposes together with developers (Figure 1.17, panel C). In some countries however, governments do not participate in direct development. In Australia for example, states acquire vacant or unproductive land in greenfield and brownfield areas, but do not redevelop the land, rather selling land plots to developers at public auctions or leasing for public interest goals. In other countries, strategic land management plays a crucial role in spatial planning and housing policy. As part of the practice of ‘active land policy’ in the Netherlands for example, strategic land management is carried out by local governments by actively acquiring land in advance of needs for the purposes of urban development and renewal. Local governments not only rezone land and provide basic servicing, but also provision infrastructure and participate in development through joint ventures and public-private partnerships.

Figure 1.17. Implementation of strategic land management

Note: Multiple responses allowed.

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Implementing LVC: common considerations

While countries’ experiences vary significantly, the OECD-Lincoln LVC survey highlights some common issues that need to be addressed for effectively implementing LVC. The following sections discuss some key considerations.

Eliciting public support

The OECD-Lincoln LVC survey highlights how a lack of public support hinders the successful utilisation of LVC. Across all relevant instruments, resistance by property owners was identified as a major obstacle for LVC implementation in the majority of countries surveyed. Understandably, any increase in fees on land and property is likely to be unpopular because such fees are clearly visible. As a result, governments often lack the political will to adopt LVC. Conversely, countries such as Brazil and Colombia have successfully implemented LVC instruments in part due to strong political will that stems from public support and supportive legislation.

Eliciting greater public understanding, support and participation is key to successfully implementing LVC. Land value increments are captured more successfully when communication channels with land owners and stakeholders exist and the benefits from a proposed public intervention are clearly laid out. Landowners may more readily accept contributions to well-chosen projects which raise wellbeing substantially and are perceived to do so. The survey nonetheless highlights how consultation processes with property owners that are affected by LVC instruments are lacking or insufficient in many countries. Providing opportunities for dialogue between affected owners and the government is important to share information and garner public support. For example, communication channels and dialogue are a key component of successful LVC implementation in Japan, where communication procedures are laid out in legislation (OECD, 2022[8]). Dialogue can also be very important when LVC concerns minority peoples that are typically marginalised, such as in the case of indigenous groups whom have different understandings of land (OECD, 2019[11]).

Establishing fair and transparent rules

Establishing clear and fair rules is particularly important for LVC as it involves the potentially contentious agenda of sharing costs to enjoy the benefits of a public good. However, the survey highlights how such legal frameworks are lacking in many countries. The vast majority of countries lack a legal definition of LVC. Clear legislation concerning LVC, its processes, the determination of fees and taxes, affected property owners, and procedures for resolving disputes may reduce conflict, elicit public support, and bring LVC to the political mainstream.

The OECD-Lincoln LVC survey provides insights into how LVC rules can be designed. Examples from Colombia, Finland, and Israel suggest how fees are better accepted by land owners when they are charged in relation to the increase in land values that a public improvement generates, as opposed to when they are charged to simply cover the costs of the improvement. In addition, examples from countries such as Colombia, Ecuador, Mexico, and Sweden emphasise the importance of equity issues. Specifically, these examples highlight how LVC fees are better accepted when they consider the characteristics of landowners, by providing provisions for exemptions or discounts based on socioeconomic status.

Developing local government capacity

In the majority of countries surveyed, local governments take the leading role in many tasks concerning LVC, including defining land owners affected by the instrument, setting the rates for fees and contributions, negotiating with land owners and developers, and managing land assets, among others. In addition, successful LVC requires sound planning and land use principles.

The OECD-Lincoln LVC survey highlights how a lack of such capacities is one of the key obstacles for successful implementation of LVC across all instruments studied. In particular, local governments in many countries struggle with identifying affected owners and levying fees due to a lack of cadastre and registry data and related expertise. In this context, national governments should provide lower-level governments with adequate administrative support, policy guidelines, and accurate data to facilitate the proper implementation of LVC as a fiscal tool. For example, major cities in Germany (such as Frankfurt) successfully utilise developer obligations to provide for affordable housing, made possible in part due to strong local government capacity stemming from administrative support structures (OECD, 2021[12]). In addition, spatial planning frameworks should clearly define roles of different levels of government in preparing plans and land use regulations that serve as the baseline for LVC administration, such as in the case of Ecuador, Israel, and the Netherlands.

References

[7] Henao González, G. (2005), Instrumentos Para La Recuperación de Plusvalías En Bogotá, Café de Las Ciudades 4, https://www.cafedelasciudades.com.ar/economia_37.htm (accessed on 2 September 2020).

[5] Kim, J. and S. Dougherty (eds.) (2020), Local Public Finance and Capacity Building in Asia: Issues and Challenges, OECD Fiscal Federalism Studies, OECD Publishing, Paris, https://doi.org/10.1787/a944b17e-en.

[8] OECD (2022), “Financing Transportation Infrastructure through Land Value Capture: Concepts, Tools and Case Studies”, OECD Regional Development Working Papers.

[12] OECD (2021), Housing Affordability in Cities in the Czech Republic, OECD Publishing, Paris, https://doi.org/10.1787/bcddcf4a-en.

[11] OECD (2019), Linking Indigenous Communities with Regional Development, OECD Rural Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/3203c082-en.

[10] OECD (2017), Land-use Planning Systems in the OECD: Country Fact Sheets, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/9789264268579-en.

[2] OECD (2017), The Governance of Land Use in OECD Countries: Policy Analysis and Recommendations, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/9789264268609-en.

[1] OECD/European Commission (2020), Cities in the World: A New Perspective on Urbanisation, OECD Urban Studies, OECD Publishing, Paris, https://doi.org/10.1787/d0efcbda-en.

[3] Smolka, M. (2019), “Value Capture”, The Wiley Blackwell Encyclopedia of Urban and Regional Studies.

[4] Smolka, M. (2013), Implementing Value Capture in Latin America: Policies and Tools for Urban Development, Lincoln Institute of Land Policy.

[6] van Oosten, T., P. Witte and T. Hartmann (2018), “Active land policy in small municipalities in the Netherlands: “We don’t do it, unless...””, Land Use Policy, Vol. 77, pp. 829-836, https://doi.org/10.1016/j.landusepol.2017.10.029.

[9] World Bank (2022), World Bank Country and Lending Groups, https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups (accessed on 25 Feb 2022).

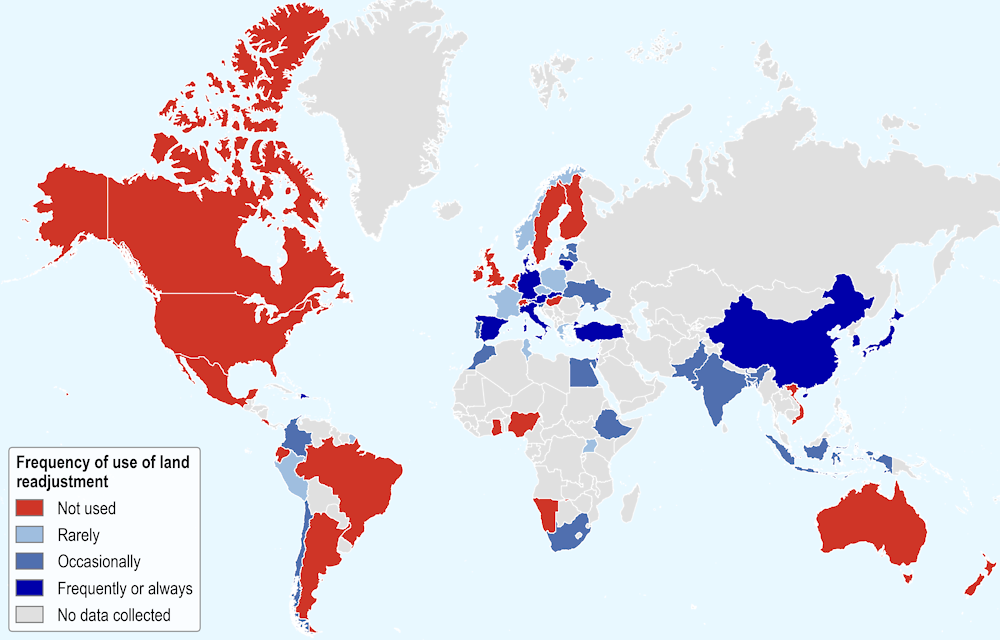

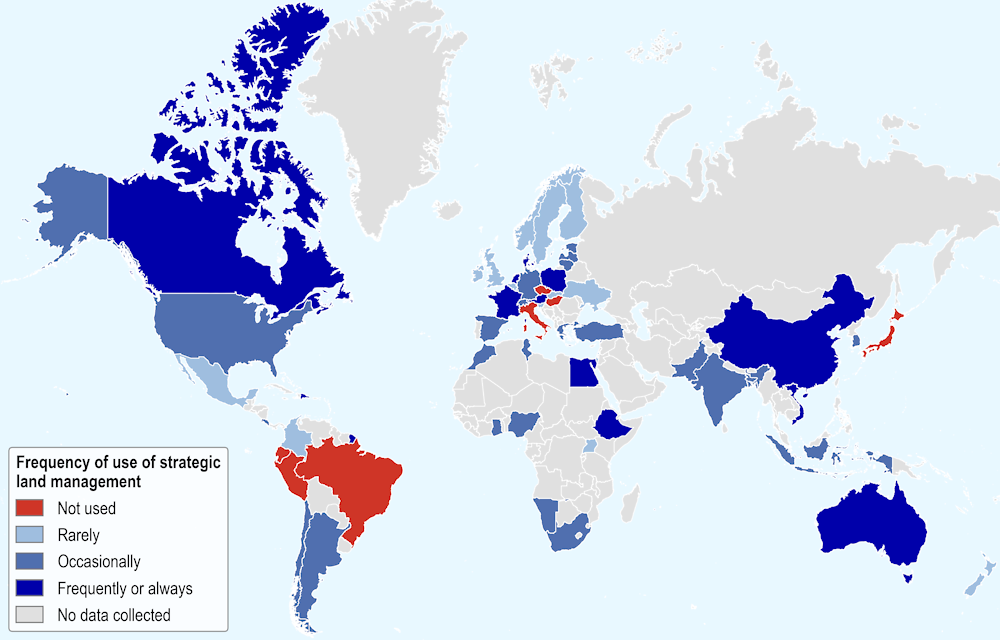

Annex 1.A. Frequency of LVC instrument use across the globe

Annex Figure 1.A.1. Use of the infrastructure levy by country

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Annex Figure 1.A.2. Use of developer obligations by country

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Annex Figure 1.A.3. Use of charges for development rights by country

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Annex Figure 1.A.4. Use of land readjustment by country

Source: Authors’ elaboration based on OECD-Lincoln LVC survey

Annex Figure 1.A.5. Use of strategic land management by country

Source: Authors’ elaboration based on OECD-Lincoln LVC survey