This chapter provides an overview and an assessment of housing taxes in OECD countries. It covers the wide range of taxes that are commonly levied on housing in the OECD and examines their design from an efficiency, an equity and a revenue perspective. It also looks at the role of specific tax policies in addressing current housing market challenges. The chapter outlines a number of options for reform that governments could consider to enhance the design and functioning of their taxes on housing.

Housing Taxation in OECD Countries

3. Housing tax policies in the OECD and options for reform

Abstract

3.1. Key findings

This chapter provides a comparative assessment of housing tax policies in OECD countries and identifies reform options to enhance the design of housing tax systems. The chapter starts by providing an overview of the different types of taxes that are levied on housing in OECD countries and discusses trends in housing-related tax revenues. The chapter then assesses housing tax policies in OECD countries. It examines the efficiency, equity and revenue effects of housing taxes, and evaluates the role of specific tax policy instruments to address current housing challenges. Based on the assessment, the chapter outlines a number of reform options that governments could consider to enhance the design of their housing tax policies.

The design of housing taxes is of growing importance given pressures on governments to raise revenues, improve the functioning of housing markets, and combat inequality. As they continue to navigate the COVID-19 pandemic, many countries are looking to raise tax revenues without threatening the economic recovery. Many governments are also under increasing pressure to address rising inequality and declining housing affordability, which is especially affecting low-income and young households. In addition, the growing international mobility of both capital and people may encourage governments to raise more revenues from less mobile tax bases, in particular real estate (Dolls et al., 2021[1]). This increased attention on housing taxes reinforces the need to design them effectively and fairly.

Overall, this chapter finds that there is significant room to enhance the efficiency, equity and revenue potential of housing taxes in OECD countries. Many countries still levy recurrent property taxes on outdated property values, which significantly reduces their revenue potential (as revenues have not risen in line with property values), their equity (as households whose properties have increased in value may not be paying more tax), as well as their economic efficiency (as property taxes levied on outdated values provide incentives for people to remain in undervalued housing even if it no longer suits their needs). Reliance on transaction taxes is high, despite the potential for these taxes to reduce residential, and to some extent, labour mobility. The majority of countries fully exempt capital gains on main residences, and while there may be justification for such an approach, an uncapped exemption provides vastly greater benefits to the wealthiest households and further distorts the allocation of savings in favour of owner-occupied housing. Other forms of tax relief for owner-occupied housing, in particular mortgage interest relief, have been found to be regressive and ineffective at raising homeownership levels. In some countries, features of rental income taxation and inheritance tax rules applying to housing also reduce progressivity and revenue potential. The assessment also shows that, while housing taxes are often viewed as harder to avoid and evade than other taxes, tax systems leave room for such behaviours, reducing the efficiency, fairness and revenues of housing taxes.

This chapter also finds that some housing tax policies may help address current housing market challenges, although they may not always be the most effective tools. Tax policies may be used to address specific housing market challenges, such as significantly reducing the carbon footprint of housing, encouraging a more efficient use of land and housing, and boosting the supply of affordable housing. However, taxation may be a blunt tool and may even be counterproductive under certain circumstances. In particular, where tax relief is intended to encourage homeownership, it can sometimes contribute to raising house prices and therefore to redistributing wealth to current homeowners if housing supply is fixed. Even where tax policies can play a positive role (e.g. vacant home taxes, tax incentives for energy-efficient housing renovations), they may not be as effective in achieving their desired outcome as alternative policy instruments (e.g. regulations) and will generally need to be complemented by a range of other policy measures.

This chapter identifies a number of reform options that countries could consider to simultaneously enhance the efficiency, equity and revenue potential of housing taxes. Strengthening the role of recurrent taxes on immovable property, in particular by ensuring that they are levied on regularly updated property values, while lowering housing transaction taxes would increase efficiency in the housing market and improve vertical and horizontal equity. Capping the capital gains tax exemption on the sale of main residences at a high capital gain threshold and gradually removing or capping mortgage interest relief for owner-occupied housing would strengthen progressivity. At the same time, these reforms would reduce upward pressure on house prices. Tax incentives for energy efficient housing renovations could be better targeted to ensure that they reach low-income households. This could contribute to greater emissions reductions and enhance the equity of tax incentive schemes. Caution should be exercised when considering tax incentives to encourage homeownership; in most cases, increasing the supply of housing and a more efficient use of the housing stock through both tax and non-tax measures is likely to have a greater impact on housing affordability. Strengthened reporting requirements, including third-party reporting to the tax authority and international exchanges of information for tax purposes, are also key to ensuring that housing taxes are enforced properly. The chapter discusses many other reform options that could help enhance the design, functioning and impact of housing taxes.

Any assessment of housing tax policies should take a holistic view of their interactions with other tax and non-tax policies and with housing market conditions. Interactions between different housing tax policies should be carefully assessed. For instance, residential mobility will be affected directly by both transaction taxes and capital gains taxes, and indirectly by the design of the recurrent tax on immovable property. Reforms aimed at enhancing mobility should therefore consider all three taxes. Carefully assessing interactions between taxes may also help identify cases where, before introducing new tax instruments, countries could consider reforming the design of existing housing taxes. For instance, there may be less need for special taxes to reduce speculation where short-term capital gains are adequately taxed. Similarly, a recurrent tax on immovable property based on regularly updated market values may reduce the need for tax instruments (e.g. infrastructure levies) aimed at capturing property value increases resulting from local public investments. Interactions between tax and non-tax policies are also key. As mentioned, there may be cases where non-tax policies may provide a more effective and equitable alternative to tax measures, especially when the goal is to promote housing affordability. There may also be cases where the success of tax measures depends on other policy settings or housing market conditions.

Housing tax reforms require careful timing and consideration for their impact across different households. Housing tax reforms can have a sizeable impact on house prices, with potentially significant distributional effects as well as wider financial and economic repercussions. A gradual implementation of reforms can help prevent negative macroeconomic shocks while also alleviating the adverse effects of reforms on specific groups of individuals, at least in the short run. Accompanying housing tax reforms with other tax or transfer measures may also help mitigate the impacts of some reforms on more vulnerable people and enhance the public acceptability and political feasibility of policy changes.

3.2. Overview of housing taxes in OECD countries

This section provides an overview of the range of taxes levied on housing in OECD countries and the revenues collected from the main taxes on housing. The section starts by describing the different types of taxes that are commonly levied on the acquisition, holding and disposal of housing. Next, the section examines the revenues that OECD countries collect from property taxes, which include a subset of taxes on housing. The section also looks at the evolution of property tax revenues over time, and compares trends in revenues to house price developments. This overview lays the groundwork for the detailed policy assessment in Section 3.3.

3.2.1. Housing taxes along the housing investment cycle

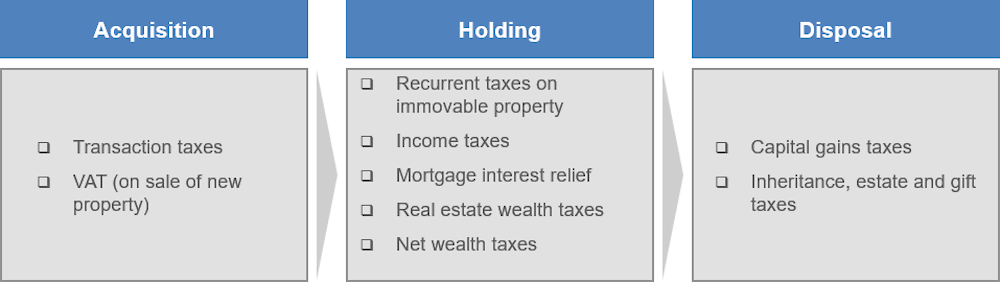

Across OECD countries, a range of taxes commonly apply at different stages of a housing investment (Figure 3.1). As discussed below, housing tax systems share common features across countries, and the tax treatment differs markedly between owner-occupied and rented property. In the acquisition phase, transaction taxes are commonly applied across countries. In the holding phase, recurrent taxes on immovable property are levied in all OECD countries. The income generated by rental property is also commonly taxed, while imputed rents from owner-occupied housing (i.e. the in-kind income earned by owner-occupiers living in their homes) are typically exempt. Mortgage interest relief is also widespread across countries, particularly for rented property. On the disposal of housing, many countries exempt capital gains on the sale of main residences, while capital gains on secondary properties (e.g rental housing, holiday homes, pied à terre in urban centres) are usually taxed, and tax liabilities can often be reduced for longer holding periods. Inheritance and gift taxes may also be levied when immovable property is transferred to heirs. Annex A outlines the tax treatment of housing in all OECD countries.

Figure 3.1. Taxation of housing assets over the asset lifecycle

On the acquisition of housing assets, transaction taxes are widely applied across OECD countries. 30 out of 38 OECD countries apply transaction taxes on housing. Transaction taxes are typically levied on the purchase of a housing asset at a flat rate, although in some cases tax rates depend on the value of the housing asset (Australia, Canada, Israel, Korea, Mexico, Portugal, and the United Kingdom). New residential housing is often exempt from transaction taxes, but Value Added Tax (VAT) usually applies on newly built residential property, though sometimes at a reduced rate. A number of countries also apply transaction tax exemptions or concessions for first-time buyers (e.g. Australia, Canada, Italy, and the United Kingdom), which is typically conditional on the value of the property.

During the holding period, all OECD countries levy recurrent taxes on immovable property. Recurrent taxes on immovable property are levied in all 38 OECD countries (though not in all sub-central governments). Recurrent taxes on immovable property are typically paid by property owners (although there are exceptions where the tax is levied on the occupant of a property) and are in most cases levied on both buildings and land, although a few subnational governments and countries levy taxes only on land (New South Wales1 in Australia and Denmark) or apply different tax rates on land and buildings (Finland and some municipalities in Hawaii and Pennsylvania, United States). In most countries, tax obligations depend on the estimated market value of the property, which in practice can differ significantly from its true market value (see Section 3.3.1), but four countries (the Czech Republic, Israel, Poland, and the Slovak Republic) use area-based systems, where the tax liability is primarily based on the size of the property. A minority of countries levy recurrent taxes on immovable property at progressive rates (e.g. Chile, Denmark, Greece, Korea, Latvia, Mexico), although these taxes also have an element of progressivity in countries that apply a tax-free threshold (e.g. Lithuania).

The approach to the taxation of housing income differs significantly between owner-occupied and rental property. Income from rental property is taxed in the vast majority of OECD countries, with 34 countries levying personal income taxes (PIT) on rental income. Rental income is typically taxed at flat rates in countries with dual income tax systems (e.g. Denmark, Finland) and at progressive PIT rates in countries with comprehensive tax systems (e.g. Canada, Germany, New Zealand). On the other hand, the taxation of imputed rents from owner-occupied property is rare. Only four OECD countries (Denmark, Greece, the Netherlands and Switzerland) tax imputed rents (though generally at lower levels than rental income).

Mortgage interest relief, spread over the asset-holding period, is common across OECD countries. 17 OECD members provide a form of mortgage interest relief (via tax deductions or credits) for owner-occupied housing. In a few countries, mortgage interest relief is capped (Estonia, Finland and Luxembourg) or only applies below an income (Chile) or asset value threshold (Korea). Mortgage interest relief is more commonly available for rented property than for owner-occupied housing, with 26 countries offering a (typically uncapped) tax deduction or credit.

A few OECD countries levy wealth taxes on overall net wealth including the ownership of housing, although preferential tax treatment is typically granted to owner-occupied property. Three OECD countries (Norway, Spain and Switzerland) levy annual taxes on total net wealth above a certain threshold. Owner-occupied properties typically benefit from preferential tax treatment under net wealth taxes. For instance, Spain applies an exemption threshold for the main residence of up to EUR 300 000, in addition to the standard EUR 700 000 net wealth tax exemption threshold. In Norway, only 25% of the owner-occupied property value is subject to the tax,2 which rises to 95% in the case of secondary housing. A few countries also levy taxes at the national level on overall real estate wealth above a certain threshold (e.g. France, Korea).

On the disposal of housing assets, significant differences exist between the tax treatment of capital gains on main residences and other housing. Twenty countries provide full and unconditional capital gains tax exemptions on sales of main residences, while full exemptions (9 countries) and other favourable tax treatment (5 countries) are available conditional upon a minimum holding period, the value of the gain or the reinvestment of gains in another property. Capital gains on other housing assets are taxed in 33 countries, though again often at concessionary rates subject to a minimum holding period. Where capital gains taxes are levied, countries apply a mix of progressive and flat tax rates.

Inheritance, estate and gift taxes are also levied in many countries when housing assets are passed on to heirs, although the main residence can benefit from preferential tax treatment under specific conditions. A number of countries fully or partially exempt the main residence, while others apply below-market values or lower tax rates. Most countries make tax relief conditional upon certain requirements (e.g. the beneficiary living with the donor prior to, at the time of, or following the donor’s death). Other residential property is typically fully included in the inheritance or estate tax base (OECD, 2021[3]).

3.2.2. Property tax revenues in OECD countries

Property tax revenues, which include a subset of taxes on housing, account for a small share of overall tax revenues

Existing data from the OECD Revenue Statistics Database do not allow for all housing tax revenues to be identified, but those property tax revenues that can be identified, provide useful insights into a subset of housing taxes. As discussed above, OECD countries levy a wide range of taxes on housing. For some taxes, in particular income taxes, revenues cannot be disaggregated between housing-related taxes (e.g. taxes on housing capital gains, rental income and imputed rents, if taxed) and non-housing related income taxes. Given these data limitations, this section focuses on property tax revenues, which include revenues from a subset of taxes on housing, in particular recurrent taxes on immovable property and transaction taxes. Importantly, however, property taxes also include a number of non-housing related taxes, including taxes on non-housing assets and taxes on assets held by businesses.

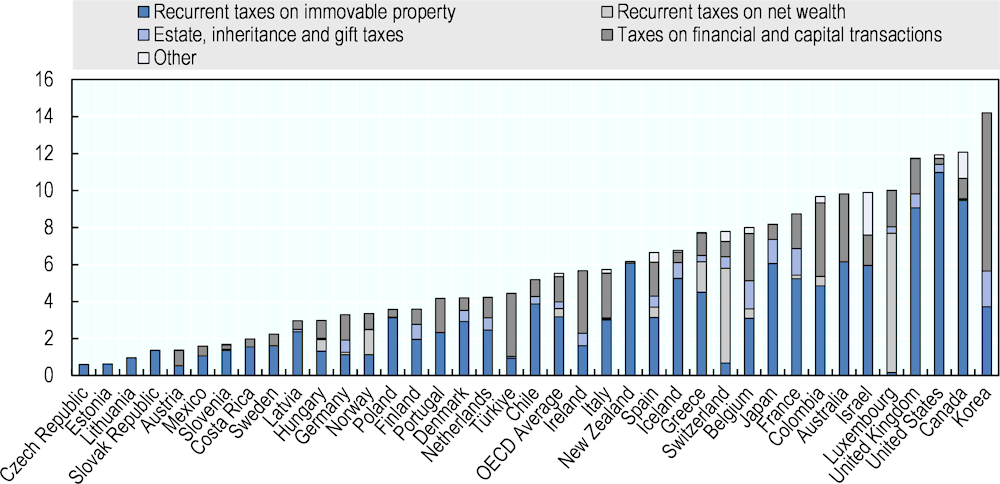

Property taxes typically represent a small source of revenue for OECD countries. On average across OECD countries, property taxes represent around 6% of total tax revenues, a far smaller share than other taxes, including taxes on goods and services (33% of total tax revenues), social security contributions (26%), personal income taxes (23%), and corporate income taxes (10%) (OECD, 2020[4]). However, there is some variation across countries, with a minority of countries raising 10% or more of their total tax revenues from property taxes. Property tax revenues account for around 14% of total tax revenues in Korea, 12% in the United Kingdom, the United States, and Canada and 10% in Luxembourg, while accounting for less than 1% of total tax revenues in the Czech Republic, Estonia and Lithuania (Figure 3.2).

Recurrent taxes on immovable property are the largest component of property tax revenues. Recurrent taxes on immovable property represent the most significant source of property tax revenues in the majority of OECD countries and, on average, account for 62% of countries’ total property tax revenues. Taxes on financial and capital transactions, which include transaction taxes on housing, account for 27% of total property tax revenues on average. Both net wealth taxes and inheritance, estate and gift taxes, which are levied on a broad range of assets including housing, generally account for small shares of total property tax revenues in OECD countries (Figure 3.2).

Figure 3.2. Property tax revenue as a share of total tax revenues, 2020

Note: 2019 data for Australia, Greece, Japan, New Zealand and the OECD average. Data include taxes paid by households and non-households and include household and non-household real estate.

Source: OECD Revenue Statistics

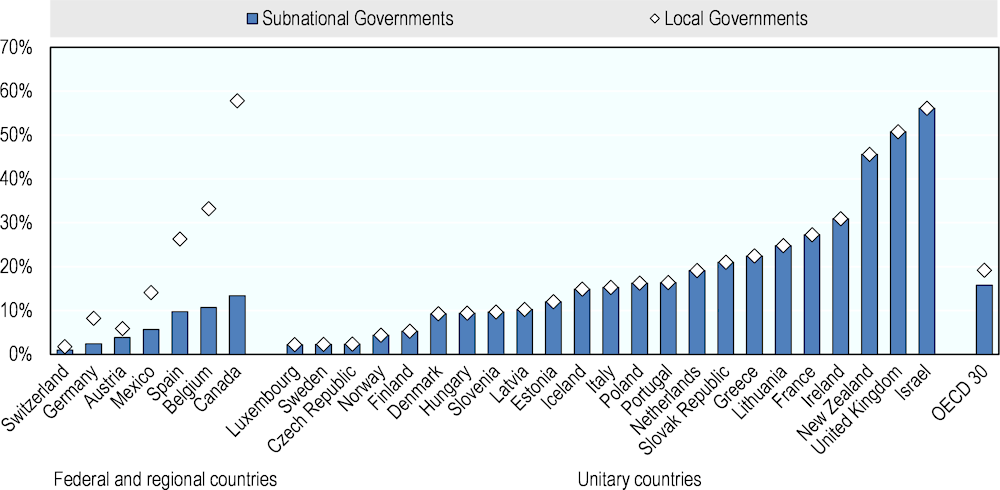

Recurrent taxes on immovable property represent a major source of revenue and an important policy lever for sub-central governments. In most countries, revenues from recurrent taxes on immovable property are fully or largely assigned to local governments. As a result, even if revenues from recurrent property taxes are a small part of total tax revenues, they account for a significant share of sub-central government tax revenues. Indeed, recurrent property tax revenues account for 19% of local government revenues and 16% of total sub-national government revenues (local governments and state/regional governments in federal countries) on average across OECD countries (Figure 3.3). Recurrent taxes on immovable property are also the taxes over which local governments have most control, with powers to make decisions on the introduction and removal of the tax, the definition of tax rates and bases, as well as tax reliefs, although the level of autonomy varies across countries (OECD, 2021[5]). This greater autonomy enables subnational governments to adjust their fiscal policy to local demands and contributes to increasing their political accountability (OECD, 2021[5]).

Figure 3.3. Recurrent taxes on immovable property as a percentage of local and state government’s revenues, 2019

Note: Local and state revenues are consolidated to reflect own-source revenue (defined as total revenue minus the inter-governmental transfer revenue of that government level). The allocation of revenues between different levels of government is specified in the Fiscal Decentralisation Database. Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics (for recurrent tax on immovable property); OECD Fiscal Decentralisation Database (for SNGs’ revenue); Making Property Tax Reform Happen in China: A Review of Property Tax Design and Reform Experiences in OECD Countries (OECD, 2021[5])

Increases in housing values have not been reflected in property tax revenues

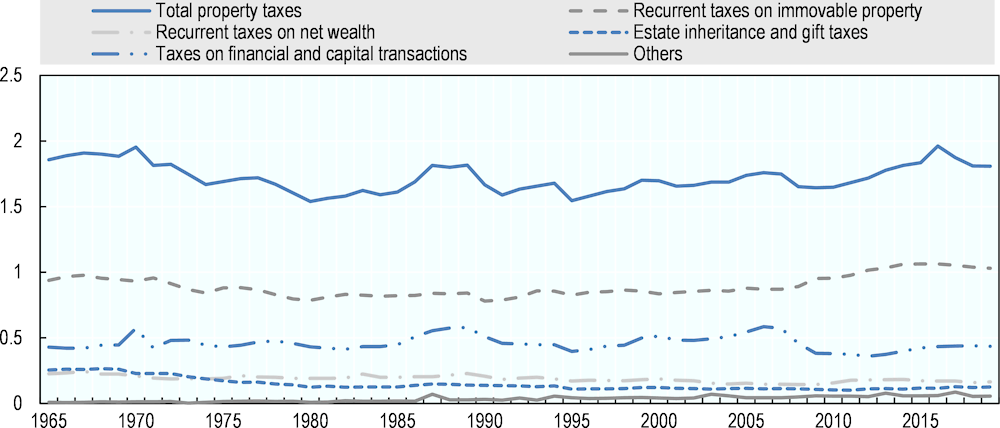

Looking at their evolution over time, overall property tax revenues have remained remarkably stable as a share of GDP since the mid-1960s. Total property tax revenues as a share of GDP have remained fairly constant, oscillating between 1.5% and 1.9% over the past six decades (Figure 3.4). Recurrent taxes on immovable property have inched upwards from 0.94% in 1965 to 1.03% of GDP in 2019. On the other hand, between 1965 and 2019, revenues from inheritance, estate and gift taxes declined from 0.25% of GDP to 0.13%, and revenues from net wealth taxes dropped from 0.23% of GDP to 0.16%. This reflects the fact that some countries have abandoned these taxes while others have narrowed their tax bases (OECD, 2018[6]; OECD, 2021[3]). Revenues from financial and transaction taxes have historically exhibited greater volatility than revenues from other property taxes, and have still not recovered from their marked decline after the global financial crisis.

Figure 3.4. Property tax revenue as a share of GDP over time across OECD countries (unweighted average), 1965-2019

Note: Tax revenues for the Property taxes and Others categories in Iceland in 2016 are calculated as the mean of values for 2015 and 2017. Iceland experienced unusually high tax revenues in 2016 from one-off stability contributions from entities that previously operated as commercial or savings banks and were concluding operations. The tax revenues, equivalent to 15.7% of Iceland’s GDP in 2016, led to a spike in the OECD average Property taxes and Others categories (Revenue Statistics, 2018).

Source: OECD Revenue Statistics Database

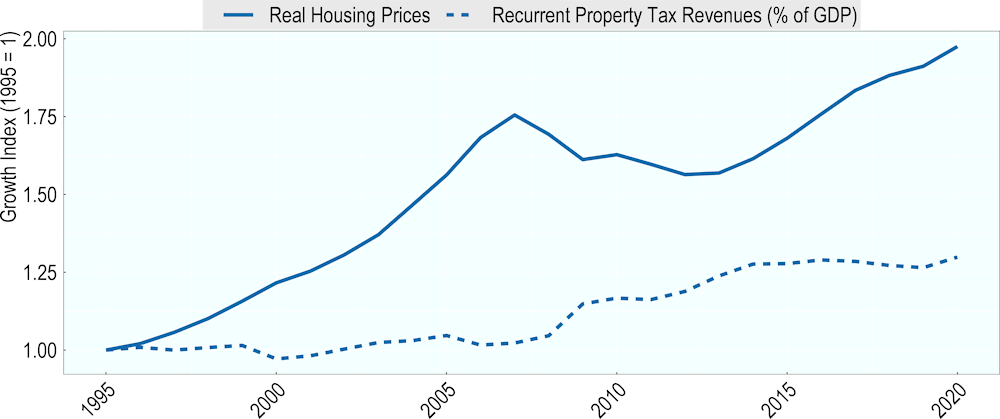

Evidence suggests that revenues from taxes on housing have not kept up with increases in house prices. The sustained growth in property values over recent decades (see Chapter 1) should have been accompanied by a comparable rise in property tax revenues, but the design of these taxes has weakened this relationship in practice. Figure 3.5 displays the average growth in real house prices together with the average growth in recurrent property tax revenues as a percentage of GDP for 15 OECD countries over the period 1995-2020. The two have diverged considerably in recent decades, with the growth of real housing prices far outpacing that of property tax revenues. As discussed in Section 3.3.1, property taxes are often levied on significantly outdated and underestimated property values that do not reflect price developments. Some OECD countries also cap the amount by which property value assessments and tax liabilities can increase in a given year, which further disconnects recurrent property tax revenues from property values (OECD, 2021[5]). These patterns are consistent with existing research finding particularly low levels of buoyancy for recurrent taxes on immovable property (Belinga et al., 2014[7]; Dougherty and de Biase, 2021[8]), as well as a low elasticity of property tax revenues with respect to housing prices (Lutz, 2008[9]). Similar gaps have likely occurred between housing price growth and revenues from other taxes on housing. In particular, capital gains taxes on the sale of main residences are commonly exempt, resulting in substantial forgone revenues (e.g. (Corlett and Leslie, 2021[10]; Grudnoff, 2016[11]; Hungerford, 2010[12])). In a number of countries, other tax incentives typically aimed at promoting homeownership, such as transaction tax exemptions for first-time buyers, have further narrowed tax bases and reduced the revenue raising capacity of housing taxes.

Figure 3.5. Mean growth in real housing prices and mean growth in recurrent property tax revenues (% of GDP) over time, 15 OECD countries, 1995-2020

Note: The property tax indicator refers to all recurrent property taxes collected and not just those levied on household assets. Average of Canada, Colombia, Denmark, Finland, France, Germany, Ireland, Israel, Japan, Netherlands, Norway, Spain, Switzerland, United Kingdom, United States. Some countries (e.g. Belgium, Italy, Korea, Portugal, Sweden) that undertook significant reforms of their property tax systems during the period under consideration were removed from this calculation.

Source: The data on real housing prices is taken from the OECD National and Regional House Price Indices dataset. The data on recurrent property tax revenues is taken from OECD Revenue Statistics.

3.3. Policy assessment and options for reform

This section assesses housing tax policies in OECD countries and discusses a range of options for reform. The first part of this assessment (section 3.3.1) examines existing housing tax policies and identifies reform options that could help enhance their efficiency, equity and revenue potential. The second part of this assessment (section 3.3.2) focuses on the role of specific housing tax policy instruments in addressing current housing challenges, in particular housing affordability and environmental sustainability. This section shows that designing housing tax policies requires carefully balancing different objectives and assessing interactions between different types of policies and housing markets. Overall, there is significant room to improve the design and functioning of housing taxes and there are a number of concrete reform options that governments could consider. This section also highlights that housing tax policy instruments have a role to play in addressing current housing market challenges, although in some cases non-tax instruments may be more effective and equitable policy tools.

3.3.1. Assessment of housing tax policies and options to enhance their efficiency, equity and revenue potential

There is significant scope to improve the design and functioning of recurrent taxes on immovable property

Recurrent taxes on immovable property are levied in all OECD countries. All OECD countries, though not all sub-central governments, levy recurrent taxes on immovable property. Recurrent taxes on immovable property are typically paid by property owners, but there are some exceptions (e.g. the Council Tax in the United Kingdom and the Taxe d’habitation in France) where the tax is levied on the occupant (regardless of whether they own or rent the property).3 Most OECD countries apply recurrent taxes on immovable property on the value of both land and buildings. Pure land taxes are found in only three OECD countries (New South Wales in Australia, Denmark and Estonia), while Finland and some municipalities in Hawaii and Pennsylvania, United States, apply higher tax rates on land than on buildings (i.e. split-rate taxation). Most OECD countries apply value-based property tax systems, but four countries (the Czech Republic, Israel, Poland, and the Slovak Republic) use area-based systems, where the property tax is based on the size of the property (although adjustments can be made depending on location or other dwelling characteristics). Recurrent taxes on immovable property are most commonly levied at flat rates, but a minority of countries levy them at progressive rates (Australia, Chile, Colombia, Denmark, Greece, Ireland, Korea, Latvia, Mexico, Slovenia).

Recurrent taxes on immovable property are considered one of the most economically efficient forms of taxation. While the nature of the property tax has long been debated in the theoretical literature (see Box 3.1), extensive research has highlighted its efficiency properties (Grover et al. (2017[13]); Brys et al. (2016[14]), Slack and Bird (2014[15]), Norregaard (2013[16]); Johansson et al. (2008[17]), Diamond and Mirrlees (1971[18]), (Ramsey, 1927[19])). Recurrent taxes on the immovable property of households are a comparatively efficient source of tax revenue because the tax base – typically land and improvements – is highly immobile, which limits the scope for behavioural responses to the tax. This is particularly the case for land, which is in fixed supply. Indeed, in theory a pure land tax would be more efficient as it would not discourage investment in capital improvements, but most countries tax both land and improvements because of the practical difficulties of measuring the value of each separately. Additionally, a recurrent tax on residential property may act to some extent as a “benefits tax”, in that it may be seen as a (partial) payment for local public goods (see Box 3.1), and therefore be less distortive than a pure tax. Recurrent taxes on immovable property are also typically capitalised into house prices over time, which suggests that these taxes can help slow house price increases and stabilise fluctuations in the housing market (Oliviero et al., (2019[20]), Blöchliger et al., (2015[21])) and are less distortive than other taxes that are not capitalised into prices (Slack and Bird, 2015[22]). Finally, recurrent taxes are difficult to evade due to the highly visible nature of immovable property, and can also contribute to more efficient land usage. Empirically, recurrent taxes on immovable property have been found to be among the least damaging taxes to long-run economic growth (Johansson, 2016[23]; Cournède, Fournier and Hoeller, 2018[24]; Johansson et al., 2008[17]).

Recurrent taxes on immovable property have also long been identified as a good source of revenue for local governments. Recurrent taxes on immovable property lend themselves to local government taxation for several reasons. First, the tax is borne mainly by local residents with limited spillovers (Norregaard, 2013[16]). Second, as mentioned above, there is a significant link between the tax and the services received, and local public services and investments are to some extent reflected in the property tax base. Third, the property tax tends to be a relatively stable and predictable source of revenue (Blöchliger et al., 2015[21]; Norregaard, 2013[16]). Lastly, recurrent taxes on immovable property may also increase local government accountability. Sub-central and local governments typically have a greater degree of autonomy over the design and implementation of recurrent taxes on immovable property than for other taxes (see Section 3.2), which, coupled with the high salience of the property tax, makes taxpayers more likely and able to hold their local governments accountable.

From a distributional perspective, several studies find that recurrent taxes on immovable property are regressive with respect to income, but these studies have limitations. Several studies find that recurrent immovable property taxes are regressive with respect to income because tax liabilities are a larger share of income for low-income households (Andriopoulou et al. (2020[25]), Kim and Lambert (2008[26]), Palameta and Macredie (2005[27]), Chawla and Wannell (2003[28])). However, there are limitations to these studies that suggest that recurrent property taxes may not be as regressive as generally thought, and may even have some progressive features. Studies typically note that the tax-to-income ratio declines across the income distribution; however, the regressive effect is highest for the lowest-income households and is much less pronounced (although still present) when comparing lower-middle-income households to top income households (Andriopoulou et al. (2020[25]), Palameta and Macredie (2005[27])). This suggests that careful tax design and the provision of tax relief for the lowest income households can alleviate this regressive effect, a finding supported by a few studies (Joumard, Pisu and Bloch (2012[29]), O’Connor et al. (2015[30])). In addition, some studies find that absolute liabilities rise with income because higher-income households own more valuable property (Andriopoulou et al. (2020[25])). More generally, the distributional impacts of recurrent property taxes will differ across countries depending on the distribution of housing assets. Where immovable property is highly concentrated at the top, a shift in the tax mix towards immovable property taxation is expected to have more progressive effects than where housing assets are more equally distributed along the income distribution. Most studies also only look at owner-occupied housing and ignore the impact of taxing secondary real estate, which is likely to be progressive as the highest income households hold significantly more secondary real estate than lower-income households (see Chapter 2).

Property taxes are likely to be progressive with respect to wealth, but empirical research is sparse due to data constraints. While there are a number of studies measuring tax-to-income ratios across the income distribution, there are fewer studies measuring property tax liabilities along the wealth distribution or as a share of wealth. One study finds that in Canada, the ratio of recurrent property tax liabilities to home values is mostly flat across the income distribution (Chawla and Wannell, 2003[28]). While quality data on housing wealth and corresponding tax liabilities are sparse, patterns in homeownership across the wealth distribution suggest that recurrent taxes on immovable property should be progressive with respect to wealth, with tax-to-wealth ratios rising for higher wealth households. As households at the top of the wealth distribution own higher value properties and hold the majority of housing wealth, tax liabilities are likely to be higher as a share of wealth for wealthier households. Low-wealth households tend not to own property, so property taxes are likely to be low at the bottom of the wealth distribution. However, the tax-to-wealth ratio may be higher for households in the upper middle of the wealth distribution, who hold the majority of their wealth in their main residence, than for top wealth households that also hold other assets (e.g. financial and business assets) that are not subject to recurrent taxes on immovable property. As owner-occupied housing wealth is less concentrated than secondary real estate and financial wealth across the wealth distribution, taxing owner-occupied housing may be less progressive than taxing other asset classes.

The distributional effects of recurrent property taxes will also depend on dynamic factors including tax capitalisation and the final economic incidence of the tax. The degree of tax capitalisation, i.e. the extent to which future tax liabilities reduce the price of housing assets, will affect the distributional consequences of recurrent property taxes by determining who bears the tax’s final economic incidence. For instance, where full capitalisation occurs (i.e. when after controlling for all housing characteristics, differences in housing prices are exactly equal to the present value of variations in expected tax liabilities), current owners bear the final economic incidence of a tax change, while partial capitalisation suggests that current owners are able to partly shift the incidence onto new buyers. Empirical studies find strong evidence for the capitalisation of recurrent immovable property taxes into house prices, with some studies finding full capitalisation (Borge and Rattsø, 2013[31]; Gallagher, Kurban and Persky, 2013[32]; Palmon and Smith, 1998[33]; Oates, 1969[34])). The distributional effect will therefore depend on the profile of incumbent and prospective owners; if the latter are younger and less wealthy households, a strong degree of tax capitalisation may suggest more progressive effects. In the case of rental housing, the distributional effects of recurrent taxes on immovable property will also depend on whether the owner or the renter bears the final economic incidence of the tax. For instance, a property tax may be more progressive where property owners are unable to shift the full tax burden onto renters in the form of higher rents. In contrast, where property owners can fully shift the property tax onto renters, it will have the same distributional impacts as a tax levied on the occupants of a property (e.g. the Council Tax in the United Kingdom or the Taxe d’habitation in France). The degree of tax capitalisation and the final economic incidence of the tax will ultimately depend on demand and supply elasticities as well as other factors including regulations (e.g. rent controls) (Hilber (2017[35])).

Recurrent property taxes also raise liquidity concerns for income-poor but asset-rich households. Evidence shows that low-income households hold housing wealth (Chapter 2), which is an illiquid asset that, in the case of owner-occupied housing, does not generate income. Higher recurrent taxes on immovable property may therefore lead to liquidity issues if taxpayers do not have the necessary income to pay the tax. This issue will be particularly challenging in periods during which house prices increase significantly, as homeowners could see the value of their property increase without necessarily seeing a corresponding increase in their income (European Commission, 2012[36]).This issue has also been raised with regard to retirees who have high owner-occupied housing wealth compared to their incomes (Chapter 2). However, some evidence from Canada shows that low-income retired homeowners do not face higher property tax liabilities than other low-income homeowners (Palameta and Macredie, 2005[27]), which may partly reflect tax design leading to low effective property taxes, resulting for instance from property tax relief for seniors or the fact that they are often levied on outdated property values. Given these features of tax design and tax relief are common across OECD countries, these results could apply in other countries, though further research would be needed.

The efficiency, equity and revenue raising potential of recurrent taxes on immovable property also critically depend on the way they are designed. As discussed in detail below, the efficiency, equity and revenue raising potential of recurrent property taxes ultimately depends on their design including the breadth of the tax base, the applicable tax rates, the availability of tax relief for low-income households, and perhaps more fundamentally on whether the tax is levied on regularly updated property values. The assessment below suggests that there is significant room to improve the design of recurrent taxes on immovable property in the OECD and that countries could consider a number of reforms to boost their efficiency, equity and revenues. There are also various strategies that governments could adopt to enhance the public acceptability of property tax reforms.

Box 3.1. The theoretical conceptualisation of recurrent taxes on immovable property

The theoretical literature can be broadly grouped into three alternative views on the nature of recurrent taxes on immovable property. The different conceptualisations bear important implications for the assessment of the efficiency, equity and final economic incidence of recurrent property taxes.

The traditional view

The “traditional view” conceptualises local property taxes largely as taxes on housing services (Edgeworth, 1897[37]). It is based on a partial equilibrium approach in which the property tax levy is conceptually divided into a tax that falls on immobile land and a tax on mobile capital (i.e. buildings and improvements). While the former is capitalised into land values, the latter is shifted onto the final housing consumer. Empirical work based on this view finds that recurrent property taxes are regressive with respect to income, as the share of taxes paid falls along the income distribution. Property taxes, where they are levied on structures, are also found to be inefficient as they distort the allocation of housing capital.

The capital view

The “capital view” considers the recurrent property tax to be a tax on capital (Mieszkowski, 1972[38]). The approach is based on a general equilibrium model, in which capital is in fixed supply at the national level but mobile across sub-national jurisdictions. While property tax changes on a jurisdictional level may temporarily affect house prices locally (following the mechanisms outlined in the traditional view), capital allocation adjusts over time, equalising after-tax returns of capital. From a national perspective, the tax burden falls on capital owners, which given a higher concentration of capital among high-income and wealth holders implies that property taxes have progressive distributional effects. Regarding their impact on economic efficiency, property taxes are expected to distort the allocation of capital and therefore to generate inefficiency costs.

The benefit view

The “benefit view” conceptualises recurrent taxes on immovable property as a fee for local public services (Hamilton, 1975[39]). Following this view, mobile taxpayers “vote with their feet” and locate in jurisdictions that offer their preferred level of local public services and housing values. Inter-jurisdictional competition coupled with consumer mobility therefore implies that local public services can be provided efficiently as the distortive impact would be small if taxpayers believe the tax aligns with the cost of public services. Moreover, the distributional impact is considered neutral as tax liabilities are offset by gains from consuming public services.

Value-based property tax systems, particularly those relying on market values rather than annual rental values, are more efficient and equitable than area-based ones. Value-based systems that rely on market values are preferable to area-based systems that rely on the size of the property, which is likely to be a poor proxy for taxpayers’ housing wealth and ability to pay as it disregards other physical characteristics of the property and its location,4 which are key determinants of its value. In practice, area-based property taxes are rare in the OECD (the Czech Republic, Israel, Poland, and the Slovak Republic) and they are typically not purely area-based as they often include adjustments taking into account other characteristics of the property, including its location. Value-based property taxes, on the other hand, include both taxes relying on capital values (i.e. market prices of the property) and taxes relying on annual rental values (i.e. prices at which the property can be rented). While the two values may be mathematically equivalent under certain conditions, most countries rely on capital values as this method allows capturing the highest and best use of a property (rather than current use as is the case with rents) (Slack and Bird, 2014[15]) and can avoid valuation challenges where rent controls are in place (Kelly, White and Anand, 2020[42]).

Regularly updating property values is also key to the efficiency, equity and revenue potential of recurrent taxes on immovable property. Levying the tax on outdated property values creates distortions between older housing that has not been revalued for some time and newer housing that has been recently valued, as well as between properties that were valued at the same time but have experienced varying degrees of price growth. The low tax burdens arising from outdated values also reduce incentives to use the current housing stock efficiently, giving homeowners an incentive to remain in undervalued homes. For instance, in large cities where house prices have increased significantly but property tax burdens (based on outdated property values) have not, older households are not incentivised to downsize to smaller and less valuable homes and free up housing space for younger families. In addition, levying taxes on outdated property values reduces horizontal equity (as households with properties of similar value may not face similar tax liabilities) and vertical equity (as households with more valuable housing may not pay more taxes) (Mirrlees et al., 2011[43]). Empirical evidence finds that outdated property assessments tend to make recurrent property taxes regressive (Hodge et al., 2017[44]; McMillen and Singh, 2020[45]). Levying recurrent property taxes on properties whose values are not regularly updated also means that increases in property values may in some cases go fully untaxed, for instance if capital gains on housing are exempt. Finally, outdated property values undermine the revenue potential of property taxes (see Section 3.2.2) and their ability to limit house price volatility and growth, and infrequent revaluations increase the risks of sudden spikes in tax liabilities when properties are eventually revalued (Slack and Bird (2014[15])). In some cases, these potential spikes can add to the pressures faced by governments to temporarily defer or permanently abandon further revaluations. Thus, ensuring that recurrent property taxes are levied on regularly updated values is a prerequisite to guarantee their efficiency, equity and revenue raising potential.

While experiences across the OECD vary, many countries do not have provisions for regular revaluations or have postponed revaluations. Several countries regularly revalue land and properties, including New South Wales in Australia (yearly; taxable values are the average of the preceding three years), Lithuania (yearly; taxable values are valid for five years5), New Zealand (every three years), and Norway (yearly for municipalities using values estimated for net wealth tax purposes; every ten years otherwise). On the other hand, a number of countries rely on significantly outdated property values. For instance, property values used for tax purposes date from 1973 in Austria, 1975 in Belgium, 1970 in France, 1964 in former West Germany and 1935 in former East Germany,6 1941 in Luxembourg, and 1991 in the United Kingdom. Several countries index the values with inflation or use a corrective factor (Slack and Bird (2014[15])). While indexing is simple and may help ensure revenue buoyancy, it leads to inequities in the long run as it does not capture varying price growth across different areas or properties. Thus, regular revaluations are the only method guaranteeing that property taxes continue to raise revenue in an efficient and equitable way.

There are different approaches to revaluing properties, but digitalisation is reducing the costs of regular appraisals. The most common valuation approach is the sales (or rent) comparison method, which uses recent sales and property-specific data in order to compare the property being appraised with similar properties (OECD, 2021[5]). Regularly appraising property values according to this method is administratively costly. Digitalisation and the use of computer-assisted mass appraisals (CAMA), which estimate values for a group of properties using mathematical modelling, may reduce the costs associated with frequent property revaluations, although they require high-quality data and significant technical capacity, and may be better undertaken by higher levels of government (OECD, 2021[5]).7 Data from digital platforms advertising properties for sale (e.g. Zillow, Seloger) may also enhance the ability of governments to accurately undertake regular property valuations. In addition to being technically challenging, property revaluations can be highly unpopular. To address this issue, countries relying on outdated values and wishing to set up a system of regular valuations could consider embedding such a reform in a more comprehensive property tax overhaul, with measures to mitigate potential increases in tax liabilities, as was done in Denmark and Ireland (Box 3.2).

Box 3.2. Recent reforms updating cadastral values for recurrent property taxation

Denmark

Denmark froze property values in 2002, which contributed to booming housing prices in the first decade of the 21st century and a fall in effective tax rates. These tax savings were shown to be unequally distributed across regions, with the largest average benefits accruing to homeowners in the Greater Copenhagen area (Dam et al., 2011[46]).

In 2017, a major property tax reform was passed which entailed a reassessment of properties’ fair market values. Under this new system, property values are to be updated every second year (starting in 2020) and updated tax liability assessments began to be issued in 2021. Given the nearly two decade-long tax freeze, reassessments had been expected to significantly raise tax obligations, particularly in areas having witnessed significant house price increases.

To cushion the increase in tax liabilities and increase political support, the government embedded the update of property values in a comprehensive property tax reform. The statutory property tax rate was lowered from 1% to 0.6% and a surtax aimed at high-value properties was applied above a value threshold. To address liquidity concerns and protect owner-occupiers, homeowners whose overall property taxes increase with the new system were compensated through a tax rebate in 2021 and will have the option to defer the future increase in recurrent property tax liabilities until the sale of the property.

The comprehensive approach to Denmark’s property tax base reform is likely to have contributed significantly to its political success. While measures compensating adversely affected taxpayers will impact tax revenues in the short run, the reform increases the equity and future revenue-raising potential of the tax, and is expected to reduce house price volatility in the long run.

Ireland

Following the introduction of the Local Property Tax (LPT) in 2013, property values for tax purposes were due to be revalued in 2016. As this revaluation was subsequently delayed, property values were outdated and properties that had been built since 2013 were not subject to the tax.

The LPT reform introduced in 2021 cut tax rates, broadened the base, required taxpayers to update their self-assessed property valuation and brought previously exempt housing (built since 2013) into scope.

The reform is expected to decrease or leave property tax liabilities unchanged for the majority of taxpayers. Around one third of the taxpayers are expected to face an increase in their recurrent property tax burden of up to EUR 100 (USD 118) per year while only 3% should face an increase of more than EUR 100. To support lower-income households, the reform also increased the income threshold below which taxpayers are eligible for property tax deferral and lowered the interest charged on deferred tax payments from 4% to 3%.

Allowing for tax payments in instalments may reduce liquidity constraints and salience, while third-party remittance may also enhance tax compliance. Property tax payments often involve one or two large payments, which may raise liquidity issues given insufficient financial planning and tight household budgets (Slack and Bird, 2014[15]). Households may need to save in advance to pay the tax and then bear the responsibility of remitting the tax, which also increases its salience. Tax payments in instalments may therefore help individuals manage their expenses and reduce their liquidity constraints, as well as reduce the salience of the property tax. Studies have found that well-designed instalment schemes can increase tax compliance (OECD, 2021[5]), Reschovsky and Waldhart (2012[50])). The option for third-party remittance (e.g. in Ireland where taxpayers can opt for the property tax to be remitted by their employer or pension provider) may also help reduce compliance costs.

There is a strong case for providing tax deferral in certain cases to alleviate liquidity issues, though deferral programmes may raise some administrative complexities or cause temporary revenue shortfalls. There is a strong case for addressing liquidity issues through tax deferrals to reduce the potential for hardship and the need for less efficient and equitable forms of relief (such as broad exemptions or delaying property revaluations). Several countries offer tax deferrals (typically subject to interest payments) allowing taxpayers to delay some or all of their tax payments to some future period when taxpayers have a greater ability to pay (e.g. until the house is sold or transferred). This effectively gives rise to a tax debt secured against the housing asset. These deferral provisions are typically restricted to certain categories of taxpayers, such as low-income and senior taxpayers (see Box 3.3). Tax deferrals raise some challenges, however. If deferral provisions are targeted, there may be administrative and equity challenges associated with defining and identifying qualifying taxpayers. On the other hand, an automatic right to deferral (i.e. not dependent on income or wealth) may be simpler but poorly targeted and could lead to significant revenue shortfalls in the short-and medium-run (Slack and Bird, 2014[15]; Munnell, Hou and Walters, 2022[51]). Charging interest on unpaid tax liabilities could also discourage people from using tax deferral where interest rates could rise and property values could fall, and raise complexity, although digitalisation has made it much easier to track tax liabilities over time. Countries should charge interest at a rate that ensures that households are neither penalised nor advantaged by their decision to defer. An alternative option for tax deferral could be to register the tax authority’s right to an equity share in the property, equal to the tax liability as a share of the housing’s market value at that time, which would accrue on sale to the tax authority (Muellbauer, 2018[52]).8 Such a system would protect individuals from falls in property values, but allow tax authorities to benefit from rising values. At the same time, an equity-based deferral system would expose tax authorities to housing market fluctuations. Administrative considerations aside, some studies of existing deferral programmes show surprisingly low take-up, because elderly households typically wish to leave property to their heirs without substantial tax obligations attached to them (Slack and Bird, 2014[15]) and because liquidity issues may be less of a concern than commonly expected (Bowman, 2006[53]).

Property tax relief can lead to unintended effects if it is not carefully designed, but is an alternative to enhance the equity of recurrent taxes on immovable property. Property tax relief on owner-occupied housing may enhance the equity of property taxes, but there are risks that, in addition to narrowing the tax base, the relief could be capitalised into house prices and weaken the link between taxes paid and local public services received. Relief should be designed in a way that minimises these potential negative effects while strengthening progressivity. One option is to provide a limited exemption to all taxpayers (e.g. homestead exemptions in the United States). Relief should be provided in the form of a flat-amount, rather than as a percentage of the housing value; a flat-amount exemption has a progressive impact on the distribution of property taxes because lower-income households tend to have less valuable properties, so the relief accounts for a larger share of their home values (Langley, 2015[54]). A limited basic exemption would also remove from the tax base very low-value properties on which limited tax revenue is typically collected. Alternatively, a more targeted property tax credit or exemption can be provided. Many countries target relief at low-income homeowners as they are more likely to lack the liquidity to pay the property tax, but additional criteria could be considered. For instance, in the United States, about one-third of states cap property tax liabilities as a share of income, an approach referred to as a circuit breaker, and generally target the tax relief to lower-income households and seniors. This type of income testing could be complemented by wealth testing (e.g. by taking into account the value of the taxpayer’s main residence or total housing wealth) to target support to taxpayers who are both low-income and low-wealth and avoid providing relief to households with limited income but sizeable housing wealth. Property tax relief could also take into account the number of occupants or dependent children (e.g. Belgium). Importantly, the need for property tax relief will also depend on other features of property tax systems. Where property tax liabilities tend to be low and where a well-functioning tax deferral system is in place, tax relief may be less necessary (see above).

Box 3.3. Property tax deferrals in different countries

Several OECD countries provide property tax deferral schemes, which are commonly restricted to certain types of taxpayers, including seniors and low-income households. Deferrals can also be used as transitional measures during reforms to protect taxpayers from significant increases in property tax obligations.

In Canada, provincial and local governments administer tax deferral schemes, which are commonly restricted to seniors, widowed and disabled taxpayers. Tax deferrals are commonly capped and interest (at or below market rate) is charged on the unpaid amount. The province of Alberta offers a “Seniors Property Tax Deferral Program” providing taxpayers with a low-interest equity loan on their primary residence, which covers property tax payments until the sale of the house (or any earlier date), at which point the loan is repaid plus interest (the programme charges simple instead of compound interest). Only taxpayers over 65 are eligible under the condition that they hold at least 25% equity in their primary residence and the property is covered by insurance.

In Denmark, a property tax deferral scheme was introduced as part of a comprehensive property tax reform (see Box 3.2), in which property value reassessments risked increasing recurrent property tax liabilities significantly. To alleviate liquidity concerns, the reform allowed deferring increases in tax liabilities until the sale of the property.

Ireland provides full and partial property tax payment deferral to taxpayers who meet certain conditions related to their financial situation and property characteristics (residential vs. rental property). Interest is charged on the unpaid amount while the available deferral duration depends on the specific case and the taxpayer’s income (adjusted for mortgage interest payments on the main residence), personal insolvency or hardship (i.e. a significant and unexpected financial loss or expense).

In the United States, many states provide partial or full property tax deferral to eligible seniors, low-income, disabled or widowed taxpayers, or active military personnel. The deferred amount may be capped and may be combined with other tax relief (such as homestead exemptions), and interest charges apply. Payment of the outstanding amount is due on death or sale of the property. Eligibility for the programmes is often tied to both age and income limits (in addition to minimum equity requirements and certain property characteristics).

Progressive tax rates may be used to enhance the equity of recurrent taxes on immovable property, although progressive taxation might be more effectively achieved at higher levels of government. Progressive property tax rates apply in a minority of OECD countries and may enhance vertical equity, as taxpayers with higher-value properties face proportionately higher tax liabilities. Progressivity can also be achieved through tax relief for poorer and low-wealth households (see above). The effectiveness of progressive tax rates in increasing the overall progressivity of the tax system will depend on the distribution of housing along the income and wealth distributions; it will be enhanced in countries where housing wealth is concentrated at the top (OECD, 2021[5]). However, progressive tax rates may be more distortive than flat rates, as taxpayers may, for instance, bunch below value thresholds or move to lower-tax locations (Best and Kleven, 2018[55]). These behavioural effects will depend on tax design, however. More generally, there is a question as to whether the property tax, which is levied at the local level and intended to finance local public services, should be progressive. Redistribution is typically better achieved at higher levels of government to ensure that residents in poor and rich localities are considered equally. An alternative to progressive property tax rates on individual properties consists in levying progressive taxes on taxpayers’ total net housing wealth (e.g. Korea and France both levy national-level progressive taxes on overall real estate wealth above a certain threshold).

Higher recurrent taxes on secondary residences may enhance progressivity, but this depends on tax incidence and could create equity issues regarding renters. In many countries, secondary residences are in practice subject to higher taxation due to exemptions or higher tax-free thresholds for owner-occupied housing. As secondary real estate is highly concentrated at the top of the income and wealth distributions (see Chapter 2), imposing higher recurrent property tax rates on secondary residences could enhance progressivity. However, this could increase the already highly preferential taxation of owner-occupied housing and may lead to equity concerns in the case of rented housing. It is also important to distinguish between secondary property used for long-term rentals and properties used for short-term rentals, as well as secondary residences that do not generate income (e.g. holiday homes, pied à terre in urban centres). Higher taxes on long-term rental properties could reduce equity if renters, who tend to have low wealth and lower incomes (Chapter 2), ultimately bear the economic incidence of the tax. In contrast, if the incidence of higher taxes on short-term holiday rentals were to fall on short-term renters, this may be less concerning from an equity perspective. Higher recurrent property taxes on housing not used to generate income would be expected to enhance equity, as the incidence would fall upon the owner.

The use of banding, caps and assessment limits reduces the progressivity and revenue potential of recurrent taxes on immovable property. While property tax caps, assessment limits, and banding have commonly been used to keep property tax liabilities low, alleviate liquidity issues, and smooth property value increases, these policy measures generate a number of issues. In particular, caps limiting the increase in tax liabilities and assessment limits restricting the increase in cadastral values ultimately reduce progressivity, as people with the most valuable property or experiencing the most significant increases in housing values stand to benefit the most (Slack and Bird, 2014[15]). Caps and assessment limits also reduce the extent to which tax liabilities reflect rising house prices, which reduces tax revenues. The use of banding systems (i.e. where properties are assigned to value bands and the same tax is owed for properties within the same band) also raises equity issues. The tax burden is the same for all the properties within each band, which implies that the effective tax burden (measured as the tax liability as a share of the property value) is highest for the lowest-value properties and lowest for the highest-value properties in each value band.

Countries can adopt various strategies to address the unpopularity of property tax reforms and enhance their public acceptability and political feasibility. Recurrent property tax reforms have traditionally been met with strong public resistance due to the taxes’ high salience (as it is often the most visible tax that people pay, particularly when it is paid in a lump-sum), the non-direct link to income and potential liquidity issues, its perceived regressivity, and issues around property valuation (Slack and Bird, 2014[15]). There are different options that governments may consider to enhance the public acceptability and political feasibility of property tax reform. One option is to bundle reforms with other tax changes (e.g. reductions in transaction or labour taxes) or improvements in local public service delivery (Slack and Bird, 2014[15]). Indeed, empirical analyses show that taxpayers who directly benefit from their tax contributions, through improvements in local public services for instance, are more willing to pay higher property taxes (Giaccobasso et al., 2022[56]). Proactive efforts to disseminate information as to how property tax revenues are spent are also critical as taxpayers may not always be aware of how tax revenues are used by local governments (Giaccobasso et al., 2022[56]). More generally, public support and compliance is also promoted by designing a simple, easily understandable and well-enforced property tax, which includes a well functioning and well-communicated property valuation system and appeals process (OECD, 2021[5]). Additional measures to simplify tax compliance, such as the option for property tax withholding by the employer or the pension provider (e.g. Ireland) or the mortgage provider (e.g. escrow accounts in the United States), may also be considered. Measures to mitigate potential regressive effects and liquidity issues, such as property tax deferral and relief to low-income or low-wealth households (see above), are also likely to make property tax reforms more palatable.

Reforms involving shifts from distortive taxes towards recurrent taxes on immovable property may also raise political and governance challenges between different levels of government. There have been frequent calls to shift the tax mix away from taxes deemed distortive (e.g. income taxes or property transaction taxes) towards recurrent taxes on immovable property (Arnold et al., 2011[57]) (Andrews, Caldera Sánchez and Johansson, 2011[58]; Norregaard, 2013[16]; IMF, 2013[59]). However, such shifts often imply reducing taxes mostly raised at central government levels, and increasing revenues from taxes commonly levied by local governments. A shift towards recurrent taxes on immovable property will therefore affect intergovernmental fiscal relations, as it would increase tax revenue and autonomy at sub-central levels. A tax mix shift towards recurrent property taxes may also require some central government co-ordination between municipalities for reform to happen. Indeed, sub-central governments may be reluctant to raise property taxes given the potential for lower intergovernmental transfers, political sensitivity due to their proximity to the taxpayer, and tax competition between municipalities. There may also be regional inequalities between municipalities with different revenue raising capacities (Blochinger, 2018). For instance, municipalities where property values are higher may be able to levy lower property tax rates while maintaining revenues. These adverse effects could be alleviated through coordination whereby common tax base rules are applied across municipalities and the central government sets minimum and maximum tax rates.

Shifts from transaction taxes to recurrent taxes on immovable property can also include transitional measures to reduce potential impacts on house prices and concerns about households paying both high (pre-reform) transaction taxes and high (post-reform) recurrent taxes. Several OECD countries have introduced reforms in recent years aimed at reducing property transaction taxes and raising recurrent taxes on immovable property (OECD, 2021[5]). Such tax shifts may raise concerns about those property owners who paid the higher transaction taxes (before the introduction of the reform) and are liable to increased recurrent taxes on immovable property upon the introduction of the reform. In addition, the capitalisation of lower transaction taxes may not be matched by the capitalisation of higher recurrent immovable property taxes, potentially causing house prices to increase, if taxpayers are myopic about future tax liabilities or value lower taxes today more than future higher taxes. To help taxpayers adjust to tax changes, smooth tax capitalisation and enhance public acceptability, tax shifts can be gradually phased in. For instance, a gradual shift is being implemented in the Australian Capital Territory (ACT) where the property transfer tax (residential conveyance duty) is being phased out over a 20-year period (earlier for some types of properties), while broadening the base and increasing the rates of the recurrent tax on unimproved immovable property (Tax and Transfer Policy Institute et al., 2020[60]), making the tax overall more progressive. Another option may be to let taxpayers choose between tax regimes to limit increases in tax liabilities and enhance support for the reform. For example, in 2021, the New South Wales government in Australia invited taxpayers to comment on a proposed property tax reform that would allow property owners to choose between the existing tax regime, including higher transaction taxes and lower recurrent taxes on immovable property, or the new regime, which abolishes transaction taxes (or refunds transaction taxes recently paid) and increases recurrent property taxes (NSW Treasury, 2021[61]). While allowing taxpayers to choose between systems might raise administrative complexity and create tax minimisation opportunities, the benefits of successfully implementing the reform may outweigh these drawbacks.

The design of property transaction taxes should minimise welfare costs and ensure that residential mobility is not impeded

Transaction taxes on immovable property are common across OECD countries. Transaction taxes on immovable property, which are levied in 30 out of 38 OECD countries, apply nearly always to the market value of the property at the time of sale (that is, the purchase price). Transaction tax rates are generally flat, although seven countries apply progressive tax rates with respect to the property value (Australia, Canada, Israel, Korea, Mexico, Portugal, and the United Kingdom). The tax is due by the buyer of the property9 at the time of the property purchase. Four countries provide tax exemptions below a certain housing value threshold (Australia, Austria, Canada, and Portugal) while six countries apply exemptions or preferential taxation for first-time buyers (Australia, Canada, Hungary, Italy, and the United Kingdom). New residential housing is commonly exempt from transaction taxes (or subject to lower tax rates, e.g. France), and Value Added Tax (VAT) usually applies, though sometimes at a reduced rate.

Property transaction taxes are attractive from an administrative and political economy perspective. Transaction taxes have a number of administrative advantages. As the tax base is generally the purchase price (or closely related to the purchase price), it is highly visible and precisely measured. Transaction taxes are levied at a time when taxpayers usually have greater liquidity, especially if they are selling a property to purchase a new one, and thus avoid some of the difficulties associated with taxing illiquid housing assets. Additionally, buyers have an incentive to report the housing transaction to acquire the legal documents and guarantee their property rights (Norregaard, 2013[16]) (although there is evidence that some taxpayers declare lower purchase prices to evade transaction taxes; see below). Overall, transaction taxes are commonly associated with high compliance rates and relatively low administrative costs compared to other taxes on housing. Transaction taxes also seem to raise fewer political economy hurdles than other housing taxes. Even though they are highly salient taxes, as taxpayers are responsible for remitting the tax and evidence on tax capitalisation suggests that taxpayers take them into consideration when agreeing on a purchase price, public opposition to transaction taxes seems less pronounced than for some other property taxes. This may be in part because they are levied when taxpayers expect to incur a range of expenses (e.g. taxes, legal fees, moving costs) and have greater liquidity.

However, the literature has repeatedly emphasised the distortive nature of transaction taxes. The conclusion that property transaction taxes are highly distortionary and therefore detrimental to economic growth follows from the well-known Diamond and Mirrlees (1971[18]) finding that taxing intermediate transactions is inefficient. As such, it is always preferable to tax the income and services provided by assets than their purchase or sale. In both cases, taxation discourages asset ownership, but a transaction tax also discourages transactions that would allocate the asset more efficiently. To decrease distortions and enhance efficiency, a reduction in property transaction taxes, financed through increases in less distortive taxes, has therefore been strongly advocated (Brys et al., 2016[14]; Andrews, Caldera Sánchez and Johansson, 2011[58]).

Transaction taxes can have adverse efficiency effects by discouraging housing transactions, which can in turn affect residential and labour mobility. Transaction taxes can deter transactions on housing markets by affecting the payoff of the housing transaction for the buyer and the seller. On the one hand, they can increase the purchase cost for the buyer if the tax-inclusive price of the housing asset increases. On the other hand, they can reduce the price received by the seller if the tax is capitalised, leading to a lower pre-tax house price. The final economic incidence depends on demand and supply elasticities. If buyers are less responsive to higher prices, they will bear a larger share of the tax burden. In contrast, if buyers are more price-elastic than sellers, transaction taxes will be capitalised into house prices and predominantly fall on sellers (and after-tax house prices will not change much in response to the tax change). In either case, however, the tax may discourage an otherwise mutually beneficial transaction, and prevent a more efficient allocation of housing. Transaction taxes may also have wider repercussions on labour markets as higher transaction taxes may prevent relocations allowing people to access employment opportunities.

Empirical evidence generally finds that transaction taxes reduce prices and transaction volumes, but evidence regarding the magnitude of economic distortions is mixed. Across OECD countries, higher transaction taxes are correlated with a reduction in residential mobility (Causa and Pichelmann, 2020[62]). The vast majority of studies exploiting transaction tax reforms or discontinuities in tax rate schedules find a significant negative effect of transaction taxes on transaction volumes, based on evidence from Australia (Davidoff and Leigh, 2013[63]), Canada (Dachis, Duranton and Turner, 2012[64]), Finland (Eerola et al., 2019[65]), Germany (Dolls et al., 2021[1]; Fritzsche and Vandrei, 2019[66]), the United Kingdom10 ( (Best and Kleven, 2018[55]; Besley, Meads and Surico, 2014[67]), and the United States (Kopczuk and Munroe, 2015[68]). Several empirical analyses show that the tax burden is mostly capitalised into house prices (i.e. the tax incidence falls on the seller) (Besley, Meads and Surico, 2014[67]; Dachis, Duranton and Turner, 2012[64]; Davidoff and Leigh, 2013[63]; Dolls et al., 2021[1]; Kopczuk and Munroe, 2015[68]), with some studies even showing a disproportionately higher price decrease relative to the property tax increase (also referred to as over shifting) (Davidoff and Leigh, 2013[63]; Kopczuk and Munroe, 2015[68]) for properties that are expected to be traded frequently in the future (Dolls et al., 2021[1]). However, some empirical analyses question the magnitude of the distortions caused by transaction taxes. Results by Slemrod, Weber and Shan (2017[69]) show that transaction taxes only have small effects on buying and selling behaviours, which is why the authors conclude that transaction taxes generate comparably small welfare costs. Other studies suggest that the negative correlation between transaction taxes and transaction volumes could be driven partly by shifts in the timing of housing transactions (Besley, Meads and Surico, 2014[67]; Fritzsche and Vandrei, 2019[66]) or responses to non-tax factors that accompany transaction tax reforms such as the Great Recession and tighter mortgage market regulations (Haider, Anwar and Holmes, 2016[70]).

The relationship between transaction taxes, residential mobility, and labour mobility is complex as it may depend on relocation motives, homeownership patterns among workers and tax design. Different relocation motives might influence the impact of transaction taxes on residential mobility. For instance, relocation due to significant life events (e.g. changing jobs, retirement) might be less affected by transaction taxes than short-distance moves to better align housing with individual needs. In both the United Kingdom (Hilber and Lyytikäinen, 2017[71]) and Finland (Eerola et al., 2019[72]), evidence shows that short-distance, housing-related relocations are more strongly affected by transaction tax changes than long-distance, job-related moves. While Hilber and Lyytikainen (2017[71]) find no effect of transaction taxes on long-distance moves, results by Eerola et al. (2019[72]) show significant negative effects, suggesting that transaction taxes may also affect labour markets. Eerola et al. (2019[65]) also find evidence that transaction taxes have a stronger effect on property upsizing than on downsizing and on moves involving small adjustments in housing unit size. The effect of transaction taxes on labour mobility might also be influenced by the prevalence of homeownership among workers. In Germany, Petkova and Weichenrieder (2017[73]) find that particularly mobile workers self-select into the rental market, and while transaction taxes lower labour mobility for owner-occupiers, they have a limited effect on typically more mobile renters. The design of transaction taxes may also influence their impact on mobility; for example, Caldera Sanchez and Andrews (2011[74]) find that higher transaction tax rates have a larger effect on mobility than lower rates. Overall, the evidence suggests that the impact of transaction taxes on mobility is complex, depends on country-specific circumstances, and may affect short-distance residential moves more than long-distance labour mobility.