Productivity growth reflects changes in the volume of output that are not explained by corresponding changes in the volume of observable inputs. While the simplest productivity measures are single-factor ratios where output is divided by the amount of a single input, e.g. labour in the case of labour productivity, such measures are affected by changes in the volume of other inputs. This is why Multifactor Productivity, sometimes called Total Factor Productivity, where output is divided by a combination of observable inputs, is often preferred. This chapter discusses the importance of multifactor productivity for economic growth and the associated measurement issues drawing on the economic literature.

Identifying the Main Drivers of Productivity Growth

2. The importance of MFP for economic growth

Abstract

Introduction

Productivity growth reflects changes in the volume of output that are not explained by corresponding changes in the volume of observable inputs. The easiest way to think about it is as an output-to-input ratio. While the simplest productivity measures are single-factor ratios where output is divided by the amount of a single input, e.g. labour in the case of labour productivity, such measures are affected by changes in the volume of other inputs. For example, an increase in the volume of capital at the disposal of workers usually leads to higher labour productivity. This is why Multifactor Productivity (MFP), sometimes called Total Factor Productivity (TFP), where output is divided by a combination of observable inputs, is often preferred. It is possible to think about MFP from a production-maximisation as well as from a cost-minimisation perspective. A positive change in MFP raises the volume of output that can be produced with a given volume of inputs and, at the same time, reduces the volume of inputs that are necessary to produce a given volume of output.

This chapter discusses the importance of MFP for growth and associated measurement issues drawing on the economic literature. Solow’s growth accounting framework is at the heart of MFP measurement, and MFP itself is commonly referred to as Solow’s residual.

In order to assess the importance of MFP for economic growth, it seems more relevant to focus on its contribution to labour productivity growth than on its contribution to GDP growth. Indeed, the main theoretical channels through which MFP influences GDP growth is through labour productivity growth. Empirically, MFP accounts for a significant part of labour productivity growth. Moreover, its trends and fluctuations have been driving labour productivity growth in advanced economies since the mid-20th century.

Turning to measurement issues, the exact contribution of MFP to labour productivity growth depends on whether the composition of labour and capital is accounted for, and which types of assets are considered. Accounting for intangible capital turns out to be key for advanced economies. But even with these adjustments, the average contribution of MFP to labour productivity growth remains significant.

Nevertheless, distinguishing between the contributions of MFP and production factors is not always as clear-cut as it seems because some asset complementarities that are typically neglected in growth accounting exercises may contribute to MFP growth. For example, human capital and organisational capital within firms may increase the returns to ICT or R&D investments. Uncovering such complementarities is an active area of research and this will be discussed in subsequent sections of this report. Firm-level data typically allow to capture these effects more precisely than country- or industry-level data due to the variability in the distribution of assets across firms.

Until the 1990s, most productivity studies were based on the view that working with industry-level data was sufficient to understand productivity developments. However, the increasing access to and the use of firm-level microdata has revealed that there is pervasive productivity heterogeneity across firms, including within narrowly defined industries. It turns out that aggregate MFP growth depends on MFP growth within firms, as well as on reallocations between existing firms, and business creations and destructions. Understanding the origins of MFP growth and the factors contributing to it requires considering all these mechanisms and moving away from the representative firm assumption. Nevertheless, macroeconomic approaches remain key to ensure an exhaustive firm coverage and capture all interdependencies and spillovers across firms.

Solow’s growth accounting framework is at the heart of MFP measurement

Even though a number of measurement improvements have been introduced over time, most empirical measures of MFP growth in the macroeconomic literature continue to largely rely on the framework introduced by Solow in 1957. This framework has two main advantages that explain its popularity: it only imposes minimal restrictions to the shape of the production function, and the MFP growth estimates in this framework are based on observable variables. The main restriction to the production function is that the factor (MFP) shifting the production function affects all inputs in the same way. Indeed, MFP arises as a multiplicative factor to the production function (it is said to be Hicks neutral). Output is a function of MFP and of aggregate capital and hours worked , bundled together in a production function F:

The relative change in the volume of output between consecutive periods can then be decomposed into the contribution of the change in the volume of inputs and the contribution of MFP growth:

Under perfect competition, the output elasticities and can be mapped to the price of capital and the price of labour, which then allows to rewrite and as the shares of capital and labour income in value added. The share of labour income in value added can be calculated from the national accounts and, under the additional assumption that the production function has constant returns to scale, the share of capital income in value added is equal to one minus the labour share. Nevertheless the constant returns to scale assumption is convenient but not absolutely needed if the return to capital can be measured directly.

The strongest assumption underlying the growth accounting framework is the equality that is imposed between output elasticities and the remuneration of production factors. Nevertheless, this assumption is difficult to bypass, unless the price-elasticity of the demand addressed to firms or of their markup rate can be estimated.

Equation (2) is at the core of MFP measurement, and of growth accounting more generally. When the capital and labour income shares sum to one, it can be rewritten in a way that also highlights the contribution of MFP to labour productivity growth:

The application of the growth accounting framework has led to diverging results regarding the importance of MFP for economic growth

Based on equation (3), Solow (1957) reached the conclusion that between 1909 and 1949, MFP explained the overwhelming part (nearly 90%) of the growth in private non-farm GDP per hour worked in the United States. The rest of this growth was explained by capital deepening, i.e. by the increase in the stock of capital per hour worked.

Since then, a large number of economic studies have applied Solow’s growth accounting methodology to better understand what are the main determinants of economic growth over time, and to what extent the accumulation of production factors (e.g. labour, capital) contributes to differences in growth rates or output levels across countries. As emphasised by Bosworth and Collins (2003), while relying on apparently similar techniques that are all related to the growth accounting framework developed by Solow (1957), different authors have reached opposite conclusions, with some of them claiming that capital accumulation is an unimportant part of the growth process and others that it is the fundamental determinant of growth.

Clarifying this issue is important from an economic policy perspective. Indeed, if factor accumulation is the main determinant of economic growth, growth-enhancing policies should focus on increasing employment rates, raising the skills of the workforce and encouraging investment in productive assets. If on the contrary, MFP, understood as a proxy for technological progress, is the main contributor to economic growth, such policies should focus more on encouraging innovation and technology transfers from more advanced countries.

In order to assess the importance of MFP for economic growth, it is better to focus on labour productivity growth

In order to assess the importance of MFP for economic growth, it seems more relevant to focus on its contribution to labour productivity growth than on its contribution to GDP growth. Indeed, GDP growth depends on both labour productivity growth and workforce growth, but the main theoretical channels through which MFP influences GDP growth is through labour productivity growth. While economic factors such as income per capita may have an influence on population and workforce growth, the latter are also driven by exogenous factors such as geography, migration, culture and institutions as well as specific policies (Alvarez-Diaz et al., 2018). This justifies why workforce growth should be considered separately.

Focusing on labour productivity rather than GDP growth contributes to explain why different authors reached different conclusions regarding the importance of MFP for economic growth. Indeed, even though the growth rate of MFP enters in the same way in Equation 2 and Equation 3, the contributions of MFP to labour productivity and GDP growth are different. For example, Tinbergen (1942) found that MFP accounted for less than 30% of US economic growth over 1870-1914 while Solow (1957) concluded that MFP explained nearly 90% of GDP per hours worked in the US private non-farm sector over 1909-1949. Admittedly, the periods covered are different, but dynamic population growth over the period covered by Tinbergen probably explains a large part of economic growth over this period.1

Table 2.1 puts together four different growth accounting exercises, over different sets of economies and different periods. It shows that the contribution of MFP to labour productivity growth is usually higher than its contribution to GDP growth, especially for Latin American and East Asian economies, and also more homogeneous across economies and time. This is largely because population growth tends to be higher in developing than in advanced economies. For this reason, the contribution of MFP to GDP growth is mechanically lower in developing than in advanced economies, even in the case where MFP grows at the same rate everywhere. Overall, MFP accounts for a significant share of labour productivity growth over all economies and periods covered in Table 2.1, and there is no major difference across groups of economies and time.

Table 2.1. Contributions of MFP to GDP and labour productivity growth across economies and time

|

|

Capital share |

GDP growth |

Share of GDP growth contributed by |

Share of labour productivity growth contributed by |

|||

|---|---|---|---|---|---|---|---|

|

|

Capital |

Labour |

MFP |

Capital deepening |

MFP |

||

|

OECD 1947-73 |

|

|

|

|

|

|

|

|

France |

0.40 |

5.4% |

41% |

4% |

55% |

41% |

59% |

|

Germany |

0.39 |

6.6% |

41% |

3% |

56% |

41% |

59% |

|

Italy |

0.39 |

5.3% |

34% |

2% |

64% |

34% |

66% |

|

Japan |

0.39 |

9.5% |

35% |

23% |

42% |

33% |

67% |

|

United Kingdom |

0.38 |

3.7% |

47% |

1% |

52% |

47% |

53% |

|

United States |

0.40 |

4.0% |

43% |

24% |

33% |

45% |

55% |

|

OECD 1960-90 |

|

|

|

|

|

||

|

France |

0.42 |

3.5% |

58% |

1% |

41% |

58% |

42% |

|

Germany |

0.40 |

3.2% |

59% |

-8% |

49% |

57% |

43% |

|

Italy |

0.38 |

4.1% |

49% |

3% |

48% |

50% |

50% |

|

Japan |

0.42 |

6.8% |

57% |

14% |

29% |

62% |

38% |

|

United Kingdom |

0.39 |

2.5% |

52% |

-4% |

52% |

51% |

49% |

|

United States |

0.41 |

3.1% |

45% |

42% |

13% |

55% |

45% |

|

Latin America 1940-80 |

|

|

|

|

|

||

|

Argentina |

0.54 |

3.6% |

43% |

26% |

31% |

29% |

71% |

|

Brazil |

0.45 |

6.4% |

51% |

20% |

29% |

54% |

46% |

|

Chile |

0.52 |

3.8% |

34% |

26% |

40% |

13% |

87% |

|

Mexico |

0.69 |

6.3% |

40% |

23% |

37% |

-43% |

143% |

|

Venezuela |

0.55 |

5.2% |

57% |

34% |

9% |

63% |

37% |

|

East Asia 1966-90 |

|

|

|

|

|

||

|

Hong Kong (China) |

0.37 |

7.3% |

42% |

28% |

30% |

46% |

54% |

|

Singapore |

0.53 |

8.5% |

73% |

32% |

-5% |

116% |

-16% |

|

Korea |

0.32 |

10.3% |

46% |

42% |

12% |

69% |

31% |

Source: Easterly and Levine (2001) for capital shares, GDP growth and contributions to GDP growth. They sourced these data from Christenson et al. (1980) and Dougherty (1991) for OECD countries, Elias (1990) for Latin American economies, and Young (1995) for East Asian economies.

OECD calculations for the contributions of capital deepening and MFP to labour productivity growth. Assuming that labour and capital shares sum to 1 (which is the case under perfect competition and constant returns to scale), the contribution of MFP to labour productivity growth C’(A) can be calculated from the capital share and the contributions of labour and MFP to GDP growth, C(L) and C(A) using the following formula:

.

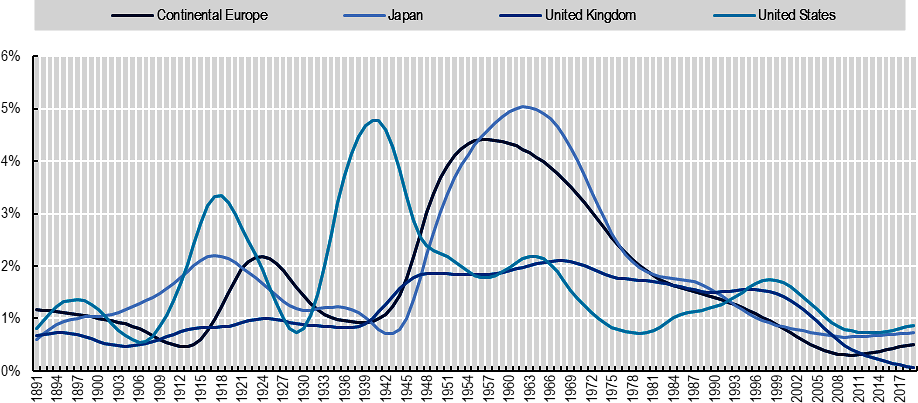

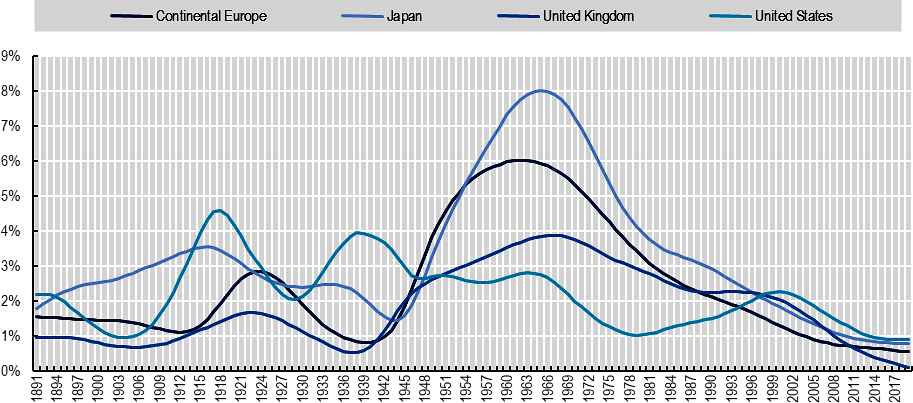

MFP underlies most changes in aggregate labour productivity growth over time

A stable share of labour productivity growth accounted for by MFP does not imply that MFP growth is constant over time. Actually, the opposite is true. The magnitude of MFP growth varies significantly over time and its trends and fluctuations have a direct impact on labour productivity growth (Figure 2.1 and Figure 2.2). The productivity wave in the United States that started before the Second World War reached Europe and Japan with a delay after the War and these countries enjoyed a spectacular phase of MFP and labour productivity growth until the early 1970s. Since then, MFP and labour productivity growth have continuously declined in all advanced countries. Only the United States enjoyed a temporary pickup in productivity from the mid-1990s until the mid-2000s.

Denison (1985) showed that MFP was at the root of the decline in labour productivity growth in the United in the early 1970s. Jorgenson (1988) traced it to slower productivity growth at the level of individual industries and connected it to the increase in energy prices following the first (1973) oil price shock.

The temporary surge in labour and MFP productivity growth in the United States from the mid-1990s to the mid-2000s is related to Information and Communication Technology (ICT). Jorgenson et al. (2008) showed that ICT had a contribution to labour productivity growth through increased ICT capital services per hour worked (capital deepening channel) and a contribution through MFP, with an increase in MFP growth in the ICT-producing industry and in the industries that are the most intensive users of ICT (MFP channel).

While labour productivity and MFP growth in the United Kingdom and the United States between the mid-1990s and the mid-2000s were similar, no rebound in labour productivity growth occurred in continental Europe or Japan during this period. Noticeably, ICT capital deepening is not the main explanation to the divergence between Europe and the United States during this decade. The divergence is mainly related to MFP, in particular to MFP in ICT-intensive services industries such as wholesale and retail sale, finance and insurance (Timmer et al. 2011, Gordon 2020).

After the mid-2000s, labour productivity growth slowed in all advanced economies. For the United States, Fernald et al. (2017) attribute this to a slowdown in MFP that started before the 2008-09 Great Financial Crisis (GFC). Depending on the statistical method used, the MFP slowdown in the United States may have started in early 2006 or even before. Even though MFP growth is potentially subject to mismeasurement, in particular when it comes to the output growth of ICT sectors, neither Byrne et al. (2016) nor Syverson (2016) find evidence that mismeasurement has worsened in the early 2000s and may explain the slowdown in measured MFP. Fernald and Inklaar (2020) also conclude that MFP has been the main driver of the slowdown in labour productivity growth in Europe since the mid-2000s, and that in Southern Europe, this slowdown has been even more pronounced than in the United States.

Figure 2.1. Annual MFP growth in continental Europe, Japan, the United Kingdom and the United States, 1891-2019

Note: “Continental Europe” groups together Finland, France, Germany, Italy, the Netherlands and Spain. Annual MFP growth is smoothed with a Hodrick-Prescott filter.

Source: Bergeaud et al. (2016), OECD calculations based on their online Long-term Productivity Database (v.2.4).

Figure 2.2. Annual labour productivity growth in continental Europe, Japan, the United Kingdom and the United States, 1891-2019

Note: “Continental Europe” groups together Finland, France, Germany, Italy, the Netherlands and Spain. Annual labour productivity growth is smoothed with a Hodrick-Prescott filter.

Source: Bergeaud et al. (2016), OECD calculations based on their online Long-term Productivity Database (v.2.4).

The contribution of MFP to labour productivity growth is sensitive to the measurement of the volume of output and inputs

Measuring the volume of output

Measuring the volume of output for an entire economy implies accounting for heterogeneous goods and services. In this context, volumes cannot be meaningfully measured by summing up quantities of e.g. apples and automobiles. The usual approach in national accounts is to deflate observed values with appropriate price deflators. The unit of measure of volumes is then price-adjusted currency units, or constant prices for short.

As discussed in APO-OECD (2021), the measurement of output values and prices is especially difficult in some economic sectors:

Household sector. The output of this sector is not exchanged through market transactions and values and prices cannot be observed. Therefore, only the goods and the housing services produced by the household sector are included in the national accounts. When household members enter the labour force, this mechanically raises output, but MFP growth should be largely unaffected because MFP measurement accounts for both output and input growth.

Informal economy. Effectively accounting for the existence and size of the informal economy matters critically for an accurate and consistent measurement of economic growth, employment and MFP. To account for the informal economy, all OECD countries introduce exhaustive adjustments to their official GDP measures. Nevertheless, the informal economy is difficult to measure by nature and doing so requires putting in place specific surveys and crossing different statistical sources. As a result, only a minority of emerging economies have the necessary resources to account for the informal economy in their regular national accounts (Conference of European Statisticians, 2021). Developing a statistical framework for measuring the informal economy is one of the priority areas for the update of the 2008 SNA and the Balance of Payments Manuel (BPM6).

Non-market sector. Since non-market output (e.g. administration and defence, and possibly education and health) is distributed for free or at prices that do not reflect full production costs, its value is conventionally calculated as the sum of input values. In most countries, the non-market output volume is estimated by deflating input values and assuming zero productivity. Changes in the size of the non-market sector (e.g. because some activities are transferred to the market sector) may thus distort output and productivity comparisons over time. Moreover, the use of direct indicators to measure the volume of non-market output in a few countries (e.g. the United Kingdom) and not in others may distort cross-country comparisons of productivity evolutions.

Digital economy. The measurement of price indices is notoriously difficult for computers, peripherals, communication equipment and software (ICT equipment for short), even in countries with the most advanced statistical systems. The main issues are (1) to fully capture the rapid quality changes of these products in order to split observed price changes into pure price changes and quality changes, and (2) to introduce new products in price indices as soon as possible in order to capture the significant price declines that typically happen right after their introduction to the market. Nevertheless, these measurement issues are not new and there is no evidence that they have worsened over time (Byrne et al., 2016). The main issue for cross-country comparisons is that different countries may use different quality adjustment techniques for similar ICT equipment, thus leading to undue differences in the corresponding price indices, and in the volume measurement of output and capital services (Schreyer, 2002).

On the input side, APO-OECD (2021) discusses two main measurement improvements that have been progressively implemented in growth accounting studies following Jorgenson and Griliches (1967). They aim at accounting for the composition of the labour force and the capital stock. Only a summary of this discussion is provided thereafter, as well as an illustrative calculation of the share of MFP in labour productivity growth in APO economies when the composition of labour and capital is taken into account.

Accounting for the composition of labour

Traditional measures of labour input, such as employment or hours worked, only account for the volume of labour. These measures treat the labour input of all workers equally, ignoring heterogeneity among workers with potentially different skills and contributions to output and productivity changes. Nevertheless, workers with different skills are not fully interchangeable and firms treat them as distinct inputs by paying different wage rates. The need to account for not only the volume of hours worked, but also the characteristics of the workforce was laid out in the OECD Measuring Productivity Manual (OECD, 2001), and the System of National Accounts 2008 (2008 SNA).

In this approach, workers are grouped together according to differences in marginal productivity, and the contribution of each group to economic growth is calculated as the growth rate in hours worked for this group, weighted by its share in total labour income. In this case, Equation 2 is rewritten as follows:

Similarly, the decomposition of labour productivity growth becomes:

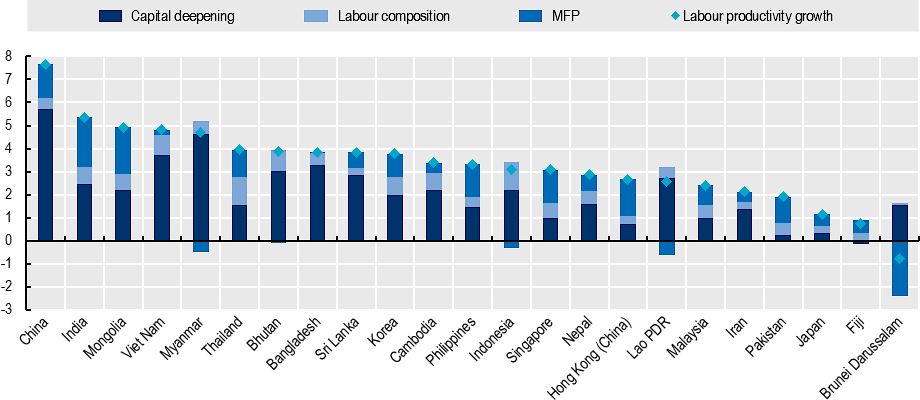

There is no international consensus on how to group workers together, but most studies use a subset of the five variables used by Jorgenson et al. (1987) to cross-classify workers in their productivity analysis of the United States: age, education, employment class occupation and sex. The Asia QALI project (Nomura and Akashi 2017) which is used as input to the APO Productivity database accounts for differences in age, education, employment class and sex across workers. Labour composition (or labour quality) accounts for 20% of labour productivity growth on average across APO economies over 2000-2019 (Figure 2.3). If labour composition was not explicitly taken into account, this contribution would be included in the contribution of MFP.

Figure 2.3. Labour productivity growth in Asian economies, 2000-2019

Annual percentage change

Note: Capital deepening accounts for the composition of capital. In particular, ICT is considered as a specific asset class for the calculation of capital services.

Source: APO Productivity database, 2021.

Accounting for the composition of capital

Accounting for the composition of capital follows the same logic as accounting for the composition of the labour force. Nevertheless, most firms own the capital that they use in the production process. Therefore, the prices of capital services cannot be directly observed, contrary to wages, and they need to be imputed. Following Jorgenson and Griliches (1967) and Hall and Jorgenson (1967), this is done by calculating a user cost of capital, which depends on the rate of return to capital, the asset depreciation and revaluation rates, and the asset price.

In this approach, capital goods are grouped together by homogenous type (e.g. dwellings, transport equipment, information and communication technology) and the contribution of each group to economic growth is calculated as the growth rate of the corresponding capital stock, multiplied by its user cost. As explained in APO-OECD (2021), the user cost of asset i at date t can be calculated as follows:

where is the purchase price of the asset, is the rate of return to capital, is the depreciation rate of the asset, and is its expected price change for a new asset between dates t and (t+1).

As compared to a situation where only the aggregate capital stock would be considered, assets that depreciate fast and/or whose price is expected to decline over time (e.g. ICT assets) receive a higher weight in a growth accounting equation that takes the composition of capital into account. In this case, the decomposition of labour productivity growth becomes:2

Figure 2.3 shows that even though capital deepening and labour composition account for the largest part of labour productivity growth in Asian economies over 2000-2019, the average absolute contribution of MFP remains significant. Excluding Brunei Darussalam, this average amounts to 30% of labour productivity growth.

Extending the asset boundary to better account for intangible capital

Usually, the capital input that is accounted for in growth accounting studies is limited to the produced capital that falls within the asset boundary of the 2008 SNA. This includes residential and non-residential buildings, machinery and equipment, cultivated biological resources, and intellectual property products. Corrado et al. (2009) have opened the way to accounting for a broader definition of intangible capital. They define it as computerised information, innovative property and economic competencies (Table 2.2).3

Accounting for intangible assets has a substantial impact on overall investment, the level and growth of labour productivity, and the relative contributions of capital and MFP to labour productivity growth in the United States (Corrado et al., 2009). Treating expenditure on intangibles as investment instead of intermediate consumption mechanically increases the level of GDP and labour productivity. The impact on growth rates is related to the pace at which investment on intangibles increases over time. According to Corrado et al. (2009), intangible investment in the United States started to grow more rapidly than tangible investment in the 1970s and outpaced it from the 1990s onwards. Taking into account both the upward revision in labour productivity growth and in capital growth, the contribution of MFP to labour productivity growth is revised downwards, from 35% to 25% over 1973-95 and from 51% to 35% over 1995-2003.

Table 2.2. Intangible capital: From the SNA asset boundary to the broader definition considered by Corrado et al. (2009) and their followers

|

|

Asset boundary of the 2008 SNA |

Intangible assets considered by Corrado et al. (2009) and their followers |

|---|---|---|

|

Tangible assets |

Dwellings |

|

|

Other buildings and structures |

||

|

Machinery and equipment |

||

|

Transport equipment |

||

|

ICT equipment (computer hardware and telecommunication equipment) |

||

|

Cultivated biological resources |

||

|

Intangible assets |

Intellectual property products |

Computerised information |

|

Computer software and databases |

Computer software and databases |

|

|

Innovative property |

||

|

R&D |

R&D |

|

|

Mineral exploration and evaluation |

Mineral exploration and evaluation |

|

|

Entertainment, artistic and literary originals |

Entertainment, artistic and literary originals |

|

|

|

Development of financial innovations |

|

|

|

Architectural and engineering design |

|

|

|

Economic competencies |

|

|

|

Brand equity (advertising expenditure and market research) |

|

|

|

Firm-specific human capital (training) |

|

|

|

Organisational structure |

Source: Corrado et al. (2009), 2008 SNA.

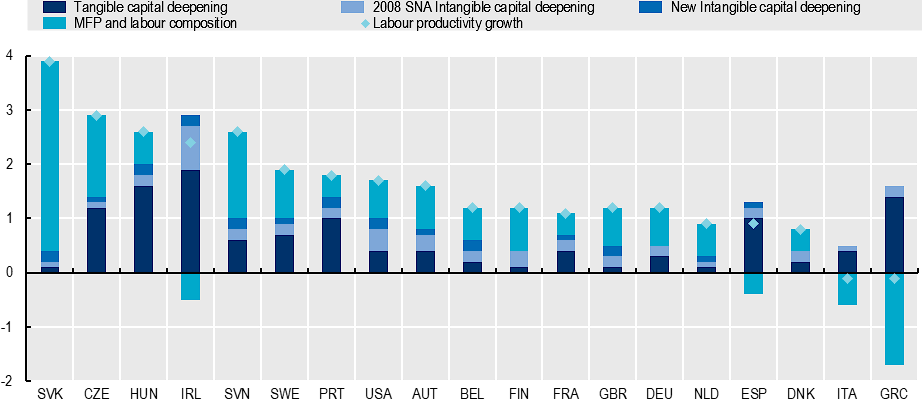

Extending this methodology to Europe for the period 2000-13 suggests that on average across 17 European countries, accounting for new intangibles reduces the absolute contribution of MFP to labour productivity growth from 58% to 50% over 2000-2013 (Corrado et al, 2018; Figure 2.4).4 These new results allow distinguishing how capital deepening contributes to labour productivity growth for three different asset classes: tangible capital, intangible capital falling within the asset boundary of the 2008 SNA, and new intangibles (i.e. those not included in national accounts). The impact of new intangibles is highest in Belgium, the United Kingdom and the United States (17%, 17% and 12%, respectively), but even in these two countries, the joint absolute contribution of MFP and labour composition to labour productivity growth remains very significant (50%, 58% and 39%, respectively).

Since intangible investment tends to increase with GDP per capita (van Ark et al., 2012), it is expected that the contribution of intangibles to labour productivity growth is lower in developing APO economies than in OECD economies.

Figure 2.4. Contribution of intangible assets to labour productivity growth in selected advanced economies, 2000-13

Note: The contribution of MFP includes the effect of labour composition.

Source: Corrado et al. (2018).

The distinction between the contributions of MFP and production factors to labour productivity growth is not as clear-cut as it seems

In a steady state, MFP is at the origin of capital deepening

Growth accounting is a mere decomposition of output growth into the contributions of production factors and MFP. It does not explain what the driving forces behind the growth of production factors and MFP are, nor how these variables are related to each other. The growth model developed by Solow (1956) partially fills this gap by putting demographic and technical change at the origin of the economic growth process. In these models, capital accumulation is endogenous and, in a steady state, capital grows at the same pace as output and the capital-deepening ratio grows over time at the same pace as technical change.

Growth accounting ignores the fact that capital accumulation is driven by MFP and underestimates the contribution of MFP to economic growth by treating capital accumulation as exogenous. One way to account for the fact that part of the contribution of MFP to GDP and labour productivity growth occurs via capital accumulation is to adjust equation (3) by including the capital-output ratio instead of the capital-deepening ratio . In this way, all increases in are attributed to MFP and only the fluctuations in are attributed to capital.

For example, Klenow and Rodriguez-Clare (1997) use this growth accounting equation to reassess the contribution of MFP to GDP and labour productivity growth in the four East Asian Tigers analysed by Young (1995). With this adjustment, MFP growth accounts for most of labour productivity growth in Hong Kong (China) and Korea between the mid-1960s and the early 1990s.

One important caveat with this approach is that, in practice, economies may deviate from steady state and may fluctuate for reasons that are unrelated to MFP, e.g. because the relative price of capital varies and triggers capital-labour substitution. Then, it is probably safer to consider that the contributions of MFP to labour productivity growth given by equation (3) and indicated in Table 2.1 are lower bounds, but without going as far as attributing all changes in to MFP.

Complementarities between assets may foster MFP growth

One of the main limitations of macroeconomic growth accounting, beyond the fact that it leaves MFP as an unexplained residual, is that it neglects potential complementarities between assets. Such complementarities may explain why some investments have a more significant influence on labour productivity depending on the existence of other assets, the qualification of the workforce, or the existence of adequate economic regulations.

The divergence between Europe and the United States at the time of the ICT-driven productivity boom in the United States (1995-2005) is very significant in this respect. As discussed previously, ICT capital deepening is not the main explanation to the divergence between Europe and the United States between the mid-1990s and the mid-2000s. The main explanation is related to MFP in ICT-intensive services industries. In the United States, ICT-intensive intensive industries experienced an increase in MFP growth between 1995 and 2005 that was reversed after 2005. By contrast, all industries in Europe experienced a two-step decrease in MFP, a first one after 1995 and a second one after 2005.

Intangible capital complementing ICT seems to have played a significant role in explaining this divergence between Europe and the United States. By comparing the performance of domestic European firms and of European affiliates of US multinationals, Bloom et al. (2012) showed that management practices were a key explanation to why US firms were able to reap the benefits of ICT much better than their European counterparts. This result complements Bresnahan et al. (2002) who showed that returns to ICT investments are higher in firms with a more decentralised work organisation and a higher level of human capital.

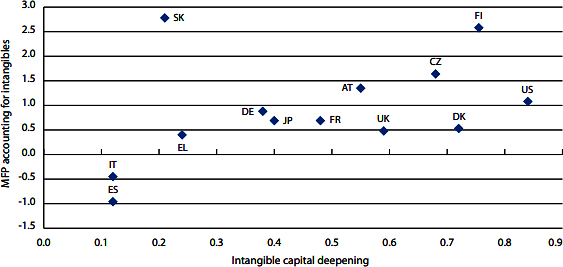

Similarly, the direct contribution of intangible capital that can be measured with growth accounting decompositions does not seem to account for its full contribution to labour productivity growth. For example van Ark et al. (2009) highlight a positive correlation between intangible capital deepening and MFP growth, even after the direct contribution of intangibles has been accounted for (Figure 2.5). Here again, the unmeasured interaction of intangible capital with other assets (e.g. with ICT) or economic institutions may explain this finding.

Some of the complementarities between assets (e.g. between human capital on the one hand, and ICT or R&D on the other hand) will be explored in the subsequent sections of this report. Nevertheless, additional research is needed to fully understand them. Firm-level data typically allow to capture these effects more precisely than country- or industry-level data due to the variability in the distribution of assets across firms.

Figure 2.5. Spillover effects from intangible capital

Source: van Ark et al. (2009), Figure 8.

Understanding productivity requires looking into the granular origins of MFP

There is pervasive productivity heterogeneity across firms, including within narrowly defined industries

Until the 1990s, most productivity studies were based on the view that working with industry-level data was sufficient to understand productivity developments. However, the increasing access to and use of firm-level microdata has revealed a substantial degree of heterogeneity in output, employment, investment and productivity across firms operating within the same narrowly defined industries. The heterogeneity across firms that is pervasive in microdata, even at industry level, is at odds with the representative firm assumption that has long been used in productivity studies. For example, Syverson (2004) estimated that within 4-digit SIC5 industries in the United States, the average MFP ratio between the 90th and the 10th percentile plants is around two, with some industries showing much larger differences. Hsieh and Klenow (2009) found even larger productivity differences across firms in People’s Republic of China (hereafter “China”) and India, with average MFP ratios between the 90th and the 10th percentile plants within narrowly defined industries being around five.6

Similarly to aggregate MFP estimates, the heterogeneity in measured productivity across firms first depends on the inputs that are considered in the production function and how they are measured. Nevertheless, the available empirical evidence suggests that productivity dispersion is a very robust phenomenon and that no single factor can explain it by itself. For example, the quality of labour input plays a role in productivity dispersion but accounting for it leaves a large part of the observed heterogeneity unexplained. Using matched employer-employee data, Fox and Smeets (2011) show that accounting for labour quality only reduces the 90-10 percentile productivity ratio within Danish industries from 3.3 to 2.7. Adequately measuring capital, in particular accounting for intangible capital, is important as well, but the potentially relevant factors are extremely diverse. They include management practices (Bloom and van Reenen, 2007, 2010 – see also the Section on human capital in this report), complementarities between ICT capital and human resource practices (Bloom et al. 2012), experience with production processes (Thornton and Thompson 2001, Levitt et al. 2013), the existence of networks of firms that are used to work together (Kellogg, 2011), the ownership structure of firms and whether they belong to larger groups (Schoar 2002, Atalay et al. 2014), to name just a few.

While assessing all the possible factors contributing to productivity dispersion across firms belonging to the same narrowly defined industries is an active area of research, it is clear that the heterogeneity in firm-level productivity and the way firms combine inputs and organisational settings will help identify these factors and contribute to a better understanding of the determinants of aggregate productivity. At the same time, macroeconomic approaches remain key to ensure an exhaustive firm coverage and capture all interdependencies and spillovers across firms.

Box 2.1. Productivity measurement at the firm level

While firm-level data can bring new insights for productivity analysis, there are also some specific data limitations at this level. First, because producer-specific prices are unobserved at the firm level, output is typically measured by dividing nominal revenue by an industry-level deflator (Syverson, 2011). While necessary, this approximation means that unaccounted price differences across firms within industries are embodied in output and productivity measures. Therefore, measured productivity may reflect efficiency, as well as market power allowing some firms to charge prices that are substantially higher than their marginal costs. These issues affect both labour productivity and MFP measurement.

Regarding MFP measurement more specifically, the breakdown of investment into asset types at the firm level is generally less detailed than at the national or industry level. Productivity studies at the firm level typically construct capital stocks using a permanent inventory method with the same capital depreciation patterns for all industries and only break down assets into structures and equipment (see e.g. Decker et al., 2020).

The traditional growth accounting method where output elasticities are estimated with input cost shares, thus assuming perfect competition, is commonly used to measure MFP in the literature based on firm-level data (Foster et al. 2001, Syverson 2011).

An alternative approach is to estimate production functions directly and to consider as MFP the residual of the econometric specification. This approach raises econometric issues because input choice by firms is likely correlated with some productivity determinants that are known to the firm but unobserved by the econometrician (e.g. organisational characteristics influencing how inputs are combined, or marketing assets influencing market power). In this context, the log production function of a firm i is typically modelled as follows (similar equations are estimated in each industry):

In this specification, , and correspond to capital, labour and material input, respectively, and (log) MFP includes three additive terms: is common to all firms in the industry, corresponds to MFP determinants that are known to the firm but unobserved by the econometrician, and includes other factors that are purely unexpected. Given some additional assumptions regarding the timing of decisions by firms, Olley and Pakes (1996) showed that it is possible to control for by using observable variables (they used investment and capital), and they suggested a consistent two-step estimator for , and . Wooldridge (2009) later streamlined this approach by introducing a one-step estimator. Wooldridge’s (2009) approach is now the dominant approach to estimate production functions and MFP with firm-level data.

Both firm-level MFP measures are commonly used in OECD research on productivity (Gal 2013, Berlingeri et al. 2017b).

Beyond the above-discussed limitations for productivity analysis at the firm level, two other limitations, related to data access and to the representativity of the available samples of firms, need to be taken into consideration. In spite of the progressive development of data centres dedicated to researchers, significant obstacles remain for transnational access to official microdata. Moreover, many commercial databases assembling data from stock-quoted companies are not representative of the entire population of firms. Small firms, in particular, may not be adequately covered. In order to address these two issues, the OECD has developed a micro-data approach to access confidential firm-level data, in collaboration with experts from national statistical agencies, governments and research organisations in 29 countries. The resulting MultiProd database covers the full population of firms, or a representative sample, in most sectors of the economy for a large number of countries (Berlingeri et al. 2017b).

Aggregate productivity growth depends on productivity growth within firms, as well as on reallocations between existing firms, and business creations and destructions

Not only do firms with very different productivity levels coexist within industries at a given point in time. The distribution of productivity across firms may also evolve over time because the productivity of newly created, surviving and disappearing firms differs. Different decompositions of how individual firms contribute to aggregate productivity growth have been proposed in the literature (e.g. Foster et al. 2001, Melitz and Polanec 2015). They all have in common that aggregate productivity growth depends on (1) within-firm productivity growth for surviving firms, (2) reallocation between firms with different productivity levels or growth rates, and (3) entry (creation) and exit (destruction) of firms.

This heterogeneity opens up new channels to analyse aggregate productivity growth. Based on a wide range of productivity studies, De Loecker and Syverson (2021) highlighted that reallocations typically explain between 20 and 40% of the total change in an aggregate productivity index where firms receive a weight corresponding to their output or employment share. Nevertheless, depending on the countries and periods analysed in the literature, there is considerable variation around this average and the mechanisms leading to higher or lower shares of within-firm productivity growth or reallocations are not yet fully understood (Syverson, 2011).

A large number of studies show that competition fosters within-firm productivity growth as well as reallocations towards more productive firms, but in proportions depending on market characteristics and economic conditions.7 For example, Foster et al. (2006) showed that aggregate productivity growth in the US retail sector in the 1990s happened almost exclusively through the exit of less efficient single-store firms and by their replacement with more efficient national chain store affiliates that were able to propose much lower prices. On the other end of the spectrum, Schmitz (2005) showed that increased international competition triggered very significant within-firm productivity growth in the US iron ore mining sector in the 1980s. These large productivity gains ensured that the US producers could remain competitive and avoided any significant reallocations towards foreign producers. Pavcnik (2002) and Collard-Wexler and de Loecker (2015) discuss other examples where the impact of competition is more balanced between within-firm productivity growth and reallocations, which is generally the case in practice. All these examples clearly demonstrate the value added of firm-level data to understand the role of firm heterogeneity, business dynamism and reallocations in aggregate productivity developments.

Firm-level data shed new light on the origins of the aggregate productivity slowdown

Productivity studies relying on firm-level data can also shed new light on the productivity slowdown debate, beyond issues related to statistical measurement (Byrne et al. 2016, Syverson 2017) and to the pace and impact of recent innovations (Gordon, 2016). Focusing only on these issues would neglect the fact that the recent productivity slowdown may be related to specific firms or barriers preventing reallocation between firms with different productivity levels or developments.

The productivity slowdown that is observed since the early 2000s in Europe and the United States cannot be attributed to structural shifts between industries with different productivity levels. There have been reallocations between industries (e.g. from manufacturing to services), but they tend to compensate each other at the aggregate level over each subperiod (ECB, 2021). Therefore, aggregate productivity developments are mainly driven by intra-industry effects which can only be explained by analysing more granular data.

Looking at the microeconomic evidence, several complementary explanations seem to contribute to the aggregate productivity slowdown. The first one is related to the productivity slowdown of specific firms or sectors. Based on an exhaustive coverage of firms in the US nonfarm private sector, Decker et al. (2017) break down labour productivity growth by firm size and show that the slowdown is mostly visible for the largest firms, which points to technological slowdown because these firms are also those with the largest productivity gains. Consistently, the European Central Bank (ECB, 2021) provides evidence showing that innovation in the European manufacturing sector has slowed down over the past two decades. The patenting activity of this sector has been mostly flat since the financial crisis of 2008-09, and the market share of high-technology manufacturing exports has declined sharply over time, to the benefit of China. This finding is supported by firm-level evidence showing a slowdown in MFP growth of European manufacturing firms at the frontier.

Complementing the evidence of a productivity slowdown for specific types of firms (e.g. manufacturing frontier firms), recent OECD research has pointed to the increasing productivity divergence between firms belonging to the same industry (Andrews et al. 2016, Berlingeri et al. 2017a, Gal et al. 2019). For example, Berlingeri et al. (2017a, Figure 8) showed that, on average across countries and industries, the ratio between the MFP of firms in the top decile (national frontier firms) and the median firm has increased by 4%, and the ratio between the MFP of the median firm and firms in the bottom decile has increased by 12% between 2000 and 2012.8 On the one hand, this productivity divergence is positively correlated with a reallocation of market shares towards frontier firms, thus contributing to higher aggregate productivity growth (Criscuolo et al., forthcoming). On the other hand, it is also correlated with lower within-firm productivity growth for non-frontier firms, thus pointing to barriers to technology diffusion and contributing to lower aggregate productivity growth (Andrews et al., 2015). This second effect is especially significant in more ICT- and intangible-intensive sectors, consistently with the idea that the diffusion of new technologies may be more difficult for ICT and may require investment in complementary intangible assets (Gal et al., 2019; Corrado et al., 2021). Consistently with this finding, the European Central Bank (ECB, 2021) provides evidence that innovation has accelerated in the European services sector, but only benefits a few firms at the frontier.

References

Alvarez-Diaz M., B. D’Hombres, C. Ghisetti, N. Pontarollo and L. Dijkstra (2018): The Determinants of Population Growth. JRC Working Papers in Economics and Finance, 2018/10.

Andrews D., C. Criscuolo and P. Gal (2015): Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries. OECD Productivity Working Papers, No. 2, OECD Publishing, Paris, https://doi.org/10.1787/5jrql2q2jj7b-en.

Andrews D., C. Criscuolo and P. Gal (2016): The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy, OECD Productivity Working Papers, No. 5, OECD Publishing, Paris, https://doi.org/10.1787/63629cc9-en

APO-OECD (2021): Towards Improved and Comparable Productivity Statistics. A Set of Recommendations for Statistical Policy.

Atalay E., A. Hortaçsu and C. Syverson (2014): Vertical Integration and Input Flows. American Economic Review, Vol. 104(4), pp. 1120-1148.

Bergeaud A., G. Cette and R. Lecat (2016): productivity Trends in Advanced Countries Between 1890 and 2012. Review of Income and Wealth, Vol. 62(3), pp. 420-444.

Berlingeri G., P. Blanchenay, and C. Criscuolo (2017a): The great divergence(s). OECD Science, Technology and Industry Policy Papers, No. 39. OECD Publishing, Paris, https://doi.org/10.1787/953f3853-en.

Berlingeri G., P. Blanchenay, S. Calligaris and C. Criscuolo (2017b): The Multiprod Project – A Comprehensive Overview. OECD Science, Technology and Industry Working Papers, No. 2017/04. OECD Publishing, Paris, https://doi.org/10.1787/2069b6a3-en.

Bloom N. and J. van Reenen (2007): Measuring and Explaining Management Practices across Firms and Countries. Quarterly Journal of Economics, Vol. 122(4), pp. 1351-1408.

Bloom N. and J. van Reenen (2010): Why Do Management Practices Differ across Firms and Countries? Journal of Economic Perspectives, Vol. 24(1), pp. 203-224.

Bloom N., R. Sadun and J. Van Reenen (2012): Americans do IT better: US multinationals and the productivity Miracle. American Economic Review, Vol. 102(1), pp. 167-201.

Bosworth B.P. and S.M. Collins (2003): The Empirics of Growth: An Update. Brookings Papers on Economic Activity, Vol. 2, pp. 113-206.

Bresnahan T.F., E. Brynjolfsson and L.M. Hitt (2002): Information Technology, Workplace Organisation and the Demand for Skilled Labor: Firm-Level Evidence. Quarterly Journal of Economics, Vol. 117(1), pp. 339-376.

Byrne D.M., J.G. Fernald and M.B. Reinsdorf (2016): Does the United States have a Productivity Slowdown or a Measurement Problem? Brookings papers on Economic Activity, Spring, pp. 109-157

Christensen L.R., D. Cummings and D.W. Jorgenson (1980): Economic Growth 1947-73: An International Comparison. NBER Chapters, in New Developments in Productivity Measurement and Analysis, pp. 595-698.

Collard-Wexler A. and J. de Loecker (2015): Reallocation and Technology: Evidence from the US Steel Industry. American Economic Review, Vol. 105(1), pp. 131-171.

Conference of European Statisticians (2021): In-Depth Review if Measuring the Non-Observed/Informal Economy. ECE/CES/BUR/2021/OCT/3 https://unece.org/sites/default/files/2021-10/03_In-depth%20review%20of%20measuring%20informal%20economy.pdf.

Corrado C., C. Hulten and D. Sichel (2009): Intangible Capital and U.S. Economic Growth. Review of Income and Wealth, Vol. 55(3), pp. 661-685.

Corrado C., J. Haskel, C. Jona-Lasinio and M. Iommi (2018): Intangible Investment in the EU and US Before and Since the Great Recession and its Contribution to Productivity Growth. Journal of Infrastructure and Development, Vol. 2(1).

Corrado C., C. Criscuolo, J. Haskel, A. Himbert, and C. Jona-Lasinio (2021): New evidence on intangibles, diffusion and productivity", OECD Science, Technology and Industry Working Papers, No. 2021/10, OECD Publishing, Paris, https://doi.org/10.1787/de0378f3-en

Criscuolo C., I. Desnoyers-James, A. Himbert, F. Manaresi and M. Reinhard (forthcoming): Productivity Divergence and Productivity Growth: Channels and Determinants. OECD mimeo.

Decker R.A., J. Haltiwanger, R.S. Jarmin and J. Miranda (2017): Declining Dynamism, Allocative Efficiency and the Productivity Slowdown. American Economic Review: Papers and proceedings, Vol. 107(5), pp. 322-326.

Decker R.A., J. Haltiwanger, R.S. Jarmin and J. Miranda (2020): Changing Business Dynamism and Productivity: Shocks versus Responsiveness. American Economic Review, Vol. 110(12), pp. 3952-3990.

De Loecker J. and C. Syverson (2021): An Industrial Organization Perspective on Productivity. NBER Working Paper Nr. 29229.

Denison E.F. (1985): Trends in American Economic Growth, 1929-1982. Washington: The Brookings Institution.

Dougherty C. (1991): A Comparison of Productivity and Economic Growth in the G7 Countries. PhD Dissertation, Harvard University.

Easterly W. and R. Levine (2001): It’s not Factor Accumulation: Stylised Facts and Growth Models. World Bank Economic Review, Vol. 15(2), pp. 177-219.

Elias V.J. (1990): Sources of Growth: A Study of Seven Latin American Economies. International Center for Economic Growth.

European Central Bank (ECB, 2021): Key Factors behind Productivity Trends in EU Countries. Occasional Paper Series, Nr 268.

Fernald J.G., R.E. Hall, J.H. Stock and M.W. Watson (2017): The Disappointing Recovery of Output after 2009. Brookings Papers on Economic Activity, Spring 2017, pp. 1-81.

Fernald J.G. and R. Inklaar (2020): Does Disappointing European Productivity Growth Reflect a Slowing Trend? Weighing the Evidence and Assessing the Future. International Productivity Monitor, Vol. 38, pp. 104-135.

Foster L., J. Haltiwanger and C.J. Krizan (2001): Aggregate Productivity Growth: Lessons from Microeconomic Evidence, in New Developments in Productivity Analysis, eds. E. Dean, M. Harper and C. Hulten, pp. 303-363, University of Chicago Press.

Foster L., J. Haltiwanger and C.J. Krizan (2006): Market Selection, Restructuring and Reallocation in the Retail Sector in the 1990s. Review of Economics and Statistics, Vol. 88(4), pp. 7848-758.

Fox J.T. and V. Smeets (2011): Does Input Quality Drive Measured Differences in Firm Productivity? International Economic Review, Vol. 52(4), pp. 961-989.

Gal P.N. (2013): Measuring Total Factor Productivity at the Firm Level using OECD-ORBIS. OECD Economics Department Working Papers, No. 1049. OECD Publishing, Paris, https://doi.org/10.1787/5k46dsb25ls6-en.

Gal P.N., G. Nicoletti, T. Renault, S. Sorbe and C. Timiliotis (2019): Digitalisation and productivity: In search of the holy grail – Firm-level empirical evidence from EU countries, OECD Economics Department Working Papers, No. 1533, OECD Publishing, Paris, https://doi.org/10.1787/5080f4b6-en

Gordon R.J. (2016): The Rise and Fall of American Growth. Princeton University Press.

Gordon R.J. and H. Sayed (2020): Transatlantic Technologies: The Role of ICT in the Evolution of U.S. and European Productivity Growth. NBER Working Paper No. 27425.

Hall R.E. and D.W. Jorgenson (1967): Tax Policy and Investment Behaviour. American Economic Review, Vol. 57, pp. 391-414.

Hsieh C.T. and P.J. Klenow (2009): Misallocation and Manufacturing TFP in China and India. Quarterly Journal of Economics, Vol. 124(4), pp. 1403-1448.

Jorgenson D.W and Z. Griliches (1967): The Explanation of Productivity Change. Review of Economic Studies; Vol. 34, pp. 349-383.

Jorgenson D.W., F. Gollop and B. Fraumeni (1987): Productivity and U.S. Economic Growth. Harvard University Press.

Jorgenson D.W. (1988): Productivity and Postwar Economic Growth. Journal of Economic Perspectives, Vol. 2(4), pp. 23-41.

Jorgenson D.W., M.S. Ho and K.J. Stiroh (2008): A Retrospective Look at the U.S. Productivity Growth Resurgence. Journal of Economic Perspectives, Vol. 22(1), pp. 3-24.

Kellogg R. (2011): Learning by Drilling: Interfirm Learning and Relationship Persistence in the Texas Oilpatch. Quarterly Journal of Economics, Vol. 126(4), pp. 1961-2004.

Klenow P.J. and A. Rodriguez-Clare (1997): The Neoclassical Revival in Growth Economics: Has it Gone too Far? NBER Chapters, in NBER Macroeconomics Annual 1997, Vol. 12, pp. 73-114.

Levitt S.J., J.A. List and C. Syverson (2013): Toward an Understanding of Learning by Doing: Evidence form an Automobile Assembly Plant. Journal of Political Economy, Vol. 121(4), pp. 643-681.

Melitz M.J. and S. Polanec (2015): Dynamic Olley-Pakes Productivity decomposition with Entry and Exit. RAND Journal of Economics, Vol. 46(2), pp. 362-375.

Nomura, K. and Akashi, N. (2017), Measuring Quality-adjusted Labour Inputs in South Asia, 1970-2015. KEO Discussion Paper No. 143. KEO: Tokyo.

OECD (2001): Measuring Productivity OECD Manual: Measurement of Aggregate and Industry-level Productivity Growth. OECD Publishing, Paris, https://doi.org/10.1787/9789264194519-en.

Olley S.G. and A. Pakes (1996): The Dynamics of productivity in the Telecommunications Equipment Industry. Econometrica, Vol. 64(6), pp. 1263-1297.

Pavcnik N. (2002): Trade Liberalization, Exit and Productivity Improvement: Evidence from Chilean Plants. Review of Economic Studies, Vol. 69(1), pp. 245-276.

Schmitz J.A. (2005): What Determines Productivity? Lessons from the Dramatic Recovery of the U.S. and Canadian Iron Ore Industries Following their Early 1980s Crisis. Journal of Political Economy, Vol. 113(3), pp. 582-625.

Schoar A. (2002): The Effect of Diversification on Firm Productivity. Journal of Finance, Vol. 62(6), pp. 2379-2403.

Schreyer P. (2002): Computer price indices and international growth and productivity comparisons, Review of Income and Wealth, Vol. 48(1), pp. 15-31.

Solow R.M. (1956): A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics, Vol. 70, pp. 65-94.

Solow R.M. (1957): Technical Change and the Aggregate Production Function. Review of Economics and Statistics, Vol. 39, pp. 312-320.

Syverson C. (2004): Product Substitutability and Productivity Dispersion. Review of Economics and Statistics, Vol. 86(2), pp. 534-550.

Syverson C. (2011): What Determines Productivity? Journal of Economic Literature. Vol. 49(2), pp. 326-365.

Syverson C. (2017): Challenges to Mismeasurement Explanations for the U.S. Productivity Slowdown. Journal of Economic Perspectives, Vol. 31(2), pp. 165-86.

Timmer M.P., R. Inklaar, M. O’Mahony and B. van Ark (2011): Productivity and Economic Growth in Europe: A comparative Industry Perspective. International Productivity Monitor, Vol. 21, pp. 3-23.

Tinbergen (1942, 1959 for the English translation): Zur Theorie der Langfristigen Wirtschaftsentwicklung. Weltwirtschatliches Archiv, Vol. 55(1), pp. 511-549.

Thornton R.A. and P. Thompson (2001): Learning from Experience and Learning from Others: An Exploration of Learning and Spillovers in Wartime Shipbuilding. American Economic Review, Vol. 91(5), pp. 1350-1368.

van Ark B., J.X. Hao, C. Corrado and C. Hulten (2009): Measuring Intangible Capital and its Contribution to Economic Growth in Europe. EIB Papers, Vol. 14(1), pp. 62-93, European Investment Bank, Luxembourg.

Wooldridge J.M. (2009): On Estimating Firm-Level Productivity Functions Using Proxy Variables to Control for Unobservables. Economics Letters, Vol. 104(3), pp. 112-114

Young A. (1995): The Tyranny of Numbers: Confronting the Statistical Realities of the East Asian Growth Experience. Quarterly Journal of Economics, Vol. 110, pp. 641-680.

Notes

← 1. According to the US Census Bureau, the US resident population grew from 38.6 million in 1870 to 92.2 million in 1910 (1870 and 1910 are two Census years), which corresponds to an average demographic growth of 2.2% per year between these two dates. Even though demographic growth does not directly translate into growth of the workforce, it probably explains a large part of the average US GDP growth rate (4.1% per year) over the period covered by Tinbergen (1870-1914).

← 2. In order to simplify the exposition, the potential difference between productive and wealth capital stocks for each asset type is neglected. See APO-OECD (2021) for details.

← 3. When Corrado et al. (2009) wrote their paper, neither computer software and databases nor R&D were treated as investment in the US national accounts. These intangible assets are now capitalised in the national accounts of the US and of all countries following the 2008 SNA.

← 4. This contribution includes the effect of labour composition because Corrado et al. (2018) do not break down the contributions of MFP and labour composition. Due to their very low labour productivity growth over the period, Italy (IT) and Greece (EL) are excluded from this calculation.

← 5. SIC stands for Standard Industrial Classification. It has been replaced by the North American Industry Classification System (NAICS) in 1997.

← 7. Digitalisation and the emergence of new business models since the early 2000s create challenges to competition. This is reflected by increases in concentration, mark-ups and profits, particularly in the United States and to a lower extent in Europe. Most empirical analyses differ in their interpretation and implications for productivity developments. While some authors claim that increased concentration, mark-ups and profits are indicative of greater efficiency and innovation, other argue that these trends point to growing market power, strategic increases in barriers to entry, and/or a less dynamic environment, which leads to declining productivity. A more detailed discussion on competition and productivity can be found in a dedicated section of this report.

← 8. For this analysis, Berlingeri et al. (2017a) consider 14 OECD countries, 7 industries, and measure MFP following Wooldridge’s (2009) methodology.