Despite undergoing significant structural transformation since 1991, the resilience and competitiveness of Kazakhstan’s economy remains challenged by limited private-sector development and a high degree of economic concentration in the country’s extractive sectors. While many macroeconomic trends are doubtlessly strong, the benefits of the country’s extractive-fuelled growth have not been sufficiently shared throughout the economy, resulting in uneven productivity growth, investment and inclusion. This chapter introduces some of the key economic trends and challenges in Kazakhstan that are relevant to contextualise this survey and the policy specific chapters later in the report.

Insights on the Business Climate in Kazakhstan

2. An economic overview of Kazakhstan: trends and challenges

Abstract

2.1. Overview and policy context

More than three decades since Kazakhstan became independent, reducing the role of the state in the economy, developing the private-sector and fostering economic diversification remain important priorities for the government. To achieve these ends, the government has developed numerous economic development strategies, invested significant public resources in industrialisation programmes, and implemented a range of regulatory and legal reforms to support domestic and international business. The impact of these policy interventions has been varied. Kazakhstan has undoubtedly become a much easier and more attractive country for doing business, and the country’s macroeconomic performance over the past two decades has been impressive (OECD, 2021[1]). At the same time, progress in transforming the role of the state in the economy from the primary driver of economic output to a facilitator of private-sector growth, and in diversifying and increasing the resilience of the economy, remains limited.

Kazakhstan has significantly deepened its co-operation with the OECD in recent years. The country is an active member in a number of substantive committees and working groups, and there is regular work and co-operation between the OECD and the government of Kazakhstan on identifying and implementing reforms to support its journey towards OECD standards. Domestically, the government’s guiding strategies for economic reform, such as the “Kazakhstan-2050” programme and the Strategic Development Plan 2025, prioritise a number of areas where progress could directly address issues highlighted in the report as well as in the broader body of OECD work on Kazakhstan.

This chapter is structured around a number of observations on Kazakhstan’s economy that are relevant to the report and ongoing policy debates to support private-sector development in the country. Section 2.2 introduces some high-level socio-economic trends that give context to the broader discussions in the report. Section 2.3 gives an overview of questions of structural transformation and diversification, while Section 2.4 discusses private-sector development and business dynamism. Section 2.5 concludes with an overview of the country’s external trade position and integration into global value chains (GVCs).

2.2. Disruption and resilience: key socio-economic trends

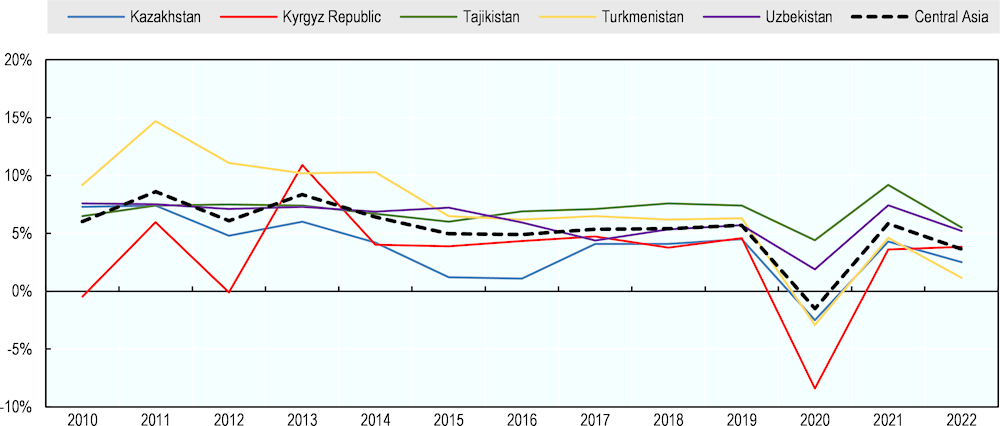

Kazakhstan has made significant progress since beginning its transition to a market economy in 1991. After emerging from the post-transition recession in 1996, Kazakhstan’s real GDP has grown at an average annual rate of 5.0%, in line with the regional average of 5.4%, and above the OECD average of 2% over the same period (Figure 2.1) (World Bank, 2023[2]).1 FDI stocks in the last pre-pandemic year of 2019 equalled 84.0% GDP, a 28.9 pp increase since 2000, while net inflows were equal to 2.1% GDP, down from 7.5% over the same period as above (UNCTAD, 2023[3]) (World Bank, 2023[2]). Part of the drop-off in inflows can be explained by that FDI in countries with capital-intensive extractive sectors can be irregular but substantial when it occurs, whilst the volume of both inflows and stocks relative to GDP, which has grown substantially since 2000, obscures the fact that both measurements nevertheless demonstrate a significant expansion of inward investment in nominal terms.

Figure 2.1. Real GDP growth in Central Asia (2010-2022)

From 2010 to 2021, labour productivity increased by 35%, measured in terms of value added per worker, while levels of poverty have fallen by 32% since 2000 (measured as the percentage of population living on below USD 6.85 PPP per day). Since 2015, the unemployment rate has consistently remained around 4.9%, against a Central Asian average of 5.2%, while youth (15-24 years old) unemployment, at 4% in 2021, is below the regional average of 10.7%. Total external debt reached 83.6% GDP in 2021, with gross public debt at 25.1% GDP in the same year (IMF, 2022[4]).

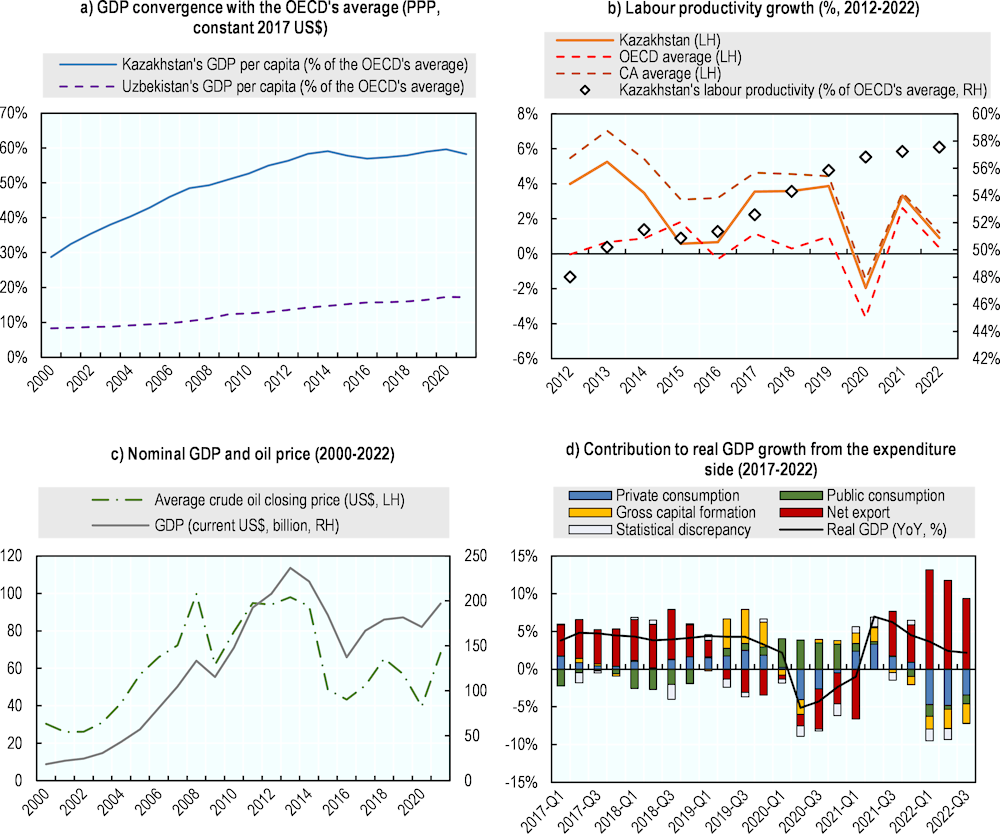

GDP and productivity growth are decelerating. Although GDP growth remains stronger than in most OECD economies, it has been decelerating since 2001, with the deceleration intensifying following the Global Financial Crisis of 2008-09 (GFC) and the 2014-15 commodity price shock. Having steadily converged with the OECD average from around 2000, the convergence process began to stagnate following the 2014-15 commodity crash (Figure 2.2a). A similar trend is true of productivity growth, which has slowed in recently years, particularly after the GFC, and which remains around 60% of the OECD average (Figure 2.2b). The productivity slowdown has been more pronounced in non-extractive sectors, which continue to account for the largest share of employment but lower shares of domestic and foreign investment. At the firm level, the productivity of SMEs is roughly half that of larger firms in the country, the latter predominating in the country’s extractive sectors, indicating that aggregate levels of productivity growth mask an uneven distribution of this growth across the private-sector (EBRD, 2017[5]) (EBRD, 2022[6]).

Figure 2.2. Growth in Kazakhstan: regional context, OECD convergence, the resource question, and contributions

Note: OECD calculations based on OECD data and data from the National Statistics Office of Kazakhstan; Uzbekistan included as a comparator in charts throughout this report due to its inclusion in an accompanying report.

Growth continues to be primarily driven by the extraction and export of natural resources. For over two decades, Kazakhstan’s growth has been closely correlated to global oil prices (Figure 2.2 c); as the price of oil has risen, so too has GDP, with the reverse also true. This reflects the fact that net exports – the majority of which are hydrocarbons – are one of the key contributors to annual growth (Figure 2.2 d). Particularly high prices for oil have helped offset significant public spending during the global pandemic, with a 70% growth of government revenues in 2022 largely attributable to the international price of oil (2021-2022 seeing a 177% increase in oil revenues vs. 27% for non-oil revenues, with only a modest increase in export volumes) (IMF, 2022[4]).

The extractive sector therefore continues to be a major source not just of growth, but of fiscal resilience, enabling the government to accumulate significant buffers. One major challenge for the government is dealing with the volatility that an overreliance on resource rents creates for macroeconomic stability (for example, via exchange rate volatility), and the concomitant challenges of developing a sound and predictable environment for business. At the same time, the government must contend with the fact that, whilst it remains a competitive exporter of hydrocarbons, the global decarbonisation transition will erode this competitiveness; the IEA expects, if signatories to the Paris Agreement on Climate meet their stated net zero targets, that global demand for hydrocarbons will fall 50% by 2050 (IEA, 2022[10]).

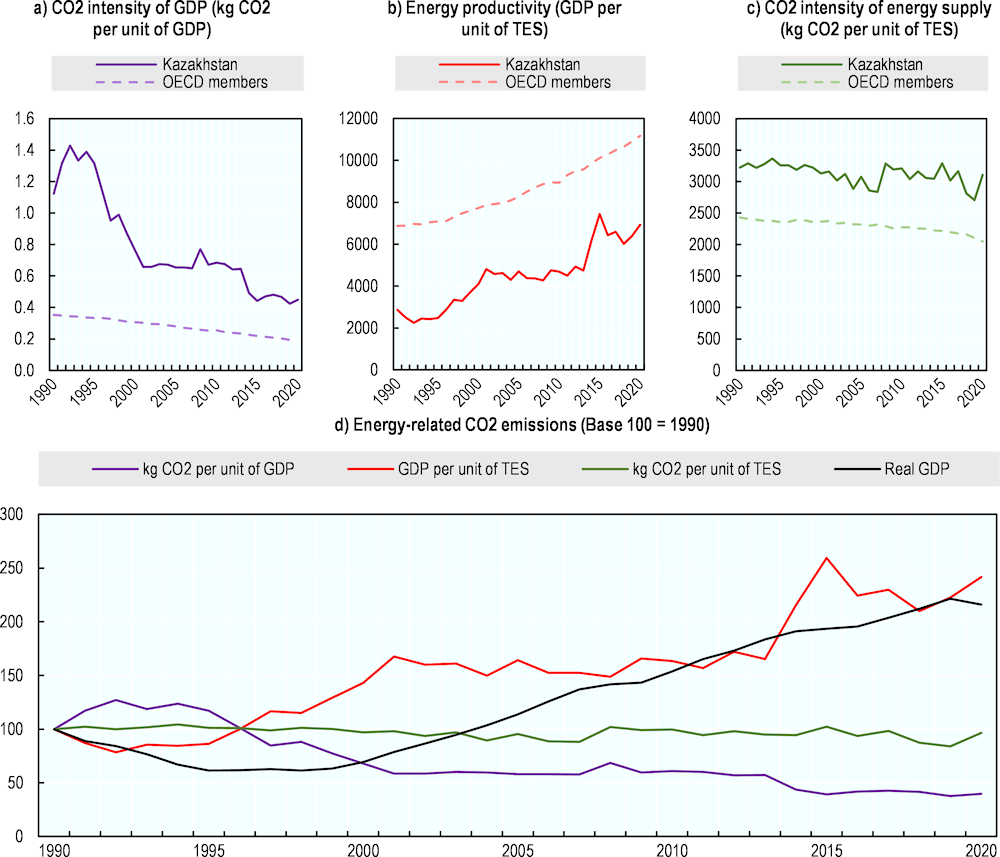

Although Kazakhstan has one of the most energy-intensive economies in the world, the country is increasing the productivity of emissions and energy consumption relative to output. Kazakhstan’s CO2 intensity – the volume of CO2 required to produce 1 USD PPP of output – fell almost by 50% between 2000 and 2020, although current levels (0.45kg CO2/USD PPP) remain 73% above the global average (Figure 2.3a) (IEA, 2022[11]). At the same time, the energy productivity of growth is improving (calculated as GDP per unit of total energy supply, expressed as the ratio of USD/tonne of oil equivalent). In 2000, 1 tonne of oil equivalent (TOE) in Kazakhstan would have produced USD 4,098 in output, compared to USD 6,925 in output in 2020. This represents a significant increase in the productivity energy in growth, but it is nevertheless a level that remains far below the OECD average, where the equivalent TOE would produce 1.6 times as much economic output (Figure 2.3b).

Figure 2.3. CO2 and energy intensity of Kazakhstan’s economy

The persistently high levels of CO2 emissions and energy required for Kazakhstan’s growth is due to the carbon footprint of the extractive sector, and the dominance of fossil fuels in the country’s energy supply. Nevertheless, there is a positive downwards trend across most emissions intensity and growth indicators, including the CO2 intensity per unit of total energy supply (a key factor in the decarbonisation of the domestic energy sector), which indicates that Kazakhstan is gradually modernising its industrial base and the energy sector (Figure 2.3c). Bringing Kazakhstan closer to OECD standards in terms of energy and CO2 intensity, and therefore closer to the government’s own long-term emissions reduction targets, will require significant investment in infrastructure.

There is a significant public health cost to the emissions-intensive nature of Kazakhstan’s economy. The OECD estimates that Kazakhstan has a significant level of premature deaths due to particulate matter (PM2.5) exposure (slightly below 600 per 1,000,000 inhabitants), and that the welfare costs of premature mortality due to exposure to PM2.5 pollution amount to around 6% GDP in 2019 (OECD, 2022[13]). In part, this reflects the fact that some 98.6% of Kazakhstan’s population are exposed to PM2.5 in the air, a level which is not only substantially higher than the OECD average of 61.6%, but which has remained stubbornly flat since 2000, whilst the corresponding level in the OECD has gradually fallen over the same period (OECD, 2023[14]).

2.3. Structural change and diversification

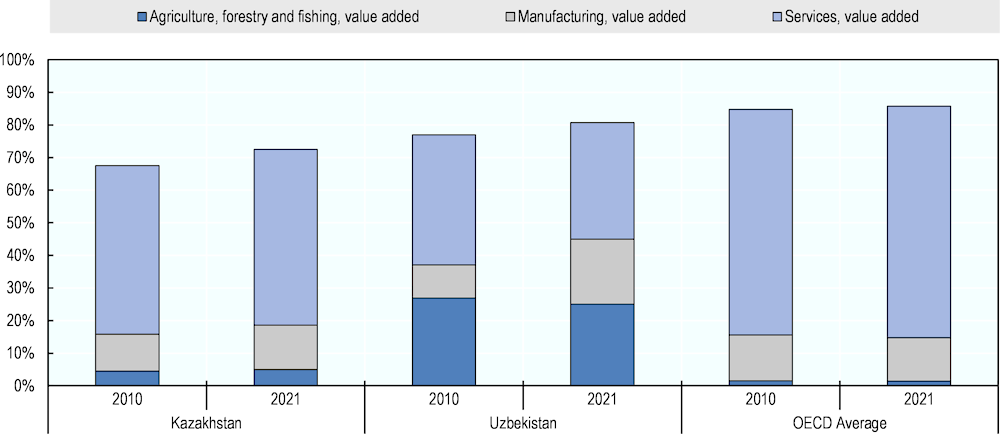

Kazakhstan experienced a rapid process of structural transformation in the 1990s. Since 1992, the value added of agriculture has dropped from 23.2% of GDP to 5%, a level that is nevertheless higher than the OECD average of 1.4%. At the same time, the value added of the services sector jumped from 25.1% around 55% of GDP, a level that is also significantly below the OECD average of 71%. The value added of manufacturing fell steadily, from 16% to 13%of GDP, in line with the OECD average (Figure 2.4).

Figure 2.4. Value added of the agricultural, manufacturing and service sectors (% GDP)

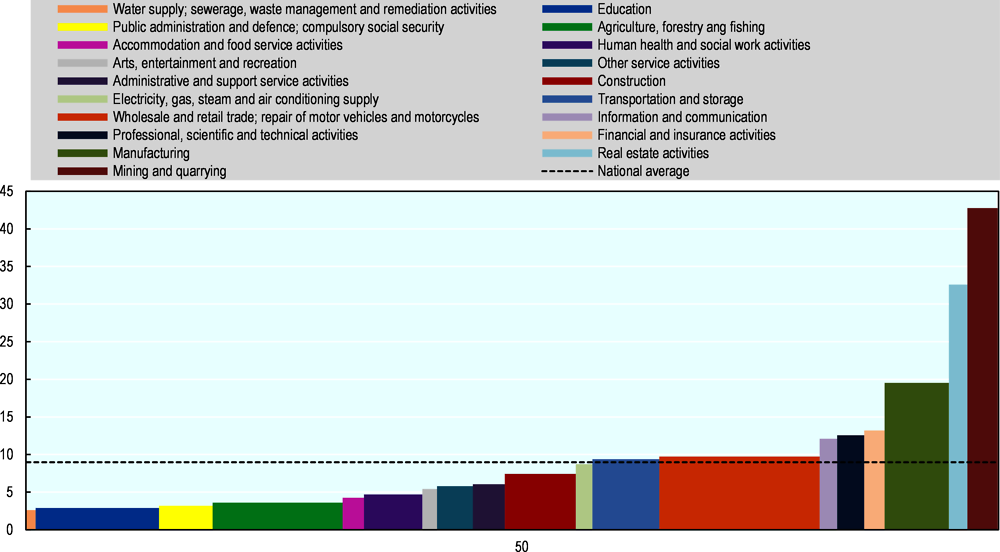

The economic logic of structural change is the reallocation of labour and capital to lower productive activities to higher ones, yet many people in Kazakhstan employed in low productivity jobs. Some 81.5% of the population are employed in sectors where productivity is around or below the national average (Figure 2.5), though the high degree of economic informality – particularly in low productivity sectors such as trade and agriculture – may mean that there are in fact more workers in lower productivity activities than official data suggest. One of the challenges for Kazakhstan is that the national average is 28% of the average of the three most productive sectors – mining, real estate services, and manufacturing. As a consequence, there emerges a significant issue around the inclusivity of growth, since these most productive sectors account for the most productive jobs and highest levels of investment but contribute little to overall employment (a combined 11.7%). What is more, the sustainability of these sectors is highly uncertain, both in terms of their vulnerability to short-term price shocks and their exposure to the longer-term effects of global decarbonisation. The productivity picture that emerges at a national level therefore masks significant sustainability and inclusion challenges, be it at the sectoral, firm, gender or regional level.

Around 41% of the population are employed in sectors where average productivity is less than half of the national average. For example, the education sector accounts for 12.7% employment and the public administration 5.5%, but the value added per worker in these sectors is 2.9 million KZT and 3.2 million KZT respectively, significantly below the national average of 9 million KZT. The agricultural sector continues to account for 13.4% of total employment, with value added per worker averaging KZT 3.6 million (around USD 7,750). The challenge for policymakers is ensuring that the benefits of strong macroeconomic performance are distributed throughout society in a way which is inclusive and underpins social cohesion.

Figure 2.5. Value added per worker and sectoral share of employment, 2021

Note: Horizontal axis runs 0-100%. It is important to note that the chart does not show informal employment, which remains significant in Kazakhstan as in other countries in Central Asia.

Source: OECD calculations based (ILO, 2023[9]) and (UN, 2023[15])

The depth and resilience of structural change is linked to the more challenging issue of diversification. To a significant extent, the expansion of Kazakhstan’s service sector – whether it is job creation in high-value services like finance or lower-value ones like retail and hospitality – has been driven by rents from the export of primary commodities. This is not to diminish successes in creating high-quality service sector jobs in Kazakhstan, but to highlight the link between diversification and the resilience of the non-tradable sector. Another of the major challenges for the government is to insulate the determinants of private-sector success – investment, productivity growth, innovation etc. – from the volatility of the terms of trade.

As noted in Section 2.2, a significant component of Kazakhstan’s economic success is attributable to the hydrocarbon sector. In 2020, the fuel exports represented half of the value of Kazakhstan’s total exports, with net exports one of the key contributors to GDP growth (Observatory of Economic Complexity, 2023[16]). Expanding the definition of the extractive sector to include fuels, material processing and crude materials would mean that the extractive sector accounted for 76% of total exports and 29% of GDP (OECD, 2020[17]). The challenge for Kazakhstan is that, as important economically as the extractive sector is, the extent of positive and durable linkages with the broader economy in terms of generating productivity and competitiveness is limited, and may even impede the ability of firms in non-oil sectors to grow and innovate via so-called “Dutch Disease” (Frankel and Romer, 1999[18]) (Corden and Neary, 1982[19]).

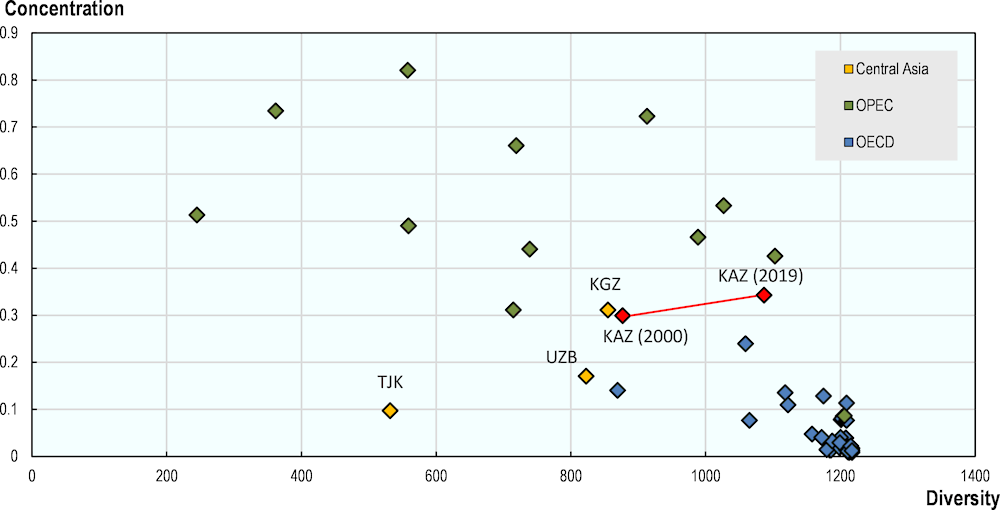

Kazakhstan has started to diversify its economy, but the impact on the composition of output has been limited. One of the clearest indications of the limited impact of diversification in Kazakhstan is the concentration of its export basket. Between 2000 and 2019, Kazakhstan significantly increased the range of products it exports, becoming by far the most diversified exporter in Central Asia in terms of the number of different export products and moving much closer to the OECD average ( Figure 2.6 ) Yet the significant increase in the number of products exported has made only minimal difference to the concentration of the country’s exports in volume terms.

Figure 2.6. Export diversification (2019)

Note: Concentration of exports is measured with a normalized Herfindahl-Hirschman index (HHI) on exported products classified according to the HS 4-digits system. Diversity is measured as the number of exported products according to the HS 4-digits system. The HHI is an index traditionally used to assess the concentration of markets for competition regulators, with a value of 0.15 being competitive, 0.15-0.25 moderately concentrated, and above 0.25 being highly concentrated.

Source: OECD computation based on OEC data (Observatory of Economic Complexity, 2023[16]).

In other words, despite exporting a wider range of products, the overall concentration of the country’s export basket attributable to hydrocarbon products in terms of volume and value has in fact increased. The 0.3 HHI value of Kazakhstan’s export basket in 2019 can be considered to be highly concentrated, similar to that of the 0.496 average of OPEC countries, and significantly higher than the OECD average of 0.042 and above the Central Asia average of 0.23, though this is nevertheless relatively concentrated. That the volume of non-oil exports remains low is indicative of the competitiveness and connectivity barriers SMEs in non-oil sectors face in international trade, which is discussed in Section 2.3 below; a more detailed breakdown of Kazakhstan’s trade is given in Section 2.5.

2.4. Private-sector development and business dynamism

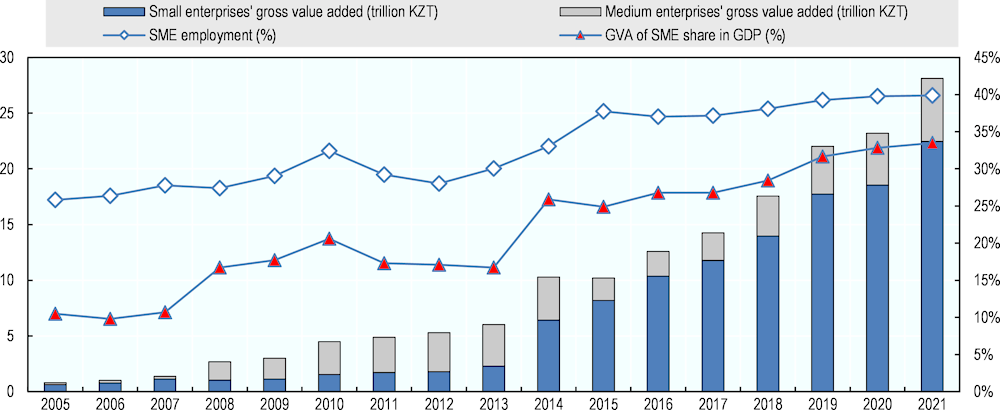

SMEs are a major driver of employment and growth, and their dynamism can be seen as a broader indicator of the health of the business climate. In 2022, small firms accounted for 97.7% of all firms in Kazakhstan, while medium-sized firms accounted for 1.6% and large firms 0.6%. As well as being the largest section of the business community, the weight of SMEs in Kazakhstan's economy has increased over the past two decades, with the share of SMEs in Kazakhstan’s gross value added (GVA) rising from 6% of GDP in 2005 to 34% in 2021, with the share in employment increasing from 16% to 40% over the same period (Figure 2.7 ).

Figure 2.7. SME share in trade, GDP and employment (2005-2021)

Note: GVA is expressed in trillion Tenge.

Source: OECD calculations based on data from National Statistics Office of Kazakhstan (National Statistics Office of Kazakhstan, 2023[20])

The contribution of SMEs to trade is growing, but firm internationalisation is held back by productivity and connectivity barriers. While the total number of SMEs has grown, firm growth has largely been in (often non-tradable) sectors with relatively low levels of internationalisation and productivity. While the lack of productivity in these sectors may be attributable to domestic business climate issues, the general competitiveness issue may be further compounded by the “Dutch Disease” of resource dependence, which via the channel of currency appreciation raises the relative cost of non-oil exports, thereby lowering their competitiveness on international markets. Lastly, Kazakhstan faces significant connectivity penalties. The country is large, geographically remote, and largely peripheral to global trade flows, and addressing these penalties requires significant investment in sustainable and high-quality connectivity infrastructure as well as considerable improvements to the country’s soft infrastructure of customs and other trade-related regulation (ITF, 2019[21]).

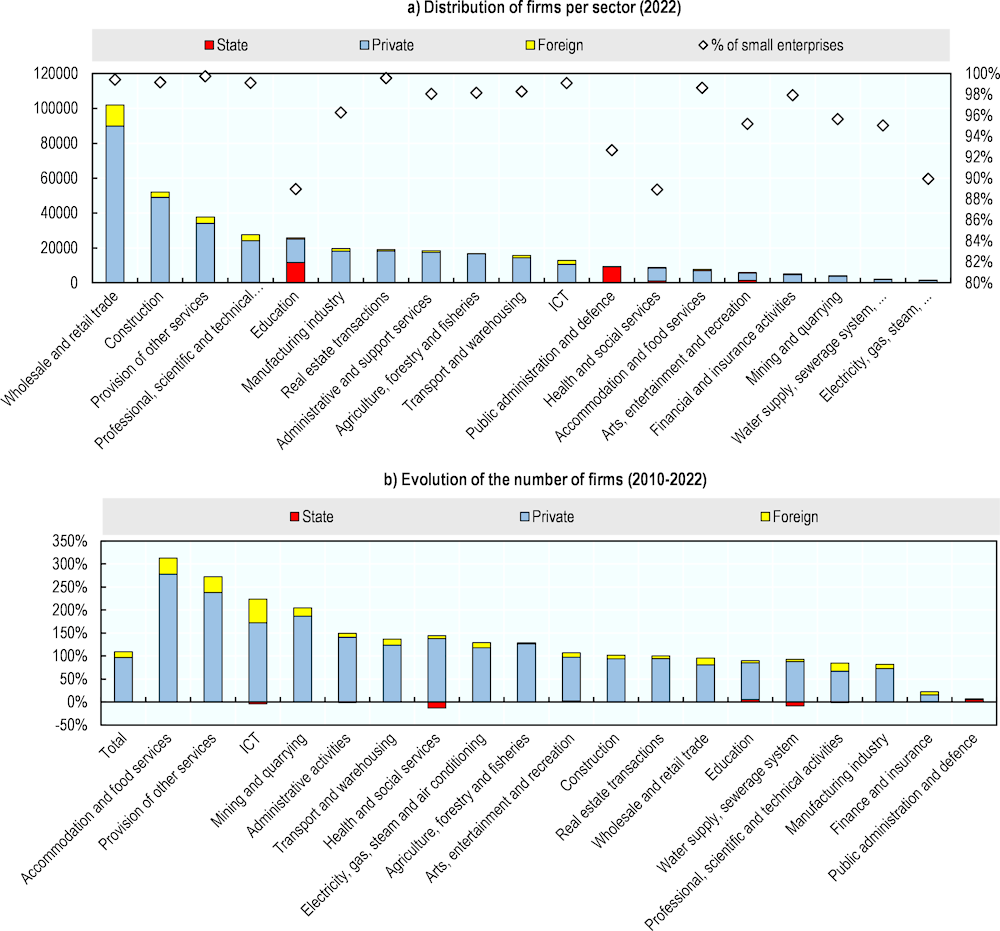

Successive reforms to support private-sector development have made it easier to do business in Kazakhstan. The operational environment for opening and operating a business – in terms of the ease of registration, managing licensing and permitting etc. – has become significantly easier in recent years. It is perhaps unsurprising that, given the increased ease of doing business and relatively strong macroeconomic performance, there has been a significant increase in the number of new firms operating in Kazakhstan (Figure 2.8 . Between 2010 and 2022, higher productivity sectors such as mining and manufacturing have seen significant increases in the number of firms operating (102% and 107% respectively), though the contribution of these firms to the overall business population (1% and 4.9%) and employment (3.2% and 6.6%) in 2022 was still relatively low. At the same time, some of the sharpest rates of firm growth were in lower productivity sectors such as agriculture (a 272% increase) and construction (205%).

Figure 2.8. Business dynamism in Kazakhstan (2010-2022)

Source: OECD calculations based on enterprise data from the National Committee of Statistics of Kazakhstan.

SMEs are present in most sectors of the economy. The largest number of SMEs are found in trade, construction and other undefined services. The sectors the fewest SMEs are education, healthcare, and electricity provision, though this in large part reflects the role of large SOEs in these areas of the economy. It is unsurprising that the footprint of SMEs is smaller in the extractive sectors and sectors adjacent to them (such as manufacturing), but there are nevertheless a large number of smaller enterprises in the industrial ecosystems and supply chains of these higher productivity areas. There has also been a notable growth in the number of foreign firms operating in Kazakhstan. The number of firms with foreign ownership has increased in a number of higher productivity sectors, such as ICT (51%), mining (18%) and professional and technical services (17%).

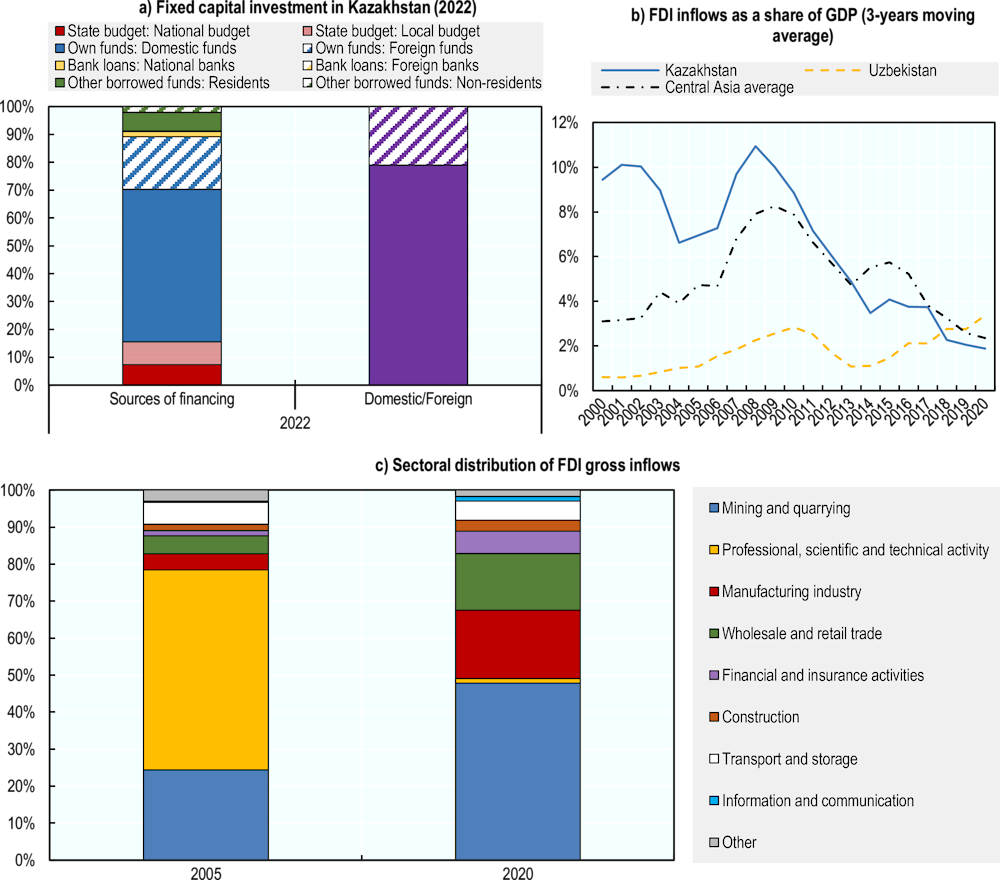

Difficulties in accessing finance and attracting investment may hold back productivity growth, innovation, and ultimately the competitiveness of SMEs. Despite concerted efforts to increase investment, levels of both domestic and foreign fixed capital formation remain low. The consequences for underinvestment in Kazakhstan are significant, particularly in the context of the digital and decarbonisation transitions, which require significant levels of capital-intensive modernisation. Within Kazakhstan, the major footprint of SOEs in the national banking sector, onerous collateral requirements and high market lending rates make access to finance one of the key challenges for the local private-sector. In 2020, the most recent year for which data are available, domestic credit to the private-sector equalled 25.6% GDP, and significantly below the OECD average of 160.7% (World Bank, 2023[2]). The shallowness of domestic credit is compounded by an underdeveloped domestic capital market, with the USD 45.3 billion market capitalisation of the Kazakhstan Stock Exchange (KASE) large for Central Asia but is dwarfed by more established exchanges elsewhere (KASE, 2023[22]). One result of access to finance challenges is that firms are heavily reliant on internal funds for financing needs, which may limit the scope of investment – and incentives for investing – at the firm level (Figure 2.9).

One of the consequences of difficult access to finance is the limited level of investment in ICTs and intangible capital at the firm-level, which may hold back productivity growth and competitiveness. Innovation, the major driver of competitiveness, requires both access to technologies and the infrastructure necessary to use them, and the intangible capital (skills, managerial ability, etc.) required to identify opportunities for innovation and to harness those opportunities. The level of investment in ICT is extremely low as a share of total investment and is significantly below the OECD average (1.98% GFCF vs. 11.4% OECD average) (National Statistical Office of Kazakhstan, 2023[23]). This may in part reflect the industrial structure of Kazakhstan, with key industries such as mining being extremely capital-intensive. It also highlights the broader difficulty of ensuring that the banking sector can channel capital resources to productivity-enhancing investments that benefit the wider economy, something that is made difficult by the onerous cost of borrowing for SMEs. Another channel through which access to finance difficulties affect the competitiveness of domestic firms is in innovation capacities. For example, in 2018, the last year for which data are available, gross domestic expenditure on R&D in Kazakhstan amounted to 0.12% GDP; the equivalent figures for the EU and the OECD were 2.1% and 2.4% respectively (OECD, 2023[24]). Relative to GDP, Kazakhstan is now spending half of what it spent on R&D in 2002, which will undoubtedly have an impact on the innovation, productivity and competitiveness of the local private-sector.

Despite a relatively open regulatory environment for investment, levels of FDI remain low. As a source of financing, FDI remains relatively small in Kazakhstan (Figure 2.9 a), and in 2020, FDI inflows were equal to 2% of GDP, with levels having fallen continuously relative to GDP since the Global Financial Crisis in 2008-09 (Figure 2.9 b). Mining and quarrying accounted for the largest share of FDI in 2020, with manufacturing and wholesale trade the industries that were the other two largest recipients (Fig. 2.9c). The largest investors in 2022 were the Netherlands (29.75%), the USA (18.23%), Switzerland (9.86%) and Belgium (5.57%); China accounted for 5.11% of the total. FDI tends to be concentrated in a handful of regions, notably Atyrau Region (29.4% in 2022), Almaty (27%, Astana (8%) and the East-Kazakhstan Region (7.9%), with the regional concentration of FDI relatively unchanged in recent years (National Statistical Office of Kazakhstan, 2023[23]).

Figure 2.9. Foreign direct investment in Kazakhstan

It is notable that the government has a wide-ranging policy programme to support privatisation, better corporate governance of SOEs, and to rationalise the role of the state in the economy more generally. Kazakhstan is therefore acutely aware of the importance of addressing these issues if the country is to transition to a more sustainable and inclusive model of growth. For example, in its Comprehensive Privatisation Plan 2021-2025, the government has listed 675 public and quasi-public bodies that will be privatised, liquidated or corporatised ahead of privatisation. The government also continues to work with the OECD on these issues, notably through projects on corporate governance of SOEs (OECD, 2021[26]).

The large direct role of the state in the economy may be another challenge for private-sector development. In the OECD Product Market Regulation indicators, Kazakhstan was ranked the fifth most restrictive economy in the countries covered by the index, the economy the third highest level of distortion due to state involvement, and the most restrictive economy in terms of public ownership (OECD, 2018[27]). Whilst the country scores well in areas such as the administrative barriers on start-ups, the playing field nevertheless appears to be highly uneven due to the widespread presence of the state in the economy, from the banking sector to key network sectors and major heavy industries, and the governance of SOEs.

The interaction between the role of the state in the economy and structural transformation towards a market economy is complex and multifaceted (Hausmann and Rodrik, 2003[28]) (Amsden, 2001[29]) (Ha-Joon (Ed.) and Rowthorn (Ed.), 1995[30]). In a context where the government is actively seeking to foster the creation of high-quality jobs for a rapidly expanding labour force, the extensive presence of SOEs creates myriad challenges that will continue to frustrate private-sector development: soft budgetary constraints on SOEs can contribute to inefficiencies, governance issues around incumbents, subsidies to support below cost-recovery services and the impact on investment (IMF, 2021[31]). Taken together, the extent of SOE presence in the economy, the poor governance and oversight of many of these enterprises, and the location of these SOEs in key network sectors, all contribute to make the playing field for business uneven, limiting the effectiveness of otherwise encouraging reform efforts to improve the business and investment climate in the country.

2.5. Trade and economic internationalisation

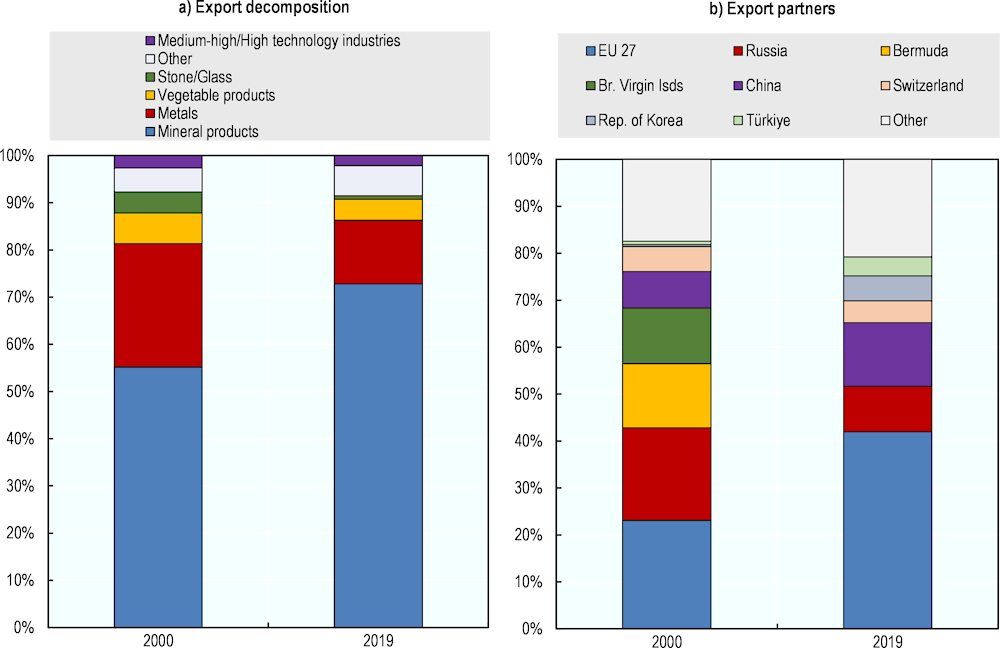

Kazakhstan became a member of the World Trade Organisation in 2015, and external trade is a major driver of growth and domestic output. In 2021, trade was equivalent to 58% of Kazakhstan’s GDP while the export of goods and services amounted to 33.6% of GDP, against an OECD average of 28.2% (World Bank, 2023[2]). The country’s main trading partners are the EU, Russia and China, and its export basket is dominated by mineral products and metals, which taken together accounted for over 80% of all exports in 2021 (Fig. 2.10). Revenues from the export of hydrocarbons and other minerals have helped to reinforce Kazakhstan’s large fiscal and external buffers, with the country having a current account surplus of 2.8% of GDP in 2022, following a 4% deficit in 2021 (IMF, 2023[32]).

Kazakhstan’s trade profile has three overarching and interrelated characteristics. First, the country has an extremely concentrated export basket, one which has become more concentrated overtime despite domestic efforts to diversify exports. Second, the country has a relatively diverse range of export partners, but export routes to these markets are limited. Finally, the nature of the country’s export basket and domestic industries mean that it has a low level of integration in global value chains beyond being a provider of low-technology and generally unprocessed products, chiefly fuels and minerals (OECD, 2021[33]). All three of these characteristics attest to the need for reforms to increase the competitiveness of non-extractive industries and to raise the value-added of extractive industries by moving to more sophisticated activities that create higher productivity employment within those industries, and to improve the trade connectivity of the country to allow non-extractive sectors to be more competitive on global markets.

Minerals and metal products accounted for over 80% of all exports in 2022, and the concentration of Kazakhstan’s export basket has grown over the past two decades (Figure 2.10 ). Kazakhstan made significant efforts to diversify range of products that it exports, but the diversification of products has made little impact to the overall concentration of exports in terms of value. Higher value-added capital goods such as machinery account for a very small share of the country’s exports (around 1%) but are the single largest single category of imports (27.4%). In other words, the industrialisation and modernisation of Kazakhstan’s is funded to a large extent by resource revenues.

Figure 2.10. Structure of trade: export basket and partners (2010 and 2019)

In 2019, the EU was the largest market for Kazakhstan’s exports, followed by China and Russia. The EU accounted for 42% of Kazakhstan’s exports in 2019, while China accounted for 13.6% in the same year. While the EU market has grown significantly for Kazakhstan since 2000, Kazakhstan has in recent years become increasingly oriented towards China and other Asian markets. For example, Kazakhstan’s exports to China grew 71.3% in 2015-2020, or by USD 3.9 billion in nominal terms; exports to India grew 682% over the same period, with this almost entirely attributable to oil exports. Exports to the EU have in fact fallen over the same period, particularly to the country’s three largest EU partners, Italy (17.4%), the Netherlands (-36.7%) and France (-34%) (Observatory of Economic Complexity, 2023[16]).

Given the connectivity penalty Kazakhstan suffers, it is unsurprising that its largest trading partners for lower value-to-weight goods are geographically proximate, particularly the Central Asian economies. In recent years Kazakhstan has been actively exploring ways to diversify its trade routes, one example of this being the development of the Middle Corridor, with the importance of diversifying international trade routes increasing due to the significant volume of Kazakhstan’s trade that transits Russia and the risk of secondary sanctions there (Kenderdine and Bucsky, 2021[35]).

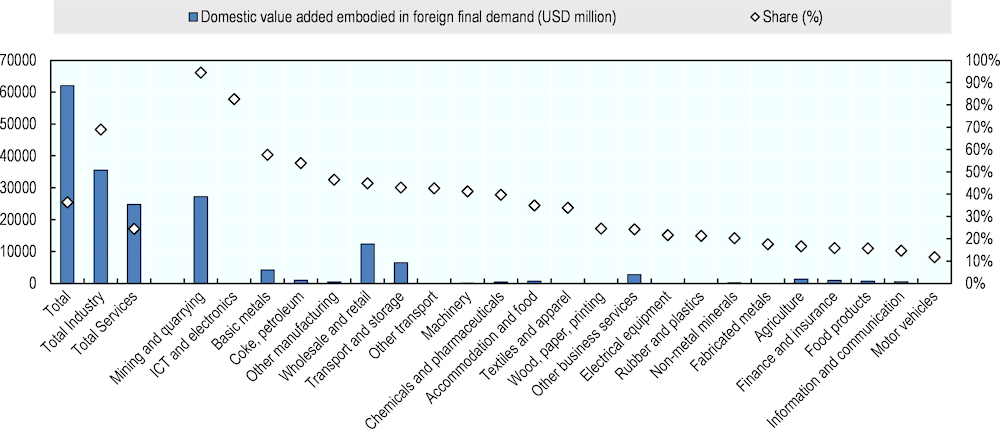

Kazakhstan’s inclusion in the OECD Trade in Value Added (TiVA) indicators allows for a more detailed look at the interaction between foreign demand and domestic output in Kazakhstan, as well as a more in depth look at the country’s integration into global value chains (GVCs) than is possible for other Eurasia economies. In 2018, the most recent year for which TiVA data are available, 36.3% of Kazakhstan’s domestic value added was driven by foreign final demand, though there was significant variation at the industrial level (OECD, 2021[33]). For example, the domestic value added in mining and quarrying is almost entirely driven by foreign demand (94.5%), which although logical given the size of that industry’s output relative to domestic needs, is nevertheless indicative of the precarious relationship between output in the country’s most productive sectors and external demand (Ibid.).

Figure 2.11. Domestic value added in foreign final demand (2018)

Given the low level of more sophisticated exports, the role of imports for exports – beyond the capital goods necessary for the extractive sector – is limited. There are a number of sectors where the foreign value added (FVA) content of exports – i.e., the extent to which a good exported by Kazakhstan has benefited from externally sourced inputs – but these are limited, and their overall contribution to gross exports – for example, ICT and electronics, rubber and plastics, or textiles – is low (Figure 2.11 ). This has a number of implications for Kazakhstan’s trade, notably that it means that the value added of exports is generally created within Kazakhstan, rather than from reprocessed intermediate goods sources externally. The broader conclusion, however, is that the data highlight the very limited degree of integration of Kazakhstan in GVCs – the country has a small number of industries that are embedded in GVCs, particularly at more sophisticated stages of these GVCs, and its contribution to the value added of its export markets is primarily through fuel and other basic goods.

References

[29] Amsden, A. (2001), the rise of “the rest”: Challenges to the west from late-industrializing economies, Oxford University Press, https://doi.org/10.1093/0195139690.001.0001.

[19] Corden, M. and P. Neary (1982), Booming Sector and De-Industrialisation in a Small Open Economy, The Economic Journal, No. No. 368, pp. 825-848, https://doi.org/10.2307/2232670.

[6] EBRD (2022), Kazakhstan Country Strategy 2022-2027, EBRD.

[5] EBRD (2017), Kazakhstan diagnostic paper: Assessing progress and challenges in developing a sustainable market economy, EBRD, https://www.ebrd.com/publications/country-diagnostics.

[18] Frankel, J. and D. Romer (1999), Does Trade Cause Growth?, American Economic Review, No. 89(3):379-399, https://doi.org/10.1257/aer.89.3.379.

[30] Ha-Joon (Ed.), C. and R. Rowthorn (Ed.) (1995), The Role of the State in Economic Change, Oxford University Press, https://academic.oup.com/book/5167.

[28] Hausmann, R. and D. Rodrik (2003), Economic Development as Self-Discovery, Journal of Development Economics, No. 72(2), 602-633, https://growthlab.cid.harvard.edu/files/growthlab/files/2002_econ_development_self_discovery_hausmann_rodrik.pdf.

[11] IEA (2022), Uzbekistan 2022: Energy Policy Review, International Energy Agency, Paris, https://iea.blob.core.windows.net/assets/0d00581c-dc3c-466f-b0c8-97d25112a6e0/Uzbekistan2022.pdf.

[10] IEA (2022), World Energy Outlook, IEA, Paris, https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf.

[9] ILO (2023), ILOSTAT, ILO, Geneva, https://ilostat.ilo.org/.

[32] IMF (2023), World Economic Outlook Database, IMF, DC, https://www.imf.org/en/Publications/WEO/weo-database/2023/April.

[4] IMF (2022), Republic of Kazakhstan: 2022 Article IV Consultation, IMF, DC.

[31] IMF (2021), State-Owned Enteprises in Middle East, North Africa, and Central Asia: Size, Costs, and Challenges, IMF, DC, https://doi.org/10.5089/9781513594088.087.

[21] ITF (2019), Enhancing Connectivity and Freight in Central Asia, OECD Publishing, Paris, https://www.itf-oecd.org/sites/default/files/docs/connectivity-freight-central-asia_2.pdf.

[22] KASE (2023), Kazakhstan Stock Exchange: Overview of KASE equity market in February 2023, KASE, Astana, https://kase.kz/en/.

[35] Kenderdine, T. and P. Bucsky (2021), Middle Corridor - Poliy Development and Trade Potential of the Trans-Caspian Transport Route, ADBI Workign Paper Series, No. 1268, ADBI, https://www.adb.org/sites/default/files/publication/705226/adbi-wp1268.pdf.

[7] MacroTrends (2023), Crude Oil Prices - 70 Year Historical Chart, MacroTrends, https://www.macrotrends.net/1369/crude-oil-price-history-chart.

[23] National Statistical Office of Kazakhstan (2023), Об инвестициях в основной капитал в Республике Казахстан (январь-февраль 2023г.), National Statistical Office of Kazakhstan, Astana, https://new.stat.gov.kz/ru/industries/business-statistics/stat-invest/publications/5194/.

[20] National Statistics Office of Kazakhstan (2023), Enterprise Statistics, National Statistics Office of Kazakhstan, Astana, https://new.stat.gov.kz/ru/industries/business-statistics/stat-org/.

[8] National Statistics Office of Kazakhstan (2023), Main Indicators, National Statistics Office of Kazakhstan, https://stat.gov.kz/official/industry/11/statistic/7.

[16] Observatory of Economic Complexity (2023), Kazakhstan, OEC, MIT, https://oec.world/en/profile/country/kaz#:~:text=Economic%20Complexity,-%23permalink%20to%20section&text=Kazakhstan%20has%20a%20high%20level,expected%20exports%20in%20each%20product.

[14] OECD (2023), Air pollution exposure (indicator), https://doi.org/10.1787/8d9dcc33-en (accessed on 20 April 2023).

[24] OECD (2023), GERD as a percentage of GDP, https://www.oecd.org/sti/scoreboard.htm.

[12] OECD (2023), Green Growth Indicators, OECD Publishing, Paris, https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH.

[13] OECD (2022), Green Economy Transition in Eastern Europe, the Caucasus and Central Asia: Progress and Ways Forward, OECD Green Growth Studies, OECD Publishing, Paris, https://www.oecd-ilibrary.org/docserver/c410b82a-en.pdf?expires=1677162424&id=id&accname=ocid84004878&checksum=F2BCEEF95E86BA77A3ACBB7C97571F14.

[1] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, Paris, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[26] OECD (2021), Ownership and Governance of State-Owned Enterprises: A Compendium of National Practices 2021, OECD Publishing, Paris, https://www.oecd.org/corporate/Ownership-and-Governance-of-State-Owned-Enterprises-A-Compendium-of-National-Practices-2021.pdf.

[33] OECD (2021), Trade in Value Added (TiVA) 2021 ed: Principal Indicators, OECD Publishing, Paris, https://stats.oecd.org/Index.aspx?DataSetCode=TIVA_2021_C1.

[17] OECD (2020), OECD Tax Policy Reviews: Kazakhstan 2020, OECD Publishing, Paris, https://www.oecd-ilibrary.org/docserver/872d016c-en.pdf?expires=1679396564&id=id&accname=ocid84004878&checksum=5537B095685026BCB89BE0C725439AC0.

[27] OECD (2018), The Regulation of Goods and Services Markets in Kazakhstan: An International Comparison in 2018, OECD Publishing, Paris, https://www.oecd.org/economy/reform/indicators-of-product-market-regulation/.

[15] UN (2023), Value added by industries at current prices (ISIC REV. 4), United Nations, New York, http://data.un.org/Data.aspx?d=SNA&f=group_code%3A204.

[34] UN Comtrade (2023), UN Comtrade Database, UN Comtrade, Geneva, https://comtrade.un.org/.

[25] UNCTAD (2023), Foreign direct investment: Inward and outward flows and stock, annual, UNCTAD, Geneva, https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740.

[3] UNCTAD (2023), UNCTATStat, UNCTAD, Geneva, https://unctadstat.unctad.org/EN/.

[2] World Bank (2023), World Bank Development Indicators, World Bank, DC, https://databank.worldbank.org/source/world-development-indicators.

Note

← 1. The regional average includes Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan, but excludes Turkmenistan.