The subject of this chapter is the governance and financial aspects of social services in Spain. First, it describes how different Autonomous Communities deal with information management, more specifically on the development of information systems for social services, and the involvement of the non-profit and for-profit sector. Secondly, it explains the principles of financing of the Autonomous Communities, and shows statistics on the financing and expenditures of social services. Finally, it presents the limited mechanisms for intra- and inter-autonomic co‑ordination.

Modernising Social Services in Spain

5. Financing, expenses and governance of social services in Spain

Abstract

The financing of expenses and the governance of the social services system are closely related issues. An analysis of the costs of social services in the different autonomous communities would be impossible (or would inevitably lead to incorrect conclusions) unless the financing mechanisms and the existing tools to supervise the different actors’ work and to monitor expenditure were also studied. Finally, it is extremely important to understand the extent to which the data being analysed are reliable and complete. This section is entirely dedicated to these topics. The main findings show that the lack of a national information system for social services (or at least of harmonised data models and protocols) leads to information on funding and expenditure that is incomplete and non-comparable across regions. In addition, the co‑ordination among the institutions that provide social services is challenging because of the complex governance system at local, regional and national level.

5.1. The role of the third sector and the importance of information management

Information management presents a number of challenges in the autonomous communities. Although most, if not all, autonomous communities are making efforts to improve their information technology structure, the current situation of information management should be improved. The lack of timely and complete information about the provision of services, human resources, detailed expenditure and financing sources makes it difficult to analyse the situation as a whole (at regional level and even more at national level) and draw reliable conclusions on the effectiveness of social services systems. Although strategic plans are in place, there is a lack of sufficient data for services to be better planned.

A significant example of this lack of information are the services provided by the third sector. They are of great importance in many autonomous communities, but key figures allowing researchers and policy makers to quantify the services provided are generally not documented or are only partially documented. This section opens with an analysis of these issues, including the role of the third sector in providing social services.

5.1.1. The role of information systems in service planning and implementation

In their daily work, professionals working in social services are faced with decisions regarding the quality of the service they provide. Those responsible for managing these services must make decisions that will affect not only the experience of users, but also of the professionals working under their management. High-level decision makers in charge of making strategic decisions (such as the regulation of private providers, the regional organisation of services or the implementation of a single user registry) know that these decisions will affect not only the immediate experience of service users and providers, but also how social services function as a whole (including costs, and the capacity to adapt systems to new situations) and in the long term.

Decision-making processes can be more or less complex depending on the problems being addressed. In general, and even more so in the case of strategic decisions, these processes follow a cycle that can be summarised as follows: (i) identification of the problem (what needs to be solved or improved?), (ii) identification of possible solutions, (iii) analysis of these solutions (such as costs, benefits, consequences linked to other problems), (iv) selection of a solution, (v) implementation of the solution and (vi) evaluation of the results once the solution has been implemented.

Although not sufficient, the quality of the information available is a key element to ensure that the solutions adopted lead to an effective improvement in the quality of services. This applies throughout the entire process and at all levels. For example, social workers will be able to better assess the situation of a person requesting assistance if they know his/her family situation, economic situation, employment history, medical history, judicial history, and, of course, any assistance from social services (in any region of the country) that this person may have received in the past. The head of a social services centre, faced with high demand and lengthening waiting lists, will be able to give priority to certain urgent cases in a fair and efficient manner, provided that they know the typology of the cases on the waiting list, the time elapsed since the request/evaluation of each case, the workload of the professionals under their responsibility and, if possible, the availability of other centres nearby to take on some cases. In the context of strategic planning, the analysis required to carry out a reform at the regional level (and even more so at the national level) based on concrete (i.e. from field services), complete (i.e. covering the whole territory and all levels of service) and relevant (i.e. that do not leave out variables that are vital in the analysis of the different solutions) data, will lead to a better assessment of the situation (what do we want to improve?). This includes a thorough analysis of the costs, benefits and implications of each possible solution, and will ultimately make an informed evaluation of the reform’s impact possible.

In a significant number of autonomous communities, there is no single data-collection system containing information on the social services of all local entities. Each situation leading to different information-related issues. Some examples (many other might be cited) are:

In the Balearic Islands, there are currently three systems: Operated by the Consell de Mallorca, the Historia Social Integrada [Integrated Social History – HSI] integrates the information of users of the social services of all the islands, with the exception of the municipalities of Palma and Calvià, as each have their own information system: NOU and SIAP.

In the Community of Madrid, there is no common information system for the entire community.

Primary care centres have access to the Sistema de Información de Usuarios/as de Servicios Sociales, an IT solution provided by the central government [Information System for Users of Social Services – SIUSS]. However, not all municipalities transfer data to the SIUSS.

In Catalonia, although the HESTIA system is used in 80% of the basic areas, there are currently 12 different computer systems.

In the Basque Country, there is an application that the Basque Government makes available to municipalities and that they can use. However, each municipality is responsible for organising the information systems and the provincial councils have their own application.

In addition, the lack of interconnectivity hinders integrated or holistic intervention and, above all, complex case management that requires attention from several professionals for social inclusion. The implications of this lack of co‑ordination are manifested in various ways, such as the lack of integration of social services with other sectors, including the health system and employment services. Each system has its own resources and professionals, as well as a differentiated management and economic structure. There is also a lack of emphasis on evaluation and data to provide information on user experience and outcome, or on whether the interventions are useful or yield results. Recently, there have been new initiatives in certain autonomous communities to introduce these concepts and quality and satisfaction surveys (see Section 5.3.2). In many autonomous communities, the exchange of information between private and public entities is difficult because they do not have integrated systems. The reasons for this are understandable, with user privacy probably the most important. However, poor integration means there is a lack of information on the third-sector’s activities: services provided, users, types of intervention, and so on, which can lead to duplication in places where there is no co‑ordination between the two management bodies. An exception is Castile‑León, where statistics reflect all social services activities and work is under way on technological innovations that will give authorised professionals from third-sector entities access to the computer system. This will make it possible to have data on all services, including those provided by entities, whether they are collaborators or agents. A detailed analysis of the Information Technology systems that support the action of social services in Spain, along with recommendations to improve them and to create a national information system of social services can be found in (Fernadez, Kups and Llena-Nozal, 2022[1]).

5.1.2. Contracting social services in the third sector

As explained in the previous section, while recognising its very important role, it is impossible to quantify the action of private providers, and in particular of third sector entities, in the provision of social services. However, it is possible to analyse the mechanisms of collaboration between public and private actors from a statutory perspective.

The provision of services can be carried out directly by public entities or by private actors: either from the third sector or for-profit companies that are subcontracted or receive a subsidy. In general, there are different rules for primary and specialised social services. In all communities, private entities can provide specialised care services, although the prerequisites and the openness of the system to the initiative vary greatly from one community to another (Table 5.1). In general, services that are reserved for direct management – such as information, evaluation, assessment, guidance and child adoption services – cannot be subcontracted. Regarding primary care, only home care services are usually provided by private entities. However, private entities are not authorised to provide primary care social services of any kind in Castile‑La Mancha, Extremadura and Murcia. In Aragon, Catalonia, the Community of Valencia, Galicia and Navarre they are only authorised to do so in particular situations.

Several autonomous communities give preference to the participation of non-profit entities rather than for-profit entities as social services providers, for example in the Balearic Islands and Castile‑La Mancha. In Andalusia, for-profit providers can only be contracted in the absence of other social initiative entities. In some autonomous communities, conditional priorities are established between social initiative entities and for-profit entities. For example, in the Canary Islands, similar conditions of effectiveness, quality and social profitability are required. In Murcia and the Basque Country, priority is linked to effectiveness, quality and equal costs. The relevant Murcia regulations additionally focus on preferential access for people with a low socio‑economic status as an additional criterion when selecting a provider.

Private providers are generally contracted through a mix of different legal instruments, which vary between non-profit and for-profit providers. Agreements, social accordance1 and subsidies are favoured for non-profit entities. Contracts are used for for-profit entities, and tendering may be used to select them. In the Basque Country, for example, in addition to the accordance, contracts are used when it is not possible to resort to the accordance regulation due to the innovative nature of the services. Additionally, subsidies or agreements are used for non-profit entities that offer benefits or services not included in the Basque Social Services System’s services catalogue. Murcia notes that co‑operation methods other than agreements are possible if appropriate. Some regions, such as the Community of Madrid, are currently exploring the possibility of developing new regulations to define in detail the mechanisms necessary to facilitate collaboration with the private sector and to anticipate all the possible options (subsidy, accordance, agreement and tendering) and the suitability of each of them depending on the services.

Table 5.1. The regulation of private participation in providing services varies among autonomous communities

|

Region |

Authorisation for private entities to provide services |

Regulatory instruments (and to which entities they apply) |

Additional information |

|

|---|---|---|---|---|

|

|

Primary (1) |

Specialised |

|

|

|

Andalusia |

Authorised |

Authorised |

Social accordance (non-profit) Contract (for-profit) |

Social initiative entities have priority and only in their absence may they be merged with private for-profit entities. Social initiative organisations may receive subsidies, while for-profit suppliers are contracted via tenders. |

|

Aragon |

Authorised in particular situations |

Authorised |

Accordance |

Services not reserved for direct management (information, assessment, guidance and diagnosis and adoptions) may be subcontracted. Non-profit organisations are involved in disability services and child protection. Other services can be done with for-profit organisations. |

|

Contract |

A law on private entities providing social services is being drafted for the comprehensive regulation of private entities, centres and services. It will introduce administrative accreditation. |

|||

|

Asturias |

Authorised |

Authorised |

Concerted action agreements (non-profit) Contract |

Direct management or management using its own resources is preferred. |

|

Balearic Islands |

Authorised |

Authorised |

Collaboration agreements, subsidies and grants |

Third-sector social entities have priority over other private entities. |

|

Community of Madrid |

Authorised |

Authorised |

Collaboration agreements and subsidies (non-profit) Contracts (for-profit and non-profit) |

The new law would potentially define in more detail the mechanisms necessary to ensure collaboration with the private sector, provide for all possible options (subsidy, accordance and tendering) and consider how suitable each of them are to each service. |

|

Community of Valencia |

Authorised in particular situations |

Authorised |

Contracts (for-profit and not-for-profit entities) |

NGOs and private for-profit companies provide specialised services, mainly in home care and residential services. |

|

Concerted action (social initiative entities), subsidies |

|

|||

|

Canary Islands |

Authorised |

Authorised |

Agreement (non-profit) Contract (various options) Subsidies (NGO) |

For the establishment of indirect management options, when similar conditions of effectiveness, quality and social profitability exist, the responsible public administrations will ideally give priority to social initiative entities. |

|

Cantabria |

Authorised |

Authorised |

|

|

|

Castile‑León |

Authorised |

Authorised |

Accordance, subsidies |

|

|

Castile‑La Mancha |

Unauthorised |

Authorised |

Contract, accordance Agreement (non-profit) |

Social initiative entities have priority over other private entities. |

|

Catalonia |

Authorised in particular situations |

Authorised |

Purchase Contract |

Co‑operation is organised through agreements. |

|

Extremadura |

|

Authorised |

Contract, agreement, subsidy |

|

|

Galicia |

Authorised in particular situations |

Authorised |

Contract, accordance, subsidy (non-profit) |

Subcontracting is more common at the regional level. At the local level, since the dependency law entered into force, home care services have been outsourced to a large extent. However, the main provision of the home care service, understood as basic, regular and continuous care, cannot be outsourced. |

|

La Rioja |

Authorised |

Authorised |

Contract, Agreement (non-profit), subsidy (non-profit) |

|

|

Murcia |

|

Authorised |

Accordance |

Other co‑operation options are possible. |

|

Agreement |

When there are similar conditions of effectiveness, quality and costs, the public administrations will give priority to services and centres of non-profit private initiative entities and preferably serve people of a low socio‑economic status. |

|||

|

Navarre |

Authorised in particular situations |

Authorised |

Accordance subsidy (non-profit) |

In no case may the management of a service that is being provided directly with its own means be converted into indirect accordance by means of an agreement. |

|

Basque Country |

Authorised |

Authorised |

Accordance, contract (when, due to the nature of the services, it is not possible to resort to the accordance system), grant or agreement (for non-profit entities offering services not included in the catalogue) |

The public administrations will give priority to non-profit entities when there are similar conditions of effectiveness, quality and costs, Work is under way for a decree in 2021 on consultation with the sector and on public-private supply. |

Notes: (1) In general, primary care is the responsibility of the municipality, but home care may be provided by private entities.

Source: 2021 OECD Social Services Questionnaire.

5.2. Funding sources vary with respect to type and level of care

5.2.1. Principles of funding in Spain and the fiscal situation of public administrations before the COVID‑19 crisis

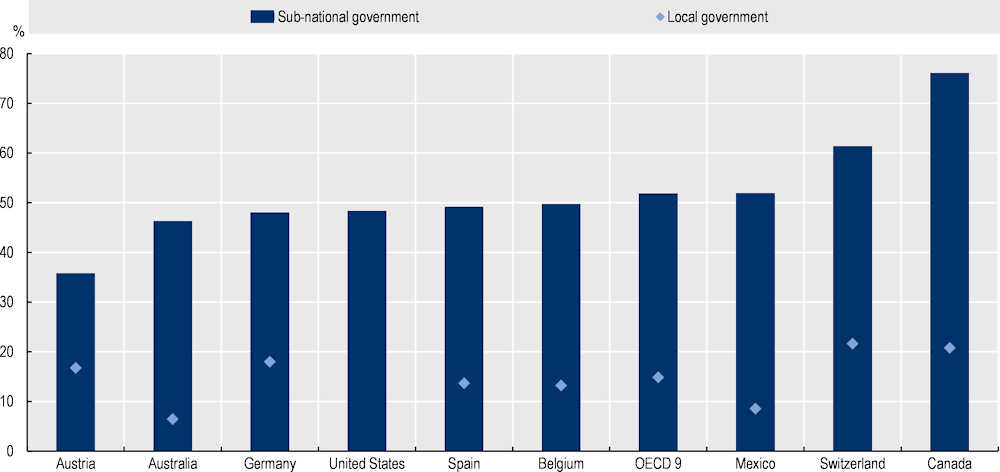

As part of the process of decentralising the Spanish system of government, the public financing system has transferred funds from the central government to the autonomous communities. In 2016, the expenditure of the autonomous communities and local entities accounted for 35.5% and 13.7% of overall public administration expenditure, respectively (OECD, 2017[2]). Considering all subnational levels, the combined share of expenditures in Spain is very close to the average of the nine (near)-federal OECD countries (50%) (Figure 5.1). The 13 percentage point increase in the share of expenditure at the subnational level (as a percentage of public spending) between 1995 and 2016 has been the largest of all OECD countries. This growth is largely due to the education and health sectors having been decentralised in 2002 and 2005. Spain, along with Australia, Canada, Denmark, Finland, Germany, Japan, Sweden, Switzerland and the United States, is part of a group of OECD countries that combine high decentralisation of expenditures and high decentralisation of public revenues (OECD, 2019[3]).

Figure 5.1. In Spain, the sharing of expenditures between central and subnational governments is close to the OECD average

Note: OECD 9 is the unweighted average of the nine (near)-federal OECD countries. The local government average does not include the United States.

Source: OECD (2017[2]), Subnational Government Structure and Finance Dataset, http://stats.oecd.org/Index.aspx?DataSetCode=SNGF.

The system for funding public services in Spain is complex. At the regional level, there are two different systems: the foral regimes of the Basque Country and Navarre, and the common regime in the 15 other autonomous communities. In the common regime, the central government manages a significant portion of tax revenues and uses these revenues to finance its own activities and to transfer funds to the autonomous communities. Specifically, the central government keeps all revenues from corporate taxes and transfers half of the revenues from personal income and value‑added taxes (VAT), 58% of certain excise duties and all revenues from taxes on electricity, wealth and other taxes. The regions of the common regime have autonomy in determining the rates of taxes on income, wealth, capital transfers, the levy on lottery and betting winnings, vehicles and hydrocarbons. In the foral regime, the three Diputaciones [provinces] of the Basque Country and Navarre collect almost all taxes (apart from import duties, payroll taxes, VAT and import levies on excise duties) themselves. They use these revenues to finance their expenses and to transfer a portion dedicated to common expenses to the central government (de la Fuente, 2019[4]).

Public funding also has elements of solidarity redistribution that Act 22/2009 on the financing of the autonomous communities has reinforced. For inter-regional redistribution by the Fondo de Garantía de Servicios Públicos Fundamentales [Essential Public Services Guarantee Fund], 75% of the theoretical tax revenues are redistributed (assuming equal tax rates) according to the needs of each autonomous community.2 The Fondos de Suficiencia, Co‑operación y Competitividad [Sufficiency, Co‑operation and Competitiveness Funds] redistribute resources between the central government and the communities according to complex criteria such as distribution in the previous period and population density and growth (de la Fuente, 2019[4]).

As a result of various trade‑offs between horizontal (between regions) and vertical (from the central government to the regions) transfers of funds, Australia is the only OECD country where the redistribution of public financial resources between regions is similar to that of Spain. However, inequalities have not been eliminated. They persist because the foral communities contribute less than their population and economy would suggest; and because of stability clauses that link vertical transfers to the amounts from the previous period, reproducing differences in the provision of public services over time (Lago-Peñas, Fernández-Leiceaga and Vaquero-García, 2017[5]). Finally, transfers from the Fondo de Garantía [Guarantee Fund] do not consider other factors that influence the demand for social and other public services, nor how differences in price levels between regions affect the costs of service provision for local users.

Local entities are funded from several sources. They collect taxes on real estate, on business, professional and artistic activities, and on the vehicle trade and vehicle registration, and they may tax construction activities and real estate capital gains. In 2017, taxes accounted for 52% of public entities’ revenues, transfers accounted for 28%, fees accounted for 13% and other sources accounted for 7% (REAF asesores fiscales, 2018[6]).

The Organic Act 2/2012 on Budgetary Stability and Financial Sustainability established strict rules for public budgets. Article 135 of the Constitution enshrines the principle of budgetary stability (OECD, 2019[7]; Salazar-Morales and Hallerberg, 2018[8]). The law specifies that, under normal circumstances (outside of structural reforms, natural disasters, pandemics and recessions), all levels of public administrations must have a surplus or balanced budget. The central government has the authority to control, monitor and sanction subnational entities that do not comply with budget rules. Expenses can only increase in line with economic growth.

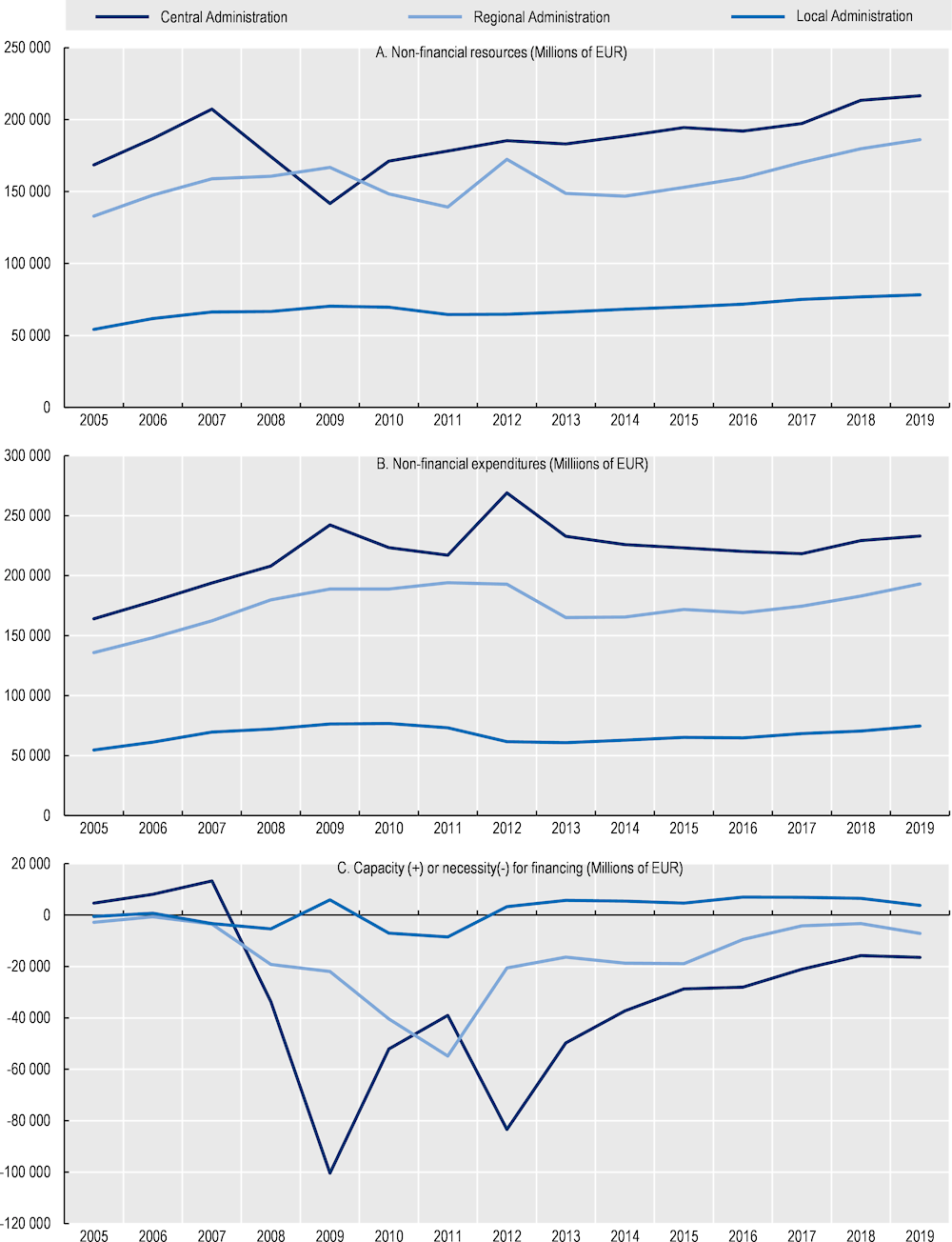

Economic recovery combined with the aforementioned new rules resulted in fiscal consolidation in the years leading up to 2020. Following the global financial crisis, central government revenues fell between 2007 and 2009 (Figure 5.2). The fall reached the autonomous communities in 2010 and particularly in 2011, when local entities’ resources decreased slightly. From 2012, the resources of the different levels of government began to grow again, partly due to increased tax rates on personal income, VAT and excise duties. At the same time, expenses decreased, meaning the need for financing reduced. This resulted in local governments collectively achieving a slight surplus in 2019. By causing a reduction in tax revenues and increase in public expenditures, the COVID‑19 crisis disrupted fiscal consolidation in Spain in 2020 and will most likely continue to do so.

Figure 5.2. Between the time of the financial crisis and the COVID‑19 crisis, public administrations had consolidated their fiscal situation

Note: Non-financial resources consist of current resources (mainly taxes) and capital resources.

Source: Treasury (2020[9]), “Contabilidad Nacional. Operaciones no financieras” [National accounts. Non-financial operations], Central Information Office of the General Comptroller of the State Administration,https://www.igae.pap.hacienda.gob.es/cigae/Anual.aspx.

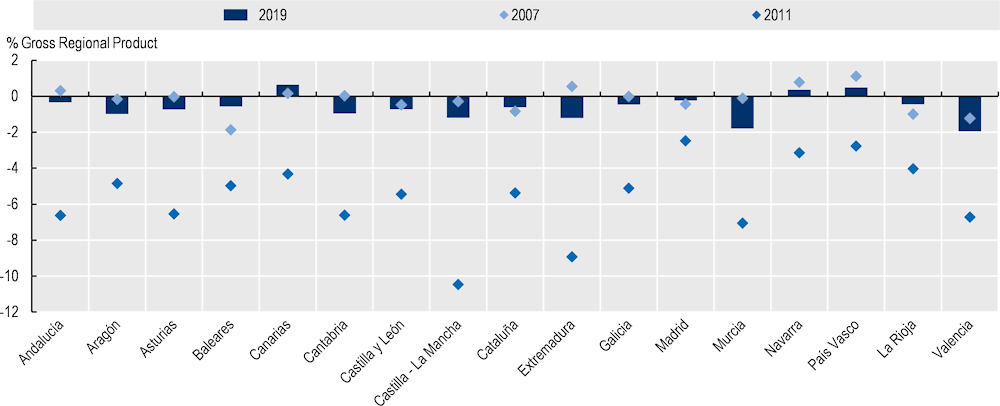

Although only a minority of the autonomous communities had a budget surplus in 2019, all had drastically improved their fiscal situation compared to in 2011. The Canary Islands, Navarre and the Basque Country had more significant resources than they used in 2019, and most other communities had a funding requirement of less than 1% of their regional gross domestic product (GDP) (Figure 5.3). However, it should also be noted that in 11 autonomous communities the deficit in percentage terms was larger (or the surplus was smaller) in 2019 than in 2007. Extremadura had a surplus in 2007 and a deficit in 2019. The funding requirements of Castile‑La Mancha, Extremadura, Murcia and the Community of Valencia exceeded 1% of their regional GDP.

Figure 5.3. The funding needs of regional governments were less significant in 2019 than in 2011

Source: Treasury (2020[9]), “Contabilidad Nacional. Operaciones no financieras” [National accounts. Non-financial operations], Central Information Office of the General Comptroller of the State Administration, https://www.igae.pap.hacienda.gob.es/cigae/Anual.aspx.

5.2.2. Differences among autonomous communities in the funding of social services

The funding of social services is the responsibility of each level of government. However, it may be supplemented by transfers from higher administrative levels (Pontones Rosa, Pérez Morote and González Giménez, 2010[10]). The regional government is responsible for funding specialised social care services that fall under its jurisdiction. Often, specialised services are managed and provided by the regional government. In turn, local entities (municipalities, provinces or islands, depending on the functional structure), must fund basic care services, but with variable contributions from regional and central government levels. In addition, as shown above, beneficiaries of social services may be asked to pay a portion of these costs (co-payment). The amount of the co-payment should not exceed the financial capabilities of the beneficiaries, as this might indirectly exclude them from access to services (Resa, 2001[11]).

The European Union may also contribute to funding, particularly investing in the improvement of social services. In the 2014‑20 period, Spain received around EUR 3.7 billion in European Union funds dedicated to social inclusion through the European Social Fund, the European Regional Development Fund and the European Agricultural Fund for Rural Development. In Spain, most of these funds are earmarked for labour market integration, but they can also help improve access to public services (European Commission, n.d.[12]). For the 2021‑27 period, the European Social Fund Plus includes funds to help the most vulnerable people and to provide food and basic material assistance to people with high levels of deprivation (European Commission, 2020[13]). Other funds may also provide one‑time financing. For example, in 2020, the City of Madrid and the European Investment Advisory Hub, funded by the European Commission and the European Investment Bank (EIB), signed a financing agreement for a feasibility study for a “social impact bond” that seeks alternative solutions for people living in temporary accommodation (European Commission, 2020[14]). In theory, private social services providers can also access funds from the European Fund for Strategic Investments (EASPD, 2015[15]).

Some autonomous communities think that European funds could make an even bigger contribution to funding social services in the near future. The 2017‑20 Second Strategic Plan for Social Services of Aragon explicitly states within its objectives the need to explore new ways of funding the system. It also indicates the associated measures to “promote the incorporation of European funds in the financing of services” and “inform and share with social entities the potential of financing with European funds” (Departamento de Ciudadanía y Derechos Sociales, 2017[16]). Similarly, the 2017‑21 Strategic Plan for Social Services of Castile‑León notes that “[...] taking advantage of funding opportunities from Europe, become strategic objectives in the medium and long term in order to enable our social services to become a true laboratory for experimentation and innovation in the social sphere” (Gerencia de Servicios Sociales, 2017[17]). However, it is sometimes difficult to trace clearly the amount of European contributions to regional spending on social services. In general, it is likely that European funds that go directly to local entities and especially to third-sector providers are not counted in the breakdown of regional social services funding. In fact, in hardly any cases do the tables provided by regional authorities during the fact-finding missions show the funding of primary care social services provided by the communities indicate a contribution from the European Union.

The Concerted Plan is the central administration’s main channel of co-funding for basic care social services. The plan is an annual co‑operation agreement between the central and regional governments that has been in place since 1988. The plan seeks to guarantee basic services to citizens throughout the territory and to establish principles of co‑ordination and co-financing. However, Navarre and the Basque Country – the communities of the foral regime – do not participate in it. In addition to commitments for co-financing, management, information and technical assistance, the communities have agreed to co-finance an amount at least equal to the central government’s contribution. In recent years, the contributions of the autonomous communities have far exceeded those of the Concerted Plan. One consequence of this situation is that the information on funding published in the annual reports of the Concerted Plan (see Box 5.1) is incomplete because some communities only report the contributions that will co-finance what falls within the context of the Concerted Plan, omitting of the rest of the expenditure. In other cases, the municipal bodies do not report their total expenditure to the regional authorities. As a result, information on financial contributions cannot be compared between the communities (MSCBS, 2019[18]).

In addition to the funds associated with the Concerted Plan, regions may also co-finance the expenses of local entities through other programmes. For example, in the province of Albacete in Castile‑La Mancha, part of the funds that local entities receive to provide services under their jurisdiction and to develop programmes under regional jurisdiction comes from the Regional Social Action Programme and the Regional Social Integration Plan (Pontones Rosa, Pérez Morote and González Giménez, 2010[10]).

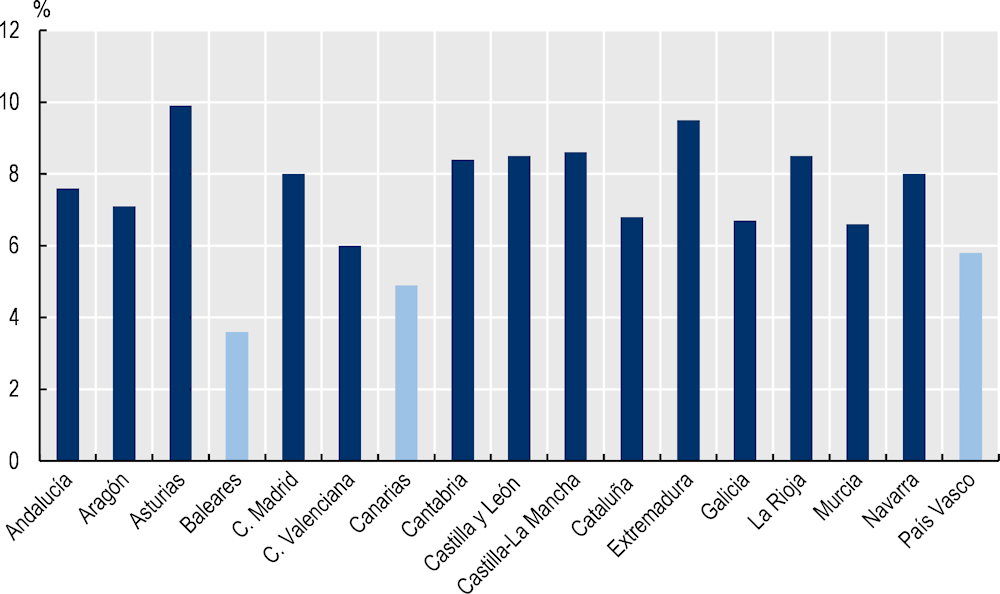

The share of the regional budget devoted to social services varies greatly between regions. Social services expenses may constitute up to 10% of the total budget, as is the case in Asturias and Extremadura, or 6% or less, as is the case in the Community of Valencia (Figure 5.4). By way of comparison, and on average, education represents 21% and health care 33% of the regional budget. The variation in the share of the budget dedicated to social services reflects several situations: political priorities and population structures with different needs, or differences in the relative contribution of the autonomous community and local entities to social services.

Figure 5.4. Social services account for up to 10% of the regional budget

Notes: The percentages of the Basque Country, the Canary Islands and the Balearic Islands cannot be directly compared with those of the other autonomous communities due to the significant expenses of the provincial and island councils (diputaciones, cabildos and consejos insulares).

Source: Asociación Estatal de Directoras y Gerentes en Servicios Sociales [State Association of Directors and Managers in Social Services] (2019[19]), “El Gasto Social por Comunidades: Sanidad, Educación y Servicios Sociales” [Social Expenses by Autonomous Communities: Health, Education and Social Services].

Users may be asked to contribute to the cost of some services, usually expensive ones, such as home care and residential facilities. With the exception of Galicia, Murcia and the Community of Valencia, regional social services laws specify that the social services catalogue must establish the services subject to co-payment (see Section 4.3.2).

The level of co-financing of primary care services by regional administrations varies considerably across regions. Central government contributions represent less than 5% of funding in each region (Table 5.2). The relative share of regional and local government contributions varies greatly. Asturias is the exception, where the contribution of the regional and local levels is almost identical. In the Balearic Islands (only for basic community services) and in Murcia, local entities contribute 3.0‑3.5 times more than the regional government. In the other regions, the regional government finances a larger share than the local entities – from 1.3 times more in Cantabria to 32 times more in Extremadura. One issue is that the amount of users’ co-payments is not known in most communities. A reason for this may be that local entities do not include these co-payments in their general or agreement-related reports to avoid funding cuts. Therefore, Table 5.2. may underestimate the financial contribution of local entities, which in some cases may have higher expenditures than they report to the regional government. The fact that the boundaries between the resources of the central government, autonomous communities, local corporations and user co-payment are not clearly defined often makes it difficult to quantify the real contribution of each administration.

Table 5.2. Regional budgets are the most important source of funding for basic social services in most of the communities

Distribution of funding sources for primary care social services, 2018

|

|

Central government |

Autonomous community |

Local entities |

Co-payments |

Other |

|---|---|---|---|---|---|

|

Andalusia |

1 |

64 |

34 |

1 |

0 |

|

Aragon |

2 |

61 |

37 |

||

|

Asturias |

2 |

47 |

45 |

5 |

|

|

Balearic Islands |

2 |

22 |

77 |

||

|

Community of Madrid |

4 |

85 |

11 |

||

|

Community of Valencia |

4 |

45 |

51 |

||

|

Canary Islands |

2 |

24 |

72 |

0 |

1 |

|

Cantabria |

2 |

55 |

43 |

0 |

|

|

Castile‑León |

4 |

82 |

13 |

0 |

|

|

Castile‑La Mancha |

4 |

70 |

26 |

||

|

Catalonia |

|||||

|

Extremadura |

97 |

3 |

|||

|

Galicia |

2 |

10 |

88 |

||

|

La Rioja |

14 |

86 |

|||

|

Murcia |

4 |

29 |

67 |

||

|

Navarre |

|||||

|

Basque Country |

3 |

21 |

37 |

27 |

12 |

Note: The funding for the Balearic Islands refers exclusively to basic community social services and does not include specific primary care community social services. For Andalusia, the co-payment refers to the users’ contribution to the home care service. The information for La Rioja and the Basque Country cannot be directly compared to the other communities because there is a lack of information on the funding of entities for La Rioja and the distribution for the Basque Country refers to primary and specialised care and to economic benefits. Empty boxes mean information was not reported, boxes with a zero mean data were reported but less than 0.5%.

Source: 2021 OECD Social Services Questionnaire.

Regarding trends, according to the information communicated by regional authorities the total amount allocated to primary care services has increased in most regions in nominal terms, generally ahead of inflation. Asturias and Murcia are the exceptions. The most substantial increase has occurred in Castile‑La Mancha. The (already important) role of regional administrations in funding primary care social services has grown significantly in several autonomous communities. Particularly between 2012 and 2018, the share of funding provided by the community grew in Aragon, the Balearic Islands, Castile‑La Mancha and Extremadura, and slightly in Castile‑León. In the same communities, with the exception of Castile‑León, the relative contribution of local entities has decreased. In Cantabria, Galicia, Murcia and the Basque Country, the composition of funding has remained almost constant and in Andalusia, Asturias and La Rioja, the share of regional contributions has decreased.

Regional laws and regulations set out different criteria for the allocation of regional co-financing to local entities for primary care services. Some laws or decrees explicitly list the criteria, while others establish tools for an agreement (such as agreements between local and regional authorities) to determine how to distribute these funds. In some cases, there are clear criteria, while others simply refer to the needs and the funding or management capacity of the different levels of government (Table 5.3).

A key criterion for the distribution of co-financing is a municipality’s population. This is to be expected, given that the size of the population influences the needs and funding capacity. Municipalities with a population above a certain threshold typically receive a smaller subsidy in percentage terms than small municipalities or associations of municipalities (Table 5.4). An additional factor explicitly mentioned in some communities, such as the Community of Madrid, the Community of Valencia, the Canary Islands and Castile‑León, is the dispersion or concentration of the population. This factor reflects the fact that the provision of services is generally more costly in (associations of) municipalities with a widely dispersed population than in more densely populated municipalities. Some communities have defined specific criteria to allocate resources based a more strict assessment of the needs of the different local entities. For example, the Community of Madrid and Navarre not only mention the size and dispersion of the population, but also other criteria such as population under and over working age, beneficiaries of minimum income schemes and/or social services. Other communities, such as the Canary Islands and the Community of Madrid, include macroeconomic criteria such as unemployment rate and GDP per capita. Finally, in the Balearic Islands, explicit reference is made to the improvement of ratios as a criterion for allocating funds.

Table 5.3. Some communities include particular needs and qualitative improvement in their decisions to allocate co-financing funds for municipal social services

|

Criteria for the allocation of community co-financing to local entities for the financing of primary care social services |

Percentage of co-financing specified in the Social Services Law? |

|

|---|---|---|

|

Andalusia |

Social Services Map; Needs and financing capacity of local entities |

No |

|

Aragon |

Contributions and needs |

Yes |

|

Asturias |

Size of the local entity |

No |

|

Balearic Islands |

Population, improvement of ratios |

Yes |

|

Community of Madrid |

Population criteria (volume and distribution of the population (under 16 and over 65 years of age, immigrant and dependent population), recipients of the guaranteed minimum income, the inverse relationship of GDP per capita and the dispersion of the population and number of municipalities). There are discussions to include other criteria, such as the rate of people at risk of poverty and/or marginalisation and a criterion to reflect rural access. |

No |

|

Community of Valencia |

Population distribution and concentration |

Yes |

|

Canary Islands |

Number of inhabitants, unemployment rate, dispersion and double insularity |

Yes |

|

Cantabria |

|

No |

|

Castile‑León |

Population, population dispersion and the demands presented by local entities with respect to the uniqueness of their situation. |

Yes |

|

Castile‑La Mancha |

The financing criteria will be established according to the type of agreement and the nature of expenditure associated with each of them, in accordance with objective parameters that will make it possible to homogenise funding at the regional level. |

[Specified in legislation] |

|

Catalonia |

Currently population criteria, but there are plans to use more complex criteria |

Yes |

|

Extremadura |

Population, number of localities and number of social workers |

[Specified in a decree] |

|

Galicia |

Population and type of municipalities |

[Specified in a decree] |

|

La Rioja |

Priority will be given to municipalities with lower economic and management capacity. |

No |

|

Murcia |

Population |

No |

|

Navarre |

Population, distance between each population centre, social situation of each basic zone and the population served by the basic social services (unemployed people, older people, minors, those served by the social service, dependents, minors in need of protection, people on minimum wage). |

[Specified in a decree] |

|

Basque Country |

As of 2017, each administration is responsible for funding the services and provisions or providing the financial assistance for which it is responsible. In addition, the Consejo Vasco de Finanzas [Basque Council of Finances], which is made up of the Basque Government, the Association of Basque Municipalities (EUDEL) and the provincial councils, decides on the funding of services and the participation of municipalities and provincial councils in such funding. |

|

Source: 2021 OECD Social Services Questionnaire.

Table 5.4. Co-financing may cover almost all the expenses of supra-municipal local authorities

Percentage of co-financing of local authorities’ expenses on social services

|

Large municipalities |

Associations of municipalities/Small municipalities |

|

|---|---|---|

|

Andalusia |

||

|

Aragon |

>=50% (professional staff) |

[Same] |

|

Asturias |

43.2% (population over 20 000) 69.1% (population between 5 000 and 20 000 inhabitants) |

80.2% (population under 5 000) |

|

Balearic Islands |

>=50% (minimum professional staff); 10% (improvement of ratios) |

[Same] |

|

Community of Madrid |

||

|

Community of Valencia |

Funding by the provincial councils will not be able to finance services or personnel in towns that are home to more than 25% of the total population of their respective province. Funding by the provincial councils will not reach municipalities with more than 20 000 inhabitants – the Regional Government of Valencia will fund these. |

Regional law will establish the population threshold of the municipalities to be funded by each provincial council, taking into account the different distribution and concentration of the population in each municipality. |

|

Canary Islands |

40% (population over 95 001) 50% (specialised services managed by the island town councils) |

50% (population between 20 000 and 950 000) 60% (population under 20 000) |

|

Cantabria |

||

|

Castile‑León |

The community co-funding for primary care staff is 100%. Local authorities fund the facilities. |

[Same] |

|

Castile‑La Mancha |

Joint contribution of the regional ministry and the ministry: 55% (population over 20 000) Home care: 76% of the hourly cost defined in order 1/2017 |

Joint contribution of the regional ministry and the ministry: 70% (population < 20 000) Supra-municipal level: 99.98% Home care: 76% of the hourly cost defined in order 1/2017; 100% in towns with fewer than 2 000 inhabitants |

|

Catalonia |

>= 66% (staff of basic social services, programmes and projects, and home care and tele‑assistance services) |

|

|

Extremadura |

<90% |

<99% |

|

Galicia |

Joint contribution of the community and the central government: <=75% (population between 20 001 and 60 000) 67% (population over 60 000) |

Joint contribution of the community and the central government:<=80% (population under 20 000) |

|

La Rioja |

Co-financing possible for (as a priority) infrastructure and facilities of the second level (population over 20 000) |

The government may (co-)finance human resources of first level social services and the construction and renovation of social services infrastructure and the purchase of facilities (population of fewer than 20 000). |

|

Murcia |

||

|

Navarre |

Core professional staff (50%; 80% in special action areas) Operating costs and costs associated with regional dispersion and specific costs (100%) |

[Same] |

|

Basque Country |

Source: 2021 OECD Social Services Questionnaire.

Some regions also use categories of expenses as co-financing criteria. In Aragon, the Balearic Islands, Castile‑León and Navarre, the co-financing rates do not vary according to the size of the entity. However, Navarre, for example, offers strengthened co-financing in special action areas and where there is significant regional dispersion. The differences between the low and high rates of regions with differentiated rates vary greatly from one community to another. For example, in Extremadura, the difference in maximum co-financing rates between large and small municipalities is only 10 percentage points. In Asturias, on the other hand, co-financing for primary care social services in municipalities with fewer than 5 000 inhabitants is almost double the co-financing for municipalities with more than 20 000 inhabitants (80.2% and 43.2%). Finally, co-financing for different expenses may also vary. Some communities (such as Aragon and Castile‑León) favour the co-financing of professional staff, while others (such as La Rioja in its large municipalities) prioritise funding infrastructure and equipment.

Box 5.1. Funding social services in Ceuta and Melilla

The autonomous cities of Ceuta and Melilla contribute to the autonomous and local treasuries’ funding system. They also have a special indirect tax scheme. For example, there is a 50% rebate on corporate income tax, a 50% deduction on personal income tax and a tax on production, services and imports instead of VAT (Ministerio de Hacienda, 2015[20]).

Regarding the funds of the Concerted Plan, unlike the 17 autonomous communities, Ceuta and Melilla receive a minimum economic allocation of 0.5% of the total budget (MSCBS, 2019[18]). In 2012, 2015 and 2018, the Concerted Plan Report indicated that Ceuta had funded 50% of Concerted Plan projects, thus providing the minimum corresponding economic allocation. However, the budgets of the city of Melilla – which are more detailed and include the amount, budgeted for each programme, service and provision managed by the Regional Ministry of Social Services and Equality – indicate that the funding by the city of Ceuta is greater than what stated in the Concerted Plan Report. The information reported by Melilla in the Concerted Plan Reports shows that this represents a minimal source of funding (4.0% in 2012, 2.4% in 2015 and 4.4% in 2018). In addition, Ceuta and Melilla received funds linked to the Family Protection and Child Poverty Attention Programme: Development of Basic Social Services.

In comparison with autonomous communities, the provision of social services in Ceuta and Melilla faces additional difficulties. In 2016, Ceuta launched a plan to promote and develop primary care, with a special focus on consolidating the management and implementation of dependency linked to Act 09/2006 (Ciudad Autónoma de Ceuta, 2020[21]). Therefore, it established five major areas to classify the programmes, services and provisions managed by the Regional Ministry of Social Services and Equality. A 2005 analysis, albeit rather outdated, noted difficulties that probably still exist: isolation of the site and small number of inhabitants, which increases the costs per person when providing social services (Ciudad Autónoma de Melilla, 2005[22]).

Sources: Autonomous City of Ceuta (2020[21]), “Memoria de presupuestos del año 2020 – Programa 231: Prestaciones Sociales” [2020 budget report – Programme 231: Social benefits]; Autonomous City of Melilla (2005[22]), “Diagnóstico del área de estructura social” [Assessment of the social structure area];Treasury (2015[20]), “Financiación autonómica: Ceuta y Melilla” [Autonomous region financing: Ceuta and Melilla], https://www.hacienda.gob.es/es-ES/Areas%20Tematicas/Financiacion%20Autonomica/Paginas/Ceuta%20y%20Melilla.aspx; Ministry of Health, Consumer Affairs and Social Welfare (MSCBS, 2019[18]), “El Sistema Público de Servicios Sociales – Plan Concertado de Prestaciones Básicas de Servicios Sociales en Corporaciones Locales 2018‑19” [The Public Social Services System – Concerted Plan for Basic Social Services in Local Corporations 2018‑19].

5.3. There are large differences in per capita expenditures and expenditure control

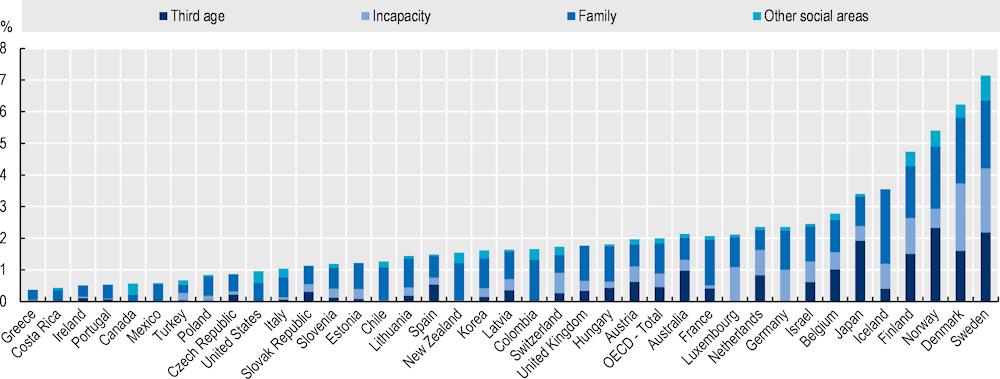

It is difficult to compare social services expenditure in OECD countries because not all structure public services in the same way. For example, some countries prioritise the provision of services to their citizens, while others favour financial assistance that allow citizens to pay for services. Nevertheless, the OECD Social Expenditure Database (SOCX) provides adequate indications of social services spending in different countries. In 2017, Spain spent 1.5% of its GDP on services 3 for older people (residential care, home care and other services), people with disabilities (residential care, home care, rehabilitative services and other benefits), families (other benefits) and other social areas. This compares to an OECD average of 2.0% (Figure 5.5). It is likely that in Spain, as in other countries, this statistic does not include the entire amount of social services expenditure due to the lack of information on the expenditure of local entities (Adema and Fron, 2020[23]).

Figure 5.5. Expenditure on social services in Spain is below the OECD average

Note: The benefits selected are benefits in kind for older people (residential care, home care and other benefits), people with disabilities (residential care, home care, rehabilitative services and other benefits), families (other benefits) and other social areas.

Source: OECD (2020[24]), OECD Social Expenditure Database, https://stats.oecd.org/Index.aspx?datasetcode=SOCX_AGG.

5.3.1. Expenditure

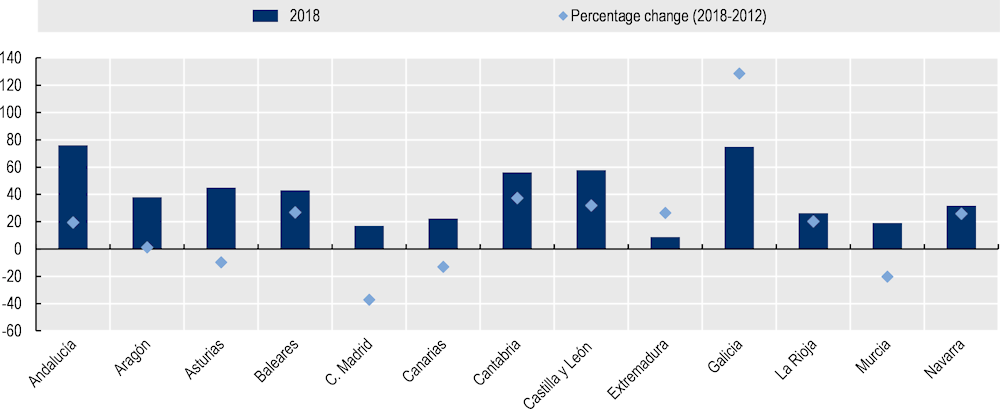

In most of the regions with available data, spending per capita dedicated to primary care social services increased between 2012 and 2018. The increase was more significant between 2015 and 2018 than before 2015, reflecting the economic recovery and the autonomous communities’ renewed interest in investing in social services. It should also be noted that the budgetary effort made by regional administrations is not necessarily aimed at increasing the total resources dedicated to social services; rather, it is often used to alleviate the burden on local entities. For example, in Extremadura, spending on primary care services per capita grew by a quarter between 2012 and 2018, but the regional administration’s contribution grew even more, by almost 50%.

Figure 5.6. Since 2012, most communities have increased their spending on primary services per capita

Note: The statistics for Navarre refer only to the regional government’s contribution to basic social services. Full costs are estimated to be more than 1.5 times higher. For the Balearic Islands, only basic community services are shown. The information from the Basque Country is missing because there was no disaggregation between primary and specialised care services. A comparison with the Plan Concertado report reveals that OECD estimates are almost equal to the Concerted Plan in seven regions, lower in one, higher in three and non-comparable in one (Balearic Islands), reflecting the lack of national homogeneous reporting rules for social services expenditure.

Source: 2021 OECD Social Services Questionnaire.

Spending levels vary significantly from one community to another, but the comparison is not always easy. In some cases, such as in Navarre, the total expenditure of municipalities and other local entities is not known. In others, the way in which certain specific benefits are distributed between primary and specialised care differs. For example, in Castile‑León, specialised care spending is 1.4 times greater than primary care spending, while in Extremadura, specialised care spending is more than 14 times higher than primary care spending (this large difference is probably due to accounting differences between these two regions, rather than in the budget allocated to specialised services). Therefore, regional administrations lack a global perspective on total spending. In addition, differences between the regular and foral system, the regional organisation and the distribution of financial responsibility between the autonomous and local levels limit the relevance of this comparison.

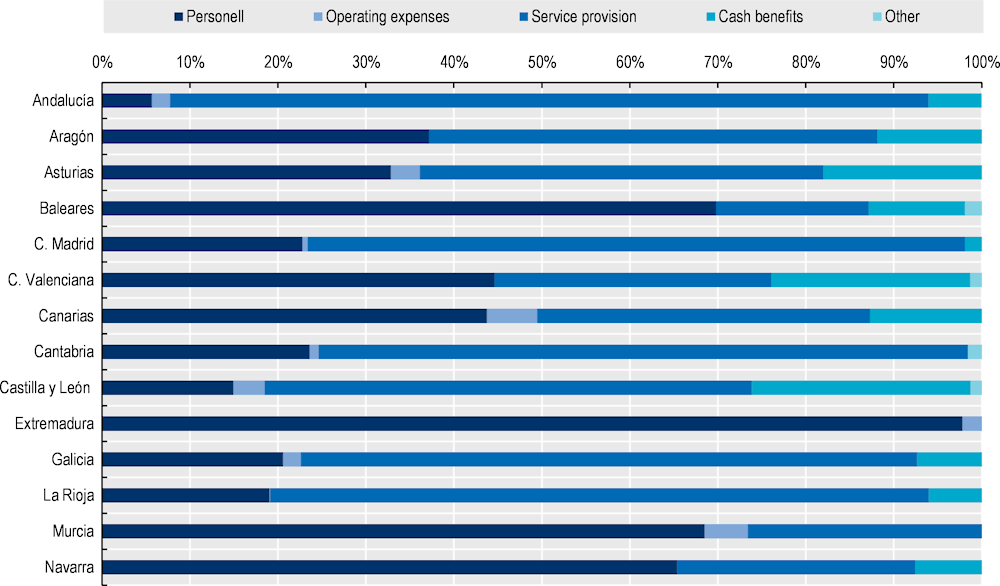

It is also difficult to compare how autonomous communities distribute expenses among functional categories. For example, some communities distinguish between expenses associated with administrative staff and staff providing services, while others do not.

Figure 5.7. In some communities, cash benefits account for around 20% of primary care spending

Note: Does not include minimum income programmes. The Cash benefits category mainly corresponds to the Ayudas de Emergencia [Emergency aids]. Missing information for Castile‑La Mancha, the Canary Islands and the Basque Country.

Source: 2021 OECD Social Services Questionnaire.

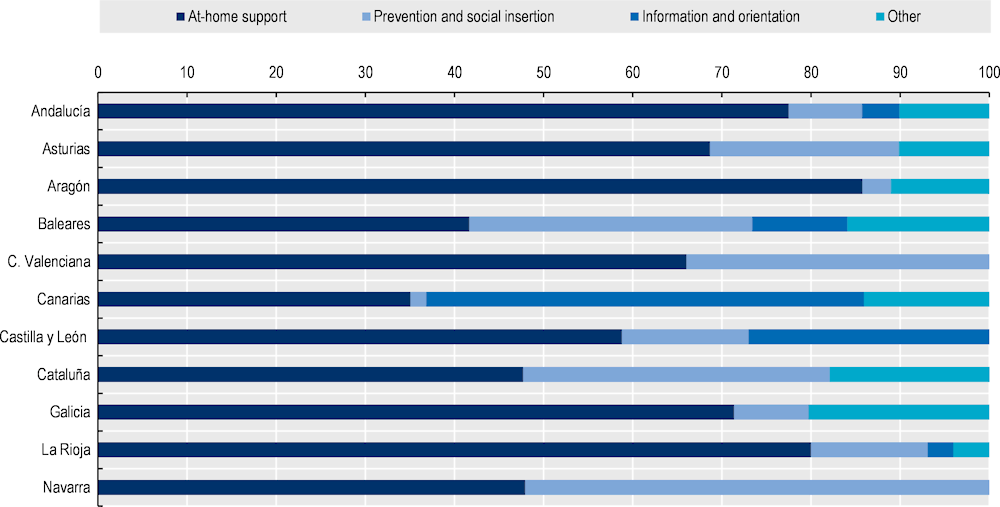

Home care is by far the category that accounts for the largest share of spending on primary care social services in all communities, representing at least 38% of spending in the Canary Islands and as much as 86% in Aragon (Figure 5.8). Prevention and social integration is the category with the second highest expenditure (up to 52% in Navarre) and information and guidance is the third (up to 49% in the Canary Islands).

Figure 5.8. Home care accounts for the largest share of primary care spending

Source: 2021 OECD Social Services Questionnaire.

Looking at the communities for which a complete breakdown of expenditure is available, expenditure on specialised care is higher than expenditure on primary care.4 In 2018, spending per capita was EUR 223 in the Community of Madrid, EUR 231 in Castile‑León, EUR 356 in Cantabria and EUR 529 in Asturias. Of the total expenditure on secondary care, the provision of services is the largest category, rising from 56% in the Community of Madrid to 97% in Asturias. As for the type of services, of the total expenditure on specialised services, dependency services and services for older people are the highest, ranging from 49% (in Madrid) to 70% (in Extremadura). Services for people with disabilities represent slightly more than a quarter of spending (24% in La Rioja, 26% in Castile‑León and 29% in Extremadura). Finally, services for women and people with drug addictions account for 1‑2% of expenditure, while social inclusion can account for up to 9% (in Madrid) of expenditure on specialised social services.

5.3.2. Cost-control and inspection mechanisms

Local entities and third-sector service providers typically have to report basic information on their expenses and users to the administrations that co-finance their activities. Requirements may vary between local entities and third-sector providers (see Section 5.1.3 for an overview of the role of private providers), but in general documentation to support expenditure is always required (Table 5.5). In addition, local entities must also submit a summary of the people served, with the breakdowns and level of detail required for each situation. In some communities (Castile‑La Mancha and Castile‑León), the information must be communicated through their information systems, while in other, the information exists in the form of reports or briefings and is not linked to databases or information systems. There may also be monitoring committees, as in Asturias, La Rioja and Navarre, to inspect compliance with the agreements and make changes if necessary.

Table 5.5. Local entities and private providers are often required to document their expenditure and, in some cases, their activities

Information requirements from local entities and private providers on activities co-financed by the community.

|

|

Local entities |

Private providers |

|

|---|---|---|---|

|

Andalusia |

Certification of expenses Evaluation and services sheets (population, funding sources, investments) |

|

|

|

Aragon |

The service provision costs shall be published by the managing entity, either in general terms or by service and user. |

||

|

Asturias |

Documentation of activities, expenditure and users to regional authorities |

Contract: Only the invoicing is checked, to ensure that it complies with the contract. Institutions that provide direct care services: Monthly commissions to monitor the service, study complex cases and analyse the continuity and quality of the service. |

|

|

Balearic Islands |

The information requested is required by the central government to prepare the Concerted Plan Reports. |

||

|

Community of Madrid |

Documentation to support expenditure, broken down by each of the items financed. Annual programming of the centre’s activities and activity reports as technical supporting documentation for compliance with the agreement. |

Documentation to support expenditure, broken down by each of the items financed. |

|

|

Community of Valencia |

Financial and descriptive reports (programme by programme, type of service provided, number of users, number of men/women accessing the programme, population sector, activities carried out, budget used, and so on) |

||

|

Castile‑La Mancha |

Technical and economic report using the MEDAS computer system (user information) |

||

|

Castile‑León |

Expenditure of people served under the Framework Agreement for the Co-financing of Social Services and information on users within the SAUSS |

||

|

Catalonia |

Reports on expenditure and people served |

||

|

Extremadura |

Auditors’ certificates of expenditure and technical reports |

||

|

Galicia |

Annual reports |

||

|

La Rioja |

Documentation to support expenses Monitoring commissions with each of the local entities |

Annual report At least two monitoring commissions per year |

|

|

Murcia |

The expenses and payments of the subsidies received are justified through the supporting documentation models established in each call for proposals. |

||

|

Navarre |

Annual reports |

There are monitoring committees and reports for subsidies and contracts. |

|

|

Basque Country |

Agreements |

||

Source: 2021 OECD Social Services Questionnaire.

The financial reports produced by local entities and private providers are typically subject to accounting controls, but there are few other mechanisms to assess and monitor expenditure efficiency (Table 5.6).

In several communities, a theoretical possibility exists of recovering (a portion of) funds from suppliers who have not fulfilled their obligations or who have committed infringements. This may even involve sanctions that exclude offenders from the social services system for a certain period. In practice, the instrument for fund recovery is rarely used. Instead, most of the regional administrations favour dialogue to resolve conflicts and difficulties.

Few efficiency or impact evaluations of expenses and service quality exist. The Castile‑León strategic plan intends to carry out studies and research on proof of the efficiency and social impact of social policies, specifically in rural areas. The Social Reality Observatory of Navarre is implementing the pilot project ‘Cerca de ti’ [‘Close to You’]. This project aims to put efficiency at the centre of the evaluation. In addition to the evaluation programmes carried out (or not) by the regional authorities, there are other institutions that also carry them out. For example, in 2008, a research group from the University of the Basque Country and the Public University of Navarre conducted a study on improving the management of social services by developing and implementing an indicator model in collaboration with six Basque town councils (Erkizia Olaizola et al., 2008[25]).

Some communities are considering economic incentives aimed at improving the quality of services. For example, from 2020, the administration responsible in the Balearic Islands offers up to 15% more funding for local entities that commit to improving professionals/users ratios. Likewise, the Community of Valencia has established priority criteria for agreements with private entities: in addition to ratios, labour stability and employment quality are taken into account, as well as whether the provider applies measures aimed at continuous quality improvement. Catalonia is also thinking about conducting a review of payment methods, in order to make them more results-oriented, including taking into account the user experience.

Table 5.6. Most of the autonomous communities have only limited ability to evaluate the efficiency of expenses

Instruments for the control of social services expenditure

|

|

Recovery of funds |

Efficiency/impact evaluations |

Additional information |

|---|---|---|---|

|

Andalusia |

✓ |

✘ |

Restitution mechanisms are in place in case of non-compliance by local entities. In general, however, there is an attempt to discuss and establish objectives in a co‑ordinated manner. |

|

Aragon |

✘ |

✘ |

The regional government is not able to question or go beyond the information on expenditure and users reported by the municipalities. No penalties are imposed, but meetings are held in the event of non-compliance with contracts. In theory, suppliers can be excluded from public funding for a period of between one and five years for serious violations. |

|

Balearic Islands |

✓ (since 2020) |

? |

The information transmitted by the local entities is very partial (geographically). There is no statistical plan to oblige municipalities to report the information. There is no structure with indicators on the objectives because there is no computer infrastructure for this. The General Directorate of Planning, Equipment and Training will verify compliance with the requirements established in the Financing Plan regarding the required professional ratios, as well as the correct implementation and execution of the programmes. Non-compliant municipalities do not usually face financial repercussions. Since 2020, efforts are being made to create incentives for funding. Municipalities may receive more funds if they improve staffing ratios by 10% and by 10‑15% for home care (for other groups than dependent people) and financial assistance. |

|

Community of Madrid |

✘ |

✘ |

The agreements do not contain clauses that imply a reduction in future payments in the event of insufficient quality. There is no measure to monitor the efficiency of the expenses, other than to ensure that they do not exceed what is stated in the agreement. |

|

Community of Valencia |

✓ |

? |

Act 3/2019 stipulates that employment stability and the quality of work of the professionals of private entities providing services will be considered to be a criterion that can be used to evaluate these entities’ access to public funding. In addition to labour stability and employment quality, certain priority criteria are established for agreements with private entities such as: improving the ratios of staff hired for the service offered, applying measures aimed at co-responsibility and sensible and beneficial uses of time, and applying quality assurance or continuous improvement systems. |

|

Canary Islands |

✓ |

✘ |

The audit criteria are specified in the agreements for subsidised and subcontracted entities (Article 67) or in the contracts. The range of cases can be broad. In general, failure to comply with the established criteria may lead to the initiation of a reimbursement proceeding, as established in the general law on subsidies, or the removing the possibility of contracting with the public administration. |

|

Cantabria |

The law on social services states that the person or institution that provides the concerted services must be subject to the financial control measures of the administration, in relation to the public funds provided for the financing of the agreements (Article 59). |

||

|

Castile‑León |

✓ |

? |

Allocated funds and the fulfilment of the responsibilities they entail can be monitored at the end of each financial year. It also includes a review of the objectives of the legislature and a review of the resources invested in the services, each of which refer to the catalogue of benefits and services of the annual expenditure implemented. This makes it possible to evaluate the budgetary efforts in relation to the results obtained. The strategic plan looks to carry out studies and research on the evidence of the efficiency and social impact of social policies, with specific reference to those developed in rural areas. |

|

Castile‑La Mancha |

✘ |

There is a draft decree on social agreements. |

|

|

Catalonia |

? |

? |

Decree No. 69/2020 on social agreements provides that providers must submit, at the request of the competent authority, an accounting audit in which the terms set out in the public call for tenders for the relevant service may be legally required. There are four‑year framework programmes with local entities for primary care and specialised care. Those contracts set out criteria and monitoring arrangements that are linked to expenditure rather than quality, efficiency or results. The strategic plan provides for a review of payment methods to make them more results-oriented and the introduction of criteria such as user experience, quality objectives and evaluation indicators and criteria. Screening has been in place for a year and could constitute a pilot tool for analysing process and results to allow for results-based payment. |

|

Extremadura |

✓ |

✘ |

Reimbursement criteria apply to specialised services, and every contract provides for inspections. Fifty percent of a financial allocation is paid upon signature of an agreement, and two payments of 25% are made subject to verification. Payments of 100% are also possible, subject to verification. The regional authorities do not undertake evaluations that consider the user experience. Some local affiliates are expected to do so. |

|

Galicia |

✓ |

? |

Under Article 33 of the Act on Social Agreements, the contracting administration may request external audits. Calls for tender for social agreements may provide for, without prejudice to the cause for the termination of an agreement, penalties for the unsatisfactory delivery of a service or amenity. Penalties must be proportional to the severity of the breach, and each penalty must not exceed 10% of the value of the social agreement. |

|

La Rioja |

✘ |

Grant monitoring includes data collection and annual visits. There is little information on the efficiency and impact of expenditure on users. |

|

|

Murcia |

✘ |

Efficiency is not a criterion. According to Decree No. 10/2018, which establishes the legal framework for social agreements in the area of specialised social services for older people and people with disabilities), the parties to an agreement must submit to financial monitoring by the administration’s competent bodies in relation to the public funding provided for social agreements. |

|

|

Navarre |

? |

Municipal services are provided via agreements signed every four years, with the financial arrangements reviewed yearly. Regional Law No. 13/2017 of 16 November on social agreements in the areas of health and social services establishes how many agreements must be evaluated. Article 8 of the Regional Law provides that agreements must include requirements relating to conditions for staff, especially with regard to safety at work, union rights and gender equality. At the strategic level, the forthcoming decree is intended to encourage quality. At the operational level, the approach taken is not to interfere, but rather to assist, advise and improve. The Social Reality Observatory promotes a culture of evaluation. For example, the ‘Close to You’ pilot project aims to put efficiency at the heart of the evaluation process. |

|

|

Basque Country |

✓ |

Reviews through audits of 10% of grants, both competitive and nominative; of random self-audits of agreements representing up to 10% of the total. As planning is person-centred, surveys on demand and needs are undertaken. Satisfaction surveys are also carried out in residential care facilities. |

Legend: Exists = ✓ Does not exist = ✘ Planned but not implemented =?

Source: 2021 OECD Social Services Questionnaire.

In addition to – or even more important than – expenditure control, the competent regional authorities supervise the quality of the social services provided within their jurisdiction. Legislation on social services generally designates the body competent to inspect social centres and services: in almost all communities, that body is the regional ministry or department responsible for social services, or a body that reports to it. For example, as indicated in (Table 5.7), in Andalusia these are the Local Social Services Inspection Units of the Regional Ministries of Education, Sport, Equality, Social Policy and Conciliation. In many cases, the body may work with other authorities with inspection powers. The competent body may also be responsible for accrediting new centres. However, inspection is not always the responsibility of the regional authorities; for example, supra-municipal local bodies or municipalities with more than 20 000 inhabitants in Catalonia may request to manage the inspection of services under their responsibility.

There are inspection plans for social resources and services in most autonomous communities. In addition to verifying compliance with current regulations, protecting users’ rights and investigating complaints of poor service quality or even allegations of mistreatment, inspections aim to improve the overall quality of social services (Gobierno de Navarra, 2019[26]). For example, studies are undertaken with the aim of continuously improving centres’ operations (Andalusia), or to assess a type of resource based on a representative sample (Community of Valencia). Inspection services are organised differently among the autonomous communities. For example, the Basque Country defines specific inspection coverage parameters according to service type, while the Community of Valencia has established a minimum ratio of 1 inspector to 150 000 inhabitants, “provided that sufficient funds are available”. It is also interesting to note that inspection units in some autonomous communities focus largely on inspecting specialised care services.

Table 5.7. Inspection plans have often complex objectives

The plans, bodies and priorities involved in inspecting social centres and services

|

|

Plan |

Body |

Priorities |

Additional information |

|---|---|---|---|---|

|

Andalusia |

✓ (2020) |

Local Social Services Inspection Units of the Regional Ministries of Education, Sport, Equality, Social Policy and Conciliation |

- users’ rights - compliance with mandatory requirements - studies for the continuous improvement of the operations of social centres and services - co‑operation in updating the social services map - strengthening the Social Services Inspectorate. |

Inspections in 92 community service centres had been scheduled for 2020. Owing to the COVID‑19 health emergency, only 51 centres were ultimately inspected. |

|

Aragon |

~ (2016‑18) |

Social Centres and Services Inspectorate |

- reviewing centres’ physical and operational arrangements – ensuring respect for users’ rights by promoting good practices in care for them, particularly dependent people. |

The plan was adopted in order to provide a tool for planning inspection activities. |

|

Asturias |

✓ (2020) |

In addition to its own inspection unit, the regional ministry responsible for social affairs will have the support of the inspection units of other departments and will work with other administrations with inspection powers. |

- authorising new centres or significant modifications - accrediting privately owned centres; ex officio full or single‑aspect inspections; inspections following complaints, orders from a higher body or at the reasoned request of other administrative bodies (including inspections of all residential centres for dependent people); and advice on the authorisation and accreditation of centres. |

|

|

Balearic Islands |

✘ |

Island Council |

||

|

Community of Madrid |

✓ (2019‑20) |

Subdirectorate General for Quality Control, Inspection, Registration and Authorisation |

The first eight priorities are: - monitoring compliance with the minimum physical, operational and quality requirements for social services centres - verifying that restraints are used rationally and on a case‑by-case basis - monitoring aspects that inspections have found to be in need of improvement - verifying that users have tailored care programmes (...) - inter-agency co‑ordination - evaluating the quality of social services - improving care quality. |

The Subdirectorate that maintains the register of social action bodies, centres and services also carries out inspections and monitors the quality of social services provision. |

|

Community of Valencia |

✓ (2019‑22) |

Subdirectorate General of Planning, Management, Evaluation and Quality and of the Accreditation and Inspection Unit for Centres and Services |

- supervising and monitoring centres and services - observing and verifying care quality - developing specific campaigns (for example assessing one resource type based on a representative sample) - optimising inspection activities. |

A ratio of at least one inspector to 150 000 inhabitants will be ensured, provided that sufficient funds are available. Programme contracts provide for evaluation and monitoring criteria. Documentation containing indicators will be created for each programme, including user questionnaires. Programme contracts are expected to be concluded during the first four months of 2021. |

|

Canary Islands |

✓ (2020) |

Articles 84 to 89 of Act No. 16/2019 of 2 May on Social Services in the Canary Islands regulate the inspection of social services. |

||

|

Cantabria |

✘ |

The regional ministry responsible for social services, with support from other regional ministries and public administrations with inspection powers. |

- ensuring that users’ rights are respected - monitoring compliance with the regulations in force and quality levels - supervising how the public funds granted are spent and ensuring their proper use - providing advice and information to bodies and users, as well as to the administrative departments responsible for planning and programming - suggesting improvements. |

|

|

Castile‑La Mancha |

✓ (2020) |

Regional Ministry of Social Welfare, with the support of inspection units attached to other departments of the Autonomous Community Administration. |

- monitoring sanctioned centres and services - monitoring the competence of social services and care services for dependent people, verifying that they meet the relevant requirements and conditions - the safety of users of social services and care services for dependent people, verifying compliance with the regulations in force and identifying risks with a view to reducing them. |

|

|

Castile‑León |

✓ (2020) |