Despite many years of remarkable socio-economic progress in the Dominican Republic, rates of labour informality have remained persistently high. The predominance of informal employment means that most of the population lacks social protection, which amplified the socio-economic impact of the coronavirus (COVID‑19) pandemic. Beyond the immediate effects in the context of the pandemic, informality goes against inclusive and productive development. The Dominican Republic must continue its efforts to place formalisation at the centre of its development strategy for the following reasons: First, formalisation is key to expanding the breadth of the social protection system and reaching the most vulnerable groups. Second, barriers to the formalisation of companies should be reduced, which can have a positive effect on productivity growth, tax collection and increased trade opportunities, and can eventually lead to the creation of more formal job opportunities. Third, investing in skills development and production transformation are key policy areas for generating greater formalisation through gains in productivity as well as through better job prospects for the workforce.

Multi-dimensional Review of the Dominican Republic

3. Towards more formal jobs in the Dominican Republic

Abstract

Introduction

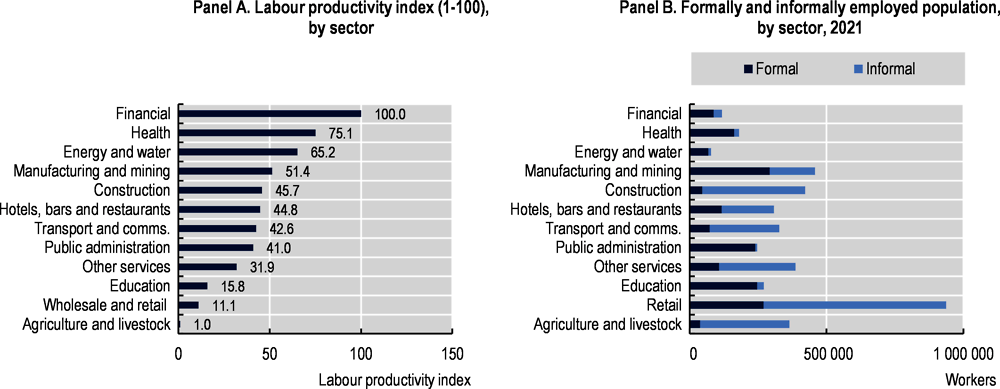

The Dominican Republic has recorded remarkable economic growth rates in most years after the 2003‑04 economic crisis, but these have not translated into comparable improvements in labour market outcomes. Between 2010 and 2019, the country recorded an average gross domestic product (GDP) growth rate of 5.64%, considerably higher than the average GDP growth rate for Latin America and the Caribbean (LAC) countries (1.23%) and for the Organisation for Economic Co‑operation and Development (OECD) member economies (2.1%) (World Bank, 2022[1]). Despite this period of prosperity, those sectors primarily enabling economic growth did not create sufficiently high-quality jobs, and large numbers of workers remain concentrated in low-quality jobs and sectors with low productivity growth (see Initial Assessment in Part I). While some labour outcomes have progressed, the Dominican Republic’s labour market still faces deep structural challenges that have limited the social impact of the economic expansion. Labour market participation, for example, has improved over the last decade, but remains relatively low and with significant gaps across socio-economic groups (gender, age, education level and income) and territories. For instance, female labour participation rates increased from 48.2% to 52.7% between 2014 and 2019, but still remained well below the male participation rates of 75.9% and 77.9%, respectively.1

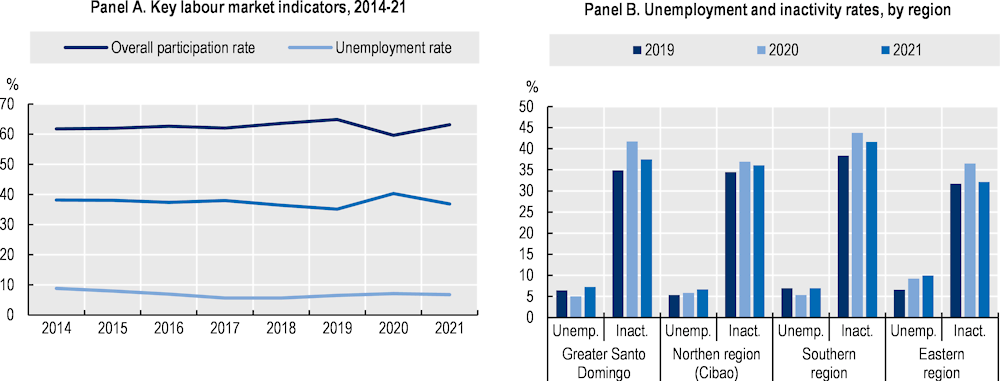

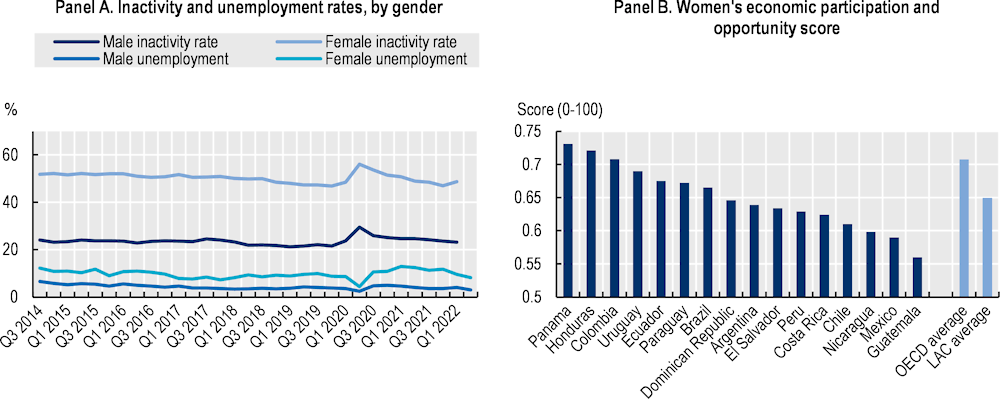

The Dominican Republic’s labour market continues to face long-standing challenges that were aggravated by the impact of COVID-19. The modest, yet positive, evolution of some labour market outcomes in the last decade was negatively affected by the COVID-19 crisis. The unemployment rate decreased from 8.8% to 6.5% between 2014 and 2019 but increased to 7.1% in 2020. The inactivity rate had slightly improved, decreasing from 38.2% in 2014 to 35.1% in 2019, but it then increased to 40.3% in 20201 (Figure 3.1, Panel A). The impact of the COVID-19 crisis on labour market outcomes has also been markedly heterogeneous across socio-economic groups and territories. For example, the unemployment rate rose by 0.5 percentage points in the northern region of the Dominican Republic and by 2.6 percentage points in the eastern region (see Figure 3.1, Panel B). Conversely, it declined by 1.5 percentage points in the Greater Santo Domingo region and by 1.6 percentage points in the southern region, most likely because many people there were not actively seeking employment during the COVID-19 pandemic, hence the increasing rate of inactivity. Although several of these indicators recovered in 2021, they had not yet reached pre-pandemic levels by end-2021.

Figure 3.1. The COVID‑19 crisis, cushioned by a series of emergency social programmes, had a differentiated impact on labour market outcomes across regions in the Dominican Republic

Note: Panel A: 2014‑21 data are from the third quarter of each of the relevant years. This graph uses Q3 data because data from the first and second quarters of 2020 were collected by telephone during the COVID‑19 pandemic and not by the usual method of the Encuesta Nacional Continua de Fuerza de Trabajo (ENCFT).

Source: Authors’ elaboration based on BCRD (2022[2]).

Labour informality, which remains a critical and persistent challenge and is the main topic of analysis in this chapter, is high in the Dominican Republic and it amplified – and was amplified by – the effects of the COVID‑19 pandemic. Containment measures to curb contagion had significant effects on labour markets worldwide. The government of the Dominican Republic launched several emergency programmes in order to mitigate the effects of the confinement measures (e.g. the Programa de Asistencia al Trabajador Independiente [Pa’ Ti programme]). Despite this, the crisis had a greater impact on workers in the informal labour sector, who could not sustain their livelihoods due to lockdown measures. This chapter provides an in-depth analysis of labour informality in the Dominican Republic and proposes strategic areas of action for increasing the country’s formal labour force. This chapter is structured in four sections. The first section analyses informality and its negative impacts in terms of lack of social protection coverage from the perspectives of both individuals and households. The second section analyses the barriers that companies face in moving towards formality, which is a necessary step in boosting labour market formalisation, and on the relevance of production transformation to create formal job opportunities. The third section analyses the impact of low productivity levels in preventing greater formalisation rates and focuses on skills development as a critical policy area for improving productivity and formalisation. The final section presents a set of policy recommendations for a labour formalisation strategy.

Informality leaves many workers and their households without adequate social protection coverage

Informality is one of the greatest development challenges facing the Dominican Republic. Informal labour is a complex and multidimensional phenomenon and is both a cause and a consequence of low development levels (OECD et al., 2019[3]). It erodes tax collection, undermines productivity growth and leaves a large share of the workforce vulnerable to shocks due to lack of social protection. Informal work perpetuates low productivity levels, unsophisticated economic structures, a low-skilled labour force, and weak labour market institutions and regulations. All of these factors, however, are also key contributors to informality (Basto‑Aguirre, Nieto‑Parra and Vázquez-Zamora, 2020[4]; OECD, 2020[5]). The choice to operate informally can result from an exclusionary formal labour market or can be a voluntary decision in response to high costs and other burdens of formality (Jütting and De Laiglesia, 2009[6]). However, informality is also an alternative to unemployment, particularly for low productivity sectors and low-skilled workers. In this way, it plays a critical role in alleviating poverty. The formal sector can grow by: 1) creating more formal jobs, 2) transforming jobs from informal to formal and 3) destroying informal jobs.

This section analyses the phenomenon of informality and its impact on limiting the coverage of the Dominican Republic’s social protection system. Informality has many pervasive effects. This section focuses on how widespread informality leaves large segments of the population with no access to social protection, with greater incidence of this being evident among the most vulnerable in society, and examines informality from the individual and household perspectives in order to better understand the vulnerabilities it creates. Indeed, understanding the vulnerabilities of informal workers and their dependents is critical to rethinking social protection and to tackling informality via differentiated policies. Throughout this chapter, the definition of informal employment is based on that used by the OECD and the International Labour Organization (ILO) (OECD, forthcoming[7]; ILO, 2018[8]), which considers status in employment and classifies workers according to the labour-based benefits for dependents and the characteristics and sector of the economic unit for independent workers. On the other hand, the definition of the informal sector used in this review is the one proposed by the Central Bank of the Dominican Republic (CBDR), which uses criteria at the company level in order to classify economic units as being part of the formal or informal sector. Both concepts are explained in detail in Box 3.1.

Box 3.1. Defining and measuring informality: A methodological note

What informality is and how it should be measured is a matter of broad discussion. Countries employ a wide range of approaches in order to measure informality. Informality can refer either to informal employment or to the informal sector.

Figure 3.2. Approaches to measuring informality

Source: Authors’ elaboration.

i) Informal employment

This report provides its own definition of informal employment. The methodology follows the set of criteria described in ILO (2018[8]) and replicated by OECD/ILO (2019[9]). Calculations for the Dominican Republic use 2019, 2020 and 2021 microdata of the ENCFT (BCRD, 2022[2]). The ENCFT provides information on the labour market through household surveys, which gather information on the level of economic activity and other sociodemographic data, such as the characteristics of the population, the household and its members. This approach provides new data for comparing informality measures in the Dominican Republic with standardised data from 13 other LAC countries. These countries are included, together with countries from other regions, in the OECD’s Key Indicators of Informality based on Individuals and their Household (KIIbIH) database (OECD, forthcoming[7]). The KIIbIH database uses household surveys in order to provide comparable indicators and harmonised data on informal employment and the well-being of informal workers and their dependents. This chapter analyses informality and its relationship with the vulnerability of informal workers and their household members.

Informal employment at the individual level

By using the job as the unit of reference, informal employment is determined according to the following criteria:

In the case of employees, a job is considered informal if it is not subject to national labour legislation, income taxation, contributory social protection or employment benefits.

In the case of own-account workers and employers, the status of informal employment is determined by the informal nature of the activity.

In the case of family workers, all jobs are classified as informal employment (e.g. a family member working in a family business without set remuneration).

Informal employment at the household level

Measuring informality at the household level allows policy makers to monitor workers’ vulnerabilities in the informal economy more effectively, as they can assess how such vulnerabilities may be passed on to dependents and can thus design specific and differentiated policies for households with different compositions. Using this classification for informal employment, we can assign households to three categories of informality (see Table 3.1): 1) formal households, where all working household members are formally employed; 2) informal households, where all working household members are informally employed; and 3) mixed households, where at least one working household member has a formal job and at least one has an informal job (OECD, forthcoming[7]).

Table 3.1. Household informality categories

|

Household informality composition |

|

|---|---|

|

Formal |

100% of workers employed in formal jobs |

|

Informal |

100% of workers employed in informal jobs |

|

Mixed |

At least one household member is formally employed and one is informally employed |

ii) Employment in the informal sector

This chapter uses the informal sector statistics published by the Central Bank of the Dominican Republic (BCRD), together with the National Statistical Office (ONE, for its acronym in Spanish), to illustrate the size of the informal sector and hence its employment levels. Their definition of the informal sector is an adaptation from ILO’s definition (ILO, 2013[10]) and considers the condition of the company in which the main economic activity takes place, as well as their workers’ access to social security. In particular, a company is considered part of the informal sector if it does not meet the following conditions: (1) being registered in the National Taxpayers Registry (RNC) and (2) keeping records of business transactions in auditable accounting books. These statistics are calculated using the ENCFT.2 It is worth mentioning that the main labour market indicators published by the BCRD are calculated taking into account all persons aged 15 and over. All figures regarding the informal sector presented in this chapter follow such official definition unless stated otherwise.

Labour informality is persistently high, particularly affecting the most vulnerable population

Most informal workers are trapped in a vicious cycle of vulnerability and inadequate social protection. Informal workers have no access to adequate levels of social protection (see Box 3.1), although they may have basic coverage in certain areas, such as non-contributory healthcare. Informal labour is also associated with low and/or unstable income. This prevents informal workers from saving and from investing in human capital and moving to higher-productivity jobs or to creating their own formal enterprises, which maintains them as informal – and therefore vulnerable – workers. This generates a vicious cycle, a “vulnerability trap”, that affects large segments of the population in the Dominican Republic and in other LAC countries (OECD et al., 2019[3]). Most of those who work informally are insufficiently protected from the various risks to which they are exposed, including illness or health problems, unsafe working conditions, or less protection of their labour rights, all factors that were aggravated by the COVID‑19 crisis (OECD, forthcoming[7]).

The Dominican Republic’s labour market has shown persistently high levels of informality for decades. In addition to the common causes of informality, the Dominican Republic has a series of particular structural conditions that have enabled and boosted the reproduction of this phenomenon in the country, such as birth under-registration, low education attainment (Corbacho, Brito and Osorio Rivas, 2012[11]) and teenage pregnancy (UNDP, 2017[12]).

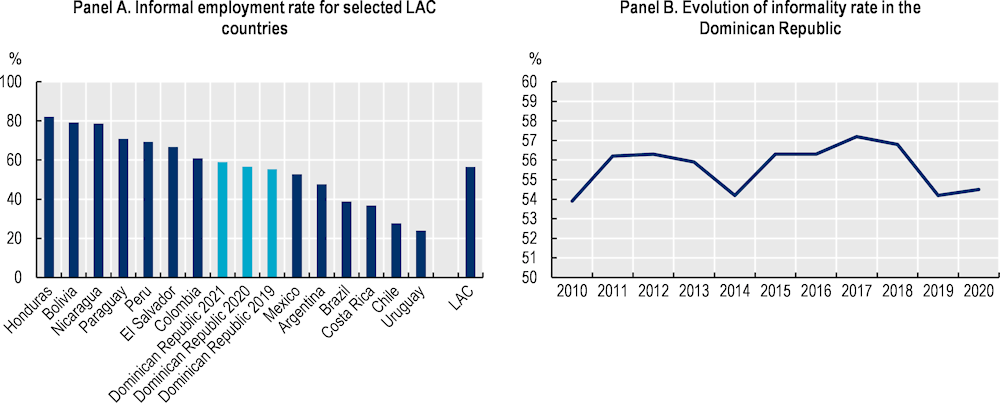

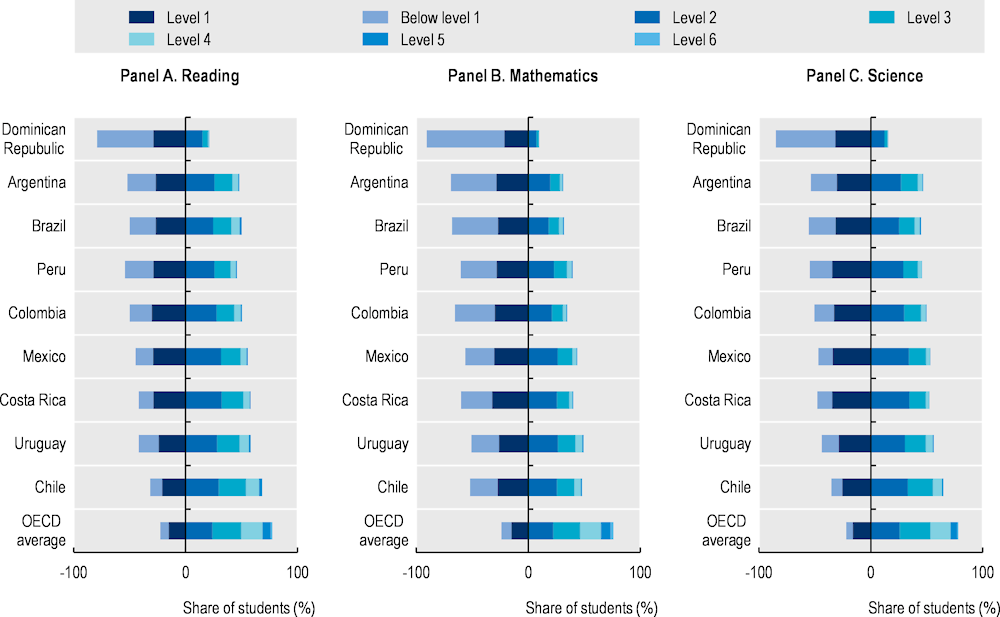

In 2021, the informal employment rate in the Dominican Republic reached 59.0%, slightly above the 2019 rate of 55.3%. This is considerably higher than informal employment rates in Brazil, Costa Rica and Mexico but below those in the Plurinational State of Bolivia (hereafter: Bolivia), El Salvador, Honduras and Peru. This informal employment rate is similar to the LAC average of 56.5% (Figure 3.3, Panel A). According to ILO data, the informal employment rate has been consistently high in the Dominican Republic, staying above 50% over 2010-20 decade (Figure 3.3, Panel B).

Figure 3.3. The Dominican Republic’s labour market shows persistently high levels of informality

Note: The LAC average is the unweighted average of selected LAC countries. The Dominican Republic’s estimate is for the third quarters of 2019, 2020 and 2021.

Source: Panel A: Authors’ calculations based on the informal employment definition (OECD, forthcoming[7]; ILO, 2018[8]), using 2018 household surveys or the closest available year. For comparability purposes and availability of microdata at the time of calculation, 2019 and 2020 estimates for the Dominican Republic use the ENCFT for the third quarter (BCRD, 2022[2]). Panel B: Authors’ calculations using ILO data (ILO, 2021[13]).

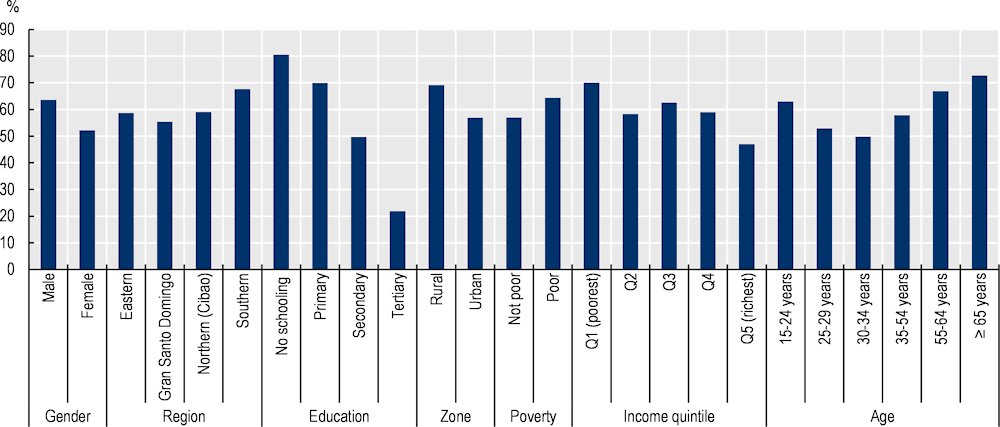

Figure 3.4. Informality increases vulnerabilities for traditionally disadvantaged groups

Informality rate by socio-economic characteristics, 2021

Note: This figure uses the ILO definition of informality (ILO, 2013[10]).

Source: Authors’ calculations using (BCRD, 2022[2]) (ENCFT 2022).

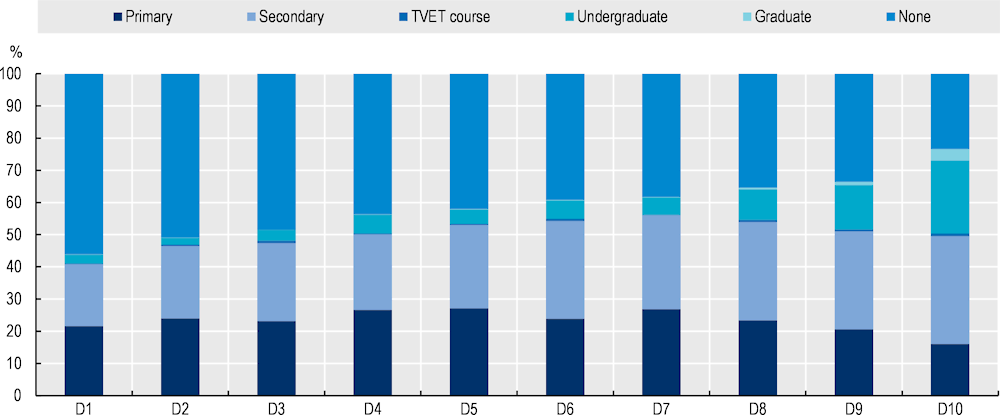

Labour informality reinforces other vulnerability conditions associated with income, education level, location, age and gender. Informality more frequently affects individuals in the poorest income quintile; those with low levels of education; rural populations, with a higher incidence among people in the northern (Cibao) and southern regions of the Dominican Republic; the younger and older cohorts; and men (Figure 3.4). In 2021, there was a difference of around 23 percentage points between the rates of informality in the poorest income quintile (70.5%) and the wealthiest income quintile (46.97%). Similarly, those with no education have informality rates of around 80.5%, compared with 21.9% among those with a tertiary education. In rural areas, informal employment was 69.1%, which is 12.19 percentage points higher than in urban areas (56.9%). At the same time, informality rates among younger (62.9%) and older workers (72.8%) are higher than the average for the population aged between 25 and 55 years (53.51%). Finally, informality affects more men than women, with informality rates at 63.6% and 52.2%, respectively.

Almost one-half of Dominicans live in completely informal households, with a particular incidence in rural areas and low-income groups

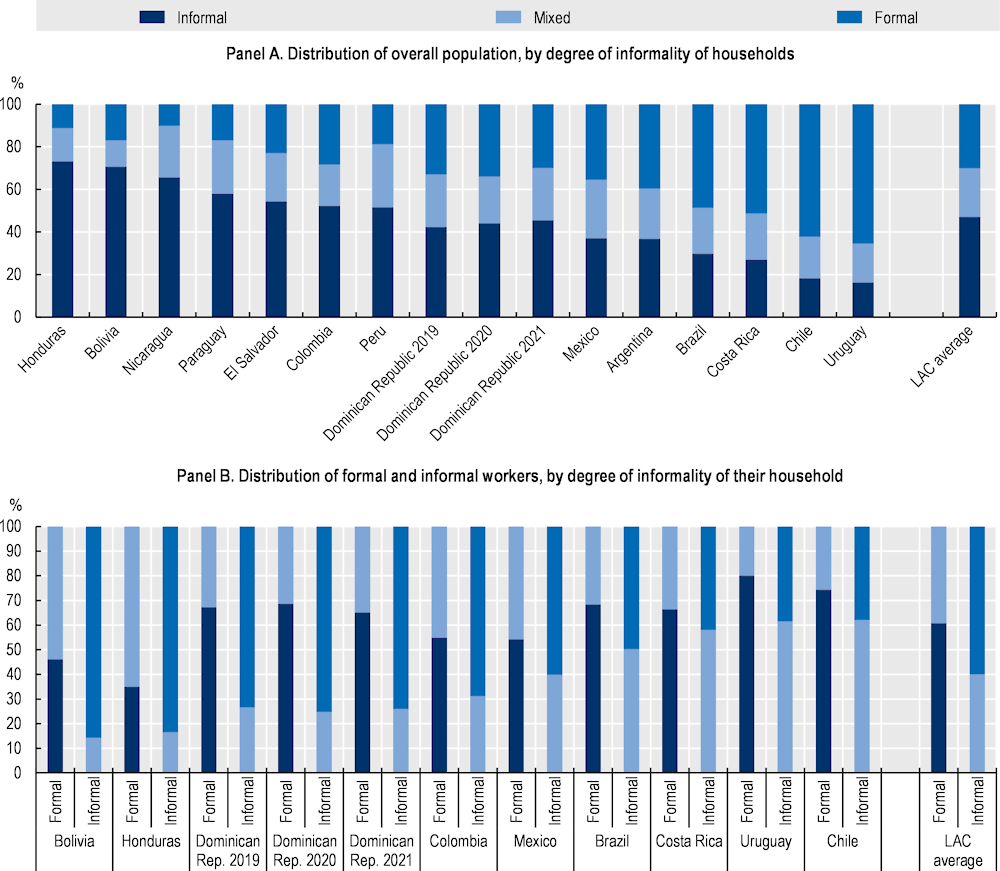

Figure 3.5. Almost one-half of Dominicans live in a completely informal household

Note: Estimates for selected LAC countries are derived from data for 2018 or the closest available year. The LAC average is the unweighted average of selected LAC countries.

Source: Authors’ calculations based on OECD (forthcoming[7]), using the KIIbIH database. In order to ensure microdata comparability and availability, the Dominican Republic’s 2019, 2020 and 2021 estimates use the ENCFT for the third quarter (BCRD, 2022[2]).

The incidence of labour informality is largely heterogeneous across Dominican households. This highlights the importance of making a concerted effort to extend social security to the most vulnerable households, particularly those where all workers are informal (i.e. informal households). In this regard, a household-level approach to analysing informality acknowledges that a completely informal household is more vulnerable than a household where at least one worker is formal. A mixed household is less vulnerable than an entirely informal one because the benefits provided by contributory social protection are often extended to the other members of the household (see Box 3.1). An accurate understanding of household composition in terms of informality allows for better targeting and differentiation of social protection policies so that they can address specific needs and mitigate the negative consequences of informality on individuals’ and households’ well-being (OECD, forthcoming[7]).

In the Dominican Republic, almost one-half of the population lives in households dependent only on informal employment. In 2021, 45.4% of the population lived in households where all workers were employed in informal jobs. This was more than a three-percentage-point increase from 2019, and placed the share of informal households in the country at a similar level to the LAC average (45%) and significantly above some countries in the LAC region, including Costa Rica (27%) and Mexico (37%). The distribution of individuals across different types of households also indicates a contraction in the proportion of mixed households (from 25% to 24%) and a decrease in the share of completely formal households (from 33% to 30%) in the same period (Figure 3.5, Panel A). This means that only one-third of the Dominican population lives in fully formal households. Moreover, three-quarters of informal workers live in a completely informal household, which excludes them from contributory social security systems (Figure 3.5, Panel B).

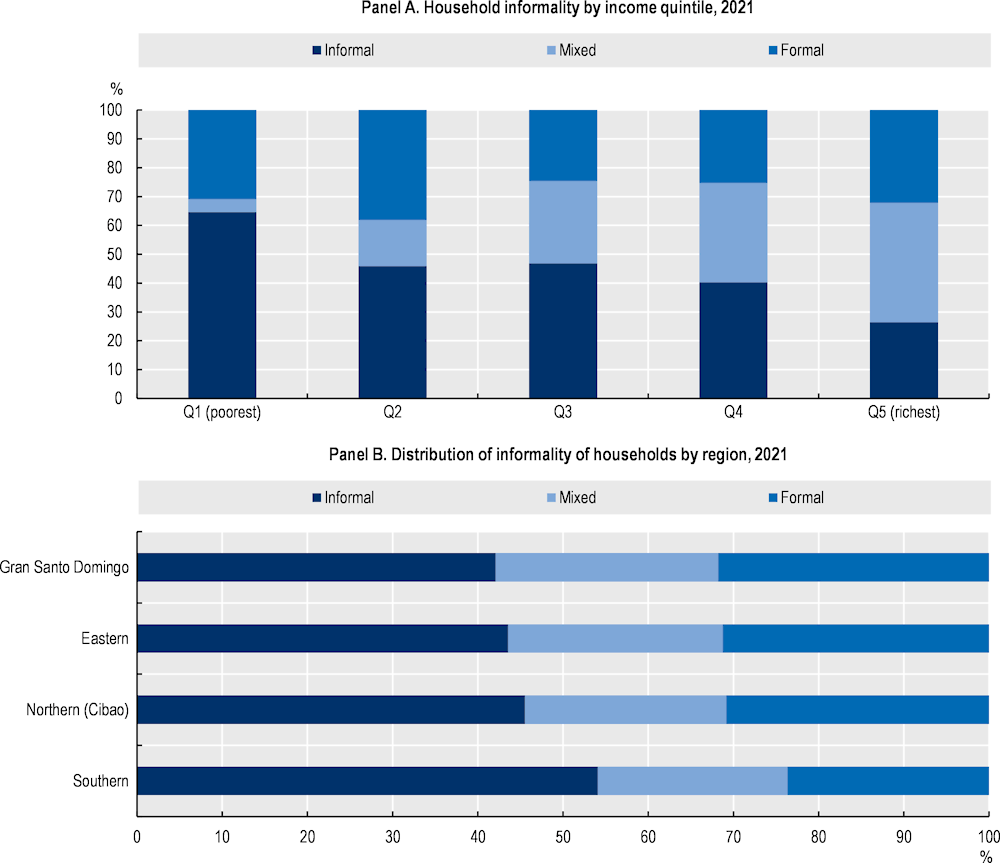

Most low-income and rural households depend only on informal employment

Low-income households primarily depend on informal work, leaving them in a vulnerable position due to their lack of contributory social protection. In the Dominican Republic in 2021, 64.6% of people in the poorest income quintile lived in a household that depended only on informal employment, compared with 26.4% of those in the wealthiest income quintile. Similarly, only 4.5% of people in the poorest income quintile live in a mixed household, and 30.1% live in a completely formal household. In contrast, 41.4% and 32.2% of the population in the wealthiest income quintile live in mixed or completely formal households, respectively (Figure 3.6, Panel A). It is worth mentioning that informality is not always the consequence of a condition of vulnerability. In fact, it is sometimes the result of a decision to avoid incurring formal work costs such as paying taxes, social security contributions, among others (e.g. high-income doctors who decide to operate informally). Household informality in the Dominican Republic’s wealthiest quintile is a clear illustration of this, with 26.4% of it belonging to an informal household and 41.4% to a mixed household (Figure 3.6, Panel A).

Households in rural areas have significantly higher levels of informality. As much as 56.6% of the population in rural areas lived in a completely informal household in 2021, while 21.6% lived in mixed households and 21.8% lived in formal households. In contrast, 43.0% of individuals in urban areas lived in completely informal households, with 25.2% living in mixed households and 31.8% in formal households in the same year. The formality of households constitutes a critical matter in policy decisions since the coverage of individuals in formal employment who live in mixed households helps to extend social protection to other family members. There are also considerable differences in informal household composition between regions: 54.1% of the total population in the southern region lives in a completely informal household, compared with 42.1% of the population in Gran Santo Domingo. The highest proportion of mixed households is found in the eastern region (25.2%) and Gran Santo Domingo (26.2%) (Figure 3.6, Panel B).

Figure 3.6. Income levels and geographic location also shape households’ degree of informality

Note: Data for 2021 for the Dominican Republic correspond to the ENCFT for the third quarter. Income quintiles were created using salaried workers’ income, independent workers’ income from both primary and secondary occupations, and other national and international income as derived from the ENCFT.

Source: Authors’ calculations based on the KIIbIH database (OECD, 2021[14]) and the ENCFT 2022 (BCRD, 2022[2]).

While informality leaves a large share of workers unprotected, the response to the COVID‑19 crisis showed ways to strengthen social protection

Low levels of social protection have amplified the negative impact of the COVID‑19 crisis, particularly for vulnerable informal workers. Protecting informal workers has become imperative, particularly for those outside traditional social assistance programmes (Basto‑Aguirre, Nieto‑Parra and Vázquez-Zamora, 2020[4]; OECD, 2020[15]). One direct effect of the lack of social protection in the context of the COVID‑19 crisis has been an increase in poverty levels. Despite government efforts to support those most affected by the pandemic, monetary poverty increased from 21% in 2019 to 23.4% in 2020, and the extreme poverty rate increased from 2.7% to 3.5% over the same period. In other words, the crisis pushed approximately 268 515 Dominicans into poverty, 93 127 of whom fell into extreme poverty (MEPyD, 2021[16]). The social crisis is worse in the eastern region, which is highly dependent on tourism, with the poverty rate rising 6.7 percentage points between 2019 and 2020, from 19.6% to 26.3%.

The share of employment in the informal sector grew with the COVID‑19 crisis, which also pushed many workers into inactivity. Employment in the informal sector accounted for 51.3% of total employment in 2020, three percentage points higher than in 2019 under pre-pandemic conditions. Employment in the informal sector continuously increased during 2020, showing the vulnerability of this type of employment to shocks. This has been accompanied by a move of many workers to inactivity, particularly in the formal sector. While the annual share of workers in the informal sector fell by 5.8% in the last quarter of 2020, the share of workers in the formal sector fell by 11%.3 In 2021, employment in the informal sector contracted to 50.9%.

The COVID‑19 crisis has underscored the importance of reinforcing social protection in the Dominican Republic. As most informal workers fall outside the coverage of traditional contributory social security mechanisms, they are more dependent on other public social assistance programmes. These are usually non-contributory programmes delivered through cash transfers, solidarity pensions and in-kind transfers. However, social assistance programmes are generally targeted only at poor or particularly vulnerable populations and are delivered under some specific conditions (see Box 3.1). Therefore, a large share of informal workers who are not poor, but who are still vulnerable, find themselves without any safety net and are particularly exposed to adverse shocks, as in the COVID‑19 crisis. They do not have social protection associated with employment, nor do they have access to existing social assistance programmes, as they are not eligible (Basto‑Aguirre, Nieto‑Parra and Vázquez-Zamora, 2020[4]; OECD, forthcoming[7]).

Box 3.2. Social assistance in the Dominican Republic

Social targeting through the Unified System of Beneficiaries

The Unified System of Beneficiaries (Sistema Único de Benificiarios - SIUBEN) is the main instrument used to target the social policies in the Dominican Republic. SIUBEN is responsible for identifying, characterising, registering and prioritising families living in poverty in order to inform social policies, mainly social assistance programmes. SIUBEN is responsible for calculating the Multidimensional Poverty Index of the Dominican Republic (MPI‑DR) and the Quality of Life Index (Índice de Calidad de Vida; ICV). These measures are used to determine the eligibility of an area, household or individual for government social programmes.

Social assistance includes both conditional and unconditional programmes

Before the COVID‑19 crisis, Progresando con Solidaridad was the primary social policy for poverty reduction in the Dominican Republic. This programme was also the main channel of social assistance from the government of the Dominican Republic. Cash transfers from several social assistance programmes were delivered through the Solidaridad card, which was given to low-income families identified by SIUBEN. Progresando con Solidaridad included three conditional programmes. The first was the Comer es Primero (PCP) programme, a cash transfer programme for households living in poverty. It also included the Incentivo a la Asistencia Escolar (ILAE) and Bono Escolar Estudiando Progreso (BEEP) programmes. These programmes aimed to incentivise education through cash transfers paid to households living in poverty with family members aged between 5 and 21 years who were attending school.

The government’s unconditional programmes included Programa Protección a la Vejez en Pobreza Extrema (PROVEE), Incentivo a la Educación Superior (IES), Programa de Incentivo a la Policía Preventiva (PIPP), and Programa Incentivo Alistados Armada República Dominicana (PIAARD). PROVEE is a cash transfer for those elderly people who are in extreme poverty. The IES is a cash payment to support low-income students who are enrolled in higher education. The PIPP and PIAARD are cash transfers to help police officers and military personnel buy food and supplies. There are also specific programmes to help households pay for electricity, kitchen gas, and natural gas (i.e. Bonoluz, Bonogás Hogar, and Bonogás Chofer).

The Progresando con Solidaridad programme was transformed into the new Supérate programme in June 2021 with a renewed strategy to fight poverty. Once fully implemented, Supérate will have several components with which to achieve its objectives in the areas of educational inclusion (Aprende and Avanza); health, food security and emergency support (Aliméntate, Micronutrientes, Bono Navideño, Bono Familia Acompañada and Bono de Emergencia); economic inclusion (Empléate and Emprende); housing (Familia Feliz, Bonoluz and Bonogas); and support for women (Cuidados and Supérate Mujer), among others. According to their objectives, each of the programme’s components will determine certain eligibility criteria to assign periodic transfers to beneficiary families through the Supérate card. Beneficiary families should be registered in SIUBEN in order to be part of the programme.

Source: Decree 377 of 2021 (PDR, 2021[17]) and Presidency of the Dominican Republic (PDR, 2021[18]).

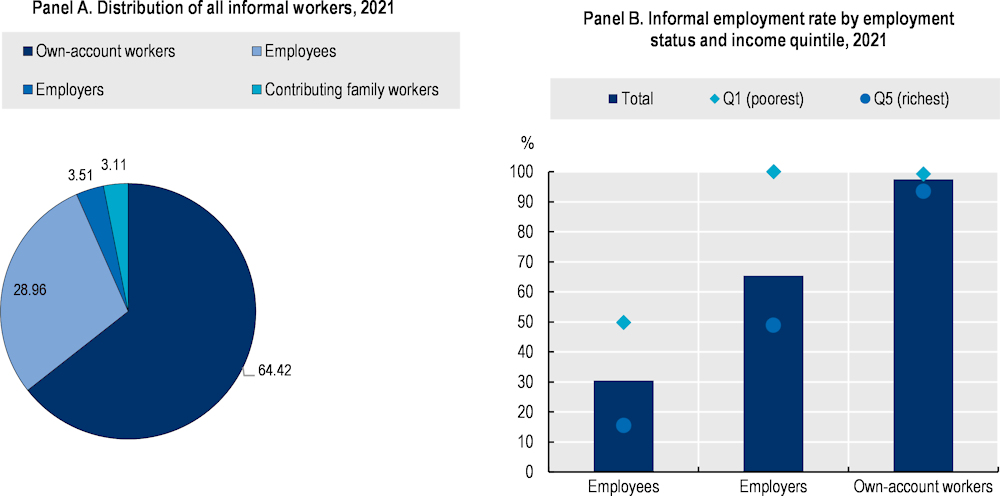

Figure 3.7. Informal employment predominantly affects own-account workers and presents substantial disparities for employees across income quintiles

Note: Household income was calculated by aggregating the ENCFT variables “ingreso_asalariado”, “ingreso_independientes”, “ingreso_asalariado_secun”, “ingreso_independientes_secun”, “otros_ingresos_nac_a” and “otros_ingresos_ext” at the household level. For comparability purposes and availability of microdata, 2019, 2020 and 2021 estimates for the Dominican Republic use the ENCFT for the third quarter.

Source: Authors’ elaboration based on ENCFT 2022 (BCRD, 2022[2]).

The COVID‑19 emergency policy to protect households was initially based on expanding traditional social assistance programmes and gradually evolved to reach as many informal workers as possible. During the beginning of the crisis, the policy response to COVID‑19 used existing mechanisms to reach the most vulnerable. However, these mechanisms soon showed that a large share of informal workers were left outside the scope of both the non-contributory and the formal contributory systems, and thus had no support during the crisis. This is why the Dominican Republic, like many other countries in the LAC region, enacted additional emergency programmes and new mechanisms in order to reach informal workers without any type of social protection (see Box 3.3).

In the Dominican Republic, own-account workers face the highest informal employment rate and are particularly vulnerable, being outside the reach of both contributory and non-contributory regimes. Of all informal workers, 65% are own-account, 29% are employees, 3.5% are employers and 3.1% are contributing family workers (Figure 3.7, Panel A). More than 90% of own-account workers held informal employment in 2021; similarly, more than one-half of employers and almost one-third of salaried employees were informal workers. These figures are even more disparate between the wealthiest and the poorest social strata. In the poorest household income quintile, the informality rate reaches 71% and affects employers (100% informal), own-account workers (99.3% informal) and employees (49.8% informal) (Figure 3.7, Panel B). By contrast, in the wealthiest income quintile, the overall informality rate is 47% and mainly affects own-account workers, which are 93.5% informal; employees are 15.5% informal and employers are 48.9% informal (Figure 3.7, Panel B).

Box 3.3. The COVID‑19 policy response in the Dominican Republic

The Quédate en casa and Pa’ Ti programmes supported households during the crisis

The Quédate en casa programme was created to support lower-income informal workers and families in vulnerable conditions. Initially, it covered 811 000 families by increasing their subsidies through the conditional cash transfer (CCT) programme Solidaridad from DOP 1 500 to DOP 5 000 (Dominican pesos) monthly. After a few months, the government identified another 690 000 families, categorised as poor or vulnerable by SIUBEN, who were also targeted to receive the Quédate en casa temporary economic support. In addition, for households where the primary income earner was particularly vulnerable to COVID‑19, an additional amount of DOP 2 000 was transferred, resulting in more than 350 000 households receiving a total transfer of DOP 7 000. Beneficiaries of these programmes primarily included informal workers.

The Pa’ Ti programme supported freelance business workers. A monthly transitional amount of DOP 5 000 was transferred to freelance workers’ bank accounts. Beneficiaries were identified through a database of freelancers who had loans with the formal financial system.

The FASE programme and other emergency support measures for enterprises and formal workers

The Employee Solidarity Assistance Fund (Fondo de Asistencia Solidaria al Empleado; FASE) programme supported enterprises to retain formal jobs. During the height of the COVID‑19 crisis, the government of the Dominican Republic created a Guarantee and Financing Fund to benefit micro- and small-sized enterprises through an agreement with the Central Bank of the Dominican Republic (BCRD), the Superintendency of Banks and the Association of Commercial Banks of the Dominican Republic.

The FASE programme had two stages. FASE 1 paid contributions to workers whose employers: 1) were contributing to the Social Security Treasury (Tesorería de la Seguridad Social; TSS) on behalf of workers before the pandemic began, and 2) had closed their operations because of reduced economic activity due to the social distancing measures implemented because of COVID‑19. Under these conditions, FASE 1 paid up to 70% of the salaries for those formal workers that had to stop working, up to a maximum of DOP 8 500. Afterwards, FASE 2 paid contributions to enterprises that had continued their operations during the crisis in order to subsidise the salaries paid to formal workers, up to a maximum of DOP 5 000 per worker.

In addition, the government created a special fund to pay the Christmas bonus to all suspended workers who were currently, or who had been, enrolled in the FASE 1 cash transfer programme. The fund paid more than DOP 2.3 billion to recipients, and payments were distributed in the first 15 days of December 2020 to 1 million families in the Dominican Republic.

In terms of tax support, the annual income tax payment that certain companies were required to make in April 2020 was divided into four payments. The Directorate General of Internal Taxes (Dirección General de Impuestos Internos; DGII) temporarily exempted the hotel/tourism sector from advance income tax payments. Emergency measures were granted in order to make advance income tax payments more flexible for the entire productive sector, allowing these to be paid in three instalments immediately after the emergency period was over.

The BCRD also implemented measures to adapt the monetary policy framework

The BCRD implemented a series of measures that increased the flow of resources to households and businesses and encouraged lower interest rates to address the COVID‑19 crisis. These measures provided liquidity (in both local and foreign currencies) to financial intermediaries in order to address the effects of the crisis on the economy and the population. The approved measures included: 1) increasing liquidity for financial intermediaries; 2) increasing the financial resources released in order to channel new loans to the different productive sectors and households; 3) increasing foreign currency liquidity for financial intermediaries; 4) reducing the reserve requirement coefficient in local currency for savings and credit banks and credit corporations; 5) offering greater liquidity in foreign currencies in order to channel new loans to productive sectors, especially tourism and exports; 6) reducing the monetary policy interest rate, the overnight deposit interest rate, the overnight repo rate and the repo rate up to 90 days; and 7) implementing a special regulatory treatment.

Source: BCRD (2020[19]).

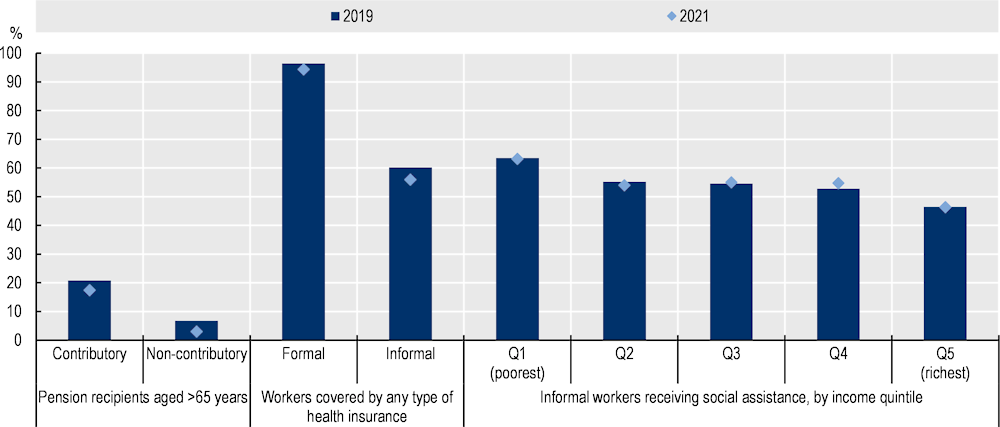

Before the COVID‑19 pandemic hit the Dominican Republic, 18.6% of Dominicans did not have access to any type of social protection. While 93.3% of formal workers had access to contributory healthcare in 2019, only 60.18% of informal workers had access to any kind of healthcare scheme, most through subsidised public healthcare (Figure 3.8).4 Similarly, among the poorest quintile of the population, 36.5% of informal workers did not live in households covered by traditional social assistance programmes in 2019. That figure remains high for the second- and third-income quintiles, at around 45%, meaning that a significant share of households live in poverty or economic vulnerability without coverage. The long-term effects of widespread informality also affect living conditions for the elderly, who end their productive life without any income substitution. In 2019, only 20.7% of those aged over 65 years received a contributory pension, and 6.7% received a solidarity pension. The latter figure decreased to 4.3% in 2020.

The COVID‑19 crisis has increased awareness of the weaknesses in the social protection system and can represent an opportunity to advance system reforms. The current social protection system in the Dominican Republic was created by Law 87-01 in 2001. This established a contributory regime, through which the government provides coverage for formal employees, as well as a subsidised regime to cover independent workers with earnings below the minimum wage or in vulnerable economic conditions. Finally, a mixed regime (Régimen Contributivo Subsidiado) was created to cover independent workers with higher earnings, although this system has not yet been implemented. The subsidised scheme grew significantly during the COVID‑19 crisis. Between December 2019 and December 2021, 2 035 071 additional people joined the subsidised regime of the National Health Insurance (Seguro Nacional de Salud; SeNaSa).

One key issue for debate in a future reform is how to expand the reach of the subsidised regime to all poor and economically vulnerable households. An adequate expansion of this non-contributory social security requires improved identification of the targeted population, as well as improvement in the frequency of updates of the public registry used to classify households’ eligibility for social programmes and SIUBEN, and in its interoperability with other public registries. Similarly, the mixed regime outlined in Law 87-01, which would have targeted own-account workers who are not eligible for the subsidised regime, was never put in place. This should be a matter for debate in the reform of the social protection system, as such a measure could strengthen coverage. However, it has to be considered that a voluntary affiliation mechanism could end up leading to the avoidance of contributions of some workers with payment capacity, thus undermining the system’s financial sustainability in the presence of adverse selection problems. In addition, a mixed system could be costly in terms of administration and collection due to the labour informality of a large part of the target population (Pellerano and Féliz-Matos, 2018[20]).

Figure 3.8. Low pre-pandemic levels of social protection aggravated the impact of the COVID‑19 crisis

Key indicators for social protection across different categories, as a share of the population

Note: Social assistance includes cash transfers, solidarity pensions and other types of transfers reported in the third quarter of the ENCFT 2019.

Source: Authors’ calculations based on (BCRD, 2022[2]).

Women and youth still face greater barriers to entering the formal sector

Dominican women still face significant barriers to participating and thriving in the Dominican labour market compared with their male peers, limiting their autonomy and increasing their economic vulnerability. The underrepresentation of women in the labour market has remained rather stagnant. Female participation rate in the labour market has remained 27 percentage points lower than male participation rate, on average, since 2014. While in 2015 the global participation rate for men was 76.3%, that for women was 48.1%. More than half a decade later, little progress was made in closing the gender gap. In 2021, the global participation rate for men was 75.7%, while for women it was 51.2% (see Figure 3.9, Panel A). Similarly, in terms of unemployment, women also face more difficulty in finding a job. While in 2021 women had an average unemployment rate of 12.1%, that of men was 3.9%. Overall, in terms of women’s economic participation and opportunity, the Dominican Republic is ranked 101st out of 156 countries according to the 2021 World Economic Forum’s Global Gender Gap Index,5 with a score of 0.65 (see Figure 3.9, Panel B). This means that Dominican women are 35% less likely to have equal economic participation and opportunities than Dominican men (WEF, 2021[21]).

Despite some recent efforts to strengthen the economic autonomy and empowerment of women, there are still institutional barriers that reinforce gender inequalities in the labour market. On the basis established by the Labour Code in 1992, there are several institutional efforts aimed at closing the gender gaps in the labour market, such as the updates on the Regulation on the Maternity and Breastfeeding Allowance (CNSS, 2017[22]) and the adherence to ILO’s Convention on the Protection of Maternity in 2014 (CDRD, 2014[23]; ILO, 2000[24]). However, there are still certain norms that hinder progress towards gender equality. For instance, although the current legislation establishes a period of maternity leave of twelve weeks for women, paternity leave is limited to just two days (CDRD, 1992[25]). There is no provision in the law mandating equal remuneration and no restrictions on employers asking about family status during interviews or hiring processes (OECD, 2019[26]). More recently, the MTRD has made important efforts to regulate the domestic work sector – made up of 92% women workers who earn 57% less than the average of those employed in the country (Cañete Alonso and Cuello, 2022[27]; MTRD, 2022[28]). The Resolution 551-08 (CNSS, 2022[29]) established a fixed and subsidised contribution to social security for domestic workers, regardless of their salary. Under this new pilot scheme, the employer assumes 66.5% of the contribution, 3.3% is paid by the worker, and 30.2% by the State.

Beyond labour legislation, Dominican women face complex structural barriers that make the playing field unlevelled compared to men. Notably, the national government has not been able to consolidate a comprehensive reproductive health care policy, from sex education in school to lifelong provision of contraception, and the body autonomy of women remains very limited. Consequently, teenage pregnancy remains a common problem. In 2020, there were 90.58 births per 1 000 women between 15 and 19 years old, compared to the averages of the LAC region with 60.26 and OECD countries with just 20.84 (World Bank, 2022[1]). High rates of adolescent pregnancy are a crucial factor that limits the opportunities of Dominican women to thrive in the formal labour market. In fact, 50% of women that had children during their adolescence work in the informal labour market versus 27% of other older mothers (UNDP, 2017[12]). Gender gaps should also be approached and addressed with an intersectional lens, since certain ethnic, socio-economic, geographical and migratory conditions can considerably increase the barriers and hinder the opportunities in the labour market. In terms of gender pay gap, the country scored 0.55 in wage equality for similar work in 2021, which means that women are 45% less likely to receive an equal wage for similar work than men (WEF, 2021[21]).

The vulnerability of women during the pandemic was much higher given the nature of their participation in the labour market, which deepened the negative impact on them. Women lost more jobs (7.5%) compared with men (4.9%), with greater job loss in the informal sector (8.4% versus 3.9% respectively). The over-representation of women in the sectors most affected by the crisis (such as retail and wholesale, the hospitality industry, and other services) contributed to the deterioration of their labour market outcomes (OECD et al., 2020[30]). Ninety percent of women in the Dominican Republic worked in these sectors before the pandemic, while the LAC average was about 80% (Gutiérrez et al., 2020[31]). All of these factors combined to contribute to the rate of female poverty increasing to 118 women for every 100 men in the Dominican Republic (ONERD, 2021[32]). The significant increase in the underutilisation of the female labour force since 2020 could create difficulties in job reintegration in the future.

Women also faced an extra unpaid work burden due to confinement measures and the closure of schools. Before the COVID‑19 crisis, women accounted for 77% of the care workload in the average household, working 31.2 hours per week in care and household duties, while men contributed 33% of the time spent on these duties, equivalent to 9.6 hours (VPRD, 2019[33]). Lockdowns imposed an extra burden of care work on women, affecting their availability to work or search for a job, as well as the working hours they were willing to offer for paid work. In 2020, 41% of women in the Dominican Republic reported an increase in care work as the main reason that they remained inactive or stopped their job search, compared with 25% of men (ONERD, 2021[32]). The disproportionate impact of the pandemic on women’s labour outcomes may permanently affect gender equality in the Dominican Republic.

Figure 3.9. Women face greater barriers for thriving in the labour market, which limits their autonomy and increases their economic vulnerability

Note: Panel B: The Global Gender Gap Index benchmarks the current state and evolution of gender parity across four key dimensions (Economic Participation and Opportunity, Educational Attainment, Health and Survival, and Political Empowerment).

Source: Panel A: Authors’ elaboration based on BCRD (2022[2]). Panel B: Authors’ elaboration based on WEF (2021[21]).

Dominican youth also face higher rates of unemployment and inferior job quality. The youth participation rate in the labour market increased from 36% in 2009 to 45% in 2018; however, it remained 19 percentage points lower than total labour force participation in 2018. The youth unemployment rate was 10 percentage points higher than the general unemployment rate before the pandemic, and unemployed people aged between 15 and 24 years faced more prolonged periods of unemployment (6.2 months) than the duration of unemployment for the active population aged between 25 and 64 years (5.1 months) (CEDLAS and WB, 2020[34]). The informality rate for people aged between 15 and 24 years stood at 60%, 3 percentage points higher than for the general population. Moreover, the Dominican Republic has been experiencing a contraction in the youth-employed population since mid-2018.

The crisis has deepened the need for policies to tackle the vulnerabilities of youth employment. The Dominican Republic has made different efforts in order to improve the transition from school to formal employment and to strengthen education and training among young people. In 2020, the Social Cabinet of the President’s Office launched the Oportunidad 14‑24 programme, which aims to reintegrate vulnerable adolescents and young people aged 14‑24 years, who are at great risk of social vulnerability (due to factors such as lack of employment, peer pressure and social insecurity), into productive and educational activities. The Oportunidad 14‑24 programme provides training and education courses for young Dominicans, especially those who have dropped out of school. In addition, it offers the possibility of doing internships with professional organisations and provides support for entrepreneurship, including financial aid. Because of the COVID‑19 pandemic, the employment rate for those aged between 15 and 24 years fell by 16% in Q4 2020, a significantly greater reduction than the 6% decline in employment for the general population in the same period. More recently, however, youth employment has recovered, with an increase of 1.5% between Q3 2019 and Q3 2021. This increase translates into approximately 10 000 additional youth being employed (i.e. those aged 15‑24 years). However, the crisis disproportionately affected young people, not only through job losses but also through suspended education and training programmes, posing significant barriers to finding a first job (ILO, 2020[35]). For this reason, the government launched the Empléate and Emprende programmes in 2021, as part of the Supérate programme. These new programmes connect Supérate beneficiary families with a series of complementary services that include technical and vocational training, labour intermediation, advice for the development of formal productive enterprises, financial and technological coaching, and family agriculture support (PDR, 2021[18]). Preventing the adverse effects of COVID‑19 from becoming permanent among the youth population will be critical to supporting the country’s long-term recovery.

Challenges and opportunities to move from analysis to action

Building a universal social protection system that protects the most vulnerable workers and households brings a challenge for a country’s public finances. The high level of informality hinders the collection of social security contributions from informal workers and leaves them outside the protection scope of the system. Faced with these restrictions, making the operation of the system more efficient and improving the targeting and allocation of scarce resources is fundamental. First, to move towards universal coverage, the country must reach fundamental agreements on social protection and go through several structural reforms to materialise such agreements.

The OECD Development Centre team met in Santo Domingo with several government officials and other specialised actors from the social security sector to discuss the country’s main challenges in this area and possible strategies to solve them. They shared their visions around the main challenges and opportunities. Table 3.2 shows the results of the discussions and summarises key policy recommendations.

Table 3.2. Consolidate a robust and sustainable social protection system in order to protect informal workers and their household members

|

Policy recommendation |

Challenges and opportunities for implementation |

|---|---|

|

1.1. Strengthen social protection systems, and build on the lessons learned during the COVID-19 pandemic: |

|

|

Improve interoperability across different existing registries, integrating all social protection information systems and strengthening the role of SIUBEN in order to reach vulnerable, informal populations, and exploiting the potential of digital technologies. |

The central role that SIUBEN currently plays is an opportunity to implement this strategy. However, achieving such a connection between systems, modifying the labour code, and modifying the law of the social protection system are considerable challenges. Achieving interoperability between basic registries first could be more strategic. An overly ambitious integration could leave certain institutions out. It is essential to define the primary and secondary actors in the system, depending on their levels of responsibility, to be involved in such interoperability. In addition, it is crucial to have fair justifications for the information required by the institutions. |

|

Enhance a co-ordinated conditionality associated with social protection programmes, in order to make them a catalyst for better educational, economic and social inclusion. |

The biggest challenge of this recommendation is the modification of the labour code and the law of the social protection system. One opportunity could be to centralise the co-ordination of the strategy in a single institution. |

|

Adopt the household lens in order to better understand its composition (i.e. informal, mixed, or formal), and thus better identify the right mix of interventions and develop integrated policy packages for each type of household. |

Adopting a more granular lens at the household level is an opportunity to include other aspects of the life cycle, gender and geography. A new lens could also create social inclusion surveys by type of household, in addition to taking into account households’ distribution by quintiles and other structural factors. |

|

1.2. Make social protection contributions more flexible in order to include informal workers: |

|

|

Progress towards a system that allows more flexibility for workers to contribute to the social protection system, particularly for those who face difficulties in making regular contributions through traditional channels (e.g. those earning less than the minimum wage, working through digital platforms or working in part-time jobs). This is particularly relevant for own-account workers (e.g. a flat rate for their contributions). |

The current situation brings a window of opportunity because various sectors are advocating for changes in social security for the first time since the system was created 20 years ago. However, one of the great challenges is the reluctance of the sectors. Also, extending protection to independent workers, without sufficient contributions, can become a problem due to the additional burden for the State. There are two alternatives: implementing a single subsidized-contributory system or implementing a contributory system and a subsidised system with an independent-workers approach. In any case, simplifying and standardising the labour legislation is crucial to encourage a higher level of formalisation that increases the number of contributing workers. |

|

1.3. Progress towards a universal and more sustainable social protection system |

|

|

In the short to medium term, efforts should be made to extend coverage to categories of the population not covered by social protection and across all regions of the Dominican Republic. |

Identifying and reaching those missing sectors not yet covered is an important challenge. Strengthening the existing universal protection schemes and extending them to all sectors may be an opportunity. |

|

In the longer term, the Dominican Republic should move toward a universal social protection system that is sustainable. Technical and political discussion is required in order to assess the convenience of developing a system where coverage depends less on individuals’ employment status and where general taxes, instead of workers’ contributions, gain relevance as a source of financing social protection systems. |

One opportunity of the current situation is that there are ongoing discussions about a possible modification of the 1992 labour code. The implementation of a universal social protection system must go hand in hand with a comprehensive tax reform. Other key structural aspects to change include the improvement of the civil registry of people and the regularisation of immigrants that allows them to channel their contributions to the social security system. Also, the universalisation of social protection must include new figures such as passive labour market policies. However, a great challenge would be negotiating with some parties whose economic interests would be affected. |

Note: Based on the meeting held on 23 June 2022, to discuss the draft analysis and policy recommendations with officials from the Ministry of Labour, the Ministry of Economy, Planning and Development (MEPyD), the Central Bank, the National Statistics Office (ONE), the Association of Industries (AIRD), CIEF Consulting/IFISD and the European Union.

Source: Authors’ elaboration.

There are structural barriers to the formalisation of companies and to the creation of more formal jobs

In addition to mitigating the pervasive impact of informality, which limits social protection and increases social vulnerability, it is crucial to understand the underlying causes of this phenomenon. The causes of informality are diverse and vary across countries, time periods and segments of the informal economy. There are several institutional, behavioural, and structural factors that can determine whether an enterprise or a worker decides to operate formally or not (OECD/ILO, 2019[9]), including the Dominican Republic’s production structure. Belonging to a sector with low productivity and widespread informality may hinder a company’s transition to formality or its decision to hire workers formally. Likewise, a company’s size is closely related to its capacity to deal with the extra burdens that operating formally entails. But beyond these factors, there is a portion of companies that may have the capacity to operate formally but that remain informal because of the additional economic and bureaucratic costs involved in operating formally (Jütting and De Laiglesia, 2009[6]). The procedural and economic burdens of operating formally include the administrative and tax processes (the bureaucratic burden), the tax costs of operating formally (the tax burden), non-wage-related labour costs, and minimum wage regulations. The bureaucratic burden, for example, often involves cumbersome procedures and, therefore, higher operational costs.

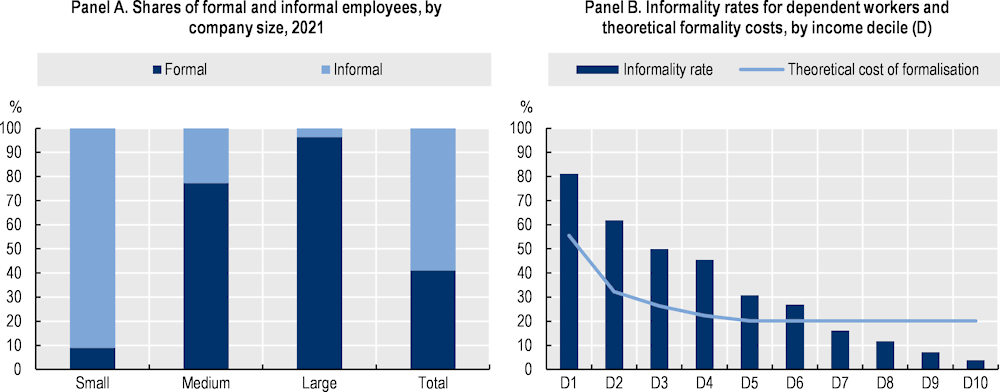

Figure 3.10. Informal work mainly affects small businesses and low-income employees in the Dominican Republic

Note: Panel A: Small enterprises have fewer than5 employees, medium-sized enterprises have between 6 and 20 employees, and large enterprises have more than 20 employees. Panel B: Blue bars represent informality rates by labour income decile for workers aged 15‑64 years in 2013. The theoretical costs of becoming formal (black line) is expressed as the proportion of dependent workers’ wages that workers would pay in social security contributions in order to become or remain formal.2

Source: Panel A: Authors’ calculations based on the KIIbIH database and the ENCFT 2022 (BCRD, 2022[2]). Panel B: Authors’ elaboration based on OECD/IDB/CIAT (2016[36]).

Formalisation remains unattractive or unaffordable for many Dominican companies, especially the smaller ones. Informality is a problem that is commonly concentrated among micro-, small- and medium-sized enterprises (MSMEs). In the Dominican Republic, 91.0% of small enterprises’ employees and 22.8% of medium-sized enterprises’ employees are informally employed. In contrast, only 3.7% of employees in large enterprises are informally employed (see Figure 3.10, Panel A). MSMEs dominate the Dominican productive landscape. They represent approximately 94.6% of all businesses in the Dominican Republic (MICM, 2020[37]), contribute around 38.6% of GDP (UNDP and MICM, 2020[38]) and generate more than 51.4% of total employment (MICM, 2020[37]). On average, 68.2% of MSMEs are created as microenterprises, 29.3% are created as small enterprises, and only 2.5% are created as medium-sized enterprises (FondoMicro, 2014[39]).

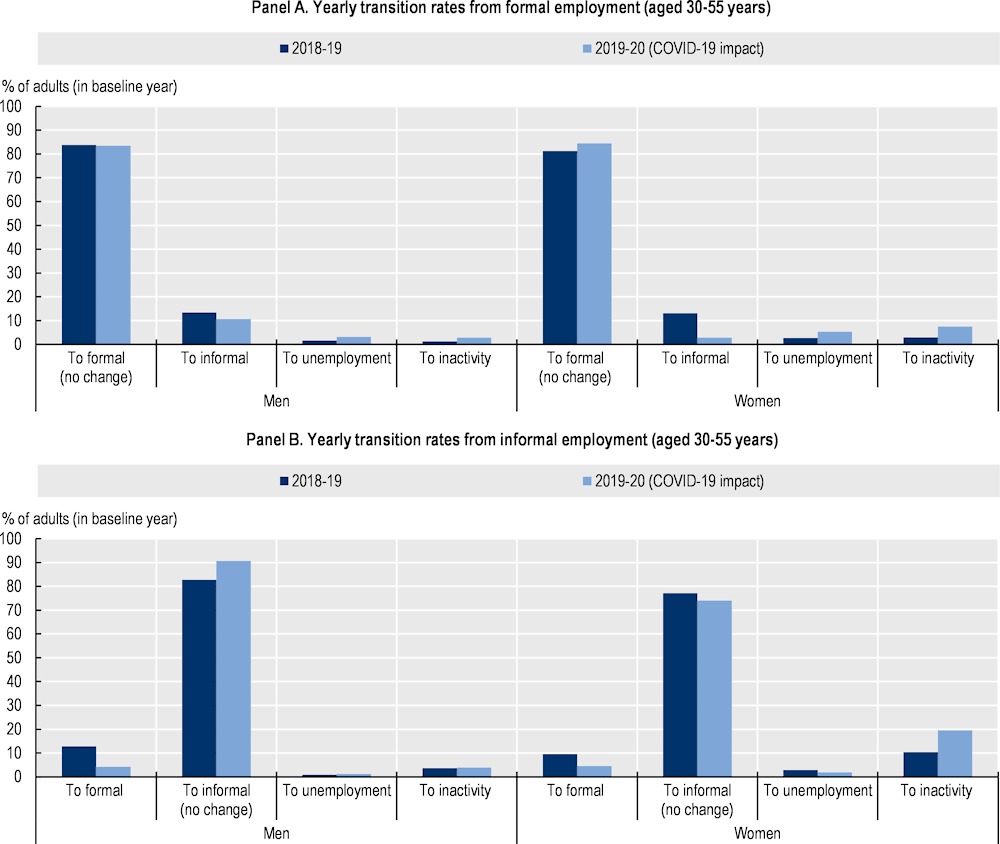

Figure 3.11. Transitions from formality and from informality (aged 30‑55 years) by gender

Source: Authors’ calculations based on the KIIbIH database (OECD, 2021[14]) and the ENCFT 2018, 2019 and 2020 (BCRD, 2022[2]).

The cost of hiring formally is high for low-income workers in the Dominican Republic relative to their income. Among workers in the poorest income decile, formalisation would represent an additional cost of almost 60% of the workers’ income. From the fifth income decile onwards, formalisation represents a burden of 20% of the workers’ income6 (see Figure 3.10, Panel B) (OECD/IDB/CIAT, 2016[36]). Although moving towards formality would undoubtedly bring significant benefits for informal workers in terms of social protection coverage (healthcare, pension, unemployment), and for society as a whole in terms of productivity, growth, social security and tax revenues, the theoretical costs of formalisation remain too high for low-income workers relative to their income.

Barriers to formalisation are reflected in a segmented labour market, where transitions between informality and formality are relatively scarce, particularly for women. Between 2018 and 2019, 13.4% of men and 13.1% of women aged 30‑55 years transitioned from formality to informality, but more than 80.0% of men and women retained their same labour status. Similarly, 12.8% of male informal workers transitioned from informal to formal employment between 2018 and 2019, while only 9.6% of informal female workers transitioned to formal employment. Between 2019 and 2020, during the COVID‑19 pandemic, the rate of transitions from informal to formal employment dropped significantly, to 4.2% among men and 4.5% among women; 19.5% of female informal workers transitioned to inactivity and 1.91% transitioned to unemployment during the crisis, while these figures were only 3.9% and 1.24%, respectively, among male informal workers (see Figure 3.11).

Streamlining companies’ administrative and tax procedures has helped reduce disincentives to firm formalisation

Administrative obligations associated with formality can be a strong incentive for companies to remain informal. These bureaucratic burdens include rigid labour market regulations, cumbersome processes and high costs of operation (CNC and IDB, 2019[40]). The labour market in the Dominican Republic is governed by the 1992 Labour Code (CDRD, 1992[25]). The Labour Code regulates all matters related to the definition of the labour contract, its modalities, and the official and private regulation of the conditions of different types of labour contracts. In addition, it regulates the procedures for enforcing the law by both administrative authorities and the courts. The Code establishes the Ministry of Labour and the courts as responsible for enforcing the law and its regulations.

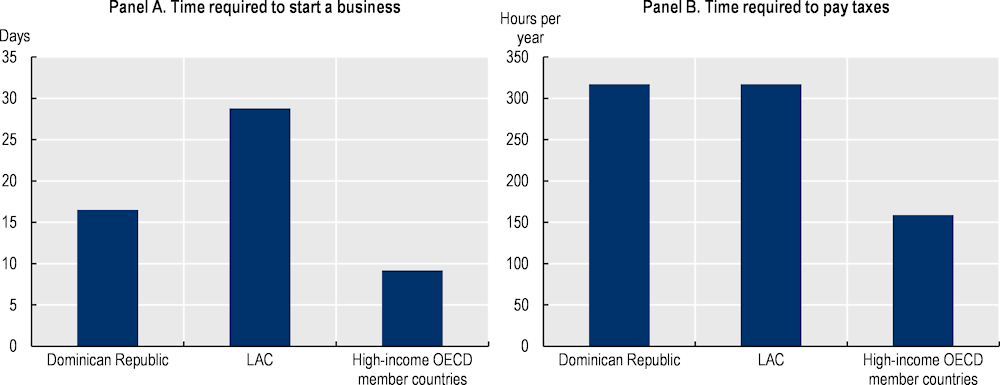

The Dominican Republic has made efforts to reduce the bureaucratic burden of setting up a formal business, becoming much more competitive than the LAC average. Setting up a formal company in the Dominican Republic requires seven procedures that take approximately 16.5 days (World Bank, 2020[41]). The average time required to set up a business in LAC countries is 28.8 days, while in high-income OECD member countries, it is only 9.2 days (see Figure 3.12, Panel A). The formalisation process includes: 1) verifying the availability of the company name, via the National Office for Industrial Property (Oficina Nacional de la Propiedad Industrial; ONAPI); 2) purchasing the company name via ONAPI; 3) paying the incorporation tax (via the DGII); 4) registering the company with the Chamber of Commerce; 5) obtaining a taxpayer identification number from the National Taxpayers Register (Registro Nacional de Contribuyentes; RNC) and applying for tax receipts (via the DGII); 6) registering employees with the Ministry of Labour; and 7) registering employees with the TSS (World Bank, 2020[41]).

The government created the Formalízate website as a one-stop shop in order to streamline bureaucratic formalisation procedures and to encourage businesses to formalise. The Ministry of Industry, Commerce and MSMEs (MICM) created the Formalízate website in 2015, through Decree 182-15 (MICM, 2015[42]). This has generated significant savings, in terms of both time and money, for enterprises dealing with all the necessary procedures for formalising employment. In order to operate this service, the MICM is in charge of co‑ordinating several institutions throughout the formalisation process, including the Ministry of Labour, ONAPI, the DGII, the Chamber of Commerce, and the TSS.

Even though Dominican enterprises face a reduced number of procedures for paying taxes compared with LAC countries and OECD member countries, they still spend too much time complying with such procedures. In total, Dominican enterprises must comply with seven tax payment procedures, including payments for corporate income tax; value added tax (VAT); employee social security contributions (health, pension and National Institute of Technical and Vocational Training (Instituto Nacional de Formación Técnico Profesional; INFOTEP); and taxes for vehicles, fuel and electronic transfers. In LAC, the average number of tax payment procedures per enterprise is 28.2, while it is 10.3 among high-income OECD member countries. Companies spend an average of approximately 317 hours per year on all tasks linked to paying taxes, which is in line with the LAC average of 317.1 hours per year. In contrast, companies in high-income OECD member countries spend half that time per year paying taxes, on average, at 158.8 hours per year (see Figure 3.12, Panel B (World Bank, 2020[41])).

Figure 3.12. The bureaucratic burden of setting up a business and complying with tax obligations is still higher in the Dominican Republic than in OECD member countries

Note: Panel A: Time required to complete each procedure (calendar days) does not include time spent gathering information; each procedure starts on a separate day (two procedures cannot start on the same day); procedures fully completed online are recorded as half-days; a procedure is considered completed once the final document is received; and no prior contact with officials is accounted for. Panel B: Time required to comply with three major taxes (hours per year) includes collecting information and computing tax payable; preparing separate tax accounting books; completing the tax return and filing with agencies; and arranging payment or withholding.

Source: Authors’ elaboration based on World Bank (2020[41]).

The tax burden associated with formal status can be high for some MSMEs

The Dominican Republic’s tax structure has a relatively high dependence on indirect taxes. In 2020, 61% of the government’s revenue came from taxes on goods and services, followed by 16% from corporate taxes on income, profits, and capital gains, and 10% from taxes on individuals on income, profits, and capital gains (OECD et al., 2021[43]). In terms of direct taxation, as the country’s tax base for personal income tax continues to be quite limited, corporate taxes are highly relevant. In addition, despite the economic growth that certain highly productive sectors have generated, the Dominican treasury does not receive revenues from sectors such as the Free Trade Zones, which are exempt from taxation.

Nonetheless, the tax wedge in the Dominican Republic is below the LAC regional average. The tax wedge is calculated by expressing the sum of personal income taxes, all compulsory social security contributions paid by employees and employers, and payroll taxes minus cash benefits as a percentage of the total labour cost. In the Dominican Republic, the average tax wedge is around 19.2%, while the average tax wedge in LAC countries is around 21.7%. Argentina has the highest tax wedge, at 34.6% of labour costs. Brazil, Colombia and Uruguay also have tax wedge figures of 30% or more. Honduras has the lowest tax wedge, at 10% of labour costs. When broken down by income deciles, the Dominican Republic’s tax wedge is 1.2% for the three poorest income deciles, 19.2% for deciles four through nine, and 25.6% for the richest (tenth) decile. This shows that only decile ten has an additional burden on account of personal income tax (OECD/IDB/CIAT, 2016[36]).

Small enterprises face more difficulty in coping with the corporate tax burden than larger companies do. In the Dominican Republic, small formal enterprises more frequently express that their biggest obstacle to operating formally is the tax rate of 12.5%, compared with the 8.1% rate for medium-sized enterprises and 11.3% for large enterprises (World Bank, 2016[44]). The fact that small enterprises struggle to cope with the country’s tax burden becomes particularly problematic in a productive landscape heavily dominated by MSMEs, which are the most affected by formal work barriers.

Although the Dominican Republic has implemented simplified tax regimes for small taxpayers, tax rates are not differentiated for MSMEs or newly formalised enterprises. In 2009, the Dominican Republic implemented three special policies for small taxpayers that included a simplified procedure for taxation based on purchases, taxation based on income, and taxation on the transfers of industrialised goods and services (CDRD, 2008[45]). These simplified procedures replaced the regular procedures for corporate income tax (Impuesto sobre la Renta; ISR) and tax on the transfer of industrialised goods and services (Impuesto sobre Transferencia de Bienes Industrializados y Servicios; ITBIS) (Salazar-Xirinachs and Chacaltana, 2018[46]). In 2019, the country implemented the Simplified Taxation Regime (Régimen Simplificado Tributarion - SRT) with new benefits, such as flexibility in the payment of the ISR, exemption from specific procedures, exemption from payment of tax on assets, simplification of payments, and the implementation of simplified forms for the payment of the ISR and the ITBIS (CDRD, 2019[47]). However, these measures do not include special tax rates exclusively designed for MSMEs to further incentivise formalisation in the Dominican Republic (e.g. providing tax exemptions during the first years of operation).

The tax burden on businesses in the Dominican Republic is similar to the LAC average, but greater than that of OECD member countries. In the Dominican Republic, a company has to pay approximately 48.8% of its profits in taxes and contributions. The highest burdens are due to a corporate income tax rate of 29.1% and social security contributions to pensions (15.6%), healthcare (0.4%) and the INFOTEP (1.5%). In line with the total tax burden in the Dominican Republic, companies in LAC countries pay, on average, 47% of their profits in taxes and contributions. In contrast, companies in high-income OECD member countries pay 39.9% of their profits in taxes and contributions (World Bank, 2020[41]). VAT, although not paid by companies, generates an annual burden of approximately 163 hours per year for compliance, while corporate income tax and pension contributions generate a burden of 74 hours and 80 hours per year for compliance, respectively (World Bank, 2020[41]).

The weak tax morale in the Dominican Republic not only undermines corporate revenue collection, but also makes it difficult to move towards a tax system that relies more on personal wealth and income rather than on companies. Taxing companies can, in turn, have an impact on formal employment. Formal businesses surveyed in the Dominican Republic report corruption as their biggest obstacle, with 14.0% of small businesses, 31.0% of medium-sized businesses and 16.1% of large businesses reporting this (World Bank, 2016[44]).7 This reflects markedly weak tax morale among the country’s entrepreneurs, who, distrusting institutions because of the level of corruption, find little incentive to pay taxes (OECD, 2019[48]). According to the Latinobarómetro survey, only 43% of Dominicans believe that not paying taxes is not justified (Latinobarómetro, 2016[49]) and 27.5% of Dominicans have heard about someone who managed to avoid paying taxes entirely (Latinobarómetro, 2020[50]).

Non-wage labour costs can represent a barrier to formalisation, particularly for small employers

Annual non-wage labour costs were established in the Dominican Republic through four fundamental labour laws. In 1980, Law 116/80 created INFOTEP and introduced a 1% fee on workers’ annual wages in order to finance it. In 1992, Law 16/92 established the current Labour Code and set the current rates of several non-wage labour costs: 1) the annual leave contributions, which amount to 4.9% of the annual wage (14 days) for the first 5 years of employment and 6.3% (18 days) afterwards; 2) the severance contributions, ranging from 4.55% during the first year of employment to 160.9% after 20 years; 3) the Easter royalty, amounting to 8.33% of the annual wage; 4) the company’s profit bonus, ranging from 15.7% during the first three years of operation to 21% from the fourth year onwards; and 5) the pre-notice fee, which increases from 2.5% between months 3 and 6, to 4.9% between months 6 and 12, to 9.8% after the first year. Then, in 2007, Law 87/07, which created the Dominican Social Security System, introduced a contribution of 1.3% of workers’ annual wages for occupational risk insurance. Finally, Law 188/07, which amended Law 87/07, changed wage charges for pension contributions (7.1%) and family health insurance (6.7% during the first year of employment, 7.0% for the second year, and 7.1% from the third year onwards) (see Table 3.3) (Collado Di Franco, 2018[51]).

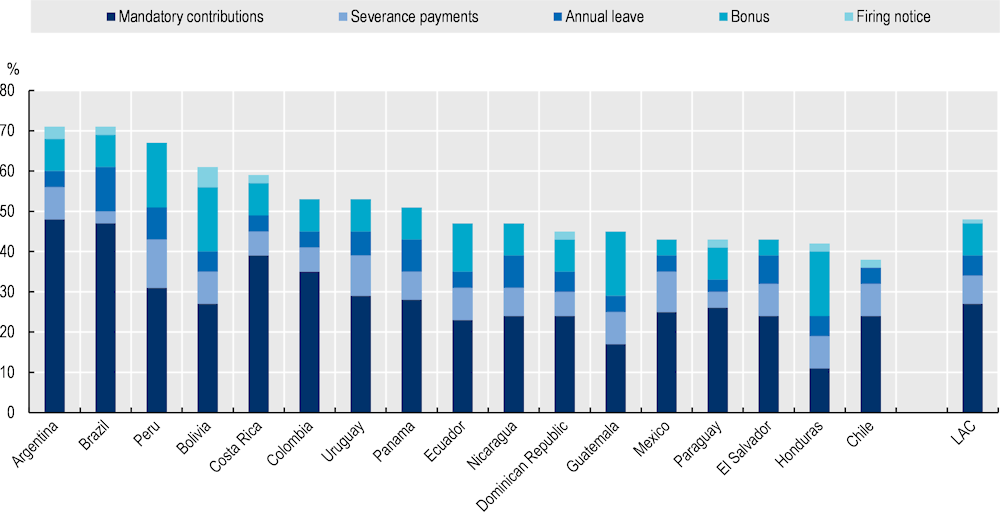

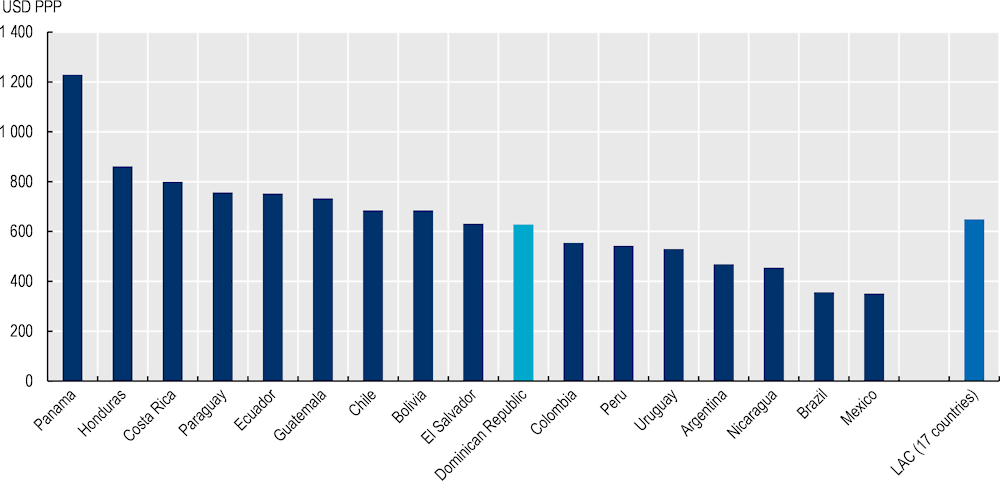

Effective non-wage labour costs in the Dominican Republic are below the average across LAC countries. As a percentage of the average net wages of formal salaried workers in the Dominican Republic, hiring a formal worker entails 24% of wages going towards mandatory contributions, 8% going towards bonuses, 5% going towards annual leave, 6% going towards severance pay and 2% going towards firing notice, for a total of 45% (Alaimo et al., 2017[52]). In LAC, among the countries with the highest non-wage labour burdens, Argentina, Brazil, Peru and Bolivia top the list. The average for the LAC region is 49.5% of the average net wages of formal salaried workers, which is distributed as follows: 27.3% for mandatory contributions, 13.8% for salaried costs (8.4% for bonuses and 5.4% for annual leave) and 8.4% for job security provisions (7.3% for severance pay and 1.1% for firing notice). Among OECD member countries in the LAC region, Chile and Mexico are below the region’s average at 38% and 44%, respectively. Chile is the country with the lowest non-wage labour costs in the whole LAC region. While Chile has no bonus fee, Mexico and Colombia have no firing notice charges (see Figure 3.13).

Figure 3.13. The Dominican Republic has total non-wage labour costs slightly below the LAC average

Non-wage cost of salaried labour (as a percentage of the average net wages of formal salaried workers)

Note: Includes the additional cost of wages paid by workers and employers according to the definition included in the relevant country’s labour law. It is referred to as the average formal wage in the country.

Source: Alaimo et al. (2017[52]), Measuring the Cost of Salaried Labour in Latin America and the Caribbean.

While most non-wage labour costs are relatively stable over time, those in case of dismissal increase drastically after the first year of employment, potentially exerting a disincentive for employers to hire formally. In the first year of employment, the total burden of a formal employee for the employer amounts to 45.04% of the employee’s annual salary and 54.48% in case of dismissal. By the fifth year of employment, non-wage labour costs in case of dismissal have almost doubled, amounting to 98.61%. This increase is mainly due to the rise in the burden of severance pay, the increase in the company’s profit share (bonus), and pre-notice payments. After 20 years of employment, the non-wage labour costs of a formal employee in case of dismissal amount to 222.75% of the employee’s annual salary for the enterprise (see Table 3.3).

Minimum wage regulations have many sector- and size-related variants that often lead to confusion in their application

The 1992 Labour Code created the National Wages Committee to set minimum wage rates for workers in all economic sectors, as well as to define how these wages are to be paid. The Committee establishes thresholds for 15 sectors of the Dominican economy, including agriculture, retail and manufacturing. The rates may be established at the national, regional, provincial, or municipal level, for the Distrito Nacional (National District), or exclusively for a given enterprise (Art. 455 of the Labour Code (CDRD, 1992[25])). The Committee reports to the Ministry of Labour. It has four members: two appointed by the executive branch and two representing employers and workers, while the Executive appoints the director-general. The National Wages Committee has set 16 sectoral categories of minimum wages8 (ILO, 2013[53]), which entail more than 600 rates for their subcategories because the minimum wages can vary by the task within occupational categories. For instance, the construction sector alone has more than 500 minimum wage rates. The large number of minimum wages creates widespread confusion among Dominican employers and workers, hindering proper compliance with current legislation.

Table 3.3. Companies face rising non-wage labour costs to employ a worker formally

Annual non-wage labour costs of employing one person (percentage of the annual salary)

|

Contribution |

1st year |

5th year |

10th year |

15th year |

After 20th year |

|---|---|---|---|---|---|

|

Pension plan |

7.10% |

7.10% |

7.10% |

7.10% |

7.10% |

|

Family health insurance |

6.67% |

7.09% |

7.09% |

7.09% |

7.09% |

|

Occupational risk insurance |

1.30% |

1.30% |

1.30% |

1.30% |

1.30% |

|

INFOTEP |

1.00% |

1.00% |

1.00% |

1.00% |

1.00% |

|

Easter royalty |

8.33% |

8.33% |

8.33% |

8.33% |

8.33% |

|

Holidays |

4.90% |

6.29% |

6.29% |

6.29% |

6.29% |

|

Non-wage labour costs (excluding bonus) |

29.30% |

31.12% |

31.12% |

31.12% |

31.12% |

|

Participation in company profits (bonus) |

15.74% |

20.98% |

20.98% |

20.98% |

20.98% |

|

Non-wage labour costs (including bonus) |

45.04% |

52.10% |

52.10% |

52.10% |

52.10% |

|

Severance pay (cesantías) |

4.55% |

36.72% |

80.43% |

120.65% |

160.86% |

|

Pre-notice |

4.90% |

9.79% |

9.79% |

9.79% |

9.79% |

|

Maximum non-wage labour costs (in case of severance) |

54.48% |

98.61% |

142.32% |

182.54% |

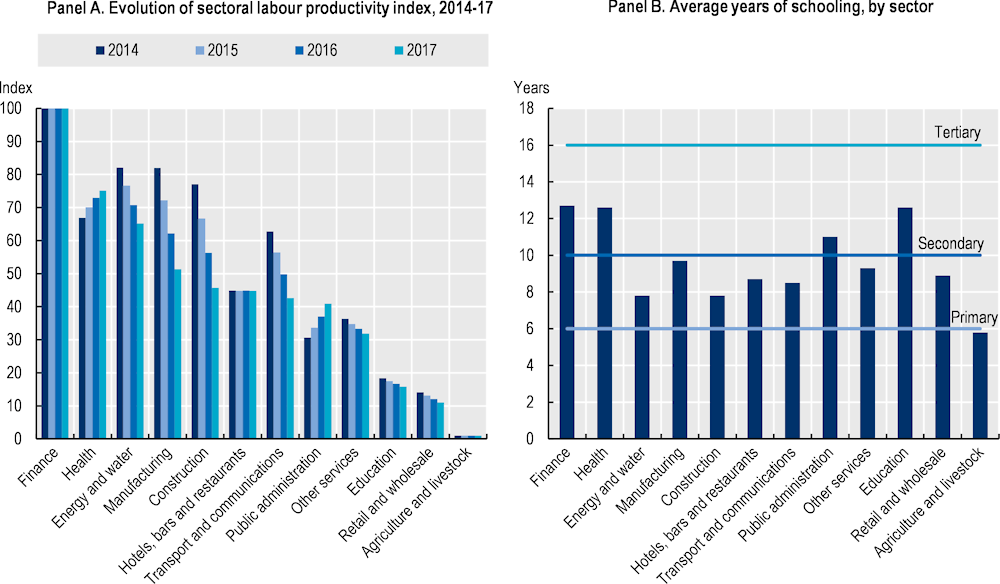

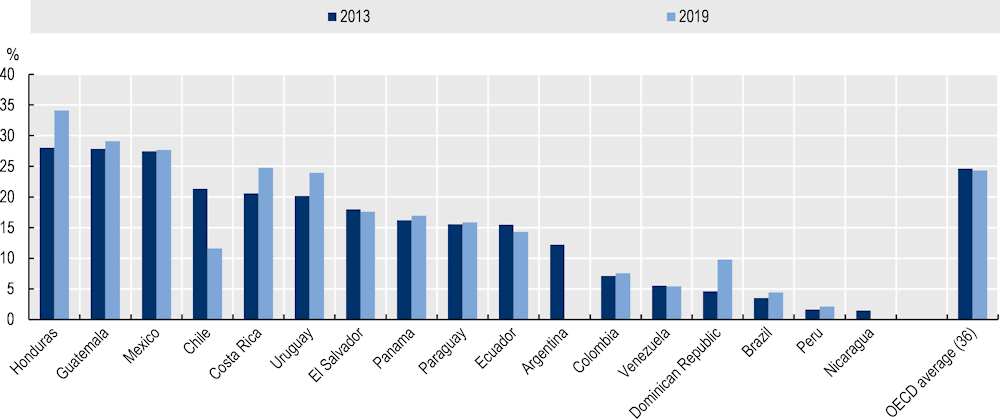

222.75% |