Achieving net-zero emissions requires a combined focus on accelerating the transition in the near term, making the transition itself resilient for the longer term, and ensuring that the transition serves to improve broader resilience rather than creating new fragilities. This chapter assesses some of the potential bottlenecks that could slow down or derail the net-zero transition, reinforcing the case for taking a resilience lens to the transition as well as the need to better embrace systems-level thinking beyond individual policy approaches and sectors.

Net Zero+

5. A resilience lens on the net-zero transition

Abstract

This chapter draws on work carried out under the responsibility of the Environment Policy Committee, the Committee on Agriculture, the Trade Committee, the Public Governance Committee, the International Energy Agency and the Nuclear Energy Agency.

The economy-wide challenge of the net-zero transition

This chapter lays out the challenge of achieving net-zero emissions and sets the scene for subsequent chapters that explore different dimensions of building resilient climate action. It assesses some of the potential bottlenecks that could slow or derail net-zero targets, reinforcing the case for applying a resilience lens to the transition. It also emphasises the importance of a whole-of-government approach to ensure a rapid and resilient net-zero transition, and the need to think beyond individual policy approaches and sectors to better embrace the systems-level thinking described in Part I of this report.

Applying a resilience lens requires a triple focus on accelerating the net-zero transition in the near term, making the transition itself resilient for the longer term, and ensuring that it serves to improve broader resilience rather than creating new fragilities.

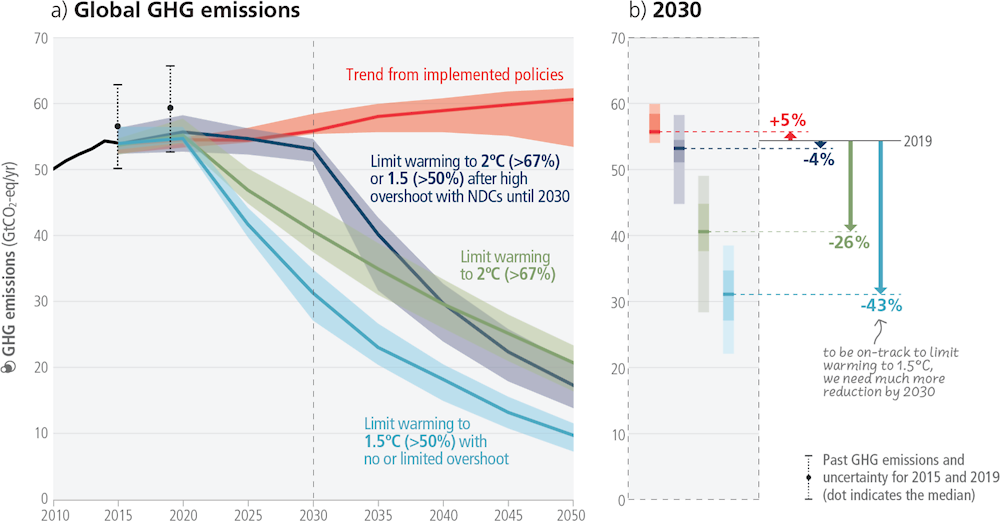

The challenge of limiting temperature rise to 1.5°C and achieving global net-zero emissions in 2050 is unprecedented in terms of the scale and pace of transformation required. It implies a significant acceleration of action relative to what has been achieved to date, with radical changes across economies and societies in the near term. Countries’ current national commitments and policies, while ambitious, will fall short of meeting the 1.5°C target (Figure 5.1). A dramatically steeper decline in emissions is needed to reach net zero by 2050 and stand a chance of avoiding the climate tipping points described in Part I of this report.

Figure 5.1. Limiting warning to 1.5°C or 2°C requires rapid, deep, and in most cases immediate, emissions reductions

Progress on reducing emissions to date has generally been solid but incremental. Data from the International Programme for Action on Climate (IPAC), carried out under this project, shows that major OECD emitters such as the EU, US and Japan decreased their gross emissions from 2010 to 2019 by 14%, 7% and 5% respectively (Figure 5.2). Nonetheless, these countries remain a considerable distance from their 2030 emissions targets. Additional reductions are required from 2019 to 2030 of 38% (EU), 44% (US) and 34% (Japan).

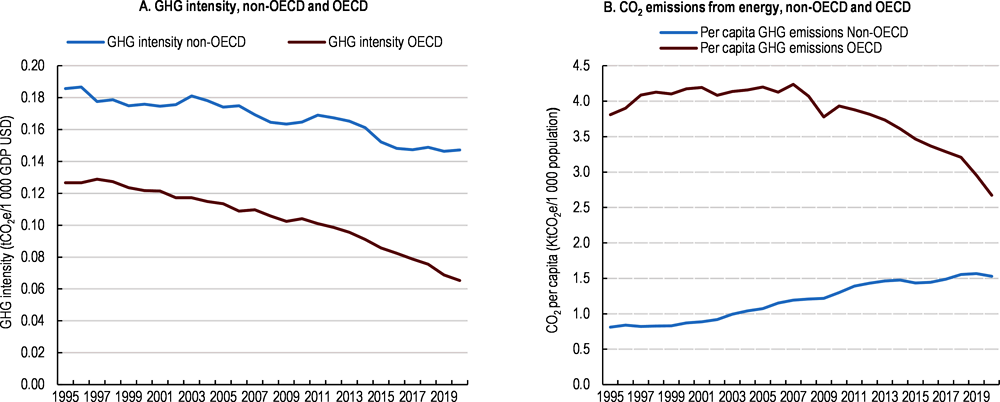

At the same time, emissions in many emerging economies such as Brazil, China, India and Indonesia have not yet reached their expected peaks. To reach climate targets it is essential that countries reduce energy intensity and decouple greenhouse gas emissions (GHGs) from economic growth and consumption. However, while GHG intensity is declining in both OECD and non-OECD countries, per-capita emissions from energy are increasing in non-OECD countries (Figure 5.3)

Figure 5.2. Accelerated progress is required to stay on track towards 2030 emissions targets

Figure 5.3. Per-capita emissions have fallen in the OECD but are increasing in non-OECD countries

Note: The underlying GDP data used for this chart stems from (OECD, 2023[3]); the underlying CO2 emissions data stems from (IEA, 2022[4]).

Source: (IEA, 2022[4]).

The figures above illustrate that a resilient net-zero transition necessitates a fair and globally co-ordinated response, with policy approaches tailored to differing national circumstances, and with financial and non‑financial support sufficient to fulfil the needs of developing countries. Developing countries are set to account for the bulk of energy generation and consumption – and, on current trajectories, emissions growth – in the coming decades due to economic and population dynamics.

Globally, despite impressive long-term ambition – i.e. 133 countries having adopted net-zero targets by February 2023, covering 83% of emissions – shortfalls in nearer-term climate policy persist. The number and stringency of countries’ climate policies has increased since 2010, but progress has been uneven. While most countries covered by IPAC adopted new climate policies between 2015 and 2020, several did not, and others removed or weakened policies. To date, no country has adopted all the major policy types identified by IPAC,1 clearly showing that a step change in pace is required to achieve climate goals.

Meanwhile, the rapidly changing global circumstances described in Part I of this report, combined with the substantial social and economic implications of the net-zero transition, mean that an accelerated pace will not be enough. Transition strategies must be designed with resilience to disruptions and changing conditions in mind. Efforts also need to be made to ensure that the transition itself does not increase the vulnerability or fragility of systems, whether through technical, social, or economic vulnerabilities.

Potential bottlenecks to the net-zero transition

To ensure a smooth transition that is resilience to changing circumstances, governments need to identify and then anticipate a range of potential bottlenecks to the transition, some of which are described in this section.

Bottlenecks related to stable and secure supply of low-carbon electricity

Net-zero emissions implies substantial changes in the way energy is produced and consumed. As energy is a major source of direct and indirect emissions for most economic sectors, a shift to net-zero emissions implies substantial changes across end-use sectors as well as in energy supply. The shift implies a rapid decline in fossil sources, a rapid rise in low-emissions sources (including some fossil fuels with carbon capture and storage), and a considerable increase in the use of electricity as an energy vector.

A wide-reaching systems reorganisation is necessary to achieve this transition. The shift towards electricity is a key example. For example, in the IEA’s Net Zero by 2050 scenario, electricity is projected to account for more than 50% of total energy use in 2050, up from a mere 20% today (IEA, 2023[5]). This implies doubling electricity generation at the same time that the electricity sector undergoes substantial reorganisation as it decarbonises.

A potential bottleneck to the overall transition is therefore a mismatch between rapidly growing electricity demand and the needed stable supply of low-emissions electricity. According to the IEA scenario, global electricity demand will more than double by 2050, even as total energy use declines slightly due to rapid efficiency gains. Demand patterns are projected to change considerably. Geographically, most of the demand growth will be in developing and emerging economies. The main end-use sectors of industry, transport and buildings will all greatly increase their demand for electricity as their contribution to net-zero emissions requires replacing point-of-use solid, gaseous and liquid fuels with electricity and hydrogen produced from electricity. Industry alone will consume almost as much electricity in 2050 (78EJ) as the world’s total power demand today (86EJ). Demand for electricity in transport will grow by a factor of 18, with its share of total electricity demand rising from 2% today to more than 20% (IEA, 2021[6]).

Without careful planning, competing new sources of demand for stable low-carbon power might not be met by sufficient supply of clean power. For example, a country with fast-growing traditional sources of electricity demand that also sees an acceleration of electricity demand due to end-uses switching away from fossil fuels, could experience demand crunch at certain times or in certain regions of its electricity grid. An example would be the confluence of increased demand for air conditioning due to rising temperatures, rapid growth of electric vehicle charging, new direct sources of electricity in industry, and a nascent green hydrogen industry requiring continuous electricity supply for electrolysers. By some estimates, hydrogen production capacity is expected to reach 5 000 gigawatts (GW) by 2050, requiring a low-carbon power production of 21 000 terawatt-hour (TWh) purely to produce the hydrogen before considering other demand needs. This implies a total cumulative investment need of USD 11.7 trillion in renewable power, electrolysers and pipeline reconfiguration by 2050 (IRENA, 2022[7]). This confluence of demand sources could lead to a need to continue running emissions-intensive thermal power to meet the peaks and/or a spike in power prices. The latter would result in some demand centres being uneconomic and create affordability concerns for domestic power consumers.

Avoiding this work depends in part on a rapid scale-up in renewables. The IEA’s net-zero scenario forecasting very rapid growth in wind and solar in the next five years (IEA, 2022[8]) and further into the future. Renewables generation nearly triples by 2030, and nearly triples again by 2050, with most of the growth led by wind and solar. The investment needs of this growth have been much discussed, though a key additional factor is delivering this investment growth in times of high inflation and rising costs of capital (see below). Another low-carbon source of power is nuclear power in those countries that accept it (Box 5.1).

However, stable zero-carbon power is not just about generation technologies. Stable delivery of power through reinforced and digitised transmission and distribution networks will be essential, along with a strong focus on maintaining power system flexibility. Power systems need to consistently match supply with demand through flexible sources. Weather-dependent renewables such as wind and solar are not flexible power sources unless combined with back-up electricity storage. Traditionally, power systems have four main sources of flexibility – flexible generation, interconnection through grids, managing demand, storing electricity – and thermal power generation has traditionally supplied the lion’s share of flexibility (IEA, 2022[9]). As thermal generation phases out in a rapid transition scenario at the same time as more and more parts of the economy come to depend on electricity, it is essential that other forms of flexibility scale up to maintain stable power systems.

The IEA estimates that flexibility needs will increase by a factor of four by 2050 in a net-zero transition with improved power grids, battery storage and demand management becoming key factors. This points to rapid growth in the need for grid-scale power storage, including battery storage, at a time when demand for batteries will be growing strongly from the transport sector, leading to a bottleneck of critical materials for batteries (see below). It also points to a need for greatly reinforced electricity grids, with investment needs tripling by 2030 (IEA, 2022[10]). Increasing digitalisation of power system management has to play a key role in addition to expanded investments in physical transmission capacity, eased by improved permitting processes.

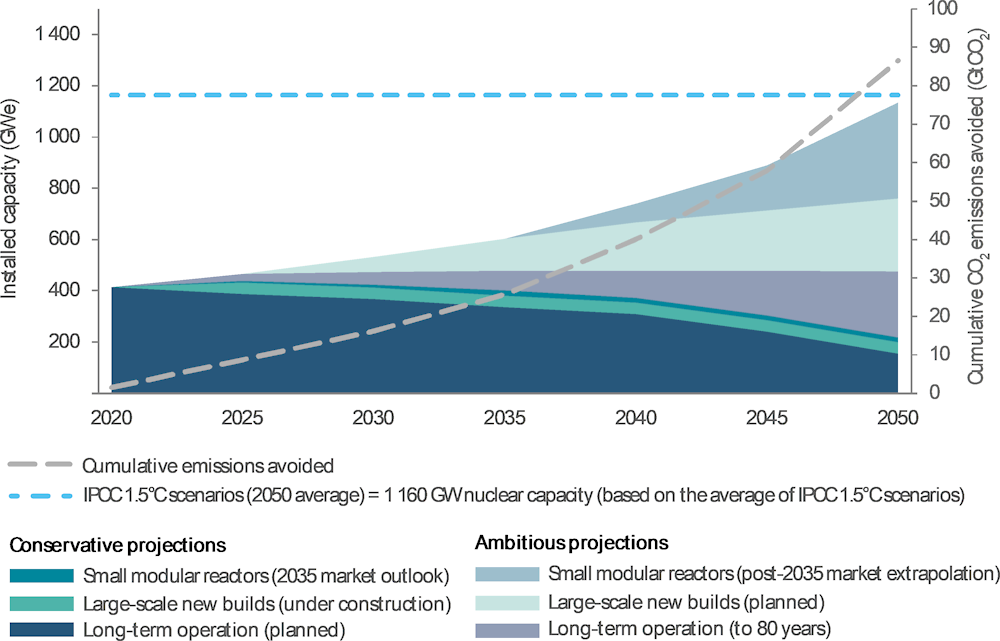

Box 5.1. The role of nuclear power for net-zero transitions

In a special report published in 2018, the IPCC considered 90 pathways consistent with a 1.5°C scenario – i.e. pathways with emissions reductions sufficient to limit average global warming to less than 1.5°C. The IPCC found that, on average, the pathways for the 1.5°C scenario require nuclear energy to reach 1 160 gigawatts of electricity by 2050, up from 394 gigawatts in 2020. This is an ambitious target for nuclear energy, though not beyond reach. It can be achieved through a combination of long-term operations, large-scale new builds and small modular reactors, as shown in Figure 5.4.

The 444 nuclear power reactors in operation worldwide today provide 394 gigawatts of electrical capacity that supplies approximately 10% of the world’s electricity. Nuclear energy is the largest source of non-emitting electricity generation in OECD countries and the second largest source worldwide (after hydropower). There are approximately 50 more nuclear reactors under construction to provide an additional 55 gigawatts of capacity and more than 100 additional reactors are planned. Existing nuclear capacity displaces 1.6 gigatonnes of carbon dioxide emissions annually and has displaced 66 gigatonnes of carbon dioxide since 1971 – the equivalent of two years of global emissions (NEA, 2022[11]).

The nuclear sector can support future climate change mitigation efforts in a variety of ways. Existing global installed nuclear capacity is already playing a role, and long-term operation of the existing fleet can continue to make a contribution for decades to come. There is also significant potential for large-scale nuclear new builds to provide non-emitting electricity in existing and embarking nuclear power jurisdictions; in particular, to replace coal. In addition, a wave of near-term and medium-term nuclear innovations have the potential to open up new opportunities with advanced and small modular reactors (SMRs), as well as nuclear hybrid energy systems, reaching into new markets and applications. These innovations include sector coupling combined heat and power (co-generation) for heavy industry and resource extraction, hydrogen and synthetic fuel production, desalination, and off-grid applications.

Figure 5.4. Nuclear power to 2050 in IPCC scenarios

The potential bottleneck around stable, low-carbon power generation overlaps with other bottlenecks related to the transition. These include resilient supply of critical materials; regulations that allow for the development and commercialisation of new technologies; development and distribution of skills needed given the rapid shifts in technologies and therefore job needs; and the need to massively increase investment flows. These are discussed briefly here and treated in more depth in subsequent chapters.

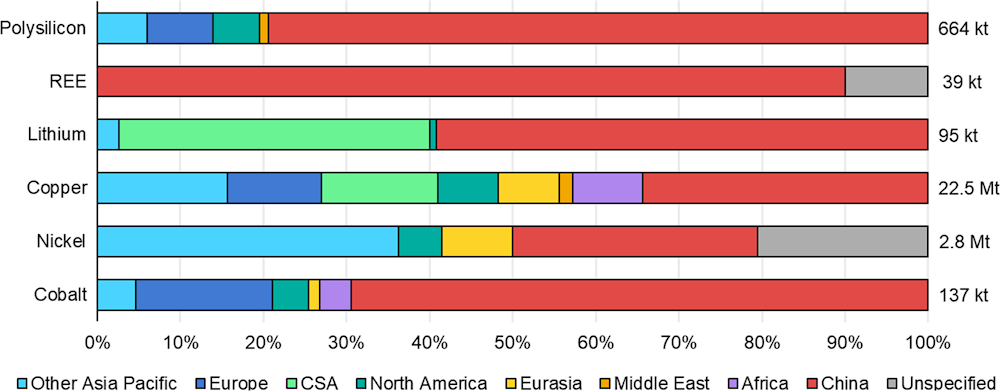

Bottlenecks related to materials supply for the transition

Technologies needed for the energy transition require more critical minerals and metals per unit of energy than fossil fuel-based energy sources. Several renewable energy technologies as well as batteries for electric vehicles all require significant quantities of materials such as lithium, nickel, cobalt, graphite and rare earth elements. In addition, scaled-up power grids are reliant on copper. The IEA estimates that to reach net zero by 2050, up to six times more minerals would be required for the energy sector than today (IEA, 2021[6]). Even common metals such as steel and aluminium are essential for the construction of renewable energy plants such as wind turbines. Supply issues and rising prices of these materials materially impacted wind turbine production and outlook in 2022, pointing to another potentially important bottleneck for the transition.

While mineral supply chains have responded to increased demand in the past, the sudden increase in demand due to a rapid energy transition could lead to supply shocks, potentially slowing the transition and causing energy security crises. As overall technology costs have fallen over the past decade, the relative proportion of material costs has risen, leaving final products relatively more exposed to price volatility in critical minerals. Without reliable supply chains for key minerals and metals, many of which currently come from high-risk areas, it will not be possible to scale up clean energy technologies quickly enough to meet global climate goals.

Critical minerals, and their use in clean energy supply chains, present several vulnerabilities. First, mineral reserves are often geographically concentrated and, in the case of some minerals, in countries with high political risk. For example, the Democratic Republic of Congo accounts for around 75% of global cobalt production, with the top three lithium producers occupying 90% of the market (IEA, 2023[5]). China is also dominant both for minerals supply (being home to 60% of the world’s rare earth elements) but also in particular for processing capacity. Important geographical concentration also currently exists in locations with capacity for transforming minerals into components of clean energy technologies. The dominance of China here is quite striking, as reflected by the regional production of minerals after processing (Figure 5.5).

Figure 5.5. Regional shares of global production of selected critical materials, 2021

Geographical concentration can also bring sustainability risks to companies lower down the critical minerals supply chain. Environmental, social and governance (ESG) requirements necessitate scrutiny of supply chains and there are potential reputational risks if mining practices are found to be environmentally or socially damaging. Mines also tend to have long development times, meaning that industry cannot respond quickly to structural shocks requiring ramping up of production. This would be the case if or when a strong political signal is given to accelerate the transition.

Accordingly, policy makers seeking more resilient and sustainable supply chains can ensure that their policies are sending a clear signal that the transition will accelerate. This can trigger new international investments in mineral production and mines that can help overcome long lead-times. Governments can also take steps to diversify sources of supply, whether within their own borders; through new partnerships and agreements; or by providing finance overseas to de-risk new projects. This is even more important given a rise in export restrictions; the OECD’s annual database on critical raw materials shows that the global incidence of export restrictions increased more than five-fold in the last decade, with several countries significantly intensifying use of these measures. In recent years, about 10% of the global value of exports of critical raw materials faced at least one export restriction measure (Kowalski and Legendre, 2023[12]).

Another means to improve resilience of mineral supply is through a policy push to encourage greater recycling of minerals, which will help improve the resilience of supply chains to price shocks due to geopolitical events in key countries. Recycling will become especially important as the number of electric vehicle (EV) batteries reaching the end of their useful mobile life jumps considerably – several policy options exist to accelerate recycling in this market (Moïsé and Rubínová, 2023[13]).

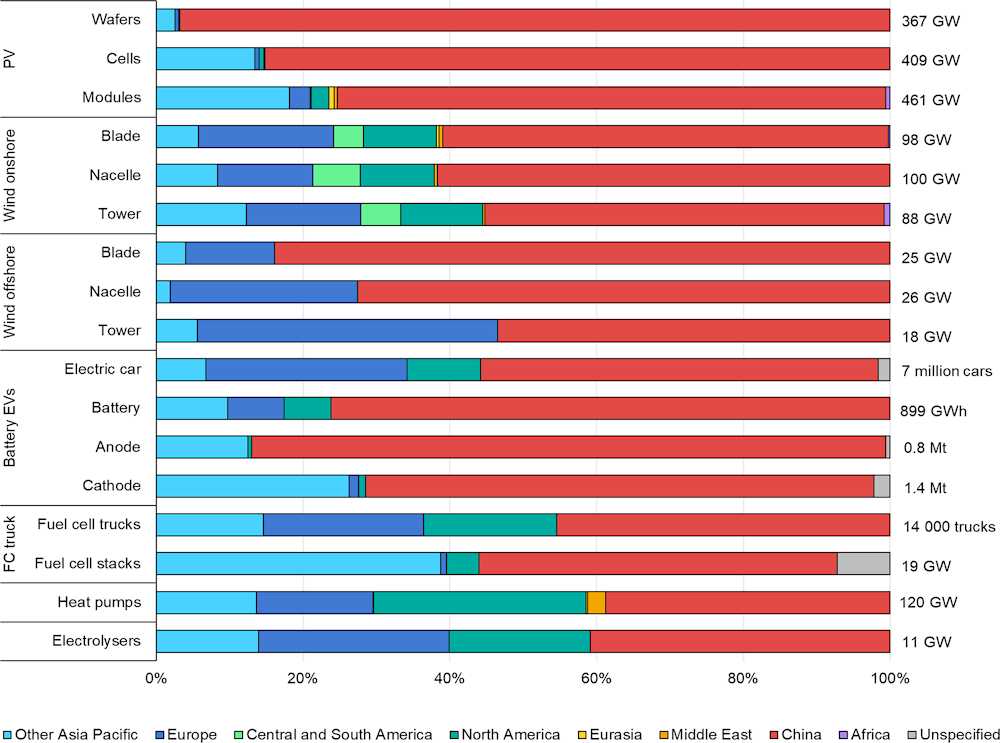

Beyond the supply of processed minerals, important geographical concentrations have emerged further down manufacturing supply chains of clean-energy technologies. Here again, the strong role of China is clearly visible, notably in the manufacturing of the main components needed for solar PV installations (Figure 5.6). While this imbalance has not so far slowed the speed of deployment of technologies globally, it does point to potentially important future dependencies as the world moves away from fossil fuels and increasingly relies on renewable energy reliant on these technologies. This highlights the importance of international trade for a resilient transition and the need to diversify supply chains and manufacturing capacity. Recent investment-focused policies, such as the United States’ Inflation Reduction Act, aim to accelerate this diversification.

Figure 5.6. Regional shares of manufacturing capacity for selected clean energy technologies and components, 2021

Bottlenecks related to rising costs of capital

The past decade has seen a boom in renewable energy, with rapid and consistent decreases in the cost of clean-energy technologies. The annual average growth rate in clean energy investment has risen dramatically from 2% from 2015 to 2020 to 12% since 2020. In 2022, clean energy investment is expected to reach USD 1.4 trillion, up from USD 1.1 trillion in 2017, though part of the increased investment is going towards higher costs rather than new energy capacity or energy savings. With overall energy investment growth remaining sluggish (projected 8% increase, with almost half linked to higher costs), clean energy was projected to take up three-quarters of overall energy growth in 2022 (IEA, 2022[10]).

Despite these trends, overall low-carbon investment levels remain below those needed to reach net zero. Investment also remains unevenly distributed across the globe. Investment levels will need to increase even more sharply across all regions if they are to be compatible with climate goals.

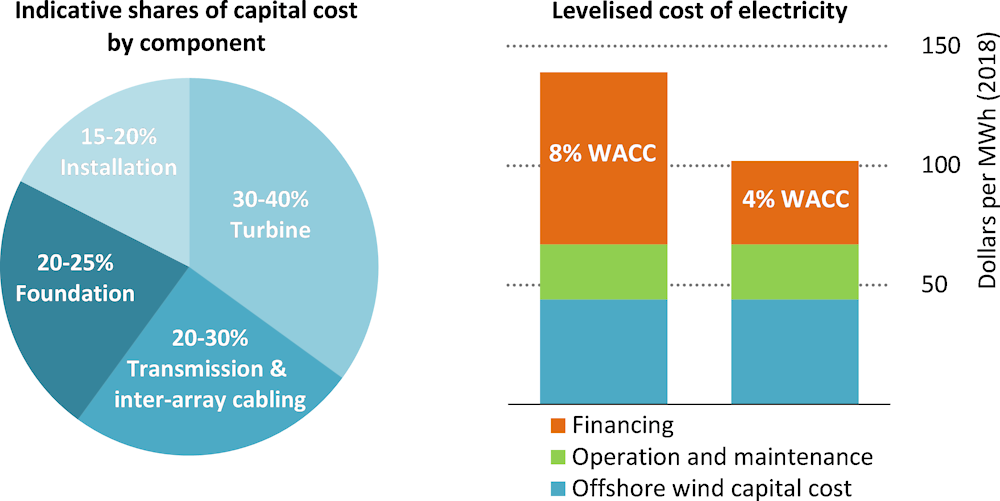

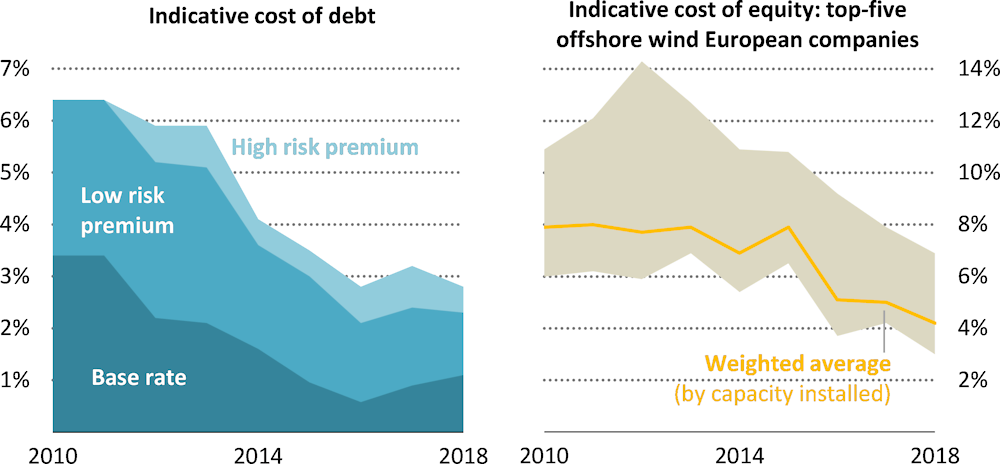

Energy system models frequently do not adequately consider the important role of the cost of capital. This risks distorting the outlook for renewable energy. The rapid development of renewable energy over the past decade has taken place at a time of historically low interest rates. Figure 5.7 illustrates how lower base rates have been instrumental in bringing down the levelised cost of electricity generation (LCOE) of offshore wind. Such favourable investment conditions cannot be taken for granted. This raises questions about the possibility of progress towards net-zero emissions stalling in a time of higher financing costs, requiring careful consideration given the trend towards high inflation and tightening monetary policy in many parts of the world since 2022 (OECD, forthcoming, 2023[14]).

Figure 5.7. Trends in cost of debt and equity for offshore wind projects

Note: WACC = weighted average cost of capital. LCOE = levelised cost of electricity.

Source: (IEA, 2019[15]).

An important factor affecting investment levels is the financing costs borne by investors, or the minimum required rate of financial return for investing in a company or project. The financing cost of an investment is typically given as the weighted average cost of capital (WACC).2 In general terms, higher interest rates will result in a higher WACC, potentially strangling investment.

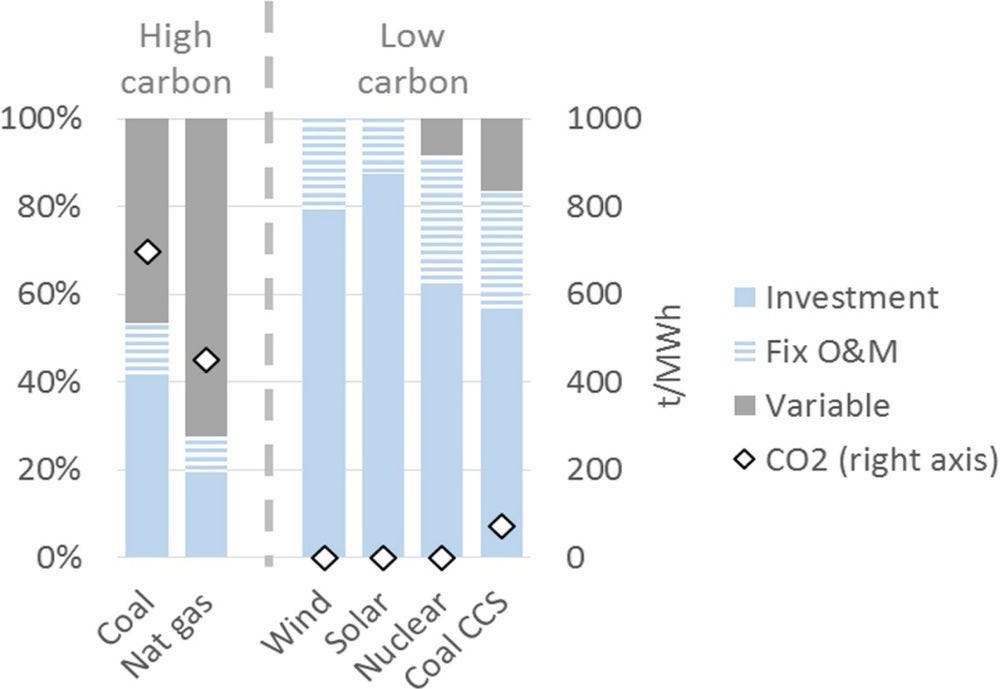

The cost of capital plays a driving role in the net-zero transition in two ways. First, capital costs affect all investments, with higher WACCs representing an obstacle to the net-zero transition insofar as they limit the overall availability of capital for investment of any kind. Second, in addition to this effect on the economy at large, capital costs have a particular effect on low-carbon investments (OECD, forthcoming, 2023[14]). Costing structures differ significantly between different types of investment and play an important role in determining the effect of capital costs. For instance, in the energy sector, fossil-fuel plants require relatively small upfront investments, with the majority of their lifetime costs stemming from fixed operation and maintenance costs (O&M), and variable costs such as fuel, equipment wear and tear, and emissions permits (Figure 5.8). On the other hand, investments in renewable energy technologies require a large amount of upfront capital but have lower lifetime fixed O&M costs and almost no variable costs (Hirth and Steckel, 2016[16]). Due to their capital intensity, financing costs can account for as much as 50% of the levelised cost of electricity (LCOE) of offshore wind projects, as seen in Figure 5.9 (IEA, 2019[15]). Financing costs are estimated at around 25-50% of the LCOE of new solar PV plants, depending on the region in question (IEA, 2022[9]).

Thus, while the costs of all investments increase with higher WACC, they do so unequally. A higher WACC will tend to favour less capital-intensive fossil-fuel investments over low-carbon alternatives. As a result, the cost of renewables will increase more rapidly than fossil fuels as the WACC increases. Estimates suggest that a WACC increase of two percentage points can lead to a 20% increase in the LCOE for wind or solar PV (IEA, 2022[10]). Figure 5.10 illustrates the greater sensitivity of the cost of renewable electricity to capital costs compared to electricity generated from coal or gas.

Figure 5.8. Cost composition of different power generation techniques

Figure 5.9. Offshore wind: Indicative shares of capital costs by component and levelised costs of electricity for projects completed in 2018

Figure 5.10. Relative increases in levelised cost of electricity from rising cost of capital

Note: The chart shows the increase in levelised cost of electricity (LCOE) across different technologies as the discount rate increases, relative to the LCOE of each technology when the discount rate is 1%. The discount rate corresponds to the cost of capital in the IEA’s LCOE methodology. The results assume a carbon price of 30 USD/ton, a heat price of 37.06 USD/MWh and average coal and gas prices from base year.

Source: (IEA, 2020[17])

Modelling shows that WACCs have a strong bearing on the shares of renewable energy in a cost-optimal energy mix, given renewable technologies’ greater sensitivity to capital costs relative to other energy sources. Carbon pricing can attenuate this effect but becomes less impactful as WACCs increase. Moreover, attempts to raise carbon prices to the levels needed to meet net-zero targets have been unfruitful in many major economies to date, even at low costs of capital. This suggests that an even higher carbon price to compensate for high WACCs would be politically unfeasible in many economies (Hirth and Steckel, 2016[16]; Pahle et al., 2022[18]).

Increasing capital costs could also have negative impacts on innovation or other technologies key for net zero. For instance, green hydrogen development, which is both capital-intensive and heavily reliant on vast renewable energy capacity, is doubly exposed to capital-cost volatility (Cordonnier and Saygin, 2022[19]). In this way, rising WACCs could potentially create a vicious cycle, posing a broad threat to net-zero transitions.

Developing countries are particularly vulnerable to rising WACCs. The cost of capital is habitually highest in developing countries; the IEA (2021[20]) estimates that financing costs are up to seven times higher than in Europe and the United States. Research shows that this has acted as a significant barrier to low-carbon investment and the net-zero transition in developing countries, reflected in stagnant clean energy investment levels. The developing country perspective on this issue is explored in more detail in Chapter 10.

Emerging evidence from the current crisis

Investment conditions have been very different in 2022-23 than for much of the past decade. Russia’s ongoing war of aggression in Ukraine has had dramatic impacts on global energy and food supply. Global supply chains are still experiencing pressures as a result of the COVID-19 pandemic. These crises, combined with other factors, have caused high inflation in many parts of the world.

Beginning in late 2021, central banks in many countries began hiking interest rates in response to inflationary pressures, leading to higher capital costs.3 These interest rate increases have continued throughout 2022 and it is expected that monetary policy will continue to be tightened for some time as it will likely take several years for inflation to be durably reduced (OECD, 2022[21]). These trends threaten the progress made on low-carbon investment in the past decade and could have important implications for the net-zero transition.

For the first time in a decade, the cost of renewable energy has increased, with the LCOE from variable renewables set to become 20-30% more expensive compared to 2020 levels (IEA, 2022[10]). The outcome for investment is difficult to predict but it is certainly possible that a higher cost of capital will have significant constraining effects on net-zero investments. The implications for developing countries could be particularly marked, as the global increase comes on top of much higher financing and investment risk in those countries, which has already been recognised as a constraint to investment.

Certain factors may mitigate the negative consequences for low-carbon investment. Despite cost increases, renewables remain the most cost-efficient option for power generation in many countries, even before accounting for high coal and gas prices. Second, national climate policies, and increasing use and expectation for ESG investment criteria or green taxonomies continue to underline the importance of renewable energy investment. Third, concerns over energy security, stoked by the Russian invasion of Ukraine, are driving further interest in renewables, particularly in Europe (IEA, 2022[10]).

If these factors make it difficult to predict how low-carbon technologies will fare relative to the rest of the economy, it is certain that rising interest rates will invariably hamper all investment, including low‑carbon. The deep slump in stock markets and sudden need to protect portfolios from inflation has led to upheaval in investment. Portfolio choices previously thought to be relatively safe have performed badly, and riskier assets, in particular, now appear less attractive. High interest rates have reduced the value of future profits, making firms or technologies in early stages of development less desirable (The Economist, 2022[22]). The extent of impacts will depend partly on how long high inflation and interest rates remain. Policy responses from governments will be equally important. Furthermore, even if issues related to the cost of capital are overcome in developed countries, the limited availability of cheap capital for low-carbon investments in developing countries remains a key bottleneck in the global transition to net-zero emissions (OECD, forthcoming, 2023[14]).

Potential solutions

Policy makers should continue to monitor evidence from the current crisis as it emerges. It is important to also prepare responses to minimise collateral damage from the rising costs of capital, thereby protecting low-carbon investment. There are several useful options that policy makers should consider.

Fundamentally, the best way for governments to shield net-zero technologies from the risks associated with rising costs of capital is to put in place strong political commitments to the net-zero transition and maintain the stringency of core climate policies. Political support for the transition at the highest level sends a strong signal to investors and financial institutions about the future role of these technologies (OECD, forthcoming, 2023[14]).

In several major economies, recent government policy intervention has also shown a powerful effect in reducing barriers to investment and stimulating growth. For instance, by expanding clean energy tax credits for both production and investment, and providing for the direct transfer of tax credits to a third party, the US Inflation Reduction Act (IRA) is expected to reduce burdens related to financing clean energy projects. The Act significantly expands loan and loan guarantee authority under the Department of Energy’s Innovative Energy Loan Guarantee Program and Energy Infrastructure Reinvestment Financing Program. This authority to support innovative projects that face financing challenges at early stages has been described by a former assistant energy secretary as “a sleeping giant in the law” (Penn, 2022[23]). The support and long-term policy visibility provided by the IRA is expected to have a sizeable positive impact on investment in renewables, with the IEA revising upwards its forecast for capacity growth to 2027 by more than 25% in 2022 compared to 2021 (IEA, 2022[8]).

As a second example, Germany revised its Renewable Energy Sources Act in July 2022 in response to the energy crisis. It sets ambitious new targets for 2030 for the share of renewables in electricity generation and for solar PV and wind capacity. Support policies were also implemented, including regulations to reduce permitting times for onshore wind. And, renewable energy technologies were legally established as a matter of overriding public interest. The impact of these policies on renewable energy is expected to be significant, with the IEA recently revising upwards its five-year forecast for capacity growth by 52% in 2022 compared to 2021 (IEA, 2022[8]).

Policies to reduce investor risk are key to lowering WACCs and, consequently, to keeping renewables above the commercial viability threshold. Finance for utility-scale renewables can be tailored to address specific risks; for instance, by incorporating political risk insurance for uncertainty around project development, partial risk guarantees for revenue risk, or guarantees for non-payment due to delays related to necessary infrastructure (OECD, 2022[24]). Regulation to ensure high-quality and predictable governance can lower risk perception among investors, which can serve to reduce WACCs. Even in countries with strong governance and lower political risks, governments can still act to reduce permitting barriers that add costs to renewables projects in particular (IEA, 2022[8]). It is also important to develop and strengthen financing markets for low-carbon technologies to put downward pressure on financing costs through competition between investors (Egli, Steffen and Schmidt, 2018[25]).

Fiscal support for renewable energy and other key net-zero technologies also still has a role to play. Given renewable energy cost trends over the past decade, some governments have been considering phasing out subsidies for more mature technologies, viewing these as sufficiently competitive. However, the implications of rising costs of capital and the risks of exposing these technologies to the open market suggest that this move may be premature. Fiscal support from governments will be important to ensure the continued economic viability of these technologies in the face of more challenging investment conditions. In addition, government support serves to mitigate perceived investor risk, which also keeps financing costs in check (Pahle et al., 2022[18]).

Central banks can also consider green monetary policies to protect investments essential to the transition. Options include creating dual rates for refinancing, with a lower rate for low-carbon technologies acting as a form of green credit guidance for banks. This has been proposed before, notably as an adjustment to the European Central Bank’s system of Targeted Long-Term Refinancing Operations (TLTROs) to incentivise green lending (Voldsgaard, Egli and Pollitt, 2022[26]). Elsewhere, innovative approaches by central banks such as green quantitative easing involving the purchase of green bonds only could contribute to keeping interest rates low for climate-friendly sectors specifically. While this is a promising option, it is largely untested and warrants further research (Pahle et al., 2022[18]).

To ensure that capital continues to go where it is needed, governments also have an important role in supporting the evolution of market products and measurement methodologies to allow investors to better align portfolios with climate objectives, including through improving the use of ESG investing practices. These are discussed further in Chapter 9. Another important option on the financial side relates to reform of multilateral development banks (MDBs). There is growing recognition of the opportunity for MDBs to be changed to better respond to the needs of developing countries faced with the climate crisis, including an explicit call for reform in the Sharm el-Sheikh Implementation Plan. Expanding both the scope and the volume of MDBs’ financing can improve developing countries’ access to capital at low cost, thereby alleviating some of the described effects of this bottleneck (Songwe, Stern and Bhattacharya, 2022[27]). Possible options to address the shortfall of affordable finance in developing countries are addressed in further detail in Chapter 10.

Bottlenecks related to innovation and technology commercialisation, including for hard-to-abate sectors

Some of the technologies necessary to reach net-zero emissions already exist but their cost needs to be reduced so that they can become fully competitive with carbon-based alternatives and be deployed rapidly and at scale (IPCC, 2022[28]). This said, climate targets cannot be achieved by only deploying existing mature technologies, such as power from wind and solar PV. Other technologies such as green hydrogen are still in their infancy and need to be further developed. According to the IEA’s Net‐Zero Emissions by 2050 Scenario, half of the global reductions in energy-related CO2 emissions through 2050 will have to come from technologies that are currently at the demonstration or prototype phase.

In heavy industry and long‐distance transport, the share of emissions reductions from technologies that are still under development today is even higher. For example, the decarbonisation of the manufacturing industry requires not only the adoption of technologies that are close to the market, such as a massive increase in renewable electricity generation to enable the electrification of low-temperature heat processes, but the deployment of many technologies that are still far from maturity, notably bio-based products and green hydrogen (Anderson et al., 2021[29]). However, the production of green hydrogen is still about three times more expensive than grey hydrogen (made out of natural gas through steam reforming) even under the most favourable conditions. Major cost reductions – and the rapid deployment that they would induce – crucially depend on massive improvements in the cost of electrolysers through research and development, and large-scale demonstration projects. Even within technologies that are considered mature such as renewable energy there is room for breakthrough innovations; for example, in geothermal or concentrated solar power. All of these require regulations that do not create barriers to entry for these technologies, but rather, allow for their deployment and then, scaling.

Insufficient pace of technological innovation is therefore a clear bottleneck for a rapid transition, especially as low-carbon innovation rates were actually slowing until 2020. Proactive policies to drive innovation are therefore essential, as explored further in Chapter 7.

Bottlenecks related to skills transitions

The transformation needed for the energy transition implies substantial shifts in employment between firms and between sectors as some traditional jobs become obsolete in time, particularly in the fossil-fuel industry. While there is likely to be a net increase in jobs globally, some sectors, firms and communities will suffer significant negative impacts, which is why a proactive approach by governments to ensure a fair and equitable transition to net zero is essential. Such policies can include reskilling and retraining, but to be effective it is necessary to understand which skills are currently lacking in particular regions and sectors in order to have a better visibility of where potential skills bottlenecks lie.

Potential skills gaps and shortages are already recognised in a number of sectors important for the net-zero transition, such as renewable energy, energy and resource efficiency, renovation of buildings, construction, environmental services and manufacturing (OECD, 2020[30]). However, data is not yet comprehensive. Understanding the types of skills that are lacking and the extent to which the lack of appropriately trained workers is a potential bottleneck for the transition in different countries is an important focus area for future work. In addition, better data will inform governments of the best strategies for scaling up reskilling programmes both to complement workers’ skill sets and to maximise transferability of skills from existing industries (including fossil-fuel based) to those essential for the net-zero transition. This is discussed further in Chapter 8

Bottlenecks related to agriculture and land use

The net-zero transition debate often focuses on energy and industry despite the important role of agriculture and the essential role of land use, land-use change and natural ecosystems for overall net-zero transition. The agriculture, forestry and other land-use (AFOLU) sector account for around 22% of global GHG emissions, of which around 11% is from agriculture (IPCC, 2022[31]), highlighting its importance for mitigation efforts.

Policies to ensure rapid and sustained reductions in direct emissions from agriculture (particularly nitrous oxide and methane) and CO2 emissions from land use, land-use change and forestry (LULUCF) are integral to the transition (Henderson et al., 2021[32]). Moreover, net-zero transition scenarios often rely heavily on CO2 removals via enhanced carbon sequestration in soils and biomass in the AFOLU sector. Strong policy action is needed to take advantage of these important sources of mitigation, including actions to address bottlenecks for the uptake of mitigation practices.

The significant amount of agricultural support with strong potential to harm the environment and distort markets and trade can be an obstacle to the transition, and should be phased out. These include market price support, output-based transfers and unconstrained payments to variable inputs, which are known for their potential to increase pressures on natural resources and to raise national GHG emissions. Even though the global effect of removing market price support is uncertain, these measures potentially contribute to higher national GHG emissions. These types of support are also potentially most production- and trade-distorting; are inefficient tools for transferring income to farmers; and tend to be inequitable as they are not targeted to producers with low incomes. Unconditional support to high emission intensity products should also be avoided as well as subsidies to fossil fuel and fertiliser consumption (OECD, 2022[33]). Instead, budgetary support should be oriented towards investments in innovation to foster emissions saving, sustainable productivity growth, and new mitigation technologies. Such investments would benefit from renewed partnerships between the public and private sectors to maximise synergies on research and development (OECD, 2022[33]).

Climate policies in AFOLU will pose different challenges depending on the costs they impose on producers, the sources of mitigation they target, and their impacts on food production and rural livelihoods. Policy packages that align productivity and mitigation will minimise trade-offs between climate objectives, and producer and consumer welfare. This includes most practices that augment soil carbon stocks in agriculture as well as land-sparing productivity improvements, whereby productivity on existing agricultural land is intensified in a sustainable way in order to “spare” remaining land for nature. The effectiveness of these measures will also depend on policies to protect and ensure the permanence of carbon stocks in agricultural soils and forests (OECD, 2019[34]; Henderson et al., 2022[35]).

Furthermore, the net-zero transition will require stronger policy actions to stimulate afforestation and deep cuts to agricultural emissions that will certainly entail trade-offs between mitigation; competition for land with food production and bioeconomy feedstocks; and producer livelihood objectives (Henderson et al., 2021[32]). These trade-offs need to be managed with well-designed policy packages that can stimulate emission reductions and soften the impacts on food consumers and producers, including through the provision of appropriate social safety nets (OECD, 2019[34]; Henderson et al., 2021[32]).

Investment in accurate and affordable measurement, reporting and verification (MRV) procedures and technologies is also critical, particularly for policies that depend on providing incentives for precise emission reductions (e.g. carbon-pricing policies). While MRV is important for policies in all sectors, it is particularly challenging in the AFOLU sector, given the wide geographical distribution of producers and the diffuse nature of emission and mitigation sources. Important progress is being made in this area but further R&D is needed to improve the accuracy and scalability of MRV approaches for important mitigation sources such as soil carbon sequestration and contracting solutions to address the issues of non‑permanence (to be sure that gains are not quickly erased by a change in agricultural practices) and lower transaction costs, and to provide greater assurance of additionality (where actions are being awarded carbon credits) (OECD, 2019[34]; Henderson et al., 2022[35]). Policy packages will also need to address additional farm-level barriers to adoption such as access to credit, behavioural barriers and technical knowledge gaps to stimulate widespread adoption of low-emission practices (Wreford, Ignaciuk and Gruère, 2017[36]).

The role of government in a rapid and resilient transition

Governments have a wide range of policy instruments at their disposal to accelerate the transition towards net zero. These are well known and have been extensively analysed, including by the OECD, the IPCC and others. They include price-based measures including different forms of carbon pricing; non-priced‑based measures including subsidies and tax incentives; regulatory policies; technology deployment incentives; R&D investment; de-risking policies and so on. Public governance tools such as green budgeting, infrastructure-planning procedures and public procurement are vital for realising climate objectives and must be fully aligned with them in order to drive the needed public and private investment.

The process of selecting, designing and implementing appropriate policy mixes is complex and highly specific to country and local contexts. To help governments with this, the OECD has developed a framework for designing and implementing decarbonisation strategies while considering broader economic and social issues (D’Arcangelo et al., 2022[37]). The methodological framework consists of a series of steps to design country-specific decarbonisation strategies and monitor efforts, organised in two main stages: i) a ‘diagnostic’ stage to identify priority areas; ii) an ‘action’ stage to devise and evaluate concrete policy interventions, including a strong focus on ensuring fairness of policies by assessing distributional effects and focusing on public communication. Other OECD work is focusing specifically on the role and effectiveness of individual policies, notably the OECD’s new Inclusive Forum on Climate Mitigation Approaches. That work is not repeated here; instead, this section reviews progress on reforming public governance for climate objectives and focuses on the important role that “centres of government” can play in developing genuinely whole-of-government approaches to climate change.

Progress on reforming public governance for the net-zero transition

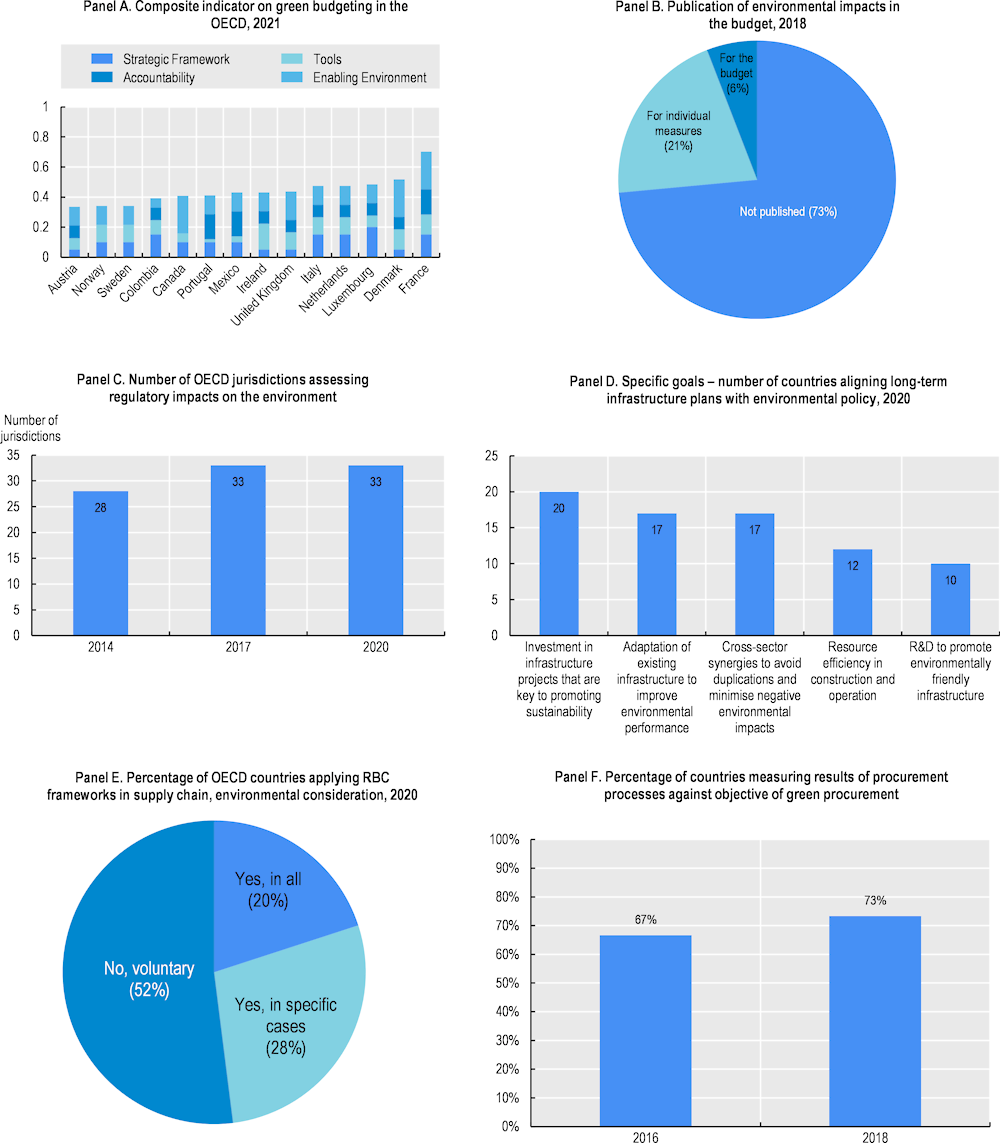

Ramping up public governance tools is critical to achieving the ambitious changes needed for climate and environmental action. Revamping these tools to deliver on these changes also helps reinforce trust in climate action by strengthening the climate governance framework and demonstrating commitment. OECD countries are steadily making progress in using public governance tools to align with environmental objectives but there is room for growth (Figure 5.11). For example, OECD countries and the European Union increasingly require consideration of potential environmental impacts when designing regulations (Figure 5.11, Panel C). In general, policy makers have been provided with methodological information about how and what to include when assessing potential environmental impacts of rules. Engaging all relevant stakeholders, including trade unions, through social dialogue and public consultation can help ensure that regulations are appropriate, effective and efficient. It will also contribute to better acceptance of and compliance with sometimes burdensome regulatory measures among all stakeholders.

Budgets can be powerful instruments for aligning policies with national and global climate and environmental commitments. “Green budgeting”, the use of budgetary policy-making tools to give policy makers a clearer understanding of the environmental and climate impacts of budgeting choices, and help them achieve climate and environmental goals, is becoming more common across OECD countries (OECD, 2021[38]). The OECD composite indicator on green budgeting practices notes that, in 2021, 14 out of 38 OECD countries (37%) reported practising green budgeting (Figure 5.11, Panel A) (OECD, 2022[39]). More and more regional and subnational governments are also launching green budgeting exercises (OECD, 2022[40]).

Despite its growing use, green budgeting still raises challenges for OECD countries when it comes to implementation. The OECD is working with Members on this topic through the OECD Paris Collaborative on Green Budgeting, a platform for countries to share best practices and build resources on how green budgeting can inform public expenditure decisions. Established in 2017, it aims to design new, innovative tools to assess and drive improvements in the alignment of national expenditure and revenue processes with climate and other environmental goals. This is a crucial step in achieving a central objective of the Paris Agreement on climate change, the Aichi Biodiversity Targets and the United Nations’ Sustainable Development Goals: aligning national policy frameworks and financial flows on a pathway towards low greenhouse gas emissions and environmentally sustainable development.

Figure 5.11. Governing green: key indicators

Source: (OECD, forthcoming[41]), OECD and EC (2020), Joint Survey on Emerging Green Budgeting Practices; OECD (2018), OECD Budget Practices and Procedures Survey; OECD Indicators of Regulatory Policy and Governance surveys 2014, 2017 and 2021; OECD (2020), Survey on the Governance of Infrastructure; OECD (2020), Survey on Leveraging Responsible Business Conduct through Public Procurement; OECD (2018), Survey on the Implementation of the 2015 OECD Recommendations on Public Procurement.

Countries are also gradually developing responsible public procurement frameworks that account for environmental considerations alongside social considerations to ensure that public investments work for people, planet and society along global supply chains (Figure 5.11, Panels E and F).

Linking major infrastructure decisions and plans with climate and environmental objectives is critical to shaping the net-zero transition. Governments face challenges to tie infrastructure planning to climate objectives. This includes putting in place criteria for selecting infrastructure projects in line with these objectives and delivering, operating, maintaining, upgrading or retiring infrastructure assets in ways that accelerate the reduction of carbon emissions. Governments should develop long-term strategic infrastructure plans that align with commitments on environmental protection and climate-change mitigation. Further, countries can mobilise greater amounts of private financing for sustainable quality infrastructure by adapting regulatory frameworks, strengthening procurement systems and adopting infrastructure certifications.

Innovative governance approaches can help ensure the effectiveness of green policies. Mission-oriented innovation and anticipatory governance mechanisms can be used to inform climate and environmental decision-making and policies, further discussed in Chapter 7. Strategic foresight, as examined in Part I of this report is an important tool and is being used in several places including the European Environment Agency, Germany, Ireland, the Netherlands, and the UK. Behavioural insights (BI) can also help governments to better design and implement green policies through approaches that consider behavioural barriers and biases. Canada’s Privy Council’s Impact and Innovation Unit is using BI in a survey to measure and promote acceptability and uptake in climate action and green policies among Canadians.4

Centres of government at the heart of whole-of-government approaches

The systemic, long-term, and cross-border nature of climate change represents a complex challenge for traditional governance practices – calling for an increase in government co-ordination. Misalignment of strategic objectives often results from the complex interaction between different administrative and political variables, relating to conflicting sectoral interests, contextual political priorities, and poorly designed co‑ordination mechanisms (OECD, forthcoming 2023[42]).

Bolder climate action requires a shift towards more integrated, evidence-based and co-operative policy action to ensure political buy-in, avoid political inertia, and reconcile short- and long-term objectives and needs. Preliminary OECD evidence provides an overview of the institutional set-ups used by governments to steer, co-ordinate, and deliver on climate policy (OECD, forthcoming 2023[42]). These set‑ups are generally fragmented, as they need to engage actors and institutions across public administrations. Efforts to tackle this fragmentation through institutional levers include: dedicated ministry of the environments; superministries; dedicated units or leadership at the centre of government (CoG); and line ministries with no overarching co-ordinating or steering body.

Uniquely placed to align the machinery of government around strategic priorities, centres of government play an essential role in the prioritisation of high-level policy objectives, and the co-ordination of the design and implementation of policy responses across government, such as those needed to deliver on climate. CoGs increasingly play a direct or indirect climate-related role, whether through the articulation of policy priorities or their monitoring or co-ordination of the head of government’s agenda in climate-related events. Nine of the 38 OECD Members have explicitly tasked the CoG with responsibilities linked to climate resilience (OECD, forthcoming 2023[43]). While still a minority of OECD countries, there is an upward trend in this regard. For most of these countries, this shift has occurred in the past two years, a clear sign of the perceived need for increased levels of co-ordination and coherence to deliver on national and international commitments. CoG’s role in this policy area can be broken down into two key functions: (i) steer and co‑ordinate environmental and climate action at the domestic level and/or monitor the implementation of a national climate strategy and; (ii) co-ordinate government position for international environment- and climate- related commitments and negotiations.

Policy makers and regulators should also proactively consider how to strategically increase interactions among wider public sector institutions in order to co-ordinate and harmonise climate-relevant actions across sectors and borders. Some countries have already identified synergies among sectors that can be captured through sector coupling as well as co-benefits to decarbonisation that extend beyond the sector in question (such as the improvement in air quality that accompanies climate mitigation efforts). Some regulators have also looked beyond national borders to benefit from cross-border co-operation. This is the case in Europe, for example, through the Body of European Regulators for Electronic Communications (BEREC) working groups focusing on promoting sustainability among European e-communications regulators. Further examples of this kind of cross-sectoral co-ordination and collaboration may be helpful in strengthening such practices.

Leading by example: A greener and more resilient public sector

To promote climate action, governments need to lead by example, taking assertive measures to transform government institutions, policies and operations to face environmental challenges. To effectively act on these issues, governments need to have detailed information on the environmental impacts of their work across agencies, levels of government and types of operations.

Governments can also lead by example through green procurement; strengthening responsible supply chain requirements on their suppliers; and encouraging suppliers to implement responsible business conduct (RBC) standards if they want to conduct business with the public sector. With public procurement accounting on average for 12% of GDP in OECD countries and 20-30% of GDP in developing economies (OECD, 2020[44]), green procurement is an effective strategic policy tool for promoting sustainability, inclusiveness, and resilience (for a discussion of the role of the private sector and RBC in enabling a resilient net-zero transition see Chapter 9). Countries are gradually developing responsible public procurement frameworks that account for environmental considerations, including for global supply chains (Figure 5.11, Panel E) (OECD, forthcoming[45]).

Some countries have already put in place whole-of-government strategies to make their operations greener and support the achievement of their domestic and international commitments on climate and environmental targets. For instance, Canada has put in place the Greening Government Strategy to support the governments’ commitment for net-zero emissions by 2050, including an interim target of a 40% emissions reduction by 2025 for federal facilities and conventional fleet. In the United States, the federal government is directed to align its management of federal procurement and real property with a 100% clean energy economy by 2035 and net-zero emissions no later than 2050 (Executive Office of the President, 2021[46]).

Subnational governance: The role of cities and regions

Subnational governments play an important role in climate action and support the urgently needed transformation to achieve a climate-resilient and net-zero emissions pathway. It is estimated that 50-80% of adaptation and mitigation actions already are or will be implemented at the regional and local levels (Regions4SD, 2016[47]). Many cities and regions have adopted climate targets and actions that are more ambitious than those of their national governments (OECD, 2019[48]). Subnational governments can mainstream climate action into their spatial planning, infrastructure, local economic and fiscal policies through climate strategies that are locally tailored to be in line with national objectives (OECD, 2019[49]). They are also responsible for most public spending and investment with impacts on the climate and environment (OECD, 2021[50]). At the same time, cities account for more than 70% of global energy-related CO2 emissions and two-thirds of energy demand (IEA, 2016[51]). These shares are expected to increase significantly over the coming decades if there is no significant climate action.

Acting alone, cities’ full potential in the response to climate change remains untapped. Local governments are estimated to have direct power to cut up to one-third of GHG emissions in their cities but the remaining two-thirds of urban emission reductions depend either on national and state governments or on co‑ordination across levels of government (Coalition for Urban Transitions, 2019[52]).

This hinders systemic and impactful action because national governments often do not sufficiently consider geographical disparities across regions and cities. There is huge variation in emissions per capita as well as in the challenges to transitioning to net zero across regions within the same country (OECD, 2021[50]). Moreover, GHG emissions data in regions and cities are still lacking or are not reported in a comparable manner due to a range of financial, regulatory and capacity challenges. Because of the lack of comprehensive GHG emission monitoring and reporting frameworks at the local and regional levels, subnational governments are unable to demonstrate to national policy makers that they are significantly contributing to achieving national targets.

To overcome these challenges, a “territorial” approach to climate action can deliver better understanding of domestic GHG emissions, local challenges and local exposure to climate risks by sector and geographic area. This will allow national and subnational governments to tailor relevant, placed-based policies. In this process, national governments have a crucial role in supporting local governments in their place-based actions to drive the net zero transition. For example, cities and regions play an essential role in decarbonising buildings. Buildings and construction are an indispensable component of transition to a zero-carbon society as they account for nearly 40% of energy-related global CO2 emissions, with up to as much as 70% in large cities like Paris, New York or Tokyo. Not only do cities and regions own an important share of public buildings but they are responsible for land use and building code enforcement. They are familiar with the local building stock and are in close contact with citizens and local businesses. Cities and regions are fundamental to OECD work on an effective multilevel governance approach to decarbonising buildings (OECD, 2022[53]).

Applying systems thinking to the net-zero transition

Part I of this report identified the importance of systems thinking in improving economic resilience while taking action on climate change. Such thinking is also important in the design and delivery of government net-zero strategies. Systems thinking acknowledges that challenges occur within complex systems, recognises these interconnections and interdependencies and seeks to address the system as a whole rather than its parts. Some countries, such as the United Kingdom, have made strides in leveraging systems thinking to promote strategic coherence across policy sectors for climate resilient development (OECD, forthcoming 2023[54]).

The need for systems thinking stems from the recognition that patterns of behaviour are a product of the system they are embedded in rather than independent of it. This means changes in systems’ design and structure are needed to bring about the significant behavioural change (OECD, 2022[55]) required for a resilient net-zero transition. The IPCC calls for such “transformative” change to reverse current behavioural patterns, for example, in the transport sector in order to meet climate mitigation goals (IPCC, 2022[28]). Lasting behavioural change will also be essential to ensuring the transition remains durable in the long run. This is exemplified particularly well in the rapid rebound of global emissions following their decline during the first wave of COVID-19 lockdowns.

Current policy practices rarely focus on improving the overarching design or structure of a system. Rather, they address specific system parts. For example, in the transport sector, climate policy efforts often focus on replacing emitting technologies (combustion engines) with low-carbon alternatives (electric vehicles). But emissions from the transport sector continue to grow because the overall design of transport systems and the mental models these designs are based on remain unchanged. A transportation system focused on private passenger vehicles maximises individuals’ mobility but undervalues people’s proximity to places they access. This encourages urban sprawl and the demand for private vehicles, and reduces the use of shared and active modes of transport. Focusing on individual components within this system does little to address the unsustainable design of the system itself. As a result, urban sprawl and reduced shared or active modes of transportation will further increase demand for private vehicles, obstructing mitigation efforts. (OECD, 2021[56]).

A systemic approach would: i) envision the objectives of a system and the patterns of behaviour a well-functioning system would result in, and challenge the mental models prevailing in the current system; ii) aim to understand why the current system is not achieving these goals or behavioural patterns; and iii) develop policies to redesign the system to better achieve its goals and foster desirable patterns of behaviour.

In the case of the transport system, its objective is to provide individuals with access to places, minimising the effort individuals need to make to do so. This is informed by a combination of each individual’s mobility and their proximity to the places they would like to access. However, the current transport system focuses almost exclusively on the former, enhancing mobility through private vehicle use. Policies to rebalance the system towards accessibility rather than just mobility include street redesign, spatial planning, and enhanced use of shared modes of transportation. This, in turn, would reduce demand for private vehicles, making it easier to replace the existing vehicle fleet with low-carbon alternatives. Such systems redesign can also harness important other benefits, such as increasing well-being (OECD, 2021[56]).

The OECD recently applied a systemic approach to transport systems redesign in Ireland. The analysis shows how this approach can tap into immense potential for emissions reductions through lasting behavioural change while enhancing well-being and ensuring a just transition (OECD, 2022[55]). Policies included road space reallocation, the mainstreaming of on-demand shared services, and communication strategies that shed light on the benefits of a transition towards sustainable transport systems and the consequences of inaction. While such policies are already often part of current policy efforts, they need to be scaled up considerably in order to take advantage of their transformative potential.

Box 5.2. Systems thinking in the UK’s Net Zero Strategy Directorate

The UK government has set a bold and ambitious target to reach net-zero carbon emissions by 2050. The Net Zero Strategy Directorate in the Department for Business, Energy and Industrial Strategy (BEIS) uses a systems approach to visualise how different parts of the net-zero system are interconnected. This helps identify where to make changes in the system to achieve government priorities. The directorate can then use this insight to support delivery modelling, policy development, and the reporting or understanding of net zero.

In particular, the directorate has made use of systems maps to build its understanding and Sankey diagrams to show anticipated changes to the energy system over time. The directorate is also building and developing a systems interrogation tool for land use and heat and building systems to help inform decisions by policy makers.

Joining up air quality and climate-change policies

Climate change and air quality were historically seen as separate issues, even though greenhouse gases and air pollutants are co-emitted. A systems approach appeared to be an effective way to join up these two areas and build a shared understanding of how to simultaneously tackle both issues. There are many past examples of where actions have been taken to combat one of these issues with a knock‑on effect on the other. For example, diesel cars were incentivised to tackle greenhouse gas emission but had unintended consequences on air quality.

A soft systems methodology was used to convene experts and facilitate knowledge exchange between stakeholders holding responsibility for different parts of the system. The Air Quality Expert Group subsequently wrote up a report to summarise the findings of this workshop. This publicly available report shares key findings and highlights potential risks associated with different policies. For example, the report summarises the risks and hazards of potential climate policies (for example, the risk of bioenergy to air quality) which helps stakeholders consider how these could be mitigated.

Source: (OECD, forthcoming 2023[42]).

Chapter conclusions

Achieving net-zero emissions requires a combined focus on accelerating the transition in the near term, making the transition itself resilient for the longer term, and ensuring that the transition serves to improve broader resilience rather than creating new fragilities. To do this, governments need to get the policy basics right, implementing nationally appropriate policy mixes that consider the full range of policy options, both price- and non-price-based.

Implementing ambitious climate policies alone is not enough, however. As this chapter has shown, the net-zero transition is vulnerable to various bottlenecks, including materials shortages, supply-chain vulnerabilities, skills gaps, rising costs of capital, and obstacles to scaling up clean energy supply. A whole‑of-government approach is needed to raise awareness of such potential disruptions and develop strategies to anticipate and overcome them.

References

[29] Anderson, B. et al. (2021), “Policies for a climate-neutral industry: Lessons from the Netherlands”, OECD Science, Technology and Industry Policy Papers, No. 108, OECD Publishing, Paris, https://doi.org/10.1787/a3a1f953-en.

[52] Coalition for Urban Transitions (2019), Climate Emergency, Urban Opportunity: How National Government Can Secure Economic Prosperity and Avert Climate Catastrophe by Transforming Cities, https://urbantransitions.global/en/publication/climate-emergency-urban-opportunity/.

[19] Cordonnier, J. and D. Saygin (2022), “Green hydrogen opportunities for emerging and developing economies: Identifying success factors for market development and building enabling conditions”, OECD Environment Working Papers, No. 205, OECD Publishing, Paris, https://doi.org/10.1787/53ad9f22-en.

[37] D’Arcangelo, F. et al. (2022), “A framework to decarbonise the economy”, OECD Economic Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/4e4d973d-en.

[25] Egli, F., B. Steffen and T. Schmidt (2018), “A dynamic analysis of financing conditions for renewable energy technologies”, Nature Energy, Vol. 3/12, pp. 1084-1092, https://doi.org/10.1038/s41560-018-0277-y.

[46] Executive Office of the President (2021), Executive Order 14008 Tackling the Climate Crisis at Home and Abroad.

[32] Henderson, B. et al. (2021), “Policy strategies and challenges for climate change mitigation in the Agriculture, Forestry and Other Land Use (AFOLU) sector”, OECD Food, Agriculture and Fisheries Papers, No. 149, OECD Publishing, Paris, https://doi.org/10.1787/47b3493b-en.

[35] Henderson, B. et al. (2022), “Soil carbon sequestration by agriculture: Policy options”, OECD Food, Agriculture and Fisheries Papers, No. 174, OECD Publishing, Paris, https://doi.org/10.1787/63ef3841-en.

[16] Hirth, L. and J. Steckel (2016), “The role of capital costs in decarbonizing the electricity sector”, Environmental Research Letters, Vol. 11/11, p. 114010, https://doi.org/10.1088/1748-9326/11/11/114010.

[5] IEA (2023), Energy Technology Perspectives 2023.

[4] IEA (2022), Greenhouse Gas Emissions from Energy.

[8] IEA (2022), Renewables 2022.

[10] IEA (2022), World Energy Investment 2022, IEA, https://www.iea.org/reports/world-energy-investment-2022.

[9] IEA (2022), World Energy Outlook 2022, IEA, https://www.iea.org/reports/world-energy-outlook-2022.

[20] IEA (2021), Financing Clean Energy Transitions in Emerging and Developing Economies, https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies.

[6] IEA (2021), Net Zero by 2050.

[17] IEA (2020), Levelised Cost of Electricity Calculator, https://www.iea.org/data-and-statistics/data-tools/levelised-cost-of-electricity-calculator.

[15] IEA (2019), Offshore Wind Outlook 2019, IEA, https://www.iea.org/reports/offshore-wind-outlook-2019.

[51] IEA (2016), Energy Technology Perspectives 2016, OECD Publishing, Paris, https://doi.org/10.1787/energy_tech-2016-en.

[28] IPCC (2022), Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, https://doi.org/10.1017/9781009157926.

[7] IRENA (2022), Geopolitics of the Energy Transformation: The Hydrogen Factor, https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen (accessed on 24 March 2022).

[12] Kowalski, P. and C. Legendre (2023), “Raw materials critical for the green transition: Production, international trade and export restrictions”, OECD Trade Policy Papers, No. 269, OECD Publishing, Paris, https://doi.org/10.1787/c6bb598b-en.

[1] Lee, H. and J. Romero (eds.) (2023), Summary for Policymakers, IPCC.

[13] Moïsé, E. and S. Rubínová (2023), “Trade policies to promote the circular economy: A case study of lithium-ion batteries”, OECD Trade and Environment Working Papers, No. 2023/01, OECD Publishing, Paris, https://doi.org/10.1787/d75a7f46-en.

[11] NEA (2022), Meeting Climate Change Targets: The Role of Nuclear Energy, OECD Publishing, https://www.oecd-nea.org/jcms/pl_69396/meeting-climate-change-targets-the-role-of-nuclear-energy?details=true.

[3] OECD (2023), “Labour Force Statistics: Population and vital statistics”, OECD Employment and Labour Market Statistics (database), https://doi.org/10.1787/data-00287-en (accessed on 3 February 2023).

[33] OECD (2022), Agricultural Policy Monitoring and Evaluation 2022: Reforming Agricultural Policies for Climate Change Mitigation, OECD Publishing, Paris, https://doi.org/10.1787/7f4542bf-en.

[40] OECD (2022), Aligning Regional and Local Budgets with Green Objectives: Subnational Green Budgeting Practices and Guidelines,, OECD Publishing, Paris, https://doi.org/10.1787/93b4036f-en.

[39] OECD (2022), Composite Indicator on Green Budgeting in the OECD.

[53] OECD (2022), Decarbonising Buildings in Cities and Regions, OECD Urban Studies, OECD Publishing, Paris, https://doi.org/10.1787/a48ce566-en.

[24] OECD (2022), “OECD blended finance guidance for clean energy”, OECD Environment Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/596e2436-en.

[21] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/f6da2159-en.

[55] OECD (2022), Redesigning Ireland’s Transport for Net Zero: Towards Systems that Work for People and the Planet, OECD Publishing, Paris, https://doi.org/10.1787/b798a4c1-en.

[2] OECD (2022), The Climate Action Monitor 2022: Helping Countries Advance Towards Net Zero, OECD Publishing, Paris, https://doi.org/10.1787/43730392-en.

[38] OECD (2021), Green Budgeting in OECD Countries, OECD Publishing, Paris, https://doi.org/10.1787/acf5d047-en.

[50] OECD (2021), OECD Regional Outlook 2021: Addressing COVID-19 and Moving to Net Zero Greenhouse Gas Emissions, OECD Publishing, Paris, https://doi.org/10.1787/17017efe-en.

[56] OECD (2021), Transport Strategies for Net-Zero Systems by Design, OECD Publishing, Paris, https://doi.org/10.1787/0a20f779-en.

[44] OECD (2020), Integrating Responsible Business Conduct in Public Procurement, https://www.oecd-ilibrary.org/docserver/02682b01-en.pdf?expires=1673259936&id=id&accname=ocid84004878&checksum=B8A94B660ACFD34FBFFA031A4EDA0698.

[30] OECD (2020), Making the green recovery work for jobs, income and growth, OECD Policy Responses to Coronavirus (COVID-19).

[48] OECD (2019), ““An integrated approach to the Paris climate Agreement: The role of regions and cities””, OECD Regional Development Working Papers 2019/13, https://doi.org/10.1787/96b5676d-en.

[34] OECD (2019), Enhancing Climate Change Mitigation through Agriculture, OECD Publishing, Paris, https://doi.org/10.1787/e9a79226-en.

[49] OECD (2019), “Financing climate objectives in cities and regions to deliver sustainable and inclusive growth”, OECD Environment Policy Papers, No. 17, OECD Publishing, Paris, https://doi.org/10.1787/ee3ce00b-en.

[41] OECD (forthcoming), Composite Indicator on Green Budgeting in the OECD.

[45] OECD (forthcoming), Policy brief: Economic benefits for governments to ensure the integration of RBC standards throughout supply chains in public procurement activities.

[43] OECD (forthcoming 2023), Strenghtening decision-making processes to deliver on climate commitments: Review of current government practices.

[42] OECD (forthcoming 2023), Strengthening decision-making processes for climate resilience: review of current government practices.

[54] OECD (forthcoming 2023), Strengthening decision-making processes for climate resilience: Review of current government practices.

[14] OECD (forthcoming, 2023), The role of the cost of capital in clean energy transitions.

[18] Pahle, M. et al. (2022), “Safeguarding the energy transition against political backlash to carbon markets”, Nature Energy, Vol. 7/3, pp. 290-296, https://doi.org/10.1038/s41560-022-00984-0.

[23] Penn, I. (2022), Expansion of Clean Energy Loans Is ‘Sleeping Giant’ of Climate Bill, https://www.nytimes.com/2022/08/22/business/energy-environment/biden-climate-bill-energy-loans.html.

[47] Regions4SD (2016), RegionsAdapt 2016: An assessment of risks and actions, Regions for Sustainable Development, https://www.regions4.org/publications/regionsadapt-2016-report-an-assessment-of-risks-and-actions.

[31] Shukla, P. et al. (eds.) (2022), Summary for Policymakers, Cambridge University Press, https://doi.org/10.1017/9781009157926.001.

[27] Songwe, V., N. Stern and A. Bhattacharya (2022), Finance for climate action: Scaling up investment for climate and development.

[22] The Economist (2022), Rising interest rates and inflation have upended investing, https://www.economist.com/briefing/2022/12/08/rising-interest-rates-and-inflation-have-upended-investing.

[26] Voldsgaard, A., F. Egli and H. Pollitt (2022), “Can we avoid green collateral damage from rising interest rates?”, UCL IIPP Blog, https://medium.com/iipp-blog/can-we-avoid-green-collateral-damage-from-rising-interest-rates-1259ea94c9ea (accessed on 15 December 2022).

[36] Wreford, A., A. Ignaciuk and G. Gruère (2017), “Overcoming barriers to the adoption of climate-friendly practices in agriculture”, OECD Food, Agriculture and Fisheries Papers, No. 101, OECD Publishing, Paris, https://doi.org/10.1787/97767de8-en.

Notes

← 1. Policies covered under the Climate Actions Policy Measurement Framework https://www.oecd.org/climate-action/ipac/.