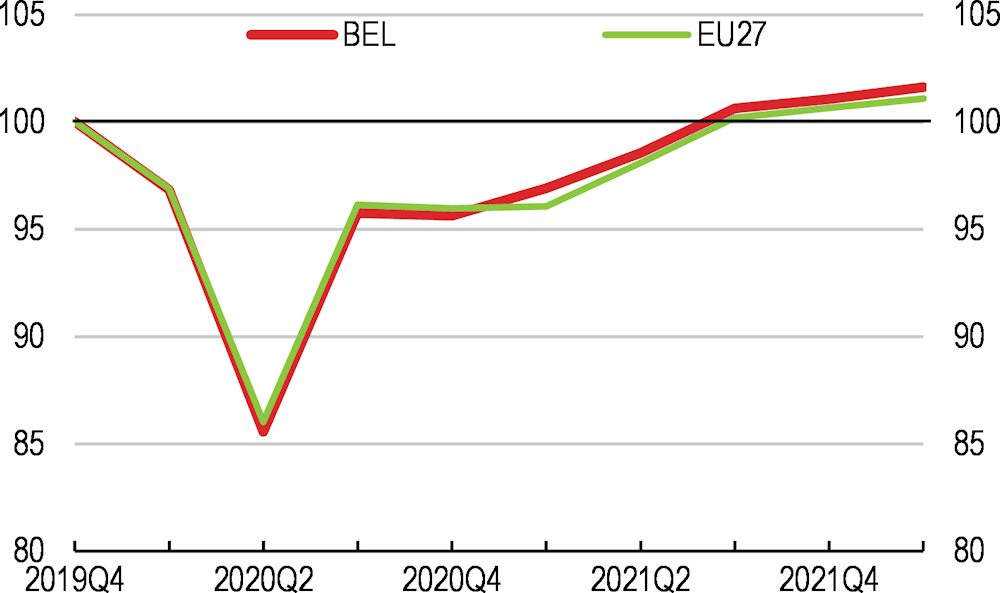

Timely and extensive policy support and high vaccination rates enabled a swift recovery of GDP to pre-pandemic levels (Figure 1). However, supply constraints, labour shortages and high inflation are weighing on the recovery.

OECD Economic Surveys: Belgium 2022

Executive summary

Policies have enabled a robust recovery from the pandemic, but risks have increased

Figure 1. Activity has rebounded from the pandemic

Real GDP, 2019Q4 = 100

The effects of the war in Ukraine and elevated uncertainty add to the existing challenges from rising inflationary and supply pressures and the imbalanced recovery from the pandemic. Despite a GDP growth of 6.2% in 2021 and overall resilience of labour markets to the pandemic, the recovery was uneven, with a disproportionate effect of the pandemic on low-skilled and young workers. Inflation increased to record highs and vacancy rates have risen significantly to 4.7%, reflecting skill mismatches and low activity rates.

The short-term outlook is subject to particularly high uncertainty. Growth is projected to slow down (Table 1), with lower external demand and the EU embargo on Russian oil adding to high inflation, despite high household savings, automatic wage indexation and energy support measures partially mitigating the adverse effects. In the near-term, fiscal policy can provide temporary, well-targeted and means-tested support to cushion the immediate effects of the commodity and food price shocks on vulnerable households and firms.

Reskilling and enhancing the employability of vulnerable groups can help address labour shortages. Active labour market policies should be targeted to groups with large employment gaps (long-term unemployed, low-skilled, mothers with young children, migrants and those with disabilities). The use of statistical tools should be expanded to allow interventions at an earlier stage, and services, especially training, should be tailored to individual needs of disadvantaged workers.

Reform of the wage setting mechanism at the firm level, while keeping high levels of wage coordination which contributes to low wage inequality, can help boost reallocation. Decentralised wage bargaining, within the framework of sector-level agreements, should be used more to better align wages with productivity at the individual firm level. This would help high-performing firms to attract skilled workers and grow, and lower-productivity firms to overcome a temporary drop in demand and reduce their risk of being turned into a “zombie firm”, raising productivity growth.

Table 1. The growth outlook has deteriorated

|

|

2021 |

2022 |

2023 |

|---|---|---|---|

|

Gross domestic product |

6.2 |

2.4 |

1.0 |

|

Private consumption |

6.4 |

3.6 |

0.9 |

|

Unemployment rate |

6.3 |

6.0 |

6.4 |

|

Consumer price index |

3.2 |

9.0 |

4.8 |

|

Fiscal balance (% of GDP) |

-5.5 |

-5.6 |

-4.8 |

|

Public debt (% of GDP) |

108.4 |

106.1 |

107.2 |

Source: OECD Economic outlook (database).

The recovery plans provide an opportunity to support the recovery and fasten the digital transformation and the green transition. Supply bottlenecks and rising cost of materials, highly regulated construction permits and environmental procedures can be a barrier to the implementation of major investments, most notably in 5G and building renovation. All regions have committed to streamline these procedures, but efforts should be frontloaded.

Medium-term fiscal challenges should be addressed

Public debt increased to 108.4% of GDP in 2021 and sizeable efforts will be needed to stabilise and lower the debt-to-GDP ratio.

A medium-term consolidation strategy, based on spending reviews, should be used to start to lower public spending and the debt-to-GDP ratio. Public spending, at around 55% of GDP in 2021, is high and there is room to improve spending efficiency in some areas (e.g. education). There are gaps in the fiscal framework, including the lack of multiannual budgeting and expenditure rules, which can decrease transparency, consistency and effectiveness of fiscal policy over time. Strengthening the mandate of the High Council of Finance to provide transparent, uniform and highly visible in-depth analysis and monitoring of public finances at different levels of government, even if it can’t impose binding targets or recommendations, can also help.

A broad tax reform is planned following detailed impact assessments analysing the effects on different important socio-economic indicators. The tax wedge for low-wage workers remains above the OECD average, which lowers labour market participation and purchasing power of lower-income households. There is scope to broaden the base by reducing regressive tax expenditures. As part of the planned reform, introducing a progressive tax rate schedule for all types of capital should be considered.

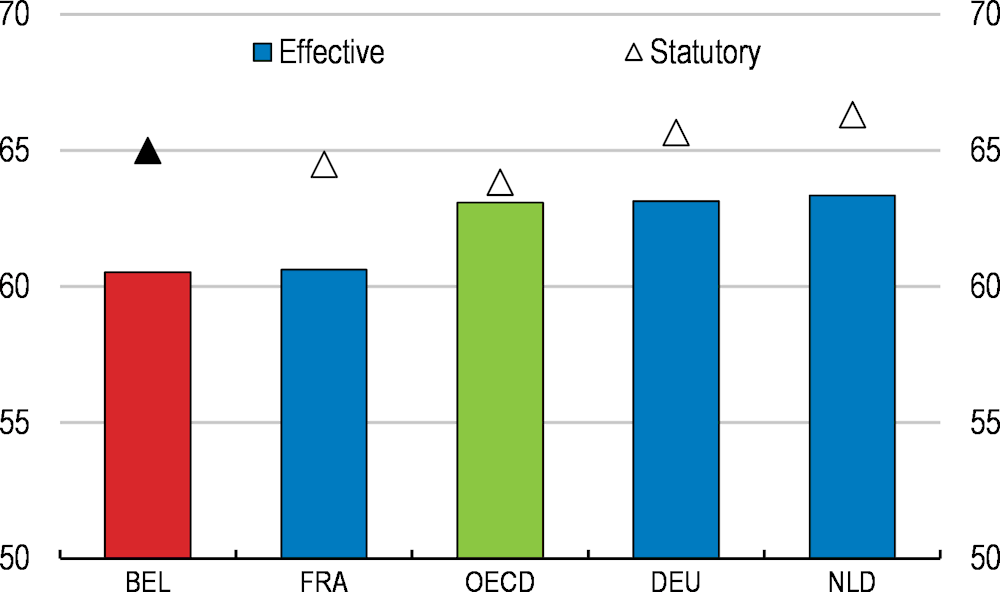

Pension expenditures are projected to increase from 12.2% to 15.2% of GDP by 2070 and the effective retirement age remains low (Figure 2). A pension reform focusing on boosting the employment of older workers is foreseen in the recovery plan, which is welcome. A rise in the effective age of exit from the labour market could be encouraged by introducing penalties and bonuses for those retiring before and after the statutory retirement age. Upskilling is needed to maintain the employability of older workers, but their lifelong learning participation is low. Incomplete access to information and guidance regarding training and weak support from employers are barriers to participation among older workers.

Figure 2. The effective retirement rate is low

Average effective age of labour market exit and statutory pensionable age, 2020

Increasing equality of opportunity for disadvantaged groups is key

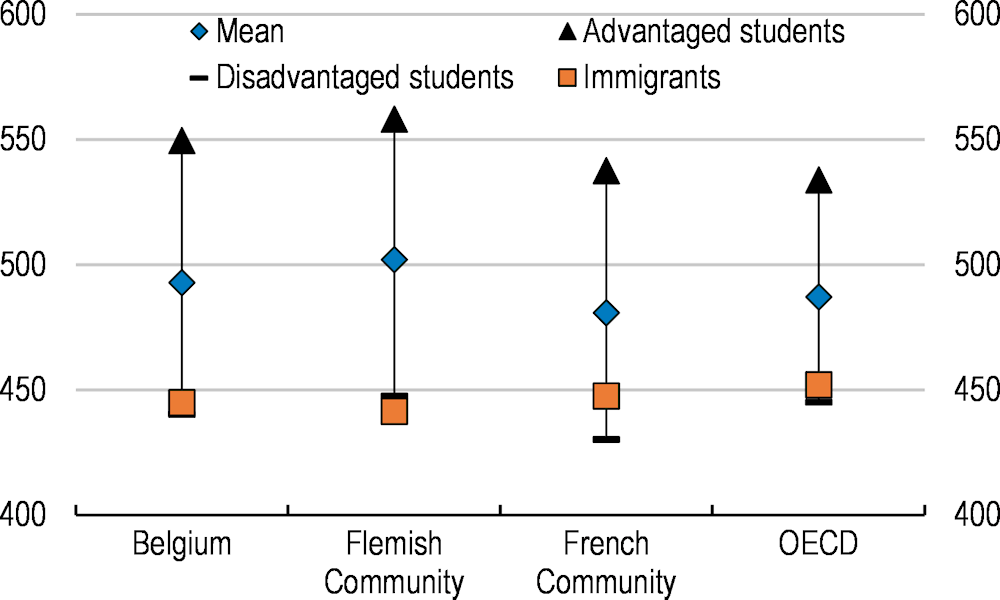

Income inequality is low, but reforms are needed to improve equal access to opportunities. Poverty risks are high for the unemployed, inactive and the low skilled. Large employment gaps among mothers with young children, migrants and those with disabilities reflect low skills, especially digital, and weak work incentives. Inequality in education is high (Figure 3): disadvantaged students accumulate learning losses of over 3 years by age 15. Moreover, 70% of low-income households are overburdened by housing costs.

Reforms are needed at all levels of government given division of competencies. A number of measures in the recovery plans reflect different policy priorities and needs and can help ensure that the digital and green transitions do not exacerbate the social divide.

Strengthened work incentives for single parents and policies to facilitate the return to work of those on disability and sickness benefits are needed. Currently, the labour market participation of low-income single parents, especially women, is discouraged by higher taxes and lower benefits when taking up employment. In-work benefits would support employment and avoid long-term benefit dependency. Gaps in individual support for sickness and disability beneficiaries hamper their return to work.

Gaps in participation in lifelong learning by age and skills are large. Effective career guidance to reach those who need it the most and have difficulties understanding the high number and complexity of lifelong learning schemes offered by various different authorities is needed. As career guidance is increasingly delivered digitally, options for face-to-face delivery should remain for those with poor digital skills or access.

Figure 3. Inequity in education in high

PISA reading score, 2018

Note: Immigrants are students whose mother and father were born in a country other than where the PISA test was taken.

Source: OECD PISA 2018 database.

Disparities in education outcomes in compulsory education should be reduced. Schools are incentivised to diversify their student intake, but not to achieve good educational outcomes for weaker students. Reliable performance indicators and other data on successful study progression should be used to inform school funding based on educational improvements made with disadvantaged students. Low mobility between general and vocational tracks reduce the prospects of students from disadvantaged backgrounds.

Stronger incentives and training for new teachers can reduce attrition and attract teachers to schools with a high concentration of disadvantaged pupils. Induction programmes for new teachers should be strengthened to provide a smooth transition into the profession. Rewarding teaching in disadvantaged schools with financial incentives or improved and stable career prospects can also help.

Lack of affordable and quality housing can increase residential segregation and exacerbate barriers to opportunity. Social housing supply falls vastly below demand, especially in large cities, such as Brussels. More low-income households should be eligible to rental support in the near-term to complement plans to increase the stock of social housing.

Addressing the green transition requires bold reforms and investments

Increasing coordination and coherence across federal and regional governments and strengthening carbon prices to guide private investors is key.

Better coordination across governments is needed to meet climate and energy targets. The update of the national energy and climate plan should present a more coherent path to achieve national targets and an integrated national overview of the federal and regional plans. Reaching internal effort sharing of the 2020 climate objectives took seven years, and lessons from this process should be used to avoid delays for 2030 climate objectives and targets.

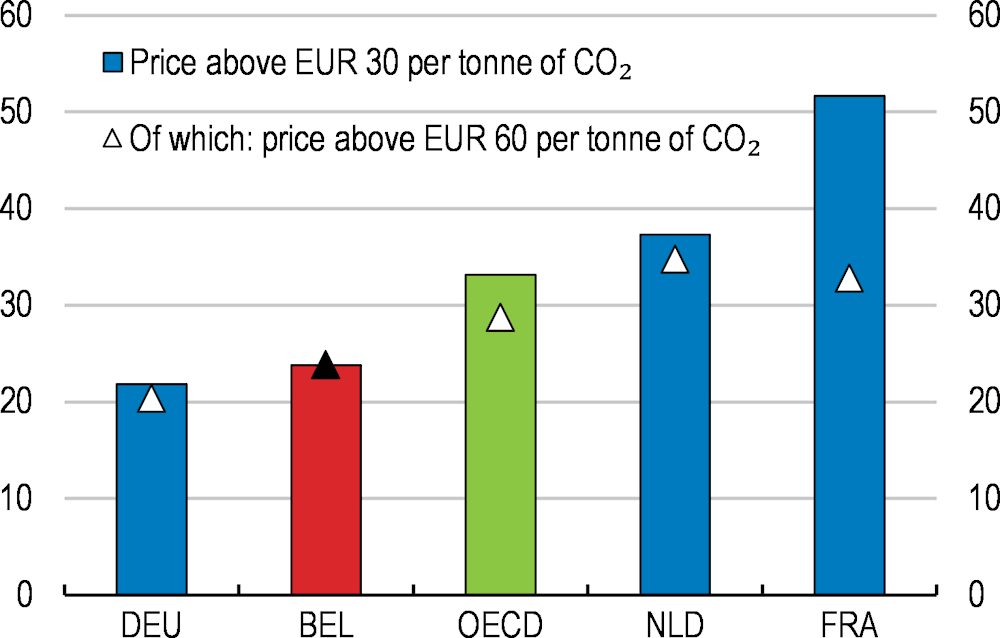

Emissions not subject to the EU Emissions Trading System, such as buildings and transport, do not have an explicit carbon price, with a low pricing of carbon emissions (Figure 4). Uniform carbon pricing in the medium-term, once the current energy shock subsides, would effectively mitigate emissions, but needs to be complemented by flanking measures to support vulnerable households, a clear and predictable regulatory environment and support to green innovation.

Figure 4. More effective pricing of carbon emissions is needed

Share of total CO2 emissions from energy use, 2018

Note: Includes explicit carbon pricing from carbon taxes, ETS and fuel taxes, not other market and regulatory measures or public service obligations.

Source: OECD (2022), Effective Carbon Rates database.

Main findings and recommendations

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Ensuring a strong recovery and addressing medium-term fiscal challenges |

|

|

The planned investments in the recovery plans could be delayed by lengthy regional permit procedures. |

Frontload reform of construction and environment permits to ensure timely and effective implementation of the recovery plans. |

|

The economic rebound from the pandemic has been rapid, but risks to the recovery have been elevated by the war in Ukraine. |

When providing fiscal support to vulnerable households and firms affected by high energy prices, ensure that it is targeted and temporary. |

|

Fiscal support during the pandemic was appropriate, but increased the public debt as a share of GDP by around 10% from 2019. Public spending is one of the highest in the OECD. |

Start to lower public spending and the public debt to GDP ratio through a medium-term consolidation strategy, based on spending reviews. |

|

Gaps in the fiscal framework can lower the effectiveness of implementing a medium-term fiscal strategy. |

Strengthen the rules-based fiscal framework, for example through the introduction of multiannual budgeting, including an expenditure rule. Increase the visibility of the non-binding budget recommendations of the High Council of Finance by increasing the transparency of their assessment of debt sustainability at all levels of government, based on a uniform methodology. |

|

Taxation remains tilted towards labour, while there is scope to broaden the tax base eroded by a number of regressive tax expenditures. Differences in taxation of different types of financial income increase capital misallocation and there is no personal capital gains tax. |

Reduce tax expenditures that do not benefit low-income households to finance lower labour taxation for low-wage earners. Consider introducing a progressive tax rate schedule for taxation of all types of capital, as part of the properly prepared broad tax reform. |

|

The effective age of exit from the labour market is low. Pension reforms should be accompanied by higher employment of older workers, but their participation in lifelong learning is low. |

Introduce penalties and bonuses for retirement before and after the statutory retirement age. Increase the participation of older workers in lifelong learning by providing guidance for training selection. |

|

The way wages are set for individual workers and firms may be hindering job reallocation and lowering productivity growth. |

Make more use of the possibility of decentralised wage bargaining, within the framework of sector-level agreements, to better align wages with productivity at the individual firm level. |

|

Addressing the green transition more effectively |

|

|

There is room to improve the coherence of regional and federal policies in the national energy and climate plan. The agreement on effort sharing of the 2020 climate objectives took seven years to reach. |

Ensure that revisions of the energy and climate plan present an integrated national overview of the federal and regional plans. Swiftly define internal effort sharing of the 2030 climate objectives, for example by establishing an independent expert body to advise and monitor actions. |

|

Belgium makes no use of explicit carbon taxation beyond EU Emissions Trading System (ETS). |

Introduce in the medium-term a carbon tax for sectors not subject to the EU ETS by implementing a minimum price that reflects the evolution of prices in the EU ETS, accompanied by compensatory measures for vulnerable households. |

|

Increasing equality of opportunities |

|

|

Digital skills and participation in lifelong learning are low for the low educated, the low income and those with disabilities, leading to low employment rates and in labour market transitions. |

Streamline lifelong learning programmes and actors involved, and prioritise vulnerable groups for face-to-face career guidance. |

|

The long-term unemployment rate is high and the employment of mothers with young children, migrants and those with disabilities is low. |

Expand the use of statistical tools to target vulnerable groups for tailored active labour market programmes. |

|

Gaps in individual support for sickness and disability beneficiaries hamper their return to work. |

Further scale up individual placement and support programmes for sickness and disability beneficiaries, conditional on their evaluation. |

|

High participation tax rates for low-income single parents and second earners with children weaken work incentives, especially for women. |

Introduce in-work benefits for low-wage workers with children. |

|

Schools are incentivised to diversify their student intake, but not to achieve good educational outcomes under challenging conditions. |

Use reliable performance indicators and other data on successful study progression to inform school funding based on educational improvements made with disadvantaged students. |

|

Low mobility between general and vocational tracks contributes to social inequality in education outcomes. |

Further encourage schools to organise programmes across tracks and enable transfers between them. |

|

New teacher attrition is high, especially in disadvantaged schools, and early career working conditions are precarious. |

Reward teaching in disadvantaged schools with higher pay or faster conversion to fixed appointments. Enable and expand professional insertion before graduation from initial teacher education and strengthen induction of new teachers. |

|

Social housing supply is too low and price differentials with the private market hinder relocation, thereby distorting work incentives. |

Expand rent allowances to cover low-income private market tenants while proceeding to increase the social housing stock. |