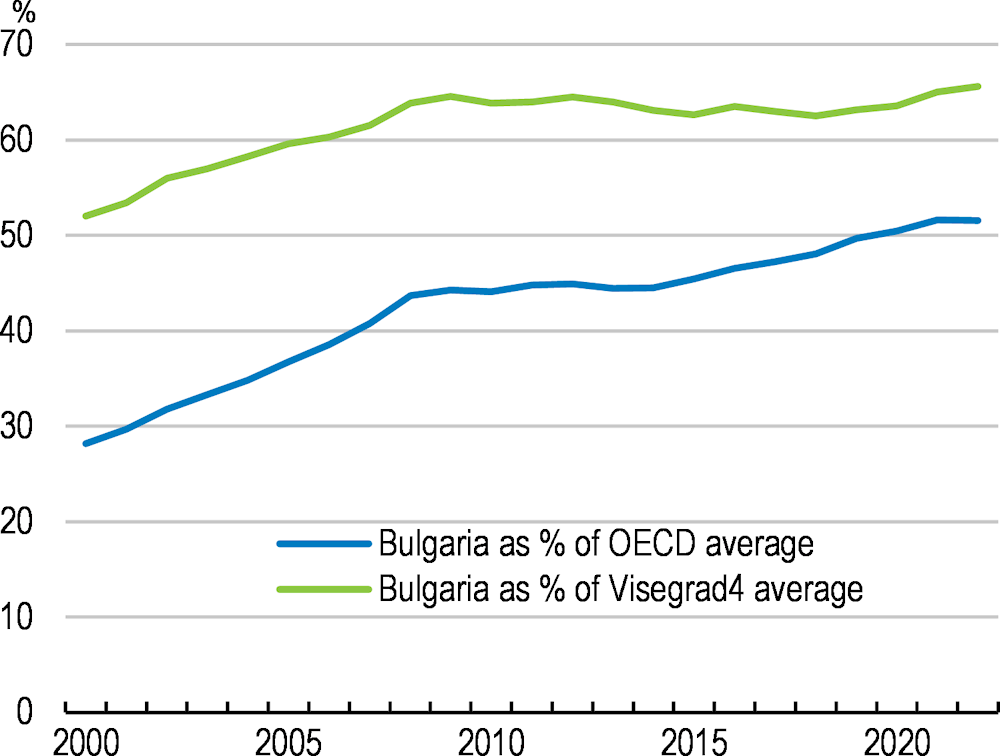

Bulgaria’s economic convergence towards more advanced economies continued over the past decade with average GDP growth of 2.3%. Bulgaria reached half of the OECD’s average disposable income per capita in 2019, but convergence was slower than prior to the Global Financial Crisis and the country did not gain ground on regional peers with higher incomes (Figure 1).

OECD Economic Surveys: Bulgaria 2023

Executive summary

Bulgaria’s robust recovery has been interrupted by the global energy crisis

Figure 1. Convergence has slowed

Disposable income per capita

Higher energy prices, aggravated by Russia’s war of aggression against Ukraine, and weaker global demand will lower growth in 2023 (Table 1). The Bulgarian economy was rebounding from the pandemic when it started in February 2022 to face new headwinds from the war in Ukraine. As most of the energy supply comes from domestic coal and nuclear energy, reliance on Russian gas was more limited than in many other countries. With the exception of nuclear fuel and oil, Bulgaria had modest trade links with Russia. Interconnection with some neighbouring countries drove up electricity prices in the domestic market and fuelled energy exports, making Bulgaria the third largest exporter of electricity in Europe. After a strong rebound in 2021, growth moderated to 3.4% in 2022 and is anticipated to slow further in 2023 before rebounding.

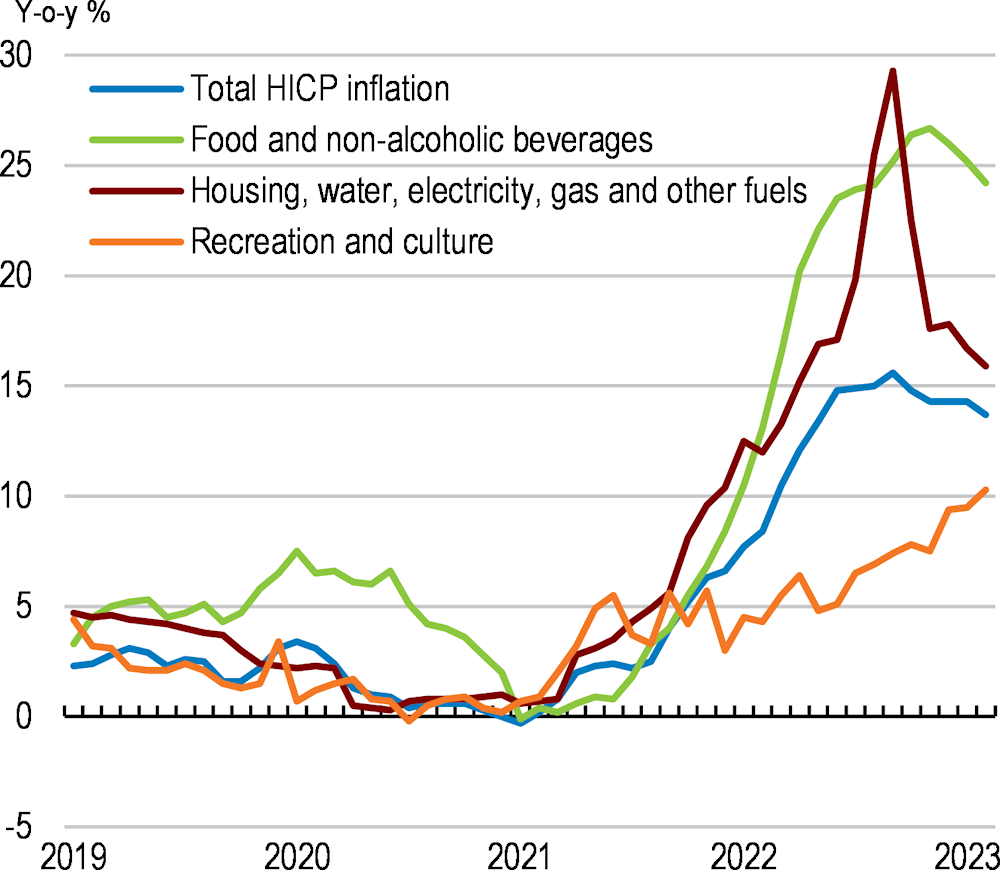

The global surge in energy and food prices has pushed inflation to levels not seen in decades (Figure 2), but headline inflation is starting to decline very gradually as energy prices moderate. Inflation has become increasingly broad-based with core inflation picking up pace in 2022, on account of second-round effects from higher food and energy prices, strong private consumption and robust wage growth.

Table 1. Growth has slowed but is set to regain momentum

|

2021 |

2022 |

2023 |

2024 |

|

|---|---|---|---|---|

|

Real GDP at market prices (annual percentage change) |

7.6 |

3.4 |

1.9 |

3.2 |

|

Consumer price index (% change) |

3.3 |

15.3 |

8.2 |

4.4 |

|

Unemployment rate (% of labour force) |

5.3 |

4.3 |

4.5 |

4.2 |

|

General government gross debt (% of GDP) |

35.1 |

37.2 |

39.6 |

41.8 |

Source: OECD Economic Outlook 112 database.

Figure 2. Surging energy prices lifted inflation

There is strong momentum in wages. In recent years, real wages have grown strongly, supported by productivity gains and labour shortages. In 2022, the inflation-induced loss in purchasing power was partly offset by strong and broad-based nominal wage growth, as well as upward adjustments of social transfers. The government increased the minimum wage by around 10% in 2022 and again by 10% in January 2023. These developments create a risk of second-round inflation in the current environment.

Monetary conditions in Bulgaria follow those in the euro area through a currency board arrangement. The Bulgarian lev has participated in the exchange rate mechanism II since July 2020 and the authorities currently aim to adopt the euro in January 2025. While the currency board has contributed to a sound macroeconomic position and a stable exchange rate, this arrangement leaves a central role to fiscal policy in managing inflation.

Short-term supports need to be carefully designed and a sound path for the public finances ensured

Fiscal discipline has resulted in low public debt. The deficit is narrowing following the COVID crisis and with energy supports financed by windfall revenues. However, spending pressures related to ageing, upgrading of infrastructure and raising skills will need to be financed by greater tax collection efficiency and higher environmental taxes.

A temporary freezing of energy and water prices for households, an energy subsidy scheme for industrial end-users of electricity and other measures for high energy consumers have been introduced to cushion the impact of the energy crisis. While some measures are targeted, most are not and reduce price signals to consumers. The general government deficit is estimated to have been reduced to 2.9% of GDP in 2022 from 3.9% in 2021. Making the supports more targeted towards the most vulnerable and designing them in a way that keeps up energy saving incentives would help limit inflationary effects of fiscal policy.

Public debt is low, but ageing-related spending pressures are mounting and there are several areas where increases in social spending could strengthen growth and social outcomes. More needs to be spent on education to improve quality and on addressing large infrastructure needs. Substantial amounts of EU funds are expected in the ongoing programming period, but there is no overall public investment strategy. The fiscal council could play a stronger role in ensuring a long-term approach to fiscal policy.

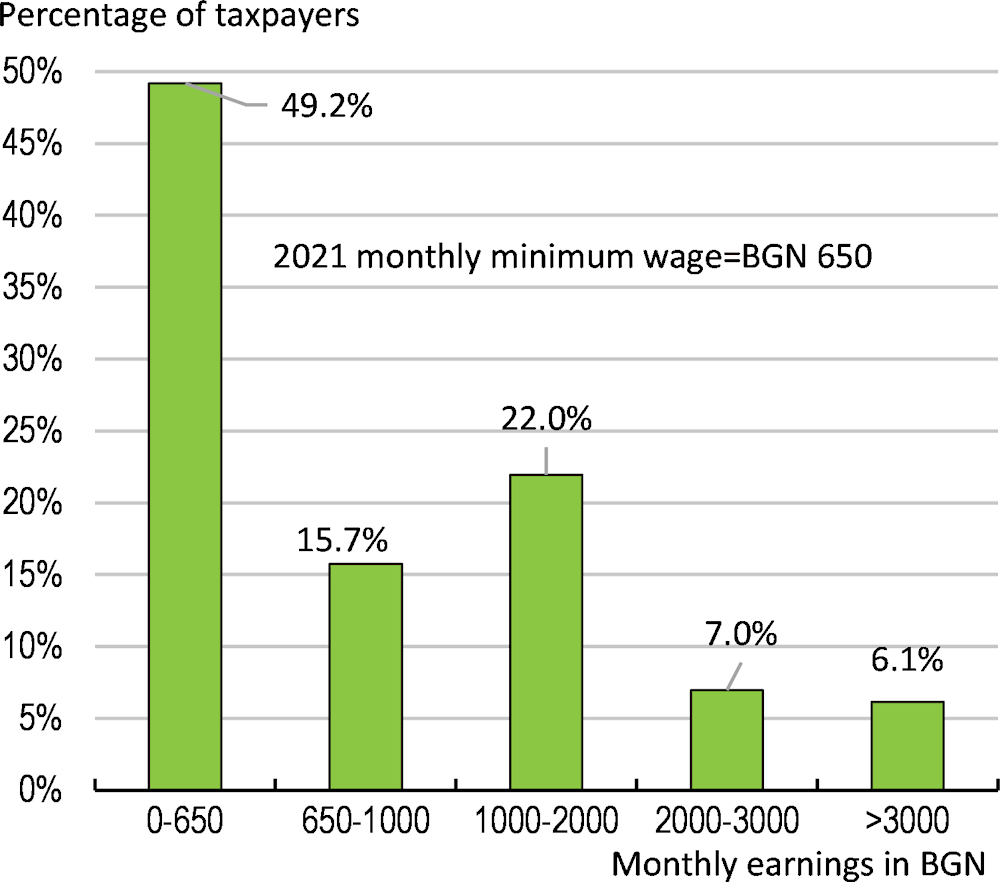

Additional current spending needs could be financed by improved revenue collection efficiency and environmental, property and inheritance taxes. Informality is widespread, particularly in the form of additional undeclared “envelope” wages. Half of all taxpayers are registered at the minimum wage (Figure 3). Reducing the underreporting of revenues for income tax and social security contributions, making it more difficult for multinational companies to shift profit overseas, enhancing VAT compliance and examining shifting the administrative responsibility for collection of property taxes to the central government could all help bring in additional revenue.

Figure 3. Half of taxpayers declare earnings at the minimum wage

Structural reforms would boost growth

Growth is constrained by the low level of investment and unfavourable demographic trends. Productivity has been the major driver of growth in recent years and an ambitious agenda of structural reforms could boost it further.

The investment rate at 20% of GDP is relatively low, while public investment at 3.4% is in line with the OECD average. To attract private capital, procedures around the entry and exit of firms could be streamlined. Educational attainment has improved with 40% of younger cohorts holding a tertiary degree. Raising educational attainment further and improving quality would help realise significant productivity gains in the long term.

Corruption imposes high transaction costs on businesses. Whistle-blower protection is now anchored into law. However, the system detecting and investigating corruption is fragmented, leaving some grey areas. The creation of a new body with investigative powers is welcome, but greater transparency and more stringent regulations would help the detection and reporting of corruption cases. Investigations should not be obstructed and effective mechanisms to investigate the Chief Prosecutor should be established.

The workforce is shrinking and ageing

Since 2010 the working-age population has shrunk by around 19%, while the number of people aged above-65 has increased by 12.6%. These unfavourable demographic trends reduce the economy’s growth potential.

Average fertility at 1.58 is close to the OECD average, but masks low birth rates among educated women, who have fewer children than they desire. The solid employment rate and the high share of women in management positions, as well as a low measured gender wage gap, imply high opportunity costs of having children for high-skilled women. Childcare is not available countrywide, and its quality is often not considered adequate. Many children are born into disadvantaged families.

Net emigration has contributed to population decline for decades. A more targeted and ambitious effort should be envisaged to make Bulgaria a more attractive place to live and to encourage workers to come, including better engaging with the diaspora to attract people back and revisiting immigration policies.

Even though the population is shrinking, many people do not work. Due to a lack of childcare facilities and homecare for the elderly, many people, mostly women, engage in caregiving and are out of the labour force. A sixth of the workforce is on disability benefits, which are more generous than social assistance and do not require registering with the Employment Agency.

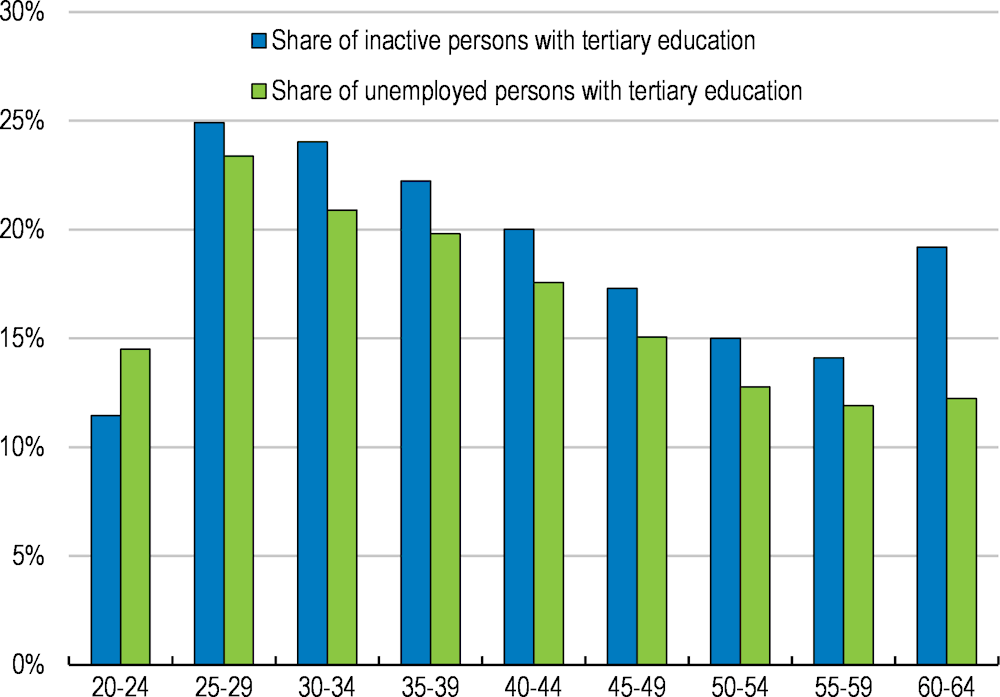

Figure 4. Many educated people are not working

Practical training is lacking in tertiary and vocational education. A significant share of inactive and unemployed people are tertiary graduates, in particular in younger cohorts (Figure 4). Tertiary education has expanded rapidly, but quality has not kept pace, and it is not practice oriented. Vocational training often fails to equip students with practical skills as it is not always workplace based.

A strategy to reach net-zero is needed

The energy intensity of the economy fell in the 2000s and has since remained stable. Emissions, driven by the energy and transport sectors, have stayed at the same high levels for two decades. A comprehensive strategy to reach net zero emissions by 2050 is still to be set out.

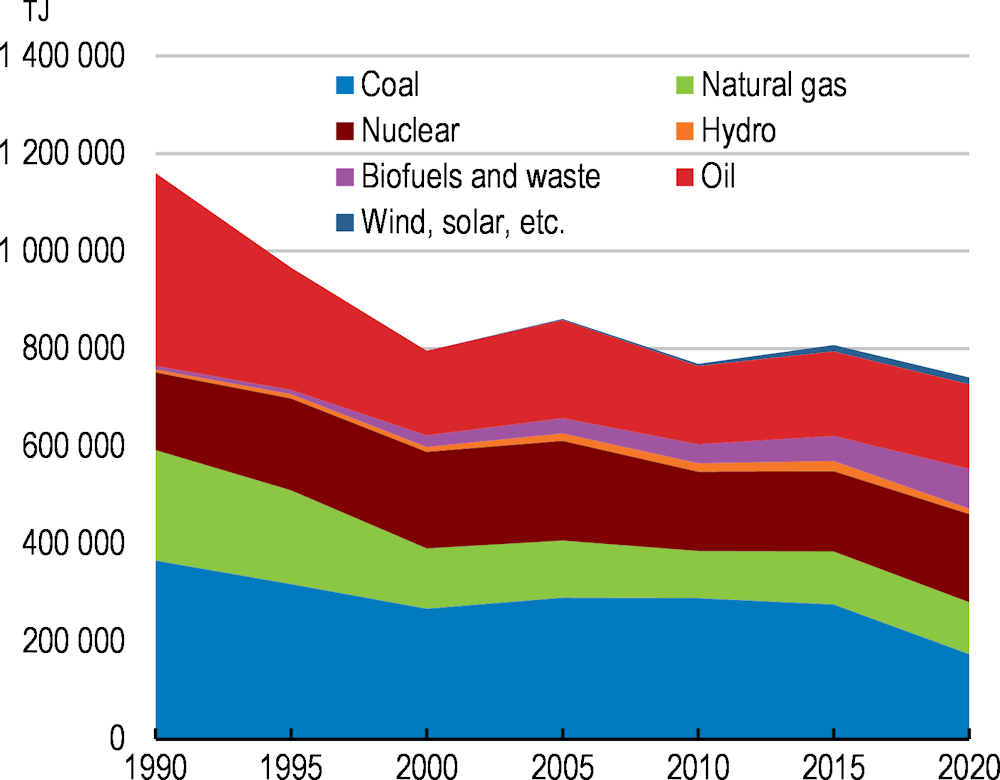

Coal remains a major source of energy, despite a sizeable decline over past decades (Figure 5) and there is no roadmap to phase it out. Nuclear power plays a key role in Bulgaria’s energy transition, serving as a baseload source of electricity. Investment in renewables, which account for a fifth of the energy supply, needs to pick up. Investment in upgrading the grid and expanding storage facilities is needed to allow for a more widespread use of renewables.

Figure 5. Coal is still a key source of energy

Total energy supply

Source: IEA World Energy Balances https://www.iea.org/data-and-statistics/data-product/world-energy-statistics-and-balances.

|

Main findings |

Key recommendations |

|

|---|---|---|

|

Managing high inflation and the public finances and meeting long-term spending needs |

||

|

Inflation is high with strong growth of nominal wages in the context of the currency board. While the debt ratio is low, the underlying fiscal balance may have weakened in recent years. |

Stand ready to tighten fiscal policy if inflation remains high. |

|

|

Support measures during the cost-of-living crisis are mostly untargeted and distort price signals. |

Make support measures to households and firms more targeted to the most vulnerable and ensure that they incentivise energy savings. |

|

|

Informality is common and incentives to underreport wages are high. |

Raise awareness of the consequences of underreporting wages, enhance compliance measures, digitalise transactions, and increase incentives to declare actual wages. |

|

|

Several foreign companies shift profits, value added taxes are evaded and assigning the property tax to the subnational level has reduced collection efficiency. |

Increase enforcement and collection efficiency of corporate income taxes, value added taxes and property taxes. |

|

|

Spending pressures related to ageing, health and education, as well as infrastructure and the green transition, are mounting. |

Establish a more integrated medium- and long-term fiscal strategy linking spending and resources. |

|

|

The cost of capital is relatively low in international comparison, but uncertainty and the lack of long-term government strategy for infrastructure investment hinder investment. |

Assess the medium- to long-term needs for infrastructure and other capital spending and prepare a public investment strategy based on cost-benefit analysis. |

|

|

Improving the business climate |

||

|

Several bodies need to be contacted to set up a limited liability company, there are minimum capital requirements, and it is costly. |

Establish a one-stop shop for setting up businesses and reduce the costs. |

|

|

Liquidation of SMEs is cumbersome and makes exit difficult. |

Introduce a simplified procedure for the liquidation of SMEs. |

|

|

Boosting the number of workers through better jobs and higher incomes |

||

|

Childcare has become free in public facilities, but supply falls short of demand. |

Ensure access to subsidised quality childcare countrywide. |

|

|

The Migration Strategy 2021-25 aims at attracting Bulgarians living abroad and foreign workers to come to Bulgaria, but only a small number are relocating to Bulgaria. |

Develop a comprehensive suite of measures, including the provision of information about jobs and support related to administrative requirements for the (re)settlement in Bulgaria. |

|

|

Social assistance benefits are low and coverage is weak, while a large number of working-age people are on disability pensions and do not work. |

Overhaul the social welfare system to provide better social support, stepping up existing efforts to gradually increase benefits to approach the poverty line, while improving activation. |

|

|

Incentives to register with the Employment Agency are limited. Part of the population has no health insurance. |

Increase incentives to register with the Employment Agency, including improved training and consider providing minimum (social) health coverage for people who register, with a six-month limit. |

|

|

A sixth of the working-age population are on disability benefits, detached from the workforce. |

Activate people with work capacity by regular assessment of the extent of incapacity by independent experts. |

|

|

Vocational training is not always workplace based. Students have limited practical skills when they graduate, so the government spends extra money to train them or offers them subsidised employment. |

Intensify cooperation between local authorities and the private sector to extend workplace-based vocational training across the country. Involve businesses in the design of curricula. |

|

|

Accelerating the green transition |

||

|

While there are a number of policies and targets in place, there is no comprehensive strategy for the green transition. |

Complete an overarching strategy for the climate transition, building on the Strategic Vision for the Sustainable Development of the Electricity Sector, and ensure it is consistent with the public investment strategy, with a roadmap and policies to achieve zero net emissions. |

|

|

The existing grid capacity is not sufficient to manage future demands and a greater role for renewables. |

Expand grid capacity to avoid constraints with the expansion of renewables generation. |

|

|

Energy intensity and emissions are high. |

Gradually increase environmental taxes for sectors outside of the EU Emissions Trading System (ETS), including excise taxes on fuels, and align these carbon prices with the ETS-price, while protecting poorer households and preserving security of energy supplies. |

|

|

Fighting corruption |

||

|

Corruption continues to impose high transaction costs. |

Continue designing and adopting effective measures to rein in corruption. |

|

|

The system detecting and investigating corruption is fragmented, leaving some grey areas. |

Extend the authority of bodies to detect and investigate corruption to cover the entire economy. |

|

|

Detection of corruption is difficult. |

Enhance transparency and checks and balances and implement the recently-adopted whistle-blower legislation to facilitate the detection and reporting of corruption cases. |

|

|

There are few checks and balances in public-private transactions, leaving room for corruption. |

Make all proposed transactions involving significant amounts of public money or public assets subject to conflict of interest checks. |

|