OECD Economic Surveys: Chile 2018

Assessment and recommendations

Abstract

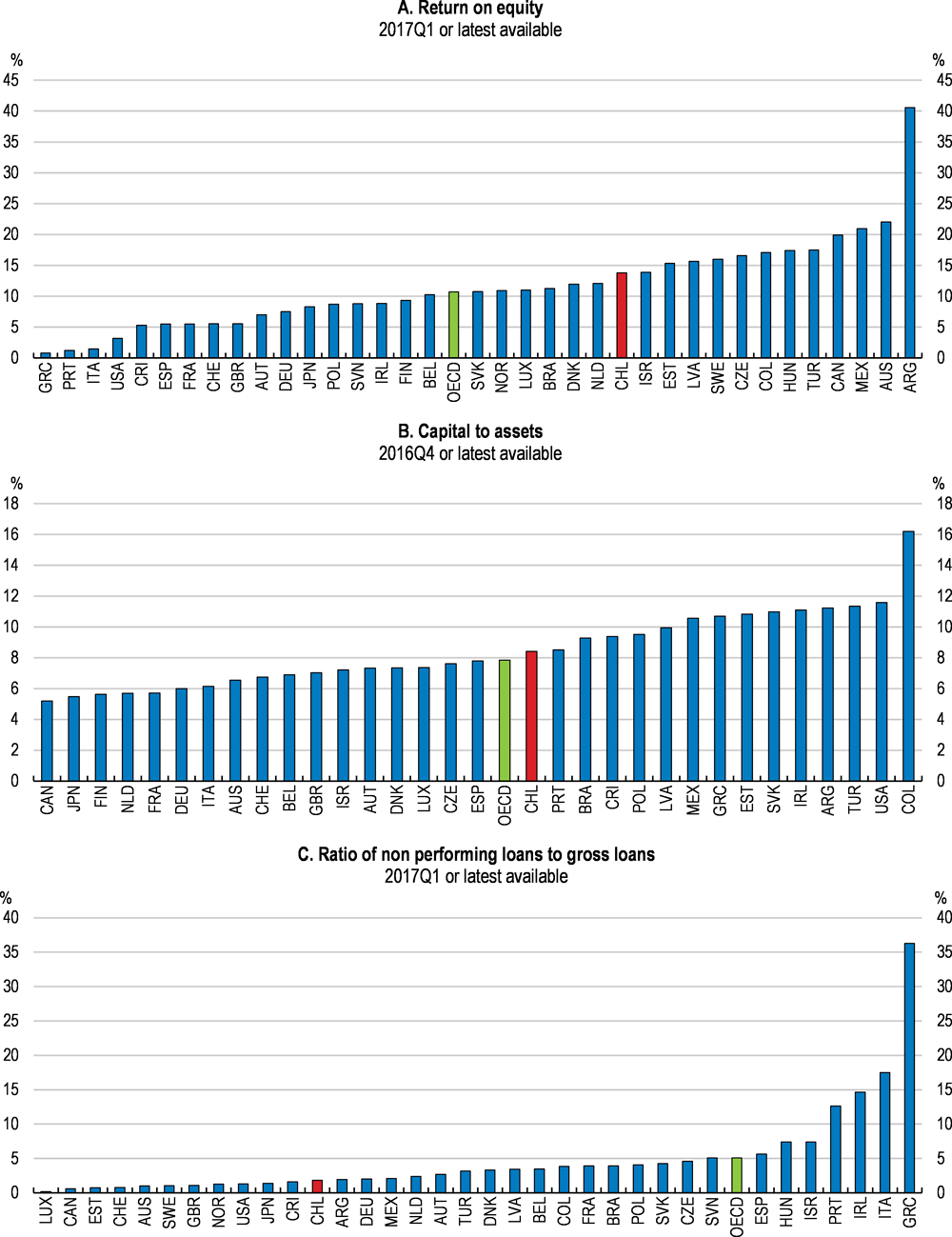

The quality of life of Chileans improved significantly over the last decades, supported by a stable macroeconomic framework, bold structural reforms, such as trade and investment liberalisation, and buoyant natural-resource sectors. The quality of life approaches the OECD average along some dimensions of well-being -- notably jobs and earnings, work-life balance, health and subjective well-being (Figure 1, Panel A). The catch up in GDP-per-capita terms and the reduction in inequalities have been among the most rapid in the OECD in the last few decades (OECD, 2015a). Still, progress has recently slowed (Panel B) and the ratio of the highest decile of disposable income to the lowest decile is among the highest in the OECD, despite being lower than in other Latin American countries (Panel C).

Figure 1. Incomes have risen and well-being is high in many dimensions

1. Each well-being dimension is measured using one to three indications from the OECD Better Life Indicator set with equal weights.

2. Indicators are normalised by re-scaling to be from 0 (worst) to 10 (best).

3. Or latest available year. For Chile data refer to 2015. The P90/P10 ratio is the ratio of income of the 10% of people with highest income to that of the poorest 10%.

Source: OECD (2017), OECD National Accounts Statistics and Income Distribution and Poverty databases; OECD (2016), "Better Life Index 2016".

Even though Chile fared relatively well during the global financial crisis, important challenges remain. The end of the commodity cycle and slower global trade have been the main drivers of lower growth, investment and business confidence. Domestic factors have also played a role. The rise in self-employment and involuntary part-time employment due to the decline in growth are undermining incomes and the financing of social protection.

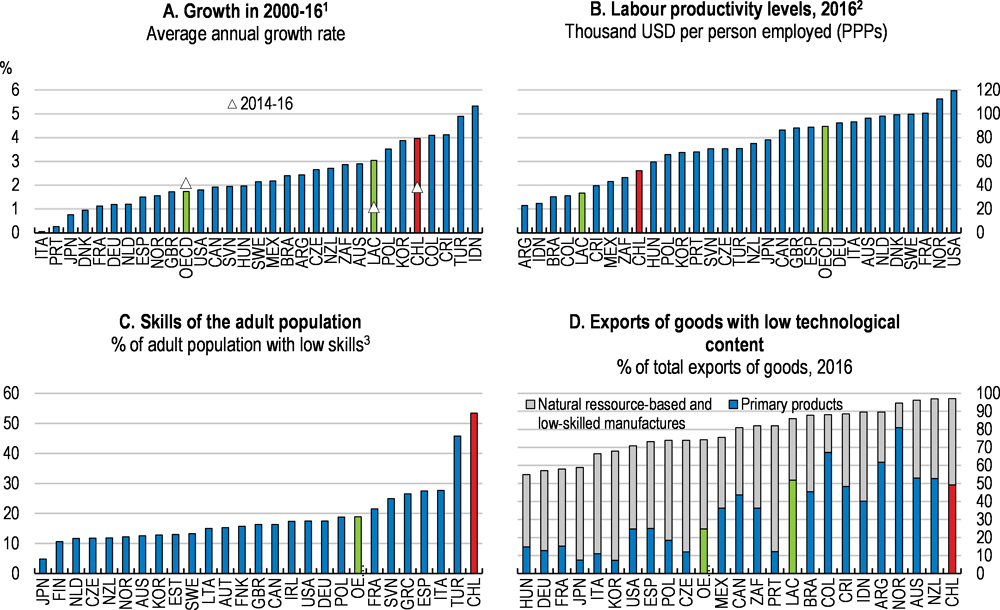

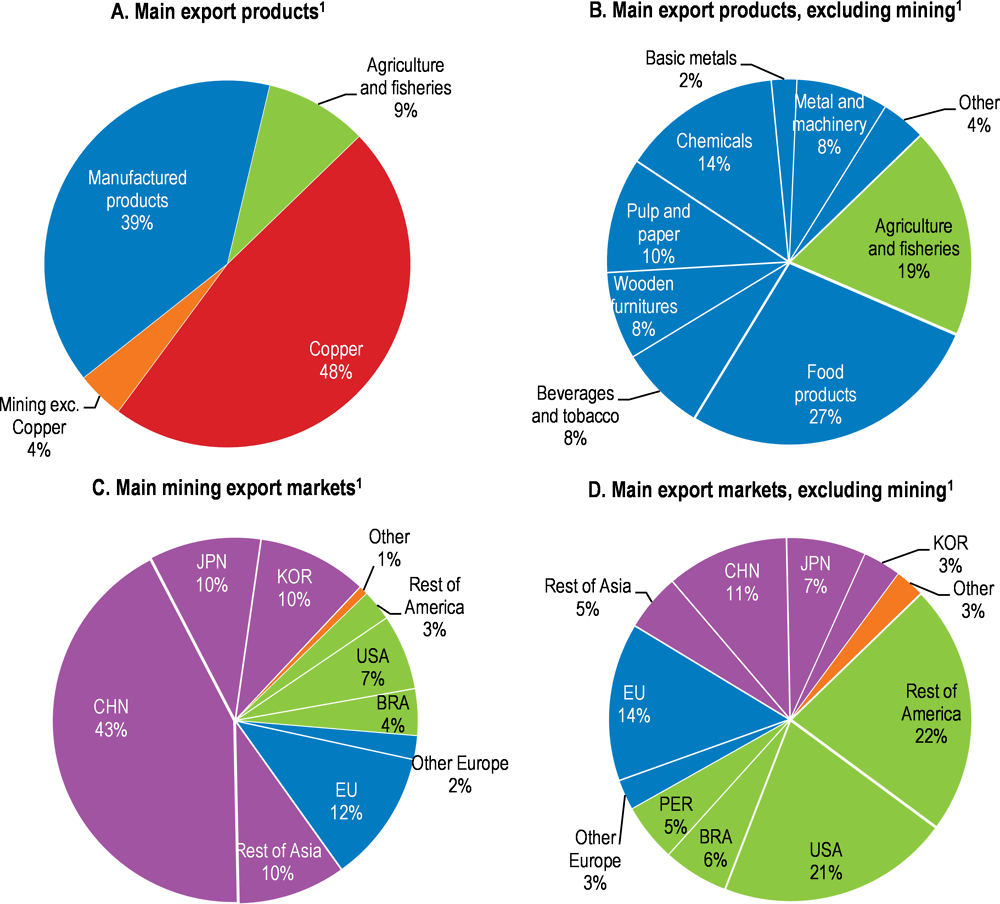

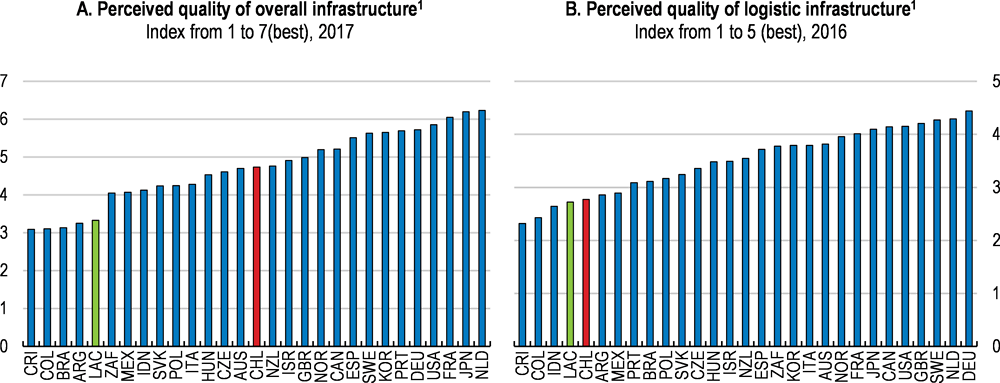

Chile’s catch-up in living standards is challenged by low and stagnant productivity and a still high level of inequality. The declining relative poverty rate of 16.1% in 2015 remains high by OECD standards and the income of the highest income decile exceeded 2.8 times the median in 2015 in line with an average of 3.0 in Brazil, Costa Rica and Mexico, but much higher than in the OECD average country (2.0). The very high share of low-skilled workers, gaps in infrastructure and low investment in innovation and R&D hinder productivity and are associated with a persistent dependence of exports on mostly natural resources, notably copper, agriculture and fisheries, and low-technology manufactures (Figure 2). Low levels of activity and employment rates for women, youth, low-skilled and indigenous groups, large earnings gaps between men and women, and the high share of temporary contracts and self-employed exacerbate persistent income disparities. Productivity and inequality are also affected by the education system, whose weak and unequal results strongly reflect socio-economic backgrounds (OECD, 2015a; OECD, 2016a). At the same time, population ageing, projected to be one of the steepest in Latin America, will pose social challenges in terms of inclusiveness and well-being, in the decades ahead.

Figure 2. Growth has been resilient but productivity and exports’ technological content are low

1. LAC is the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico.

2. Or latest available year. The value for Argentina and South Africa are estimates based on the World Development Indicators.

3. Adults with literacy skills of level 1 or below.

Source: OECD (2017), Economic Outlook 102 Database (and updates), National Accounts and Productivity Databases; OECD (2016), Skills Matter: Further Results from the Survey of Adult Skills; and OECD calculations based on Comtrade data.

Ongoing improvements in the education sector, reforms in the labour market, the implementation of the 2014-18 Productivity Agenda, and efforts to raise the efficiency of electricity markets and the sustainability of the pension system have aimed at tackling these challenges. However, further structural reforms are needed for more robust private investment and more inclusive growth, ensuring the provision of high-quality public services over the longer term. OECD simulations show that the implementation of key structural reforms would significantly raise GDP per capita by 5.2% after 10 years, or yearly real GDP growth by around 1.2 percentage points, on average, over this period (Box 3, Table 5). Against this background, the main messages of this Survey are:

A solid macroeconomic policy framework has smoothed adjustment to the end of the commodity boom, contributing to low unemployment, resilient household consumption and a stable financial sector.

Raising incomes and well-being further will depend on strengthening skills and greater inclusion of women and low-skilled workers in the labour force. Increasing the quality of education, reforms to ensure the training system benefits the unemployed and inactive and measures to reduce the segmentation of the labour market would enhance productivity and inclusiveness.

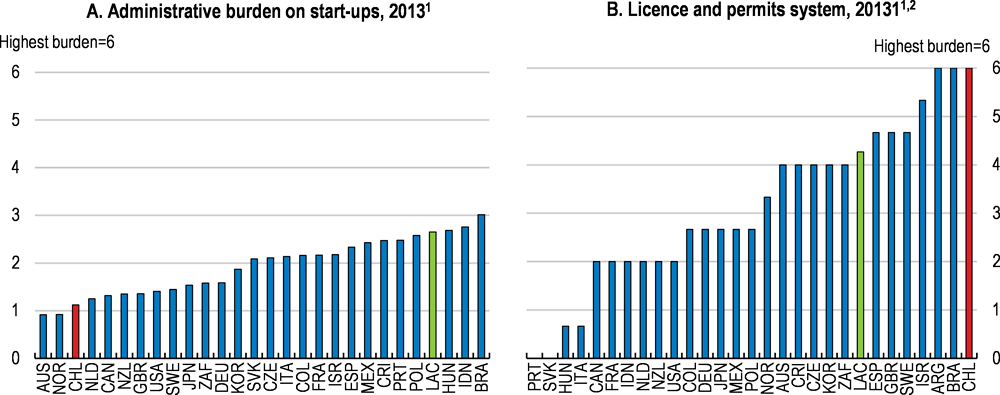

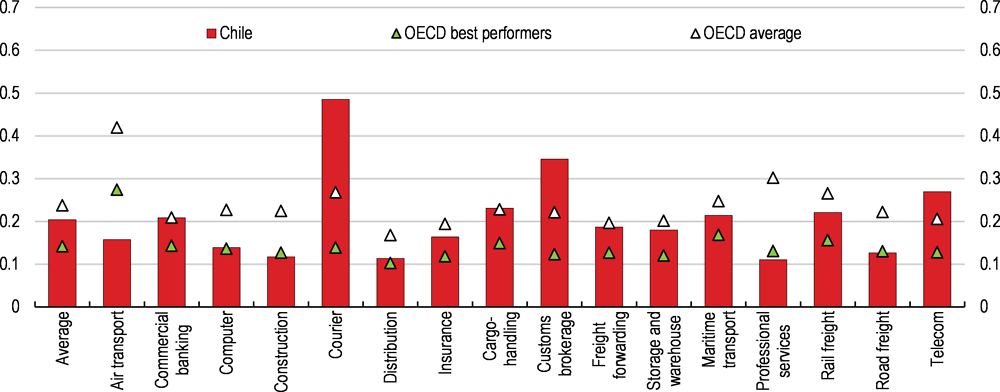

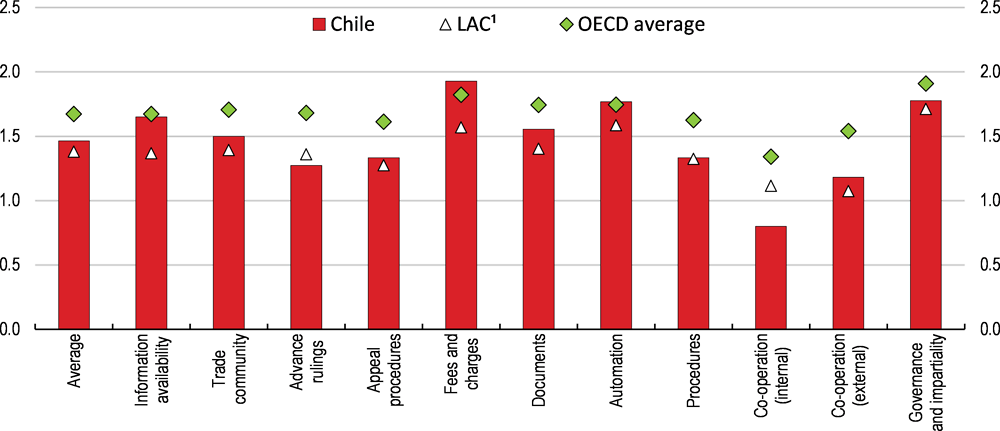

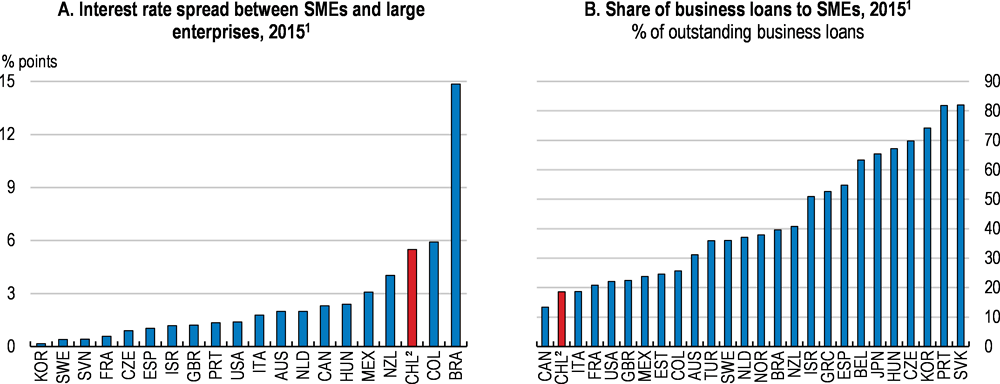

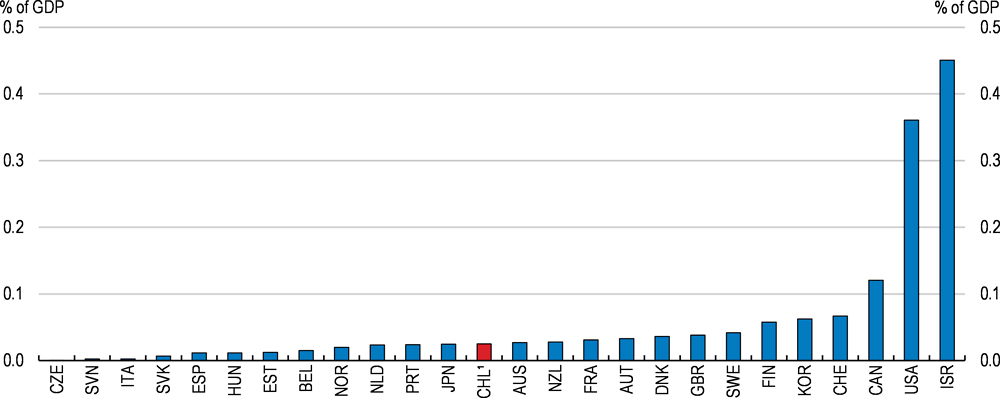

Business entry costs and export procedures have been progressively eased. However, promising firms still lack opportunities to grow, export and innovate. Further simplification of trade and regulatory procedures, and reforms in the transport sector, would strengthen productivity.

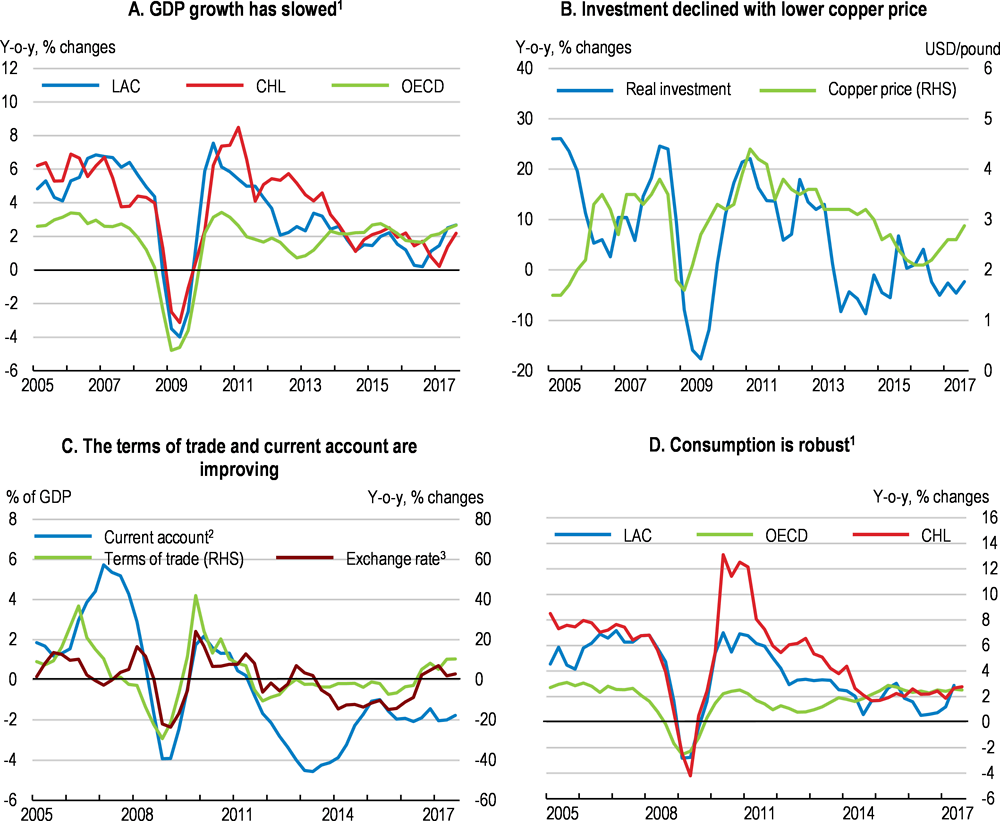

The economy has been resilient to the commodity shock

The economy grew by 5.3% annually between 2010 and 2014, more than double the OECD average (Figure 3, Panel A). This was driven by a sharp rise in terms-of-trade after the 2008 financial crisis as the value of copper exports boomed along with strong external demand. Since mining is very capital intensive, investment grew from approximately 21% of GDP in 2002 to almost 25% of GDP in 2012, generating large spillovers on other sectors, in particular construction.

Figure 3. The adjustment to the decline of copper price is easing

1. LAC is the unweighted average of Argentina, Brazil, Colombia, Costa-Rica and Mexico.

2. Four-quarter moving average.

3. Nominal exchange rate in US dollars per national currency.

Source: OECD (2017), Economic Outlook 102 Database (and updates); Central Bank of Chile (2017), Statistical database.

Growth has slowed since 2014 due to weaker global trade and the fall in copper prices, but by less than in Latin American peers. Together with higher costs from more difficult extraction, lower copper prices have reduced mining profitability and thereby investment (Panel B). Recently, a modest recovery in commodity prices has reversed some of the earlier terms-of-trade losses (Panel C). However, in the first half of 2017, growth decelerated further as a long-lasting strike in the largest copper mine, linked to regular collective negotiations, weighed on exports and activity. The economy appears close to the end of the adjustment, helped by an improving outlook in its main trading partners, notably Latin American countries (OECD, 2017a).

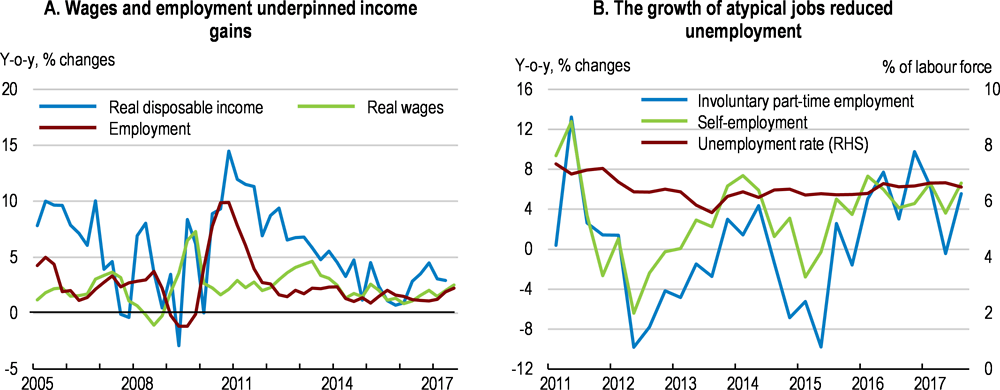

Growth was aided by the solid macroeconomic framework, the floating exchange rate and the stable financial system. Private consumption remained robust (Figure 3, Panel D) thanks to the historically low joblessness, strong credit growth, and a rise in public consumption. Employment is rising and annual wage growth has been robust, partly linked to minimum wage hikes and frequent indexation of wages on past inflation (Pérez Ruiz, 2016), underpinning solid gains in disposable income (Figure 4, Panel A). The unemployment rate, around 7%, remains historically low (Panel B). However, the prolonged growth slowdown raised involuntary part-time employment and self-employment, while, on average, self-employed earn 20% less than a wage employee with the same skills and experience (Barrero and Fuentes, 2017). The long-term decline in informality has stopped over 2013-17 (Ciedess, 2017).

Figure 4. The labour market has been resilient

Source: OECD (2017), Economic Outlook 102 Database (and updates); Central Bank of Chile (2017), Statistical Database; INE (2017), Encuesta Nacional de Empleo.

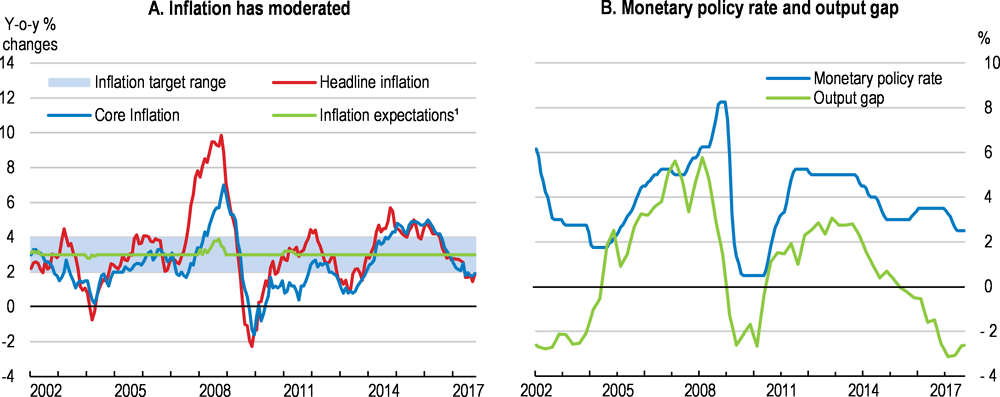

Inflation has been on a downward trend since the beginning of 2016 (Figure 5, Panel A). Inflation exceeded the official target band over 2014-16, mostly due to the pass-through from the sharp peso depreciation. However, the stabilisation and the subsequent appreciation of the exchange rate as well as the wider output gap drove core and headline inflation below the lower bound of the policy tolerance range in the middle of 2017. In this context, monetary policy has been supportive. The Central Bank reacted by cutting its interest rate from 3.5% in December 2016 to 2.5% in May 2017, well below historical norms (Panel B). At the same time, inflation expectations remain well anchored, and prudential measures have moderated lending growth, thereby containing vulnerabilities.

Figure 5. Inflation has moderated

1. Inflation expectations at 23 months.

Source: OECD (2017), Economic Outlook 102 Database (and updates); Central Bank of Chile (2017), Statistical Database.

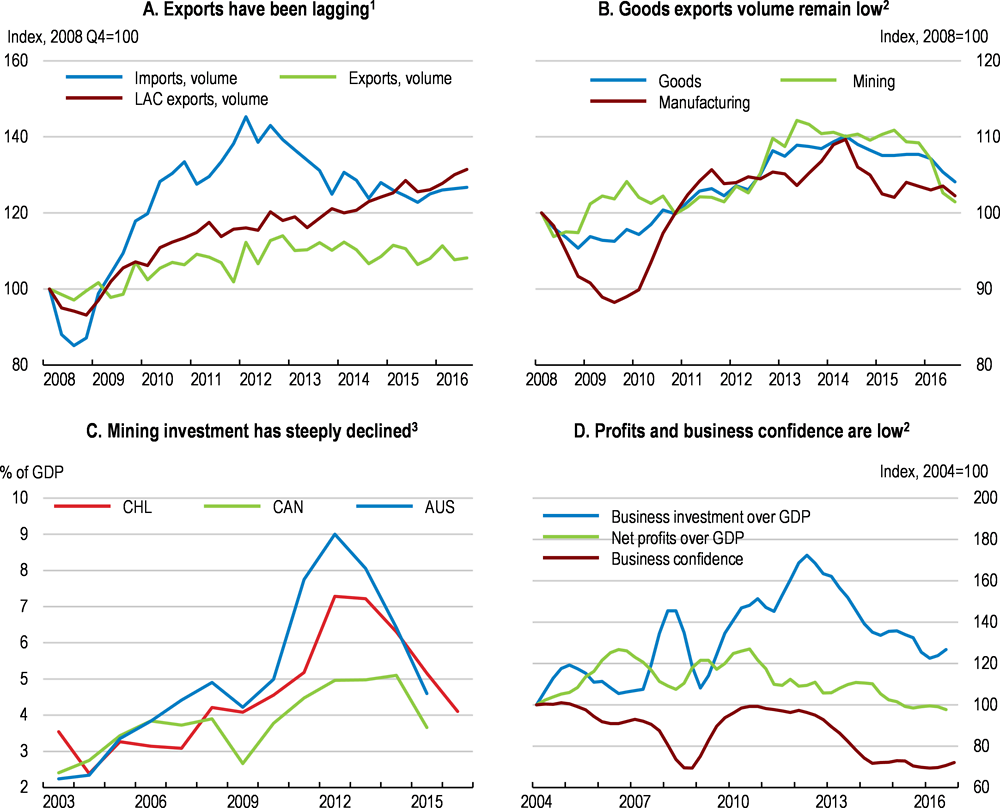

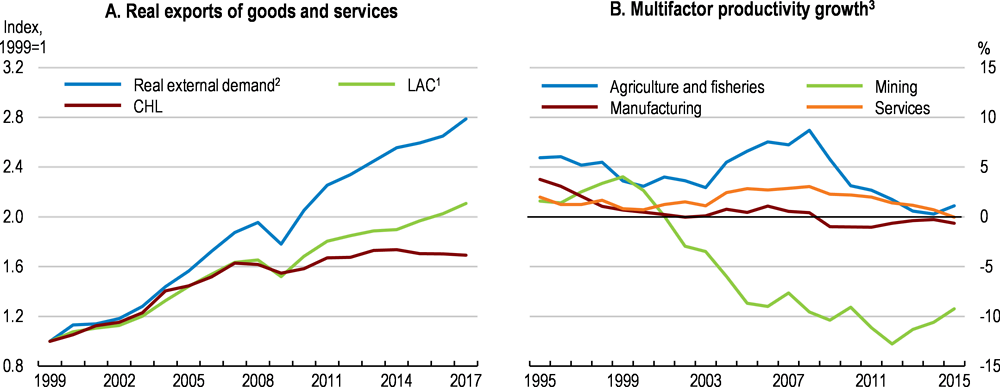

Export recovery has been affected by global trade conditions, commodity developments and structural rigidities. Despite the depreciation of the peso, most of the adjustment to lower copper prices has taken place by import compression. Since 2011, the increase in non-mining exports has been held back by low growth in Chile’s main trading partners and negative supply shocks in the salmon and wine sectors (Figure 6, Panels A and B). A strike in the main copper mine further weighed on exports in the first half of 2017. The dependence of the recovery on a few export sectors highlights Chile’s competitiveness problems (Figure 8). Indeed, non-price competitiveness is hampered by Chile’s specialisation in price-sensitive products and weak innovation. Moreover, product and labour market rigidities reduced the speed of reallocation of labour and capital to more competitive sectors, and reduced potential for more inclusive growth by keeping resources in low paying jobs. This had a tendency to maintain non-productive jobs and income disparities as better quality jobs were not created (Adalet Mc Gowan et al., 2017). Exports are expected to strengthen thanks to revived world demand, in particular from Chile’s main Latin American trading partners.

Figure 6. Exports and business investment are lagging

1. Goods and services. LAC is the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico.

2. Four-quarter moving averages.

3. Mining investment in Chile in 2016 is an estimate based on information from listed companies.

Source: OECD (2017), Economic Outlook 102 Database (and updates); Central Bank of Chile (2017), Statistical Database.

Investment will recover only slowly. The adjustment of investment in the mining sector has been a significant drag on private investment and the recovery (Figure 6, Panel C). Moreover, lower internal financing capacity, uncertainty about the internal and external environment have reduced business confidence and held back business investment, despite historically low interest rates (Panel D). Household investment will also be a drag on growth in the short term. The scheduled end of reduced VAT rates on new home sales in 2016 has pushed forward construction activity, while welcome higher requirements on provisions to housing loans could negatively impact credit conditions.

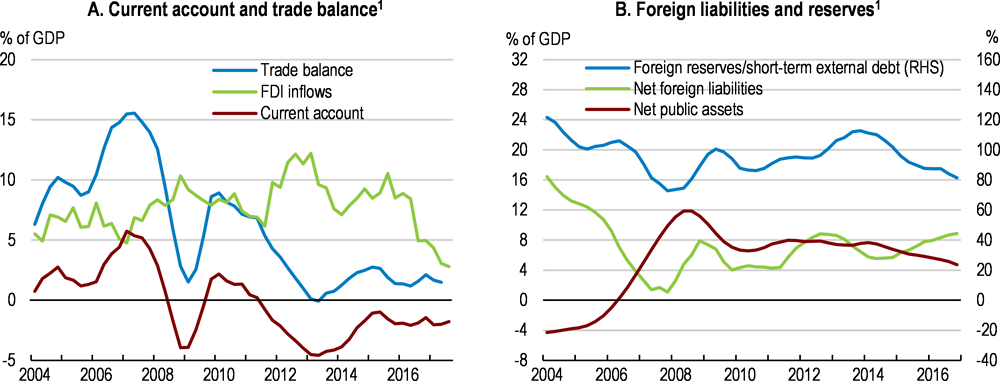

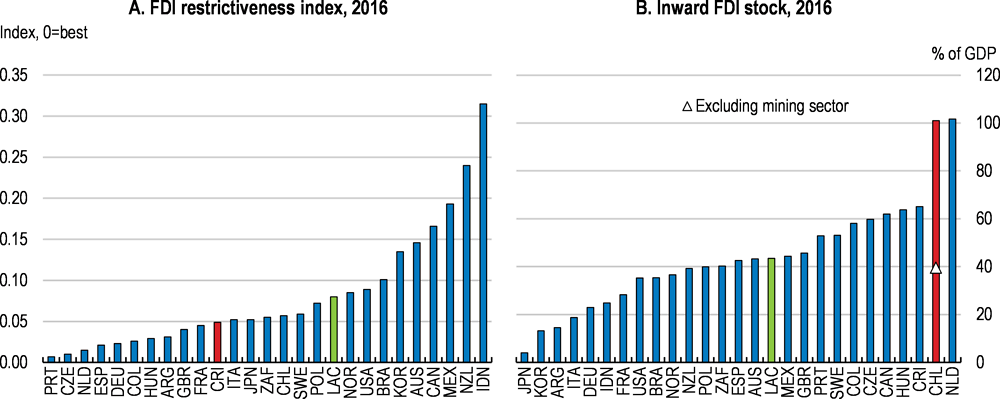

Chile’s current account balance has been in deficit since 2011. However, FDI inflows, mainly to the mining sector, have funded a large part of the deficit (Figure 7). Net foreign liabilities remain limited, net external public assets are above 4% of GDP, due to assets held by the two sovereign wealth funds (Box 1), and reserves are above 80% of short-term external debt.

Figure 7. External imbalances are contained

1. Four-quarter moving averages.

Source: OECD (2017), Economic Outlook 102 Database (and updates); Central Bank of Chile (2017), Statistical Database.

The short-term outlook is improving but Chile faces several medium-term challenges

Growth is projected to gain strength in the short run, accelerating from 1.7% in 2017 to almost 3% in 2018 and 2019 (Table 1). Exports will grow at a more solid pace, underpinned by improving export markets and a rebound in copper prices. Strengthening demand, good financing conditions and recent policy measures to support exports and productivity will reinvigorate business investment. As growth picks up, the unemployment rate will edge down and wage growth will increase. This will lower income disparities and private consumption is projected to accelerate with increasing real disposable incomes.

Table 1. Macroeconomic indicators and projections

Annual percentage change, volume (2013 prices)1

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|---|---|---|---|---|---|---|

|

|

Current prices (CLP billion) |

|||||

|

GDP at market prices |

148,855.3 |

2.2 |

1.5 |

1.7 |

2.9 |

2.9 |

|

Private consumption |

93,735.5 |

2.0 |

2.4 |

2.6 |

2.8 |

2.9 |

|

Government consumption |

19,080.0 |

4.5 |

5.1 |

3.7 |

2.8 |

2.5 |

|

Gross fixed capital formation |

35,444.7 |

-0.9 |

-0.6 |

-1.4 |

2.9 |

4.3 |

|

Final domestic demand |

148,260.2 |

1.6 |

2.0 |

1.9 |

2.8 |

3.1 |

|

Stockbuilding2 |

-862.3 |

0.3 |

-0.9 |

1.3 |

0.0 |

0.0 |

|

Total domestic demand |

147,397.8 |

2.0 |

1.2 |

3.2 |

2.8 |

3.1 |

|

Exports of goods and services |

49,212.9 |

-1.9 |

0.0 |

-0.6 |

3.1 |

3.5 |

|

Imports of goods and services |

47,755.3 |

-2.8 |

-1.6 |

5.7 |

3.4 |

4.5 |

|

Net exports2 |

1,457.5 |

0.3 |

0.5 |

-1.7 |

-0.1 |

-0.2 |

|

Memorandum items |

||||||

|

GDP deflator |

_ |

4.2 |

3.8 |

4.5 |

3.3 |

2.7 |

|

Consumer price index |

_ |

4.3 |

3.8 |

2.2 |

2.5 |

3.0 |

|

Private consumption deflator |

_ |

5.5 |

3.7 |

2.1 |

2.5 |

3.0 |

|

Unemployment rate |

_ |

6.2 |

6.5 |

6.7 |

6.5 |

6.3 |

|

Central government financial balance3 |

_ |

-2.1 |

-2.7 |

-2.8 |

-1.9 |

-1.7 |

|

Potential growth |

_ |

3.1 |

2.9 |

2.7 |

2.5 |

2.5 |

|

Output gap |

_ |

0.9 |

-0.1 |

-1.6 |

-2.9 |

-2.5 |

1. OECD projections are elaborated from seasonal and working-day-adjusted quarters for selected key variables, from which annual data are derived. Small differences between adjusted and unadjusted annual data may occur.

2. Contribution to changes in real GDP.

3. As a percentage of GDP.

Source: OECD Economic Outlook 102 Database (and updates).

The main risks to growth relate to the performance of Chile’s principal trading partners and the evolution of commodity prices. Lower or higher growth in China, the United States and Latin American neighbours could reduce or boost external demand (Figure 8). In particular, further recovery of copper prices would boost confidence and investment, and increase government revenues. Alternatively, lower export prospects would weigh on growth. Domestic measures to boost competition and productivity and the new infrastructure fund could also increase investment more than assumed. By contrast, growth could be weakened if uncertainty in the business sector does not dissipate. A faster-than-expected rise in global long-term rates would have a limited negative impact on the financial sector and growth (Central Bank of Chile, 2017b). The economy may also confront unforeseen shocks, whose effects are difficult to factor into the projections (Table 2).

Figure 8. Exports remain highly specialised, 2015-16

Note: Average percentage shares over 2015-16 for trade in goods.

Source: Central Bank of Chile (2017), Statistical Database.

Table 2. Events that could lead to major changes in the outlook

|

Shock |

Possible impact |

|---|---|

|

Rise of protectionism and a slowdown in global trade |

The benefits of integrating into the world economy will be lower if global protectionism were to rise. Export prospects would decrease. |

|

Increased weather variability and natural disasters, such as droughts, wildfires and landslides |

Depending on the nature and scale of the natural disaster, the fall in output from agriculture and other sectors could be regional or national. Infrastructure would be damaged and ongoing investment projects would be delayed but it could boost reconstruction expenditures. |

|

A hard landing of emerging economies, particularly in China. |

Global economic prospects and exports momentum would decline. In particular, copper prices, exports and public revenues would be lower than expected. Financial and real spillovers through other emerging countries would also reduce growth. |

Continued fiscal consolidation is needed over the medium term

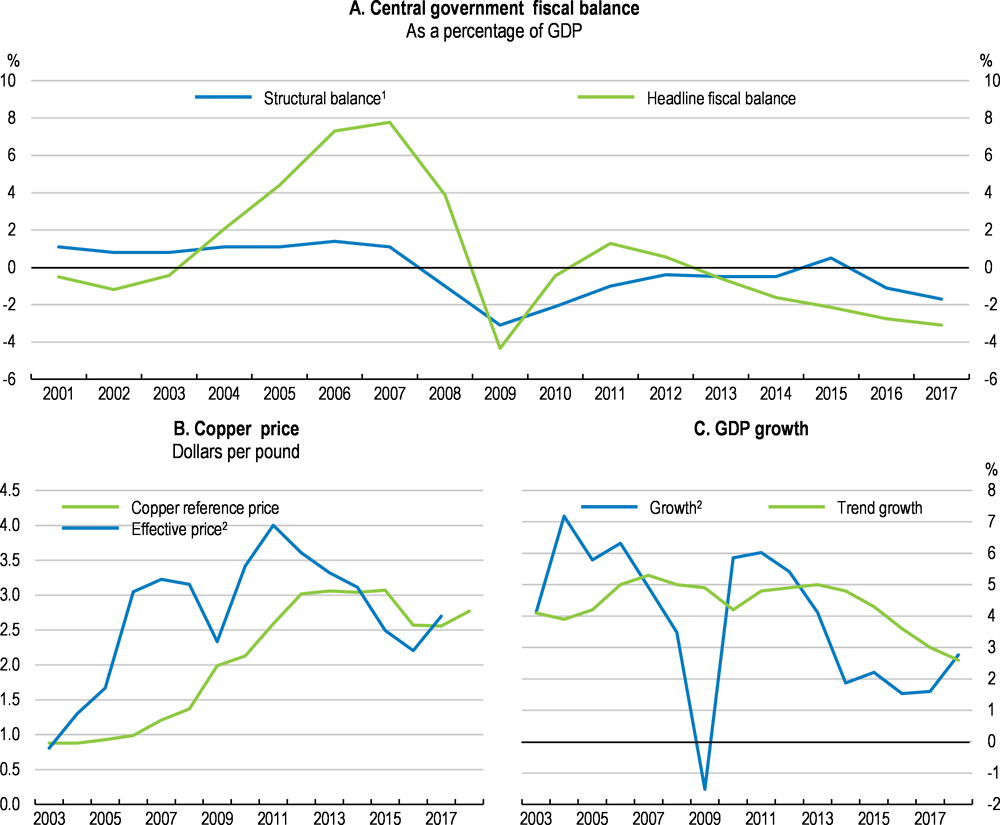

The commodity price shock and the growth slowdown led to a rise in the fiscal deficit after 2011, broadly in line with the fiscal rule (Table 3, Box 1). Non-mining and mining revenues were hit by the sharp fall in copper prices and lower growth. In addition, new education and social spending exceeded short-term revenue gains from the 2014 tax reform (see below). The deficit remained close to 2.8% of GDP in 2017 and will decline around to 1.7% in 2019 according to OECD projections (Table 1).

Table 3. The central government fiscal situation has deteriorated

Percentage of GDP

|

2003 |

2007 |

2011 |

2013 |

2014 |

2015 |

2016 |

|

|---|---|---|---|---|---|---|---|

|

Total revenues |

20.2 |

25.5 |

22.6 |

20.9 |

20.6 |

21.2 |

21.1 |

|

Copper revenues |

1.0 |

8.1 |

4.1 |

2.1 |

1.9 |

1.3 |

0.4 |

|

Non-copper revenues |

19.2 |

17.3 |

18.4 |

18.9 |

18.7 |

19.9 |

20.6 |

|

Total expenditures |

20.7 |

17.7 |

21.3 |

21.5 |

22.2 |

23.3 |

23.8 |

|

Social spending1 |

na |

na |

11.6 |

12.3 |

12.6 |

13.3 |

13.9 |

|

Other public spending |

na |

na |

5.1 |

5.0 |

5.2 |

5.2 |

5.2 |

|

Public investment |

3.2 |

3.1 |

4.1 |

3.6 |

3.8 |

4.2 |

4.0 |

|

Interests |

1.1 |

0.6 |

0.6 |

0.6 |

0.6 |

0.7 |

0.8 |

|

Fiscal balance |

-0.4 |

7.8 |

1.3 |

-0.6 |

-1.6 |

-2.1 |

-2.7 |

|

Structural balance |

0.8 |

-1.1 |

-1.0 |

-0.5 |

-0.5 |

0.5 |

-1.1 |

|

Structural primary balance2 |

1.4 |

1.0 |

-0.9 |

-0.4 |

-0.3 |

0.7 |

-0.8 |

|

Fiscal impulse3 |

0.0 |

-0.7 |

1.1 |

-0.1 |

0.1 |

1.1 |

-1.5 |

|

Gross debt |

12.7 |

3.9 |

11.1 |

12.7 |

14.9 |

17.4 |

21.3 |

|

Net debt |

6.6 |

-12.9 |

-8.6 |

-5.6 |

-4.3 |

-3.5 |

1.0 |

1. Education, health and social protection.

2. Structural deficit (national definition) plus net interest payments. Copper revenues are cyclically adjusted using an estimate of long-term copper prices (Box 1).

3. Change in structural primary balance.

Source: Dipres.

Box 1. The fiscal rule and its implementation

Chile’s structural balance rule puts an ex ante ceiling on government expenditures. Each year, two committees provide estimates for trend GDP growth and forecasts for long-term copper price (10 years ahead). Revenues are adjusted cyclically for deviation from trend GDP growth and long-term copper price based on the estimates of two committees of experts working for its Advisory Fiscal Council, while expenditures are not cyclically adjusted (Figure 9).

Figure 9. Central government fiscal balance

1. The historical series evaluates the structural deficit using the historical parameters of each budget law.

2. The long-term copper price - an estimate of the average price of copper over the next ten years - and trend growth are determined yearly by two committees of experts working for Chile’s Fiscal Advisory Council.

Source: Dipres (2017), Indicador del balance cíclicamente ajustado; OECD Economic Outlook 102 Database (and updates).

The authorities have progressively reduced annual structural balance targets from a surplus of 1% of GDP over 2001-07 to 0% in 2009, and shifted to a structural consolidation path over 2009-14, as methodological changes in 2011 revealed a larger-than-previously-estimated structural deficit. A Fiscal Advisory Council comments and provides recommendations on the rule implementation since 2013. The structural adjustment was made even more gradual in 2016 in light of lower copper prices and a decline in the projected long-term growth.

The Chilean fiscal framework builds on two sovereign wealth funds, the Social Stabilisation Fund (ESSF) and the Pension Reserve Fund (PRF), that help reduce the impact of commodity fluctuations on activity, as public revenues remain dependent on copper (Box 2). In particular, the Social Stabilisation Fund finance fiscal deficits that may occur in periods of low growth and/or low copper prices and may also be used to finance the payment of public debt (including recognition bonds) and contributions to the Pension Reserve Fund. The Pension Reserve Fund complements the financing of pensions and social welfare arising from the old-age and disability solidarity basic pensions as well as solidarity pension contributions.

Much of the deterioration in the fiscal deficit was cyclical and linked to lower copper prices. The structural budget deficit (national definition abstracting from the cycle and short-term fluctuations in copper prices) has been broadly stable over 2011-16 (Box 1). Furthermore, the structural primary balance has been broadly stable between 2011 and 2016 (Table 3). Prudent fiscal management has been rewarded by the lowest sovereign bond spreads in the region. General-government gross debt at 28% of GDP in 2016, around 131% of revenues, was much lower than the average of Colombia and Mexico (59.3% of GDP or 207% of revenues). However, persistent headline deficits have increased public debt by around 10% of GDP in gross and net terms since 2011. Concerns about long-term growth also led to credit rating downgrades for long-term foreign-currency denominated sovereign debt from A+ to AA- by Standard & Poor’s and from A+ to A by Fitch in the middle of 2017.

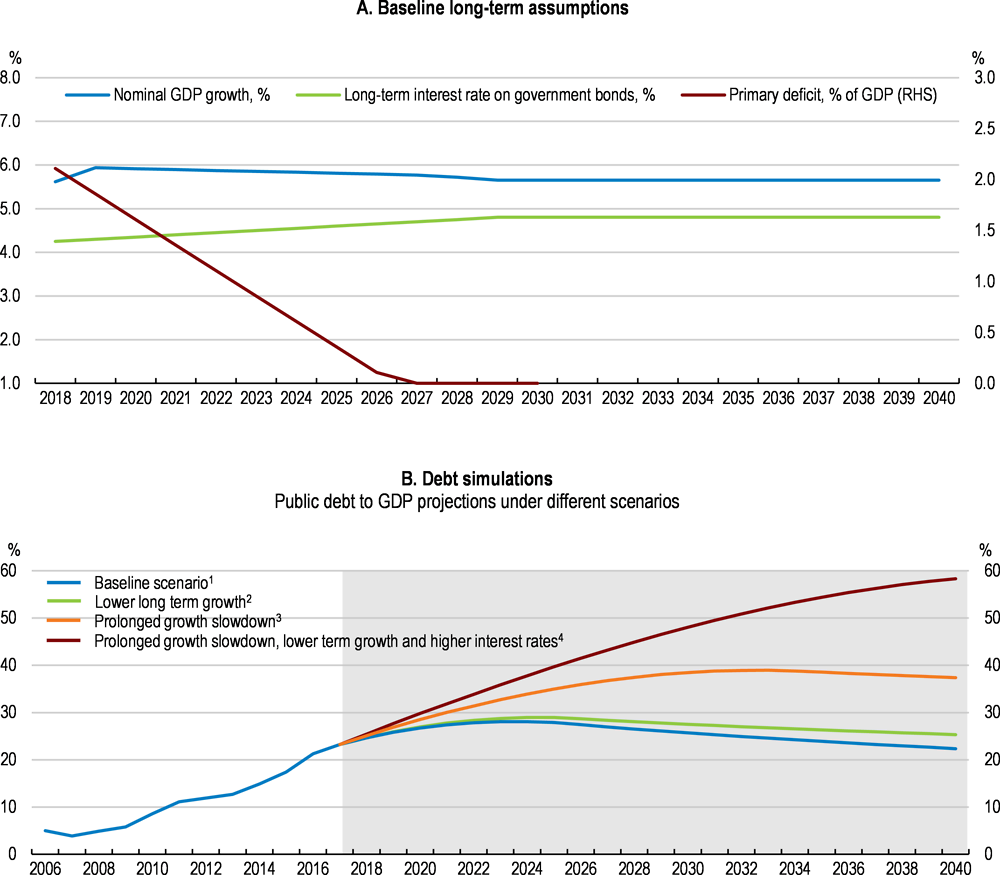

Under a baseline scenario where long-term growth remains close to 3% in volume terms and inflation is close to the central-bank target, if the government continues a gradual fiscal consolidation plan of 0.25% of GDP per year in line with the fiscal rule (Figure 10, Panel A), gross central-government debt will remain on a sustainable path (Panel B). Although long-term growth could be supported by higher immigration and female employment (Central Bank of Chile, 2017a), the effects of ageing could be larger than expected (Braconier et al., 2014; Acosta-Ormaechea et al., 2017) and the prolonged slowdown could push down productivity through hysteresis effects. With lower long-term growth, at 2% per year, the gross debt-to-GDP ratio would only be slightly above the baseline in 2040. However, foreseen increase in health and long-term care expenditures could reach more than 7% of GDP by 2060 (de la Maisonneuve and Oliveira Martins, 2015). If the authorities were only able to shrink the primary deficit by 0.15% of GDP each year, government debt could reach 38% of GDP in 2040 or close to 60% if the consolidation was further delayed and interest rate on government debt were to rise significantly. The literature tends to limit prudent debt levels to 40-55% of GDP in emerging economies and 70-90% in higher-income countries (Fall et al., 2015). As copper-related revenues are likely to remain low, achieving medium-term consolidation objectives in line with the fiscal rule will require substantial new permanent fiscal revenues (see below).

Figure 10. Illustrative public debt paths

1. Baseline long-term assumptions of Panel A. In addition, the nominal interest rate on government assets is set at 2%.

2. Same assumptions as in 1, but nominal long term growth of 5%.

3. Same assumptions as in 2, except primary deficit achieves balance in 2035.

4. Same assumptions as in 2, except primary deficit achieves balance in 2040 and real long-term interest rates are higher by 1.5 percentage point over 2019-2040.

Source: OECD calculations based on the OECD Economic Outlook 102, Dipres and Central Bank of Chile.

The fiscal rule has been effective at smoothing public expenditures and maintaining a moderate public debt level (Marcel, 2013; Korinek, 2013; IMF, 2016). However, the public financial management framework could be further enhanced to meet forthcoming fiscal challenges. A new public registry of external economic experts improved the transparency of the estimation of the structural balance in 2017 (Annex). However, the mandate and resources of the Fiscal Advisory Council fall short of OECD best practices (OECD, 2014a). Greater independence for the Fiscal Advisory Council should be built in law to ensure independent assessment of compliance with the fiscal rule. Broadening the mandates of the Fiscal Advisory Council to update the elasticities used for structural revenues, provide independent economic projections for the budget and produce more comprehensive public analyses of fiscal policy and medium-term budgetary plans would help maintaining a strong government financial position, and bolster Chile’s international reputation for fiscal prudence. Incorporating an explicit medium-term target in the fiscal rule would also help, as fiscal targets have been changed in the current slowdown (Box 1).

Monetary policy will remain supportive

The Central Bank conducts monetary policy on an inflation-targeting framework and flexible exchange rate regime. Monetary policy has operated in a difficult environment of high inflation and low growth following the end of the commodity boom and the associated exchange-rate depreciation. Inflation remained above the 2−4% target band over 2015-16, but the Central Bank was effective in avoiding a de-anchoring of inflation expectations (Figure 5). In 2018, the Central Bank will reduce the frequency of monetary policy meetings from 12 per year to 8, increase their duration and extend its public statements, including a vote count, the likely change of monetary policy, additional assessments of the economic situation, to raise the transparency of its decisions.

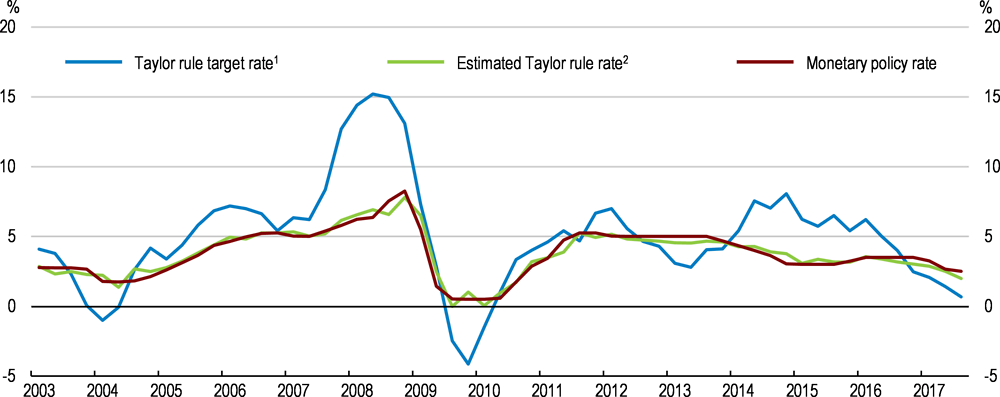

Monetary policy has become more accommodative at the end of 2016. Once inflation started to decline, the Central Bank softened its policy guidance and cut its interest rate from 3.5% in December 2016 to 2.5% in May 2017. This stance is consistent with a Taylor rule (Figure 11). The Central Bank plans to keep its monetary policy interest rate around current levels and to start raising it once the economy starts closing the activity gap (Central Bank of Chile, 2017c). Monetary policy would therefore remain appropriately accommodative over 2018.

Figure 11. Monetary policy has become more accommodative

1. The displayed Taylor rule is computed as: nominal interest rate = real natural interest rate + inflation rate +0.5 (inflation gap) + 0.5 (output gap); the inflation target is set at 3%; the natural real interest rate is taken to be 1%, as suggested by Central bank of Chile (2017).

2. The estimated Taylor rule rate is based on a simple quarterly regression of nominal interest rate on lagged nominal interest rate, current inflation and output gap estimated over 2002-2013.

Source: OECD calculations and Central Bank of Chile (2017), Monetary Policy Report - September, Santiago.

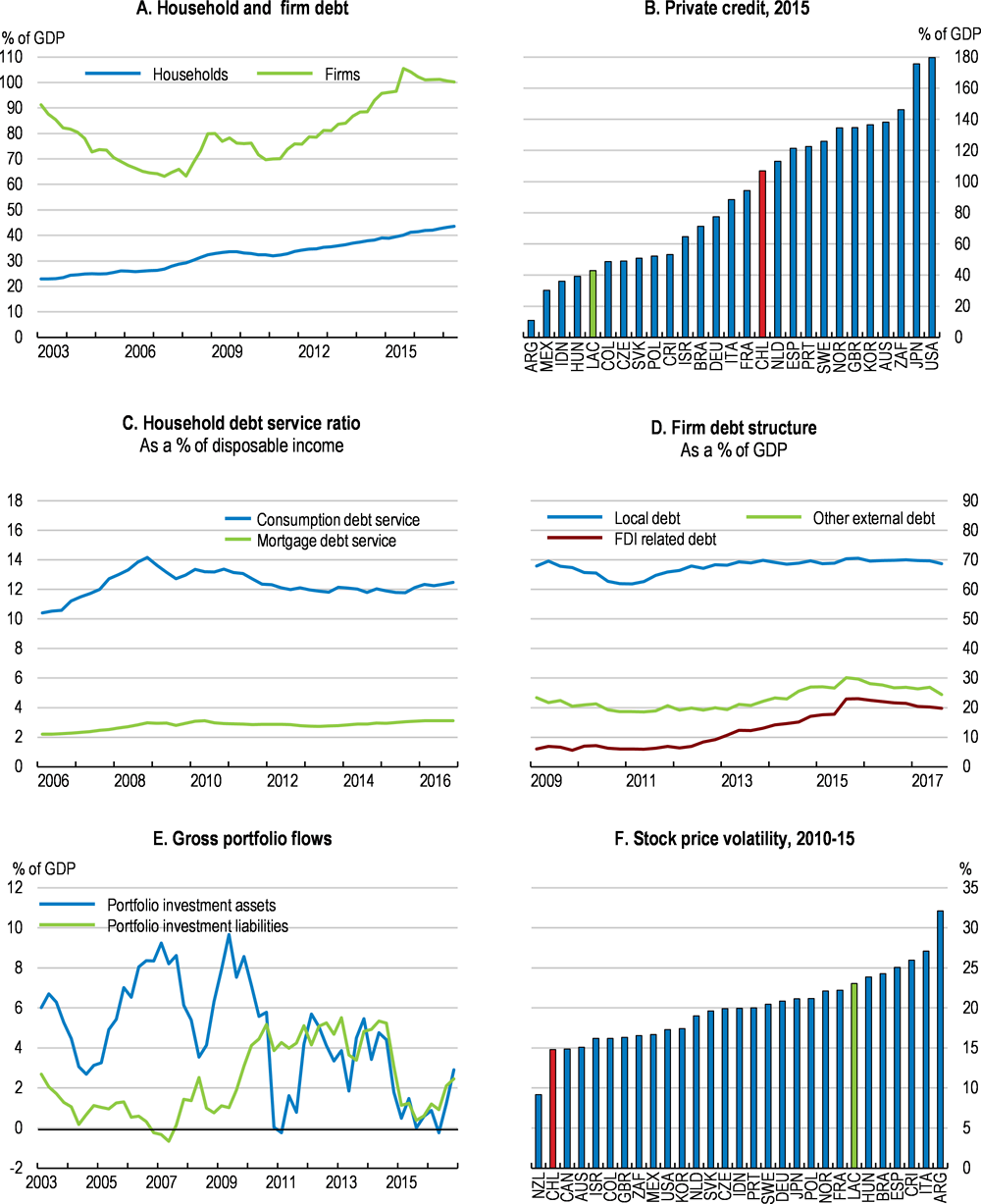

Banking regulation and supervision are being strengthened

Compared to many other emerging markets, Chile’s financial markets are open and deep, supported by a free-floating currency and a sound fiscal and monetary policy framework. The Central Bank (2017b) considers that risks from household and firm debt are contained, despite the rapid increase in private indebtedness (Figure 12). Home purchases and household debt rose in anticipation of the 2016 housing VAT hike (IMF, 2016), but the average household debt service ratio decreased with lower interest rates. In addition, the Banking Supervisor adjusted the provision requirements on housing loans with high loan-to-value ratios to better capture expected losses and limit housing market risks going forward.

Figure 12. Financial developments have been mixed

Note: LAC is the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico.

Source: OECD (2017), National Accounts Database; Central Bank of Chile (2017), Statistical Database; IMF (2017), Financial Soundness Indicators Database; BIS (2017), Total credit statistics; World Bank (2017), Global Financial Development Database.

Similarly, the increase in non-financial corporate debt does not necessarily imply a significant risk to financial stability thanks to a series of mitigating factors. Long maturities, natural hedges through exports and the use of currency derivatives limit rollover risks and currency mismatches (Central Bank of Chile, 2017b). Moreover, almost half of firms’ external debt is through parent-subsidiary commitments, where the associated risks for borrowing firms are lower than for bank debt and bond debt between unrelated parties (Ahrend et al., 2012; Caldera Sánchez and Gori, 2016). However, a prolonged period of lower growth could increase servicing risks (Central Bank of Chile, 2017b).

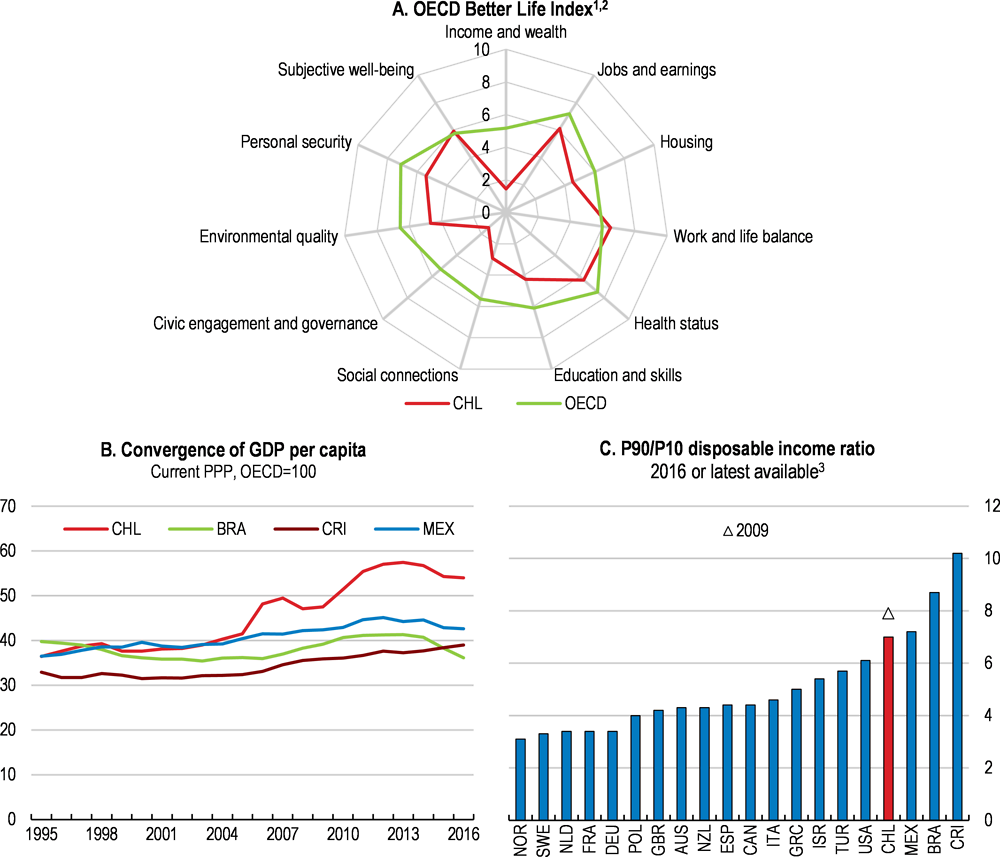

The banking sector has been resilient to adverse economic developments. Banks’ profitability is above the OECD average, despite the growth slowdown (Figure 13, Panel A). The banking system is mostly well-capitalized and non-performing loans are low (Panels B and C). According to the Central Bank’s stress tests, the banking system would face most stress scenarios without significant financial stability risks (Central Bank of Chile, 2017b).

Figure 13. The financial sector remains stable

The government is strengthening financial regulation. A 2015 bill strengthened the financial stability council with a specific mandate to oversee systemic risks and those arising from financial conglomerates. The 2017 draft banking law would gradually incorporate Basel III capital adequacy requirements. The bill also introduces macro prudential tools and a legal framework covering prevention and early intervention for banks, and strengthens the governance of the bank supervisor. The rapid adoption of the bill would strengthen the regulatory framework. In addition, a Financial Market Commission (FMC) was created in 2017 (Annex). However, the transfers of some core competences, such as banking supervision, would only take place with the adoption of the draft banking law. Moreover, establishing a consolidated credit register for bank and non-bank credit providers as was foreseen by a 2011 draft legislation will be key to improve risk monitoring.

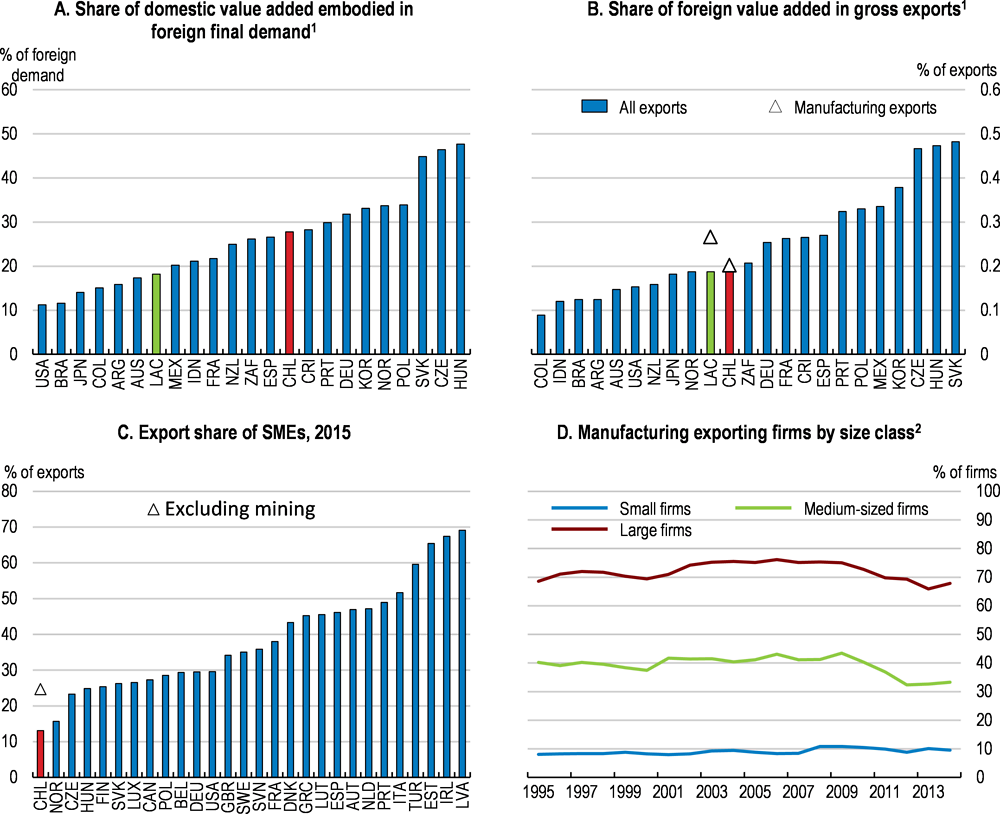

New sources for broader-based growth are needed over the longer term

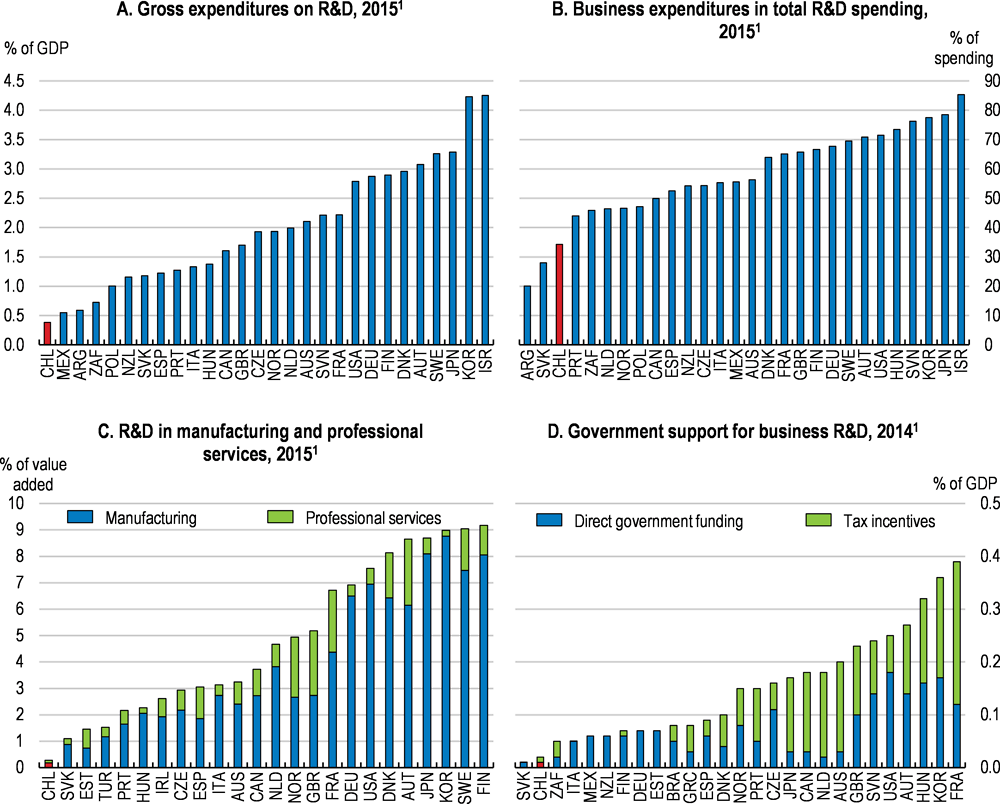

To sustain growth Chile needs to diversify the economy towards non-resource activities. The economy remains highly dependent on copper (Box 2) and commodity prices and salmon diseases have challenged the traditional engines of growth. Mining, fisheries and aquaculture and forestry exports, with the exception of fruit and wines, have seen a sharp reduction in their growth rates over the past decades. Progress towards more resilient and inclusive growth is held down by low skills, pervasive labour market mismatches, and difficulties of small and young dynamic firms to grow. According to OECD simulations, structural reforms could boost new sources of growth substantially (Box 3). Largest gains come from improving product market regulations in network sectors and streamlining business regulations and permitting procedures.

Box 2. Copper and the economy

Chile’s copper resources are estimated at 29% of the world’s copper reserves and is the largest copper producer, having produced 37% of the world’s copper in 2016 (Cochilco, 2017). However, the employment contribution of the sector is close to only 3% owing to the high capital intensity of the sector. Public revenues from the copper industry constitute an important share of government income but have recently been affected by the low copper prices.

Table 4. Copper dependence in Chile in 2010-16

|

|

2010-2016 |

2016 or last available data |

|---|---|---|

|

Mining gross value added (% of constant prices GDP) |

11.0 |

10.3 |

|

Of which copper gross value added (% of constant prices GDP) |

9.8 |

9.2 |

|

Employees in the mining sector (% of total employment) |

2.9 |

2.5 |

|

Mining exports (% of current prices total goods exports) |

56.6 |

50.9 |

|

Of which copper exports (% of current prices total goods exports) |

52.1 |

46.4 |

|

Mining investment (% of constant prices gross fixed capital formation) |

25.21 |

22.2 |

|

Copper revenues (% of central government fiscal revenues) |

11.4 |

1.7 |

|

Of which state-owned companies (% of central government fiscal revenues ) |

6.1 |

1.7 |

|

Of which private companies (% of central government fiscal revenues ) |

5.3 |

0.0 |

1. 2010-2015.

Source: Central Bank of Chile (2017), Statistical database, Cochilco (2017), 1997-2016 Yearbook: Copper and Other Mineral Statistics and Dipres (2017).

Revenues from the copper sector are (OECD, 2014): i) a special tax on the profits of Codelco, the largest state-owned mining firm which produce around one third of Chilean copper; ii) a tax (10%) on copper exports of Codelco-owned mines that goes directly to the Ministry of Defence (Ley Reserveda del Cobre); iii) corporate taxes on private mining firms; and iv) the 2006 royalty fees (Royalty minero) for medium and large mining firms which rates depend on the firm’s profit (between 0 and 14%). Changes in government revenues related to changing copper prices are smoothed thanks to the fiscal rule (Box 1).

Source: OECD (2014), Export restrictions in raw material trade: facts, fallacies and better practices 2014, OECD Publishing; Cochilco (2017), 1997-2016 Yearbook: Copper and Other Mineral Statistics.

Box 3. Illustrative simulations of the potential impact of structural reforms

Simulations, based on historical relationships between reforms and growth in OECD countries, allow gauging the impact of the structural reforms proposed in this Survey and are based on specific examples of reforms, spending and tax changes (Table 5). These estimates assume swift and full implementation of reforms in three main dimensions (Table 6): product market regulations, investment policies and employment protection of regular contracts and other measures to increase labour supply, notably pension and childcare.

Table 5. Potential impact of structural reforms on GDP per capita after 10 years

|

Structural policy |

Policy change |

Total effect on GDP per capita |

Impact on supply side components |

|||

|---|---|---|---|---|---|---|

|

2016 |

After reform |

MFP |

K / Y |

L / N |

||

|

|

|

in percent |

in percent |

in pp2 |

||

|

Product market regulation1 |

||||||

|

Improve regulation in network sectors (Rail, telecoms and post) |

2.0 |

1.5 |

1.4 |

1.0 |

0.2 |

0.2 |

|

Streamline business licensing and regulations |

1.5 |

1.2 |

1.4 |

0.7 |

0.2 |

0.5 |

|

Investment specific policies1 |

||||||

|

Increase business R&D expenditures |

0.1 |

0.3 |

0.5 |

0.5 |

||

|

Labour market policies1 |

||||||

|

Improve labour market regulations |

2.6 |

2.3 |

0.6 |

0.5 |

0.2 |

|

|

Increase spending on activation |

3.3 |

7.0 |

0.3 |

0.1 |

0.1 |

|

|

Increase family benefits in kind |

0.8 |

1.0 |

0.4 |

0.2 |

||

|

Increase the legal retirement age |

62.5 |

65.0 |

0.6 |

0.4 |

||

|

Total |

5.2 |

|||||

1. Table 6 presents the detailed measures.

2. Percentage points.

Source: OECD calculations based on Balázs Égert and Peter Gal (2017), "The quantification of structural reforms in OECD countries: A new framework", OECD Journal: Economic Studies, Vol. 2016/1 and Balázs Égert (2017), “The quantification of structural reforms: taking stock of the results for OECD and non-OECD countries”, OECD Economics Department Working Papers, forthcoming.

Table 6. Type of reforms used in the simulations

|

Structural policy |

Structural policy changes |

|

|---|---|---|

|

Product market regulation |

||

|

Improve regulation in network sectors (Rail, telecoms and post) |

Eliminate the constraints on the number of competitors in freight and passengers services. Creating an accounting and legal separation between infrastructure managers and service providers. Remove barriers to entry for service providers by imposing local loop unbundling. Remove entry barriers on providing basic letter services. |

|

|

Streamline business licensing and regulations |

Develop further the single digital contact point (Escritorio Empresa) at the national and integrated agencies at the local level for all licensing procedures. Use systematic “silent is consent” rules to speed up procedures. |

|

|

Investment specific policies |

||

|

Increase business R&D expenditures |

Increase public incentives by 0.1% of GDP to raise business R&D from 0.1% of GDP to 0.3% of GDP. This assumes a long-run elasticity of business R&D around 0.5: on average, one extra dollar of public incentives induces half a dollar of recorded private R&D spending. |

|

|

Labour market policies |

||

|

Improve labour market regulations |

Lower severance payments from 1 month per year of tenure and a minimum of 6 months to 1/4 monthly salary per year of tenure and drop the minimum cap. |

|

|

Increase spending on activation |

Increase expenditure per unemployed as a percentage of GDP per capita from 3.3 to 7. |

|

|

Increase family benefits in kind |

Increase family benefits in kind, such as childcare services, from 0.8% of GDP to 1%. |

|

|

Increase the legal retirement age |

Raise the legal retirement age of women to 65. |

|

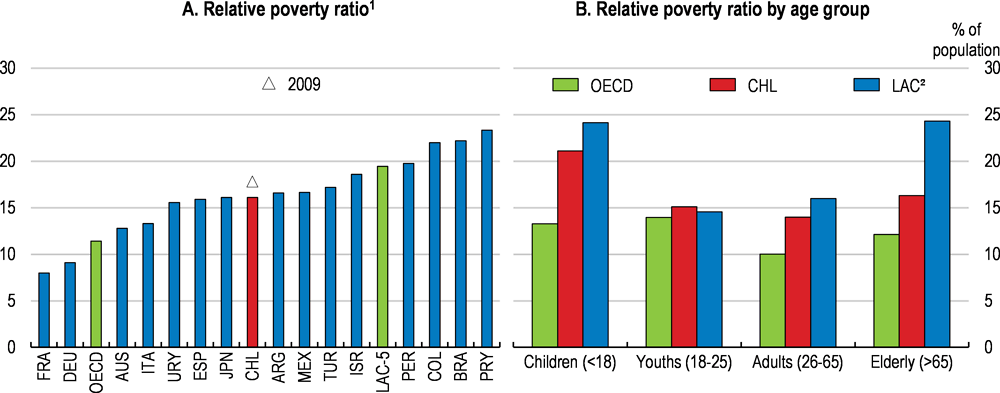

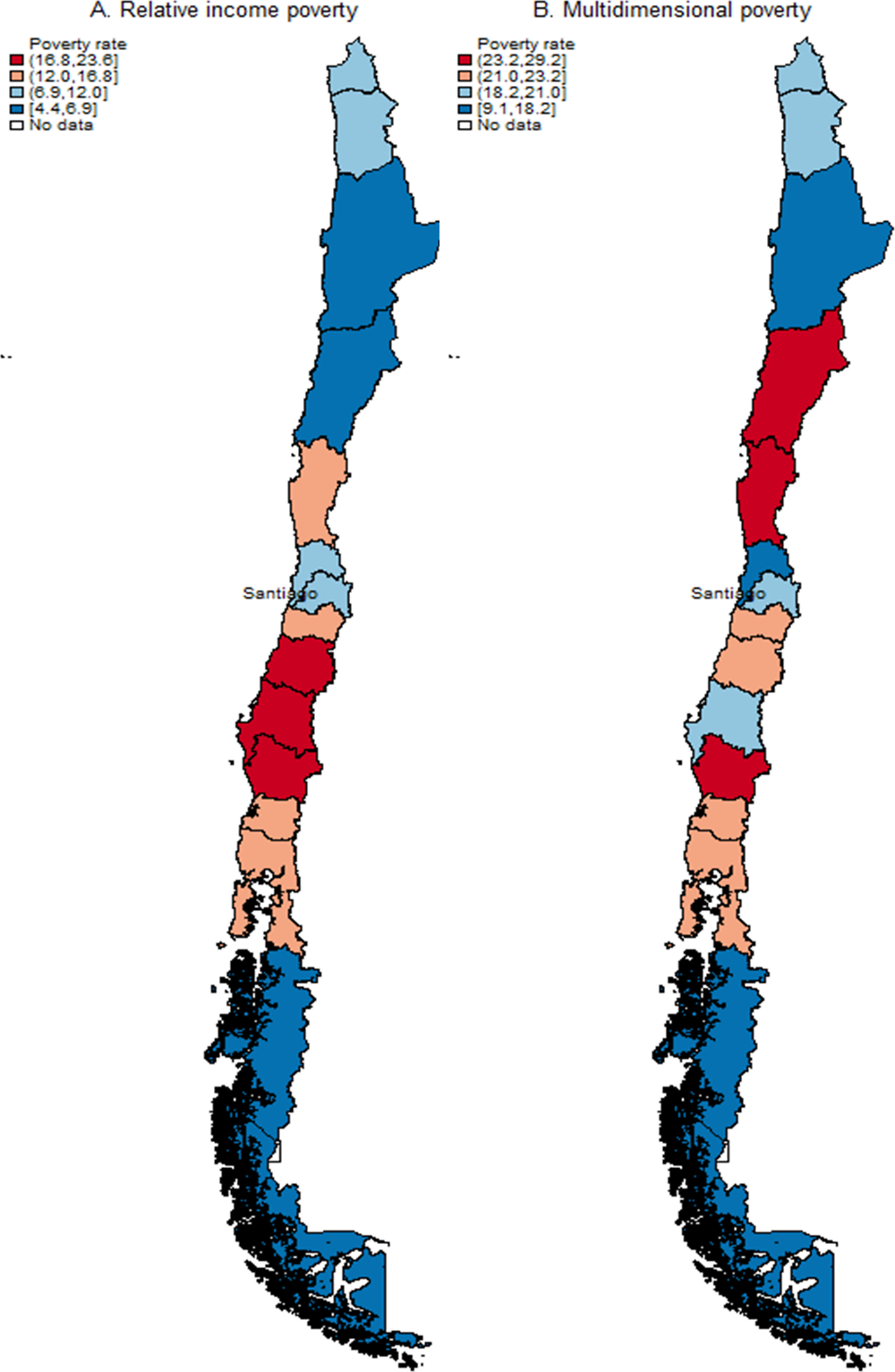

Sustainable growth also needs to be more inclusive. The illustrative structural reform package in Box 3 would have a positive impact on inclusiveness outcomes, notably by improving job quality, while competition and innovation policies may also contribute to enhance equity, by reducing firms’ rents and market dominance (OECD, 2017b). Income inequality and poverty have declined substantially and they are lower than in other countries of the region. However, inequality remains high. Poverty rates remain high in some groups, notably for the youth, young adults and those with children (Figure 14). The significant intergenerational transmission of income levels also points to entrenched inequalities (Daude and Robano, 2015; OECD, 2010). In addition, poverty varies significantly across regions (Figure 15). High inequalities among regions relate to differences in economic diversification, the quality of education and skills and public services provision (such as, training, health and job search assistance). For example, differences among municipalities in the provision of training courses, and technical and professional formation are large and lead to unequal opportunities, notably for rural households and some indigenous groups (Correa and Dini, 2017; World Bank, 2017).

Figure 14. Poverty has declined substantially but remains high

1. Relative poverty rates after taxes and transfers (threshold of 50% of the median income). Data for Argentina are from the third quarter of 2016 and are representative of urban centres of more than 100.000 inhabitants. Data for all other countries refer to 2014 or Chile for 2015. LAC-5 refers to Argentina, Brazil, Colombia, Mexico and Peru.

2. LAC refers to Bolivia, Chile, Dominican Republic, Ecuador, Mexico, Peru, Paraguay, Panama and Uruguay.

Source: CEDLAS (2017) and OECD Income Distribution Database (2016).

Challenges of making growth more inclusive will rely on reducing informality, improving social spending, and creating high quality opportunities in the labour market and through education. Equity would rise with higher social spending and a reform of the pension system that currently leave many with very low entitlements. Better access to quality jobs and education are also important avenues for inclusiveness, which also help raise incomes through higher productivity and better export performance. These are discussed in more detail below.

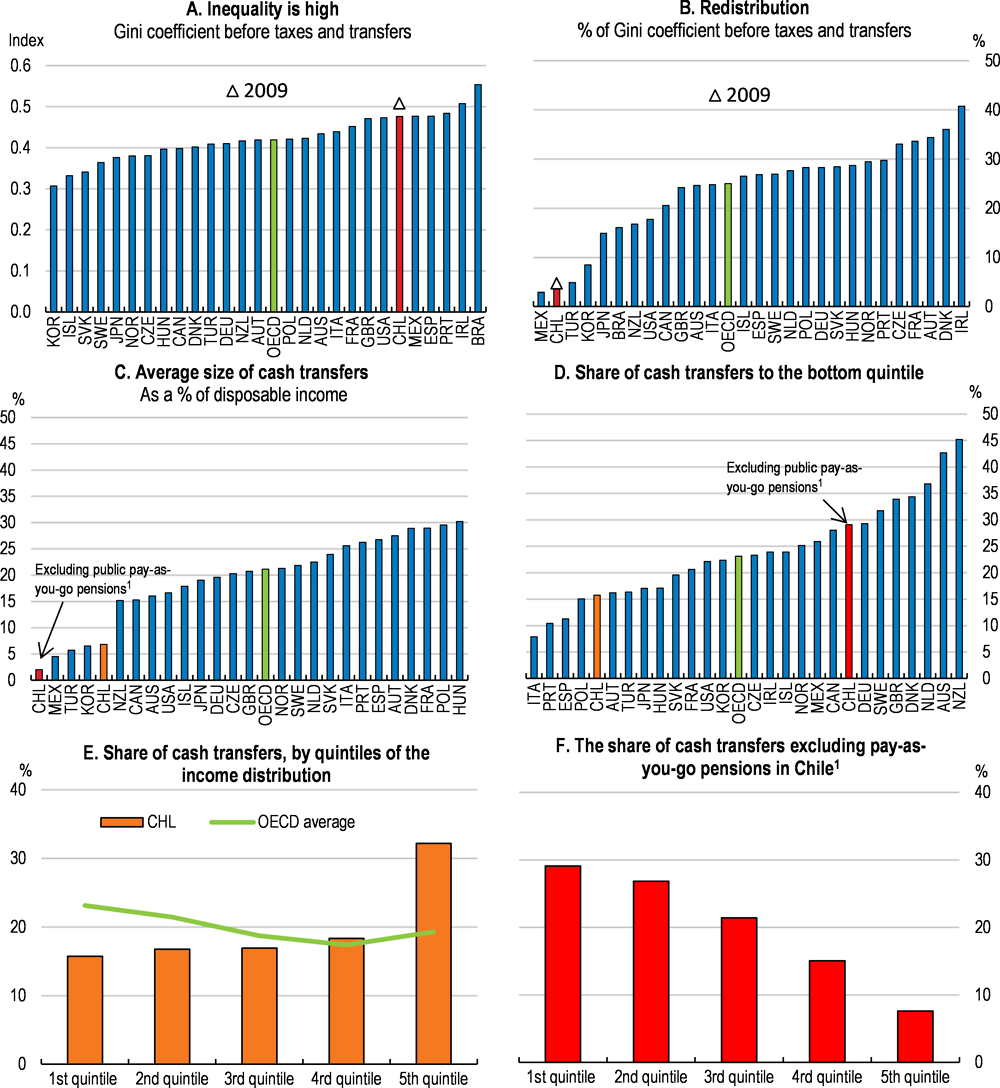

Strengthening social support

The tax and transfer system could do more for redistribution (Figure 16). Although recent efforts improved social protection and lowered poverty, public social expenditures on families accounted for only 1.8% of GDP in 2015, below the OECD average of 2.2%. The government has strengthened the cash transfers system for vulnerable households. However, cash-based redistribution among the working-age population remains low by international standards (Panels C). Higher redistribution could be achieved by higher cash transfers towards vulnerable populations and spending on universal assistance, such as family or education-related transfers (Causa and Hermansen, 2017).

Eligibility to means-tested cash transfers and in-kind benefits has recently been revised. A new tool (Registro Social de Hogares) has been implemented in 2016 building mainly on administrative data (Annex). It improves transparency and reduces potential bias in the estimation of the vulnerable population that was previously based on self-reported data (Larrañaga et al., 2015). The new system is perceived by Chileans as fairer and more transparent (IDS, 2017). It should be carefully evaluated and corrected in case of need to better target vulnerable groups.

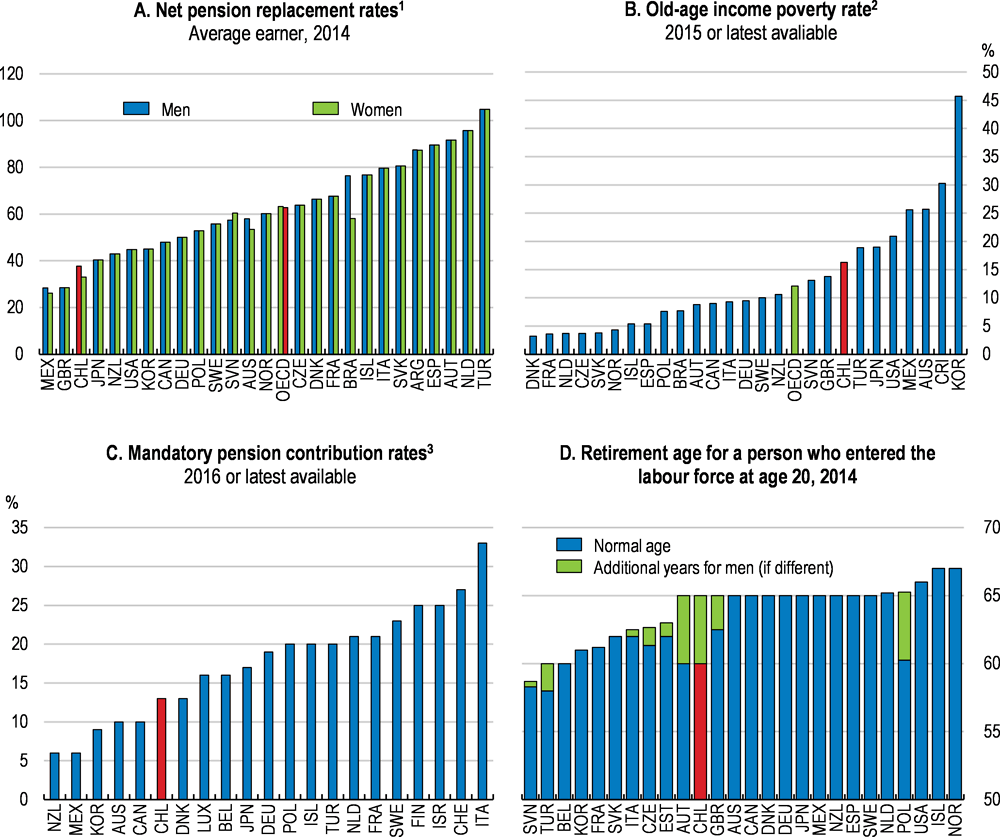

Raising equity with ongoing pension reform

Chile’s private funded pension system, complemented by a public solidarity pillar, is delivering modest pensions for middle-income individuals. Low contributions, a low retirement age of 60 years for women (65 for men), and contribution gaps caused by self-employment, informal employment, unemployment or professional inactivity reduce old-age pensions, notably for women (Bravo et al., 2015). In the absence of reform, the projected replacement rate for an individual that retires in 40 years is low according to the OECD pension model (Figure 17). Weak lifetime savings contribute to old-age poverty. The adoption of a 2017 draft bill would improve pension replacement rates and equity for middle-income individuals and complement the 2008 public solidarity pillar that helped reduce old-age poverty. In line with past OECD recommendations (OECD, 2016b), the 2017 draft bill foresees a gradual increase in mandatory employers’ contributions by five percentage points until 2021 and increase the ceiling on contributions of high-income workers (Annex and Box 4).

Box 4. The 2017 draft pension bill

The 2017 draft bill would increase the pension contribution rate by five percentage points. These additional employer contributions would be managed by a new public entity. Three percentage points from the additional contributions would be allocated in new individual public accounts and two percentage points would finance a new redistributive fund. This would complement the 2008 public solidarity pillar targeted at the lowest-income retirees. The new redistributive fund would have three elements:

A transitory inter-generational component: this would complement the current pensions from the private pension system and increase private pensions by 20% initially and be progressively phased out as the impact of higher contributions would fully kick in around 2080.

A permanent women top-up: women would receive transfers to bring their pensions at a level comparable to men over a longer time span. The compensations would depend of the retirement age and women would receive the same pension of a male retired with the same age and savings only if they retire at age 65 or later. This would increase incentives to delay retirement.

A permanent intra-generational component across retirees: once the inter-generational component and women top-ups are financed, the remaining additional contributions would be transferred to the new public individual accounts. Each individual would receive contributions based on the number of months they contributed during the year and independent of their monthly earnings.

The draft bill would also expand the coverage of pension contributions to unemployed workers under private individual unemployment insurance accounts, while today pension contributions are only paid by unemployed under the unemployment solidarity pillar (Fondo Solidario). In addition, the reform would make pension contributions mandatory for the self-employed who issue invoices, with a phase-in period of six years. Finally, for new low-income pensioners, the bill would improve longevity risk protection by ensuring a defined-income-tested pension through the pension supplementary complement (Aporte Previsional Solidario).

Overall these measures would go in the right direction. However, extending the retirement age, especially for women, could raise GDP per capita by 0.6% after 10 years (Box 3) and establishing a link between retirement ages and life expectancy would also help maintain reasonable pension replacement rates and sustainability over the medium term. Further increasing the non-contributory safety net (Pensión Básica Solidaria) and the provisional solidarity support (Aporte Previsional Solidario) would reduce old-age poverty, even if a high increase could have adverse effects on public finances, household savings and formalisation (OECD, 2013). The OECD had also recommended separating the sources of financing for non-contributory and contributory public pensions (OECD, 2016b).

Figure 15. Regional disparities in poverty rates are high

Note: Relative poverty rates after taxes and transfers (threshold of 50% of the median income) in 2015. The multidimensional poverty measure captures deprivations in education, health, jobs and social security, housing, and network and social cohesion.

Source: OECD calculations using CASEN 2015.

Figure 16. Low cash transfers to the working-age population hamper redistribution

1. Cash transfers excluding pensions from the old pension system and military pensions for Chile.

Note: Data refer to the working-age population and the latest available year (2015 for Chile). Redistribution is measured by the difference between the Gini coefficients before and after taxes and transfers, in per cent of the Gini coefficient before taxes and transfers. Monetary subsidies include cash support, such as work-related insurance transfers (i.e. unemployment insurance, sickness, maternity leave, work-injury benefits); universal transfers (i.e. disability, family, education-related transfers covering the whole population or part of it on the basis of criteria other than income or previous employment); and assistance transfers (i.e. social, unemployment, family and education assistance, often subject to income or assets tests). In-kind transfers, such as health or educational services are not included. Housing benefits are not included.

Source: OECD, Income Distribution Database and Causa, O. and M. Hermansen (2017), "Income redistribution through taxes and transfers across OECD countries", OECD, Economics Department Working Papers, No. 1453.

Figure 17. Pensions remain low and unequal

1. The net replacement rate is calculated assuming labour market entry at age 20 in 2014 and a working life equal to the pensionable age in each country The net replacement rates shown are calculated for an individual with the average worker earnings.

2. Percentage of the population aged over 65 with equivalent incomes below half median household disposable income.

3. Includes the average private pension management fee of 1.16% as well as the disability insurance of 1.41% of the employees’ gross income the employer has to pay the pension fund manager (2016).

Source: OECD (2015), Pensions at a glance 2015 and; OECD (2017), Income Distribution Database.

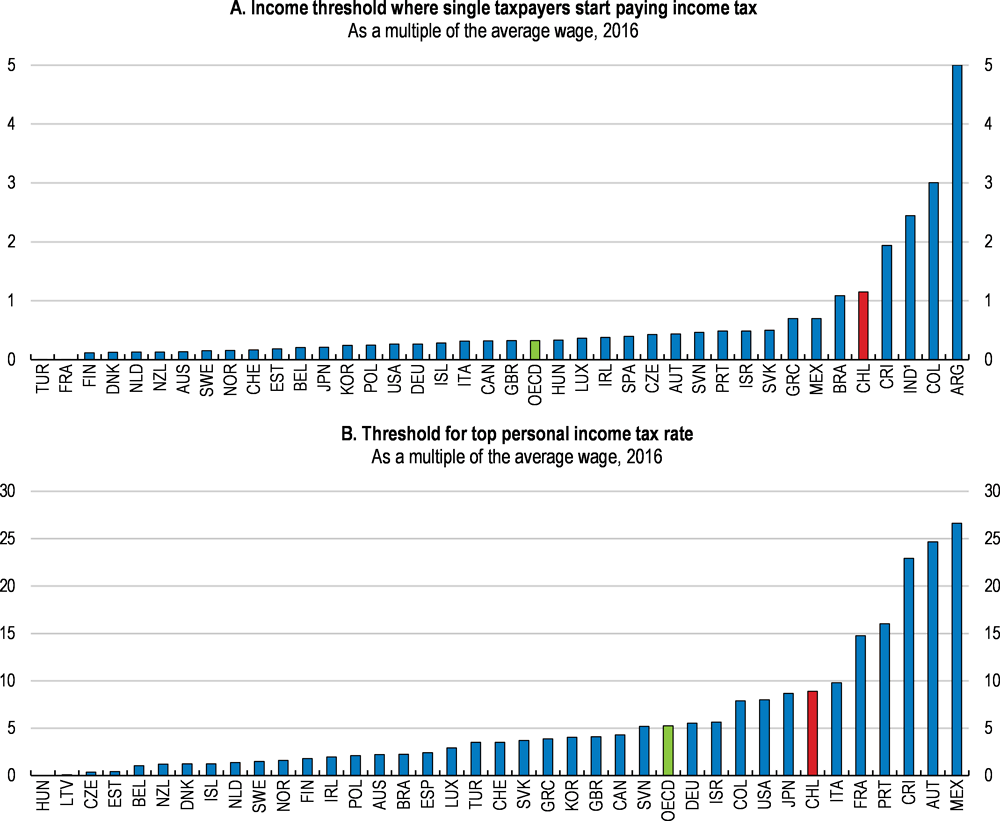

Financing higher social spending and increasing redistribution through tax reform

Higher social spending will require continuing to reform the tax system to increase revenues and improve growth and equity in the medium term (Box 5). The 2014 tax reform was phased in over 2015-17 and involved significant changes in corporate and personal income tax liabilities, particularly regarding shareholders taxation. It increased the overall effective tax rates on higher-income individuals, because of the immediate – accrual - taxation of firm profits (World Bank, 2014) and introduced welcome environmental taxes. However, additional revenues could still be raised in a productivity-, environmentally-, and equity-friendly way, as argued in the previous Surveys (OECD, 2013a and 2015e). The personal income tax yields a low share of overall revenue mainly because the tax base is very narrow. Almost 76% of tax payers are exempted and the top rate applies only at very high income levels (Figure 18). As a result, the current personal income tax has poor redistributive power in Chile (Barreix et al., 2017). Making significant changes in the personal income tax rate schedule, especially by lowering the bands at which the personal income tax and the higher income rate are levied could lead to an increase in revenues of 1.3% of GDP (IADB, 2013).

Figure 18. Personal income tax structure

1. For India, the average worker income is for the organised manufacturing sector as reported in the Annual Survey of Industries.

Note: For Chile, data refer to the 2017 thresholds divided by the 2016 average wage.

Source: OECD, Taxing wages in Latin America and the Caribbean 2016; OECD, Taxing Wages 2011; OECD, Tax Database; Servicio de Impuestos Internos and; OECD calculations.

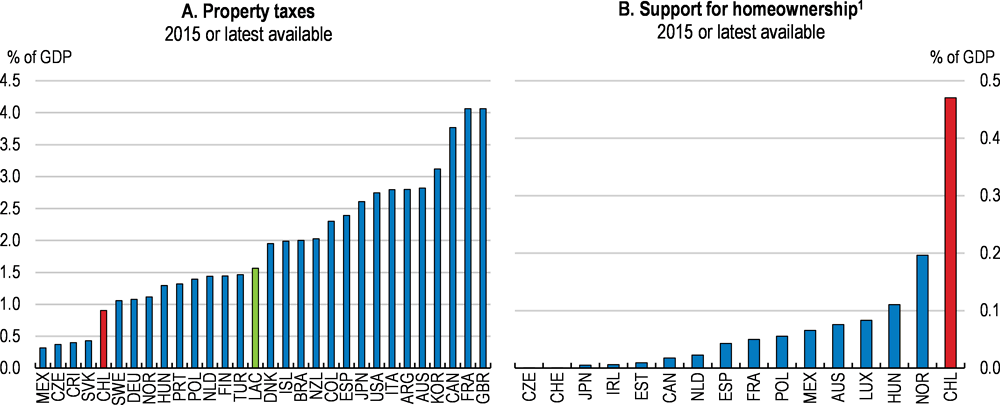

In a welcome move, the 2014 tax reform eliminated the VAT exemption on the customary sale of new or used property in 2017. It also included a capital-gain tax on the sale of residential property acquired after 2004. Over the lifetime of each taxpayer capital gains over around USD 310 000 are taxed. This could mitigate the negative impact on the residential mobility of households. Despite these advances, there is room to reform housing taxes and support programmes, so that owning is not favoured over renting, thus easing the geographic mobility, notably of low-income households, by developing the rental sector (Caldera Sanchez, 2012; Salvi Del Pero, 2016). Property tax revenues were amongst the lowest in the OECD in 2015 (Figure 19, Panel A). Exemptions of housing tax and inheritance tax for housing and mortgage interest deduction should also be progressively eliminated (Panel B) as they tend to be capitalised into real house prices. This would redistribute income from insiders towards new entrants in the housing market and lower-income households and would avoid overly penalising newly indebted household through a sharp decline in housing values (Caldera Sanchez, 2012).

Figure 19. Property taxes are low and support for homeownership is high

1. The estimate for Chile is a lower bound. It includes the “Solidarity Fund for Housing Choices” and “Integrated Housing Subsidy System”, but spending on the “Extraordinary Programme for Economic Re-launch and Social Integration” is not included.

Source: OECD (2017), Revenue Statistics and Affordable Housing databases; OECD/ECLAC/CIAT/IDB (2017), Revenue Statistics in Latin America and the Caribbean 2017, OECD Publishing.

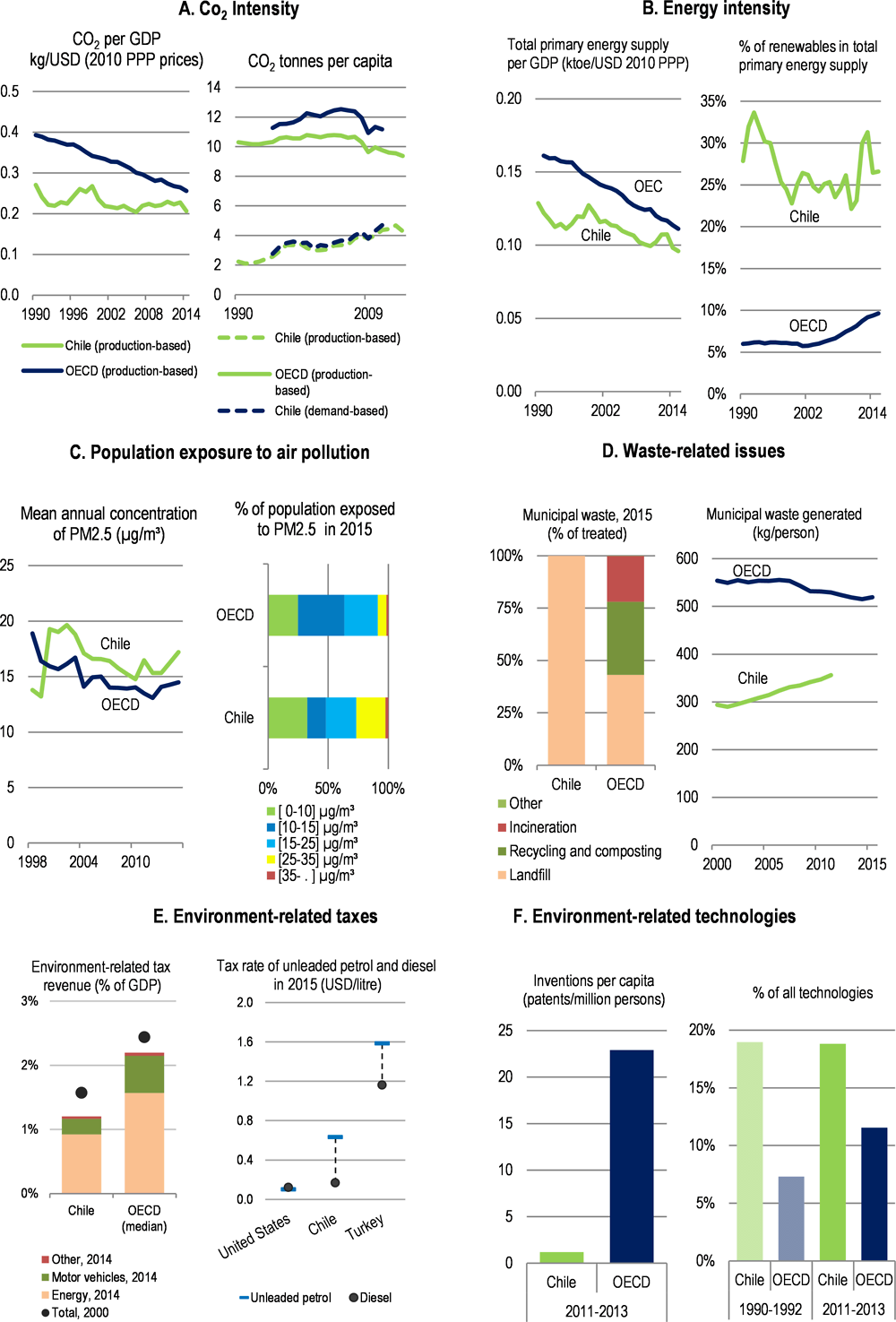

Developing green taxes will also be crucial to internalise the externalities associated with production and consumption. Since 2014, the tax rate on new car purchases is based on emissions and fuel efficiency. Chile also introduced a carbon tax and a tax on local air pollutants in 2017. The carbon tax will help to increase the currently very low effective tax rates on fuels (OECD, 2013b). However, its base should be broadened as it covers only a small share of energy users, while its rate is low (OECD, 2016c). Revenues from environmentally-related taxes remain among the lowest of all OECD countries (Figure 39). Energy taxes are only levied on road fuels and at a very low level and the petrol-diesel tax differential is among the largest in the OECD. Heavy trucks get a refund on diesel taxes, and energy used outside the transport sector is effectively not taxed (OECD, 2013b; 2016b). Chile should increase taxes on fuels to levels that are aligned with their external costs, phase out the tax refund for the diesel for trucks, and broaden the coverage of the vehicle tax to commercial vehicles.

Box 5. Estimated long-term fiscal effects of some key OECD recommendations

Table 7 presents an order of magnitude of the long-term fiscal effects of some of the OECD recommendations presented in this Survey. These estimates are based on illustrative scenarios for specific spending and tax items, existing estimates for the elasticity of taxes to GDP, and the Ministry of Finance’s evaluation of the pension reform announced in 2017. The effects of the structural reforms quantified in Box 3 are decomposed into their impact on GDP, including estimated behavioural responses, and their direct fiscal costs.

Table 7. Illustrative long-term fiscal effects of some OECD recommendations

|

Measure |

Change in fiscal balance (% GDP) |

|---|---|

|

Accounting effects of the structural reforms proposed in Box 3 |

|

|

Increase family benefits in kind, such as childcare services, from 0.8% of GDP to 1%. |

-0.2 |

|

Increase expenditure per unemployed as percentage of GDP per capita from 3.3 to 7. |

-0.4 |

|

Increase public support for business R&D to raise business R&D from 0.1% of GDP to 0.3% of GDP. This assumes a long-run elasticity of business R&D around 0.5: on average, one extra dollar of public incentives induces half a dollar of recorded private R&D spending (Westmore, 2013). |

-0.1 |

|

Accounting effects of other revenue and spending measures |

|

|

Increase property tax, notably recurrent taxes on housing, from 0.9% of GDP to OECD median (1.7%) |

0.8 |

|

Increase green taxes from 1.2% of GDP to OECD median (2.2%) |

0.9 |

|

Increase spending on the solidarity pillar from 0.8% of GDP to 1.0%. |

-0.2 |

|

Expected impact of other measures as evaluated by other institutions |

|

|

Lower the bands at which the personal income taxes and the higher income rate are levied to the OECD average (IADB, 2013). |

1.3 |

|

Raise employer pension contributions by 5 percentage points. The measure increases contributions on public employees and lower personal income tax revenues for public and private workers (Dipres, 2017). |

-0.5 |

|

Effect of structural reforms in Box 3 on the budget through higher GDP growth |

|

|

The estimated impact on GDP per capita (Box 3) would lead to higher GDP by 5.2%, abstracting from population growth. The public-spending-to-GDP ratio of 23.8% of GDP in 2016 would be lowered to 23.8/1.05222.6% of GDP and, assuming a long-run tax revenues to GDP elasticity of one (Frickle and Sussmuth, 2014), the estimated effect on the fiscal balance would be 1.2% of GDP. |

1.2 |

Source: OECD calculations based on IADB (2013), Recaudar no basta: los impuestos como instrumento de desarrollo; Frickle, H. and B. Sussmuth (2014), “Growth and volatility of tax revenues in Latin America”, World Development, Vol. 54, pp. 114-138; Dipres (2017), Informe Financiero: Proyecto de ley que crea nuevo ahorro colectivo, aumenta cobertura de pensiones y fortalece el pilar solidario; and Westmore, B. (2013), "R&D, Patenting and Growth: The Role of Public Policy", OECD Economics Department Working Papers, No. 1047, OECD Publishing.

Enhancing access to high-quality jobs

Job quality, in the form of earnings, labour market security and the quality of the working environment can raise well-being, foster productivity while reducing labour market inequalities (Cazes et al., 2015). Chilean workers do not perform badly in many dimensions of job quality when compared to other workers in emerging economies, while, they experience relatively poor job quality compared to other OECD countries (OECD, 2015b). Low average earnings and high levels of inequality weigh on workers’ well-being, as well as a relatively weak social protection.

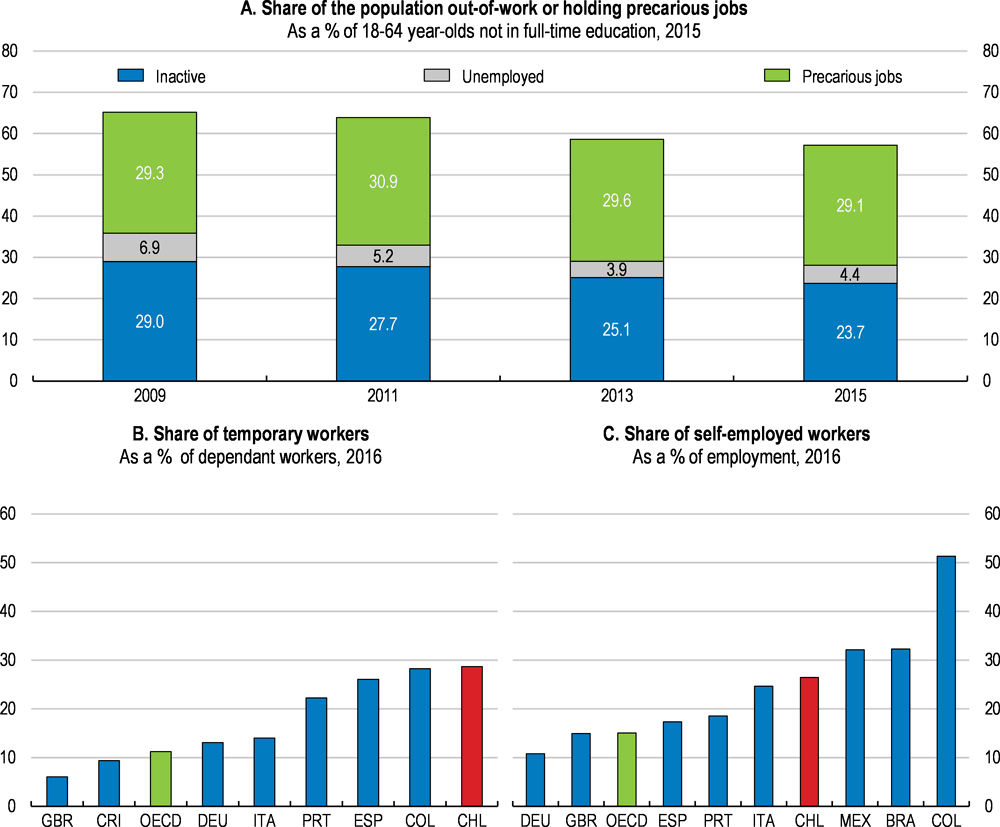

The segmented labour market weighs on productivity and the quality of jobs

Excessive reliance on self-employment and short-term contracts has led to a high share of workers holding precarious jobs (Figure 20). The share of temporary contracts, although decreasing since 2012, is the highest among OECD countries. Informality, the share of wage earners and self-employed without contributions to the pension system, was 32% of employment in 2015 and has been stable since 2006 held back by cyclical conditions. Informality affects particularly the low-skilled, women, youth, immigrant and indigenous workers. Temporary and informal workers typically face a wage penalty and frequent unemployment and inactivity spells (Gonzalez and Huneeus, 2016; OECD, 2015b) and are less likely to receive on-the-job training (Carpio et al, 2011).

Figure 20. A high share of the population holds precarious jobs

Note: Precarious jobs are defined as unstable jobs (all those jobs being not permanent) or informal jobs (not affiliated to the pension system) or having near zero earnings (monthly labour income is lower than the first decile) or jobs with restricted hours (working less than 20 hours a week).

Source: Garda and Undurraga, “Employment barriers of vulnerable groups in Chile”, forthcoming and; OECD Labour Force Statistics Database.

A 2016 reform expanded the coverage and scope of collective bargaining, extended collective bargaining rights, and eliminated the replacement of workers on strike. So far, the implementation of the reform did not have an impact on litigation (Ministry of Labour, 2017). During the first six months of 2017, compared to the same period over 2010-15, the proportion of firms going to strike went down while the duration of strikes remained stable. Increasing worker’s negotiating power is important, particularly in a country characterised by vast inequalities, but further reforms need to address the segmentation of the labour market.

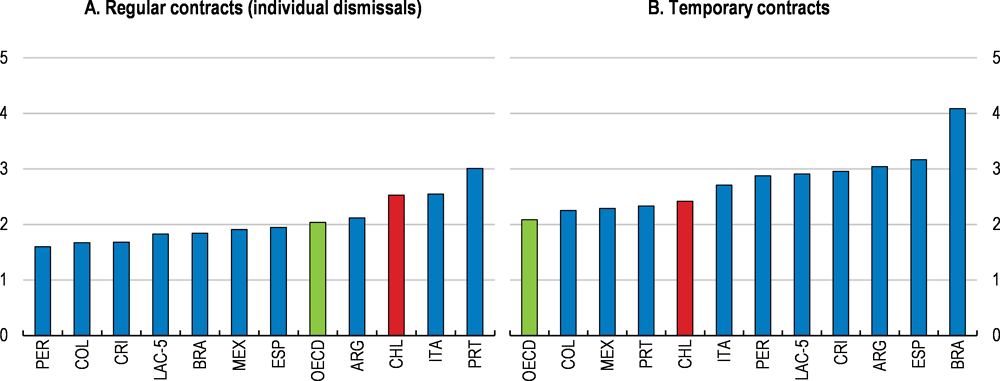

Decreasing labour market rigidities would help to generate more permanent and formal jobs (Di Porto et al., 2017; IDB, 2015; OECD, 2008). Employment protection legislation on open-ended contracts is relatively restrictive in Chile (Figure 21). Reducing the costs of dismissing a permanent worker, notably the high severance payments, would increase the chance of workers obtaining permanent contracts and training, increasing productivity and wages. It would also facilitate better job matches and mobility of high-ability workers towards innovative firms (Adalet McGowan and Andrews, 2017). Reducing dismissal costs on permanent contracts could increase GDP per capita by 0.6% after 10 years (Box 3). An alternative would be to introduce a contract with employment protection increasing with tenure, as similarly done in Italy and Spain (OECD, 2017c; OECD, 2017d). To further enhance formalisation expanding existing wage subsidies for young and low-paid workers in newly formalised jobs would be advisable. This would benefit the most vulnerable by decreasing the cost of formalisation and could increase their access to high-quality jobs. These reforms would boost inclusiveness, given that informal and temporary workers have both the lowest salaries and the lowest levels of protection, and increase growth by curbing low-productivity and low-quality jobs.

Figure 21. Formal employment protection legislation appears to be restrictive overall

Index scale of 0 to 6, from least to most restrictive, 2013¹

1. Or most recent available year.

2. LAC-5 refers to the simple average of Argentina, Brazil, Colombia, Mexico and Peru. OECD refers to the simple average of OECD countries.

Source: OECD (2017), Employment Protection Legislation Indicators Database.

Reforms to the employment protection legislation should be accompanied by a more effective social safety net and efficient on-the-job training, placing and re-skilling policies. The unemployment benefit system, which is based on individual accounts with complements from an insurance fund (Solidarity Fund), assures that workers have savings in the event of losing their jobs and avoid work disincentives (Reyes et al., 2010). Recent measures increased replacement rates and eased access to the Solidarity Fund increasing its take-up rate. However, the coverage and benefits of the unemployment system remain limited, in part due to self-employed workers. The main reason is the short duration of employment contracts and their high turnover (Gonzalez and Huneeus, 2016; Central Bank of Chile, 2016). Only 50% of employees that terminate a contract in a year have enough contributions in their accounts to access benefits. Also, 50% of the workers under fixed-term contracts have non-contributing periods lasting more than three months in 2015 which impedes their access to the Solidarity Fund (Sehnbruch et al., 2017). Reducing the required minimum contribution periods would increase coverage of vulnerable jobseekers, in line with the short duration of contracts.

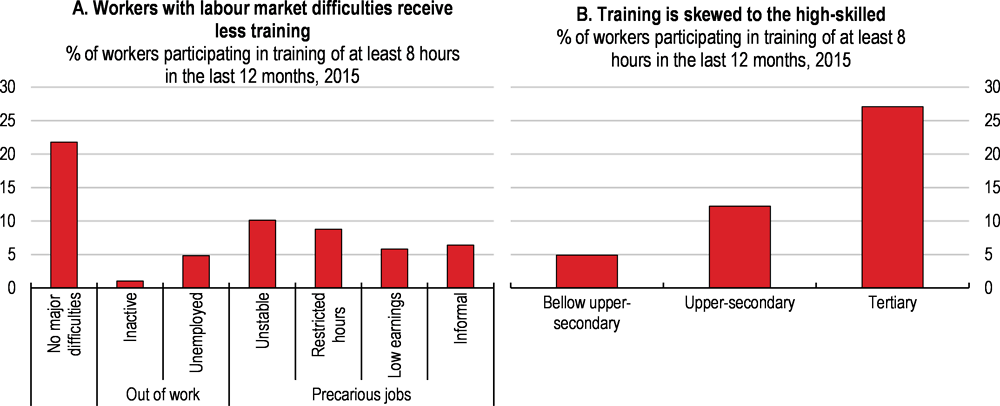

Improving the effectiveness of active labour market policies

Chile lacks a lifelong learning system with well-defined objectives and a clear national regulatory framework. Inequities in the access to training have hold back productivity and inclusiveness. Low-skilled workers and those facing labour market difficulties receive less training (Figure 22). Several studies have concluded that publicly funded training programmes and the life-long training system are ineffective and poorly targeted (Larrañaga et al., 2011). The main public programme (Impulsa Personas), allocated to firms through tax credits, has benefited mostly large firms, which tend to have less vulnerable and more educated workers (Larrañaga et al., 2011; Rodriguez and Urzúa, 2011).

Figure 22. Training programmes are badly targeted

Note: Panel A refers to people aged between 18 and 64 not in full-time education. People facing labour market difficulties are out-of-work (unemployed or inactive). Workers holding precarious jobs are defined as unstable jobs (all those jobs being not permanent) or informal jobs (not affiliated or contributing to the pension system) or having near zero earnings (monthly labour income is lower than the first decile) or jobs with restricted hours (working less than 20 hours a week). See Garda and Undurraga (forthcoming) for definitions. Panel B refers to people aged 25-64.

Source: OECD calculations based on CASEN (2015).

Training programmes should be re-thought to target the workers most in need. Recently, some efforts to raise the inclusiveness and effectiveness of training policies have been undertaken (Annex). These efforts should continue and more coordination among the actors providing or receiving training should be achieved. Quality certification should become a requirement for public training programmes. Another desirable change is to limit their eligibility to workers with medium and low salaries, so as to allocate public resources to those who have less ability to pay and greater deficiencies in labour competencies.

A systematic and regular assessment of the labour market impact of activation programmes should be implemented, so as to focus funding on those that are performing well. This would allow investing in more effective programmes, such as Más Capaz, targeted to the most vulnerable, including women, young and low-skilled workers. These types of training programmes have proven to be modestly (but persistently) effective in terms of the quality of the jobs found in the region (IDB, 2015), especially for the unemployed in Chile (Brown et al., 2016). However, it would be desirable to include modules for the development of socio-emotional skills and on-the-job training to achieve a larger impact, especially for those out of work (IDB, 2015).

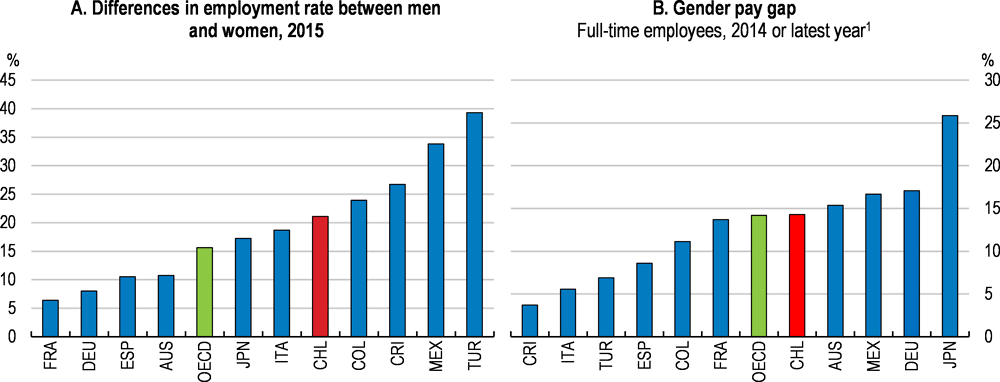

Creating more opportunities for women

Despite progress, the difference in employment rates between men and women at 20 percentage points is clearly larger than in the average OECD country (Figure 23). This holds back growth and equity, as increased employment opportunities for women could contribute to a more equal income distribution (Causa et al., 2015). Women also get substantially lower pay and their jobs are usually of lower quality, informal or temporary. The participation of women in the labour market or in good quality jobs is held down at least in part by economic barriers related to costly childcare (Garda and Undurraga, forthcoming).

Figure 23. Gender gaps remain large

1. Gender pay gap is difference between male and female median wages divided by the male median wages.

2. For Chile and Mexico, data refer to 2015. For France and Spain, data refer to 2012.

Source: OECD, Employment Database.

Reforms to increase coverage and raise the quality of early childhood education and childcare were recently introduced (Annex). Efforts towards universal early education have raised coverage to 86% and 93% for 4 and 5 year olds respectively in 2015, very close to the OECD average. Still, for children aged 3, at 56% the coverage remains far from OECD average (78%) (OECD, 2017e). Cultural and social factors also play a significant role in explaining the low female labour force participation. Parents need to understand the importance of sending the children to early education, while centres need to provide high-quality education, be near the house or work, with accessible transport and compatible opening hours. Continuing to expand opening hours, access to high-quality public early childcare and measures to promote the up-take of early education are needed to facilitate quality employment for mothers, notably for the poorest children and in rural areas. This will also have a positive impact on children skills. Furthermore, policies to promote flexible work arrangements, shared mother and father parental leave together with incentives to allow fathers to take parental leave, breaking stereotypes, would reduce female unpaid work (OECD, 2012). In addition, a law requiring firms with more than 20 female employees to provide childcare is a barrier to female employment and is partly capitalised in lower female wages (Rojas et al., 2016; Prada, et al., 2015). Financing childcare through general revenues would raise female employment and wages in medium sized and large firms.

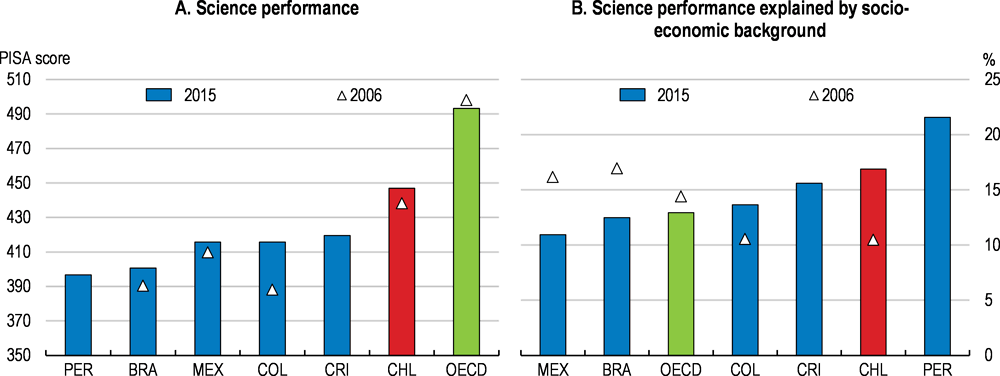

Strengthening the quality of education is key to increasing supply of quality workers

The quality of education is a win-win policy for raising both productivity and inclusive growth. Chile’s education system has made substantial progress in improving coverage and performance (Figure 24). Nonetheless, important challenges remain related to quality and equity. For example, PISA scores in science remain below the OECD average and are largely dependent on socio-economic backgrounds (Figure 25). Chilean students also have larger performance gaps related to gender than in other OECD countries, with boys outperforming girls in science and mathematics (OECD, 2017e).

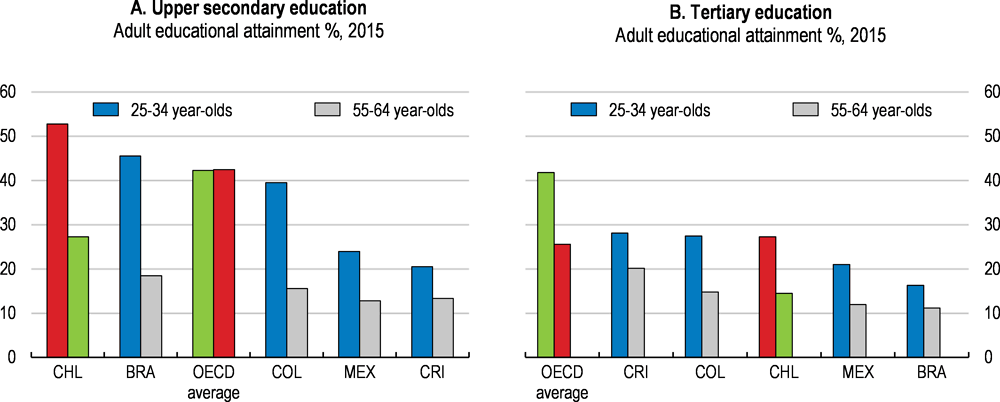

Figure 24. Education attainment has progressed over the recent years

Figure 25. School results have improved, not equity

Note: Panel B displays the percentage of variation in science performance explained by the PISA index of economic, social and cultural.

Source: OECD, PISA 2006 and 2015.

A wide-ranging educational reform was introduced in 2015 to improve quality and equity from early childhood education and care (ECEC) to higher education (Annex). The Inclusiveness law prohibits three widespread practices that historically have contributed to inequity in educational opportunities: student selection, profit making, and co-payment. The reform also increases teacher performance incentives by providing them with better career prospects at all levels of education.

The school reform will help improve social mobility and skills outcomes for all. The country should continue to monitor and discourage school level practices that hinder equality of educational opportunity based on socio-economic status, gender, ethnicity, or immigration status (OECD, 2017f), while pursuing efforts to develop stronger professional pathways for educators and school leaders. Inclusiveness will depend on encouraging girls’ entry into fields of study traditionally dominated by men, such as mathematics and science. Also, maintaining and strengthening the Preferential School Subsidy, which favours schools with larger proportions of vulnerable students, notably indigenous and immigrant children, ensuring that the resources reach schools, monitoring their impact, and creating incentives to invest the majority of the funds in capacity building for continuous instructional improvement, can improve further the quality of education (OECD, 2017f).

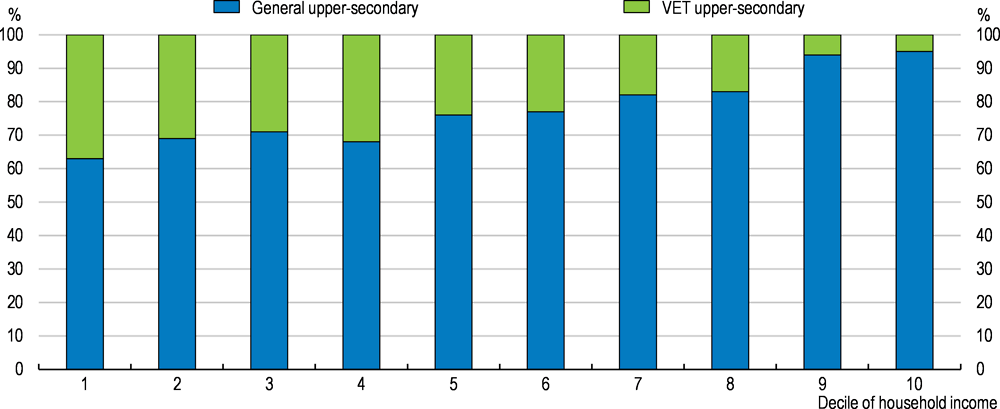

Enhancing Vocational Education and apprenticeships to meet labour market needs

Improving Vocational Education and Training (VET) can substantially enhance skills and inclusiveness. Students in VET tend to come from more disadvantaged backgrounds (Figure 26). VET in upper-secondary education is well-developed but inequities and quality remain an issue. Workplace training, as part of VET programmes, is poorly developed and the mechanisms to assure its quality are weak (OECD, 2015a; Kis and Field, 2009). In particular, there is no coordination with VET and the Chilean certification organisation (ChileValora), though some efforts have aimed at raising quality and equity in VET (Annex). In a welcome step, the Advisory Council for Professional Technical Training, (an entity headed by the Ministry of Education in collaboration with other ministries, agencies and experts) is developing the Professional Technical Training Strategy 2018-2030, which seeks to establish a road map to improve vocational training.

Figure 26. Students in VET tend to come from a more disadvantaged background

Distribution of students in upper-secondary education, by access programme, 2015

Note: Vocational education and training (VET) upper-secondary refers to Technical-Professional Mid-level Education (Técnico-Profesional) and general upper-secondary to Humanistic-Scientific Mid-level Education, (Enseñanza Media Científico-Humanista).

Source: OECD (2017), Education in Chile, Reviews of National Policies for Education, OECD Publishing.

Developing an apprenticeship system and enhancing the work-based component in VET would improve youth’s opportunities to get better quality jobs. A welcomed national qualification framework is being developed. Also, a system of control and monitoring of firm-based training, to ensure minimum quality standards, needs to be set up. Offering the possibility to link it to formal education creating a dual-VET system (at secondary and post-secondary education) can increase work-based learning in formal education while making it more relevant for youth and employers. The apprenticeship system may require a co-funding system by public resources and employers. For example, an apprenticeship levy depending on the firm size, such as in France, or a levy payed only by the largest firms, such as in the United Kingdom would encourage the involvement of the private sector, especially small and medium firms (Kuzcera, 2017). This could be accompanied by targeted subsidies to encourage participation of the most vulnerable.

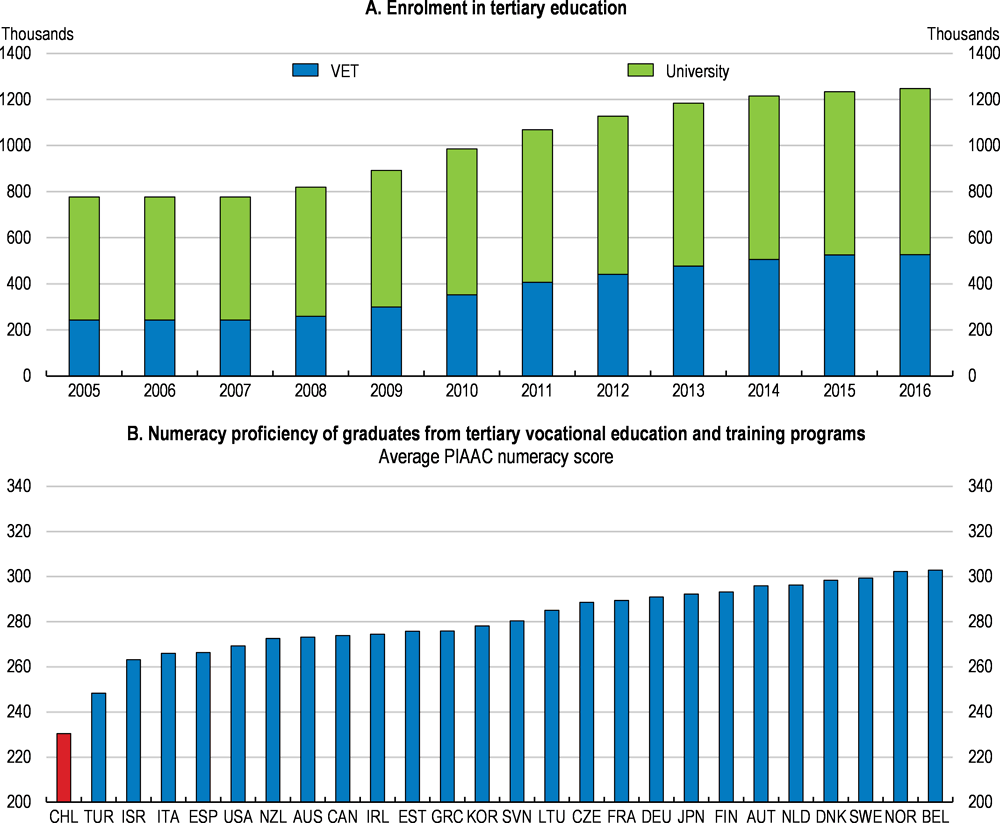

Improving quality and access to higher education

Enrolment in higher education institutions almost doubled in the last decade (Figure 27), including among the less advantaged. In 2017, 85% of Chilean students in undergraduate studies were enrolled at private institutions, VET or universities, with around 12% of them attending non-accredited institutions (SIES, 2017; OECD, 2017e). Typically, students from rich families get state-subsidised university places, while lower-income tend to attend lower quality private institutions and accumulate debt (OECD, 2017e). The government recently created two public universities and 15 public VET centres, and a wide-ranging higher education reform, approved in January 2018, would address access and quality issues (Annex).

Figure 27. The rapid increase in tertiary education enrolment has created quality challenges

Note: Vocational education and training (VET) institutions include Professional Institutes (Institutos Profesionales- IP) and Technical Training Centres (Centros de Formación Técnica, CFT).

Source: OECD calculations based on PIAAC (2012 and 2015) and; Servicios de Educación Superior, Ministerio de Educación, Chile.

Tuition fees relative to average income in Chile are high and households finance most of tertiary education spending, 64% in Chile compared to 30% in the OECD (OECD, 2017e). The student aid system is complex, consisting in scholarships and loans. Since 2016 grants through the “free education” (gratuidad) programme make access to education more equal, favouring the admission of vulnerable students. This policy has been gradually implemented and will benefit students from the bottom six deciles of family income in 2018. From 2019, a mechanism based on structural fiscal revenues would extend free higher-education to higher income deciles. The financial aid system could be simplified and merged to better target low income students, as the existing scholarships and loans favour universities that attract the less vulnerable (OECD, 2017f). Expanding the gratuidad programme to higher deciles of income would require large public resources. The higher-education funding system should better balance access and quality, providing more incentives to enhance the latter.

Strengthening productivity growth and export performance

A broad-based decline in multi factor productivity (MFP) growth weakened labour productivity performance. Resilient wage growth has weighed on cost competitiveness and exports (Figure 28). The productivity slowdown is affected by declining commodity prices and investment as in much of Latin America. However, there are factors specific to Chile, such as the fall of ore grades, which forces copper producers to process more ore to produce the same quantity of refined copper (CNP, 2017), and over-exploitation of fisheries, while the adoption of new technologies remains low in many firms.

Figure 28. Exports and productivity have stalled

1. LAC is the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico.

2. Export markets’ growth for Chilean goods and services, in volume terms (with export markets as of 2010).

3. Five-year moving average. Multi-factor Productivity is adjusted for human capital and hours of work (CNP, 2017).

Source: OECD (2017), Economic Outlook 102 Database; CNP (2017), Informe de Productividad Anual 2016, Comisión Nacional de Productividad and OECD calculations.

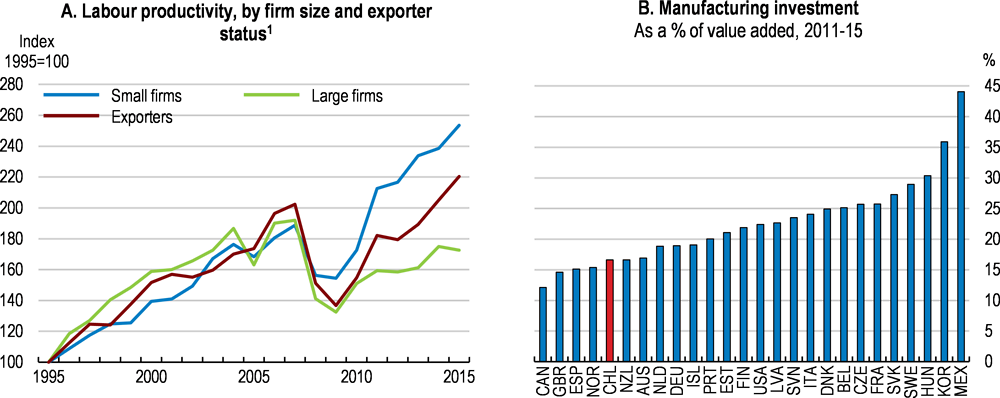

In the manufacturing sector, a large decrease in allocative efficiency, notably for exporters, led to lower productivity growth (Figure 29, Panel A) and is partly linked to labour and product market rigidities. Disappointing productivity outcomes are also attributable to low capital intensity, resulting from a high labour force growth rate and persistently weak investment (Panel B). The large share of low skilled workers and micro and small firms and low management capacity weigh on labour productivity (Syverson, 2014), as well as Chile’s lack of scale and geographical remoteness that constrain benefits from international connections and agglomeration (Boulhol and de Serres, 2010; OECD, 2015c).

Figure 29. Manufacturing investment is weak and allocative efficiency has declined

1. Median establishment. Exporting establishments sell directly some of their production abroad. Small establishments have less than 50 employees and large ones have 200 employees or more.

Source: OECD (2017), National Accounts Database; OECD calculations based on the Encuesta Nacional Industria Anual (ENIA).

Improving the regulatory environment to boost dynamism