Rebalancing toward a consumption-driven growth model has paused due to the investment- led rebound and the slow recovery of tourism-related industries likewise set back the rebalancing towards services. Even though finance and information technology were key drivers when many other industries shrank, they are not as important for employment creation as retail, or hotels and catering are. Losing their jobs, many migrant workers returned to their hometowns, thereby reversing urbanisation, another growth-enhancing process. Urban unemployment rates are falling after a moderate rise during the start of the pandemic.

Infrastructure investment, half of which goes to transportation and public facilities, has levelled off. Increasing industry capacity utilisation rates keep business investments strong. Real estate investment has stalled on the back of property company defaults and falling sales.

Exports reached historical highs, but imports lag somewhat behind. Pent-up global demand for COVID-19-related protection materials and for teleworking-related goods boosted exports. Imports keep slowing as producers are increasingly relying on domestic inputs and the import content of consumption remains low. Lagged recovery of consumption and worldwide travel restrictions weigh on tourism services imports. China’s commitments under the Phase I trade deal with the United States have been delayed.

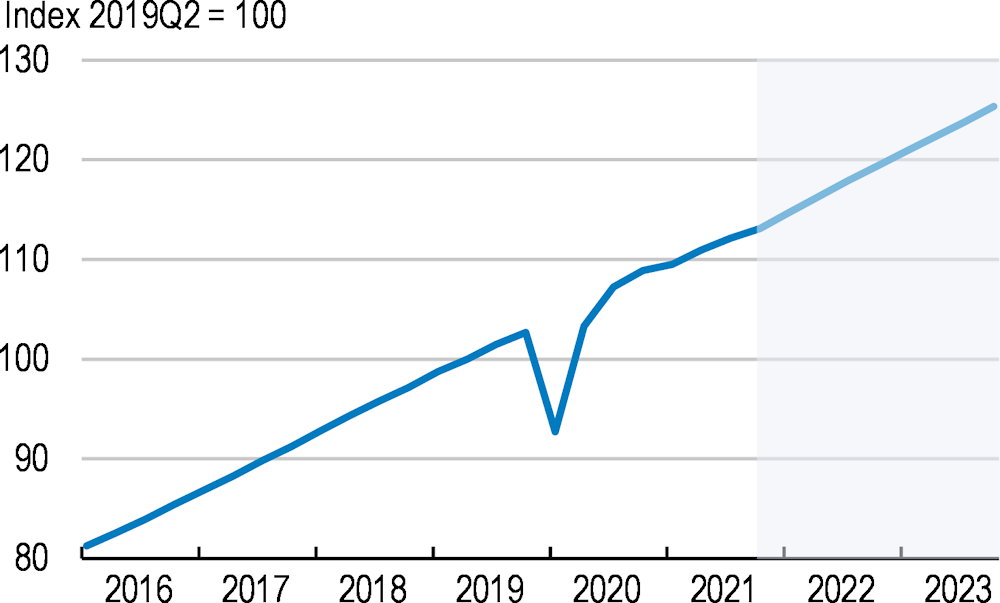

The recovery brought activity back to pre-crisis levels in the third quarter of 2020 and has maintained momentum. The growth rate in 2021 will be high (reflecting the low base), but will return to its gradually declining path thereafter. China needs to spend more on “soft” (education, health, social protection) as well as “hard” investment (environmental facilities, renewable energy, urban transit systems etc.), while excess capacity in real estate should be worked off.