Colombia’s potential to make exports an engine of growth and job-creation is large, thanks to stable macroeconomic conditions and several trade agreements. However, the potential remains unrealised. Exports have remained low over the last decades and highly concentrated in terms of goods, destinations and regions. The costs to trade are among the highest in the world, driven by infrastructure bottlenecks and weak logistics. Good progress has been made in improving primary roads but significant gaps remain in other areas. Colombia has now a historic opportunity to explore new export opportunities beyond extractive activities, including agriculture or services. Realising Colombia’s potential and opportunities will require promoting competitiveness and productivity by reducing the scope of non-trade barriers, continuing to improve infrastructure and boosting competition in services, including logistics. Optimising innovation support programmes and fostering entrepreneurship and access to finance would also be fundamental. Going digital, by promoting further adoption and use of ICT technologies, would also boost firms’ competitiveness and the connectivity of regions.

OECD Economic Surveys: Colombia 2019

Chapter 1. Boosting exports and integration into the world economy

Abstract

In both developed and emerging economies, trade openness has gone hand in hand with better economic performance and opportunities for workers, consumers and firms (OECD, 2012[1]). Exports in particular can contribute significantly to growth and job creation. Exporting firms tend to be more productive and can serve as conduit for technology transfer, generating technological spillovers with positive backward and forward linkages to the domestic economy. Exports can also be a powerful tool to improve job-quality in emerging economies, as exporting firms pay higher wages and hire more workers than non-exporters (Brambilla, Depetris Chauvin and Porto, 2017[2]).

Colombia has solid foundations to become more integrated into the world economy and some recent success cases illustrate that its large potential can be realised. This chapter discusses what can be done to raise export performance. Raising productivity would be fundamental. Productivity is hampered by weak competition, burdensome regulations, skill gaps and an unbalanced tax structure, as described in the Key Policy Insights section of this survey. This chapter focus on other structural factors affecting export performance, such as infrastructure and logistics gaps, trade policies, competition in non-tradable sectors, innovation or access to finance.

Increasing trade protectionism may dampen exports growth worldwide, but at the same time, new opportunities are emerging for Colombia. This includes increasing trade integration with other member of the Pacific Alliance (Chile, Mexico and Peru) and better prospects for convergence with Mercosur.

Colombia is not making the most out of international trade

The economy is relatively closed

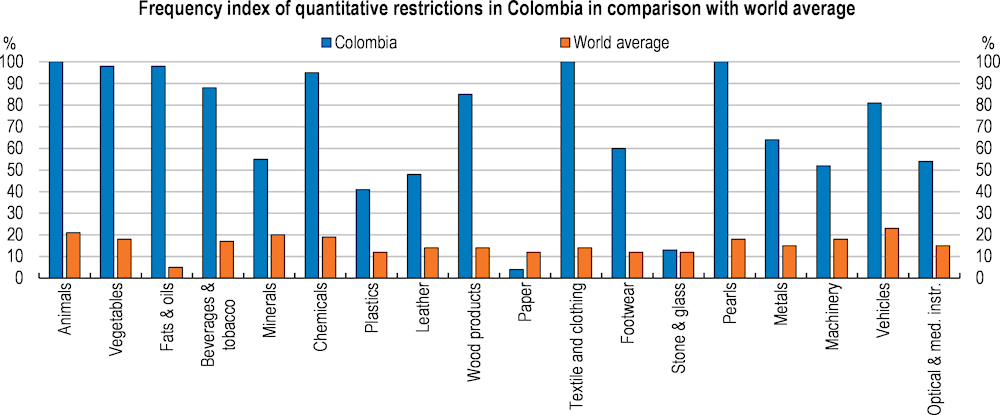

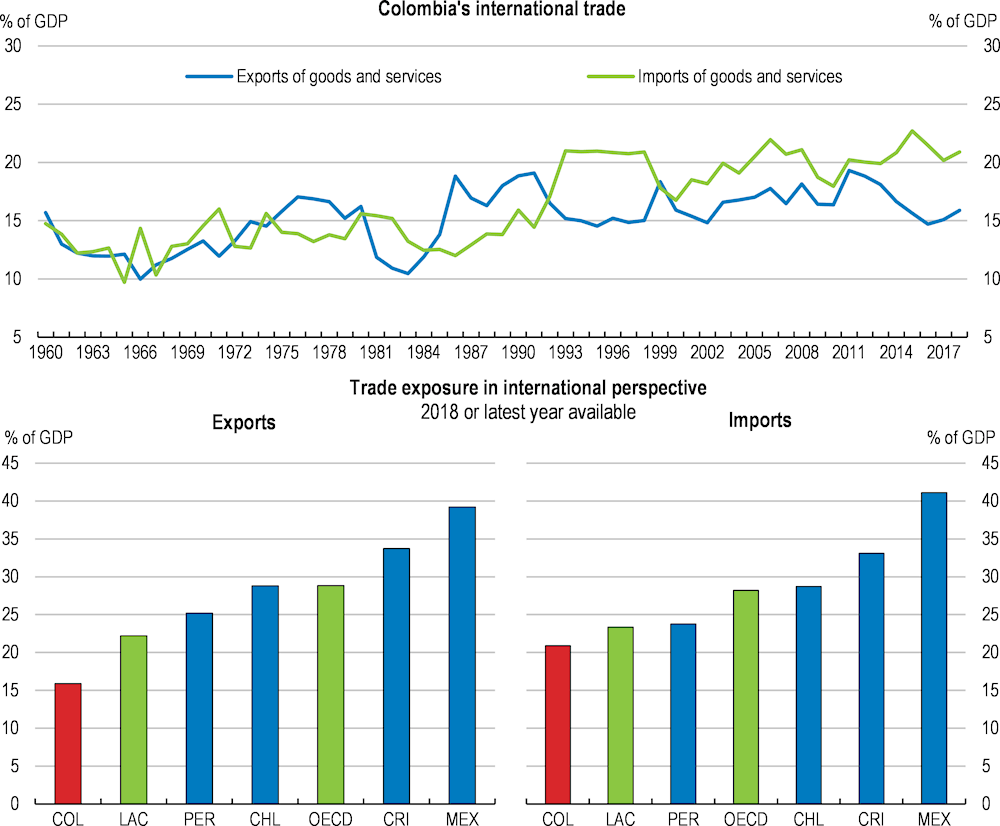

Exposure to trade has remained relatively low over time (Figure 1.1, Panel A). Exports represent 15% of GDP, slightly below the level 50 years ago. Imports have increased relative to GDP but remain relatively low (Figure 1.1, Panel B). The low and stagnant exposure to trade contrasts with dynamics seen in most advanced and emerging economies, where the role of trade has increased significantly over the last 50 years (OECD, 2012[1]).

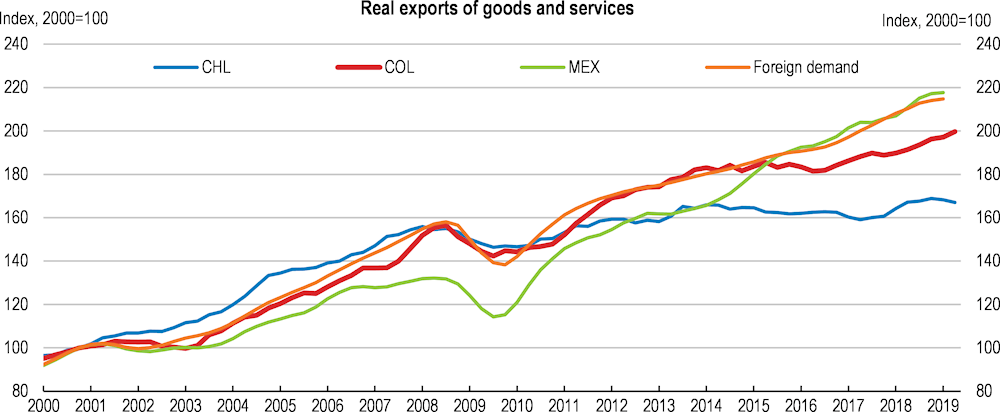

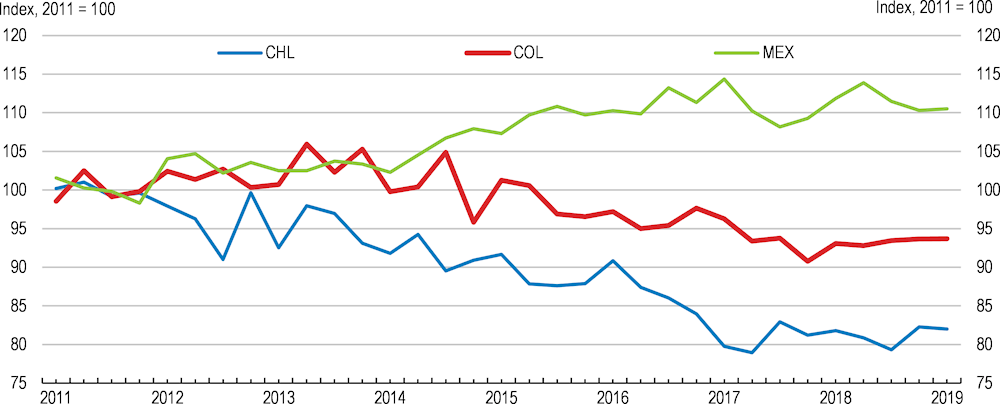

Exports were hit hard by the fall in commodity prices, the fall in world demand (Figure 1.2) and the situation in Venezuela, one of Colombia’s main trading partners. Short-term data show that exports are growing again, including in non-oil sectors. Nevertheless, export performance indicators have continued to deteriorate (Figure 1.3), indicating that export growth remains low relative to the growth in foreign demand. Foreign demand has gradually strengthened after the collapse in global trade following the 2008 financial crisis. The real exchange rate has depreciated 30% from its peak in 2012, which should have supported competitiveness. The relatively weak performance of exports under these favourable cyclical conditions indicate that export performance is strongly affected by structural factors.

Figure 1.1. Trade exposure is low

Note: Exports and imports of goods and services represent the value of all goods and other market services provided to/from the rest of the world. They include the value of merchandise, freight, insurance, transport, travel, royalties, license fees, and other services, such as communication, construction, financial, information, business, personal, and government services. They exclude compensation of employees and investment income (formerly called factor services) and transfer payments. LAC and OECD are defined according to the definitions of the World Bank.

Source: World Bank, World Development Indicators database.

Figure 1.2. Exports have remained weak since 2013

Note: Foreign demand is defined as the export market for goods and services (in volumes) in US dollars, 2010 prices.

Source: OECD Analytical database.

Figure 1.3. Export performance has deteriorated

Note: Export performance is measured as actual growth relative to the growth of the country’s export market, which represents the potential export growth for a country assuming that its market shares remain unchanged.

Source: OECD Analytical database.

Prices are high

Colombia has not shared in many of the benefits that an increasingly integrated global economy is offering, such as access to a wider variety of quality goods and services at more competitive prices for both firms and consumers.

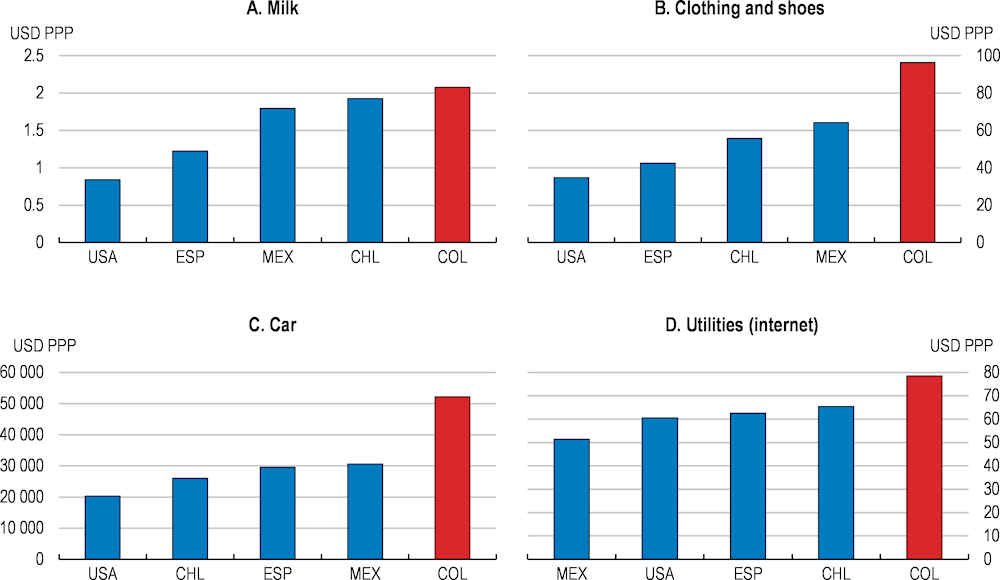

At present, prices for tradable goods are substantially higher than in other countries, including regional peers (Figure 1.4). Relatively high prices also affect services, including in key sectors such as telecommunications, which provide inputs to other sectors across the economy.

Figure 1.4. Prices are high

Note: Clothing and shoes prices are proxied by the price of a dress in a chain store. Car prices are proxied by the price of a Toyota Corolla or equivalent new car. Mobile prices are those of 1 min. of prepaid mobile tariff local. Prices are converted to PPP dollars by using conversion rates published in the IMF’s World Economic Outlook.

Source: OECD computations based on Numbeo and IMF data.

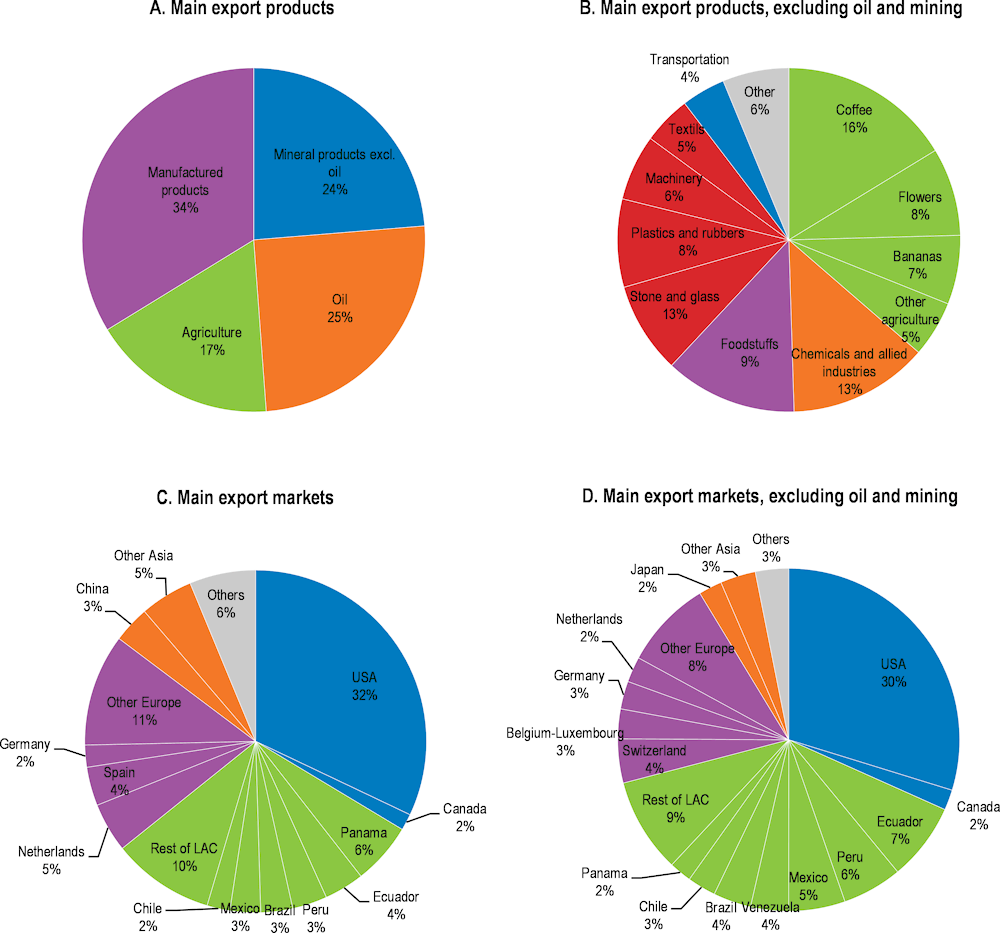

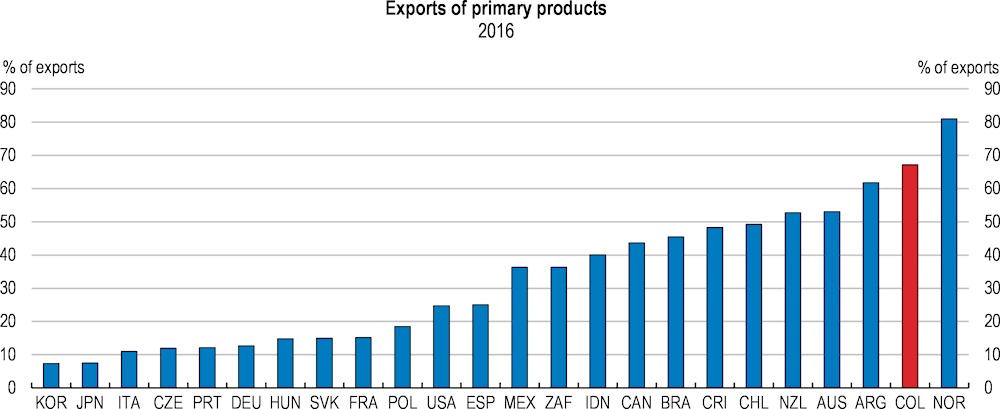

Good exports are concentrated in few products and destinations

Oil and other minerals account for half of the export basket (Figure 1.5), despite being a small producer in the world. The share of primary exports, which includes also raw agriculture exports, is close to 70% (Figure 1.6), which is high in international comparison. The United States is the main export destination, including of non-oil products. Other countries in the region, particularly Panama and Ecuador, are also important markets. Exports to other large economic areas, such as China or the Euro Area, are small in comparison with other countries in the region.

Figure 1.5. Exports are concentrated in products and destinations

Note: All data refer to 2016.

Source: OECD calculations based on BACI database (“Base pour l’Analyse du Commerce International”: Database for International Trade Analysis) from the CEPII (Centre d'Etudes Prospectives et d'Informations Internationales).

Figure 1.6. The share of primary goods is very high

Note: According to Lall (2000)’s classification. Primary products are oil, mining and raw agriculture products.

Source: OECD computations based on CEPII (2017), BACI Database and World Bank, World Development Indicators database. ‘

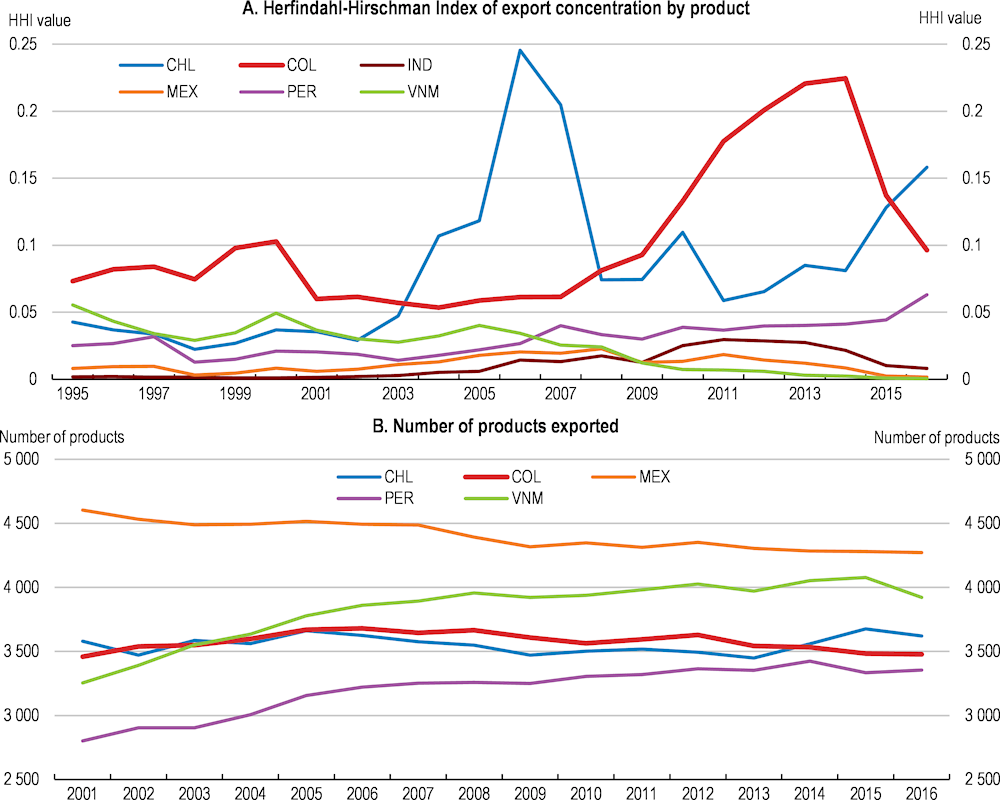

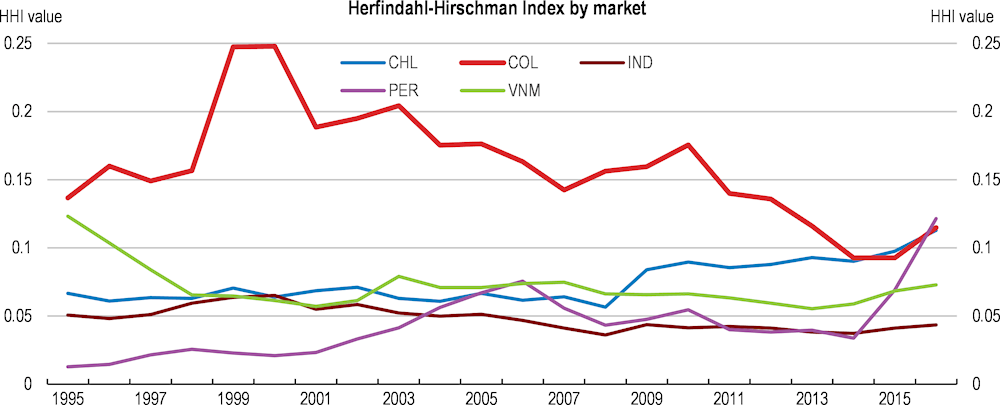

Colombia is the least diversified country among the six largest Latin America countries (Linares, Rodriguez and Gonzalez Pandiella, forthcoming[3]). It is also less diversified than other emerging economies in Asia (Figure 1.7, Panel A). Exports were more concentrated than in peer countries in the 1990s, before the rise of the oil sector. Concentration increased significantly in the 2000s, following the strong growth in oil and mining activities. This was also amplified by a fall in exports to Venezuela, the main traditional destination for Colombian manufacturing exports (Garavito, Montes and Esguerra, 2013[4]). With the end of the commodity boom, export concentration has receded but remains higher than in peer countries, including other countries in the region with large commodity sectors such as Peru. Other emerging countries have managed to increase product diversification of their export baskets over the last fifteen years. On the contrary, the number of products exported by Colombia has remained constant (Figure 1.7, Panel B). There has been good progress in tapping new markets and reducing concentration of destinations (Figure 1.8). Few firms concentrate most exports (BanRep, 2017[5]; Garavito, Montes and Esguerra, 2013[4]). The fall in exports to Venezuela has exacerbated firm concentration, as this has been traditionally the market where small and medium Colombian enterprises initiated their exporting activities (Garavito, Montes and Esguerra, 2013[4]).

Figure 1.7. Exports are concentrated by products

Note: The Herfindahl-Hirschman Index (HHI) measures the dispersion of trade across an exporter’s products. Countries with higher preponderance of trade concentrated in a very few products will have a higher value in the index.

Source: OECD computations based on trade statistics from Trade Map.

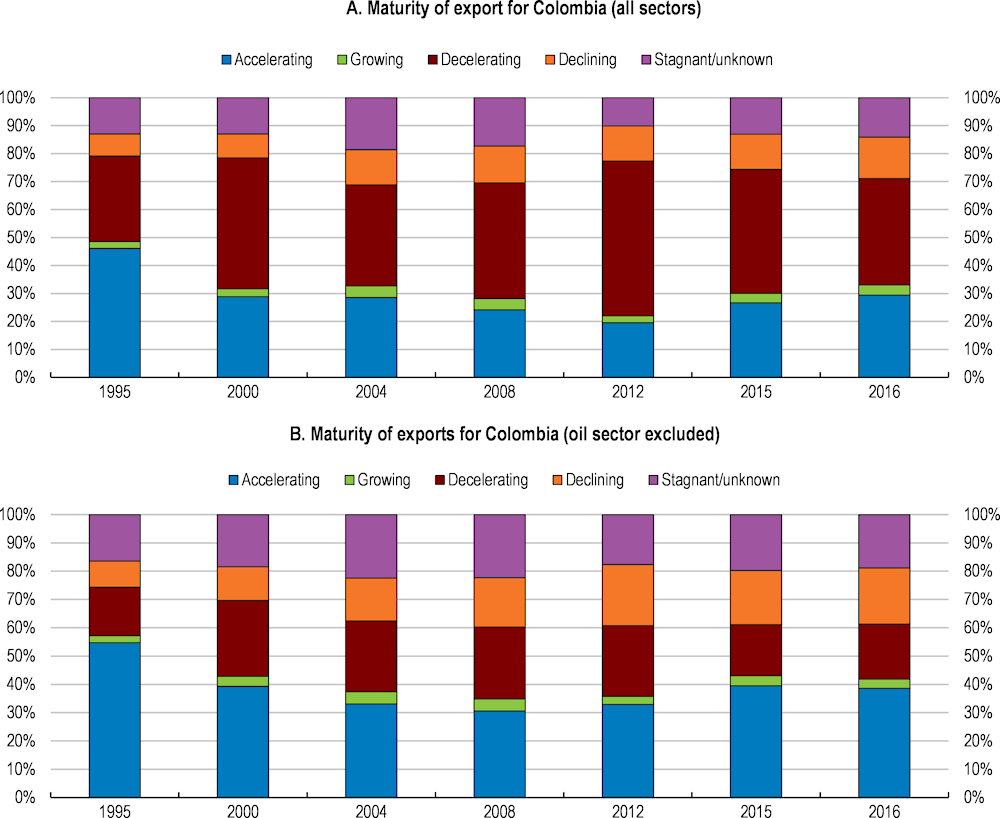

Exports are largely concentrated in products whose demand is decreasing (Figure 1.9, Panel A). Zooming into non-oil exports shows a similar picture, with the share of exports whose demand is decreasing reaching 40% (Figure 1.9, Panel B). The level of sophistication of the export base has not improved either (Linares, Rodriguez and Gonzalez Pandiella, forthcoming[3]), with the main proportion of exports considered as low-technology exports (López, Enciso and Montes, 2015[6]). This contrasts with other countries in the region such as Mexico or Costa Rica that managed to enhance the sophistication of their export basket. Empirical research suggests that achieving a higher level of sophistication in the export basket helps to make growth stronger (IMF, 2018[7]).

Figure 1.8. Exports are also concentrated by destinations

Note: The Herfindahl-Hirschman Index (HHI) measures the dispersion of trade across an exporter’s partners. Countries with higher preponderance of trade concentrated in a very few markets will have a higher value in the index.

Source: OECD computations based on trade statistics from Trade Map.

Figure 1.9. Exports are concentrated in products whose demand is decreasing

Note: Accelerating products are those whose demand is growing over time at increasing rates. Growing demand products are those whose demand is increasing, but the rate of growth is not. Decelerating products are those whose demand is decreasing at increasing rates. Declining demand products are those whose demand is decreasing, but not at increasing rates.

Source: OECD calculations based on BACI database from the CEPII.

FDI has become more diversified but integration in global value chains remains limited

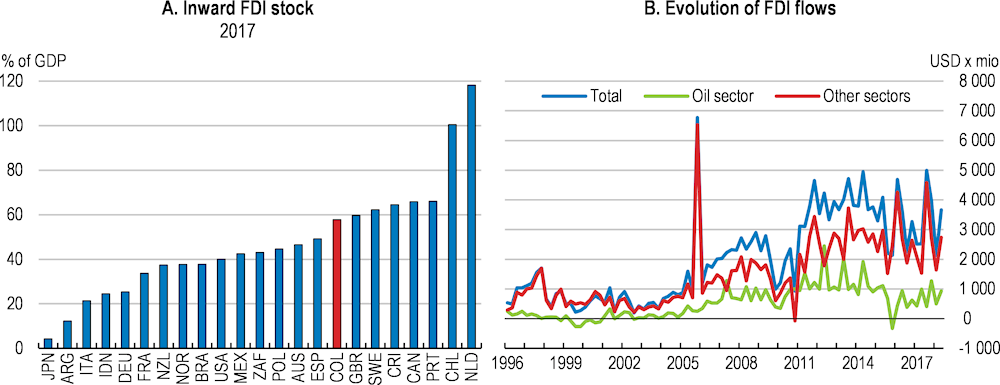

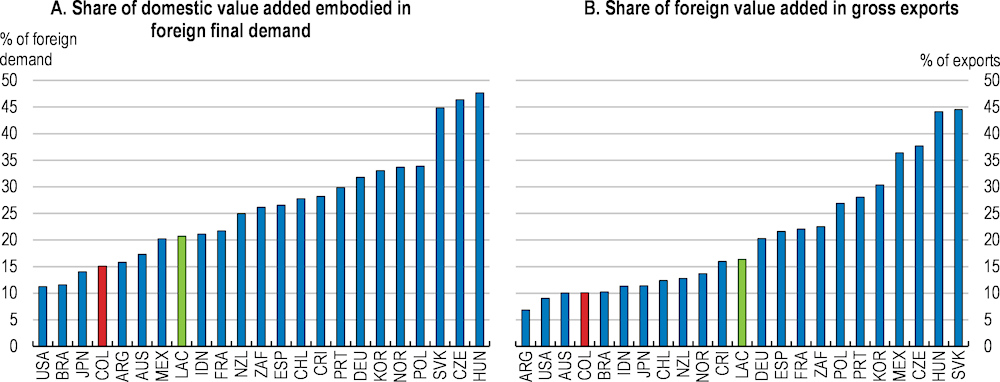

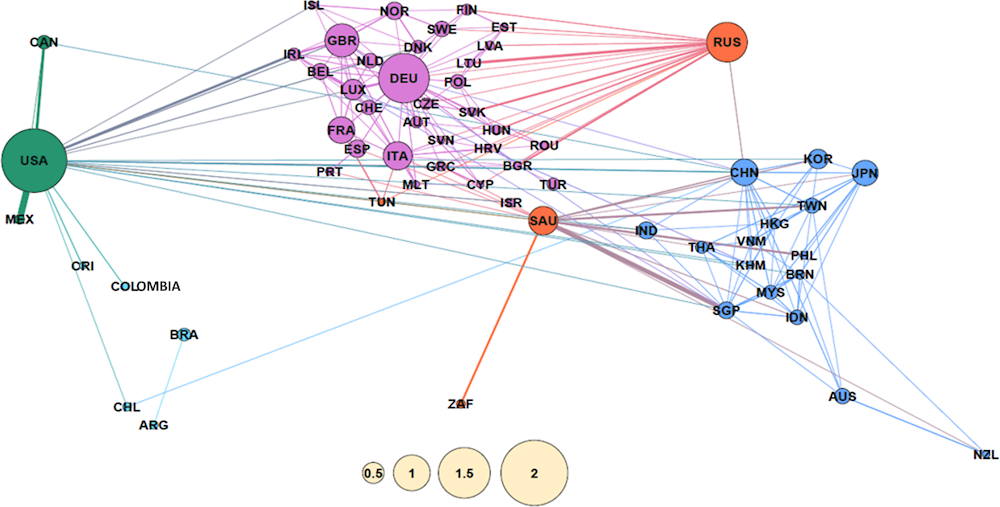

Foreign direct investment (FDI), which had been largely concentrated in the oil sector, has recently become more diversified (Figure 1.10). However, it has remained focused on natural resources and economic activities related to the domestic market (Garavito, María Iregui and Teresa Ramírez, 2012[8]). Integration in global value chains (GVC), that can help to boost higher value-added exports and diversification, remains limited. The share of foreign value-added embodied in Colombia’s export is low (Figure 1.11, Panel A). The foreign value-added of content of exports is also low (Figure 1.11, Panel B). Colombia’s only discernible GVC link is with the United States (Figure 1.12), while many Asian and European economies are tightly intertwined through their trade relationships, both among themselves and with advanced economies.

Figure 1.10. FDI has become more diversified

Figure 1.11. Integration in global value chains is limited

Note: LAC refers to the unweighted average of Argentina, Brazil, Chile, Costa Rica and Mexico. The foreign value added content of Colombian exports does not capture the extent to which foreign intermediates enter supply chains for products eventually absorbed by Colombia’s domestic demand. Colombian firms import a significant part of their intermediate inputs, notably machinery and equipment.

Source: OECD (2017), OECD/WTO NowCast Tiva Estimates.

Figure 1.12. Colombia has remained on the side lines of global value chains

A map of global value chains

Source: Criscuolo and Timmins (2017).

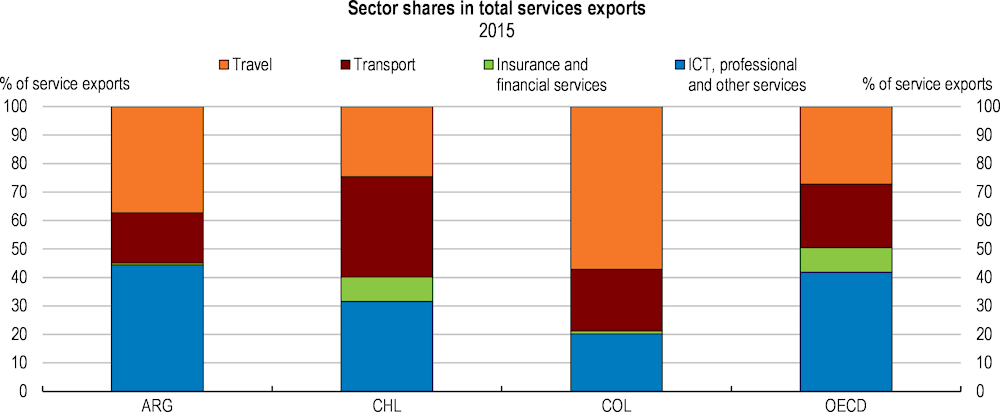

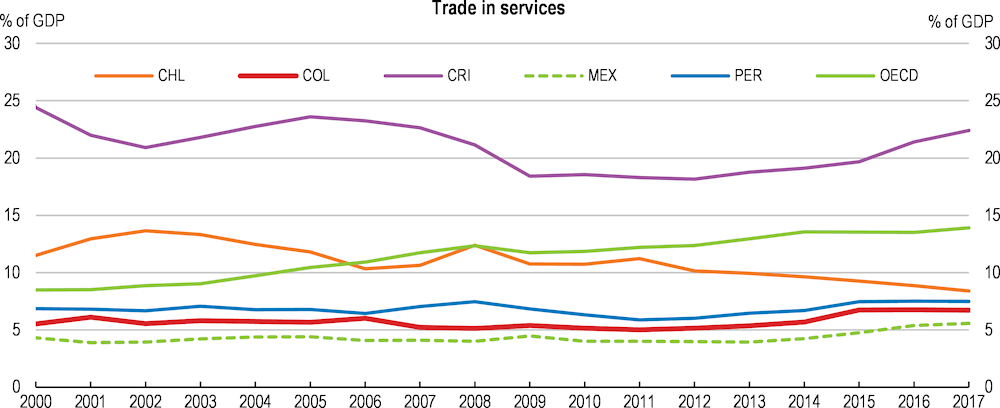

Trade in services is relatively low

Service trade is the fastest growing segment of the global economy and an important component of many developing countries exports. Trade in services has remained relatively low, even in comparison with regional peers (Figure 1.13).

Figure 1.13. Trade in services is low

Note: Trade in services is the sum of service exports and imports divided by the value of GDP, all in current U.S. dollars.

Source: World Bank, World Development Indicators database.

Recent good performance in the tourism sector, benefiting from the new opportunities that the peace process is opening and progress in improving air connectivity and hotel supply, shows that Colombia has also good potential in this area. The number of international visitors has increased substantially, reaching 6.5 millions in 2017, indicating that Colombia is starting to take advantage of the competitive advantage that the country’s climate, coastline and cultural assets provide.

There is also room to increase exports of services with higher technological content (Figure 1.14). The strong government emphasis on boosting the adoption of digital technology, encompassed under the strategy so-called Economía Naranja, would help to increase services exports in the ICT sector. Improving skills and its relevance to new labour market demands (see Chapter 2), as well as strengthening proficiency in English,would also enhance export performance in these areas.

Figure 1.14. There is room to boost knowledge intensive service exports

Colombia’s untapped potential is large

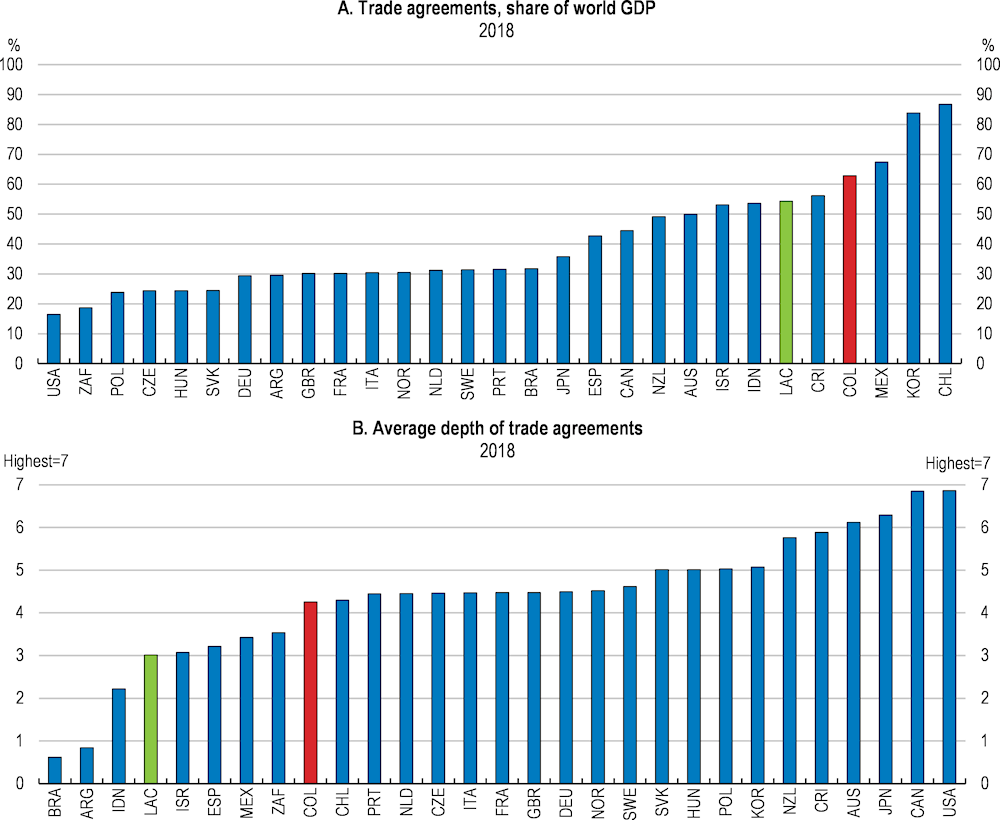

Colombia's geographic location is privileged, strategically located in the north western tip of South America, near the Equator line. Its extensive coasts on the Atlantic and Pacific oceans provide convenient access to Europe, the United States, the Caribbean and the Pacific Basin. It has 16 trade agreements in force (Figure 1.15), providing preferential access to more than 60 countries and close to 1 500 million consumers in markets such as the United States, the European Union, Brazil, Mexico, Chile, Peru or Korea. Public views concerning trade are positive, as recent opinion surveys indicate that 66% of citizens are in favour of signing free trade agreements “with many countries” (Gallup, 2018[9]). All this, together with continuous macroeconomic stability, provide Colombia with great potential to make trade an engine of growth and jobs. Actions in different policy areas, as outlined in this chapter, can facilitate that the large potential is realised (see Box 1.1).

Figure 1.15. Existing trade agreements are wide

Note: LAC refers to the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico. As measured by Dür et al. (2014), see Box 3. Trade agreements are weighted by partner countries’ GDP in

PPP US dollars. In Panel B, the computations exclude the domestic country GDP.

Source: Dür et al. (2014).

Box 1.1. Realising the potential of the agriculture sector

Colombia’s abundant land and freshwater resources and diverse climate allow for the cultivation of a wide variety of crops and forest products. While agriculture is a key sector in terms of employment, productivity is low (OECD, 2015[10]). The internal conflict, which triggered massive displacement of the rural population and engendered illicit crop production, deeply affected the performance of the sector.

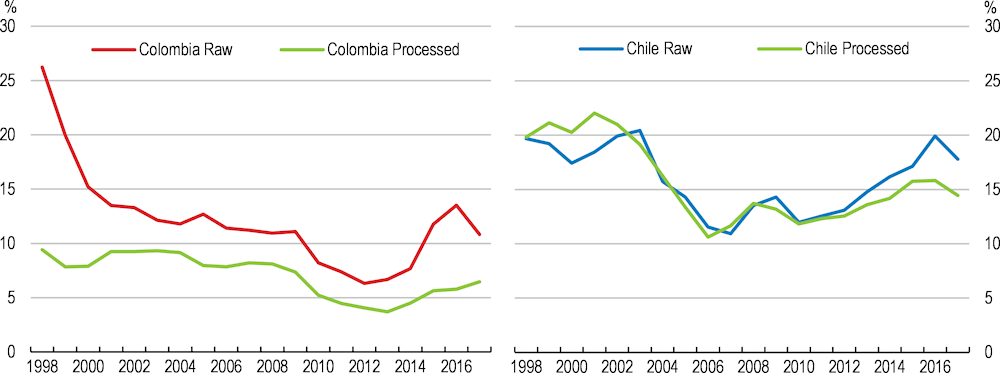

After a strong decline, the share of exports of raw agriculture products has started to increase again (Figure 1.16). To build on this recent progress, Colombia will need to adapt to global changes in agriculture trade. The share of processed products in global trade has been increasing, to the detriment of primary agriculture products. In general, the demand for goods of higher knowledge content is expected to increase more in the future, also in the agro sector. The share of processed agriculture exports remains low, in contrast with other countries in the region such as Chile.

Figure 1.16. The share of processed agriculture exports remains low

Share of raw and processed agriculture and food exports over total exports

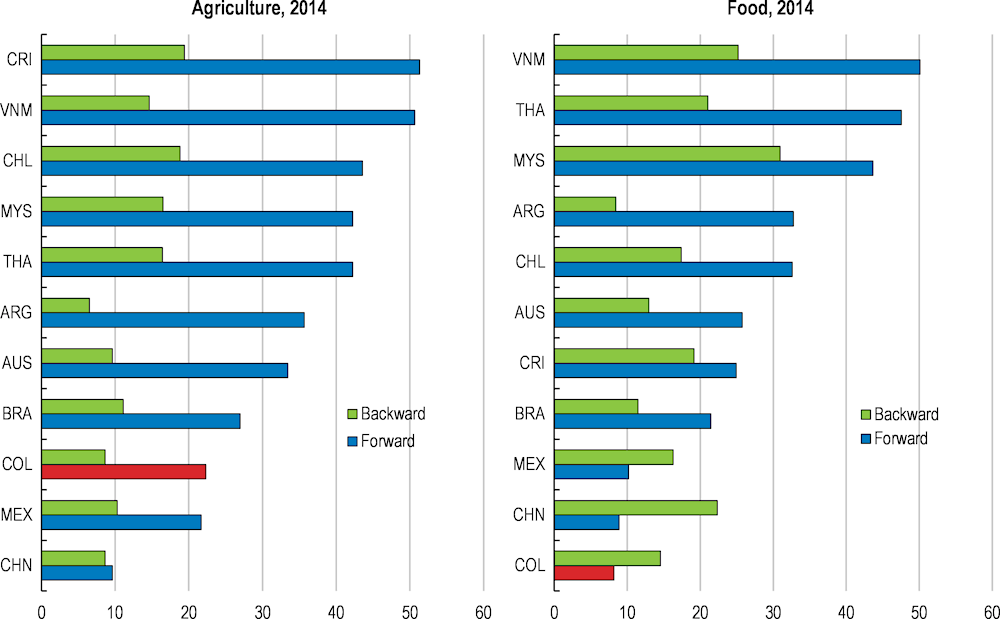

GVCs are also changing the nature of production and specialisation in agriculture and food around the world (Greenville, Kawasaki and Beaujeu, 2017[11]). Colombia is in the bottom in terms of participation in global value chains in agriculture and food (Figure 1.17). Globally, services are an important part of value added in exports in agro-food, even greater than in the manufacturing sector. In Colombia, the services value added share of food exports is relatively low (OECD, 2015[12]), particularly with respect to foreign services. This highlights that the functioning of services markets is critically important also for the agro sector.

Given these trends, Colombia will need to continue improving productivity and competitiveness in primary agriculture products to sustain its improving position in this area. Refocusing agriculture support policies would be a fundamental step. Producers receive relatively high levels of support in the form of market price support, input subsidies and direct transfers, accounting for 90% of public spending in the sector.

Figure 1.17. Colombia’s participation in agriculture GVCs is small

Note: Forward participation index: Domestic value added embodied in foreign exports, as % of total gross exports of the source country. Backward participation index: Foreign value.

Source: OECD (2017a), OECD/WTO NowCast Tiva Estimates.

Refocusing policy efforts away from direct payments to producers into providing public goods and services, such as rural infrastructure or technical assistance, which have been largely neglected (OECD, 2015[13]), would be fundamental to improve productivity and competitiveness in the sector.

Completing and updating the rural cadastre would also be a crucial step to promote a better use of land, as it will improve legal certainty and facilitate transactions. More than 40% of land ownership continues to be informal, and it will be also important to speed up the process of formalisation and registration of land rights.

Colombia could also seize increasing opportunities in the processed agriculture segment. This would require adding value to raw products and differentiating them. Differentiation can be achieved through customisation and innovation, where R&D, design, branding or ICT services are fundamental. The sector would also benefit from a better performance in packaging, storage, and transport logistics sectors (Meléndez and Uribe, 2012[14]). Argentina’s wine sector is a good example of how differentiating products, based on innovation and by adding value through marketing and branding services, can allow tapping into new markets and boost exports, incomes and jobs (Artopoulos, Friel and Hallak, 2013[15]).

Cost-to-trade is very high

Many of the factors that limit exports and participation in GVCs are shared across Latin America, including long distances from world manufacturing hubs, low intra-regional integration, and low firm productivity. But the high costs and time delays associated with importing and exporting hampers Colombia’s performance particularly (Figure 1.18), even in comparison with regional peers. Costs arising from infrastructure gaps, customs procedures, and weak logistics services hinder firms’ ability to be competitive in external markets.

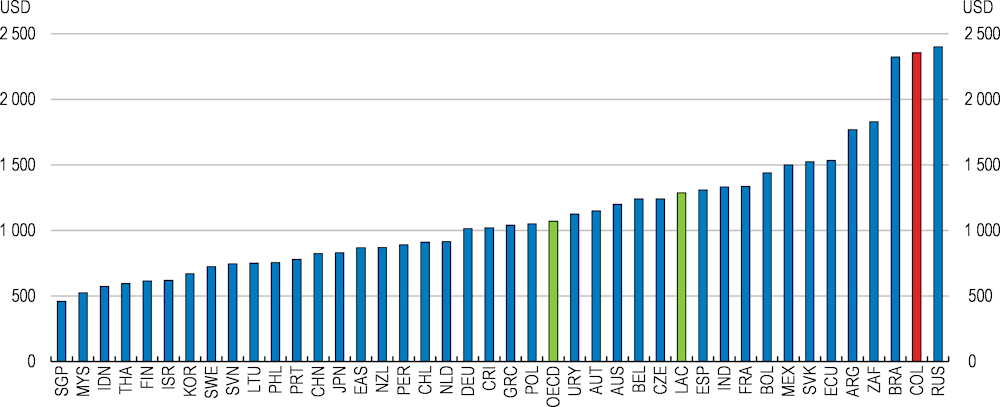

Figure 1.18. Trading is costly in Colombia

Fees levied on a 20-foot container in US dollars

Note: LAC and OECD are defined according to the definitions of the World Bank.

Source: World Bank, World Development Indicators database, 2014.

Infrastructure gaps are large

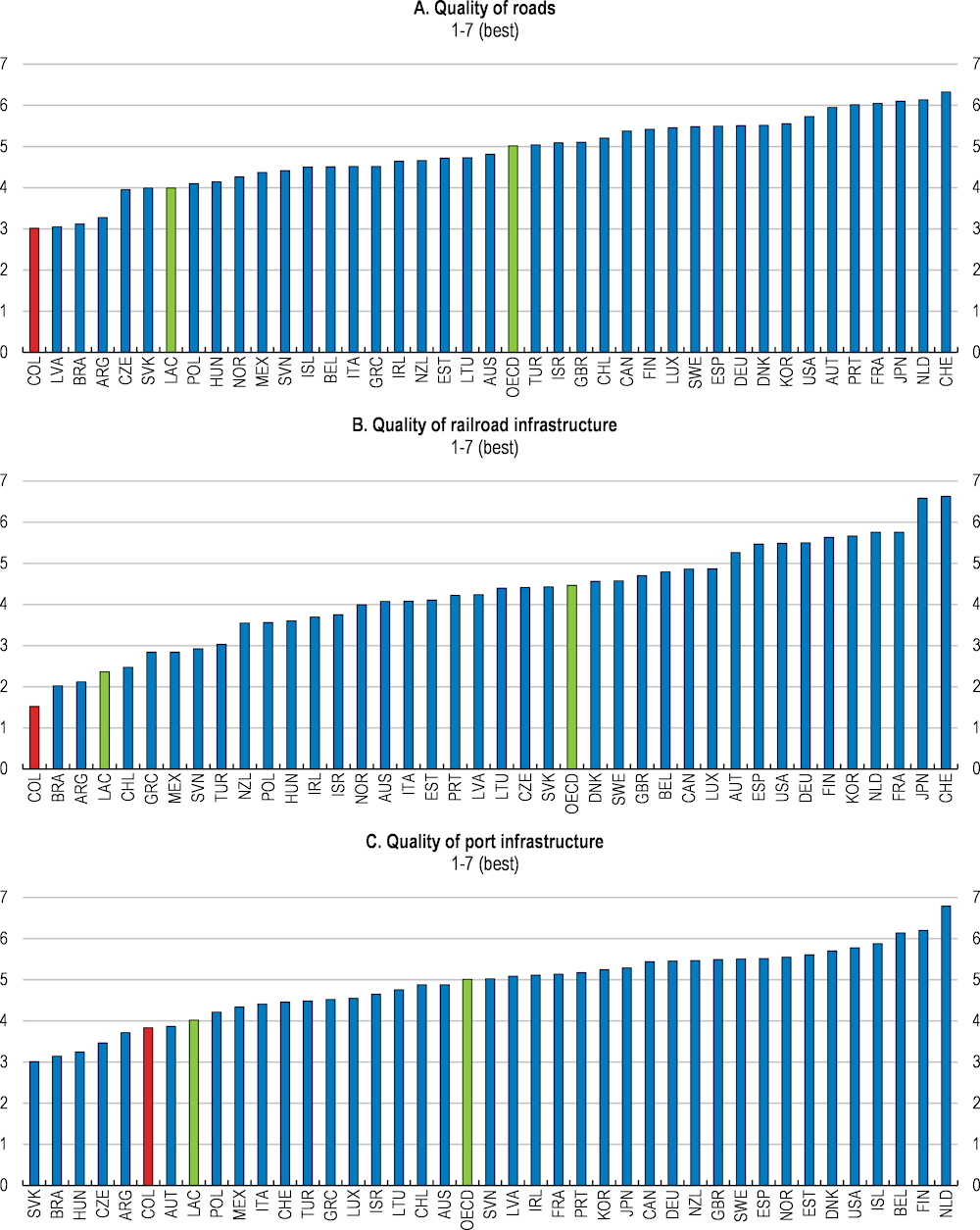

Infrastructure bottlenecks are large and existing in all transport areas (Figure 1.19). This includes ports, the main portal for shipping imports and exports, and roads, the primary way to move goods from warehouses to ports (Chapman, 2018[16]). These infrastructure bottlenecks have contributed to poor connection between regions and cities. Regional economies have developed patterns of self-sufficiency that have not facilitated specialisation or economies of scale, affecting productivity and competitiveness.

Figure 1.19. The quality of infrastructure is relatively low

Note: LAC refers to the unweighted average of Argentina, Brazil, Chile and Mexico.

Source: World Economic Forum, The Global Competitiveness Index dataset (2007-2017).

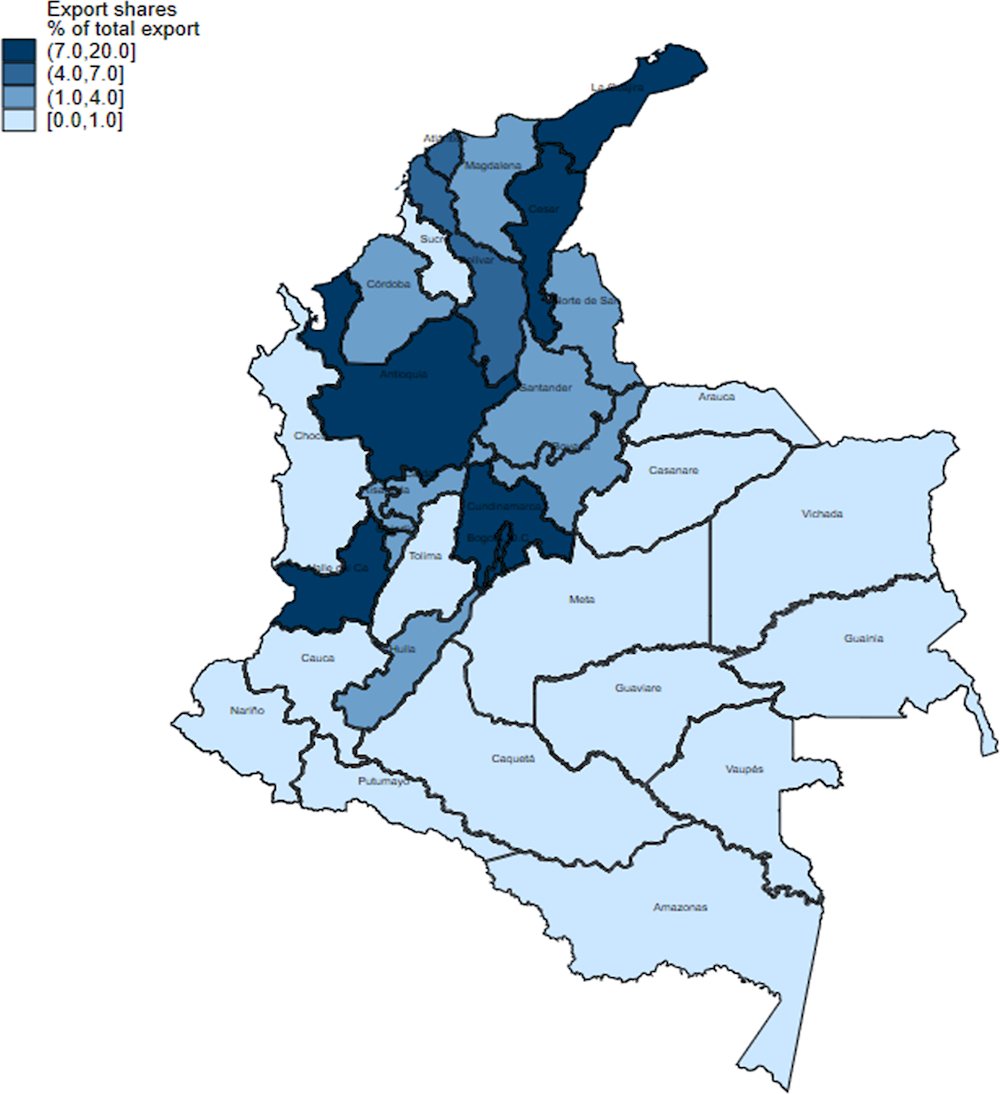

Infrastructure gaps also imply that not all regions are able to seize the opportunities that trade can offer for local development. Several regions suffer from poor connectivity with the main customs offices in the country. As a result exports are largely concentrated in few regions (Figure 1.20). Half of the country’s non-oil exports come from four Departments.

Figure 1.20. Exports are concentrated in a few regions

Note: Exports excluding oil and petroleum (related) products. Data refer to the period January – May 2018.

Source: DANE.

Improving roads

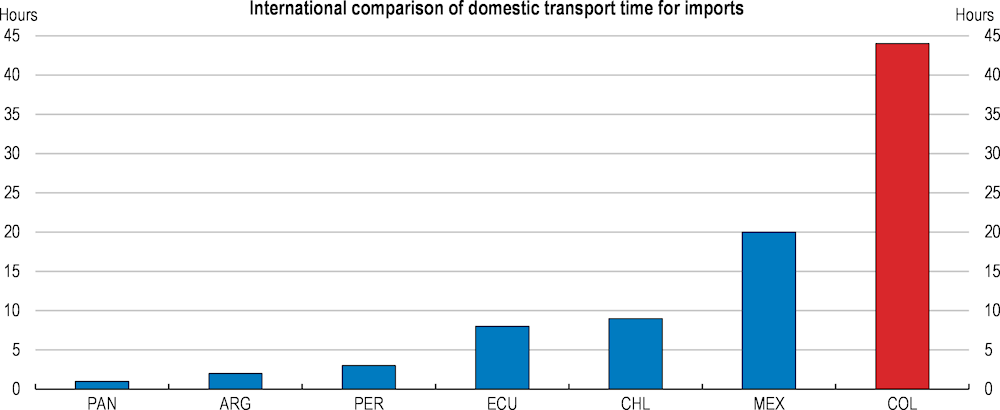

To illustrate the magnitude of Colombia’s high domestic transportation costs, it is often mentioned that it costs more to bring a shipment from a Colombian warehouse to a Colombian port than it costs to send the same shipment from the port to Asia. This is confirmed by recent studies finding that domestic transportation costs represent around 5% of the total price of an export, while international transportation represent 4.5% of the price (García et al., 2017[17]). When compared internationally, the 44 hours required to move shipments between a warehouse and port in Colombia doubles the hours necessary in Mexico (Figure 1.21).

Figure 1.21. Domestic transport in Colombia is more than twice as slow as in neighbours

Mountainous geography contributes to high transportation costs, but closing large gaps in road infrastructure and addressing inefficient regulations in the freight transport sector can go a long way to reduce transport costs. This would increase exports significantly in all sectors, but particularly in agriculture and manufacturing (De La Cruz et al., 2016[18]).

Colombian authorities have moved decisively to improve road infrastructure recently. An extensive public-private programme (so-called fourth generation, 4G) holds the promise of achieving a fundamental improvement in primary roads in Colombia. It has benefited from a steady improvement in the Colombian Puplic Private Partnerships framework, whose regulations rank now as one of the most robust in the world (International Bank for Reconstruction and Development / and The World Bank, 2018[19]). By the end of 2018 the financing of 17 projects, out of the 30 planed under 4G, is expected to be close. This amounts to USD 8.4 billions. 4G is expected to reduce domestic transportation times considerably. However, it remains important to continue to evaluate thoroughly the PPP projects and to record life-time contingent liabilities in a timely and transparent way.

The 4G programme has suffered from delays due to contractual problems, as the concessionaries of some key projects were affected by Odebrecht corruption cases. This created uncertainties about the balance of risks in some contracts in case the concessionary is affected by corruption allegations. Authorities have reacted promptly and pursued legal changes, but these changes remain subject to judicial uncertainty. The lack of uniformity in environmental licensing has also caused delays and uncertainties in several 4G projects.

Last, financial constraints to finance projects have also emerged, as the pipeline of projects is substantial, most of the investors are local and the size of the financial market remains small. Around 24% of funding is coming from abroad. This highlights that for a successful implementation of 4G projects, there is a need to gradually extend the investor base, incorporating more international investors

The ongoing improvements in primary goods has the potential to reduce domestic transportation costs and times. Yet, such improvements would still be dampened by poor access to cities and hubs for external trade, such as the main customs offices. According to estimates from the Transport Ministry, road traffic congestions to access the main cities, such as Barranquilla, Bogotá or Medellin, imply losses of 2% of GDP per year. This highlights the importance of improving access to cities and trade hubs, based on intermodal transport solutions.

Beyond primary roads, gaps in secondary and tertiary roads are large and critical. Only 10% of tertiary roads are in good shape. Gaps are particularly acute in rural areas, particularly in those affected by the armed conflict. A prompt and successful improvement in roads in these areas is fundamental for its economic and social development and for allowing those regions to benefit from the gains that trade can offer. Some innovative and promising initiatives have been launched, such as Public Works for Taxes (obras por impuestos) mechanisms, which allow firms to pay part of their taxes in kind, by executing and delivering public works, such as roads (Box 1.2).

Box 1.2. Paying taxes in kind: public works for taxes mechanisms

Public Works for Taxes mechanisms facilitate that the public sector and the private sector work together to reduce infrastructure gaps. Through these mechanisms, private companies advance the payment of their income tax to finance and execute directly public investment projects that either national or subnational governments have prioritized.

Peru was the regional pioneer and launched these schemes in 2008. Colombia is making use of these schemes in areas affected by the armed conflict (so-called Zomac), which cover 53% of the territory. Specialised firms, such as those in engineering or construction sectors, can execute the project themselves. Firms from other sectors can subcontract the execution of the project to specialised firms.

Firms can select among projects prioritised by local governments, regions, ministries or other governmental agencies. They can also propose projects on their own. This can help to accelerate investment in projects that boost participating firms’ competitiveness and also of the area where these firms are located. In that case the project is subject to an ex-ante evaluation by the relevant government body to ensure it has public interest.

Works should be in six specific areas: road infrastructure, energy, education, health, water treatment and sewerage. Upon finalization of the projects, the resulting infrastructure is delivered to the government, who determines which entity will be in charge of the management and maintenance. Projects are subject to audit and ex-post evaluation.

These schemes help to bridge acute needs for investment in areas where state capacity to execute projects is limited and the wishes of firms wanting to practice corporate social responsibility, who can get involved in works of high social impact. To make the most of these schemes, it remains crucial to ensure that the selected projects reflect well governments priorities, or in case of projects proposed by firms, that they benefit society at large.

Secondary and tertiary roads are under regional and municipal responsibility. Historically, regional and municipal investment on transport has been very low and of low quality. There have been good progress at national level to coordinate and to promote more investment on infrastructure. The so-called Transport Master Plan estimates that closing existing gaps would require additional investment in the order of 1.3% of GDP per annum during the next 20 years. This would require finding additional financial resources. One promising possibility is to raise additional revenues via property taxes, whose revenues are allocated to subnational governments. For that, completing and updating the cadastre is a necessary initial step. Existing cadastral information is incomplete, with about one third of the country not covered and half of existing information outdated. The problem is particularly acute in rural areas. A functional and complete rural cadastre would also be the starting point to promote a better use of land and promote rural development (OECD, 2015[10]).

Updating and completing the cadastre would also provide additional resources particularly to more disadvantaged areas, where the cadastre is more incomplete and more outdated and, at the same time, gaps in roads coverage and quality are largest. Currently municipalities have to compensate the national technical office to compute property values and they are often pressured by local lobbies not to do so (OECD, 2015[20]). The national government could provide cadastral services at lower or free cost and link increases in transfers from the central government to the completion or update of the cadastre.

Improving ports

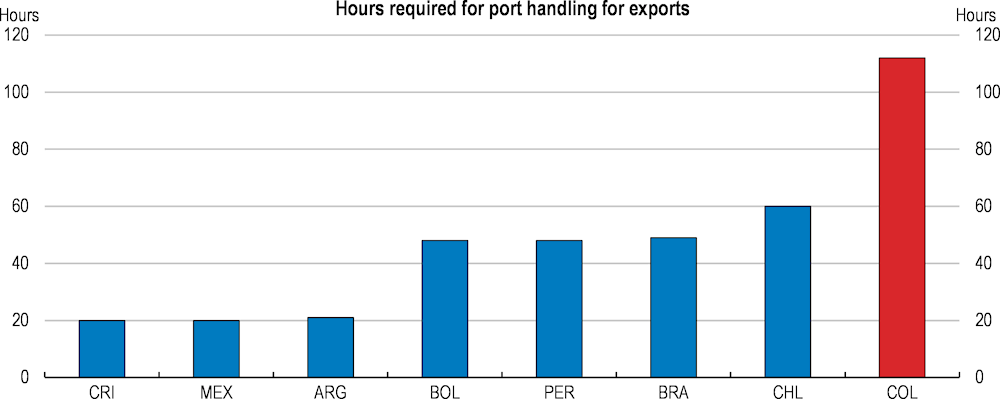

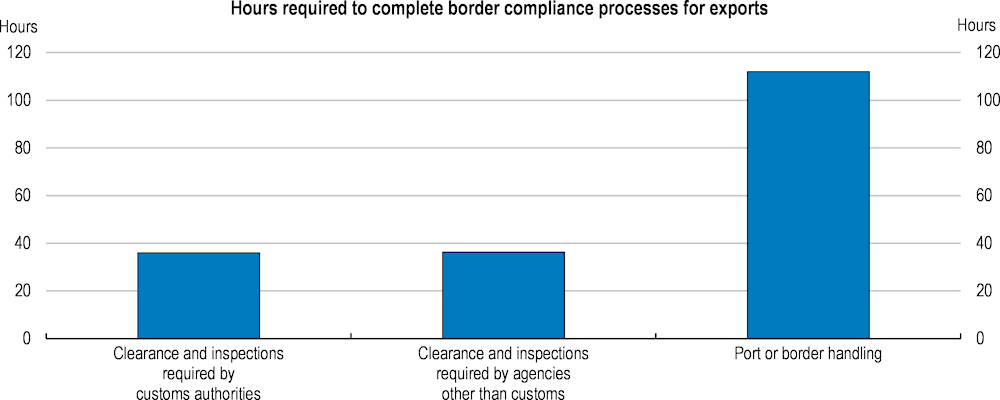

With the majority of global trade carried by sea, developing strong, well-functioning maritime transport infrastructure is a key element of economic growth. The Colombian ports system is composed of 40 public ports and 18 private ports. The system has increased its capacity in recent years. However, international rankings indicate that port and border handling remains a significant bottleneck for import and export processing times. Colombia’s exports required nearly twice as much time for handling (112 hours) as exports from the next slowest peer country (Figure 1.22). Port and border handling explains most of the delay for processing exports (Figure 1.23).

Figure 1.22. Ports are slower than in regional peers

Figure 1.23. Port and border handling is main time delay for processing exports

Efficiency analysis comparing ports across Latin America also shows that there is room to improve the efficiency of Colombian ports (Morales et al., 2013[21]). The port of Cartagena is the best performing, while Barranquilla and Santa Marta perform among the least efficient in Latin America.

Research shows that in emerging economies increasing private sector participation, reducing corruption in the public sector, improving liner connectivity and the existence of multimodal links help to increase port efficiency (Suárez-Alemán et al., 2016[22]). The latter is particularly important in Colombia as there are gaps in all transport infrastructure sectors. There is also room to increase competition between ports as a way to boost efficiency.

Improving port logistics also offers great potential for greater efficiency and lower costs. There are 140 tolls of which only 41 are digitalised. This implies high costs for users, including administrative costs. There are no one–stop shops for all the permissions and payments required to dock, load and unload cargo in Colombian ports. Moving to paperless and online solutions, where all required documents from various governments agencies are collected, would reduce the administrative burden created by the existence of paper forms and multiple repeated requests for the same information. There is also room to improve port performance by upgrading scanners, as only 10 Colombian ports have digital scanners.

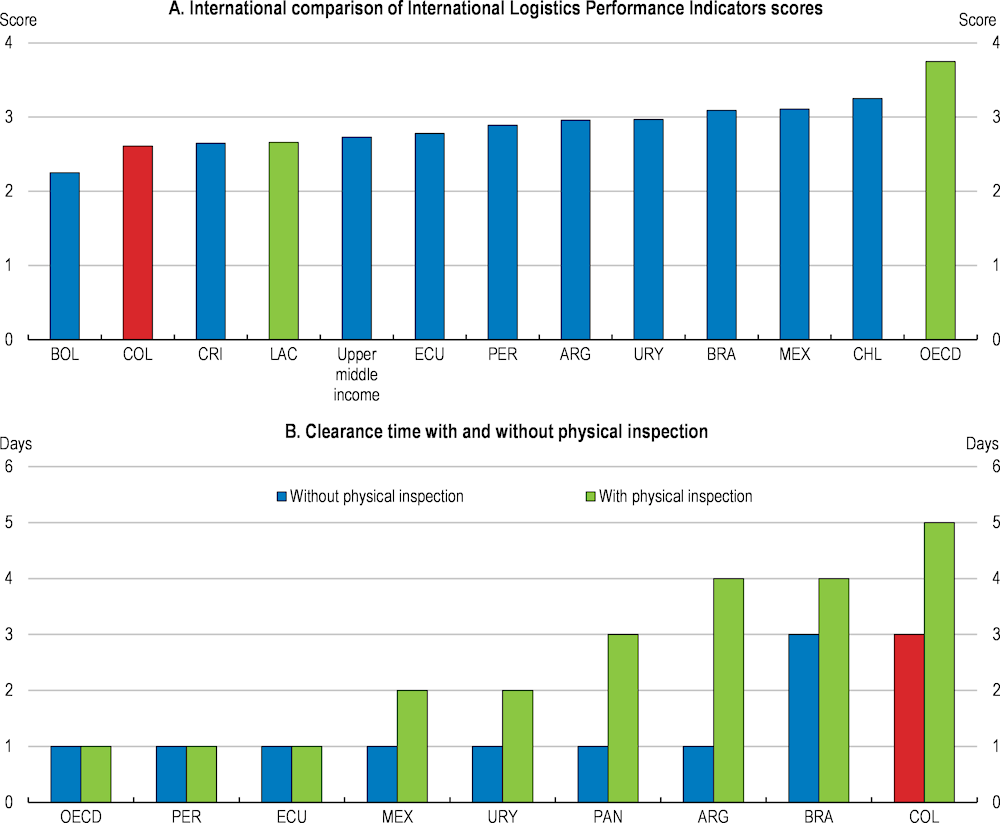

Trade facilitation can help

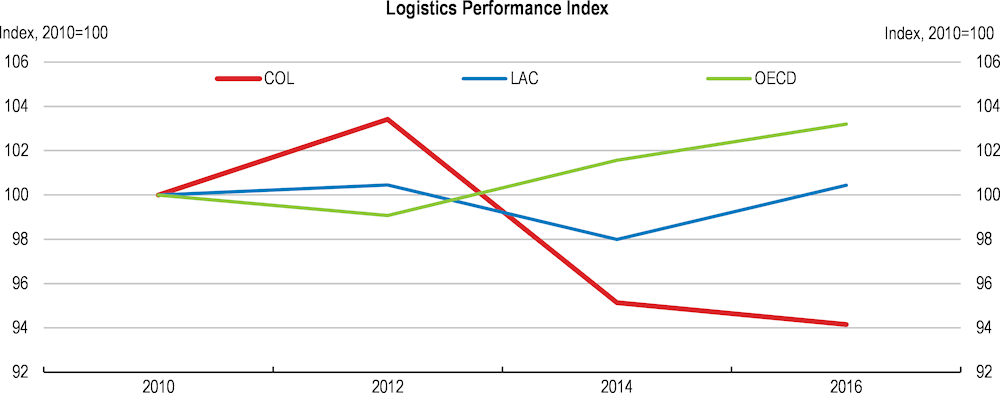

If goods move in and out of a country faster, trade costs will fall. Logistics play a crucial role in facilitating the movement of goods. Colombia’s performance in logistics is also well behind OECD standards and most countries in the region (Figure 1.24, Panel A). Besides infrastructure, this relates to weak clearance processes, uncompetitive shipment prices, low quality logistics services, and poor ability to track and trace consignments. Whether physically inspected or not, Colombian export shipments require more time for clearance than shipments from other countries (Figure 1.24, Panel B). Training, simplified regulations and rules of origin, or technological solutions can help to improve inspection times.

Figure 1.24. Logistics operations in Colombia perceived as lacklustre

Note: LAC, Upper middle income and OECD are defined according to the definitions of the World Bank.

Source: World Bank, Logistics Performance Index, 2016.

Empirical analysis undertaken for this chapter suggests that improving logistics can give a significant boost to exports (Dek and González Pandiella, forthcoming[23]). Should Colombia have improved its logistic performance in line with improvements made by peer countries, exports could have been significantly higher (Box 1.3).

Box 1.3. Assessing the impact of logistics on exports: a synthetic control method approach

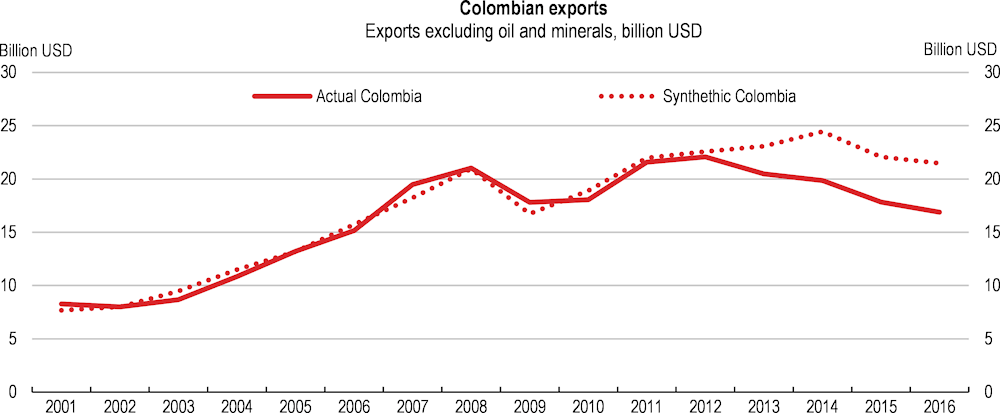

Progress in improving logistics has been significantly lower than in OECD and regional peer countries, with logistics indexes showing a worsening since 2012 (Figure 1.25). The synthetic control method (see (Abadie, Diamond and Hainmueller, 2014[24])) can help to gauge the impact that this weak performance in logistics has on exports (Dek and González Pandiella, forthcoming[23]). The synthetic control method uses a data-driven procedure to construct a synthetic control unit, so-called synthetic Colombia, using a weighted combination of comparison units (other countries) that approximates the characteristics of the exposed unit (Colombia) before an event or intervention. The synthetic Colombia can then be used to simulate the development of Colombia after the event (in this case the lack of progress in improving logistics services). Results indicate that, had Colombia improved its logistic performance in line with improvements made by peer countries, exports would have been significantly higher (Figure 1.26). This highlights that, beyond physical infrastructure, logistics also matters and that policy efforts in this area will pay off in terms of higher exports and growth.

Figure 1.25. Logistics performance has deteriorated

Figure 1.26. Real Colombian exports vs synthetic Colombian exports

Note: The following countries were used to construct the synthetic Colombia: Chile, Ecuador, Finland, Latvia, Mozambique, Nigeria and Turkey.

Source: OECD calculations.

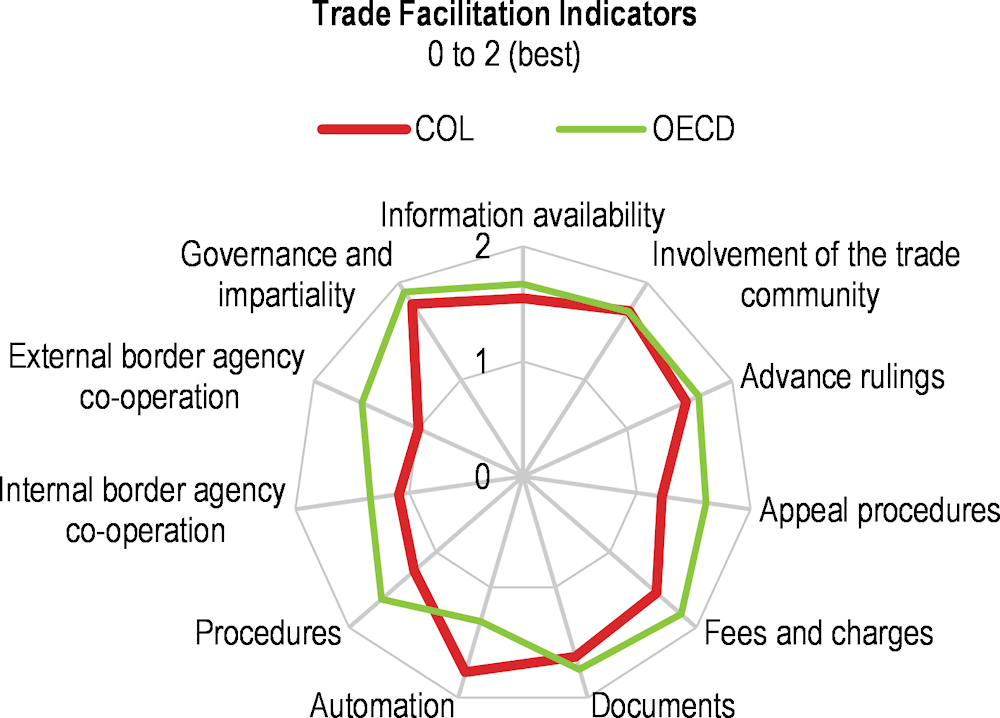

The OECD’s Trade Facilitation Indicators can help to identify in which areas policy efforts would be beneficial to reduce logistics costs. Colombia has set up a single window for foreign trade (Ventanilla Única de Comercio Exterior, VUCE). It has helped to reduce authorisation times and the number of procedures to comply by exporters and importers. But internal and external border agency cooperation and customs procedures are the areas where Colombia has room to improve (Figure 1.27). These are initiatives which are less demanding in terms of financing than building physical infrastructure but the resulting pay-off could be large. OECD estimates indicate that, by cutting red tape, and harmonising and automating border processes, trade costs could fall up to 18%, with a stronger impact on emerging economies.

Figure 1.27. There is room to improve trade facilitation

To enhance internal agencies cooperation, Colombia should increase efforts to move to joint inspection processes in which all inspections take place in a single time and place. Cooperation and exchange of information between agencies in charge of processing the movement of goods through its borders, those collecting government revenues, those protecting national security, and those safeguarding public health could be improved. Progressing in the integration of the customs system with the single window for foreign trade by ensuring that the resulting platform is sufficiently resourced to operate efficiently, would be a key step ahead, as it would eliminate duplicities and reduce regulatory burden. Improving risk profiling mechanisms and moving to an integrated risk management system can help to reduce long delays in inspections (OECD, 2014[25]).

Achieving the interoperability of the customs declaration with the other countries of the Pacific Alliance (Chile, Mexico and Peru) would be a major step to improve external border agency cooperation. Fostering the automation of customs processes and promoting and making the advance clearance of goods more user-friendly would also help to improve customs procedures.

Acknowledging the large positive effect that trade facilitation measures can have to spur trade, the government has recently launched a permanent interagency body, the Round Table on Trade Facilitation (Mesa de facilitación del comercio), aimed at reducing delays and costs associated to trade. The round table has representatives from the private sector and will have a strong regional emphasis. First initiatives, such as those aimed at decreasing the use of cash transactions in trade operations, are encouraging and the round table holds the promise of being a powerful catalyser of structural reforms in this important area. Tax authorities are also exploring the use of big data and machine learning to improve risk-profiling and reduce inspection times.

Boosting competition in key services

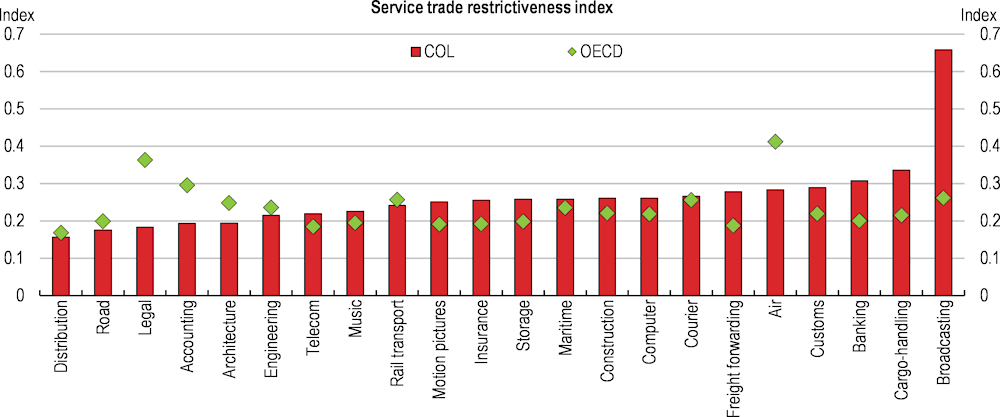

Restrictive services trade regulations disproportionately discourage exporting activities of SMEs (Rouzet, Benz and Spinelli, 2017[26]). The recent experience in the telecommunication sector, where measures to favour entry and improve competition triggered a significant decrease in prices, illustrate that boosting competition in key services helps to reduce costs for downstream firms and improve its competitiveness.

Reviewing existing trade barriers in key services areas (Figure 1.28), such as cargo-handling, storage or freight forwarding, would improve competition in the logistics sector and reduce costs. For example, foreign companies can only provide multimodal freight services if they have a domiciled agent or representative legally responsible for its activities in Colombia. In the same vein, international cabotage companies can provide cabotage services (i.e. between two points within Colombia) “only when there is no national capacity to provide the service”. Colombia prohibits foreign ownership of commercial ships licensed in Colombia and restricts foreign ownership in national airlines or shipping companies to 40%. FDI in the maritime sector is limited to 30%. The owners of a concession providing port services must be legally constituted in Colombia and only Colombian ships may provide port services within Colombian maritime jurisdiction; however, vessels with foreign flags may provide those services if there are no capable Colombian-flag vessels.

In professional services, lessening restrictions on movement of natural persons (e.g. through the recognition of qualifications and reduced residency requirements) could further facilitate trade, in particular in legal and accounting services.

Figure 1.28. Restrictions in some key service sectors are high

Note: Index scale from 0 to 1 (most restrictive regulations).

Source: OECD (2017), Services Trade Restrictiveness Index.

According to the OECD’s Product Market Regulations index, there is significant room to improve regulations in the road transport sector to favour entry and competition, particularly in freight transport. Colombia’s trucking industry is highly fragmented with many one-truck firms that are relatively inefficient (OECD, 2017[27]). The performance of the sector is hampered by an old cargo fleet. A scrapping scheme, which is planned to be eliminated in 2019, has made it profitable to maintain old trucks, as importing a new truck requires scrapping an old one. This has created a market for old trucks and raised prices. Furthermore, there are also plans to eliminate government intervention in price setting in freight transport. Going ahead with these plans and with the elimination of the scrapping scheme would be a fundamental step to improve freight transport, which will have a significant economy-wide positive impact, as all firms make use of those services, in particular exporting firms. There is also scope to improve regulations in railway, particularly concerning entry into the freight transport market, where currently franchised companies are granted exclusive rights, hence limiting competition.

Improving infrastructure planning

Colombia has made good progress in establishing a robust legal framework to improve infrastructure planning and coordination. However fundamental parts of the framework have not been implemented. A law approved in 2013 foresaw the creation of an agency dedicated to the planning of infrastructure (Unidad de Planeación Integrada del Transporte), with a particular emphasis on ensuring that a multi-modal view of transport infrastructure is shared across all level of government and in the pre-selection of projects. The latter is particularly needed as the methodology to evaluate projects is currently not standard across government agencies. The emphasis on establishing a multi-modal view is also warranted, as investment in certain areas, such as rail transport, would be more effective if they are undertaken within a multi-modal vision of transport infrastructure.

It would also be beneficial if the agency is tasked with providing subnational governments with technical assistance and advice, to avoid that insufficient planning, non-competitive procurement and corruption continues to hamper local and departmental infrastructure, particularly in rural areas.

The creation of such an agency would be in line with international evidence suggesting that having an entity in charge of coordinated and harmonised planning helps to improve infrastructure in a cost-effective way (Salehi Esfahani and Ramírez, 2002[28]; Andres, Guasch and Straub, 2007[29]). Despite completing all legal requirements for its creation in 2015, the entity has never been set up. In the same vein, the 2013 law foresaw the creation of a much needed regulation commission for transport infrastructure. Colombia has good experience with similar agencies in other key sectors such as energy, where both a unit in charge of planning and a regulator were set up and were instrumental to improve performance in that sector.

Lowering input costs for exporters

Trade tariffs have fallen

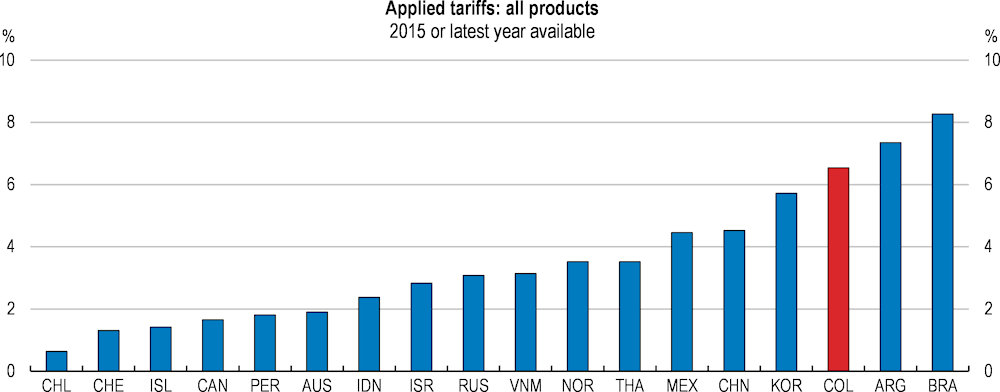

Colombia has made important efforts to promote trade integration in the recent years. In the last years, following the negotiation of several trade agreements, average tariffs were reduced from 12.4% in 2000 to 6.5% in 2015. Yet, Colombia holds the fourth highest tariffs in Latin America, after Venezuela, Argentina, and Brazil. Average tariffs are five times higher than in Chile (Figure 1.29).

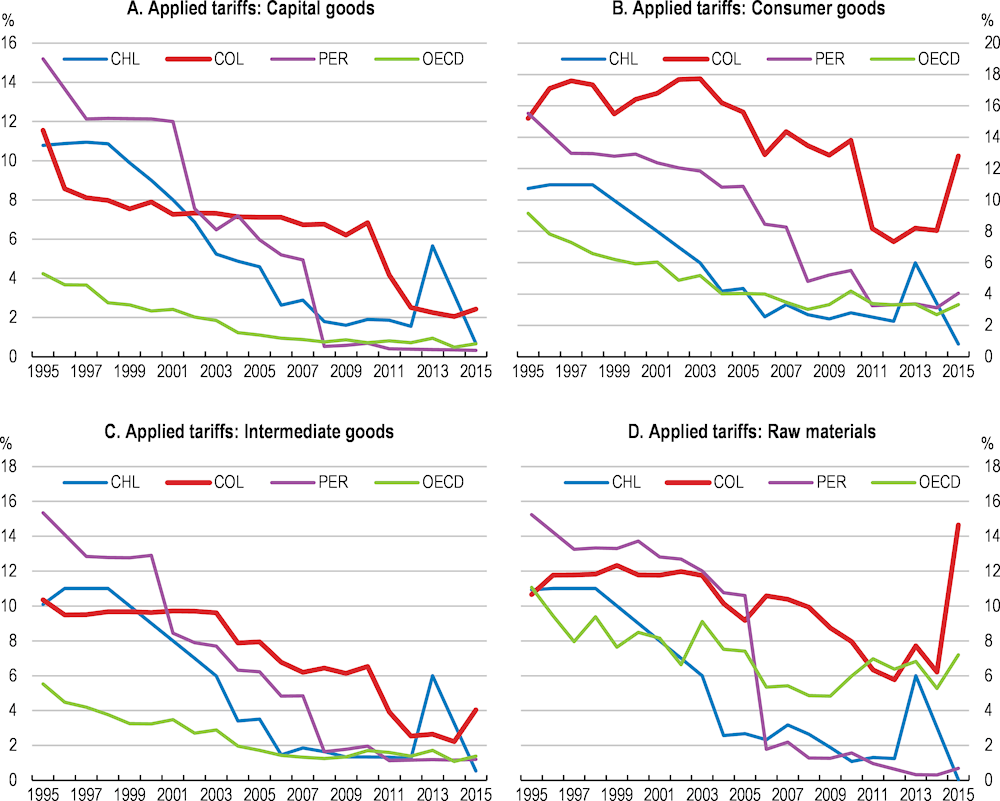

Tariffs have been decreasing across all product groups (Figure 1.30). Largest differences with respect to tariff levels in OECD and peer countries are found in consumer goods and raw materials. Since 2011, Colombia has been reducing the tariffs on capital goods not produced in the country to zero. This covers around 3 600 tariff positions. For those produced in Colombia tariffs range from 5% to 10%. This suggests that, notwithstanding progress achieved to facilitate the use of capital goods, there is still scope to foster higher competition in capital goods, which would improve Colombian firms’ competitiveness.

Figure 1.29. Tariffs are higher than in peer countries

Figure 1.30. Tariffs have fallen

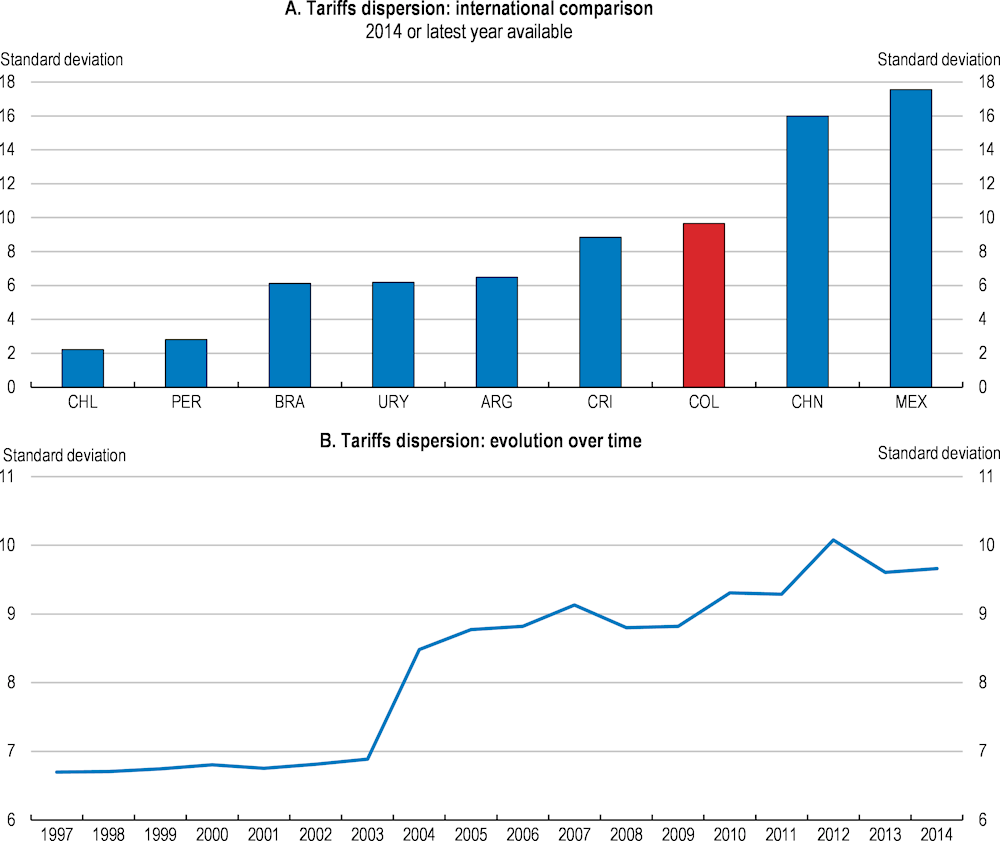

Tariffs dispersion is high

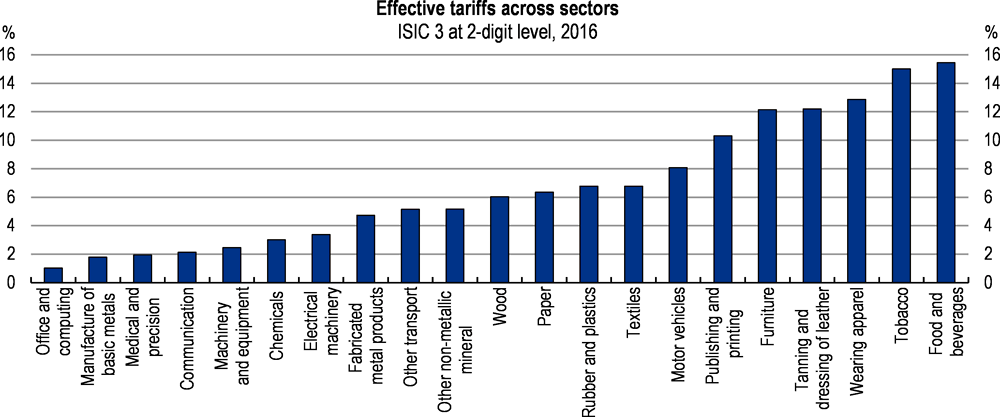

The high tariff dispersion (Figure 1.31, Panel A) has been increasing overtime (Figure 1.31, Panel B). The highest tariffs are in agricultural and manufacturing sectors (Figure 1.32). Nominal tariffs on agricultural products average 18% but can be as high as 70% for beef and 49% for dairy. In manufacturing clothing, footwear and the automotive sector have the highest tariffs.

Figure 1.31. Tariffs dispersion has increased over time

Note: Data show the standard deviation of tariffs based on the 6-digit product category classification available in UNCTAD’s TRAINS.

Source: UNCTAD, TRAINS.

Continuing to reduce tariffs, particularly those in capital goods and raw materials, would help to increase firms’ productivity and competitiveness. Firms would gain improved access to intermediate and capital inputs not only through inputs but also via the reaction of domestic producers to rising competition. This would help sectors more intensive in capital goods, but it will also help traditional sectors, which would access better inputs at lower prices. This includes the textile sector, highly dependent on raw materials, such as threads. Colombia’s domestic production of threads is scarce, which implies higher costs, limiting Colombian firms’ competitiveness in foreign markets and their job-creation potential.

Figure 1.32. Tariffs are highest for food and some manufacturing sectors

Previous episodes of tariff reductions attest that this channel can be strong in promoting productivity and inclusive growth (Eslava et al., 2013[30]). This will have a positive impact in terms of job-quality, as higher productivity would help more firms tap external markets, and Colombian exporters tend to pay 43% higher salaries than non-exporters (Brambilla, Depetris Chauvin and Porto, 2017[2]).

Opening up to the world economy would entail some job reallocations across sectors, implying that some workers will need to search for a new job. In previous episodes of tariff reductions, workers displacements have been found to be relatively short-lived (Eslava et al., 2010[31]). For affected workers, active labour market policies can go a long way to reduce the burden of adjustment. Such policies can also help workers move across sectors through training, job search assistance and activation measures (World Bank, 2013[32]; Flanagan and N. Khor, 2012[33]). Supporting workers with unemployment insurance and relevant training (see Chapter 2) would be the best way to equip them with the means to succeed in an open and changing world.

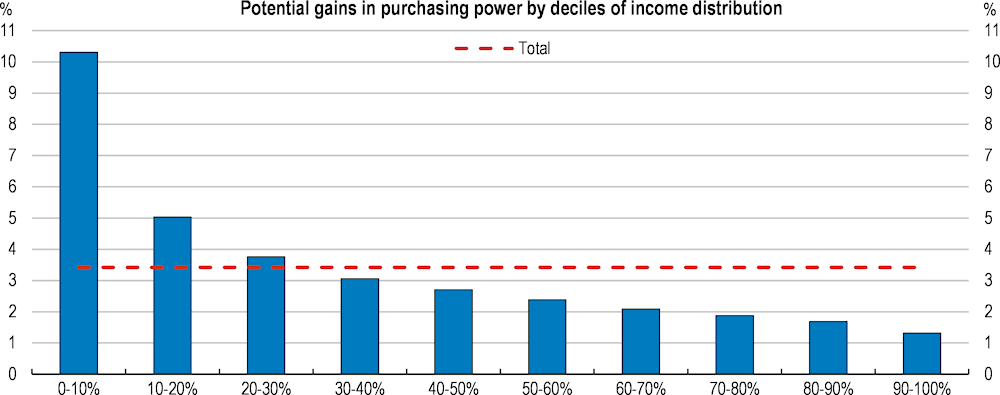

The tariff structure has also important repercussions in terms of well-being and income distribution. Tariffs are taxes on imported goods and since people with different levels of income consume these goods at different intensities, changes in tariff reductions will also have a distributional impact. Analyses of the incidence of tariffs across the income distribution conclude that tariffs tend to have a regressive effect (OECD, 2018[34]; Furman, Russ and Shambaugh, 2017[35]; Porto, 2006[36]).

An analysis based on Colombian household survey data conducted for this chapter reveals similar results. Reducing tariffs would result in income gains across the entire income distribution, but the largest benefits of lower tariffs would accrue to lower income households. In a scenario of tariffs being halved, the purchasing power of the poorest households, i.e. those in the lowest income decile, would increase by more than 10% (Figure 1.33). Overall, average household income would increase by 3.5%. The marked pro-poor feature of the tariff reduction is explained by the fact that lower income households spend more on traded goods as a share of their income. In addition, the higher tariffs are placed on key consumer goods, such as food and clothing, which represent a relatively larger share in the consumption basket of lower income families. This finding is in line with other studies indicating that phasing out tariffs on rice would lift 1.2 million Colombians out of poverty and a further 443000 out of extreme poverty (Perfetti et al., 2017[37]). Thus, from a consumption perspective, the Colombian tariff structure is regressive. Reducing tariffs would therefore also contribute to reduce income inequality and poverty.

Figure 1.33. Reducing trade barriers would benefit especially low-income households

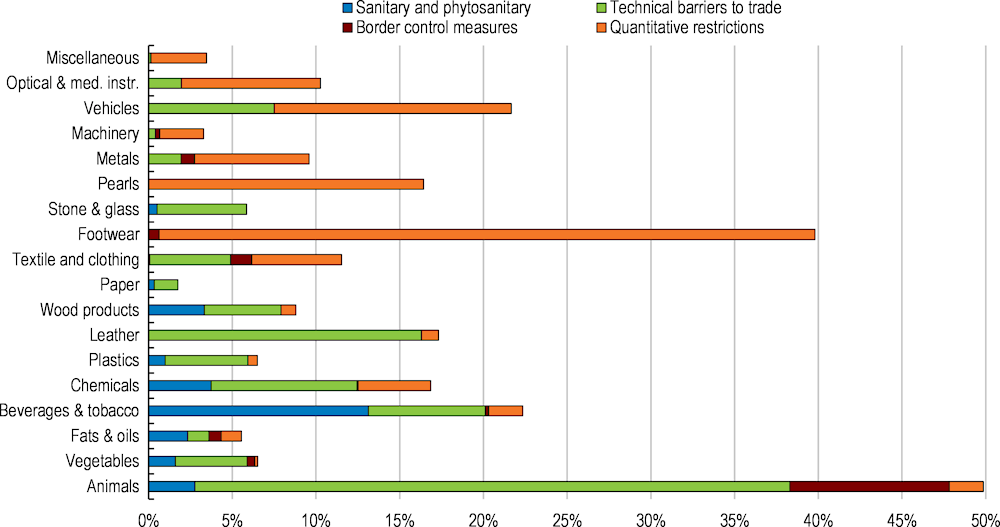

Non-tariff trade measures are numerous

Besides tariffs, other policies also affect trade flows, but often in a much less transparent manner.

This includes sanitary measures, technical barriers, border control measures and quantitative restrictions. Even without protectionist intent, non-tariff measures can raise trade costs, divert managerial attention, and penalize small exporters and those located in disadvantaged areas where access to legal and regulatory information is difficult. Countries imposing non-tariff measures may end up hurting their own competitiveness by making it difficult for domestic producers and exporters to access critical inputs in a timely fashion (Cadot, Malouche and Sáez, 2012[38]).

Colombia has been making an increasing use of non-tariff measures (Garcia et al., 2014[39]). The number of products affected is relatively large (Table 1.1. ), and larger than in other countries in the region such as Chile or Mexico (Cadot, Gourdon and van Tongeren, 2018[40]). In particular, Colombia makes ample use of quantitative restrictions (Figure 1.34.), which can take the form of registration and import licensing requirements and quotas, and are deemed to be the more distortive kinds of barriers, as they directly restrict trade flows. Many non-tariff measures aim only at protecting incumbents in certain sectors (World Bank, 2015[41]).

Table 1.1. Non-tariff measures are prevalent across all sectors

|

w |

Frequency index |

Prevalence score |

||||||

|---|---|---|---|---|---|---|---|---|

|

2017 |

Sanitary and phyto sanitary |

Technical barriers to trade |

Border control measures |

Quantitative restrictions |

Sanitary and phyto sanitary |

Technical barriers to trade |

Border control measures |

Quantitative restrictions |

|

Animals |

100 |

99 |

100 |

100 |

6.8 |

3.9 |

1.0 |

1.1 |

|

Vegetables |

100 |

100 |

82 |

98 |

4.6 |

5.8 |

0.8 |

1.0 |

|

Fats & oils |

100 |

100 |

100 |

98 |

4.7 |

6.9 |

1.0 |

1.0 |

|

Beverages & tobacco |

89 |

100 |

85 |

88 |

4.9 |

6.1 |

0.8 |

0.9 |

|

Minerals |

32 |

35 |

2 |

55 |

0.5 |

1.0 |

0.0 |

0.6 |

|

Chemicals |

89 |

92 |

7 |

95 |

2.7 |

3.5 |

0.1 |

0.9 |

|

Plastics |

20 |

41 |

0 |

41 |

0.4 |

0.8 |

0.0 |

0.5 |

|

Leather |

19 |

94 |

9 |

48 |

0.9 |

1.3 |

0.1 |

0.6 |

|

Wood products |

76 |

73 |

27 |

85 |

1.6 |

0.6 |

0.2 |

0.6 |

|

Paper |

8 |

72 |

0 |

4 |

0.3 |

1.8 |

0.0 |

0.0 |

|

Textile and clothing |

2 |

34 |

100 |

100 |

0.1 |

0.4 |

2.0 |

1.1 |

|

Footwear |

0 |

57 |

53 |

60 |

0.0 |

1.3 |

0.6 |

0.7 |

|

Stone & glass |

13 |

23 |

0 |

13 |

0.2 |

0.5 |

0.0 |

0.1 |

|

Pearls |

0 |

9 |

2 |

100 |

0.0 |

0.2 |

0.0 |

1.0 |

|

Metals |

1 |

8 |

20 |

64 |

0.0 |

0.2 |

0.2 |

0.7 |

|

Machinery |

0 |

12 |

2 |

52 |

0.0 |

0.1 |

0.0 |

0.6 |

|

Vehicles |

0 |

46 |

1 |

81 |

0.0 |

0.9 |

0.0 |

1.3 |

|

Optical & med. instr. |

20 |

27 |

1 |

54 |

0.4 |

1.0 |

0.0 |

0.8 |

|

Arms |

0 |

11 |

0 |

100 |

0.0 |

0.2 |

0.0 |

1.9 |

|

Miscellaneous |

0 |

11 |

0 |

25 |

0.0 |

0.2 |

0.0 |

0.3 |

|

Work of Arts |

0 |

13 |

0 |

13 |

0.0 |

0.1 |

0.0 |

0.1 |

Note: The frequency index captures the percentage of products that are subject to one or more non-tariff measures. The prevalence score captures the average number of non-tariff barriers which apply to a product.

Source: OECD calculations based on (Cadot, Gourdon and van Tongeren, 2018[40]).

While frequency measures of non-tariff measures are useful to learn how extensive the use of non-trade barriers is across an economy, they do not give information about its impact in terms of higher costs to import. For that non-tariff measures have to be converted into ad-valorem tariff equivalents. The OECD has developed a novel method to estimate trade equivalents, distinguishing explicitly the different impact that different types of measures can have on trade (Cadot, Gourdon and van Tongeren, 2018[40]). Estimates for Colombia show that non-tariff measures imply significant increases in trade costs both in agriculture and in manufacturing sectors, reaching 40% in footwear or 20% for vehicles (Figure 1.35). This adds to the high tariffs that these sectors also have. Quantitative restrictions are the ones that imply higher tariff equivalents, particularly in manufacturing.

Figure 1.34. Quantitative import restrictions are prevalent across all sectors

Figure 1.35. Non-tariff barriers imply high additional tariffs on imports

Because non-tariff measures increase costs they can have a detrimental impact on competitiveness and export performance. Studies for Colombia show that existing non-trade barriers in 2001 implied a tariff of 40% on exports (Garcia et al., 2014[39]). The use of non-tariff barriers have increased substantially since then, which suggest that the implicit tax on exports would be larger now. From a consumption perspective, similar to tariffs, non-tariff barriers also have distributional implications, whose detrimental effects are largest for low-income individuals.

This indicates that reviewing these measures, with a view to reducing their scope and impact, should be a priority in an agenda to boost export performance. Quantitative measures would require particular attention, as they are the most distortive, and in addition, to higher economic costs they also entail significant administrative costs. Reducing further the processing times of import license applications, via the single window for foreign trade, including through faster issuance of import-related permits, would also be important. Adopting common standards can also be a promising way to reduce the costs associated to other non-tariff measures, such as technical barriers, as they help to build trust and facilitate smoother trade.

Colombia plans to submit all new non-tariff barriers to a regulatory impact assessment. This holds the promise of ensuring that new measures respond to genuine reasons and do not act to safeguard vested interests in some markets. However, there is also a need to deal with the stock of existing measures, many of which will continue to penalize firms and competitiveness. International experiences show that dealing successfully with the legacy of measures requires intensified public-private dialogue, in which the private sector can flag problems and contribute to the solution, and a strong technical team (Cadot, Malouche and Sáez, 2012[38]). Colombian legislation provides a good basis for the review of the legacy of measures, as it establishes that regulators must review their technical regulations every 5 years to decide whether regulations should remain in place or need an update. Mexico and Indonesia illustrate that an agenda to streamline existing non-tariff barriers can act as a powerful tool to implement reforms essential to strengthen the competitiveness of domestic firms. There is also a need to ensure greater coordination between all institutions in charge of dealing with non-tariff trade barriers (García, Collazos and Montes, 2015[42])

There is also room to enhance cooperation with other countries in terms of rules of origin, sanitary measures and other technical barriers. This would help particularly to boost intra-regional trade. Considering more systematically international standards in the development and revision of regulation can reduce trade costs (OECD, 2017[43]). International standards are increasingly pursued in Colombia, although this still rests on a discretionary regulatory framework. Consolidating explicitly the use of international standards in regulations would be desirable. There are also capacity constraints in Colombian standardisation and accreditation systems (OECD, 2014[25]). Developing further laboratory and testing facilities would enhance the ability of firms to expand globally, as the demand for certified products is growing strongly.

Gathering information on regulatory requirements in target markets can also imply significant trade costs for exporters (OECD, 2017[43]). The measures with a more negative impact on Colombian exporters to other countries in Latin America are those related with labelling, certificates of origin and product certificates (ICT, 2015[44]). Relevant information is dispersed among the different government entities related to foreign trade and is not easily accessible, generating additional costs for exporters. Beyond engaging in intergovernmental cooperation to harmonise rules and regulations, centralising all the information in one single tool, and making it easily available, would also help.

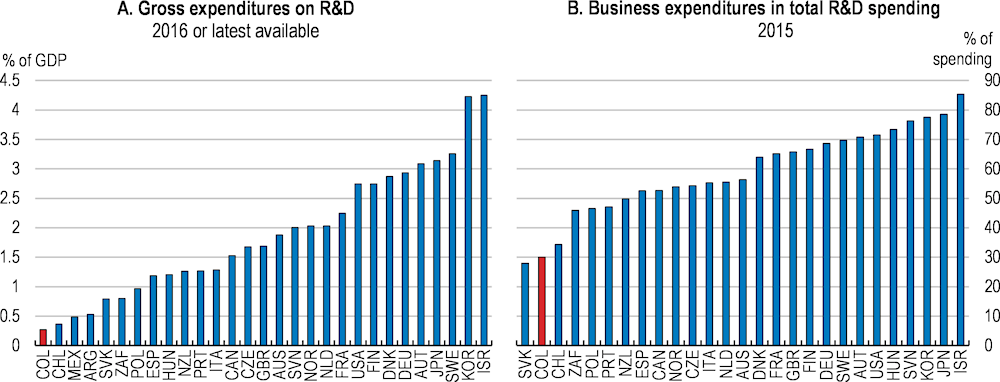

Boosting innovation

Innovation can be a powerful engine to boost productivity and improve exports prospects. Innovation can be particularly helpful to facilitate small non-exporting firms entering external markets (Cassiman, Golovko and Martínez-Ros, 2010[45]). Innovation also boosts product diversification (Crespi et al., 2015[46]). Spending on research and innovation is relatively low (Figure 1.36, Panel A), amounting to 0.25 % of GDP, which is well below the OECD average of 2.4%. The gap is especially pronounced for business R&D (Figure 1.36, Panel B). Acknowledging that innovation is a key pillar for boosting growth and diversifying the economy, the authorities aim at increasing R&D spending to 1% of GDP.

Figure 1.36. Spending on R&D is low

Source: OECD, Research and Development Statistics and National Account databases; OECD, Main Science and Technology Indicators database.

According to firm survey data, firms introducing innovation in products, processes, organizational processes or marketing remain rare (OECD, 2017[27]). Competitive pressure is one of the most powerful incentives to innovate, and limited competitive pressures on Colombian firms may have significantly restrained innovation. Fostering a more competitive business environment would be a powerful way to promote more innovation. Cooperation between firms and universities is also low (OECD, 2017[27]). Colombia remains below other countries in Latin America, such as Argentina, Brazil and Chile, in number of patents. The number of PhD students has increased, suggesting improving prospects for innovation activities.

Innovation programmes, such as the R&D tax credit, have improved overtime. Until 2016, it was mainly used by one company, Ecopetrol. Efforts to promote its use have proven to be useful and the take up increased to 150 companies in 2017. Any company can use the tax credit regardless of size or sector; however, most tax credits have been awarded to large companies (89% in 2017).

Additional resources have become available to fund R&D activities, including allocating 10% of natural resources royalties to a specific R&D fund (Fondo de Ciencia, Tecnología e Innovación). However, weak governance implies that a large part of funding remains unused. Recent reforms have tried to improve governance by allocating the funding directly to research centres. This could also avoid excessive fragmentation in projects and would favour larger projects with larger impact.

Further efforts to simplify the innovation system are warranted, as several reviews have identified an excessive dispersion of public support programmes (OECD, 2014[47]). SMEs, whose capacity to navigate complex support systems is more limited, would benefit the most if the system is streamlined. There is also a need to improve accountability. Multiples institutions are involved simultaneously in the design, implementation and monitoring of support programmes. This makes the evaluation of programmes difficult (OECD, 2014[47]).

Going digital

The adoption and effective use of ICT hardware and software is a form of business innovation (OECD, 2018[48]), which can boost firms’ competitiveness and the connectivity of regions. Going digital, by promoting further adoption and use of ICT technologies, has been identified by the government as a key pillar to boost growth and inclusiveness.

Going digital offers a large potential for firms to internationalise activities. Some recent examples of successful Colombian start-ups include a mobile application aimed at facilitating the arrangement of home services, which has made Colombia a regional leader in this area. This case shows that digital technologies can be a powerful tool to diversify exports, particularly in intensive-knowledge and high-growth areas and tap new external markets.

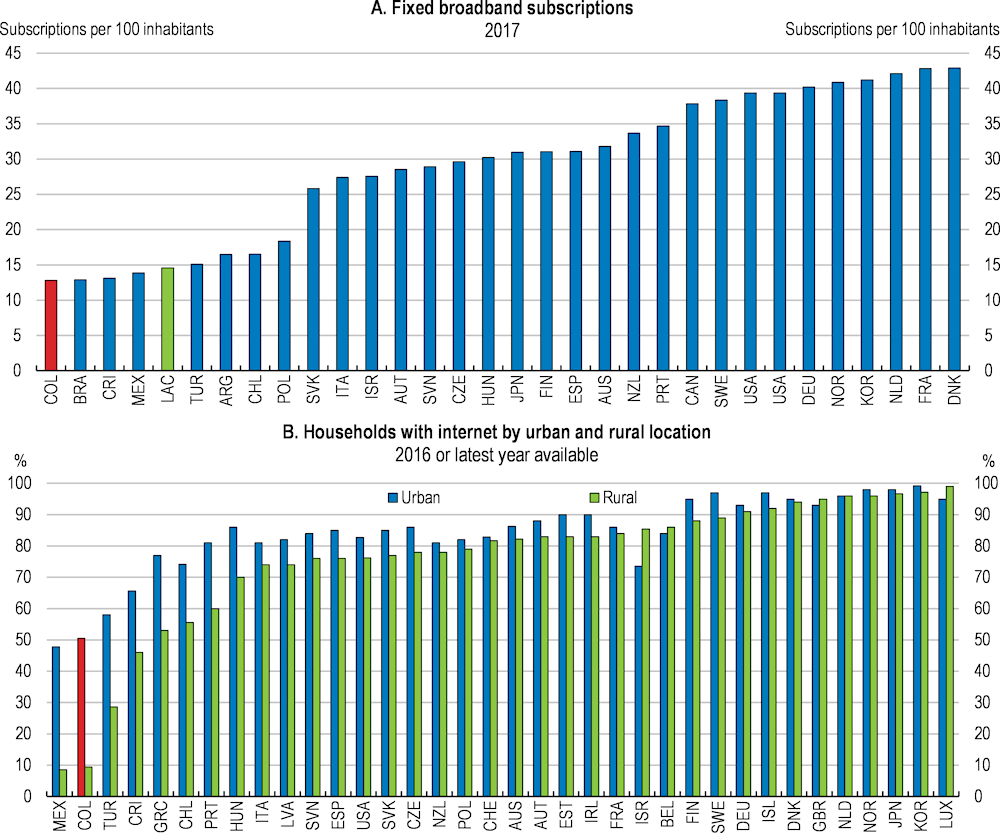

Despite good progress in terms of digital adoption, connectivity remains relatively low (Figure 1.37, Panel A). Low connectivity can be partly explained by the cost. The price of a subscription to a fixed broadband represent 12% of the average wage for the poorest 40% of the population (Roseth et al., 2018[49]). This is 4 times larger than in the OECD and nearly two times more than in Chile or Mexico. Prices have recently fallen, following some regulatory changes that favour entry and competition in the telecommunications sector (SIC, 2017[50]). This illustrate that, beyond deploying the needed infrastructure, further strengthening the position of the regulator, and effective enforcement of pro-competition regulations help to promote higher use of ICT technologies. It will also help to close digital divides, which remain high along the lines of firm size or individuals’ income.

Progress has also been achieved in closing the gap between urban and rural areas. Yet, it remains significant (Figure 1.37, Panel B). Rural areas suffer also from low quality, as services become unavailable some times and access to high-speed connections lags behind. Further efforts to bridge the digital divides so that services attain the greatest national coverage are warranted. Encouraging further broadband investment in remote areas would help to bring the benefits of the digital transformation to all Colombians. Given high market concentration in telecommunication systems at the regional level, surveillance of market practices is also warranted.

Improving the attractiveness of Colombia for investment in digital activities would also be key. Reducing the regulatory burden faced by companies, as analysed in the Key Policy Insights section of this survey, would be particularly important. Improving access to finance by young and innovative firms would also be fundamental. This includes bank finance (see next section) but also improving funding for riskier investments.

Figure 1.37. There is room to boost the adoption of ICT, particularly in rural areas

Note: LAC refers to the unweighted average of Argentina, Brazil, Chile, Costa Rica and Mexico.

Source: OECD, Broadband Portal; OECD (2018).

Easing access to finance

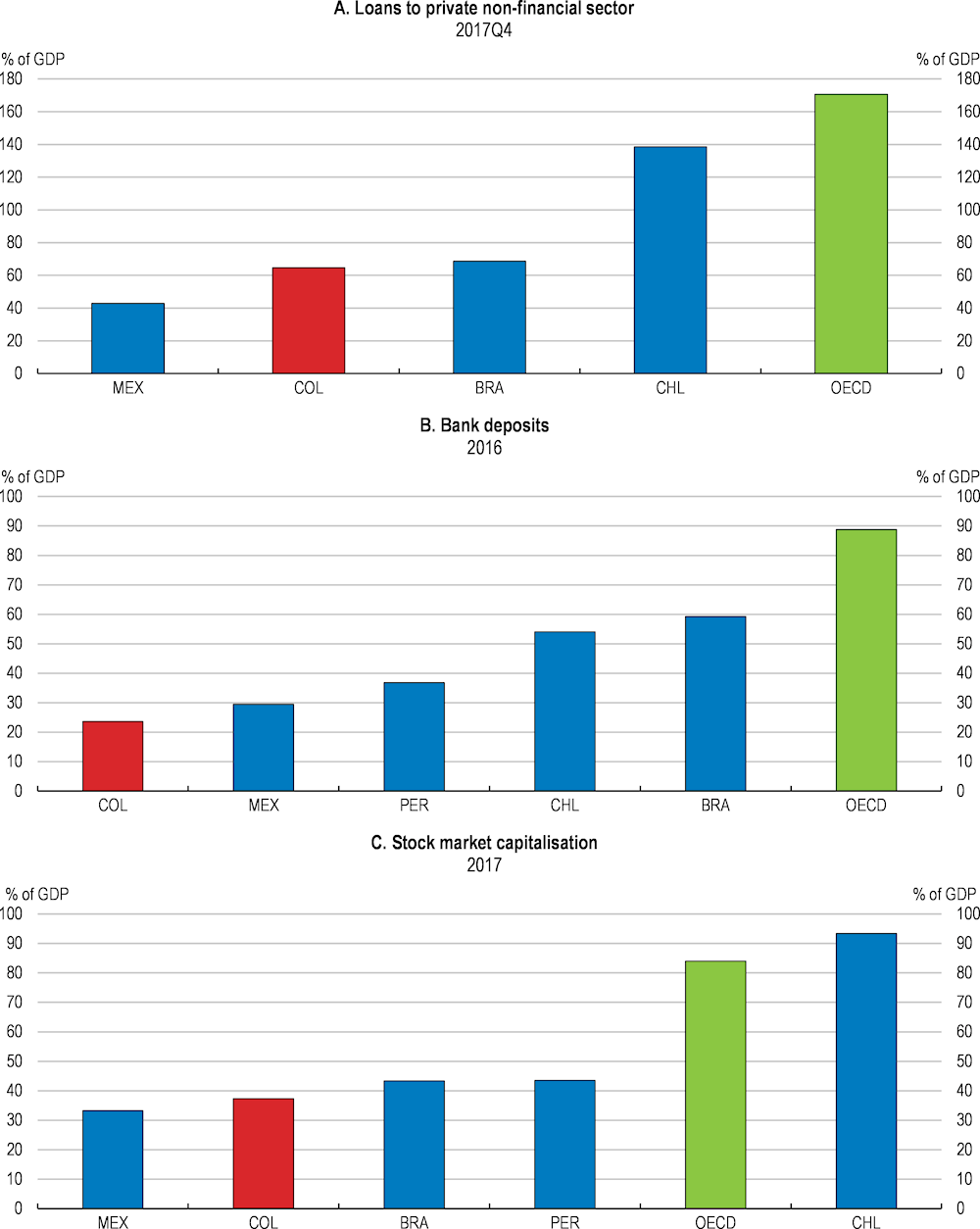

Access to finance has improved in recent years. However, financial markets remain less developed than in other OECD countries and peer countries in Latin America (Figure 1.38). Empirical evidence shows that financial development enhances trade (Johansson and Olaberría, 2014[51]), particularly in goods whose production tends to be more dependent on external finance. Empirical analysis confirms that credit availability is an important driver of trade performance in Colombia (Restrepo Ángel, Cuervo and Uribe, 2012[52]). Thus, higher financial development would facilitate higher exports and diversification.

Figure 1.38. There is room to develop financial markets

Source: Bank for International Settlements; For Panels B and C: World Bank, Financial Development and Structure Dataset.

Long-term financing is little developed, constraining investment and growth. Commercial banks are the principal source of long-term corporate and project finance. Loans rarely have a maturity in excess of five years. Only the largest companies participate in the local stock or bond markets, with the majority meeting their financing needs either through the banking system, by reinvesting their profits, or through credit suppliers.

Improving bank financing

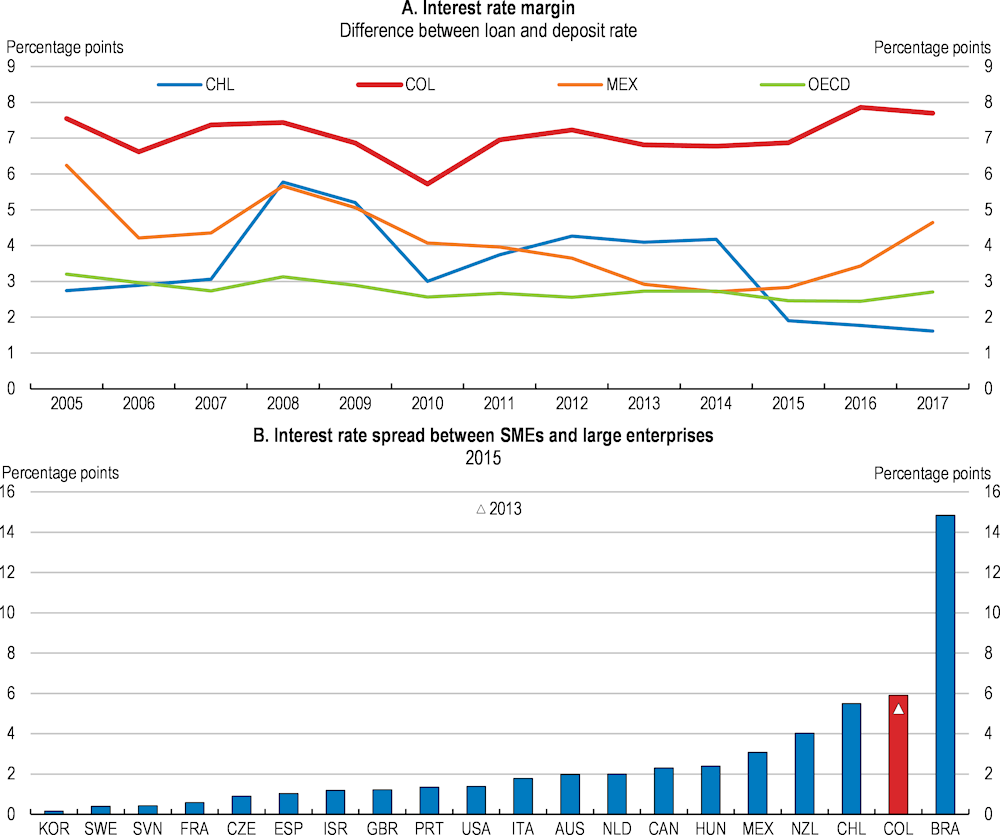

Domestic credit to the private sector has increased but interest rate margins remain high (Figure 1.39, Panel A). Margins, calculated as the difference between deposit and loan rates, exceed 7% in Colombia, well above the margins observed in Chile or Mexico. Despite efforts to broaden access to finance by SMEs, the cost of bank finance remains particularly high for SMEs (Figure 1.39, Panel B).

High margins have been associated with low competition in the banking sector (OECD, 2015[20]). Low competition particularly affects lending activities, while there is more competition on the deposits side (Banco de la República, 2017[53]). Colombia’s financial institutions are characterised by a high degree of concentration, with 70% of assets concentrated in three main banking groups. Colombia allows bank branches and subsidiaries to have business in the country but relaxing the prior approval process for establishing representative offices of banks and securities companies, which is relatively stringent (OECD, 2018[54]), would help to improve competition in the sector.

Costs associated with forced investments by banks in certain instruments (such as agricultural development bonds) can also partly explain the high margins. Relaxing the forced investment requirementswould reduce costs for banks, which would help to reduce margins. Phasing out the financial transaction tax would improve financial inclusion and provide room for more competition among banks.

Some progress has been achieved in improving access to credit by SMEs. In particular, the activities of Bancoldex have been useful in improving access in terms of lower interest rates, higher loan amounts and better payment terms. As a second tier bank, Bancoldex grants credit to commercial banks, which in turn use these resources to fund loans to firms. The credit lines of Bancoldex are not subsidized, and most of them are not directed to specific sectors of activity, or to specific types of firms. This horizontal approach has been found to be key for Bancoldex's good performance. (Eslava, Maffioli and Meléndez, 2014[55]) find that Bancoldex credits have a positive impact on firms output of about 5 percentage points per year, with a positive impact on investment of about 20 percentage points. The effect on employment and exports is also significantly positive. These results suggest that the second-tier model succeeds in assigning credit to profitable activities that would not have access to credit in the absence of Bancoldex.

There are plans to expand Bancoldex activities, which is welcome given its positive impact. In case of an expansion into lending to specific sectors or firms, it will be important that the focus is on segments where low access to credit is caused by a market failure. This is the case of young companies, which have little access to finance in Colombia, and firms initiating export activities.

Figure 1.39. Interest rate spreads are high

Source: World Bank and OECD (2017), Financing SMEs and Entrepreneurs 2017: An OECD Scoreboard, OECD Publishing.

Developing the equity market

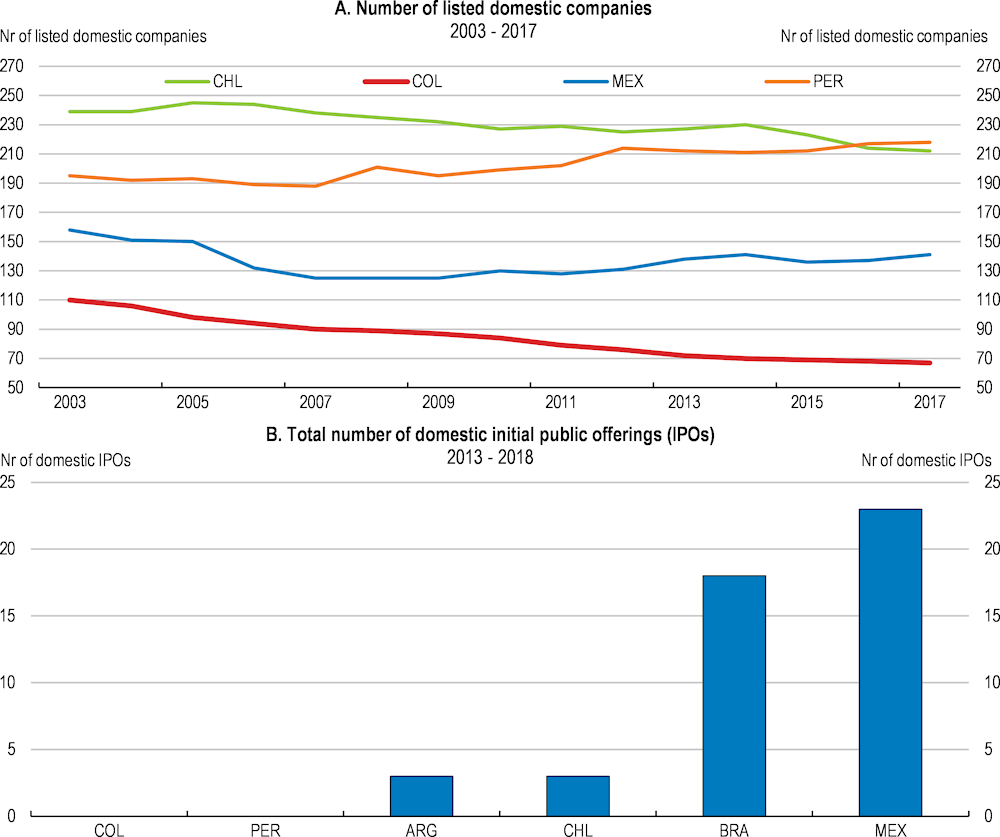

The government bond market has flourished since its development in the 1990s, and is widely perceived to be a well-functioning and liquid market. In contrast, several major obstacles impede the further development and growth of Colombia’s corporate bond market and equity market (WEF, 2016[56]) The government issued decree 1019 of 2014 with the aim to expand the number of issuers. Though issuances have risen in recent years, the corporate bond market remains underdeveloped, has low liquidity and is dominated by financial-sector issues.

The stock market is dominated by only a few companies (Figure 1.40), including Ecopetrol, the state-run oil company that accounts for nearly 45% of the total market capitalization. Contrasting with experiences in other countries in the region, there has not been any initial public offering in the last 5 years. Liquidity in the Colombian equity market is among the lowest among peer emerging economies. This lack of liquidity increases transaction costs for market participants, prevents participation of certain investor types and increases risks (namely, systemic and liquidity).

Figure 1.40. Few firms participate in the stock market

Note: For Panel B, data until May 2018 are included.

Source: World Bank, World Development Indicators database; World Federation of Exchanges database.

Policy actions to facilitate the development of the equity market include simplifying requirements and reducing costs for SMEs. Several emerging economies, such as India, Thailand or Singapore have successfully created specific market segments for SMEs within their main exchanges, with less thight listing and disclosure requirements and lower costs (WEF, 2016[56]). Another option would be to eliminate the restriction for banks from participating in the equity market. Allowing them to participate as investors and intermediaries would help greatly to develop the market, given that banks have greater access to liquidity. Adequate controls and restrictions on their participation could mitigate risks associated with their expanded role in the markets (WEF, 2016[56]). Acknowledging the importance to bolster capital markets the authorities have just finalised a capital markets expert commission with the aim of examining policy options to boost and diversify financing sources beyond the traditional banking channel, including for SMEs. This is a promising step to promote and give further impetus to a policy agenda for the development of capital markets in Colombia.

Boosting financial inclusion

There is also a large potential to increase financial development by extending banking services to a greater share of the population. Positives steps have recently been taken in that direction, such as the simplification of procedures for opening bank accounts. Yet, the lack of interoperability across financial institutions and instruments remains a key concern, as it implies high fees, which limit financial inclusion. Fostering, modernising and unifying the payments system should be a priority and there are ongoing efforts in that direction. The government has also prioritised the coverage of the banking network and the use of digital transactions. Mobile banking systems also present unused opportunities in this context, as most of the population, including those in low to medium income brackets, own a mobile phone (Fernández De Lis et al., 2014[57]). Moving in this direction, an enabling framework for mobile money has been established, allowing financial institutions, different to banks, to offer digital financial services.

Facilitating the transition from cash payments into bank or electronic payments would also foster financial development and help to reduce informality (Rogoff, 2016[58]). Policy options include banning cash for transactions above a certain threshold, as done recently by France, Spain, Italy, Mexico or Peru, or taxing cash transactions as opposed to transactions through banks or electronic platforms. South Korea illustrates the potential of using the tax system with that purpose, as it introduced a tax incentive for electronically traceable payments, which succeeded in reducing cash transactions, increased financial inclusion and tax revenues and reduced income inequality (Jae et al., 2017[59]).

Box 1.4. Recommendations for boosting exports and integration into the world economy

Trade policies

Phase out import restrictions and review other non-tariff barriers with a view towards reducing them.

Reduce tariff dispersion.

Widen the scope of regulatory impact assessment, including also the stock of regulations.

Logistics and trade facilitation

Reduce barriers to entry and competition in transport.

Improve customs logistics, including by increasing inter-agency cooperation and making further use of paperless online solutions for permissions and payments.Move to inspection processes in which all inspections happen in a single time and place.

Infrastructure

Prioritise improving multimodal transport connectivity of ports and customs.

Proceed with the creation of the agency dedicated to planning and harmonised evaluation of projects and a regulator for the transport sector.

Agriculture

Update and complete the cadastre to promote investment in rual areas and boost property tax revenues.

Refocus policy efforts on providing public goods and services, such as training centres or technical assistance, instead of on providing direct payments to producers.

Innovation

Simplify the innovation support system by reducing the number of programmes and improving the accountability of agencies in charge of its delivery.

Access to finance

Induce more competition in the banking sector, phase out gradually the financial transaction tax and reduce regulatory requirements for banks to hold certain instruments.

Simplify requirements and reduce costs for the participation of SMEs in the equity market.

References

[24] Abadie, A., A. Diamond and J. Hainmueller (2014), “Comparative Politics and the Synthetic Control Method”, American Journal of Political Science, http://dx.doi.org/10.1111/ajps.12116.

[29] Andres, L., J. Guasch and S. Straub (2007), “Do Regulation and Institutional Design Matter for Infrastructure Sector Performance?”, Policy Research Working Paper No.4378, http://econ.worldbank.org.

[15] Artopoulos, A., D. Friel and J. Hallak (2013), “Export emergence of differentiated goods from developing countries: Export pioneers and business practices in Argentina☆”, Journal of Development Economics, Vol. 105, pp. 19-35.

[53] Banco de la República (2017), Concentración y competencia en los mercados de depósitos y crédito-Informe especial de estabilidad financiera, Banco de la República, http://www.banrep.gov.co/sites/default/files/publicaciones/archivos/informe-especial-de-concentracion-y-competencia-en-los-mercados-de%20deposito-y-credito-sep-2017.pdf.

[5] BanRep (2017), El sector exportador colombiano en el mercado de los Estados Unidos, Banco de la República, https://publicaciones.banrepcultural.org/index.php/emisor/article/view/7817/8197 (accessed on 6 November 2018).

[2] Brambilla, I., N. Depetris Chauvin and G. Porto (2017), “Examining the Export Wage Premium in Developing Countries”, Review of International Economics, Vol. 25, pp. 447-475.

[40] Cadot, O., J. Gourdon and F. van Tongeren (2018), “Estimating Ad Valorem Equivalents of Non-Tariff Measures: Combining Price-Based and Quantity-Based Approaches”, OECD Trade Policy Papers, No. 215, OECD Publishing, Paris, http://dx.doi.org/10.1787/f3cd5bdc-en.

[38] Cadot, O., M. Malouche and S. Sáez (2012), “Streamlining Non-Tariff Measures:A Toolkit for Policy Makers”, https://openknowledge.worldbank.org/bitstream/handle/10986/6019/683590PUB0EPI007902B009780821395103.pdf?sequence=1&isAllowed=y.

[45] Cassiman, B., E. Golovko and E. Martínez-Ros (2010), “Innovation, exports and productivity”, International Journal of Industrial Organization, Vol. 28/4, pp. 372-376, http://dx.doi.org/10.1016/J.IJINDORG.2010.03.005.

[16] Chapman, A. (2018), “Deconstructing cost to trade in Colombia”, mimeo.

[46] Crespi, G. et al. (2015), “Long-Term Productivity Effects of Public Support to Innovation in Colombia”, Emerging Markets Finance and Trade, http://dx.doi.org/10.1080/1540496X.2015.998080.

[18] De La Cruz, R. et al. (2016), Colombia: Towards a High-income Country with Social Mobility, Inter-American Development Bank,IDB, https://publications.iadb.org/bitstream/handle/11319/7435/Colombia-Toward-a-High-Income-Country-with-Social-Mobility.pdf?sequence=5&isAllowed=y.

[23] Dek, M. and A. González Pandiella (forthcoming), “Assessing the impact of logistics on exports: a synthetic method approach (forthcoming)”, OECD Economics Working Paper, OECD Publishing.

[30] Eslava, M. et al. (2013), “Trade and market selection: Evidence from manufacturing plants in Colombia”, Review of Economic Dynamics, Vol. 16/1, pp. 135-158, http://dx.doi.org/10.1016/J.RED.2012.10.009.

[31] Eslava, M. et al. (2010), “Trade Liberalization and Worker Displacement: Evidence from Trade Reforms in Colombia 1”.

[55] Eslava, M., A. Maffioli and M. Meléndez (2014), “Credit constraints and business performance: evidence from public lending in Colombia”, Documentos CEDE, http://www.cadena.com.co.

[57] Fernández De Lis, S. et al. (2014), Crowfunding en 360°:alternativa de financiación en la era digital, BBVA Research, http://www.bbvaresearch.com (accessed on 5 November 2018).

[33] Flanagan, R. and N. Khor (2012), “Policy Priorities for International Trade and Jobs”.

[35] Furman, J., K. Russ and J. Shambaugh (2017), US tariffs are an arbitrary and regressive tax | VOX, CEPR Policy Portal, https://voxeu.org/article/us-tariffs-are-arbitrary-and-regressive-tax.

[9] Gallup (2018), “Opinion Surveys: Colombia”, https://www.elespectador.com/noticias/politica/encuesta-gallup-de-agosto-santos-supera-uribe-en-opinion-favorable-articulo-808975.

[8] Garavito, A., A. María Iregui and M. Teresa Ramírez (2012), “Inversión Extranjera Directa en Colombia: Evolución reciente y marco normativo”, Borradores de Economía N°713, http://www.banrep.gov.co/sites/default/files/publicaciones/archivos/be_713.pdf (accessed on 6 November 2018).