Digital transformation holds important potential for productivity, growth and well-being. The German government has made good progress in addressing some key issues, but much potential remains for unleashing the full benefits of digital transformation and data. Low penetration of high-speed broadband due to few fibre connections and an urban-rural divide in connection speeds, as well as below average mobile broadband data consumption and speeds weaken the foundations for digital transformation. Sluggish adoption of key ICT tools and activities, combined with low investment in knowledge-based capital and digital security concerns, further limits firms’ potential to innovate and create value with data. In particular SMEs require support to catch up. Addressing connectivity bottlenecks, incentivising investment and supporting business dynamism during the recovery by reducing administrative burden, facilitating access to financing, and accelerating progress towards digital government can boost technology diffusion and productivity growth. To empower everyone to thrive in digital environments, high demand for numeracy and literacy skills and shortages of ICT specialists, notably among women, need to be addressed. Making the most of digital transformation also requires a national digital transformation strategy and governance that ensures effective policy co‑ordination.

OECD Economic Surveys: Germany 2020

2. Unleashing the benefits of digital transformation

Abstract

2.1. Boosting productivity and improving policy coherence

Digital transformation holds important potential for productivity, growth and well‑being. The German government has made good progress in addressing some key issues, but much potential remains for unleashing the full benefits of digital transformation and data. Digital transformation is underpinned by connectivity, the adoption of ICT tools and activities and effective use of data by firms, governments and individuals, and refers to the economic and societal effects of digitisation1 and digitalisation2 (OECD, 2019[1]). Benefitting from digital transformation while addressing challenges across the many areas it affects requires an integrated approach to policy making. Building on core insights from the OECD’s Going Digital project, this chapter identifies key priorities for action and recommendations across several policy areas on making the most of digital transformation for Germany. The COVID-19 crisis has illustrated many opportunities of digital transformation for the economy and society, amplifying the importance of several of these recommendations.

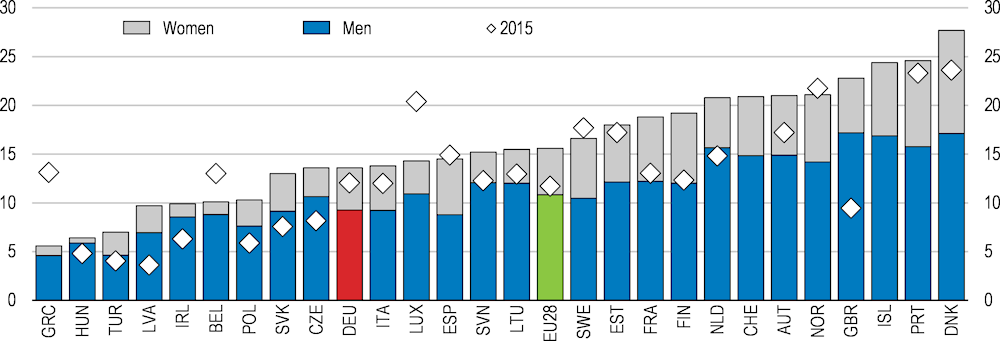

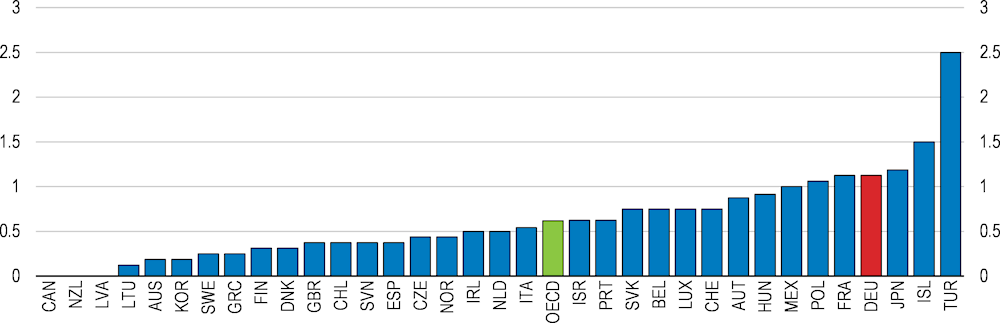

In Germany, digital‑intensive sectors (high and medium‑high) have contributed 62% of growth in value added, compared to 54% on average across OECD countries, between 2015 and 2018 (Figure 2.1). A sector’s digital intensity depends on a range of factors, including the adoption of advanced ICT tools, the human capital required for their effective use, purchases of intermediate ICT goods and services, and turnover from online sales, among others (Calvino et al., 2018[2]). Between 2009 and 2018, digital‑intensive sectors also contributed 40% of new jobs in Germany, a net creation of 1.6 million jobs.

Figure 2.1. Digital-intensive sectors contributed significantly to recent growth in value added

As a percentage of average annual growth in real value added 2015-18, chain-linked volumes (reference year 2015)

Note: 2015-17 data for Germany, Greece, Latvia, Lithuania, Norway, Poland and Portugal, Switzerland. 2015-16 data for Canada. Digital intensity is defined according to the taxonomy described in: Calvino, F., C. Criscuolo, L. Marcolin and M. Squicciarini (2018), “A taxonomy of digital‑intensive sectors”, OECD Science, Technology and Industry Working Papers, No. 2018/14, OECD Publishing, Paris, https://doi.org/10.1787/f404736a-en. Factors that define digital intensity of sectors include: ICT tools; human capital needed for their effective use; ICT tangible and intangible (i.e. software) investment; purchases of intermediate ICT goods and services; stock of robots; and turnover from online sales.

Source: Going Digital Toolkit. https://goingdigital.oecd.org/en/indicator/08/.

Better connectivity, wider diffusion of ICT tools and effective use of data by firms hold important potential for innovation and productivity. Such potential lies, for example, in business processes innovation, automation of routine tasks, more efficient interactions with suppliers and customers, and the use of data in innovation. Labour productivity is high in Germany but is held back by weak capital deepening and slow diffusion of ICT tools and activities to less productive firms (OECD, 2018[3]). In addition to more investment in ICTs, firms also need to invest in complementary assets: the greatest benefits from digital transformation are often found in firms that also invest in knowledge-based capital and skills (Gal et al., 2019[4]).

Unleashing the full benefits of digital transformation requires coherent policies and co‑ordination across all areas affected by digital transformation. This can be achieved through a comprehensive national digital transformation strategy and a governance approach that ensures effective co‑ordination. Germany’s efforts in this respect are evident. Multiple digital-related strategies and policies exist and the key measures are summarised in the implementation roadmap Digitalisierung Gestalten (Shaping Digitalisation) (Bundesregierung, 2019[5]). This document is co‑ordinated by a dedicated unit in the federal Chancellery and serves as a tool to monitor the implementation of existing measures (Box 2.1). The government also allocates significant funding to different aspects of digital transformation (Bundesregierung, 2019[5]), with additional funds being released via the COVID-19 recovery package.

Box 2.1. Towards a national digital transformation strategy

The implementation roadmap Digitalisierung Gestalten presents an important step towards a comprehensive national digital transformation strategy. The document brings together existing and planned digital-related policies across the government in five priority areas: digital skills, infrastructure and facilities, innovation and digital transformation, digital transition of society, and modern state. The document is updated periodically to monitor the implementation of digital‑related policies. It will be enhanced with an interactive online dashboard with indicators developed by the federal ministries that are implementing respective policies, designed to measure and provide public information on implementation progress.

Source: (Bundesregierung, 2019[6]; OECD, 2020[7]).

A next step should be to develop a national digital transformation strategy. A comprehensive set of policy areas to consider and key steps for developing a national digital transformation strategy are provided by the OECD’s Going Digital Integrated Policy Framework that is designed to help governments improve policy coherence and co‑ordination (OECD, 2020[7]). Key steps to develop such a strategy include to: i) identify Germany’s overarching vision and priorities for digital transformation; ii) involve all relevant stakeholders into strategy development; iii) integrate and/or co‑ordinate (with) all other digital‑related strategies and policies and responsible actors; iv) provide clear objectives for each priority area; v) and ensure coherence among the policies designed to achieve these objectives.

A successful strategy requires leadership and governance that ensures effective co‑ordination. Currently, most responsibilities for digital-related policies reside in different line ministries. In some cases, ad hoc co‑operation across these ministries exist. The federal Chancellery provides light co‑ordination in the context of its implementation roadmap, organises digital ministerial cabinet meetings, and has set up a digital council of external experts; it also has a dedicated unit to co‑ordinate and develop digital cross‑sectional topics such as the forthcoming national Data Strategy. These are useful elements of a governance approach, which however may need to evolve to effectively co-ordinate the development and implementation of a national digital transformation strategy. This may also involve a deeper integration of such a strategy with public funding allocated to digital transformation.

This chapter identifies priority areas and key policy levers to unleash the benefits of digital transformation in Germany. These include: addressing connectivity bottlenecks and increasing quality of service (Section 2.2); strengthening foundations for firms’ digital transformation (Section 2.3); overcoming key barriers to firms’ successful digital transformation (Section 2.4); supporting business dynamism during the recovery to boost technology diffusion (Section 2.5); and improving skills to thrive in the digital age (Section 2.6). Main findings and recommendations are summarised in a table at the end of the chapter.

2.2. Addressing connectivity bottlenecks and increasing quality of service

Access to fixed and mobile high‑quality broadband at competitive prices is a key foundation for people, firms and the government to tap into digital opportunities. The COVID-19 pandemic has shown the essential role of broadband networks as work and education have shifted to homes. For example, 35% of German employees report to have worked partially or completely from home during the enforcement of mobility restrictions in early April of 2020 (SOEP, 2020[8]). As a consequence, demand for broadband communication services has soared, with over 9.1 terabits per second (Tbps) in data transmitted (which equals the simultaneous transmission of up to 2 million high-definition videos), a 120% increase in videoconferencing traffic and a 30% increase in online and cloud gaming at one of the biggest Internet Exchange Points in Frankfurt (DE-CIX, 2020[9]).

Increasingly data-intensive applications are driving demand for more bandwidth, a trend that is set to continue (Cisco, 2018[10]). As for other OECD countries, networks have proven to be resilient during the mobility restrictions of the COVID-19 pandemic (OECD, 2020[11]). However, lacking the fundamental infrastructure for an increasingly data-driven economy and society would restrain Germany’s potential to unleash the benefits of digital transformation and to cope with health emergencies, such as pandemics. Proposals in Germany to establish a right to work from home for those workplaces allowing for it, as a response to the COVID-19 pandemic, also depend on the availability of high‑quality broadband.

Expand fixed networks and increase their quality

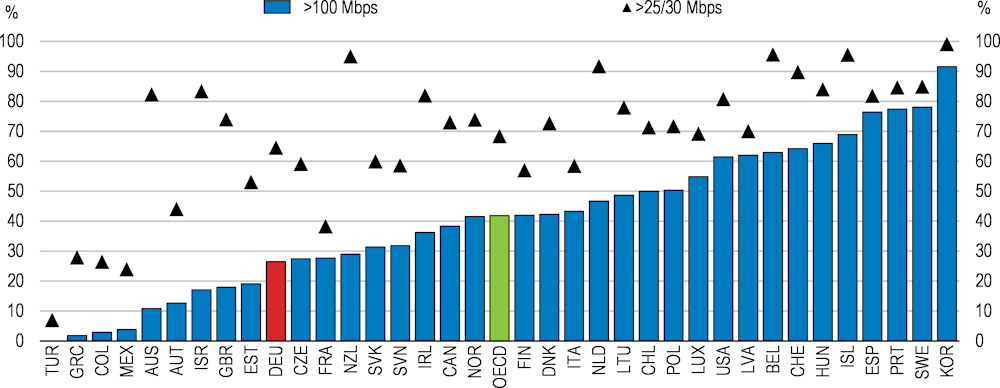

Germany lags behind on broadband subscriptions in higher speed tiers

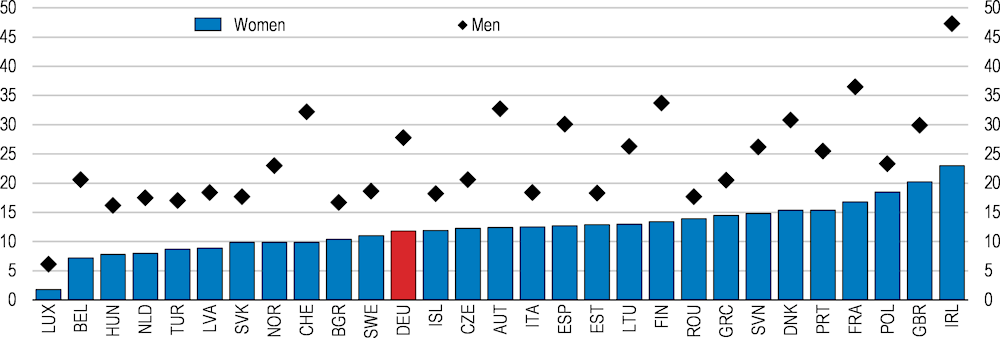

In 2019, Germany had 42.2 fixed broadband subscriptions per 100 inhabitants, compared to an OECD average of 31.8. However, the share of such subscriptions in the higher speed tiers is low (Figure 2.2). Higher network speeds are important for the use of key ICT tools, such as cloud computing (Section 2.3) and many other data-intensive activities and demanding applications across sectors as for example industry automation, services relying on augmented reality or medical imaging. In addition, high and symmetrical download and upload speeds are necessary to support work from home and use.

Figure 2.2. Germany has a low share of Internet subscriptions in higher speed tiers

Fixed broadband subscriptions with contracted speed faster than 25/30 Mbps and 100 Mbps, December 2019.

Notes: Australia: Data reported for December 2018 and onwards is being collected by a new entity using a different methodology. Figures reported from December 2018 comprise a series break and are incomparable with previous data for any broadband measures Australia reports to the OECD. Speed tier data are only for services purchased over the National Broadband Network (NBN), which comprise the majority of fixed broadband services in operation. There is no public data available for the speed of non-NBN services. Data for Canada, Switzerland and United States are preliminary. New Zealand: Speed tiers are for 2018 instead of 2019.

Source: OECD Broadband Portal, https://www.oecd.org/sti/broadband/broadband-statistics.

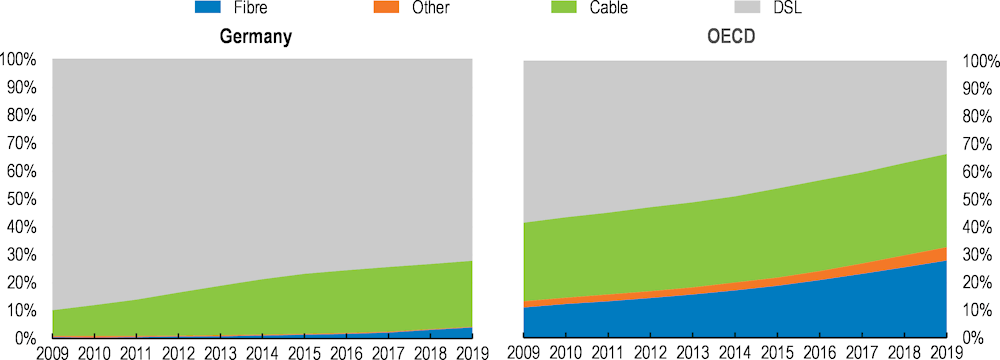

The low share of faster Internet subscriptions correlates with the infrastructure technology mix in Germany. Digital subscriber line technology (DSL) constitutes the large majority of total fixed broadband subscriptions. The share of fibre-to-the-Home connections is particularly low in Germany at only 4.1%, compared to an OECD average that now reaches 28% (Figure 2.3). DSL connections suffer from an inherent asymmetrical capacity as they use telephone infrastructure that was primarily built for low-speed analogue voice service. Most are characterised by low upload speeds, making them poorly suited to support the increase in telework during the COVID-19 pandemic (OECD, 2020[12]). As data for a large number of fixed broadband operators show, the demand for fibre subscriptions is rising, with a 42% take-up rate for homes connected by these companies (BREKO, 2020[13]). While transitioning from DSL to fibre takes long-term and proper network planning, broadband providers could be encouraged in the medium term to deploy fibre deeper into their networks, gradually phasing out DSL and replacing it with fibre-to-the-home.

Figure 2.3. The share of fibre is low and has increased only slowly in Germany

Technology mix of fixed broadband subscriptions in Germany and the OECD, 2009 – 2019

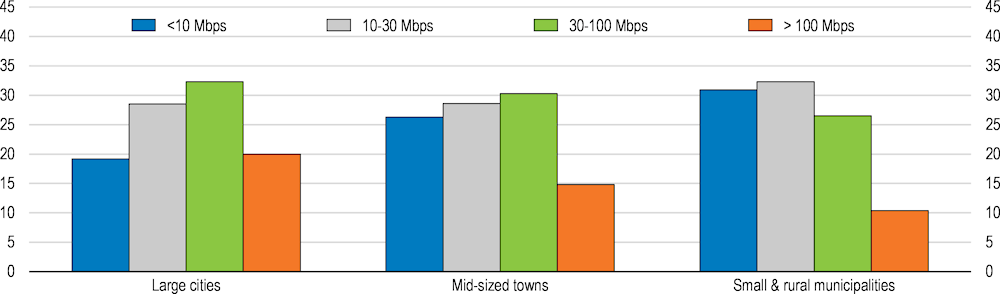

Figure 2.4. Germany faces an urban-rural divide for Internet subscriptions above 30 Mbps

Broadband subscriptions in firms, 10+ employees, without financial sector, by speed tiers and locations, 2017

Note: Excludes firms without any broadband subscription (around 5% of surveyed firms).

Source: (Alipour, forthcoming[14]).

At the subnational level, larger cities have typically been connected first with higher speed broadband. In 2019, 94% of households in large cities had access to fixed broadband with download speeds of over 100 Megabits per second (Mbps) compared to only 53% across rural municipalities (BMVI, 2020[15]). Regional gaps in coverage rates tend to narrow over time. However, Germany’s urban-rural divide translates into regional disparities with respect to higher speed broadband subscription rates among firms (Figure 2.4 above). Small and rural municipalities lagged behind large cities by a factor of two regarding local firms’ subscription rates to broadband of at least 100 Mbps in 2017 (Alipour, forthcoming[14]).

Only a small amount of public funds for broadband deployment has been disbursed

The German government has recognised this gap and has set an ambitious goal for high‑speed connectivity in its coalition agreement: nationwide gigabit Internet coverage by 2025 (CDU, CSU and SPD, 2018[16]). To achieve this goal, the federal government has put in place a number of public broadband subsidies. Between 2016 and 2030, around EUR 11 billion has been or will be made available by the Federal Government’s state aid programme for broadband deployment. This includes 70% of special assets (“Sondervermögen Digitale Infrastruktur”), financed mostly by the EUR 6.6 billion in revenue generated by the 2019 spectrum auction (to be paid in instalments until 2030), which are channelled into Gigabit network deployment. Additional funds of approximately EUR 11 billion are provided by the Länder.

However, only a small amount of the disposable funds of the Federal Government’s state aid programme has been paid out so far. As of September 2020, only EUR 750 million had been paid out. One of the reasons for delays in the disbursement of funds is the German two-stage system of granting subsidies and drawing on funds. In this system, a preliminary grant approval decision has to be issued by the competent authority and the disbursement of funds is triggered only when the construction process reaches certain pre‑agreed milestones, which often take a long time to be achieved. Germany has taken measures to improve this process, such as the establishment of a focus team for project acceleration and a federal project management agency. However, the two-stage system should be further simplified. This includes reducing administrative procedures to ease the participation of smaller providers. In addition, funds are only paid out very late in the process, which might act as an additional barrier given that network deployment is capital intensive. The government could review this practice to ensure that the programme is taken up more widely.

Streamline administrative processes and rights of ways to spur fixed infrastructure deployment

Another reason for insufficient infrastructure deployment may be the long administrative processes, including for rights of way. The German Law for the Facilitation of the Expansion of Digital High-Speed Networks (“Gesetz zur Erleichterung des Ausbaus digitaler Hochgeschwindigkeitsnetze”, DigiNetz Act) implemented the European Union’s Cost Reduction Directive 2014/61/EU and is aimed at speeding up network deployment and reducing respective costs. However, processing times for applications submitted to municipalities (“Wegebaulastträger”) still take three to four months, which adds to the total length of rights of way approvals, delaying network expansion.

In addition, approval procedures are not streamlined and often require approval from several different public authorities. While Germany plans to take measures to accelerate approval procedures in the context of the upcoming amendment of the Telecommunication Act, additional steps should be taken to shorten administrative approval times and streamline rights of way processes, respecting the responsibilities of relevant entities at different levels of government. In Spain for example, the Ministry of Energy, Tourism and Digital Agenda examines whether a municipality’s management instruments comply with the Spanish Telecommunication Law through periodic reports.

Construction bottlenecks as described in the Key Policy Insights also play a key role as private companies as well as municipalities have struggled to commission construction works in a timely manner. At times, this even hinders applications for public subsidies as deployment timelines cannot be met. Another reason for slow fibre deployment may be the reluctance to use alternative deployment methods such as microtrenching, i.e. laying fibre less deep. While the DigiNetz Act allows for microtrenching, this option has been little used. Measures that ease the use of alternative deployment methods are foreseen in the upcoming amendment of the Telecommunication Act.

More competition in the fixed broadband market could boost high-quality broadband

Another factor in low penetration of high-speed subscriptions may be that costs lower uptake rates: fixed broadband connections are relatively expensive in Germany compared to peer countries. In June 2020, German consumers paid USD PPP 43 for a connection of 100 Mbps and above (360 GB per month), compared to USD PPP 36 in France, USD PPP 38 in Italy, USD PPP 40 in Sweden (Strategy Analytics, 2020[17]).

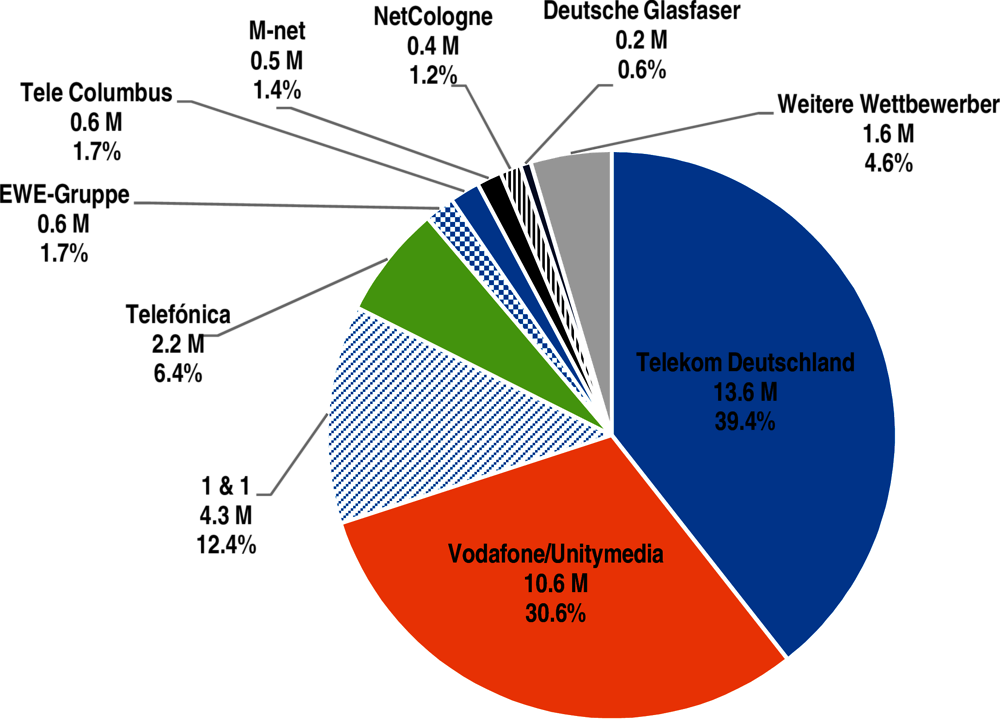

Comparatively higher prices often reflect the state of competition in a country. With Vodafone’s acquisition of Liberty Global’s (Unitymedia) business in Germany in 2019, the competitive landscape is currently undergoing significant changes. On the one hand, the merger might lead to an increase in network speeds as Vodafone might upgrade existing cable lines, which, in turn, might incentivise more fibre deployment. Moreover, the merger remedy of granting Telefonica access to Vodafone’s cable network might enable Telefonica to compete with bundled services containing high-speed Internet access. On the other hand, Deutsche Telekom and Vodafone now own more than 70% of fixed broadband connections, while Deutsche Telekom alone owns almost 40% of connections (Figure 2.5). It will be important for the relevant authorities to continue to monitor competitive dynamics in the market for fixed broadband services in Germany. In addition, competition in connectivity of multi-dwelling buildings can be fostered.

Figure 2.5. Germany has a concentrated fixed broadband market

Fixed broadband market shares by number of customers, July 2019

Current legislation in Germany allows for housing cooperatives and property management companies to sign bilateral contracts with network operators, which require all tenants to pay a monthly fee for the connection. Historically, these operators have mainly been cable companies. Consequently, this makes existing cable connections relatively more attractive, as accessing a different service would require a tenant to pay for both connections. This may represent an entry barrier for communication operators other than cable network operators (Monopolkommission, 2011[19]). While the legislation has been extended to allow a similar approach for non-cable TV services, it still favours existing connections. Eliminating this legislation would lower switching costs for consumers to other providers and increase competition between different network operators.

To further promote competition while at the same time reducing deployment costs, Germany could promote in-building infrastructure (and cost) sharing for fibre wiring in multi-dwelling buildings. For example, current legislation in France imposes symmetrical obligations for the party deploying in-building fibre wiring and requires operators that have deployed a fibre optic network in a building to comply with reasonable requests for access from other operators.3 An agreement determines the technical and financial conditions of access between the concerned parties and any refusal of access has to be justified (Gouvernement de la République française, 2019[20]).

To further foster competition, Germany should also facilitate passive infrastructure sharing, i.e. the sharing of network elements such as ducts and cabinets, and increase the transparency of existing passive infrastructure such as ducts. While the German infrastructure information system “Infrastrukturatlas” aims at providing this transparency, the tool could benefit from being fully digitalised, from being easily accessible and publicly available, as well as from additional features such as geo-referencing and displaying prices of usable assets directly to the user. The upcoming amendment of the Telecommunication Act, which foresees the creation of a central information system, presents an opportunity to revise the current infrastructure information system and address its shortcomings. Mexico has set up such an information system to foster infrastructure sharing and deployment (Box 2.2). Increased access to ducts has had positive fibre-to-the-home deployment effects in countries such as France, Spain and Portugal. In addition, communication operators could be encouraged to jointly invest with other infrastructure providers, such as local electricity providers. Measures such as dig-once policies or the joint use of ducts can increase efficiency and lower the costs of infrastructure deployment.

Box 2.2. Increasing the transparency for infrastructure deployment in Mexico

In Mexico, the Secretariat of Communications and Transportation (SCT) issued an interagency agreement that allows for close to 110 000 state-owned structures to be used and shared, by concessionaires (licensees), permission-holders and infrastructure developers, as passive infrastructure for telecommunication networks under non-discriminatory, equal-access and non-exclusive conditions. Information pertaining to the relevant properties, including geo-referenced location, as well as physical, economic, technical, safety and operational conditions and the market value are published on an on-line platform called ARES operated and managed by Institute for National Assets (Instituto de Administración y Avalúos de Bienes Nacionales, INDAABIN). Interested parties can use the platform as a search engine and indicate their interest in a particular building and INDAABIN will serve as a one-stop portal for all the requests. Apart from the 110 000 federal buildings, other interested public institutions, for instance at the municipal level can become a member of the portal and present their properties that fulfil the necessary technical conditions.

Increase mobile network coverage and quality

Germany has fallen behind on mobile broadband subscriptions, speeds and data usage

Although mobile broadband services have been a major driver of increasing connectivity in Germany over recent years, subscriptions are well below the OECD average. While there are 87 mobile broadband subscriptions per 100 inhabitants in Germany, the OECD average is 114.5. Germany has also fallen behind the OECD average on mobile data usage (Figure 2.6). Low data consumption may be linked to comparatively higher prices among peers for larger mobile data packages as well as differences in prices between third generation (3G) and fourth generation (4G) mobile data packages. In May 2020, German consumers paid around USD PPP 34 for a 10 GB data plan (including 900 calls), while consumers paid USD PPP 22 in Spain, USD PPP 24 in France, USD PPP 27 in Italy, and USD PPP 29 in Sweden (Strategy Analytics, 2020[17]).

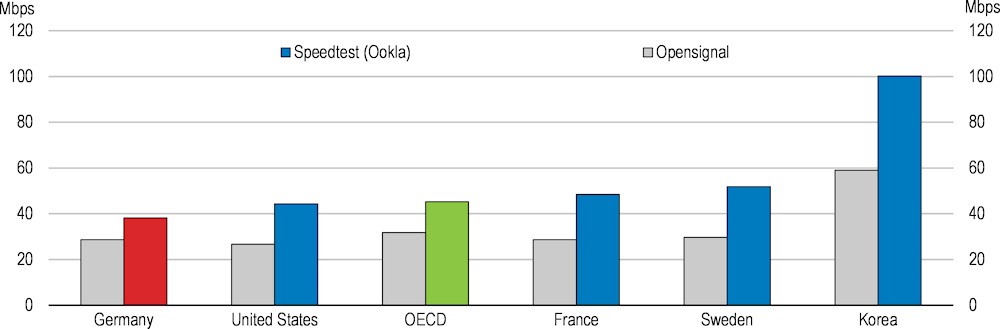

Germany is also falling behind on mobile network performance. The average download speed on Long Term Evolution (LTE) networks in Germany is below the OECD average according to two different providers of speed tests, which provide different perspectives on and measurement of the mobile Internet (Figure 2.7). Moreover, download speeds on LTE networks are not even available in all parts of Germany, as white spots with no or only second generation (2G) connections are still common in Germany (zafaco GmbH, 2020[21]).

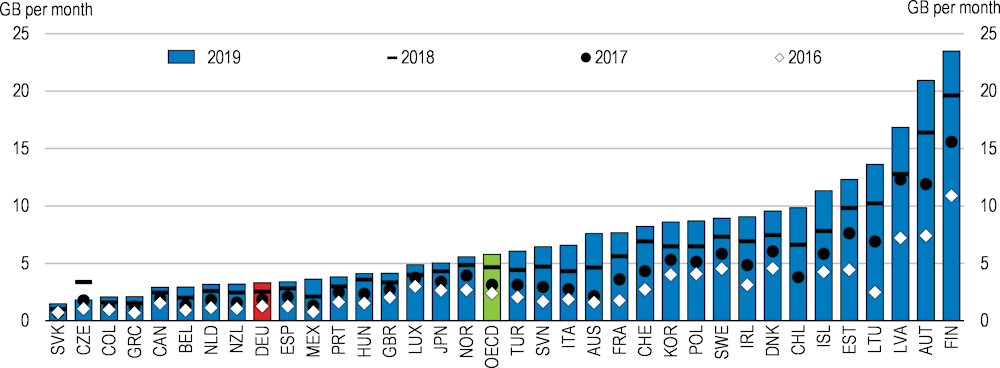

Figure 2.6. German mobile broadband subscribers consume less data than the OECD average

Mobile data usage per mobile broadband subscription, 2019

Note: The multiplier 1024 is used to convert TB into GB; the total amount of GB is divided by the yearly average number of Mobile broadband subscriptions. Australia: Data reported for December 2018 and onwards is being collected by a new entity using a different methodology. Figures reported from December 2018 comprise a series break and are incomparable with previous data for any broadband measures Australia reports to the OECD. Data for Canada and Switzerland are preliminary. OECD average includes estimates.

Source: OECD Broadband Portal, https://www.oecd.org/sti/broadband/broadband-statistics.

Figure 2.7. Germany has fallen behind peer countries on mobile download connection speeds

Average download speed on LTE networks for selected countries and the OECD, 2020

Note: Speedtest (Ookla) data are for May 2020, Opensignal data are for the average download connection speed on Long-Term Evolution networks, collected between 1 January and 30 March 2020.

Source: Speedtest (Ookla), www.speedtest.net/global-index, Opensignal, https://www.opensignal.com/reports/2020/05/global-state-of-the-mobile-network.

Ensure fast implementation of the national mobile strategy and streamline rights of ways for mobile infrastructure

Germany has also set itself ambitious targets for mobile access. Contracts signed between the federal Ministry of Transport and Digital Infrastructure (BMVI) and mobile network operators at the 2018 mobile telecommunication summit aim for an LTE coverage of 99% of all households throughout Germany by the end of 2020, and a 99% LTE coverage of all households in each federal state by 2021 (BMVI, 2019[22]). The German mobile strategy (“Mobilfunkstrategie”), published at the end of 2019, aims at closing gaps in the LTE network and making Germany a leading country in fifth generation cellular networks (5G) (BMVI, 2019[23]). Following the COVID-19 pandemic, the German Government is planning to direct an additional EUR 5 billion towards 5G infrastructure development (BMF, 2020[24]).

While these initiatives are welcome, a timely and effective implementation of measures to improve access to public properties, to speed up approval procedures, and to facilitate access to information on infrastructure deployment will be crucial to achieve the strategy’s objectives. Measures such as the amendment of the Federal Highway Law that eliminates minimum distance rules for cell towers close to highways are welcome. Nevertheless, the overall procedure to construct a cell tower currently takes two to two and a half years as most of the time is spent on the determination and acquisition of locations to build the towers (OECD, 2019[25]). As mentioned above, Germany could improve its information system “Infrastrukturatlas” to facilitate the identification of available public assets.

Successful entry of a fourth operator will depend on a national roaming agreement

The 2019 auction of spectrum in the 2 Gigahertz (GHz) and 3.6 GHz bands paved the way for 5G deployment in the country. While Deutsche Telekom received most of the spectrum, the auction allowed for the entrance of a new player with 1&1 Drillisch, which has the potential to significantly spur competition in the German mobile market. The auction was linked to coverage obligations, which could considerably improve coverage and increase network speeds. Obligations included each operator’s commitment to a minimum data rate of 100 Mbps available by the end of 2022 for 98% of households in each state, all federal highways, all main roads and along the major railway routes. Also, each carrier must install 1 000 5G base stations and 500 other base stations in defined areas by the end of 2022. At the end of 2024, 5G coverage should be extended to seaports, main waterways and all other road and rail routes (RCR, 2019[26]).

The entrance of a fourth operator can significantly spur innovation and competition in the German mobile market, as observed in other OECD countries (such as Chile and France) when a fourth operator entered the market. Currently, the market is characterised by less innovation in terms of contracts offered compared to other European markets such as France and Finland, where for example more “roam like at home” contracts, more unlimited data offers or more flexible contract durations can be found. In addition, none of the three mobile network operators provides a mobile post-paid contract with a minimum contract period below 24 months.

For the fourth operator to substantially increase competition in the mobile market, it will be important for it to close a domestic roaming agreement with one of the three existing mobile network operators, as has been the case for the entrance of Iliad Free to the French market. In addition, the fourth operator needs to be considered when current spectrum licences expire, especially the band below 1 GHz. Existing spectrum licenses should not be extended automatically as this would undermine the improvements in competition stemming from the entry of a fourth player. In addition, it is important to ease and promote passive infrastructure sharing due to positive effective cost reductions especially in rural and remote areas. If Germany also envisages active infrastructure sharing, consideration should be given to safeguarding an adequate level of mobile communications infrastructure competition.

Operators need to upgrade and extend fibre backhaul for 5G network deployment

An important prerequisite for a wide 5G deployment is to deploy fibre deeper into mobile backbone networks and to lay fibre to mobile cells in order to offload mobile traffic into fixed networks. Not all mobile cells and towers are currently connected to fibre networks. It is expected that all German network operators need to significantly deploy more fibre in their networks to achieve the goals in the mobile strategy and to enable 5G.

Since November 2019, the German regulator has made spectrum available for corporate licences for local 5G industry campus networks, enabling major industry players to run their own private networks in the frequency range of 3.7 to 3.8 GHz. Industry players interested in these frequencies indicated that they may want to use these frequencies for automation processes as well as for agriculture. While this may help German companies to increase efficiency in production, it is important to award all frequencies to users as soon as possible. This will allow for an assessment of the amount of spectrum that may be unused and the development of a plan for its efficient use. As of September 2020, 74 of the reserved frequencies have been awarded out of 78 applications (Bundesnetzagentur, 2020[27]).

2.3. Strengthening foundations for firms’ digital transformation

High‑speed and affordable broadband is an essential but not a sufficient foundation for firms’ successful digital transformation. It can be considered a general-purpose technology (Bresnahan and Trajtenberg, 1995[28]) that underpins productivity and economic growth (Czernich et al., 2011[29]; Rohman and Bohlin, 2012[30]). High-speed broadband has become crucial for many firms, in particular in knowledge‑intensive sectors, as illustrated by its fundamental role for increased teleworking during the COVID-19 crisis (OECD, 2020[12]). However, reaping the gains from broadband requires firms of all sizes, across sectors and territories to adopt a wider set of ICT tools and activities, which together can boost competitiveness, spur innovation and increase productivity (Draca, Sadun and Van Reenen, 2009[31]; Gal et al., 2019[32]).

Table 2.1. Firms with higher speed broadband are more likely to adopt other ICT tools and activities

Estimated percentage point change in the likelihood of adopting ICT tools and activities for German firms by speed tiers of broadband subscription

|

ERP |

CRM |

e-purchase |

e-sales |

Social media |

Cloud computing |

BDA |

|

|---|---|---|---|---|---|---|---|

|

100+ Mbps subscription |

3.32*** |

3.07*** |

1.12 |

4.321*** |

9.75*** |

6.85*** |

3.07** |

|

30-100 Mbps subscription |

1.60* |

2.06** |

2.57*** |

2.87*** |

6.61*** |

6.96*** |

-1.20 |

|

Observations/Firms |

24685/22316 |

24593/22241 |

24857/22467 |

30126/26511 |

26330/22724 |

9488/8546 |

5821/5821 |

|

Survey years |

2012-2015, 2017 |

2012, 2014, 2015, 2017 |

2012-2015, 2017 |

2012-2017 |

2013-2017 |

2014, 2016 |

2016 |

Note: Firms with 10 or more employees, excluding financial sector. ERP stands for enterprise resource planning, CRM for customer relationship management, BDA for big data analysis. This table reports OLS regression results based on representative repeated cross-section survey data of German firms for the period 2012-2017. Dependent variables equal 100 if a given ICT tool or activity is adopted and 0 otherwise. Coefficients reflect the percentage point change in the likelihood of a firm adopting a given ICT tool or activity associated with broadband speed tiers of 100+ Mbps and 30-100 Mbps, respectively compared to a baseline speed of <10 Mbps. In addition to a broad set of control variables, regressions (except big data) control for year, municipality and industry (4 digit) fixed effects. Big data uses fixed effects at the county level instead of the municipality level. Standard errors are clustered at the municipality level (not reported); ***, ** and * denote significance at the 1%, 5% and 10% level, respectively. Table A1 in the Annex provides additional detail.

Source: (Alipour, forthcoming[14]).

Firms’ adoption of high-speed broadband tends to correlate with the adoption of other ICT tools and activities. Table 2.1 (above) reports estimates on the complementarity between firms’ broadband subscriptions by speed tiers (30-100 Mbps or 100+ Mbps) and their adoption of other ICT tools and activities in Germany. These tools and activities enable firms to perform in increasingly knowledge-intensive economies, optimise processes and integrate into digital markets, and collect, store, exchange and analyse big data. The complementarity between the speed of Internet subscriptions and other ICTs are strongest for key tools that enable firms to create value with data such as cloud computing and social media as well as with tools that enable digital market integration and process optimisation such as e-sales, customer relationship management (CRM) and enterprise resource planning (ERP).

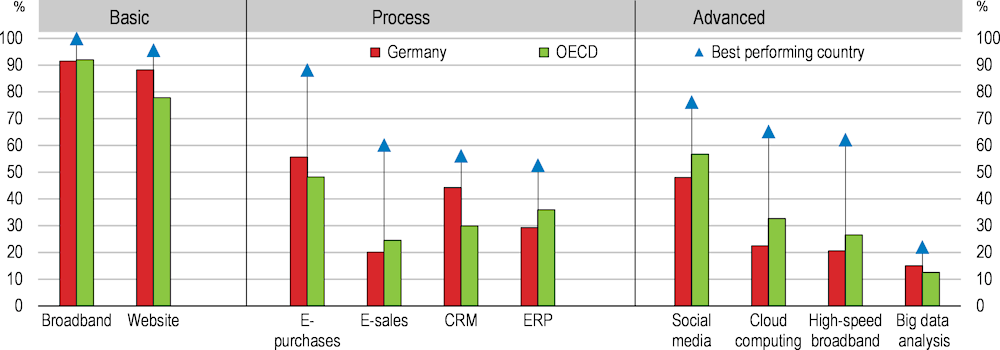

Foster firms’ adoption of ICT tools and activities needed to create value with data

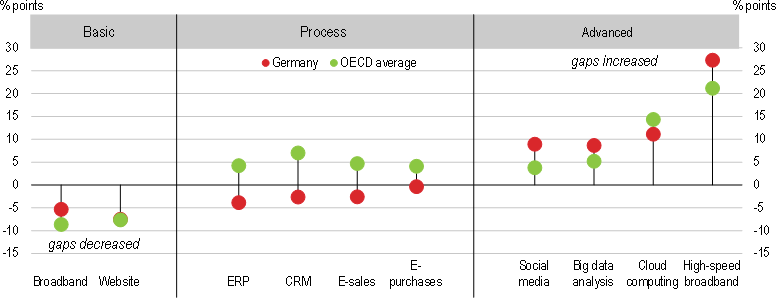

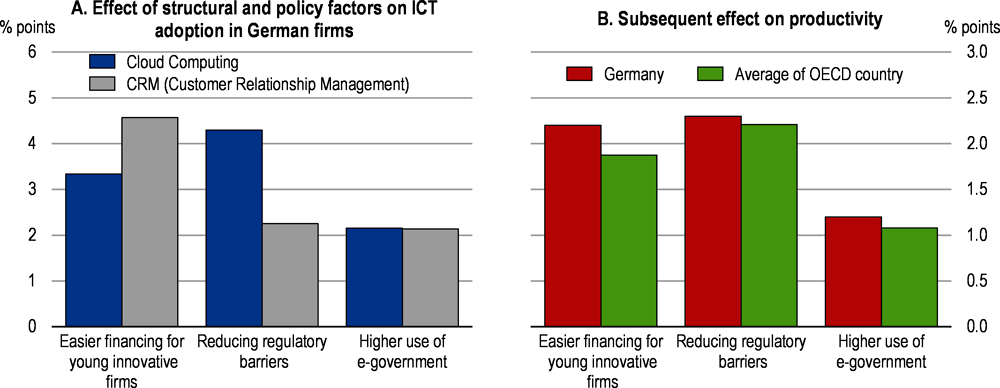

Basic ICT tools such as broadband and websites, which enable firms to digitise information and establish a presence online, are widely diffused in Germany. ICT tools and activities that enable firms to digitalise and optimise processes, such as CRM are fairly well diffused too, as are 3D printing and robots, notable industrial robots in large firms (OECD, 2019[33]; Eurostat, 2018[34]). However, Germany is not among the best performing countries in the OECD for most process‑related ICT tools and activities and remains even below the OECD average for ERP and e‑sales (Figure 2.8), including for e‑commerce intensity (e‑commerce in total turnover) (OECD, 2019[35]).

For more comprehensive digital transformation and data‑driven innovation, firms will need to adopt newer and more advanced ICT tools and activities notably those that enable them to collect, store, exchange and process (big) data. Firms in Germany significantly lag behind in the adoption of most of these tools and activities, including high‑speed broadband (100+ Mbps), cloud computing and social media. Shares of firms with a high‑speed broadband subscription or that purchase cloud computing are less than half of those in the best performing countries (Figure 2.8). On big data analysis (BDA), German firms have caught up between 2016 and 2018. Some more general catch-up is evident in above average growth rates in firms’ adoption of other advanced ICT tools (except for high‑speed broadband) over recent years. An important sector in which Germany has fallen behind in digital transformation is health (Box 2.3).

Figure 2.8. German firms lag in the adoption of advanced ICT tools and activities

% of firms, 2019 or latest year available

Note: Firms with 10 or more employees, excluding financial sector. ERP stands for enterprise resource planning, CRM for customer relationship management; high-speed broadband are subscriptions with 100+ Mbps.

Source: OECD ICT Access and Usage by Businesses database, http://oe.cd/bus.

Firms notably lag in the adoption of cloud computing. Cloud computing can be used for advanced process optimisation and for many data‑intensive applications in firms. The share of firms in Germany that purchase cloud computing is over 40 percentage points (pp) below the best performing country (Finland) and 8pp below OECD average. In particular medium‑sized firms lag far behind (-14pp) the OECD average. This is striking, given that smaller and younger firms tend to be key beneficiaries from cloud computing in other countries, leveraging the cost-efficiency and flexibility of scaling up and/or down digital operations as compared to legacy information technology (IT) infrastructure (Bloom and Pierri, 2018[36]). Firms in Germany lag behind for all types of cloud computing and across all sectors, with the largest gaps (all firms) occurring in manufacturing (-11pp to average) and transportation and storage (-10pp to average).

Box 2.3. Digital transformation of Germany’s health care system

Digital transformation of the health care system holds important potential for Germany. For example, electronic health records (EHR), telemedicine, electronic prescriptions and automated reimbursements could bring important efficiency and monetary gains, estimated at EUR 34 billion (about 12% of health spending) in 2018. Around 70% of these gains would come from digital transformation in health care delivery, i.e. notably physicians and hospitals, compared to 30% from effects in sickness funds (McKinsey, 2018[37]).

Germany’s health care system showed strength in successfully managing the COVID‑19 pandemic. This should not divert attention from the fact that Germany has fallen behind many other countries in the digital transformation of health care. Germany lags important digital health fundamentals, including digital services, ranking 16th out of 17 countries analysed in the Bertelsmann Digital-Health-Index, which covers 13 EU member states, the UK and 3 other OECD countries. Contrary to Germany, in Estonia and Denmark citizens can already consult diagnostic results and vaccination data online, and telemedicine practices are commonplace in Canada and Israel (Bertelsmann Stiftung, 2018[38]).

Telemedicine turned out particularly beneficial in the context of the COVID-19 pandemic by allowing continuity of certain health care in times of social distancing while reducing infectious exposure (CDC, 2020[39]). More generally, telemedicine can improve safety and cost-effectiveness, and can in some cases lead to better health outcomes than conventional face-to-face care (Oliveira Hashiguchi, 2020[40]). Despite evident benefits, telemedicine still represents a small fraction of all health care activity and spending in Germany. In 2017, less than 10% of Germans used telemedicine, compared with 18% in the EU and almost 50% in Estonia and Finland. The share of general practitioners who use electronic networks to exchange medical data with other providers is low too, and so is the use of electronic prescriptions (European Commission, 2019[41]).

Evolutions in the legal framework over recent years have significantly improved the conditions for digital transformation of Germany’s health care system. For example: the 2015 E‑Health Act introduced a basic statutory electronic patient record and a roadmap for building a telematic infrastructure; the 2019 Drug Safety and Supply Act expanded the possibilities of tele‑medicine through new rules for electronic prescriptions (BMG, 2019[42]); the Appointment-service and Care Act mandates sickness funds to introduce an electronic patient record by 2021 at the latest (BMG, 2019[43]); and the 2019 Digital Healthcare Act brings additional improvements, e.g. with regards to online video consultations and access to a secure healthcare data (BMG, 2019[44]).

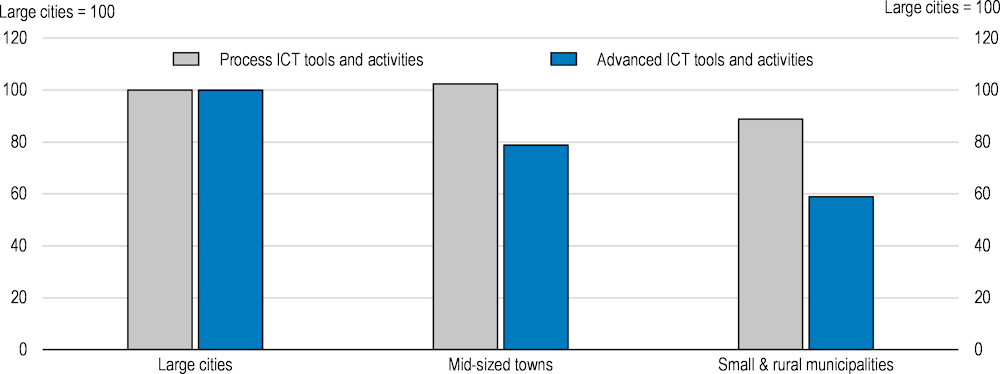

Firms’ backlog on newer and more advanced ICT tools and activities is most visible outside of large cities. As a federal and quite decentralised country, Germany has many important firms outside large cities, including “Mittelstand” firms, many of which are small and medium-sized (SMEs, 10-249 employees) or mid-range (250-3000 employees) enterprises. The use of newer and more advanced ICT tools and activities in small and rural municipalities is almost a third lower than in large cities (Figure 2.9). In contrast, firms in smaller towns and rural municipalities are almost as likely as in large cities to use process‑related ICT tools and activities. This is in line with the finding that the share of firms with lower Internet speed subscriptions (below 30 Mbps) does not decrease in smaller towns and rural areas (Section 2.2, Figure 2.4). It might also indicate that process-related ICT tools and activities require less bandwidth than newer and more advanced ones that enable firms to create value with data.

Figure 2.9. Firms in small and remote places lag furthest on advanced ICT tools and activities

User rates (index) across settlement types in Germany, by types of ICT tools and activities, 2017 or latest available

Note: The index of user rates is set to 100 for large cities. Process ICT tools and activities include e‑purchases, e-sales, customer relationship management and enterprise resource planning; data for these are for 2017. Advanced ICT tools and activities include cloud computing, big data analysis and social media; data for these are for 2016.

Source: (Alipour, forthcoming[14]).

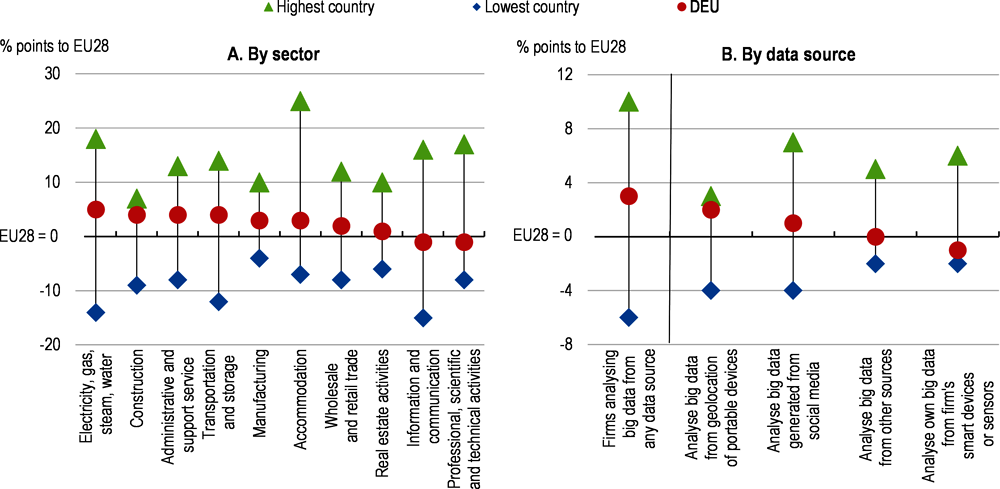

Creating value with data, for example through data-driven innovation, often requires big data analysis (OECD, 2015[45]; Niebel, Rasel and Viete, 2019[46]). Germany has caught up fast over recent years with the OECD average on the share of firms performing big data analysis, from 6% in 2016 (-5pp to average) to 15% in 2018 (+2pp to average), and also reduced the distance to the best performing country from 13pp to 7pp over the same period. However, a closer look at firms’ performance of big data analysis by sector and data source provides a mixed picture. While key sectors such as manufacturing and transport are above average, the gaps to the best performing country remain important across all sectors (Figure 2.10, Panel A).

Much of firms’ potential to create value with data in Germany and Europe is considered to reside in the use of firm-related and machine generated data in the context of industry 4.0, which is of strategic importance for factory automation in German industries (BMWi, 2019[47]). Generally, firms that invest for the first time in digital technologies tend to focus more strongly on the potential of data, notably data from their own operations and machines (Bitkom, 2018[48]). Strikingly, only 3% of firms in Germany use data from their own sensors or devices to perform big data analysis, which is below the European Union (EU) average of 4% (Figure 2.10, Panel B) and far less than in leading countries, such as the Netherlands (10%), Finland (8%) and Belgium (7%). Data on the geolocation of portable devices and from social media, which are more likely customer-related data, are the most widely used data sources for firms’ big data analysis in Germany.

The government has recognised the urgent need to boost firms’ collection, sharing and effective use of data, notably with project GAIA‑X that establishes key building blocks for a federated European data infrastructure to strengthen Europe’s competitiveness in global digital and data‑driven markets (Box 2.4). The government is also developing a Data Strategy, which has been announced as covering four main areas: 1) improving data sharing and securing access to data, 2) promoting responsible data usage and increasing the potential for innovation, 3) improving data competencies and establishing a data culture, 4) Making the state lead by example (Bundesregierung, 2019[49]). It is crucial that this strategy provides an effective data governance framework, including for a data-driven public sector, to enhance access to and sharing of data, and includes ambitious objectives and measures to help firms boost their collection and use of data, for example measures concerning open data, data portability, and contractual agreements (OECD, 2019[50]). Australia and Finland are considered to be advanced among OECD countries that have or are developing a national or sector‑specific data strategy.

Figure 2.10. Data from firms’ sensors and devices remains underused for big data analysis

% firms performing big data analysis, differences in percentage points to EU28 average, 2018 or 2016

Note: Firms with 10 or more employees, excluding financial sector.

Source: (Eurostat, 2018[34]).

The more data firms collect and use, the more relevant AI becomes to create value with data. Fast growing investments in AI over recent years reflect high expectations of its potential. Globally, the United States attracts the largest share of equity investments in AI start‑ups, although China is rising fast, while Europe attracts only a small share. Within the European share, Germany accounts for only 14% of investment, after the UK with 55% (OECD, 2019[51]). Diffusion of AI in firms, such as for data analytics, natural language processing, image recognition, and automation (OECD, 2019[33]) is still poorly measured and probably at an early stage. The most advanced users of AI tend to be large firms that are already sophisticated users of ICT tools and activities, notably in the ICT, automotive and financial services sectors. However, important potential looms in many other sectors too, e.g. in retail, media and entertainment, health care, and education (MGI, 2017[52]; OECD, 2020[53]). AI’s crosscutting applicability has become evident also for tackling the COVID‑19 pandemic, for example in predicting the evolution of the virus or accelerating medical research on drugs and treatments (OECD, 2020[54]).

Box 2.4. GAIA-X: towards a federated data infrastructure for Europe

GAIA-X is an ambitious project to create a federated and trustworthy data infrastructure for Europe in a strengthened European Digital Single Market. The project aims to benefit data subjects and data controllers by fostering data sharing and innovation with the mission to strengthen digital sovereignty for business, science, government and society and to unleash digital and data-driven innovation. Initiated by the Federal Ministry for Economic Affairs and Energy (BMWi) and the French Ministry for Economy and Finance, GAIA-X involves industries from both countries, in particular cloud services providers and customers (BMWi and BMBF, 2019[55]; BMWi, 2020[56]). Representatives from several European countries are currently involved and other European partners from business, science and politics are invited to join.

GAIA-X is conceived as a European digital ecosystem that can be distinguished in three ways. 1) A data ecosystem that fosters ontologies for interoperability and application programming interfaces (APIs) within and across sector specific data spaces according to the EU data strategy. This should facilitate the emergence of smart services, artificial intelligence (AI), and big data market places and applications. 2) An infrastructure ecosystem that enables services based on common standards. This involves network and interconnection providers, cloud solution providers, high performance computing as well as sector specific clouds and edge systems. 3) Federation services to operate the GAIA-X ecosystem, following the principles of security by design and privacy by design in order to ensure highest security requirements and privacy protection, while supporting the free flow of data (BMWi, 2020[57]; BMWi, 2020[58]).

GAIA-X also relates to the European Data Space initiative that is part of the European Data Strategy (EC, 2018[59]) (EC, 2020[60]), which aims to create a genuine single market for data. For example, one initiative that could provide impetus for the implementation of the European Data Strategy in the mobility sector is the current expansion and optimisation of Germany’s National Access Point for traffic and mobility data as part of the German Mobility Data Space, promoted in the framework of the German Presidency of the EU Council. This Data Space could contribute to the development a common European Mobility Data Space that connects the national access points of the participating member states (EC, 2020[61]).

Source: (BMWi and BMBF, 2019[55]; BMWi, 2020[56]; EC, 2018[59]; EC, 2020[60]; BMWi, 2020[57]; BMWi, 2020[58]; EC, 2020[61]).

Germany’s AI Strategy recognises the important role of data and AI and bundles a range of (mostly existing) initiatives including on data infrastructure, data governance, and industrial data (BMWi, 2019[47]). An update of the strategy is currently underway. Investments of EUR 3 billion support the strategy’s implementation. So far, EUR 1 billion was allocated in two tranches via the federal budgets for 2019 and 2020 to be spent until 2022 and 2023 respectively. An additional EUR 2 billion will be allocated via the COVID-19 recovery package. Important parts of Germany’s AI funding is targeting scientific AI-related research, as put into practice in the Cyber Valley in Tübingen, Europe’s largest AI research consortium with scientific and business partners. This should ultimately strengthen Germany’s position among the top countries for AI‑related publications and patents (OECD, 2019[33]; Baruffaldi, 2020[62]). Additional measures should be considered to boost the adoption of AI in firms alongside the range of policy instruments that can foster the adoption of ICT tools and activities more generally (Box 2.5; Sections 2.3. and 2.4).

Box 2.5. Fostering the adoption of ICT tools and activities by firms

Different types of policy instruments can be used to promote the adoption of ICT tools and activities by firms. Most common is direct financial support, followed by indirect financial support and other measures such as regulatory guidance or sandboxes.

Financial support includes direct financial support measures for firms’ adoption of ICT tools, such as for cloud services (Korea), big data (Portugal), digital consultancy services and digital skills (Denmark, Slovenia). Indirect financial support includes tax credits or other relief for ICT investment (Brazil, Japan) and subsidies to credit institutions to enable lending at preferential rates to firms in priority sectors that invest in digital products (Russian Federation).

Non-financial measures often raise awareness of the opportunities and risks of ICT tools and activities, for example via tailored advice and counselling services (Australia, Lithuania, Sweden), including on regulations relevant to new business models (Turkey) or by sharing the experience of “digital champions” or offering mentoring schemes (Portugal, Slovenia). Other measures include guiding principles and assessments to ensure that regulation is fit for digital transformation. For example, Denmark introduced a mandatory assessment of regulation to ensure it facilitates new business models, is technology-neutral, and ensures user-friendly digitalisation.

Regulatory sandboxes are another non-financial measure that allows firms to test new ICT tools and activities in a real-world environment while providing the opportunity for advancing ICT-related regulation through regulatory learning. With its Regulatory Sandbox Strategy, Germany aims to systematically establish regulatory sandboxes as frameworks for testing innovation and regulation across technologies and policy areas (BMWi, 2020[63]).

Source: (OECD, 2020[64]); (OECD, 2020[65]); (BMWi, 2020[63]).

Firms’ effective use of ICT tools and data underpins innovation across sectors (OECD, 2019[66]). While Germany has long been considered a world leader in technology, engineering and innovation (EC, 2012[67]) the innovative edge of many German firms cannot be taken for granted in the digital age. Germany still has a high share of innovative firms, as measured by the Eurostat Community Innovation Survey. However, this share decreased by over 16pp between 2008 and 2016, while it increased by almost 15pp in the Netherlands and by 10pp or more in Great Britain, Finland, and Belgium; the latter two now have a higher share of innovative firms than Germany (Duc and Ralle, 2019[68]). Germany’s initiatives to boost firms’ digital innovation potential, including in the context of industry 4.0 (BMWi, 2019[69]), such as via the High-tech Strategy and the Regulatory Sandbox Strategy (BMBF, 2018[70]; BMWi, 2020[63]), are crucial in this context. However, they need to be complemented with measures that overcome key barriers to firms’ successful digital transformation (Section 2.4), including to boost investment in knowledge‑based capital. This is paramount for firms of all seizes across all sectors and particularly urgent for firms operating at the digital frontier, such as those in the automotive industry.

Strengthen the automotive industry’s capacity for data‑driven innovation

Firms in the automotive industry need to innovate in business models to capture the increasing share of digital value in their core products and to remain competitive with new entrants, including players from outside the automotive industry. The automotive industry is Germany’s largest industrial sector, accounting for around 20% of total German manufacturing industry revenues and 4.7% of gross domestic product (GTAI, 2018[71]). The COVID-19 crisis reduced demand for German cars, and with plant closures production over the first nine months of 2020 was down by one third compared with the same period in 2019 (VDA, 2020[72]). This adds to existing challenges resulting from global trade and the transition to alternative power trains, electrification in particular. Against this background, automotive firms are facing digital transformation at several fronts: in production and innovation, in their core products, and in evolving (urban) mobility patterns that are shaping the role, use of, and demand for cars (ITF, 2019[73]).

The German automotive industry is a leader in industry 4.0, championing the digitalisation of business processes and supply chains and the automation of production systems (WEF, 2016[74]). Key benefits from industry 4.0 are improvements in cost, quality and delivery, including through closer co‑operation with suppliers, transparent inventory management and just-in-time/sequence logistics, shorter material lead times, and improved in-plant material flows (Kern and Wolff, 2019[75]). While the industry in Germany has remained strongly focussed on the digitalisation of production and logistics (VDA, 2018[76]), its core products, cars in particular, have started transforming through fast-paced digital and data‑driven innovation. A growing share of cars’ value is moving from the mechanical, physical good to the car as a digital platform. This transformation has increased the importance of connected systems and autonomous driving for the industry (SAP, 2018[77]).

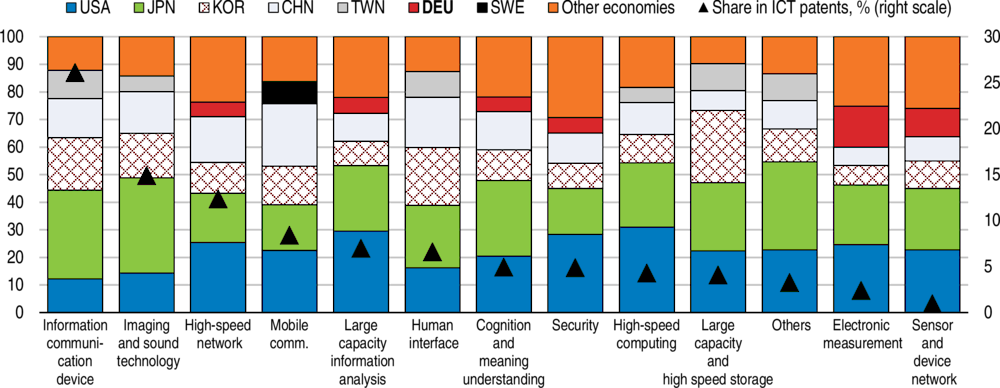

Compared to other industries in Germany, the automotive industry performs well on specific patents for the industry’s digital transformation, but Germany is not an international leader in ICT‑patents and related R&D spending. German automotive firms account for 43% of International Patent Classification patents in “Electric Digital Data Processing” (IW, 2018[78]). However, on a range of ICT-patents Germany lags behind the top players, featuring among the top five in less than half of the ICT-related patent categories shown in Figure 2.11. In contrast, the United States, Japan, Korea and China dominate across all of these categories. The same countries are also home to the top corporate research and development (R&D) investors contributing most to develop AI-related technologies (EC and OECD, 2019[79]). Overall, Germany’s share of ICT‑related patents in the total number of IP5 patents (patents from the world’s five largest IP offices) is below the OECD and EU averages and R&D expenditures in ICT equipment and information services are low (OECD, 2017[80]).

Figure 2.11. Germany lags behind top economies in ICT-related patenting

Share of the top five economies’ shares of patents in ICT-related technologies, 2014-17

Note: Data refer to IP5 families, by filing date, according to the applicants' residence using fractional counts. Patents in ICT are identified using the list of IPC codes in Inaba and Squicciarini (2017).

Source: OECD, STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, September 2020.

A central development in the evolution of cars is autonomous driving technology, which requires ICT hardware and software that are not among the traditional German industrial strengths. Cars capable of level 4 automation (the highest level is 5) are on the road in test mode and sales of vehicles with this degree of automation could rise significantly by 2030 (McKinsey, 2016[81]). While German manufacturers hold 55% of autonomous driving related patents worldwide, co‑operations of suppliers with several manufacturers may lead to fast diffusion of autonomous driving innovation, which may undermine long‑term advantages (Bardt, 2017[82]). Software is also often not patentable in Europe and can be supplied globally by few players. In addition, leading firms of key automated driving hardware, such as microprocessors, are not based in Germany (ifo, 2019[83]). These aspects could undermine the strength of Germany’s automotive sector over time, if value creation in the industry increasingly relies on innovation in and production of ICTs.

On the one hand, autonomous driving could weaken German premium cars’ core value propositions such as driving dynamics or precision steering, with implications for the margins that companies gain from selling premium cars that can be re-invested in R&D (ifo, 2019[83]). On the other hand, automation is an opportunity for German manufacturers to innovate in new functions and services to remain competitive. Autonomous driving may further underpin evolutions in mobility that affect the role of cars in the value chain. High and full autonomy may allow passengers to dedicate more time in mobility to other activities than driving, for example work and entertainment. This would shift even greater shares of value from cars as physical goods into services offered and data collected in mobility. This may benefit firms controlling more segments of the value chain, such as Tesla, which is involved in battery production, autonomous driving technology and software, direct retailing and insurance (Chen and Perez, 2018[84]).

The creation, delivery and capture of value that resides in digital components and services requires business models and competencies that are not common in the automotive industry, for example competencies related to networks, software and data. Today, these tend to be concentrated among established digital technology companies, many of which have entered the autonomous vehicle market already (CB, 2019[85]). Some of them have made important in-roads, for example, in autonomous driving (e.g. Waymo) and cars’ digital operating (e.g. Android Automotive OS) and infotainment systems (e.g. Apple CarPlay). These entrants can leverage interoperability and synergies with other digital platforms they operate, including cloud computing. On key services, such as autonomous driving, German automotive firms may increasingly have to partner with foreign companies that have the talent, expertise, and networks needed to excel in data-driven value creation.

The government has advanced several initiatives over recent years in support of the automotive industry’s digital transformation. Building on the 2015 Strategy for Automated and Connected Driving, the 2018 action plan Digitalisation and Artificial Intelligence in Mobility bundles several measures related to data usage, vehicle automation, connectivity, real world test beds, ethical rules, legal and regulatory reviews, and international standardisation (BMVI, 2015[86]; BMVI, 2018[87]). A large testbed was established on the A9 highway with a focus on automated and connected driving and related infrastructure implications. Urban testbeds in several major German cities are serving to trial interactions between vehicles, infrastructure and other road users and to gather experience for industry and research in real traffic and driving situations of varying complexity. These testbeds should also allow citizens to experience the potential of new technologies "hands-on" and provide insights for further policy decisions (BMVI, 2017[88]). Germany also participates in two Important Projects of Common European Interest, one on microelectronics (EUR 1 billion) and one on the battery value chain (EUR 1.25 billion), and runs a programme on ICTs in electro mobility (BMVI, 2019[89]; BMWi, 2018[90]; European Commission, 2019[91]). In the context of the COVID-19 crisis, the government provided demand stimuli by temporarily lowering VAT and increasing incentives for purchasing electric cars.

In addition to addressing the industry’s need for skills (Section 2.5) more attention should be paid to standard‑setting, in particular with regards to connected and automated driving, which is shaped by multiple technologies and industries with complex interoperability implications (VDA, 2018[76]; NPM, 2020[92]). Germany has not been a front‑runner so far on ICT‑related standard setting for connected and automated driving, where international standardisation bodies and consortia play an important role. The establishment of Working Group 6 of the National Platform on the future of Mobility and Germany’s engagement at the European level as well as in the Working Party on Automated/Autonomous and Connected Vehicles within the World Forum for Harmonization of Vehicle Regulations (WP29) of the United Nations Economic Commission for Europe are good steps. However, sustained efforts are needed to catch up with countries such as Japan and China that are considered to have taken a lead in using standardisation as a strategic instrument to shape the state of the art of technical solutions and regulatory guidelines (VDA, 2019[93]). Germany’s automotive industry would benefit from the pursuit of a more strategic and co‑ordinated approach to standard-setting related to autonomous driving technologies across standardisation bodies, consortia and industry domains (OECD, 2017[94]).

Digital transformation also underpins changes in mobility patterns that are likely to affect the role, use of, and demand for private cars, in particular in cities. Key trends that are likely to shape urban mobility include shared mobility services and autonomous driving, both of which rely heavily on ICTs. In the long-run, intra‑urban travel may shift more to public transport and shared mobility (ITF, 2019[73]). While global demand for private cars is still on the rise, the International Transport Forum estimates that between 2015 and 2030, growth in urban transport demand (passenger-kilometres) in the OECD will be strongest in shared mobility (15%, including all modes), while demand for private cars may slightly decrease. In a scenario in which all private car use is replaced by the massive uptake of shared mobility in conjunction with existing public transport systems, vehicle-kilometres and CO2 emissions could be reduced by 30-60%, compared to current mobility patterns (ITF, 2019[73]).

An important step underway to improve Germany’s legal framework for evolving urban mobility is the current review of the Personenbeförderungsgesetz (Passenger Transport Act) that may improve the conditions for ride‑ pooling (BMVI, 2019[95]). Other initiatives include the government’s mFund, which supports investment in data‑driven innovation, research projects, SMEs and start-ups in mobility (EUR 200 million 2016-2020 and EUR 250 million starting 2021), and the German Association of the Automotive Industry’s Urban Mobility Platform that involves major cities, automotive firms and suppliers and aims at launching pilot projects (VDA, 2018[76]). Looking ahead, strategic considerations should take into account the interrelated and increasingly converging trends of automated driving, shared mobility and alternative powertrains.

2.4. Overcoming key barriers to firms’ successful digital transformation

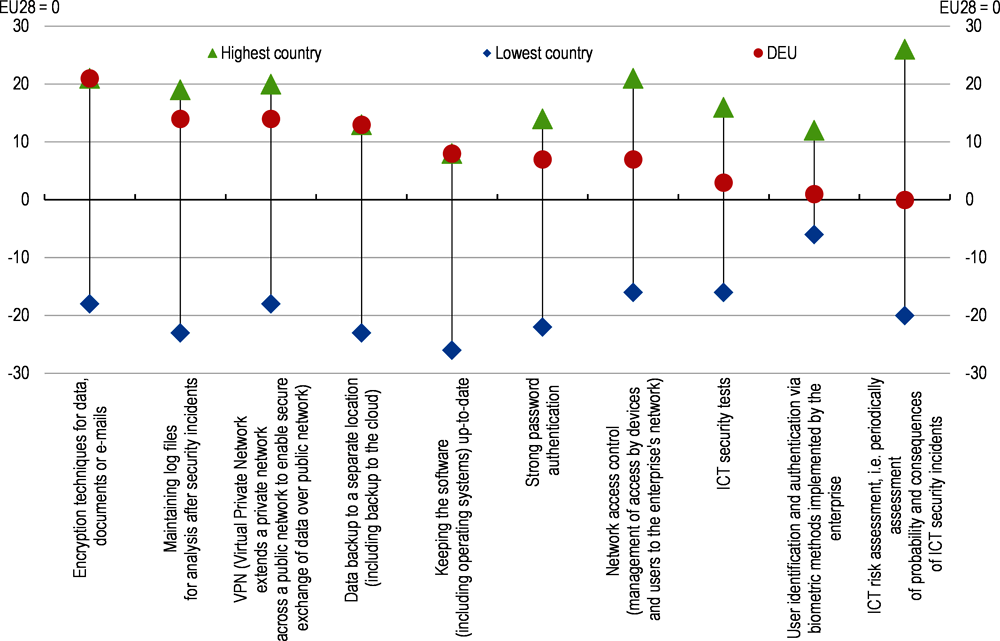

Germany should address three key barriers to digital transformation: first, low investments in ICTs and knowledge‑based capital that are crucial for the effective use of data and to drive innovation; second, specific hurdles faced by SMEs; third, concerns about digital security that discourage many firms from adopting key ICT tools, such as cloud computing.

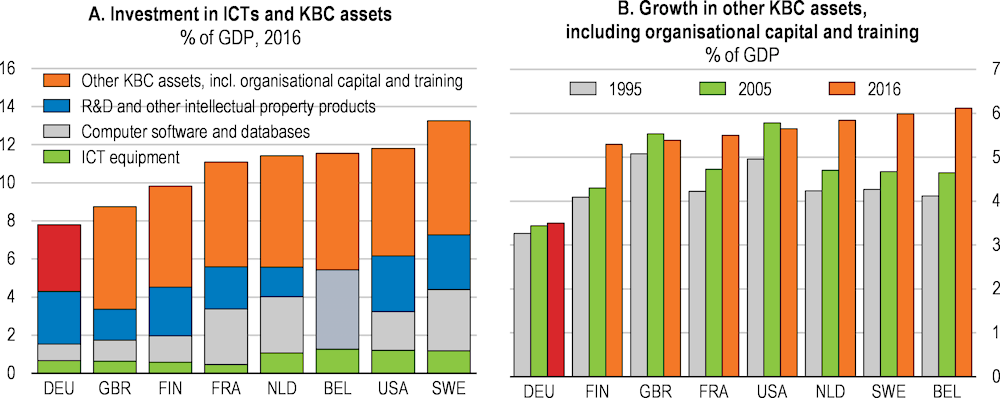

Boost investment in knowledge‑based capital

Unleashing the potential of digital transformation for innovation and productivity requires firms to invest not only in ICT equipment but also in knowledge-based capital, including R&D, intellectual property, software, data, organisational capital, design and training (OECD, 2013[96]). Investment in knowledge-based capital has significant effects on productivity in Germany, notably when combined with investments in tangible assets (DIW, 2017[97]). However, low levels and sluggish growth of investment in knowledge‑based capital undermine the innovation potential of German firms (Bertelsmann, 2019[98]; BDI, 2020[99]) and the contribution of knowledge-based capital to productivity growth (OECD, 2018[3]; Demmou, 2019[100]). This may also relate to low growth of knowledge‑intensive services in Germany, compared with other countries such as the United Kingdom and the United States (SVR, 2019[101]).

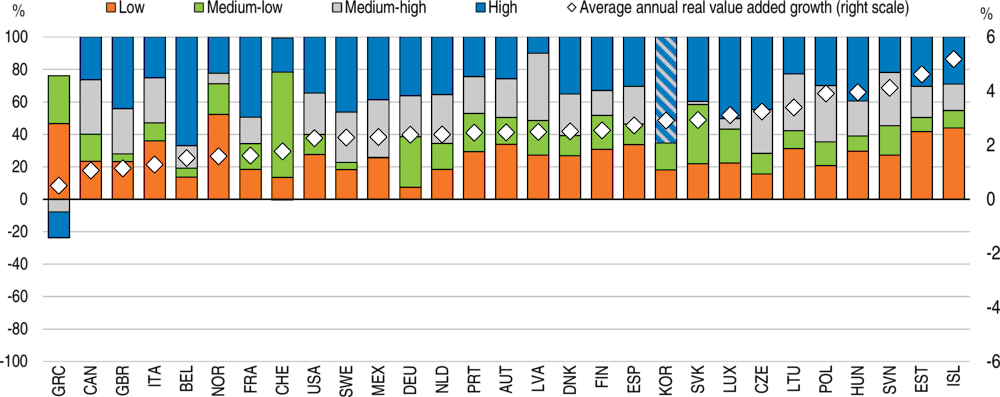

In Germany, investment in knowledge-based capital is low and tends to be concentrated in only a few sectors and firms. While investment in R&D is above and in ICT equipment is close to the respective OECD average, investments in software and databases are less than two thirds of the OECD average (OECD, 2019[33]). Investments in other knowledge-based assets, including organisational capital and training have remained low over the past three decades, compared to best performing countries (Figure 2.12). In addition, investment in R&D, software, licences, patents are concentrated in a small number of larger firms in a few sectors, in particular in the manufacturing sector for R&D (car manufacturing accounts for 30%) and the ICT sector for software (the ICT sector accounts for 40%). Investments in organisational capital and training are spread out more broadly across sectors (DIW, 2017[97]).

While Germany’s gross domestic expenditure on R&D is at the higher end among OECD countries and has increased over the past decade, the share of business R&D in value added in industry (2.17%) is below OECD average (2.54%) and decreased between 2005 and 2015. However, the intensity of business R&D adjusted for industrial structure is above OECD average, which can be explained by the German economy’s relative specialisation in R&D intensive industries. Strikingly, the SME share in business R&D is below 10%, compared to over 60% in the ten countries with the highest share (OECD, 2017[80]).

Figure 2.12. Investment in ICTs and knowledge-based capital is low

Note: KBC stands for knowledge‑based capital. No breakdowns of intellectual property products available for Belgium. Other KBC assets are estimated based on INTAN-Invest data and cover all industries except real estate, public administration, education, health and households.

Source: OECD calculations based on OECD National Accounts database and INTAN-Invest data, http://www.intaninvest.net/.

A key policy instrument to address R&D market failures are expenditure-based R&D tax incentives, which account for 55% of total government support for business R&D in the OECD area in 2017, up from 30% in 2000 (OECD, 2020[102]). Germany introduced R&D tax incentives in early 2020, subsidising 25% of maximum EUR 2 million R&D expenditures per year, limited to EUR 15 million in total (direct and tax) support per firm (BMF, 2019[103]). As part of the COVID-19 recovery package, this cap has been increased to EUR 4 million per firm until the end of 2025 (BMF, 2020[104]). While this measure is expected to benefit R&D in SMEs, the initial cap is likely to limit the effects for larger “Mittelstand” firms, so called mid-range companies, which are key players for innovation with important potential for R&D (ZEW, 2018[105]; ZEW, 2019[106]). Based on closely monitoring the instrument’s uptake, further refinements should consider increasing the cap and account for the role of direct R&D support (Appelt et al., 2020[107]). Monitoring and potential refinements of the instrument should also consider interactions with related instruments such as the Central Innovation Programme for SMEs (Zentrales Innovationsprogramm Mittelstand) (BMWi, 2019[108]; ifo, 2019[109]) and the potentially complementary depreciation allowance for “digital goods” that is currently in planning.

Knowledge-based assets themselves can act as a barrier to accessing asset‑based financing, in particular for SMEs. Lenders often face important challenges to recognise SMEs’ knowledge-based assets as collateral, and may struggle to understand their role for firms’ success, how to value these assets, and how to realise value in case of a default (Brassel and Broschmans, 2019[110]). Where bank financing plays a dominant role, as in Germany, this can work against investment in knowledge-based assets (OECD, 2019[111]). This might partly explain or reinforce the technology bias in digital‑related investments of SMEs’ in Germany, 83% of which invest in technology, compared to only 64% that invest in related skills (European Commission, 2018[112]). Germany may consider other countries’ approaches to address this issue. For example, the French public investment bank Bpifrance supports investments in knowledge‑based capital through uncollateralized loans and bank loan guarantees, and the French Ministry of the Economy and Finance launched a website to help businesses and investors develop knowledge-based capital intensive business strategies (DGE, 2018[113]). The UK’s Intellectual Property Office subsidises IP audits for SMEs, which helps strengthen SMEs’ IP protection strategies and creates awareness of knowledge-based asset value (OECD, 2019[114]).

The need to reduce information and financing barriers to firms’ investments in knowledge-based capital and ICTs should also be reflected when reviewing key digital related strategies and policies, such as the Digitale Strategie 2025 (Digital Strategy 2025) and the Mittelstand‑Digital (SME Digital) strategy, which currently lack attention to this issue (BMWi, 2016[115]; BMWi, 2019[116]). Beyond WIPANO, a programme for knowledge and technology transfer via patents and standards that promotes the patenting and exploitation of inventions and funds research projects on standardisation, and the above-mentioned incentives to invest in R&D, policies should aim to boost firms’ investments in software, databases, organisational capital and training, which remain particularly low compared to other countries (Figure 2.12 above). Existing programmes that provide investment incentives for some of these forms of knowledge‑based capital, such as the ERP Digitalisierungs und Innovationskredit (KfW, 2020[117]), could be scaled up, including with more funding.

Step up support to accelerate the digital transformation of SMEs

SMEs are at the heart of the German economy, champions in some international niche markets, and key partners of larger multinationals as upstream suppliers. Germany’s SMEs play a key role in automotive industry supply chains, and account for the bulk of the German international trade surplus (VDA, 2018[76]; OECD, 2019[118]). While in the context of the COVID-19 crisis SMEs suffered in many sectors, IT and telecommunication were among the few sectors that experienced increasing demand, for example to support telework (Meffert, Mohr and Richter, 2020[119]). To remain competitive in an increasingly digital and data-driven economy, including with less mobile staff and customers during containment, SMEs need to invest more in advanced ICTs, knowledge-based capital and the skills they need to succeed in digital transformation (Section 2.6).

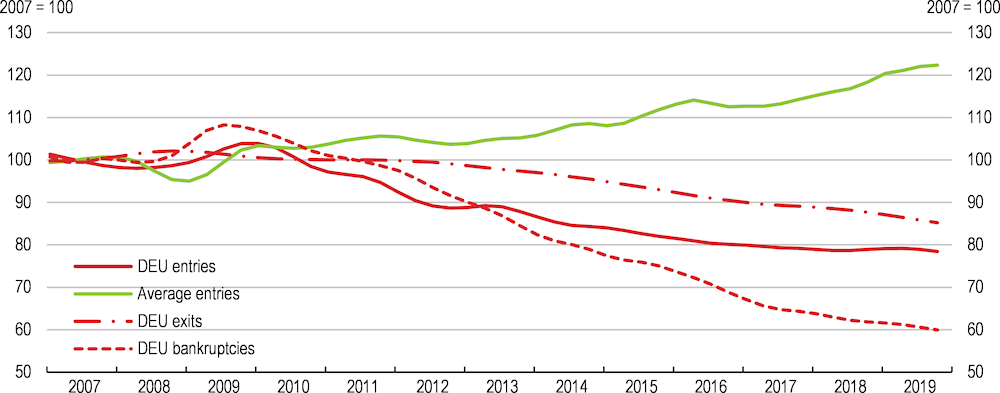

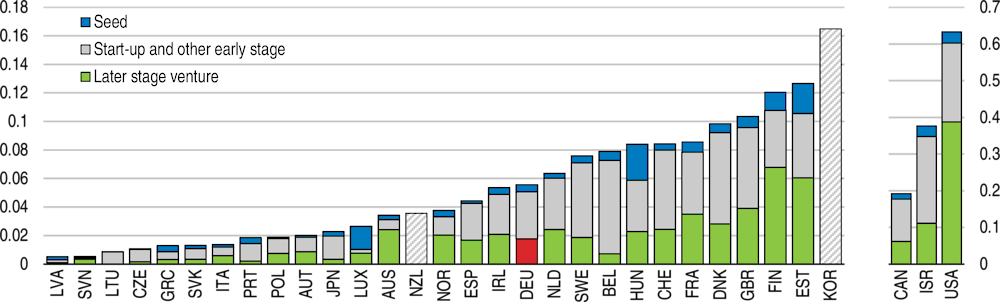

Over recent years, digital transformation trends of German SMEs have shown a positive dynamic, but gaps with larger firms remain. Between 2016 and 2018, 40% of SMEs completed digitalisation projects successfully, which corresponds to some 1.5 million SMEs, up from 26% between 2014 and 2016 (KfW, 2020[120]). However, large firms remain frontrunners in the adoption of newer and more advanced ICT tools and activities that enable firms to create value with data. Across OECD countries, the gap between large and small firms is closing for the adoption of basic ICT tools, and in Germany this is also the case for process-related ICT tools and activities (Figure 2.13). Large firms, however, still drive the adoption of newer and more advanced ICT tools and activities, in most cases, even more so in Germany than across OECD countries. This may also reflect Germany’s general backlog in the adoption of such tools and activities (Section 2.2, Figure 2.4 above), in particular of high‑speed broadband. Policies supporting their adoption should thus notably target smaller firms.

SMEs often face barriers to access external finance and many invest only little in their digital transformation. Key reasons include uncertainty about success, difficulties for lenders to assess digital transformation projects and a low share of investments that could account as collateral. In part as a result, SMEs tend to finance digital transformation projects mainly from their cash‑flow (Saam, Viete and Schiel, 2016[121]). Currently, SMEs finance such projects by 87% with internal funds, while bank loans only account for 7%, a proportion that does not necessarily reflect firms’ first choice. Indeed, firms conducting loan negotiations on digital transformation projects are more likely to report difficulties in accessing credit than enterprises negotiating loans for capital expenditure (KfW, 2020[122]). Over the past three years, average digitalisation expenditure stagnated at EUR 17 000 per firm. The EUR 19 billion SMEs invested in digitalisation in 2018 remains low compared to the EUR 34 billion spent on traditional innovation and the EUR 220 billion spent on material assets (KfW, 2020[120]).

Figure 2.13. Small firms are not yet catching up in the adoption of advanced ICT tools and activities

Percentage point change in the gap between small and large firms for the adoption of ICT tools and activities, 2010 to 2019 or latest available

Note: Firms with 10 or more employees, excluding financial sector. For Germany, data refer to 2013-2014 for using social media, purchasing cloud computing services and 2016 for having performing big data analysis. For OECD average, data refer to 2011-15 for using social media, 2009-14 for purchasing cloud computing services and 2016 for having performing big data analysis.

Source: OECD ICT Access and Usage by Businesses database, http://oe.cd/bus.

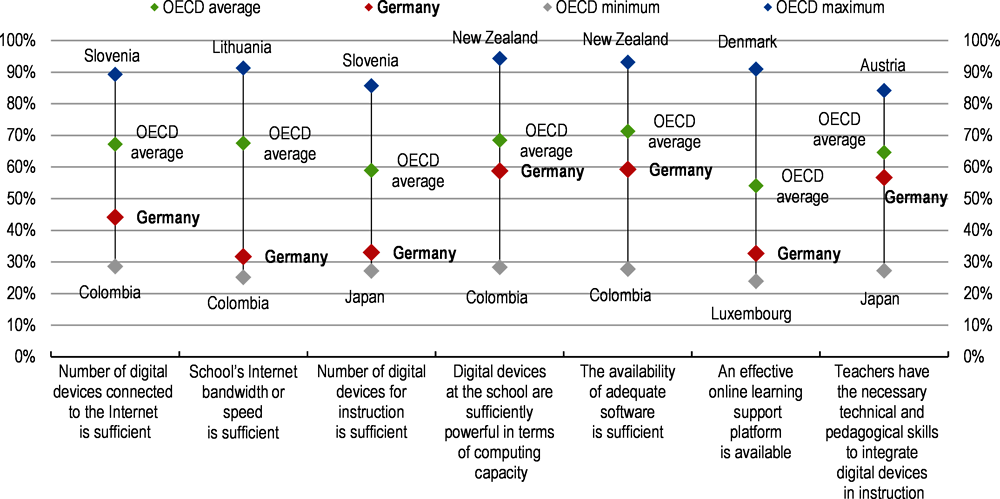

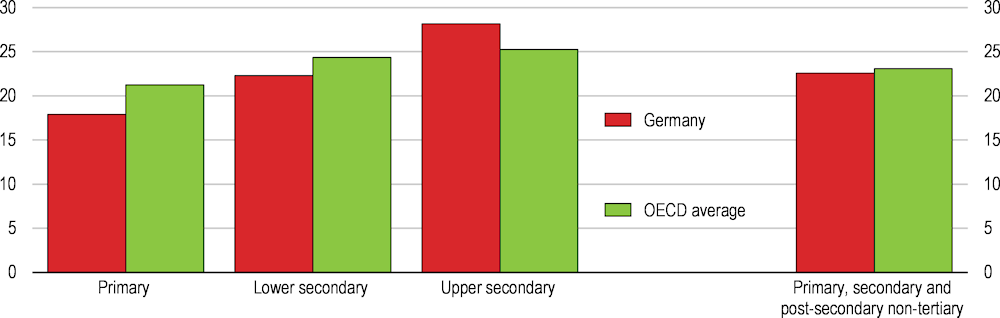

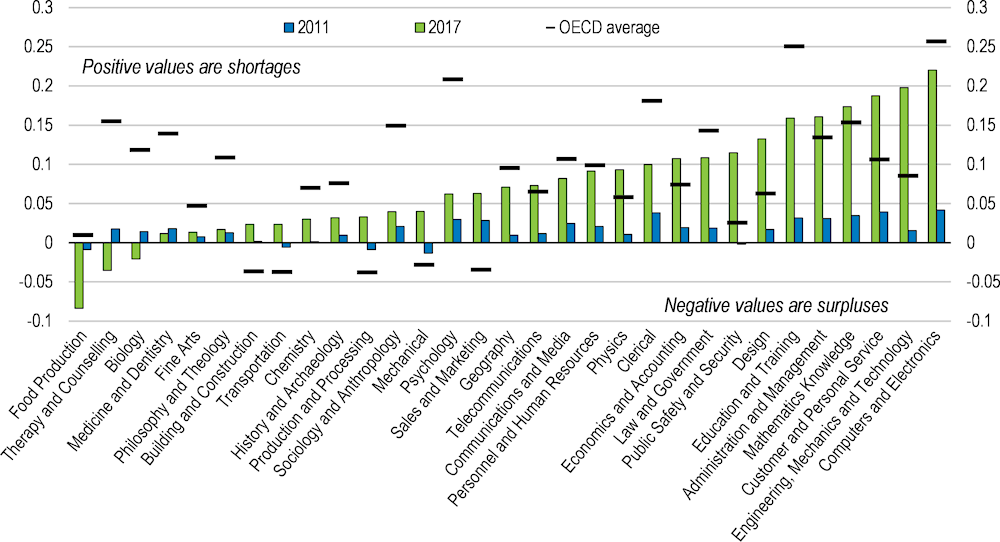

Policies in support of SMEs’ digital transformation include several well‑targeted measures. The government’s 2019 Mittelstand-Digital strategy raises awareness and provides guidance on digital transformation for SMEs (BMWi, 2019[123]), including through Mittelstand 4.0 Kompetenzzentren, which provide local contact points offering specific digital expertise to SMEs (BMWi, 2017[124]). The Go Digital programme subsidises authorised digital transformation consultants for SMEs (BMWi, 2018[125]), and the recently launched Digital Jetzt (Digital Now) programme subsidises investments in ICTs, including software and related training in firms with 3-499 employees (BMWi, 2019[126]). Several additional programmes exist at sub‑national level. The largest programme, Digital Now, provides around EUR 50 million annually over four years (BMWi, 2020[127]). While in sum this is substantial, more may be needed to significantly accelerate the digital transformation of the over 2 million eligible firms.