Zeev Krill

Robert Grundke

Marius Bickmann

Zeev Krill

Robert Grundke

Marius Bickmann

Germany intends to reach climate neutrality in 2045, tripling the speed of emission reductions that was achieved between 1990 and 2019. Soaring energy prices and the need to replace Russian energy imports have amplified the urgency to act. Various policy adjustments are needed to ensure implementation and achieve the transition to net zero cost-effectively. Lengthy planning and approval procedures risk slowing the expansion of renewables, while fossil fuel subsidies and generous tax exemptions limit the effectiveness of environmental policies. Germany should continue to rely on carbon pricing as a keystone of its mitigation strategy and aim to harmonise prices across sectors and make them more predictable. Carbon prices will be more effective if complemented by well-designed sectoral regulations and subsidies, especially for boosting green R&D, expanding sustainable transport and electricity network infrastructure, and decarbonising the housing sector. Subsidies for mature technologies and specific industries should be gradually phased out. Using carbon tax revenue to compensate low-income households and improve the quality of active labour market policies would help to support growth and ensure that the transition does not weaken social cohesion.

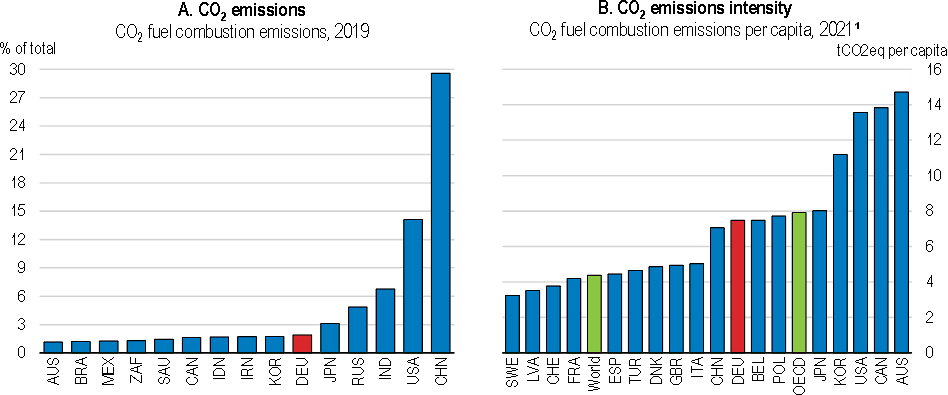

Germany is still a large emitter of greenhouse gases (GHG) (Figure 2.1), but it is also at the forefront of efforts to reduce emissions. Germany released 39% less GHG emissions in 2021 than in 1990. It intends to reach climate neutrality in 2045, which requires tripling the speed of emission reductions, and lowering the usage of fossil fuels in electricity generation to zero in 12 years by strongly expanding renewable energy supply. This is a massive challenge with considerable economic and social costs. Still, it also holds large potential to create new economic opportunities and improve people’s lives, as well as to help to avoid the much higher economic costs of missing global climate change mitigation targets. Russia’s war of aggression against Ukraine has revealed vulnerabilities due to an over-reliance on energy imports from Russia and emphasised the possible contribution of renewables to raise energy security. Furthermore, renovating the existing housing stock would improve housing quality and lower energy bills, while shifting to net zero transport would bring greener and less polluted cities. As a country with high technological capacity, Germany can benefit by developing new technologies and providing key competences for the development of new value chains, such as the one for green hydrogen.

1. 2019 for China and World.

Note: Panel A shows countries with the highest share of global emissions.

Source: IEA Greenhouse gas emissions from energy database.

This chapter identifies a mix of policies, which would help to achieve the transition to net-zero cost-effectively while ensuring that the costs of the transition are shared in a fair way. As the global climate is a public good, the chapter emphasises the important role of international cooperation in addressing carbon leakage and other externalities to achieve substantial progress towards a net-zero global economy. The analyses and recommendations are informed by two new OECD studies on the economic and distributional consequences of different mitigation policy options for Germany (Bickmann et al., forthcoming[1]) as well as on labour market transitions of workers displaced from high carbon-intensity sectors during the last three decades (Barreto, Grundke and Krill, forthcoming[2]). The remainder of the chapter is structured as follows: after describing the high costs of climate change for Germany, the chapter discusses recent progress towards the national climate targets. It then highlights the policy instruments needed to reach a net-zero economy cost-effectively, including by addressing carbon leakage and other challenges to manufacturing. The following section analyses the distributional consequences of more ambitious mitigation policies and discusses ways to reduce adjustment costs for workers and households and build strong public support for the green transition. The last section discusses targeted policies for three main emitting sectors: electricity, transport, and housing. A discussion of the agricultural sector, land use, land use change and forestry (LULUCF) as well as an in-depth chapter on climate change adaptation and nature-based solutions can be found in the OECD Environmental Performance Review of Germany (OECD, forthcoming[3]).

Germany is increasingly affected by the consequences of climate change. Since 1951, the number of days with temperatures above 30°C has almost tripled and since 1881, when measurements began, winter precipitation has increased by 27%. The average annual temperature is already 1.6 degrees higher than in 1881 (German Environment Agency, 2021[4]). This has strong effects on the economy and human lives. According to the European Environmental Agency, economic losses due to extreme climate-related events since 1980 accumulated to about 3% of 2020 GDP, with higher losses per capita than in most EU countries (2022[5]). In a recent study conducted for the German Federal Government, the estimated economic loss was almost three times as high (Prognos, IOW and GWS, 2022[6]). Floods and heavy rains caused most of the damage to properties and infrastructure, while heatwaves caused 99% of fatalities, estimated at 1,400 a year (Box 2.1). Existing studies likely underestimate the actual costs of climate change, as indirect effects on biodiversity and health are hard to quantify using available data.

The floods that hit Germany in 2021 swept away many buildings and caused severe damage to infrastructure. More than 180 people were killed, and over 800 were injured. The overall damages are estimated at EUR 40 billion, the single most costly event in post-war history of Germany. Climate change increases the likelihood of such an event by a factor of 1.2 to 9, implying that the damage of the floods that could be attributed to climate change ranges from EUR 7.1 to 35.9 billion (Prognos, 2022[7]).

The floods highlighted weaknesses in the German insurance coverage for natural hazards as well as in the warning and response systems and communication channels (OECD, forthcoming[3]). About 30% of the affected residents did not receive any warning. Of those who were warned, 85% did not expect a very severe flooding and 46% did not know what to do (Thieken et al., 2022[8]). In addition, most of the buildings that were hit were not insured against flood damage, which led the government to establish a special fund (of EUR 30 billion) to partially compensate for the losses (Osberghaus, 2021[9]).

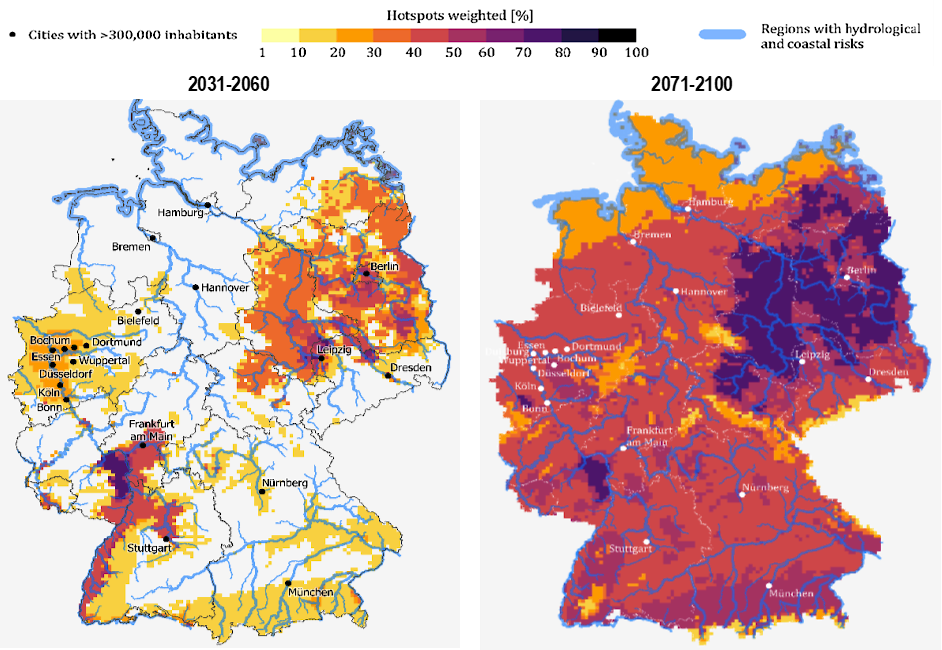

With climate change, occurrences of extreme events such as heatwaves, drought and heavy rainfall will rise sharply, and so will the related economic costs (German Environment Agency, 2021[4]). In 2022, a severe drought led to historically low water levels in the Rhine, which disrupted ship transport from Rotterdam to the economic centres in the Southwest of Germany. This further exacerbated supply chain bottlenecks, hindering the post-pandemic rebound of industrial production (see Chapter 1). Climate extremes would occur most frequently in the south, southwest and east of Germany (Figure 2.2) and would have a great impact on agriculture, water management and biodiversity. Loss of yields, forest fire risks and a reduction in fish species and water quality are all among the potential risks, even if better adaptation policies could reduce some of the damages (German Environment Agency, 2021[4]) (Box 2.2).

Germany’s adaptation efforts have focused on developing regular, robust climate risk assessments. Its results have informed a whole-of-government approach to building climate resilience based on the overarching national adaptation strategy established in 2008. The federal government’s role in building climate resilience is focused on technical guidance, facilitation and co-ordination. At the same time, investment and the implementation of adaptation measures are under the responsibility of sectoral agencies and Laender governments. Implementation progress has been sluggish and heterogenous across sectors and regions, with many localities remaining highly exposed and vulnerable to climate change. To improve climate resilience, information should be shared more efficiently with those expected to act, namely local and regional policymakers, infrastructure investors, businesses and property owners. Additionally, incentives to scale up preventive adaptation action need to be strengthened, and measures to support the availability and take-up of insurance against natural hazards should be examined (Box 2.1).

The government sets out an ambitious vision for strengthening its climate adaptation engagement in the 2022 Immediate Programme for Climate Adaptation. It aims to develop a Federal Climate Change Adaptation Act, complementing the Federal Climate Change Act. It shall give the federal government the mandate for developing a new adaptation strategy, revising the nationwide funding mechanism for adaptation, and developing measurable targets to increase accountability for adaptation actions carried out by different actors. The act provides an opportunity to clearly determine roles and responsibilities at different governance levels, and to rethink how adaptation resources can be mobilised in favour of preventative action.

Source: OECD (2023), Environmental Performance Reviews: Germany 2023, OECD Publishing, Paris, forthcoming.

Climate change will affect Germany even more through its economic consequences in other parts of the world. Climate risks are higher for low and medium-income economies that have difficulties to cope with the consequences of climate change due to weaker infrastructure and institutional quality and higher reliance on sectors that are adversely affected by climate change (German Council of Economic Experts, 2021[10]). As a result, climate change will significantly affect trade with and migration flows from these countries.

Note: Maps of extreme values show regions that could be affected by a particularly large number of climatic extremes.

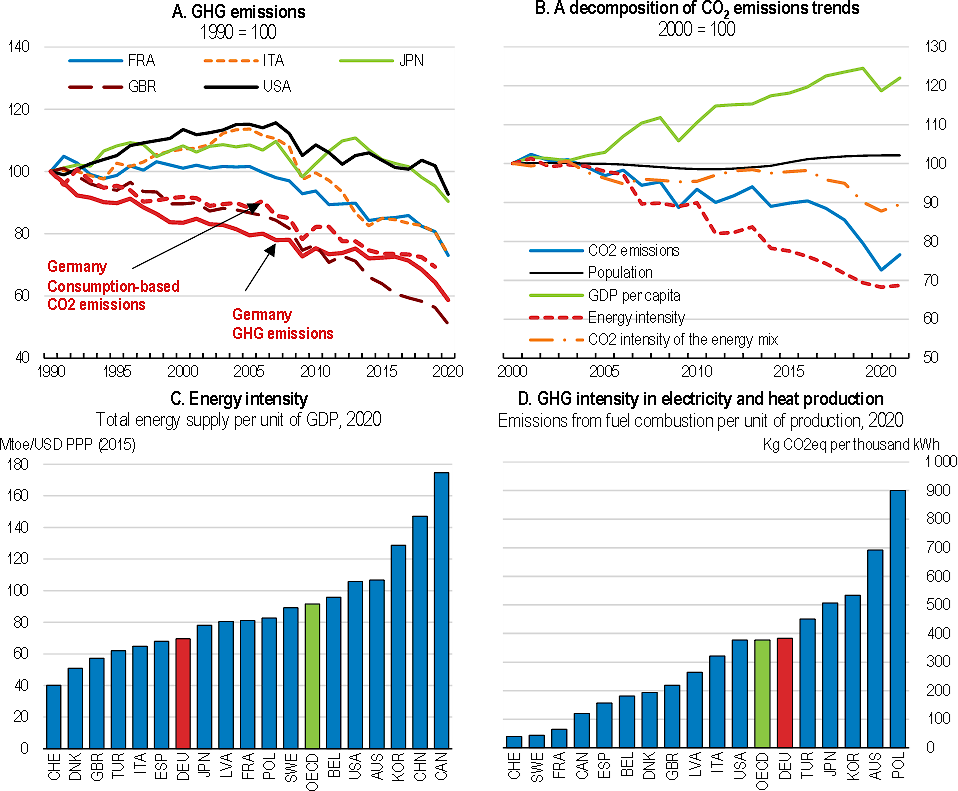

Germany has made considerable progress in reducing greenhouse gas emissions (Figure 2.3, Panel A). Yet, it remains one of the largest emitters of GHG per capita among OECD countries, mainly due to the high share of industry in GDP and fossil fuels, including coal, in the production of power and heat. It has reduced production-based emissions by 36% from 1990 to 2019, among the largest reductions in the OECD and G20 countries, while at the same time GDP increased by 54%. This was achieved without increasing the displacement of emissions to other countries, as the trend after including emissions embodied in imports is similar. Some of the improvement was due to particular circumstances after reunification and not due to policy measures, efficiency gains or structural change (Schleich et al., 2001[11]). From 1989 to 1994, emissions in East Germany fell by almost half, mainly due to a reduction in lignite-based power generation.

So far, the decoupling of emissions from economic activity has been reached mainly by reducing energy use per unit of GDP (Panel B), which is now below most OECD countries (Panel C). Progress in reducing emissions per unit of energy produced has been slower, and the use of fossil fuels in the production of power and heat is still high (Panel D). Nevertheless, progress has accelerated in recent years due to remarkable growth in renewable energy supply and a decline in coal use (Figure 2.4). Germany’s share of electricity generation from solar and wind is amongst the highest in G20 countries.

The COVID-19 pandemic and its associated restrictions reduced emissions by 9% in 2020, so that Germany reached its 2020 emissions reduction target. However, little of this reduction is set to be permanent, with over half of the emission reduction due to the temporary drop in economic activity (Council of Experts on Climate Issues, 2021[12]). Already in 2021 (when COVID-19 restrictions continued), emissions increased by about 4.5%. Some changes to working and consumption patterns might persist, but their effects on emissions are uncertain and likely to be limited. For example, if 15% of employees work full time from home, direct effects on emissions due to reduced car commuting are expected to amount to 4.5 million tons of CO2, about 3% of emissions in the transport sector (Bachelet, Kalkuhl and Koch, 2021[13]). However, over the longer term, working from home can incentivise to move away from expensive inner cities and commute greater distances or slow down the shift to more efficient cars for those who will commute less (Marz, 2022[14]).

Note for panel A: CO2 emissions from fuel combustion. GDP per capita refers to GDP USD PPP at 2015 prices divided per population, energy intensity refers to total energy supply per unit of GDP (USD PPP at 2015 prices), and CO2 intensity of the energy mix refers to CO2 emissions per unit of total energy supply.

Source: IEA Greenhouse gas emissions from energy database; Our World in Data based on the Global Carbon Project; OECD (2022), Green Growth Indicators, OECD Environment Statistics (database); IEA (2021), IEA World Energy Statistics and Balances (database)

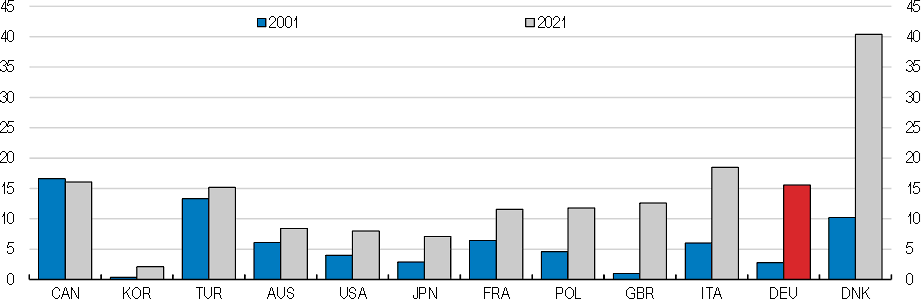

Share of primary energy from renewable sources, %

Note: Renewable energy sources include hydropower, solar, wind, geothermal, wave, and tidal. Countries ordered by the change (in percentage points) in the share of renewables since 2001.

Source: IEA World Energy Balances database.

The strong reduction of GHG emissions is a result of sustained political will, substantial changes to the regulatory framework, targeted support, and a history of cooperation with neighbouring countries. Above all, establishing a feed-in tariff scheme in the 1990s encouraged the creation of a protected niche market for renewables, without prioritising a specific technology. The scheme spurred a significant development and deployment of renewable technologies and helped to reduce abatement costs in Germany and other countries. It is a good example of a successful innovation policy, which was adjusted after the market matured (Box 2.3). The ecological tax reform of 1999 and the introduction of the EU emissions trading system (EU ETS) in 2005 have also strongly contributed to breaking the link between GHG emissions and economic growth.

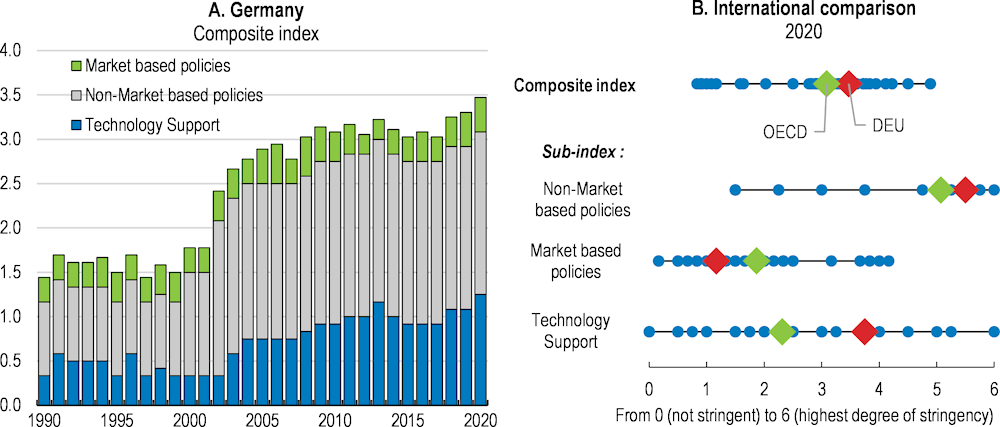

The OECD Environmental Policy Stringency index illustrates the rise of climate mitigation efforts in Germany in the last two decades (Figure 2.5). Like in the average OECD country, non-market-based policy instruments such as performance standards contributed most to this increase. However, in recent years the technology support sub-index shows a significant rise as well. For example, the sub-measure of support for wind energy has increased significantly since 2018. The EU ETS contributed to the increase in the stringency of market-based policies since 2006, and the introduction of the national emissions trading mechanism in 2021 is another important step in that direction. Nonetheless, the scope for market-based policies, including higher and more unified carbon pricing, remains significant (see below).

Germany is a pioneer in producing and deploying renewables. Already in 1991, it instituted one of the world’s first feed-in tariff schemes to encourage renewables, allowing the related administration to develop technical competence and relevant knowledge. In 2000, the German government decided to gradually phase out nuclear power over 30 years and to expand the feed-in tariff scheme for a wide range of renewable energies that were not yet competitive (the Renewable Energy Sources Act, or EEG). The tariffs incentivised investment by covering the difference between the cost of production and the electricity market price. This was financed by the renewable energy surcharge on electricity consumption.

The tariff spurred significant deployment of solar technology, bringing down its cost. However, in 2008 the drop in solar photovoltaic prices, while tariffs adapted only slowly, led to soaring subsidy costs. In response, Germany reformed the scheme and moved to rely on auctions in setting the target price. This brought down the subsidies to less than five cents per kWh in 2017, while keeping renewables competitive (relative to coal). Overall, solar and wind capacities soared from about 9 gigawatts to 118 gigawatts between 2000 and 2015. During this time, Germany accounted for about a third of total renewable installations within the European Union. In addition, new industries were created, and German companies became global champions in the production of renewables by developing cutting-edge technologies. At its peak in 2011, more than 150 000 individuals worked in the solar energy sector. Since then, German distributors have turned to China for scaling up supply at a reduced cost, relying on technology standards and certification that provide reliability.

The cost reductions enabled Germany to increase the ambition of its renewable energy targets. Already in 2010, the government set targets for renewable energy expansion, energy efficiency, CO2 reduction, and low-carbon transportation. The nuclear fleet was maintained as a “bridge technology”, but following the accident in Fukushima the nuclear exit was advanced to the end of 2022. Moreover, during the late 1990s’, Germany liberalised and decentralised its domestic energy market. The Federal Network Agency was established in 1998 as part of this process. Its task is to regulate the electricity and gas markets while ensuring fair competition and overseeing the transmission networks.

The OECD Environmental Policy Stringency Index, from 0 (not stringent) to 6 (highest degree of stringency)

Notes: The Environmental Policy Stringency Index includes climate change and air pollution policies, such as performance standards for NOx, SOx, and PM. OECD is an unweighted average of countries with available data.

Source: Kruse, T., et al. (2022), “Measuring environmental policy stringency in OECD countries: An update of the OECD composite EPS indicator”, OECD Economics Department Working Papers, No. 1703, OECD Publishing, Paris, https://doi.org/10.1787/90ab82e8-en.

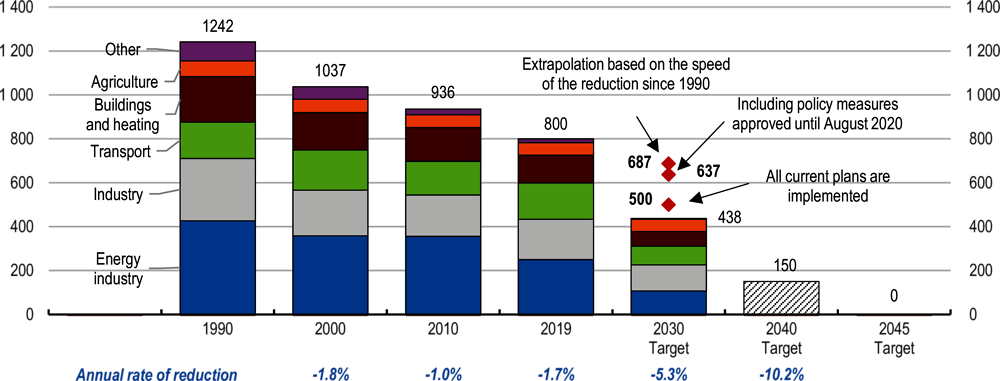

Despite progress in lowering overall emissions, Germany struggled to meet its 2020 sectoral emission reduction targets. So far, electricity production has been the largest source of emission reductions, with a rapid shift in electricity generation away from coal towards renewable energy. The share of renewables in electricity generation increased from 17% in 2010 to 41%% in 2021. However, progress is slower in other sectors (Figure 2.6). Emissions in international aviation, for example, rose sharply since 2005, and in 2021, emissions in the transport and buildings sectors were above the annual targets specified in the Federal Climate Change Act. The uneven progress largely reflects differences in matured green technologies and abatement costs between sectors, with higher costs in the building and transport sectors (Council of Economic Experts, 2019[19]). Nonetheless, too many people use motorised vehicles for most of their trips due to urban sprawl and the allocation of public space and investment in favour of private cars. Low coverage of effective policy instruments such as carbon pricing also plays a major role in explaining the variation in mitigation progress between sectors.

Progress is also uneven across households. The average emissions per capita in the highest decile of the household income distribution is 5.8 times larger than in the bottom 50% of the distribution. Even though a large share of emission reductions has come from higher-income households, their reduction has been smaller in relative terms. Emissions in the upper decile declined by 42% from 1990 to 2019, whereas the average decline was 57% for individuals in the bottom half of the income distribution (Chancel, 2021[20]).

GHG emissions (excluding land use, land-use change and forestry)

Germany has raised the ambition of its climate targets, building on a strong consensus across the population on the importance of fighting climate change and in a reaction to a Supreme Court decision in April 2021, which declared the Climate Change Act as partly unconstitutional because it shifted the burden to future generations. In June 2021, the German Bundestag passed an amendment of the Federal Climate Change Act, aiming to reach climate neutrality (net-zero) by 2045, five years earlier than previously planned. In addition, GHG emissions shall be reduced by 65% in 2030 compared to 1990 levels (excluding Land Use, Land-Use Change and Forestry) and by 88% in 2040. This would require tripling the speed of progress since 1990. The Act also stipulates permissible annual emission volumes for each sector. After 2050, negative greenhouse gas emissions are to be achieved. The EU Fit for 55 proposal and the national targets are broadly aligned in terms of emission reduction (see below).

Until recently the announced policy measures were insufficient to triple the speed of emission reduction and reach these ambitious targets (Figure 2.7) (Umweltbundesamt, 2022[21]). However, the Federal Government introduced two ambitious policy packages: the “Easter Package” in April 2022 and the “Summer Package” in July 2022, focusing on expanding renewables capacity. The legally binding goal is to double the share of renewables in total electricity supply, to reach 80% by 2030 (Table 2.1). Planning and approval procedures for infrastructure investments were facilitated by a law that declares the expansion of renewable energy production as an objective of national interest and prioritises it over nature protection objectives as well as other social and environmental concerns. Likewise, the law obligates Germany’s large states to dedicate between 1.8% to 2.2% of their lands (depending on their wind conditions) to onshore wind power by 2032. Moreover, the policy packages introduced measures to accelerate the expansion of the electricity grid and boost incentives for switching to renewables for heating (e.g., from gas heating to heat pumps). Likewise, the renewable energy surcharge, which is a levy on electricity consumption to finance renewables subsidies, was abolished to lower electricity prices and incentivise switching to electric driving and heating systems. The new government also aims to phase out coal “ideally by 2030ˮ, ahead of the previously agreed timelines. It is the first industrialised economy aiming to phase out both nuclear and coal. According to the Climate Action Tracker, if all measures planned in the coalition treaty were implemented in legislation, Germany would get close to its domestic emissions target by 2030, with emissions cut by 57% to 63% below the 1990 level (Climate Action Tracker, 2022[22]). Nonetheless, achieving carbon neutrality in 2045 will require full implementation of these measures and many additional policy adjustments to reach the target cost-effectively.

Greenhouse gas emissions (excluding LULUCF), tonnes of CO2 equivalent, millions

Note: The Climate Protection Act also states that the footprint of the LULUCF must be improved to at least -25m tonnes of CO2 eq. by 2030, at least -35 million tonnes of CO2 eq. by 2040, and at least -40 million tonnes of CO2 eq. by 2045.

Source: OECD Environment Statistics; Umweltbundesamt, Climate Action Tracker.

|

Sector |

Main instruments in place |

|---|---|

|

Electricity generation |

EU ETS; phase-out of coal generation, ideally by 2030 and no later than 2038; 2% of Germany’s territory is to be dedicated to onshore wind energy; roofs of new commercial buildings are to be used for solar energy; policies to expand electricity grids; improving grid connections with neighboring countries. |

|

Manufacturing, Industrial processes and product use |

EU ETS (large emitters); subsidised loans by KfW; Funding green hydrogen plants and pilot programmes; minimum quotas of climate-neutral products in public procurement. |

|

Transport |

Expanding the rail network and better connecting the train with airport hubs; excise duty on transport fuels; National Emissions Trading System in the heating and transport sectors; limiting new registrations of cars and vans to carbon-neutral vehicles from 2035 onwards (EU regulation); purchase premium for carbon-neutral cars until the end of 2025; technology development support to manufacturers; public investment in public charging points and support for the installation of private charging points; distance-based toll charges for trucks of more than 7.5 tonnes. |

|

Heat and buildings |

National Emissions Trading System in the heating and transport sectors; building standards for energy efficiency; various funding schemes to support energy efficiency and heat pumps, including on-site energy consultation with experts; every newly installed heating system is to be run on at least 65% renewable energy from 2024; banning the installation of oil-fired heating systems from 2026. |

|

Agriculture |

Agri-environmental payment schemes (voluntary programmes paying farmers to achieve environmental criteria); expansion of organic farming; aid programmes to protect forests and encourage carbon sink. |

Source: Author’s compilation based on various sources.

The energy crisis due to Russia’s invasion of Ukraine has helped to build the necessary consensus to accelerate the transition towards renewables, which could also raise energy security. Soaring fossil fuel prices created strong incentives to shift to renewables and have facilitated consensus on new measures across levels of government. Nonetheless, some measures to raise energy security could turn out to be counterproductive for climate policy. For example, a sequence of gas supply deals, such as the agreed 15-year gas supply partnership with Qatar (supply is expected to start in 2026), and further expansion of LNG import infrastructure risk to lock in fossil fuels-based technologies, even though the government required the new infrastructure to be compatible with hydrogen fuels. Moreover, Germany has allowed the restarting of coal-fired power plants, which were initially scheduled to close in 2022 and 2023, as long as the gas emergency plan's second "warning phase" remains in place (Chapter 1). According to the Federal Network Agency, if renewables are expanded as planned and the European electricity market continues to function well, Germany will not experience an electricity shortage from 2025 to 2031. This holds true even if electricity consumption rises due to the electrification of transport and heating, the nuclear power plants are shut down, and coal is phased out by 2030 (Bundesnetzagentur, 2023[23]). Energy security will be at lower costs if the expansion of renewables supply is combined with available measures to shift electricity use across time and reduce peak demand times on the grid (see the section on modernising the transmission network below). Ensuring that infrastructure investments in renewables progress fast is crucial to achieve both energy security and the ambitious mitigation targets.

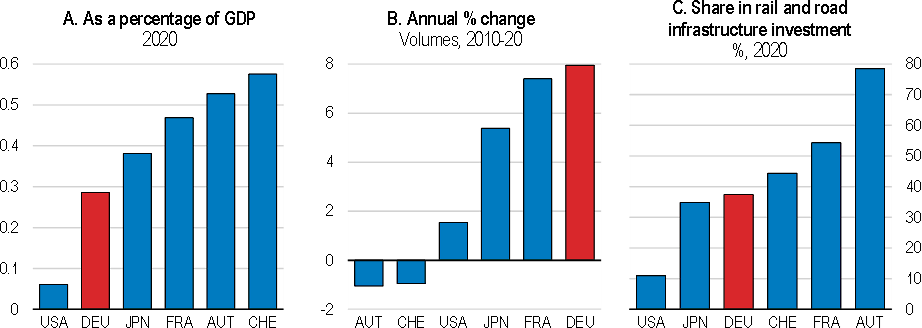

Achieving carbon neutrality will require massive investment in technologies and infrastructure by both the private and the public sectors. According to KfW (the German state-owned investment and development bank), the total volume of necessary investments is estimated at EUR 5 trillion, including about EUR 0.5 trillion in emission removal technologies that could compensate for sectors, such as agriculture, that are more difficult to decarbonise. If this sum is spread out evenly until 2045, EUR 191 billion or 5.2% of Germany’s 2021 GDP would need to be invested each year. This high amount includes investments that would be undertaken anyway but must be adjusted to include low-carbon technologies. The additional necessary climate action investment averages EUR 72 billion per year until 2045, about 2% of 2021 GDP. Other estimates range from EUR 52 to 97 billion (Brand, Römer and Schwarz, 2021[24]). Investment as a share of GDP was 20.3% on average in 2011-20, down from 22.5% in 2001-10. The increase in investment by 2 percentage points of GDP to above 22% of GDP seems feasible. A significant part of the additional investment is needed in industry and energy sectors to modernise the electricity grid or develop and scale up green technologies (Figure 2.8). The public investment share is projected at around 500 billion, 10% out of the total needed investment (Brand and Römer, 2022[25]).

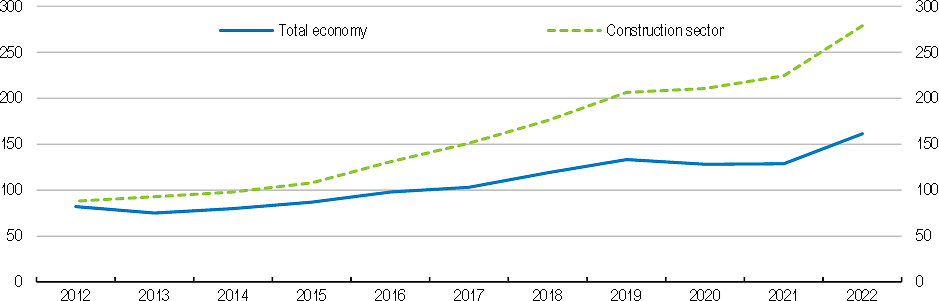

Total investment needed to achieve the target of net-zero climate neutrality until 2045, EUR billion

Substantial public support to increase investment is planned in the next few years. The federal government has adopted several comprehensive climate programmes before and during the COVID-19 crisis, totalling over EUR 80 billion (BMF, 2022[26]). For example, about 40% of the German Recovery and Resilience Plan (EUR 11.5 billion) was dedicated to climate policies and the energy transition. These programmes include a mix of direct investments and subsidies for firms and households that would mainly be financed by the Climate and Transformation Fund (KTP). This Fund receives revenues from three sources: the EU ETS, the national emission trading system, and direct transfers from the federal budget (expected to account for about 50% of total revenues in 2021-26). In 2020-22, the Fund received an additional EUR 100 billion in credit allowances from the federal budget, as the national debt brake was suspended for three years due to the COVID-19 crisis and unused funds for pandemic related support programmes were redirected to the EKF to counter the pandemic-related reluctance to invest (Chapter 1). The Fund is expected to spend EUR 180 billion from 2022 to 2026, mainly for supporting the green transition in transport, building and industry sectors and abolishing the Renewable Energy Surcharge (Figure 2.9). Boosting public investment is timely as financing costs are still low, although skilled labour shortages in the construction and planning sector as well as material shortages will likely limit the speed of implementation of investment projects and increase their prices (Figure 2.10). Further promoting the transition between secondary education and VET positions in high demand, expanding VET and adult education opportunities for low-skilled and unemployed workers, and facilitating the migration of skilled workers from non-European countries, as envisioned under the Fachkraeftestrategie, are essential to ease labour shortages (see Chapter 1). Facilitating the ability of EU construction companies and material producers to operate in Germany by removing trade barriers, such as the additional testing requirement for construction products, and fostering digitalisation of the construction sector would increase market competition, lower prices and help boost investment (European Commission, 2018[27]).

Completed vacancy time, number of days

Note: The numbers refer to the values in November of each year.

Source: Federal Employment Agency.

Two independent, interdisciplinary bodies advise the Federal Government on climate policies and contribute to evidence-based policy making. From 2022 onwards, the Council of Experts on Climate Issues will regularly present its assessment of climate policies to the Bundestag and the Federal Government. If the Council finds in its annual examinations that a sector has missed its emission targets, the relevant federal ministry must present an action programme within three months to ensure the sector will comply with its annual emission budget in the subsequent years. The Science Platform on Climate Policy, a body of scientific experts, supports the German Federal Government in evaluating climate protection measures and conduct policy analysis, including on the economic consequences of the mitigation efforts.

To better evaluate the efficiency of public spending, impact assessment studies should be an integral part of all existing and new policy programmes and plans, which requires better data collection and analysis (Chapter 1). Better data collection is also required to assess emissions from land use, land-use change, and forestry (LULUCF) in a timely way and define a sensible target, which is in line with other sectoral targets (Council of Experts on Climate Issues, 2021[12]). Furthermore, it is key to regularly monitor trade-related emissions. So far, the trend in total emission reduction after including emissions embodied in imports is broadly in line with the trend according to the production-based definition (Our World in Data, 2022[28]). Nevertheless, this could change, especially if carbon prices in Germany rise to levels required to reach ambitious emission reduction targets but remain low in other countries (see below).

The cost of cutting emissions differs between emission sources, abatement measures and over time. Setting a price on emissions helps to find the most cost-efficient solution. It encourages firms, households and the government to realise all opportunities to reduce emissions which cost less than the marginal emission price and allow activities where abatement costs are higher than the marginal emission price (de Serres, Murtin and Nicoletti, 2010[29]) (D’Arcangelo et al., 2022[30]; Pisany-Ferry, 2021[31]). Due to high uncertainty and information asymmetry about the heterogeneity of abatement costs across the economy, more directive approaches, such as regulations and standards, raise total abatement costs compared to emission pricing by missing opportunities for low-cost emission reductions. Nonetheless, these policy tools are still needed in specific cases to overcome market failures and coordination problems (see below). Emission pricing is also technology-neutral and a transparent policy that simplifies the decisions for the government and reduces the scope for lobbying influences, as the only information required is the measurement of emissions. Pricing mechanisms have been shown to substantially alter behaviour for GHG emissions (Andersson, 2019[32]) (Dechezleprêtre, Nachtigall and Venmans, 2018[33]). For example, the United Kingdom has substantially reduced emissions by adopting a carbon price floor on top of the EU-ETS price in 2013. This led the coal share in electricity production to fall from 40% to 5% by 2018, and to a shift to less-emission intensive gas power plants (Blanchard and Tirole, 2021[34]).

Emission pricing is well recognised in Germany as an efficient way to achieve the green transition (Ministry For Economic Affairs and Climate Action, 2022[35]). Germany participates in the EU ETS, a cap-and-trade system that sets a carbon price for obligated participants, namely power generators, large emission-intensive industrial facilities, and airlines for flights within the European Union. The cap declines over time, ensuring that the desired emission mitigation target in the EU ETS sectors is achieved cumulatively. Due to the high share of industry in GDP and the high coal share in electricity generation, around half of German emissions are covered by the scheme, compared with only 40% on average in the European Union. The permit price has increased substantially since 2019 and stood at around EUR 85 per tonne in 2022. Moreover, in 2021 Germany implemented a national trading system for emissions in the non-ETS sectors (i.e., buildings and transport), with a fixed price of EUR 30 per tonne in 2023 that will rise to EUR 45 in 2025. From 2026, allowances will be auctioned within a price corridor of EUR 55 to EUR 65. The price corridor beyond 2026 will be decided in 2024 after an evaluation of the first phase of the system and depending on policy developments at the EU level (Box 2.4). In 2022, revenues from carbon pricing stood at 0.3% of GDP (EUR 13.2 billion).

Meeting Germany’s ambitious objective of reducing emissions by 65% in 2030 (compared to 1990 levels) will require higher carbon prices. Simulations conducted for this Survey show that raising carbon prices to reach the EU Fit for 55 targets for ETS and non-ETS sectors would reduce emissions in Germany by 67% in 2030, indicating that Germany’s national targets and the Fit for 55 targets are aligned (Box 2.4, Box 2.5, Table 2.2). This requires a doubling of the ETS carbon price compared to a benchmark scenario, which is based on 2021 policies. In the benchmark scenario, the European Union and Germany reduce their emissions by 44% and 53% in 2030, respectively.

The carbon price in sectors covered by the Effort-Sharing-Regulation (ESR), which are not covered by the ETS, would need to increase to about USD 323 (EUR 273) in 2030 in Germany, which is much higher than in other EU countries. This is because Germany has pledged higher emission reductions in the ESR sectors than other EU countries and faces higher marginal abatement costs. Abatement costs are higher because GHG intensity in the ESR sectors (especially in transport) is lower, implying fewer emission savings potential compared to other EU countries (Box 2.4) (Bickmann et al., forthcoming[1]).

Fit for 55 is a set of policy proposals to reduce net greenhouse gas emissions by 55% in 2030 (compared to 1990 levels). The package aims to reduce emissions in the EU ETS by 62% compared to 2005 levels (a decrease of 19 percentage points compared to the current target), to include the maritime shipping sectors in the ETS, increase the share of renewables in electricity supply to 40% and create a new, separate emissions trading system for the buildings and road transport sector from 2027 (although in case the energy prices are "exceptionally high", it will be delayed to 2028).

The Commission also proposes to gradually remove free emission allowances from the EU ETS, which are currently allocated to non-power producers, and simultaneously introduce a carbon border adjustment mechanism (CBAM) to address the risk of carbon leakage. Currently, these free allowances are allocated based on an efficiency benchmark equal to the average emissions of the best-performing 10% of the installations producing the same product. Installations that meet the benchmarks and are, therefore, among the most efficient in the European Union receive the allowances they need to cover their emissions for free. According to the proposal, installations that will benefit from free allocations will need to comply with several additional requirements, including in the form of energy audits. The CBAM will initially apply to imports of certain goods and selected inputs whose production is carbon intensive and at most significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. In these sectors, the free allowances will be phased out from 2026 until 2034.

Country-specific emission reduction targets in sectors that are not covered by the ETS are established for the year 2030 in the context of the EU’s Effort Sharing Regulation (ESR). The target for Germany is a 50% reduction in 2030 compared to 2005 levels, which is higher than for other countries. For example, France is supposed to reduce ESR emissions by 47.5%, Italy by 43.7% and Poland by 17.7% in 2030. The carbon price in the new EU trading system for the buildings and road transport sectors is expected to be restricted in the first years. If the price of allowances exceeds EUR 45, additional allowances will be released, increasing the supply on the market. In addition, a new Social Climate Fund will help vulnerable households, micro-enterprises, and transport users cope with higher carbon prices. The fund would be part of the EU budget and be financed by assigned revenues of up to EUR 65 billion.

Source: European Commission.

Main EU Fit for 55 scenario

|

|

Germany |

Rest of European Union |

|---|---|---|

|

Total CO2 emissions reduction vs 1990 |

-67% |

-46% |

|

CO2 emissions reduction in the ETS sectors, compared to benchmark |

-36% |

-17% |

|

CO2 emissions reduction in the ESR sectors, compared to benchmark |

-27% |

-10% |

|

Change in welfare (real consumption), compared to benchmark |

-0.86% |

-0.29% |

|

Change in GDP, compared to benchmark |

-1.22% |

-0.34% |

|

Renewables share in electricity generation (change in p.p compared to benchmark) |

77% (+15) |

60% (+3) |

|

Coal share in electricity generation (change in p.p compared to benchmark) |

5% (-15) |

5% (-2) |

|

Change in total electricity supply, compared to benchmark |

-7.8% |

-2.1% |

|

Change in electricity generation, compared to benchmark |

-9.9% |

-2.4% |

|

Change in electricity imports, compared to benchmark |

+22.9% |

+1.9% |

|

Change in electricity price, compared to benchmark |

+4.7% |

+2.8% |

Note: Simulations are conducted using a Computable General Equilibrium Model (CGE) (Box 2.5). The table shows results from a scenario implementing the EU Fit for 55 targets, which means that the EU as a whole reduces emissions by 55% in 2030. Results are shown relative to a benchmark scenario, which assumes based on 2021 policies that the EU and Germany reduce their emissions by 44% and 53% in 2030, respectively. Non-EU countries are assumed to reduce emissions as in the benchmark scenario. The results of the CGE simulations should not be interpreted as projections but can be used to analyse reallocation and distributional effects across regions, sectors and households. The welfare measure does not account for the beneficial environmental aspects of emission reduction.

Source: (Bickmann et al., forthcoming[1]).

This Survey applies a multi-sector, multi-region Computable General Equilibrium (CGE) model to analyse the economic and distributional effects of different policy scenarios of carbon emission abatement for Germany (Bickmann et al., forthcoming[1]). The model uses a standard top-down structure for representing production, consumption, and trade and includes a discrete representation of alternative power generation technologies. CO2 emissions enter the model in two ways: First, they arise from the energy sector, where they are linked in fixed proportions to the use of fossil fuels, with CO2 coefficients differentiated by the specific carbon content of different fuels. Second, the model also accounts for process-based CO2 emissions. Constraints on the amount of emissions in each region are implemented through a cap-and-trade system and endogenous carbon price adjustments. Emission reductions take place by fuel switching, energy savings or output reductions.

The model relies on data from the global macroeconomic balances published by the EU Joint Research Centre (JRC) (Vandyck et al., 2021[36]). They include detailed macroeconomic accounts and information on physical energy flows and carbon emissions for 49 regions and 31 sectors in five-year intervals until 2070, which rely on nationally determined contributions (NDCs) to emission reductions. These data are used to establish a benchmark scenario for the year 2030, which is based on 2021 policies and against which all other model scenarios are compared. For the European Union, the benchmark presumes a GHG emission reduction of 44% below 1990 levels by 2030. Germany reduces its GHG emissions by 53% in the benchmark. In addition, the JRC data set assumes that the United States and other OECD countries reduce their emissions by 27% and 18% compared to 2005, whereas China increases emissions by 108% compared to 2005.

All simulations depart from the benchmark scenario and implement the EU Fit for 55 targets: A reduction of ETS emissions by 61% compared to 2005 levels and national emission reductions in ESR sectors, which in the case of Germany correspond to a 50% reduction compared to 2005. Overall, these targets lead to an EU-wide emission reduction of 55% in 2030 (compared to 1990 levels). Importantly, the model does not quantify the total effects of emission abatement from today’s perspective, but rather the impact of implementing these stricter climate targets for 2030 compared to the benchmark scenario. Relative to the benchmark scenario, the EU Fit for 55 targets correspond to an EU-wide ETS emission reduction of 22%. In the ESR sectors, Germany needs to reduce emissions by 27% compared to the benchmark, whereas the remaining European countries need to reduce emissions by 10%.

The main EU Fit for 55 scenario keeps the ETS and ESR cap-and-trade systems in the EU separated and allows for trade in emission rights across countries in the ETS, but not the ESR. Revenues from the ETS carbon price in non-power producing sectors are fully recycled back as output-based subsidies/rebates. These subsidies/rebates are a simplified representation of the free allowance allocation in the EU ETS, as they are exogenous from the perspective of the firm and keep marginal emission reduction incentives in place. The remaining revenues from power producers and the carbon tax on ESR (non-ETS) sectors are collected by the government, which recycles them to households as (net) transfers after ensuring that government spending remains constant in real terms. Non-EU regions do not reduce emissions compared to the benchmark. The remaining scenario analysis focuses on different policy options by changing assumptions compared to the main EU Fit for 55 scenario:

1. Reforming the EU cap and trade system by including the ESR sectors in the ETS. One scenario with full integration and one scenario with only partial integration, i.e., all economic sectors are included in the ETS, but households remain outside of the scheme.

2. Addressing carbon leakage and protecting the competitiveness of domestic industries. One scenario expands the output-based subsidies (at the expense of recycled revenues to households) to include automotive and machinery and equipment sectors, which are not part of the ETS and therefore do not receive full rebates from emission pricing in the main EU Fit for 55 scenario. In a second scenario, carbon tariffs equal to the carbon price difference between the import partner and the European Union are applied to the direct carbon content of imports. At the same time, output-based subsidies are set to zero.

3. Multilateral abatement efforts. This scenario assumes that the United States and China reduce emissions according to their new NDCs. The United States pledged to cut emissions by 52% relative to 2005, whereas China committed to limit the increase in emission to 69% compared to 2005. Other OECD countries reduce emissions by the same proportion as the United States.

4. Additional regulations for the German electricity market. One scenario models a complete coal exit in Germany by 2030. The second scenario introduces a subsidy scheme for renewable energy, which transfers all CO2 pricing revenues that are not rebated to non-power producers in the ETS sectors to the renewable energy sector.

To analyse the distributional effects of mitigation across different types of households, the model links the CGE results to micro-simulations using detailed German survey data on household incomes and consumption expenditures and econometric estimates of behavioural parameters of the demand system. Using sectoral gross value-added shares at Laender level, the CGE simulation results are further disaggregated regionally.

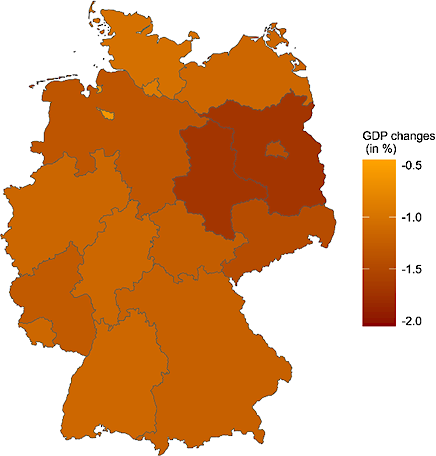

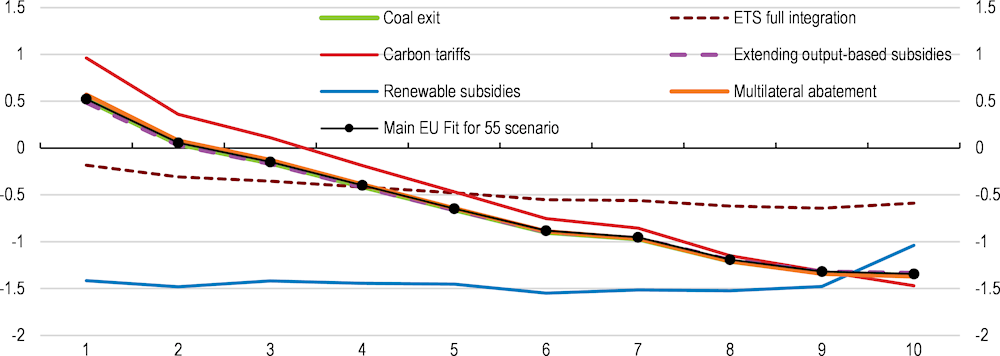

The Computable General Equilibrium model shows that reaching the EU Fit for 55 targets by increasing carbon prices would lead to a loss in GDP and welfare (measured as real purchasing power) by 2030 as production costs rise (Table 2.2). Still, these transition costs will help to avoid the much higher economic costs of missing global climate change mitigation targets, which are not considered in the simulations. GDP and welfare are expected to decline more in Germany than in other EU countries, due to higher carbon prices in ESR sectors, but also to higher emission reductions in the ETS sectors in Germany. With rising ETS prices, coal-based electricity generation becomes less profitable due to its high emission intensity. As Germany uses much more coal for electricity generation than the EU average, it will reduce emissions in the ETS sectors more strongly than other EU countries. The sharp drop in coal-based electricity generation leads to a substantial increase in renewables supply, and its share in electricity production almost reaches the 2030 renewables target of 80% of electricity supply without any further regulation (Table 2.2). However, increased renewables supply and rising electricity imports cannot fully compensate for the exit of coal power plants. Therefore, total electricity supply falls and prices rise, which particularly hurts energy-intensive industries (see below).

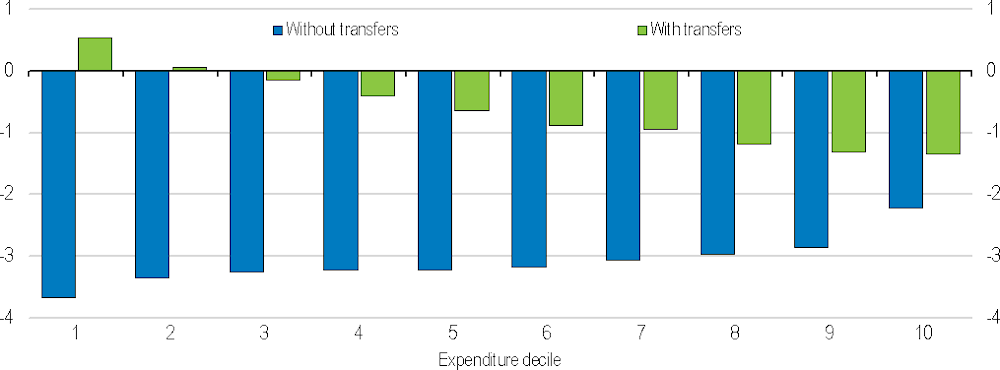

Recycling revenues generated through carbon pricing strongly influences the distributional effects of more ambitious emission abatement (Figure 2.11). If revenues from carbon pricing are not recycled to households, poorer households lose a considerable share of their real income compared to the benchmark scenario because wages decline, and labour is their main income source. In addition, they spend a higher share of their income on electricity, transport and heating, which become more expensive relative to other goods due to carbon pricing. In the poorest household decile, expenditures on energy and transport amount to 18.9% of total expenditures, while the highest decile only spends 10.1%. However, if revenues from rising carbon prices are recycled as an equal lump sum to each household, real household income in the lower two deciles rises compared to the benchmark scenario. For other households, labour and capital income losses as well as increases in energy and transport prices outweigh the gains from transfers. Overall, lump-sum revenue recycling results in a progressive effect of emission abatement (Bickmann et al., forthcoming[1]).

Real household income changes by expenditure decile, compared to the benchmark scenario (in %)

Note: Carbon price-related revenues are recycled, transferring the same amount to each household.

Source: (Bickmann et al., forthcoming[1]).

The carbon price level needed to reach emission targets and its impact on GDP and welfare is highly sensitive to the institutional set-up. Harmonising carbon prices across sectors, enabling countries to trade emission allowances in the ESR sectors, increasing the predictability of future carbon prices, and phasing out fossil fuel subsidies and distorting tax exemptions would allow reaching the targets with lower prices and economic costs. Likewise, facilitating the expansion of renewable energy supply and better integrating the European electricity grid would mitigate electricity price rises and volatility and support energy-intensive industries (see below). The following sections discuss policies to improve the carbon pricing strategy and the institutional set-up.

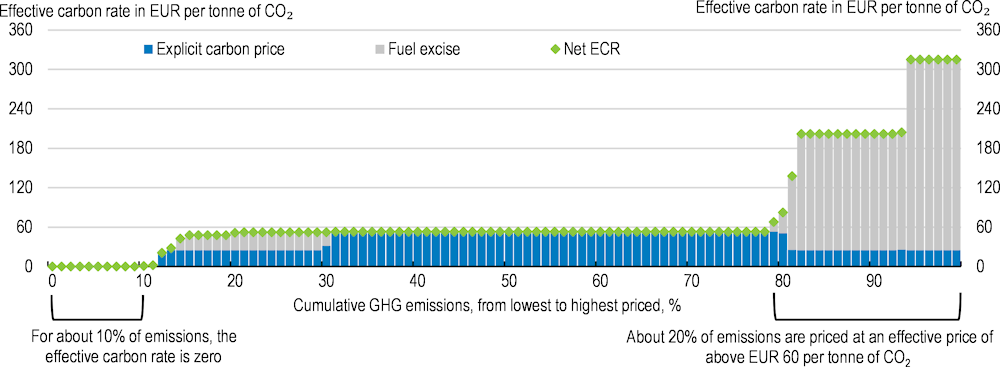

In 2021, Germany priced 90% of its GHG emissions, explicitly or implicitly, with an average effective marginal carbon rate of EUR 81 (in 2021 prices), up by 46% since 2018. However, heterogeneity across sectors is large. Most unpriced emissions were from shipping and aviation fuels and from other GHG emissions rather than CO2 (like F-gases and methane). A small part of industrial CO2 emissions, not covered by the EU ETS, were unpriced as well. Emissions from road transport, accounting for about 20% of total emissions, were priced at a relatively high marginal effective price due to fuel excise taxes, which implicitly tax GHG emissions (Figure 2.12).

Share of CO₂ emissions subject to different levels of Net Effective Carbon Rates (Net ECR), 2021

Note: The explicit carbon price comprises the EU-ETS and the national emissions trading scheme. The Net Effective Carbon Rate measures the effective marginal price of an additionally emitted tonne of CO2, which differs from the average emission price. For example, free allocations of emission rights in the EU ETS to non-power producers do not affect marginal prices and incentives to reduce emissions. Still, they affect the average carbon price (not presented in the chart) and may affect investment decisions. The Net Effective Carbon Rate measure does not include all subsidies or tax exemptions for fuel and electricity use, which considerably weaken carbon price incentives in Germany (Burger and Bretschneider, 2021[37]).

Source: OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

Carbon prices across sectors are also further impacted by many fossil fuel and other harmful environmental subsidies and tax expenditures amounting up to EUR 65 billion (Burger and Bretschneider, 2021[37]). These subsidies and tax expenditures weaken and distort price signals, hamper the market breakthrough of environmentally-friendly products, and jeopardise climate goals (Table 2.3). Furthermore, energy-intensive industrial companies and airlines receive free allowances under the current EU ETS and other support, which hinders necessary resource reallocation and makes carbon prices less effective in changing consumption habits. For example, energy intensive companies are expected to receive EUR 27.5 billion until 2030 as partial refunds (up to 75%) to compensate them for higher electricity prices resulting from the EU ETS. Under current EU legislation, up to 43% of the emission cap can be distributed as free emission allowances to industrial installations.

|

Subsidy description |

Estimated annual cost, 2018 |

|

|---|---|---|

|

Tax exemption for kerosene fuel in the aviation industry1 |

EUR 8.4 billion |

|

|

Energy tax concession for diesel fuel |

EUR 8.2 billion |

|

|

Distance allowance – a tax deduction of traveling from home to work, regardless of means of transport2 |

EUR 6.0 billion |

|

|

Lower VAT on meat and other animal products |

EUR 5.2 billion |

|

|

Lower concession electricity and gas charges for public spaces |

EUR 3.6 billion |

|

|

Favourable tax treatment for privately used company cars2 |

EUR 3.1 billion |

|

|

Electricity and energy tax reductions for the manufacturing and agriculture sectors3 |

EUR 2.9 billion |

|

|

Relief from electricity and energy taxes for certain energy-intensive processes and procedures |

EUR 1.3 billion |

|

|

Concessions for energy-intensive industry regarding electricity grid fees |

EUR 610 million |

|

|

Exemption of agricultural vehicles from the vehicle excise duty (agriculture diesel) |

EUR 470 million |

|

|

Tax concession for agricultural diesel fuel |

EUR 470 million |

|

Notes: (1) Including international flights taking off or landing in Germany. (2) This measure does not necessarily support fossil fuels (for example, electric cars can also benefit from the measure). However, most allowances end up supporting the usage of combustion-engine vehicles. (3) Including reimbursements of the peak equalisation charges for manufacturing companies.

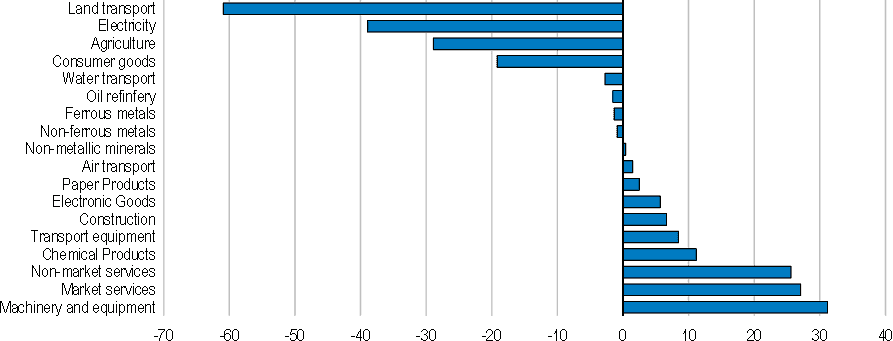

Concerns about German firms’ competitiveness and increased cost of living, especially for poor households, are the main reason for many of these subsidies and tax expenditures. For example, after introducing the national emissions trading system in 2021, the German government raised subsidies to emission-intensive trade-exposed industries under the provision that they undertake emission reduction measures. Although sometimes overstated, these concerns are valid. Simulations for this Survey show that higher carbon prices in the European Union would increase electricity prices and reduce output, employment and exports in Energy-Intensive Trade-Exposed (EITE) industries in Germany more than in other sectors (Box 2.5, Table 2.2, Table 2.4, Main EU Fit for 55 scenario). Nonetheless, not all sectors will lose competitiveness, even within the EITE industries. This is due to substantial market power in export markets, which allows to pass on part of the costs to consumers in other countries. Likewise, some industries are less carbon- and energy-intensive than others, which provides them with a comparative advantage and allows them to benefit from reduced factor demand in shrinking sectors and lower factor prices. In the CGE model, the expected output reduction is strongest for oil refineries, ferrous and non-ferrous metal industries as well as some ESR sectors such as consumer goods and transport services, while chemical, automobile and machinery and equipment increase output and exports (Table 2.4).

Change in production by sector, compared to benchmark scenario (in %)

|

Sector (share in employment) |

Main EU Fit for 55 scenario |

ETS full integration |

Extending output-based subsidies |

Carbon tariffs |

Multilateral abatement |

Coal exit |

Renewable subsidies |

|---|---|---|---|---|---|---|---|

|

EITE industries Total (6.6%) |

-1.7% |

-1.7% |

-1.8% |

-2.9% |

-0.1% |

-1.9% |

-0.6% |

|

Chemical products (3.5%) |

0.4% |

-0.8% |

0.3% |

0.6% |

0.8% |

0.2% |

0.7% |

|

Paper products (1.2%) |

0.1% |

-0.7% |

0.0% |

0.3% |

0.4% |

-0.2% |

0.6% |

|

Non-metallic minerals (0.9%) |

-0.5% |

-0.9% |

-0.6% |

0.4% |

0.3% |

-0.6% |

-0.3% |

|

Ferrous metals (0.7%) |

-1.4% |

-2.1% |

-1.3% |

-11.0% |

0.7% |

-1.6% |

1.8% |

|

Non-ferrous metals (0.4%) |

-1.0% |

-1.6% |

-1.1% |

-2.0% |

1.2% |

-1.3% |

2.0% |

|

Oil refinery (0.0%) |

-18.8% |

-8.9% |

-18.8% |

-18.5% |

-16.9% |

-18.7% |

-15.0% |

|

Other industries |

|||||||

|

Machinery and equipment (8.1%) |

0.6% |

0.0% |

0.8% |

0.2% |

0.1% |

0.6% |

-0.2% |

|

Transport equipment goods (3.4%) |

0.2% |

-0.1% |

0.5% |

-0.3% |

-0.6% |

0.1% |

-0.8% |

|

Consumer good industries (3.2%) |

-2.1% |

-0.8% |

-2.2% |

-1.8% |

-2.5% |

-2.2% |

-2.8% |

|

Services |

|||||||

|

Land transport (2.1%) |

-9.4% |

-2.0% |

-9.4% |

-9.3% |

-7.8% |

-9.3% |

-10.2% |

|

Air transport (0.3%) |

1.4% |

-0.2% |

1.3% |

-4.4% |

13.1% |

1.5% |

1.0% |

|

Water transport (0.1%) |

-14.2% |

0.5% |

-14.2% |

-13.9% |

-11.4% |

-14.1% |

-16.2% |

|

Market services (36.9%) |

-0.1% |

-0.2% |

-0.1% |

-0.1% |

-0.4% |

-0.1% |

-1.2% |

|

Non-market Services (27.9%) |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.0% |

-0.3% |

Note: Please see Box 2.5 for a description of the methodology and simulation scenarios.

Source: (Bickmann et al., forthcoming[1]).

Existing subsidies and tax expenditures should be carefully evaluated and better targeted. Subsidies favouring EITE industries can help to address competitiveness concerns (see below) (Böhringer, Lange and Rutherford, 2014[38]). However, not all EITE industries will suffer from higher carbon prices, and many of the existing subsidies are not limited to companies exposed to international competition and should be abolished. Moreover, by hampering a stronger decline of output and emissions in EITE industries, these subsidies and ETS payment rebates lead to higher demand and prices for emission certificates in the ETS, causing higher emission reduction requirements and costs for other firms and sectors (Böhringer, Lange and Rutherford, 2014[38]).

Remaining firm support should be well targeted and incentivise emission reductions, for example by supporting the development of green technologies (see below). Providing high polluters with free allowances as part of a grandfathering scheme or using abatement subsidies to incentivise emission reductions below a pre-defined baseline are other options to reduce the effective tax burden of firms, while maintaining high marginal cost of CO2 emissions (D’Arcangelo et al., 2022[30]). Nevertheless, it is crucial that all subsidies include sunset clauses, announced upfront, to strengthen abatement incentives and reduce future fiscal costs. Subsidies indirectly supporting households, such as the tax exemptions for diesel and kerosene fuel and reduced VAT rates for meat and other animal products, should be phased out and partly replaced by direct transfers to vulnerable households. The phase-out of subsidies could also support the financing of public investments and rising pension and health care costs (see Chapter 1). As energy prices are high, the phase-out could be linked to energy price levels: accelerating the phase-out in case the energy prices decline, and vice-versa.

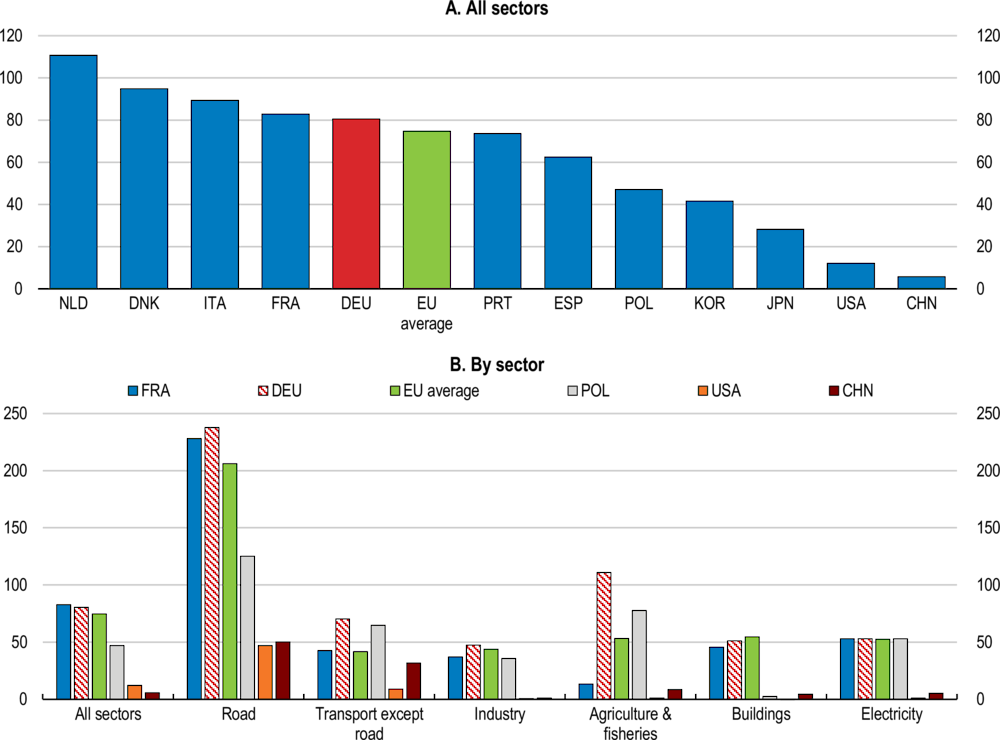

Carbon prices do not only differ strongly across sectors, but also across countries (Figure 2.13). In the European Union, many countries do not explicitly price emissions in non-ETS sectors and where emission pricing exists, emission allowances cannot be traded across countries or with the EU ETS, preventing the equalization of abatement cost across countries and sectors. In particular, the largest emitting sectors – electricity production and industry – faced relatively moderate effective carbon rates in 2021. Harmonising carbon prices across sectors and countries would help to reduce emissions where it is the least costly but imply higher carbon prices for emission-intensive industries (D’Arcangelo et al., 2022[30]).

Net Effective Carbon Rates, EUR per tonne of CO2, 2021

Note: The Net Effective Carbon Rate measures the effective marginal price of an additionally emitted tonne of CO2.

Source: OECD (2022), Pricing Greenhouse Gas Emissions.

According to simulations conducted for this Survey, Germany would benefit significantly from the expansion of the EU-ETS to all sectors in the EU economy (Box 2.5, Table 2.5). Including the ESR sectors in the ETS would raise welfare as marginal abatement costs in ESR sectors are much higher compared to other EU countries and ETS sectors, and because Germany has pledged to reduce emissions in ESR sectors by much more. As a result of merging the two systems, German firms in ESR sectors can buy emission certificates from other EU countries and ETS sectors, allowing them to expand production and employment. Particularly, some emission-intensive ESR sectors such as land and water transport as well as consumer goods industries would raise output compared to the main EU Fit for 55 scenario (Table 2.4). However, the increased demand for ETS emission certificates would raise the ETS price and reduce-emission intensive electricity production, which in turn would raise electricity prices and lower output and emissions in many EITE industries in Germany (Table 2.5). Particularly, ferrous and non-ferrous metal and chemical industries but also automotive and machinery and equipment industries would shrink. In contrast, oil refinery would strongly expand due to higher fuel demand from ESR sectors. Overall, total emissions in Germany would decrease by only 64% in 2030, while emissions reductions in other EU countries would be larger than in the main EU Fit for 55 scenario.

|

Main EU Fit for 55 scenario |

ETS full integration |

Extending output-based subsidies |

Carbon tariffs |

Multilateral abatement |

Coal exit |

Renewable subsidies |

|

|---|---|---|---|---|---|---|---|

|

Total CO2 emissions reduction vs 1990 |

-67% |

-64% |

-67% |

-66% |

-67% |

-69% |

-71% |

|

CO2 emissions reduction in the ETS sectors vs 2005 |

-64% |

-66% |

-64% |

-63% |

-67% |

-68% |

-74% |

|

CO2 emissions reduction in the ESR sectors vs 2005 |

-50% |

-38% |

-50% |

-50% |

-50% |

-50% |

-50% |

|

The ETS CO2 price, times higher than in the benchmark |

1.84 |

1.95 |

1.84 |

1.75 |

2.00 |

1.66 |

1.35 |

|

The ESR CO2 price, in USD (which equals 0 in the benchmark) |

323 |

78 |

323 |

322 |

337 |

321 |

334 |

|

Change in welfare (real consumption), compared to Benchmark |

-0.86% |

-0.52% |

-0.87% |

-0.77% |

-0.87% |

-0.87% |

-1.38% |

|

Change in GDP, compared to Benchmark |

-1.22% |

-0.52% |

-1.22% |

-1.19% |

-1.25% |

-1.23% |

-1.40% |

|

Renewables share in electricity generation |

77.2% |

79.1% |

77.2% |

74.4% |

80.7% |

81.6% |

100% |

|

Coal share in electricity generation |

5.3% |

3.7% |

5.3% |

8.5% |

1.4% |

0.0% |

0.0% |

|

Change in total electricity supply, compared to benchmark |

-7.8% |

-6.0% |

-7.8% |

-7.4% |

-8.7% |

-8.6% |

-3.0% |

|

Change in electricity generation, compared to benchmark |

-9.9% |

-9.0% |

-9.9% |

-8.9% |

-9.6% |

-11.7% |

10.4% |

|

Change in electricity imports, compared to benchmark |

+22.9% |

+38.2% |

+23.0% |

+15.0% |

+5.1% |

+37.8% |

-64.5% |

|

Change in electricity price (consumer prices), compared to benchmark |

+4.7% |

+7.6% |

+4.7% |

+3.3% |

+6.9% |

+6.1% |

-13.8% |

Note: See Box 2.5 for a description of the methodology and simulation scenarios.

Source: (Bickmann et al., forthcoming[1]).

To mitigate the adverse effects of an expanded ETS on EITE and other industries, it is crucial to facilitate the expansion of renewable energy supply and better integrate the electricity grid with neighbouring countries (see below). This would mitigate electricity price increases in Germany when coal power plants exit the market due to higher ETS prices (Bickmann et al., forthcoming[1]). Moreover, as high energy prices due to the war in Ukraine currently weigh on energy-intensive industries, a gradual phase in of carbon price harmonisation would be prudent. Introducing a separate cap-and-trade system for ESR sectors as currently discussed for the European Union, at least for residential heating and transportation fuels, would prevent ETS and electricity prices from rising too strongly, while allowing for harmonisation of carbon prices in ESR sectors due to emission rights trading across countries. If the carbon price in this scheme exceeds the ETS price by more than a certain threshold, a limited number of allowances could be traded between the two systems to mitigate price differences (Edenhofer et al., 2021[39]). The number of tradable allowances could increase gradually over time until the two systems are unified. Another option would be to expand the ETS to some more specific sectors. A partly integrated ETS system excluding households is not as efficient as a fully integrated ETS system, but still welfare improving (Bickmann et al., forthcoming[1]).

As mentioned above, Germany implemented a national trading system for emissions in the non-ETS sectors in 2021, with a growing fixed price until 2025. From 2026, allowances are to be auctioned. Until the European trading system for road transport and heating starts operating (Box 2.4), Germany should set the emissions cap in its national trading system according to its national targets and issue a quantity of tradable emission allowances consistent with this cap. In addition, Germany should expand its use of the existing EU mechanism that allows trading ESR emission reduction obligations with other EU countries to avoid the need to reduce emissions drastically in a very short period.

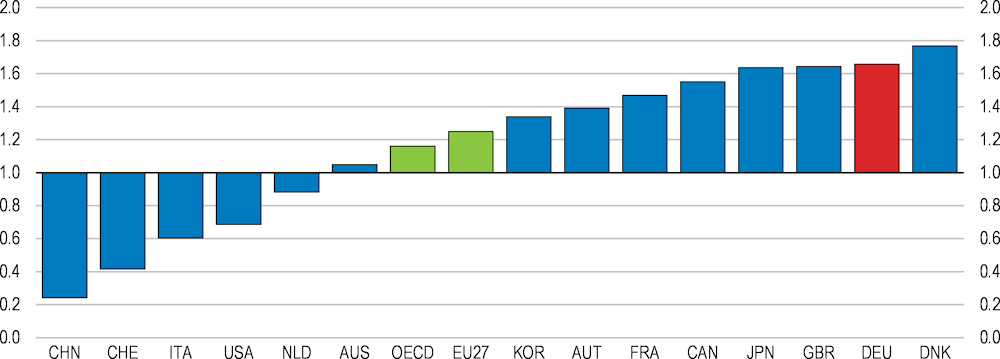

A fundamental challenge in climate policy is that climate protection constitutes a global public good and each country has an incentive to free ride on the emissions abatement of other countries while contributing little itself. International agreements are trying to minimise this problem and following the 2015 Paris Agreement, many countries have announced ambitious national targets to reduce GHG emissions. Still, there are considerably differences in environmental stringency and effective carbon prices between countries, with increasing divergence in recent years (Figure 2.13) (OECD, 2021[40]). Countries with the highest effective (implicit and explicit) carbon rates in 2018, including Germany, saw carbon rates rise further, while there was little change in countries with low initial rates (OECD, 2022[41]). The war in Ukraine and the soaring energy prices in Europe are only amplifying those differences. Further mitigation actions risk the migration of economic activities abroad to enjoy lower costs in countries with lower environmental standards. This so-called carbon leakage increases global emissions and could hurt the competitiveness of the German economy in the domestic and export markets (OECD, 2021[42]; OECD, 2020[43]). Moreover, it is an obstacle to public support for the implementation of climate mitigation policies, especially in Germany, where economic growth in recent decades has been driven by a strong export-oriented manufacturing sector (D’Arcangelo et al., 2022[30]).

Simulations for this Survey show that implementing EU Fit for 55 targets without more ambitious mitigation action in non-EU countries would lead to reduced output and exports in many German EITE industries (see above). However, the simulations also show that output-based subsidies, which redistribute carbon tax revenues back to producers as lump sums at the industry level and keep emission reduction incentives for firms in place (Box 2.5), can mitigate these negative competitiveness effects from unilateral climate mitigation policies. In contrast, introducing a tariff that equilibrates carbon prices between domestic and imported products, while phasing out output-based subsidies, would hurt industries with a high share of imported and emission-intensive intermediate goods and – if not complemented by export rebates – would not address competitiveness concerns on export markets (Table 2.4). This would particularly hurt the ferrous and non-ferrous metal, automotive and the machinery and equipment industries, which are highly integrated in global value chains. A carbon tariff would only support a few industries by protecting them from emission-intensive imports, such as chemicals, paper products, non-metallic industries as well as consumer goods (Table 2.4). On the macro level, the simulations show that abolishing the output-based subsidies in favour of a carbon tariff would be slightly welfare-improving because it leads to a more efficient labour and capital allocation and generates additional income that can be distributed to households, indicating that the design of a carbon price for imports should be carefully evaluated.

International agreements that enforce faster global emission reduction would limit the risk of carbon leakage and at the same time lower the risk of climate change (Nordhaus, 2015[44]) (G7, 2022[45]). Simulations conducted for this survey show that multilateral abatement, where the European Union reaches EU Fit for 55 targets and non-EU countries reach their NDCs in 2030, would significantly improve production and exports for EITE industries in Germany compared to the main EU Fit for 55 scenario of unilateral EU abatement (Table 2.4). Due to higher carbon prices in non-EU countries, the relative competitiveness of German EITE industries would increase in both export and domestic markets. However, stronger emission reductions in non-EU countries would lower demand for German products and increase prices of imported intermediate inputs. This would hurt other export-oriented manufacturing sectors in Germany, which are less emission intensive and highly integrated in global value chains, such as automotive and machinery and equipment, but also the services sectors (Table 2.4). The total effect on Germany’s GDP and welfare compared to unilateral EU abatement would be minimal (excluding the long run gains from reducing global emissions).

Even if carbon pricing is unified across sectors and carbon leakage issues are addressed, there are arguments for complementing carbon pricing with other mitigation policy tools. Market failures such as imperfect information and collective decision problems are hard to solve just by setting prices. Likewise, carbon pricing may be less effective for long-run investments of households, either because of liquidity constraints or because of a present bias. For example, some might not retrofit their homes even when it makes economic sense because savings will be realised far in the future (see the section on the building sector). High uncertainty, a lack of complete future markets, and technological path dependence reduce the effectiveness of carbon pricing to support innovation, which could lower the costs of replacing fossil fuels (Acemoglu et al., 2012[46]). Moreover, government commitment problems to carbon pricing can be severe. Carbon prices will have to reach high levels to meet net-zero emissions, which will cause strong reallocation and distributional effects hurting certain groups more than others (see the section on distributional consequences of emission reductions below). If distributional consequences are unaddressed, public opposition and lobbyism of interest groups can derail abatement efforts. If firms anticipate these commitment problems and expect prices to remain low, they might underinvest in innovative green technologies (Edenhofer et al., 2021[39]). Therefore, a mix of policy instruments is needed to reduce the economic and social costs of the green transition (D’Arcangelo et al., 2022[30]).

Well-designed regulations and standards can help overcome coordination failure and realise network effects, for example, by setting technical standards for electric vehicle charging stations or green hydrogen (D’Arcangelo et al., 2022[30]). Likewise, they can help to solve problems such as split incentives between homeowners and tenants, causing households to underinvest in energy efficiency measures (see the section on the building sector). Nevertheless, in a country like Germany, where carbon pricing mechanisms are already in place, the use of regulations should be done sparingly. Ill-designed and uncoordinated regulations risk to increase the cost of decarbonisation by complicating performance monitoring and blurring price signals. Regulations are also more open to lobby influence of special interest groups than a transparent carbon pricing scheme.

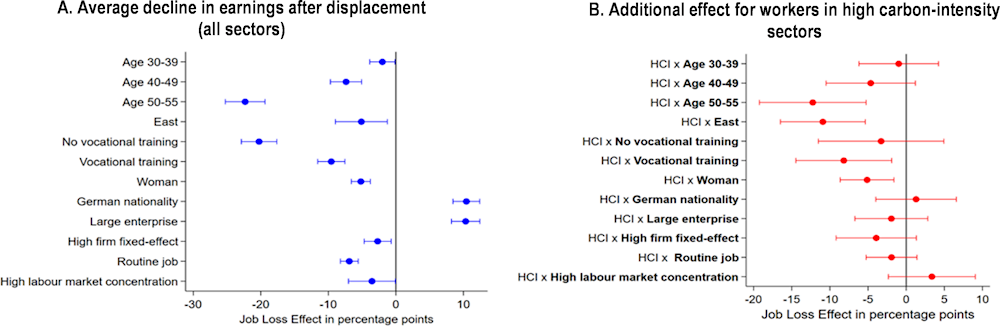

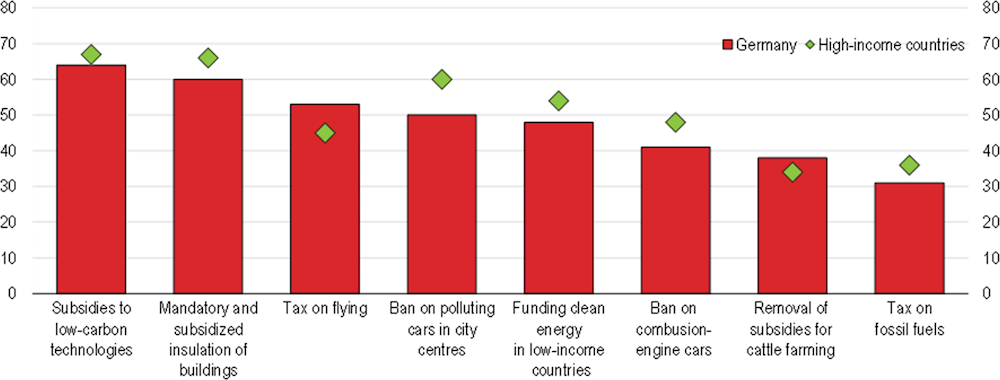

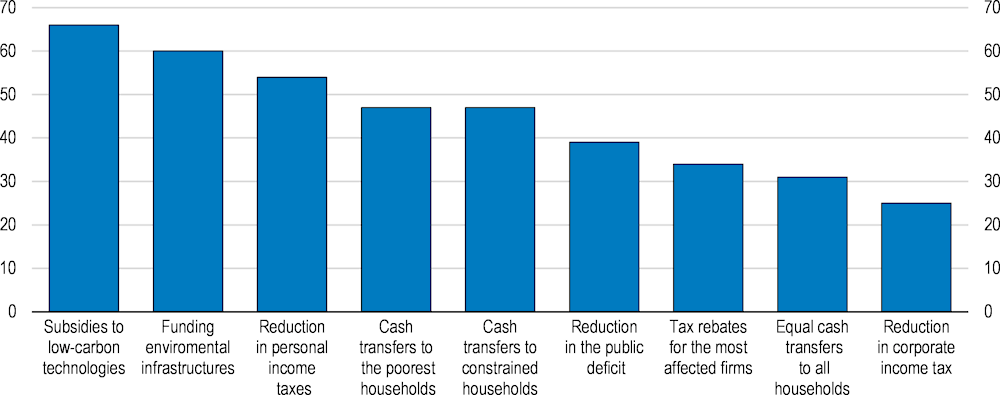

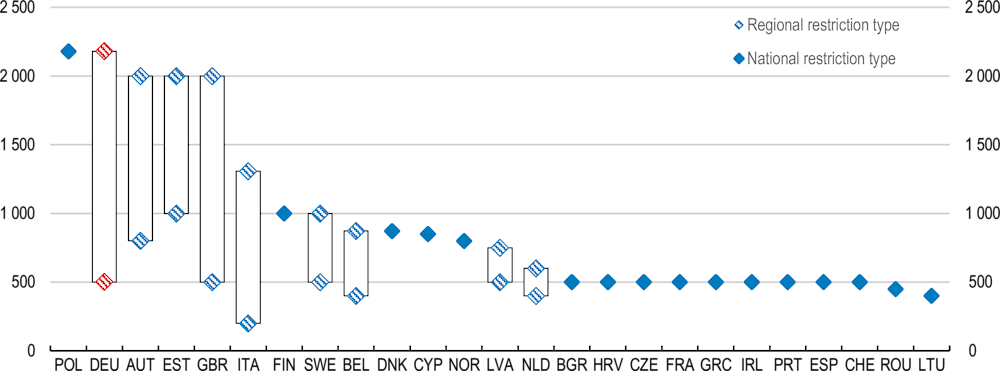

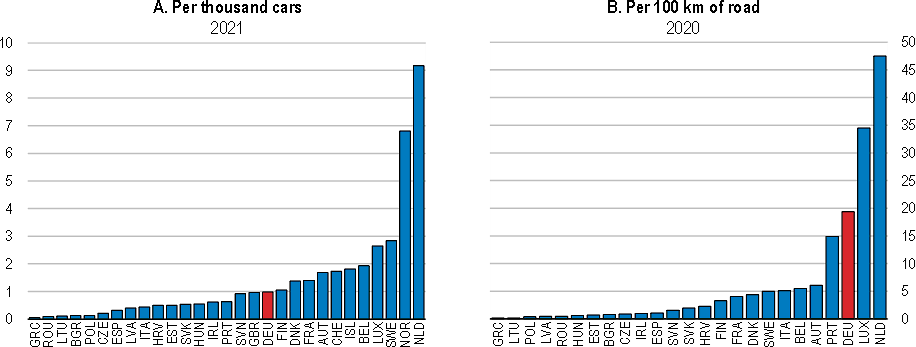

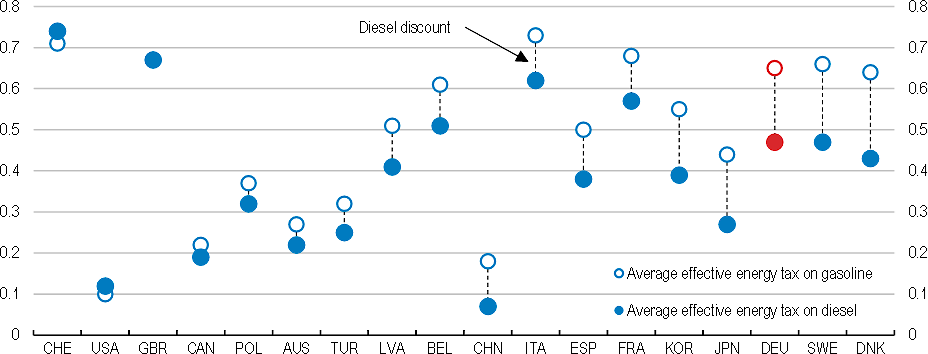

Accelerating the coal phase-out signals a higher government commitment to reducing emissions and expanding renewables. Nonetheless, simulations conducted for this Survey show that introducing additional regulation to mandate the exit of coal power plants by 2030 would raise electricity prices and hurt EITE and other industries compared to the main EU Fit for 55 scenario, where Fit for 55 targets are reached without additional regulation (Box 2.5, Table 2.4). Increasing electricity prices would incentivise the expansion of renewables to reach a share of 82% of electricity production, but supply increases are insufficient to compensate for the coal exit and cover electricity demand, and electricity imports increase strongly (Table 2.5). Emissions in the German ETS sectors would fall strongly due to higher electricity prices allowing to reduce overall emissions by 69% in 2030. However, if total emission allowances in the EU ETS are not reduced, the shrinking demand for emission rights due to the coal exit and higher electricity prices would lower the ETS price and allow polluting firms in other EU countries to increase production and emissions, including to export electricity to Germany (the so-called waterbed effect). This problem is even more severe in the case of using carbon tax revenues to subsidise renewable energy supply (see below), where falling ETS prices strongly increase output in emission-intensive industries in other EU countries. The European Union introduced the Market stability reserve in 2019, among others, to reduce these waterbed effects. It makes automatic adjustments to the supply of certificates in the EU ETS based on the surplus in the market so that the price does not fall. The higher the surplus, the more certificates are withheld from auction. Germany could support initiatives to expand these kinds of mechanisms so that additional national regulations, such as the coal exit or other regulations concerning the expansion of renewables, would be more effective in reducing total emissions.