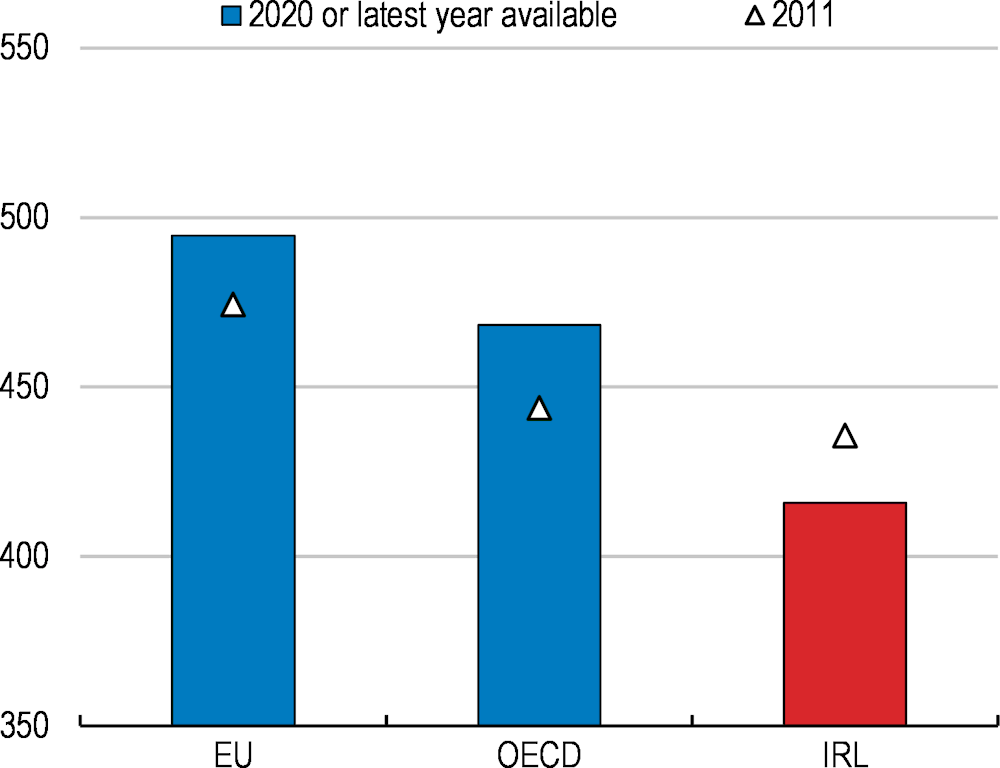

The economy weathered the COVID-19 pandemic and is coping well with the repercussions from Russia’s war of aggression against Ukraine. The government reacted forcefully to shield households and businesses from both shocks. Buoyant exports from the multinational sector and very high vaccination rates helped the economy recover strongly when the strict lockdown was lifted (Figure 1).

OECD Economic Surveys: Ireland 2022

Executive Summary

Challenges remain despite the well-managed COVID crisis

Figure 1. Exports continue to support growth

Gross domestic product, volume

Note: 1. Excludes those large transactions of foreign corporations that do not have a big impact on the domestic economy.

Source: OECD, National Accounts database and Central Statistics Office.

The reopening of the economy was accompanied by a strong bounce-back in activity, but inflationary pressures emerged. High inflation, while still driven by elevated energy prices, has become more broad-based, especially through higher transport and service costs. In addition, property prices have been rising, reflecting strong demand, past underinvestment, and a sluggish supply response. The government has acted to offset some of the energy price shock.

High inflation and low confidence are set to lower domestic demand. On the external side, exports of multinational-dominated high-growth sectors will continue to support GDP growth, albeit at a decelerating rate (Table 1). While inflationary pressures are projected to gradually abate, war-related factors may keep up inflation, thereby denting domestic demand and slowing the economy further.

Table 1. Economic growth is slowing

|

Annual rate of change unless noted1 |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|

|

Real GDP |

13.4 |

10.1 |

3.8 |

3.3 |

|

Modified total domestic demand2 |

5.9 |

8.0 |

0.9 |

3.1 |

|

Unemployment rate (% of labour force) |

6.2 |

4.7 |

5.3 |

5.1 |

|

Core consumer price inflation |

1.7 |

4.8 |

4.6 |

3.0 |

Note: 1. OECD Economic Outlook 112 projections for 2022-24, not taking into account the quarterly data released on 2 December 2022 for 2022 Q1-Q3. 2. Excludes those large transactions of foreign corporations that do not have a big impact on the domestic economy.

Source: OECD Economic Outlook 112 database.

Labour markets have been resilient in the face of the pandemic, and labour shortages are increasing in some sectors, such as construction. Despite gains in labour force participation for youth and women, those with lower educational attainment continue to struggle to secure and retain employment. During the pandemic, the government has expanded training using digital technologies and the development of additional apprenticeship schemes, particularly for sectors – such as construction – that are in high demand.

The financial sector appears to have weathered recent shocks relatively well. Banks have returned to profitability and continue to work down their non-performing loans. Innovation in the sector has continued apace with growing digitalisation and the rising importance of Fintech.

The financial sector faces some structural problems. Mortgage arrears remain important and their low resolution may limit credit supply. Returns on equity are low and two banks are withdrawing from the market, raising concerns about concentration. The rise of lending by non-banks creates risks that need to be monitored closely.

Fiscal policy is currently performing well, but pressures loom

Fiscal policy had enough room to react to the crises forcefully. While spending rose, strong revenue growth meant budget balances did not deteriorate as much as elsewhere in the OECD. However, fiscal policy is facing a number of pressures in the short run and on its longer-term sustainability.

The strong rebound in the economy allowed the authorities to withdraw COVID-19 support measures for households and firms. Thanks to excess corporate tax receipts, the budget is expected to move back into balance in 2022, despite substantial government support related to the energy shock. The government has put part of these extra receipts in the National Reserve Fund. A new fiscal rule is also trying to make spending less procyclical and avoid creating backlogs of spending that are currently a challenge for policymakers.

High inflation is putting pressure on the government to increase spending, which may undermine the new spending rule before it gains sufficient credibility to constrain policy. Additional persistent stimulus to demand should be avoided in the current context of high inflation. Any further fiscal support for vulnerable households should be temporary and targeted, and should be designed to maintain incentives for energy savings.

In the longer term, several underlying pressures will create threats to fiscal sustainability. The plans to raise the state pension age have been abandoned, and the September pension reform is centred around increasing social security contributions. More rapid population ageing will push up health costs. Climate change objectives will require government support over the coming decades. The recent multilateral agreement on corporate taxation could reduce the buoyancy of receipts, although effects are very uncertain.

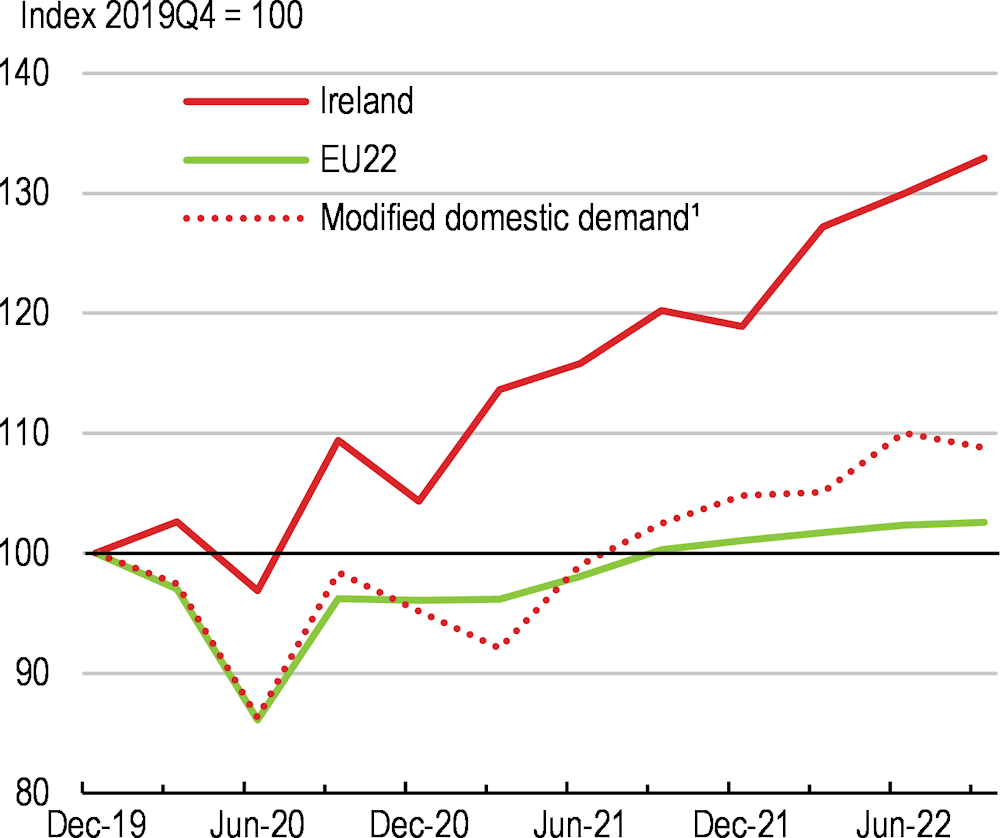

Improving housing affordability is a priority

The sharp increases in house prices in recent years have heightened affordability concerns. The housing stock has hardly kept pace with the rise in the number of households, and remains low (Figure 2). After the lifting of the lockdown, housing market pressures intensified, causing house prices to rise rapidly. Accommodation is hard to find, particularly for lower-income families.

The government has launched an ambitious Housing for All initiative. The programme seeks to improve zoning, planning, land availability and provision of social housing. Public investment in housing is being increased. The policy aims to increase homeownership and affordability, in a break with earlier policy efforts to ensure neutrality between ownership and renting.

Boosting residential accommodation will require action to enable a stronger supply response. The regulation and permitting system is complex and slow, and housing developments can be subject to judicial review, further slowing supply. The new planning system gives back the primary decision to the local level, which requires additional expertise and resources to make it effective and timely. In addition, construction costs are elevated and the demand for workers in the sector exceeds supply. The State is also a large landowner of sites that could be developed. Finally, expanding housing supply needs to be better embedded in planning for transport and infrastructure.

Figure 2. Housing markets face supply pressures

Dwellings per thousand inhabitants

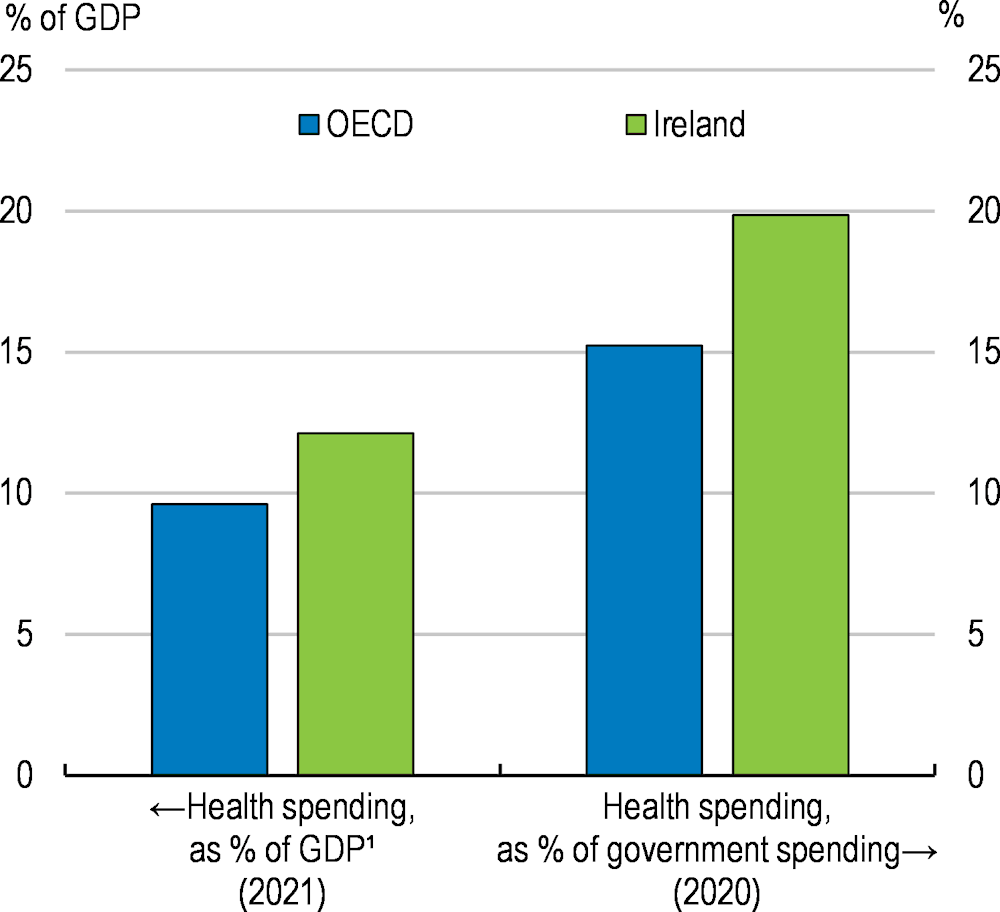

There is scope for efficiency gains in healthcare

Health gains have been impressive over recent decades. Life expectancy is now amongst the best in the OECD and the population rates their health as good. Improving spending efficiency, reducing waiting times and simplifying the interaction of different parts of the system are key.

Spending on healthcare is now comparatively high. After a period of retrenchment, spending on health has risen recently and is now high in comparison with other OECD countries. It also accounts for a sizeable share of government spending (Figure 3). This largely reflects high costs. Pay is high and pharmaceutical spending does not make the most of low-cost alternatives. As ageing begins to accelerate, spending pressures are projected to increase. Already spending on long-term care is elevated. Achieving efficiency gains will be important in addressing these pressures.

Figure 3. Spending on healthcare is high

1. Health spending for Ireland is computed as share of GNI*.

Source: OECD, Health Expenditure and Financing database; and OECD, National Accounts database.

The government has initiated a far-reaching overhaul of the health sector. The Sláintecare reforms will reconfigure the sector by moving away from a largely hospital-based system to one that will better integrate primary, community and long-term care. This will also involve some decentralisation, with the creation of Regional Health Areas. Effective implementation should remove the burden on expensive hospital care, improve data availability and governance as well as financial reporting and management, and allow for some simplification of the complex interactions between the private and public elements of the system.

Progress will require overcoming some longstanding problems. The period of spending retrenchment has left a number of legacy issues. Waiting times are long with private patients able to jump queues causing concerns about a de facto two-tiered system. Past underinvestment in buildings and equipment is slowly being corrected, but will take time to overcome fully. Working conditions, particularly during the COVID-19 pandemic, are difficult and attracting and retaining staff is a concern.

Reducing greenhouse gas emissions requires bold reforms

Ireland did not meet its 2020 emission reduction target. In addition, greenhouse gas emissions per capita are amongst the highest in the OECD, partly due to the importance of agriculture. The government has adopted demanding reduction targets for 2030 and 2050, seeking to reach net zero emissions by mid-century.

A major plank of abatement policy is the establishment of carbon budgets and sectoral emissions ceilings. Emission reductions in the power generation sector is key to obtaining overall emission reductions. Ireland has already begun to develop renewable resources, but development of additional onshore and offshore wind generation capacity will require major investment, including in the grid infrastructure to ensure it can deal with more intermittent supply. It will be important to frontload the reforms to streamline and simplify the planning and judicial review process in order to facilitate the investment needed to meet the climate targets. The transport sector accounts for around one-fifth of greenhouse gas emissions.

The agriculture sector presents particular difficulties for abatement. Achieving methane emission reductions has proven to be difficult and the dairy herd has actually been growing, making the targets even more difficult to reach. Without more progress in agriculture, meeting the 2030 target will require greater effort from other sectors. This will raise the overall costs of reductions substantially.

|

Main findings |

Key recommendations |

|---|---|

|

Improving macroeconomic policy and fiscal sustainability |

|

|

The rapid rise in energy prices has been a large shock to households and the government has reacted by softening the blow. |

Target support on the most vulnerable households, while keeping the impact on domestic activity broadly neutral. |

|

Fintech and credit provision by non-banks are on the rise. |

Ensure adequate supervision and regulation of non-banks by the Central Bank of Ireland. |

|

There is a need to strengthen the ability of fiscal policy to address future shocks. High inflation is putting pressure to increase government spending, which has led to a temporary breach of the new spending rule in 2022-23. |

Continue to put excess windfall tax receipts in the National Reserve Fund. Consider strengthening the expenditure rule by giving it legislative status. |

|

The government cancelled the planned increase in the state pension age during the pandemic. The new pension reform aims to address structural shortfalls in the social security funds by increasing social security contributions. |

Re-introduce the planned rise in the state pension age and link the statutory retirement age to life expectancy at retirement. |

|

Pursuing structural reforms and providing housing |

|

|

The labour market participation of those with low education attainment remains low and labour market shortages are rising in some sectors. |

Continue to support training and apprenticeships in areas of the economy where labour supply is in high demand. |

|

Low housing and rental supply leads to high prices and low affordability. Housing for All is an ambitious strategy, but implementation challenges are large in the near term. Permitting delays and judicial reviews constrain housing supply. Housing for All gives some of the planning responsibilities back to local planning authorities. |

Prioritise supply-side policies in the implementation of the Housing for All Strategy. Expedite the streamlining of planning and judicial review processes, for example by establishing a special division in the High Court with sufficient tools, resources and technical capacity to reduce delays. Address capacity issues in the planning system and sufficiently resource local planning authorities. |

|

Keeping Ireland healthy |

|

|

Home care for the elderly incurs lower societal costs, but when the patient becomes sicker, the costs rise and the quality of care diminishes. |

Establish integrated funding and service delivery to offer home care and admission to long-term residential care when needed. |

|

The Single Assessment Tool is a key IT tool to support enhanced operational integration across all health and social long-term care providers, enabling large efficiency gains and the provision of more effective person-centered care services. |

Accelerate the implementation of the Single Assessment Tool across the country in order to move towards more effective person-centered care services. |

|

The Sláintecare reforms are overhauling the Irish healthcare system. The system is currently overly centralized, complex and biased towards expensive hospital-based treatments. |

Implement the reforms to create Regional Health Areas and rebalance healthcare delivery across primary, community and long-term care and hospitals. |

|

The success of Regional Health Areas will depend on a suitable funding system and data availability. The funding system is currently fragmented across care settings and lacks transparency, limiting the traceability of healthcare spending. Monitoring the health system is hindered by its complexity, lack of adequate information, fragmented data governance and underdeveloped digital infrastructure. |

Introduce a Population-Based Resource Allocation funding model, as planned, to improve financial reporting and management and strengthen equity in health outcomes. Prioritise reforms to enhance the take-up of a unique health identifier across health services and centralise governance and appropriate national health information functions within a single independent body. |

|

Achieving net zero emissions by 2050 |

|

|

Planning and permitting delays coupled with judicial review concerning major investments slow the development of renewable energy capacity and through increasing uncertainty deter investment and raise prices. |

As a matter of urgency, expedite the planning process to reduce uncertainty concerning major investments in wind turbine capacity. |

|

Reducing emissions in the transport sector requires action across many policy dimensions. |

Realign transport policies to reduce private car ownership and facilitate the provision and use of low- or no-carbon travel alternatives. |

|

The overall costs of abatement will rise substantially if agriculture does not contribute more to emission reductions. |

Ensure that farmers face stronger economic incentives to reduce emissions in line with the rest of the economy, such as by pricing methane emissions. |