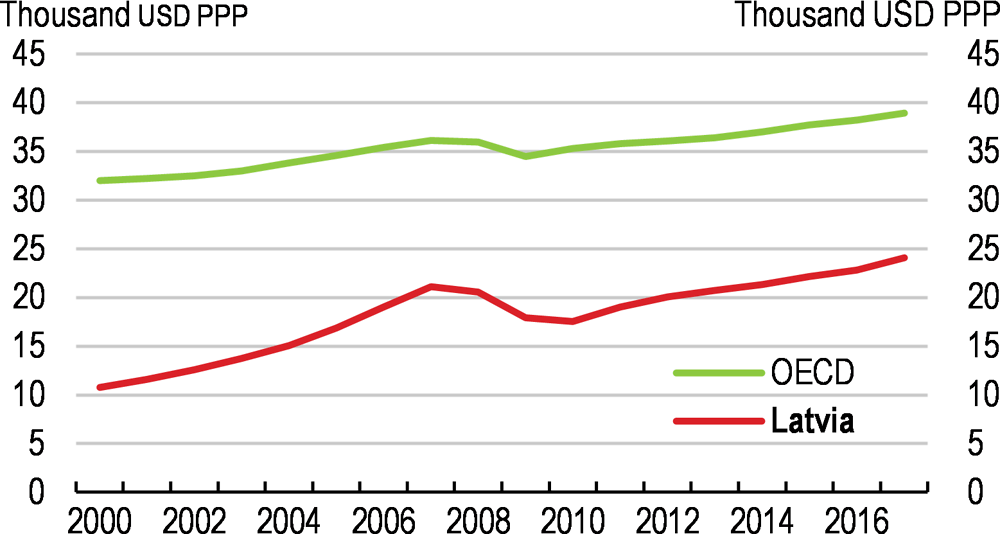

The economy is in a broad-based upswing led by domestic demand. Fast earnings increases are supporting private consumption. A strong rebound of investment pushed GDP growth rates above 4% in 2017 and 2018. GDP growth is expected to slow to around 3% in 2019 and 2020, as world trade weakens and investment slows to a more sustainable pace.

OECD Economic Surveys: Latvia 2019

Executive summary

Strong growth is set to moderate

Figure A. GDP per capita growth has been strong

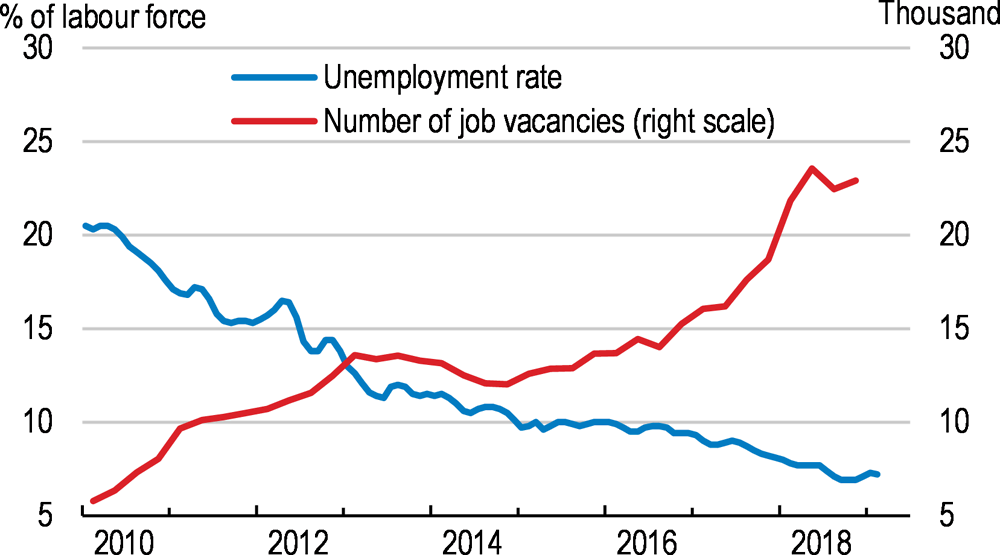

Unemployment has been decreasing fast and job vacancies are continuing to grow. Latvia continues to lose workers through migration and more than 40% of all emigrants between 2009 and 2016 were high-skilled. This contributes to rising skill shortages. Along with a 13% rise in the minimum wage in 2018 this has fuelled wage growth, which is running at roughly 8%. Exporters still enjoy rising market shares and strong profitability, although continued increases in unit labour costs could ultimately undermine their competitiveness.

Figure B. The labour market is tightening

Macroeconomic policies are sound. The ECB’s policy interest rates are low and fiscal policy is broadly neutral , as the phasing in of personal and corporate income tax reform is compensated by higher excise taxes and spending restraint in some other areas.

While wage growth has been buoyant, for now, inflation looks stable and credit growth is weak. Core inflation has been firmly anchored around 2%. While private sector debt and non-performing loans have fallen fast to comfortable levels and the banking sector is well capitalised, credit growth remains close to nil. Banks remain cautious after heavy losses, partly caused by inefficient insolvency procedures, in the aftermath of the 2008 crisis. The widespread under-declaration of income also plays a role.

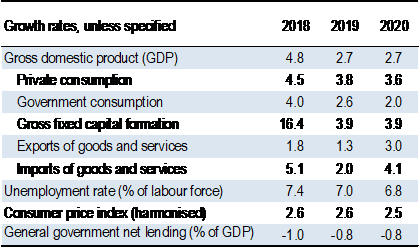

Table A. Economic growth will remain robust

Source: OECD Economic Outlook 105 database.

Anti-money laundering efforts have been stepped up. Latvia banned its banks from servicing certain types of high risk “shell companies” and oversaw a reduction in non-resident deposits by more than 60 % to reduce money-laundering risks. Based on recommendations of international experts (Moneyval, 2018) the new government, assisted by the OECD, works on implementing an action plan that would strengthen the quality and capacity of Latvia’s supervisory, control and law enforcement bodies and enhance international cooperation on anti-money laundering and combating of terrorism financing.

Making growth more inclusive and greener

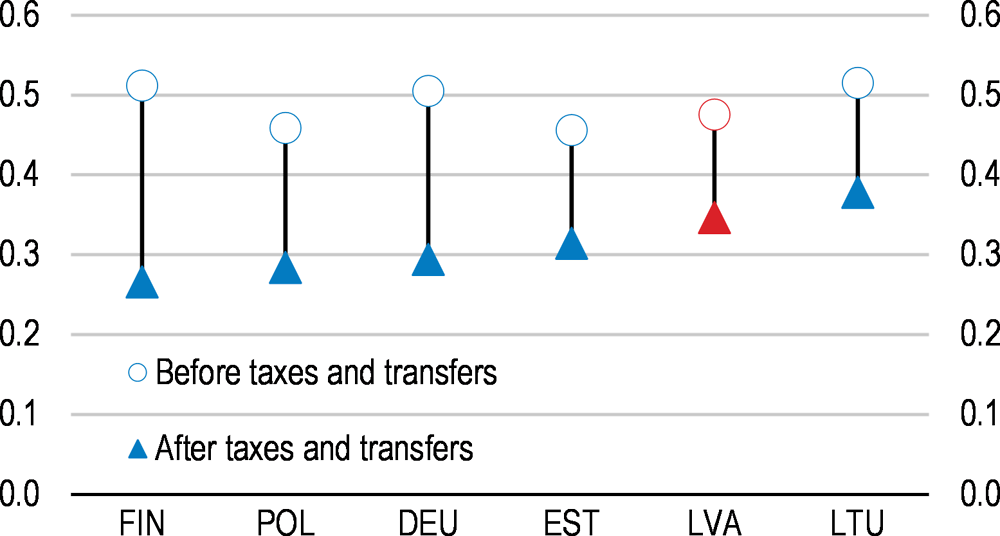

Income inequality and poverty remain high. Living standards have improved fast overall, but regional disparities in income per capita are pronounced. Social protection is limited and housing conditions are poor for a relatively large share of the population. Taxes and benefits could do more to lower inequality.

Personal income tax reform has lowered labour taxes for some lower-income households. Yet, a new social contribution earmarked for health spending has limited this effect. Taxes on higher-income workers and progressivity remain limited, as more than 90% of taxpayers pay the lowest rate of 20%. Social assistance remains low and while they improved, work incentives for accepting low wage jobs remain limited for benefit recipients.

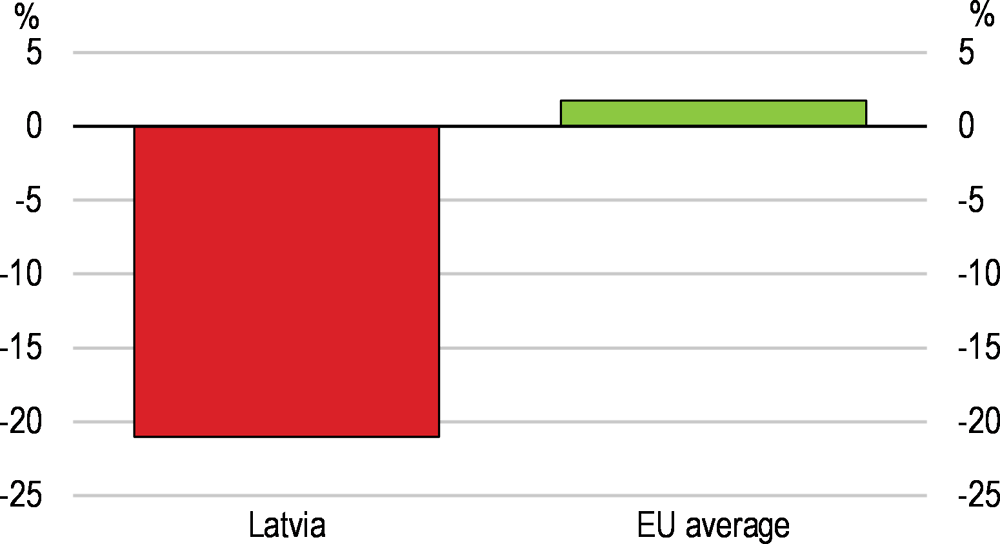

Figure C. Taxes and benefits could do more to lower inequality

Gini coefficient, 2016 or latest available year

Municipalities are relatively small. This undermines the provision of high-quality public services, including education and public transport. The government has initiated a territorial reform aiming at reducing the number of municipalities significantly. This should entail large efficiency gains and help address the deepening rural-urban divide.

Healthcare financing has increased from a low level, but a recent reform involves serious risks. Despite a fast increase life expectancy is still among the lowest in the OECD and highly unequal. A recent reform reduced high out-of-pocket payments that induce many patients to miss doctors’ appointments. But workers not paying mandatory social contributions and pensioners, who receive their pension from another country now have to pay a voluntary levy, otherwise they will be excluded from parts of the healthcare package, endangering their health. The new government’s proposal to abolish this levy and restore universal access to healthcare services is thus welcome.

Improvements in energy efficiency could provide for lower emissions. A lack of integrated land and transport planning has led to urban sprawl and limited the attractiveness of public transport. Most households are homeowners and many lack access to credit and financial resources to invest in energy efficiency. Homeownership associations have often been overwhelmed with complicated decision-making procedures and the logistics of energy efficiency investments, hindering a stronger uptake of dedicated EU and other public subsidies.

Faster productivity growth is essential for well-being, as the population declines

Latvia needs stronger productivity growth to improve living standards. This would help to counteract the effects of ageing and emigration of high-skilled workers. Productivity growth has slowed down after 2008, as the financial crisis impaired the credit channel impeding stronger capital deepening and investment in innovation. Shortages in skills needed to take up digital technologies and weak competition in some sectors with an important presence of state-owned and municipal enterprises (SOEs) hold back productivity, too.

Figure D. The working age population is falling

Population aged 15-64, % change, 2000-17

Source: United Nations, Department of Economic and Social Affairs, Population Division (2017), World Population Prospects: The 2017 Revision, DVD Edition.

High informality hinders stronger investment growth and inclusiveness. A widespread practice of under-declaration of income weighs on tax revenues, much needed to invest in education and infrastructure, on workers’ training opportunities and on firms’ access to finance. It also makes for patchy pension contribution records. The government is working to strengthen the capacity of the tax adminisitration and other law enforcement agencies, but progress with filling vacancies has been slow and lenient sentences continue to impede the fight against tax crime.

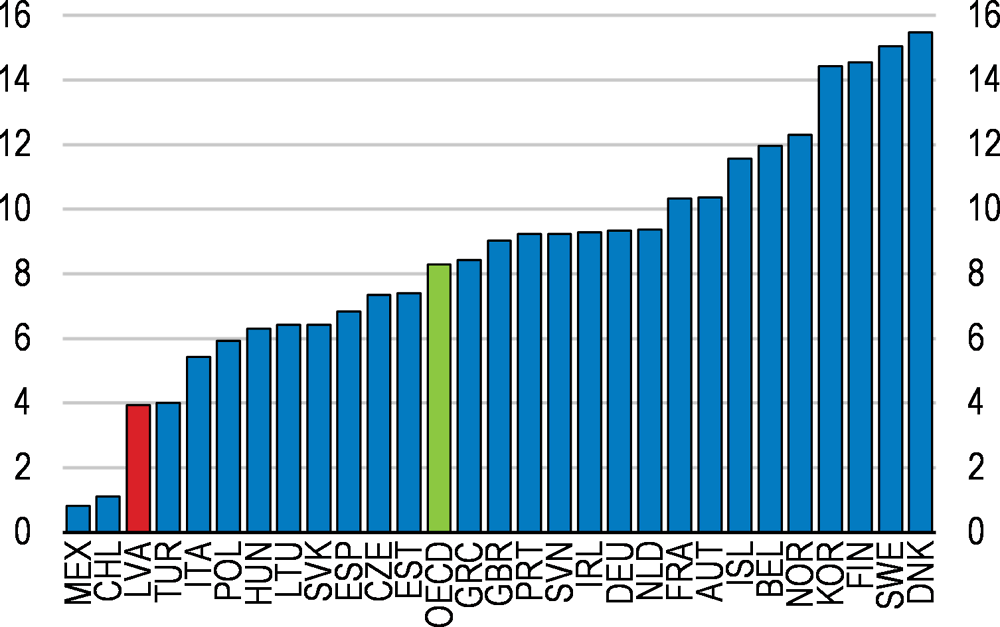

The very low recovery rate in insolvencies negatively affects access to credit and investment. Fraud with low penalties for abusers and low accountability of insolvency administrators eroded investors’ trust in the past. Recent insolvency administration reforms improve transparency and monitoring of proceedings, but trust in the independence of the judiciary and its capacity to deal with economic and other crimes should be strengthened. Encouraging swift initiation of insolvency proceedings could help restructure viable firms and liquidate unprofitable ones faster.

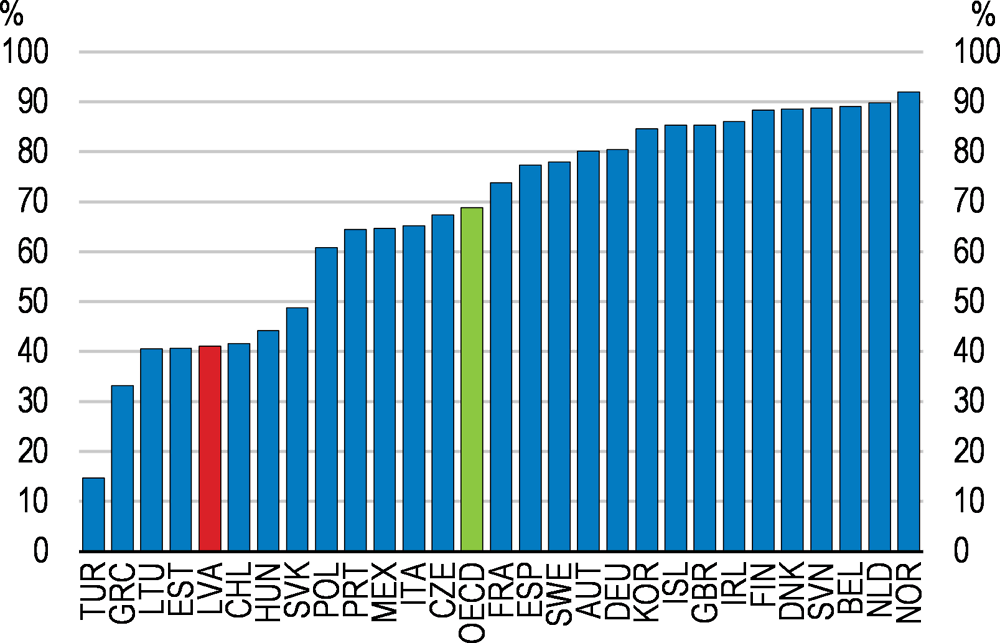

Figure E. Recovery in insolvencies is low

Note: The recovery rate is calculated based on the time, cost and outcomes of insolvency proceedings and is recorded as cents on the dollar recovered by secured creditors.

Source: World Bank, Doing Business 2019 database.

Governance of SOEs needs to improve to avoid undermining fair conditions for competition. The rationale for state ownership is not rigorously applied, preventing evidence-based decisions on privatisation. Enterprises owned by municipalities are not subject to the framework that monitors SOEs and ensures their good governance. Unlike in many OECD countries the competition authority cannot intervene against administrative acts that endanger fair conditions for competition.

Innovation performance is weak. Only a few firms innovate and R&D spending is relatively low. The supply of researchers and research quality are weak. Various measures to promote knowledge transfer are in place but researchers have little incentive to collaborate with industry. The government has reformed institutional financing to reward performance and promote consolidation. Taking these reforms further would improve efficiency and make room for higher wages and better working conditions for researchers to attract more qualified personnel.

Figure F. Supply of researchers is weak

Per thousand of total employed, 2017

Skill shortages need to be adressed

Education and training have to become more responsive to labour market needs. Vocational training curricula have been updated with the involvement of social partners, a welcome move. But Latvia’s many small enterprises often lack the capacity to offer the full extent of work-based learning programmes. Promoting the provision of joint training could be a solution.

Participation in adult learning is increasing, but remains low among the low-skilled. Spending on active labour market policies has been shifted from public work schemes to more effective training and activation measures, but remains low.

Limited access to affordable housing in dynamic areas impedes access to jobs. Unemployment and income differences between Latvia’s regions are large, but buying a new home in booming areas is out of reach for most workers. Both the private rental and the social housing sectors are very small. The government plans to develop the private rental market by supporting access to long-term finance and housing with limits on rents, a welcome move.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Improving well-being, inclusiveness and green growth |

|

|

Informality, such as under-declaration of income and tax evasion, is high, weighing on the access of workers to social security and training, on productivity and on tax revenues that are much needed for higher spending. |

Continue the engagement of social partners in the fight against informality through sectoral agreements. Offer sufficiently high wages to attract qualified personnel in law enforcement agencies. |

|

Spending on healthcare is low and high out-of-pocket payments limit access to healthcare of low-income households. Denying parts of the healthcare package to some workers and pensioners that do not pay the new levy risks undermining their health status. |

Increase spending on healthcare to reduce out-of-pocket payments. Ensure that all residents have access to the full healthcare package as envisaged. |

|

The average size of municipalities is low, undermining the provision of high quality public services, including education and public transport. |

Increase the size of municipalities by merging local administrations. |

|

Social transfers and work incentives for low wage earners are low. |

Increase the guaranteed minimum income and consider tapering its withdrawal further. |

|

A lack of integrated transport planning for the Riga metropolitan area and the country as a whole limits the attractiveness of public transport, increasing car traffic, congestion and pollution. |

Consider building an association of public transport buyers for the Riga metropolitan area and possibly for the country as a whole to coordinate transport planning and provision. |

|

Effective tax rates on CO2 and air pollutants are low. |

Increase energy taxes and align the effective taxation of emissions of CO2 and other pollutants across different fuels and uses. |

|

The housing stock is old and has low energy efficiency. Many homeowners lack financial resources and decision-making procedures in homeowner associations are complicated. |

Encourage housing management agencies to initiate and manage energy efficiency investment for a large set of buildings and provide lower-income homeowners with grants covering up to 100% of the costs. Introduce means-tested tax incentives for the refurbishment of basic amenities. |

|

A lack of affordable housing in dynamic areas exacerbates skill shortages and weighs on well-being. |

Provide more public funding for affordable rental and social housing. |

|

Fiscal policy |

|

|

Public debt is low and the deficit under control. |

Reduce the deficit as planned. |

|

Despite recent personal income tax reform, taxation of labour income remains high for lower income earners and progressivity limited. A new social contribution earmarked for health spending increased the tax burden on some vulnerable groups. |

Monitor the impact of personal income tax reform, especially on low-income households. In the longer run, consider abolishing the social contribution earmarked for healthcare and further steps to make the personal income tax more progressive. |

|

Strengthening productivity |

|

|

The provision of work-based learning is low, as many small firms do not have the capacity to provide training. |

Promote joint training offers involving several firms. |

|

Participation in adult learning is increasing, but remains low for low-skilled and elderly workers. Scarcities in general and digital skills need to be addressed. |

Implement as early as possible the planned financial support for firms providing training to employees, with stronger financing for the low skilled. |

|

Competition looks weak in sectors with a strong involvement of state-owned enterprises. |

Develop more detailed guidelines to review the rationale for state ownership and apply them more rigorously. Strengthen the authority of the Competition Council to intervene against anti-competitive behaviour by state-owned and municipal enterprises. |

|

Spending on active labour market policies is low and heavily dependent on EU Funds. The caseload of counsellors is high. |

Hire more counsellors in Public Employment Services. Evaluate EU funded training to identify the most effective programmes. Plan for the financing of EU funded training beyond the current EU budgetary cycle, if necessary from national sources. |

|

The quality of research is low and science-industry collaboration is weak. |

Promote sharing of resources among universities and research institutions. Improve wages, working conditions and career prospects for researchers in public institutions and provide stronger incentives to collaborate with industry. |

|

Abuse of insolvency procedures in the past has undermined the judiciary’s credibility and the recovery of bank credit growth. Trust in the independence of the judiciary and its effectiveness in addressing corruption is low and its capacity to deal with economic crimes, including under-declaration of income and tax evasion, needs to be strengthened. |

Improve the quality and speed of judgement through training and specialisation of judicial staff. Ensure the accountability of judges, including by extending the deadlines for dealing with disciplinary cases. |

|

Dealing with money laundering issues that came mainly from banks specialised in foreign customer services has been a challenge. |

Ensure continued commitment at the highest level of the government to swiftly implement the government action plan, strengthening the anti-money laundering and combating of terrorism financing framework. |