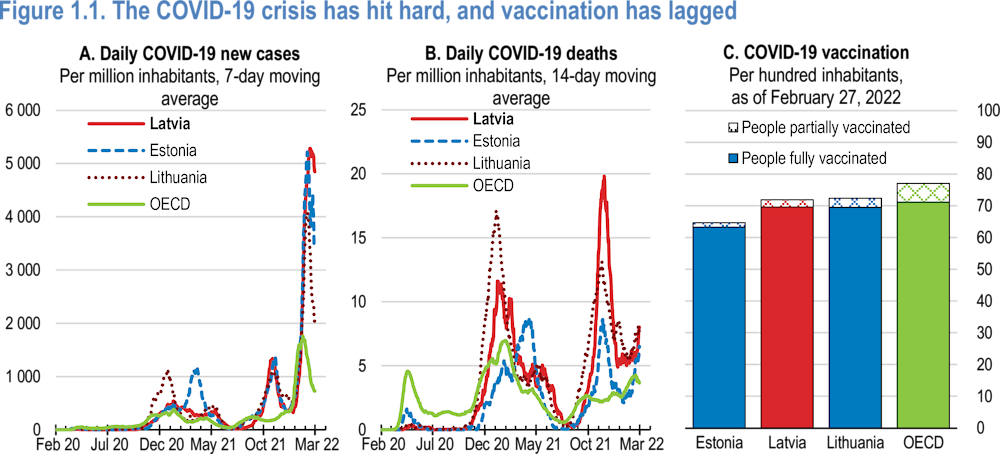

Like most other people around the world Latvians have suffered considerably from the COVID-19 pandemic. After having had few infections in the first wave in the spring of 2020 but a severe second wave, a new wave began to build in mid-summer 2021 (Figure 1.1). Vaccination has been slow until recently, with only about 67% of the population fully vaccinated in mid-January 2022 (Panel C), below the OECD average rate, and with substantial internal geographic variation (Central Statistical Bureau, 2021[1]). Earlier containment measures were largely lifted at end-June, boosting economic activity, but a state of emergency was imposed for three months on 11 October following the summer resurgence of cases.

OECD Economic Surveys: Latvia 2022

1. Key Policy Insights

Figure 1.1. The COVID-19 crisis has hit hard, and vaccination has lagged

The pandemic has been superimposed on long-standing structural weaknesses and social challenges. Although per capita income is continuing to converge to levels enjoyed by Latvia’s more affluent trading partners, the 2020 gap in PPP terms was still 22.5% from the OECD average and nearly double that compared to the top half (Figure 1.2). Nevertheless, it has continued to catch up during the COVID-19 crisis (during the last year and a half).

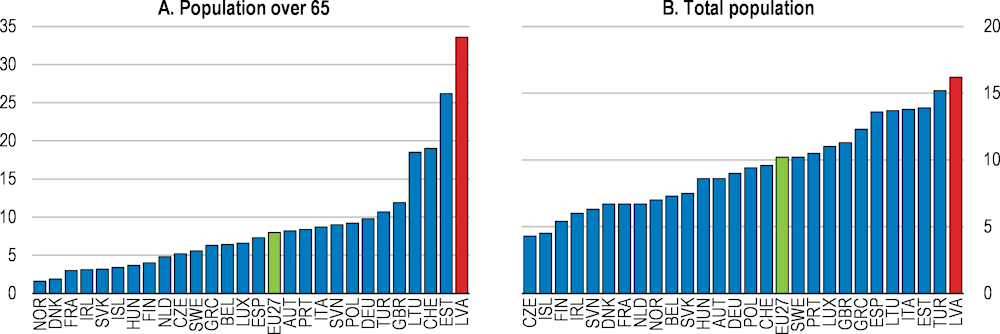

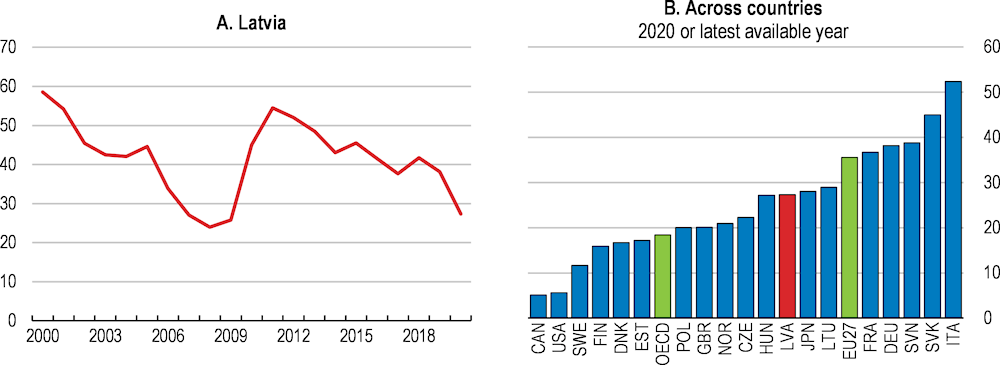

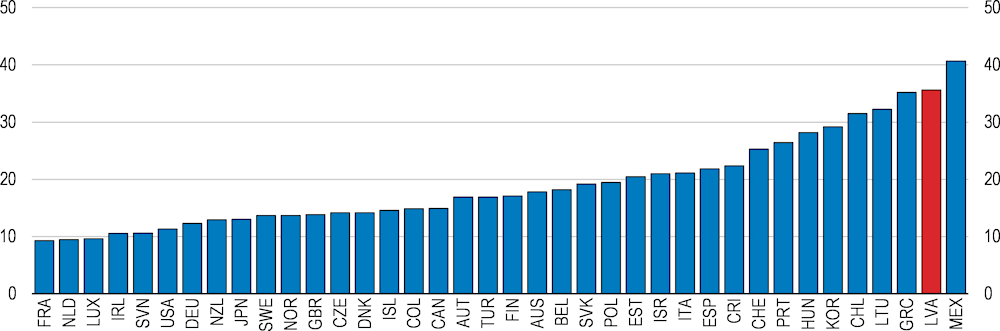

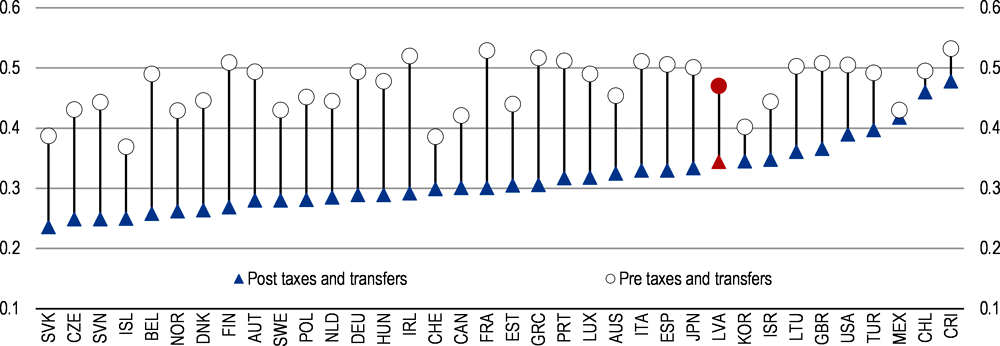

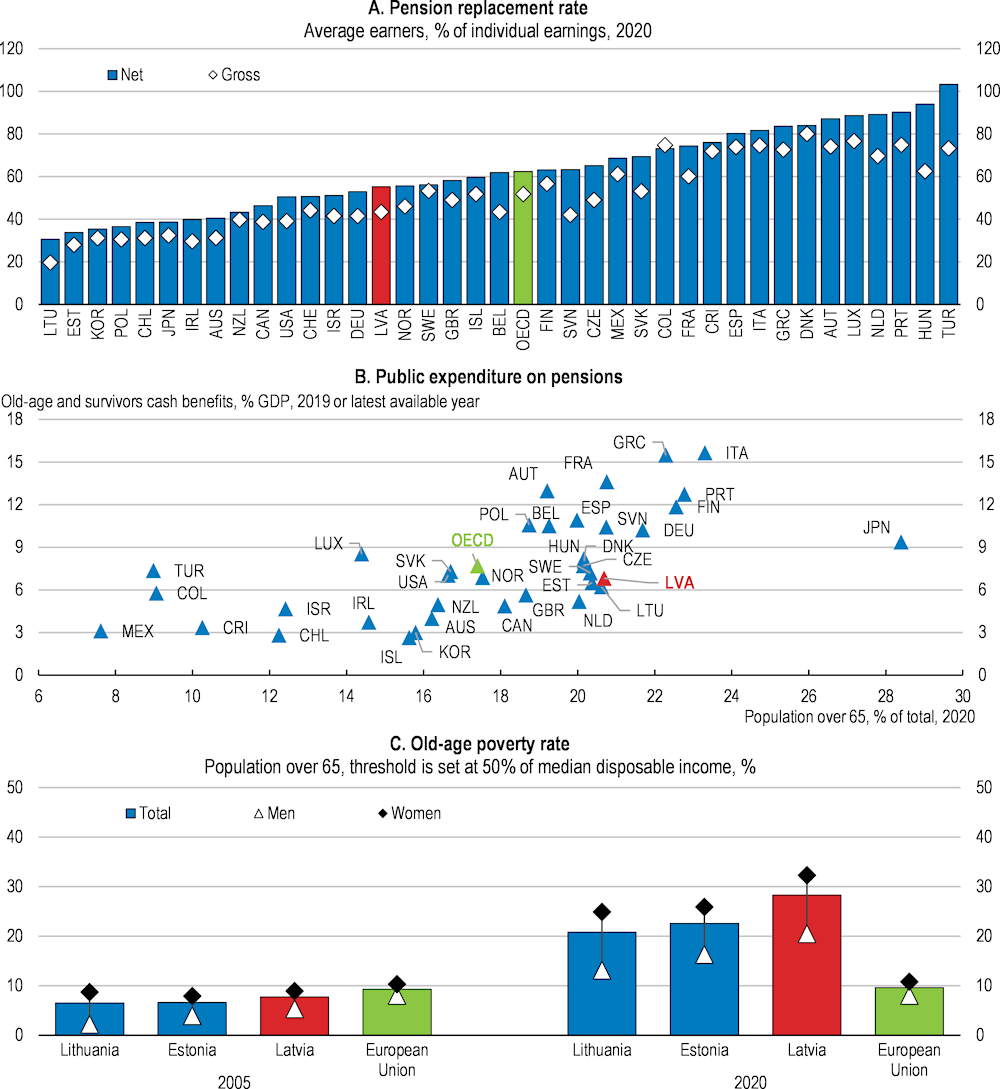

Income and wealth inequality are quite pronounced: Latvia’s latest Gini estimate was 34.5 in 2020, higher than in most other OECD countries (see Figure 1.4 below). The share of net household wealth held by the top decile was around 60% in 2015, fourth highest out of 27 OECD countries. Absolute poverty is widespread, also in relative terms, especially among the elderly (Figure 1.3).

Figure 1.2. Latvia is still catching up steadily to its most affluent trading partners

Gap in GDP per capita against the upper half of OECD countries, %

Note: Percentage gap with respect to the population-weighted average of the highest 19 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Source: OECD calculations.

Figure 1.3. The poverty rate is high, especially for the elderly

Poverty rate (set at 50% of median disposable income) after taxes and transfers, %, 2019

Against this background the main messages of this Survey are:

The economy is expanding, with growth in 2021 above potential rates thanks to supportive fiscal policy settings and accommodative Euro Area monetary policy. However, substantial uncertainty persists. Accordingly, fiscal support targeted on businesses and households hit by those restrictions should be maintained. A credible fiscal strategy to prepare for ageing and climate challenges should be devised.

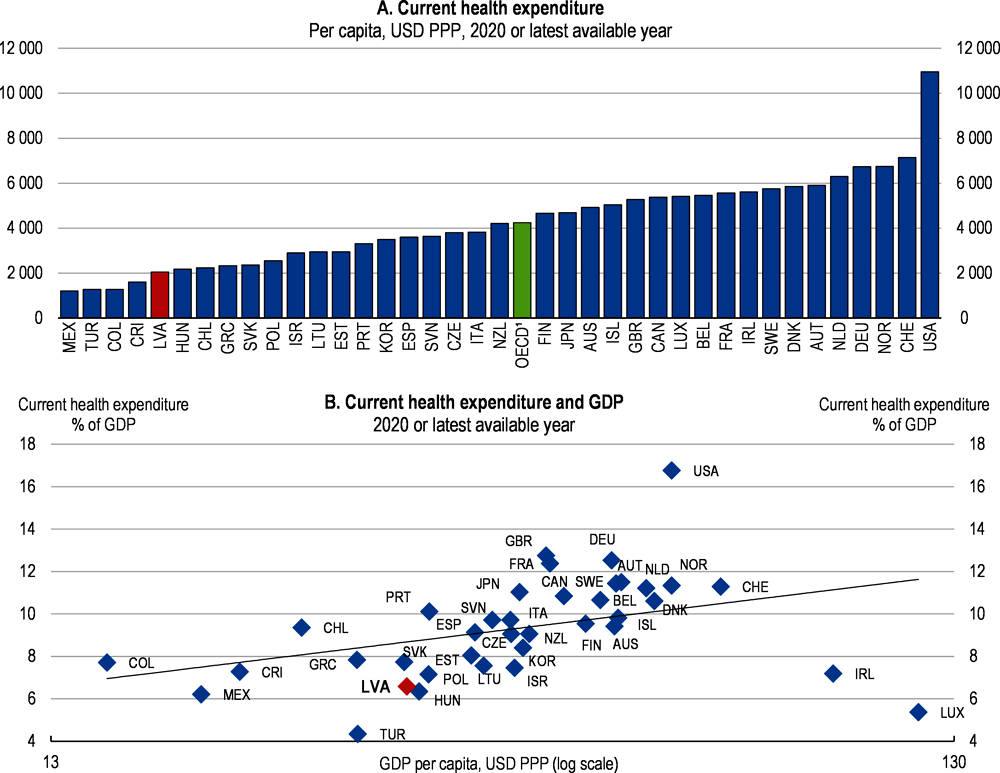

Policy should have an increased focus on inclusion and environmental sustainability. There has been clear longer-term improvement in the quality of life for the average Latvian, but income and other gaps remain sizeable. Greater public outlays on pensions, affordable housing and health and long-term care are called for but should be paid for by revenue increases on a variety of tax bases. The future pension burden should be alleviated by further programmed increases in the pension-eligibility age. While some of the funds for health care may be found in further efficiencies in the hospital network, much more funding is needed for preventive measures, primary and home care and mental health treatment. Environmental outcomes and the transition to carbon neutrality also require greater policy attention.

Focusing on exports is key for Latvia’s growth strategy, given its demographic outlook. However, Latvia’s export market share for goods and services has underperformed. This may be attributable to the industrial structure, with exporters relying on low labour costs rather than innovation. Nonetheless, Latvia is in a good position to make the necessary structural changes, as considerable EU funding will be available in the coming years. To promote export growth and diversification and attract more sophisticated FDI, it should focus mainly on three policy areas: the business environment (including infrastructure), skills and innovation.

The economy is recovering, but negative risks predominate

The COVID-19 crisis interrupted Latvia’s gains in income and employment. GDP per capita rose from 62% of the OECD average in 2015 to about 71% in 2021. Prior to the crisis the unemployment rate had fallen to below 6 ½ per cent (its lowest rate in 10 years), while job vacancies were rising quickly. At the same time, the macroeconomic context appeared balanced, with inflation largely under control and prudent fiscal policies in place. In the aftermath of the COVID-19 outbreak, unemployment peaked at about 8.7%, with a larger hit to women’s hours worked than men’s (Ciminelli, Schwellnus and Stadler, 2021[2]). The newly unemployed were mainly young adults from Riga. Still, the decline in GDP was smaller than in most OECD countries due to a relatively mild first wave of COVID-19 and resilient demand for Latvia’s main export goods such as wood, agricultural products and electronics.

Despite a stronger and deadlier second wave, the hit to activity was less severe than from the first wave. Private spending picked up starting in the spring of 2021, as people and firms first adapted to remaining restrictions and then reacted to their elimination. In addition, it was supported by a steep rise in wages, attributable to increases in the statutory minimum wage in January 2021 and in public-sector pay (notably of medical and teaching staff), as well as shortages in skills-intensive sectors such as ICT and professional services. By the second quarter of 2021 real GDP had already regained its pre-crisis level. In the third quarter of 2021, GDP growth slowed again, partly because pandemic-related measures and slow vaccination rollout caused activity in some sectors to remain subdued.

GDP held up well also in the fourth quarter of 2021 even with a month-long lockdown. GDP in the fourth quarter of 2021 was nearly unchanged with respect to the third quarter, and GDP in 2021 in total was up by 4.8%. Private consumption declined due to constrained spending options and higher prices. Export growth slowed but remained robust, and in December 2021, the value of goods exported was 36% higher than a year before, led by mineral products, chemicals, base metals and wood products. The sectors that grew most rapidly in 2021 were information and communication technology, financial services and health care. In 2021, investment in machinery was robust compensated for a significant decline in housing because of unfavourable weather conditions and higher costs. After declining steadily from June 2021, the seasonally adjusted unemployment rate increased slightly as from October 2021 to 7.3% in January 2022. The requirement to be vaccinated to work in some sectors might have prevented faster gains in employment, as could skills mismatch. Inflation has been in positive territory only since March 2021 and reached 7.4% year on year in January 2022, driven mainly by rising housing, food and natural gas prices, while the corresponding figure for core inflation (excluding food, energy, alcohol and tobacco) was 3.7%.

Strong economic growth is projected, but downside risks remain substantial. According to the latest OECD Economic Outlook (December 2021), GDP is expected to grow by 3.6% in 2022 and 4.8% in 2023 (Table 1.1). Goods exports will remain robust, despite global shortages of some key components and elevated shipping costs. The sectors most dependent on face-to-face contacts (such as travel and air transport) are predicted to recover more slowly, with important effects on the rest of the economy. An acceleration of capital spending supported by EU funds, including the Recovery and Resilience Facility (RRF), is expected to support medium-term growth. Headline inflation will start slowing gradually in 2022 before rising again in 2023 as the labour market tightens.

Uncertainty is exceptionally high, with substantial downside risks to activity and vulnerabilities (Table 1.2), including those associated with the ongoing pandemic. A major COVID-19 wave began in the late summer of 2021, leading to the imposition of a three-month state of emergency on 11 October. Another wave got underway at the end of 2021 and has peaked only in mid-February 2022. Other downside risks include geopolitical and trade tensions and the process of deglobalisation that might be encouraged by the COVID-19 crisis, which could challenge supply-chain management, impose additional costs on firms and hurt productivity growth worldwide. This could lead to higher inflation in Latvia, notably in the building sector, given the strength of wage gains in a context of lack of capacity, especially of qualified labour. Inflation could be structurally higher than expected, as prices converge with those of wealthier trading partners.

Table 1.1. Macroeconomic indicators and projections

Annual percentage change, volume (2015 prices)

|

|

2018 |

2019 |

2020 |

Estimates and projections |

||

|---|---|---|---|---|---|---|

|

|

Current prices (billion EUR) |

2021 |

2022 |

2023 |

||

|

Gross domestic product (GDP) |

29.2 |

2.5 |

-3.8 |

4.8 |

3.6 |

4.8 |

|

Private consumption |

17.3 |

0.2 |

-7.4 |

4.8 |

4.2 |

5.6 |

|

Government consumption |

5.3 |

3.4 |

2.6 |

4.4 |

1.9 |

2.0 |

|

Gross fixed capital formation |

6.4 |

6.9 |

0.2 |

3.0 |

6.2 |

7.4 |

|

Housing |

0.7 |

3.8 |

-1.9 |

-14.6 |

5.0 |

4.3 |

|

Final domestic demand |

29.0 |

2.3 |

-3.8 |

4.2 |

4.2 |

5.3 |

|

Stockbuilding1 |

0.3 |

0.9 |

0.0 |

5.0 |

-1.1 |

0.0 |

|

Total domestic demand |

29.4 |

3.1 |

-4.0 |

9.2 |

2.9 |

5.1 |

|

Exports of goods and services |

17.9 |

2.1 |

-2.2 |

6.2 |

5.1 |

4.4 |

|

Imports of goods and services |

18.1 |

3.0 |

-2.5 |

13.5 |

4.0 |

4.8 |

|

Net exports1 |

-0.2 |

-0.6 |

0.2 |

-4.2 |

0.6 |

-0.4 |

|

Other indicators (growth rates, unless specified) |

||||||

|

Potential GDP |

. . |

3.0 |

2.8 |

2.7 |

2.8 |

2.8 |

|

Output gap2 |

. . |

0.0 |

-6.2 |

-4.7 |

-4.0 |

-2.0 |

|

Employment |

. . |

0.1 |

-1.9 |

-2.9 |

2.2 |

1.3 |

|

Unemployment rate (% of labour force) |

. . |

6.3 |

8.1 |

7.5 |

6.6 |

6.2 |

|

GDP deflator |

. . |

2.6 |

-0.1 |

6.7 |

4.1 |

2.7 |

|

Harmonised consumer price index |

. . |

2.7 |

0.1 |

3.2 |

4.9 |

2.7 |

|

Harmonised core consumer price index3 |

. . |

2.2 |

0.9 |

1.9 |

3.8 |

2.7 |

|

Household saving ratio, net (% of disposable income) |

. . |

0.1 |

9.1 |

12.9 |

8.2 |

4.9 |

|

Current account balance (% of GDP) |

. . |

-0.7 |

2.9 |

-3.3 |

-2.1 |

-2.3 |

|

General government financial balance (% of GDP) |

. . |

-0.6 |

-4.5 |

-8.7 |

-5.4 |

-3.9 |

|

Underlying government primary financial balance² |

. . |

0.1 |

-1.3 |

-6.2 |

-4.2 |

-3.9 |

|

General government gross debt (% of GDP) |

. . |

48.1 |

56.1 |

61.7 |

65.4 |

67.3 |

|

General government gross debt (Maastricht, % of GDP) |

. . |

36.7 |

43.3 |

49.0 |

52.6 |

54.6 |

|

General government net debt (% of GDP) |

. . |

11.6 |

16.9 |

24.0 |

27.6 |

29.6 |

|

Three-month money market rate, average |

. . |

-0.4 |

-0.4 |

-0.5 |

-0.5 |

-0.5 |

|

Ten-year government bond yield, average |

. . |

0.3 |

-0.1 |

0.0 |

0.0 |

0.1 |

1. Contribution to changes in real GDP.

2. Percentage of potential GDP.

3. Harmonised index of consumer prices excluding food, energy, alcohol and tobacco.

Source: OECD Economic Outlook 110 (December 2021) and updated historical data.

Table 1.2. Potential vulnerabilities of the Latvian economy

|

Vulnerability |

Possible outcome |

|---|---|

|

Renewed major global pandemic. |

This would most likely lead to new containment measures that would reduce economic activity and employment and worsen the public finances. The impact on the external balance would be unclear. |

|

Geopolitical risks eventuate or global trade tensions deepen. |

Geopolitical tensions or disruptions to trade could jeopardise exports and investment. |

|

Deglobalisation results in the disruption to or even dismantling of some supply chains. |

Even though Latvia is not a major player in GVCs (Chapter 2), its economic integration in Europe means it would suffer from stagflationary effects. |

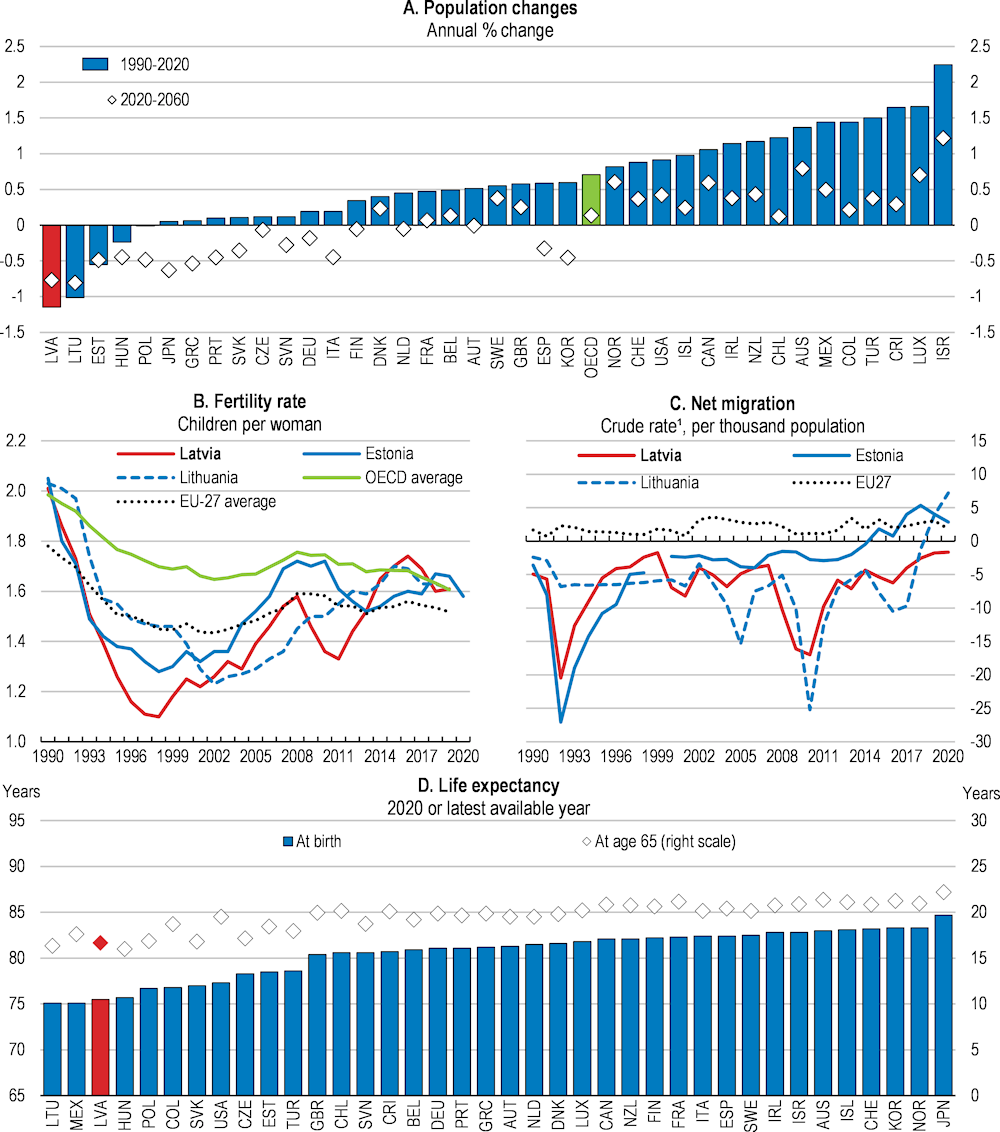

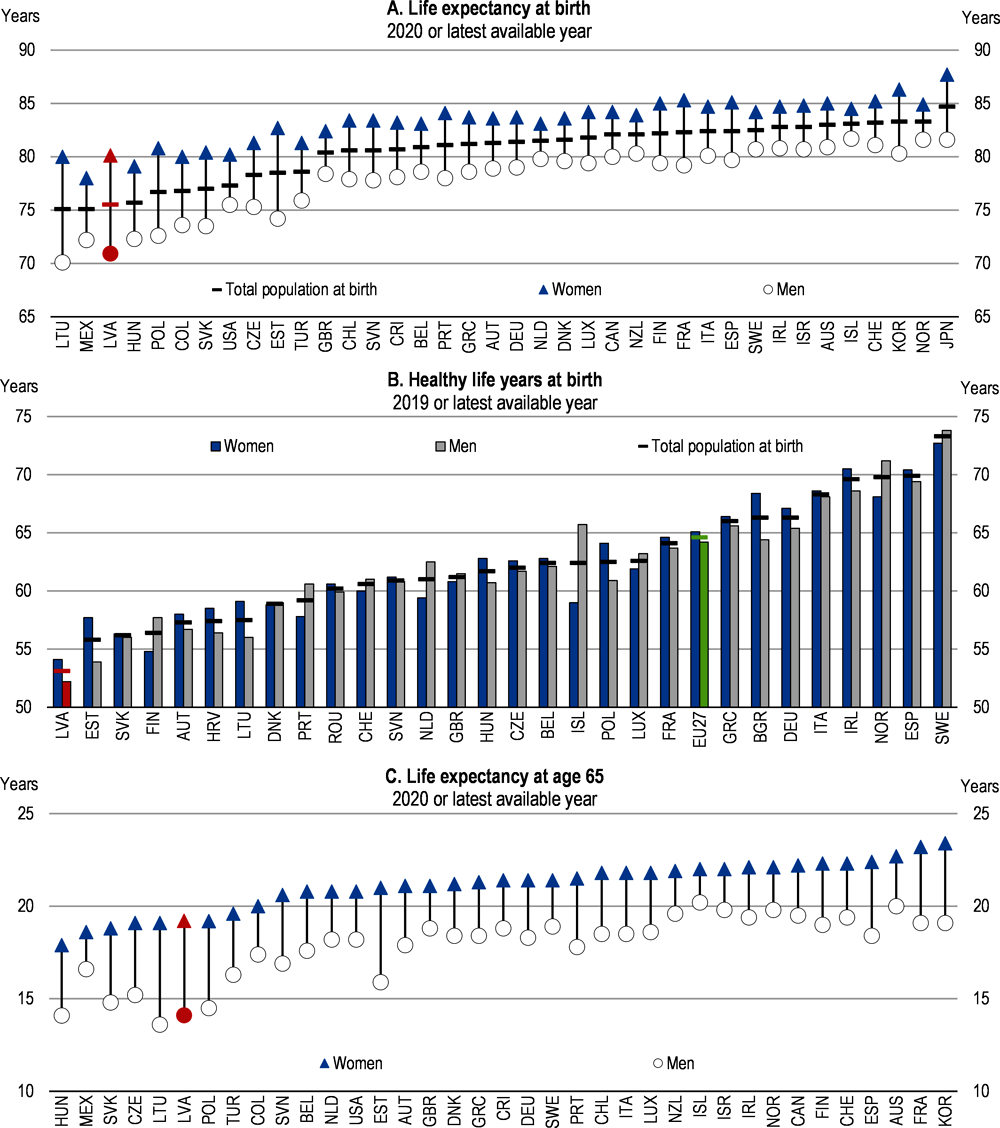

There are a number of factors influencing the medium-term strength of the expansion and the pace of living-standard convergence with more affluent nations. Foremost among these is the ongoing demographic shrinkage (and the associated loss of agglomeration benefits) from natural population decline due to a low fertility rate and negative net migration (though official projections show this to be reversing to a small net population gain in the coming few years). This downward pressure has been limited thus far because of the absorption into the working-age population of a modest baby boom in the 1980s but should begin to bind seriously going forward. Labour supply could also be limited by the poor health of some groups, notably older working-age men, whose harmful lifestyle choices – most prominently heavy alcohol consumption – limit their capacity for work in too many cases (see below).

Some traditional activities are also facing or are likely to confront negative structural shocks. In particular, the markets for trans-shipment of Russian commodities (notably coal) for re-export through Latvian ports as well as for east-west financial transactions from the former Commonwealth of Independent States are likely to be eventually lost. In addition, there are threats to the trucking sector from the EU-proposed Mobility Package I, which would require that vehicles return to their country of origin every eight weeks starting 21 February 2022; to the forest products sector from the EU Biodiversity Strategy for 2030; and to a broad swath of the economy from the gradually worsening (mainly indirect) effects from climate change and from the policy uncertainty surrounding how that will be dealt with.

On the other hand, there are considerable opportunities if the appropriate policy changes are made. Such reforms and investments would place Latvia’s entrepreneurs in a better position to seize the chance to move up the value chain, notably in food (such as dairy) and wood products, where downstream integration has been quite limited thus far, and to promote expanded exports in innovative products and services held back by a lack of R&D (Chapter 2). Considerable EU and national funding amounting to an average of around 6% of GDP per year is available that could help to address structural challenges, assuming good project selection and execution: from the Recovery and Resilience Fund, part of which is to be allocated to a National Reindustrialisation Plan; from Cohesion Funds; from the Common Agricultural and Fisheries Policies; and from deemed new domestic fiscal space (see below). But some of these funds would also best be spent on tackling the drivers of the major equity challenges Latvia faces.

Fiscal and tax policies need to focus on supporting both growth and inclusion

Fiscal policy has moved robustly to counter the pandemic

On the eve of the COVID-19 pandemic at end-2019 Latvia’s general government deficit was less than 1% of GDP and its Maastricht debt 37% of GDP. With considerable assets (mainly in the form of currency and deposits), Latvia’s net public debt was less than 12% of GDP, and its sovereign credit ratings had improved. While almost three-quarters of its public debt is held by non-residents, none is denominated in foreign currency.

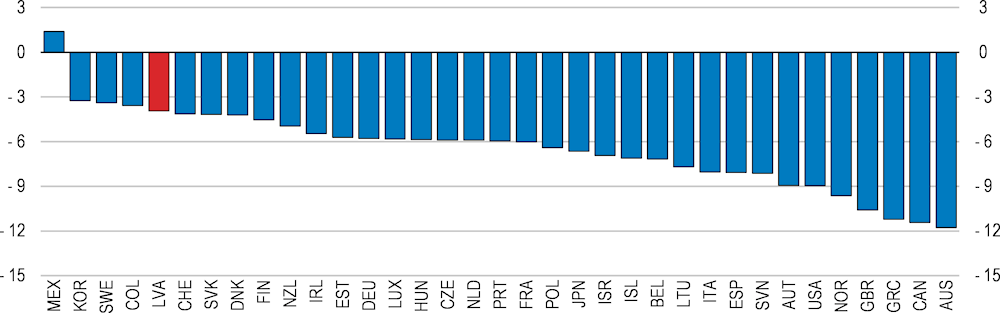

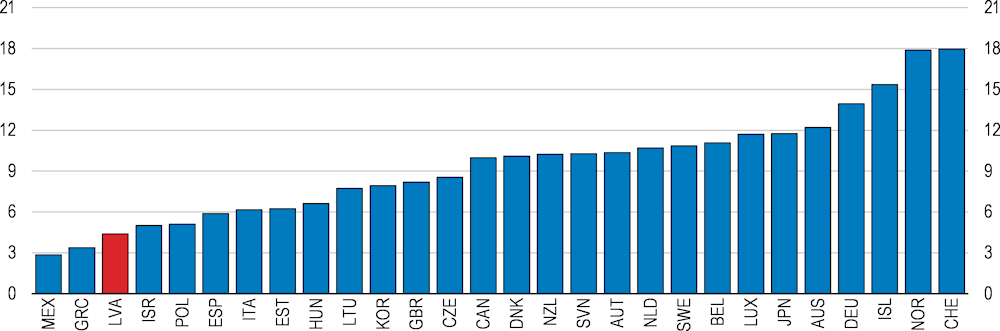

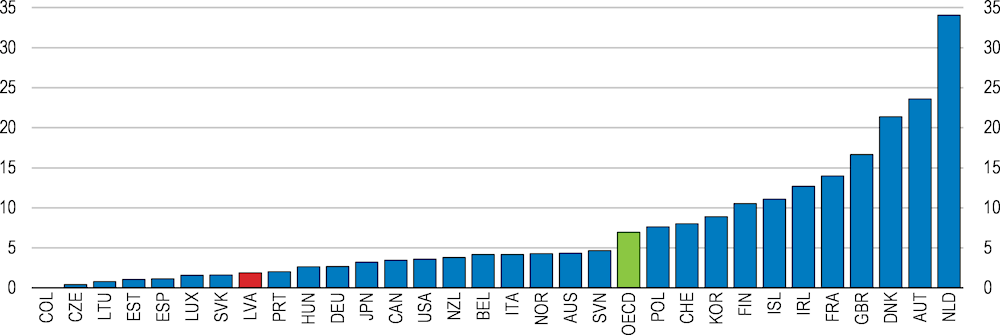

To counter the pandemic the authorities extended substantial policy support, albeit less than in most other OECD countries (Figure 1.4), largely because less was needed in the absence of a severe first wave of COVID-19 in Latvia in the spring of 2020. The 2020 deficit increased by 4 percentage points of GDP and debt by around 6.5 points. Most of the fiscal expansion is judged to be cyclical. However, late in 2020 the authorities made more substantial moves to shore up business and household finances; these have caused a sharp increase in the deficit (Box 1.1). It also took steps to counter the effects of surging energy prices late in 2021.

Box 1.1. Measures taken by Latvia to mitigate the COVID-19 crisis

Early in the crisis, the authorities developed “Latvia’s Strategy to Mitigate the Negative Impact of the COVID-19 Crisis”, published on 26 May 2020. Wisely, the Strategy did not focus solely on overcoming the short-term effects of what would prove to be a downturn of unknown duration and severity. It went further and described the medium-term measures that would align with the government’s goals. There were to be five “action lines”: human capital, innovation, business environment for export capacity, access to finance and infrastructure; and these were to be implemented in three phases: economic stabilisation, reorientation and growth. The Strategy served as the basis for the follow-on National Industrial Policy Guidelines for 2021-2027, which was released in August 2020. That document set specific and ambitious quantitative objectives for exports and R&D for 2023 (when stabilisation and reorientation were assumed to be completed) and 2027.

The most recent (October 2021) update on support measures in 2020-22 can be found in Republic of Latvia ( (Republic of Latvia, 2021[3]), Table A). According to Ministry of Finance data from early January 2022, total support including sectoral budget financing, personal benefits, tax payment deadline extensions, loans and guarantees, and spending of additional EU funds amounted to 4.4% of GDP in 2020, 7.2% of GDP in 2021 and 3.3% of GDP planned in 2022. The main items in 2021 have been: 1) a one-time payment of 500 euros for each child(which cost EUR 188 million); 2) a one-time payment of 200 euros for retirees and people with disabilities (which cost EUR 110 million); 3) extra spending for health care (EUR 559 million, including EUR 165 million in bonuses for doctors) and transport (EUR 228 million); and 4)business loans for working capital worth 30% of gross compensation in October-November 2021 up to a ceiling of 100000 euros per month available to firms whose turnover was down at least 20% or 30% (depending on other criteria) from the corresponding period of 2019/2020(EUR 513 million thus far). Substantial short-time work compensation benefits (EUR 136 million) and wage subsidies (EUR 33 million) were also disbursed. In all, an estimated 6.9% of GDP was provided in 2021 (Republic of Latvia, 2021[3]).

Figure 1.4. Fiscal support in the first year of the pandemic was adequate

General government financial balance, % of GDP, change between 2019 and 2020, % pts

According to 2022 budget projections, baseline economic assumptions result in a deficit of 4.8% in 2022, 2.1% in 2023 and 1.3% of GDP in 2024, following 9.3% in 2021, and see Maastricht debt at 51.7% of GDP at the end of 2022, almost 15 percentage points above pre-pandemic levels. The budget includes measures to fund additional public investment and COVID-related measures in 2022 (0.8% of GDP for each), but spending as a share of GDP will fall by 4.2 percentage points, of which 1 point is in health and education. Two key redistributive policy measures were included. First, there was an increase in the non-taxable minimum in the personal income tax system from 300 euros per month (330 euros per month for pensioners) to 350 euros per month in January 2022 and then 500 euros per month in July 2022, at a budgetary cost of 153 million euros (almost a half per cent of GDP) annually once fully implemented. Second, family benefits were increased to up to 100 euros per month per child for households of four or more children (less for smaller families) at a cost of 91 million euros per year (0.3% of GDP).

Nevertheless, there are grounds for caution in assessing the fiscal outlook in the short and medium terms. First, the budget assumes a steady and sizeable acceleration in potential growth of a full percentage point in the coming few years, much of it in 2022. This allows the projected pickup in actual growth to be absorbed without as much pressure on resources and thus on domestic interest rates. Second, fiscal demands are multiplying, including for lower taxes on labour and more pay for health-care workers and teachers (see below). Third, the impact of further extensions of the COVID-19 crisis could prove more costly for the budget. The Fiscal Discipline Council early on predicted that debt could exceed 50% of GDP already in 2022, an outcome now shared by the latest OECD Economic Outlook and the official budget forecast. Finally, interest rates could rise earlier than expected, forcing up debt service. The latest EU Debt Sustainability Monitor (February 2021) placed Latvia as one of 11 countries that are at short-term risk of fiscal stress, though it foresaw no medium- or long-term risks, despite the continuing population shrinkage and ageing. Latvia has had a system of fiscal rules for a number of years (Box 1.2), and they have been fully complied with for the most part (Bova and Manescu, 2020[4]). Owing to the COVID-19 crisis the European Union’s (and Latvia’s) rules have been in suspension since 2020, and this will be the case again in 2022. Otherwise the Fiscal Discipline Law would have required the central government to take the tightest of its various fiscal rules in order to set its spending ceiling. Of course, with its Maastricht debt at around 50% of GDP (and net debt much smaller still), Latvia is well below the ceiling of 60% of GDP. Discussions are underway at the EU level as to what should be implemented in 2023. There are a variety of proposals on the table, but two worthy of mention include a call for an increase in the Maastricht debt ceiling to 100% of GDP in combination with a spending rule in line with trend output growth (Francová et al., 2021[5]) and the replacement of fiscal rules by standards plus a stochastic debt sustainability analysis (Blanchard et al., 2021[6]). Latvia may want to return to even tighter national fiscal rules in order to maintain a sound fiscal position, reduce policy pro-cyclicality and enhance public spending efficiency.

Box 1.2. Latvia’s fiscal framework

Prior to their suspension in 2020, Latvia had a complex set of fiscal rules, notably: 1) the EU maximum general government deficit of 3% of GDP and a target structural budget balance of -0.5% of GDP; and 2) a maximum real general government spending increase (net of interest, EU funds, smoothed capital outlays, cyclical unemployment spending and discretionary revenue measures) that does not exceed average potential GDP growth over the decade ending in year t+4. This is then subjected to a separate “inheritance rule” from the previous Medium-Term Budget Framework based on the latest growth of certain spending items like pensions, social spending, EU funds and interest that can shift the ceiling by no more than 0.1% of GDP.

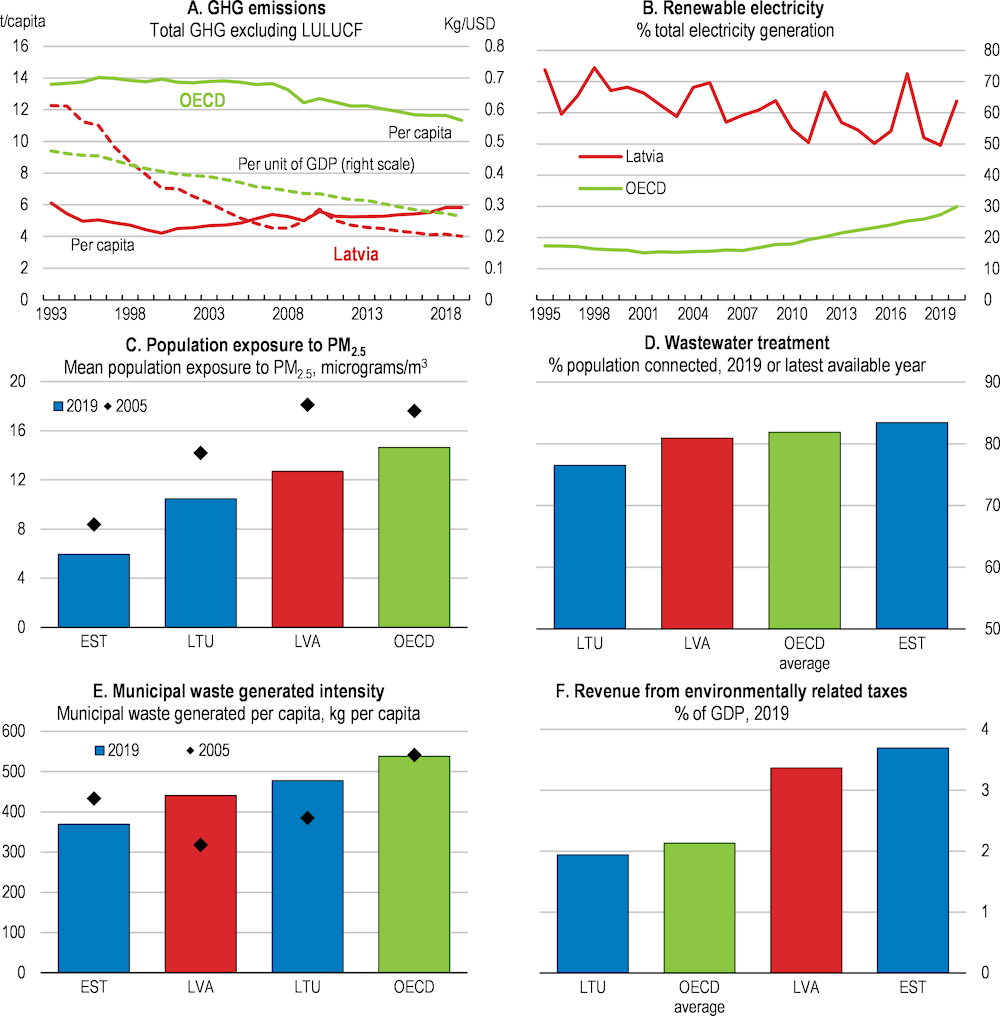

Besides deciding what to do with the considerable EU funding that will be available in coming years and to ensure spending bottlenecks are avoided (Box 1.3), the authorities need to devise a credible fiscal strategy, including effective associated fiscal rules, to almost eliminate the structural deficit if they wish to restore flexibility to handle future unexpected shocks and control debt in the long term (Figure 1.5). The pace of consolidation implied in the short term and the small deficit permitted thereafter (0.3% of GDP, in line with the government’s medium-term objective) are key to achieving this (even though government debt is not quite stabilised), while at the same time allowing the financing of several equity-enhancing spending demands on the budget as well as foreseeable future spending pressures related to climate change and the low-carbon transition, and ageing. The latter will be felt largely only on health and long-term care (all of these are discussed below). The present policy settings assume that (gross) public pension replacement rates will shrink from 55% to 20% over the coming half century, which seems difficult to sustain, even accounting for the system of funded private pensions that will provide about a third of future pension income. Nevertheless, if non-contributory old-age benefits are raised in line with median incomes every year starting in 2023, as planned, that will impose a rising fiscal cost, though it will prevent worsening old-age poverty. Part of the fiscal strategy should also be to improve spending efficiency. That is being enhanced by an inter-agency spending review process that has been underway since 2016 and has generated EUR 341 million in cumulative savings. The scope of the review each year is defined and approved by the government as is the destination of any funding reallocations. It has also involved the adoption of best-practice tools for budget openness and accessibility, which inform citizens in an interactive and visible way about the areas in which and the extent to which taxpayers' money is being spent and what results are expected.

Box 1.3. Substantial government investment is expected, supported by EU funds

Latvia is expected to receive a substantial amount of EU resources from 2021 to 2027. The lion’s share is expected to come from the Cohesion Funds (almost EUR 5 billion, about 17 per cent of 2020 GDP). In addition, Latvia is one of the largest recipients of grants under the Recovery and Resilience Facility (RRF): EUR 2.02 billion (about 6.7 per cent of 2020 GDP), of which EUR 1.85 billion has been already approved. The remainder will be allocated in 2023 based on the economic situation. According to the Ministry of Finance, government investment is planned to reach its peak in 2024 and then decline gradually. These funds will have a large effect on real GDP: an IMF simulation suggests that an increase in capital expenditure of ½ per cent of GDP per year could increase real GDP growth by 0.7 per cent above baseline projections over the medium term. Accordingly, it would be wise to ensure sufficient fiscal space exists in the national budget to take up the slack of declining EU support after 2024.

A significant share of the RRF funds will be devoted to climate change and digital transition. The authorities intend to allocate 37% for climate-related measures, 20% for the digital transition, 20% for reducing inequality, 11% for health care, 10% for economic transformation and 2% for promoting the rule of law. Several issues should be addressed to ensure an efficient allocation of funds. First, as the Fiscal Discipline Council has argued, the use of these funds should be coordinated with other national planning documents, especially the National Development Plan, to avoid spending bottlenecks, create synergies and boost effective multipliers. Second, all outlays should be subject to rigorous cost/benefit analysis and preferably be justified by assessing their strategic payoff. Third, the authorities should aim to reduce efficiency gaps in the public expenditure process, particularly on project appraisal and management of Public-Private Partnerships. Fourth, to avoid overheating in the construction sector, Latvia should make it easier to issue work permits for construction employees from outside the European Union and support firms embracing digital technologies that increase labour productivity (Chapter 2).

Source: (IMF, 2021[7]).

Figure 1.5. A fiscal consolidation strategy is needed to prepare for ageing pressures

General government debt, Maastricht definition, as a percentage of GDP

Note: The offsetting-ageing-costs scenario assumes a primary general government balance of -1% of GDP from 2024. The without-offsetting-ageing-costs scenario assumes that increased spending on health, long-term care and pensions will add 1.8 percentage points of GDP to annual government spending at the peak in 2055 and 1.6 percentage point of GDP by 2060, in line with European Commission (2021). An increase of 0.8 per cent of GDP by 2060 is due to a rise in spending on health and long-term care, and another 0.8 per cent is due to a rise in public pension spending that is greater than the increase in the contributions. The consolidation scenario assumes a primary balance of -0.3% of GDP from 2024, in line with the medium-term objective of the government.

Source: OECD Economic Outlook 110 database; (Guillemette and Turner, 2021[8]); (European Commission, 2021[9]).

Box 1.4. Quantifying the GDP and fiscal impact of proposed structural reforms

The estimated impact of some key structural reforms proposed in this Survey are calculated below using historical relationships between reforms and growth in OECD countries (Table 1.3). As these simulations abstract from detail in the policy recommendations and do not reflect Latvia’s particular institutional settings, the estimates should be seen as purely illustrative.

Table 1.3. Illustrative economic impact of some reforms proposed in this survey, after 10 years

|

GDP per capita (%) |

Through employment |

Through productivity |

|

|---|---|---|---|

|

Spending on active labour market policies, per employed, as a share of GDP, is increased to reach approximately 75% of the level of the OECD average |

1.4 |

0.9 |

0.5 |

|

Business R&D spending is increased by 0.2% of GDP |

0.3 |

- |

0.3 |

|

The pension age is increased by half a year |

0.5 |

0.5 |

- |

|

Tax increases to fund the extra spending |

-0.4 |

-0.2 |

-0.2 |

|

Total |

1.8 |

1.2 |

0.6 |

Note: All reforms are assumed to be implemented immediately.

Source: OECD Long-term model and J. Arnold (2008), "Do Tax Structures Affect Aggregate Economic Growth?: Empirical Evidence from a Panel of OECD Countries", OECD Economics Department Working Papers, No. 643, OECD Publishing, Paris.

The following estimates (Table 1.4) roughly quantify the long-run fiscal impact of selected structural reforms proposed in this Survey. Since the assessment of the reform impact of recommendations on GDP is estimated in a budget-neutral way, it already incorporates any negative effect of GDP of tax increases described in this box. The fiscal estimates below do not take into account any consequent effects of reforms on GDP and hence fiscal revenues, because these seem too uncertain. The sum of the reforms is deliberately deficit-reducing because this Survey calls for eventual fiscal tightening.

Table 1.4. Illustrative budget impact of recommended fiscal/structural reforms

|

Measure |

Fiscal balance effect (% of GDP) |

|---|---|

|

Deficit-increasing measures |

1.5 |

|

Increase the Guaranteed Minimum Income and taper its withdrawal1 |

0.4 |

|

Boost spending on Active Labour Market Policies, notably in training2 |

0.2 |

|

Increase spending on health and long-term care |

0.5 |

|

Provide more public funding for affordable rental and social housing, and/or enrich housing benefit3 |

0.2 |

|

Provide more means-tested financial support for tertiary students |

0.1 |

|

Improve wages and conditions for researchers, and provide incentives to collaborate with industry |

0.1 |

|

Offsetting tax measures |

2.2 |

|

Increase effective corporate income tax rates |

0.3 |

|

Increase personal tax progressivity4 |

0.2 |

|

Increase selected excise taxes and remove subsidies for the energy sector5 |

0.3 |

|

Increase excise tax on undertaxed forms of alcohol, smoking tobacco and other products containing nicotine |

0.1 |

|

Increase real property tax, implement a gift/estate tax and/or deem capital gains to be realised at death6 |

0.5 |

|

Accelerate efforts to fight informality and tax evasion |

0.8 |

Notes: The policy changes assumed for the estimation are the following:

1. The Guaranteed Minimum Income is increased to 20% of the median income with a tapering of the withdrawal, a variant of the calculation in (European Commission, 2018[10]).

2. Spending on active labour market policies as a share of GDP (0.18%) is increased by 0.2 percentage points to reach approximately 75% of the level of the OECD average (0.48%); see Figure 1.11 below.

3. Public funding for housing allowances as a share of GDP (0.05%) is raised to the OECD average (0.27%), for example.

4. Progressivity of the personal income tax is increased, as described in (Rastrigina, 2019[11]).

5. Changes in the energy tax regime consist of harmonising the tax rate for diesel, oil products and gasoline, removing subsidies for natural gas and raising excise on heating fuel.

6. The gap in property tax as a share to GDP between Latvia (0.9%, according to OECD Revenue Statistics) and the OECD average (1.9%) is halved, for example.

Source: OECD calculations.

Fiscal policy could also do more to reduce poverty

As described above, Latvia has an unequal distribution of income and wealth. Only the poorest 2% of the population are classified as “needy”, as distinct from “low-income” households, whose definition is locally determined within a range. Fiscal redistribution only moderately reduces disparities in market incomes, less than in a majority of OECD countries (Figure 1.6).The first channel for income redistribution is the progressivity of public spending in the form of cash transfers to households (apart from in-kind social spending on education and health care, which are excluded from such analysis). However, social benefits are low in relation to GDP, below Lithuania’s (though catching up) and well below Estonia’s. There is also a tax-free Guaranteed Minimum Income to which all are entitled as a form of social welfare, but it remains modest, despite very recent increases: it is the amount needed to reach a threshold defined in 2021 as 109 euros per month for the first person and 76 euros per month for each subsequent member of the household. It is subject to an assets test; various forms of income and assets are exempt from inclusion; and it is granted for either three or six months, though renewals are allowed. The 2019 Economic Survey recommended 0.5% of GDP be devoted to raising it to 40% of median income (rather than the much lower level of officially defined “needy” income) for those who cannot work (20% for those who can) so as to lower poverty by 9 percentage points (OECD, 2019[12]).

The second main mechanism for redistribution is through taxation. Latvia’s GDP share of corporate income tax is one of the lowest in the OECD. The logic is to attract business activity, notably in the way of foreign direct investment. The tax, levied only on distributed profits, is borne mainly by the affluent, as opposed to the growing GDP share of taxes on goods and services (now fifth-highest in the OECD), which are slightly regressive (though tax systems’ distributional effects should be judged in combination with the benefits side of the ledger). The global agreement on minimum effective corporate tax rates could lead Latvia to collect more corporate income tax once the European Union issues the resulting directive that implements the Pillar Two rules (OECD, 2020[13]): indeed, recent private estimates point to a gain of 100 million euros (over 30%) if the internationally agreed floor rate is 15% ( (Barake et al., 2021[14]), Table 2). Latvia’s statutory personal tax rates have been somewhat progressive only since 2018, with little evidence thus far on the impact of that change. Currently tax-based redistribution comes through the Solidarity Tax of 25% imposed on individual income earned above the threshold for payment of social insurance contributions (in 2021 above 62800 euros), though this is paid by very few taxpayers. Indeed, the proceeds of the Solidarity Tax in 2021 are forecast to be only 57 million euros (0.2% of GDP). Progressivity is achieved by the presence of a differentiated non-taxable minimum, a tax allowance that is not available to those earning above a certain income threshold, currently 1800 euros per month. In principle, greater progressivity of personal income tax rates (though that would be likely to encourage tax evasion and avoidance and dull work incentives more generally), a higher Solidarity Tax rate or a larger non-taxable minimum could all increase fiscal redistribution in the medium term. In any case the amount of redistribution achieved by the tax and transfer system should be monitored regularly.

Figure 1.6. Taxes and transfers do not moderate income inequality much

Household income distribution, Gini coefficient¹, 2019 or latest available year

1. Scale from 0 "perfect equality" to 1 "perfect inequality",

Source: OECD Income Distribution database (IDD).

Much of Latvia’s income disparity is geographically determined (see below). The east of the country is much poorer than average. Three-quarters of the take from the personal income tax goes to the municipalities, which would seem to allow them to handle such challenges. However, the potential to overcome them is constrained by taxing entirely based on residence (which is a common practice among OECD countries). One result is that increasingly the city of Riga lacks a lucrative tax base compared to the surrounding Pieriga region, home to many commuters.

Finally, there are some missed opportunities to achieve a fairer distribution of income and wealth and gain tax revenues as well. First, recurrent property tax is low compared to the OECD average both relative to total tax revenues as well as GDP. The previous Survey called for increasing it to the average GDP share in the OECD, which implies an increase of 0.8 percentage point of GDP. However, the authorities believe that low recurrent property taxes are a crucial determinant of competitiveness, at least with its Baltic neighbours: Estonia has no such tax at all, while Lithuania’s is zero for those whose homes have cadastral values of less than EUR 150000. They also fear that many homeowners could not afford any further tax burden, having acquired their homes for paltry sums when they were privatised at independence. Yet, competitiveness considerations are likely to pertain only to those applied to business properties, and a revenue-raising reform could avoid taxing low-value residential properties by having a minimum threshold below which such houses are not taxed. Secondly, the redistributive effectiveness of the tax system is limited by the lack of a gift or estate tax in Latvia (OECD, 2021[15]), though personal income tax is levied on recipients other than the spouse and children of the donor/deceased. Furthermore, unrealised capital gains are exempt at death and transferred with a step-up in basis (the unrealised capital gain is not taxed possibly over multiple generations). Latvia could either impose a more complete system of gift/estate taxation or deem all capital gains to be realised at death (as is done in Canada, for example) or at least not allow a step-up in basis (as is done in Australia) to avoid intergenerational transfers that yield increasingly concentrated wealth. Admittedly, however, it is unclear how much additional revenue this would raise despite high administrative costs, and it might have modest negative effects on saving incentives.

Table 1.5. Past OECD recommendations on taxation and spending

|

Topic and summary of recommendations |

Summary of action taken since 2019 Survey |

|---|---|

|

Raise more taxes from the taxation of real estate and energy. Ensure that energy taxes are uniform across fuels and uses. |

Energy taxes are heavily constrained by cross-border shopping, but scope exists to increase taxes on natural gas, diesel and home heating fuels over time. The authorities see property taxes as equally constrained by competitiveness concerns as well as affordability problems for many who acquired their homes at independence. |

|

Phase out the microenterprise tax regime. |

Its features are being made less attractive: applicable rates are being raised in 2021; no new firms are being admitted; only unincorporated firms are able to access it; and their employees are now subject to personal taxation. However, salary restrictions are being abolished. The number of declarations and employees has fallen sharply in the past few years to below 20000 and 34000, respectively, per quarter. |

|

In the longer run consider further steps to make the personal income tax more progressive. |

In 2018 a progressive tax schedule was introduced. It has three rates of 20%, 23% and 31%. But the system overall does not achieve much redistribution. Another important source of tax-based redistribution is the differentiated non-taxable minimum, which is being raised from 300 euros per month (330 euros per month for pensioners) in 2021 to 350 euros per month for the first half of 2022 and then 500 euros per month in the second half. |

The financial system is sound, but credit provision could be improved

Banks, especially the larger ones, are in good financial shape

Latvia’s banks are well capitalised, have ample liquidity, sound profitability and moderate costs. None were allowed to pay dividends last year during the COVID crisis. Yet a number of banks that had previously focused on serving foreign customers, in particular from CIS countries, have been continuing to feel the loss of that business in recent years. The sector’s assets began to fall in 2016 (though the declines have ended in the pandemic with the rise in household deposits and banks’ participation in the ECB’s TLTROIII operations). At the same time nonbanks, notably fintechs (see below), have been gaining market share, presumably by providing more competitive pricing. However, intermediation has been weak, and credit constraints are widespread.

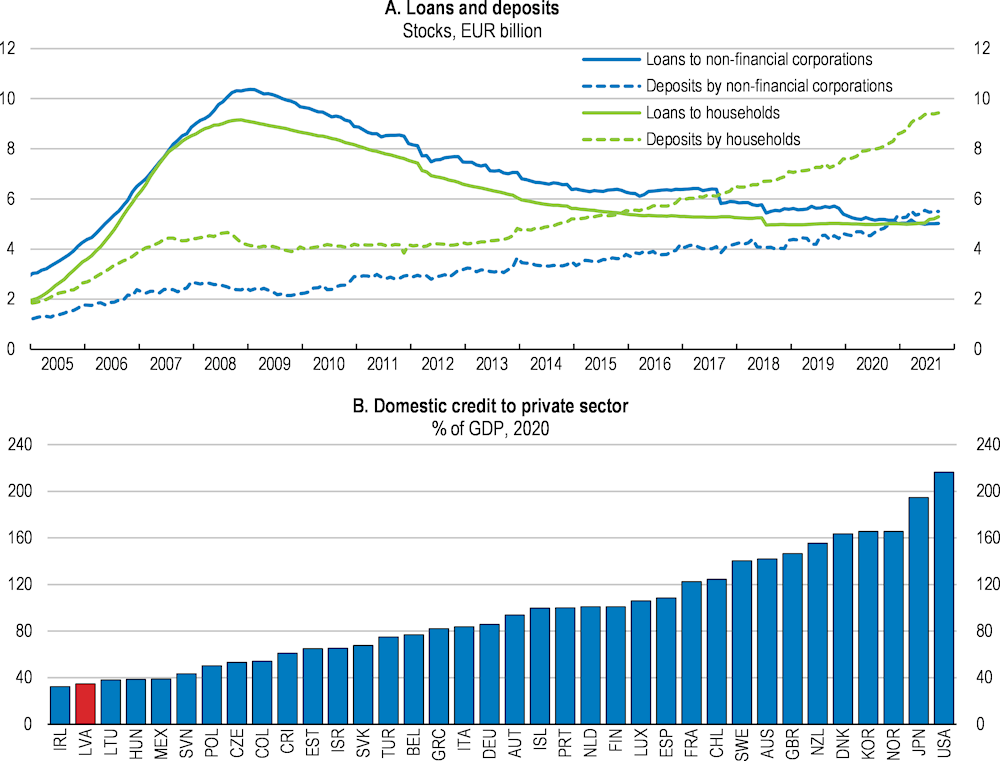

Credit growth is modest

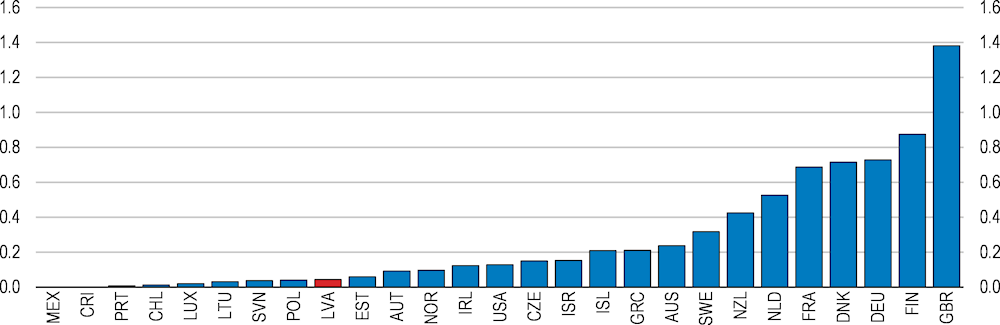

The Global Financial Crisis hit the Latvian economy hard, its financial system in particular. One sign of the ensuing strain was the failure of Latvia’s second-largest bank in 2018, while another is still visible in the form of substantial financial-risk and credit aversion. Most Latvian households and firms take on little debt and try hard not to fall behind in their repayments. Banks maintain tight credit standards and high credit spreads in their credit-evaluation models despite marked improvement in the business environment. However, there is still EUR 500 million in payday loans outstanding, though that has been shrinking; the regulatory ceiling on the interest rate on such loans is 0.07% per day (29.1% per annum).

The growth in credit demand has long been weak, as exemplified by the outstanding stock of loans to nonfinancial corporations (NFCs), which has been falling year on year since the end of 2019, while their household counterpart has been largely unchanged for some time now (Figure 1.7). On the other hand both NFCs and households have seen double-digit growth in low-risk deposits over that period, as spending has been curtailed and involuntary saving has accrued because of government-imposed pandemic-related restrictions. Households’ debt-service ratio is low and fairly flat across income, wealth, age and household-size classes. Overdue loans (30-90 days) have been rising slightly for NFCs in recent quarters but are still trending down for households, as well as for foreign clients for whom they are still high. Nonperforming loans are the lowest in a decade at 4.7% for the top four banks in 2020 but much higher than that for their smaller rivals. These outcomes do not appear to have been attributable to the debt-service moratoria introduced in the wake of the pandemic, nearly all of which expired by mid-year 2021: early indications are that no significant change in asset quality has been observed since then.

Figure 1.7. The banking system is not providing much credit to the economy

Nonetheless, there are some signs that credit supply remains impaired. One is the relatively high lending rates: for example, rates on new loans to nonfinancial corporations in 2020 were more than double those in the average euro-area country. Furthermore, Latvia (like its Baltic neighbours) is among a small number of such countries which have not seen a significant decline in the past five years. In principle, this could be explained by the associated risks, but recent Bank of Latvia research shows that the quality of Latvian banks’ loan portfolios, their funding costs and other conventional factors thought to affect lending rates do not go far in explaining them (Benkovskis, Tkacevs and Vilerts, 2021[16]): indeed, lending rates faced by Baltic nonfinancial corporations are among the highest in the euro area, once such factors are accounted for.

Access to credit was tight prior to the pandemic and is likely to be still so. The latest ECB Household Finance and Consumption Survey found that 8.8% of all households were credit-constrained in 2017, fifth most among the 20 countries included. Especially hard hit were larger and younger households, renters and those still paying off mortgages, and those having low net wealth and who are without tertiary education (Bank of Latvia, 2020[17]). Although getting credit was ranked relatively highly by Latvian firms (15th) in financial-sector stability by senior executives in autumn 2020 (Sauka, 2021[18]), access to finance was a major barrier to investment in mid-2020 cited by 14% of 370 firms surveyed by the European Investment Bank (2020[19]), compared to the EU average of 6%. Dissatisfaction with the cost of external finance was expressed by 16% of firms, well above the 5% average EU outcome, and with the amount of collateral demanded by lenders by 14%, double the EU-average share. Not surprisingly, micro and small firms were less satisfied than their larger counterparts. Low debt-recovery rates in bankruptcy proceedings no doubt force up lending rates (Chapter 2).

The government’s response to the structural challenges of overcoming the nation’s lag in capital markets and building a culture of investment, including in green finance, in part through supporting fintech development, as well as the global move to greater digitalisation in the sector came in its Financial Sector Development Plan 2021-2023. These goals overlap substantially with improving financial literacy, which is now the subject of efforts starting with children in kindergarten. OECD evidence shows that Latvian adults have satisfactory financial knowledge, but below-average behaviour and attitudes (OECD, 2020[20]); men seem to have worse outcomes than women.

Fintech has the potential to lessen the access problems just described and intensify competition with traditional finance providers, but how much it could lower borrowing costs is still unclear. It has been developing steadily in Latvia. Progress has occurred thanks in part to the European Union’s Revised Payment Services Directive, which largely took effect in January 2018 and was designed to encourage both competition and innovation in a digitalising world. The sector had 91 start-ups in Latvia as of spring 2020 (Swedbank, 2020[21]), but only eight had more than 50 employees. Surveyed firms cited the ease of doing business, the talent pool, friendly regulation and government support most frequently as their reason for setting up in Latvia. Their main complaints were about available sandboxes and incubators/accelerators, even though there are 13 incubators in Latvia. Many pointed to the difficulty of hiring IT specialists who were mostly seen as unavailable or lacking the required skills (Chapter 2).

The allocation of capital is also determined by business exit. In that regard Latvia has a bankruptcy system that favours liquidation (see Chapter 2). Yet it also has benefited from a number of other recent reforms that should prove constructive in the medium to longer term (Table 1.6).

Table 1.6. Past OECD recommendations on the allocation of capital

|

Topic and summary of recommendations |

Summary of action taken since 2019 Survey |

|---|---|

|

Improve the quality and speed of court judgements through training and specialisation of judicial staff. |

The Economic Court started its work 31 March 2021 and had already reviewed 85 cases by early September. Its judges were selected in a five-round procedure. A new Latvian Judicial Training Centre is to be established, financed by RRF funds. Other procedural changes are being implemented according to recommendations made in early 2021 by the State Audit Office. |

Progress is being made in the long battle against informality and corruption

Informality in the labour market is severe

Informality has been a long-standing problem in Latvia (OECD, 2019[12]) (Sauka and Putniņš, 2021[22]). It manifests itself primarily in underreporting of hours worked and wages paid (so-called “envelope wages”), rather than people working completely off the books, i.e. without a contract (even though such workers are 10.9% of the total, compared to 8.3% in Lithuania and 5.7% in Estonia) (Sauka and Putniņš, 2020[23]). Estimates of the size of the underground economy vary from 16.6% (Medina, Schneider and Fedelino, 2018[24]) for 2015 to 25.5% (Sauka and Putniņš, 2021[22]) for 2020, up moderately from the previous year, possibly because of the pandemic. The government’s goal is to reach the EU average of 17% by 2022.

A research programme began at the Ministry of Finance in 2020 to help inform a future action plan. It should attempt to assess the motivation for such practises, including the role of policy settings in taxation and mandatory contributions, and labour market laws and regulations (as well as tougher enforcement). For example, France’s experience with reducing informality in home services by offering a tax credit to employer households has been quite successful.

The payoff from greater formalisation would of course be higher tax receipts but also likely better training opportunities and working conditions and more reliable pension records (which would help to curb old-age poverty). The State Revenue Service (SRS) believes the personal income tax gap to be around 17% overall but an estimated 30.7% in construction in 2019, though that is down from around 40% in 2015 (Sauka, 2020[25]). In that sector, in addition to a 2019 agreement with employers to pay minimum hourly and monthly wages, a special system has required all workers to clock in and out of work with a computer chip since February 2020. Otherwise, the SRS makes use of banking information to look for disparities between outlays and declared income and maintains a permanent working group on the strategic risk of “envelope wages”. In 2025 electronic invoicing will be mandatory for all transactions between businesses. There is also a tax gap for VAT, whose size has fallen sharply since 2010. Sauka and Putnins (2020[23]) estimate that 8.0% of all enterprises in Latvia are unregistered, compared with 9.2% in Lithuania and 4.0% in Estonia.

The penalties for tax evasion are now severe, and this greater latitude should be fully utilised in practise, with vigorous enforcement of not only tax but labour laws and regulations as well. If the amount evaded exceeds about 25000 euros, it is considered a criminal offense with up to 10 years of imprisonment. One other form of potential evasion has been banned: it has been illegal to use cash in real estate transactions since May 2019. As well, transporting over 10000 euros across the border has required a declaration since July 2019. Finally, a Plan to Reduce the Shadow Economy is in the process of being adopted by the government (Republic of Latvia, 2021[26]). It aims to shrink the share of the shadow/informal economy to the average share observed among EU countries, which, according to one estimate, would entail a decline of 3.6 percentage points of GDP (about 18% of the total shadow economy) and describes in some detail 41 measures in five action areas. A review of progress is due in 2023.

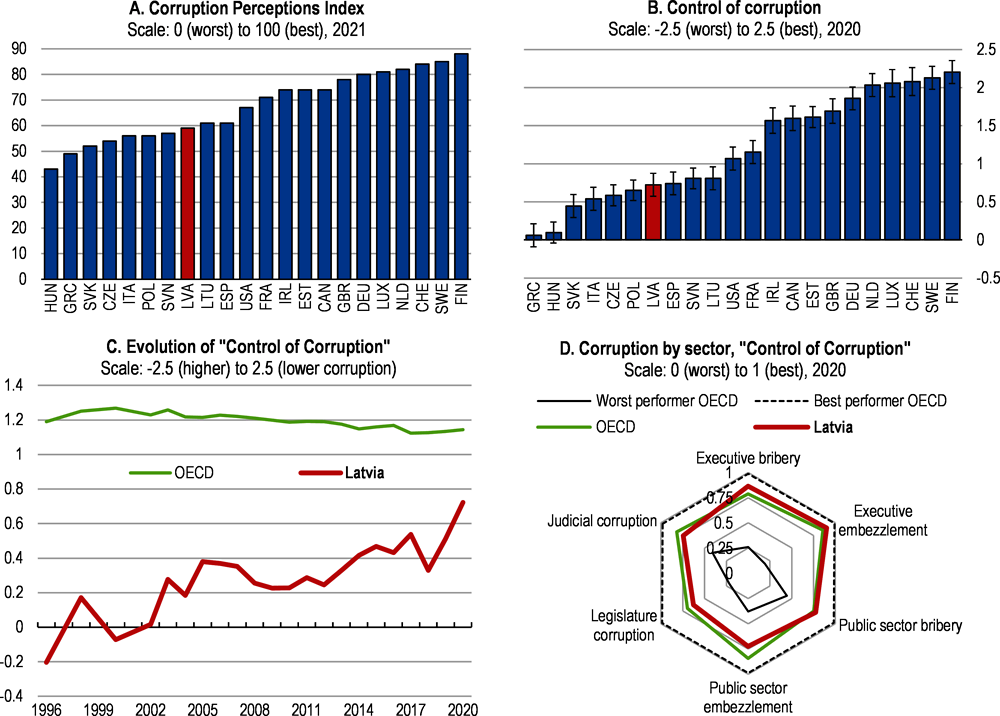

Corruption and bribery are also still seen as longstanding problems

Progress has been made in fighting corruption, but the problem remains more severe than in most other OECD countries (Figure 1.8).This is reported to be especially true in some local governments. Combating corruption was included in the National Development Plan, with indicative funding of 74 million euros over the seven years to 2027. The Plan’s objective is to enhance the citizenry’s satisfaction with the way democracy works, its participation in civic life, its perceived ability to influence political outcomes, its trust in the courts, police and the prosecutor’s office and the speed of court proceedings. Trust in government in 2019 remained low, better only than in Costa Rica and Mexico among OECD countries. The latest Corruption Perceptions Index by Transparency International showed that Latvia’s score has moved up 3 points in the last two years to a ranking of 36th out of 180 (joint 26thamong 37 OECD countries) (Transparency International, 2021[27]). Its most recent Global Corruption Barometer showed that in autumn 2020 81% of Latvians surveyed viewed corruption as a big problem (compared to an EU average of 62%), 66% thought the government was doing a bad job in fighting it (49%), 49% feared reprisals for reporting corruption (45%), and only 13% thought the government takes their views into account in its decision-making (30%), the lowest of any EU country. On the other hand, fewer people thought that the problems had worsened in the last year than elsewhere (20% compared to 32%).

Figure 1.8. Corruption is a serious albeit diminishing problem

Note: Panel B shows the point estimate and the margin of error. Panel D shows sector-based subcomponents of the “Control of Corruption” indicator by the Varieties of Democracy Project.

Source: Panel A: Transparency International; Panels B & C: World Bank, Worldwide Governance Indicators; Panel D: Varieties of Democracy Project, V-Dem Dataset v11.

In recent years Latvia’s Corruption Prevention and Combating Bureau (KNAB) has been under-resourced. Yet political and public support is strong, and it has now been given the funding needed to increase its total staffing by an eighth and to raise average monthly remuneration by 37% by 2023, making it easier to hire and retain high-quality personnel. In 2020 it initiated 39 criminal proceedings, of which 15% were for money-laundering violations. For the first time two cases were prosecuted for bribery of foreign public officials. This was described in the OECD Phase 3 Two-year Follow-up Report for Latvia (adopted 15 October 2021) (OECD, 2021[28]), which reported that the OECD Working Group on Bribery – which had made 44 recommendations to Latvia in its 2019 Phase 3 report – judged that 16 recommendations had been fully implemented, 19 had been partially implemented and 9 had not been implemented. Additionally, several cases for bribery involving high-level national public officials are pending.

KNAB and the State Revenue Service will need to coordinate their efforts to utilise their available resources and legal powers to change the culture and drive out the social acceptability of such practises. KNAB is establishing an online whistleblowing platform following the implementation of a whistleblowing law covering both public and private sectors in May 2019. It is also making greater efforts to educate the public about the negative impacts of corruption so as to reduce tolerance of it. It commissioned a survey of 421 firms and 1001 private individuals in February 2021, which found that in the past two years about a fifth of each sample had considered using a bribe of a public official. For individuals, that was mostly in health care, to find a government job or in dealing with real estate matters, while for businesses the most common contexts were in settling construction-related issues, public procurement and obtaining permits and licenses. Most entrepreneurs felt that bribery had declined in the last four years but many called for more severe penalties for anyone involved in bribery, for public officials to be appointed in open competitions and for greater openness and transparency in lobbying public officials and control of procurement procedures. However, care should be taken not to impose excessive administrative barriers in procurement processes, which are already rather slow.

Similar research published by the European Commission in 2020 following December 2019 fieldwork showed that 10% of surveyed Latvians made an extra payment in the context of health care, double the EU average (European Commission, 2020[29]). Cash payments were seen as sometimes or always acceptable by 25% of those surveyed, compared to an EU average of 16%, gifts by 57% (EU average 23%) and doing a favour by 38% (23%).The problem of corruption was seen as widespread by 47% of respondents in granting building permits, 45% in public procurement, 42% in policing and customs and 39% in health care. In 2020 the Architects Council of Europe found that most of those it surveyed across the European Union deemed the current anti-corruption measures in the procurement system based on EU Directive 2014/24 to have been ineffective. Accordingly, the government adopted an action plan to improve the public procurement system in February 2020 to enhance transparency; itis considering whether to centralise large and complex public procurements and is in the process of rolling out new tools to monitor procurement risks and creating a database of existing contracts and amendments. This should include future procurement needs, so that as much light as possible is shed on the relevant processes. Finally, Transparency International Latvia recently called for bolder reforms at the prosecution services and a comprehensive lobbying regulation and – even though the State Revenue Service has been empowered to bar from office public officials for conflicts of interest, whose definition has been widened and more clearly defined – an upgrade of the interest- and asset-disclosure system of high-level public officials (DELNA, 2021[30]). Indeed, a draft law on lobbying has been under development by a working group in the parliament since October 2019, and an associated public consultation has recently been held, but no date has been set for a final vote to adopt the law, which might be implemented following the next parliamentary elections in 2022.

A major judicial policy focus in recent years has been the so-called MONEYVAL process of the Council of Europe regarding Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) measures. In July 2018 the relevant body’s Mutual Evaluation Report found Latvia not to be fully compliant with 34 of the 40 Financial Action Task Force recommendations, though there were no cases of outright non-compliance. Latvia was therefore subjected to enhanced follow-up procedures. By the time of the first follow-up report in December 2019 (Council of Europe, 2019[31]) it was re-rated as largely compliant for all 11 recommendations for which the original classification had been only “partially compliant” and fully compliant for one other previously only largely compliant. It remains in enhanced follow-up with a further report due this year. As a result of this progress Latvia was not put on the FATF grey list in 2020. The process of improving internal-control systems, including risk-based supervision of customers, has nevertheless been unrelenting, driving down non-resident bank deposits to less than 7% of the total from as much as 55% at the end of 2014.

Table 1.7. Past OECD recommendations on informality, corruption and bribery

|

Topic and summary of recommendations |

Summary of action taken since 2019 Survey |

|---|---|

|

Continue the engagement of social partners in the fight against informality through sectoral agreements. |

The State Revenue Service signed seven new cooperation agreements in 2020-21 with sectors with a significant shadow economy, while six were renewed with changed terms, bringing the total to 39. |

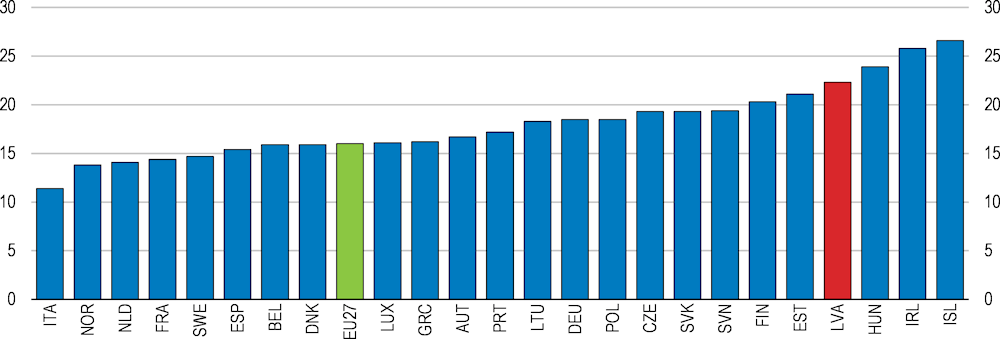

Labour market participation is high, while social protection is modest

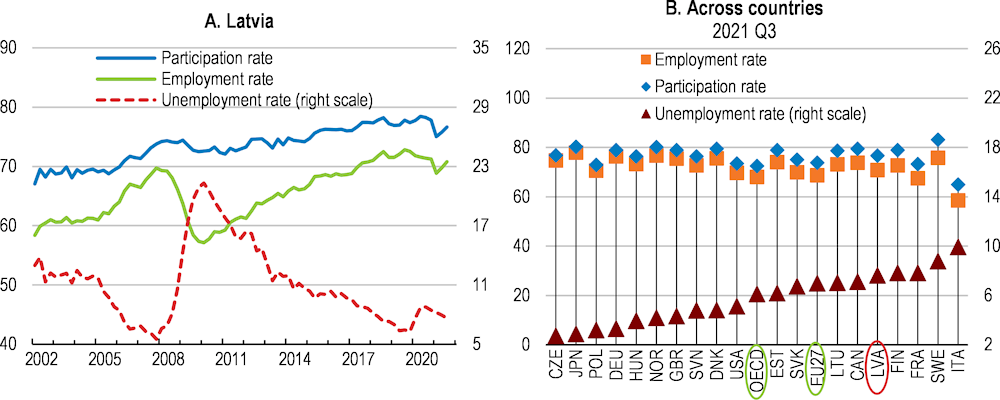

Latvia’s labour market has historically been characterised by high participation (though not as high as in its Baltic neighbours), above-average employment rates but mid-level joblessness (the record low was 5.4% in 2007). However, regional disparities abound (see below), and skills mismatches are significant, necessitating greater employer involvement in training than elsewhere (see below). The employment rate (20-64) edged down to 77.0% in 2020, which is still comparatively high. The only age group that has below-EU-average employment rates are the under 25s. In 2020 16.8% of 20-24 year-olds were not in employment, education or training (NEET), above the OECD average of 15.8%. However, that is well down from over 20% in 2017, in part because of the extension of the EU-financed “Youth Guarantee”, which has shown good results.

The labour market has been performing in line with the product market since the outbreak of the pandemic. Unemployment rose sharply in the wake of the restrictions and closures, with youth and seniors the worst hit (Figure 1.9). Large numbers of workers were also placed on furlough, with generous government support by Latvian standards until mid-2021 eliciting fears in some quarters of raised income expectations that would reduce tightening labour supply. Downtime benefits averaging 974 euros per month were offered as from November 2020 to 55200 recipients, a smaller share of the workforce than in Latvia’s Baltic neighbours; the total amount paid out was EUR 65 million, following about EUR 57 million during the pandemic’s first wave. Registered unemployment (which is traditionally lower than that measured by the LFS) averaged 7.7% in 2020, but mismatch was indicated by the number of vacancies, which reached around 3.5% just before the pandemic before falling back to about 2.3% since then.

Figure 1.9. Employment is high, but so is unemployment

All persons aged 15-64, seasonally adjusted, %

Remote working during the pandemic has been obligatory in public administration but only recommended in the private sector. According to official data, it reached a peak of 22.6% in early 2021, well below the 2-3% reported by Eurostat for the years prior to the pandemic. Eurostat reports Latvia’s share in 2020 (4.5%) was much lower than in some other EU countries, which averaged 12.0%.

Securing an adequate supply of labour

The key longer-term challenge in the labour market is securing an adequate supply of labour in view of ongoing population shrinkage (see below). Part-time workers do not look like a promising source of greater labour supply. Their share was only 7.3% of total paid employment in 2019, and informal work may mean the true rate may be even lower. The tax rate on shifting from part-time to full-time work in 2019 (that is working more hours) varied from 25% for minimum-wage workers to 36% for those on average wages, which is below the OECD average, so the tax wedge would not seem to be a major barrier to shifting if the demand for labour is sufficient. Nevertheless, direct labour force evidence shows the involuntary part-time share to have been 20.9% in 2020, higher than the OECD average of 15.5%.

Only about half of all jobless workers are eligible for the contributory and degressive unemployment benefit, having not contributed long enough or at all to the system. Replacement rates start out at 50-65% (depending on the number of years of insurance contributions). The benefit is normally available only for eight months – lowered from nine at the end of 2019, when the degressivity was also sharpened; declines now occur every two months, reaching 55% after six months. The savings were shifted to paying for higher minimum old-age pensions and basic and minimum disability pensions – though an extra four months was added in the form of a temporary unemployment assistance benefit until mid-2021 at a flat rate of 180 euros per month to handle the poor prospects of finding a job during the pandemic. The self-employed are not eligible for this benefit but can still use the public employment service. Those who are not eligible for it must fall back on the Guaranteed Minimum Income, which is below the poverty line. Prior to the latest increases welfare payments for a single person without children (a couple with two children) were equal to 22% (32%) of median disposable income, similar to Lithuanian levels (18% and 40%) but less than Estonia’s (29% and 38%). By OECD standards the effective tax rate on returning to work after receiving benefits in 2019 was comparatively moderate (78.1%) for those on the minimum wage but a very high 88.6% for those on the average wage, discouraging labour market re-entry. Therefore, it is appropriate that the benefit not be available for too long.

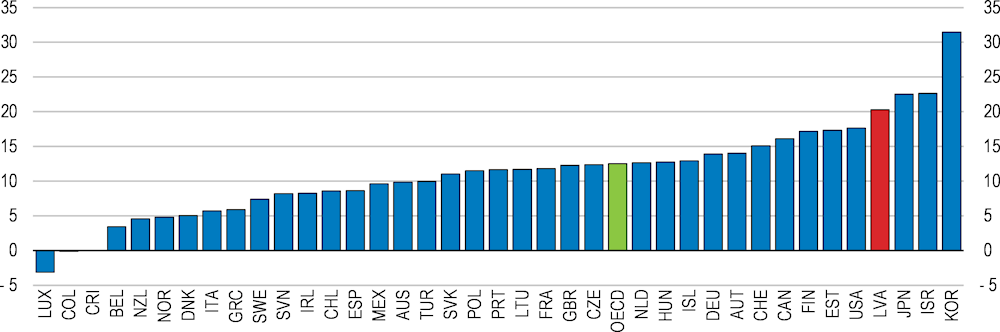

Nevertheless, long-term unemployment is relatively high, despite trend declines for nearly a decade: the share of the jobless who have been out of work for more than a year was 28% in 2020, compared to under 20% in Estonia and in the average OECD country (Figure 1.10). The long-term unemployed are provided with individualised support including mobility support of four months for moves exceeding 15km, addiction treatment and training.

Figure 1.10. The long-term unemployment share is relatively large

Long-term unemployed (over one year), % of total unemployed

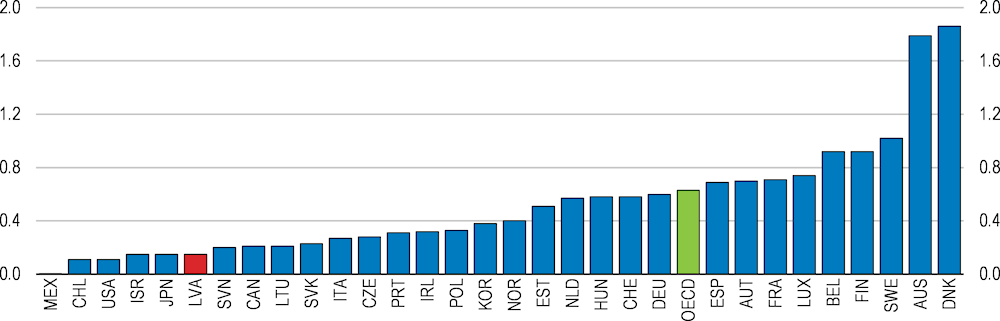

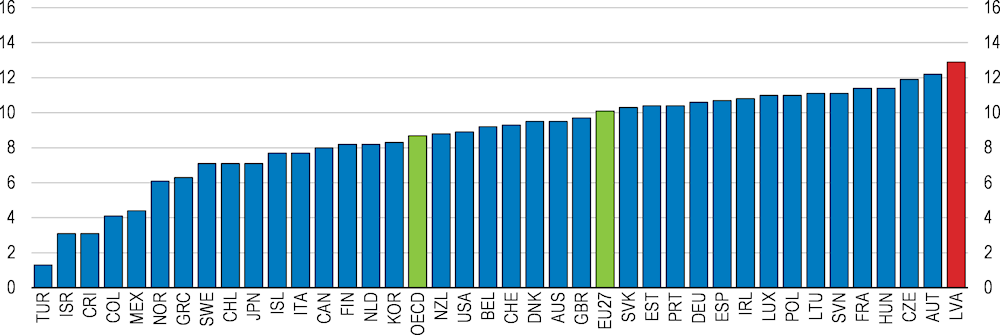

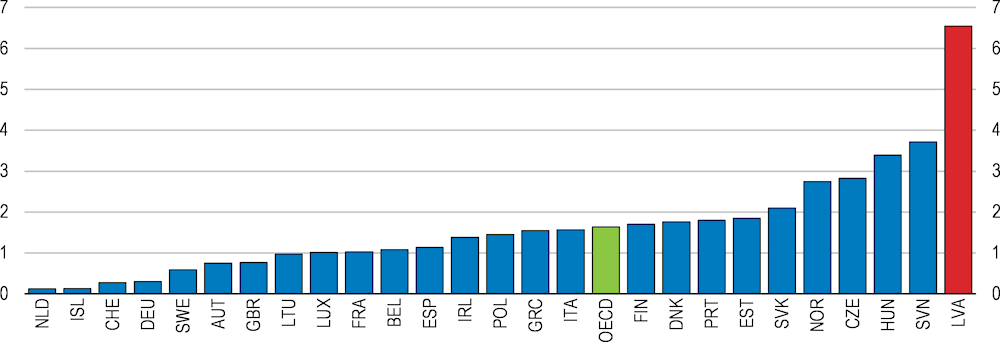

In 2018 Latvia spent less than 0.2% of GDP on active labour market policy measures (Figure 1.11). These used to focus on public-sector employment schemes but have shifted to strengthening work incentives and rehabilitation of the long-term unemployed mainly through training vouchers. A recent OECD assessment found that training vouchers for the unemployed were effective in raising the chances of the trainee finding a job and the income that goes with it, especially if combined with other measures such as mobility support but would be more effective if dispensed for a longer duration (OECD, 2019[32]). On the other hand wage subsidies for the disabled did not lead to better labour market outcomes.

Employment outcomes can also suffer when wage gains outpace trend increases in productivity. Minimum wages have recently been increased to 500 euros/month; previously minimum wages were earned by around 18% of all workers. This is still only two-fifths of average wages, which have trended up sharply over the past decade: yet labour’s aggregate share of income has risen from 44% in 2011 to 60% in 2020 (a much larger rise to a higher level than in its Baltic neighbours), as real wage gains have steadily exceeded productivity growth, in line with the so-called Balassa-Samuelson effect. While one in four workers is covered by collective agreements, union membership is much lower. Negotiations are mainly at the firm level, but in a few instances contractual agreements have been extended throughout the sector, which is automatically implemented if a sufficient number of employees are covered; this applies, for example, to the minimum wage of 700 euros/month recently negotiated in the construction sector.

Figure 1.11. ALMP spending is low

Active labour market policy (ALMP) spending, % of GDP, 2019

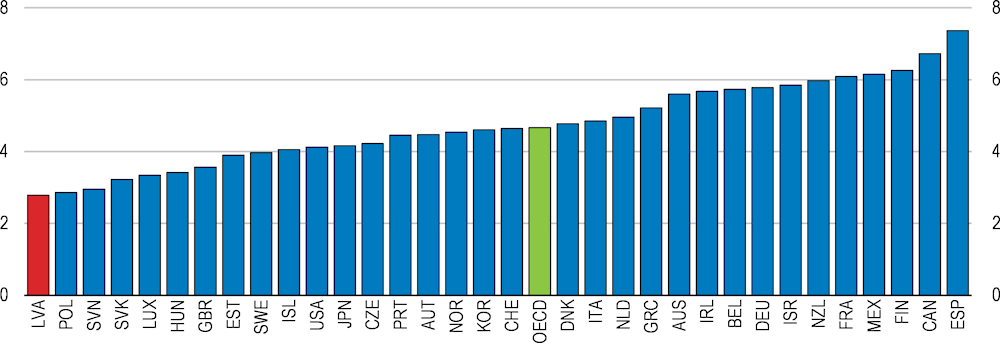

A final potential source of additional labour supply is women. However, Latvia’s female employment rate is already much higher than the EU average and the shortfall to the male rate smaller. Yet women’s work incentives are dented by the low average wages they face. Latvia’s gender wage gap has been increasing since about 2000 and by 2020 had risen to 22.3% (according to national data), among the highest in the European Union and fourth in the OECD (Figure 1.12). Latvia was one of only six OECD countries whose gap has grown over those years. Gaps are somewhat larger for full-time than for part-time workers and for those in the private sector than their public-sector counterparts. They are largest for those in the middle of the age distribution (smaller for youth and seniors).

Figure 1.12. The gender wage gap for full-time employees is comparatively large

Gender wage gap, median wages, full-time employees, 2020 or latest available year

Although some of the gap follows from female career choices, recent evidence points to the comparatively large role for presumed discrimination in determining Latvia’s gap (Ciminelli, Schwellnus and Stadler, 2021[2]), though the Labour Law imposes equal pay for work of equal value. Social attitudes towards working mothers are less favourable than in neighbouring countries, though the latest edition of the Gender Equality Index (for 2020) shows Latvia at 62.1, below the EU average of 68.0 but above all other eastern Member countries except Slovenia. Moreover, the government adopted a plan “On the Promotion of Equal Rights and Opportunities for Women and Men 2021-2023” last August, which will focus on achieving equality in the labour market and education, on preventing gender-based violence and on gender mainstreaming in sectoral policies. As well, while women continue to have unbalanced caring responsibilities, net childcare costs are among the lowest in the OECD, yielding good incentives for second earners with children to enter the labour force and putting downward pressure on the gap (Ciminelli, Schwellnus and Stadler, 2021[2]). There are some other usual policy levers for mitigating this problem: closer monitoring and public attention at the firm level (pay transparency) and developing a system of role models to tackle gender stereotypes and encourage girls to enter high-pay occupations (OECD, 2021[33]). According to responses to the recent OECD Gender Pay Transparency Questionnaire, Latvia has required public employers to report monthly on their pay levels by gender since 2018, but no such obligation exists for private employers. In neither case is there any requirement to conduct gender pay audits.

The ageing population calls for pension-system adjustments

The population is shrinking rapidly

Latvia’s population has been shrinking since it peaked at 2.7 million in 1990, reaching 1.9 million in 2020 (Figure 1.13, Panel A), an average rate of decline of over 1% per annum. How much more decrease is to be expected varies across different sources, and none have been updated for the impact of the pandemic on fertility (down), mortality (up) or net migration (probably less negative as people decided to return to their families in the crisis). While national projections show only modest further falls out to 2040, much larger drops are predicted by the United Nations and by Eurostat for 2060 and 2100. There is a fairly strong likelihood that the population will have halved in the 70 years following its peak.

The causes for this decline are twofold: first, a low fertility rate, which reached a low of 1.1-1.2 in the late 1990s, but then recovered somewhat thanks to a stabilisation in the average childbearing age, owing to improving economic-development outcomes, as well as, possibly, public family-support measures (especially childcare subsidies); and, second, steady net emigration, only modestly offset by lengthening life expectancy (Figure 1.13, Panel D). Life expectancy at birth has risen by about five years over the past 20 years, but overall and at age 65 it remains among the shortest in the OECD. Official projections predict a further lengthening of life expectancy at birth by 5.2 years by 2040.

Latvian residents have been leaving the country in fairly large numbers ever since its independence from the USSR; initially, many of those were Soviet Union soldiers, and subsequently others were Russian speakers returning to the Commonwealth of Independent States, though that flow has been falling. The principal destination countries have more recently been the members of the European Union since Latvia joined it in 2004. The migratory outflow has eased off over the past decade owing to Latvia’s healthy per capita income growth, which has allowed steady catch-up in living standards. Indeed, net migration in 2020 (-3150) was the smallest since independence, and Ministry of Economy projections foresee it offsetting up to 30% of natural shrinkage, yielding modest net immigration in the coming years, as in its Baltic neighbours.

The government has recently begun to recognise the demographic potential of the nearly 400000-strong diaspora, as was recommended in the last Survey: they have become the object of a three-year plan involving seven ministries to persuade especially families with children to return to the home country, mainly outside the Riga region. Immigration is another source of labour supply. EU citizens can enter easily, often being posted from abroad, but others must pass a labour-market test and have a job offer paying at least 1000 euros per month. The government should consider fast tracking prospective immigrants in key occupations, such as those in IT or engaged in R&D (Chapter 2).

Figure 1.13. The population has been falling and is expected to continue to do so

1. Including statistical adjustment.

Source: United Nations (2019), World Population Prospects: The 2019 Revision, Online Edition; OECD Family database, https://www.oecd.org/els/family/database.htm; Eurostat database; OECD Health Statistics database.

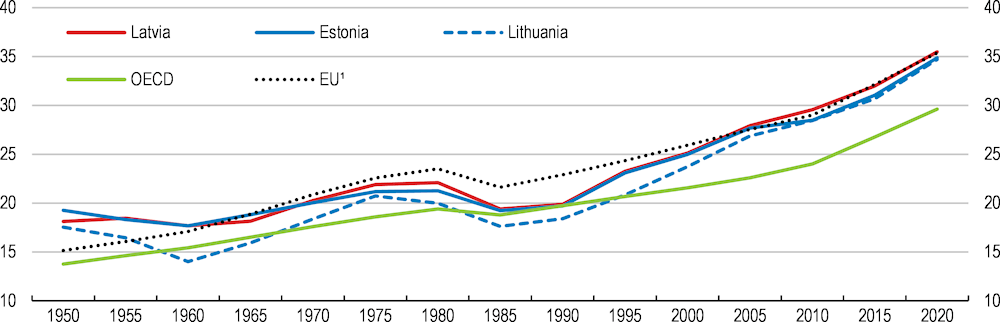

The population has also aged

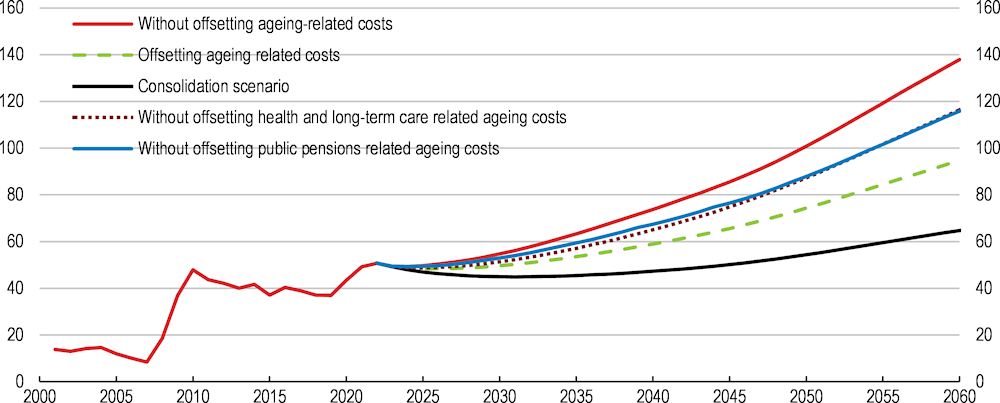

The economic effects of this challenging demographic outlook are manifold. The most obvious is probably what is commonly referred to as an ageing population, most often measured by the old-age dependency ratio (the share of adults, here taken as 20 and over, that are aged 65 and over) or its counterpart called the “demographic burden” (which is the ratio to only working-age adults rather than all adults) (Figure 1.14). That ratio began to rise sharply from below 20% in the late 1980s and by 2020 had reached 35.5%, one of the higher ratios in the OECD. In the United Nations’ medium variant it will rise by more than a percentage point per year in the 2020s before slowing and then peaking at 61.5% in 2060, still fairly high, but well below the most aged among OECD countries.

Figure 1.14. The “demographic burden” has been rising steadily

Number of individuals aged 65 and over per 100 people aged 20-64

1. Countries that are both members of the OECD and the European Union.

Source: United Nations (2019), World Population Prospects: The 2019 Revision, Online Edition.

Demographic decline is an unfavourable context for economic vibrancy and growth. But beyond the recovery from the current crisis, shortages of qualified labour caused by a shortfall in labour supply exacerbated by a lack of adult training could prove crucial, especially in certain sectors and for certain skills: Latvian employers are said to be already short of over 2000 university Information Technology graduates per year, for example. Again, the number of young Latvians in the 20-24 age cohort fell by around 60% from the 1980s to 2020, especially after 2008. With much larger cohorts of people in their 60s, OECD calculations show that the population of working age is shrinking by around 1% per year. Further out the situation looks likely to improve slightly due to a modest rebound of people in the early 2030s before falling back again around 2040. But the demographic decline is also causing weakness in domestic demand, placing even greater emphasis on growing exports as a potential source of sales (Chapter 2).

Depopulation has fallen most heavily on rural areas, resulting in big regional disparities

Depopulation has a regional aspect as well with significant development ramifications. Before the ageing trend had got underway in around 1990 and still around 2000, Riga was the Baltic/Nordic region’s largest city, bigger than Stockholm, Oslo or Helsinki, for example. But the population has fallen 18% since then, and it has dropped back to fifth now, in part because of this “hollowing out” that is also being caused by migration to the suburbs (called the Pieriga region, the only part of Latvia enjoying population growth). Beyond the greater Riga region, the almost half of Latvia’s population living elsewhere has shrunk sharply, despite the government’s considerable efforts to attract residents and economic activity there through a local government equalisation fund worth EUR 119 million (0.4% of GDP) in 2019, for example. These grants are linked to municipal personal income tax receipts, rather than the local cost of public service provision, thereby reinforcing inequality (OECD, 2019[12]). The hardest hit is the poor, south-eastern region of Latgale, which could lose 22% of its 2016 population by 2030, according to the think tank CERTUS. People are leaving such regions purportedly due to their low wages and poor job opportunities.