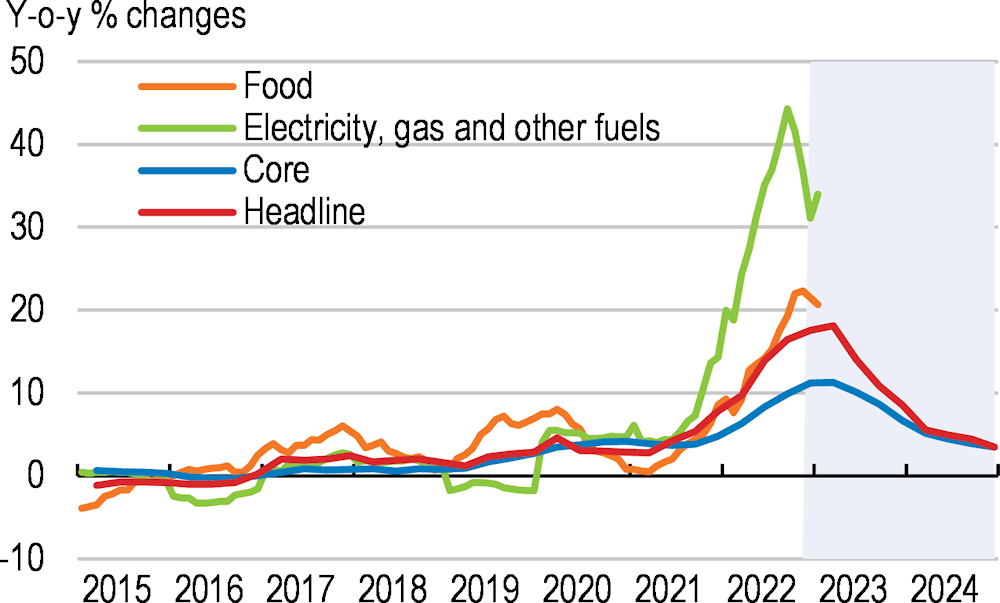

Both monetary and fiscal policies should ensure that higher inflation does not become entrenched. Monetary policy has tightened considerably since October 2021, with the key policy interest rate raised to 6.75% by September 2022. Given the sustained rise in both headline and core inflation in 2022, there are risks that this becomes entrenched in higher domestic inflation. The central bank should continue to ensure that currently elevated inflation expectations do not become entrenched and stand ready to increase interest rates further if necessary.

Fiscal policy continues to support the economy in managing higher energy prices. Following comprehensive pandemic-related packages in 2020-21, substantial policy support is being provided to manage the current cost of living crisis. In 2022, households and businesses benefitted from a temporary lowering of VAT taxes on energy and food, as well as energy allowances. This year, electricity and gas price caps and zero VAT rate on food are in place. Temporary policy support softening the blow of the energy crisis should continue as needed. There is scope to improve targeting of any future supports to avoid adding to inflationary pressures.

Long‑term fiscal pressures need to be addressed. A structural budget deficit has opened up and spending pressures from population ageing, healthcare and increased defence spending weigh on long-term fiscal sustainability, although the public debt-to-GDP ratio remains at around 50%. The low replacement rate envisaged for the public pension system could lead to additional fiscal pressures. To this end, working lives should be extended, including by aligning gradually male and female statutory retirement ages and increasing the pension age in line with life expectancy gains in good health.

Broadening the revenue base and improving spending efficiency would help improve fiscal sustainability. Reduced VAT rates and exceptions can be streamlined further and property taxation increased. Both the healthcare system and infrastructure are receiving considerable new public financing, so ensuring efficient spending will be key.

The government is making frequent use of off-budgetary funds and special vehicles to fund temporary support programmes. These funds are part of the general government sector but are not included in the state budget that is at the centre of the fiscal policy debate and approved by Parliament. Strengthening the budgetary framework by reviewing the fiscal rules in the context of European Union (EU) governance reforms and establishing a fiscal council could help maintain fiscal credibility and support better and more transparent management of public finances.