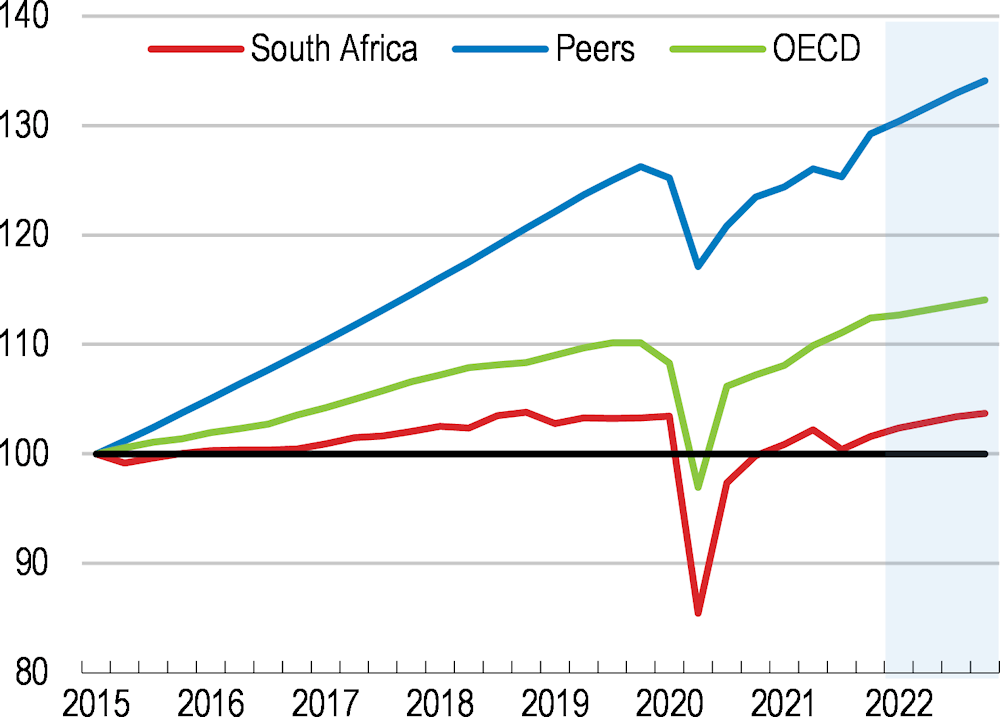

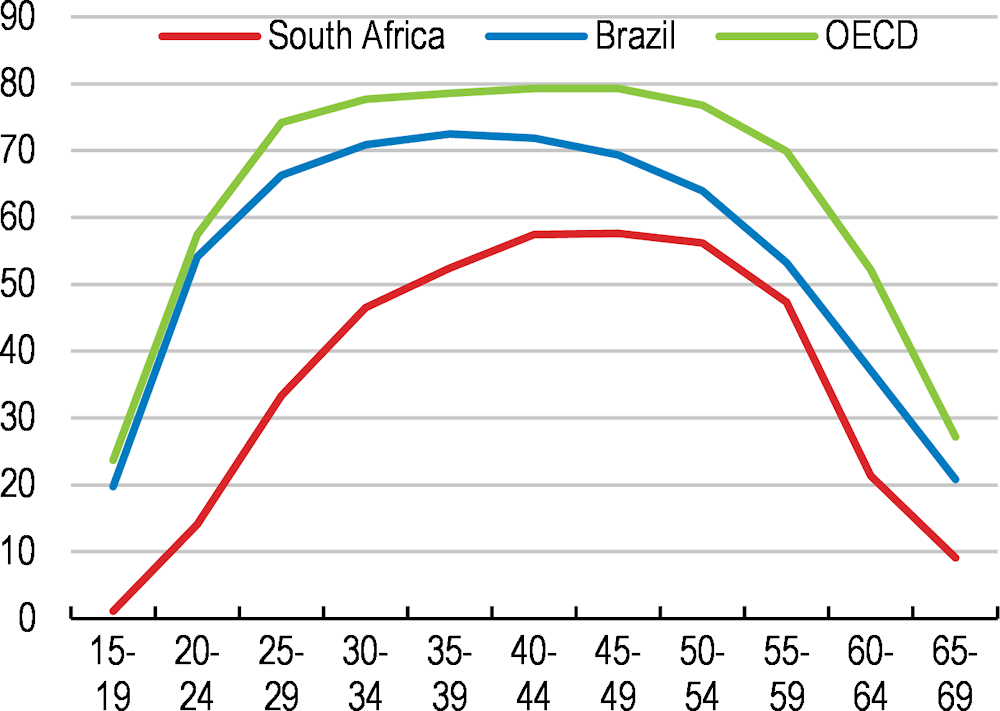

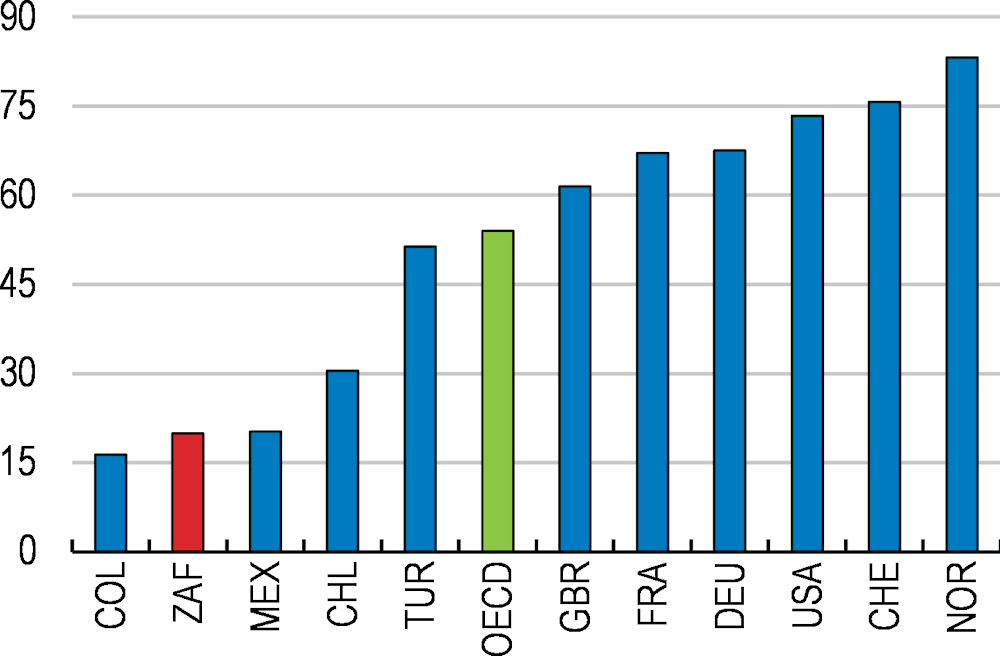

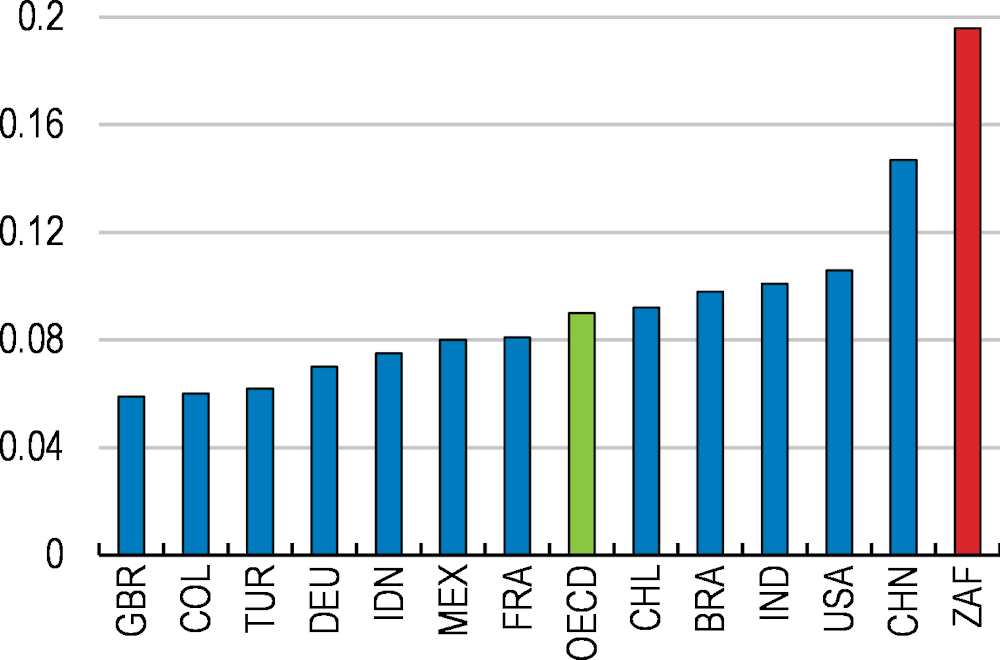

The COVID-19 crisis has weakened an already fragile economy. South Africa’s growth underperformed during the past decade: GDP per capita was already lower in 2019 than in 2008. Unemployment remains high, at around 35%, and youth unemployment even exceeds 50%. In the meantime, spending pressures are mounting to close the financing gap in health, infrastructure and higher education. To finance those needs while putting public finances on a more sustainable path, which is key to restore confidence, spending efficiency should improve and be accompanied with increased government tax revenues. In addition, the tax system could contribute further to reducing income and wealth inequalities. In the longer term, reviving productivity growth is key to lift living standards. Boosting productivity involves improving transport (road, port and rail) infrastructure, providing more stable electricity generation, fostering the quality of telecommunication networks, broadening access to higher education, as well as improving the business environment more generally.

SPECIAL FEATURES: STRENGTHENING THE TAX SYSTEM AND BOOSTING PRODUCTIVITY TO IMPROVE LIVING STANDARDS