This country note provides an overview of the labour market situation in Mexico drawing on data from OECD Employment Outlook 2024. It also looks at how the transition to net-zero emissions by 2050 is affecting the cost of household-specific consumption baskets.

OECD Employment Outlook 2024 - Country Notes: Mexico

Labour markets have been resilient and remain tight

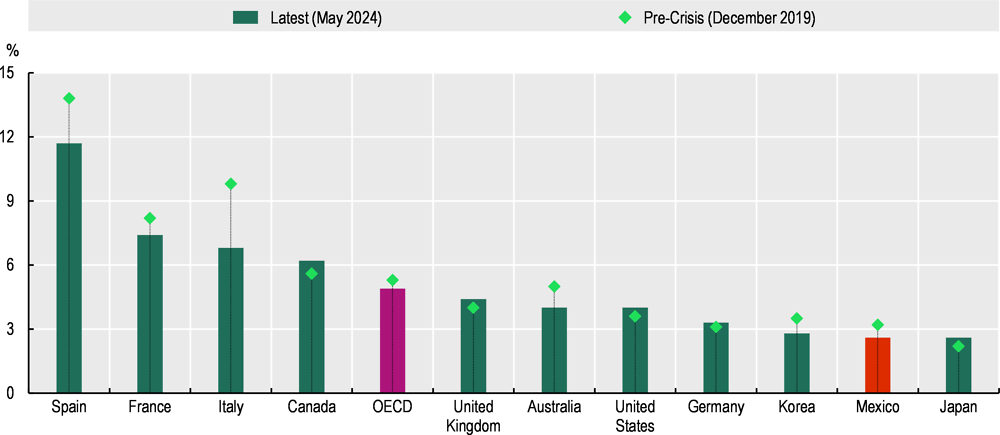

Labour markets continued to perform strongly, with many countries seeing historically high levels of employment and low levels of unemployment. By May 2024, the OECD unemployment rate was at 4.9%. In most countries, employment rates improved more for women than for men, compared to pre‑pandemic levels. Labour market tightness keeps easing but remains generally elevated.

In Mexico, the unemployment rate maintained its downward trend and fell to 2.6% in May 2024. This is the second lowest value across the OECD, and below the pre‑pandemic level. The employment rate maintained its upward trajectory and stood at 64.1% in Q1 2024, representing a 1.7% uptick from Q4 2019. The labour force participation rate for women increased from 49.3% in Q4 2019 to 51.7% in Q1 2024, but it remains significantly lower than in regional peers and other OECD countries.

Mexico’s economy is forecasted to expand by 2.2% in 2024 and then decelerate to 2% in 2025. In parallel, inflation is expected to reach 4.5% in 2024 and to edge down to 3.1% in 2025. In this context, the labour market should remain broadly stable, with the unemployment rate rising slightly to 3.1% by Q4 2025. Employment is expected to grow by 2.8% in Q4 2024 (in relation to Q4 2023) and by 2% in Q4 2025.

Following a reform to the Mexican Federal Labour Law in December 2023, the legal framework regulating work-related illnesses now incorporates 88 new health conditions, including work-induced stress, work-related cancers, or illnesses pertaining women’s health, for instance, endometriosis. Contingent upon the specific circumstances, this new framework allows workers to receive paid medical assistance, benefit from paid incapacity leave, or ultimately, receive a pension or an indemnification for these illnesses.

Figure 1. Unemployment rates remain at historically low levels in many countries

Unemployment rate (percentage of labour force), seasonally adjusted data

Note: The latest data refer to March 2024 for the United Kingdom, and June 2024 for Canada and the United States.

Source: OECD Employment Outlook 2024, Chapter 1.

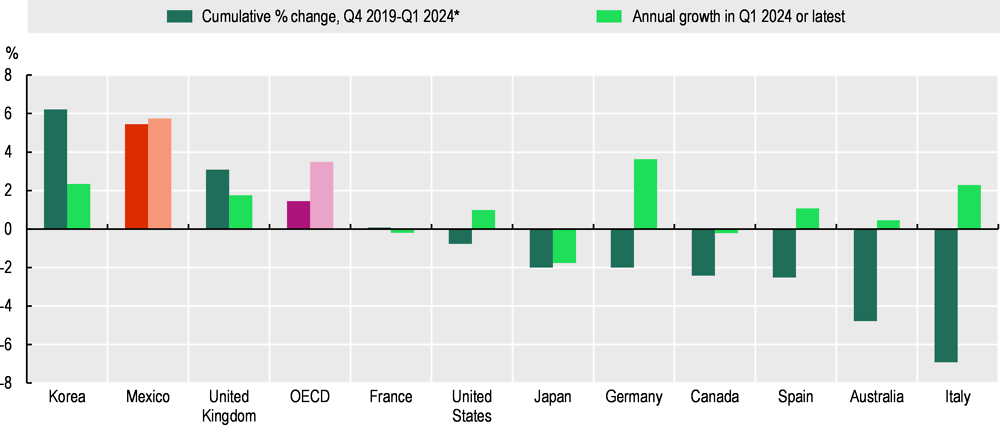

Real wages are up, but still have to make up for lost ground

Real wages are now growing year-on-year in most OECD countries, in the context of declining inflation. they are, however, still below their 2019 level in many countries. As real wages are recovering some of the lost ground, profits are beginning to buffer some of the increase in labour costs. In many countries, there is room for profits to absorb further wage increases, especially as there are no signs of a price‑wage spiral.

Compared to most OECD countries, Mexico has exhibited a remarkable wage recovery. As of Q1 2024, real wages increased by 5.4% compared with Q4 2019. This rise stands in stark contrast with other North American countries where real wages experienced a decrease of 2.4% and 0.8% in Canada and the United States, respectively.

Figure 2. Real wages remain below 2019 levels in most countries

Note: * For Canada, Japan, Korea and Mexico, the annual growth refers to Q4 2022‑Q4 2023 and the cumulative percentage change to Q4 2019‑Q4 2023. OECD is the unweighted average of 35 OECD countries (not including Chile, Colombia and Türkiye).

Source: OECD Employment Outlook 2024, Chapter 1.

Statutory minimum wages in real terms are above their 2019 level in virtually all countries

In May 2024, the real minimum wage was 12.8% higher than in May 2019 on average across the 30 OECD countries that have a national statutory minimum wage. The average figure is driven in part by particularly large increases in some countries, but the median increase was also quite significant, at 8.3%.

The increase in nominal minimum wages in Mexico from May 2019 to May 2024 was among the highest across the OECD, standing at 142%. Over the same period, real minimum wages increased by 86.6%, making Mexico the country with the highest real minimum wage increment since pre‑pandemic levels across the OECD.

The steady increment in the nominal and real minimum wages can be attributed a federal legislation that mandates an annual revision. This legislation seeks to align the minimum salary with inflation and to prevent the erosion of worker’s purchasing power. In this regard and following an agreement reached within the National Minimum Wage Commission (Conasami), a 20% increase of the minimum wage was set for 2024 (in relation to 2023).

In most countries, low-income groups are the most affected by carbon pricing reforms

Effective carbon taxing has been increasing across the OECD over the 2012 to 2021 period. In parallel, per-capita carbon emissions from energy use declined in most countries over this period. However, carbon taxes, emissions trading systems and fuel excise taxes often had a regressive impact, reflecting the reliance of low-income households on high-emitting consumption items, such as energy and food.

Over the 2012‑21 period, in 2021 constant euros, effective carbon rates increased from EUR 4 to 24 per tonne of CO2 in Mexico. Yet, such rates remain substantially lower than the OECD average of EUR 42 and are among the lowest across OECD countries. Within the same timeframe, carbon price reforms increased the cost of the average Mexican household consumption basket by 1.03%, mostly derived from the increase in fuel excise taxes.

Nonetheless, Mexico deviates from the OECD pattern, as relative burdens were larger among households in the higher deciles, indicating that high-income households utilise a greater share of their income to energy than low-income households.

Figure 3. Changes in carbon-pricing measures during the past decade: Burdens for households

Change in the cost of household-specific consumption baskets by income decile, percentage of income, 2012‑21

Note: Change in the cost of household-specific consumption baskets, as a share of household incomes (2015 in EU countries, 2016 in Mexico). Averages by income decile (equivalised disposable household income). ETS: Emissions Trading Systems.

Source: OECD Employment Outlook 2024, Chapter 5, Figure 5.10.

Contact

Stéphane CARCILLO (✉ stephane.carcillo@oecd.org)

Pablo MINONDO CANTO (✉ pablo.minondocanto@oecd.org)

This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of the Member countries of the OECD.

This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area.