This chapter describes market developments and medium-term projections for world oilseed markets for the period 2024-33. Projections cover consumption, production, trade and prices for soybean, other oilseeds, protein meal, and vegetable oil. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world oilseed markets over the next decade.

OECD-FAO Agricultural Outlook 2024-2033

4. Oilseeds and oilseed products

Copy link to 4. Oilseeds and oilseed productsAbstract

4.1. Projection highlights

Copy link to 4.1. Projection highlightsShare of oilseeds and oilseeds products directly consumed as food to remain at 24%

About a quarter by weight of the production of oilseeds and other oil crops (e.g. palm oil) is used for direct human consumption as food. Most is used for animal feed which includes protein meal and a small amount of direct feeding of oilseeds (Figure 4.1). Industrial uses for biodiesel and varnish account for more than a tenth of total oilseed and other oil crops usage. Losses and waste occur at all stages from field to final consumption. In the case of palm oil, harvesting and extraction are critical to obtain food quality oils and timing and logistics determine the level of loss. At the other end of the food chain, waste for vegetable oil includes a particular factor as it is often used in the preparation of meals (e.g. for frying) and considerable parts of the calories contained are not consumed as food.

Food use of vegetable oils is projected to account for 55% of total consumption in 2033, driven by population growth and increased per capita use of vegetable oil in lower – and middle-income countries. The vegetable oil aggregate in this Outlook includes oil obtained from the crushing of oilseeds (about 55% of world vegetable oil production) and palm oil (36%), as well as palm kernel, coconut, and cottonseed oils. The food use of vegetable oil also includes its use for frying where a considerable share becomes waste oil and is then used as feedstock for biodiesel. The direct use of vegetable oil for biodiesel, currently about 16% of global vegetable oil use, is projected to grow globally, especially in Indonesia, Brazil and in the United States, in the form of hydrotreated vegetable oil.

Protein meal utilisation is almost exclusively as livestock feed and will be constrained by slower growth in global livestock production, especially in high-income countries. Soybean meal accounts for about three-quarters of the global protein meal sector. Demand growth in the People’s Republic of China (hereafter “China”) is expected to slow down considerably, driven by improved feed efficiency combined with efforts to achieve lower protein meal shares in livestock feed rations. In the European Union, the second-largest user of protein meal, consumption is expected to decline as animal production declines and other protein sources are increasingly used in feed. By contrast, in Southeast Asia increasing animal production is projected to raise demand for imports of protein meal.

As a result of a slowdown in the expansion of the mature oil palm area and only a slight recovery in yields, palm oil production growth in Indonesia and Malaysia is projected to be limited. Indonesia and Malaysia are still projected to account for 82% of global palm oil production, although production in other tropical countries is expected to expand more strongly.

Growth in world exports of soybeans, about 42% of global production and dominated by the Americas, is expected to slow considerably over the next decade due to the projected slower growth in import demand by China. Indonesia and Malaysia, will continue to dominate the vegetable oil trade, jointly accounting for nearly 55% of global vegetable oil exports. India, one of the world’s biggest consumers of vegetable oil, is projected to maintain its high import growth to satisfy growing domestic demand.

The ongoing downward adjustment of prices in the oilseed sector is expected to continue during the first years of the Outlook period. Thereafter, prices are expected to increase slightly in nominal terms, while declining in real terms following the long-term trend of agricultural commodity prices.

The future demand for protein meal in China depends on the balance between feed intensity and efficiency especially in restructuring the pig meat sector. The scope to increase palm oil output in Indonesia and Malaysia will increasingly depend on oil palm replanting activities and accompanying yield improvements (rather than area expansion), creating new challenges as yields of palm oil have been stagnant for several years. Sustainability concerns (i.e. deforestation and the use of sustainability certifications for vegetable oil) and concerns about the high saturated fat content of palm oil also influence the consumer acceptance and demand for palm oil. The use of vegetable oil as biodiesel feedstock is mostly determined by biofuel policies, which include countries’ mandated blending ratios. In particular, the use by some countries of Sustainable Aviation Fuel (SAF) holds potential and could result in strong demand growth for vegetable oil.

4.2. Current market trends

Copy link to 4.2. Current market trendsNominal prices declined from record highs and fluctuated in a narrow range

International prices for oilseeds have been fluctuating in a relatively narrow range since late 2023, mainly reflecting prospects of sufficient global supplies of soybean, rapeseed and sunflower seed in the 2023/24 season. Meanwhile, world vegetable oil prices stabilised after falling sharply from record highs to reach multi-month lows in mid-2023, as below-potential growth in palm oil outputs coincided with subdued global demand. For oil meals, international soymeal quotations declined in recent months, primarily underpinned by a favourable production outlook in Argentina.

Global soybean production in 2023/24 is anticipated to expand by about 5% from the previous season, mainly due to forecast output increase from South America. While unconducive weather in some major soybean regions in Brazil is seen as compromising its production outlook, largely favourable conditions in Argentina are expected to facilitate a significant output recovery there. World palm oil production is expected to increase marginally in 2024. Despite generally favourable weather conditions across Southeast Asia, production growth could be limited by subdued yields in both Indonesia and Malaysia.

There are many uncertainties that can affect the market in the coming months, such as adverse climatic conditions, changes in policies, and the evolution of ongoing conflicts.

4.3. Market projections

Copy link to 4.3. Market projections4.3.1. Protein meal consumption

Feed demand is slowing, shaped by developments in China

Only a small proportion of oilseed supplies is consumed directly. Normally, oilseeds are crushed into vegetable oil and protein meal. The protein meal content of soybeans is about 80% for other oilseeds this share is 50-60%. Protein meal is almost exclusively used as feed and its consumption is projected to continue to grow at 0.9% p.a., considerably below that of the last decade (2.4% p.a.).

The link between feed use of protein meal and animal production is related to the intensification of animal production, which increases demand for protein meal. Greater feed efficiency leads to a reduction in protein feed per animal. Demand is also affected by the composition of animal husbandry and herd sizes. The link between animal production and protein meal consumption is associated with a country’s level of economic development (Figure 4.2). Lower income countries, which rely on backyard production, consume less protein meal, whereas higher income economies which employ intensive production systems use higher amounts of protein meal. Because of a shift to more feed-intensive production systems in developing countries in response to rapid urbanisation and increasing demand for animal products, growth in protein meal consumption tends to exceed growth in animal production.

China accounts for more than a quarter of global protein meal demand and is therefore shaping global demand. Growth in China’s demand for compound feed is expected to be slower than in the previous decade due to declining growth rates in animal production, especially pig meat, and the existing large share of compound feed-based production. The protein meal content in China’s compound feed is expected to remain stable after it surged in the last decade but continues to exceed current levels in the United States and European Union.

In the European Union, and the United States, protein meal consumption is expected to grow at a slower rate (or decline faster) than animal production due to improving feeding efficiencies. In addition, in the European Union animal products, primarily poultry and dairy, are increasingly marketed by the large retail chains as produced without feed from genetically modified crops which also curbs demand for soybean meal.

4.3.2. Vegetable oil consumption

Per capita demand for vegetable oil for food is slowing down

The two dominant uses of vegetable oil are for food and food preparation (55%) and as biodiesel feedstock (18%). A considerable share of food use is for frying rather than consuming directly which results in an amount of used cooking oil which can be used as feedstock for biodiesel production. Vegetable oils are also used for cosmetics, varnishes, and increasingly in animal feed, especially for aquaculture.

Per capita consumption of vegetable oil for food is projected to decline slightly (-0.2%) due to declining food demand in high-income countries, while an increase of 0.8% p.a. increase was observed during 2014-23. In emerging markets such as China (27 kg/capita) and Brazil (28 kg/capita), the consumption of vegetable oil for food is set to reach levels comparable to those of wealthier economies (Figure 4.3).

India, the world’s second largest consumer and leading importer of vegetable oil, is projected to sustain a per capita consumption growth of 1.0% p.a., reaching 11 kg/capita by 2033. This substantial increase will be the result of both increases in its domestic production, crushing of increased domestic oilseed production, and imports of mainly palm oil from Indonesia and Malaysia. However, numerous programs have been implemented by the Indian government to increase local production and rely less on vegetable oil imports.

As urbanisation increases in low-income countries, dietary habits and traditional meal patterns are expected to shift towards greater consumption of processed foods that have a high content of vegetable oil. For least developed countries (LDCs), the per capita demand for vegetable oil is projected to remain stable at 6.5kg/capita.

The global uptake of vegetable oil as feedstock for biodiesel (about 18% of global vegetable oil use) is projected to increase more slowly at 1.3% p.a. over the next ten years, compared to the 6.8% p.a. increase over the previous decade when biofuel support policies took effect. The use of vegetable oil as feedstock for biodiesel depends on the policy setting (Chapter 9) and the relative price development of vegetable oil and crude oil (see below). In general, national targets for mandatory biodiesel consumption are expected to increase less than in previous years. In Indonesia, the growth in the use of vegetable oil to produce biodiesel is projected to remain strong and reach 14.5 Mt by 2033 due to supportive domestic policies. In the United States, Hydrotreated Vegetable Oil (HVO) or Renewable Diesel is considered an advanced biofuel and is expected to drive the considerable growth of biodiesel production. In addition, used oils, tallow, and other non-feed and non-food feedstocks are increasing their share in the production of biodiesel, especially in the European Union and China, largely due to specific policies.

4.3.3. Oilseed crush and production of vegetable oils and protein meal

Slowing global oilseed crush and limited growth in palm oil production

Globally, the crushing of soybeans and other oilseeds into meal (cake) and oil accounts for about 90% of total usage. The demand for crush will increase faster than demand for other uses, notably direct food consumption of soybeans (including for meat and dairy replacements), groundnuts and sunflower seeds, as well as direct feeding of soybeans. The crush location depends on transport costs, trade policies (e.g. different tariffs for oilseeds and products), acceptance of genetically modified crops, processing costs (e.g. labour and energy), and infrastructure (e.g. crushing facilities, ports and roads).

Soybean crush is projected to expand by 49 Mt over the Outlook period, significantly less than the 65 Mt in the previous decade. Chinese soybean crush is projected to increase by 16 Mt, accounting for about 33% of the world’s additional crush, the bulk using imported soybeans. The growth in China, although large, is projected to be considerably lower than in the previous decade. Global crush of other oilseeds is expected to grow in line with production over the Outlook period and to occur more often in the producing country.

World production of protein meals from oilseed crush is dominated by soybean meal, which accounts for more than two-thirds of world protein meal production. Production is concentrated in a small group of countries (Figure 4.4). In China and the European Union, most protein meal production comes from the crushing of imported oilseeds, primarily soybeans from Brazil and the United States. In the other important producing countries ‒ Argentina, Brazil, India, and the United States ‒ domestically-produced soybeans and other oilseeds dominate.

Global vegetable oil production includes the crush of oilseeds as well as palm oil, palm kernel oil, coconut oil and cottonseed oil. Palm oil and palm kernels are joint products, and the latter is crushed into palm kernel oil meal. Coconut oil is mainly produced in the Philippines, Indonesia, and Oceanic islands. Palm kernel oil and coconut oil have important industrial uses. Cottonseed oil is a by-product of cotton ginning (Chapter 10). Global palm oil output has outpaced the production of other vegetable oils over the past decade. However, growth in palm oil production is expected to weaken due to increasing sustainability concerns and the aging of oil palm trees in Indonesia and Malaysia, which account for almost one-third of the world’s vegetable oil production and for more than 80% of global palm oil production.

At the global level, palm oil supplies are projected to expand at an annual rate of 0.7%. Increasingly stringent environmental policies from the major importers of palm oil and sustainable agriculture norms (e.g. in line with the 2030 UN Agenda for Sustainable Development) are expected to slow the expansion of the oil palm area in Indonesia and Malaysia. This implies that production growth needs to come from productivity improvements, including an acceleration of replanting. Palm oil production in other countries is expected to expand more rapidly from a low base, mainly for domestic and regional markets. For example, Thailand is projected to produce 3.4 Mt by 2033, Colombia 2.0 Mt, and Nigeria 1.7 Mt. In several Central American countries, niche palm oil production is developing with global sustainability certifications in place from the outset, positioning the region to eventually reach broader export markets.

4.3.4. Oilseed production

Challenges remain for palm oil and rapeseed yield growth

The production of soybeans is projected to grow by 0.8% p.a., compared to 2.0% p.a. over the last decade. Growth will be dominated by yield increases, accounting for about 80% of production growth. Soybeans have the advantage of being fast growing which allows for double cropping, especially in Latin America. Consequently, a considerable share of additional harvested area increase will result from double-cropping soybeans with maize in Brazil and wheat in Argentina.

Brazil has in recent years been the largest producer of soybeans and production is expected to grow at 0.7% p.a. over the next decade – slightly stronger than the United States, the second largest producer, at 0.5% p.a., due to double cropping with maize. The production of soybeans is projected to grow strongly elsewhere in Latin America, with Argentina and Paraguay producing 49 Mt and 11 Mt, respectively, by 2033. In China, soybean production is expected to continue to increase in response to reduced policy support for the cultivation of cereals, but at slower pace than in the previous decade. Soybean production is also expected to increase in India, the Russian Federation (hereafter “Russia”), Ukraine, and Canada.

The production of other oilseeds (rapeseed, sunflower seed, and groundnuts) will also grow at a slower pace, at 0.8% p.a. compared to 2.9% p.a. over the previous ten years (2014-2023). China (a major producer of rapeseed and groundnuts) and the European Union (which mainly produces rapeseed and sunflower seeds) are the most important producers of other oilseeds, with a projected annual output of 41 Mt and 30 Mt, respectively, by 2033. However, limited growth in output is projected for both regions (0.8% p.a. for China and 0.2% p.a. for the European Union) as relatively higher prices for cereals are expected to generate strong competition for limited arable land. Ukraine and Russia, major producers of rapeseed and leading producers of sunflower seed, are both expected to increase their production of other oilseeds beyond 20 Mt per year by 2033. Canada, the largest exporter of rapeseed, is projected to increase its production of other oilseeds by 1.1% p.a., to reach 21 Mt by 2033.

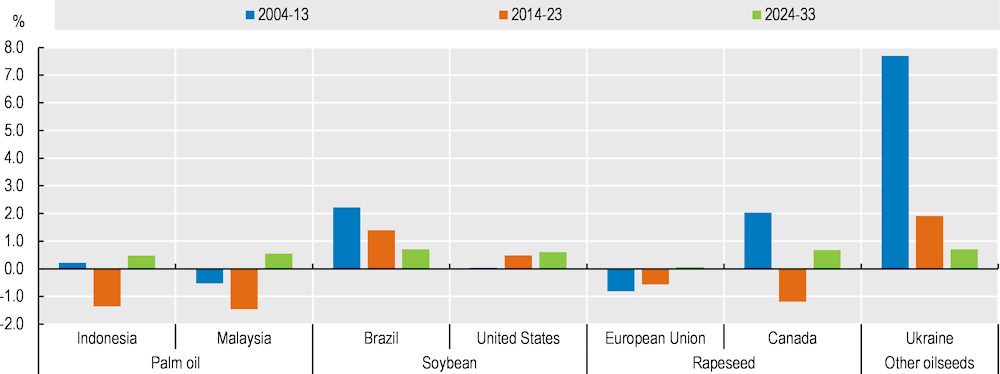

Yields for major producers of palm oil and for some major suppliers of rapeseed have fallen or grown slowly during the last decade (Figure 4.5). There are many reasons for this development: 1) a significant increase in production area so that less favourable land is used for production reducing average yields; 2) the ageing of oil palms as well as labour shortages has reduced yields; 3) restrictions in the use of pesticides adversely affected average rapeseed yields in the European Union; and 4) shifting weather patterns. It remains uncertain how this will play out over the coming decade, but lower area expansion could result in a recovery in yields over the Outlook period. If this is not the case it will be a challenge to satisfy growing demand, especially for vegetable oil.

Soybean stocks are projected to reach a stock-to-use ratio of almost 13% by 2033, which remains low compared to the past two decades, so harvest failures could quickly lead to market shortages.

Figure 4.5. Average annual yield growth for palm oil and oilseeds

Copy link to Figure 4.5. Average annual yield growth for palm oil and oilseeds

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

4.3.5. Trade

Trade is significant for oilseeds and products, but slowing down

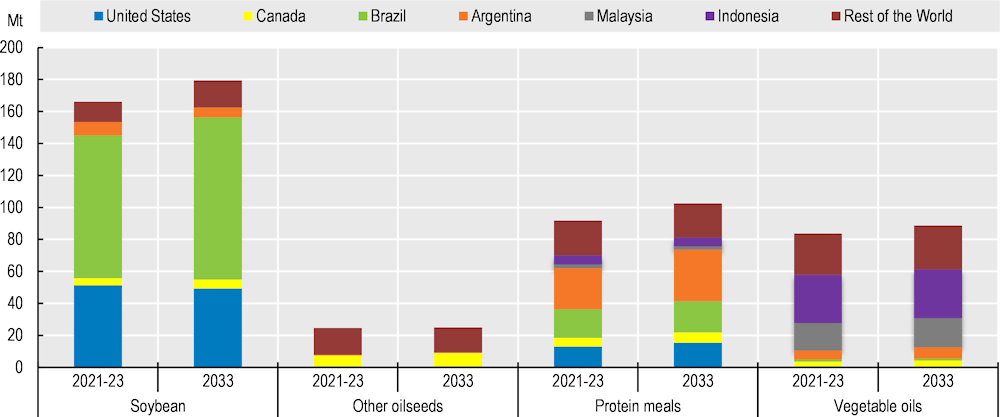

Over 40% of world soybean production is traded internationally, a high share compared to other agricultural commodities. The expansion in world soybean trade is directly linked to projected slower growth of the soybean crush in China and Chinese imports are projected to grow by 0.8% p.a. to about 110 Mt by 2033 (down from 2.8% p.a. in 2014-2023), accounting for about 61% of world soybean imports. Exports of soybeans originate predominately from Brazil and the United States. Brazil is the largest global exporter of soybeans with steady growth in its export capacity and is projected to account for 56% of total global exports of soybean by 2033.

For other oilseeds, the internationally traded share of global production remains much lower at about 13% of world production as the two largest producers, China and the European Union, are net-importers. The main exporters are Canada, Australia, and Ukraine, which are projected to account for 71% of world exports by 2033. In Canada and especially in Australia, more than half of the production of other oilseeds (primarily rapeseed) is exported. Additionally, oilseeds are crushed in the production countries and exported in the form of vegetable oil or protein meal, which is of high importance for Argentina, Ukraine and Russia.

Vegetable oil exports, which amount to 35% of global vegetable oil production, continue to be dominated by a few players, namely Indonesia and Malaysia. These two countries are expected to continue to account for almost 55% of total vegetable oil exports during the Outlook period (Figure 4.6). However, the share of exports in production is projected to contract slightly in these countries as domestic demand for food, oleochemicals, and, especially, biodiesel uses is expected to grow. India is projected to continue its strong growth in imports at 1.0% p.a., reaching 18 Mt by 2033, to meet increasing demand driven by population growth, urbanisation, and rising disposable incomes. At the same time, the Indian government is carrying out several projects in order to be less dependent on imports. These programs aim at implementing farm techniques and services to strengthen and support more local production.

Figure 4.6. Exports of oilseeds and oilseed products by region

Copy link to Figure 4.6. Exports of oilseeds and oilseed products by region

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The projected growth in world trade of protein meal is 0.8% p.a. over the Outlook period and Argentina with its clear export orientation is expected to remain by far the largest meal exporter. The largest importer is the European Union, with imports expected to continue to decline due to reduced domestic demand for protein meal. More than 90% of the global import growth in protein meal is projected to occur in Asia, in particular in Southeast Asia with its increasing animal production. As the domestic crushing capacity in Asian countries is not expected to keep pace with protein meal demand, expansion of the livestock sector is expected to require imported feed.

4.3.6. Prices

Real prices remain under pressure over the next decade

Oilseed and product prices are expected to increase slightly in nominal terms, while declining in real terms following the long-term trend of agricultural commodity prices (Figure 4.7). Due to expected stronger demand for vegetable oil than protein meal, prices of vegetable oil are projected to rise compared to protein meal. This will also favour other oilseeds prices over soybeans as they contain higher shares of vegetable oil.

4.4. Risks and uncertainties

Copy link to 4.4. Risks and uncertaintiesEnvironmental concerns influence global oilseed supply chains

The integration of environmental sustainability consideration into trade regulations could influence global oilseed and oilseed product trade. On the one hand the trade share of soybeans and vegetable oils at around 40% of production is considerably higher than for most other agricultural commodities. On the other hand, palm oil and soybeans are often mentioned when the link between agriculture and deforestation is discussed. Both products are included in the European Union deforestation regulation of 2023 (Regulation (EU) 2023/1115) as relevant products alongside cattle, cocoa, coffee, rubber and wood. The impact on global soybean and palm oil trade remains uncertain but could impact global oilseed and oilseed product markets. In producing countries several measures to address these deforestation concern, including certification of deforestation free production, have been implemented and increase in relevance for trade.

The scope for increasing palm oil output in Indonesia and especially in Malaysia will increasingly depend on replanting and yield improvements rather than new area expansion. In recent years, growth in production has been sluggish given the low profitability of the sector and rising labour costs in Malaysia. There has been some replanting progress by major palm oil companies in Indonesia. In addition to the slowdown in yields, sustainability concerns will also influence the expansion of palm oil output as demand in developed countries favours deforestation-free oils and seeks sustainability certification for vegetable oil used as a biodiesel feedstock and, increasingly, for vegetable oils entering the food chain. However, there are concerns about competing certification schemes in Malaysia and Indonesia.

Other consumer concerns regarding soybeans stem from the high share of production derived from genetically modified seeds. In the European Union in particular, retailer certification schemes of animal products based on feed free of genetically modified products are gaining momentum and may shift feed demand to protein sources other than soybean meal. This may further reduce protein meal demand as the European Union accounted for 13% of global demand in 2021-23.

Biofuel policies in the United States, the European Union, and Indonesia, the three largest users of biodiesel, remain a major source of uncertainty in the vegetable oil sector given that about 16% of global vegetable oil supplies go to biodiesel production. In Indonesia, attaining the proposed 30% biodiesel mandate is doubtful given the need for government subsidies and possible medium-term supply constraints. In the United States Renewable Diesel or HVO receive considerable support in some states that show strong production growth rates. In particular, the California Low Carbon Fuel Standard favors expansion of renewable diesel over other types of biofuel. In the European Union, policy reforms, reduction of overall diesel use and the emergence of second-generation biofuel technologies will likely prompt a shift away from crop-based feedstocks, especially vegetable oils. Globally, Sustainable Aviation Fuels (SAF) are expected to be a substantial use of biofuels but the timing of introduction remains largely uncertain. The development of crude oil prices, which affects the competitiveness and profitability of biodiesel production, remains a major source of uncertainty.

The development of animal production in China remains the major driving force for global protein meal demand and soybean trade. Overall, the development of the meat demand is shaped by declining population and slower but still substantial economic growth. The pig meat industry recovery from ASF combined with its restructuring directly impacts demand for protein meal. Protein meals compete in part with other feed components in the production of compound feed, so changes in cereal prices will prompt adjustments in the balance between compound feed ingredients and hence protein meal demand.