This chapter first discusses the Romanian business environment and capital market before providing an overview of the state‑owned enterprise sector – including information regarding its size, sectoral distribution, and economic and financial performance. It then outlines the legal and regulatory frameworks bearing on SOE governance, including details on the general corporate governance framework as well as on sectoral laws and regulations applicable to SOEs. It finally describes ownership arrangements and examines how the state exercises its ownership rights, with a particular focus on policies and practices underpinning board and executive appointments, performance monitoring and financial oversight of SOEs.

OECD Review of the Corporate Governance of State-Owned Enterprises in Romania

1. The state‑owned enterprise landscape in Romania

Abstract

1.1. Economic and political context of Romania

Romania is located in South-eastern Europe, bordering on the Black Sea. It has a population of 19.3 million people as of 2020 (OECD, 2022[1]). It is a unitary state with a central government under which regional and sub-regional authorities exercise delegated powers. The intermediate administrative level consists of 41 counties.1 Lower-level administrative units are categorised as either ‘towns’ or ‘communes’. Romania joined the North Atlantic Treaty Organisation (NATO) in 2004 and the European Union (EU) in 2007.

Table 1.1. Selected economic and social indicators for Romania (2018‑21)

|

2018 |

2019 |

2020 |

2021* |

|

|---|---|---|---|---|

|

Current prices RON billion |

Percentage changes, volume (unless stated otherwise) |

|||

|

Real GDP growth |

951.7 |

4.2 |

‑3.7 |

6.3 |

|

* Private consumption |

607.3 |

3.9 |

‑5.1 |

4.1 |

|

* Capital formation |

200.4 |

12.9 |

4.1 |

7.5 |

|

* Experts of goods and services |

398.4 |

5.4 |

‑9.4 |

11.3 |

|

Inflation rate, average consumer prices |

6.8 |

3.8 |

5.3 |

|

|

General government fiscal balance (% of GDP) |

‑4.4 |

‑9.3 |

‑8.0 |

|

|

General government gross debt (% of GDP) |

44.5 |

59.4 |

62.4 |

|

|

Unemployment rate (% of labour force) |

3.9 |

5.0 |

5.1 |

|

|

Current account balance (% of GDP) |

‑4.9 |

‑5.0 |

‑6.5 |

|

|

GDP per capita (EUR – current prices) |

10 500 |

11 520 |

11 360 |

.. |

|

At-risk-of-poverty rate (% of total population) |

32.5 |

31.2 |

30.4 |

.. |

Note: * Estimate made in late 2021.

Source: OECD (2022[1]) OECD Economic Surveys: Romania 2022, https://www.oecd-ilibrary.org/economics/oecd-economic-surveys-romania-2022_e2174606-en and Eurostat.

Economy. After a difficult transition to a market-based economy in the 1990s, and notwithstanding current weaknesses caused by the COVID‑19 induced crisis, Romania’s economy has improved significantly over the last decade. In less than 20 years, Romania has reduced the gap in GDP per capita to the OECD average by half, from close to 70% to around 35% (OECD, 2022[1]). That said, the crisis hit the economy hard as GDP fell by 3.7% in 2020 before surpassing its pre‑crisis level in 2021 (Table 1.1). In its 2022 Economic Survey of Romania, OECD recommends a strong commitment to structural reform, bolstered by the availability of funding connected with the EU Recovery and Resilience Plan, to return the Romanian economy to a long-term trajectory of growth above the European average (OECD, 2022[1]).

The risks facing Romania’s economy include inequality and fiscal sustainability. Despite the progress achieved so far, Romania has the second-lowest GDP per capita (at EUR 11 360) among EU member states and likewise, according to Eurostat estimates, one of Europe’s highest shares of population who are at risk of poverty. While Bucharest and many secondary cities have become hubs of prosperity and innovation, poverty remains widespread in rural areas. In addition, while Romania’s government debt at just over 60% of GDP is not in itself alarming, the persistent public budget deficits raise concerns about debt sustainability that will need to be addressed in the medium term.

Government. Romania is a semi-presidential republic, with a division of powers between parliament and the president’s office as established by the Constitution of 1991. The head of state is the President, elected for a period of five years and eligible for a second term. The current president has served since 2014. Parliament is bicameral, consisting of a Senate with 136 seats and a Chamber of Deputies with 330 seats. Members of both chambers are directly elected by party-lists and serving for a period of four years. The head of government is the Prime Minister who is appointed by the President with the consent of parliament. The Council of Ministers (Romania’s cabinet) is appointed by the Prime Minister.

Following parliamentary elections in December 2020, the largest parliamentary party is the Social Democratic Party (PSD) with 29.3% of the votes for Senate and 28.9% of the votes for the Chamber of Deputies. In second place came the National Liberal Party (PNL – 25.6% and 25.2% respectively), followed by the USR-PLUS Alliance2 (15.9% and 15.4%) and the Alliance for Unity (AUR – 9.2% and 9.1%). The current government is a “grand coalition” including the two largest parties whose leaders have agreed to serve as Prime Minister on a rotating basis. The current office holder is Mr. Nicolae Ciuca who heads the PNL; he will cede the post to the leader of the PSD in May 2023.

Legal system. Romania is a civil law jurisdiction wherein the national Constitution and acts of parliament are the primary source of law. Because Romania is an EU member state, its legal system treats EU law as binding. Structurally, the judicial system comprises three instances for civil, administrative and criminal matters: 188 local courts (judecatorii); 41 country courts (tribunale); 15 Courts of Appeal (curti de apel); and the High Court of Cassation and Justice, which is the court of last instance. A number of specialised courts also exist, including family courts and commercial courts, as well as a separate military court system. The Constitutional Court of Romania acts as an independent constitutional jurisdiction and is not part of the ordinary court system.

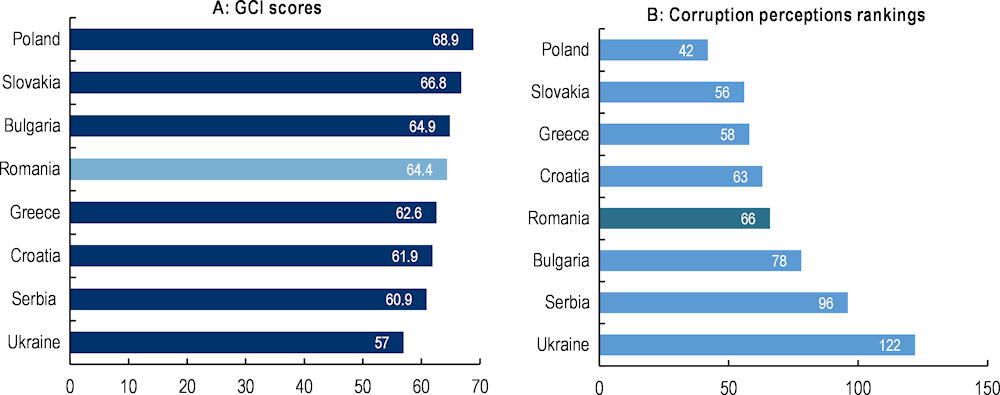

Business environment. Romania ranked 55th out of 190 countries in the 2020 version of the now-discontinued World Bank Ease of Doing Business report, and 51st out of 141 economies in the Global Competitiveness Index (GCI) 2019 (Figure 1.1). Whilst hardly impressive, these rankings do not differ significantly from the respective indices’ ranking of other post-transition economies in like circumstances. With respect to integrity, Romania ranked 66th out of 180 countries (with 1 being the best and 180 the worst) in Transparency International’s 2021 Corruption Perceptions Index.

Figure 1.1. Business climate indicators in Romania

Note: The GCI Index provides a scorecard of competitiveness on a scale from 0 to 100; hence a high score indicates a high degree of competitiveness. The corruption perception index is the ranking of each country in terms of its perceived level of corruption; hence a high score indicates a high risk of corruption.

Source: World Economic Forum (2019[2]), The Global Competitiveness Report, https://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf; Transparency International (2021[3]), Corruption Perceptions Index, https://www.transparency.org/en/cpi/2021

Capital market. The Bucharest Stock Exchange (BVB) was re‑established as a public interest institution in 1995 after a long period of inactivity. In 1997, the exchange listed the first companies of national importance and created the first stock market index BET. The exchange was demutualised and became a joint‑stock company in 2005. The BVB also merged with Rasdaq, the Electronic Exchange of Securities from Bucharest that same year. In 2010, the BVB became a listed company with its shares trading on the Regulated Market. In 2015, the exchange launched the AeRO market, a multilateral trading system (MTS) dedicated to serving SMEs. By the end of 2020, 72.17% of BVB’s share capital was in the hands of Romanian institutional investors, 5.25% was owned by foreign institutional investors and 19.96% by Romanian private individuals.3

The Bucharest Stock Exchange operates two markets: the Main Market, which is the regulated market, and the alternative trading system, the AeRO market. The Main Market targets large mature companies, whereas the AeRO market is designed for SMEs. To become listed on the Main Market, companies are required to be legally structured as a joint‑stock company and to have a minimum market capitalisation of EUR 1 million. In addition, companies are required to have at least a 25% free‑float and a minimum of three years of financial reporting history. There are specific requirements for the three tiers of the Main Market: Premium, Standard and International.

The AeRO market is designed to serve the needs of SMEs. A company wanting to list on AeRO needs to have an anticipated market value of at least EUR 250 000 and a minimum of 10% free‑float or at least 30 shareholders. Companies seeking to raise capital on this market have to be established as a joint‑stock company (SA) prior to the listing. Specific requirements apply to companies listed on the three tiers of the AeRO market: Premium, Standard and MTS International.

By the end of 2020, the Main Market of the BVB listed 76 companies, of which 54 (71%) were listed on the Standard tier, 19 on the Premium tier and three on the International one. The market capitalisation of the Main Market totalled EUR 28.8 billion, with EUR 1.7 billion in the Standard tier, EUR 15.6 billion in the Premium and EUR 11.5 billion in the International tier. The AeRO Market listed 242 companies of which 222 (92%) were in the Standard tier. The market capitalisation of this segment totalled EUR 1.2 billion. Importantly, 18 companies listed on the BVB were identified as SOEs.4 Of these, nine were listed on the Main Market (three on the Standard tier and six on the Premium tier) and nine on the AeRO market (all on the Standard tier).

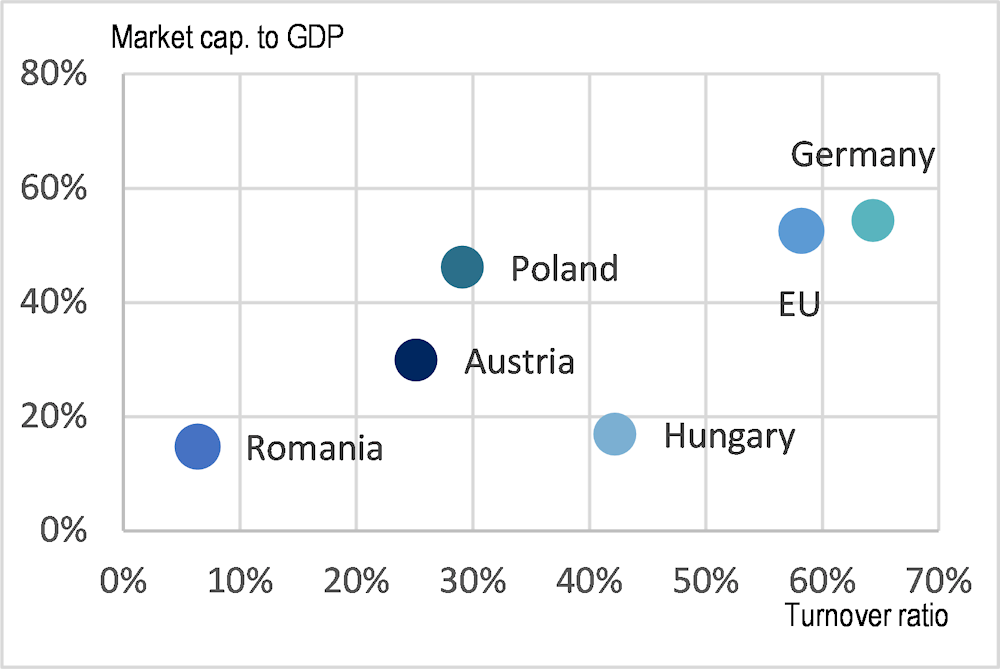

The Romanian equity market is still in a developing stage. When compared to EU and other peer countries, its market capitalisation to GDP and its turnover ratio are the lowest. However, it is worth mentioning that developing the capital market has been one of the Financial Supervisory Authority (FSA)’s main objectives since 2014. An important milestone for the Romanian capital market was the upgrade from Frontier to Secondary Emerging market status by the global index provider FTSE Russell. The reclassification as Secondary Emerging market increases the visibility of the Romanian stock market and decreases the country risk premium since the new status places Romania in the investable universe of a wider range of investors. In addition, a series of measures were adopted to increase transparency and ease market access overall, raising the attractiveness of the local capital market.

Figure 1.2. Market capitalisation and turnover (end of 2020)

Note: Turnover ratio corresponds to the total value traded over the market capitalisation.

Source: OECD (2022[4]), Capital Market Review of Romania: Towards a National Strategy, OECD Publishing, Paris, https://www.oecd.org/corporate/capital-market-review-of-romania-9bfc0339-en.htm

With respect to investors, as of early 2020, private corporations and holding companies was the largest investor category holding 30% of the listed equity in Romania. Their relative importance as owners in the equity market is higher compared with other European peer countries and the EU. The public sector ranked second owning 29% of the total market capitalisation. Institutional investors held 15% of the listed equity in Romania, a relatively low participation compared with their importance in other European markets such as Germany, Hungary and Poland where they own around 30% of the listed equity. In terms of ownership structure, the Romanian stock market is fairly concentrated. In six of every ten listed companies, the largest single shareholder holds over 50% of the equity capital. This level of control and concentration is much higher than in other European countries. Around one‑third of the listed equity was in the hands of foreign investors.

1.2. Overview of the Romanian state‑owned sector

1.2.1. Number and type of state‑owned enterprises

There is a sizeable state‑owned enterprise sector in Romania. According to data provided by the Ministry of Finance, as of end 2020, the state‑owned stakes (between 1%‑100%) in 860 enterprises, of which 410 were majority-owned (with the state owning at least 50% of the ordinary share capital or voting rights). Out of the remaining 450 enterprises, 205 had state holdings of between 10%‑49% of shares or voting rights, which implies that in some circumstances they could be considered as SOEs under the terms of the OECD Guidelines on Corporate Governance of State‑Owned Enterprises (the “SOE Guidelines”).

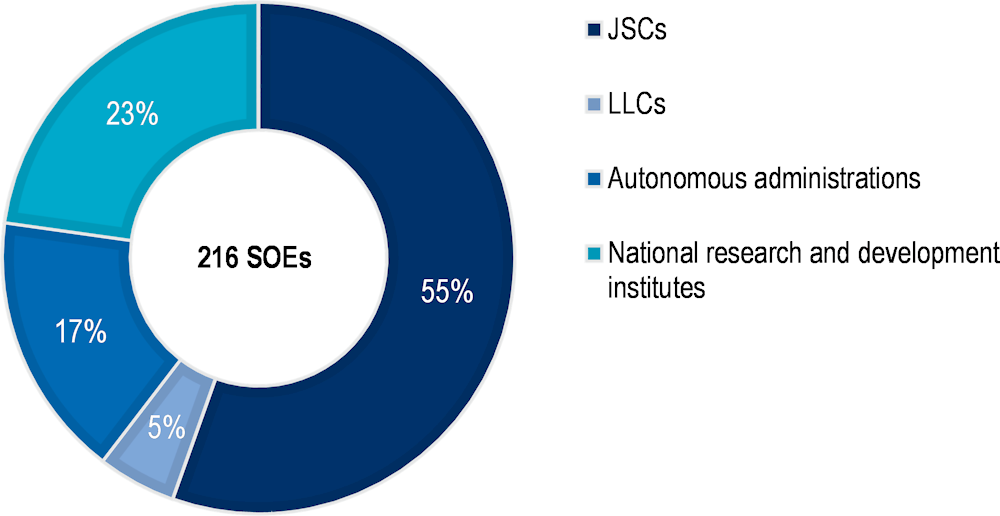

It is important to note, however, that as of 2020, 194 majority-owned (and 88 minority-owned) SOEs were in insolvency proceedings. According to the provisions of Law no. 85/2014 on insolvency, these firms are considered inactive (and exempted from corporate governance requirements). The remainder of this report focuses on the 216 active majority-owned SOEs under the oversight of central government institutions, and on the legal and administrative provisions applicable to them.

1.2.2. Legal forms of SOEs

State‑owned enterprises in Romania can basically take three legal forms: (i) joint stock companies (JSCs); (ii) limited liability companies (LLCs); and (iii) autonomous administrations. The first two categories are legal forms identical to the ones found among private enterprises, as provided by Romania’s Companies Law (no. 31/1990). As mentioned above, all stock-market listed SOEs must have the form of joint stock companies. As of end 2020, there were 121 JSCs (18 of which listed) and ten LLCs in Romania.

Autonomous administrations (known as “regii autonome” in Romanian) are statutory corporations fully-owned by the state which are subject to Law no. 15/1990 on the reorganisation of state economic units as autonomous administrations and companies, with subsequent amendments. As of end 2020, there were 36 autonomous administrations in Romania. Overall, all SOEs regardless of their legal form are subject to the corporate governance provisions of GEO no. 109/2011 (as amended and approved by Law no. 111/2016), which stands as the main law on state‑owned enterprises (see section 1.3 for details).

While national research and development institutes5 also exist to carry out public policy objectives, they are exempted from the application of corporate governance provisions otherwise applicable to SOEs and are only subject to Law no. 324/2003 amending and approving Government Ordinance no. 57/2002 on scientific research and technological development. As of end 2020, there were 49 such national research and development institutes.

Figure 1.3. Breakdown of majority-owned and active SOEs according to their legal forms (as of end 2020)

Source: Information provided by the Romanian authorities.

1.2.3. Size and sectoral distribution of the SOE sector

Reflecting, in part, large‑scale privatisations in previous decades, SOEs still play an important role in the Romanian economy – in terms of their overall volume, but even more so because of their role in systemically important sectors such as energy and transportation. The total SOE sector is valued at approximately USD 19 billion and employs around 183 000 people (Table 1.2). Based on the table, Figure 1.3 and Figure 1.4 provide an additional overview of the sectoral distribution of Romania’s state‑owned sector.

One characteristic of Romania’s SOE landscape is that the country has an internationally very high share of statutory corporations (85 out of a total 216 active companies). However, in terms of economic weight, the picture is a bit different: the statutory corporations account for a relatively limited 14% of the sector’s total valuation and 21% of its employment. In addition, just two large firms account for a large share of the statutory corporations’ employment and equity value, namely the national property administration (RAAPPS) and the forestry service (Romsilva).

Table 1.2. Size and sectoral distribution of Romania’s central state‑owned enterprise sector (end‑2020)

|

|

Majority-owned listed entities |

Majority-owned unlisted enterprises |

Statutory corporations |

||||||

|---|---|---|---|---|---|---|---|---|---|

|

N° of enterprises |

N° of employees |

Value (USD mn) |

N° of enterprises |

N° of employees |

Value (USD mn) |

N° of enterprises |

Number of employees |

Value (USD mn) |

|

|

Primary sectors |

1 |

5 673 |

2 731 |

18 |

3 034 |

249 |

23 |

15 336 |

192 |

|

Manufacturing |

5 |

3 237 |

243 |

25 |

10 111 |

235 |

3 |

731 |

83 |

|

Finance |

9 |

7 485 |

1 988 |

||||||

|

Telecoms |

3 |

2 171 |

198 |

||||||

|

Electricity and gas |

2 |

4 032 |

1 832 |

6 |

18 142 |

4 118 |

|||

|

Transportation |

3 |

6 715 |

1 034 |

15 |

50 710 |

2 829 |

4 |

2 575 |

122 |

|

Other utilities (including postal services) |

6 |

33 385 |

584 |

||||||

|

Real estate |

2 |

46 |

23 |

1 |

2 073 |

1 306 |

|||

|

Other activities |

7 |

140 |

38 |

29 |

6 039 |

626 |

54 |

11 561 |

576 |

|

Total |

18 |

19 797 |

5 878 |

113 |

131 113 |

10 850 |

85 |

32 276 |

2 280 |

Note: Value of enterprises denotes market valuation in the case of listed companies and book equity value for the rest.

Source: Information provided by the Romanian authorities.

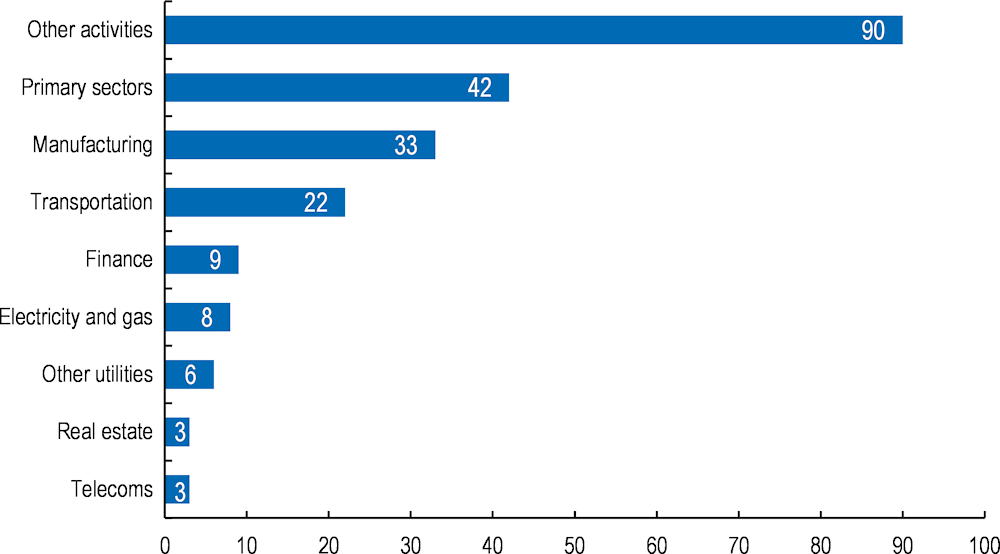

Figure 1.4 provides an overview of the sectors in which individual SOEs are found. Like in other countries, the collectively classified “other activities” predominate, and as in other countries these companies tend to be comparatively small special-purpose entities found across all parts of the public sector. Moreover, in the case of Romania, 54 of them are statutory corporations mostly taking the form of national research and development institutes. A further large cluster of mostly small companies is found in the primary sectors, which span from the extractive industries to agriculture and forestry.

Figure 1.4. Sectoral distribution by number of central majority-owned enterprises (2020)

Note: Other utilities include the postal service. Data includes the 216 central majority-owned listed and unlisted SOEs, as well as statutory corporations, that were active as of end 2020.

Source: Information provided by the Romanian authorities.

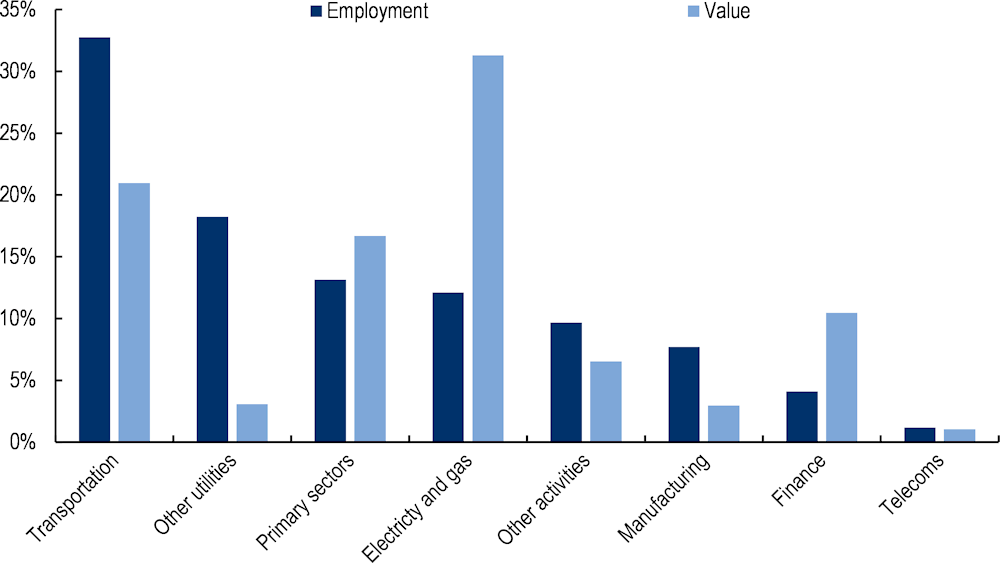

However, in terms of economic importance, the sectoral distribution is quite different. Figure 1.5 illustrates that in value terms, most of the state‑owned economy is concentrated in just two sectors, namely energy (which in the figure is spread over “electricity and gas” and the “primary sectors”) and transportation. By far the largest employers in the state‑owned sector are found in the transport sector (which includes pipeline operators and hence is partly linked with the energy sector) with close to a third of the overall SOE employment. This is followed by the “other utilities” which account for 18% of Romania’s SOE employment, the “primary sectors” (13%) and “electricity and gas” (12%).

These sectoral differences do to a large extent reflect the importance of a few, large state‑owned enterprises, which are described in more detail in a later section of this report. For instance, the railway sector (which in Romania includes two operating companies and one infrastructure owner) is by far the largest individual employer in the state‑owned sector, followed by the postal company and the forestry industry. In terms of valuation, again, the energy sector stands out. The electricity generators Hidroelectrica and Nuclearelectrica come first and third in terms of valuation. The natural gas producer Romgaz is second. Finally, one reason for the high values of companies related to the energy sector is that many of them are listed in stock markets, which tends to raise corporate valuation.6 The role of individual listed SOEs is reviewed in more detail below.

Figure 1.5. Sectoral distribution of the central SOE sector by value and employment (2020)

Note: Other utilities include the postal service. Data includes the 216 central majority-owned listed and unlisted SOEs, as well as statutory corporations, that were active as of end 2020.

Source: Information provided by the Romanian authorities.

1.2.4. SOEs’ share of the economy

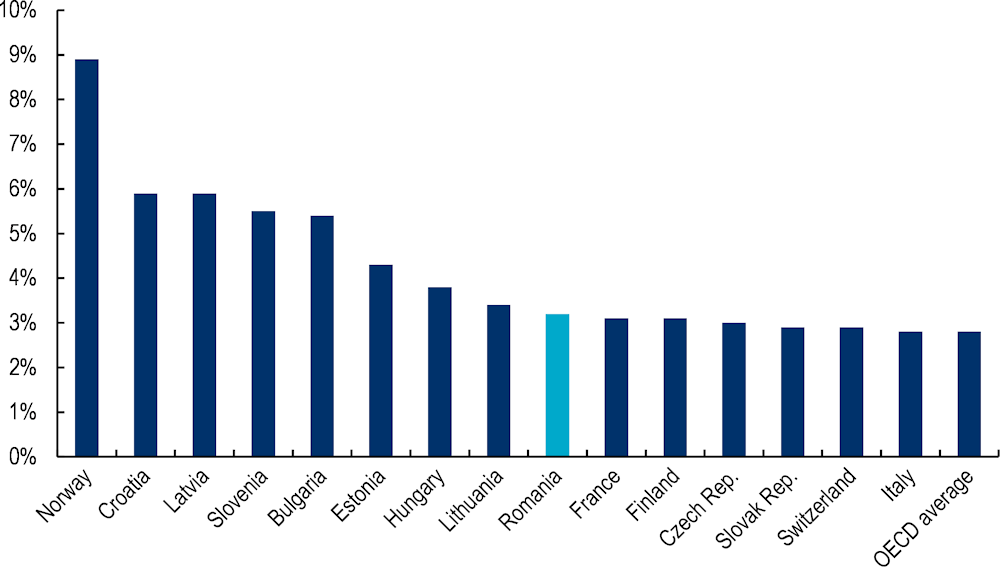

In the absence of detailed GDP figures for the state‑owned sector, the OECD relies on the share of employment to illustrate SOEs’ relative weight in the economy. An estimate is provided in Figure 1.6.

Figure 1.6. SOEs’ share of total dependent employment compared with other countries

Source: OECD Secretariat estimates based on data collected for OECD (2017[5]), The Size and Sectoral Distribution of State‑Owned Enterprises, https://www.oecd-ilibrary.org/governance/the-size-and-sectoral-distribution-of-state-owned-enterprises_9789264280663-en and OECD Labour Force Statistics Database, http://dotstat.oecd.org/

At the national level, SOEs employ 183 181 people. As a share of the dependent employment7 this is 3.2% which is somewhat above OECD average (Figure 1.6), but relatively low compared with most other post-transition economies. Of note, this does not provide a full picture of state involvement in Romania’s corporate sector as the country has an unusually large number of enterprises held by regional and municipal authorities. However, these “sub-national SOEs” fall outside the scope of the present study.

1.2.5. SOEs listed in stock markets

Compared with other post-transition economies, Romania has a relatively large portfolio of stock-market listed SOEs. Overall, 18 majority-owned SOEs are traded on the stock exchange. This includes eight that are listed on the exchange’s main market and ten that are traded on the alternative trading system known as the “AeRO market”. In another eight companies the state holds sizeable minority stakes (including three on the main market and five on the AeRO Market). The state invested companies account for 14.2% of market capitalisation. Romgaz (with 70% of state ownership) is the only double‑listed SOE; since 2013 it has been admitted to trading both on the Bucharest Stock Exchange and the London Stock Exchange.

The largest and most valuable listed SOEs are concentrated in the energy sectors (i.e. hydrocarbons and electricity). Table 1.3 shows that, as earlier alluded to, the largest five majority state‑owned companies all fall within these sectors. So does the oil producer OMV Petrom, until recently the most highly valuated listed company in Romania, in which the state has retained a sizeable minority stake after selling the majority to Austria’s ÖMV. A complete list of stock-market traded companies with a consolidated public sector ownership of at least 10% is provided in Annex B.

Among the other four listed companies, Electrica, whilst formally categorised as a “management consultancy” firm, is actually a key player in the electricity distribution and supply market in Romania. With the state holding 48.8% of the shares, and in the absence of other large blockholders, this company would be categorised as an SOE in the sense of the SOE Guidelines since the state can effectively control it. Conversely, the state’s stake in the oil refiner Rompetrol (at 44.7%) is actually exceeded by that of another shareholder, Kazakhstan’s KazMunayGaz (which holds 48.1%).

Table 1.3. The ten largest listed companies with a state participation exceeding 10%

|

Company name |

Main sector of operations |

Stock market(s) of listing |

State ownership share |

Market capitalisation (USD mill.; end‑2020) |

|---|---|---|---|---|

|

OMV Petrom |

Extraction of crude petroleum |

Bucharest main market |

20.6% |

5 192 |

|

Romgaz |

Extraction of natural gas |

Bucharest main market and London Stock Exchange |

70.0% |

2 731 |

|

Nuclearelectrica |

Electric power generation |

Bucharest main market |

82.4% |

1 358 |

|

Electrica |

Management consultancy activities |

Bucharest main market |

48.8% |

1 096 |

|

Transgaz |

Transport via pipeline |

Bucharest main market |

58.5% |

840 |

|

Rompetrol Rafinare |

Manufacture of refined petroleum products |

Bucharest main market |

44.7% |

489 |

|

Transelectrica |

Electric transmission and distribution |

Bucharest main market |

58.7% |

473 |

|

Conpet |

Transport via pipeline |

Bucharest main market |

58.7% |

166 |

|

Transcom |

Maintenance and repair of motor vehicles |

Bucharest AeRO |

48.1% |

86 |

|

Antibiotice |

Manufacture of pharmaceuticals |

Bucharest main market |

53.0% |

82 |

Source: Information provided by the Romanian authorities.

In addition to now being among the companies in the stock markets, Romania’s listed SOEs have also played a significant role in developing the markets. A recent OECD study of Romania’s capital markets found that the four largest IPOs of all time in Romania concerned SOEs (Table 1.4). This was part of a deliberate strategy by various governments to use the listing of SOEs not only to enhance the governance of the companies but also to help develop the national stock markets. The large listings concerned energy companies and public utilities in the energy sector. On the one hand, this makes good sense because these companies were valuable and profitable, hence easy to bring to the market; on the other hand, it may raise some concerns about the protection of minority shareholders, since many of them are still subject to important public policy objectives that could change over time.

Table 1.4. The largest 10 initial public offerings on Romania’s stock markets

|

Issuer name |

Economic sector |

SOE? |

Year |

Proceeds (EUR mill.) |

|---|---|---|---|---|

|

Electrica |

Utilities |

Yes |

2014 |

456.2 |

|

Romgaz |

Energy |

Yes |

2013 |

399.0 |

|

Nuclearelectrica |

Utilities |

Yes |

2013 |

75.7 |

|

Transgaz |

Utilities |

Yes |

2007 |

69.1 |

|

Sphera Franchise Group |

Consumer Cyclicals |

No |

2017 |

64.0 |

|

MedLife |

Healthcare |

No |

2016 |

43.4 |

|

Transelectrica |

Utilities |

Yes |

2006 |

34.4 |

|

SC Teraplast |

Consumer Cyclicals |

No |

2008 |

14.9 |

|

Flamingo International |

Technology |

No |

2005 |

12.3 |

|

Alumil Rom Industry |

Consumer Cyclicals |

No |

2006 |

8.9 |

Source: OECD (2022[4]), Capital Market Review of Romania: Towards a National Strategy, OECD Publishing, Paris, https://www.oecd.org/corporate/capital-market-review-of-romania-9bfc0339-en.htm

1.2.6. Economic and financial performance of SOEs

The economic and financial performance of SOEs is important on efficiency grounds, but also because some Romanian SOEs represent an increasingly important source of revenues for the state budget. In 2001, Ordinance no. 64/2011 established that at least 50% of SOEs’ net profit should be paid as dividends to the national or local budget. However, in response to growing fiscal pressures during the 2016‑19 period (where increases in public expenditures concurred with a reduction of certain taxes), the law was amended by GEO no. 29/2017 to provide that SOEs’ financial reserves may be redistributed in the form of dividends to the state of local budget.8 In addition, GEO no. 114/2018 provides that 35% of SOEs’ financial reserves found in cash should be distributed as dividends. As such, between 2016‑19, some SOEs distributed 85%‑90% of their net profits as dividends to the state budget.9

Overall, however, the growing fiscal reliance on dividends has concurred with a deterioration of SOEs’ financial and operational performance. The European Commission, which regularly monitors the situation, has attributed the decline in operational performance largely to the weakness of the governance of the Romanian state‑owned sector (Box 1.1). Moreover, while some SOEs do indeed remain quite profitable, most of the national state ownership portfolio is not.

Box 1.1. Performance of Romania’s SOEs according to the European Commission

The findings below are drawn from the European Commission’s ‘Country Report Romania 2020’ issued on 26 February 2020:

The performance of state‑owned enterprises is deteriorating. The operational and financial results of state‑owned enterprises declined substantially in 2018 and the first half of 2019. Aggregate profits, at RON 3.5 billion in 2018, decreased by 53% compared to 2017, according to the Ministry of Finance data. In particular, companies in the energy and transport sectors contribute to this situation. Arrears are also increasing again, having reached RON 4.4 billion (EUR 932 million) at the end of 2018, 11% higher than in December 2017.

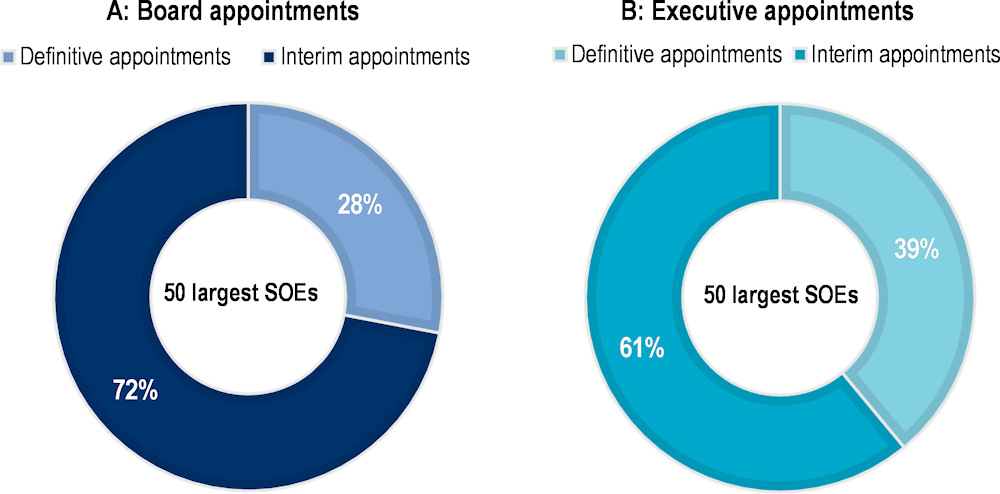

The deterioration of corporate governance contributes to poor performance. Romania has a very solid corporate governance framework for state‑owned enterprises, but its implementation has been limited. Loss-making companies are not asked to restructure or modify their business plans. Debts to the state budget, social security or other state‑owned enterprises amount to 90% of all arrears by state‑owned enterprises, which represents a financial risk for the state but also demonstrates a permissive attitude from public sector suppliers and creditors. Interim boards and managers became a standard practice in most companies. The authorities applied 60 financial penalties for administrative offences under the corporate governance legislation, but the amounts tend to be symbolic. Furthermore, different Ministries and departments involved in overseeing state‑owned enterprises seem to disagree increasingly on the respective responsibilities, despite clear allocations under the law.

The future of the Sovereign Development and Investment Fund is unclear. The creation of the Fund was announced in 2017. It should receive the state’s shares in some 30 state‑owned enterprises to boost investment, but with unclear objectives or strategy. A first law was approved in spring 2018 but rejected by the Constitutional Court. In November 2018, the government addressed the Court’s concerns and adopted framework legislation. It accelerated the assessment of how to create the Fund outside the budget perimeter, but plans are unclear.

Source: European Commission (2020[6]), European Semester Country Report Romania 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020SC0522&from=EN

A 2022 report by the Romanian Fiscal Council observed that while the state’s portfolio has showed positive returns on equity and assets in most recent years (albeit significantly less than private firms), this is entirely attributable to the five most profitable SOEs without which the aggregate operating result would be sharply negative. This report moreover seems to confirm the European Commission’s assessment that the situation has deteriorated in recent years. In 2019, the state‑owned companies registered an aggregate net loss of RON 1.8 billion, and while 2020 recorded a return to positive territory with a total net profit of RON 0.9 billion, this reflected one‑off government assistance to enterprises related to the COVID‑19 crisis (Romanian Fiscal Council, 2022[7]). While there is high heterogeneity in the performance of SOEs, central SOEs in the portfolios of the ministries of economy, energy and transport produce 75% of total declared revenues (74% net of subsidies) and receive 87% of total subsidies. However, when adjusted for subsidies, the profit of the central SOEs in the portfolio of the Ministry of Economy and the Ministry of Transport in particular fall into negative territory, driving down overall performance significantly (World Bank, 2020[8]).

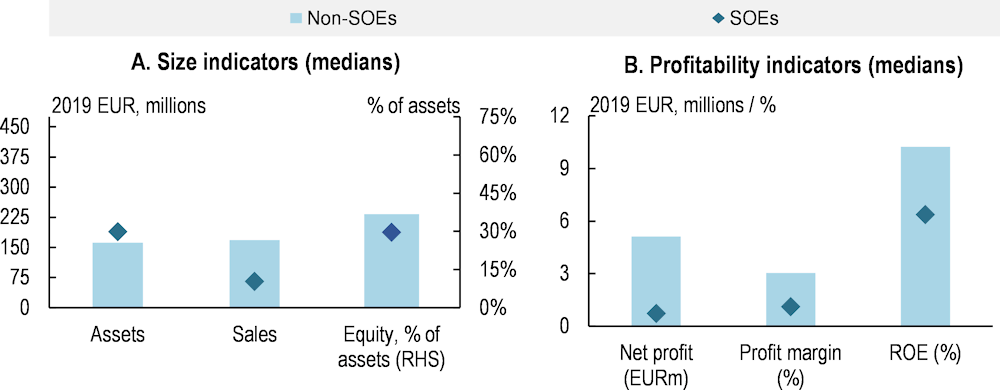

Recent analysis by the OECD sheds further light on the relatively weak performance of Romania’s SOEs. OECD analysed a sample of 279 large unlisted companies of which 42 were identified as SOEs (defined in this study as a company where the state owns at least 20% of the share capital) (OECD, 2022[4]). A comparison of the respective size and indicators of financial performance of companies shows that while the median SOE is slightly larger than the median non-SOE in terms of asset size, SOEs underperform significantly both in terms of sales and profitability (Figure 1.7). To the extent that SOEs provide services that the private sector will not, or is not suited to, due to an inherently low profitability in the specific industry, this is natural and not necessarily cause for concern. However, in the Romanian case, the gap between SOEs and non-SOEs is very pronounced. The cited study argues that this is an argument for listing a number of large SOEs in the stock market with the double purpose of enhancing their performance and making the markets deeper and more liquid.

Figure 1.7. Financial indicators for large SOEs and private companies (not traded in stock markets)

Source: OECD (2022[4]), Capital Market Review of Romania: Towards a National Strategy, OECD Publishing, Paris, https://www.oecd.org/corporate/capital-market-review-of-romania-9bfc0339-en.htm, based on data from the OECD-ORBIS Corporate Finance dataset.

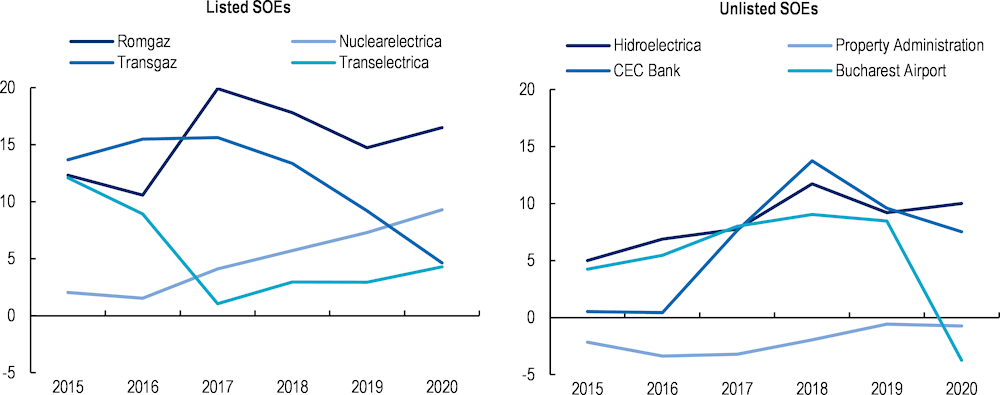

The development of financial performance indicators in some of the largest SOEs shed further light on these findings. Figure 1.8 shows the rate of return on equity (RoE) of four listed and four unlisted Romanian SOEs since 2015. The figures apparently confirm the notion that unlisted SOEs have not been particularly profitable. The RoEs of unlisted SOEs have in recent years varied in a band from ‑5% to 15% compared with 0% to 20% for the listed firms, which can be expected to show a performance that is closer to their private sector peers. At the same time, the variation among firms is considerable. The most consistent performer among the unlisted firms has been Hidroelectrica (as mentioned elsewhere a top candidate for privatisation) with a RoE generally around 10%.10 Bucharest Airport was also quite profitable until the COVID‑19 induced crisis triggered major losses. Conversely, the National Property Administration statutory corporation (Regia Autonomă Administrația Patrimoniului Protocolului de Stat, RA AAPS) has been consistently loss-making for the last many years.

Additional corporate information not on display indicates that the overall poor performance of unlisted SOEs observed in Figure 1.8 may be in part triggered by particularly bad results in a small number of large firms. In particular, the rail freight company CFR Marfa recorded mounting deficits in 2015‑17, which wiped out its equity capital and led to a major recapitalisation.

Figure 1.8. Rates of return on equity in large listed and unlisted SOEs (2015‑20)

Source: Information provided by the Romanian authorities.

1.2.7. Perspectives on privatisation

In the context of Romania’s transition from a post-communist economy to a market-based system, Law no. 15/1990 undertook the restructuring of state enterprises into commercial companies with share capital and fully-owned autonomous administrations (regii autonome), the latter thus remaining as state property and solely operating in strategic economic sectors such as defence production, transport, energy, natural gas and mining. The law also created the National Agency for Privatisation (NAP) tasked with organising the privatisation process and ownership certificate programme (i.e. the Mass Privatisation Programme). Further privatisation efforts were undertaken by Law no. 58/1991, Law no. 55/1995 and Law no. 77/1994.

In the aftermath of the 2008 global financial crisis and as part of Romania’s commitments under the IMF-EU-World Bank economic recovery programme, efforts were made to accelerate privatisations, focusing on state‑owned companies operating in the energy sector. Through initial public offerings (IPOs), 10% of the share in nuclear energy company Nuclearelectrica were sold in November 2013, and 15% of the shares in the state‑controlled gas producer Romgaz were sold in November 2013. Both IPOs were oversubscribed and generated about EUR 450 million in gross proceeds (IMF, 2014[9]). While the Romgaz transaction was completed at the upper end of the price range, the Romgaz IPO was the first time a Global Depository Receipts (GDRs) was issued in conjunction with a public offering on the Bucharest stock exchange. A dual listing of Electrica on both the Bucharest and London Stock Exchanges was undertaken in 2014, which had a significant impact on its capitalisation and liquidity.

In the context of the COVID‑19 pandemic, privatisation efforts came to a halt in 2020, with the enactment of a two‑year ban on the sale of SOE shares that was formally motivated by concerns about having to sell state assets at artificially low prices. The ban expired in 2022.

In March 2022, the initiation of the listing of the shares of Hidroelectrica on the Bucharest Stock Exchange was approved by the shareholders (including the Ministry of Energy with 80.06% of the shares, and Fondul Proprietatea with 19.94% of the shares), with Fondul as the selling shareholders of up to 19.94% of the share held in Hidroelectrica. The listing is aimed to be completed by Q1 2023. Further, the listing of Salrom (51% state‑owned, with 49% of the shares held by Fondul) was approved by the shareholders in July 2021 and approved by government memorandum in July 2022. As part of its commitments under the EU Recovery and Resilience Plan, Romania should also list, lease or restructure at least three central state‑owned companies operating the energy and transport sectors by Q2 2026 (European Commission, 2021[10]).

1.3. Legal and regulatory framework

1.3.1. Main laws and regulations on corporate governance

Companies Law no. 31/1990

The Companies Law no. 31/1990 is the primary legislation for the corporate sector in Romania. It applies to all companies, and contains provisions regarding the management of the company, the appointment and dismissal of board members and executive managers, the composition and functioning of the management bodies and the remuneration of their members, as well as their responsibility, revocation and liability towards the company. According to the law, a company may be established as a general partnership, limited partnership, joint-stock company, partnership limited by shares, and a limited liability company.

The Companies Law was amended several times,11 with significant revisions driven by Romania’s efforts to join the European Union and introduced in 2004, 2006 and 2007 in order to comply both with the European Commission’s recommendations on corporate governance and the OECD Corporate Governance Principles.12 In particular, Law no. 441/2006 brought substantial reform by introducing two alternative corporate management systems (the one‑tier and two‑tier system), as well as significant changes to the rights, duties, attributions and powers granted to the members of the management bodies of the companies.

Overall, the main amendments in 2006 and 2007 of the Companies Law aimed at enhancing corporate governance rules regarding: board independence; the requirement for the managers to inform the board of directors of their actions on a regular basis; the clear separation between executive and non-executive directors; the right of directors to request information from executive managers regarding the daily management of the company; independence requirements for board committee members; and the duty of loyalty for directors and executive managers.

Laws and regulations on capital markets

The Capital Market Law no. 297/2004 applies to all companies listed on the stock exchange or a recognised alternative trading system. It was amended by GEO no. 32/2012 and the subsequent Law no. 24/2017 regarding the issuers of financial instruments and market operations, and by Law no. 158/2020 which implements the 2017 EU Shareholder Rights Directive II. The law applies to listed SOEs (currently 18 majority-owned and eight minority-owned (10‑49%) at the central level of government). It regulates the functioning of the financial instruments and markets, and provides for the rights and obligations of companies listed on the regulated market.

The law also defined the responsibilities of the former National Securities Commission (CNVM), which were later attributed to the Financial Supervision Authority (FSA) created by Government Emergency Ordinance no. 93/2012 approved by Law no. 113/2013 as an integrated regulatory and supervisory body for the non-banking financial market. The FSA is responsible for the authorisation, supervision and control of the insurance‑reinsurance market, financial instruments and investments market and private pensions market.

National Corporate Governance Code

The Bucharest Stock Exchange (BVB) Code of Corporate Governance includes a set of principles and recommendations which can be adopted on a comply-or-explain basis by companies whose securities are traded on the regulated market. The first code was adopted in 2001. Following Romania’s accession to the EU in 2007, a new code harmonised with European legislation was issued in 2008, recommending that issuers adopt a clear and transparent corporate governance framework, which should be disclosed to the general public. The code was revised in 2016 to enhance the recommendations around access to information for investors and the protection of shareholders’ rights, in line with Romanian and European legislation. It applies to all listed SOEs, but there is no requirement or expectation that unlisted firms adhere to it.

The code differentiates two tiers of companies – standard and premium – with corporate governance requirements being more stringent on the latter. The code imposes obligations pertaining to having majority non-executive board members, minority shareholder protection, investor relations and shareholder engagement, internal audit, and board and executive remuneration.

In particular, it comprises four sections, each including general principles, as well as “provisions to comply with”. According to the BVB rulebook, companies listed on the Bucharest Stock Exchange are required to include a corporate governance statement as a specific section in their annual report which should contain a self-assessment on how the “provisions to comply with” are observed, and include the measures taken in order to comply with the provisions that are not fully met. In accordance with the comply-or-explain principle, all cases where a company does not observe the “provisions to comply with” must be reported to the market via the company’s annual report.

As part of its monitoring role regarding the implementation of the code, the Bucharest Stock Exchange (BVB) also published a Compendium of Corporate Governance Practices and a Manual for Reporting Corporate Governance in order to assist companies to implement the Code (BVB, 2015[11]; 2015[12])

1.3.2. Legal and regulatory framework applicable to SOEs

Law no. 15/1990 on the Restructuring of State Enterprises into Commercial Companies and Autonomous Administrations

As mentioned above, in 1990, the Law on the Restructuring of State Enterprises (Law no. 15/1990) undertook the conversion of the former socialist “state economic enterprises” into (i) commercial companies with share capital, and (ii) (fully-owned) autonomous administrations (“regii autonome”). The latter were to remain state property and operate only in strategic sectors of the economy, such as defence production, rail and urban transportation, energy, natural gas and mining. According to Article 18 of Law no. 15/1990, the legal form of the company is to be established by its articles of association. Government Emergency Ordinance no. 30/1997 further introduced the reorganisation of autonomous enterprises into companies, with the aim of submitting them to a privatisation process.

Government Emergency Ordinance no. 109/2011 on state‑owned enterprises

Government Emergency Ordinance no. 109/2011 on corporate governance of public enterprises (hereafter referred to as “GEO no. 109/2011”) represents the main framework for the ownership and corporate governance of SOEs in Romania. It was introduced in the aftermath of the 2008 global financial crisis which severely impacted the Romanian economy (including SOEs) and was conditioned on financial assistance agreements with the IMF, EU and World Bank.

Prior to the adoption of GEO no. 109/2011, SOEs (referred to in Romanian law as public enterprises13) operated on the basis of Law no. 15/1990 (autonomous administrations), while incorporated SOEs operated under Law no. 31/1990 (companies). Since the former was deemed to comprise important gaps for the good governance of autonomous administrations, and the latter was deemed not adapted to the specificity of SOEs, it was considered necessary to develop new corporate governance mechanisms for SOEs, in addition to those regulated by the existing general legislation.14

According to the Romanian authorities, GEO no. 109/2011 was developed with explicit reference to OECD instruments, notably the SOE Guidelines and the G20/OECD Principles of Corporate Governance, and aimed to (i) establish transparent selection procedures for SOE board members and executive managers in order to safeguard their independence and objectivity, (ii) introduce mechanisms to protect the rights of minority shareholders, and (iii) increase transparency regarding the activity of SOEs and the state’s shareholding policy. As such, GEO no. 109/2011 introduced provisions on, inter alia, the protection of minority shareholders, internal and statutory audit, transparency and reporting requirements. GEO no. 109/2011 was amended once by GEO no. 51/2014, until it was later approved and amended by Law no. 111/2016 (see details below).

Of note, the most important objective of GEO no. 109/2011 was reportedly to professionalise SOE boards by ensuring that directors are sufficiently qualified and are independent enough to discern and promote the interests of the company. As such, the Ordinance sought to limit political intervention in the appointment process by introducing detailed rules and criteria-based procedures for the selection of directors and executive managers, which are to be applied by independent committees or human resources recruitment specialists.15 Other provisions include (i) the requirement for both boards and executive managers to draw “administration plans” outlining the company’s objectives, (ii) the requirement to establish at least two board committees, and (iii) the right of minority shareholders to contest board nominations. All the specific provisions introduced by GEO no. 109/2011 compared to the general ones of the Companies Law no. 31/1990 are summarised in Table 1.5.

Table 1.5. Changes brought by GEO no. 109/2011 compared to the general provisions of the Companies Law (no. 31/1990)

|

Specific provisions |

Details |

|---|---|

|

Professional management |

GEO no. 109/2011 requires minimum qualification criteria for the selection of SOE board members and executive management, which are not provided by Law no. 31/1990. |

|

Procedures for the selection of board members |

GEO no. 109/2011 provides for a specific process for the selection of board members and executive management, while the Companies Law entitles the boards of directors and general meetings of shareholders to decide on the selection and appointment of board members. For large enterprises, GEO no. 109/2011 requires the use of independent external consultants in the selection process. While representatives from line ministries are allowed to fill several seats on the boards, candidates are required to go through the due process of evaluation by the independent consultant. |

|

Separation of responsibilities |

According to GEO no. 109/2011, the chairperson of the board of directors cannot be the same as the general manager, whereas the Companies Law allows the general manager to act as chairperson of the board of directors, subject to the prior approval of the general meeting of shareholders. |

|

Board and executive remuneration |

GEO no. 109/2011 imposes certain basic rules and criteria for the remuneration of the company’s management structures, while the Companies Law accepts the approval of the shareholders. |

|

Limits on the number of board members |

GEO no. 109/2011 provides that one‑tier boards be comprised of at least five and a maximum of nine directors, while the Companies Law has no provisions regarding these. For two‑tier boards, GEO no. 109/2011 provides that they be comprised of between three to seven members. |

|

Board committees |

GEO no. 109/2011 requires boards to set-up at least two committees (an audit committee, and a nomination and remuneration committee), while the Companies Law only suggests that board committees can be established (except for JSCs whose annual financial statements are subject to financial audit, where the creation of an audit committee shall be mandatory). |

|

Administration plan |

GEO no. 109/2011 requires executive and non-executive directors to jointly elaborate an administration plan within 90 days of their appointment, which should be submitted for approval by the board of directors. The Companies Law does not impose such an obligation on board members. |

|

Reporting requirements |

Reporting requirements are extended by GEO no. 109/2011 compared to the standards imposed by the Companies Law. In particular, companies subject to GEO no. 109/2011 are required to have a website where they should disclose: the decisions of the general meetings of shareholders; annual financial reports; half-yearly accounting reports; annual audit report; annual directors’ report; the list of directors and their CVs; Codes of Ethics; and the remuneration report. |

|

Protection of minority shareholders |

The protection of minority shareholders is also extended by GEO no. 109/2011 compared to the standard requirements of the Companies Law. According to GEO no. 109/2011, minority shareholders with more than 10% of the voting rights may require the use of the cumulative voting method to appoint the members of the board of directors. The provision goes even beyond the Capital Markets Law applicable to listed companies, where the cumulative vote can only be requested by a significant shareholder. |

Source: Ministry of Finance (2014[13]), Evaluation of the implementation of the emergency ordinance no. 109/2011, https://mfinante.gov.ro/domenii/guvernanta/rapoarte-generale-periodice

In spite of the improvements brought by GEO no. 109/2011 to the corporate governance framework of SOEs, a 2014 report commissioned by the Ministry of Finance found that, three years after the adoption of the ordinance, its application was still far below expectations. While the process of board selection and appointment provided by GEO no. 109/2011 had been carried out in 33 large enterprises by mid‑2014, most of these boards were revoked soon after by decision of the shareholders’ representatives during the AGM for various reasons – including the failure of the board to submit its administration plan in time as required, or the non-approval of the submitted plan by the line ministry. Board members removed from office were replaced with interim members, and the process had not started in more than 200 SOEs in the central government’s portfolio (Ministry of Finance, 2014[13]). The report identified several inter-related factors explaining this stalemate, including (i) lack of monitoring, enforcement mechanisms and accountability, and (ii) unclear institutional arrangements, roles and responsibilities (Box 1.2).

Based on these identified shortcomings, the report issued recommendations to (i) improve the performance management framework for SOEs, and (ii) establish a clear ownership structure within government. Regarding the first objective, the report recommended that – instead of having two different administration plans, one drawn by the board and one by executive management, which might encourage collusion between non-executive and executive members to set achievable goals and possibly ignore long-term objectives – the relevant line ministry first establishes a “letter of expectation” which sets out the general (short-, medium- and long-term) objectives for each company. Based on these guidelines, the board, in collaboration with executive management, should then develop a business plan and set concrete targets.

This objective goes hand-in-hand with the need to strengthen the capacities of ministries to monitor companies in their portfolio. As such, the report also recommended that each line ministry set up specialised departments – comprised of qualified professionals – to oversee and monitor SOEs, collect information and prepare regular reports on their performance, and represent the state owner during AGMs without compensation by the company they supervise for meeting attendance (which was previously the case) as it might distort incentives. In order to increase political accountability, the report also recommended that line ministries be required to regularly submit reports to the government on the implementation of GEO no. 109/2011 and on the evolution of enterprises in their respective portfolios.

Regarding ownership arrangements, the report further recommended the establishment of an independent ownership structure, in line with OECD standards, responsible for: (i) developing a state ownership policy, (ii) regularly reviewing the legal status of SOEs (including autonomous, national and commercial companies) which may change depending on SOEs’ performance, sector of operation and sectoral policies, (iii) identifying the public policies that SOEs have to carry out, and ensuring that these obligations and costs are made public, (iv) identifying SOEs for privatisation, restructuring and liquidation and organising these procedures; (v) monitoring the implementation of GEO no. 109/2011 and establishing reporting lines between SOEs and line ministries; (vi) ensuring proper representation of the state in AGMs; and (vii) monitoring the functioning and quality of SOE boards, developing instruction manuals and facilitating training programmes.

Law no. 111/2016, amending and approving GEO no. 109/2011

GEO no. 109/2011 was revised and codified by Law no. 111/2016, which introduced important amendments to the legislative framework on corporate governance of SOEs, based on the identified shortcomings and subsequent recommendations of the 2014 report on implementation of GEO no. 109/2011 (Box 1.2).

Box 1.2. Main provisions of Law no. 111/2016

Ownership arrangements

In the aim of separating ownership from regulatory functions of line ministries, the law required the establishment of corporate governance structures in public authorities with ownership roles. It also attributed a co‑ordination function to the Ministry of Finance, along with sanctioning powers for non-compliance with corporate governance requirements. The Ministry of Finance is also tasked with preparing and publishing annual aggregate reports on the activity of central and local SOEs.

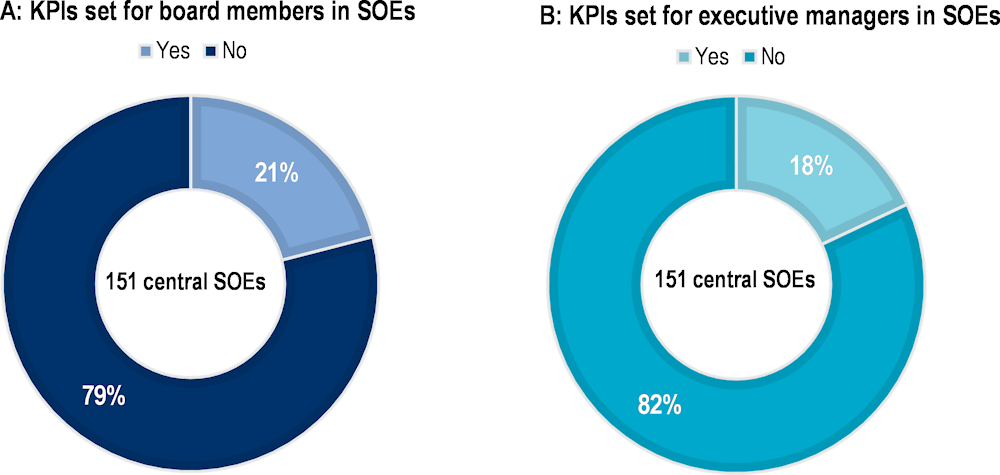

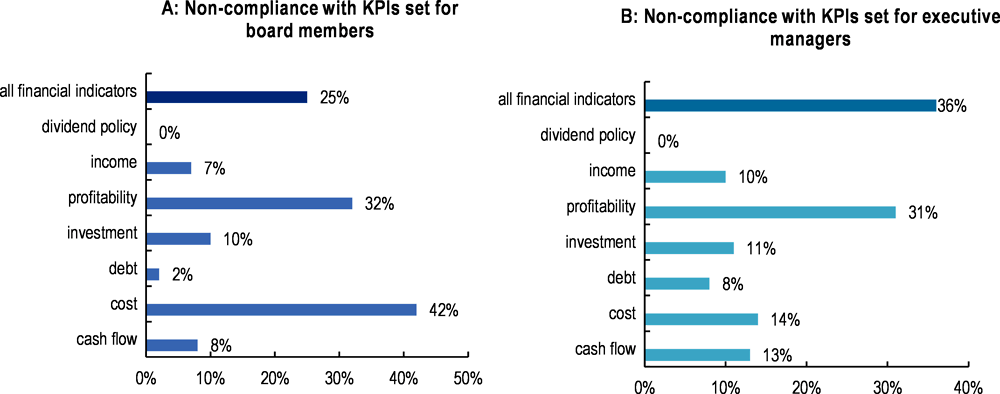

Objective‑setting and performance management framework for SOEs

The law introduced a performance management framework for SOEs, to be designed and implemented through several instruments: (i) letters of expectation to be prepared by the state owner – in collaboration with minority shareholders – for individual SOEs detailing their long-term objectives (i.e. for a period of four years), (ii) declarations of intent to be prepared by SOE board and executive candidates, and (iii) administration plans to be jointly prepared by SOE board members and executive management upon their appointment setting out concrete targets, based on which performance indicators are then required to be developed by line ministries and included in the mandate contracts16 of SOE board and executive members, in line with the provisions of Government Decision no. 722/2016.

Source: Romanian Government (2016[14]), Law no. 111/2016, https://legislatie.just.ro/Public/DetaliiDocumentAfis/178925 and Romanian Government (2016[15]), Government Decision no. 722/2016, https://legislatie.just.ro/Public/DetaliiDocument/182501

At present, all state‑owned enterprises regardless of their legal form are required to observe the provisions of GEO no. 109/201117 (as approved by Law no. 111/2016), with a few exceptions. Two defence and national safety SOEs (CN Romtechnica SA and Rasirom RA) are exempted as well as a maritime enterprise (Damen Shipyards Mangalia SA), whose operational management is entrusted to its minority shareholder in spite of it being majority-owned by the state. Credit institutions (CEC Bank, Eximbank) are also exempted from the provisions of GEO no. 109/2011 (as approved by Law no. 111/2016), on the grounds that they are subject to specific prudential standards applicable to the financial sector.18

Some subsequent attempts were made to amend, and apparently weaken, the provisions of the law. A legislative attempt to amend Law no. 111/2016 to exempt around 100 SOEs (including the largest ones) from corporate governance requirements was made in December 2017 but was deemed unconstitutional in 2018 (European Commission, 2019[16]). In addition, in 2018, the government attempted to set up a Sovereign Development and Investment Fund, to which it intended to transfer the ownership of around 30 SOEs, and to be classified outside the budget perimeter with very broad objectives, including job creation, infrastructure development, innovation and competitiveness. While the creation of the Fund received parliamentary approval in 2018, it was deemed unconstitutional in 2019, and its future remains unclear (European Commission, 2019[16]; 2020[6]).

Although the legal framework for SOEs has been strengthened since 2011 in the aim of professionalising SOE boards and insulating them from political interference, it should be noted that there is at least one important loophole in the law. It allows for interim appointments of board members and management, in order to ensure business continuity. These four-to-six months interim appointments stand in stark contrast with the four‑year mandates allowing for stability, accountability and long-term planning, and have become standard practice in recent years. As such, the provisions of the law have only been marginally observed and implemented since 2016, and SOE board appointments remain highly politicised (see Section 1.4.4 for more information).

Other relevant laws and regulations

The state’s expectations from SOEs can also be found in the following laws and regulations, which are briefly summarised below (Table 1.6) and described in more detail in other relevant sections of the review:

Government Ordinance no. 64/2001 (as amended by GO no. 29/2017) on the dividend policy

Government Ordinance no. 26/2013 (approved with amendments by Law no. 47/2014) on strengthening the financial discipline of SOEs in which the state (via central or administrative‑territorial units) is sole or majority shareholder or directly or indirectly holds a majority stake

Law no. 85/2014 on insolvency

Law no. 672/2002 on public internal audit

Law no. 162/2017 on statutory audit of annual financial statements

Order of the Minister of Public Finance no. 666/2015 on the application of IFRS by SOEs

Law no. 98/2016 on public procurement and Law no. 99/2016 on sectoral public procurement

Law no. 544/2001 on access to information of public interest (applicable to any public authorities and institutions, including those managing public financial resources)

Government Decision no. 722/2016 on the methodological norms underpinning the appointment procedure for board members and executive management in SOEs, and with regard to establishing financial and non-financial performance indicators for monitoring the performance of SOEs

Order of the Ministry of Finance no. 1952/2018 on the disclosure requirements of line ministries, as well as those of the Ministry of Finance as part of its monitoring responsibilities.

Table 1.6. SOE legal and regulatory framework

|

Law |

Main provisions relevant to SOEs |

|---|---|

|

Companies Law no. 31/1990 |

As the primary legislation for the Romanian corporate sector, it applies to all companies in Romania, and contains provisions regarding the management of the company, the appointment and dismissal of board members and executive management, as well as their responsibility, revocation and liability towards the company. |

|

GEO no. 109/2011 (amended and approved by Law no. 111/2016) |

Main law regulating the ownership and corporate governance of SOEs. |

|

GD no. 722/2016 |

Secondary legislation detailing the provisions of GEO no. 109/2011 regarding the establishment of financial and non-financial indicators for monitoring the performance of SOEs, and remunerating SOE boards and executive management. |

|

Ordinance no. 26/2013 (amended and approved by Law no. 47/2014) |

The Ordinance aims at strengthening the financial discipline of SOEs in which the state (via central or administrative‑territorial units) is the sole or majority shareholder, or directly or indirectly holds a majority stake. |

|

Bucharest Stock Exchange (BVB) Code of Corporate Governance |

The Bucharest Stock Exchange (BVB) Code of Corporate Governance includes a set of principles and recommendations which can be adopted on a comply-or-explain basis by companies whose securities are traded on the regulated market. It differentiates two tiers of companies – standard and premium – with corporate governance requirements being more stringent on the latter. |

|

Law no. 85/2014 on Insolvency |

The law does not provide for any protection from the application of insolvency or bankruptcy procedures based on the legal status of SOEs. The minimum amount of the claim for which the request for opening of the insolvency procedure can be filed is of RON 50 000 both for the creditors and for the debtors. |

|

Law no. 672/2002 on Internal Public Audit |

Main legislation regulating the exercise of public internal audit in public entities. |

|

Law no. 98/2016 on Public Procurement and Law no. 99/2016 on Sectoral Public Procurement |

Main laws on public procurement transposing the provisions of the EU Directive on procurement (EC 2014/25/EU) into national legislation. These laws regulate the procedures for awarding public procurement contracts, as well as certain aspects related to their execution. |

|

Law no. 162/2017 on Statutory Audit of Annual Financial Statements |

The regulation transposes into national legislation the requirements of EU Regulation no. 537/2014 on statutory audit, which is to be performed by financial auditors or by authorised audit firms that are registered as members of the Chamber of Financial Auditors in Romania (CAFR). The law requires inter alia public interest entities to have an audit committee composed of a majority of non-executive and independent members. |

|

Order of the Minister of Public Finance no. 666/2015 on IFRS standards for a number of SOEs |

The regulation transposes the requirements of International Financial Reporting Standards (IFRS) into national accounting regulations for 17 SOEs. |

|

Law no. 15/1990 on Reorganization of Economic Entities as Regies Autonomes or Commercial Companies |

The law undertook the conversion of the former socialist “state economic enterprises” into (i) commercial companies with share capital, and (ii) (fully-owned) autonomous administrations (“regii autonome”). The latter were to remain state property and operate only in strategic sectors of the economy, such as inter alia the defence industry, rail and urban transportation, energy, natural gas and mining. |

|

Law no. 544/2001 on Access to Information of Public Interest |

The law provides that any person has the right to request and obtain information of public interest from any public authority or institution that uses or manages public financial resources (including autonomous administrations and corporatised SOEs operating under the Companies Law). |

|

Order of the Ministry of Finance no. 1952/2018 |

The Order regulates the procedure for monitoring the implementation of the provisions of GEO no. 109/2011 (as amended and approved by Law no. 111/2016) regarding the corporate governance of SOEs. |

|

GO no. 64/2001 (amended by GO no. 29/2017) on the distribution of profit |

Government Ordinance no. 64/2001 on the distribution of profit in national enterprises, national companies and fully or majority state‑owned companies, as well as autonomous administrations, regulates the distribution of a minimum share of 50% transfers from the state or local budget in the case of autonomous administrations, or dividends, in the case of national enterprises, national companies and fully or majority state‑owned companies. Further, Government Ordinance no. 29/2017 stipulates that the government as an owner has the right to receive dividends, including from previous years’ reserves. |

Source: Adapted from World bank (2021[17]), Romania: Policies in support of a fiscally sustainable recovery.

1.4. Ownership framework and responsibilities

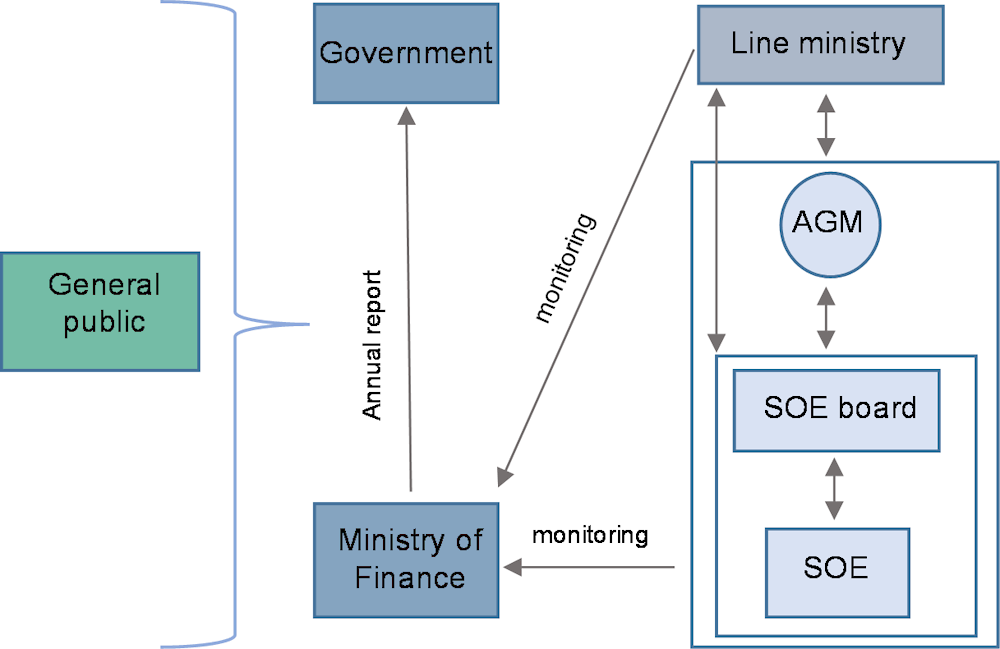

1.4.1. Ownership arrangements and co‑ordination

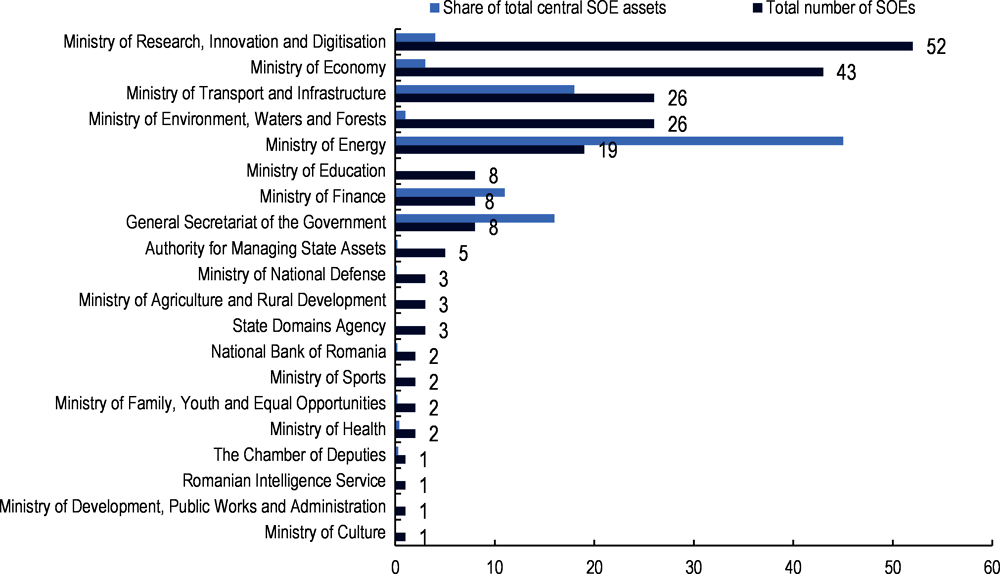

Ownership framework

As of 2020, the ownership of the 216 SOEs considered in this report was dispersed across 20 central government institutions (including 14 line ministries and six other central institutions). However, five ministries concentrated the majority of SOEs (166), representing 71% of the central state‑owned sector total value (Figure 1.9). In addition, with only eight SOEs in both of their portfolios, the General Secretariat of the Government and the Ministry of Finance respectively owned 16% and 11% of the total value. The remaining 13 central institutions exercising ownership functions each oversaw a portfolio of SOEs representing less than 0.5% of the total value.

Figure 1.9. Breakdown of SOEs held by central government, by number and share of total equity value of the central state‑owned sector (in percentage) as of end 2020

Source: Information provided by the Romanian authorities, detailed in Annex A.

The five ministries with the largest number of SOEs in their portfolio as of 2020 included the Ministry of Energy with 19 SOEs accounting for an equity value of USD 8.7 billion or 45% of the state owned sector’s total value, the Ministry of Transport (26 SOEs; USD 3.5 billion; 18% of total), Ministry of Research, Innovation and Digitisation (52 SOEs; USD 754 million; 4% of total), Ministry of Economy (43 SOEs; USD 627 million; 3% of total) and Ministry of Environment, Waters and Forest (26 SOEs; USD 202 million; 1% of total). These portfolios – along with the ones of the Ministry of Finance and General Secretariat of the Government (GSG) – include Romania’s most economically important SOEs. Details of the individual SOEs are provided in Annex A.

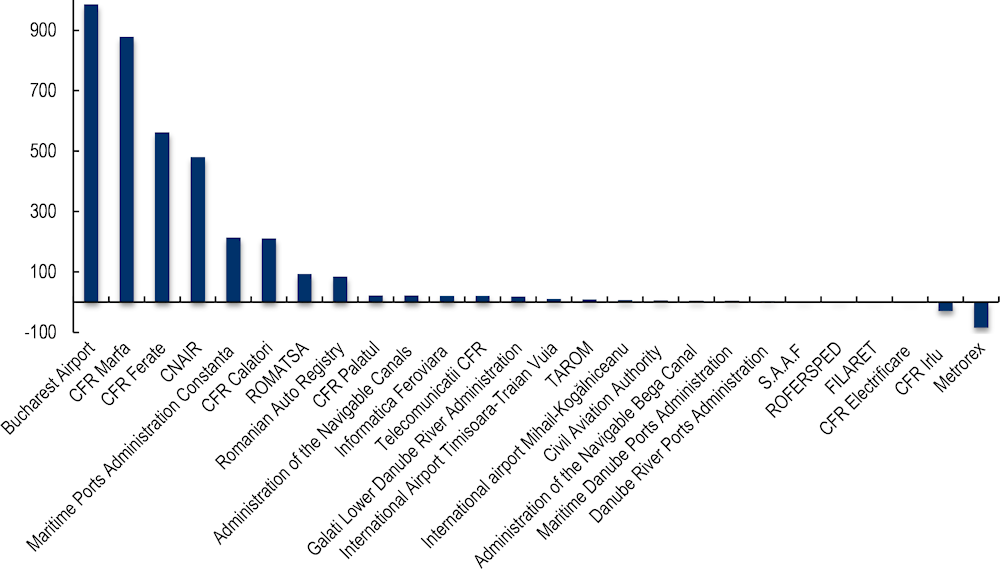

Ministry of Transport and Infrastructure

The Ministry of Transport and Infrastructure is responsible for implementing European legislation regarding transport and transport infrastructure. As of end 2020, it exercised ownership over 26 SOEs operating in the naval, air, railway and road transport sectors (Table 1.7). The portfolio includes a majority of unlisted fully incorporated companies (including some of strategic interest, such as CNAIR), with only five statutory corporations. These SOEs tend to be fully state‑owned, except for nine companies where minority investors own stakes of between 2%‑40% (in the naval and air transport sectors). While in 2020 transport SOEs accounted for 85% of subsidies allocated from the state budget for both exploitation and investment activities, this portfolio also included the SOEs with the highest outstanding payments among central public enterprises as of end 2020, including CFR, CFR Marfa, CFR Calatori, and TAROM, due to the outbreak of the COVID‑19 pandemic.

Table 1.7. Overview of SOEs under the oversight of the Ministry of Transport

|

Domain |

Description of individual SOEs |

|---|---|

|

Naval |

Administration of the Navigable Canals (80% state‑owned company) organises and manages the operation of the navigable canals on the Danube, including locks and telecommunications installations. Galati Lower Danube River Administration (fully-owned autonomous administration) is responsible for ensuring minimum navigation depths (through maintenance dredging, coastal and floating signage, construction works and repairs, etc.). Maritime Ports Administration Constanta (80% state‑owned company), Administration of Ports of the Danube River (80% state‑owned company) and Maritime Danube Ports Administration (79.9% state‑owned company) were all established as JSCs and are port authorities, respectively operating in (i) the ports of Constanta, Midia, Mangalia and Tomis, (ii) ports located on upper (fluvial) Danube, and (iii) ports located on the maritime Danube. Administration of the navigable bega canal (fully-owned statutory corporation) is a waterway authority. |

|

Air |

Bucharest Airport (80% state‑owned), international airport Timisoara – Traian Vuia (80%), international airport Mihail-Kogălniceanu (60%), Air transport company TAROM (98.7% state‑owned). Civil Aviation Authority and Administration of Air Traffic Services ROMATSA (both fully-owned autonomous administrations). |

|

Railway |

CFR Palatul (administration of the CFR Palace building and rental activities), CFR (national railway company), CFR Marfa (freight transport operator), CFR Calatori (passenger services), CFR Irlu (locomotive maintenance and repair), Telecomunicatii CFR (telecom infrastructure), Electrificare CFR (electrification installation of the national railway company CFR), S.A.A.F (railway asset administration company), Filaret (typography and printing activities), Informatica Feroviara (IT services), Metrorex are all fully-state owned companies. |

|

Road |

CNAIR (fully owned company) is the road infrastructure administration, and the Romanian Auto Registry is an autonomous administration responsible for the improvement of road safety and the reduction of polluting emissions (including through individual road vehicle approval authenticity certifications and technical checks, pollution tests, etc.). |

Note: Rofersped is a subsidiary of CFR Marfa.

Source: Ministry of Transport (2021[18]), Annual report on the activity of SOEs under the authority of the Ministry of Transport 2021, https://www.mt.ro/web14/documente/interes-public/rapoarte/2022/Raportul%20anual%20%c3%8eP%202021.pdf

The total equity value of the central state‑owned sector in the portfolio of the Ministry of Transport is driven by four large enterprises in the air transport and railway sectors, including: Bucharest Airport (USD 986 million in equity, 1 459 employees), CFR Marfa and CFR (with respectively USD 878 million and 562 million in equity, and 4 814 and 23 218 employees), and CNAIR (USD 479 million equity, 6 916 employees). In 2020, three fully state‑owned companies were loss-making, including: Electrificare CFR (‑1.2 million), CFR Irlu (‑29.4 million), and Metrorex (‑85.4 million).

Figure 1.10. Equity value of the central state‑owned sector in the Ministry of Transport’s portfolio (in million USD)

Source: Information provided by the Romanian authorities, detailed in Annex A.

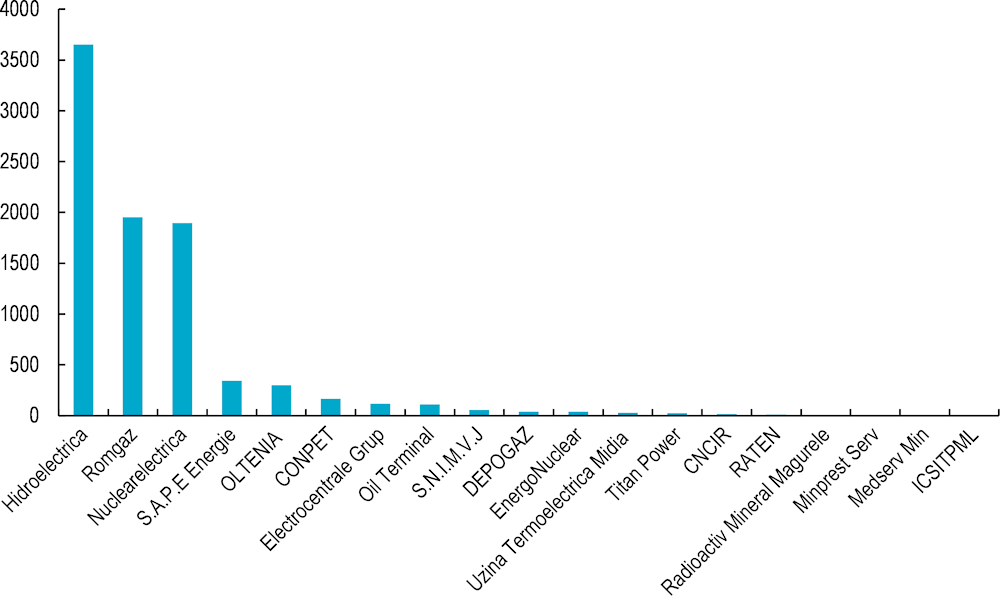

Ministry of Energy

The Ministry of Energy exercises ownership rights over enterprises operating in the field of electricity (including production, transport, distribution and supply of electric and thermal energy), minerals (including exploitation, processing, transport and distribution of hydrocarbons), and is responsible for energy efficiency policies and the implementation of the EU Green Deal. Of note, the portfolio includes the top four companies on the electricity market (Hidroelectrica, Nuclearelectrica, Oltenia, OMV Petrom), accounting for three‑quarters of the electricity delivered to the network (with the remainder including over 100 generators, each with a market share of less than 5%). While energy SOEs received around 2% of total subsidies granted to central SOEs from the state budget in 2020, they accounted for the largest share of dividends redistributed to the state budget, with SOEs operating in the electricity production and natural gas extraction sectors accounting for more than 70% of total payments to the state budget in 2020 (Ministry of Finance, 2021[19]).

The total equity value of the central state‑owned sector in the portfolio of the Ministry of Energy is driven by three large enterprises. With USD 3.6 billion in equity and 3 400 employees, Hidroelectrica is the largest majority-owned company (80% of state shareholding) in the portfolio, followed by Romgaz (1.9 billion in equity, 5 673 employees, 70% state shareholding) and Nuclearelectrica (1.8 billion in equity, 2011 employees, 90% state shareholding). The portfolio of majority-owned SOEs includes four listed enterprises (Conpet, Oil Terminal, Nuclearelectrica and Romgaz), 14 unlisted companies, and one statutory corporation (Raten).

The Ministry of Energy’s portfolio also includes three listed, minority-owned SOEs: Petrom (20% state ownership, 8 billion in equity, 9 939 employees), Rompetrol (44.7% state ownership, 336 million equity, 1 119 employees), and Electrica (48% state ownership, 1 021 billion in equity, 120 employees).

Figure 1.11. Equity value of the central state‑owned sector in the Ministry of Energy’s portfolio (in million USD)

Note: Figure includes majority owned-SOEs only (i.e. at least 50% state ownership). As such, Petrom, Rompetrol and Electrica are excluded.

Source: Information provided by the Romanian authorities, detailed in Annex A.

General Secretariat of the Government

The General Secretariat of the Government (GSG) is subordinated to the Prime Minister. As of end 2020, it exercises ownership rights over eight SOEs categorised as of high economic and social importance, including the Property Administration (RAAPPS), a fully-owned autonomous administrations with 1.3 billion equity and 2073 employees, and two listed energy companies: the technical operator of the natural gas transmission system Transgaz (58% state‑owned with 953 in equity and 4 145 employees), and the electricity transmission system operator Transelectrica (58% state‑owned with 852 million in equity and 2021 employees). Four subsidiaries of Transelectrica constitute the rest of the portfolio: Opcom (power market generator), Smart (transmission grid maintenance services), Formenerg (training activities for personnel in the energy sector), and Teletrans (IT and communications services for electrical transport networks).

Ministry of Finance

The Ministry of Finance exercises ownership over SOEs operating in the financial, credit and insurance sectors, including credit institutions, financial and non-financial institutions and insurance companies. The portfolio comprises eight SOEs, including three credit institutions – CEC Bank (full holding), EximBank (95% state‑owned) and Banca Românească (99% state holding) – which are however exempted from the application of GEO no. 109/2011 (as amended and approved by Law no. 111/2016). The rest of the portfolio is composed of the fully-owned company Imprimeria Nationala (responsible for the issuance and circulation of securities), the fully-owned National Credit Guarantee Fund for Small and Medium Enterprises and its subsidiary the Local Guarantee Fund, the fully-owned Romanian Counter-Guarantee Fund, and the insurance‑reinsurance company Exim Romania (98.6% state holding). As of end 2020, the Ministry of Finance also held a minority stake in Fondul Proprietatea (5.14%).

Ministry of Economy