This chapter presents the overall assessment and recommendations of the review. The recommendations are categorised according to the three pillars of cross-cutting, business innovation and research system and linkages recommendations. The assessment is structured following the chronological order of the review, with an initial overview of the Korean innovation system, its evolution and challenges for the future, followed by a comprehensive analysis of business sector R&D and innovation, the production, circulation and diffusion of knowledge as well as governance for a new era of innovation in Korea.

OECD Reviews of Innovation Policy: Korea 2023

1. Overall assessment and recommendations

Abstract

1.1. Recommendations

This section introduces the overall assessment and recommendations (OAR) of the OECD Reviews of Innovation Policy: Korea 2023. The second section presents an overview of Korea’s innovation system, guiding the reader through its evolution to the opportunities and challenges it may face in the future. The following sections capture these characteristics in greater detail by innovation actors, starting from the third section on business innovation; the fourth section on the production, circulation and diffusion of innovation; and the fifth section on Korea’s science, technology and innovation (STI) governance structure. The final section provides an overview and summary of Korea’s innovation system’s strengths, weaknesses, opportunities and threats (SWOT).

This review’s OAR show that Korea is on its way to becoming an innovation leader and needs to continue to build on its current strengths, such as its leadership position in manufacturing industries, a highly educated workforce and excellent information and communications technology (ICT) infrastructure. Korea’s research and development (R&D) spending as a share of gross domestic product (GDP) is among the highest in the world at 4.9% of GDP in 2021. The recommendations presented here suggest rebalancing spending towards areas that require attention, such as fostering a mission-oriented approach and disruptive innovation. Korea needs to address several imbalances and faces a number of innovation-related challenges for sustainability in the years ahead, including climate and ageing. The OAR introduces recommendations that respond to these challenges by:

creating a shared vision for Korean society (Recommendation 1)

directing STI systems to enable transitions and address societal challenges (Recommendation 2)

improving the efficiency of R&D policy implementation and evaluation (Recommendation 3)

fostering internationalisation of STI (Recommendation 4)

strengthening the role of the service industry (Recommendation 6)

strengthening the diffusion of innovative technologies (Recommendation 7)

further developing linkages between universities and businesses (Recommendation 11).

The 11 recommendations are grouped into 3 pillars. While all recommendations are important, they are listed roughly in the order of importance, starting from the overall vision, the need to redirect the STI system towards societal challenges and the need for efficient policy implementation:

1. The first pillar deals with cross-cutting recommendations, including developing a shared national vision of Korea's future economic and societal development (Recommendation 1), built upon a solid foresight exercise and a broad-based consultation with all stakeholders within the innovation system. Such an exercise should demonstrate the importance of adopting additional measures to help direct STI systems towards accelerating key transitions (e.g. net-zero) and addressing societal challenges (Recommendation 2). Such strategies need to be underpinned by efficient R&D policy implementation and evaluation (Recommendation 3). Further efforts in internationalising STI will help stimulate knowledge exchanges and international opportunities (Recommendation 4). The transition will necessitate strengthening skills and behaviours in order to gain international leadership in innovation (Recommendation 5).

2. The second pillar deals with business innovation. The high value-added service sectors need to be further strengthened, as they can help accelerate the transition towards the knowledge economy (Recommendation 6). The uptake of new technologies by small and medium-sized enterprises (SMEs) and the global connectivity of start-ups need to be supported (Recommendation 7). Finally, rebalancing the policy mix for business innovation can help generate economic and social benefits from support to R&D and innovation (Recommendation 8).

3. The third pillar deals more specifically with the research sector. Universities (Recommendation 9) and government research institutes (GRIs) (Recommendation 10) will need a set of measures to enhance knowledge production, and additional measures are needed to drive linkages between these actors and businesses (Recommendation 11).

1.1.1. Pillar 1: Cross-cutting recommendations

Recommendation 1: Create a shared national vision and long-term plan for Korea’s development

Overview

Korea has experienced rapid development over the past 60 years. It has successfully caught up with some of the world's most developed nations and has created prosperity and well-being in its society.

However, these transitions have also created a number of imbalances, as have been pointed out throughout this assessment, between the older and younger generations; between the Seoul capital area as one of the world’s largest and most prosperous metropoles and rural areas; between globally competitive conglomerates and much less competitive SMEs; between a world-leading manufacturing sector and a below-average service sector; between a thriving domestic start-up scene and limited internationalisation of these start-ups, to name just a few.

Korea also faces acute challenges in meeting carbon emission goals in a strongly energy-dependent economy and one of the most acute demographic challenges globally.

Above all, Korea has been striving to switch from a successful catch-up economy to a world leader for over a decade. It has reached that status in a few sectors, such as ICT manufacturing. However, overall, Korea remains a fast follower rather than a leader in key technology sectors, such as artificial intelligence (AI) or biotechnology, for example.

In order to address all these issues holistically and in the context of a longer time frame, Korea needs to enact a paradigm shift by creating stronger links between sectoral strategies. Ideally, a cross-cutting and holistic vision would accelerate society’s development towards an inclusive, knowledge-based economy where STI would play a key role.

In the absence of a whole-of-government national development vision covering all areas of policy, Korea should create explicit links and co‑ordination mechanisms between existing sectoral strategies:

The Ministry of Science and ICT (MSIT) has adopted a Science and Technology Future Strategy for 2045. This remains a sectoral strategy for science and technology (S&T), which does not address innovation and is not connected to an overall economic development vision.

An initiative was launched by the Ministry of Economy and Finance (MOEF) in June 2021 for a mid- to long-term economic and social policy roadmap. Similarly, there are no indications that this plan takes into account the role of S&T.

Detailed recommendations

Recommendation 1.1.. Carry out a foresight exercise to create a vision linking the Science and Technology Future Strategy for 2045 and the long-term strategy of the Ministry of Economy and Finance. A top-level expert group would be set up to include a diverse group of highly prestigious domestic and foreign experts from business, academia and other key actors, including from social sciences. It would be tasked with drawing up alternative scenarios of Korea in 2045, with respect to the structure of the economy (evolution of the balance of manufacturing vs high value-added services); inclusiveness with respect to regional development (Seoul capital area vs regions); including socially disadvantaged groups; addressing societal challenges; opening up to international co‑operation; and achieving a world-leading status. Elements of both existing strategies should be considered with equal weighting, with a view to unifying the vision, particularly around the green and digital transitions, to realise synergies and focus future policy action across government towards achieving these overarching goals.

Recommendation 1.2. Organise a broad societal consultation on linking the Science and Technology Future Strategy for 2045 and the long-term strategy of the Ministry of Economy and Finance. Following the publication of the results of the foresight exercise with its different scenarios, consultations could be organised at all levels, including for citizens who should be able to contribute ideas and views on the various scenarios, their desirability in terms of outcomes, the impact of various policy options and their robustness relative to the various scenarios, identifying policy choices that have the greatest likelihood of positive outcomes, as well as the pitfalls that need to be avoided.

Recommendation 1.3. Set up a whole-of-government steering committee to develop a shared vision for Korea’s development and the role of STI in contributing to it, built upon the key findings from the foresight and consultation exercise. In such a process, all areas of policy, such as digital policy, social policy, education, environmental and health policies, should be discussed as they interact with STI. These issues fall outside the traditional STI policy portfolios but invariably affect the effectiveness of policy makers’ interventions. The shared vision should then be presented to a broad group of stakeholders for further consultation and buy-in. It is important that all stakeholder groups feel full ownership of this vision.

Recommendation 1.4. Draft an actionable and budgeted action plan for linking the Science and Technology Future Strategy for 2045 and the long-term strategy of the Ministry of Economy and Finance initiative, with clear responsibilities and monitoring mechanisms. Clear intermediate objectives should be set at five-year intervals to reach the desired scenario in 2045. A more detailed action plan should be developed for the first five-year period, with assigned responsibilities, key performance indicators and a monitoring process.

Recommendation 2: Direct STI systems to enable transitions and address societal challenges

Overview

Korea’s S&T enterprise has been a critical component in its economic development and its ability to avoid the middle-income trap many other countries face today. These impressive S&T resources will be equally critical in enabling Korea to handle a number of increasingly urgent societal challenges, such as an ageing population, growing polarisation (between generations, regions and income groups) and climate change. However, science and technology do not automatically or inevitably provide solutions to such problems. In fact, they can contribute to exacerbating them. A range of actions should be considered to ensure that knowledge and innovation can contribute effectively to ensuring Korea’s future economic, social and environmental sustainability.

Detailed recommendations

Recommendation 2.1. Ensure the long-term continuity of STI orientations across different governments. Different countries have found different ways to achieve this. One option would be to make the S&T Basic Plan a ten-year rolling plan. In order to allow the longer-term perspective needed to address ambitious and complex societal challenges while providing room for adaptation (aligned with the political cycle), the Basic Plan could become a ten-year plan revised every five years. A binding five-year investment plan with earmarked financial resources would be attached to the first five years. This would allow both: 1) continuity to address issues like climate change or ageing that cannot be tackled in a five-year government term; and 2) flexibility to accommodate new priorities or approaches by the newly elected president within the longer-term framework (e.g. very few new challenge areas or sub-areas could be added/suppressed). Another option would be to create a dedicated, national, long-term, future-oriented programme for addressing major challenges, which could be governed under a specific long-term financial arrangement with regular evaluation milestones, such as the French Future Investment Programme (PIA) or the Dutch Top Sectors Policy.

Recommendation 2.2. Establish a whole-of-government approach to and policy co‑ordination on certain key policy priorities. In particular, in order to achieve net-zero targets:

Rapidly ramp up investment in innovation for renewable energy sources, such as solar and wind energy, to reduce carbon emissions. This should include strengthening the demand for renewable energy sources (e.g. through public procurement, supportive regulation and legislation, demonstrators and test sites) and, more generally, strengthening the broad diffusion and uptake of renewable energy technologies and solutions across industries and sectors.

Complement government support for investment in low-carbon technologies by further improving innovation-enhancing market mechanisms, such as a carbon pricing system, which sets prices sufficiently high to effectively incentivise producers and consumers to reduce carbon emissions.

Strengthen public communication and education about the severity of global warming while emphasising the opportunities that low-carbon technologies represent for Korean firms and the economy more generally.

Recommendation 2.3. Mobilise untapped resources for tackling societal challenges.

Mobilise and provide support for students, researchers, cities, citizens, municipalities and companies (including start-ups) to contribute to addressing specific societal challenges, e.g. through competitions and prizes, pledges, innovation funding, proof-of-concept funding, experimentation, etc.

Create experimentation spaces to test new solutions (innovation labs, including regarding public sector innovation), assess the current higher education and research institute system, structure and organisation according to its ability to contribute to strategic technological and societal innovation and transformation priorities and objectives.

Strengthen climate literacy in primary and secondary schools.

Recommendation 2.4. Support initiatives that connect and catalyse basic research from different disciplines around a specific societal challenge. The Convergence Research and Convergence Accelerator programmes launched by the US National Science Foundation can serve as inspiration. They seek to address societal challenges and “accelerate solutions toward societal impact” by building on basic research and “integrating knowledge, methods, and expertise from different disciplines and forming novel frameworks to catalyse scientific discovery and innovation” around a specific societal problem.

Recommendation 2.5. Focus the role of the Innovation Office on strategic policy making in order to ensure holistic co‑ordination and contribute to enhancing synergies and co‑operation between programmes. Korea’s unique annual comprehensive and systematic review of all R&D programmes reduces duplications across the whole government structure and contributes to ensuring a broad consistency with the S&T Basic Plan. However, this systematic review at the central level is a resource-intensive task that tends to focus the attention and resources on programme management and compliance rather than on strategic issues. The government should consider the costs and benefits of this review process and delegate to ministries and agencies relevant tasks that could be performed at lower levels without hindering cross-government co‑ordination. While centralising certain tasks is important, this recommendation applies the subsidiarity principle, where lower governance levels fill in the details of decisions made at higher levels. This would allow the Science, Technology and Innovation Office (hereafter, the “STI Office”) and the President’s Advisory Council on Science and Technology (PACST) committees to focus on strategic policy making, budgeting and monitoring, as well as on national missions (see Recommendation 2.8).

Recommendation 2.6. Implement high-level national missions targeting large and ambitious societal challenges.

A small number of pilot national missions (two to three) should be designed collectively and endorsed by PACST, chaired by the President of Korea. These missions should be included in the Basic Plan and revised or continued every five years after a thorough evaluation. The multi-year funding of each mission should be programmed in the above-mentioned five-year investment plan attached to the Basic Plan. The missions address key societal challenges facing Korean society through integrated intervention across the government structure and throughout the innovation cycle (from upstream research down to deployment). The missions are systemic in that they combine a wide range of activities (research, infrastructure, skill formation, etc.) on different types of potential technological and non-technological solutions, using a package of policy interventions (subsidies, regulatory reforms, procurements, etc.).

The implementation and monitoring of missions should support dedicated cross-ministerial co‑ordination groups tailored to co‑ordinate each mission. Furthermore, within the STI Office, dedicated operational teams should integrate the policy co‑ordination, budgeting and performance evaluation for each mission. PACST could review and validate the mission strategic roadmaps and evaluation every five years and on an annual basis the monitoring reports of each mission. As part of their plan submitted to the government, the GRIs should specify their potential contribution to national missions. This initiative could also act as a “governance laboratory” for the challenge-based transformative governance framework proposed in Box 1.1.

Box 1.1. Towards a challenge-based transformative governance framework in Korea

The OECD proposes that in the coming years, Korea turns gradually towards a new “virtual architecture” for the governance of STI systems. The proposal is to structure strategic orientation and policy making along some broad challenges involving several ministerial portfolios and set up spaces for continuous cross-ministerial co‑ordination around these challenges across the policy cycle. The main objective of this new type of STI governance is to set up mechanisms to allow for complex and long-term “transformative” policy issues to be collectively understood and led across the whole policy cycle, from strategic orientation to policy making and co‑ordination and, finally, evaluation set to provide feedback into strategies and policies.

Some of these challenges would be thematic, i.e. addressing economic and societal challenges, while others would relate to the challenge of strengthening the system as a whole (e.g. improving basic science, upgrading business innovation, etc.).

These thematic challenges, set every five years in the Basic Plan, would extend far beyond R&D and aim at mobilising society as a whole and guiding research and innovation (R&I) activities (in a broad sense, i.e. including social innovation) to solve these challenges. Each challenge would have a dedicated “nested” structure of governance composed of bodies with high-level representatives of each ministry, overseeing more operational sub-committees with mid-level policy makers in charge of the relevant programmes and initiatives in different areas relevant to the challenge.

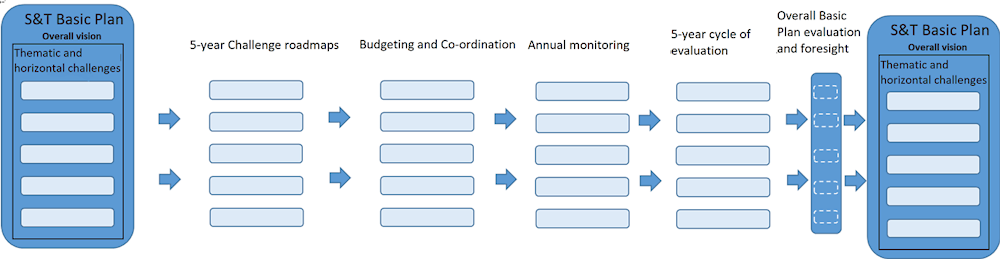

These challenges would also structure the entire policy cycle, from strategic orientation to evaluation. The process could start with the selection of the challenges as part of the Basic Plan development process. PACST would endorse these challenges. With support from the STI Office, cross-ministerial challenge groups would develop five-year challenge roadmaps for each challenge, with associated budgets. The groups would also review activities and produce annual monitoring reports for each challenge (Figure 1.1).

Figure 1.1. The challenge-based transformative governance framework

Source: OECD based on stakeholder discussions.

The entire STI governance structure is impact-oriented and structured around challenges with clear objectives.

STI activities have better visibility and accountability due to the challenge-based structure (e.g. implementing challenge-based budgeting).

There is systematic co‑ordination throughout the five-year and annual policy cycles based on continuous interactions.

The pooling of resources and strengthening of cross-ministerial co‑operation supports realising the challenges’ objectives.

Note: The missions proposed in Recommendation 2.6 represent a way to experiment with such a challenge-based structure, which involves the integration of policy co‑ordination, budgeting and performance evaluation functions and continuous cross-government monitoring of actions and progress.

Recommendation 3: Improve the efficiency of R&D policy implementation and evaluation

Overview

Effective R&D policy evaluation is needed to flexibly adjust and achieve desired objectives. This means going beyond simple monitoring indicators and assessing the impact of policies.1

Detailed recommendations

Recommendation 3.1. Revise the methodology used in the pre-feasibility test2 to make it better suited to the characteristics of R&D programmes. Although the methodology of the pre-feasibility test has been adapted and a two-step process implemented, further improvements can be made to make it more suitable for risky and exploratory R&D programmes. This creates a scenario where certain crucial strategic directions hinge on the outcome of this technical process, resulting in inefficient strategies to bypass the test. Valuable insights could be gleaned from the ex ante evaluation of the European Commission’s Research and Innovation programmes.

Recommendation 3.2. Inter-ministerial programmes should be implemented using joined-up approaches where different agencies work together to manage the programmes, and the ministries are represented in dedicated governance structures. In many cases, Korea’s large inter-ministerial projects result in allocating different projects to the respective agencies of the different ministries, in contrast with agency co‑operative schemes found in other countries (e.g. Pilot-E in Norway). While in some cases, a single agency is tasked with funding projects for different ministries, it remains rare and administrative silos tend to be replicated within large-scale programmes.

Recommendation 3.3. Set up a research and innovation assessment framework focused on impact and learning. This framework could build on and expand the experience of the Research Excellence Framework (REF) in the United Kingdom. Such a framework would make it possible to identify good practices – and challenge areas –within the Korean STI system. It would have wider coverage than the UK REF because it would be applied to higher education institutions and GRIs (with different modalities to be adapted for these organisations). Furthermore, it would include research as well as innovation activities. Under this framework, both institutions would be required to submit “R&I impact case studies” that demonstrate the impact of their R&I activities on wider society (including national missions). These case studies would also include an auto-assessment of the bottlenecks and difficulties encountered that hindered impact delivery. The set of case studies would be analysed, and the results of the analysis would be discussed at the government level to feed into policy decisions regarding strategic (re-)orientation and needed structural reforms.

Recommendation 4: Foster the internationalisation of science, technology and innovation

Overview

The Korean innovation system needs to be better integrated into the international STI ecosystem to be stimulated by the flow of ideas and exploit international opportunities. This applies to international co‑operation on a bilateral and multilateral basis, as well as the integration of foreign brainpower in the Korean ecosystem.

Detailed recommendations

Recommendation 4.1. Enhance scientific excellence and international co‑operation through regional S&T funds. Current discussions about Korea’s association with Horizon Europe are on the right track and will open up possibilities to collaborate and compete with the best European minds. In addition, Korea could consider establishing a regional fund for innovation similar to Horizon Europe in East Asia and Southeast Asia. A research excellence fund, such as the European Research Council, should also be considered in the region. Such a fund recognises excellent research and can be a strong incentive for developing world-class scientific projects.

Recommendation 4.2. Envisage the development of large regional scientific infrastructures with neighbouring countries. In the past, it has been shown that geopolitical tensions can be overcome in science. Such was the case of the European Laboratory for Particle Physics (CERN), established in the aftermath of World War II, which brought together scientists from formerly belligerent European nations to work together on peaceful nuclear research. The ultimate result was one of the world’s leading scientific infrastructures, which has also benefited from significant economies of scale and allowed European countries to compete in the domain with much larger countries, such as the United States. This model was replicated at Synchrotron Light for Experimental Science and Applications in the Middle East (SESAME), which brings together scientists from Bahrain, Cyprus,3 Egypt, Islamic Republic of Iran, Israel, Jordan, Pakistan, the Palestinian Authority, and most recently in the Southeast Europe region in the South East European International Institute for Sustainable Technologies (SEEIIST), which brings together scientists from Albania, Bulgaria, Greece and all seven units from former Yugoslavia, some of which have no diplomatic relations. A similar infrastructure in partnership with East Asian and Southeast Asian neighbours may benefit Korea, particularly in disciplines where Korea lacks the critical mass to compete globally.

Recommendation 4.3. Facilitate international mobility of researchers, innovators and entrepreneurs in the public and private sectors. In view of the demographic trend and a reduction in the supply of skilled labour domestically, Korea could do more to harness skilled immigration. Action is needed to adapt cultural attitudes towards foreigners to encourage the acceptance and integration of foreigners into Korea’s traditionally homogeneous society. Regulations should ensure equivalent hiring and promotion opportunities. Voluntary classes and counselling services for foreigners that would help them integrate into Korean society could also be useful.

A further increase in the share of English-language curricula in Korean universities would help attract more international students and help Korean students be more open to international co-workers and scientific and business partnerships.

Researchers could also benefit from foreign talent for collaboration and mobility schemes to (temporarily) move abroad, which could spur creative thinking and knowledge transfer. Programmes enabling and fostering this kind of exchange should be at a larger scale. Consider supporting international post-doc positions, i.e. funding positions for foreign post-docs to spend time in Korea.

Recommendation 4.4. Increase internationalisation in recruitment, evaluation and funding allocation. Use the opportunity presented by the increased acceptance of online meetings to involve more foreign peers in the assessment of research funding applications (e.g. at the National Research Council for Economics, Humanities and Social Sciences [NRC]), recruitment processes (at universities) and evaluations of funding programmes, institutions, research and education.

Recommendation 4.5. Create incentives for researchers to participate in international collaboration. Today, there is an incentive to apply for national research grants under the project-based system, and international collaboration is seen as presenting additional transaction costs without the benefit of additional recognition. This situation leads to a low number of international co-publications compared to other OECD countries. Including international collaboration projects and co-publications as a recruitment, evaluation and career progression criterion would incentivise enhanced collaboration. Specific grants for international co‑operation projects could be provided, along with assistance to overcome administrative hurdles that may arise on such projects.

Recommendation 4.6. Foster internationalisation of industrial R&D. R&D activities of foreign-owned firms can generate considerable knowledge spillovers and economic benefits for host countries (see, for example, (Veugelers and Cassiman, 2005[1]); (Dunning and Lundan, 2008[2])). Similarly, overseas R&D activities of multinational firms can help them adapt products and services to new markets and enter global value chains (GVCs). It can also help multinationals tap into new talents and technologies, complementing a company’s business strategy. Firms engage in international R&D networks if a number of conditions are fulfilled. Besides governmental and macroeconomic stability, these include international mobility of researchers, inward and outward foreign direct investment (FDI) flows and intellectual property (IP) protection. Korea is below the OECD average for these three indicators. With regard to IP protection, firms are, for instance, often reluctant to share intellectual property as IP protection is perceived to be low, leading them to favour secrecy over sharing intellectual property with foreign firms and personnel.

Recommendation 5: Enhance skills and attitudes in order to gain a leadership position in innovation

Overview

Korea’s education system produces a high number of tertiary-educated individuals with above-average representation in science, technology, engineering and mathematics (STEM) disciplines. It provides an excellent basis for technical and theoretical skills and knowledge. Nevertheless, Korea needs to achieve a step change to gain a leadership position in innovation: it needs to boost creativity, entrepreneurial learning and risk acceptance. Korea also needs to better attract and leverage the influx of foreign talent.

Detailed recommendations

Recommendation 5.1. Actively encourage and celebrate risk taking. Launch high-profile initiatives to promote ambitious and bold actions, targeting new generations of potential entrepreneurs. Risk taking needs to be actively encouraged and celebrated with initiatives to emphasise the importance of taking risks and accepting potential failure as a natural complement to success. Korea should further develop communication campaigns celebrating entrepreneurs and risk takers as well as prizes for entrepreneurs.

Recommendation 5.2. Expand the use of innovation challenge prizes. Innovation challenge prizes can stimulate positive public perceptions toward innovation, mobilise talent and capital and strengthen problem-solving practices involving various stakeholders. Korea could benefit from innovation challenge prizes by showcasing creative problem-solving innovation best practices to promote risk taking, especially among youth.

Recommendation 5.3. Align human resource policies to encourage risk-taking behaviour. Examine incentive structures in higher education and public research organisations to analyse the potential adverse impact of risk taking on individuals’ careers. Incentivise risk taking and ensure that negative outcomes resulting from professionally correct behaviour do not bear punishment, i.e. if negative outcomes arise due to external factors, this is not imputed to the professional in charge.

Recommendation 5.4. Increase the emphasis on entrepreneurial education in the curriculum for younger generations and adults looking for a career change. Exchanges and study trips to other developed countries can be beneficial. For example, the 2013 initiative of sending venture capitalists to Silicon Valley allowed them to become familiar with risk-taking practices and investing successfully in early-stage companies.

Recommendation 5.5. Facilitate entrepreneurial leaves of absence from universities and government research institutes. This would enable an academic to start a business, e.g. by taking unpaid leave from their institution, and have a guaranteed return to employment in case of failure. Korea should also consider modernising career progression and pay policies currently based on seniority and ensure that staff using an entrepreneurial leave of absence are not penalised.

In order to encourage the development of more young and highly-talented entrepreneurs, particular emphasis should be placed on mentoring. Stimulating the secondment of undergraduate and graduate students to innovation-oriented companies could be beneficial not only to shaping entrepreneurial mindsets and enriching experiences in industry but also for SMEs that face a talent shortage in terms of adopting advanced technologies.

Recommendation 5.6. Strengthen critical-thinking skills and creativity in primary and secondary education by allowing more diversity in types of schools and curricula. Introduce more diverse subjects and increase the emphasis on critical-thinking skills and creativity in university entrance examinations.

Recommendation 5.7. Strengthen programmes for the formation of practically relevant AI skills in the higher education system. Provide easily accessible digital technology training programmes for SME managers and employees to increase their awareness of the potential of digital technologies and enhance their digital skills.

Recommendation 5.8. Evaluate university-level entrepreneurial education programmes based on their content quality instead of relying on quantitative metrics only. Provide financial incentives to incubators and accelerators for hiring experienced staff to facilitate the provision of high-quality coaching and mentoring services by experts such as former entrepreneurs and venture capitalists.

1.1.2. Pillar 2: Recommendations concerning business innovation

Recommendation 6: Strengthen the role of the service sector in the knowledge-based economy

Overview

While continuously supporting strengths in the manufacturing sector, Korea needs to prepare for an increased role of services, particularly high value-added services, such as licensing of intellectual property, ICT services, media, financial services and other business services that can also have strong export prospects.

Detailed recommendations

Recommendation 6.1. Develop a dedicated service innovation strategy and action plan. Such a strategy should be built based on a prospective study evaluating the opportunity to develop high-value-added services, such as intellectual property licensing, ICT services, media, financial services and other business services for innovation, growth and competitiveness. It should be developed in a broad consultation, considering Korea’s strengths and prioritising knowledge-intensive service sectors with considerable growth potential.

Improved co‑ordination is necessary between ministries and funding agencies to foster R&D in humanities and social sciences, along with science and technology R&D in STEM disciplines. To better support service R&D, it is important to increase its budget and programmes and establish a separate evaluation system tailored to its unique characteristics, including technology transfer, different from the evaluation system used for manufacturing R&D.

An action plan should describe specific instruments, timelines, responsible institutions and monitoring mechanisms. Examples of measures could include financial incentives for service innovation (such as grants targeted at innovation in services), specific policies to enhance critical skills for service industries, as well as actions to raise awareness about service jobs as potentially attractive relative to manufacturing.

Recommendation 6.2. Address remaining regulatory restrictions on trade in services, such as foreign equity limits, requirements for foreign service providers to establish a local presence and register, and limitations on their mobility and duration of stay. This could considerably increase the “servicification” of the economy and increase trade in services. This would strengthen not only the competitiveness of the services sector but also the manufacturing industries that rely on service inputs. The Korean government has successfully implemented the regulatory sandbox as an interim policy measure to ease regulations on critical service industries, particularly finance, and to adopt disruptive technologies, especially in the ICT sector. Korea should continue its efforts in this regard. Furthermore, if the regulatory sandbox can facilitate the creation of innovative business models in heavily regulated sectors, the Korean government should take further steps to eliminate outdated regulatory restrictions in the service sector more broadly.

Recommendation 7: Strengthen the diffusion of innovative technologies to SMEs and support the global connectivity of start-ups

Overview

While Korea has an excellent digital infrastructure, the diffusion of digital technologies to SMEs has been slow. SMEs’ absorptive capacity and the pace of their digital transformation can be enhanced through initiatives to strengthen their technology readiness and leverage existing skills more effectively. Furthermore, while start-up entrepreneurship is vibrant in Korea, it can be strengthened further through measures to enhance entrepreneurs' digital proficiency and improve the global connectivity of the start-up ecosystem.

Detailed recommendations

Recommendation 7.1. Boost diffusion of digital technologies by reducing stringent product market regulations, particularly on e-commerce platforms, barriers in service and network sectors and barriers to trade and investment.

Recommendation 7.2. Enhance the quality and quantity of labour force skills in SMEs to accelerate the digital transformation. Low ICT adoption by SMEs is contributing to the large gap in productivity with large conglomerates. To increase the uptake of ICT, the quality of labour force skills could be improved through specialised digital skills training and lifelong learning programmes. In addition, the untapped labour force of women and retired able workers could be incentivised to work in start-ups and SMEs through flexible work arrangements and fiscal incentives, thereby increasing Korea’s potential labour supply.

Recommendation 7.3. Strengthen SMEs’ access to digital and other emerging technologies by building on recent measures taken during the coronavirus (COVID‑19) pandemic to digitalise public services and by supporting the provision of advisory services for helping SMEs tailor digital tools and technology watch services.

Recommendation 7.4. Reduce the administrative burden in the provision of government support for start-ups. This is particularly important in the case of business innovation support at the seed and scale-up stages, which are critical to the success of start-ups. Policies such as the National R&D Innovation Act, which consolidated the existing 264 R&D regulations for each department into a single rule, are indicative of progress already made in this area.

Recommendation 7.5. Strengthen the global connectivity of the start-up ecosystem by conducting more international events that help Korean start-ups connect with relevant foreign experts and by supporting start-ups in developing globally competitive business models and entering foreign markets. To strengthen the global connectivity of Korean start-ups, advice programmes for developing overseas markets could also be valuable, particularly for high-tech start-ups that should cater to an international market.

Recommendation 7.6. Remove barriers for firms to invest in data and complementary intangible assets, including software and databases. Evidence shows that SME productivity growth suffers from barriers to the use of intangible assets as collateral in asset-based financing, which can impede initial investment in these types of assets. Reviewing accounting practices and improving the measurement of key intangible assets is also important.

Recommendation 7.7. Implement government support programmes for the adoption of digital technologies by SMEs in a flexible manner aligned with companies’ needs. While the diffusion of digital technologies to SMEs can be enhanced through governmental support programmes, such programmes are most effective when support for the introduction of digital tools is tailored to individual company needs. An example includes the Korea AI Manufacturing Platform, a “smart factory” initiative where the government makes parallel efforts to establish a database of manufacturing data while private sector providers establish “smart factory” services to manufacturing firms. A holistic approach could provide for broadening the scope of services included to encompass not only manufacturing process optimisation but also energy efficiency, carbon footprint, waste optimisation and other relevant issues. It could also help expand the concept to service sectors, which could benefit from similar improvements.

Recommendation 7.8. Promote and disseminate good practices for SME collaboration with large companies, other SMEs and GRIs. Government support for collaboration should be comprehensive and enable SMEs to create diverse collaborative models, such as: 1) with large companies, to strengthen and expand the value chain; 2) with other SMEs, to share knowledge and experiences within the industrial complex; and 3) with GRIs, to improve R&D capacity.

Recommendation 7.9. Increase access to finance for start-ups and strengthen the exit model for a sustainable start-up ecosystem. Korea has significantly improved financial support for start-ups recently. On top of the current various supporting programmes, equity crowdfunding, which is not among the largest in the current set of programmes, could become a significant vehicle for improving financial access. International good practices show equity financing also has merit in terms of entrepreneurship promotion and research commercialisation.

Weak exit mechanisms, in terms of mergers and acquisitions (M&As) and initial public offerings (IPOs), have been recognised as a chronic problem in Korean start-up ecosystems. Recent policy changes that permit large companies to own corporate venture capital (CVC) for M&As of prominent start-ups are a step in the right direction, but further IPO and CVC deregulation could enhance start-up finance.

Recommendation 8: Streamline and assess the impact of public support on R&D and innovation

Overview

While Korea’s business R&D and innovation are strong, they can be further enhanced by addressing various imbalances and strengthening the role of SMEs, foreign multinational enterprises (MNEs), and creative industries in business innovation.

Detailed recommendations

Recommendation 8.1. Reduce regulatory barriers to business entry and exit, such as excessively stringent bankruptcy laws and barriers to entry in certain sectors, such as accounting, legal, telecoms, broadcasting, and air and rail transport.

Recommendation 8.2. Strengthen the global integration of Korean business innovation by cutting red tape and making it easier for foreign MNEs to do business in Korea. Encourage collaboration on innovation between Korean and foreign firms to enhance MNE investment in research labs in Korea.

Recommendation 8.3. Maintain support policies for R&D and innovation by SMEs, including start-ups, while simplifying innovation support. Decrease complexity by consolidating support into fewer and broader programmes and decrease the administrative burden for applications and reporting of outcomes. Market needs could be the most important criterion to streamline and monitor government support programmes since the accommodation of market signals is likely to enhance the relevance and quality of programmes. The Tech Incubator Program for Startups (TIPS), a widely recognised and successful start-up support scheme, validates the efficacy of a market-based approach in Korea’s business context. This type of market need-based programme evaluation could also be applied to new government support programmes in the form of demand assessment. Korea should also provide appropriate incentives for all innovation activities (including service innovation).

Recommendation 8.4. Upgrade the evaluation of publicly supported business R&D and innovation activities by including qualitative outcomes and quantitative indicators. Encourage radical innovation alongside incremental innovation by providing support for explorative, long-term projects and not tying subsidies to short-term and quantitative outcomes only.

Recommendation 8.5. Provide public support for collaborative innovation activities, such as through the widespread introduction of innovation vouchers that are easy to obtain and use. Encourage technology collaboration between large and small firms (e.g. through collaborative platforms and R&D tax credits) to facilitate technology diffusion to SMEs.

Recommendation 8.6. Strengthen support for green innovation, including green hydrogen and carbon capture, usage, and storage through technology demonstration and deployment programmes, as well as public investment in clean technology infrastructure and networks (e.g. clean power grid extensions and battery storage facilities, electric vehicle (EV) charging stations).

Recommendation 8.7. Broaden government support policies for creative industries, from the provision of financial incentives and export promotion to cultural and global exchanges among creative industries. Encourage Korean entertainment and gaming companies to engage in more responsible and sustainable employment and training practices.

Recommendation 8.8. Assess the impact of the current R&D tax credit arrangements and consider adapting to achieve the best value for money, notably by incentivising academia-business collaboration and collaboration between large and small firms. R&D tax credit arrangements in a number of countries offer significant additional incentives for collaborative research and generate benefits beyond the tax credit received when R&D is undertaken in-house. Furthermore, based on re-examining the design of the R&D tax credit, Korea should focus on strengthening disruptive innovation in firms (often in the service sector). Evidence from OECD countries shows that R&D tax credits primarily favour incumbent firms rather than start-ups. Carry-over provisions or cash refunds, which could benefit start-ups, should be considered to strengthen the effectiveness of R&D tax credit incentives.

1.1.3. Pillar 3: Recommendations concerning the research system and linkages

Recommendation 9: Strengthen universities’ ability to conduct relevant and excellent research to serve the needs of Korean society

Overview

The Korean higher education system faces a number of rather daunting challenges, some of which are endemic and some exogenous. The government needs to find more effective ways to encourage and incentivise universities to become stronger institutions (independent, strategic, resilient, relevant and impactful) to handle these challenges for the benefit of both universities and society. This requires rethinking the role of government to become more effective in “nudging” (incentivising) such change.

Detailed recommendations

Recommendation 9.1. Strengthen the autonomy of universities and their ability and incentives to become more resilient, relevant and impactful, both nationally and internationally. This could include:

Promoting excellence and strategic development through long-term funding (similar to Finland’s Flagship Program) instead of the current system of rather small-scale project funding. Part of the funding could be based on long-term strategies and mid-term performance contracts, impact evaluations and programmes that encourage strategic profiling of universities (with regard to research, education and general mission – in particular, addressing societal challenges).

Strengthening the autonomy of universities, coupled with providing long-term funding, carrying out internal governance reforms and improving strategic management capacity to allow universities (along with public research institutes [PRIs]) to play a key role in implementing national priorities and missions.

Reviewing current incentive structures at universities and their impact on research excellence, industry-academic co‑operation and internationalisation, and adjusting those incentives to better match desired objectives such as net-zero and the digital transition.

Moving from rather onerous funding allocation and project supervision towards more effective “nudging” (incentivising) of universities to become more strategic, differentiate themselves more, support more breakthrough research, and change recruitment systems. Currently, funding is frequently allocated formally in competition, where universities and researchers dedicate considerable time to filling out applications. However, almost everyone ends up getting funding, and there is little meaningful follow-up, a shift in behaviour or dialogue.

Allocating funding to teams and encouraging collaboration among faculty across departments and institutions, including multidisciplinary research, for example, to address global challenges and national missions.

Recommendation 9.2. Upgrade evaluation and assessment. Initiate discussions among universities, research funders and policy makers on how to shift research evaluation away from an emphasis on quantitative metrics (number of papers and patents) towards more qualitative assessments. The San Francisco Declaration on Research Assessment (which has not been signed by any institution in Korea) could serve as an inspiration. Incentivise actors to develop and try different approaches (at the university level, research funders, etc.). Produce regular quantitative and qualitative assessments of Korean research quality and long-term impact, taking into consideration international positioning (similar to the Academy of Finland’s or the National Science Foundation’s reports). The research and innovation assessment framework proposed in Recommendation 3.3 is a way to do this. However, this upgrade should be applied and mainstreamed throughout the research system for project, programme and institutional evaluation.

Recommendation 9.3. Enable and encourage research programme funders to promote more high-risk (and potentially more transformative) research and innovation at GRIs and universities. This can be done by:

Adopting a portfolio management approach to R&I funding (i.e. an approach where not all projects are expected to be successful), as is the case in national missions.

Enriching and diversifying the research funding landscape by incentivising companies or wealthy individuals to use earnings or wealth to fund academic research (e.g. tax incentives, such as in Denmark or Sweden).

Recommendation 10: Continue strengthening government research institutes to meet the needs of government and industry in the post-catch-up period

Overview

Like PRI systems elsewhere, despite the frequent reorganisations and reforms of recent decades, the Korean PRI system still bears the marks of Korea’s fragmented governance culture and its history of focusing on catch-up. Therefore, there is a need to reinforce the government’s efforts in recent years to adapt GRIs better to national industrial and societal needs and to explore the potential for providing more holistic support to policy and smaller firms.

The GRIs organised under the National Research Council of Science & Technology (NST), which focus on science and technology and have been decisive in modern Korea’s industrial and economic development, went through a “role and responsibilities” process in 2019, redefining their scope and tasks as Korea moves from industrial catch-up to advanced country status. One implication of this change is that the activities of the GRIs need to be more closely aligned with the evolving needs of industry and society, and the government can no longer dictate the specific tasks GRIs should undertake. Like universities, the GRIs need to be components in a national “knowledge infrastructure” supportive of the needs of the major Korean multinationals, other large Korean firms, and broader society in response to societal challenges. A stronger flow of knowledge from GRIs and universities will support the development of new companies and industries. At the same time, smaller and less capable firms inside and outside the supply chains of the major companies need to improve their technological capabilities to remain competitive.

Detailed recommendations

Recommendation 10.1. Building on the Role and Responsibility exercise in which government research institutes revisited their missions, the financing model of the GRIs could be tailored to their missions. International best practices could be referred to and further developed according to the Korean context, such as research and technology organisation (RTO) models for some GRIs and national research institutes for others. This involves reinforcing GRI autonomy by rebalancing the funding currently dominated by project-based funding with term time horizons of up to three to five years, which are insufficient for developing lines of basic research.

On the one hand, there should be an increase in long-term institutional funding under the control of the GRIs themselves. This will allow the GRIs to establish and maintain market-relevant capabilities on which to build their other functions. Specific projects desired by the government can be satisfied via separate contracts.

On the other hand, encourage GRIs to achieve a greater proportion of income via contracts with the private sector and (where appropriate) with public authorities that respond directly to client needs and do not require government agency approval. In some cases, such as when supporting companies with limited absorptive capacity, it may be appropriate to support this activity using grants to cover part of the cost.

While GRIs should be permitted, and potentially even urged, to compete for project-based funding, particularly for collaborative research ventures with companies, universities and other GRIs, it is important to dissuade competition with the private sector for such funding, as it can result in crowding out the private sector.

Allow variation in the financial models of GRIs, based on their specific missions. GRIs needing to conduct large amounts of more fundamental research should receive a larger proportion of institutional funding than those whose other activities are less dependent on research.

Recommendation 10.2. Evaluate the performance of the GRIs in relation to their missions. This entails:

Making the GRIs responsible for internal monitoring at the project and programme level, subject to the routine activities of the national audit.

Focusing the evaluation of GRIs on their impact on society while requiring break-even financial performance. Generate evidence about other kinds of outputs, but crucially also outcomes and – to the extent possible – societal impacts.

Recommendation 10.3. Increase co-production of knowledge between GRIs and universities to strengthen GRIs’ more fundamental research capabilities, signal universities about the need for use-oriented fundamental and applied research, and increase the quality and relevance of graduate and undergraduate education. This can involve creating joint posts between universities and GRIs, adjunct positions for senior GRI researchers in universities, and allowing GRIs to host PhD students ad hoc and outside the graduate schools in universities. These joint initiatives could be supported by dedicated university liaisons in the tasks of top research management in the GRIs. The objective of strengthening the relationships between GRIs and universities could also be reflected in the formal missions of universities’ top senior managers (e.g. “Innovation Vice President”).

Recommendation 11: Further develop linkages between universities, government research institutes and business

Overview

To overcome the barriers between academia and industry, co-creation instruments should be designed to facilitate matchmaking and offer financial incentives that bridge the two communities. Unfortunately, these communities do not naturally mix, representing a “social failure” due to their radically different values, time horizons, lifestyles and social circles.

Detailed recommendations

Recommendation 11.1. Create incentives and governance arrangements in universities and government research institutes, including ensuring collaboration with industry, is an official mission of universities and GRIs, at the same level as research (and teaching for universities). Set objectives for GRIs and universities alike concerning private co-financing and collaborative projects in general. Korea should also adapt the monitoring metrics by decreasing the importance of patent count and including: 1) commercialisation and royalty revenue; 2) co-publications; and 3) co-patenting.

Recommendation 11.2. Expand “seed” innovation vouchers with low face value and accessible to SMEs with minimal administrative procedures to initiate a large number of co‑operations between academia and industry.

Recommendation 11.3. Expand and systemise public-private innovation partnerships, such as matching grant programmes within the project-based system, whereby government funds match the funds provided by industry for a specific R&D project. Such programmes are widespread in other OECD countries and allow enterprises to reduce the costs and risks associated with R&D and innovation. On the other hand, they can be more efficient than direct grants since the readiness of the industrial partner to pay half the cost warrants their legitimacy and market potential. Comparable and successful models, including the US manufacturing extension programme, should be further studied and referenced.

Recommendation 11.4. Further invest in high-visibility infrastructure for science parks and excellence centres, with good networking institutions and public-private governance to foster the development of true collaborative research. For example, public-private co‑operative excellence centres on AI could be further developed to cover different AI applications, including Electronics and Telecommunications Research Institute (ETRI), Naver, Kakao and other public and private actors, to create a Korean AI powerhouse. Similarly, on the Smart Factory initiative, public-private partnerships such as the Korea AI Manufacturing Platform (KAMP) could be further developed with public and private entities, including start-ups, to develop the concept beyond process optimisation and include energy optimisation, environmental optimisation (including carbon footprint) and ultimately expand the concept to service industries.

Recommendation 11.5. Organise “triple helix” (academia, industry, government) and “quadruple helix” (include civil society) events around social innovation (resolving societal challenges). Such events could include specific competitions with grants as prizes for the best proposals.

Recommendation 11.6. Further develop technology extension services that directly support local firms, bringing about pragmatic improvements in their operations and practices with commercially proven technologies. Technology extension services fall between basic business development services, such as business planning and basic marketing, and high-end R&D (such as technology transfer offices and centres of scientific excellence). Such services should provide technology development, transfer and services, proactively addressing SME needs rather than waiting for them to ask (or trying to “push” patents developed at the provider’s own initiative). Such services can be provided by technology centres or by extending the task of some universities (as has been done in the US university system).

Recommendation 11.7. Develop (temporary) mobility schemes between the public and private sector, facilitating leave of absence of public research faculty to do a secondment in industry and for researchers from industry to spend time in GRIs and universities. Further develop industrial Master of Science (MSc) and PhD programmes of a dual nature, combining academic studies with practical experiences in research facilities.

Recommendation 11.8. Foster the presence and effective functioning of proof-of-concept programmes. Proof-of-concept programmes could be crucial in bridging the gap between academia’s early-stage research and businesses’ later-stage development by upgrading technology that is not yet market-ready and facilitating potential business model development.

1.2. Introduction

Korea has achieved remarkable economic growth, stemming from its continued investment in science, technology and innovation. Building on past success, the government recognises the importance of research and innovation, and STI has long been understood as a pillar of the country’s economic development. The country leads in private and public R&D investment, the former being particularly high compared to global and OECD standards. It also benefits from a large skills base with an exceptionally large share of the population with tertiary education. On the digital front, Korea represents an exemplary case in terms of building a sound infrastructure, investing in cutting-edge technologies and setting up institutional frameworks for their development.

However, Korea is at a critical juncture where it may need to reconsider the role of STI in its future growth model. The challenges Korea is facing can be captured in two aspects. On the one hand, strong investment records in STI have come at a price, leaving many gaps in the economy and society. The discrepancies are particularly acute in terms of productivity, where the benefits of fast economic development are concentrated in certain sectors of the economy. Investment in applied research fields and industrial competitiveness have helped create companies of global renown but, at the same time, have hindered Korea from exploiting the full potential of its rich experiences and assets. Against this backdrop, on the other hand, Korea is facing a number of societal challenges both internally and externally. The new challenges call for new solutions, and depending on the country’s preparedness and openness to novel approaches, such trends can be perceived as either opportunities or threats. Korean society is rapidly ageing, the economy depends economically and socially on carbon-intensive manufacturing industries, and despite the country’s leadership, the digital transition may accelerate the already present divide in both the economy and society.

1.3. Overview of the Korean innovation system, its evolution and challenges for the future

1.3.1. Korea is on the path to becoming a global leader in science, technology and innovation

Starting in the 1960s and over the following three decades, Korea successfully transformed from a low-income to a high-income economy. Korea’s catch-up process evolved from an inward-looking and import substitution industrialisation strategy into an outward-looking export growth strategy. STI played a central role, with GRIs facilitating the transfer of key technologies to Korea and their very quick adoption by industry, particularly the large conglomerates. In addition, during the 1990s-2000s, Korea undertook domestic reforms to liberalise its economy, which led to a gradual rise in the country's participation in GVCs, with the GVC participation index increasing from around 40% in 1995 to 56% in 2010 (OECD, 2021[3]),4 and lowered barriers to FDI (the FDI regulatory index declined from 0.532 in 1997 to 0.143 in 2010) (OECD, 2020[4]). GDP grew by an average of 7.9% per year during the 1960‑2000 period, and between 2011 and 2021, compound annual growth stood at 2.38%, thus still narrowing the income gap with advanced economies.

Korea is a digital economy leader supported by a sound digital infrastructure, propelled by the government’s strong commitment to investment in new technologies and a vibrant and innovative private sector. Since the 2000s, Korea has been far ahead of other OECD countries in terms of fixed broadband penetration and currently has the highest percentage of fibre in total fixed broadband connections (OECD, 2022[5]), which is key to mobile network systems and rising data traffic driven by the digital transformation (OECD, 2020[6]). It was also one of the first movers in 5G technologies, with 5G subscriptions reaching 19.4 million (26.8% of total mobile subscriptions) by October 2021. Already in 2019, Korea issued a national 5G strategy, “5G+”, to integrate advanced devices and services across upstream and downstream industries into the 5G infrastructure (MSIT, 2019[7]). In parallel, the government formulated the 2019 Five-Year Development Programme for Quantum Computing Technology and the 2020 Strategy for Artificial Intelligence. Major Korean ICT firms are also aggressively pursuing cutting-edge technologies. In 2022, Samsung announced it would invest USD 356 billion in semiconductors, biopharmaceuticals and telecommunications over the next five years to lead in new next-generation telecommunications and robotics industries. Moreover, in 2019, Korea ranked fourth among OECD countries in transforming its government into a user-driven and fully digital platform that helps ensure a more comprehensive approach to the digital transformation of the public sector. It is also increasingly using data-driven regulation as a complement to traditional regulatory tools, which, by improving transparency and reducing information asymmetries, can steer the market in the right direction (OECD, 2020[8]).

Korea contained the spread of the COVID‑19 virus effectively from the early outset of the pandemic. Damage to its economy from the crisis was relatively limited, owing to the government’s swift and effective measures to protect households and businesses. Real GDP increased by 2.6% in 2022 with continued strong export growth, rising investment and continued policy support (OECD, 2021[9]; 2023[10]). STI policies were driving Korea’s efforts to navigate the health crisis. Both targeted sectoral and horizontal measures supporting digital cross-border sales, the automation of administrative processes and the establishment of digital one-stop-shops significantly accelerated SMEs' incorporation of digital tools, thereby increasing their ability to address business complications arising from COVID-19 early (Bianchini and Kwon, 2021[11]). Additional measures included the implementation of the self-quarantine safety protection app from the outset of the pandemic to better monitor symptoms and quarantine compliance, as well as applications to overcome the shortage of masks by providing information on real-time mask stocks (OECD, 2022[12]) by Korean information service firms Naver and Kakao.

Korea has the second-highest R&D intensity among OECD countries, driven by high business enterprise expenditure on R&D (BERD). Korea’s gross domestic expenditure on R&D (GERD) represented 4.6% of GDP in 2020,5 second only to Israel among OECD countries. The annual growth rate of R&D has been steady at 7% for the period 2011‑19, growing faster in business enterprises (8%) than in government (4%) and higher education institutions (4%). The vast majority is attributed to exceptionally high BERD, which was also the second-highest after Israel among OECD countries (3.7% of GDP in 2020). Large firms spend 62.5% of the total, while the rest is shared among SMEs (25.4%)6 and venture firms (12.1%) (Statistics Korea, 2022[13]). The composition of BERD by firm size and industry has remained largely unchanged for a decade. Expenditure for publicly funded research is also among the highest in OECD countries, as Korea ranks fourth in terms of government budget allocations for R&D (GBARD) after the United States, Germany and Japan. In terms of sector performance, public research is concentrated in GRIs more than in universities, with the highest level of government expenditure on R&D (GOVERD) among OECD countries (0.46% of GDP). Higher education expenditure on R&D (HERD) is slightly below the OECD average (0.38% vs 0.41%) (Statistics Korea, 2022[13]).

Korea's large investments in R&D and innovation in terms of human and financial resources appear to have only partially paid off in terms of increased innovation outputs. R&D outputs in quantitative measures, such as the number of patent applications and publications, are globally leading and steadily increasing: between 2006 and 2020, scientific publications per million inhabitants increased from 895 to 1 741 (OECD average 1 214). However, the productivity of scientific production remains low. For instance, the percentage of publications in the global 10% top-cited journals is around 8%, placing Korea in the bottom third of OECD countries (OECD, 2022[14]). Furthermore, the number of firms with self-reported innovations is relatively low, with about 40% (United States: 63%; Germany: 61%; Switzerland: 72%) (OECD, 2022[15]).

A highly skilled human resource base offers strong potential for future growth if utilised effectively. Korea’s share of the younger adult (25‑34 years old) population with tertiary education stands at 70% and is the highest among OECD countries and partner economies (OECD, 2022[16]). Among those, STEM graduates represent 31%, above the OECD average of 27% (OECD, 2021[17]). In the most recent OECD Programme for the International Assessment of Adult Competencies (PIAAC) survey (OECD, 2019[18]), Korea scores significantly above average in literacy and numeracy, though average in problem solving in technology-rich environments (OECD, 2019[18]). However, the International Institute for Management Development (IMD)’s university education ranking based on an employer survey shows low employer satisfaction with Korean graduates, placing Korea at rank 48 out of 63 in 2020 (IMD, 2021[19]).

1.3.2. Striking a balance: Achieving economic growth and development for all in Korea

Korea has a wide productivity gap between the service and manufacturing sectors and between firms of different sizes. This is, for instance, reflected by the low value added per employee in services, which is only 60% of that in the manufacturing sector, a gap wider than in most OECD countries (OECD, 2022[20]).7 Labour productivity in the ICT industries is the highest relative to total productivity among OECD countries at 280%. However, the disparities between ratios of ICT manufacturing and ICT services productivity to total productivity are the widest in the OECD, with 4.9 and 2, respectively (Germany: 1.7 and 1.5; United States: 2.3 and 2.2), showing that in view of Korea’s strengths in ICT, productivity in ICT services has more potential to grow (OECD, 2022[20]). In addition, despite the relatively high diffusion of digital technologies in Korea (in particular world-leading fixed broadband and 5G subscriptions), Korean firms, notably SMEs, still lag in the adoption of crucial technologies, not least because workers in SMEs tend to be older and less skilled in digital technologies, in spite of both horizontal and sectoral policies supporting the rapid uptake of digital technologies prompted by the COVID‑19 pandemic (Bianchini and Kwon, 2021[11]). In an effort to support service industries, the government announced the Service R&D Promotion Strategy in 2020 and pledged to invest KRW 7 trillion (Korean won) for five years starting in 2021.

Significant regional disparities exist in Korea, particularly between the capital region (Seoul, Gyeonggi and Incheon) and the rest of the country. For instance, 64.5% of R&D organisations (universities, PRIs and firms) are centred in the capital region, and 69.8% of national R&D investment occurs in the capital region, while the rest is spread across the 15 metropolitan cities and provinces, each with less than 3% of the total (KOSIS, 2022[21]). Efforts to promote regional innovation include four additional special R&D zones (“innopolises”) to foster the development of new technologies and their commercialisation. In 2019, 12 “innotowns” were additionally created to sharpen the focus on technology transfer from universities and GRIs to regional firms. The government seeks to transform the landscape and unleash the potential of regions by including the Regional Balance New Deal as one of the pillars of the Korean New Deal 2.0.

Korea’s population is markedly polarised by age group, posing threats to economic viability. While the Korean STI system benefits from a highly educated younger population, the rising old-age dependence ratio is expected to be the second-highest in 2050 (OECD, 2022[22]).8 Korea also showed the highest poverty rate after taxes and transfers for those between 66 and 75 years of age among OECD countries, straining the overall economy as fewer young people will have to bear the costs for an ever larger share of the old-age population (OECD, 2021[23]). Furthermore, the concentration of high-skilled young employees in cities risks exacerbating the already increasing inequality across age groups, largely due to the dichotomy between conglomerates and SMEs, leaving less skilled and, in particular, the old-age population in rural areas behind. Korea has the largest difference in tertiary educational attainment between the group of 25‑34 year-olds (70%) and the 55‑64 year-olds (25%) in the OECD (OECD, 2021[17]). The threat of increasing gaps in access to talent between large companies and SMEs crucially risks reducing the latter’s innovation capabilities.

Gender equality has improved, but there is still much room for improvement. The female labour force participation rate increased from 49% in 1990 to 59% in 2020.9 However, it is still below the OECD average of 65% (Switzerland: 80%; Sweden: 80.3%; Germany: 75.8%; Japan: 72.5%). Most of this increase has occurred in the services sector, which is less productive. Furthermore, only 24% of STEM entrants are women (Germany: 40.6%; United Kingdom: 32%) (OECD, 2022[24]). As part of Korea’s most recent Basic Plan, of which four have been published since 2004 with five-year cycles, the dimension of “gender innovation” was included. This set a standard for a gender-responsive approach to innovation, aiming to improve female participation rates in science and engineering.

1.3.3. Several of Korea’s strengths risk widening industry gaps even further

Korea exhibits a high productivity gap between large firms and SMEs, particularly micro-firms. More than 83% of Korean workers are employed by SMEs, the second-highest share in the OECD. The contrast is even larger when considering micro-enterprises with fewer than ten employees, which employ many more than the OECD average and contribute much less to the aggregate value added (OECD, 2019[25]). Furthermore, the high business concentration in leading companies is demonstrated by the fact that the four largest chaebols (Samsung, Hyundai Motor, SK and LG) accounted for 48.5% of sales among the top 71 business groups in Korea in 2020 (Pulse, 2021[26]). SMEs dominate the service sector, but their higher value-added activities are concentrated in manufacturing rather than services, and overall labour productivity levels of SMEs are only around 26% (OECD, 2022[27]) of that of large firms. Reasons behind their lagging performance include operational deficiencies due to low adoption of new technologies; a digital skills gap among old-age workers; and a dual labour market whereby large firms attract talent through better working conditions. Recent training initiatives launched by the Korean government have emphasised the importance of lifelong learning, including continuous upskilling of employees to ensure their preparedness for new technologies.

A traditionally strong manufacturing sector has allowed Korea to become an industrial powerhouse. The contribution of manufacturing to national income amounted to 27.1% in 2020, the second-highest share among OECD countries,10 and has underpinned Korea’s export-driven growth model. Korea continues to benefit from its world-leading competitive position in manufacturing. A strong manufacturing base may increase resilience towards external shocks and allow for the expansion of related services industries, which are often dependent on the strength of the former (Pisano and Shih, 2012[28]). In particular, the accelerated development of new technologies will create new competitive advantages for manufacturing companies that are able to integrate these technologies and develop innovative new service-based business models. This process, sometimes called the "servicification" of manufacturing, can help companies create new revenue streams, improve customer satisfaction and differentiate themselves from their competitors.