[3] Agence France Trésor (2022), Monthly Bulletin, https://www.aft.gouv.fr/files/medias-aft/7_Publications/7.2_BM/386_Monthly%20bulletin%20July%202022.pdf (accessed on 2023 14 April).

[29] Bank of Canada (2022), Government of Canada Bond Purchase Program, https://www.bankofcanada.ca/markets/market-operations-liquidity-provision/market-operations-programs-and-facilities/government-canada-bond-purchase-program/.

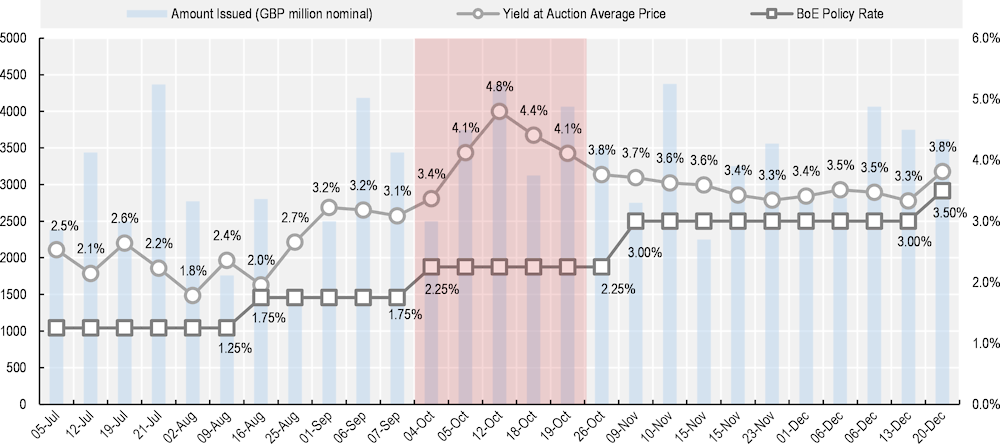

[34] Bank of England (2022), Asset Purchase Facility: Gilt Sales – Market Notice 20 October 2022, https://www.bankofengland.co.uk/markets/market-notices/2022/october/asset-purchase-facility-gilt-sales-market-notice-20-october-2022.

[20] Bank of England (2022), Bank Rate history and data, https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp (accessed on 3 March 2023).

[15] Bank of England (2022), Gilt Market Operations – Market Notice 28 September 2022, https://www.bankofengland.co.uk/markets/market-notices/2022/september/market-notice-28-september-2022-gilt-market-operations (accessed on 30 March 2023).

[11] BIS (2022), Annual Economic Report: June 2022, https://www.bis.org/publ/arpdf/ar2022e.pdf.

[14] BIS (2022), BIS Quarterly Review: December 2022 International banking and financial market developments, http://www.bis.org/publ/qtrpdf/r_qt2212.htm.

[13] Blanchard, O. (2023), Fiscal Policy Under Low Interest Rates, MIT Press, https://doi.org/10.7551/mitpress/14858.001.0001.

[36] Board of Governors of the Federal Reserve System (2022), Plans for Reducing the Sise of the Federal Reserve’s Balance Sheet, https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm.

[35] Debrun, X., J. Ostry and C. Wyplosz (2020), Debt Sustainability, Oxford University.

[28] Engstrom, E. and S. Sharpe (2022), “(Don’t Fear) The Yield Curve, Reprise”, FEDS Notes, Vol. Washington: Board of Governors of the Federal Reserve System.

[31] European Central Bank (2022),, Monetary Policy Statement – Press Conference, https://www.ecb.europa.eu/press/pressconf/2022/html/ecb.is221215~197ac630ae.en.html.

[37] European Central Bank (2022), Securities lending of holdings under the asset purchase programme (APP) and pandemic emergency purchase programme (PEPP), https://www.ecb.europa.eu/mopo/implement/app/lending/html/index.en.html (accessed on 6 March 2022).

[33] European Central Bank (2022), “The Transmission Protection Instrument”, Press Release, https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220721~973e6e7273.en.html.

[38] Federal Reserve (2022), “Repo and Reverse Repo Agreements”, Federal Reserve Bank of New York, https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/repo-reverse-repo-agreements (accessed on 3 March 2022).

[23] Government of Canada (2022), Update on the 2022‑23 Debt Management Strategy, https://www.budget.canada.ca/fes-eea/2022/report-rapport/anx2-en.html.

[16] HM Treasury (2022), Chancellor brings forward further Medium-Term Fiscal Plan measures, https://www.gov.uk/government/news/chancellor-brings-forward-further-medium-term-fiscal-plan-measures (accessed on 3 March 2023).

[17] HM Treasury (2022), The Growth Plan 2022, https://www.gov.uk/government/publications/the-growth-plan-2022-documents/the-growth-plan-2022-html#:~:text=The%20Growth%20Plan%202022%20makes,sustainable%20funding%20for%20public%20services (accessed on 30 March 2023).

[2] IMF (2022), World Economic Outlook, https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022.

[27] Lane, P. (2019), “The Yield Curve and Monetary Policy”, Speech in the Centre for Finance and the Department of Economics at University College London.

[8] Lunsford, K. and K. West (2019), “Some Evidence on Secular Drivers of US Safe Real Rates”, American Economic Journal: Macroeconomics, Vol. 11, pp. 113‑139.

[4] Ministero dell’Economia e delle Finanze (2022), Modifications to the government bond auction calendar for August 2022, https://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/modifiche_calendari/Modifications-to-the-Government-bond-auction-calendar-August-2022.pdf (accessed on 14 April 2023).

[5] Ministero dell’Economia e delle Finanze (2022), Changes to December 2022 auction calendar, https://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/modifiche_calendari/Modifications-to-the-Government-bond-auction-calendar-December-2022.pdf (accessed on 14 April 2023).

[6] Ministry of Finance (2022), JGB Monthly Newsletter, https://www.mof.go.jp/english/policy/jgbs/publication/newsletter/jgb2022_05e.pdf (accessed on 4 April 2023).

[41] Ministry of Finance (2022), JGB Monthly Newsletter April 2022, https://www.mof.go.jp/english/policy/jgbs/publication/newsletter/jgb2022_04e.pdf (accessed on 14 April 2023).

[7] Ministry of Finance (2022), JGB Monthly Newsletter November 2022, https://www.mof.go.jp/english/policy/jgbs/publication/newsletter/jgb2022_11e.pdf (accessed on 14 April 2023).

[40] Ministry of Finance (2022), JGB Monthly Newsletter November 2022, https://www.mof.go.jp/english/policy/jgbs/publication/newsletter/jgb2022_11e.pdf (accessed on 4 April 2023).

[1] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/f6da2159-en.

[24] OECD (2022), OECD Sovereign Borrowing Outlook 2022, OECD Publishing, Paris, https://doi.org/10.1787/b2d85ea7-en.

[22] OECD (2017), OECD Sovereign Borrowing Outlook 2017, OECD Publishing, https://www.oecd-ilibrary.org/governance/oecd-sovereign-borrowing-outlook-2017_sov_b_outlk-2017-en.

[26] OECD (2014), OECD Sovereign Borrowing Outlook 2014, OECD Publishing, https://www.oecd-ilibrary.org/governance/oecd-sovereign-borrowing-outlook-2014_sov_b_outlk-2014-en.

[25] OECD (2013), OECD Sovereign Borrowing Outlook 2013, OECD Publishing, https://www.oecd-ilibrary.org/governance/oecd-sovereign-borrowing-outlook-2013_sov_b_outlk-2013-en.

[12] OECD (2012), OECD Sovereign Borrowing Outlook 2012.

[42] OECD Publishing, P. (ed.) (2023), OECD Interim Economic Outlook of March 2023: A fragile recovery, https://doi.org/10.1787/d14d49eb-en.

[9] Rachel, L. and L. Summers (2019), “On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation”, BPEA Conference of 7 March‑8.

[10] Ranaldo, A., P. Schaffner and M. Vasios (2021), “Regulatory effects on short-term interest rates”, Journal of Financial Economics, Vol. 141/2, pp. 750‑770, https://doi.org/10.1016/j.jfineco.2021.04.016.

[39] Reserve Bank of Australia (2022), From QE to QT – The next phase in the Reserve Bank’s Bond Purchase Program, https://www.rba.gov.au/speeches/2022/sp-ag-2022-05-23.html.

[30] Reserve Bank of New Zealand (2022), Reserve Bank details planned sales of New Zealand Government Bonds, https://www.rbnz.govt.nz/hub/domestic-markets-media-releases/reserve-bank-details-planned-sales-of-new-zealand-government-bonds.

[32] Sveriges Riksbank (2022), “Policy rate raised by 1 percentage point”, Press Releases, https://www.riksbank.se/en-gb/press-and-published/notices-and-press-releases/press-releases/2022/policy-rate-raised-by-1-percentage-point/.

[18] UK DMO (2023), Revision to the DMO’s financing remit 2022‑23: September 2022, https://www.dmo.gov.uk/media/pddhdwib/pr230922_2.pdf (accessed on 3 March 2023).

[21] UK DMO (2022), Gilt Market: Data, https://www.dmo.gov.uk/data/gilt-market/ (accessed on 3 March 2032).

[19] UK DMO (2022), Revision to the DMO’s financing remit 2022‑23: Autumn Statement 2022., https://www.dmo.gov.uk/media/jhebewha/sa171122.pdf (accessed on 30 March 2023).