This chapter focuses on Gotland’s business environment. Considering specificities of “insularity”, such as limited knowledge exchange networks and a geographically constrained market, it proposes policies that encourage innovation and entrepreneurial activity on the island. The chapter starts by analysing the existing business support ecosystem and identifies potential gaps for support and barriers to innovation and entrepreneurship that currently exist. It then discusses specific business areas that have the potential to further contribute to regional development, including the agro-food and hospitality industries, the creative and cultural industry, the bioeconomy and the circular economy. Skills and education, which play a central role in a healthy business environment, are considered in the last section of the chapter.

OECD Territorial Reviews: Gotland, Sweden

3. Gotland’s business environment: Fostering innovation and entrepreneurship

Abstract

Assessments and recommendations

Assessments

For island economies, boosting innovation and entrepreneurship are essential to staying competitive and overcoming disadvantages such as lacking agglomeration effects. On Gotland innovation and entrepreneurship have helped to diversify the local economy (agriculture, agro-foods, limestone and cement industry, forestry, creative and cultural industry, digital services and tourism). In some cases, it has also determined the survival of small rural communities by assuring basic services or developing new business models. The fact that the island functions as a national testbed for renewable energy and hosts emerging clusters in the blue and agro-food economies are essential assets that can offer significant potential if developed strategically.

Gotland enjoys one of the highest rates of start-ups in Sweden, yet entrepreneurs are older than in other Swedish regions and small and micro businesses make up the majority of businesses. Gotland has the second-highest share of start-ups per capita in the country (12.5 per 1 000 inhabitants just after Stockholm with 14.8). Ninety-one percent of all privately owned workplaces have 0‑4 employees and less than 1% have over 50 employees. While not all local firms have the capacity or willingness to grow, it is important to identify the ones with potential and help them obtain the resources to allow for growth and add employees, moving beyond the limits of their home market.

Although start-ups have good support structures and early entrepreneurs’ access to the university, support for business growth and scale-ups are still under-developed and only punctually covered. The incubator programme by Science Park Gotland is renowned as one of the best in Sweden, as well as for its remarkable potential for research and skills development through the university, which are at the heart of entrepreneurship support on Gotland. Yet, the system is not equipped to follow the business life cycle and provides consecutive support with every step of the way, especially for growth and scale-ups. This holds the risk of being stuck at the pilot stage for many of the ongoing projects and rarely having businesses that allow for more job creation. On Gotland, more needs to be done to understand where there is an ambition to grow, motivate entrepreneurs and offer them the needed support.

Enhancing innovation can help mitigate seasonal effects on Gotland, which may create precarious income situations. A large part of the local economy is seasonally defined, growing during the summer months and shrinking in the winter. Enhancing innovation in the region can add more value to established and niche markets, helping to diversify the labour market around areas of specialisation. Constraining factors to this include the difficulty of developing a distribution channel for small-scale food products, establishing close links between the agro-food and hospitality industries to attract tourists thought the year, as well as drawing on creative and cultural industries, especially the games design university track.

Gotland is well positioned to advance its bioeconomy and circular economy in consolidation with its ongoing status as a national pilot for a sustainable energy system and ambitions for attaining a fully renewable energy system by 2040. The geographical and social closeness of the island provides a suitable environment for circular economy development that rely on material flows and synergies between users. The island is also home to a range of sectors that belong to the bioeconomy, including crop and animal production, forestry, manufacturing of food products, beverages and tobacco products and aquaculture.

Gotland records lower levels of education than the Swedish average and faces relatively high student drop-out rates before reaching university or other forms of tertiary education, making it difficult for employers to find highly skilled workers. Upskilling local employees and building a local workforce that fits the needs of the local economy is of increased importance for Gotland. Even more so, in the coming years, large numbers of teachers (and other professions) need to find successors.

Recommendations

To boost productivity and achieve sustained growth in the medium and long terms, the region should expand and better integrate its entrepreneurial support system, strengthen innovation capacity and assure skills development. To this end it should:

Provide business support across all relevant stages of the business life cycle, focusing on island-specific challenges and fostering interaction between existing stakeholders:

Assuring the business support system covers all business life cycle stages and facilitates collaborative action for innovation by:

Advancing the setup of an accelerator programme, complementing the existing incubator.

Strengthening the interaction among Gotland’s various business ecosystem actors, pilot projects and initiatives to avoid duplication and assure consecutive support for businesses entering the system.

Supporting the upgrade of the emerging clusters, the Green and Blue Centres, strengthening their business engagement and developing them into single access points for knowledge.

Strengthening collaboration between the university and business community in strategic areas, facilitating continuous stakeholder engagement roundtables on innovation facilitated by the region.

Supporting the establishment of strong “off-island” business partnerships and networks by:

Upgrading the local export office by focusing on export awareness campaigns that can help break down mental barriers and more specifically provide information specific to Gotland’s industries and Baltic markets.

Setting up a Stockholm or mainland broker. The broker should support small- and medium-sized enterprises (SMEs) in promoting local products and directly liaising with possible buyers, such as supermarket chains, restaurants and stores, and can provide advice on marketing strategies and up-to-date market and sector information.

Improving municipal services for entrepreneurs by:

Building capacity of administrative staff through peer learning with other municipalities.

Increasing SMEs’ digital skills by:

Continuing to roll out targeted programmes that combine information and communications technology solutions with management training, making better use of young people’s digital skills (i.e. in apprenticeships) and setting up advisory services to develop individualised training paths.

Updating the region’s digital agenda to incorporate learnings and changes from the COVID-19 crisis.

Encouraging young people to become entrepreneurs by:

Promoting youth entrepreneurship in formal educational programmes and extracurricular activities (e.g. model firms, entrepreneurship clubs, business plan competitions).

Setting up a mentoring programme to match younger entrepreneurs with those who have more experience, especially retired business owners, as part of a voluntary programme.

Developing co-working spaces across the island to allow for social interaction and networking amongst young entrepreneurs.

Helping local businesses better plan for succession by:

Developing systematic support to promote succession planning as part of the services provided to business, including developing ownership and leadership transition plans.

Facilitating matchmaking for succession, creating a single directory of businesses seeking successors and potential buyers/entrepreneurs across the island.

Add value to sectors of specialisation and further develop niche markets that allow for strategic diversification of the local economy. Specifically, the region should focus on:

Developing a “farm-to-table” culture in the agro-food and hospitality industries and support farms in applying technological innovations to stay competitive by:

Continuing development of a “sustainable food development office” that can support the development of local distribution pathways for small farm produce and contributes to educating the local hospitality industry about the benefits of buying local.

Further developing food-tourism routes through branding and identity, including wayfinding strategies and signage, and marketing and communications.

Continuing to support innovations in farms by helping to apply technology that already exist elsewhere. The Green Centre could leverage its university contacts and become a learning and mentoring hub for this.

Utilising the creative and cultural potential of the island, further developing the creative and cultural sectors (CCS) and fostering cross-sectoral innovation programmes:

Elaborating a CCS strategy, defining concrete measures and roles for the development of the CCS involving relevant local stakeholders. Establish closer co‑operation between the university game design programme and Region Gotland to develop possibilities around a potential games cluster.

Setting up a specific incubator/accelerator (track) for the CCS that, among others, supports game design students in their transition into professional game developers. The existing cultural entrepreneurship centre or Science Park Gotland can be a platform for this.

Supporting cross-sectoral and interdisciplinary projects involving creative industries to bolster innovation in tourism, education, mining, energy and agriculture through the creation of platforms, organisation of events for matchmaking and links with traditional sectors.

Strengthening the bioeconomy and circular economy alongside further pushing the renewable energy transition by:

Further combining technological perspectives and research with regulatory framework conditions to allow for experimentation and applied research, for instance through further developing the planned Industrial Symbiosis Park and offering local innovators an entry point.

Establishing effective governance arrangements through harmonising regulatory requirements and assuring sufficient policy co‑ordination across different circular and bioeconomy sub-sectors, such as agriculture, food, forestry, marine, waste and energy, and developing a circular economy strategy based on the regional development strategy.

Enhancing collaboration between the emerging agro-food and aquaculture clusters, the Green and Blue Centres, regarding support for innovation and entrepreneurship around the food industry and saving scarce water resources.

Developing coaching and support on circular and bioeconomy development, i.e. on waste efficiency in businesses and across value chains, helping them to minimise waste, saving water and other materials. To realise this, the region would need to find financing support from the national government or be allowed to loosen the tax regulations for such a service.

Address future labour market and skills needs by adjusting Gotland’s training and education system and help attract and retain a skilled workforce needed for businesses to thrive by:

Reinforcing the anticipatory planning and strategic understanding of future skills needs in the region by:

Building a solid evidence base on current and future demand for skills and engaging in foresight exercises to guide both public and private sectors to work hand in hand on skills development, recruitment and engagement with educational institutions to provide the necessary education and training.

Raising the level of education and allowing for more up- and reskilling through local SMEs by:

Providing a regular opportunity for young people, from primary education onwards, to reflect on and discuss their prospective futures, allowing students to consider the breadth of the labour market and particularly occupations which are of strategic economic importance, facilitating contact with role models and providing application support.

Guiding SMEs to provide upskilling opportunities to their staff and assuring reskilling programmes are compatible with the part-time and long-distance learning needs of the island.

Making the island more attractive for teachers by:

Setting up experience-sharing networks amongst teachers of different communities, considering compensation for accommodation, supporting flexible work hours and rotation systems for itinerant teachers or/and accommodation support.

Further developing the national policy that supports study loans for educational professionals moving to rural municipalities, considering that delineation according to different parts of the island might be needed to adjust for inter-regional differences.

Introduction

Gotland has a diverse economy (agriculture, agro-foods, limestone and cement industry, forestry, cultural industry, digital services and tourism). It further functions as a testbed for multiple industries including the blue and green economies that can offer significant development potential if scaled up and synergies created with other business sectors. Yet, local firms are often very small, lack the capacity or willingness to grow and are limited, with the labour market fluctuating with the seasonal economy, making it less competitive than other regions. This chapter investigates how to address barriers to business development, including market limitations, skills gaps and administrative challenges. It also suggests how to make existing innovation and entrepreneurship support networks more effective.

Innovation and entrepreneurship make regional economies more productive, more resilient and adaptive to change (OECD, 2015[1]). This is because both form the basis for new businesses and new jobs, and help to address and deal with megatrends (OECD/EC, 2019[2]). On Gotland, innovation and entrepreneurship help to diversify the local economy and make the island more attractive, for visitors and residents alike. In some cases, they even determine the survival of small rural communities by assuring basic services. For an island economy in particular, innovation and entrepreneurship are essential to stay relevant on the market and make up for the disadvantages of being a small economy without the benefits of agglomeration effects. Hence, innovation as well as the entrepreneurs who realise these innovations are crucial for the future well-being of regions.

Gotland has several strengths when it comes to entrepreneurship and innovation. Relative to other counties in Sweden, Gotland is characterised by an astounding entrepreneurial spirit. In 2019 and 2020, around 430 businesses were started each year on the island. This is the second-highest share of start-ups per capita in the country (12.5 per 1 000 inhabitants just after Stockholm with 14.8) and also more than other more urbanised regions like Skåne (12) and Västra Götaland (9.5) (Tillväxtanalys, 2021[3]). The island also benefits from a university campus, an important asset for a small population, bringing national and international students to the island and acting as a hub for knowledge exchange and creation. Good digital connectivity as well as the island’s premium brand identity and cultural heritage, both as a destination and in terms of goods produced, are essential to its current success and popularity.

Gotland also has a range of challenges. As an island, the local market is physically limited by space and there is a very large number of small and micro businesses. Many firms on the island might stay small because the market is small and they do not dare to make the leap off the island, let alone to another country. In per capita terms, Gotland is the Swedish region that exports the least (SEK 17 990 per capita, far from the country’s regional average of SEK 130 960 in 2018). Yet, some of the exported goods might not be counted as they pass through the neighbouring region of Västra Götaland: according to Region Gotland, the amount accounts for approximately 10-15% of potatoes that leave the island. Also, a large part of the labour market is seasonally defined, expanding during the summer months and shrinking in the winter, creating more precarious income situations. In the coming years, essential occupations including farmers, teachers and other occupations need to find successors. Gotland records lower levels of education than the national average and also face relatively high student drop-out rates before reaching university, making it difficult for employers to find highly skilled workers.

If Gotland wants to remain competitive with other regions, it needs to make improvements to its business support ecosystem, to help already existing industries and services to scale and strategically support the creation of new ones. Innovation support and fostering the skills needed for businesses to thrive are part of this. To advance along this line, this chapter identifies a number of recommendations that can help:

Refine Gotland’s business support ecosystem that enables entrepreneurs across different stages of the business life cycle and encourages innovative firms to experiment with new ideas, technologies and business models, which allows them to move from early stages towards growth, their market share and reach scale by reaching new markets and benefit from digitalisation.

Add value to sectors of specialisation and niche markets that allow a strategic diversification of the local labour market. In specific, the chapter will focus on: agro-food and hospitality, creative industries, as well as the bioeconomy and circular economy.

Address future labour market and skills needs by adjusting its training and education system, and help attracting and retain a skilled workforce needed for businesses to thrive.

To do this, the chapter will firstly identify a range of barriers to innovation entrepreneurship that currently exist on the island and then suggest actionable policies at the national and regional levels to address them. The chapter will also draw on important international leading practice examples Gotland could learn from.

The role of innovation and entrepreneurship in regional economies

Innovation and entrepreneurship are two complementary dynamics that feed off each other. Innovation is the process of knowledge accumulation and a new combination of existing knowledge. Firms can use this to seek new opportunities and competitive advantage. For instance, it allows them to generate more profits, through increased sales, greater brand awareness, a new customer base or higher market shares (i.e. product innovation) or through greater cost efficiency and improved productivity (i.e. business process innovation). The entrepreneur, in this context, is the driving force of the process. Entrepreneurs are the human force that identifies opportunities, takes risks and disrupts. Entrepreneurship also plays an important role in the diffusion of innovation. Innovation diffusion is a process through which firms gather knowledge, information and innovations from outside the organisation and use them to introduce their own innovative products or processes (OECD, 2020[4]). In short, entrepreneurship is fundamental to the innovation process and innovation is the driver for entrepreneurship (OECD, 2021[5]).

For countries and regions, innovation and entrepreneurship are of crucial importance to strengthen economic growth and foster competitiveness. Entries of new firms boost job opportunities and through a process of creative destruction raise aggregate productivity. They also contribute to market dynamism, improving the breadth of choices available to consumers, and increase competition, incentivising existing businesses to improve and drive inefficient firms out of the market (OECD, 2020[6]). In times of crisis recovery, for instance from COVID-19, the creative destruction process that supports innovation endeavours is of particular importance, as it allows a reallocation of assets and resources to the more productive (efficient) firms, which in turn will be able to grow and create jobs for the recovery period (OECD, 2021[5]).

Innovation and entrepreneurship are also increasingly valued for their wider social benefits, as means to address pressing environmental and societal challenges (OECD, 2021[5]). For instance, entrepreneurship provides opportunities to people who are disadvantaged in the labour market but still may be able to create successful businesses, allowing alternative pathways to employment. Entrepreneurship also offers greater flexibility and autonomy in structuring work and can be more inclusive of social objectives than a standard employment relationship. Sometimes starting a business can also become a substitute for a small labour market. Especially, in regions that are going through economic transition, entrepreneurship and innovation can contribute to these processes and can help introduce innovative solutions to economic and social challenges to the market, in areas such as driving the green transition and creating services for ageing populations (OECD, 2020[6]).

OECD research has shown that SMEs are often at the productivity frontier and amongst the most innovative firms, jump-starting entire new industries (OECD, 2015[1]). Still, it has to be noted that innovative start-ups and SMEs only represent a small subset of start-ups. Most firms have limited ambitions to grow. To encourage entrepreneurship and allow for innovation at the heart of companies with the potential and willing, appropriate policy interventions are required. These include establishing the right framework conditions for new firm development and offering direct support to help entrepreneurs and start-ups overcome specific barriers, for example in areas such as innovation and skills (OECD, 2020[6]). A sound entrepreneurship system that encourages innovation and that enables firms and founders to experiment with new ideas, technologies and business models, helps them to grow, increase their market share and reach scale, and allows for the flow of knowledge linking the private sector to research institutions and universities (Cusmano, Koreen and Pissareva, 2018[7]).

There are significant and longstanding geographical variations in entrepreneurial and innovation activity within countries (OECD, 2015[1]). As a result, OECD research has established that is important for national programmes for entrepreneurship and innovation support to account for regional differences and geographically variable impacts. National-level entrepreneurship and innovation policies often benefit from taking into account regional variations. Further, regional policy and local programmes need to reflect the special needs of the entrepreneurship landscape as well as the innovation potential in the region and communicate this effectively (OECD, 2020[6]).

Research has shown that SMEs that are able to come up with innovative products and services have the greatest potential to benefit rural regions through job creation. This is because they are likely to develop a product or service for which there is less competition and a market with growth potential. Yet, at national levels, there is often little support for specific rural innovation. In most OECD countries, the focus is on innovation systems that operate at the national or large regional level and might not be adjusted to rural types of innovation. Many of these systems are exclusively structured as complex interactions among public universities, large businesses with formal research and development (R&D) activity and government agencies. The idea that SMEs in rural regions can produce innovations and might require different or more targeted support is seldom considered (Freshwater et al., 2019[8]).

Most innovations developed in rural areas have small markets and mainly benefit the innovating firm and its direct customers. Few involve formal R&D efforts or patent applications. Rather, innovation in rural regions often results from company branches adopting innovations from their parent organisation or SMEs adopting innovations from other regions. In other cases, they involve user innovation where the rural SME produces innovations of direct value to the firm. Table 3.1 summarises some characteristics of rural innovation that should be considered in providing support:

Table 3.1. Characteristics and bottlenecks of rural innovation

|

Rural Innovation |

|

|---|---|

|

Characteristics |

Incremental and slower – less dynamic and short-lived, use of local knowledge for steady improvement |

|

Experimental – utilising space available to test until a solution is found |

|

|

Based on customer or client contacts |

|

|

Smaller firms requiring local leadership and dedication |

|

|

Natural resource focus (tourism, energy, agriculture, forestry) |

|

|

Strong use of social and human capital in innovation |

|

|

Community is driven – meaningfulness as an objective |

|

|

Targeting local markets |

|

|

Use of rural-urban links to leverage knowledge outside their location for more radical innovations |

|

|

Bottlenecks |

Dependency on young generations – need for business succession and interest/ability to work on new products and processes |

|

Reduced accessibility of networks, knowledge and support readily available (Missing links to universities or research institutions) |

|

|

Lack of digital connectivity and skills |

Source: Mayer, H., A. Habersetzer and R. Meili (2016[9]), “Rural-urban linkages and sustainable regional development: The role of entrepreneurs in linking peripheries and centers”, http://dx.doi.org/10.3390/su8080745; Freshwater, D. et al. (2019[8]), “Business development and the growth of rural SMEs”, https://doi.org/10.1787/74256611-en; Jungsberg, L. et al. (2020[10]), “Key actors in community-driven social innovation in rural areas in the Nordic countries”, http://dx.doi.org/10.1016/j.jrurstud.2020.08.004; Lee, N. and A. Rodriguez-Pose (2012[11]), “Innovation and spatial inequality in Europe and USA”, http://dx.doi.org/10.1093/jeg/lbs022; Mahroum, S. et al. (2007[12]), “Rural innovation”, National Endowment for Science, Technology and the Arts (NESTA), London; Wojan, T. and T. Parker (2017[13]), “Innovation in the rural nonfarm economy: Its effect on job and earnings growth 2010-2014”, ERR-238; Shearmur, R. and D. Doloreux (2016[14]), “How open innovation processes vary between urban and remote environments: Slow innovators, market‑sourced information and frequency of interaction”, http://dx.doi.org/10.1080/08985626.2016.1154984.

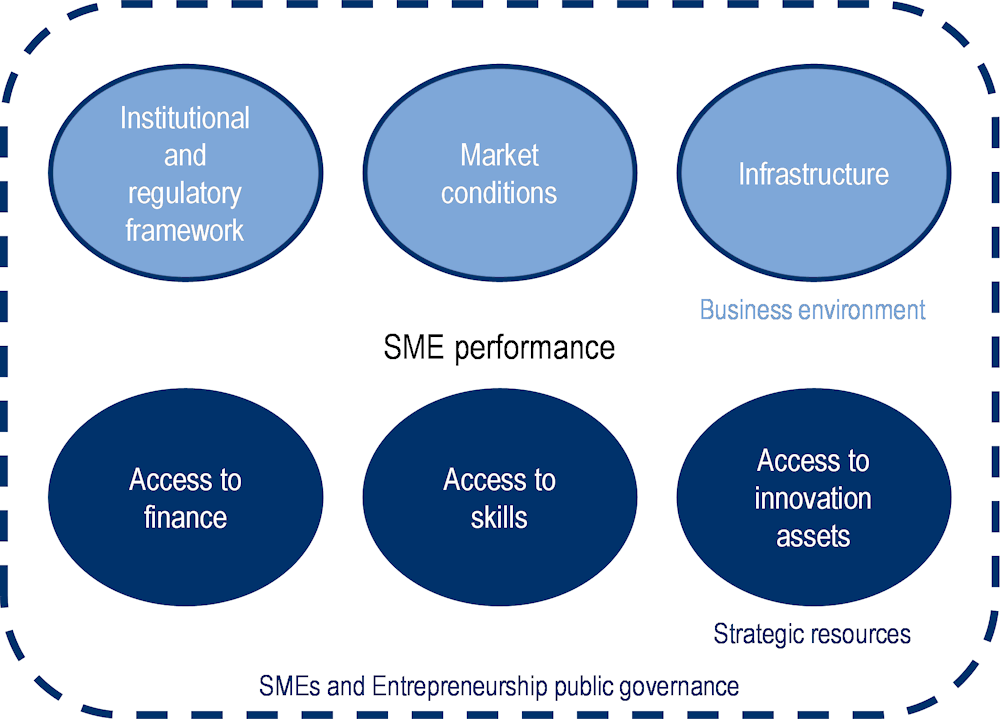

Overall, a comprehensive business environment and a well-functioning entrepreneurial “ecosystem” for business include institutional and regulatory settings, facilitate conditions to access markets and provide needed resources such as access to finance, incentivise risk-taking and experimentation by entrepreneurs, connect them to knowledge creation and ensure that business growth potential can be realised. This also involves co‑ordinated policy in a range of different areas, for example skills and education policy which promotes business and entrepreneurial skills and infrastructure policy to improve digital access and physical transportation links (OECD, 2017[15]). Regional entrepreneurial culture is also important to offer attractive opportunities for entrepreneurship and develop the abilities and attitudes among the population and administration needed to seize them (OECD, 2020[6]). Figure 3.1 depicts different business conditions for improving the business environment for SMEs and entrepreneurship. Many of these are dealt with in this review. While this chapter largely focuses on access to innovation, access to skills and market conditions in Chapters 2 and 4 are also relevant, especially the chapter on infrastructure.

Figure 3.1. OECD SME and Entrepreneurship Concept Framework

Source: OECD (2019[16]), OECD SME and Entrepreneurship Outlook 2019, https://doi.org/10.1787/34907e9c-en.

Better integrating Gotland’s business support ecosystem and helping Gotland’s business reach new markets and innovate more

Many Gotland enterprises stay small: expanding support for enterprises in their growth stage and strategically using innovation can help them advance to the next level

As mentioned above, entrepreneurship that supports regional development requires a strong business environment. This can be conceptualised as the set of factors and actors that together contribute to the emergence of productive entrepreneurship in a particular territory. Brown and Mason (2017[17]) identify four key components of entrepreneurial ecosystems whose presence and linkages affect entrepreneurs:

1. Entrepreneurial actors, which provide incubation, acceleration, coaching and mentoring services to entrepreneurs.

2. Entrepreneurial resource providers, which support entrepreneurship with financial resources (e.g. banks, business angels) and knowledge and opportunities for collaboration (e.g. large firms, research institutions).

3. Entrepreneurial connectors, fostering linkages in the ecosystem (e.g. professional associations, business brokers).

4. An entrepreneurial orientation, which includes an entrepreneurial culture (Brown and Mason, 2017[17]).

Gotland has many important business support services that provide a range of what is mentioned above. Especially regarding its small size, the range of offers is impressive (for an overview of all relevant actors involved in supporting business development on Gotland, see Table 3.2). The two most comprehensive ones will briefly be described. First, Science Park Gotland (SPG), an incubator programme linked to the university, provides workspaces, coaching and business advice as well as financial support to start-ups. The six-week incubator programme (SPG Start-up) offers ongoing business advice, access to office space and a network of contacts and helps to develop a first business model, concept and pitch. If needed, the programme can be extended into a follow-up programme lasting up to two years (SPG Summit), which aims to help develop and launch a product/service and create sustainable sales. An investment arm of Science Park Gotland provides funding between EUR 20 000 and EUR 500 000. Second, Almi, a national business development advisory and loan service, also has a regional office on Gotland. They provide funding and advice for companies through coaching (online) seminars and mentoring services. While the service had an innovation advisor until 2018, this role is currently vacant.

Table 3.2. Key actors in Gotland’s innovation and entrepreneurship support system

|

Organisation name |

Type |

Service provided |

Region-specific or part of a broader network |

|---|---|---|---|

|

Science Park Gotland (Invest) |

Incubator/Investor |

Incubation, workplaces, coaching, financing through a start-up and growth fund |

Regional, linked to Uppsala University Campus Gotland, financed by Region Gotland |

|

Almi Invest |

Start-up investor |

Venture capital for early-stage, emerging companies |

State-owned |

|

Almi business support |

Business Development Advisory and Loan Service |

Microloans, innovation loans and export financing, advisory, (online) seminars, coaching for start-up and growth phase, mentoring |

State-owned, regional offices are partly region-owned by 49% |

|

Gotland Green Centre |

Educational Centre and Business Network for the Green Economy |

Vocational training and secondary education in agriculture, farm animals, gardening, food production, business development and nature tourism for adults and young people/business development and innovation support, a business network for the food industry by the subsidiary Matbyrån AB |

Regional, owned by Hushallningssallskapet (Rural Economy and Agricultural Society) Region Gotland, LRF (Federation of Swedish Farmers) and Tillvaxt Gotland |

|

Blue Centre Gotland |

Research and network for the blue economy |

Knowledge creation and exchange, support the development of the blue industry |

Regional, linked to Uppsala University Campus Gotland |

|

Uppsala University Campus Gotland |

Higher education institution |

Knowledge creation and research in 20 departments offering bachelor’s, master’s and doctoral programmes |

Part of Uppsala University |

Source: Author’s elaboration based on Region Gotland questionnaire responses and interviews in 2021.

Gotland is also home to two emerging cluster initiatives, the Gotland Green Centre and Blue Centres. Both centres work to strengthen and modernise existing local sectors and seek to find solutions to local development challenges. The Green Centre focuses on securing the future of the green economy on Gotland, providing educational programmes and acting as a business network for the local agro-food and animal industries. In recent years, it has put a focus on developing its education and training offer and has now turned to advancing its business network and developing more innovation centred activities through participating in LEADER projects. The Blue Centre is slightly more research-oriented, seeking to find solutions to water-related issues and aquaculture, including building knowledge about sustainable food production from lakes and oceans. It is part of the University Campus Gotland and aims to bring together academia, business and industry, and industry associations along with regions and municipalities. The larger University Campus Gotland, part of Uppsala University, offers 11 degree programmes (bachelor’s and master’s) and conducts research in 20 departments.1 The university has 2 400 full-time students, approximately 1 500 of whom are on-campus students, and around 230 employees. The campus also ascribes itself a special focus on sustainability, 12 study programmes with a special focus on sustainable development and 5 major research and collaboration projects being conducted on sustainability issues, including energy transition, destination development and management of natural resources.

Businesses require different types of support throughout their business life cycle. The needs of an entrepreneur just starting their own business differ from the needs of a business owner wanting to expand their operations. For example, a start-up might require greater support in promoting their product, or service or to develop a business plan, whereas a more established business might require support in accessing talent to grow the business or access to short-term finance to support cash flow in periods of growth. Traditionally, the life business cycle is mostly described as a development of several stages. These stages are referred to as the: i) seed stage; ii) start-up stage; iii) growth stage; iv) expansion stage; v) established stage; vi) maturity stage; and vii) exit stage (EC, 2018a[18]).

Gotland’s current system provides good support structures for start-ups and early entrepreneurs and holds remarkable potential on the research and skills development side. Yet, in the system, support for business growth and scale-up in terms of business acceleration and growth are still under-developed and only punctually covered. The system is not yet set up in a way that follows a business life cycle and provides consecutive support every step of the way. This holds the danger of being stuck in a constant chain of pilots and having many start-ups but rarely having businesses in a stage where they allow for more job creation. On Gotland, more needs to be done to understand where there is an ambition to grow and motivate entrepreneurs that would like to grow in a way that offers them the needed support. Especially, Gotland needs to create more enabling conditions for post-entry growth, growth of small firms into mid-size ones and the scaling up of mid-size companies, as a lever to boost aggregate productivity growth and competitiveness.

While many rural places are home to a majority of micro SMEs that are focused on the local market and have little scope or desire to grow or expand the firms, there are generally some firms that have growth potential. This is also the case on Gotland. As mentioned in Chapter 1, small and micro businesses make up a large majority of all companies in the municipality of Gotland. Ninety-one percent of all privately owned workplaces have 0-4 employees and less than 3% have over 50 employees. It is important to consider that while each individual firm may not add many employees, a high number of small additions makes the difference: in other words, “many cents make a euro”. Because of the limited potential of the home market, a characteristic of these firms is their potential to move beyond the limits of their home market and serve external markets (Freshwater et al., 2019[8]). A 2017 survey with entrepreneurs from Gotland indicated that there is a will to grow, with 82% of small business owners demonstrating a willingness to grow and 74% seeing good expansion opportunities (Företagarna, 2018[19]).

To improve the overall offers, there is also potential to strengthen the interaction among different actors engaged in Gotland’s business support as well as the various pilot projects. Doing so can create greater cohesion and synergy in overall support and activities, which at times seem disconnected and fragmented. Common reasons for this are different authorising environments as well as reporting and funding obligations. On Gotland, more could be done to align business development agendas and offers, scan for businesses with potential and ensure consecutive support for businesses that might be able to graduate from one offer to the next. In this context, the region has a role in connecting loose ends and encouraging all actors in the system: notably Almi, SPG, Gotland Green and Blue Centres can do more to work systematically together. Regular exchanges and meetings could benefit the system and help identify gaps, duplications and options to combine strengths to boost the local economy. This can encourage a perspective where actors see themselves as one body contributing to the broader regional innovation and entrepreneurship ecosystem. Furthermore, institutions must collaborate closely in advising potential customers on what support they could benefit from best. For instance, a “no wrong door” principle for business support could be implemented, so that businesses that seek support can find it wherever they go.

One solution to this can be complementing physical presence with online services that allow easy navigation of business services according to particular needs. This can reduce complexity, help identify gaps and help direct people to the “right” offer. A local vocational college in St. Lawrence, Canada, has developed a business ecosystem pathfinding tool to assist start-ups and scale-ups in connecting with available resources. The tool called SwitchBoard2 provides navigation support and visibility to all relevant public support activities in the area of Kingston. Results are clustered and displayed according to which stage of the business circle entrepreneurs are in. In case entrepreneurs are unsure where they fit, the tool also provides assessment help and lets people research for support directed at specific groups including women.

Developing support for different types of scaling and growing

Gotland, as an island, might face specific challenges in terms of business growth or scaling. The physical limits of the land and market seize might influence how entrepreneurs think about the scale of the business, especially considering additional costs for transport export (around 30%) and challenges in skills recruitment. Further, it might be that firms stay small because the local market is small or because they see their business as a lifestyle endeavour and are merely interested in supporting themselves. They might also think that growth will require them to move off the island at some point. A combination of one or many of these regions can lead to business owners underestimating their potential or possibilities. It is therefore possible that mental barriers or questions need to be addressed before actual business support can help them. It is important for Region Gotland and actors in the regional business support system to better understand the main growth challenges and investigate how they can be addressed. If mental barriers play a role, an information or marketing campaign can help. Such a campaign could provide encouragement, provide positive examples and point to the services available.

Once businesses have set their ambitions to grow or scale, they generally have different ways, objectives and reasons for doing so. It can be the result of an inwardly targeted strategy to transform the business, for example through changes in management or composition of the workforce, or could be the result of external demands, for example through increased market share and sales. Scaling up could fundamentally change the structure and day-to-day operations of a business, or could leave these structures intact (OECD, 2021b[20]). Consequently, understanding differences in transformation models is key for developing the right support structures (for different modes, see Box 3.1). Hence, striking the right balance between R&D/technology-driven innovation support and other forms of innovation, especially incremental and social innovation which may be more suitable to Gotland’s business fabric – one that is populated by a high share of micro and small enterprises –, is important when thinking about setting up a business support ecosystem and the different offers the actors provide. At the moment is not very clear on Gotland which services target what kind of business needs.

Box 3.1. Transformation models underpinning scaling up

Recent work at the OECD has looked to capture evidence on the different transformation models underpinning businesses scaling-up activities. It identifies four stylised models:

The first model is “disruptive innovators” that invest in technological innovations, typically R&D-based, which result in disruptive changes to their product range or the ways they produce.

The second model is “gradual innovators” that prepare to scale by investing in human capital and upgrading their production processes with gains in new market shares arising from gradual improvements in the productivity of existing processes rather than from disruptive innovation.

The third model is scalers that do “more of the same”, i.e. expansion without changes in the composition of the workforce. For example, a manufacturing firm might add a second production facility or a local retailer might add another store.

The fourth model is “demand-driven scalers” that faces an external and temporary increase in demand that translates into a sales windfall.

While these models are stylised in the sense that most businesses will utilise a combination of the above models or may pursue different models as their business evolves, they demonstrate that supporting business growth requires consideration of the differing needs of businesses undergoing different forms of transformative growth.

Source: OECD (2021[21]), Understanding Firm Growth: Helping SMEs Scale Up, https://doi.org/10.1787/fc60b04c-en.

Focus on gradual innovators – Developing an accelerator and upgrading clusters

To complement the existing business support system, Science Park Gotland (SPG) should continue its plans of developing an accelerator linked to the incubator. The accelerator could cover growth needs for entrepreneurs that are looking to steadily improve their business and possibly grow from a micro business to a small business. An accelerator programme could provide an enhanced, more intensive business support service to potential growth enterprises on Gotland and deliver the following support:

Specialist advice.

Recruitment advisory service and support.

Growth workshops.

Key sector entrepreneurial support.

It could also help support building the capacity of small and even micro enterprises to recognise innovation opportunities and not consider them irrelevant or infeasible to their businesses. One aspect of this can include supporting the adoption of knowledge or technologies that have already been generated and linking them to networks where they can learn about these through the university. Many businesses could also benefit from building managerial and organisational practices to manage and accumulate knowledge and organise the business routines needed for innovation within their businesses. For small business innovation, managerial skills and formal management practices play a key role in leveraging internal strategic resources towards inhouse innovation and collaboration with external partners. For example, target setting or quality management and monitoring, are key activities to manage innovation projects and business growth. In setting up this service, it is important to co-ordinate between Almi, which is also providing growth support, and SPG, to avoid overlap and seek complementarity. Strengthening collaboration between the university and businesses community around strategic areas and upgrading centres to clusters – to foster innovation.

Furthermore, the emerging clusters, the existing Gotland Green and Blue Centres, could do more to upgrade their activities. One essential service they could offer is to build knowledge bridges between off-island knowledge institutions and the business community, thereby enabling new research and knowledge to be quickly and efficiently shared and utilised. One particular task of the centres could be to offer enterprises a single access point to the various knowledge institutions that exist within the centre’s professional field. While at a different scale, Box 3.2 provides an example of a Blue Economy Cluster Builder initiative taking place in Scotland. The important aspect of the Scottish programme describes the potential to add the business perspective to the currently rather research-focused endeavour of the Blue Centre Gotland.

Box 3.2. Blue Economy Cluster Builder, Scotland

The Blue Economy Cluster Builder is a 3-year programme to communicate and raise awareness of the benefits of the blue economy in Scottish SMEs and enable them to take advantage of new opportunities. It seeks to increase the number of Scottish companies operating in the blue economy and support the growth of the blue economy in Scotland. It will provide an inclusive and free-of-charge service to ensure that Scotland’s SMEs gain the optimum share of market growth and compete with international blue economies.

This programme aims to connect SMEs from across different sectors, including low carbon energy, subsea engineering, offshore renewable energy, marine shipping, power in the sea, fish processing, aquaculture, marine transport, oil and gas, marine protection, sensors, Internet of Things, new materials and more.

In this way, the cluster builder can identify new products, technology and services, as well as possible skills gaps and barriers to growth. It can then prepare SMEs for future opportunities and facilitate collaborations.

Cluster builder activities include:

Events for SMEs.

One-to-one support for SMEs.

Building a sustainable cluster and raising awareness of SME capabilities in the Scottish blue economy.

Establishing collaborations between SMEs and research institutes, including academia and innovation centres, and market intelligence for SMEs.

Source: Blue Economy Cluster Builder (n.d.[22]), Homepage, https://www.scottishblueeconomy.co.uk/.

Focus on more disruptive innovators – Linking to the university

For firms that are larger or looking to grow through more radical innovations, university connections play an essential role. To do that, the university needs to establish itself as a hub for more R&D intensive innovation, supporting businesses to make changes that are more radical and that heavily rely on research-based knowledge generation and experimentation. These are likely to be more attractive to more mature businesses that are looking for greater change. While measuring innovation is challenging, patents can give some indication of new technology creation and R&D expenditures provide a measure of the inputs into the innovation process (Acsa, Anselinb and Vargac, 2002[23]). Current, measurements for patents show low results on Gotland. Between 2011 and 2021, businesses from Gotland registered 30 patents, which is the lowest number of patients compared to all counties, in total and per capita. The national average lies at 1 014 for 10 years and the median at 331. The countries with the next lowest ratings are Jämtland (84), followed by Blekinge (184) and Kronoberg (198) (Patent Och Registerings Verket, 2021[24]).

The regional government of Gotland should encourage greater engagement between the university and the local business community. The three areas identified in the smart specialisation strategy can function as a framework to promote dialogue among research institutions and Gotland’s SMEs that do not currently engage with them. To structure the dialogue between the university and the business community, the region could, for example, integrate both local business and university representatives in continuous stakeholder engagement roundtables on regional innovation. Doing so would enable the university to reach out to companies, particularly SMEs, in the region that does not yet work with the university. Other possible measures include student placement schemes or the development of curricula that are more closely linked to industry needs.

Further, high levels of R&D expenditure are viewed as a vital enabling factor for innovation. On Gotland, R&D expenditures as a percentage of gross domestic product (GDP) are extremely limited. While there is no data on private sector expenditures, public sector expenditure per GDP stands at 0.03% and higher education expenditure at 0%. This is significantly lower than in many other regions and might also be a reason for the limited growth of SMEs. To increase funding or R&D on the island, more national support could be investigated. For instance, belonging to Uppsala University, the campus on Gotland does not benefit from support from the Swedish Knowledge Foundation. The foundation provides funding when activities are conducted in collaboration between academic staff and business sector partners for university colleges and new universities. Gotland should investigate if there are similar programmes it could benefit from. Alternatively, national regulation should consider the specific status of Campus Gotland and think about adjusting the rules of the Knowledge Foundation due to its particular situation.

Establishing strong off-island business partnerships and networks – Stockholm broker and local export office

Geographic proximity matters for innovation and business growth. Agglomeration or clustering can permit locally concentrated labour markets, specialisation in production and the attraction of specialised buyers and sellers (OECD, 2015[1]). As an island, Gotland can only benefit from this to a limited extent. While networks on the island are strong, tapping into knowledge systems and markets on the mainland or in other counties can be difficult, hence a barrier to business growth. In light of this, the importance of off‑island links that are conducive to knowledge flows and offer effective commercialisation of products is increased.

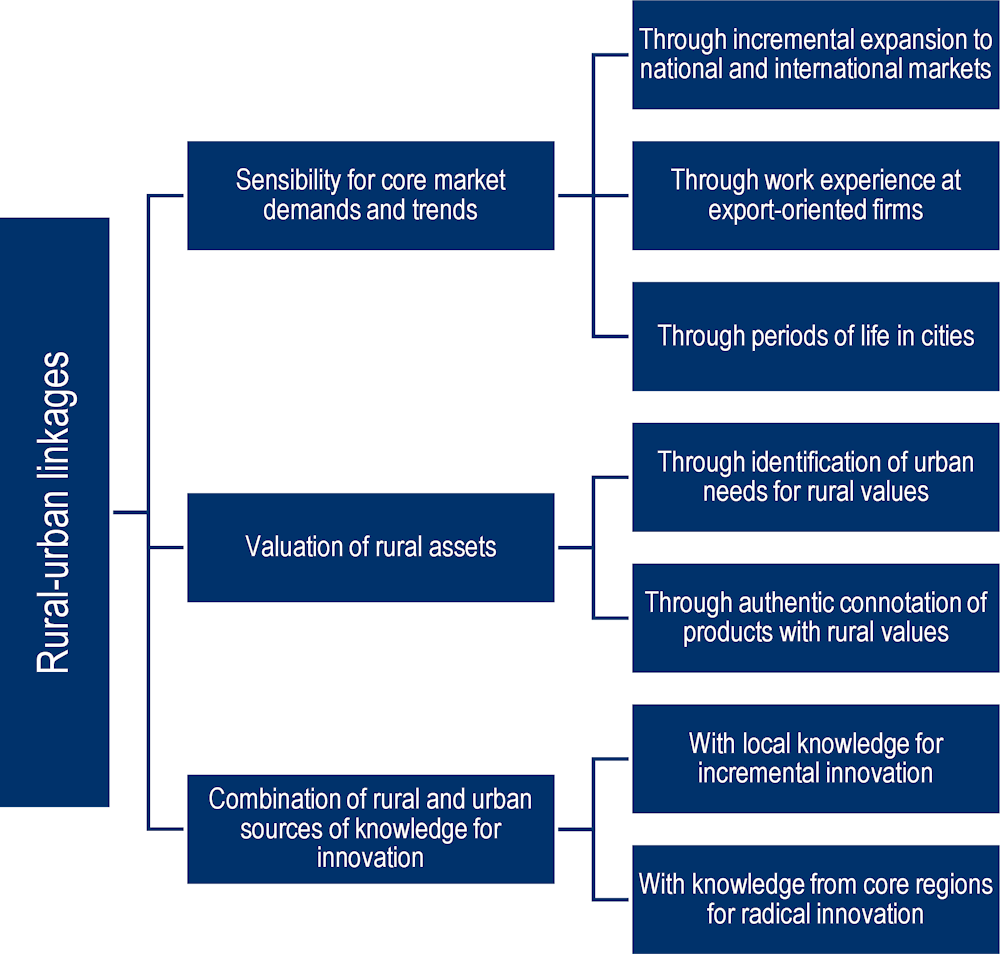

Research on rural innovation has shown that urban-rural linkages are important for businesses from the entrepreneurial perspective, notably because they allow for three things (Figure 3.2):

Sensibility for core market demands and trends.

Valuation of rural assets.

Combination of rural and urban sources of knowledge for innovation.

Engaging in rural-urban linkages and market extension activities is not easy for SMEs, which often find it difficult to identify and connect to appropriate partners and networks at the local, national and global levels. Entering unknown markets and expanding a business in off-island territories can be challenging and requires additional resources. Businesses may lack knowledge on how to market their business, what regulatory barriers they may face if they move abroad, and the logistical requirements of exporting goods. Additionally, businesses may require substantial financial investment to enter new markets and may face increased financial constraints as their activities expand. The physical limitations of the island might further influence how businesses think about the scale of the business and might make the mainland market seem further away than it is. Further, some might simply prefer to only sell to the local market.

Selling products (or services) to foreign markets can be an important way to scale up for SMEs in the tradeable sector. Going global can increase the potential for firms to scale up through several mechanisms. Beyond having the opportunity to sell their products or services to more consumers, they can also “learn from exporting” – i.e. improve product quality and adopt higher-quality standards – and optimise their sourcing strategies by choosing higher-quality inputs. A sudden surge in export – e.g. because some trade barriers are removed – can underpin a demand-driven scaling model. At the same time, accessing global markets is an innovative marketing strategy that requires dedicated investments and can thus be part of a gradual innovator growth pattern.

Figure 3.2. Rural-urban links from an entrepreneurial perspective

Source: Mayer, H., A. Habersetzer and R. Meili (2016[9]), “Rural-urban linkages and sustainable regional development: The role of entrepreneurs in linking peripheries and centers”, http://dx.doi.org/10.3390/su8080745.

Data on exports, for instance, show that SMEs are important for exports on Gotland: approximately 60% of international exports come from businesses with fewer than 250 employees. Yet, internationally, Gotland’s SMEs export the least compared to other regions (SEK 17 990 per capita, far from the country’s regional average of SEK 130 960; see also Chapter 1). To address challenges related to exporting goods and creating business links across borders and into international markets, islands across the world have developed trade commissions based on their islands. These offices help local businesses to acquire foreign investments and bridge links to innovation to ensure their businesses maintain a competitive advantage and are able to export. Two examples from Canada and the Virgin Islands are described in Box 3.3.

Box 3.3. Island Trade Commission examples – Price Edward Island, Canada, and the Virgin Islands

On Prince Edward Island in Canada, the trade commissioner’s office provides local businesses with trade, investment and innovation opportunities. They specifically focus on the following sectors: i) advanced manufacturing technologies; ii) aerospace and defence; iii) bio-industries; iv) building products; v) environmental industries; and vi) information, and communications technologies. The role of the trade commissioner is to develop a first-hand understanding of the business – meeting with you in person or visiting facilities. Having received a good understanding of your business requires support from the commissioner for the following:

Determining international competitiveness.

Deciding on a target market.

Collecting market and industry information.

Improving international business strategy.

Connecting businesses to international opportunities.

Introducing businesses to its network of Canadian trade commissioners around the world.

Providing referrals to other government agencies or organisations depending on the nature of the business’ request.

Similarly, the Virgin Islands have set up a trade commission, with the responsibility for all activities related to trade and economic development, which will function as a “one-stop-shop” for trade, business, investment, fair competition and consumer affairs. The six functional areas of focus of the trade commission include:

Policy planning R&D.

Trade and export development.

Business development.

Investment promotion and facilitation.

Licensing and regulation.

Fair trade (fair competition and consumer protection).

Source: Government of Canada (n.d.[25]), Canadian Trade Commissioner Service - Prince Edward Island, https://www.tradecommissioner.gc.ca/prince-edward-island-ile-du-prince-edouard/index.aspx?lang=eng; Government of the Virgin Islands (2021[26]), “Virgin Islands Trade Commission launched”, http://www.bvi.gov.vg/media-centre/virgin-islands-trade-commission-launched.

On Gotland, export support is channelled through the regional export office. The export office is led via the business support system Almi, mentioned earlier. The office is part of a larger network of regional export centres that were created by the Swedish government, alongside the setup of Team Sweden, a network of public organisations, agencies and companies that promote Swedish exports and investments in Sweden. The aim of the regional office is to support companies to get in touch with promotional contacts within 24 hours. The work of the regional export centre focuses on customer interactions, seminars and conferences. The Gotland office has held an export technology training and set up a stand on Gotland’s Entrepreneurs Day.

Developing a mainland broker/trade commissioner and upgrading the local export office

Gotland aims to further specialise in foodstuffs, beverages, arts and crafts that are part of high-quality, niche products. The island also has long-established mainland export businesses like the abattoir producing for Sweden’s largest organic meat brand (Smak av Gotland) and exports large quantities of carrots to the mainland. Yet, some businesses only serve the local market and do not have international reach. Making use of Gotland as a premium-quality brand identity, many of these products could be interesting for a broader market. Particularly, urban areas like Stockholm have wealthy customers who like to support locally produced, high-quality goods and food and are able to spend more. Customers these days also increasingly value transparent value chains and like to know where their product is coming from. Gotland has an advantage in this context and can easily demonstrate where products come from and who has produced them. Furthermore, people living in other countries or on the mainland might also associate Gotland’s products with experiences from their holidays or from having holiday homes/apartments on the island. Purchasing Gotlandic products (in their location) might allow them to benefit from the “Gotland feeling” on the mainland. Other potential off-island customers might not know about Gotland’s products and could therefore be targeted. Hence, there is probably potential for Gotland to reach out to other markets.

Currently, individual companies organised themselves for entering the mainland market and create several individual channels specific to their products or needs. To consolidate forces and systematise reaching the mainland market, particularly Stockholm and other major Swedish cities, the region should look into establishing something like a trade commissioner office in Stockholm. Essentially, it could function as a link between the island’s business and the Swedish mainland market, facilitating business relations, especially for SMEs. This office, functioning as an umbrella, could be responsible for promoting local products and directly liaising with possible buyers, such as supermarket chains, restaurants and other stores on the mainland. The office could also provide advice on marketing strategies and up-to-date market and sector information to help smooth Gotland companies’ path to doing business on the mainland. At the same time, this office could co-ordinate activities that help familiarise the mainland population with Gotland products and the island as a destination, including at trade fairs and local markets for instance.

In this broker role, the commissioner should also tap into already existing networks and activities that seek to promote Gotland’s products and support SMEs in their scale efforts. For instance, the LEADER project Goda Gotland has started to bring together the business community around food and seeks to help them increase visibility and competitiveness in the food business (Box 3.4). Co‑operating on these activities can help initiatives based on Gotland increase their impact and achieve greater results. Furthermore, Goda Gotland could think about extending their brand further to other products, so as to create a common brand for a greater variety of Gotland products, including arts and crafts. The Gotland Green Centre and its newly established subsidiary Matbyrån should also be involved in this as they are building expertise for marketing and promotion and could strengthen their support for territorial product branding.

Box 3.4. Goda Gotland – LEADER project for creating a strong food brand and viable option for small food producers

The projects and initiatives surrounding Goda Gotland, which is part of the Green Centre, are already starting to move in this direction for food products. The LEADER-supported project facilitates Gotland companies to work and collaborate on increasing visibility and accessibility for the wide range of Gotland-produced food. It seeks to create stronger and more competitive food businesses. Part of this project also aims at increasing collaborations between producers on Gotland, creating contacts and sustainable collaborations with producers in the rest of Sweden, and creating contacts and knowledge exchanges with producers in other countries. To develop its professional network, the project organises study trips, fair participation and meetings of producers and consumers. Part of this is also to develop joint communication and marketing. In addition to building connections and a brand, the project also aims to develop an e-commerce solution that enables small- and medium-sized Gotland-based food producers to have access to a larger market at a reasonable cost.

Source: Goda Gotland (n.d.[27]), About Goda Gotland, https://www.godagotland.se/valkommen/goda-gotland/.

To help businesses access other markets (this can be on the mainland as well as across the Baltic region), the island could further assess if the business service on the island works effectively in supporting SMEs reach new markets through its existing export centre. The current offer works as a collaboration of national and regional services but does not seem to focus on Gotland-specific industries or geographical considerations, i.e. investigating possible demand from the Baltic region and brokering relationships with potential business partners. Exporting activities could be supported more prominently. The office could also take up an advocating role for Gotlandic products with Team Sweden – the network of government authorities, agencies and companies that all work to promote Swedish exports abroad. Specifically, they could target existing sub-groups of Team Sweden that are focusing on industries of interest to Gotland such as the food and creative industries. Other examples to support internationalisation from OECD countries include: exporting awareness campaigns that can help overcome mental barriers, provision of information and advice on how to start exporting, and logistical support through trade support desks and trade trips. Governments may also offer financial support to entrepreneurs seeking to export, or offer guarantees to help them access finance exporting or reduce the risks involved (e.g. insurance to businesses exporting to certain countries, guarantees to banks providing loans to export businesses, foreign exchange rate risk cover) (OECD, 2020[6]).

Italy has adopted a unique approach to helping SMEs overcome barriers to accessing foreign markets through a programme that supports the costs of hiring a temporary export manager (as part of the 2015‑17 Special Plan for the ‘Made in Italy’ promotion). The programme helps SMEs to hire a full-time or part-time temporary employee to work in the small business in order to help them establish marketing, sales, accounting, information technology (IT) and other processes needed to export to a new market. There is an element of training involved in the programme as well. Once the individual has developed systems to support or enhance a firm’s export capacities, this knowledge is passed on to existing staff in the business and the temporary export manager goes on to support other small businesses. The programme entails two components: a training programme for temporary export managers and a voucher for SMEs to partially cover the cost of employing a temporary export manager. This programme serves to help firms access new markets and build their internal capacity to continue to do so through employee training (OECD, 2018[28]).

Improve municipal services for entrepreneurs

Gotland needs to improve its administrative services provided for businesses. The island does not perform well in the local business environment rankings of the confederation of Swedish enterprises (63% of Gotland’s businesses answered the questionnaire).3 It ranks 236th out of 290 municipalities and 22nd out of 29 municipalities of comparable population size. Overall, however, Gotland improved, climbing 27 points in comparison to the previous year (Svenskt Näringsliv, 2021[29]). Low rankings for the business environment might deter entrepreneurs from the mainland to set foot on the island and make the island less attractive for investments. It also puts small entrepreneurs and newcomers at a disadvantage, as many of them have fewer resources to navigate complex systems and might not be able to draw on an already established social capital.

The biggest challenges are recorded with regards to services provided by the administration, attitudes towards entrepreneurs and working with the administration. These are ranked low, including the efficiency and availability of knowledge of the business environment (for instance for building permits or licences), as well as public procurement processes. It hence seems to be cumbersome to start, run or develop companies when interacting with the local administration is required. Improvements also need to be made concerning the dissemination and provision of information. Other factors mentioned are linked to connectivity and access to employment and skills. Best results are achieved for business climate and security, and the share of goods and services purchased by the municipality from companies (Svenskt Näringsliv, 2021[29]).

While some challenges are likely linked to national regulations and troubles with permitting processes that are not of regional responsibility, the region can try to better steer local entrepreneurs through permitting and licencing processes smoothly, providing clear and easy to understand information and mitigating unpredictability, clarity and legally uncertain situations in the best possible way. This can be done by increasing the capacity of administrative staff and continuing to provide training and skills upgrades on business needs, and clearly communicating to staff that a good business climate is essential for the region’s attractiveness. It might also help to set up peer learning programmes with municipalities that rank particularly well on administrative services and attitudes towards businesses and learn from how they have been able to deal with common challenges, potential partners might be Falkenberg in Halland or Mariestad in Västra Gotland. As staff in the local administration already face capacity challenges (see also Chapter 4), having someone leave the island to join other municipalities to learn for a limited time could be challenging; to top up resources and enable learning at the same time, a model where administrative staff from other municipalities comes to visits might be more suitable.

Digitalisation offers opportunities for Gotland’s businesses to participate in the wider economy, innovate and grow

Widespread digitalisation has increased access to markets and audiences (e.g. through online shopping, online exhibitions and online performances) and pathed the way for the arrival of new technologies (e.g. three-dimensional (3D) printers, delivery drones, autonomous vehicles and augmented reality). Many of these can reduce the cost of moving people and goods. This can make rural environments more attractive to people and to firms, and has lowered the barriers to settling in rural places. Furthermore, digitalisation and its technologies continue to offer a large potential for innovation and growth of SMEs. In fact, fast Internet access has become a necessity for many who wish to exploit their full economic potential. Digitally enabled enterprises use a variety of technologies to facilitate key aspects of their business including communication, collaboration and the co‑ordination of activities.

Gotland has a very well-developed fibre optic network throughout the island and occupies a leading position among the regions of the country. In 2020, 88% of the population/households had access to the fibre optic network: almost 92% of the permanent population/households have access to the network and just over 60% of all properties with holiday homes (see Chapter 1). This is a large advantage over many other rural regions and has the ability to reduce the geographic gaps between the mainland and, indeed, the rest of the world. While Internet access is good, providing a stable electricity supply is a precondition for Internet operation and this has presented itself as challenging in recent years on Gotland. For an in-depth discussion on energy supply, please refer to Chapter 2.

In order for SMEs to engage with the digital economy, grow and innovate, they need to be equipped with the necessary digital literacy skills to adopt digital technologies. OECD data show that rural areas lack digital skills (see Chapter 1). In addition, research has also shown that many SMEs lack a strong understanding of how the adoption of digital technologies will improve their business productivity and efficiency (Ollerenshaw, Corbett and Thompson, 2021[30]). Digital competency includes the ability to keep up with digital developments in a way that provides opportunities to be able to start and run companies or to strengthen companies’ ability to innovate and be competitive. It also means being familiar with digital tools and services and having the ability to follow and participate in digital development. The effective adoption of automation and digitalisation requires strong managerial skills in SMEs.

To be able to take advantage of the existing Internet connectivity, digital skills and knowledge about digitalisation need to increase, also on Gotland. Targeted programmes that combine information and communication technology (ICT) solutions with management training and advisory services can be especially effective for successful digitalisation. The Gotland Green Centre, as well as other business support services, could look into developing constant activities to strengthen SMEs’ management capabilities, including for example technology adoption and IT engagement, which is often a leading enabler for productivity-enhancing activities. Currently, processes are often one-off offers dependent on project-related funding and therewith only provided intermittently. Furthermore, the digital skills of young people can be strategically used in businesses. In Germany, the programme Apprentices as Digitalisation Scouts (Digiscouts) promotes digitalisation in companies using the knowledge of digital natives. Projects are to be initiated and also implemented by the trainees themselves and accompanied by virtual forms of co-ordination. In order to better assess the individual needs of businesses on the island, providing individualised training paths in a concept similar to the Web Association Bergerac in France could be an option for Gotland (Box 3.5).

Box 3.5. Initiative for developing digital skills

Web Association Bergerac, “La Wab” or “WAB”, Digital Training Hub (France)

The WAB is a hub for innovation and digital training operating in rural Bergerac, France, that supports local enterprises and helps them make progress towards a digital transition. The WAB offered free digital audits to small rural businesses that resulted in a personalised report on the company’s digital preparedness. It is also a “web school” that helps young people to become web experts following a two-year training course in the digital field. Through digital training, it teaches local businesses how to design effective digital strategies and identify new opportunities and markets for their business development. The WAB is also a business accelerator and a co-working space that offers support for the development of small enterprises.

WAB work involves:

Mapping the needs of all businesses in their area through a survey. In partnership with the employment department of the local government four main categories of questions investigate: i) the perception of digital tools; ii) equipment and budget dedicated to digital tools; iii) digital needs; and iv) challenges.

Carrying out in-depth digital audits of interested companies. These consist of a two-hour interview with the business manager and a personalised report on the company’s digital preparedness, both in terms of the quality of its equipment and skillsets. The audit also assesses the benefits and costs of digital transition for the individual company.

Producing individualised digital roadmaps and training paths. The “digital roadmap” consists of an individually tailored course taken from a selection of 30 vocational courses on digital skills. So far a total of 48 managers took advantage of this opportunity within the project.

Source: EU (2018[31]), Digital and Social Innovation in Rural Services, https://enrd.ec.europa.eu/sites/default/files/enrd_publications/publi-eafrd-brochure-07-en_2018-0.pdf.

Between 2015 and 2020, Gotland had a Regional Digital Agenda (RDA). The purpose of the agenda was to create a strategy and action plan to effectively utilise the opportunities of digitalisation throughout society including business digitalisation, public e-services, broadband expansion, general IT usage, e-health, digitally supported community planning and digitally supported education. The agenda presented 30 focus areas with 76 concrete sub-goals. Of these, a total of 57 (75%) have been completed. Work is underway in 10 (13%) areas. For 5 (6.5%) areas, work has not yet begun. Most of the uncompleted or underway work is in the area of e-health, which has shifted its targets to 2030. Considering this digital strategy is now expired and many advancements have been made with regard to digitalisation since the COVID-19 pandemic, it might be important for Gotland to evaluate the strategies outcomes more closely and develop an update to this important digital agenda.

Missing entrepreneurs – Encouraging young people to become entrepreneurs

Despite having many entrepreneurs relative to its population size, Gotland does not have very many young entrepreneurs. The island has the lowest rate of young start-up founders compared to other Swedish regions. It reaches a rate of 20% for the under 31-year-olds, compared to the Swedish average of 25% for under 31-year-olds (Tillväxtanalys, 2021[3]). Furthermore, a larger than average share of start-ups is founded by people over the age of 50 with 31% in comparison to 24% in Sweden (Tillväxtanalys, 2021[3]).

This suggests, that more can be done on Gotland to support youth in realising their entrepreneurial potential. At the European level, estimates suggest that about 40% to 45% of young people have an interest in pursuing entrepreneurship but only a few youths are self-employed or actively work on a business start-up (OECD/EU, 2020[32]). Important barriers for youth entrepreneurs include lack of experience and skills, low levels of collateral and savings and under-developed professional networks. According to OECD work, key actions to support youth entrepreneurship include addressing the finance gap faced by young entrepreneurs and improving the appeal of support initiatives by better capturing youth perspectives in the design of initiatives. It is also stated that financial support tends to have a greater impact on the sustainability of the business but evaluations note that training, coaching and mentoring are often more valued by youth entrepreneurs (OECD/EC, 2021[33]).

To better understand the challenges for youth entrepreneurship on Gotland, the island might want to further investigate the concrete challenges for their young entrepreneurs. Common reasons can include:

Low levels of awareness and few entrepreneurship role models, due to a small professional network and little contact with business owners. Young people may also lack awareness of the availability of programmes that support new business ventures.

Lack of entrepreneurship skills, for instance, in opportunity recognition, business planning, financial management, sales and marketing, inducing a lack of appropriate education and training offers to provide a strong foundation to support young people’s entrepreneurial ambitions.

Difficulty in accessing finance due to their lack of proven experience and lack of personal savings, collateral and credit history.