This chapter discusses the issue of logistics, in view of the project of railroad rehabilitation and construction near the industrial park of the metropolitan area of Cuautla. The railroad is likely to carry a significant volume of goods and materials, which will be directly linked to the manufacturing pole. Some recommendations for the future are provided, in order to consolidate this project, enhance road safety and promote accessibility in general.

OECD Territorial Reviews: Morelos, Mexico

Chapter 4. Transport and logistics strategy of the State of Morelos

Abstract

Introduction

The economic development strategy of the State of Morelos is centred on the labour market with a focus on improving productivity through education in schools and universities and through vocational training. One of the aims is to support the development of industry in Morelos and add to inward investment that already includes significant investment in the automotive sector with Nissan, Bridgestone and Continental plants. The second strand of policy is to invest in transport infrastructure to improve connectivity both inside the State and with the national highway and rail networks. The objective is to reduce transport costs for businesses based in Morelos, expand the market for local producers and achieve better integration with centres of production and consumption across Mexico.

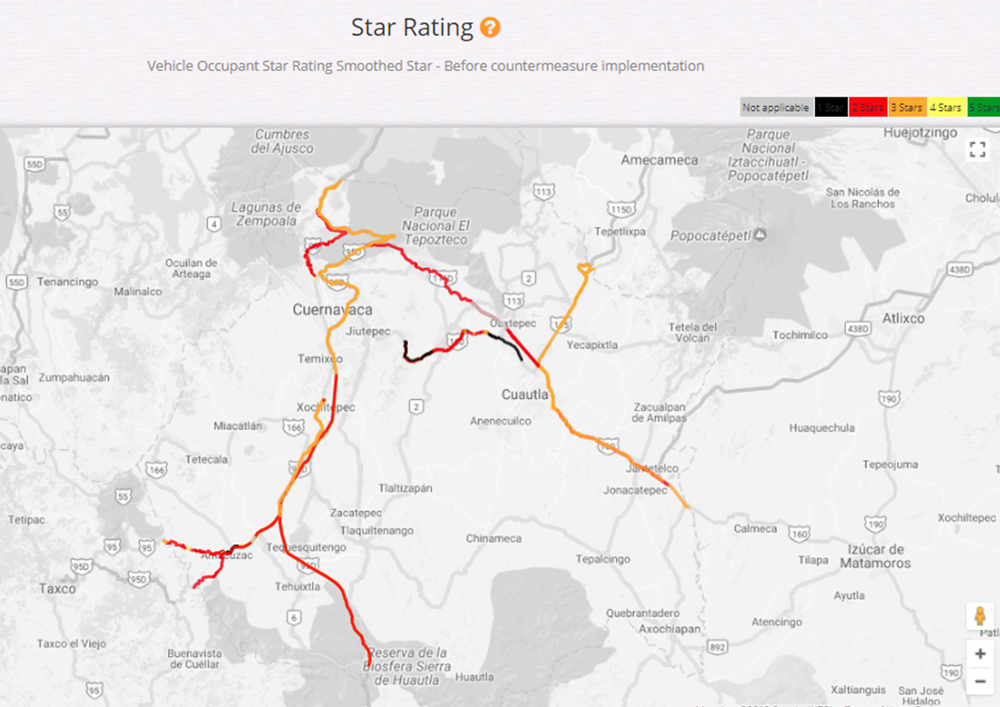

The Autopista del Sol running through the State capital Cuernavaca is a key north-south federal highway running from Mexico City to Acapulco and to Oaxaca, Chiapas and the southern border of Mexico. It has been improved over the last five years with Federal funding for the expansion of the Cuernavaca bypass and a bypass at Tlalpan in the south of Mexico City. Federal funding has also been attracted to strengthening east-west road connections, particularly the link eastwards from Cuernavaca and Cuautla (the third largest municipality in the state) south-east and then northeast to Puebla, Mexico’s fourth largest municipality. Improvements to this route continue with the expansion of the La Pera-Cuautla section of the highway. This has been controversial, as while the connectivity benefits are substantial so is the damage to a sensitive environment, as the road cuts through the historical town of Tepoztlán. These roads are clearly visible on Figure 4.1, given the volume of freight transported on them. They also carry heavy passenger traffic. Complementing these Federal projects, State funds from the Government of Morelos have been used to improve road links between a number of municipalities in Morelos, together with investment in regional airports.

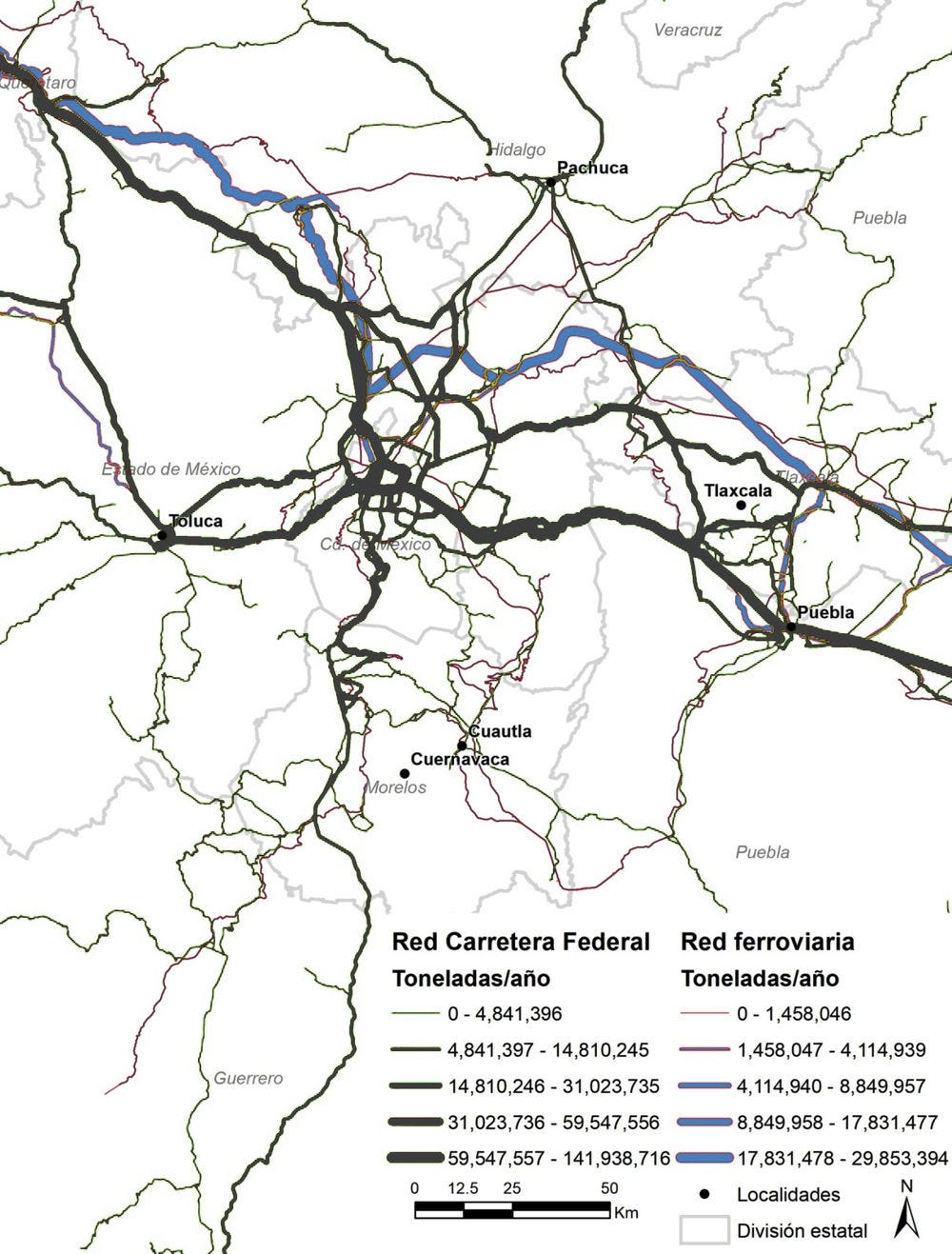

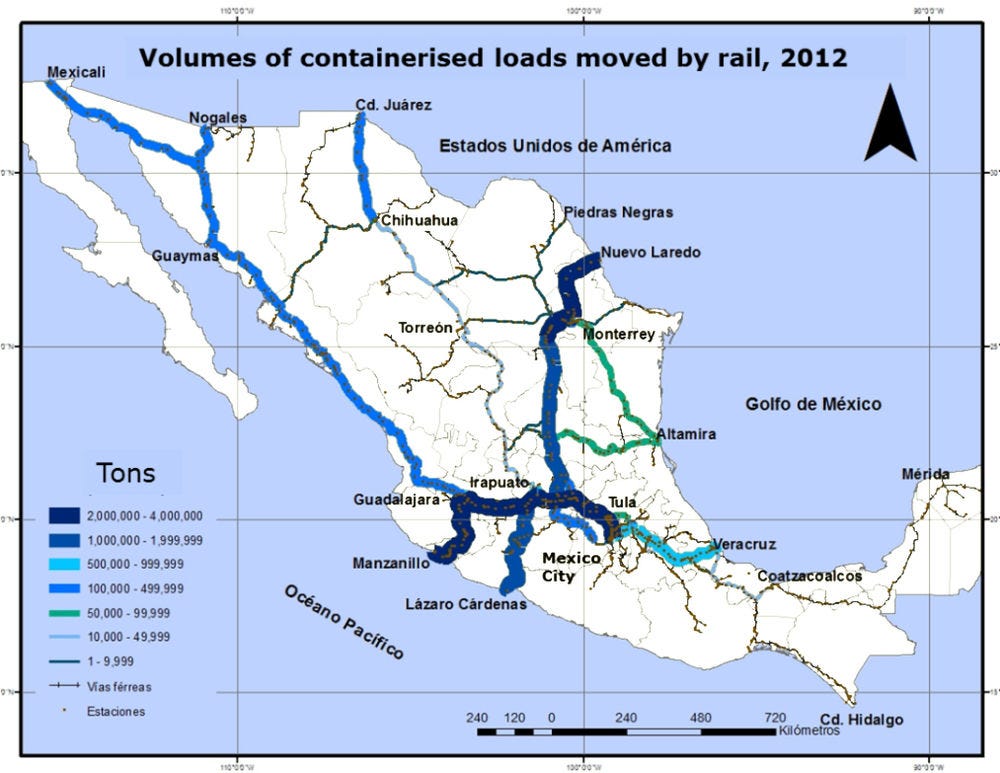

Morelos has 259 km of rail alignments according to Promedia, most disused (black lines in Figure 4.1). The state is making a significant investment to rehabilitate a 103 km link from the Cuautla industrial park north to the municipality of La Paz, in the south-east of the Mexico City conurbation. Here it will join the Ferrosur/Ferromex mainline network (black line running north from Cuautla in Figure 4.2). Seven kilometres of line in Cuautla have been rebuilt to date.

Whilst track and sleepers have been removed over most of the route through theft over the years, the alignment has been preserved. As well as serving plant in the industrial park, the government hopes the rail line will serve agricultural business shipping produce from Morelos and result in the development of an intermodal container park, substituting rail for some freight transport on the roads. The fundamental goal is to create a pole for economic growth in Cuautla. Shifting freight from road to rail in the interests of road safety is an important secondary objective.

Figure 4.1. Volume of freight transported on the road (grey) and rail (blue) networks of Morelos and central Mexico (Tonnes per year, 2016)

Source: Instituto Mexicano de Transporte.

National Logistics Strategy

Strategic planning for logistics in Mexico is based on the National Development Plan for 2013-18 and the Programme for the Communications and Transport Sector.1 The objectives of the programme are to:

Develop transport and multi-modal logistics infrastructure that provides for competitive costs and improved safety and drives economic and social development.

Provides for adequate, efficient and safe logistics and transport services that increase the competitiveness and productivity of economic activities in Mexico.

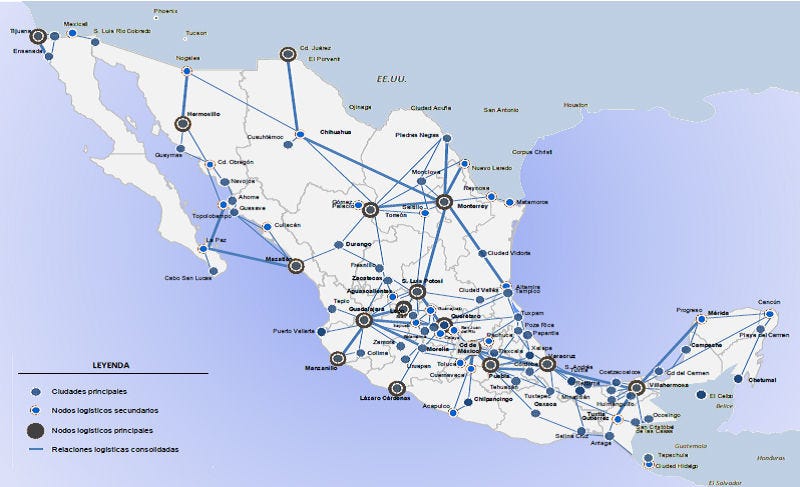

Initiatives under the programme include a National System of Logistics Platforms (NSLP), under joint development by the Secretariat of Communications and Transport (SCT) and the Secretariat of Economy with support from the Inter-American Development Bank. Preparatory work has identified strategic logistics nodes across the country (Figure 4.2), proposing 85 logistics platforms of different types for each of the nodes and outlining public policies to develop them. Cuernavaca/Cuautla is identified for development as a regional logistics node.

The NSLP initiative is underpinned by modelling of freight movements undertaken by the Instituto Mexicana del Transporte (IMT) to identify the volumes of traffic carried on the highway and rail networks, section by section (see Figure 4.1 and Figure 1.4). As Figure 4.1 reveals, the highway between Mexico City and Cuernavaca is one of the most heavily trafficked roads in the region, only the roads to Puebla, Queretaro and Toluca carry more freight.

Figure 4.2. Strategic Logistics Nodes

Source: SCT, SE and IDB (2013[30]), Sistema Nacional de Plataformas Logísticas (SNPL), available at: http://logisticsportal.iadb.org/sites/default/files/presentacion_sistema_nacional_de_plataformas_logisticas.pdf

The investments in improving connectivity in Morelos will all show a return on investment under cost-benefit assessment. As is typical in middle-income countries, the number of road investments with strongly positive benefit-cost ratios greatly exceeds the capacity to fund projects. A high hurdle rate of return on investment can be used to select projects and establish priorities between similar projects serving similar purposes and is applied by the Federal government for the funding or infrastructure investments. However, allocating public resources between dissimilar projects – highways versus rail or highways versus rural roads – can only be done on the basis of a broader strategy (ITF, 2011[31]). Under cost-benefit assessment, investments in relieving congestion on a busy highway will always show a much higher return than investments to develop connectivity in rural areas, for example by building surfaced all-weather roads to replace unsurfaced roads.

The productivity and connectivity strategy developed by Morelos appears appropriate to allocating the relatively modest sums of State (as opposed to Federal) budget to be spent on road and rail investments. In future elaborations it would nevertheless benefit from examination of the data on traffic and modelling of freight flows available from IMT (Figure 4.2 and Figure 4.4).

More broadly, a public statement of the economic rationale underlying public investments in logistics and transport infrastructure would be useful for providing the basis for a stable consensus on priorities for the use of State funds in projects that often have long lead times. Existing policy documents include much detail on the individual transport investments to be made but little or no discussion of how priorities for investment are established or assessment of value for money from public expenditure (see for example the Programma Estatal de Gestión del Riesgo y Ordamiento Territorial Estado de Morelos).

IMT and the National Statistics Office (INEGI) are developing data and indicators to support the freight logistics strategy under the National Development Plan with funding from the National Science and Technology Council (CONACYT) and IMT is working on the establishment of a national logistics observatory. This initiative was reviewed by the OECD in 2016, which recommended focusing on a number of indicators highly relevant to policy in Morelos (OECD/ITF, 2016[32]). The Government of Morelos might work with IMT and with the railways to develop pilot indicators related to the State’s connectivity strategy. Areas of particular relevance for the development of empirical data and quantitative indicators to support policy making are as follows.

Road congestion is perennially an issue of high interest to road users, both logistics and freight transport business and the general public. Developing transparent indicators can help focus attention where congestion costs are largest. The Urban Mobility indicators developed by the Texas Transportation Institute, average hours delay and a comparative travel time index, might provide a model to follow (TTI, 2017[33]).

Road safety is an important policy issue but data on killed and seriously injured and exposure to crash risks are currently dispersed in Mexico. IMT collects data on Federal roads; the States collect data on other roads; CONAPRA under the Ministry of Health estimates road deaths from hospital data. There is no regular centralised reporting of data for the nation as a whole but IMT and CONAPRA prepared a consolidated estimate for ITF and the Ibero-American Road Safety Agency (OISEVI) in 2017 in a report benchmarking road safety in Latin American countries (ITF, 2017[34]). Data for Morelos is available from IMT and CONAPRA and the three might usefully co-operate to produce consolidated data for road deaths and serious injuries in the state annually, given the high social cost of crashes and the importance attached to transferring road freight to rail in the interests of safety in Morelos. Similarly, there is no reliable reporting of the incidence, causes and impacts of crashes involving heavy goods vehicles. Key risk factors such as the incidence of overloading could be included in any project to improve reporting of road crashes. The condition of the roads is also important for safety. 45 000 km of roads have recently been surveyed under an iRAP project in Mexico (iRAP, 2017[35]), led by the Ministry of Communications and Transport (SCT). Star ratings are being used to benchmark crash exposure risk in relation to infrastructure quality across a third of all paved Federal roads with surveys also collecting pavement data for asset management. Results for Morelos are presented in Figure 4.3. The government could work with iRAP to rate all the principal roads in the state.

Indicators of the efficiency of rail container services could be developed with the Mexican Rail Association, AMF. Such indicators would be valuable for the whole of the Mexican network and the new line could serve as a pilot for less intensively used lines.

Figure 4.3. Assessment of Federal Highways in Morelos for Road Safety

Development of rail and intermodal freight markets in Morelos through rehabilitation of the rail freight line from Mexico City to Cuautla

Rehabilitation of the disused railway line from La Paz in the south-east of the Mexico City conurbation to Cuautla in Morelos is underway to establish an industrial and logistics platform in the eastern part of Morelos to promote the competitiveness of local businesses and create better jobs. Public funds are being used to contribute to the financing of the project with finance provided to Ferrosur, the rail freight concession holder for this part of the national rail network, by FIDECOMP (Fideicomiso Ejecutivo del Fondo de Competitividad y Promoción del Empleo), the organisation that manages investment from Morelos’ Fund for Competitiveness and Employment. The fund raises revenue through a 2% surcharge on labour taxes levied on people and businesses established in Morelos and can cover up to a maximum of 50% of the overall cost of investment.

A total of MXN 185 million was made available to Ferrosur in two tranches in 2014 and 2015, to be repaid over 5 years (including an adjustment for inflation) from operations commencing on the line. A new agreement between the Executive of the State of Morelos and Ferrosur modified the terms of repayment to FIDECOMP. These now provide for the payment of an equivalent of USD 100 for each wagon hauled on the rehabilitated line until the investment is repaid (including allowance for inflation), with payments to begin after 8 000 wagons have been carried.

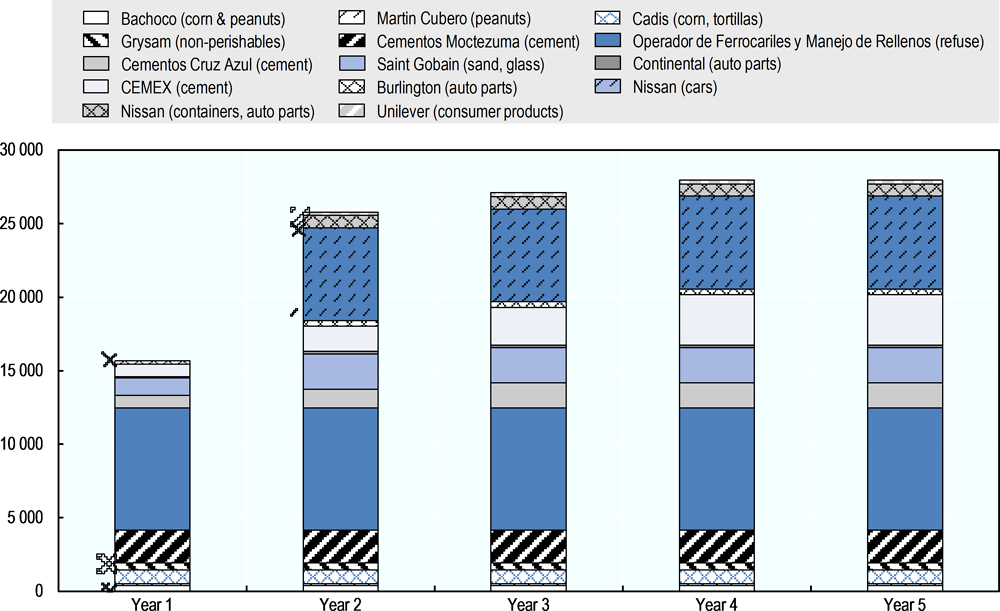

Planning for the Cuautla-La Paz rail link is advanced, with seven kilometres of line constructed and rehabilitation of the rest of the 103 km line expected to take six months. Ferrosur has consulted with potential rail freight customers in and around the Cuautla industrial park and estimated the volumes of freight that could initially be carried on the new line (Figure 4.4). The key clients are likely to be CEMEX shipping cement to domestic and international markets, St Gobain bringing in silica sand for glass manufacturing and shipping products domestically and internationally, and PEMEX bringing in oil products for local distribution from refineries in Mexico and Texas. Intermodal services are expected to develop in the first five years, including Nissan, serving its plant in neighbouring Cuernavaca. The freight actually carried will depend on the negotiation of competitive tariffs between Forrosur and shippers.

As part of a concession, Ferrosur will be required to carry freight requested by shippers, subject to agreeing terms on tariffs for carriage. These are subject to commercial negotiation under a cap established by SCT in maximum national freight rates. Should the parties fail to agree on tariffs recourse can be made to the regulator (the Agencia Reguladora del Transport Ferroviario – ARTF).

There is potential for more intermodal container traffic among shippers using rail to distribute goods to intermodal terminals elsewhere in the country. Reliable intermodal services could be an attractive alternative to road transport on the congested roads in and around Mexico City for shippers distributing goods from Mexico City and the north of the country to Morelos and further south. Consultations with ANTP National Freight Transport Association and major intermodal shippers are indicated to explore the potential for this market and provide a basis for the State Government’s proposed investment in intermodal facilities in the Cuautla industrial park.

Figure 4.4. Estimates of initial freight volumes (wagons) to be carried on the Cuautla rail line

Organisation of the National Rail Market

Mexico’s railway network is owned by the State and concessioned to private companies that run integrated track and train operations for profit under long-term contracts. Concessions provide exclusive rights to run the railways over large geographical territories but also impose trackage rights on a number of key sections of track so that companies can run trains on each other’s networks (OECD, 2017[37]).

The government broke up the former national railway, Ferrocarriles Nacionales de México (FNM or Ferronales) in the 1990s because it offered poor service and had a deficit of more than a half-billion USD annually. Planning for concessioning began in 1995 with the passing of the Law on the regulation of rail services2 and concessions were awarded between 1996 and 1999. Transfer to new operators began in 1997 and was completed in 1999. The concessionaires paid the government compensation totalling approximately USD 3 billion (2014 prices) for rights to operate the network (ITF, 2014[38]).

Three major concessions were awarded: TFM, now Kansas City Southern de Mexico (KCSM); Ferromex; and Ferrosur (originally two concessions merged in 2000); along with a number of smaller concessions. Ferromex and Ferrosur were both founded as subsidiaries of companies owned by Carlos Slim. Ferrosur was acquired by Ferromex’s parent company, Grupo Mexico, in 2011 but the networks continue to be run independently.

The concessions were structured to provide effective competition in the main freight markets, providing major industrial centres and Mexico City with alternative services to ports and the border with the USA (ITF, 2014[38]). Access to the biggest market, the greater metropolitan area of Mexico City, is provided by a neutral track access and terminal company, Ferrovalle, jointly owned by KCSM, Ferromex, Ferrosur and the government that also accommodates a commuter passenger operator. The rail line under reconstruction from Cuautla to La Paz will provide access from Cuautla to the rest of the Ferromex/Ferrosur network and joins the Ferrovalle service area at La Paz.

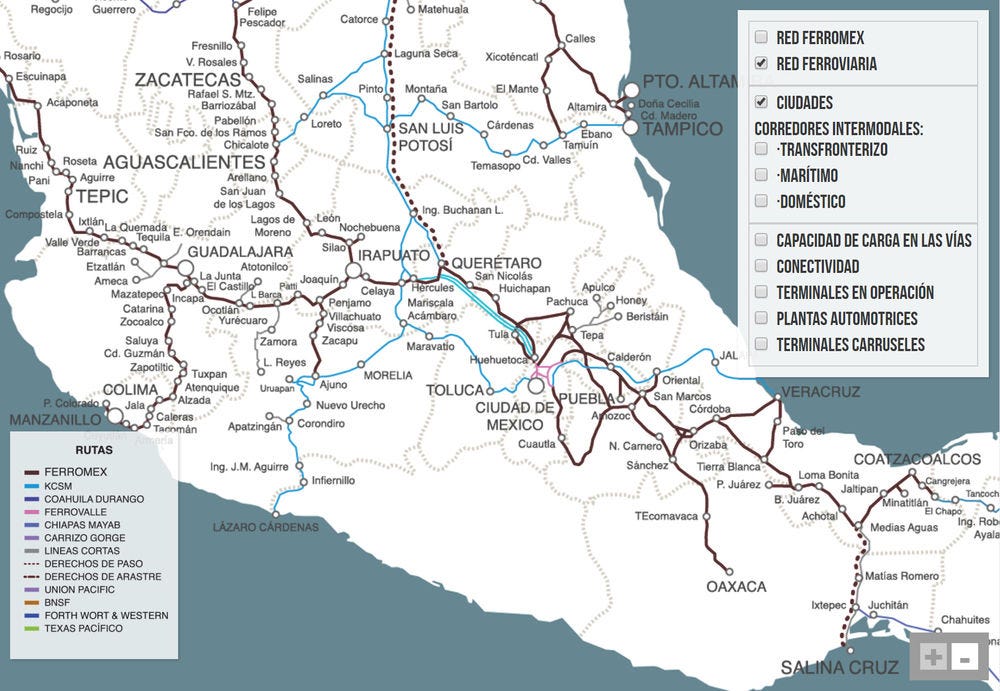

The movement of intermodal traffic on the Mexican railways is summarised in Figure 4.5. The main flows are between Mexico City and Mexico’s main ports and to crossing points along the border with the USA. The trunk line north from Mexico City to Monterrey and the Nuevo Laredo border station is concessioned to KCSM but subject to trackage rights and also carries Ferromex trains. It is of high strategic importance to Mexico’s industrial strategy and to inward investment as it supports the integrated operation of car plants and component manufacturers along its length. Plants in Mexico and the USA are able to operate as integrated production facilities with bonded containers ferrying parts and semi-finished vehicles back and forth across the border.

Figure 4.5. Containerised rail freight in Mexico by route

Source: Instituto Mexicano del Transporte.

So far there are no plans to connect Nissan’s car manufacturing plant in Cuernavaca to the new Cuautla rail link as it lies 25 km from the alignment. A rail connection to Nissan’s manufacturing plant in Aguascalientes on the northern trunk line might generate profitable traffic but rail access to the Cuernavaca site would be complicated by the urban development in the surrounding area. More broadly, some existing general intermodal shippers should find opportunities to serve a depot in Cuautla.

The current National Development Plan’s Programme for the Transport Sector includes significant federal investments to improve the speed and safety of rail freight movements through urban areas. A number of bypasses around conurbations have been funded to remove conflicts with road traffic and some of the very many at-grade road/rail crossings have been gated to reduce crash risks. Unfortunately, many of the investments in safer level crossings have been defeated by theft of the cabling, control and surveillance systems. Improving the safety of road/rail crossings remains a national priority and new investments have to satisfy safety requirements with approval from the ARTF.

Under the 1995 Railway Law, the government is responsible for developing new lines. Some financially attractive potential new links may exist but the rights granted to concessionaires do not include building significant extensions for exclusive use (a new concession would need to be tendered). The Cuautla rail alignment was part of the concession awarded to Ferrosur and is shown as part of the Ferromex network on the company’s website (Figure 4.6). However, the last train ran on the route around 30 years ago, a decade before the concession was awarded. Concessionaires are obliged to meet any shipper’s request to carry traffic on their lines, subject to reaching satisfactory agreements on tariffs, but clearly on disused alignments this is not possible. Whilst the legal framework for rights and responsibilities relating to re-establishment of a disused line under an existing concession have not been investigated in detail, it appears eminently appropriate for such initiatives to be undertaken in partnership between government, concessionaire and shippers. The Cuautla line will be the first major extension of its kind to the national rail freight network. Clarification of the rights and obligations of concession holders rehabilitating disused lines is something that appears more suited to being addressed through a review of the Railway Law or at the point when concessions are re-let rather than on a case by case basis in relation to specific projects.

Figure 4.6. Ferromex/Ferrosur (grey) and KCSM (blue) rail networks in central and southern Mexico

Source: (Ferromex,(n.d.)[39]) Ferromex Rail Networks in Central and Southern Mexico, http://www.ferromex.com.mx/ferromex-lo-mueve/sistema-ferromex.jsp.

Recommendations

An early opportunity should be sought to complete the State of Morelos’ public policy statements on strategic infrastructure planning with regard to transport and logistics, road safety and railway development. Current policy documents focus on the details of individual investments but lack an explanation of the approach to project prioritisation and value for money. A public statement of the economic rationale underlying public investments in transport infrastructure would be valuable in strengthening the basis for stable consensus on the priorities for the use of State funds in projects that typically have long lead times.

In particular, the case for support from public funds for the development of the freight railway line to Cuautla should be set out as part of the overall infrastructure and logistics development policy. There is a clear rationale for public support for this project. It will facilitate the development of the industrial park in Cuautla and provide the basis for an intermodal hub freight transport hub with the potential to serve the State and the region. Initial market assessment suggests positive returns and a relatively short payback period. The railway concession that will build the line has other investment priorities with higher expected returns and/or lower risks elsewhere in Mexico. Therefore, public intervention is required to unlock the potential benefits to the local economy. The State Government will pay for the construction costs of the line and recover the cost from the rail traffic carried once traffic exceeds an agreed threshold. No interest will be charged on the capital invested. Negotiation of this financing agreement has reached closure and the priority now is to expedite construction. It is appropriate that the government bears demand risk on this project as transferring risk to the rail operator through the financing arrangements would inevitably increase the cost of the project substantially. What the government expects in return is the generation of rail traffic and economic activity in Morelos. A public statement of these considerations would pre-empt any potential concern over the value for money of this public investment.

The initial assessment of the potential rail freight market to be served by the line has been developed by the commercial services of Ferromex in consultation with potential shippers in and around Cuautla. The overall volume of freight suited to rail transport has been identified but commercially viable traffic is less well understood as prices have yet to be discussed between the carrier and potential shippers. The associated risk is being carried mainly by the taxpayer and the government should work with Ferromex/Ferrosur and shippers to get a better idea of the commercial volumes of traffic that can be expected to be carried.

Planning for intermodal traffic is less advanced. Intermodal facilities would be built in Cuautla in a second stage. The government should convene consultations with major intermodal shippers and the ANTP National Freight Transport Association to explore the potential for this market to determine the scale and phasing of investment in intermodal facilities in the Cuautla industrial park. The potential for this market is strong given congestion on the road links to Mexico City but as yet unknown.

Construction of the railway line will be reviewed by the rail regulator, ARTF. In particular approval from the Agency is required in respect of the safety of road/rail crossings. The Government of Morelos should work pre-emptively with Ferromex/Ferrosur to establish the design criteria for crossings on the alignment in consultation with ATRF to avoid any risk of cost over-runs for remedial construction work to meet safety standards. Where gated and controlled crossings are installed the Government should consider installing surveillance cameras for monitoring by its C5 security centre.

References

[39] Ferromex((n.d.)), Ferromex Rail Networks in Central and Southern Mexico, http://www.ferromex.com.mx/ferromex-lo-mueve/sistema-ferromex.jsp.

[36] Ferrosur (2017), Estimates of Freight Volumes.

[35] iRAP (2017), A Success Story iRAP Mexico, https://s3-eu-west-1.amazonaws.com/irap-public-read/www.irap.org/3-star-or-better/iRAP-3-star-or-better-success-story-Mexico.pdf.

[34] ITF (2017), Benchmarking Road Safety in Latin America, ITF, Paris, https://www.itf-oecd.org/benchmarking-road-safety-latin-america.

[38] ITF (2014), Freight Railway Development in Mexico, International Transport Forum, Paris, https://www.itf-oecd.org/sites/default/files/docs/14mexicorail.pdf.

[31] ITF (2011), Improving the Practice of Transport Project Appraisal, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789282103081-en.

[37] OECD (2017), Review of the Regulation of Freight Transport in Mexico, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264268364-en.

[32] OECD/ITF (2016), Establishing Mexico's Regulatory Agency for Rail Transport, OECD/ITF, Paris, https://www.itf-oecd.org/sites/default/files/docs/16cspa_mexico-rail_regulation.pdf (accessed on 23 March 2018)

[30] SCT, SE and IDB (2013), Sistema Nacional de Plataformas Logísticas (National System of Logistics), http://logisticsportal.iadb.org/sites/default/files/presentacion_sistema_nacional_de_plataformas_logisticas.pdf..

[33] TTI (2017), Urban Mobility Scorecard, Texas A&M Transportation Institute, https://mobility.tamu.edu/ums/ (accessed on 23 March 2018).

Notes

← 1. Available at: http://pnd.gob.mx/.

← 2. Ley Reglementaria del Servicio Ferroviario, May 1995, http://www.sct.gob.mx/informacion-general/normatividad/transporte-ferroviario-y-multimodal/leyes-federales/.