This chapter addresses the challenges of the legal framework of Bulgaria in ensuring that the typologies, criteria and levels of administrative penalties imposed when necessary, are capable to provide a proportional and coherent response to administrative breaches. For this purpose, it considers the general rules laid down in the AVPA but also a sample of special laws exemplifying the various typologies of problems related to the level of penalties. In this context, the report makes specific recommendations to create more differentiated administrative penalties to maximize compliance, but also starts a debate to reform the system of penalties as a whole. The report also analyses other related issues such as the relationship between similar administrative offences and crimes, as well as the regime for repeated and systemic violations.

Promoting Integrity through the Reform of the Administrative Penalty System of Bulgaria

3. Typologies, criteria and levels of penalties in Bulgaria

Abstract

3.1. Bulgaria could expand the typologies of penalties to increase their effectiveness and deterrence

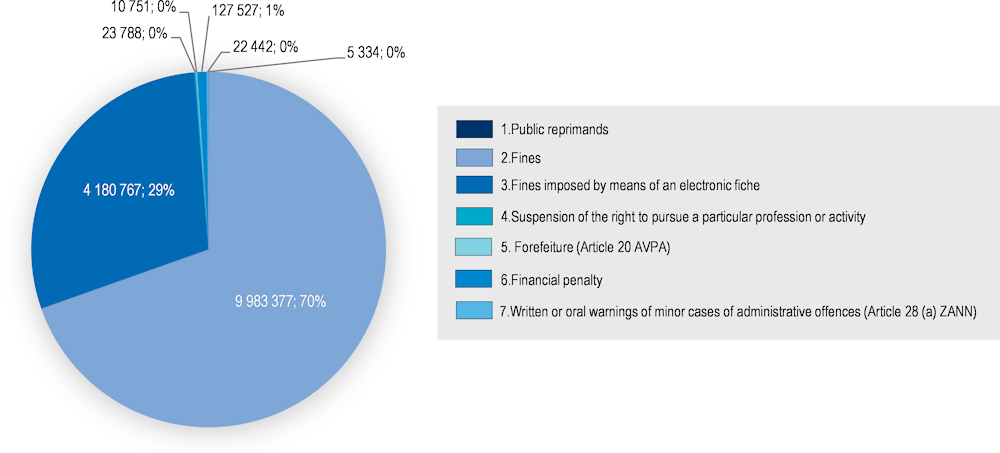

Currently, the sanction system of the AVPA includes three main types of penalties: public reprobation, fine and temporary deprivation of right to practice a certain profession or activity. The fine is the main penalty provided for in the law and used in practice. (Figure 3.1) As an imposed punishment it is an amount of money determined by the law which does not depend on the income of the offender, hence often remains unpaid due to lack of income or property of the offender. Public reprobation is practically an inapplicable and ineffective punishment. Special administrative legislation contains administrative penalty provisions that establish relatively up-to-date systems of protective measures — sanctions and corrective administrative measures. These include the Protection of public order during sports events act and the Road Traffic Act.

Figure 3.1. Number of administrative penalties imposed in 2019 by typology of penalty

Source: 2019 Annual State of the Administration Report.

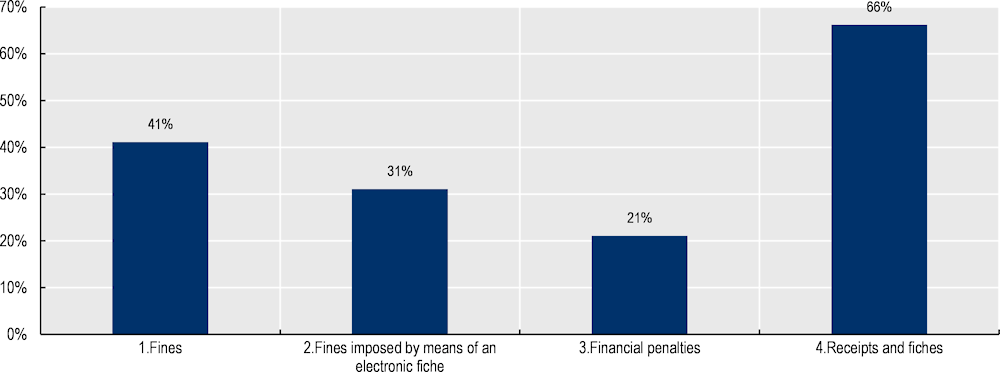

The system of penalties has remained unchanged until 2020 despite the changing social and economic conditions in the country as well as the discussion around this topic. In 2017 the report of the Centre for the Prevention and Combating of Corruption and Organised Crime (CPCCOC) on ‘Identification of existing corruption risks and practices in carrying out the control and sanctioning activities of the administration. A solution model’, concluded that offenders have a widespread sense of impunity as a direct and immediate consequence of the State’s inability to recover pecuniary sanctions/administrative punitive sanctions imposed with penal decrees. The above is evidenced by the response to the CPCCOC by the Executive Forestry Agency (EFA), which states that the average annual collection rate of the pecuniary sanctions and administrative punitive sanctions imposed is around 13-16%, but the main problem identified by the EFA is precisely the feeling of impunity of offenders, leading to further violations. The same challenges has emerged from the Annual State of the Administration Report of 2019 (Figure 3.2) as well as in the answers to the OECD questionnaire and interviews.

Figure 3.2. Percentage of fines and other pecuniary sanctions collected in 2019

Source: 2019 Annual State of the Administration Report.

The report from the CPCCOC highlighted the need to introduce new, alternative measures of control and impact on offenders, beyond the already established types of pecuniary sanctions. These measures to be imposed separately or cumulatively with other sanctions, in analogy with probation in sanction system of criminal law. For example, replacement of the pecuniary sanction with another sanction could be possible in case of non-compliance without good reason. The report also pointed out that the normative establishment of a variety of alternative administrative measures will lead to the achievement of the goals of general and individual prevention and, in general, increase of the collection rate of the financial penalties is expected. In this way, the rehabilitation/reform effect of the punishment will be achieved.

The new law amending the AVPA in 2020 included a new punishment – unpaid work for the benefit of society. However, it does not overcome the gap identified by the CPCCOC because this new punishment is not an alternative to the other administrative penalties, especially alternative to the fine. According to the new provision of Art.13, para 2 of AVPA, for an administrative violation, committed repeatedly or on a systematic basis, a penalty of unpaid work for the benefit of society may be provided, which shall be imposed independently or simultaneously with the punishments under Para.1 (public reprobation, fine and temporary deprivation of right to practice a certain profession or activity). This newly established punishment could be imposed on individuals only, but not on legal entities and sole traders. The laws that provide for such punishment are the Forest Act and the Decree for Combating Petty Hooliganism. The content and duration of this punishment are regulated in new art. 16, para. 1 and para 2 of AVPA. According to this legal provision unpaid work is work, performed for the benefit of society without restriction of other rights to punishment. The duration of the penalty may not be less than 40 hours and more than 200 hours per year for not more, than two consecutive years. The procedural rules for imposing this sanction are provided for in art. 47a, art. 58a-58c and art.63a of AVPA. Unpaid work for the benefit of society is imposed only by the court (art.47a of AVPA) and the proceedings before the district court for imposing this punishment are regulated in Art. 58a-58c of AVPA and before the cassation instance in art. 63a of AVPA. While the amendments have not yet entered into force, the following weaknesses and areas of improvement have been preliminary identified in the legal framework:

If the sanction for the violation includes one or more administrative penalties, the AVPA could provide for clear criteria when the competent authority shall determine the most severe administrative penalty – unpaid work for the benefit of society – and when fine. These criteria shall avoid the sanctioning authority’s subjective approach.

The AVPA could also provide for cases where the enforcement of the penalty unpaid work for the benefit of society should be deferred into two consecutive years, for example when it is longer than a certain duration, when the person works or other similar criteria.

A prerequisite for the imposition of this type of administrative penalty is that the offence has been repeated or that it is committed systematically. The new provision of § 1 (2) of the Additional Provisions of AVPA states that the repeated violation is committed within one year of the entry into force of an act imposing an administrative penalty for a violation of the same type, unless otherwise provided for in the same act. However, there is not definition of systematic violation in the AVPA. This legislative gap could create difficulties in practice. Such a definition could be:

A systematic violation occurs where three or more administrative violations of the particular law or its implementing acts are committed within one year

The proceedings before the district court are intended to be initiated on the initiative of the sanctioning authority. Under Article 58a of the Act, where the administrative offence is punishable by unpaid work for the benefit of society, the official referred to in Article 37 para.1 AVPA shall forward the file to the administrative authority, which shall submit it to the relevant district court for a decision within three days of its receipt. The Act does not provide for the possibility for the sanctioning authority, once it has received the file, to assess its legality in the exercise of its powers under Article 52 para.2 and para. 4 of AVPA. Such a possibility could ensure that the rules of procedure are observed in the pre-judicial stage of the proceedings before assessment by the court.

The legal framework on evidence before the court also could be improved. The law provides for the possibility of examining witnesses before a court if it considers this to be necessary. But if the court considers the examination of witnesses is not necessary, is it possible to be gathered other sources of evidence, such as written and material evidence and means of evidence and verbal means of evidence obtained by means of explanations of the person against whom the act was drawn up. It is clear that the rules on proof under Article 58b para 6 AVPA are not exhaustive. However, neither Article 58b nor Article 84 AVPA contains a restrictive reference to the Criminal procedural Code or any other procedural regulation to remedy this gap in the law.

More generally, the legislator chose to undertake this reform of the AVPA sanctions system with the introduction of one but the most severe punishment instead of option for a variety of sanctions with different severity. Following the practice of other EU Member States (Box 3.1). The AVPA could provide for other typologies of administrative penalties alternative to the pecuniary sanction in order to ensure that the deterrent goal of the administrative penalty can be realized even if the offenders have no income and the fine cannot be enforced. Indeed, in the vast number of cases the fine remains unpaid, which almost completely eliminates the preventive effect of administrative punishment. In this way the enforcing bodies would have an effective toolkit of alternative sanctions which would enhance its effectiveness and deterrence.

Box 3.1. Typologies of administrative penalties and sanctions in selected EU Member States and EU Law

In some EU Member States, such as Spain, the term administrative sanction (sanción administrativa) is used only for punitive sanctions outside criminal law. Next to that, Spanish scholarship distinguishes non-punitive administrative means or acts unfavourable to the citizen (medidas desfavorables), which are:

Restraining measures, such as multas coercitivas;

Measures to restore the infringed legality, such as the withdrawal of a permit;

Contractual penalties;

The reimbursement of aids or public grants;

The cancellation of an administrative concession;

Surcharges for late payments;

Administrative fixation of compensation for damage caused by individuals to public property.

In other EU Member States, such as the Netherlands and Germany, similar measures are named administrative sanctions as well. In these systems administrative sanctions are divided between punitive or deterrent administrative sanctions and remedial sanctions. In Austria, Germany, and Spain administrative offenses have a definition exclusively reserved for the transgression an administrative penalty can be imposed for (Ordnungswidrigkeit, Verwaltungsübertretung and infracciones administrativas).

According to Article 21 of the Code of Administrative Offences of Lithuania, the following penalties may be imposed:

“1) warning;

2) a pecuniary sanction;

3) items, which was an administrative violation of the instrument or direct object, and income, which were obtained administrative infringement, seizure;

4) special rights (the right to drive a vehicle, to fly an aircraft crew member of the aircraft maintenance work of air traffic controller, the right to hunt or to fish, the right to hold the fishing vessel's captain duties, the right to drive inland waterway transport, the right to manage the rolling stock, the right to use or importation of equipment, facilities, radio transmission, radio suppression or radio monitoring devices, the use of electronic communications resources to engage in amateur radio and other radio stations of users activities, the right to hold certain positions seagoing ship rights to design buildings or carry out construction projects expertise ) exclusion;

5) administrative arrest;

6) removal from work (duties).

The first part of Article 3-6 points following administrative penalties can only identify laws of the Republic of Lithuania.

Lithuanian Republic laws may establish other than those referred to in this article administrative penalties species.

The cases provided as an alternative penalty area (city) district court order or other body (official), hearing the cases of administrative violations, the resolution and the offender's consent pecuniary sanction or part thereof may be replaced by no more than 400 hours of free public works, counting one public works free hour for six euro pecuniary sanction. In this case, the body (official) set a time limit within which the person is required to perform the assigned free public works.”

In the Czech Republic, an administrative punishment under Section 35 of Act No. 250/2016 Coll. can be imposed for an offense and includes:

Admonition

pecuniary sanction

prohibition of activity

forfeiture of an item or substitute value

publication of a decision on offense.

In France administrative sanctions can be divided into three categories: moral sanctions, sanctions involving deprivation of rights and pecuniary sanctions.

As regards the "moral sanction", it essentially includes warnings and reprimands. For example, in the fight against doping, the French Anti-Doping Agency may issue a warning to an athlete as a sanction.

With regard to the sanction depriving an athlete of his or her rights, it is mainly the withdrawal of an authorisation or approval that can be imposed on a temporary or permanent basis. It may also consist of a ban on exercising regulated professions and activities.

Finally, as regards financial sanctions, pecuniary sanctions are one of the main administrative sanctions. Several independent administrative authorities have the power to impose pecuniary sanctions. The qualification of "administrative sanction" is generally excluded in the case of police measures, precautionary or preparatory measures and contractual sanctions, since none of them is fundamentally repressive in nature.

From the broader EU perspective, the EU imposes the obligation on Member States to introduce a huge diversity of measures and sanctions of penalties in their legislation. Article 4 and 5 of Regulation 2988/95 offer an illustration of the way EU law makes a distinction between administrative measures, administrative penalties and criminal penalties. Article 4 of this regulation determines which administrative measures may be imposed. This is the withdrawal of the wrongly obtained advantage by the obligation to pay or repay the amounts due or wrongly received, or by the total or partial loss of the security provided in support of the request for a benefit granted or at the time of the receipt of an advance. The fourth paragraph of Article 4 clarifies that these measures are not regarded as penalties. Article 5 of Regulation 2988/95 provides for the administrative penalties that can be imposed. They have to be distinguished from criminal penalties. Article 5, first paragraph, Regulation 2988/95 reads as follows:

“(1) Intentional irregularities or those caused by negligence may lead to the following administrative penalties:

(a) payment of an administrative pecuniary sanction;

(b) payment of an amount greater than the amounts wrongly received or evaded, plus interest where appropriate ; this additional sum shall be determined in accordance with a percentage to be set in the specific rules, and may not exceed the level strictly necessary to constitute a deterrent;

(c) total or partial removal of an advantage granted by Community rules, even if the operator wrongly benefited from only a part of that advantage;

(d) exclusion from, or withdrawal of, the advantage for a period subsequent to that of the irregularity;

(e) temporary withdrawal of the approval or recognition necessary for participation in a Community aid scheme;

(f) the loss of a security or deposit provided for the purpose of complying with the conditions laid down by rules or the replenishment of the amount of a security wrongly released;

(g) other penalties of a purely economic type, equivalent in nature and scope, provided for in the sectoral rules adopted by the Council in the light of the specific requirements of the sectors concerned and in compliance with the implementing powers conferred on the Commission by the Council.”

Finally Austria’s Administrative Penalty Act provides the possibility for temporary prison sentence and substitute confinment to prevent people from repeating an administrative offence of similar kind and in case the fine cannot be collected.

“Articles 11-12

Prison sentence may be imposed only if necessary to prevent culprits from repeating an administrative offence of similar kind.

The minimum of prison sentence to be imposed shall be for twelve hours. Prison sentence exceeding a two weeks’ term may be imposed only if necessary for particularly aggravating reasons. The maximum prison sentence which may be imposed is for a six weeks’ term. In case Article 11 prohibits imposing a prison sentence, the fine imposable for the respective offence in addition to the prison sentence shall be imposed. If no such fine is provided, a fine of up to EUR 2 180 shall be imposed.

Article 16

Whenever a fine is imposed, also a substitute confinement term shall be determined, in case the fine cannot be collected.

The substitute prison sentence must not exceed the maximum possible prison term applicable for the administrative offence and, if prison sentence or anything else is not provided for, it must not exceed two weeks. The maximum admissible substitute prison sentence shall be six weeks. It shall be determined in accordance with the rules applicable for imposing sentences regardless of the provisions of Article 12.”

Source: OECD Research and (European Committee on Crime Problems, 2020[1]).

3.2. Bulgaria could provide for the possibility to impose additional typologies of penalties on sole traders and legal entities, alternatively to or cumulatively with pecuniary sanctions

The liability of legal entities and sole traders for non-fulfilment of an obligation to the state or the municipalities in carrying out their activity leads to a pecuniary sanction, which is the only typology provided for by the legal framework. At the same time, several administrative laws provide for the possibility to impose coercive administrative measures such as the sealing of the commercial site under Art. 124b, para. 1 of the Law on Excise Duties and Tax Warehouses (LEDTW), prohibition for access and removal of the available goods from the site, under Art. 124c, para. 1 of LEDTW, suspension of the validity of the issued license under art. 64, para. 1, item 2 of the Commodity Exchanges and Markets Act. However, there is a clear distinction between coercive administrative measures and administrative penalties, and the former cannot be considered as an alternative to the latter, because they are imposed on different grounds and for different legal purposes. According to Art. 22. AVPA:

Applied for prevention and stopping of the administrative violations, as well as for prevention and removal of the harmful consequences from them can be compulsory administrative measures

Similarly to the natural persons, the absence of alternative options to the pecuniary sanction entails the risk that the imposed pecuniary sanction may not be enforced, for example in a situation where the sole trader and the legal entity do not possess sufficient assets. Therefore, in addition to the penalty payment, Bulgaria could impose other sanctions alternatively or cumulatively with the pecuniary sanction. Considering the practice in other EU countries (Box 3.2), they could be:

obligation for compensation/compensation for damages

promulgation of the issued court act

temporary restriction of the rights of legal entities

exclusion from tax relief

suspension or revocation of permits, licenses or concessions related to the violation

ban on participation in public procurement procedures

ban on advertising goods and services

closure of branches, premises and offices of the responsible legal entity.

This would also be in line with the assessment of the OECD Working Group on Bribery in its Phase 4 report, which recommended Bulgaria to amend its legislation to allow for the debarment of legal persons as part of the sanctions against legal persons (OECD, 2021[2])

Box 3.2. Alternative sanctions to legal entities in EU countries

According to an OECD comparative study on responsibility of legal entities for foreign bribery offences, sanctions for legal persons include pecuniary sanctions, confiscation or disgorgement, debarment from public procurement, or other forms of public advantage, and other penalties (e.g. dissolution and publication of sentence). Other examples include the oversight of the legal person’s operations and compliance efforts either by the judiciary or by a court-appointed corporate monitor, prohibition on advertising the business (e.g. Poland); and orders for the publication of sentence (e.g. Belgium, Czech Republic, France, Poland and Portugal). Similarly, a Council of Europe study lists the following non-financial penalties in place for legal entities: Exclusion from public subsidies and grants; disqualification from public contracts; annulment of procurement decisions; debarment by development banks; loss of export privileges; ban of activities; supervision; probation and bail; liquidation; public register; publication of judgement. Furthermore, according to both the Second Protocol to the Convention on the Protection of the EU’s financial interests and the Framework Decision 2003/568/JHA on combating corruption in the private sector, where an offence covered by such instruments is committed by a head of a legal person, other sanctions may be imposed such as: debarment from public procurement or public aid; temporary or permanent ban on commercial activity; placing under judicial supervision; termination by court order.

As for specific examples in Italy, penalties imposed on the basis of corporate liability under Law 231/2001 include financial penalties, exclusion from public tender processes, confiscation of the proceeds of crime, and publication of the judgment.

In Slovenia provides for a wider range of sanctions than those provided for in the Bulgarian law. For criminal offenses, the following penalties may be imposed on legal persons: (1) a pecuniary sanction; (2) confiscation of property; (3) dissolution of the legal person; (4) prohibition to dispose of the securities held by the legal person.

The pecuniary sanction may vary between EUR 10 000 and EUR 1 000 000. Where the offence has caused damage to foreign property or the legal person has obtained an unlawful property advantage, the upper limit of the pecuniary sanction imposed may be two hundred times the value of the damage or advantage.

Half or more of the property of the legal person or all of its property may be confiscated. Confiscation of property may be imposed for a criminal offence punishable by a penalty of five years’ imprisonment or a more severe penalty. In the case of insolvency proceedings as a result of the confiscation of property imposed, creditors may be paid out of the confiscated property.

The dissolution of a legal person may be imposed if the activities of the legal person have been wholly or mainly used to commit criminal offences. In addition to the dissolution of a legal person, the court may order the confiscation of property. Where the penalty of dissolution of a legal person has been imposed, liquidation proceedings are initiated. Creditors may be paid out of the property of a legal person who has been sentenced to dissolution.

Legal persons convicted for certain types of offenses may be subject to an additional penalty prohibiting the disposal of securities held by a legal person and registered in the central register of book-entry securities for a period between one and eight years.

Source: (OECD, 2016[3]); (Council of Europe, 2020[4]); Dimitrova, “Criminal Law Protection of the EU’s Financial Interests in Bulgaria”.

3.3. Bulgaria could further clarify and differentiate the liability regimes for minor and obviously minor administrative violations based on the degree of social danger of the offence

The institution of minor case of administrative offence is traditional for administrative penalty law. However, until the latest amendments, the AVPA lacked a legal definition of the minor case and the definition of Article 93 para 9 of the Criminal Code was used. The amendment to the AVPA of 22.12.2020 introduced of legal definitions of the ‘minor and obviously minor administrative offence’:

"Minor case" is one, in which the violation, committed by a natural person or non-fulfilment of an obligation by a sole trader or legal entity to the state or municipality, in view of the absence or insignificance of the harmful effects or in view of other mitigating circumstances, constitutes a lower degree of public danger, than ordinary cases of breach or non-performance of an obligation of the kind concerned.

A "obviously minor case" of a violation occurs when the act reveals a clearly insignificant degree of public danger.

The latest amendments to the AVPA, which will enter into force on 23.12.2021, clarify the institute of minor case under article 28 AVPA. A positive change is that the warning can only be written, with a one-year period from the entry into force of the warning. A legislative restriction has also been introduced in Article 29 AVPA, according to which ‘The provision of Art. 28 shall not apply to traffic safety violations for all types of transport, committed after use of alcohol, narcotic substances or their analogues’.

Despite these positive developments, the institution of the minor case shall be the subject of future legislative amendments.

A contradiction seems to emerge between the provisions of Article 28 AVPA and Article 39 para. 2 AVPA in so far as it is not clear in which cases the authority may issue a warning and when it can impose a pecuniary sanction of between BGN 10 and BGN 50. Moreover, the confession of the perpetrator, which is traditionally perceived as a mitigating circumstance in the case of Article 39 par.2, aggravates perpetrator’s situation. This requires a reconsideration of the provisions of Article 28 of AVPA and Article 39 para 2 of the AVPA which correspond to the concept of a obviously minor case and minor case. It would be appropriate to apply the exemption from administrative responsibility by means of a written warning if the case is obviously minor, as well as to minor cases under Article 39 para of the AVPA and, in other cases, to establish ad hoc offences for minor cases.

These challenges have also been confirmed in the answers to the following question of the OECD questionnaire: “Does the legislation on administrative offences and penalties within your jurisdiction provide for specific provisions for minor or obviously minor cases of administrative offences?” The number of respondents answer this question in the negative, even though they carry out administrative penalty activities on the basis of a number of legal acts. During the interviews conducted, the institution of the minor case referred to in Article 28 AVPA was mentioned as one of the most controversial in the administrative penalty.

One of the few of legislations providing for an ad-hoc offence of minor case of administrative violation is Article 415c of the Labour Code, which establishes administrative responsibility for a minor case, but the penalties provided for are lower than those for offences of the same type, which are not minor. Another such example is set out in Article 126b of Excises and Tax Warehouses Act. But these compositions are exceptions rather than the rule for the differentiation of administrative responsibility. The establishment of ad-hoc offences would be particularly appropriate in regards to violations with high levels of penalties. Since Article 28 AVPA is currently also applicable to such violations, administrative authorities can relieve the offenders from administrative responsibility and to warn the offenders that if they commit another offence, they will be punished. The question therefore arise as to how many and what attenuating circumstances must be present in order for the offender to be exempted from a minimum penalty of BGN 5 000 or BGN 10 000 and whether this is not a prerequisite for the creation of malpractice by the sanctioning authorities and the act issuers. In order this possibility to be overcome, it would be appropriate, in the case of administrative offences which are punishable by penalties with a high minimum threshold, to lay down separate offences for minor cases of administrative offences analogous to Article 415c of the Labour Code, rather than exempting offenders from criminal liability on the basis of Article 28 AVPA. This should be especially the case for infringements characterised by a rich variety of factual indications, since it is precisely when they are implemented that there may be a number of mitigating circumstances which have not been identified as constituent features of the offence. More generally, Bulgaria could establish minor administrative offences in cases of minor case and exempt from administrative liability by means of a written warning only in cases of obviously minor cases. In this way, administrative responsibility will be differentiated according to the degree of social danger of the offences of the same type and the warrant to be provided for as a legal consequence, only for the genuinely lightest cases of violations where the social danger is manifestly negligible.

3.4. Bulgaria could extend the possibility to pay reduced fine to penalties imposed by a judicial decision

Art. 79b of AVPA provides for the possibility to pay a reduced percentage of a fine when the penalty decision is subject to appeal and the infringer refuses to appeal. This article is applicable only where the fine or penalty payment has been imposed by an enforceable decision, which includes two groups of cases: when the penalty is imposed by a penalty order or when the fine is imposed by means of an electronic slip. The slip under art. 39 para 2 and para 2a is not subject to regular judicial review, and if the offender is sanctioned through such article there are no legal grounds for additional 20% discount of the amount of the penalty.

At the same time, the possibility to pay a reduced fine or penalty payment under article 79b should also be possible for persons sanctioned by a judicial decision and not only by penalty order. A fine may be imposed by a judicial decision in two cases: where the proceedings before the court are initiated for a breach that can be sanctioned by a penalty unpaid work for the benefit of the society, in accordance with Articles 58a to 58c of AVPA and culminating in a decision by which the court imposes a fine on the offender; where, in the course of criminal proceedings, the court considers that the act for which the accused person has been held criminally liable is an administrative violation but not a criminal offence and imposes a fine on him, in accordance with Article 301 (4) of the Criminal Procedure Code. In each of these cases, the offender was penalised by a law enforcement act imposing an administrative fine for an administrative offence in an amount individualised by the court. The legal position is therefore identical to that of an offender penalised by a penalty order which has not become final.

Bulgaria could thus allow the infringer penalised by a fine under Article 58b of AVPA or, in accordance with Article 301 (4) of Criminal procedure Code, to also have the possibility to benefit from the privilege of Article 79b of the AVPA and, within the time limit for appeal against the court’s decision, be able to pay the fine in a reduced amount.

3.5. Bulgaria could improve the uniformity of administrative penalties in special laws and consider reforming the system of sanctions

The principle of proportionality between the administrative violation and the administrative penalty is a fundamental principle in the administrative penalty law. This principle is guaranteed both in the construction of the corpus delicti of administrative violations and in the enforcement of the legal framework.

When the administrative penalty does not take into account the gravity of the offence, even strict adherence to the legal framework by the enforcing authorities does not guarantee that the penalty will be proportionate to the offence, which in its turn may lead to disproportionate sanctions.

Weaknesses in the legal framework related to the differentiation of administrative penalties fall into several different categories that are addressed in the following sections. Based on the domestic and comparative analysis, these difficulties could be overcome in two alternative ways: one option is modifying the special laws being affected by inappropriate levels of sanctions such as the ones pointed out in each section. Alternatively, perhaps in the longer term, Bulgaria could consider reforming the system of sanctions, setting a limited number of sanction ranges and then having each old and special law deciding the applicable ranges depending on the choice of the legislator. Box 3.3 provides an example of the latter model adopted by the Netherlands as well as of a reform that simplified the level of sanction in special laws of the Czech Republic.

Box 3.3. Unity and harmonisation of legislation concerning administrative penalties in the Netherlands, Czech Republic and Germany

Many countries struggle with the development of administrative offenses in special laws and the position of the general laws. The development of the Social Welfare State and European Law are seen as some of the causes of the expansion of administrative offenses in special laws. This causes some kind of a centrifugal force creating many deviations from the general code or general laws. This force can be counterbalanced with an effective policy of legislative quality, consisting of elements such as directives and guidance, models etc.

In the Netherlands a system of 6 categories to determine the maximum pecuniary sanction in criminal law was introduced. These categories were introduced in article 23 of the Dutch Criminal Code, which reads as follows:

“Article 23 Dutch Criminal Code

3. The maximum pecuniary sanction that can be imposed for an offense shall be equal to the amount of the category determined for that offense.

4. There are six categories:

the first category, EUR 435

the second category, EUR 4 350

the third category, EUR 8 700

the fourth category, EUR 21 750

the fifth category, EUR 87 000

the sixth category, EUR 870 000.

5. For a violation or a crime for which no pecuniary sanction has been imposed, a pecuniary sanction may be imposed up to a maximum of the amount of the first or third category respectively.

6. For a violation or a crime for which a pecuniary sanction has been imposed, but for which no pecuniary sanction category has been determined, a pecuniary sanction may be imposed up to a maximum of the amount of the first or third category, respectively, if this amount is higher than the amount of the pecuniary sanction imposed for the offense in question.

7. If a legal person is convicted, if the pecuniary sanction category determined for the offense does not permit appropriate punishment, a pecuniary sanction may be imposed up to a maximum of the amount of the next higher category. If a pecuniary sanction of the sixth category can be imposed for the act and that pecuniary sanction category does not permit appropriate punishment, a pecuniary sanction can be imposed up to a maximum of 10% of the annual turnover of the legal person in the financial year prior to the judgment or punishment order.

8. The preceding paragraph applies mutatis mutandis to a conviction of a company without legal personality, partnership, shipping company or special purpose capital.

9. The amounts referred to in the fourth paragraph are adjusted every two years, with effect from 1 January of a year, by order in council to the development of the consumer price index since the previous adjustment of these amounts. In this adjustment, the monetary amount of the first category is rounded down to a multiple of EUR 5 and, on the basis of the monetary amount of this first category and while maintaining the mutual relationship between the amounts of the pecuniary sanction categories, the amounts of the second to and determined by the sixth pecuniary sanction category.”

The 1983 legislation not only introduced this general provision, it also altered almost all special laws in order to bring them in line with the new provisions in the general code. Despite this effort to bring all special laws in line with the new general provision, this general provision still has two safety net provisions in paragraph 5 and of article 23 DCC.

The general regulation of administrative pecuniary sanctions was part of the legislative project to build the General Administrative Law Act (Algemene wet bestuursrecht). This was done in building blocks called tranches. Every building block was based upon an analysis of the general administrative issue involved and the different provisions on that issue in special laws. The choices of the legislator were proposed in the supplement of GALA in the building block, and a separate bill provided for all alterations (hundreds of them) necessary to bring special legislation in line with the general provisions on the same legal issue.

Following this legislative strategy the general provisions on administrative pecuniary sanctions were added to GALA and more than 120 acts providing for the power to impose an administrative pecuniary sanctions were altered.

Despite proposals to add such a provision, the legislator did not provide for a system to determine the maximum administrative pecuniary sanction in a way similar to article 23 DCC. This meant the centrifugal forces got claws on the determination of maximum pecuniary sanctions in special acts, resulting in pecuniary sanctions that got higher and higher. By now the special legislator has to fix the maxima of administrative pecuniary sanctions according to the categories of article 23 DCC. This obligation is provided for in the directives of the Prime Minister mentioned above. This directive reads as follows:

“Directive 5.43

1. When determining a maximum administrative pecuniary sanction, reference is made to one of the pecuniary sanction categories in the Criminal Code, unless it is necessary to link up with deviating amounts in an existing system.

2. The following model is used for the determination in which a maximum administrative pecuniary sanction is set:

The administrative pecuniary sanction to be imposed on the basis of [article ... / the articles ...] shall not exceed the amount determined for the [...] category, referred to in [article 23, fourth paragraph, of the Code. of Criminal Law.

3. If, due to the deterrent effect or major financial interests, it is necessary to be able to impose a very high administrative pecuniary sanction on companies that is in line with the highest pecuniary sanction category in the Criminal Code or that, if that is more, is related to the turnover of the company concerned, the following model is used:

The administrative pecuniary sanction to be imposed on the basis of [article ... / the articles ...] shall not exceed the amount determined for the sixth category, referred to in [article 23, fourth paragraph, of the Criminal Code] or if this is more, no more than 10% of the turnover of the company or, if the violation was committed by an association of undertakings, of the combined turnover of the companies that are part of the association, in the financial year preceding the decision in which the administrative pecuniary sanction is imposed.”

Explanation

First paragraph. In administrative law, the maximum amount of administrative pecuniary sanctions is set at an amount that is comparable to one of the pecuniary sanction categories of Article 23, fourth paragraph, of the Criminal Code (Article 27, fourth paragraph, of the Criminal Code BES). Due to the dynamic reference, the amounts are regularly indexed.

Third paragraph. In a number of legislative complexes, the maximum amount is not fixed, but is related to the turnover (see, for example, Article 57 of the Competition Act, Article 85 of the Healthcare Market Regulation Act and Article 1:82 of the Financial Supervision Act). Such an open maximum pecuniary sanction is acceptable, provided that good arguments can be given for this, such as the different sizes of companies."

The Act on Working Hours provides an example among many:

“Article 10:7 Act on Working Hours

1. The administrative pecuniary sanction that can be imposed for a violation does not exceed the amount of the fifth category, referred to in Article 23, fourth paragraph, of the Criminal Code.

2 Without prejudice to the first paragraph, the official designated on the basis of Article 10:5, first or second paragraph, increases the administrative pecuniary sanction to be imposed by 100% of the pecuniary sanction, determined on the basis of the sixth paragraph, if within a period of five years prior on the day of discovery of the violation an earlier violation, consisting of non-compliance with the same legal obligation or prohibition or non-compliance with similar obligations and prohibitions to be designated by or pursuant to order in council, has been established and the administrative pecuniary sanction for the previous violation has become irrevocable.”

In the Czech Republic, one of the reasons to re-codify the misdemeanours and other administrative offenses in the Czech Republic in 2017 was the proliferation of administrative offenses in special laws. The Act 251/2016 on Certain Misdemeanours regulates several specific misdemeanours, and Act 183/2017 modified the approximately 250 special laws in order to eliminate provisions contrary to the new regulations. One of the results was that many administrative offenses in special laws were converted into misdemeanours according to the general act 250/2016. The end result was simplification of the system.

Similarly, in German criminal law, the Act to introduce the new Criminal Code ( Einführungsgesetz zum Strafgesetzbuch (EGStGB)) of 2 March 1974 changed special legislation to bring that legislation in conformity with the change of the criminal code from a system of three types of crimes (Übertretungen, Verbrechen and Vergehen) into a system of two, with the lightest category of criminal acts being transferred to that system of administrative penalties, and taken out of criminal law. This legislative choice was designed by a change of the Criminal Code (the general act) and an act changing special legislation in order to bring that special legislation in conformity with the general act.

Source: OECD Research.

3.5.1. Special laws could reduce the use of fixed penalties, which do not allow proportionality and the differentiation of the punishment

In some areas of legal regulation, such as transport safety, and in particular for speeding offences, fixed penalties do not lead to the imposition of inappropriate penalties. These violations consist of speeding and the pecuniary sanction increases directly in proportion to the increase in speeding. In other words, the corpus delicti of the violation is not characterised by a variety of objective and subjective elements and a number of non-constituent, mitigating and aggravating circumstances that reduce or diminish social danger of the violation cannot be exhibited. However, fixed penalties should be used in a limited way. Such penalties are appropriate only where the infringement is not characterised by a variety of factual indicia relevant to its social danger and where the essential element of the violation that increases or decreases the social danger of violation may be graded or lead to a graduation of the flat-rate penalty (which is the increase in the speed, the penalties for this type of infringement being increased in proportion to the increase in speed).

In other laws, where the social danger of the offence varies and can be shown to be lower or higher, a fixed penalty is a legal impediment to the differentiation and individualisation of the penalty. Thus, the violations with different levels of social danger are punishable by the same penalty. For example, Article 67 para 2 of the Renewable Energy Act provides that: ‘A distributor who markets liquid fuels of petroleum origin in breach of Article 47 (2) or (3) shall be liable to a pecuniary sanction of BGN 50 000 or a financial penalty of BGN 100 000. The penalty provision shall refer to the rules of conduct in Article 47 (2) and (3) which have been infringed, but each of these infringements has its own social danger. The fixed penalty of BGN 50 000 for natural persons and 100 000 for legal entities does not allow the quantity of liquid fuels offered to be taken into account, nor the period during which these fuels are marketed, facts and circumstances relevant to the social danger degree of the violation. Penalties are also fixed in the Road Transport Act, although often the same provision contains multiple violation, whose degree of social danger may vary. In those legal acts, it is not appropriate to lay down fixed penalties, but relevantly defined sanctions.

The fixed amount of the penalty is not appropriate in the case of the so-called general provisions laying down penalties. For example, Article 185 of the Road Traffic Act establishes that a pecuniary sanction of BGN 20 shall be imposed for any violation of this Act and of the legal instruments issued on the basis of this Act, for which no other penalty is provided for.

Furthermore, the fixed amount of the penalty is not an appropriate option in cases where evaluation features are included in the legal composition of the violation. For example, Article 177 par.4 of the Road Traffic Act provides:

(4) (New - SG 2/18, in force from 20.05.2018) Whoever manages a road vehicle with unsecured cargo in violation of the requirements of the ordinance under Art. 127, Para. 4, shall be pecuniary sanctioned:

1. BGN 500 - in case of established minor deficiencies in securing the cargo;

2. BGN 1 000 - in case of established major deficiencies in securing the cargo;

3. BGN 1 500 - in case of established dangerous deficiencies in securing the cargo.

The features of ‘minor, major and dangerous deficiencies’ are open to interpretation and may be different in nature and type, which would increase or reduce social danger of the concrete violation. It is therefore appropriate, in this and other similar situations, the penalty to be determined relatively.

Apart from that, the fixed amount of the pecuniary sanction or proprietary sanction, in particular where it is high, renders that penalty impossible in practice. In the example given, if a legal entity does not own property and money, such penalties cannot be enforced. This problem has also been identified in other legislative acts, for example, for an infringement under Article 182 of the Tourism Act, the penalty is fixed without taking into account the possibility that the violation actually committed may present a lower or higher degree of danger to society.

Last but not least, the fixed amount of the sanction creates difficulties in a possible appeal of the penal order before the court, which can be appealed solely on the basis of the manifest injustice of the penalty, without calling into question the fact of the offence committed and the personality of the offender.

The problem of fixed sanctions is also related to the more general problem of the penalty system, which includes too few penalties, as well as to the mandatory prohibition of replacing one penalty with another penalty in Article 27 par.4 AVPA (except in the cases referred to in Article 15 par.2 of the Act — where the penalty provided for is a pecuniary sanction and the offender is a minor).

3.5.2. Special laws could reduce the wide range between the minimum and maximum penalty for a particular type of violation and the regulation of multiple administrative violations in a single legal provision with the same sanction, without taking into account the degree of social danger of the violations

The analysis of the legislation and the replies received in the course of the survey show a link between these two weaknesses in the legal framework. Very often, the establishment of multiple administrative offences in a single provision is accompanied by a wide range of penalties. These weaknesses will therefore be addressed jointly.

The special minimum and the special maximum of the sanction shall be the legal assessment of the lowest and highest possible degree of social danger of violation of the same type. Therefore, if the sanction is too wide, this would make it more difficult for the penalty to be properly differentiated based on proportionality and risk and would create the conditions for misapplication of the law.

A clear example of this weakness in the legal framework is Article 273. par. 1 item 9 of Act on the Operation of the Collective Investment Schemes and of other Undertakings for Collective Investment: ‘Whoever commits or allows the committing of the offense of: 9. (new - SG 76/16, in force from 30.09.2016, previous item 8, amend. and suppl. - SG 102/19) Art. 4, Para. 5 and 6, Art. 6, para. 4 and 5, Art. 7, para. 2 and 3, Art. 9, para. 1 and 2, Art. 10, para. 5, Art. 10a, Art. 17, para. 2, Art. 18, para. 1, Art. 37, Para. 8, Art. 48, para. 3 and 4, Art. 52, Art. 57, para. 1, 5 -10, Art. 58, para. 2, Art. 59, art. 61, para. 1 and 2, Art. 62, 63, art. 65, para. 1-3, Art. 78, para. 4 and 5, Art. 79, Art. 81, para. 2, Art. 91, Para. 1 and 3, Art. 93, para. 1, 2, 4 and 5, Art. 94, para. 1 and 2, Art. 98, para. 2, Art. 194, Para. 4, Art. 197, Para. 11, Art. 216, Para. 5, shall be punished with a pecuniary sanction from BGN 1 000 to 5 000 000;

Another example is Article 210a of the Consumer Protection Act, which has established that for violations of Art. 68c, Art. 68d, para 1 and 2, Art. 68g, items 1 – 11, 13, 15, 18 – 23 and Art. 68k, items 3 – 6 to the guilty person a pecuniary sanction in amount from BGN 500 to BGN 15 000 shall be imposed, and the sole traders and legal entities – a proprietary sanction in the amount from BGN 1 000 to BGN 30 000.

It is clear that the minimum limit of the penalty is thirty times lower than its maximum. At the same time, Article 210a of the of the Consumer Protection Act refers to a number of rules laid down in Articles 68c, 68d, 68 g and Article 68k of the Act. The referral technique aims at legislative savings and is applied in strict compliance with the Act on Normative Acts rules. However, where that legislative technique creates grounds for infringement of the principle of proportionality and the individualisation of the punishment, priority should be given to the question of the principle that the seriousness of the offence committed must correspond to the severity of the administrative penalty imposed. More than thirty individual violations referred to in Articles 68c, 68d, 68 g (11) to (1), 13, 15, 18, -23 and Article 68k (3) to (6) of the Act, but for each of these many violations with varying degrees of social danger, the sanctioning authority may impose a pecuniary sanction of BGN 500 to BGN 15 000.

Art. 221, par. 1, item 2 of Public Offering of Securities Act provides that whoever commits or admits commitment of violation of: Art. 77b, para. 5, Art. 77e, para. 7, Art. 89i, para. 2, 3 and 4, Art. 89k, para. 3, Art. 89m, Art. 89c, para. 1 and 2, Art. 89t, para. 1 and 2, Art. 100a, para. 2 and 3, Art. 100b, para. 3, 5, 7 and 8, Art. 100f, Art. 100g, para. 4, Art. 100i, Art. 100k, para. 3, Art. 100p, para. 2 and 3, 100t, 100u, Art. 100x, al. 3 and 5, Art. 100y, para. 1, 2, 3, 5, 6 and 7, Art. 100z, para. 2 and 3, Art. 110, para. 6, para. 7, sentence two and para. 9, Art. 110c, para. 1 - 3, Art. 110d, Art. 111, para. 6, sentences one and two, Art. 112b, para. 12, Art. 115, para. 1, 2, 4 - 8, 10 and 12, Art. 115a, Art. 115b, Art. 115c, para. 4 and 5, Art. 116d, para. 3, 5 and 7, Art. 116, para. 3, 5 - 7, Art. 116a, para. 2 - 7 and Art. 116a1, Art. 116c, para. 1 - 7, Art. 117, Art. 118, para. 3, sentence two, Art. 120a, para. 1 - 3, Art. 122, para. 3, Art. 131a, Art. 151, para. 3 - 6, Art. 151a, para. 4, Art. 154, para. 1 and 3, Art. 155, para. 5, Art. 157, Art. 157a, para. 7, shall be punished with a pecuniary sanction in the amount of BGN 1 000 to 2 000.

These examples show that this weakness of the legal framework is not an exception, but is found in a number of administrative laws. It would be appropriate to differentiate liability by creating separate sets of offences and providing for penalties with a narrower range. Apart from this, when it comes to sanctioning offences of the same type, it is appropriate to create, instead of such extensive sanctions, a system of heavier and lighter offences of the same type, thus differentiating penalties.

Another major weakness of the special legislation is that for multiple violations, only natural persons are subject to liability. In a number of situations, the nature of the offence does not make it possible to do so in the form of a failure to fulfil an obligation towards the state or municipalities. For example, the infringement under Article 80 par.5 of the Bulgarian Identity Documents Act, as well as many other violations by definition, can only be committed by a natural person.

However, in a number of situations, failure to comply with an administrative obligation can be both an administrative offence and a failure to fulfil an obligation towards the State and municipalities. In such cases, there is no reasonable justification for making only natural persons subject to administrative responsibility. In these situations, it is appropriate to extend the category of persons subject to administrative responsibility in the same or separate provision, using legal techniques: “a pecuniary sanction or proprietary sanction shall be imposed on ...”

3.5.3. Special laws could reduce the excessively narrow range between the special minimum and the special maximum of the administrative penalties

The too narrow range between the special minimum and the special maximum of the sanction manifests itself as a weakness of the legal framework in cases of reference to a number of rules of law, where possible violations are of varying degrees of public danger. For the sake of legislative economy, some violations are listed too broadly and the limits of sanctions are too narrow, which does not allow enforcement authorities to determine the penalty correctly. It is very often the case that the sanction provision refers to a whole legal act or to a number of legal acts.

For example, in art. 147, para 1 from Civil Aviation Act it is established that: “Unless duly provided otherwise, for any other violation of this Act, or of the Rules and Regulations for the implementation thereof, the culpable persons shall be penalised by a pecuniary sanction in the amount from BGN 100 to BGN 500.” Regardless of the subsidiary nature of the provision, which applies if no other penalty is provided for the violation, the question remains whether the public danger of the violations provided by the law and regulations is properly assessed and whether by imposing a pecuniary sanction of BGN 100 to 500, the principle of proportionality will be observed.

The narrow range between the special minimum and the special maximum of the sanction is not appropriate in the following situations:

In the case of blankets and referrals of administrative offences — using the legislative technique of referring to a number of rules in the same or other legal acts, possible infringements are of varying degrees of social danger. It is a common hypothesis that the penalty rule refers to all or many pieces of legislation. This leads to difficulties in the individualisation of the penalty, as violations present varying degrees of social danger.

In cases where, for reasons of legislative economy, the corpus delicti of violation are described too generally and the limits of sanctions are too narrow, which does not allow sanctioning authorities to determine correctly the penalty.

Therefore, sanctions with a narrow range between the minimum and the maximum can only be used as an alternative to fixed sanctions, or for violations that do not have a variety of features.

3.5.4. Special laws could reduce the provision of penalties without a special minimum, as well as of penalties with a very low special minimum

A number of laws do not establish a special minimum sanction. In these cases, the question arises as to the minimum amount of administrative penalty that the enforcement authority may impose. Indeed, a similar approach is observed when outlining the sanctioning part of the criminal law provisions of the Special Part of the Criminal Code, which contains the components of crimes and the penalties provided for them. However, the General Part of the Penal Code regulates the minimum and maximum amounts of each of the types of penalties that are subject to quantitative measurement, which is why, whenever the Special Part of the Criminal Code does not provide for a special minimum, it is the minimum in the General part which applies.

The AVPA lays down a minimum and maximum penalty only with regard to the penalties of deprivation of the right to exercise a particular profession or activity and the penalty provided for by the latest amendments to the AVPA — unpaid work for the benefit of society. However, the AVPA lacks a minimum amount of the most frequently imposed penalty, that is, the administrative pecuniary sanction, as regulated in the Penal Code. This further hampers law enforcement officers in individualising the amount of the type of administrative penalties. This problem is particularly serious where the penalty lacks a special minimum and the special maximum is high, for example for the violations under Article 49 par.1 of Foreigners in the Republic of Bulgaria Act.

With a pecuniary sanction up to BGN 3 000 shall be punished a foreigner who: 1. (amend. - SG 97/16) uses invalid passport or another document for travelling substituting it;

2. (suppl., SG 42/01; amend. – SG 82/06; suppl. - SG 36/09) loses, damages or demolishes Bulgarian identity document, residence permit or documents issued by the services for border passport-visa control; 3. as captain or member of the crew of a sailing vessel does not observe the established border and passport regime of ports and port towns; 4. (amend. – SG 29/07) does not implement his obligations of art. 17, para. 2 and of art. 30; 5. (amend. – SG 82/09) gives or accepts as pawn or concedes a personal document.

There are several possible solutions to this problem:

Establishing a minimum amount of the pecuniary sanction and proprietary sanction in the AVPA;

Legislative change in the sanctions of special laws, which do not contain minimum amounts of the pecuniary sanction and proprietary sanction.

The first approach could be extremely useful in subsequent codification, but it should only be used when the maximum level of the penalty is not too high. Hypothetically, if a penalty of up to BGN 5 000 is imposed for an offence and there is no special minimum, it is extremely inappropriate to apply a possible special minimum of BGN 100. At the same time, it is perfectly reasonable to apply a possible special minimum of BGN 100 in the AVPA for penalties with a special maximum of BGN 500, which do not contain a special minimum.

The second approach is more difficult to implement in practice because it requires a series of legislative changes to specific legislation involving more than 300 laws and multiple secondary legislation containing administrative penalty provisions. However, its use will make it possible, when differentiating penalties, to take into account the typical degree of social danger of violation of the type concerned and, not least, to rank the special minimum and maximum penalties according to the penalties for other violation of the same legal act.

3.6. The legal framework could provide more objective elements to distinguish between similar criminal and administrative offences

The distinction and differences between crimes and administrative offences is a debated issues in Bulgaria and at the international level. In particular, the problem of “competition” between the corpus delicti of administrative offences and corpus delicti of the crime arises when they affect the same object, i.e. harm the same type of public relations. That problem arises as regards the legal qualification of the act by the administrative authorities and courts, not in all cases, but only where the characteristic of the legal corpus delicti which distinguishes the crime from the offence is assessable. For example, Article 234 (1) of the Penal Code establishes that the distribution or keeping of excise goods without a tax stamp in non-minor cases is a criminal offence and, in other cases, an infringement under Article 123 par. 1 Excises and Tax Warehouses Act. The criterion of ‘non-minor case’ is the only difference between the criminal offence referred to in Article 234 (1) of the Penal Code and the infringement under Article 123 par. 1 Excises and Tax Warehouses Act. This creates difficulties in practice and causes for a different interpretation of the term ‘non-minor case’. Thus, in practice, a criminal authority may qualify the act as a criminal offence and another enforcement authority may qualify that act as an administrative offence.

Similarly, the question arises as to the legal qualification of the hooliganism, which can be qualified as ‘petty hooliganism’ within the meaning of the Decree on combating petty hooliganism or as a criminal offence under Article 325 of the Criminal Code.

Another example of competition between administrative and criminal liability is the offence under Article 53 par.1 of the Roads Act and the offence referred to in Article 216 par.1 of the Criminal Code, which establishes criminal liability for the destruction or damage of foreign property. In that merger, the criterion for differentiation is a legal criterion ‘if the act does not constitute a criminal offence’, but there is no constituent element to determine whether the act is an administrative offence or a criminal offence. Similarly, Article 290 (1) (6) of the ZPFI provides for a pecuniary sanction for the person who presents false information or documents if the act does not constitute a document offence. The competition between administrative and criminal liability can be seen in customs smuggling, the Excise Duties and Tax Warehouses Act, the Civil Aviation Act (Article 143 (1) (4) of the ZGV), etc.

In such cases, it is appropriate to establish an objective indication in both special administrative legislation and the Criminal Code of the constituent elements of the offence, serving as a clear criterion for distinguishing between a criminal offence and an administrative offence of the same type. Such an indication may be the value of the object or damage caused by the interception or a special means of committing the act, or conditions of time, place and environment, thus establishing a clearer boundary between criminal offences and administrative offences and overcoming a number of difficulties in the legal qualification of the acts.

3.7. Bulgaria could introduce provisions in special laws to establish penalties for violations, in respect of which no separate sanction is provided for

Administrative violations and penalties have been identified in hundreds of laws and regulations. This creates the risk that some violations of administrative rules will not result in a sanction. For these cases the AVPA establishes the provisions of art. 31 and Art. 32, which are applicable to violations of the bylaws, as well as for non-compliance with orders and other acts of authority of the administrative bodies. This approach deserves support, as it ensures the realisation of liability for infringements for which no sanctions have been imposed. The only problem is the differentiation of responsibility, as in art. 31 of the AVPA which establishes a sanction from BGN 2to BGN 50, with an extremely low special minimum.

Firstly, Bulgaria could raise the amount of sanctions in Articles 31 and 32 order to ensure their meaningfulness and deterrent effect (Box 3.4).

Box 3.4. Proposal for updated ranges of sanctions for breaches without specific penalties

“Art. 31. (Amend., SG 59/92; SG 102/95; SG 11/98) Who does not fulfil or violates a lawful order or ordinance of a body of the authority, including in connection with the economic measures of the state shall be fined by BNG 50 to BNG 200.

Art. 32.

(1) (Amend., SG 59/92; SG 102/95; SG 11/98; SG 25/02) Who does not fulfil or violates an order, a decree or another act issued or adopted by the Council of Ministers, unless the act represents a crime, or other administrative violation shall be fined by BGN 100 to BNG 2 000.

(2) (New, SG 24/87; Amend., SG 59/92; SG 102/95; SG 11/98; Suppl., SG 114/99, in force from January 31 2000; Amend., SG 25/02; Amend., SG 61/02) Who does not fulfil or violates an act according to para 1, related to the accountancy, taxation, customs, foreign currency or ecological legislation, unless the act represents a crime or other administrative violation shall be fined by BGN 400 to BNG 3 000.

(3) (New, SG 67/99; in force from August 27, 1999) If a civil servant, in carrying out the public employment does not fulfil or violates obligations ensuing from the acts under para 1 and 2 shall be fined by BNG 100 to BNG 300.”

Source: OECD proposal.

Secondly, Bulgaria could also introduce provisions analogous to those of art. 31 and art. 32 of the AVPA in the special legislation to establish sanctions for violations, in respect of which no separate sanction is provided for. This is because the degree of social danger of specific types of violation may vary and ranges established by Articles 31 and 32 may not be adequate and proportionate to the breach.

For example, the Road Transport Act states in Article 105 par.1 that

Infringements of this Act and of secondary legislation issued on the basis thereof, with the exception of the requirements for the transport of dangerous goods for which no other penalty is imposed, shall be punishable by a pecuniary sanction or a pecuniary sanction of BGN 200.

Paragraphs 2 and 3 also contain general provisions:

(2) Infringements of the requirements for the transport of dangerous goods for which no other penalty is imposed shall be punishable by a pecuniary sanction of BGN 500.

(3) A driver who, upon inspection by the supervisory authorities, fails to submit a document required by this Act or a regulatory act issued on the basis of this Act, unless otherwise provided, shall be liable to a pecuniary sanction of BGN 50.

The only disadvantage of those rules is that the penalties are fixed and the respective violations committed may vary in the degree of social danger. Therefore, the general provisions of the laws which lay down sanctions for violations for which no other penalty is provided should be defined in relation to the minimum and maximum sanction provided for by each special law. The minima of these penalties may be adjusted to the minimum level of the penalty laid down in the relevant law and the maximum amounts around the average for infringements of the law.

3.8. Special laws could contain provisions for sanctioning administrative violations committed repeatedly and systematically

With the latest amendments to the AVPA in Article 13 par. 2 of AVPA it is provided that an administrative offence, repeated or systematic, may be punished for via unpaid work for the benefit of the public, imposed independently or at the same time as another penalty referred to in paragraph 1. In Para. 1 (1) item 6 and para 6 of the Additional Provisions of the AVPA definitions of the same type of offence and repeated offence are introduced.

Although these legislative changes strengthen the legal framework, they do not overcome the different approaches of administrative laws with regard to repeated and systematic infringements. These gaps in the law give rise to situations in which, even though the offence is repeated or systematically committed, it is not punished more seriously, because there is no relevant legal provision providing for repeated or systematic offence. The analysis of the specific legislation also shows inconsistencies in the differentiation of sanctions. In some laws, the repeated violation is punishable by a double pecuniary sanction. For example, Article 183 par. 1 of the Tourism Act provides that:

Tour-operator or travel agent, who carries out tourist activity in a premise, which fails to meet the requirements or the Ordinance under Art. 64 shall be imposed by a pecuniary sanction in the amount of BGN 100 to 500. According to par.2 ‘For a repeated breach, the pecuniary sanction shall be in the amount of BGN 200 to 1000.

Another example is Article 178a par. 4 and 5 of the Road Traffic Act. According to para. 4:

A pecuniary sanction amounting to BGN 1000 shall be imposed to a person granted permission under Art. 148, Para 2, which: 1. fails to file a notification or a document certifying the performance of periodical checks with the competent authorities; 2. as a result of the inappropriate storage of documents certifying the performance of periodical checks for technical fitness of road vehicles has allowed their loss, theft or damage.

According to para. 5

In cases of repeated offence under Para 4 the pecuniary sanction shall amount to BGN 2 000.

Another example are the punishments under Article 143 para 1 of the Civil Aviation Act — for a first violation the sanction is of BGN 3 000 to BGN 10 000, and for a repeated violation under art. 146, the sanction is of BGN 4 000 to BGN 13 000. According to article 224 par.1 of the Wine and Spirit Drinks Act: “When the violations referred to in Articles 201 to 223 are repeated, the amount of the pecuniary sanctions or financial penalties shall be doubled.”

However, in a number of cases, the penalty for the repeated offence is three to four times more severe. For example, Article 178 g para 1 of the Road Traffic Act provides for:

Punishable by deprivation of the right to drive a motor vehicle for a period of 3 months and a pecuniary sanction of 1 000 BGN shall be any driver who drives in emergency stopping lane of a motorway without the exceptions under Art. 58, Item 3 or in the opposite traffic lane on a motorway and express road.’ According to par. 2 ‘For a repeated offense under par. 1, the punishment shall be deprivation of the right to drive a motor vehicle for a period of 6 months and a pecuniary sanction of BGN 4 000.’

Other examples may be given in this respect. For violations under Article 53 par.1 of the Roads Act, the penalty shall be BGN 1 000 to BGN 5 000 but for repeated violation - from BGN 2 000 to BGN 7 000. In accordance with Article 54 par. 2 of the Roads Act, where the offence is committed by legal entity and sole trader, the penalty shall be between BGN 4 000 and BGN 12 000. The analysis of the legislation shows that, in some cases, the penalty for repeated violations is even lower than the penalty for the first infringement of the same type. For example, for violations under Article 178 par.1, items 1 to 11 of the Road Traffic Act, the penalty for the first violation is BGN 2 000 to BGN 7 000, and Article 178 para 2 provides that when the offence referred to in paragraph 1 item 6 and item 10 is repeated, the penalty shall be a pecuniary sanction of BGN 1 000 to BGN 5 000 and a withdrawal of the permit. A possible reason for this is the different time period in which the two provisions, including sanctions for them, have been amended, but this and other similar examples point to the need for a uniform approach to repeated and systematic infringements, which are systematically regulated in the AVPA, along with the penalty rules. This approach would be particularly appropriate for future codification of legislation.

Another possible solution is that each special law may lay down its own provisions for repeated offences, the penalty being twice or doubled length, but not more that the AVPA provided for, and for violations of systematic commission the penalty should be three times, or three times longer, but not more than the maximum penalty provided for in the AVPA.

In considering these two options, Bulgaria could also take into account the experience of other EU countries which have specific provisions on recurrent and systemic violations (Box 3.5).

Box 3.5. Recurrent and systemic violations in Austria, Germany, the Netherlands and Spain

Provisions on concurrence and cumulating of penalties are important elements of the principle of proportionality regarding the severity of penalties and punishments. The amount of the administrative pecuniary sanction needs to be in conformity with that proportionality requirement.

The legal systems of administrative penalties in Austria (§ 22 VwSG), Germany (§ 19- § 21 OWiG), the Netherlands, Spain (31 LRJSP), have provisions on concurrence and cumulating of administrative penalties. The legislation in Austria and Germany has provisions dealing with transgressions that fall within legal provisions of both criminal offenses and administrative offenses. These provisions read as follows:

Ҥ 22 Verwaltungsstrafgesetz (Austria)

(1) Unless the administrative regulations stipulate otherwise, an act is only punishable as an administrative offense if it does not constitute a criminal offense falling within the jurisdiction of the courts.

(2) If someone has committed several administrative offenses through several independent acts or if an act falls under several non-mutually exclusive threats of punishment, the penalties are to be imposed side by side. The same applies if administrative offenses coincide with other criminal acts to be punished by an administrative authority.”

Ҥ 19 Ordnungswidrigkeitengesetz (Germany)

(1) If the same act violates several laws according to which it can be punished as an administrative offense, or such a law several times, only a single pecuniary sanction is imposed.

(2) If several laws are violated, the pecuniary sanction is determined according to the law that threatens the highest pecuniary sanction. The side effects threatened in the other law can be recognised.”

Ҥ 20 Ordnungswidrigkeitengesetz (Germany)

If more than one pecuniary sanction is imposed, each pecuniary sanction shall be assessed separately.”

Ҥ 21 Ordnungswidrigkeitengesetz (Germany)

(1) If an act is both a criminal offense and an administrative offense, only the criminal law is applied. The side effects threatened in the other law can be recognised.

(2) In the case of paragraph 1, however, the act can be punished as an administrative offense if a penalty is not imposed.”

“Article 31 LRJSP Concurrence of sanctions (Spain)

1. Acts that have been criminally or administratively punishable may not be punished, in cases where the identity of the subject, fact and foundation is appreciated.

2. When an organ of the European Union has imposed a sanction for the same facts, and provided that the identity of the subject and foundation does not concur, the competent organ to resolve it must take it into account for the purpose of graduating which, in its case, must impose, being able to reduce it, without prejudice to declaring the commission of the infraction.”

On the other hand, repeating a similar offense, recidivism, is considered a more serious variety of committing the latter offense. Without legal provision this could lead to a higher penalty within the general maximum of the penalty which is provided for in legislation.

According to the Spanish regulation of administrative penalties in Ley 40/2015 the continuity or persistence in the offending conduct as well as recidivism are elements of the principle of proportionality applicable to the administrative penalty. This principle is codified in article 29 LRJSP which reads as follows:

1. “Administrative sanctions, whether or not of a pecuniary nature, may in no case imply, directly or indirectly, deprivation of liberty.

2. The establishment of pecuniary sanctions must provide that the commission of the typified offenses is not more beneficial for the offender than compliance with the infringed rules.

3. In the normative determination of the sanctioning regime, as well as in the imposition of sanctions by the Public Administrations, the due suitability and necessity of the sanction to be imposed and its adaptation to the seriousness of the act constituting the infringement must be observed. The graduation of the sanction will especially consider the following criteria:

a. The degree of guilt or the existence of intent.

b. The continuity or persistence in the offending conduct.

c. The nature of the damages caused.

d. The recidivism, by commission in the term of one year, of more than one infraction of the same nature when this has been declared by a firm resolution in administrative proceedings.

4. When justified by the due adequacy between the sanction to be applied with the seriousness of the fact constituting the offense and the concurrent circumstances, the competent body to resolve it may impose the sanction in the lower degree.

5. When the commission of one offense necessarily results in the commission of another or others, only the sanction corresponding to the most serious offense committed must be imposed.

6. It will be punishable, as a continuous infringement, the realisation of a plurality of actions or omissions that infringe the same or similar administrative precepts, in execution of a preconceived plan or taking advantage of the same occasion.”