This chapter analyses the process of programming, formulation, modification and execution of the investment budget in Peru, and provides recommendations for aligning practices in Peru with OECD best practices.

Public Financial Management in Peru

5. Public infrastructure programming, budgeting and management in Peru

Abstract

5.1. Overview of public investment in Peru

Before looking at the regulatory and institutional framework of the Peruvian public investment administrative system (hereafter, the investment system), it is useful to specify some particular characteristics and recent trends in public investment in Peru, as well as the economic impact of the COVID-19 pandemic in the country. Indeed, these particularities are important to understand the evolution of the Peruvian investment system in recent years, its importance in the Peruvian economy, and its development at the national and territorial levels. The year 2020 will be taken into account for the comparative analysis, even though it represents a period of crisis generated by the spread of COVID-19 across the globe, which had adverse effects on economic activity.

5.1.1. Public investment has remained constant despite the economic impact of the pandemic

The crisis resulting from the COVID-19 pandemic had a considerable impact on the Peruvian economy. In 2020, gross domestic product (GDP) declined by 11% annually and poverty rates, based on the latest comparable international estimates, increased by more than 6 percentage points compared to the year before the pandemic. This increase is particularly significant given that poverty rates in the Latin America and Caribbean (LAC) region increased by less than five percentage points (OECD et al., 2021[1]). Nevertheless, Peru has registered a rapid economic recovery compared to its regional peers. Since May 2020, economic recovery has taken off quickly and public investment has been an important lever for the recovery of the job market (MEF, 2021[2]).

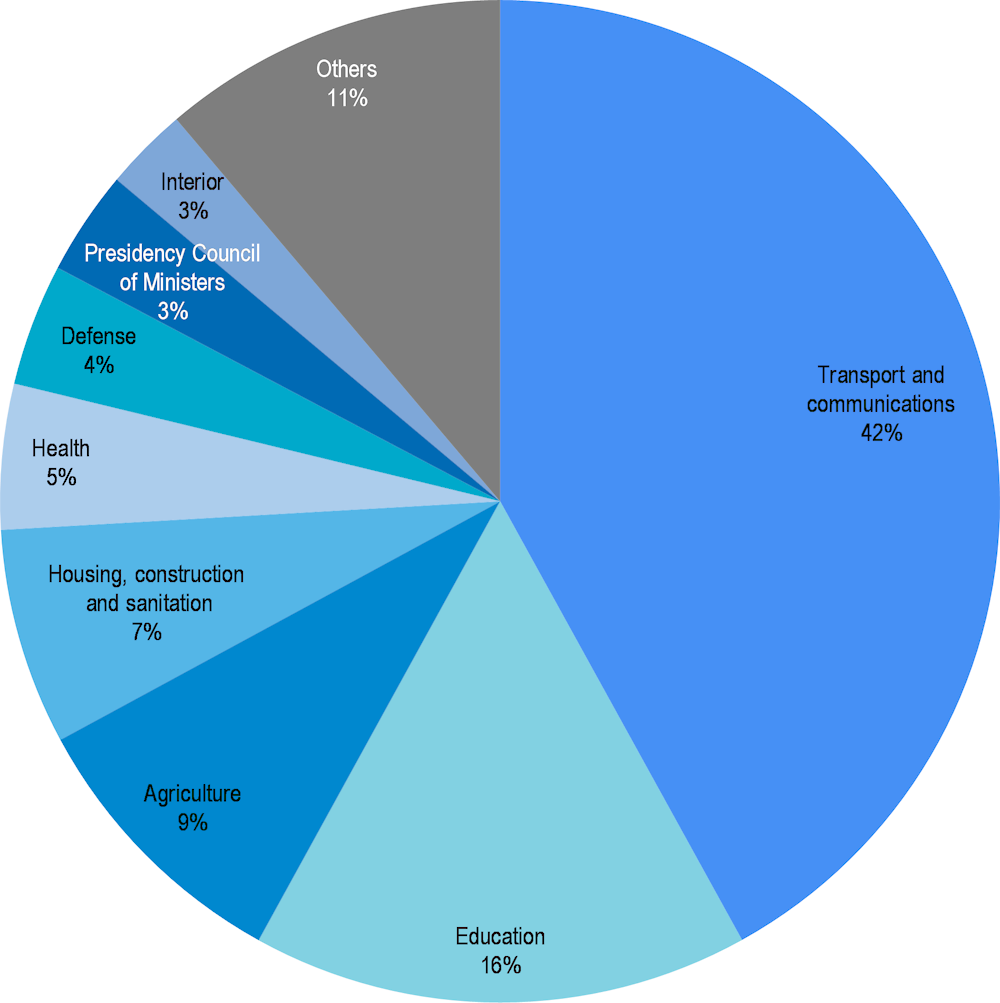

Average investment expenditure is 3% of GDP in OECD countries. By 2019, Brazil’s public investment spending was 1.7% of GDP, Chile’s 2%, Colombia’s 3.5%, Mexico’s 1.3% and Peru’s 6% (OECD, 2020[3]; 2021[4]). In recent years, public investment in Peru has represented 6-7% of total GDP (INEI, 2022[5]). This percentage has been relatively stable over the last ten years. The sectors with the highest public investment are transport and communications; education; agriculture; housing, construction and sanitation; and health (Figure 5.1). In particular, the transport and communications and education sectors accounted for 58% of the national government’s modified institutional budget (MIB) for investment in 2020.

Figure 5.1. Modified institutional budget for public investment in Peru by sector, 2020

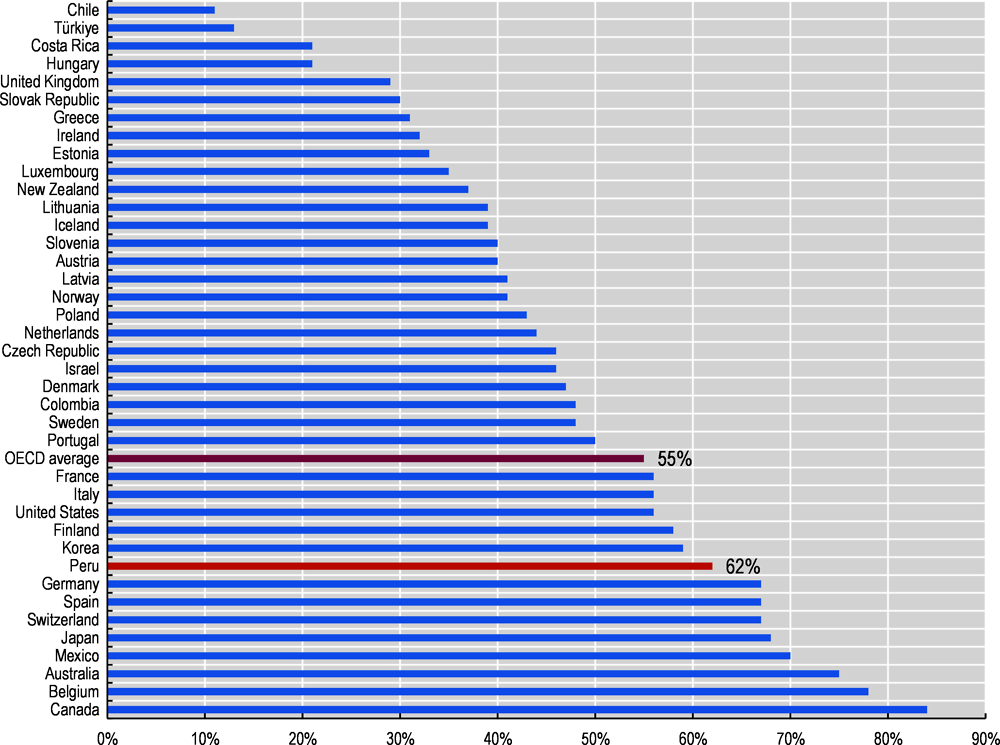

5.1.2. Subnational governments account for a high share of total public investment

Regional and local governments play a key role in a country’s economic and social development, assuming important responsibilities, especially in public investment and the provision of essential public services such as health and education. In Peru, subnational governments made 62% of total public investment in 2019. This is above the OECD average (55%) (OECD/UCLG, 2022[6]). Except for Spain (65%) and Japan (68%), countries with a higher or similar percentage of subnational investment to Peru are federal countries such as Australia (75%), Belgium (78%), Canada (84%), Mexico (70%) and Switzerland (67%) (Figure 5.2). The percentage in Peru is abovmore than that of itse regional peers such as Chile (11%), Costa Rica (21%) and Colombia (48%).1

It is important to note that a large part of subnational public investment occurs at the local level and, to a lesser extent, at the regional level. For example, in 2020, 46% of the MIP for public investment was concentrated in local governments, 34% in the national government and 20% in regional governments (MEF, 2021[2]).

Figure 5.2. Percentage of public investment at the subnational level, 2019

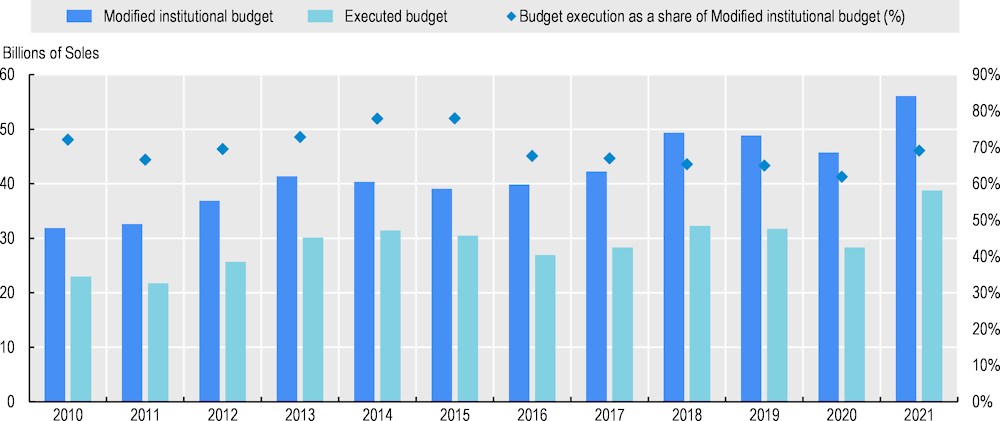

5.1.3. Investment budget execution remains a major challenge and is reflected in low levels of quality

Low public investment budget execution is a structural problem in Peru. The execution rate over the last decade has averaged below 70%, generally between 65% and 75% (Figure 5.3). It is important to highlight that this problem is particularly relevant in the case of local government public investment, where execution with respect to the MIP has averaged 63% in the last 10 years.

Figure 5.3. Evolution of the public investment Modified Institutional Budget and its execution, 2010‑22

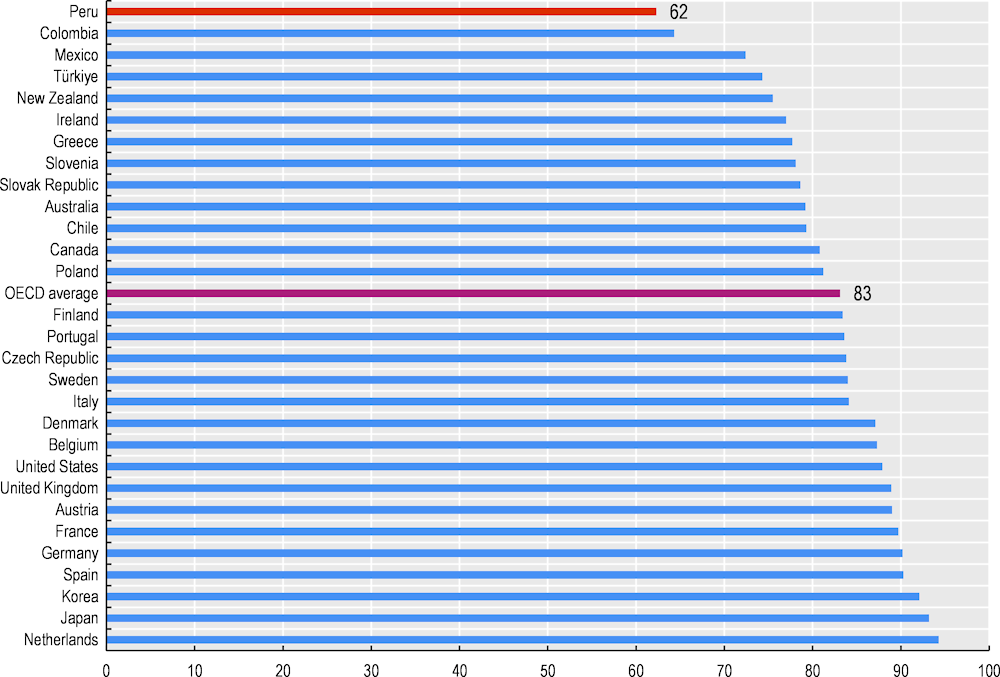

The quality of infrastructure is also a significant challenge in Peru. Infrastructure quality in Peru is below the OECD average and even below regional peers, such as Chile, Colombia and Mexico (Figure 5.4) (Schwab, 2019[8]). The quality of infrastructure investment is critical to ensure that infrastructure fulfils its potential as a catalyst for growth and development.

Figure 5.4. World Economic Forum Infrastructure Quality Index, Peru vs. OECD countries

Some of the criteria used to measure the quality and development of infrastructure are the state of road connectivity, the quality of road infrastructure, rail density and airport connectivity, among others (Schwab, 2019[8]). Peru ranks 110th out of 141 countires in road infrastructure quality, 79th in infrastructure utility and 97th in transport infrastructure (Ibid.).

5.2. From the National Public Investment System to Invierte.pe: an investment system that has matured and evolved over time

5.2.1. The beginnings of the public investment administrative system and its first reforms

Since its creation in 2000, the Peruvian public investment administrative system has been reformed to adapt to the country’s changing context and international standards (OECD, 2016[10]). At the beginning of the millennium, the need for a comprehensive system bringing together the institutional competencies relevant to the country’s public investments, and which could be part of the state’s administrative systems, began to be discussed. Since its creation with Law No. 27293 of 2000, the National Public Investment System (SNIP) has sought to optimise the use of public resources allocated to investment, improving the quality of the project life cycle, especially with regard to project formulation and evaluation. It is in this context that an investment system was created, establishing principles, processes, methodologies and technical standards aimed at certifying the quality of public investment projects (Ministry of Economy and Finance, 2014[11]).

The main objective of SNIP was to enhance its systemic component, spending public resources earmarked for investment more efficiently. The system sought to ensure that projects were efficient, sustainable and cost-effective. All of the national and subnational governments’ public investment projects under SNIP would be subject to study and analysis.

The system regulated three phases of the public investment project (PIP): pre-investment, investment and post-investment.

Pre-investment: At this stage, initial studies, called pre-investment studies (profiling, including pre‑feasibility studies and feasibility studies), were carried out to determine the relevance, social profitability and sustainability of the PIP, criteria that underpin the feasibility statement. This was a critical phase, as it established whether or not a PIP should be carried out and if it was necessary to continue with the following stages. The Formulation Unit formulated the pre‑investment studies and registered them in the system’s Project Bank. They were then passed on for evaluation by the responsible programming and investment offices.

Investment: the definitive studies (or technical dossier or equivalent documents) were then carried out and the PIP was executed. The spending agency was responsible for this phase and was in charge of preparing and registering the studies in the Project Bank, implmenting the project, closure and transfer of the PIP to the entity responsible for operation and maintenance.

Post-investment: this phase comprised the operation and maintenance of the implemented PIP, as well as the ex post evaluation of the project.

All projects had to be declared viable before moving to the investment phase. To be approved, projects had to be socially profitable, sustainable and framed with the respective planning documents. The diagnosis considered the problem the project was intended to solve, its causes and the expected effect of the investment. The analysis also took into account size and cost elements in order to make an overall cost-benefit analysis and ultimately assess the social profitability of the project (OECD, 2016[12]).

From the initial design of SNIP, the aim was to foster dialogue between the central government and subnational governments to respond to the specific needs of each regional government. Although there were a number of decentralised bodies in SNIP, the Ministry of Economy and Finance (MEF), through the General Directorate of Public Investment (DGIP), was the system’s highest technical and regulatory authority. This was where the pre-investment studies of the projects arrived with amounts determined for their evaluation and viability; likewise, the verification of the project’s viability was registered when the cost of implementing the project exceeded certain percentages with respect to the amount declared viable.

The MEF was responsible for developing the rules for the functioning of SNIP, regulating processes and procedures, issuing the technical standards to be met by projects, declaring the feasibility of projects requiring state borrowing or guarantees, ensuring that approved projects complied with technical and legal requirements, ensuring during the investment phase that projects complied with the approved conditions and parameters, and conducting the sample evaluation on the quality of feasibility approvals granted by the competent SNIP bodies (OECD, 2016[12]).

The first years of SNIP were accompanied by the territorial decentralisation process carried out in the 1990s and 2000s. This process sought to give more autonomy to territorial entities (Box 5.1). The launch of the investment system coincided with the creation of regional governments and their new political structure, which assigned new competences within a system of devolution of powers (Serrano and Acosta, 2011[13]).

As part of the decentralisation process, regional governments were created in 2002, giving them political powers, functional and regulatory responsibilities, and powers of territorial planning (Ibid.). From that year on, the MEF began delegating powers for making projects viable within SNIP. By 2007, any project could be evaluated and declared viable by the investment programming office of each sector, local or regional government, according to its competencies and without any limit on the amount. Only projects with internal indebtedness and whose investment amount exceeded a certain threshold had to be evaluated by the MEF (Ministry of Economy and Finance, 2019[14]).

Box 5.1. Territorial decentralisation in Peru

The decentralisation process in Peru was implemented in different stages. This box gives a summary of the process.

In 1989, the first Law on the Bases of Decentralisation was enacted, grouping the 24 departments into 12 “regions”. These regions were given sectoral powers with corresponding budgetary allocations. The central government retained supervisory and regulatory functions.

In 1992, transitional councils of regional administration were created in each department. They functioned as agencies under the Presidency of the Council of Ministers and were in charge of executing central government decisions. They were active until 2001.

In 2001, a process of decentralisation was initiated, which came to fruition in 2002 with the Organic Law of Regional Governments, which sets out the decentralised competences and functions of the regional governments.

In 2002, the president, seven political parties and civil society organisations signed a National Accord to commit to state policy guidelines, including decentralisation.

Between 2002 and 2004, several laws were enacted to facilitate regional elections and define legal provisions for territorial organisation, regional and municipal government, participatory budgeting, decentralised investment, fiscal decentralisation, and the accreditation and integration of regional and local governments. These include the Law on the Bases of Decentralisation.

In 2004, the government established a three-stage process to transfer 16 functions and 124 competencies. The central government began transferring funds directly to regional governments.

In 2006, the transfer process was accelerated to meet the deadline of December 2007. This deadline was met, except for Metropolitan Lima and Callao. However, not all transferred functions had an accompanying budget in 2007.

From 2007 onwards, the decentralisation process also incorporated the National Public Investment System, in that it was decreed that subnational governments and national sectors could declare the feasibility of projects under their jurisdiction without the need to go through the Ministry of Economy and Finance, as had been the case until then.

In 2008, the central government took the final steps to finalise the decentralisation process, which was completed in 2009.

In 2017, the national government decided to support regional and local governments to promote economic potential and social capital in their territories with the creation of the regional development agencies, which were initially created in three pilot regions (Apurímac, Piura and San Martín) before being implemented in all regions.

In 2018, the national government created the Multisectoral and Intergovernmental Commission for the Strengthening of Decentralisation to propose articulated intersectoral and intergovernmental management guidelines. These guidelines seek to promote and strengthen decentralisation and an Action Plan 2018-2021. “Plan 2021” is a management tool for the Secretariat for Decentralisation, which allows it to guide its actions, with strategic actions in different thematic areas, to be implemented in an articulated and concerted manner between the three levels of government.

Sources: Vammalle, et al. (2018[15]), “Financing and budgeting practices for health in Peru”; OECD (2019[16]), Multi-dimensional Review of Peru: Volume 3. From Analysis to Action; Presidency of the Republic (2002[17]), Ley de Bases de la Descentralización; Presidency of the Council of Ministers (2018[18]), Anexo: Plan Anual de Transferencia de Competencias Sectoriales a los Gobiernos Regionales y Locales 2021.

Although the initiative behind SNIP was to create a more decentralised system, some of its phases, especially the pre-investment phase, were perceived as creating an obstacle to participating in decision making. As a result, after more than a decade of using SNIP, local and regional governments demanded greater autonomy and easier access to and participation in public investment decisions, which led to a restructuring of the investment system.

5.2.2. Invierte.pe as a more flexible system to prioritise budget execution to close gaps

Despite the advances of made with SNIP, the system was criticised for its lack of flexibility and for supposedly making the pre-investment process too complex. Sectors, regions and local governments perceived it as an inflexible process, difficult to access and prioritising central decisions (Secretaría Descentralización, 2022[19]). That is why, in 2016, it was decided to make a structural reform to the system by creating the National System of Multiannual Programming and Investment Management, better known as Invierte.pe.

In the change from SNIP to Invierte.pe, different functions were attributed to the bodies that make up the system so that there would be greater autonomy, dialogue and relationships between the MEF, the sectors, local and regional governments, and the public companies subject to using the system. Likewise, through multiannual programming and the prioritisation of investments based on gap diagnosis, the aim is to establish a better link between the investment portfolio and the long-term development visions at the sectoral and territorial levels. In particular, the new system aims to streamline the investment planning and approval process, promote investment to close priority infrastructure or service access gaps, and better articulate with long-term strategic objectives (Box 5.2).

Box 5.2. Main changes and improvement objectives of Invierte.pe

Includes the multiannual investment programming phase in the investment cycle.

Links the investment portfolio to long-term development visions at sectoral and territorial levels.

Greater flexibility, decision-making possibilities and accountability for subnational sectors and governments.

Simplifies procedures relating to the formulation and appraisal of investment projects.

Eliminates cost escalation thresholds or limits.

Creates optimisation, marginal expansion, rehabilitation and replacement investments allowing, for example, the replacement of an acquired asset to be treated as an investment under the optimisation, marginal expansion, rehabilitation and replacement investments category by registering a token without the need for a social assessment and the formulation of a pre-investment study.

Creates standard factsheets for the formulation and evaluation phase.

Creates annual asset reports.

Source: Based on Ministry of Economy and Finance (2017[20]), El Nuevo Sistema de Inversión Pública.

Likewise, since 2019, the adoption of Buliding Information Modelling (BIM) was initiated for its progressive application in public investment as a collaborative work methodology for the information management of a public investment, which makes use of an information model created by the parties involved, to facilitate the multiannual programming, formulation, design, construction, operation and maintenance of public infrastructure, ensuring a reliable basis for decision making.

To date, the Implementation Plan and Roadmap of the BIM Peru Plan have been approved, as well as the "Technical Note on BIM Introduction: Adoption in Public Investment" and the "National BIM Guide: Information Management for investments developed with BIM". In addition, BIM is being implemented in ten pilot projects in the Formulation and Evaluation and Execution phases and the BIM curriculum in three public universities.

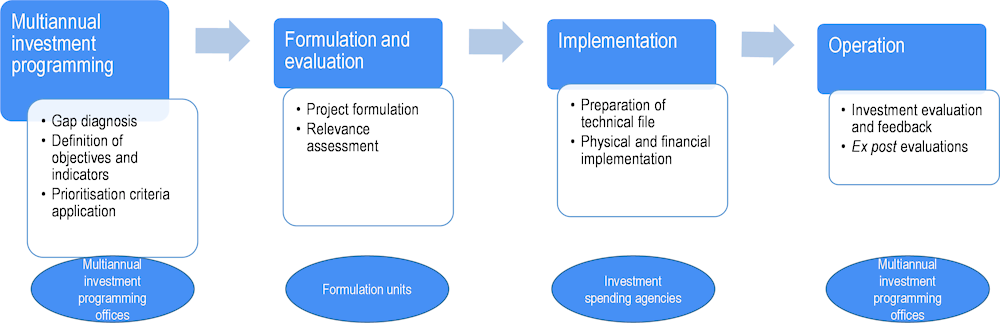

One of the objectives of Invierte.pe is to articulate long-term strategic planning with the allocation of resources in the public budget through medium-term strategic programming. In this sense, the multiannual investment programming stage seeks to establish a portfolio of investments to close gaps in infrastructure or access to previously identified priority services. The cycle continues with the formulation and evaluation phase, where ideas are matured and decisions are taken on the suitability of investment projects. The cycle continues with the implementation phase and ends with the operational phase of the investments. Physical and financial monitoring is also carried out through the investment monitoring system.

Figure 5.5. Phases of Invierte.pe

The aim of Invierte.pe is to have more detailed projects that reflect the specific reality of the country’s different territories, with the formulation units of the line ministries, regional governments and local governments granting the viability of the investment projects they formulate. Unlike SNIP, with Invierte.pe it is expected that each prioritised investment project will have a guaranteed budget, at least to launch the work. However, as will be discussed in Section 5.4, in practice, the system allows investments to be prioritised and even implemented without a budget available for the full implementation of the project.

As part of the modernisation of the investment system, the process of integrating the investment system with the state’s other administrative systems has also begun. Multiannual programming and the gap closure approach are aimed at correctly allocating public resources. They are expected to be articulated with other systems such as strategic planning and the budget and supply administrative systems. Interoperability is sought between the systems to achieve more coherent actions on the part of the state and provide more concrete and accurate information. Likewise, the aim is to standardise information management by integrating the permanent updating of the Integrated Financial Administration System (SIAF) with the Invierte.pe Investment Bank. Various initiatives were launched in 2018 to integrate the investment system into the SIAF. Despite these initiatives, cross-system integration is a constant challenge at the operational level.

5.2.3. Transfer of competences and institutional reforms of Invierte.pe

According to the OECD Recommendation of the Council on the Governance of Infrastructure (OECD, 2020[21]), governments should have an institutional framework that is clear, transparent, coherent, predictable and legitimate. Institutions should have precise functions, competent authorities, and be endowed with adequate financial and human resources to carry out their functions.

Public investment often involves different levels of government at some stages of the investment cycle, either because competences are shared or because of joint financing arrangements. For this reason, sound public infrastructure policy needs robust co-ordination mechanisms within and between levels of government. These mechanisms should foster a balance between a whole-of-government perspective and the different sectoral and regional viewpoints (OECD, 2016[22]).

As mentioned at the beginning of this chapter, Peru is one of the countries where subnational governments, and in particular local governments, participate more in public investment. With the new investment system, Invierte.pe, certain aspects were modified regarding institutional design and the functions of each body involved.

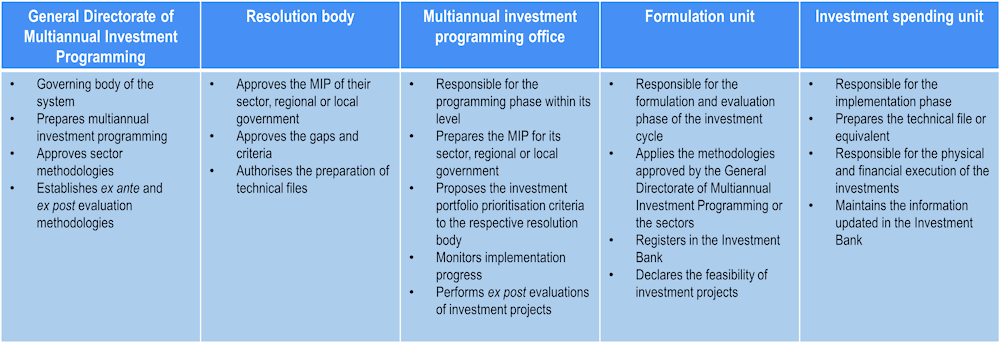

Invierte.pe has five main bodies: the MEF, through the General Directorate of Multiannual Investment Programming (DGPMI), which acts as the governing body; and each entity at the different levels of government has a resolution body, a multiannual investment programming office, a formulation unit and investment spending agencies (Figure 5.6). In Invierte.Pe’s new investment cycle, the functions of the investment programming offices were transferred to the formulation unit. In this sense, the same body formulates and evaluates the investment projects.

The MEF continues to be the governing body of the system through the General Directorate of Multiannual Investment Programming, which provides technical assistance, issues directives and guidelines, and establishes methodologies and general parameters for formulating and evaluating projects. Although the MEF maintains decision-making functions in the investment cycle, these have been reduced and its competencies have been delimited. In SNIP, the MEF was involved in almost all phases of investment decision making; in Invierte.pe, its powers have been decentralised to provide decision-making and action spaces for public entities in the formulation, evaluation, feasibility and implementation of projects (Ministry of Economy and Finance, 2017[20]).

In Invierte.pe, the sectors and regional and local governments now have their own decision-making bodies. Each has a resolution body, a multiannual investment programming office, a formulation unit and an investment spending unit.

Figure 5.6. Bodies and functions in Invierte.pe

The changes introduced by Invierte.pe require greater responsibility, commitment and capacity from sectors and subnational governments. In the framework of the implementation of Invierte.pe, capacity-building and technical assistance are availble from officials from the General Directorate of Multiannual Investment Programming and public investment specialists in the territories (virtual and face‑to-face). However, there are high levels of turnover among the officials in charge of implementing the system, thus the knowledge acquired in the field is lost.

5.3. The role of long-term strategic planning for investment

Long-term strategic planning is essential for the effective and efficient investment of public resources. Appropriate planning helps to ensure that investment decisions take into account, holistically, both long‑term development needs and objectives and that their development is transparent, inclusive and participatory. According to the OECD Recommendation of the Council on the Governance of Infrastructure (OECD, 2020[21]), the strategic vision should be based on both national and subnational development objectives, and should aim to improve the economic, natural, social and human capital that underpins well-being, sustainable and inclusive growth, competitiveness, and public service delivery (OECD, 2017[23]).

The choice of what to build should be framed by a vision for the country’s future that is articulated through an explicit statement of long-term development goals. To ensure the overall coherence of investments across sectors, centralised guidance is essential on the objectives and priorities to be pursued by infrastructure policies and the prioritisation of investments. Thus, infrastructure strategies should not only take into account the specific needs of a sector, but also ensure that investment plans contribute to wider long-term development objectives (OECD, 2020[24]).

5.3.1. Peru still lacks a medium- and long-term infrastructure policy

Most OECD countries have comprehensive plans for infrastructure investment

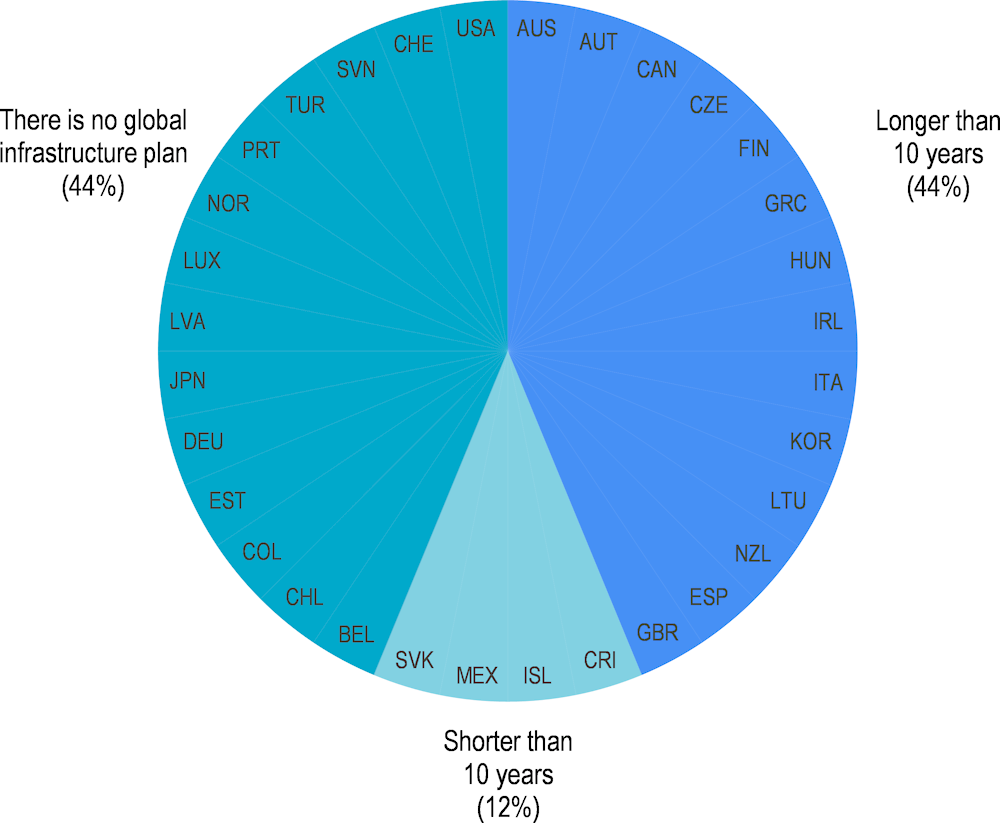

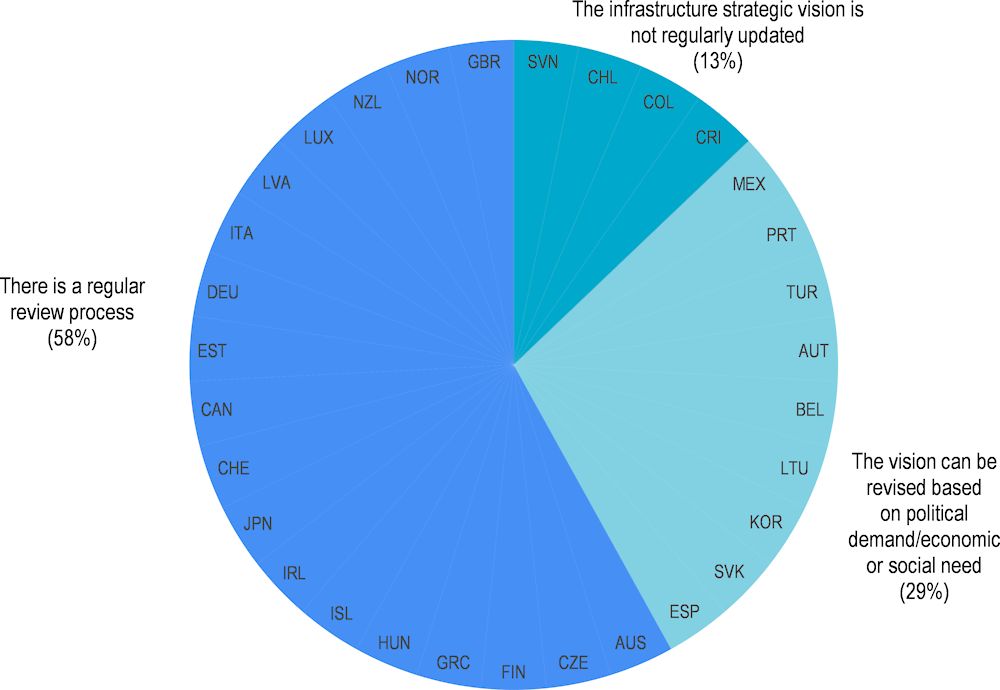

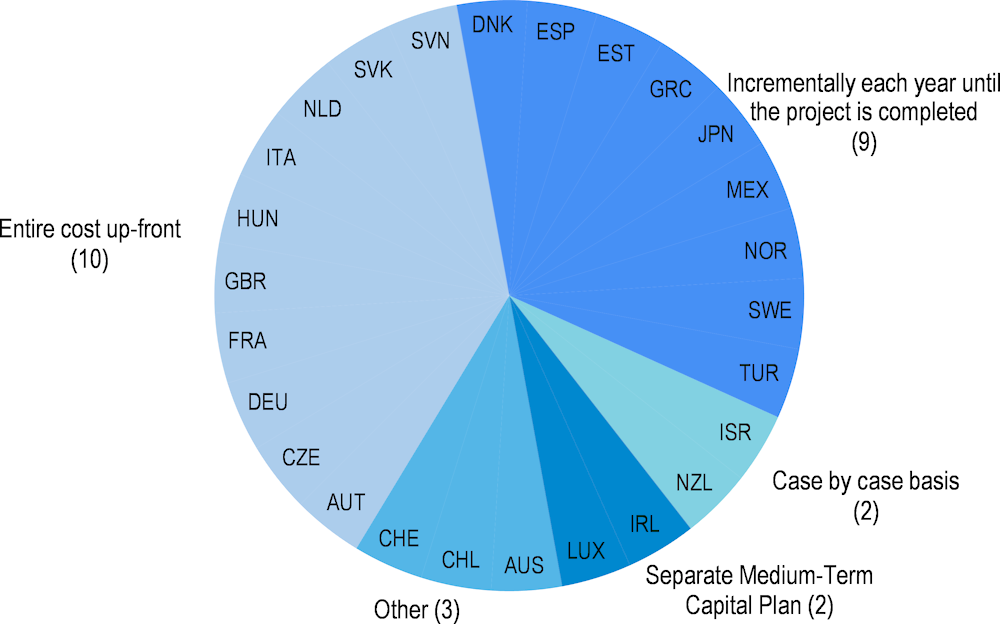

The growing trend of comprehensive plans for infrastructure investment aims to articulate infrastructure investment more coherently and promote synergies and complementarities in investment across different sectors (Figure 5.7). For example, the United Kingdom was one of the first countries to develop long-term strategic plans and to create a specialised body for this function. Similarly, Ireland, through its National Development Plan, sets out a comprehensive ten-year public investment strategy (Box 5.3).

Figure 5.7. Existence of global infrastructure plans, 2020

Box 5.3. Long-term strategic infrastructure plans for Ireland and the United Kingdom

United Kingdom

Infrastructure planning in the United Kingdom has historically been based on medium-term sectoral plans for specific sectors (e.g. energy, water, railways and highways). The relative stability and predictability of the United Kingdom’s approach to sector-based infrastructure planning and regulation was criticised when it came to developing strategic and nationally significant infrastructure projects.

The London School of Economics Growth Commission (2013) first proposed the creation of a new institutional framework to govern infrastructure strategy, delivery and financing. Subsequently, the Armitt Review looked at what structures would best support long-term strategic decision making and how to forge the cross-party consensus needed to take those decisions. The review concluded with the creation of a National Infrastructure Commission, with statutory independence.

The first National Infrastructure Commission was established in 2015 to identify the United Kingdom’s strategic infrastructure needs over the medium to long term and propose solutions to the most pressing infrastructure challenges. The National Infrastructure Commission’s mandate also recognised the role of infrastructure in promoting sustainable economic growth, improving competitiveness and providing security for investors.

In 2018, the National Infrastructure Commission published the first National Infrastructure Assessment for the United Kingdom, making recommendations on how the United Kingdom’s identified infrastructure needs and priorities should be addressed. The UK government formally responded to the recommendations through a National Infrastructure Strategy published alongside the Budget in 2020.

By bringing together expertise in the financing, delivery and assurance of major projects into a single unit, the United Kingdom seeks to draw on good practices from across sectors and improve the way government delivers projects and programmes.

Ireland

As part of Project Ireland 2040, the National Development Plan 2021-2030 sets out the overall investment strategy to make Ireland a better country for all and build a more resilient and sustainable future. It is the largest and greenest national development plan ever presented in the country’s history, focusing on priority solutions to strengthen housing, climate ambitions, transport, health, job growth in all regions and economic renewal for the next decade. This National Development Plan sets a ten-year outlook of the country’s infrastructure performance.

Sources: OECD (2020[24]); Department of Public Expenditure and Reform (2021[25]).

SINEPLAN is not designed to develop a medium- or long-term strategic infrastructure vision

Unlike most OECD countries, Peru does not have a medium- or long-term infrastructure vision and the existing planning mechanisms within the framework of the National Strategic Planning System (SINAPLAN) are not useful for achieving this objective.

SINAPLAN is the articulated and integrated set of bodies, subsystems and functional relationships whose purpose is to co-ordinate and make viable the national strategic planning process to promote and guide the harmonious and sustained development of the country, articulating the different proposals to elaborate the National Strategic Development Plan and the sectoral, institutional and subnational plans (ECLAC, 2018[26]). Its governing, guiding and co-ordinating body is the National Strategic Planning Centre (CEPLAN), which is in charge of monitoring and evaluating plans, policies, programmes, objectives and projects within the strategic planning framework.

Beyond the theoretical and methodological planning exercise carried out by SINAPLAN, there are currently no centralised strategic planning guidelines, where the linkage and articulation between sectors in infrastructure matters are collected and reaffirmed. The National Infrastructure Plan for Competitiveness is the first effort to define a vision and objectives for closing Peru’s infrastructure gaps (Box 5.4). Although it is an interesting example of how to articulate the needs of sectors in a long-term plan, the plan is limited in scope and coverage.

Box 5.4. The National Infrastructure Plan for Competitiveness

The National Infrastructure Plan for Competitiveness was drafted in July 2019 to increase productivity and competitiveness. It represents the first effort to define a vision and objectives for closing infrastructure gaps in Peru. The plan is, however, limited in its coverage. Its main emphasis is on the private sector and its portfolio is limited, leaving out sectors of great relevance, such as health.

To prepare the plan, the Ministry of Economy and Finance applied a project prioritisation methodology based on the criteria of transversality, productive potential, social impact and state resources, and short-term impact. It resulted in the identification of 52 investment projects distributed among the following sectors: transport (26), electricity (8), communications (5), agriculture (4), sanitation (4), hydrocarbons (3) and environment (2).

The National Infrastructure Plan is currently being updated to broaden its vision to incorporate social, environmental, institutional and economic dimensions. It also seeks to incorporate an approach based on sustainable development and to update project goals and objectives for the period 2022-25.

Sources: Ministry of Economy and Finance (2019[27]); PeruCompite (2022[28]).

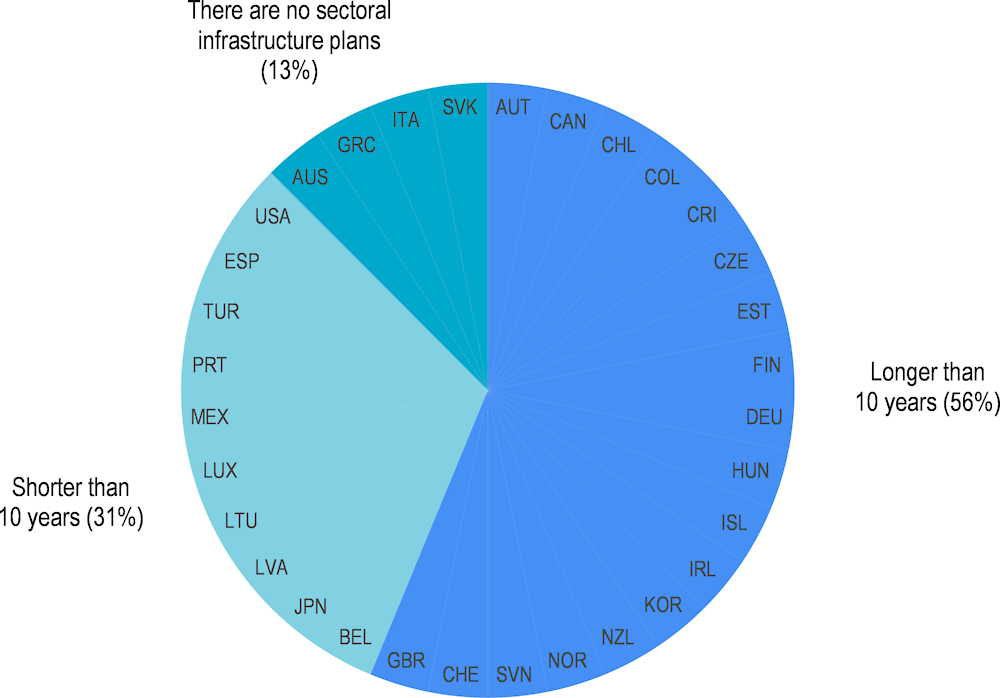

5.3.2. The vast majority of OECD countries also have long-term plans at the sectoral level

These long-term plans (Figure 5.8) seek to identify current and future needs in a specific sector as well as the resources available, and design a long-term vision that can be implemented in stages and monitored over time. They should be aligned with medium-term budgets, organising and structuring budget allocations in a way that easily corresponds to national objectives. In the case of transport infrastructure planning, in Germany (Box 5.5), fiscally sustainable long-term plans are linked to budget allocations and are aligned with medium‑term expenditures.

Figure 5.8. Existence of sectoral infrastructure plans in OECD countries, 2020

Box 5.5. Budget allocations and clear prioritisation: Germany’s Federal Plan for Transport Infrastructure 2030

The Federal Transport Infrastructure Plan (PFIT) is a comprehensive strategy for developing the federal government’s transport infrastructure, with a total investment of EUR 269.6 billion for the implementation of all top priority projects within the time frame of the PFIT 2030.

The PFIT is the federal government’s most important transport infrastructure planning tool. One of its main objectives is to achieve a realistic and bankable overall strategy for the structural maintenance and construction of German infrastructure. The German authorities emphasise linking the funds to be invested to the projects, so that all first priority projects can be implemented within the time frame set for the PFIT 2030.

The latest PFIT was published in 2003. The previous one was adopted in 1992 after the reunification of Germany. The current plan (PFIT 2030) lays the foundations for transport policy for the planning horizon up to 2030. According to the Basic Law, the federal government is responsible for financing the construction and structural maintenance of the federal transport infrastructure, which is the focus of the PFIT. This infrastructure includes federal highways and federal roads (together referred to as federal highways), federal railways, and federal waterways.

The PFIT comprises the investments necessary for capital maintenance and replacement infrastructure investment as well as improvement and new construction projects. The foreseen needs for maintenance and replacement of structures have been included in the plan as a total amount for each mode of transport. In assessing project-specific improvement and new construction works, the PFIT focuses on projects that significantly impact large areas and that develop a significant capacity and/or quality improvement impact.

Sources: OECD (2020[24]); Federal Ministry of Transport and Digital Infrastructure (2016[29]).

Peru does not have a tradition of long-term strategic planning at the sectoral level

Despite being a widespread practice in OECD countries, Peru does not have a tradition of long-term strategic planning at the sectoral level. The sectoral planning mechanisms or initiatives developed within the SINAPLAN framework are not interrelated and do not support or link to the MIP. Although the elaboration of the MIP should take into account prioritisation criteria originating in entities’ plans, there is no long-term vision for infrastructure. This limits the link between closing the gaps and a more general long‑term vision of the country, thus restricting the strategic capacity within the investment system.

There are some isolated cases where initiatives have been launched to develop a strategic vision for infrastructure in the education sector. In particular, the National Education Infrastructure Plan to 2025 establishes for the first time a proposal for long-term educational infrastructure planning for the improvement, rehabilitation, expansion, construction, replacement, reinforcement and management of existing infrastructure, as well as planning for new infrastructure (Box 5.6).

Box 5.6. Peru’s National Education Infrastructure Plan to 2025

The National Education Infrastructure Plan (PNIE) was conceived as the central planning instrument for educational infrastructure in Peru up to 2025. Educational infrastructure covers all educational institutions of basic education (at all levels and modalities); higher pedagogical and technological education; and technical-productive education. The objective of the PNIE to 2025 is to improve satisfaction with the educational service, enhancing the condition, capacity, management and sustainability of the public education infrastructure to achieve a quality education for all.

It proposes long-term educational infrastructure planning for the improvement, rehabilitation, expansion, construction, replacement, reinforcement and management of existing infrastructure, as well as planning for the provision of new infrastructure. It sets four objectives related to the safety and functionality, capacity, management, and sustainability of the infrastructure. Based on existing information, it also strives to elaborate a diagnosis of the physical state of the country’s public education infrastructure.

One of the positive factors identified in the PNIE is that it has been the basis and has allowed programmes such as the National Education Infrastructure Programme to prioritise and execute infrastructure projects with a high impact on closing gaps.

Sources: Ministry of Education (2017[30]); Diario oficial del Bicentenario (2021[31]).

Contrary to many OECD countries, Peru does not have the tools to update its plans

This planning exercise in education infrastructure can serve as an example to inspire similar initiatives in other sectors. However, it is important to bear in mind that this plan has had some challenges in its implementation, review and monitoring. Most OECD countries have tools to update their initial plans (Figure 5.9). This allows the vision to be systematically reviewed, adjusted and corrected, rather than becoming a static exercise that cannot respond to the needs of the population and avoid it from being completely replaced following a change in government.

Figure 5.9. Update/revision of the 2020 infrastructure vision

5.3.3. The identification of gaps has strengthened the programming process but could be broader in scope and have a more longer term perspective

Territorial inequality, coupled with the COVID-19 crisis, accentuates the need to close gaps in infrastructure or access to services and to enhance territorial development in Peru. Infrastructure has a great impact on communities and can boost the country’s long-term growth and social well-being, for example in the provision of public services such as schools and hospitals. An analysis should be carried out to identify and quantify the country’s needs in view of developing a strategic vision (OECD, 2020[3]).

In a context of needs such as Peru's, prioritisation of investments is more difficult, but this is when strategic planning is most important. It is important to avoid falling into the practice of executing investment projects without having a clear general guideline that goes beyond the immediacy of the need to be satisfied. The most challenging challenge in Peru's investment system is to be able to generate strategies with a long-term perspective, prioritising investments with technical sense. In this sense, it must be guaranteed that all projects included in the MIP meet sufficient quality and maturity standards and that the projects prioritised are those that provide the greatest value for money, taking into account economic, social and environmental objectives. The completion of ongoing projects should be an objective to avoid delays and to ensure that assets can be completed and provide an adequate service to citizens. However, it should be ensured that only those investments that have adequate budgetary funds for their full implementation are started and that they are those projects that provide the best value for money as mentioned above. Peru has high territorial inequalities; it must therefore promote investment in infrastructure to cover basic needs, improve citizens’ quality of life and help close the territorial gaps. The current system proposes development and territorial governance as useful tools to reduce the inequalities between the centre of the country and the less urbanised outskirt (Secretaría Descentralización, 2022[19]).Respect for territories and national diversity has been the basis of the decentralisation process, whose life cycle has parallelled the evolution of the investment system. Public services and the provision of goods must follow a territorial approach, where their provision is optimised by local and regional governments, seeking to satisfy the needs and expectations of citizens, and avoiding overlap and duplication between levels of government (Secretaría Descentralización, 2022[19]).

Annual investment programming should follow the gap closure objectives

New criteria for approving and financing investments are introduced in Invierte.pe. Closing priority gaps is designed as a necessary step to strengthen the country’s decentralisation process. This concept seeks to ensure that PIPs aim to generate a social impact, improving the living conditions of the population in each territory. Territorial development and closing gaps have been two main elements for the investment system to help reduce regional inequalities.

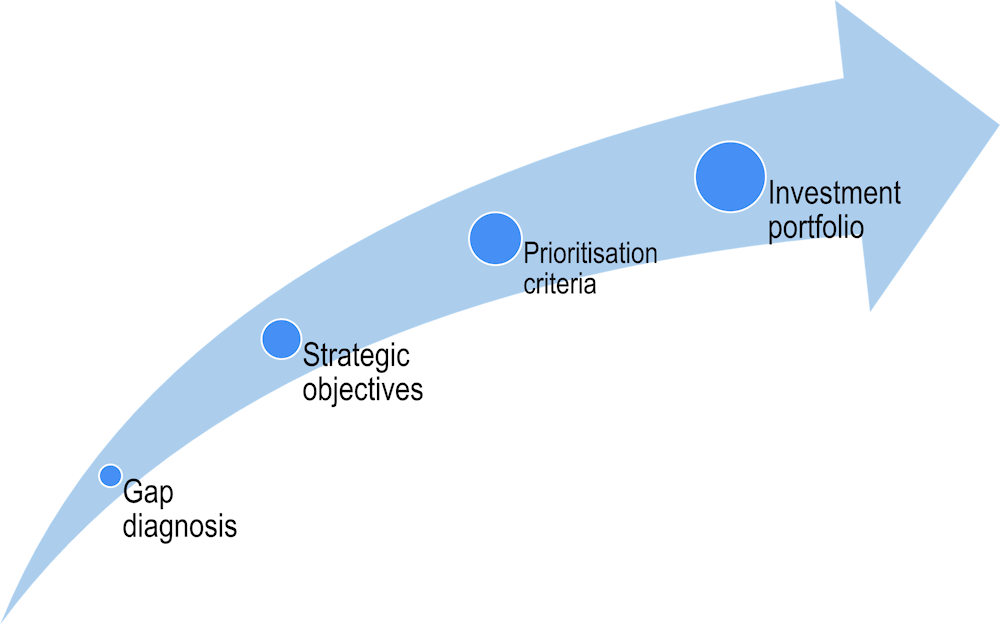

In the framework of Invierte.pe, each year sectors and subnational governments must carry out multiannual investment programming with the primary objective of closing priority gaps (Figure 5.10). In the process, the sectors conceptualise, define, update, approve and publish indicators of infrastructure gaps or access to services used by the sectors, regional governments and local governments for the preparation, approval and publication of the diagnosis of infrastructure gaps or access to services. Based on this diagnosis, entities determine their prioritisation criteria, which are used to select and prioritise the investments to be registered in the multiannual investment programme’s (MIP) investment portfolio. Gaps are defined as the difference between the optimised available supply of infrastructure and/or access to services and the demand, at a given date and specific geographic scope.

Figure 5.10. Peru’s investment selection process

Source: Author’s elaboration based on InviertePe.

The established gap closure targets must have a minimum three-year horizon. These indicators are quantitative expressions of the gaps in infrastructure and/or access to services, which are elaborated based on a variable or set of interrelated variables that allow their measurement for a given time or period (Ministry of Environment, 2019[32]).

Conducting an annual gap diagnosis is time-consuming and can become a routine exercise, and the data used are not always reliable

The implementation of Invierte.pe has brought about improvements in identifying needs, generating indicators, and defining criteria for prioritising and selecting investments. Despite this, and given the lack of time and resources for elaborating the gap diagnoses each year, the exercise runs the risk of being used in a mechanical and routine manner. Carrying out an annual gap diagnosis and indicator definition, as is currently done, may represent wear and tear for civil servants, and be an inefficient use of the public resources invested. In many cases, they may not even represent the solution to the cross-sectoral problems in Peru. Some actors state that the data and information with which the indicators are constructed have gaps or are incomplete, as they are not built jointly between sectors. In addition, there is no accurate sectoral diagnosis and programming is based on a current diagnosis of the service to be provided.

The assessment of current and future infrastructure needs is usually carried out through a comprehensive data collection to provide the executing agency with information for long-term planning. This is a resource-intensive and human capital-intensive process that provides quality information for the long term. For example, in 2015, the Colombian Ministry of Transport conducted a comprehensive analysis of the density and quality of existing transport infrastructure, growth trends in cities and regions, and current traffic flows to formulate an Intermodal Transport Master Plan that would respond to the country’s needs for the next 20 years (Box 5.7).

Box 5.7. Identifying gaps: Colombia’s Intermodal Transport Master Plan

To address infrastructure needs for the next 20 years, in 2015, the Colombian Ministry of Transport adopted an Intermodal Transport Master Plan. The plan was the product of a joint effort between different national level entities and agencies.

The plan has three key objectives: 1) boost foreign trade by reducing transport costs and times; 2) enhance regional development by improving the quality of networks for accessibility purposes; and 3) integrate the territory by increasing the presence of the state.

To this end, two initial goals were defined: 1) consolidate a list of priority projects to start structuring them in good time; and 2) develop a competitive transport network adapted to the country’s needs until 2035.

The Intermodal Transport Master Plan was based on data on the density and quality of existing transport infrastructure, growth trends in cities and regions, and current traffic flows. Based on these data, the Colombian government forecasted local and regional economic growth that will drive future transport infrastructure demand in the country over a 20-year period.

The results of the strategic foresight analysis informed the lines of work included in the Intermodal Transport Master Plan. They served as a basis for the design of transport policies such as the 4G toll road concession programme.

Source: National Infrastructure Agency (2015[33])

Similarly, some OECD countries have adopted a bottom-up perspective to guide decision makers in designing strategies for infrastructure investment. For example, the Australian Infrastructure Audit created a database to analyse the country’s infrastructure challenges (Box 5.8).

Box 5.8. Contextual analysis for infrastructure investment in Australia

In 2015, the Australian Infrastructure Audit created a database to analyse Australia’s infrastructure challenges. Extensive data were collected on major capital cities and population, and numerous congestion models were developed. The Australian Infrastructure Audit undertook a national roadshow to raise the audit’s issues and solicit proposals to address the problems identified. It also consulted widely on the policy and reform component of the Australian Infrastructure Plan. It received submissions from a diverse group of stakeholders while working closely with the independent Council. The evidence base collected and stakeholder input provided a bottom-up planning perspective.

The first Australian Infrastructure Audit process was conducted in 2015 and a second exercise was carried out in 2019. In both cases, a three-stage methodology, informed by strategic foresight methods, was applied to understand Australia’s infrastructure needs over the next 15 years. Stage 1 involved horizon scanning to understand the national and global forces likely to shape Australia in the coming years and decades. These trends focus on the changes that are likely to transform the way Australians live and, consequently, what they will need from infrastructure. Phase 2 applied these trends to the transport, water, energy, telecommunications and social infrastructure sectors to understand the likely future impacts and needs of these sectors. Based on this analysis, Stage 3 of the audit identified a set of sectoral and cross-sectoral challenges and opportunities, which are issues, gaps, problems and untapped potential where infrastructure can play a role in improving the lives of Australians and economic growth.

The Australian Infrastructure Plan and the Infrastructure Priority List are further underpinned by a detailed “place-based” analysis to provide a top-down planning perspective. The analysis projected the current and future demographic and economic characteristics for 73 regions of the country. The Australian Infrastructure Audit also estimates the direct economic contribution and gross value-added measures for each region. The regions with the most significant increases in direct economic contribution over time are identified as “hot spots”, and an attempt is made to assess what type of investment will help drive the greatest economic impact in these regions. The hot spots are Sydney, Melbourne, Brisbane and Perth, where three-quarters of Australia’s population growth is expected to occur between 2011 and 2031. Infrastructure Audit’s Infrastructure Priority List aims to provide structured guidance to decision makers and was created using both “top-down” and “bottom-up” approaches. See Box 5.14 for a detailed discussion on the framework for assessing initiatives and projects to be included on Australia’s Infrastructure Priority List.

Source: Infrastructure Australia (2018[34]); OECD/ITF (2017[35])

Finally, it is important to note that OECD countries are increasingly adopting “strategic foresight” planning methods beyond simply identifying current gaps and extrapolating past trends to forecast future needs. For example, the UK governments Intelligent Infrastructure Futures project studied how, over a 50-year period, science and technology can be applied to the design and implementation of intelligent infrastructure for robust, sustainable and safe transport and its alternatives (Box 5.9).

Box 5.9. The United Kingdom’s Intelligent Infrastructure Futures

The UK government’s Intelligent Infrastructure Futures project looked at how, over a 50-year period, science and technology can be applied to design and implement intelligent infrastructure for robust, sustainable and safe transport and its alternatives. The project involved nearly 300 people at national, regional and local levels and commissioned leading researchers to examine transport challenges in the United Kingdom.

The project sought:

smart design, minimising the need to travel, through urban design, integration and management of public transport, and local provision of production and services

a system capable of providing intelligence, with sensors and data mining providing information to support the decisions of individuals and service providers

an intelligent infrastructure, capable of processing the vast amount of information that is collected and that can adapt in real time to provide the most efficient services.

Researchers from different areas focused on exploring and describing the state of the art in various areas of science, including psychology, physical sciences and technology, to determine what these could offer in terms of infrastructure in the coming years. The project covered diverse areas such as artificial intelligence, data mining and travel psychology.

The objectives are to develop:

a technology vision for the future to review existing road maps for technology development and implementation

a set of scenarios that provide a set of credible and coherent pictures of what technology could be invested in and how society might react to those investments.

Nearly 300 people participated in these exercises, ranging from research experts to service providers to policy and investment decision makers at national, regional and local levels.

Source: Foresight Directorate (2006[36]),

5.3.4. Multiannual programming has been unrealistic and cannot provide a long-term vision

Multiannual investment programming is characterised by prioritising the pre‑investment process and strategic visioning as an early part of the investment cycle

The MIP’s guidelines emphasise that it is a collective process of technical analysis and decision making on the priorities to be given to the objectives and goals that the entity plans for achieving its expected social and economic outcomes for citizens. It concentrates the responsibility for the financial estimation of revenues and authorisation of expenditures for a given period to match existing resources and investment resources (Government of Peru, 2022[37]).

While MIP has made great strides in identifying needs and how these can inform the investment process, some limitations hinder its ultimate goal.

Programming is not binding and is not yet fully based on credible budget ceilings

Without linkage, programming ended up being an open-ended exercise of identifying needs and projects; the capacity to effectively programme investment is limited.

For there to be adequate programming in line with international best practices, this instrument must be binding so that projects that reach this programming stage can receive resources, and the link between the National Public Budget System and multiannual investment programming can be made effective.

Until 2021, the multiannual investment programming did not have budget ceilings, which led to needs estimates being made based on demands without taking into account the capacity to finance these needs. This has been identified as one of the most notorious shortcomings of the system, and pilot tests have been carried out to incorporate budget ceilings. From 2022 onwards, the ceilings are intended to limit and prevent entities from proposing portfolios that exceed the existing actual budget. In the process of maturing the investment system, looser ceilings have been implemented in conjunction with regional governments, local governments and sectors, allowing for much more realistic investment portfolios to be programmed. Using ceilings during programming is a good practice that allows for a more structured exercise.

The MIP should be both a long-term planning instrument and a programming tool that informs the annual budget process

In the long term, the MIP is designed to link the planning process (led by CEPLAN) with the annual and multiannual budget. It is in charge of: defining the gap indicators; carrying out multiannual investment programming based on the identified gaps; establishing the investment portfolio. These responsibilities are too complex to be handled by a single tool. In reality, the functions overwhelm the implementation and operational capacity of the MIP, which needs to be complemented and supported by a long-term infrastructure planning process.

5.4. Formulation and prioritisation: For an accurate diagnosis and implementation

As the resources available for infrastructure investment are limited, prioritisation is essential to ensure that these resources are invested in the right projects (OECD, 2017[23]). It is essential to have:

A clear and transparent prioritisation process, aligned with the fiscal planning framework to ensure that investments deliver the expected social and economic benefits, while contributing to the country's long-term strategic objectives.

A budgeting process that reflects prioritised projects in the budget.

An implementation process that also respects established prioritisation.

OECD good practice suggests that countries should have rigorous project formulation and selection processes that focus on socio-economic efficiency (taking into account economic, social, environmental and climate costs and benefits) and consider the entire project cycle (OECD, 2020[21]).

5.4.1. The pre-investment phase places a greater emphasis on quantity than quality

Lack of a methodology to evaluate infrastructure projects affects project quality

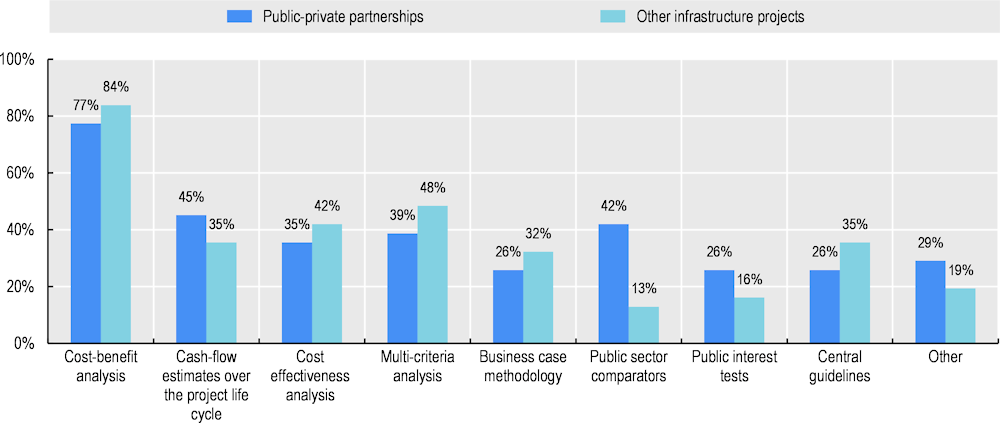

Most OECD countries have different methodologies for evaluating infrastructure projects, with cost-benefit analysis and multi-criteria analysis being the most commonly used techniques (Figure 5.11). For example, one of the strengths of the Chilean model is its social cost-benefit evaluation system, which imposes a considerable degree of rigour on the project formulation and selection process. The social evaluation methodology ensures that only projects that generate a minimum social return receive funding (Box 5.10).

Figure 5.11. Methodologies used to appraise infrastructure projects, 2020

Box 5.10. Socio-economic evaluation in Chile

The socio-economic evaluation of proposed infrastructure projects follows a rigorous process in Chile. All major projects are evaluated within the framework of the National Investment Evaluation System (NIS), overseen by the Ministry of Social Development. The NIS provides a methodology for assessing the costs and benefits of each type of infrastructure based on years of accumulated experience in each sector and international best practices. For the rail sector, the official methodology was updated in 2016. It provides guidelines to project developers concerning asset life, discount rates, rates of return, etc. The NIS also points out the importance of establishing a link between ex ante and ex post evaluation. In particular, it advises project promoters to develop performance indicators (financial, operational and socio-economic) that can inform mid-term and ex post evaluations of the project in question.

This framework offers a number of advantages:

1. First, it ensures that a uniform and consistent methodology is available for all infrastructure projects, allowing a comparison to be made between the different alternatives.

2. Second, it assigns clear responsibilities to project development (regions, sectoral ministries), evaluation (Ministry of Social Development) and approval (Ministry of Finance).

3. Third, it introduces a high degree of transparency because all inputs and outputs are made public on the Ministry of Social Development’s website.

However, the OECD has also identified some shortcomings of the NIS system. The requirement to have a socio-economic assessment is not binding, and the Ministry of Social Development may instead authorise the use of least-cost analysis for most projects. In addition, the system does not integrate environmental impacts into the assessment. The NIS also imposes considerable requirements on project developers. Smaller and poorer regions may not have sufficient resources to carry out a detailed and convincing ex ante analysis.

Sources: OECD (2017[38]).

Invierte.pe aims to facilitate and streamline the formulation and evaluation phase with tools such as standardised technical sheets (Box 5.11) for recurrent projects whose technical and economic variables are easy to understand. Procedures were simplified to streamline the investment process. Likewise, as mentioned at the beginning of this chapter, the same body that formulates the project also evaluates it and decides on its viability. While this makes the process more agile, it also weakens the quality control process during project formulation.

Box 5.11. Invierte.pe tools and formats

Standardised data sheets

Among the most relevant aspects of the formulation and evaluation phase, the phase in which the pre‑investment analysis is carried out, is the creation of standardised technical sheets. The sheets are used for the most recurrent and replicable projects, leaving the profile level studies only for the most complex projects. The sheets are pre-determined standardised formats with data for the main variables for project sizing and costing. The bodies responsible for recommending the types of projects to be standardised are the line ministries’ multiannual investment programming offices (MIPO).

The Formulation Unit evaluates these sheets and carries out the pre-investment studies. It is also responsible for registering the projects in the Investment Bank as well as the results of the evaluation of the projects.

This phase, like the other phases of the investment cycle, is decentralised, and it is the responsibility of each formulating unit of the three levels of government to formulate, evaluate and declare the feasibility of their investment projects. However, for investment projects requiring issuing of external debt above one year maturity, the DGPMI of the MEF must issue a favourable opinion prior to the viability, in order to ensure compliance with the methodologies, technical standards and quality compliance of these projects.

Formats and information systems

The new investment system, Invierte.pe, a product of the registration carried out by operators, provides formats with data and variables of investment projects, providing technical and economic information in a clearer and more precise manner. It has also developed its information systems, incorporating in its design a technological information portal (Investment Bank) that facilitates access to relevant information by the actors involved and the general public. The system has supplementary information and formats that guide the investment process of sectors and municipal governments.

Source: Ministry of Economy and Finance (2017[20]).

There are no quality assurance processes for large investment projects

The Peruvian system does not provide for special quality assurance processes for large infrastructure projects. Given the importance of large infrastructure projects in the provision of public services and the potential impact they can have on public accounts, many OECD countries have special quality assurance processes for large infrastructure projects. Best practice suggests that for projects above a high investment threshold, it is particularly important to provide for an independent function to check project costing, risk management and project governance, as is the case in Norway (Box 5.12). The United Kingdom has set up a central agency to support the governance of large projects (Box 5.13). In these cases, special approval and/or support processes (e.g. through an independent approval body) are needed to provide adequate quality assurance and control for large infrastructure projects.

Box 5.12. The two-phase quality assurance process for large projects in Norway

In Norway, projects with estimated costs above NOK 750 million (EUR 72 million)1 are subject to additional scrutiny through a two-stage quality assurance (QA) process. The process includes input from independent reviews and was initially introduced to combat cost overruns.

QA1 focuses on quality assurance of the choice of concept. It is carried out before the government cabinet selects the projects to be included in the National Transport Plan. The central objective of this analysis is to check, at a relatively early stage, that the project has undergone a “fair and rational” choice process. It is carried out by the responsible ministry or government agency and includes an investigation of alternative solutions, socio-economic impacts and the project’s relevance to transport needs. Emphasis is placed on environmental and social impacts, land-use implications and regional development. This assessment should, among other things, include a “business as usual” option (“zero option”) and at least two alternative and conceptually different options. The external reviewers’ role includes analysing and reviewing the documents.

QA2 focuses on quality assurance of the management basis and cost. It applies to projects included in the National Transport Plan but not yet submitted to parliament for approval and funding. The objective is to check the quality of inputs to decisions, including cost estimates and uncertainties associated with the project, before it is submitted to parliament for a decision on the allocation of funds. It includes the assessment of cost estimates derived from the basic engineering work and the evaluation of at least two alternative procurement strategies. However, QA2 does not include the review and update of the cost-benefit analysis carried out in QA1, unless the project appears to have changed significantly from the option chosen in QA1. In addition, QA2 focuses on project management in the implementation phase. The Norwegian project evaluation and selection process includes considerable consultation and discussion in the initial phase between agencies and lower levels of administration, as well as with other stakeholders.

1. NOK 1 = EUR 0.096 (exchange rate as of 10 October 2022).

Source: OECD (2020[24])

Box 5.13. Central agency involvement in the governance of major projects in the United Kingdom

The UK Infrastructure and Projects Authority has set up a Major Projects Review Group (MPRG), a group of experts from which panels are formed to examine the largest and most complex government projects. It is co-chaired by the Director-General of the Civil Service and the Second Permanent Secretary to the Treasury. MPRG panels challenge projects on their feasibility, affordability and value for money at key points in the project life cycle.

Projects are selected for review by the MPRG according to the following criteria:

projects with a total lifetime cost of more than GBP 1 billion (EUR 1.140 billion)1

high-risk and complex projects in terms of obtaining and delivering benefits

projects that set a precedent or are highly innovative

other projects “of interest” (as agreed by the Chairman of the MPRG, may be recommended by HM Treasury or the Infrastructure and Projects Authority).

Major departmental projects are periodically reviewed to determine if they meet the above criteria and approval is sought from the MPRG Chair to add the identified projects to the calendar.

The MPRG timetable is flexible, and the MPRG can meet at any time if a project is of “concern”. However, projects will generally be reviewed at the following key stages:

strategic feasibility study stage

feasibility study stage – before the project is put out to tender

full business case stage: after receipt of tenders but before contract award, or in the case of competitive dialogue, before closing the dialogue.

Once a project has been reviewed at any stage by the MPRG, the MPRG Panel will decide if and when the project should return to the MPRG.

The MPRG may also review departmental project portfolios and/or departmental programmes.

1. GBP 1 = EUR 1.14 (exchange rate as of 10 October 2022).

Sources: OECD (2020[24]); HM Treasury (2011[39]).

There is no process for identifying a short list of priority projects

One of the objectives of the multiannual investment programming in Invierte.pe is to provide prioritisation criteria. It is up to each sector to approve the gap indicators in their area of responsibility.

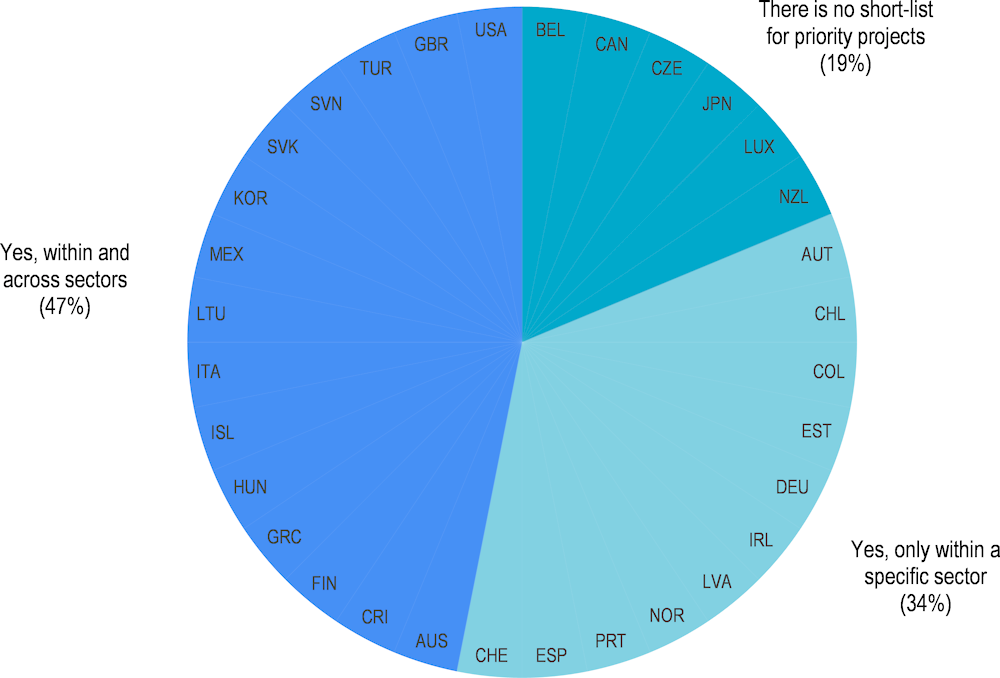

Unlike most OECD countries, Peru does not have a process to identify a short list of priority projects. There is no medium-term planning tool to link multiannual strategic planning with the annual or semi-annual execution of investment projects, nor is there a short portfolio to help predict fiscal limits and their relationship to the long-term strategy.

45% of OECD countries have a short list of priority projects at the national level (Figure 5.12). This allows countries to standardise the criteria to prioritise investment projects and set medium-term objectives. Such instruments not only help to guide public investment strategy, they also clarify national investment priorities and identify synergies and complementarities between projects (ECLAC, 2021[40]). Some countries, such as Australia, have a clearly defined process for prioritising projects and preparing short lists (Box 5.14).

Figure 5.12. Prioritisation of projects at national level

Box 5.14. Framework for assessing initiatives and projects to be included on Australia’s Infrastructure Priority List

Infrastructure Australia, an independent body with a mandate to prioritise and advance infrastructure of national importance, aims to provide independent research and advice to all levels of government, investors and infrastructure owners on the projects and reforms Australia needs to support economic growth and quality of life, and to substantially improve national productivity in all infrastructure sectors.

It is responsible for strategically auditing nationally significant infrastructure and developing 15-year rolling infrastructure plans that specify priorities at the national and state level. It works collaboratively at an early stage with proponents of potential infrastructure solutions to help them define infrastructure problems and support them in developing initiatives, and ultimately business cases, that address those problems.

One of its tasks is to draw up the Infrastructure Priority List (IPL). The IPL represents potential infrastructure solutions at two different stages of development: initiatives and projects. Most projects are first identified as initiatives and then converted into full business cases for assessment by Infrastructure Australia.

For initiatives and projects to be included on the IPL, the process is as follows:

the proponent submits an initiative or business case and other supporting information to Infrastructure Australia for consideration in the IPL

each proposal is evaluated by an Infrastructure Australia evaluator

the assessment is reviewed by Infrastructure Australia’s Assessment Panel

the evaluation group, through the executive director, makes a recommendation to Infrastructure Australia’s board of directors

Infrastructure Australia’s board of directors takes the final decision to include an initiative or project on the IPL.

The Assessment Framework sets out the analysis parameters Infrastructure Australia uses to consider initiatives and projects for inclusion on the IPL. The framework facilitates the development of evidence-based infrastructure projects and sets out a five-stage process, as follows:

1. Problem identification and prioritisation: A collaborative process between proponents and Infrastructure Australia to identify and prioritise evidence-based problems and opportunities of national significance.

Infrastructure Australia develops a consensus list of issues and opportunities of national significance and opportunities that will serve as the basis for identifying initiatives.

Problems and opportunities of national importance arise from one of these sources:

Australian Infrastructure Audit

strategic planning exercises carried out by service providers, such as transport master plans or water plans

state infrastructure strategies.

Problems and opportunities of national significance should be expressed in the form of direct statements linked to jurisdictional goals and objectives, such as improving Australia’s productivity. These statements should clarify how the problem (opportunity) could impede (support) the achievement of these goals and objectives, today and in the future.

In addition to understanding and measuring the problem, proponents should demonstrate how the problem or opportunity aligns with government priorities, as well as with other problems, programmes and projects.

2. Identification of initiatives and development of options: Proponents develop options that address the issues and opportunities identified in Stage 1 and evaluate these options to select those that are the most likely to benefit the Australian community. Infrastructure Australia assesses whether the range of options is appropriate and the assessment of options robust.

3. Business case development: Proponents develop a comprehensive business case that objectively considers the short list of options available to address the problems and opportunities identified in Step 1.

4. Business case assessment: Infrastructure Australia conducts a business case assessment and works with the proponent to clarify the content of the business case and seek supplementary information where necessary.

5. Subsequent review: This phase takes place once the project has been delivered and is operating. Working with the proponent and other stakeholders, Infrastructure Australia will seek to understand the outcomes of the project as well as the project delivery, whether the benefits have been realised as expected, whether the cost estimates were correct, and what lessons can be learnt.

See Box 5.8 for a detailed discussion on the contextual analysis for infrastructure investment in Australia.

Sources: OECD (2020[24]); Infrastructure Australia (2018[34]).

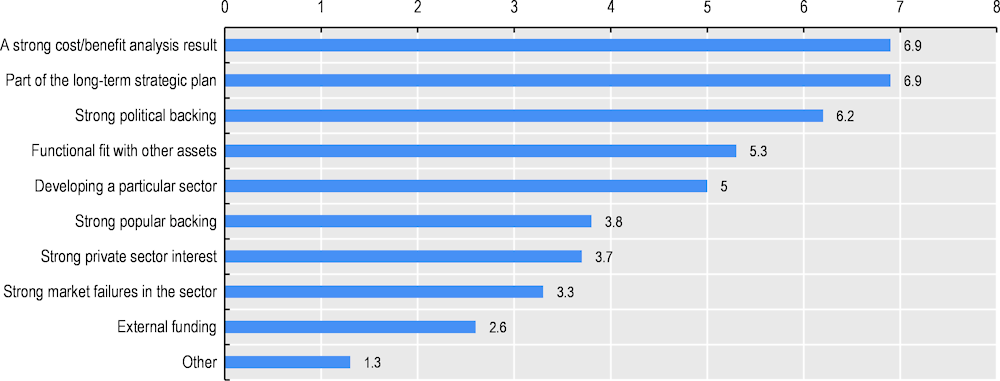

In most OECD countries, the most important element for projects to be short-listed is a good cost-benefit analysis, followed by the project being part of the long-term strategic plan and having strong political backing (Figure 5.13). Other important criteria are the functional fit of the project with other infrastructure and its importance for the development of a particular sector.

Figure 5.13. Project prioritisation and approval criteria, 2018

Note: 1 = least important, 10 = most important. The graph reflects the average number of ranking points.

Source: OECD (2018[41]), Survey of Capital Budgeting and Infrastructure Question 12.

5.4.2. Formulation of the investment budget: The approved budget does not reflect the prioritisation made

The investment budget is voted at a very micro level, indicating each of the investments to be financed (Annex 5 of the Budget Law)

In Peru, the budget does not only indicate the overall amount for investment per entity, or possibly some detail on the most important investments (either by size or strategic character), but presents the complete list of all investment projects to be financed during the year (Annex 5 of the Budget Law).

OECD countries tend to vote investment budgets at a more aggregated level usually by sectoral ministry or by mission or programme for countries that have programme budgets. In Australia, for example, each sectoral ministry develops a capital management plan where they prioritise their projects. The discussion of resource allocation is based on the various plans submitted by the sectoral ministries, and each entity is allocated capital expenditure ceilings. Based on these ceilings, banks decide which investments to initiate. Entities have two opportunities per year to submit updates of their capital plans (in February and October). Each year, entities must submit a capital budget execution report, comparing what they had budgeted with the execution and justifying any differences. This implementation report must include a capital budget statement, which shows the financing of planned asset allocations compared to budgeted capital expenditure in the current, budget and next year's estimates, as well as an asset movement table, a capital movement table and the cash flow statement.

The initial investment budget (Annex 5) is modified upon arrival in Congress

Once the multiannual programming offices of the sectors and subnational governments prioritise the projects to be integrated into the project portfolio in the multiannual investment programme, a modification stage begins. These modifications take place in the first half of the year and their revision is more about guaranteeing the prioritisation criteria, that they are aimed at closing mature portfolios and that the projects of the sectors and subnational governments are harmonised (Conversations with the DGPMI).

Once the adjustments have been made, the MIP is included in the Draft Budget Law and sent to Congress for discussion and approval. At this stage, all projects are included in Annex 5, which is the binding document for the implementation of investment projects (i.e. whatever is in this document will receive funding).

Congress has no spending initiative, but it does have the power to revise and redistribute the budget. Thus, in this revision stage, projects are added, mostly new ones, which were not programmed in Annex 5. At this point, Annex 5 has undergone significant modifications, and most of the new projects do not follow the MIP criteria, nor do they have a clear continuity with previous projects. This results in a loss of quality for new projects included in Annex 5. In addition to modifying the composition of Annex 5, it is usual to add additional amounts and increase the initial investment budget, which had been defined under the criteria of the sectoral and sub-national governments' MIPs.

5.4.3. Implementation: The initial budget approved by Congress is modified during implementation, with fewer controls on the quality of the projects added

About half of the projects implemented were in the opening institutional budget, and just over half of the projects in the opening institutional budget are implemented

Once the Budget Law has been passed, after the amendments and discussions on Annex 5, additional demands for resources are usually processed. In other words, once the Budget Law has been approved, it is usually amended by adding projects (see Chapter 2, analysis of budget amendments). Again, the projects added in budget amendments during budget execution have not followed the same quality control mechanism as the projects initially prioritised in the MIP.

There is a big difference between the initial budget, the modified budget and the executed budget for public investments in Peru. In other words, not only is not everything that is initially programmed executed, but also investments are added during the year that will be executed (or at least initiated). Of the projects included in the opening institutional budget, only 58% are executed on average, and of the total executed, only 55% were included in the initial budget (Table 5.1).

Table 5.1. Initial, Modified and Executed Public Investment Budget (2017-2021)

|

Millions of soles |

Budgeted opening institutional budget |

Executed opening institutional budget |

Budgeted modified institutional budget |

Executed of new investments |

Final executed |

|---|---|---|---|---|---|

|

2017 |

24 057 |

14 337 |

42 260 |

13 970 |

28 307 |

|

2018 |

26 599 |

15 337 |

49 334 |

16 736 |

32 273 |

|

2019 |

30 678 |

19 757 |

48 849 |

11 995 |

31 752 |

|

2020 |

32 147 |

15 438 |

45 744 |

12 892 |

28 330 |

|

2021 |

38 988 |

23 106 |

56 100 |

15 996 |

39 102 |

|

Average |

30 494 |

17 595 |

48 457 |

143 178 |

319 523 |

Source: Prepared by the authors with data from the MEF and the Comptroller General's Office (2022[42]).