This chapter explores the framework surrounding regional and local development funding in Ukraine. It assesses the different mechanisms used by the national, regional and municipal governments to fund regional development. First, the chapter describes how basic fiscal indicators related to subnational investment have changed over the past few years. Second, it examines how the distribution of Personal Income Tax could be modified to reduce territorial inequalities and to strengthen service delivery. Third, it takes a close look at the wide variety of intergovernmental grants and subventions that have been established to fund regional and local development. It takes a particularly close look at how certain practices, such as co-funding requirements, could affect regional convergence efforts. Finally, the chapter addresses the capacity of local governments to manage investment, as well as the use of public-private partnerships.

Rebuilding Ukraine by Reinforcing Regional and Municipal Governance

5. Public funding for regional development in Ukraine

Abstract

Preface: Building on Ukraine’s regional development funding mechanisms to support recovery from the war

This chapter assesses the different mechanisms that are used by the national, regional and municipal governments to fund regional and local development. In particular, it analyses the wide array of intergovernmental grants and subventions1 for regional development, and the way in which certain characteristics of these funds risk limiting regional convergence efforts. The chapter also addresses the capacity-related challenges facing local governments to effectively manage investment.

Considerations for funding Ukraine’s national recovery plan at the subnational level

The data and analysis presented in this chapter are relevant for designing and implementing subnational level mechanisms to fund Ukraine’s post-war reconstruction and recovery. The discussion of regional and local development funding is central to advising policy makers on how to set up mechanisms to fund the implementation of local reconstruction and recovery projects. At the same time, it is important to acknowledge that the conditions under which the reconstruction and recovery funds need to operate will differ from those designed for regional development. For example, in the recovery context there is a need to achieve swift results, especially in response to humanitarian needs and rebuilding critical infrastructure (e.g. roads, schools, hospitals, housing) (see Chapter 2). In addition, the combined domestic and international financing that will be available for reconstruction will likely be higher than the regional development funds allocated prior to the war. This will put additional pressure on the capacity of governments at all levels—which, as highlighted in this chapter, are already strained—to effectively allocate funding to meet local needs, as well as to ensure that funds are managed transparently and efficiently.

Similarly, the discussion of the strengths and challenges faced by municipalities when managing regional development investments presented in this chapter can inform the design of interventions aimed at boosting their capacity to manage recovery funds. More generally, by detailing the significant advances Ukraine has made since 2014 in funding regional development, this chapter highlights the steps that domestic and international policy makers can take to establish mechanisms to fund subnational recovery and reconstruction. The following paragraphs present key findings from this chapter.

The government should avoid fragmentation of subnational recovery funding

In testament to the importance that Ukraine assigned to regional development policy, between 2015 and 2019, the national government’s budget allocation for regional and local development rose significantly, from slightly over UAH 11 billion to almost UAH 76 billion (U-LEAD, forthcoming[1]). The significant increase in regional development funding since 2015 has enabled the implementation of many projects, ranging from improving economic development and energy efficiency to upgrading local water supply, sewage, and roads. It also provided subnational governments with invaluable experience and skills in managing investment funding, which the government can build on to ensure efficient investment for subnational recovery and reconstruction.

Ukraine’s framework for funding regional development, however, has been quite fragmented. Between 2015 and 2019, a total of 110 grants and subventions linked to regional and local development were implemented by a wide range of institutions. This risks increasing costs related to the administration of funding, as well as overlap among different funds in terms of objectives and target groups. Given the fragmentation of regional development funding and the wide array of national-level institutions involved in managing the different funds, the absence of a formal body to co-ordinate regional development funding risks undermining the coherence of regional development spending.

As Ukraine advances in establishing mechanisms to fund subnational reconstruction and recovery, creating a limited number of dedicated funds and subventions to ensure that overarching government objectives are met would be important to limit fragmentation. In addition, to ensure a coherent approach to funding post-war recovery efforts, the government should consider the formation of a centre-of-government body responsible for co-ordinating recovery funding. It will be important to ensure representation of subnational governments that adequately reflects their territorially-differentiated needs and absorption capacities. This body could be linked to the National Council for Recovery.

Investment in local “hard” infrastructure should be complemented by investment in skills

Over the past few years, intergovernmental expenditure on regional development has predominantly focused on “hard” infrastructure, such as roads, bridges, hospitals, factories. Between 2015 and 2019, spending on “hard” infrastructure accounted for 59% of all spending on regional development (U-LEAD, forthcoming[1]). Most investment targeted the construction and maintenance of roads.

Despite these significant investments, however, the vast destruction caused by Russia’s war against Ukraine has drastically increased the need for investment in “hard” infrastructure. By August 2022, damage to Ukraine's buildings and infrastructure as a result of the invasion was estimated at over USD 108 billion, and will likely rise further. Up to 129 000 residential buildings, over 900 healthcare institutions, 23 000 kilometres of roads and 2 200 education institutions have been destroyed or damaged as a result of the war (KSE, 2021[2]).

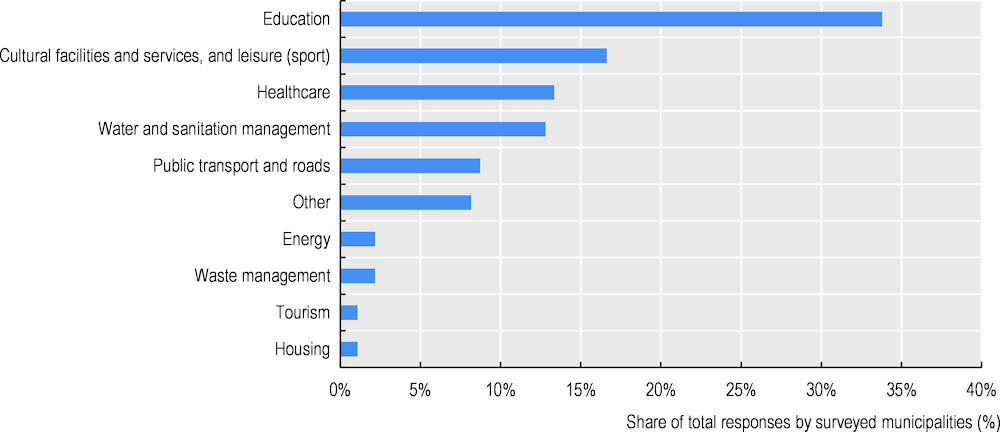

Investment in hard assets (e.g. reconstruction of roads, schools, hospitals, electricity grids) should be the priority during the reconstruction and recovery period. At the same time, however, complementary investments in human capital, as well as support for small and medium-sized enterprises (SMEs) will be essential. OECD analysis highlights that, generally, investing in “hard” infrastructure alone has little impact on regional growth unless it is associated with “soft” investments (e.g. human capital, innovation) (OECD, 2009[3]; OECD, 2020[4]). Indeed, this was also flagged, albeit prior to the war, as a priority by municipalities in an OECD survey (Figure 5.8). Striking the right balance between investment in “hard” and “soft” infrastructure is particularly important in the context of Ukraine’s post-conflict recovery, as many skilled workers have fled the country. This means that the upskilling of internally displaced people may be necessary to facilitate their economic integration into their host communities.

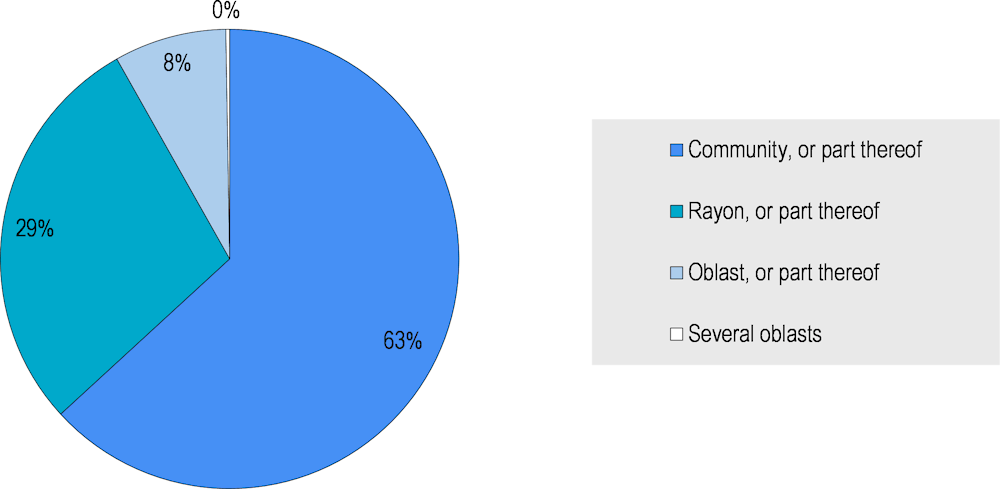

Subnational recovery funding needs to be at the right territorial scale

Prior to the invasion, regional development funding was heavily concentrated in small projects with relatively low economic impact. For instance, between 2015 and 2019, the majority of the initiatives funded through the flagship State Fund for Regional Development (SFRD) only targeted a specific community (63%), and just 8% of projects had a more regional-level focus (Figure 5.10). The dominance of projects that target local-level improvements creates the risk that resources will be used in a less-than-strategic way, as many small projects may tackle similar issues that could have benefited from inter-municipal or inter-regional intervention.

As Ukraine moves forward in designing mechanisms to fund subnational recovery projects, the government should prioritise projects that have a cross-jurisdictional focus in order to achieve economies of scale and increase the resilience of local communities to future natural or manmade shocks. The government could also consider setting up different funding ‘windows’ for initiatives that either have a local, district or regional focus. Determining the right territorial scale of subnational recovery initiatives requires a solid assessment of the particular needs of municipalities across the country and where such needs coincide or diverge. To the extent possible, this needs to be combined with feasibility studies and robust cost-benefit analysis so recovery funds are spent effectively and efficiently. In cases when the government may be unable to conduct full-scale cost-benefit analyses due to their complexity, policy makers should ensure that possible investment projects are still ranked following a more basic assessment of their expected cost and impact.

The allocation and spending of local recovery funds should be transparent and accountability mechanisms should be in place

The government should ensure that decision-making processes regarding the allocation and execution of recovery funding are transparent and that the involved actors at all levels of government are held accountable. This is particularly important as audit reports published prior to 2022 mention the strong political influence over the distribution of Socio-Economic Subvention funds, which have been used for political campaigning in local constituencies. Ukraine is advised to set up mechanisms to oversee the effective, efficient and transparent use of recovery funding, thereby reducing the risk of regional development funds being awarded based on electoral considerations.

Assessments made by the State Audit Service regarding the legal and efficient use of local resources, which were published prior to Russia’s large-scale invasion of Ukraine on 24 February 2022, revealed important violations and shortcomings in the field of public procurement (CabMin, 2021[5]). As such, the government and international partners are advised to support municipalities on issues related to local public procurement and transparent decision making, for example, by providing targeted training or by developing easy-to-use procurement guidelines. Efforts to this effect would be in line with the OECD Recommendation of the Council on Public Procurement, which calls upon countries to develop the necessary public procurement expertise in their workforce so as to be able to continually deliver value for money efficiently and effectively (OECD, 2015[6]). The government and international partners could build on the public procurement training programmes that the European Union-funded U-LEAD programme has provided to different municipalities. It could also leverage the online training course on electronic calls for proposals in the education sector that this donor initiative developed together with the Ministry of Digital Transformation of Ukraine (U-LEAD, 2022[7]). This should be coupled with measures such as mandating internal auditing by municipalities. Doing so requires, among other elements, providing municipalities with financial and capacity building support to conduct reliable and effective internal audits, and learn from audit results.

Increased expertise of municipalities to manage investment can support recovery efforts

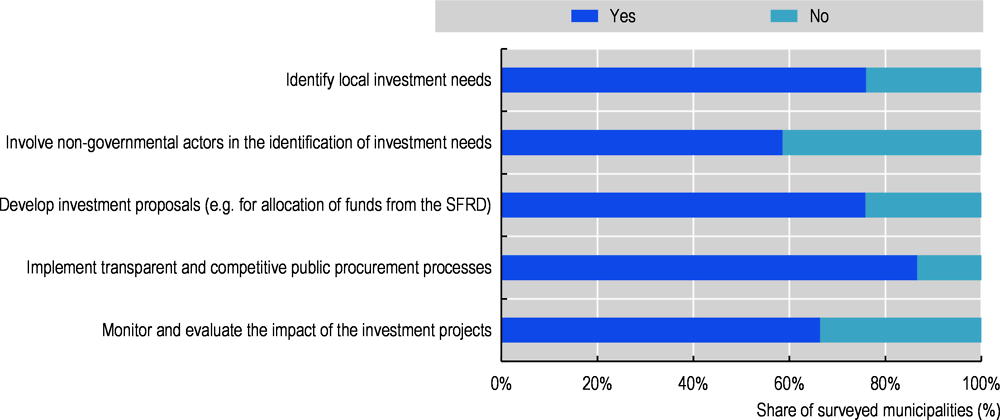

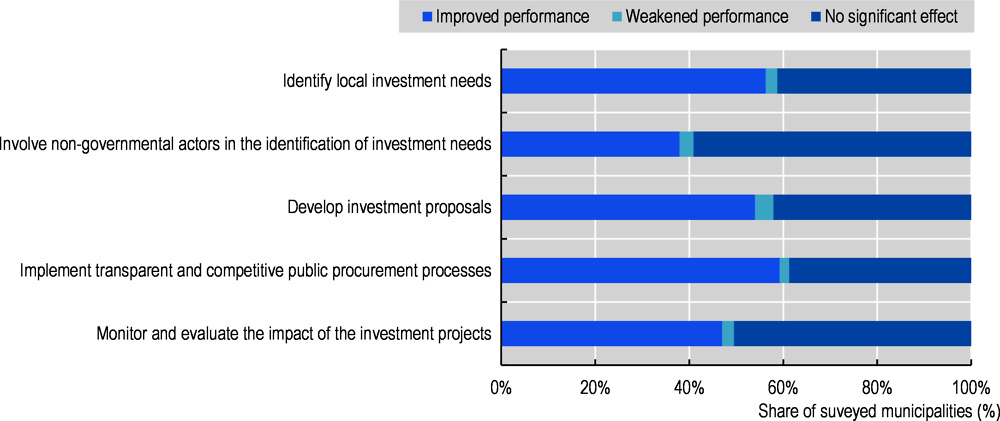

As it advances with its National Recovery Strategy, Ukraine, supported by international partners, should pay close attention to the capacity of subnational government to absorb and process recovery funding. Ukraine can build on the expertise gained by many municipal governments since 2015 in managing funds from different regional development subventions. This includes experiences in identifying local needs, developing project proposals, and implementing investment projects. According to OECD survey results, 76% of surveyed municipalities reported that they had the human resources to develop investment proposals (Figure 5.13). However, there are signs that the quality of project proposals developed by municipalities remains very low (U-LEAD, 2022[7]; OECD, 2021[8]). To address this challenge, Ukraine is encouraged to set up peer-to-peer learning trajectories, for example with European municipalities, to facilitate the exchange of approaches and good practices on the preparation, implementation, and monitoring and evaluation of investment projects.

Close attention also needs to be paid to the question of how to oversee the effective, efficient and transparent use of national and international recovery funding by subnational governments. According to OECD survey results, 87% of surveyed municipalities indicated that they had the necessary human resources to implement transparent procurement processes with appropriate control systems.

Larger cities should explore public-private partnerships and alternatives to support the subnational recovery

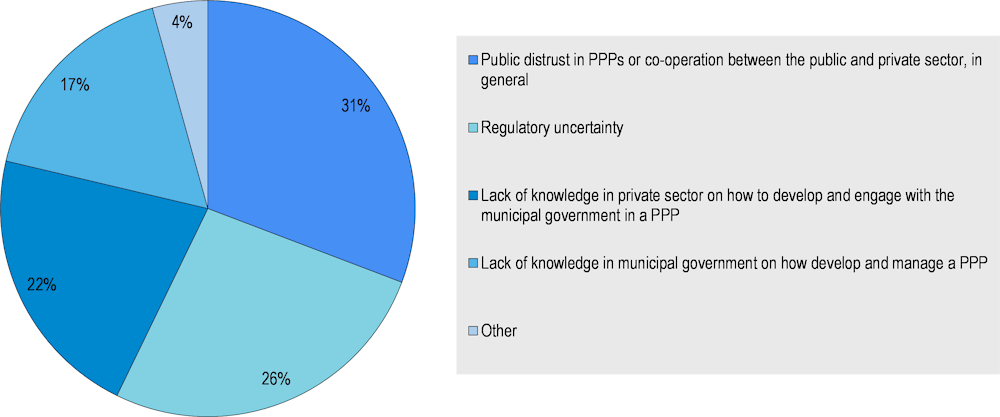

Despite the potential of public-private partnerships (PPPs) to generate resources for investment projects, their use by Ukrainian municipalities is limited (Box 5.11). According to OECD survey results, only 10% of surveyed municipalities reported that they were engaging with the private sector through PPPs. Public distrust in co-operation between the public and private sector, as well as regulatory uncertainty are cited as the main obstacles to setting up PPPs (Figure 5.15).

When determining whether to promote PPPs as a mechanism to support recovery efforts, the government should recall that, generally speaking, only larger cities have the fiscal and institutional capacities needed to implement such partnerships. It should also consider improving outreach to larger municipalities and the private sector about the potential of PPPs, their regulatory framework, while emphasising the multiple risks involved in setting up this type of collaboration. Fiscal risks relating to the use of PPPs are critical to consider. This is particularly the case given the detrimental impact of Russia’s war on Ukraine’s subnational fiscal and human resource capacities. In general, PPPs risk being used to overcome public financial management controls, which can have negative long-term fiscal repercussions for subnational governments. In fact, PPPs should only be undertaken where they are affordable and produce greater value for money than would be provided by the delivery of public services or investment through traditional means, and never to overcome budget constraints.

Introduction

Since 2015, Ukraine has witnessed a marked increase in regional and local development funding—a testament to the importance that the government assigns to regional and local development policy. Between 2015 and 2019, the central government budget allocations to regional and local development increased from slightly over UAH 11 billion (or 1.9% of the total national budget) to almost UAH 76 billion (6.9% of the total national budget) (U-LEAD, forthcoming[1]). This marked increase is due to the implementation of key elements of the regional development and decentralisation reforms since 2014 (see Chapter 4), including the creation of several subventions to fund subnational investment projects. These subventions are, however, not the only source of funding for regional and local development. Others include loans from national and international financing institutions, financial support provided by foreign governments and donor organisations, as well as public-private partnerships (PPPs). Furthermore, Ukraine’s fiscal equalisation system, which aims to help subnational governments deliver comparable levels of public services, should also be considered when designing regional and local development policy, its funding and financing. While not specifically designed to boost regional development, the equalisation system has a profound impact on subnational government capacity to finance investment.

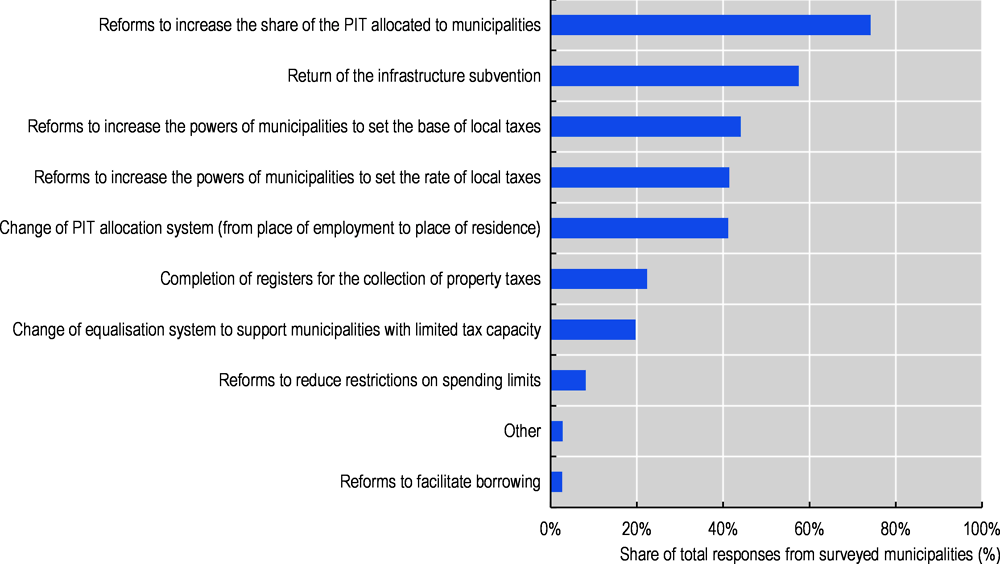

Despite the increase in funding, Ukraine’s capacity to invest in its regional development agenda has been met by four principal challenges. First, the mechanism through which the Personal Income Tax (PIT) is allocated across municipalities—60% of PIT funds go to municipalities, 15% to oblasts and 25% to the national government—appears to negatively affect PIT revenues of many smaller municipalities. Under current legislation, a company must allocate its employees’ PIT to the municipality where the company is registered. As a result, employees in large companies with offices and staff in different parts of the country pay income tax in the municipality in which the company is legally registered, which might not correspond to the place where (most of) their employees actually do their work or indeed live. Second, Ukraine’s regional development funding framework is relatively fragmented and heavily focused on funding the maintenance of “hard” infrastructure. Investing in “hard” infrastructure alone has little impact on regional growth unless it is associated with investment in areas such as human development and innovation (OECD, 2009[3]; OECD, 2020[4]). Prior to the war, this focus undermined the effectiveness of regional development policy as a means to boost regional competitiveness and growth. Third, the co-funding criteria of several of the country’s major regional development funds hamper the ability of poorer municipalities to compete for funding to fulfil their investment needs. Together, these elements risk undermining the objectives of Ukraine’s regional development policy (e.g. building regional cohesion and stimulating competitiveness) by entrenching regional disparities.

To capitalise on the increased funding for regional and local development, Ukraine needs to adjust the distribution mechanism of PIT and address the fragmentation of intergovernmental subventions for regional and local governments. In addition, the design of intergovernmental grants and subventions should better reflect territorially-differentiated investment needs and fiscal capacities. It also requires strengthening oversight mechanisms and the capacity of local governments to manage investments. These actions would help align Ukraine’s regional and local investment frameworks with the OECD’s Recommendation of the Council on Effective Public Investment across Levels of Government to which it adhered in 2018 (OECD, 2014[9]).

This chapter first looks at how Ukraine’s basic fiscal indicators related to subnational revenues and expenditures, particularly related to investment, have changed over the past years. Subsequently, it deals with Ukraine’s fiscal equalisation mechanism and explores how one of its core elements, the distribution of PIT, could be redesigned to strengthen service delivery and public accountability. It then reviews the wide variety of intergovernmental transfers used to fund regional and local development. Finally, this chapter takes a critical look at how local government fiscal and human resource capacity to manage investment has changed during the municipal amalgamation process, and discusses the use of PPPs.

Box 5.1. Recommendations for increasing the effectiveness of Ukraine’s funding for regional and local development

The following recommendations should be considered in a timeframe that is appropriate to the current context of war and post-war reconstruction and recovery.

To help Ukraine optimise the effects of the equalisation system on regional convergence and growth, the government is advised to:

Modify legislation to base personal income tax (PIT) allocation on place of residence, thereby maximising its potential to provide municipalities with financial resources commensurate with the demand for public services and investment in their territory, while also strengthening local political accountability.

Improve data processing systems related to a citizen’s place of residence to allow the government, instead of employers, to allocate PIT to subnational governments.

Conduct an ex-ante study to determine how the different proposals to reform the PIT allocation system would affect the fiscal health of the national, regional and municipal governments, as well as the size of the horizontal fiscal equalisation system necessary to offset, at least in part, territorial disparities in PIT revenues.

Set up a national/subnational government task force to identify policy interventions that would improve the efficiency and effectiveness of the PIT allocation reform, based on the findings of the ex-ante study.

To improve the effectiveness of Ukraine’s grants and subventions for regional development, the government is advised to:

Streamline the number of grants and subventions for regional development, but not reduce their value, in order to increase spending efficiency, avoid overlap and strengthen the quality of implementation. This could be done, for example, by:

Reallocating a higher share of regional and local budget grants and subventions to a single fund (e.g. the SFRD) managed by MinRegion.

Reinforce the capacity of the Inter-Departmental Co-ordination Committee for Regional Development (ICC) to effectively co-ordinate regional development policy and funding, for example by:

Ensuring that, if sub-committees are established within the ICC, one or more support the design, implementation and monitoring of Ukraine’s regional development funding mechanisms.

Balance investment in “hard” and “soft” infrastructure as a means to promote balanced regional development, for example by:

Ensuring that funds and subventions with a cross-sectoral focus, such as the SFRD, facilitate investment in areas such as innovation and skills, as well as “hard” infrastructure.

Adjust the SFRD distribution formula to improve regional convergence, for example by:

o Linking the formula to the population and GDP per capita of rayons instead of oblasts or increasing the share of SFRD funds allocated to those territories that have a relatively low GDP.

Ensure that poorer municipalities, those with limited technical and financial capacities, as well as those most affected by Russia’s war against Ukraine, can compete for regional development funding against their wealthier peers and/or those with greater technical capacities by, for example:

Providing municipalities with more clarity on eligibility criteria.

Boosting their technical skills to develop competitive proposals.

Linking co-funding requirements to the fiscal capacity of municipalities.

Setting up a complementary general block grant that provides all oblasts and municipalities with a minimum level of funding to implement their respective regional and local development strategies. This must be coupled with robust oversight mechanisms to ensure that investment projects meet clear local and/or cross-jurisdictional needs.

Modifying the SFRD regulations to promote funding of multi-year projects that have a cross-jurisdictional focus.

To help strengthen the ability of regional and municipal governments to fund regional development and finance investment in the medium and long term, Ukraine is advised to:

Develop and implement methodologies that municipalities can use to identify investment needs, given the scarcity of territorially-disaggregated data, and to effectively engage with governmental and non-governmental actors.

In collaboration with international development partners, provide training and advice to municipalities, particularly those with more limited capacities, in areas such as stakeholder engagement, as well as monitoring and evaluating investment projects.

To improve the legal and efficient use of regional development funding in the short to medium term, Ukraine is advised to:

Mandate internal auditing by all municipal governments. This requires, among other elements, providing municipalities with financial and capacity building support to conduct reliable and effective internal audits, and learn from audit results.

Ensure effective communication between the municipalities, the State Audit Service, and the ministries that manage regional development funds to identify common challenges and bottlenecks in financial management and procurement, and propose tailored actions to address them.

To increase the responsible use of public-private partnerships as a means to fund and finance regional and local development in the short and medium term, Ukraine is advised to:

Improve outreach to larger municipalities and the private sector about the potential of PPPs, the regulatory framework and, in particular, the multiple risks involved in setting up and managing a public-private collaboration. This could also include national government guidance regarding alternatives to PPPs that present value for money, and their potential benefits and risks.

Develop and disseminate training material for municipalities on assessing the value-added of PPPs, managing such partnerships, as well as establish a transparent system to track the use of public funds and determine their effectiveness.

Sources of regional development funding in Ukraine

Since 2015, Ukraine has made significant progress in its approach to planning for regional development at the national, regional and local levels. Regional and local development initiatives are funded through multiple sources, including intergovernmental transfers, shared taxes, such as PIT, as well as own-source taxes of subnational governments. Furthermore, both national and subnational governments receive donor support to finance regional and local development projects, and under certain conditions some subnational governments can borrow from national and international credit markets.

Ukraine’s performance on selected fiscal indicators since 2015

An assessment of Ukraine’s performance on a series of fiscal indicators related to subnational revenues and expenditures since 2015 points to challenges in the ability of oblasts, rayons and municipalities to fund and finance investment. It also shows a continued dependency of subnational governments on transfers by the central government and revenues from PIT.

Share of subnational expenditure as part of all public expenditure has remained stable

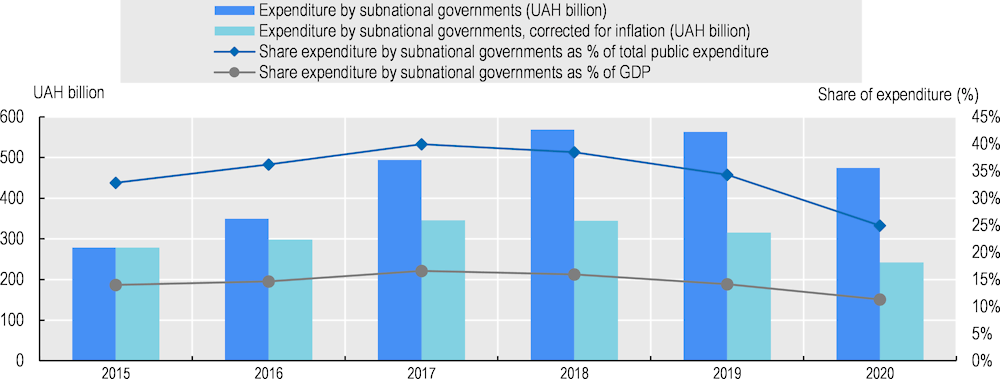

Between 2015 and 2019—prior to the COVID-19 pandemic—Ukraine reported an increase in subnational expenditure (i.e. oblasts, rayons and municipalities combined) in nominal and real terms (Figure 5.1). Over this five-year period, the share of subnational expenditure as a percentage of total public expenditure fluctuated between 33% and 40%, similar to the European Union (EU-28) average (34% in 2019), but below that of the OECD (40%) (OECD, 2022[10]). It was also similar to that of Poland (34%) whose population and three-tiered subnational government structure is relatively comparable to that of Ukraine (OECD, 2022[10]).

Figure 5.1. Subnational expenditure, 2015-2020

Source: Author’s elaboration, with data from (IMF, 2022[11]; World Bank, 2022[12]; World Bank, 2021[13]).

In 2020, however, the spending share by subnational governments dropped sharply to only 25% (OECD, 2022[10]; IMF, 2022[11]), reflecting in large part the decision of the government to reduce the size of several funds open to subnational governments in order to create the COVID ‘Stabilisation Fund’. This fund was used, in part, to make additional payments to medical workers and assistance to the elderly, and to help subnational governments cope with the pandemic. Another factor contributing to this decrease were changes in the mechanisms for funding social protection and healthcare. Since 2019, a significant part of expenditures in both areas are funded directly from the national budget. In 2019, Ukraine’s subnational expenditure as a percent of gross domestic product (GDP) was 14%, similar to that of Italy and Poland (OECD, 2022[10]). The large drop in subnational expenditure between 2019 and 2020 meant that between 2015 and 2020, subnational expenditure actually declined in real terms (-13%).

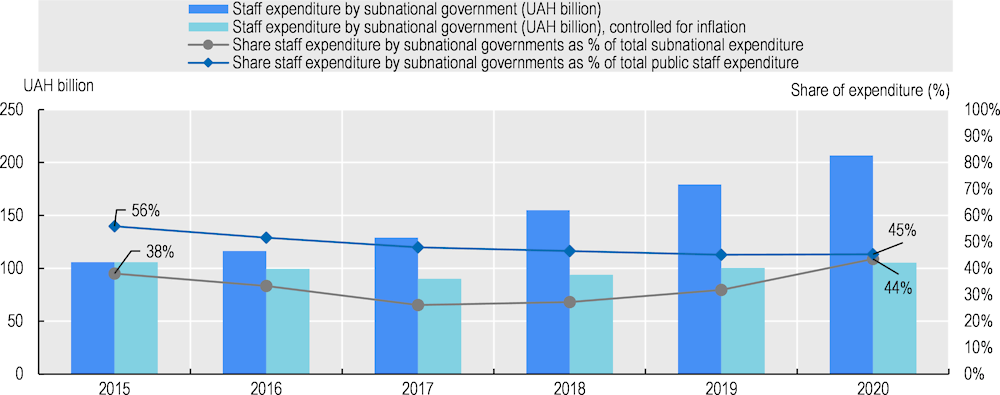

Ukraine’s subnational governments continue to be important public employers, albeit less so than in 2015. Whereas in 2015, the share of subnational staff expenditure of all public staff expenditure was about 56%, by 2019 this decreased to 45%, and was stable in 2020 (Figure 5.2). This is below the 2019 averages of the EU-28 (51%), the OECD (62%) and Poland (53%) (OECD, 2022[10]). The reduction between 2015 and 2020 can be explained by the fact that in this six-year period, staff expenditure by the national government increased more rapidly (298%) than that of subnational governments (194%). Moreover, this period coincides with the rollout of the municipal amalgamation process. In real terms, subnational expenditure on staff costs remained relatively stable between 2015 and 2020.

Figure 5.2. Staff expenditure by subnational governments, 2015-2020

Between 2015 and 2020, the share of subnational staff expenditure as part of all subnational public expenditure fluctuated between 26% and 44%, peaking in 2020 (IMF, 2022[11]). The marked increase between 2019 and 2020—from 32% to 44%—reflects the sharp drop in the overall expenditure by subnational governments and an increase in nominal staff costs. In 2019, the share of subnational staff expenditure as part of all subnational public expenditure was similar to the EU-28 average (both 32%) yet less than that of the OECD (35%) and Poland (38%) (OECD, 2022[10]).

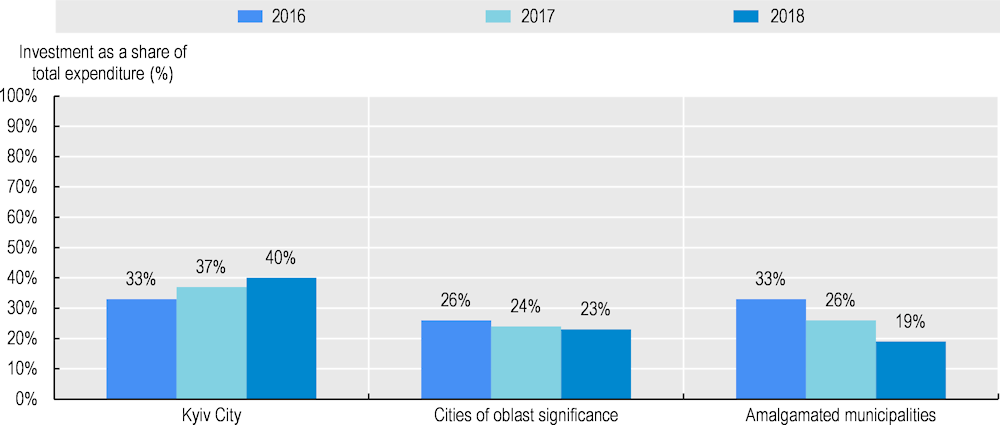

Share of subnational investment as part of total subnational expenditure increased slightly

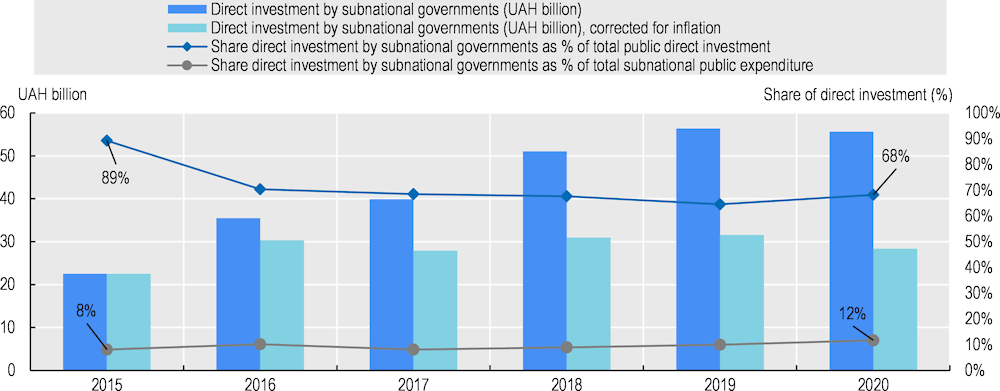

Between 2015 and 2020, direct investment by subnational governments increased both in nominal and in real terms (147% and 26%, respectively) (Figure 5.3). Meanwhile, the share of subnational direct investment as a percentage of total public direct investment dropped 21 percentage points. Despite dropping from 89% in 2015 to 68% in 2020, the share of subnational investment in total public direct investment remained well above the 2019 EU-28 (54%) and OECD (56%) averages, as well as that of Poland (49%). It was similar to that of Colombia (69%), Germany (68%), Japan (70%) and Switzerland (68%) (OECD, 2022[10]). As such, Ukraine’s subnational governments continue to play a pivotal role in public investment. Between 2015 and 2020, the share of direct investment by Ukraine’s subnational governments of all subnational expenditure increased slightly, from 8% to 12%.

Figure 5.3. Direct investment by subnational governments, 2015-2020

These fiscal indicators should be interpreted with caution as oblasts and rayons are composed of both deconcentrated and decentralised entities. This means that parts of their budgets, although categorised as “local government sector” in national accounts, should be classified as “central government sector”. For example, oblast executive committees are not elected. They represent the central government and report to a presidentially appointed oblast governor. Conversely, oblast and rayon councils have relatively few powers. As a result, the data presented above tends to overestimate the weight of the subnational sector.

Central government transfers remain a major source of subnational revenue

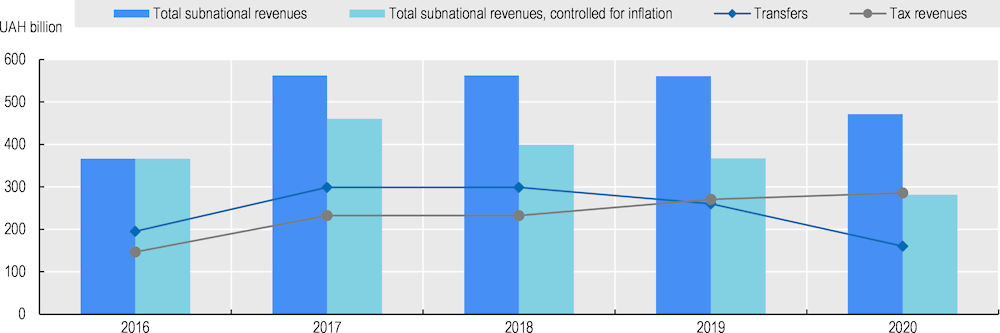

Between 2016 and 2020, subnational revenues increased significantly in nominal terms: from UAH 366 billion in 2016 to UAH 471 billion in 2020. However, when controlling for inflation, subnational revenues actually declined by 23% over this five-year period (CabMin, 2021[5]; World Bank, 2021[13]). Over these same years, subnational tax revenues as a share of total public tax revenues increased from 22% to 25%. While this is lower than the 2019 OECD average of 31%, it is slightly above that of the EU-28 (23%) and of Poland (20%) (OECD, 2022[10]; IMF, 2022[11]). This change was, however, accompanied by a reduction in the share of subnational revenue as part of all public revenue: from 40% in 2016 to 28% in 2020. Over the five-year period, revenue of the national government increased by 182% compared to 128% for subnational governments.

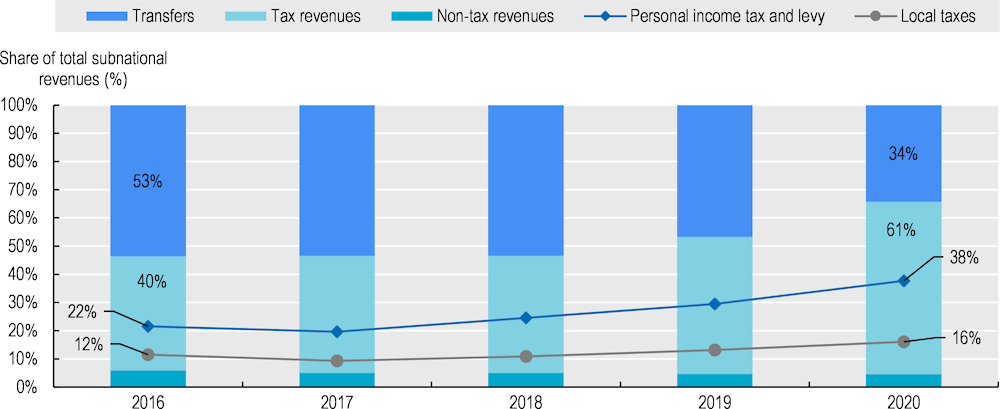

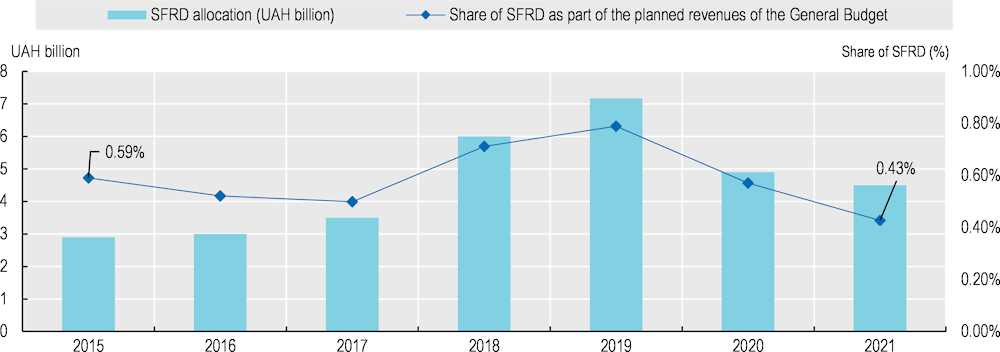

Between 2016 and 2020, the share of central government transfers as part of all subnational revenues dropped significantly, from 53% to 34% (Figure 5.4). This is less than the OECD and EU-28 averages of 38% and 45% respectively (IMF, 2022[11]; OECD, 2022[10]). It is also well below that of Poland (60%) (OECD, 2022[10]). A large portion of this reduction came between 2019 and 2020 (from 46% to 34%) (CabMin, 2021[5]; OECD, 2022[10]). This can be attributed to the government’s decision to cut the size of several funds, including the SFRD, in order to create the COVID Stabilisation Fund, as well as the aforementioned changes to the mechanisms for funding healthcare and social services. As central government transfers are often earmarked, this limits the scope for subnational governments to adapt spending to local investment needs. Generally speaking, lowering subnational government dependence on earmarked intergovernmental transfers increases their relative fiscal autonomy.

Figure 5.4. Change in the composition of subnational revenue, 2016-2020

Note: Transfers include, among other elements, grants and subventions from the national budget. Income from capital transactions, revenues from the European Union, foreign governments, international organisations and donor institutions, as well as revenues from Budget Trust Funds are excluded from this list as, during the 2016-2020 period, on average, they each represented less than 1% of all subnational revenues. Grants from local budgets to other local budgets and subventions from local budgets to other local budgets are not incorporated in this chart.

Source: Author’s elaboration with data provided by the Cabinet of Ministers of Ukraine (2021[5]).

Own-source taxes continue to represent a minor part of subnational government revenues

Between 2016 and 2019, the share of tax revenues—including own-source and shared taxes—as part of all subnational revenues, increased gradually, from 40% to 48% (Figure 5.4). In 2020, however, it jumped to 61% (CabMin, 2021[5]; OECD, 2022[10]). This is not the result of a change in the mandate of subnational governments to raise local taxes or an increase in the percentage of shared taxes that they are allowed to keep. Rather, it reflects a gradual increase of tax revenues, as well as a marked decrease in the amount of state transfers between 2019 and 2020 as a result of the creation of the COVID Stabilisation Fund (Figure 5.5.). Moreover, it reflects changes to the funding of certain costs related to social services and healthcare.

Figure 5.5. Subnational revenues from taxes and transfers, 2016-2020

Note: Official transfers include, among other elements, grants and subventions from the national budget, as well as grants and subventions from local budgets. Total subnational revenues, include intergovernmental transfers from the state budget.

Source: Author’s elaboration with data provided by the Cabinet of Ministers of Ukraine (2021[5]).

The revenues generated through the PIT as part of all subnational revenues, which are shared among levels of government, increased by 16 percentage points between 2016 and 2020. In 2020, 38% of all subnational revenues came from PIT (Figure 5.4) (CabMin, 2021[5]; OECD, 2022[10]).

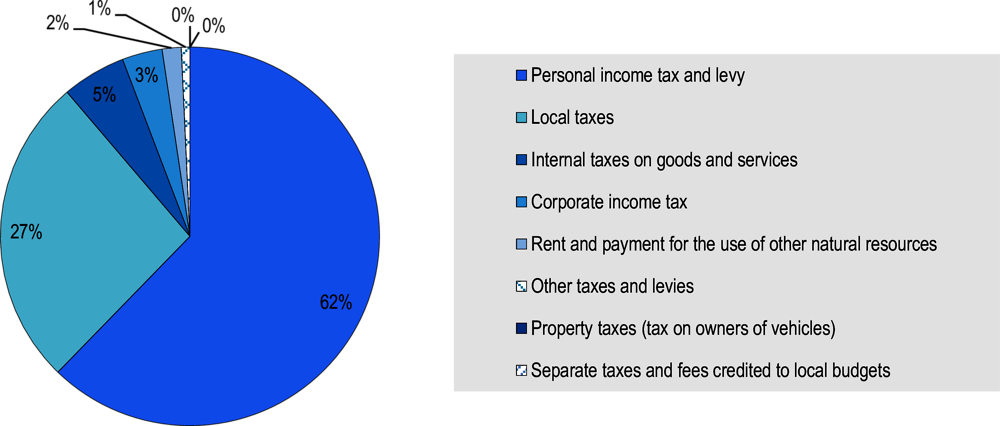

As explained in more detailed later this chapter, PIT and Corporate Income Tax (CIT) are the main elements of the country’s fiscal equalisation system, with the former generating the highest level of resources. Currently, oblasts receive a 15% share of PIT, municipalities receive 60%, and 25% goes to the national government2. An exception is Kyiv City, which receives 40% of PIT, meaning that 60% of PIT that is generated in Kyiv City flows into the national budget. This makes the criteria for PIT allocation a crucial element in determining subnational fiscal capacity, and thereby their ability to invest in regional and local development initiatives (OECD, 2018[14]; Verkhovna Rada, 2022[15]). CIT, on the other hand, is shared only between oblasts and the national government. In 2020, 2% of subnational revenues came from CIT.

As previously mentioned, tax revenues represent a significant share of total subnational revenues, the majority of which comes from shared taxes and a relatively small part from local taxes (i.e. property tax, tourist tax, single tax and certain user charges and fees). Between 2016 and 2020, the share of local taxes as part of all subnational revenues remained relatively stable, fluctuating between 12% in 2016 and 16% in 2020 (CabMin, 2021[5]; OECD, 2022[10]). In 2020, local taxes represented 27% of revenues received by subnational bodies from taxes and fees, including those redistributed by the central government (Figure 5.6). This is two percentage points less than in 2016 (29%). This reflects limited legislative changes to expand the ability of subnational authorities to raise taxes.

Figure 5.6. Breakdown of subnational taxes and fees, 2020

Note: Breakdown of taxes according to information provided by the Cabinet of Ministers. The “Local taxes” category includes property tax (other than tax on owners of vehicles), tourist tax, single tax and certain user charges and fees.

Source: Author’s elaboration with data from the (CabMin, 2021[5]).

The share of subnational expenditure on education and economic development as part of total subnational expenditure has increased

Between 2016 and 2020, there were important changes in the expenditure patterns of subnational governments. In particular, the share of subnational government expenditure on education increased from 27% to 42%, on economic development from 10% to 20% and on general public services from 5% to 10% (Table 5.1). In fact, the subnational expenditure on these three functional areas increased significantly both in nominal and real terms. Conversely, the share of subnational expenditure on social protection as part of total subnational expenditure significantly decreased, from 30% in 2016 to 5% in 2020. This is attributed, in part, to the fact that in recent years certain payments to families with children were funded through the national budget, instead of local budgets (U-LEAD, 2021[16]). Moreover, between 2019 and 2020, the share of subnational expenditure on healthcare as part of total subnational expenditure also decreased as the funding of certain costs was centralised (U-LEAD, 2022[7]).

Table 5.1. Distribution of subnational government expenses by function, 2016-2020

|

Functional area |

2016 |

2020 |

|||

|---|---|---|---|---|---|

|

UAH billion |

Share of total expenditure |

UAH billion |

UAH billion (adjusted for inflation) |

Share of total expenditure |

|

|

General public services |

19 |

5% |

48 |

29 |

10% |

|

Defense |

0 |

0% |

0 |

0 |

0% |

|

Public order, & safety |

0 |

0% |

2 |

1 |

0% |

|

Economic affairs |

35 |

10% |

94 |

56 |

20% |

|

Environment protection |

1 |

0% |

2 |

1 |

1% |

|

Housing & community amenities |

18 |

5% |

32 |

19 |

7% |

|

Health |

63 |

18% |

51 |

30 |

11% |

|

Recreation, culture, & religion |

12 |

3% |

22 |

13 |

5% |

|

Education |

95 |

27% |

199 |

119 |

42% |

|

Social protection |

106 |

30% |

24 |

14 |

5% |

|

Total |

349 |

100% |

475 |

283 |

100% |

Source: Author’s elaboration with data from (IMF, 2022[11]).

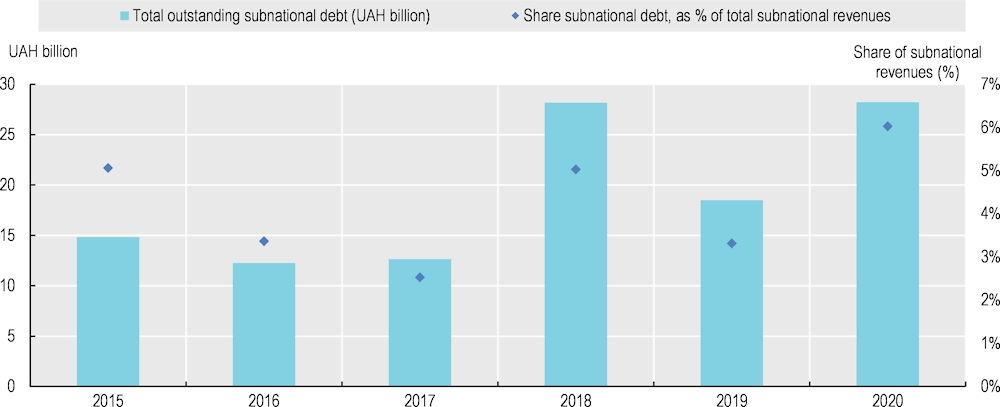

Subnational debt almost doubled in five years, but remains relatively low

Between 2015 and 2020, subnational debt almost doubled in nominal terms, from UAH 14.8 billion to UAH 28.2 billion. However, as a share of total subnational revenue, Ukraine reported only a minor increase; from 5% in 2015 to 6% in 2020 (Figure 5.7). Moreover, when controlling for inflation, in 2020, subnational debt was about the same as in 2015. Furthermore, subnational debt continues to represent only a very small part of all public debt, fluctuating between 0.6% and 1.4% between 2015 and 2020. This is well below the 2019 EU-28 (14.5%) and OECD (22%) averages. It is also well below the share of subnational debt as part of all public debt in Poland (8.9%) (OECD, 2022[10]). Compared to OECD member countries, only Greece (0.5%) has lower subnational debt as a share of all public debt. This trend can be explained by the fact that in recent years no significant changes have been made to the legislative and regulatory framework related to borrowing by subnational governments. As such, in effect only the councils of oblasts and major cities can borrow.

Figure 5.7. Subnational debt, 2015-2020

The data provided above highlight several key issues and challenges with respect to funding and financing regional development, which will be explored in the following sections. These include the PIT allocation system, the variety of intergovernmental subventions and grants used to fund regional and local development projects, and the investment capacity of local governments after the amalgamation reforms.

The impact of fiscal equalisation and PIT allocation on regional inequalities

Although not specifically conceived as an instrument to support regional development funding, Ukraine’s fiscal equalisation mechanism, through the distribution of PIT, has a strong effect on the ability of subnational governments to fund basic service delivery, as well as to make strategic investments. As such, it is essential to understand how the fiscal equalisation mechanism works and to what extent certain aspects of it may hamper the impact of Ukraine’s regional development policy. For example, the PIT allocation mechanism allows multi-office companies to credit the PIT of their employees to the municipality in which the companies are registered—often larger municipalities—and not necessarily where their employees live or work. This undermines the capacity of smaller municipalities to fund service delivery and finance investment, requiring substantial horizontal equalisation to offset at least a portion of the fiscal disparities across municipalities.

Limited evidence on the impact of the equalisation system on territorial convergence

Fiscal equalisation—the transfer of financial resources to and among subnational governments (Box 5.2)—can allow subnational governments to provide their residents with similar levels of public services at comparable levels of taxation by levelling fiscal capacities among different subnational governments (OECD/KIPF, 2016[17]; OECD, 2021[18]). Equalising transfers are usually non-earmarked, as in the case of Ukraine, which increases the relative fiscal autonomy of jurisdictions that would otherwise have fewer resources.

Box 5.2. Fiscal equalisation

Fiscal equalisation can be necessary to reduce regional disparities, in particular regional differences in fiscal capacity and expenditure needs of subnational governments. It is particularly necessary in the context of a decentralisation process. Without proper corrective mechanisms, decentralisation can result in increased inequalities among subnational governments, depending on their geographic location, socio-economic features, capacity constraints and fiscal potential. By redistributing funds from wealthier governments to those that face higher per capita costs or lower per capita revenue capacities, fiscal equalisation systems promote the principles of solidarity and territorial cohesion.

The dual functions of fiscal equalisation—to promote equality while enabling autonomy—give rise to a key challenge for policymakers: designing a system that allows differentiated public goods to be provided according to regional and local needs, while enabling comparable levels of public services to be delivered among subnational governments. In addressing this challenge, it is important to bear in mind the economic objectives that underpin equalisation, such as facilitating regional convergence and bolstering growth or mitigating the economic losses associated with interregional disparities that could arise from in-country migration.

Different modalities of fiscal equalisation

Generally speaking, three types of fiscal equalisation can be identified: revenue, cost, and gap-filling.

Revenue equalisation seeks to reduce differences in the fiscal capacities (per capita) of subnational governments. Germany and Canada are examples of countries with a revenue equalisation system. Revenue equalisation may give subnational governments an incentive to increase tax rates (i.e. thresholds) in order to reduce the tax base and to obtain higher equalisation grants. Setting tax rate ceilings and floors may reduce such strategic behaviour by subnational governments.

Cost equalisation aims to compensate subnational governments with higher per capita costs relative to other local authorities, so that they do not face an undue burden in delivering a baseline level of public services. The equalisation systems of several OECD member states (e.g. Estonia, Lithuania and Norway) integrate both cost and revenue equalising components. Cost equalisation that relies on actual spending may give subnational governments an incentive to inflate their budgets and lead to increased equalisation payments. In addition, cost equalisation payments that seek to compensate small municipalities that have relatively high costs for operating a school or hospital could prevent them from investing in measures to reduce service delivery costs, for example through amalgamation or inter-municipal co-operation.

Gap-filling equalisation seeks to bridge the gap between per capita costs and revenues for each subnational government, rather than consider either side of the ledger in isolation. Several OECD member states, including Australia, Italy and Japan, are generally recognised to have gap-filling equalisation systems.

Most equalisation systems combine elements of these three modalities of fiscal equalisation. Equalisation may take place vertically, from higher levels of government to financially weaker lower levels of government, or horizontally, across the same level of government from wealthier jurisdictions to poorer ones.

The difficulty lies in designing a system that can combine solidarity and equity principles with economic efficiency. In addition, policy makers should ensure that the equalisation system provides subnational governments with incentives to develop their economic and fiscal base, and to take measures to improve the quality and cost-efficiency of local service delivery.

Source: Author’s elaboration, based on: (OECD/KIPF, 2016[17]; Dougherty and Forman, 2021[19]; OECD, 2007[20]; OECD, forthcoming[21]).

While there is evidence that fiscal decentralisation facilitates regional convergence, there is some debate over whether fiscal equalisation might actually hinder long-term development incentives in an attempt to correct short-run disparities in fiscal capacity (Bartolini, Stossberg and Blöchliger, 2016[22]). In this regard, it is important to note that fiscal equalisation policies generally do not aim to reduce income inequalities or stimulate territorially balanced economic growth, which are objectives generally associated with regional development policy (OECD, forthcoming[21]).

Data on Canadian provinces show that equalisation payments contribute to increases in unproductive expenditure, slowing convergence (Hailemariam and Dzhumashev, 2018[23]). Conversely, a study on German municipalities found that increasing equalisation rates can lead to less distortionary taxation choices by local governments, which could be conducive to growth and productivity (Holm-Hadulla, 2020[24]). Moreover, OECD analysis shows that there is no significant correlation between fiscal equalisation and regional income equality (OECD, forthcoming[21]).

At the same time, fiscal equalisation and regional development policies can be complementary. Even when the objectives and target groups of fiscal equalisation and regional development policy may be different, the outcomes of both tools are closely related. For example, “regional development policies that succeed in reducing regional income disparities may lessen the need for generous fiscal equalisation schemes” (OECD, forthcoming[21]). However, both tools should not be conflated. Equalisation should be the main purpose of equalisation transfers, just as regional development funds should be used to boost regional development. Combining too many objectives in a single grant or transfer programme may give way to an overly complex system that fails to achieve its multiple objectives.

Ukraine’s recent modifications to the equalisation system make it fairer

Ukraine’s 2014 amendments to its Budget Code introduced an equalisation mechanism for subnational government revenues rather than expenditures, basing it on two taxes: the Personal Income Tax (PIT) and Corporate Income Tax (CIT), with the former generating the highest level of resources. The system, which takes revenue performance into consideration when calculating the equalisation grants, is designed to improve horizontal equality between local governments, while avoiding incentives for municipalities to undermine their own tax capacity (Box 5.3) (OECD, 2018[14]). Before a 2020 amendment to the Budget Code was passed, the system was imbalanced, benefiting those subnational governments with the fewest service delivery responsibilities.

Box 5.3. Ukraine’s equalisation systems: base and reverse grants

Ukraine has two horizontal equalisation mechanisms, one for oblasts and one for municipalities. They are based on the following:

1. The population of the subnational government (oblasts or municipalities);

2. Received shared tax revenues: PIT and CIT in the case of oblasts, and PIT in the case of municipalities;

3. Tax capacity index of each oblast and municipality. This is the ratio between the tax capacity per person of a local budget and the average tax capacity per person of the budgets of the same level of subnational government (e.g. municipalities or oblasts).

The tax capacity index determines which subnational governments will receive a basic grant, which ones will pay the reverse grant and which ones will be unaffected by the mechanism.

Oblasts and municipalities with a tax capacity index of less than 0.9—measured against the national average—receive a basic grant amounting to up to 80% of the difference between their tax capacity and the 0.9 threshold. However, if their tax capacity index is more than 1.1, then 50% of their revenue surplus (i.e. 50% of the PIT revenues that exceeds the 1.1 threshold) is deducted and transferred back into the State budget through a reverse grant. Subnational governments with revenues between 90% and 110% of the country’s average are not subject to compensation or deduction.

As a result, equalising transfers neither allow poorer subnational governments to overtake one another in terms of fiscal capacity, nor wealthier ones to fall below one another in terms of fiscal capacity. Furthermore, by intentionally keeping equalisation below 100%, it seeks to stimulate the development of own-source revenues. Local revenues from sources other than PIT and CIT are not subject to equalisation.

Use of the equalisation system as an incentive for voluntary amalgamations

As an incentive for voluntary amalgamations during the reform period, only “towns of rayon significance”, villages and rural settlements that merged could retain their share of PIT (OECD, 2018[14]). This left non-amalgamated municipalities without access to important public resources necessary for carrying out administrative tasks or for funding service delivery, possibly exacerbating territorial disparities.

Source: Author’s elaboration, based on (OECD, 2018[14]).

Until 2021, the equalisation baseline of rayons, cities of oblast significance and amalgamated municipalities was calculated together. This lowered the equalisation baseline for cities of oblast significance, while raising it for rayons and amalgamated communities. As such, for the 2016-2018 period, cities of oblast significance paid the most into the PIT system through reverse grants and received the least in return through base grants (SKL International, 2019[25]). Conversely, rayons, which have limited service provision responsibilities, paid the least into the system, but got the most out of it. During the same period, the convergence effect of the equalisation system3 was highest for rayons and significantly lower for cities of oblast significance and amalgamated municipalities (SKL International, 2019[25]). As part of a 2020 amendment to the Budget Code, rayons no longer receive a share of the PIT fund. This modification makes the PIT distribution more commensurate with the assignment of responsibilities among levels of subnational government.

The current PIT allocation system undermines efforts to reduce territorial disparities

The PIT is a cornerstone of subnational government ability to fund regional and local development projects and boost local well-being. However, the way the PIT distribution mechanism is set up, and in particular the role companies have in allocating the tax, runs the risk of contributing to territorial disparities.

Private companies play an outsized role in the distribution of PIT funds

Ukraine’s practice of allocating PIT to the municipality where the employer is legally registered rather than place of residence has three important ramifications. First, large companies with offices located throughout the country credit the PIT payments of their staff to the local government in which the company is legally registered. These payments might not correspond with the place where (most of) their employees work. This facilitates the tax administration of large companies as it enables them to credit the PIT to just one local government. This benefits larger municipalities where large companies are often registered, at the expense of smaller, frequently rural, communities. In turn, this increases the need for equalisation and requires that the base/reverse grant system be larger than necessary (Box 5.3). Third, it creates the conditions for companies to use PIT as a bargaining chip with local authorities, as companies can change their place of registration (and thus where the PIT payments are allocated). This gives them significant negotiating power (e.g. for favourable operating conditions) over local authorities, who do not wish to risk losing PIT funds (KSE, 2021[26]).

The current PIT allocation system may undermine democratic control

The current link between PIT allocation and place of employment (or more accurately place of company registration) risks undermining local democratic control. In principle, the more a municipality’s revenues and expenses are determined by democratically elected councils, the more likely it is that they will make planning and budgeting decisions that contribute to meeting residents’ needs and demands. Basing PIT allocation on place of residence—often the place where demand for and use of services such as public transport, education, healthcare, etc. is greatest—could strengthen democratic control. However, the positive effect that changing PIT allocation to place of residence can have on democratic control is dependent on the size of the equalisation mechanisms. Having a relatively large equalisation system in which many municipalities either receive a basic grant or pay the reverse grant could weaken the direct link between taxpayers and local leaders. Currently, however, Ukrainian municipalities where large multi-office companies are registered may spend the PIT contributions of people who do not live or work in their locality, who do not vote for them and to whom they are not politically accountable.

Possible profound implications of alternative PIT allocation systems

In early 2021, the Office of the President of Ukraine issued a decree giving the Cabinet of Ministers three months to submit draft legislation that would credit part of the PIT to local budgets, according to the registered place of residence of taxpayers. In response, over a dozen different amendments have been presented and were being reviewed when Russia launched its large-scale invasion of Ukraine on 24 February 2022.

Some of these proposals called for PIT to be shared with local governments based on where people work; while others proposed that PIT distribution should be based on place of residence or on a hybrid system that is linked to both place of work and of residence (Levitas, 2021[27]). A closer look at how some European countries such as Croatia and Romania manage the distribution of the PIT provides an indication of the pros and cons associated with the different models proposed. These include how complex the models are to establish, the incentives that they may provide to subnational governments to stimulate economic development, and the need for a strong equalisation system to offset any territorial disparities in PIT revenues (Table 5.2).

Table 5.2. Advantages and disadvantages of the alternatives to Ukraine’s PIT allocation system

|

Description and examples |

Advantage |

Disadvantage |

|---|---|---|

|

National PIT collection. Some countries such as the Slovak Republic earmark a set share of the national PIT yield for local governments and then allocate these funds to them through a formula based mainly on population size. |

- Relative simplicity of the model. No specific information on employee’s place of work is required. - Any year-on-year change in the amount of the PIT funds collected nationally will affect all local governments equally. This pairs the volume of the PIT disbursements with any changes in the overall economy. |

- As the allocation of PIT funds is not linked to the PIT generated in each territory, local governments do not have a clear fiscal incentive to boost local employment. |

|

PIT disbursement based on place of residence. Countries such as Belgium, Croatia, Italy and Sweden link PIT disbursement to the place where workers live. In Croatia, municipalities and cities are allowed to establish a PIT surcharge. |

- This system connects the financial interests of subnational governments’ electorates with the performance of subnational governments, thereby serving as an incentive for subnational governments to boost their economies. - Giving subnational governments influence over the local PIT rate can serve as a tool to strengthen political accountability. This positive effect could, however, be undermined by the need for a large equalisation system. |

- A strong equalisation system is required, otherwise unproductive communities and those with a high share of informal employment will not receive many PIT funds. - This model may create incentives for municipalities to attract high-salary workers, risking gentrification effects. - The model does not give municipalities direct incentives to increase local employment. - The institutions involved in gathering and distributing the funds require up-to-date granular data on citizens’ place of residence, and establish effective mechanisms to exchange information. |

|

PIT disbursement based on place of work. In such a system, like the one used in Romania, PIT allocation is based on the place where people actually work, instead of where their employers are registered. The national government is responsible for PIT allocation. |

- This system is potentially politically attractive due to the relative simplicity of the reform, compared to the other alternatives. |

- Kyiv City and cities with large urban centres would be ‘overfunded’ at the expense of surrounding municipalities where urban workers live. - To offset this effect, the equalisation system (e.g. base and reserve grants) may have to be larger than for some of the alternative models. |

|

Hybrid PIT distribution system. In such a system—an option currently being discussed in the Verkhovna Rada—PIT distribution would be partially based on the place of residence and place of work. |

- This system has the potential to compensate local governments for the costs they incur when providing services, such as public transportation, to people who work but do not live in their jurisdictions and vice versa. |

- This system requires up-to-date information on both people’s place of residence and work, making it complex to manage. |

Source: Author’s elaboration, based on (Levitas, 2021[27]; Hrvatski sabor, 2017[28]; Hrvatski sabor, 2020[29]; Miličević, Bubaš and Majić, 2019[30]; Verkhovna Rada, 2021[31]; OECD, 2018[14]).

Changing PIT allocation involves identifying potential ‘winners’ and ‘losers’ and taking corrective policy decisions

The government should consider opting for a PIT reform based on place of residence as it appears to have the highest potential for providing municipalities with financial resources that are commensurate with the demand for public services and investment, while also strengthening local political accountability. However, an ex-ante study would be required to determine how the reform would affect the fiscal health of the different subnational governments, as well as that of the State. A 2021 report estimates that changing PIT allocation to the taxpayer’s place of residence will increase PIT revenues of poorer rural municipalities by 50% to 70% (U-LEAD, 2021[32]). Careful consideration should be given to the question of how to compensate Kyiv City, which potentially stands to lose the most when allocating PIT based on place of residence. Ukraine should also consider giving larger municipalities some leeway to set a surcharge, as they too stand to lose if PIT allocation is based on place of residence, following the example of Croatia (Table 5.2). The ex-ante impact study should also be used to assess the effect that linking PIT allocation to place of residence would have on municipal disparities in PIT revenues, which influences the size of horizontal fiscal equalisation system.

Any reform of the PIT allocation mechanism should ensure that the government, instead of employers, allocates PIT to oblasts and municipalities. This requires investing in better information and data processing systems. Developing and operating such systems entails close collaboration among the State Treasury Service, the Ministry of Finance (MinFin) and the Ministry of Digital Transformation. In February 2022, an online service to change one’s place of residence was set up, which could be an important stepping stone for changes to the PIT allocation mechanism, as it enables the government to have up-to-date information on where people live. This is particularly relevant given the high number of internally displaced people in Ukraine.

The government could also consider creating a task force in which representatives from all affected parties (i.e. municipalities, oblasts and Kyiv City), as well as state level institutions participate to discuss the findings of the ex-ante study, and to identify policy interventions that would improve the efficiency and effectiveness of the PIT allocation reform. It is, furthermore, imperative to closely monitor the roll out of the eventual reform to assess its impact on the fiscal capacity of subnational government. In particular, this will help determine how the reform affects the investment capacity of municipalities, as well as identify any negative externalities that require further intervention.

As a key source of non-earmarked revenue for municipalities, oblasts and Kyiv City, PIT is pivotal to their ability to fund regional and local development projects and boost local well-being. As such, improving the fairness of the PIT allocation mechanism needs to be part and parcel of any effort to strengthen Ukraine’s regional development funding system.

Regional development funds in Ukraine

In 2019, the Government of Ukraine’s financial support for regional and local development was approximately seven times greater than in 2015 (U-LEAD, forthcoming[1]). The creation of different intergovernmental grants and subventions helped contribute to this increase. However, the effectiveness of these funds is undermined by a series of challenges such as a fragmented and relatively unstable fiscal framework, an emphasis on funding “hard” regional and local infrastructure, and the prevalence of small-scale local projects. This affects the ability of national and subnational governments to boost regional competitiveness and growth. Most importantly, the current set-up of many of the grants and subventions for regional and local development may aggravate, rather than reduce, regional disparities.

The proliferation of regional and local development funds leads to fragmented decision making

Subventions and grants with a regional or local development dimension in Ukraine have been in plentiful supply. Between 2015 and 2019, a total of 110 grants and subventions linked to regional and local development—with a total budgetary allocation of UAH 209 billion—were implemented. Over this period, the share of subnational funding as a percentage of public spending grew from 2.1% in 2015 to 6.5% in 2019. It also became more fragmented, with the number of annual grants and subventions substantially rising between 2015 and 2019 (U-LEAD, forthcoming[1])4. This makes the administration of funding more costly and could lead to overlap. It could also make it harder for subnational governments to understand relevant regulations and whether or not they are eligible to apply for public funds.

The 110 grants and subventions were implemented by 20 different entities, including the Ministry of Communities and Territories Development (MinRegion), MinFin, 11 line ministries and three oblast state administrations. Less than 25% of budgetary allocations for regional and local development funds were the responsibility of MinRegion, undermining its role in supporting regional development across the whole of government, and fragmenting decision making (U-LEAD, forthcoming[1]). Only three of the nine largest regional and local development grants and subventions—amounting to more than UAH 5 billion during the 2015-2019 period—were managed by MinRegion (Table 5.3).

Table 5.3. Largest regional and local development grants in Ukraine between 2015 and 2019

|

Name of grant |

Volume over 2015-2019 period (UAH) |

Years implemented |

Managing institution |

Competitive/non-competitive |

Sectoral / geographical focus |

|---|---|---|---|---|---|

|

Subvention for State Highways |

56 624 815 507 |

2015-2019 |

Ukravtodor |

Non-competitive |

Sectoral |

|

Subvention for Local Public Roads |

26 207 118 000 |

2018-2019 |

Ukravtodor |

Non-competitive |

Sectoral |

|

Socio-Economic Subvention |

17 724 516 171 |

2015-2019 |

MinFin |

Competitive |

Cross-sectoral |

|

SFRD |

17 446 036 426 |

2015-2019 |

MinRegion |

Competitive |

Cross-sectoral |

|

Highway Improvements (Lviv-Uman and Byla Tserkva-Kherson) |

8 685 483 727 |

2017-2019 |

Ukravtodor |

Non-competitive |

Sectoral and geographic |

|

Local Infrastructure Subvention |

6 301 027 665 |

2016-2019 |

MinRegion |

Non-competitive |

Sectoral |

|

Rural Healthcare Subvention |

6 000 000 000 |

2017-2019 |

MinRegion |

Competitive |

Sectoral |

Note: This chart only includes grants worth over UAH five billion between 2015 and 2019. Two other initiatives where spending was over UAH five billion included “Financial Support of Agricultural Producers” and “State Support of Livestock Breeding, Storage and Processing of Agricultural Products, Aquaculture (fish farming)”. However they were excluded from the OECD analysis on account of their sectoral focus.

Source: Author’s elaboration with data retrieved from U-LEAD (forthcoming[1]).

The proliferation of grants and subventions presents a co-ordination challenge that could potentially undermine spending efficiency, the quality of implementation, and the effectiveness of the different intergovernmental transfers. This is particularly difficult given the problems associated with the Inter-Departmental Co-ordination Committee for Regional Development (ICC) and the Congress for Local and Regional Authorities described in Chapter 4.

To address this challenge, the government should consider reallocating a higher share of regional and local budget grants and subventions to a single fund (e.g. the SFRD) managed by MinRegion. This would help ensure that overarching government objectives in the regional and local development sphere are met. MinRegion should also reinforce its efforts to effectively co-ordinate the different regional and local development funds, even when such funds are implemented by other ministries.

If it is deemed politically unfeasible to merge funds, it would be even more urgent to operationalise the ICC as a body that effectively co-ordinates regional development policy and funding. Ukraine should consider creating a sub-committee within the ICC whose objective could include co-ordinating the design, implementation and monitoring of Ukraine’s regional development funding mechanisms. This sub-committee could be tasked with monitoring possible overlap in the thematic and geographic focus of different grants. It could also propose monitoring frameworks to assess how effectively different funding mechanisms support the achievement of the government’s main regional development policy objectives. Moreover, it could function as a forum to discuss policy and legislative solutions to challenges related to issues such as the ability of subnational governments to provide co-funding, and their human resource capacity to manage investment processes. Finland’s Advisory Committee on Local Government Finances and Administration offers some insights to consider. While it focuses primarily on local government finances, the scope of its functions, its composition and the frequency of its meetings could be relevant if Ukraine decides to create a regional development funding sub-committee within the ICC (Box 5.4).

Box 5.4. Finland’s Advisory Committee on Local Government Finances and Administration

The Local Government Act provides for the establishment of an “Advisory Committee on Local Government Finances and Administration”. The Committee is a fundamental actor in the negotiation procedure between the national government and municipalities. Its key function is to provide a forum where the following topics, among others, can be discussed:

Development plans and proposed legislation related to local government finances and administration.

Proposals concerning local government finances and administration.

The division of costs between the national and local governments.

Other significant matters concerning local government finances and administration.

The Committee includes representatives from the Ministry of Finance, as well as from the Ministry of Education and Culture, the Ministry of Social Affairs and Health and the Association of Finnish Local and Regional Authorities. The Advisory Committee, which meets between 10 and 15 times per year, may set up different technical chambers to facilitate discussion.

Source: Author’s elaboration, based on (Association of Finnish Local and Regional Authorities, 2021[33]; Ministry of Finance of Finland, 2022[34]).

Possible overlap among subnational funding mechanisms may lead to an inefficient use of funds

As a result of the proliferation of funds for regional and local development, there is significant thematic overlap in the scope of subventions (Table 5.4). This may create uncertainty among subnational governments regarding which institutions are responsible for a specific topic and lead to a duplication in reporting efforts. Good examples of this are the SFRD and the Subvention for the Implementation of Measures for Socio-Economic Development of Certain Territories” (Annex Box 5.A.3) (CabMin, 2015[35]; CabMin, 2012[36]). Between 2015 and 2019, the two subventions were almost identical in size and targeted many of the same investment objectives (e.g. improving energy efficiency, water supply, sewage, or heating networks in local communities, as well as purchases of public transport infrastructure) (Verkhovna Rada, 2014[37]). Despite these similarities, the two funds are managed independently of one another: the SFRD by MinRegion and Socio-Economic Subvention by MinFin.

Table 5.4. Examples of potential overlap in the focus areas of the main funds for regional and local development

|

Area of potential overlap |

Sources of funding and managing institution |

|---|---|

|

Purchase of medical equipment |

- Subvention for the Implementation of Measures for Socio-Economic Development of Certain Territories (MinFin) - Subvention for the Implementation of Measures Aimed at the Development of the Healthcare System in Rural Areas (MinRegion) |

|

Investment in infrastructure for local roads, energy efficiency initiatives, water supply and sewage |

- SFRD (MinRegion) ˗ Subvention from the State Budget to Local Budgets for the Formation of Infrastructure of Local Hromadas (MinRegion) |

|

Investment in infrastructure for local roads |

- Subvention from the State Budget to Local Budgets for the Construction, Reconstruction, Repair and Maintenance of Highways in General Use of Local Importance, Streets and Roads of Communal Importance in Settlements (Ukravtodor) - Subvention from the State Budget to Local Budgets for the Formation of Infrastructure of Local Hromadas (MinRegion) |

Source: Author’s elaboration, based on (CabMin, 2012[36]), (CabMin, 2017[38]), (CabMin, 2015[35]), (CabMin, 2016[39]).

The possible overlap among the different funds does not in and of itself portend an inefficient use of resources. It can, however, pose the risk that some government initiatives aimed at supporting the regional and local levels duplicate each other, possibly resulting in an inefficient use of scarce public resources. This may be particularly true of the overlap between thematically similar budget funds that are being administered in separate government departments, such as the SFRD and the Socio-Economic Subvention (CabMin, 2015[35]; CabMin, 2012[36]).

In this regard, the government should consider combining thematically overlapping subventions and funds into consolidated ones with multiple budget lines. This would facilitate centre-of-government co-ordination and ensure that the institutions directly involved co-ordinate the grant and subvention design, implementation, and monitoring and evaluation mechanisms. In addition, if a sub-committee for regional development funding is created, this co-ordination body could be tasked with identifying possible overlap in proposed funding mechanisms and ensuring that corrective action is taken.

Regional development spending focuses heavily on “hard” infrastructure

Intergovernmental spending on regional development has predominantly focused on “hard” infrastructure Even though there is clear merit in investing in, for example, the construction or maintenance of roads, OECD analysis highlights that this alone has little impact on regional growth unless it is associated with “soft” investments (e.g. human capital development, innovation, research and development, SMEs, etc.) (OECD, 2009[3]; OECD, 2020[4]). A crucial challenge for policy makers is how to strike an adequate balance between both types of investment.

The government’s emphasis on “hard” infrastructure is illustrated by the fact that the two largest subventions during the 2015-2019 period were implemented by Ukravtodor, the State Agency for Motor Roads (Table 5.3). Combined, these two funds amounted to nearly UAH 83 billion (CabMin, 2017[40]). In fact, spending on “hard” infrastructure accounted for 59% of all spending on regional development (U-LEAD, forthcoming[1]). Moreover, the European Investment Bank (EIB) and the Ukrainian government signed, in late 2020, loans totalling EUR 640 million, some of which will be used to finance projects at the municipal level to rehabilitate social infrastructure (e.g. hospitals, schools, kindergartens, post offices), improve public utility services and repair damaged administrative buildings, and other key social infrastructure (European Investment Bank, 2020[41]).

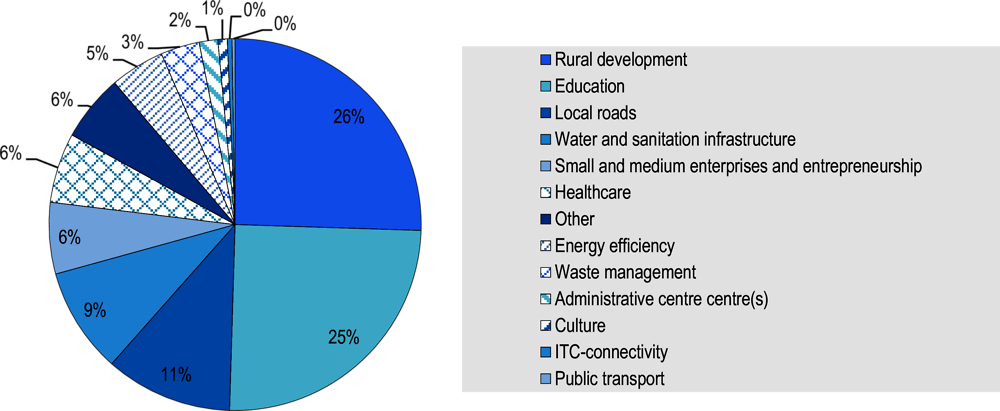

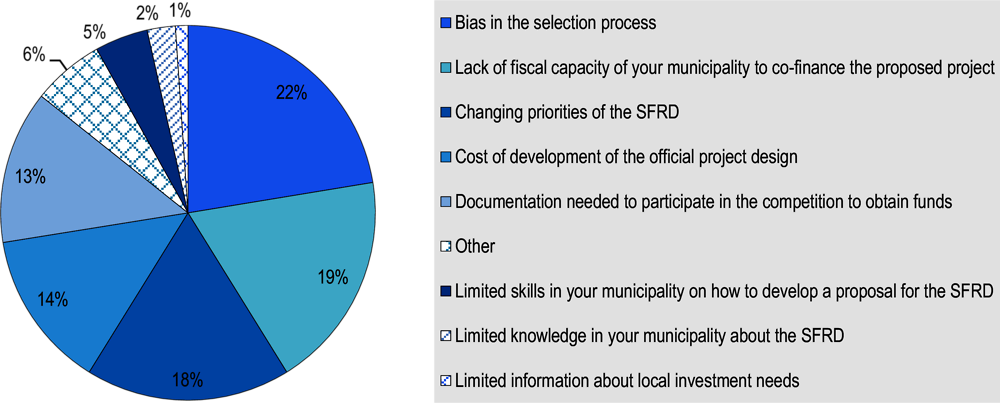

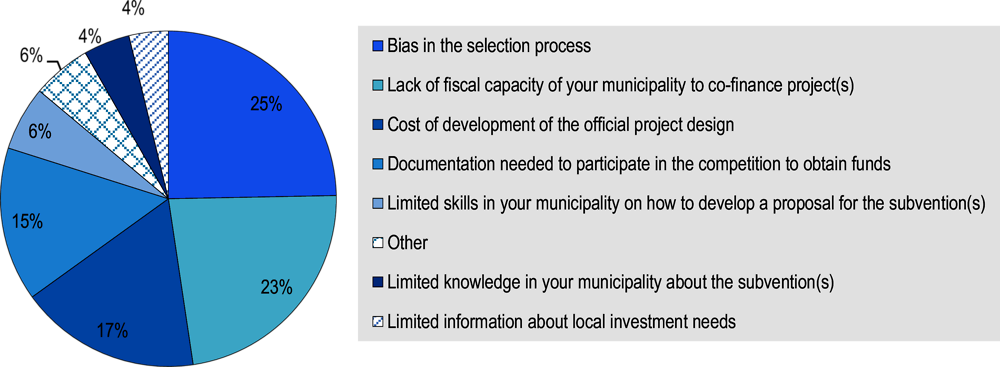

The dominant focus of these funds on “hard” infrastructure contrasts with the top investment priorities expressed by municipalities (Figure 5.8). A plurality of municipalities surveyed by the OECD in 2021 reported rural development (26%) and education (25%) to be their main investment priorities. Eleven percent of respondents considered local roads as a main investment need. This was followed by water and sanitation infrastructure (9%), healthcare, and small and medium-sized enterprises (SMEs) (both 6%) (OECD, 2021[42]).

Figure 5.8. Top municipal investment priorities

Note: Question: What is your municipality’s top investment priority? Please select only one option. Full response options: Education; Healthcare; Culture; Local roads; Public transport; Rural development; Administrative centre centre(s); ITC-connectivity (e.g. access to broadband, digitalisation); Waste management; Water and sanitation infrastructure; Energy efficiency; Small and medium enterprises and entrepreneurship;

Other. The questionnaire was filled out by 741 municipalities (51% of all Ukrainian municipalities in 2021).

Source: Author’s elaboration, based on the OECD online survey.